Notes to the Agency’s delegation of spending and financial authorities chart

February 2019

Contents

- Introduction

- Management Practices and Controls

- Financial Administration Principles

- Contracting Principles

- Interpretation of Authorities Contained in the Chart

- Organizational Levels

- Operational Positions

- Functional Positions

- 1. Spending Authorities

- A – Expenditure Initiation Authorities

- B – Commitment Authority pursuant to FAA Section 32

- C – Contracting Authorities (FAA Section 41)

- C1. Low Dollar Value (LDV) Procurement (Goods and Services)/Acquisition Cards (<$5K)

- C2. Goods

- C3. Services – Competitive Electronic Bidding System

- C4. Services – Competitive

- C5. Services – Non-Competitive

- C6. Call-up against Standing Offer or Supply Arrangement (including Temporary Help Services)

- C7. Emergency Contracting

- C8. Terms and Conditions of Appointment for Panel Members

- D – Other Transaction Authorities

- 2. Financial Authorities

- 3. Other Authorities

- 1. Spending Authorities

- Annex A

- Annex B

Introduction

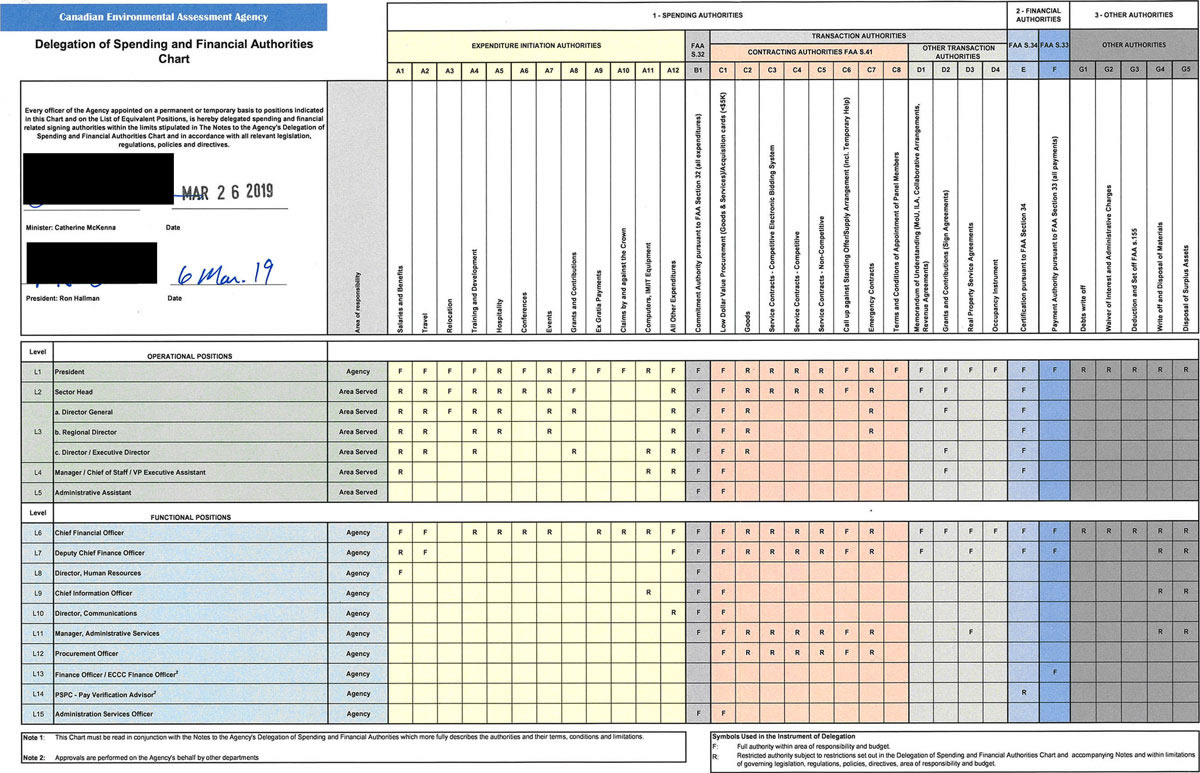

The Delegation of Spending and Financial Authorities Chart (the Chart) and its accompanying notes are the Canadian Environmental Assessment Agency’s, and successor Agency’s Footnote 1, (the Agency) framework for the Minister and the President to delegate and communicate the signing authorities to be exercised by officers of the Agency, thus empowering others to act on their behalf concerning financial matters.

