Revised Fee Proposal for Drugs and Medical Devices

May 24, 2018

Table of Contents

- Executive Summary

- Section I: Introduction

- Section II: Consultation Process

- Section III: Health Canada’s Response

- Section IV: Feedback Process

- Conclusion

- Annex A: Summary of Revised Fees

- Annex B: List of Stakeholder Engagement Events and Participants

- Annex C: Summary of Comments Received by Sector

- Annex D: Cost Recovery Impact Assessment

- Annex E: Fees and Service Standards for Drugs and Medical Devices (2019)

Executive Summary

Health Canada is the regulator responsible for helping Canadians maintain and improve their health. As the regulator for human and veterinary drugs and medical devices, Health Canada performs scientific evaluations of products before they are authorized for sale, monitors these products once made available to Canadians, and verifies compliance and acts on non-compliance using tools such as inspections. In the mid-nineties, Health Canada introduced fees for regulatory activities that are charged to industry. The practice of charging fees for these activities is consistent with other international regulators.

In Budget 2017, the Government of Canada provided commitments on its approach to fees and indicated that “businesses should pay their fair share for the services the Government provides”. From October 2017 to January 2018, Health Canada engaged in official consultations on the Fee Proposal for Drugs and Medical Devices (Fee Proposal), which aimed to update regulatory fees for human drugs, medical devices and veterinary drugs to reflect current costs. Stakeholders actively participated in the consultation process. The main concerns raised included the magnitude of the fee increases, the lack of staggered implementation, and the proposed approach to small business. The input received by Health Canada was instrumental to the development of the following revisions to the Fee Proposal (See Annex A for a summary of all revisions):

- Revising the fee setting ratio to 75% for Pre-market fees for drugs and medical devices (50% for veterinary drugs), and to 67% for all Right to Sell fees;

- Introducing a four-year phase-in period (seven years for veterinary Pre-market fees), with no annual fee increase greater than 25% for Pre-market and Establishment Licence fees, and 50% for Right to Sell fees;

- Expanded fee relief for small business including waivers to all Pre-market fees (50%) and Right to Sell and Establishment Licence fees (25%); and

- Expanded mitigation to waive fees for all publically funded health care institutions.

In making these revisions Health Canada followed five guiding principles:

- Be reasonable and fair

- Minimize impact on small business

- Apply appropriate mitigation measures and fee waivers

- Make fee increases gradual and predictable

- Ensure accountability

Health Canada is committed to openness and transparency and offers a final opportunity for stakeholders to identify concerns during the Feedback Process that will take place in June 2018.

Section I: Introduction

Health Canada introduced fees for regulatory services in the mid-nineties to partially recover costs associated with regulatory activities. In 2011, Health Canada updated fees for human drugs and medical devices. However, the veterinary drug fees have not been updated since implementation.

In Budget 2017, the Minister of Health was given the authorities to fix fees via Ministerial Order under the Food and Drugs Act. These authorities are administrative in nature and merely another regulatory mechanism with which to set or revise fees. Health Canada is now exercising these new authorities to amend fees related to human drugs, veterinary drugs, and medical devices. Fees related to food and human natural health products are not part of this proposal.

The fees being revised are broken down into three fee lines:

- Pre-market Submission / Application Evaluation Fee

- Establishment Licencing Fee

- Right to Sell Fee

Many other jurisdictions, including the United States, Australia and Europe, also charge fees for regulatory services for drugs and medical devices. Recognizing the profitability of industry and the value of regulatory services, some countries have set their fees at up to 90-100% of their costs, and regularly update their fees.

The existing Health Canada fees do not reflect the current costs of delivering the regulatory programs. Many drugs and medical devices follow complex pathways through multi-step supply chains prior to reaching Canada. These global realities have fundamentally changed the regulatory environment, have increased the complexity of regulatory work, and created new regulatory challenges for Health Canada. Health Canada must adapt to these changes to maintain the effective and efficient delivery of its regulatory activities. Over the past decade, the volume of products imported into Canada has significantly outpaced the growth of domestic production. This increases Canadians' exposure to greater risks from counterfeit or contaminated products, and products manufactured in countries with reduced regulatory oversight or less developed regulatory regimes.

Health Canada is faced with an increased volume of work as well as added complexity from technological advancement and more sophisticated data and systems. Although Health Canada has remained internationally competitive in meeting performance standards, these realities have increased the costs of doing business, and placed pressure on the regulatory system.

Section II: Consultation Process

In April 2017, Health Canada communicated its intent to update fees and began its engagement process with stakeholders. Industry associations from various sectors (such as Medical Devices, Disinfectants, Generic Drugs, Innovator/Biological Drugs, Over-the-Counter (Non-prescription Drugs), Radiopharmaceutical Drugs and Veterinary Drugs) as well as a number of individual companies were engaged.

Health Canada officially launched its public consultation with the publication of its Fee Proposal for Drugs and Medical Devices (Fee Proposal) on October 11, 2017. The consultations closed on January 4, 2018. In addition to posting its Fee Proposal on Health Canada's website, Health Canada made a Costing Companion Document available and met with associations and individual companies, and hosted sector specific sessions with industry associations to further discuss their questions and comments on the Fee Proposal. A list of engagement activities can be found in Annex B. A summary of comments received during those sessions and throughout the consultation can be found in Annex C.

Consultation Results and Responses

Generally, stakeholders were supportive of the need to review and update fees. Comments received have been grouped into six key themes:

- Fee Setting

- Costing

- Annual Fee Adjustment

- Small Business and Mitigation Measures

- Performance Standards and Penalty Provision

- Timing of Payment

Comments on specific fee lines and fee categories were also received and considered.

Section III: Health Canada’s Response

After analyzing all the comments received from stakeholders, Health Canada has developed responses and revisions to the Fee Proposal, using the following five guiding principles:

Be Reasonable and Fair: recognizing that industry needs to pay its fair share and reduce the burden on taxpayers, fees have been set reasonably and are being phased-in

Minimize Impact on Small Business: fees should not deter small businesses from doing business in Canada

Apply Appropriate Mitigation and Fee Waivers: fees should be reduced or waived in explicit circumstances to support the health care system

Make Fee Increases Gradual and Predictable: fees will be phased-in over multiple years

Ensure Accountability: remaining transparent and accountable to stakeholders through annual reporting and annual engagement is key to developing an agile and responsive fee framework

The following sub sections summarize by theme the elements of the October 2017 Fee Proposal, stakeholders’ reactions, and Health Canada’s responses. Annex E details the revised fees, performance standards and fee related processes.

Fee Setting

| Theme | Current | October 2017 Proposal | Revised May 2018 |

|---|---|---|---|

Fee Setting Ratios |

Fees set at 40%-100% of costs (from 2007 for Drugs and Devices, from 1995 for Veterinary Drugs) |

Pre-market Evaluation Right to Sell: 90% for all products Establishment Licences: 100%; one fee to be charged per establishment, regardless |

Pre-market Evaluation Right to Sell: 67% for all products Establishment Licences: No change from the October Proposal |

Timing of Implementation |

N/A |

Immediate |

Phased-in over four years (seven years for Veterinary Drug Pre-market), with no Pre-market or Establishment Licence fee increasing by more than 25% in any year, and no Right to Sell fee increasing by more than 50% in any year (excluding Consumer Price Index adjustment) |

What We Heard

Generally, stakeholders supported Health Canada’s need to update fees and recognized that current fees are out of date. However, many were concerned with how much the fees were increasing and how these increases could negatively impact the financial growth of companies, especially the increase in the Drug Right to Sell fee. Stakeholders recommended that Health Canada maintain the same fee setting ratios or use a phased-in or staggered approach for proposed fee changes to allow industry time to adapt to the increases, or establish fees based on the size of the Canadian market.

Response

Budget 2017 signalled the Government of Canada’s commitment to modernize business fees, stating that “businesses should pay their fair share for the services the Government provides”. Health Canada asserts that industry should pay fees based on Health Canada’s costs of providing regulatory services and not based on the Canadian market size, and that fees will not exceed the costs, as legislated in the Food and Drugs Act.Footnote 1

Health Canada recognizes the increase in fees impacts industry. To address this concern, Health Canada is proposing a phased-in implementation of its revised fees over multiple years as well as revised fee setting ratios for most fee lines. The changes to the fee setting ratios should address the concerns stakeholders had about the fee increases, especially for veterinary drugs as their fees have not been updated since their inception in the mid-nineties.

In response to stakeholder concerns regarding the level of effort for activities under the Drug Right to Sell fee; Health Canada has established a tiered Drug Right to Sell fee that reflects the lower level of effort related to disinfectants and over-the-counter products compared to prescription drugs. However, because of the recalculation, this resulted in a higher fee than originally proposed for prescription drugs. Given initial consultations on the proposed fee of $4,587, Health Canada chose to maintain that fee for prescription drugs even though the revised unit cost was higher. These changes have resulted in a fee setting ratio which is 67% of costs. This ratio has been applied to the other Right to Sell fees, including for medical devices and veterinary drugs. Health Canada intends to move to a 75% fee setting ratio the next time fees are updated.

In response to concerns on the predictability and impact of the revised fees, Health Canada will phase-in increases to fees over several years which will give industry more time to adjust and revise their business plans and budgets accordingly.Footnote 2 Health Canada has ensured that no fee will increase more than 25% per year for Pre-market Evaluation and Establishment Licence fees and by no more than 50% per year for the Right to Sell fees.

Self-Care Framework:

The Non-prescription drug industry and the Cosmetics industry requested that fees not be revised for their products (which include toothpastes, mouthwashes, antiseptic skin cleansers, secondary sunscreens, and anti-dandruff shampoos) until the new Self-Care Framework is implemented. Health Canada recognizes that these products are lower risk and that oversight should be proportionate to their overall risk. Existing fees relate to the costs associated with delivering the current regulatory program. As the Self-Care Framework is developed and implemented fees will be reviewed to reflect the cost of delivering the new program.

Costing

What We Heard

Several stakeholders expressed concern regarding Health Canada’s costing methodology and perceived lack of transparency. Stakeholders identified that they wanted more clarity on how costs were derived (especially for specific sectors) and wanted to ensure that they are not cross-subsidizing other sectors and fee lines.

Response

Health Canada last updated its fees for human drugs and medical devices in 2011, fees for veterinary drugs were established from 1995 to 1998 and have not been updated since. Current fees do not reflect current costs of providing regulatory services. To determine its revised fees, Health Canada used the Treasury Board of Canada Secretariat’s Guidelines on CostingFootnote 3 and costs were based on 2014-2017 data. Data was collected via a time tracking system that gathers the level of effort for each activity, including time spent reviewing submissions and applications. Fees were set based on the cost of delivering current regulatory programs. A separate Costing Companion Document was developed and made available which detailed the fee setting methodology and provided detailed costs.

Consistent with the principle of accountability, Health Canada remains committed to transparency, and moving forward, costing information will be shared annually with stakeholders.

Annual Fee Adjustment

| Theme | Current | October 2017 Proposal | Revised May 2018 |

|---|---|---|---|

| Annual Fee Adjustments | 2% annually | Annual fee adjustment tied to the Consumer Price Index (CPI) of previous year | No change from October Proposal |

What We Heard

Stakeholders were generally supportive of Health Canada’s approach to annual fee adjustments using the Consumer Price Index (CPI). However, a few stakeholders raised concerns that using the CPI would make it more difficult to predict fees for their budgeting purposes and others raised concerns that this new approach lacked clarity on when and how industry would be notified of these annual adjustments. They recommended that Health Canada provide a minimum 12 month notice.

Some stakeholders raised questions about how Health Canada’s new fee setting authorities would be exercised and suggested Parliamentary approval of changes to fees should still be sought.

Response

Annual adjustments made according to the CPI are consistent with the approach of the Service Fees Act. Health Canada will post its fee adjustment every November with the goal of giving stakeholders four to five months’ notice so they will know the exact fee increase each year. The rate of increase will be available from the Statistics Canada website in advance of publishing the fee amounts, so companies will be able to estimate and plan accordingly.

Aside from CPI updates, the ability for Health Canada to set and update fees in a timely manner is beneficial. Adjusting fees (increases and decreases) is a key element for program success, and will ensure that fees remain up-to-date and are reflective of costs. Health Canada is committed to improving program efficiencies and ensuring that its regulatory program is nimble and reactive to changes. Guidance documents will be updated and shared with stakeholders that will detail the annual adjustment process. Additional details can be found in Annex E.

With the new Service Fees Act, tabling of Fee Proposals in Parliament is no longer a standard part of the process for any Department. While Health Canada has an exemption from the Service Fees Act, the commitment to accountability and transparency remains. Health Canada will hold annual stakeholder meetings to review its fees and service standards. Regulatory changes of fees will likely take place on a two to three-year cycle.

Small Business and Mitigation Measures

| Theme | Current | October 2017 Proposal | Revised May 2018 |

|---|---|---|---|

Small Business |

Fees waived based on individual product sales; fees deferred for first year of business |

Apply the Treasury Board Secretariat’s small business definitionFootnote 4“Any business, including its affiliates, that has fewer than 100 employees or between $30,000 and $5 million in annual gross revenues”: new companies meeting the definition will be eligible to receive their first Pre-market submission free if the fee is greater than $10,000, one time only |

Applying the Treasury Board Secretariat’s small business definition: First Pre-market submission free regardless of fee amount 50% waiver for all Pre-market Evaluation fees 25% waiver for all Right to Sell fees 25% waiver for all Establishment Licence fees |

Fee Mitigation |

Fees waived based on individual product sales; fees deferred for first year of business |

Waive first Pre-market drug submission fee for a drug on the List of Drugs for an Urgent Public Health Need, as per the Access to Drugs in Exceptional Circumstances Regulations Elimination of fee deferrals |

In addition to October Proposal: All fees waived for publicly funded health care institutions Drug Establishment Licence fees pro-rated quarterly for a new application |

What We Heard

Most respondents welcomed Health Canada’s position of considering the needs of small business. However, stakeholders were concerned that the proposal focused only on new small businesses. Additionally, some stakeholders were concerned the Treasury Board Secretariat definition of a small business does not include unique organisational structures, such as academia and/or health institutions.

Medical device, Radiopharmaceutical drug and Veterinary drug sectors were particularly concerned with the impact of eliminating the current mitigation measures and the limited new mitigation. Some raised concerns that eliminating the existing mitigation provisions would have negative impacts for products with low sales volumes that service niche markets and suggested that the current practice remain in place. Some stakeholders raised concerns that they were being charged a full Establishment Licence fee even though they were not receiving their first licence for the full year.

Response

Small Business:

Recognizing the need to minimize the impact of fees for small businesses, Health Canada revised its small business strategy to provide mitigation for both pre- and post-market activities to companies that meet the Treasury Board Secretariat definition. Health Canada projects that a significant percentage of companies will qualify for small business assistance.

Additional Mitigation Measures:

In addition to mitigation measures that enable continued access to certain drugs in response to an urgent public health crisis, Health Canada is also implementing the following:

- The Radiopharmaceutical sector raised concerns that the proposed fees would significantly impact them and would cause a significant burden to publicly funded health care facilities. Health Canada is addressing this key concern by waiving all fees for publicly funded health care facilities.

- In regards to the Drug Establishment Licence fees, new applicants will have fees prorated for the portion of the Government of Canada fiscal year in which they apply. Upon license renewal in subsequent years, all applicable fees will be charged.