This document is accompanied by the following annexes:

- Delegation of Spending and Financial Authorities Chart

- Authority to Sign the Specimen Signature Record

These documents have been prepared in compliance with directives, policies and guidelines established by Treasury Board (TB) for the financial administration of the Agency and support the Minister and President in carrying out his/her responsibilities for managing the Agency and its programs and priorities in compliance with legislation, regulations, Treasury Board policies, and financial authorities (TB Policy on Financial Management). Furthermore, these documents provide guidance and assistance to employees with delegated spending and financial authorities in understanding and applying those authorities in the performance of their duties.

By signing the Chart, the Minister establishes the maximum delegated authority to each relevant position. The President subsequently delegates those authorities, or lesser authorities, to the individuals holding those positions. The President may not delegate greater authorities than presented in the Chart.

Delegated spending and financial authorities are exercised exclusively for the delivery and administration of approved Agency programs as defined in the Appropriation Acts. Prior to making a decision to spend public funds, the Cost Centre Manager (CCM) will engage in work and budget planning exercises that consider the appropriateness and legitimacy of proposed expenditures. Expenditure of public funds must fall within scope of the mandate of the Agency and the delivery of its programs, and meet established program objectives while taking into consideration value for money, cost-effectiveness and efficiency. The CCM must ensure to exercise delegated spending and financial authorities only for fulfilling assigned responsibilities within the approved mandate and scope of operations and in alignment with budgetary and statutory limitations.

Cost Centre Managers must ensure that a proposed expenditure:

- Is directly linked to Agency objectives, strategic priorities and expected results;

- Is the most cost effective method of achieving the desired results;

- Is compliant with government legislation, regulations, directives and policies;

- Is able to pass the test of public scrutiny; and,

- Is within approved budget allocations.

Note that all financial authority limits, expressed in the Notes, are inclusive of all applicable taxes.

Management Practices and Controls

Management practices, key controls and principles of delegation are established to safeguard and ensure the effectiveness of transparency and accountability when exercising spending and financial signing authorities, to exercise sound stewardship and to provide assurance that the spending of public funds is appropriate and legitimate. These standards ensure that individuals who are delegated authorities are held responsible and accountable for their actions and all requirements of independence, prudence and probity are respected. It is the responsibility of the delegated personnel to ensure that they understand the extent of their authority and financial accountability.

The Delegation of Spending and Financial Authorities Chart (the Chart) reflects the authority limits that the Minister and President have granted to positions within the Agency. The authority limits for a specific position may be restricted as deemed necessary for operational purposes. The Area of Responsibility indicated in the Chart is a key limitation in the exercise of delegated authorities. Delegation from the President does not eliminate the delegated officer from ensuring that sufficient controls exist within their area of responsibility. The delegation merely sets out the lowest level at which the authority may be exercised. Therefore, it is important to refer to the signed Chart (Annex A) and these notes to identify the authorities actually vested in a given position.

Delegation to Positions

Authorities are delegated to positions identified by title, not to individuals identified by name. Therefore, regardless of a person’s status as an employee or a non-employee (for example, a contractor) that person can obtain a spending or financial delegation authority. However, it requires the delegated persons to have successfully completed training before being granted delegated authority.

The operational positions identified in the Chart are accountable for a budget and the delivery of program and strategic priorities. The functional positions identified are for those where the incumbents hold specialized expertise based on specific roles and responsibilities within the Agency or client Department, which require function-specific knowledge, skills and attributes.

An individual who occupies a position that has been delegated financial authority, as per the Chart, may not exercise these authorities until they have been delegated the authority by the President and completed an approved Specimen Signature Record.

Sub-Delegation of Authorities

An individual whose position has been delegated with financial authorities by the Minister and President shall not sub-delegate such authorities to another individual or position. When a person receives delegated authority, that person cannot ask another person in the organization to use this delegation on his or her behalf. The President may delegate authority to an individual to “act” in a position. Where that individual has been appointed to an “acting” role, he/she assumes the delegated financial authorities of the position in which he/she is acting. At any specific time, only one individual for a specific position can be delegated spending and financial signing authorities for the identified Areas of Responsibility.

Financial Limitations on Delegated Authority

Financial limitations on delegated authority are identified within the Chart as F = Full Authority (authority to the limit of the allocated budget and Area of Responsibility, and is limited by governing legislation, regulations, policies and directives) or R = Restricted Authority (conditional authority subject to restrictions set out in this document, and is limited by governing legislation, regulations, policies and directives).

Required Training (Treasury Board)

No person exercises delegated authorities unless the required training has been completed successfully and knowledge associated with the professional and legal responsibilities has been validated. Training requirements are specified in the following Treasury Board policy instruments: Policy on Learning, Training and Development and the Directive on the Administration of Required Training. The following required training is offered by the Canada School of Public Service;

- Managers: G510 – Manager Authority Delegation Training Checkpoint (which includes G110, G510 and C451)

- Managers: Recertification after 5 years (C451-1)

- Executives: G610 – Executive Authority Delegation Training Assessment

- Executives: Recertification after 5 years (G610)

Suspension of Authorities

The suspension of delegation of financial authorities may result from:

- 1) A situation of non-compliance, as determined by a compliance monitoring process;

- 2) A situation in which the revalidation of knowledge leading to the validation of the delegated signing authorities within Treasury Board’s Required Training was not completed within the prescribed time; or

- 3) Circumstances under which due diligence has not been exercised.

Note: A compliance monitoring process is defined as a process of verification (i.e., account verification) that is designed and operated to ensure compliance while taking into account the relative importance of risks associated with each transaction.

When a compliance monitoring process establishes that a critical point in terms of non-compliance has been reached, the Chief Financial Officer (CFO) will send a letter to suspend the delegation of financial authorities to the concerned employee. Note that the CFO resolves all cases of non-compliance and can take corrective actions which can include additional training, changes to procedures and systems, the suspension or removal of delegated authority, disciplinary action, and other measures, as appropriate.

When the revalidation of knowledge within Treasury Board’s Required Training is not completed within the prescribed time, the situation is brought to the attention of the CFO to suspend the delegated financial authorities of the concerned employee. Following suspension, financial delegation authority may be reinstated after completion of the Treasury Board’s required training.

Segregation of Duties

The same individual must not exercise the following:

- both transaction authority (Section 41 of the FAA) and certification authority (Section 34 of the FAA) on the same transaction unless the transaction is a low-risk and low-value transaction (acquisition card transactions); or,

- both certification (Section 34 of the FAA) and payment authority (Section 33 of the FAA) on the same transaction.

In the event that processes or circumstances do not allow for the separation of duties, as described above, alternate control measures must be implemented and documented.

Conflict of Interest [Personal Benefit]

Delegated officers must not exercise any authorities with respect to a transaction in which he/she is a party where he/she may be perceived as deriving a personal benefit, partially, directly or indirectly (i.e., the individual is linked to/identified in the transaction – not impartial - thereby adding the element of a personal component). Such transactions can result in an actual or perceived conflict of interest and require close scrutiny and independent authorization. These can be transactions related to salaries and benefits (including awards and recognition, learning and development – training), travel, relocation, isolated post allowances and travel assistance benefits, conference attendance fees, membership fees and hospitality. With respect to these transactions, individuals with delegated authorities must not exercise:

- Any element of Spending Authority: Expenditure Initiation Authorities (Column A of the Chart), Commitment Authority pursuant to FAA Section 32 (Column B of the Chart), Transaction Authorities - Contracting Authorities (Column C of the Chart) and Other Transaction Authorities (Column D of the Chart),or

- Certification Authority pursuant to FAA Section 34 (Column E of the Chart), or

- Payment Authority pursuant to FAA Section 33 (Column F of the Chart).