Performance Standards and Penalty Provision

| Theme | Current | October 2017 Proposal | Revised May 2018 |

|---|---|---|---|

| Penalty Provision | If average performance exceeds performance standards by 10% or more, the fee is reduced the following year | An individual submission that exceeds the performance standard will receive a rebate of 25%; and a “Stop the Clock” provision to limit the standard to the time spent by Health Canada on that submission | No change from October proposal |

| Performance Standards | Each existing fee has a performance standard | All existing standards will remain unchanged, except for:

All new fee categories have a proposed performance standard |

No change from the October proposal, except for Disinfectant - Labelling Only (90 days) |

What We Heard

In general, sectors had few questions and concerns on Health Canada’s performance standards, with the exception of some Disinfectant stakeholders who challenged the proposed increases for performance standards for some of their submissions. Overall, stakeholders were supportive of the proposed penalty provision. A few suggested that Health Canada include a sliding scale whereby penalties would escalate when a performance standard is missed by a growing amount, noting that this could ensure reviews are concluded as expeditiously as possible even if the standard is missed. One point raised by stakeholders was how penalties would be triggered for joint reviews with other international regulators.

Additionally, some stakeholders requested further clarification on the proposed amendments to performance standards and details on the proposed “Stop the Clock” policy. All sectors recommended that Health Canada engage with its stakeholders on the “Stop the Clock” policy development, allowing for input to ensure that it is meaningful and transparent.

Response

Health Canada maintains that the proposed performance standards are appropriate and internationally comparable. While Health Canada recognizes that time to approval is an important metric for industry and for Canadians, the standards to be used to measure accountability and potentially trigger financial penalties will remain the review of product submissions for pre-market evaluation (i.e. Review 1). This practice aligns with other international regulators and will allow Health Canada to continue to assess how its performance compares internationally. Health Canada will continue to evaluate what additional metrics can be implemented to further strengthen and improve performance reporting and analysis.

To address the concerns of the Disinfectant stakeholders and acknowledge the differing level of effort required to review a Disinfectant Labelling Only submission, Health Canada proposes a reduced service standard of 90 days from 120 days presented in the October Proposal.

Given the general support for the proposed penalty provision, Health Canada is not making changes to its original proposal, and remains invested in offering competitive and reliable service. Recognizing that accountability continues even after a standard is missed; Health Canada will continue to report metrics to ensure transparency and accountability of submission standards. Missed performance standards for joint review and parallel review submissions with other international regulatory agencies will not trigger penalties. In addition, medical device combination applicationsFootnote 5 will be exempt from penalties. Additional information regarding how the penalties will be processed is included in Annex E, and will be detailed in updated guidance documents.

Policies and updated guidance documents will be developed on “Pause the Clock”Footnote 6. Health Canada agrees that stakeholders should be involved in the development and implementation of this new mechanism. Separate consultations on proposed “Pause the Clock” initiatives will take place in 2018-2019.

Timing of Payment

| Theme | Current | October 2017 Proposal | Revised May 2018 |

|---|---|---|---|

| Timing of Fee Payment | Some Pre-market fees pay 75% upfront and 25% after review decision | Full Pre-market fees collected upfront | No change from the October proposal |

What We Heard

A few respondents noted that the current staggered evaluation fee payment model is preferred and paying the full fee upfront may create barriers to product development, as they are accustomed to adjusting their budgets to pay fees over two fiscal years.

Response

In the current system, the majority of fees are collected before the review of a drug submission. Adjusting the timing of payment will simplify the billing process and align with the practices of other international regulators. For example, in the United States, a submission is not considered complete and acceptable for review until the fee has been paid. Health Canada is not making any changes to its original proposal.

Specific Fee Changes

In addition to the comments received on the areas applicable to all fees as described above, stakeholders provided reactions to some of the specific fees in the proposal. Their comments and Health Canada’s responses are included below.

Evaluation Fees - What We Heard & Response

Safety Updates to the Labelling:

Some stakeholders challenged the proposed fee for safety update submissions for Division 8 drugs claiming they should not have to pay if Health Canada is requesting the submission. While Health Canada may in some cases request a submission to address new safety issues, it is the responsibility of the sponsor to ensure that their product remains in compliance with regulatory requirements, especially considering new safety information, regardless of the origin of the data. Safety updates for Division 1 drugs will continue to follow the requirements outlined in the Guidance Document on Post-Drug Identification Number Changes.

Disinfectant Safety Updates:

Disinfectant safety updates for Division 8 products will be added to the Disinfectant Labelling Only fee category (rather than the Clinical or non-clinical data only, in support of safety updates to the labelling fee category) and pay the same fee. This redefinition of the fee category will better reflect the related workload, and result in a fee that is appropriate to the level of effort for these submissions.

Published Data Only Fee Category:

Some pharmaceutical stakeholders questioned the elimination of the Published Data Only fee category. Health Canada maintains that based on workload and level of effort and how some Published Data submissions are currently categorized and processed, it remains appropriate to merge these submissions into other fee categories, depending on the data submitted.

Multiple Biosimilar Submissions:

Biosimilar stakeholders were concerned with the cumulative impact of filing multiple New Drug Submissions with different indications for a single biosimilar drug, challenging the costing of reviewing these overlapping submissions. When companies choose to make this business decision to file concurrently to manage patent issues for biosimilars or other products, this does not necessarily reduce the cost to Health Canada for their review. Although some of the data supporting each submission may be the same, the intent of each submission is different and must be reviewed accordingly. Multiple overlapping submissions also create additional work with respect to correspondence, data processing and the alignment of approved labelling.

Minor Use / Minor Species Veterinary Drugs:

To be consistent with regulatory regimes in other countries, Veterinary stakeholders requested specific fees and incentives for Minor Use / Minor Species products. Health Canada will review the fee structures for veterinary drugs and will engage with stakeholders on a revised structure starting in 2019.

Establishment Licence Fees - What We Heard & Response

Stakeholders questioned why the Drug Establishment Licence fees were calculated using average costs when the level of effort across sectors may not be consistent, resulting in cross-subsidization.

The Fee Proposal did not treat product types (e.g. prescription and non-prescription) differently when calculating Drug Establishment fees. The same regulatory framework applies to each facility by the most upstream activity type, regardless of the type of product dealt with at that facility. Drug Establishment Licence fees were calculated on a per facility basis using relative level of effort to inspect each facility type. Full program costs were then allocated per facility according to activity type. Evidence in terms of regulatory oversight costs and compliance history per product type supports this approach.

Right to Sell Fees - What We Heard & Response

Generic Drug Right to Sell:

Generic drug stakeholders have identified the cumulative impact of the increased Drug Right to Sell fee on companies with several hundred products in their portfolio as potentially being a decision point in keeping products on the market in Canada. The proposed Drug Right to Sell fee for a prescription drug reflects the costs of delivering the current post-market program.

Dormant Drug Identification Numbers:

Several stakeholders questioned whether products with dormant Drug Identification Numbers (e.g. not currently for sale in Canada) would be subject to fees under the new schedule, given that the mitigation measure that previously reduced their fee to $0 has been removed. Health Canada confirms that there is no intention to charge the Drug Right to Sell fee for products that have been officially notified as dormant. However, if a drug becomes dormant during the year, the Right to Sell fee will not be rebated.

Section IV: Feedback Process

As a part of its ongoing commitment to meaningful consultations, Health Canada had committed to provide a final opportunity for stakeholders to identify concerns with the Fee Proposal.

With the publication of the revised Fee Proposal, stakeholders are invited to submit final comments where applicable, via the Feedback Process. Health Canada will be gathering and considering this feedback for the finalization of Health Canada’s revised fees for drugs and medical devices.

Scope of the Feedback Process

Health Canada will be accepting feedback on all aspects of the Revised Fees with the following exceptions:

- Costing methodology

- Legislative authority and revised process to set fees

Process

Health Canada will be gathering the feedback through written submissions and stakeholder meetings if/as necessary. Input from the feedback process will be considered for the finalization of the revised fees.

Written Submissions

Stakeholders will have until June 14, 2018 to submit their official feedback to Health Canada via a Feedback Form, available online. Stakeholders must indicate on the form the topic/area of concern for which they wish to offer feedback.