In order to ensure that such transactions can withstand the most rigorous of public scrutiny and to shield the activity(ies) from appearances of any impropriety or bad judgement, authorization must be exercised by the next higher reporting level with the appropriate delegated spending and financial signing authorities, notwithstanding the restricted authority delegated to incumbents of positions identified under Certification Authority pursuant to FAA Section 34 (Column E of the Chart) with specific conditions.

The Chief Financial Officer (L6) may exercise spending authority (initiation and commitment) and certification authority in lieu of the President for expenditures from which the President (L1), or those reporting directly to the President, can directly or indirectly benefit.

Under no circumstances can such transactions be manipulated, to conceal parties involved, in order to circumvent established key controls, by substitution or omission of information regarding individuals party to the transactions and/or by arranging for such transactions to be initiated and approved by subordinates or peers with delegated authority.

Fraud

Financial delegation is one of the basic elements essential to the prevention of fraud as it clearly defines the lines of authority, delegation of responsibilities and separation of incompatible functions.

Financial Administration Principles

Authorities for Financial Management

For the purposes of this document, financial signing authorities have been identified as spending authorities, financial authorities and other authorities. The Chart maintains the separation of these three types of authorities.

Spending Authorities

Spending authority consists of three elements: expenditure initiation authority, commitment authority, and transaction authority.

Expenditure Initiation

Expenditure initiation authority is the authority to incur an expense or make an obligation to obtain goods or services that will ultimately result in the disbursement of public funds. Types of expenditure initiation authority include:

- the decision to hire staff;

- ordering of goods or services;

- authorizing travel, relocation or hospitality; or

- entering into an arrangement for program purposes.

This authority is aligned closely with managerial, budgetary and operational responsibilities. It provides CCM the primary responsibility for initiating expenditures to be charged to their budget and ensuring that that the necessary authority exists for making an expenditure which Parliament has approved through annual appropriation acts.

Commitment Authority

Commitment authority (FAA Section 32) is the authority delegated by the President to the incumbents of positions to ensure that there are sufficient unencumbered funds available before entering into a contract or other obligation on behalf of the Agency.

Transaction/Contract Authority

Transaction authority (FAA Section 41) is the authority delegated by the Minister for the purpose of allowing delegated personnel to sign goods and services contracts, within limits determined by the Treasury Board and in consideration of other authoritative legislation, and to sign off on legal entitlements on behalf of the Agency.

Financial Authorities

Financial authorities include certification authority (FAA Section 34) and payment authority (FAA Section 33).

Certification Authority

Certification authority (FAA Section 34) is the authority delegated by the Minister to positions, to certify before payment that a good and /or service has been received as per the conditions outlined in a contract or other type of procurement vehicle.

Payment Authority

Payment authority (FAA Section 33) is the authority delegated by the Minister to financial officers, to ensure that all payments and other charges requisitioned against the Consolidated Revenue Fund (CRF), are timely, properly authorized and legal as prescribed by the Treasury Board Directive on Payments.

The designated FAA Section 33 officer is required to ensure that a payment is a lawful charge against an appropriation and does not result in expenditure in excess of the appropriation, nor reduce the balance available in the appropriation to a level that is insufficient to meet commitments charged against it.

Other Authorities

The Chart identifies other categories of authorities which will be further detailed in Section G of this document.

Contracting Principles

It is government policy to conduct contracting in a manner that will:

- stand the test of public scrutiny for prudence and probity, facilitate access, encourage competition and reflect fairness in the spending of public funds;

- ensure effective and efficient results for operational requirements;

- support long-term industrial and regional development and other appropriate national objectives, including aboriginal economic development; and,

- comply with the government’s obligations under the North American Free Trade Agreement (NAFTA), the World Trade Organization Agreement on Government Procurement, the Agreement on Internal Trade (AIT) and any other applicable trade agreements.

The incumbents occupying positions that have been delegated contracting authority must exercise this authority with prudence so that the contracting authority (on behalf of the Minister) is acting and is seen to be acting within the letter and the spirit of the Government Contracts Regulations, the Treasury Board Contracting Policy and the Government’s procurement policy instruments.

The contracting officer, in conjunction with the CCM, is responsible for determining the most appropriate action for purchasing the goods and/or services (i.e., bidding process, standing offer, request to Public Services and Procurement Canada (PSPC), etc.) and providing this service to the CCM whose budgets will eventually be charged with the expenditure item.

Interpretation of Authorities Contained in the Chart

General

The Chart has been designed to comply with the Treasury Board Directive on Delegation of Spending and Financial Authorities, to meet the requirements for the financial administration and management of the Agency’s programs.

Layout

Authority is delegated to specific position levels by “Organizational Structure”, “Finance and Human Resources” and “Other Functional Positions”. Within these position levels, authorities have been categorized by “Operational and Functional Positions” and the positions are restricted to the area of responsibility. The various types of authorities are indicated in the columns divided in sections 1 to 3, subsections A to G.

Area of Responsibility

Agency - the incumbent of the position has authority to act where indicated, on behalf of the Agency.

Area Served - the incumbent of the position has authority to act, where indicated on behalf of his/her area of responsibility.

Symbols

The authority limits in Columns A1 to G5 of the Chart define the authority level of the delegated authority and shall be interpreted as follows:

- “F” indicates full authority within area of responsibility and budget;

- “R” indicates a restricted authority subject to restrictions set out in these Notes, and within limitations of governing legislation, regulations, policies, directives, area of responsibility and budget.

Organizational Levels

The following section identifies the generic position titles to which authority has been delegated in the Chart. It is understood that the individuals appointed to these positions shall have the necessary knowledge and training to exercise the financial authorities in a responsible and prudent manner.

Operational Positions

Positions L1 to L5 are accountable for a budget and the delivery of program and strategic priorities. They reflect the organization’s hierarchy.

Level |

Operational Position |

Area of Responsibility |

Equivalent Positions |

|---|---|---|---|

L1 |

President |

Agency |

- |

L2 |

Sector Head |

Area Served |

Any EX or EX-equivalent position reporting directly to L1 (e.g., Vice-Presidents, CFO and Senior General Counsel). |

L3 |

a) Director General |

Area Served |

Any EX or EX-equivalent position reporting directly to an L2. |

L3 |

b) Regional Director |

Area Served |

Any EX or EX-equivalent position reporting directly to an L2. |

L3 |

c) Director / Executive Director |

Area Served |

Any EX or EX-equivalent position reporting directly to an L2. |

L4 |

Manager / Chief of Staff / VP Executive Assistant |

Area Served |

Any position reporting directly to an L1, L2 or L3 and managing a budget. |

L5 |

Administrative Assistant (*See Note) |

Area Served |

Administrative Support. |

*Note For acquisition card usage with prior approval from a manager. |

|||

Note for Operational Positions L1 to L5: In order to have authorities delegated to an Operational Position, a unique cost centre and budget must be assigned to that position. Also, at any point in time, only one Operational Position can have authorities against a specific cost centre. In other words, two operational positions at the same levels (Sector Head (L2), Director (L3), and Manager (L4)) cannot both have authority over the same cost centres.

Functional Positions

Positions L6 to L14 apply to incumbents holding specialized expertise based on specific roles and responsibilities within the department, and which require function-specific knowledge, skills and attributes.