Health Canada will review all the forms to determine whether the feedback falls within the scope as identified above. If the feedback falls outside of the scope of this process, it will not be considered further and the stakeholders will be informed that it will not be included.

Canada’s commitment to open government is part of the federal government’s efforts to foster greater openness and transparency to create a more responsive government. As part of this commitment, Health Canada is committed to openness and transparency and evidence-based decision making, and making more information available to Canadians than ever before. Once the Feedback Process has been completed, Health Canada will publish a list of all feedback submitted by stakeholders. Information received as part of this Feedback Process will not be considered confidential. The submissions listed will be accessible to members of the public upon request, for the sole purpose of ensuring greater transparency.

Stakeholder Meeting(s)

Depending on the nature and volume of feedback received, specific sector meetings may be organized. In order to be invited to one or more meetings, stakeholders will have to submit a Feedback Form. Stakeholders will be contacted after the close of the feedback period with the participation details.

Report

A report summarizing the feedback along with the response from Health Canada will be published on Health Canada’s website.

Conclusion

Health Canada revised its original Fee Proposal to reflect the concerns identified during the consultations, and presents balanced and responsive revised fees. Following completion of the Feedback Process, the new fee regulations will be published in Canada Gazette, Part II and implemented in spring 2019.

Transitional issues will be addressed in revised guidance documents, including how fee verification and fee deferrals will be managed for fees charged before the revised fees are implemented.

Annex A: Summary of Revised Fees

| Theme | Current | October 2017 Proposal | Revised May 2018 |

|---|---|---|---|

Fee Setting Ratios |

Fees set at 40%-100% of costs (from 2007 for Drugs and Devices, from 1995 for Veterinary Drugs) |

Pre-market Evaluation Drug Right to Sell: 90% for all products Establishment Licences: |

Pre-market Evaluation Right to Sell: 67% for all products Establishment Licences: |

Timing of Implementation |

N/A |

Immediate |

Phased-in over four years (seven years for Veterinary Drug Pre-market), with no Pre-market or Establishment Licence fee increasing by more than 25% in any year, and no Right to Sell fee increasing by more than 50% in any year (excluding Consumer Price Index adjustment) |

Annual Fee Adjustments |

2% annually |

Annual fee adjustment tied to the CPI of previous year |

No change from October Proposal |

Small Business |

Fees waived based on individual product sales; fees deferred for first year of business |

Apply the Treasury Board Secretariat’s small business definition “Any business, including its affiliates, that has fewer than 100 employees or between $30,000 and $5 million in annual gross revenues”: new companies meeting the definition will be eligible to receive their first pre-market submission free if the fee is greater than $10,000, one time only |

Applying the Treasury Board Secretariat’s small business definition: First Pre-market submission free regardless of fee amount 50% waiver for all Pre-market Evaluation fees 25% waiver for all Right to Sell fees 25% waiver for all Establishment Licence fees |

Fee Mitigation |

Fees waived based on individual product sales; fees deferred for first year of business |

Waive first Pre-market drug submission fee for a drug on the List of Drugs for an Urgent Public Health Need, as per the Access to Drugs in Exceptional Circumstances Regulations Elimination of fee deferrals |

In addition to October Proposal: All fees waived for publically funded health care institutions Drug Establishment Licence fee pro-rated quarterly for a new application |

Timing of Fee Payment |

Some Pre-market fees pay 75% upfront and 25% after review decision |

Full Pre-market fees collected upfront |

No change from October Proposal |

Penalty Provision |

If average performance exceeds performance standards by 10% or more, the fee is reduced the following year |

An individual submission that exceeds the performance standard will receive a rebate of 25%; “Stop the Clock” provision to limit the standard to the time spent by Health Canada on that submission |

No change from October Proposal |

Non-Payment of Fees |

N/A |

Authority to withdraw or withhold service or approval if the fee is not paid |

No change from October Proposal |

Performance Standards |

Each existing fee has a performance standard |

All existing standards will remain unchanged, except for:

All new fee categories have a proposed performance standard |

No change from October Proposal, except for |

Annex B: List of Stakeholder Engagement Events and Participants

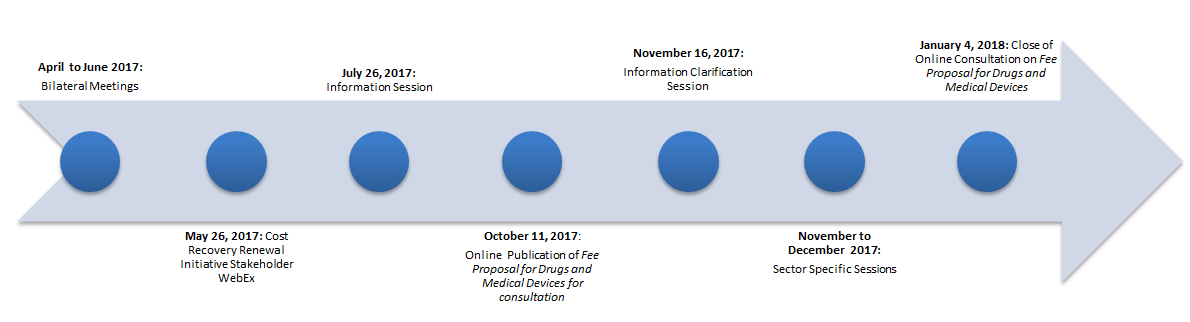

Figure 1 below describes the stakeholder engagement events Health Canada undertook during the consultation period including:

- Industry Bilateral Meetings (April to June 2017)

- Cost Recovery Renewal Initiative Stakeholder WebEx (May 26, 2017)

- Information Session (July 26, 2017)

- Online Publication of the Fee Proposal for Drugs and Medical Devices for consultation (October 11, 2017 to January 4, 2018)

- Information Clarification Session (November 16, 2017)

- Sector Specific Sessions (November to December 2017)

Figure 1 – Chronological Timeline of Stakeholder Consultation Events

Online Publication of the Fee Proposal for Drugs and Medical Devices, October 11, 2017 – January 4, 2018

| Type of Stakeholder | Number of Submission | Associations | Individual Company / Person |

|---|---|---|---|

Academia |

2 |

0 |

2 |

Consultant |

2 |

1 |

1 |

Non-profit Organization |

2 |

0 |

2 |

Non-Prescription (Cosmetic) |

1 |

1 |

0 |

Disinfectants |

6 |

2 |

4 |

Pharmaceuticals |

42 |

8 |

34 |

Radiopharmaceuticals |

5 |

5 |

0 |

Veterinary Drugs |

22 |

11 |

11 |

Medical Devices |

25 |

1 |

24 |

Other |

2 |

0 |

2 |

Annex C: Summary of Comments Received by Sector

Medical Devices

Fees and Performance

- The implementation of the revised fees should be staggered as the impact will be significant. Manufacturers may have to re-evaluate whether to maintain medical devices on the Canadian market at an increased cost.

- The revised fees do not account for the broad range of medical device companies (i.e., small businesses).

- Additional clarification and justification is required for costs, including the rationale for the fee setting ratio. The public private benefit analysis does not reflect the medical device industry.

- An independent review of Health Canada’s costs should be conducted to ensure costs are appropriately applied and justified.

- The addition of an administration-only fee for some applications and a separate fee for

Class IV Near Patient In-Vitro Diagnostic Device submissions should be considered. - Comparing fees internationally may not be appropriate given the reality of Canada’s medical devices market.

- An approach similar to the United States should be considered when the performance standard for a 510(k) submission is missed (e.g. written explanation and projected timelines).

- Performance standards should include screening time as part of “Time to First Decision.” Standards should better reflect the nature of the medical devices review process.

- Industry should be consulted on the “Stop the Clock” provision.

- Medical device performance reports and additional metrics (quarterly, annually) should be shared in a timely fashion.

Small Business and Mitigation

- The proposed Medical Device Establishment Licensing fee, on top of the Medical Device Single Audit Program in the same year, will be detrimental for small business importers.