Level |

Functional Position |

Area of Responsibility |

Equivalent Positions |

|---|---|---|---|

L6 |

Chief Financial Officer |

Agency |

none |

L7 |

Deputy Chief Financial Officer |

Agency |

none |

L8 |

Director, Human Resources |

Agency |

none |

L9 |

Chief Information Officer |

Agency |

none |

L10 |

Director, Communications |

Agency |

none |

L11 |

Manager, Administrative Services |

Agency |

none |

L12 |

Procurement Officer |

Agency |

none |

L13 |

Finance Officer / Environment and Climate Change Canada (ECCC) |

Agency |

Manager of Accounting Operations and Reporting; |

L14 |

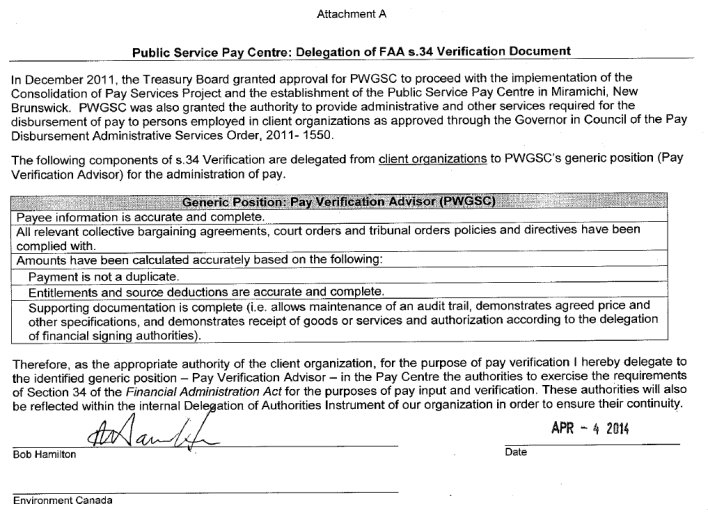

Public Service Pay Centre (PSPC) – Pay Verification Advisor (*See note 1) |

Agency |

Compensation Advisor; |

L15 |

Administration Services Officer (**See note 2) |

Agency |

- |

*Note 1: Approvals are performed on the Agency’s behalf by other departments. **Note 2: For acquisition card usage with prior approval from a manager. |

|||

1. Spending Authorities

Spending authorities include:

- Expenditure Initiation Authorities

- Commitment Authorities pursuant to FAA Section 32

- Transaction Authorities pursuant to FAA Section 41 (Contracting Authorities)

- Transaction Authorities – Other Transaction Authorities

A. Expenditure Initiation Authorities

Cost Centre Managers (CCM) exercise these authorities when making decisions to obtain goods or services that will result in the eventual expenditure of funds from an appropriation. The objective of the expenditure initiation authorities is to give CCM primary responsibility for initiating expenditures charged to their budgets.

Expenditure initiation is the authority to approve expenditures or make an obligation to obtain goods or services that will result in the eventual expenditure of funds. This would include the decision to hire staff, to order supplies or services, to authorize travel, relocation or hospitality, and to enter into some other arrangement for program purposes. This authority is aligned with managerial, budgetary and operational responsibilities (Treasury Board Directive on Delegation of Spending and Financial Authorities).

A1. Salaries and Benefits

This is the authority to request and approve human resource actions, such as the staffing of vacant and new positions, and pay actions such as requests for overtime, payment in lieu of accrued compensatory or vacation leave, and other employee related benefits, such as bilingual bonus and shift premiums.

The President receives specific delegated authorities, functions, or duties from the Central Agencies such as those specified in the Staffing Delegation Accountability Agreement. It is within the President’s authority to sub-delegate certain elements of these authorities to the incumbents of positions in the Agency pursuant to various employee-employment related Acts, regulations, directives and collective agreements (e.g., official languages, grievances, leave, etc.).

All sub-delegated CCM are required to read both the Delegation of Spending and Financial Authorities Guide and the Agency’s Human Resources Delegation Instrument before exercising their authorities. They may consult a Human Resources Advisor when exercising their expenditure initiation authority.