- The current mitigation model should be retained or the new model reassessed (especially for the Right-to-Sell fee) as there will be unintended consequences related to patient care and access.

- Industry advice should be solicited to address challenges with the current fee mitigation model.

Timing of Payment

- N/A

Annual Adjustment

- Need clarification on when and how industry will be notified about the annual adjustment.

- Industry needs at least 12 months’ notice to allow for budgets to be set appropriately.

Penalty Provision

- N/A

Other

- Health Canada should host annual in-person stakeholder meetings specifically on medical device fees and related process improvements.

Disinfectants

Fees and Performance

- The public good and private benefit need to be considered.

- Revenues from disinfectants appear to cross subsidize other products.

- Fees should not include indirect costs.

- The 400% increase in the Drug Right-to-Sell fee is too high. Individual Right-to-Sell fees should be the same as the fees for Medical Devices.

- The 810% increase for reviewing a labelling only submission is too high.

- Fees should be aligned with fees charged by the United States for hard surface disinfectants.

- Performance standards should be improved. Performance for reviewing disinfectant (labelling only) submissions should be 60 days.

- The “Stop the Clock” provision needs to be strict, transparent, and developed with input from industry.

- Health Canada should engage stakeholders annually to review fees and performance.

Small Business and Mitigation

- Mitigation measures should assist small business, especially those with low sales.

- Fees for Drug Right-to-Sell should be mitigated based on sales.

Timing of Payment

- N/A

Annual Adjustment

- N/A

Penalty Provision

- The 25% rebate is appropriate.

Other

- There is a lack of transparency and oversight associated with the new process for setting fees.

- Remove exemption of the Food and Drugs Act from Service Fees Act.

Generic and Biosimilar Drugs

Fees and Performance

- Revised fees will be implemented at the same time as other changes affecting industry (e.g. Provincial formularies). Health Canada needs to consider the overall impact of proposed fees. A transition period should be considered.

- Stakeholders do not benefit from increased fees. Specifically, Health Canada has not committed to a generic pathway which continues to make applying for Provincial formulary status challenging.

- Higher fees could result in drug shortages. The proposed Right-to-Sell fees and those associated with Drug Identification Numbers will limit patient access.

- Fee setting ratios should reflect public benefit and be returned to 50:50, especially for Right-to-Sell fee which is not justified. Costs remain the same as previously, but Health Canada will now complete the work in less time (100 days less). Further, the cost differences between the drug Right-to-Sell fee and the medical devices Right-to-Sell fee need to be better explained.

- The Labelling Only (Generic) fee is not appropriate as this change is initiated by the innovator company, not the generic company.

- Dormant products with Drug Identification Numbers should be exempt from annual fees.

- The increase in fees to evaluate biosimilar drugs will be exacerbated when multiple submissions are filed for the same indication.

- The Costing Companion Document lacked details on individual activities for various fee lines. Health Canada needs to provide detailed data to validate proposed fees.

- Revenues may cross-subsidize other industries (i.e., not be invested in the same product line that generated the revenue).

- Health Canada should commit to becoming more efficient to encourage generic market access. Higher fees may decrease Health Canada’s efficiency thus allowing inefficient practices to continue.

- Industry should be consulted on the “Stop the Clock” provision.

Small Business and Mitigation

- Meeting the Treasury Board Secretariat definition of small business will be difficult.

- Proposed mitigation measure only benefits new small business. Model does not consider impact on existing small businesses serving niche markets or those selling products at a loss to meet patient needs. Mitigation model should include all, to ensure niche products continue to be viable.

Timing of Payment

- Fees should be paid consistent with timelines of work being done.

Annual Adjustment

- Using the Consumer Price Index as a basis for the annual increase creates challenges for budget planning. Industry needs sufficient notice to plan.

Penalty Provision

- Once a performance standard is missed, there is no incentive for Health Canada to complete the work.

Other

- Exemption from User Fees Act creates a lack of transparency. There is no assurance that Health Canada will engage with stakeholders in future.

- There is a lack of Parliamentary oversight and no incentive for Health Canada to become more efficient and reduce costs. Industry should be included in fee design and implementation and have regular access to budgets and costs.

Brand Name Pharmaceuticals

Fees and Performance

- New fees will be implemented at the same time as other changes affecting the industry (Canadian Agency for Drugs and Technology in Health, Patented Medicines Prices Review Board), thus Health Canada needs to consider the overall impact on industry. Changes should be delayed until new performance standards are established and efficiencies found.

- The rationale regarding the fee setting ratio is inadequate. Fees should be set using a 50:50 ratio or new fees should be delayed or phased in over a period of time.

- Fees should be set to maintain the immunization supply and should be reduced for low volume products. Dormant products with Drug Identification Numbers should be exempt from annual fees.

- Costs need to be reassessed. The costing methodology is not transparent. Only program costs and corporate costs are quantified. Capital costs are not identified and infrastructure costs should be excluded. Further, only one drug evaluation fee is fully described yet a total of 27 separate fees are impacted by this formula. Last, there is no reference to calculating costs of anticipated new regulatory activities.

- There is no incentive to bring orphan drugs to the Canadian market.

- Increased fees may decrease efficiencies and enable Health Canada to continue with inefficient business practices. Health Canada should undertake an annual performance review and report on how it has improved its processes and the impact of new program elements on the costing model. Efficiencies could lead to tangible fee reductions over time.

- The Published Data Only fee category should be maintained as opposed to replacing it with clinical or non-clinical data and Chemistry & Manufacturing fee or clinical or non-clinical data fee.

- Revenues should be applied to the program area that generated the revenue. Also, a specific annual report on this issue should be developed and published.

- Proposed fees should be subject to an independent, third party audit, such as by the Auditor General, to ensure charges are fair.

- The “Stop the Clock” provision should be considered independently from changes to fees.

Small Business and Mitigation

- Few companies will qualify as a small business.

- Mitigation measures should consider market size.

Timing of Payment

- N/A

Annual Adjustment

- N/A

Penalty Provision

- Health Canada should use a sliding penalty to ensure that reviews are completed as quickly as possible. For example, a 10% rebate should be applied for completion within 30 days of the performance standard, 25% rebate for completion in excess of 30 days over the standard.

Other

- There will be inadequate time for consultation before the final regulations are published.

- Parliamentary oversight should be reinstated to provide opportunity for arm’s length, publicly accountable review.

- Industry must be provided with a more accurate understanding of any new fees being contemplated, beyond annual Consumer Price Index increases.

Over the Counter (Non-prescription) Products

Fees and Performance

- Regulatory reforms proposed under the Self-Care Framework were not considered. Fee changes for products addressed in the Self-Care Framework should be deferred. Including low risk products in the Fee Proposal creates inequalities for Natural Health Products, which the Self-Care-Framework is designed to address. Natural Health Products require a different model of cost recovery – one that is tied to sales.

- A further rationale on changes to fees, costs, and performance is required. Ratios of 100% will have negative impact on industry and do not consider the public/private benefit. The analysis should focus on dollars, not just fee ratio. More dialogue is needed to understand what considerations Health Canada used in international comparisons and how a more cost-effective model can be created.

- The process to establish fees lacked transparency. Stakeholders did not have access to costing information. A separate consultation is required to discuss how to share one time capital expenditure costs.

- The mechanism and fees for products with no sales needs clarification.

- Discrepancies between fees suggest inefficiencies in the system. Post-market fees shouldn’t be higher than registering product fees.

- Health Canada should show how Drug Establishment fees were calculated before and after.

- Fees relating to activities such as adverse reaction processing, causality assessment, risk communication, post-market surveillance, compliance & enforcement, and policy & technology development are better suited for today’s Category IV monographed products under the Self-Care Framework than the proposed model for drugs and medical devices.

- Further explanation is required with respect to fees for fabrication, packaging, labelling, testing and importing Active Pharmaceutical Ingredients.

- More accurate post-market maintenance costs are needed to align Pre-market review costs with Right-to-Sell costs.

- There should be a different fee structure for Right-to-Sell to ensure this fee is aligned with appropriate regulatory activities. The “one size fits all” model needs to be reconsidered. Low risk products and those without market notification should be exempt from the Right-to-Sell fee. The non-prescription industry will be subsidizing other drugs as non-prescription products represent less than 10% of the work but would pay 25% of fees. A separate Right-to-Sell fee should be established for non-prescription products.

- The Fee for Labelling Only should be based on time and effort to review prescription versus non-prescription submissions and have different performance standards. Additionally, this fee is too high and further clarification is required as to whether brand name assessments will need a supplemental Labelling Only Submission.

- There is no rationale to increase the Evaluation Fee for low-risk drugs and lengthen the performance standard.

- The elimination of Published Data Only fee category and moving those submissions to clinical or non-clinical data and Chemistry & Manufacturing fees represents a 16-fold increase in fees and will discourage companies, particularly small companies, from bringing new products to market. The Published Data Only fee should be retained.

- The proposed fee for Safety Updates should only apply to significant changes and side effects as per Food and Drugs Act.

- In accordance with Food and Drug Regulations, changing product name should only be processed as Administrative Submission; one fee for multiple brand names in one submission.

- Health Canada does not need additional resources to implement Plain Language Labelling requirements.

- Fees are lower in Australia than Canada.

- No more than 75-80% of costs should be recovered as per the Organization for Economic

Co-operation and Development (OECD) average. - Health Canada should increase efficiency, transparency and accountability for meeting performance standards. There is minimal incentive for Health Canada to develop efficient processes for regulatory activities.

- The performance standard for Division 1 should be the same as Division 8.

- The Drug Identification Number-A performance standard should be within 10 to 30 days.

- The Right-to-Sell performance standard should be a minimum standard of less than 20 days.

- The “Stop the Clock” provision will only benefit Health Canada, not industry. The process needs to be predictable and transparent and developed with input from industry.

- Fees for Category IV monographed products may have negative impact on industry; may distribute products as cosmetics, foregoing licence requirements; exempt until transition to Self-Care Products Framework.

Small Business and Mitigation

- The negative impact of the proposed fees on small business needs to be considered, along with the impact on the Canadian manufacturing sector. Health Canada should conduct a Cost Benefit Analysis to this end.

- Proposed mitigation measure only benefits new small businesses, not existing small businesses.

- Fee mitigation for some product licence holders should not result in higher fees for all licence holders as this would subsidise the former.

- No assistance is offered to small business for the many fees below $10K.

Timing of Payment

- Paying fees upfront will cause financial and accounting challenges. Splitting fees over two fiscal years has helped to manage budgets thus stakeholders need sufficient time to adjust.

Annual Adjustment

- N/A

Penalty Provision

- More details needed to explain how penalty provision was developed.

- A sliding penalty provision would help ensure that reviews that exceed performance standard are prioritised.

Other

- There was a lack of transparency/dialogue on proposed changes as well as the associated costs.

- There is a lack of central agency oversight of fee setting process.

- Paying fees in excess of the actual costs of regulatory activities is inconsistent with Treasury Board Policy.

- Central agency or parliamentary oversight is required or at least a clear and central agency dispute resolution process.

- Stakeholders need more opportunities to further review proposed fees. Health Canada should work with stakeholders to establish a process to consult on fees.

- Health Canada should develop a Regulatory Impact Analysis Statement.

Radiopharmaceuticals

Fees and Performance

- Radiopharmaceuticals should have their own fee structure to recognize the market for these products, the high production costs, and the fact that sponsors are often non-profit organizations or academic institutions. Additionally, radiopharmaceuticals are less burdensome to regulate with favourable safety profiles and low adverse reaction rates. Fees for radiopharmaceuticals should be set at 10% of fees for pharmaceuticals to facilitate access to niche products for Canadians.

- The proposed fee increases, particularly for New Active Substance and Clinical & Non-Clinical Data and Chemistry & Manufacturing, will limit innovation and access to radiopharmaceuticals, and may lead to use of inferior agents.

- There could be significant regional variation in access to test/treatments if costs of radiopharmaceutical drugs increase, as not all health care providers will be able to afford them.

- The costing lacked transparency. Fee calculations, including a breakdown of each fee, capital costs, corporate costs and program costs, should be shared.

- Health Canada’s analysis did not include the financial and administrative burden of approving radiopharmaceuticals via the Special Access Programme on a case-by-case basis. The Special Access Programme discourages healthcare practitioners from using the best options for their patients, and Fee Proposal will exacerbate this problem. Fee increases may result in more radiopharmaceuticals being released via the Special Access Programme.

- Fee increases are not accompanied by improved performance standards.

- Fee waivers for orphan drugs should be adopted as per Australia’s model.

- Discrepancies between human and veterinary drug fees need to be explained.

Small Business and Mitigation

- The current mitigation model should be maintained. Additional measures should be adopted to incentivise new products from Small and Medium Enterprises and public-sector institutions.

- Mitigation measures are too restrictive and narrow and do not account for Small and Medium Enterprises or public sector institutions. Small and Medium Enterprises should have ongoing access to mitigation measures – not just on the first application/submission.

- Radiopharmaceutical companies have limited sales opportunities and operate as non-profit or public health institutions. They do not fit the definition of “small business” because of their organizational structure and should be exempt from fees.

Timing of Payment

- Paying the full fee upfront is a disincentive to industry. The Australian approach for splitting and staging fee payments should be adopted instead.

Annual Adjustment

- Reviewing and increasing fees annually by the Consumer Price Index places too much of a burden on industry. A three year review cycle for fees is more appropriate.

Penalty Provision

- N/A

Other

- N/A

Veterinary Drugs

Fees and Performance

- Veterinary drugs and human drugs should have different fees as the market sizes are not comparable. Further, fees do not reflect the fact that human medicine is socialized.

- Canada’s small market size means drug companies are reluctant to register their products leading to a shortage of veterinary drugs, and this trend is expected to worsen as a result of the proposed new fees.

- The fee setting ratio does not reflect the public benefit of veterinary drugs, market size, or the global trade implications.

- Higher fees will negatively impact the competitiveness of Canadian animal agriculture and the ability to practice good veterinary medicine, resulting in higher risks to food and user safety, as well as animal health. Increased fees may also limit innovation, cause drug shortages or reduce access to products, and increase costs for veterinary medicines. New fees are too high to justify the return on investment.

- Fewer companies may want to make their product available in Canada. This could drive up the number of Emergency Drug Requests, thus creating a pressure on Health Canada.

- Fees should be phased-in to reflect the fact that no increases were made in 2011.

- The proposed Drug Establishment Licence fees are not transparent when reported as an average.

- Health Canada is proposing fees significantly higher than similar countries such as Australia. These fee increases equate to 10-15 years’ worth of sales.

- Health Canada should reconsider a fee and performance standard for the safety review of admissible substances.

- Incentives for collaborative evaluations/joint reviews should be included. Accepting the reviews of competent foreign agencies such as the United States Food and Drug Administration to eliminate duplicate services and result in a downward adjustment to fees. Health Canada should consider the recognition of reviews from competent foreign agencies and reduced regulatory burden for companion animal products.

- Fees should incentivize availability of products in a small market. New fee categories should be created, and incentives added for Minor Use/Minor Species and Regulatory Cooperation Council submission reviews.

- Fees should not be charged in the absence of updated guidance to facilitate quality submissions.

- Atypical or old drug activities from the Drug Establishment Licence fees for Active Pharmaceutical Ingredient sites should be exempted as this will result in significant product removal from the Canadian market. Listed atypical Active Pharmaceutical Ingredients should not be subject to Drug Establishment Licences fees if Good Manufacturing Practice requirements are not the same.

- Health Canada’s services, associated fee structure and service standards should be modernized. Additionally fees should incentivise availability of licensed products in a small Canadian market.

- Only one performance standard is improving (posting of the Right-to-Sell information to the Drug Product Database), which is irrelevant to industry.

- The 250-day performance standard to issue or renew a Drug Establishment Licence or add a foreign site is unacceptable.

- Health Canada needs to consider a fee for the safety review of admissible substances that can be used in a notified product and an associated performance standard.

- A robust appeal process must exist for companies to question performance should a disagreement arise.

- The “Stop the Clock” provisions must be clearly defined and understood.

Small Business and Mitigation

- The proposed one-time only fee mitigation is not helpful given that fee for review could exceed $200,000 (production animal) and $125,000 (companion animal).

- The current mitigation model should be maintained (especially for veterinary Drug Establishment Licence fees) as it encourages companies to bring new products to the market, including niche products.

Timing of Payment

- Paying fees upfront will make cash managing difficult and strain budgets.

- This will be compounded during the first year of implementation as companies will have to pay any remaining fees for existing submissions as well as the full fee for any new submissions filed in 2019.

Annual Adjustment

- Annual fee updates, need to be transparent and reflective of the market size and public good.

Penalty Provision

- The proposed 25% rebate is appropriate.

- Need clarification on what constitutes a Minor Information Request versus a Notice of Deficiency which stops the clock.

- The principles outlined in the Veterinary Drugs Directorate Guidance for Industry: “Management of Regulatory Submissions” must remain consistent related to Minor Information Request responses (15 days).

Other

- N/A

Annex D: Cost Recovery Impact Assessment

Executive summary

Issue

The existing fees for drugs and devices are outdated and do not reflect the current costs of delivering the current regulatory programs.

Description

Based on a comprehensive costing exercise, revised fees reflect current costs and regulatory programs, along with mitigation measures and support for small business, and a strong accountability provision of financial penalties for missed performance standards.

Cost-benefit Statement

The increase in revenue collected from industry would off-set the tax-payer funded appropriations, resulting in a zero net benefit.

“One-for-One” Rule and Small Business Lens

The new fee regulations set by Ministerial Order under the Food and Drugs Act are replacing existing fee regulations under the Financial Administration Act, which will be repealed.

All companies that meet the Treasury Board Secretariat’s definition of a small business (“any business, including its affiliates, that has fewer than 100 employees or between $30,000 and $5 million in annual gross revenues”) qualifies for significant fee waivers and will pay between 25% and 50% less than other companies.

Domestic and International Coordination and Cooperation

The United States, Australia and Europe all charge fees for the delivery of regulatory services for health products, and revise their fees on a regular basis.

Introduction

The Canadian Market

Canada is the 8th largest market for drugs and medical devices in the world, representing just over 2.4% of a global market worth approximately US$1 trillion in 2017. In 2015, the Canadian market was estimated to be worth US$24.3 billionFootnote 7 ($6.2B medical devices, $3B over the counter medicines, $10.8B prescription patented medicines, and $4.3B generic prescription medicines). The majority of drugs and medical devices sold in Canada are imported from other countries. For instance, Canadian-manufactured generic pharmaceuticals make up just 20.4% of the Canadian market, while Canadian-manufactured brand name and innovator pharmaceuticals make up only 8.8% of the Canadian market.

A report published by the Patented Medicines Price Review Board (PMPRB) indicates that Canada is generally the 5th market (following the US, Sweden, Germany, and the UK) in which New Active Substances (NASs) are launched. Footnote 8

The PMPRB also reports that of 210 New Active Substances (NASs) brought to Canada between 2009 and 2014, sales at the individual drug level of the top 30 NASs exceeded $250M per year, while the sales at the low end represented drug sales worth $25M.Footnote 9

The Fee Model

The Government of Canada provides services that benefit a specific group above the benefit that the general taxpayer receives. The key principle behind cost recovery is that, in such cases, the group receiving the additional benefit is expected to pay at least a portion of the costs of these services as user fees.

Cost-Benefit Statement

| Quantified Impacts | 2019/20 | 2020/21 | 2021/22 | 2022/23 | Total | |

|---|---|---|---|---|---|---|

| Benefits | ||||||

| Amount saved as a result of Fee Proposal | Canadian Taxpayer | $38.7M | $54.1M | $72.7M | $85.9M | $251.4M |

| Cost | ||||||

| Proposed Fee Increase | Consumers, Patients, Industry, F/P/T and private insurers |

$38.7M | $54.1M | $72.7M | $85.9M | $251.4M |

| Net Benefits (Cost) | 0 | 0 | 0 | 0 | 0 | |

B. Quantified Impacts in Non-$

No data available

C. Qualitative Impacts

- Improve performance for timelier decisions

- Improve efficiency in review processes

- Greater predictability and transparency for industry

Costs

Health Canada is proposing to recover approximately $86 million more in fees from industry by Year 4 (2022/23) of the proposal.

Table 1 – Forecasted Program CostsFootnote 10

| 2019/20 | Public Funding | Current Revenue | Proposed Increase | Full Cost | % of Cost paid by Industry |

|---|---|---|---|---|---|

| Medical Devices Program | 20,517,392 | 25,329,621 | 2,630,539 | 48,477,552 | 57.7% |

| Human Drugs Program | 95,384,255 | 72,048,151 | 35,890,278 | 203,322,684 | 53.1% |

| Veterinary Drugs Program | 7,210,477 | 1,176,650 | 138,472 | 8,525,599 | 15.4% |

| Total | 123,112,124 | 98,554,422 | 38,659,290 | 260,325,835 | 52.7% |

| 2020/21 | Public Funding | Current Revenue | Proposed Increase | Full Cost | % of Cost paid by Industry |

|---|---|---|---|---|---|

| Medical Devices Program | 19,404,824 | 25,329,621 | 3,743,108 | 48,477,552 | 59.97% |

| Human Drugs Program | 81,382,344 | 72,048,151 | 49,892,189 | 203,322,684 | 59.97% |

| Veterinary Drugs Program | 6,909,808 | 1,176,650 | 439,141 | 8,525,599 | 18.95% |

| Total | 107,696,976 | 98,554,422 | 54,074,437 | 260,325,835 | 58.63% |

| 2021/22 | Public Funding | Current Revenue | Proposed Increase | Full Cost | % of Cost paid by Industry |

|---|---|---|---|---|---|

| Medical Devices Program | 18,288,984 | 25,329,621 | 4,858,947 | 48,477,552 | 62.3% |

| Human Drugs Program | 64,234,063 | 72,048,151 | 67,040,470 | 203,322,684 | 68.4% |

| Veterinary Drugs Program | 6,551,029 | 1,176,650 | 797,920 | 8,525,599 | 23.2% |

| Total | 89,074,076 | 98,554,422 | 72,697,337 | 260,325,835 | 65.8% |

| 2022/23 | Public Funding | Current Revenue | Proposed Increase | Full Cost | % of Cost paid by Industry |

|---|---|---|---|---|---|

| Medical Devices Program | 17,148,652 | 25,329,621 | 5,999,280 | 48,477,552 | 64.6% |

| Human Drugs Program | 52,450,512 | 72,048,151 | 78,824,021 | 203,322,684 | 74.2% |

| Veterinary Drugs Program | 6,200,094 | 1,176,650 | 1,148,855 | 8,525,599 | 27.3% |

| Total | 75,799,258 | 98,554,422 | 85,972,155 | 260,325,835 | 70.9% |

Price Elasticity and Passing Costs to Consumers

The impact of the proposed increase in fees on the price paid by both public and private payers is directly tied to price elasticity. For patented medicines, regulatory changes to the PMPRB framework are designed to protect Canadians from excessive prices for patented medicines. For NASs, the price of which is set by the PMPRB, it is likely that the regulatory cost will be absorbed by the industry. In the case of generics and biosimilar drugs, the regulatory costs would be more likely to be passed on to payers depending on the level of competition in the product category. However, a new agreement between public payers and Canadian generic companies that came into effect on April 1, 2018 will see the price of nearly 70 of the most commonly prescribed drugs reduced between 25% and 40%. For medical devices there is no one body that sets prices, and it is likely that regulatory costs would be passed on to payers when the likelihood of product substitution is low but absorbed by industry where the likelihood of product substitution is high.

Decision to not Market in Canada

Industry may decide to not market certain products in Canada due to increased fees, which would result in Canadians not having access to those products. However, this scenario is remote due to the unique characteristics of many medical devices and drugs, in that health care products are usually more specialized than traditional consumer goods, so demand for these products may not be as price sensitive.Footnote 11

A 2014 study published in the Canadian Medical Association Journal indicated that the reason companies often chose to market elsewhere before coming to the Canadian market was attributed to firms’ lack of capacity to make multiple concurrent submissions and therefore chose to maximize rates of financial return when choosing the order in which to make submissions to international regulators.Footnote 12 It was not attributed to the costs associated with making a drug submission, nor was it due to the time taken by Health Canada to reach a decision on a product.

The proposed increase in fees may also not influence the order in which firms choose to make their submissions as the Canadian market is expected to remain lucrative to firms, given the rising demand in the near to mid future resulting from aging populations. Consequently, despite a proposed increase to fees, the margins on new products should continue to be competitive vis-à-vis global markets. Indeed, despite Canada’s current lower fees and competitive service standards, industry rarely launches products in Canada first.

While some firms may decide to not market certain health products to Canada, Health Canada maintains various mechanisms to ensure that products may still be brought into the country if there is a need. For example, the Special Access Programme allows companies to make products available to physicians upon request.

However, economic principles suggest that in the vast majority of cases the proposed increase to fees is not likely to affect the availability of products on the Canadian market as margins and growth rates in Canada have been strong over the past 5 years, and forecasts remain positive (although growth in the medical device sector maybe sluggish in the near term).

Benefits

Reduced Burn Rates and Opportunity Costs

Research and development costs for new patented medicines are expensive. According to the fourth in a series of comprehensive compound-based analyses of the costs of new drug developmentFootnote 13, the estimated total out-of-pocket and capitalized R&D cost per new drug was $1395 million and $2558 million in 2013 U.S. dollars, respectively. Examining R&D costs over the entire product and development lifecycle increased out-of-pocket cost per approved drug to $1861 million and capitalized cost to $2870 million. When compared to the results of the previous study in the series, total capitalized costs were shown to have increased at an annual rate of 8.5% above general price inflation.

Full costing (amortization of research failures and opportunity cost of capital) raises the average costs to $900 million (U.S.) for small molecules and $1.24 billion (U.S.) for biologics. A U.S. consulting firm pegged the number even higher, at $2.2 billion (U.S.).Footnote 14 However, these cost and length of development figures are controversial and have often been disputed and the actual value may be as much as eighty percent less.Footnote 15Footnote 16

The costs of developing generics are less contentious. The Canadian Generic Pharmaceutical Association suggests that it costs somewhere in the range of $3.5M and between three to six years to bring a generic product to the Canadian market. This includes the costs for bio-equivalence studies, development and regulatory approval.

The Fee Proposal should improve Health Canada’s ability to produce timelier regulatory decisions. Timelier regulatory decisions are expected to benefit industry in terms of reduced burn rate (the rate at which a company spends money in excess of income) and lower opportunity cost (the benefit that a company could have received had it pursued another option). For example, the sooner a therapeutic product manufacturer receives a negative regulatory decision, the sooner the manufacturer can decide to terminate or change its approach to product development, thereby allowing it to cut its losses. Alternatively, if the regulatory decision proves to be favourable, the manufacturer can bring that product to market and generate revenues earlier.

The PMPRB report on sales of drugs shows daily revenues of between $68,500 and $685,000 per day. More timely regulatory decisions would allow the market authorization holders of these products to access the market sooner and recoup their development and regulatory costs earlier.

Under the current system, Health Canada is only required to meet its approval timelines on a cumulative average basis. The average of all of Health Canada’s approvals in a given category is required to meet the service standard. If Health Canada fails to do so, fees are reduced for the subsequent year. Under the Revised Fee Proposal, Health Canada would be required to meet its timelines for each review/application or risk a fee rebate being triggered to compensate the affected company. As a result, the overall performance is expected to improve given the new individual accountability.

Small Business and Mitigation Measures

Health Canada’s approach to fee mitigation is focused on facilitating Canadians’ access to products to help them maintain and improve their health. In certain situations, Health Canada acknowledges that fee increases could result in an undue burden to small businesses and potentially impede market access.

Health Canada proposes using Treasury Board Secretariat’s definition of a small business (“Any business, including its affiliates, that has fewer than 100 employees or between $30,000 and $5 million in annual gross revenues”) as the main criteria in determining a company’s eligibility for small business fee waivers.

Additional mitigation measures being proposed include a waiver of all fees for publicly funded health care institutions and for submissions for products on the List of Drugs for an Urgent Public Health Need as well as quarterly pro-rated Drug Establishment Licence fees for new applications.

Table 2 - Forecasted Revenue with Small Business Mitigation Measures AppliedFootnote 17

| Total | |||

|---|---|---|---|

| 2019/20 | Forecasted Revenues no Mitigation Applied | Small Business Mitigation Measures Applied | Forecasted Revenues with SME Mitigation |

| Total Human Drugs | 114,460,034 | -6,521,604 | 107,938,429 |

| Total Medical Devices | 32,696,571 | -4,736,411 | 27,960,160 |

| Total Veterinary Drugs | 1,564,315 | -249,193 | 1,315,122 |

| Total Forecasted Revenues Year 1 | 148,720,920 | -11,507,208 | 137,213,712 |

| Total | |||

|---|---|---|---|

| 2020/21 | Forecasted Revenues no Mitigation Applied | Small Business Mitigation Measures Applied | Forecasted Revenues with SME Mitigation |

| Total Human Drugs | 129,155,232 | -7,214,892 | 121,940,340 |

| Total Medical Devices | 33,981,443 | -4,908,714 | 29,072,729 |

| Total Veterinary Drugs | 1,924,622 | -308,831 | 1,615,791 |

| Total Forecasted Revenues – Year 2 | 165,061,297 | -12,432,438 | 152,628,859 |

| Total | |||

|---|---|---|---|

| 2021/22 | Forecasted Revenues no Mitigation Applied | Small Business Mitigation Measures Applied | Forecasted Revenues with SME Mitigation |

| Total Human Drugs | 147,121,755 | -8,033,134 | 139,088,621 |

| Total Medical Devices | 35,270,093 | -5,081,525 | 30,188,568 |

| Total Veterinary Drugs | 2,356,335 | -381,765 | 1,974,570 |

| Total Forecasted Revenues – Year 3 | 184,748,183 | -13,496,424 | 171,251,759 |

| Total | |||

|---|---|---|---|

| 2022/23 | Forecasted Revenues no Mitigation Applied | Small Business Mitigation Measures Applied | Forecasted Revenues with SME Mitigation |

| Total Human Drugs | 159,533,499 | -8,661,327 | 150,872,172 |

| Total Medical Devices | 36,587,029 | -5,258,128 | 31,328,901 |

| Total Veterinary Drugs | 2,778,409 | -452,904 | 2,325,505 |

| Total Forecasted Revenues – Year 4 | 198,898,937 | -14,372,359 | 184,526,577 |

Annex E: Fees and Service Standards for Drugs and Medical Devices (2019)

Purpose

This annex provides additional information on the Fees and Service Standards for Drugs and Medical Devices. Guidance documents will be updated, consulted on and disseminated accordingly.

Timing of Payment

Regardless of amount of the fee, the full Evaluation fee will be invoiced once the submission is accepted for review. If the submission is not accepted for review, the company will be invoiced for 10% of the fee at the time of screening rejection. For those submissions with no screening time, or very short performance standards, invoicing will continue as per current practice.

Small Business Strategy