Human Resources |

President |

Sector Head |

Director General |

Regional Director |

Director / Executive Director |

Manager / Chief of Staff / VP Exec Assistant |

CFO |

DCFO |

Director, Human Resources |

|---|---|---|---|---|---|---|---|---|---|

Salaries and Benefits |

Full |

Restricted |

Restricted |

Restricted |

Restricted |

Restricted |

Full |

Restricted |

Full |

Long Service Awards |

Full |

no authority |

no authority |

no authority |

no authority |

no authority |

Full |

Restricted |

Full |

References:

Agency’s Human Resources Delegation Instrument

A2. Travel

This is the authority to approve requests for travel on official government business, including the authorization for travel advances and charges to the Departmental Travel Expense Card (DTEC).

In cases where travel is considered an event, please refer to the section A7 “Events” of this Guide.

Business travel includes travel related to attending a conference, travel related to training, trips for meetings and travel of other persons travelling on government business. It includes transportation by air, ground and marine modes of transportation, as well as meals and accommodation services such as hotels, motels, corporate residences, apartments, private non-commercial accommodation, and government and institutional accommodation.

For Public Service employees and other persons (non-federal government employees, such as volunteers travelling as part of volunteer agreements and individuals travelling as part of a letter of invitation) travelling on government business, travel shall be undertaken in accordance with the National Joint Council (NJC) Travel Directive, the TB Directive on Travel, Hospitality, Conference and Event Expenditures (THCEE) and the Agency’s Guideline on Travel, Hospitality, Conferences, and Event Expenditures. For other groups, including the President, executive group, persons on contract and students, the TB Special Travel Authorities should also be consulted.The rates and allowances to be reimbursed for government business travel are stipulated in Appendices B, C and D of the Travel Directive. Travel expenses must be treated as an amount payable under the contract for services rendered. All travel expenses payable should be specified and the costs should be included as part of the overall cost of the contract.

The authority to enter into a contract with persons outside the Public Service is contained in the Contracting Policy.

Cost Centre Managers (CCM) with appropriate delegation level are responsible for pre-approving travel by the most practical and economical means and ensuring that all travel arrangements are consistent with the provisions of the NJC Travel Directive and the TB Directive on Travel, Hospitality, Conference and Event Expenditures. Pre-approval from the delegated manager with Expenditure Initiation Authority must be obtained either in writing or through electronic means, using the Agency’s financial system, prior to booking of travel arrangements. Expenditure Initiation Authority may be exercised in the completion and approval of an individual trip request (prepared respecting applicable policies by the person travelling and submitted to a delegated manager for authorization) or a Blanket Travel Authority - BTA (prepared in accordance with agency guidelines respecting applicable policies by a delegated manager for an employee).

Travel* |

Module (as per NJC Travel Directive) |

President |

Sector Head |

Director General |

Regional Directors |

Director/ Executive Director |

CFO |

DCFO |

|---|---|---|---|---|---|---|---|---|

Travel within headquarters area (local travel)** |

3.1 |

Full |

Restricted |

Restricted |

Restricted |

Restricted |

Full |

Full |

Travel outside headquarters area – no overnight stay |

3.2 |

Full |

Restricted |

Restricted |

Restricted |

Restricted |

Full |

Full |

Travel in Canada and continental U.S.A. including Alaska |

3.3 |

Full |

Restricted |

Restricted |

Restricted |

Restricted |

Full |

Full |

International travel |

3.4 |

Full |

no authority |

no authority |

no authority |

no authority |

Full |

Full |

President’s travel |

3.2 to 3.4 |

no authority |

no authority |

no authority |

no authority |

no authority |

Full |

Full |

Exceptions to the NJC Travel Directive – for employees only up to $10,000 |

3.1 to 3.4 |

Full |

no authority |

no authority |

no authority |

no authority |

no authority |

no authority |

* Travel undertaken by Ministers and their exempt staff, in support of Agency business, is not subject to the travel expenditure initiation approvals noted in this section. ** Local Travel: travel within the normal office location and working environs of an employee, using means such as taxis, public transit, personal vehicle or government fleet vehicles for the conduct of the government's day to day business, can be authorized by the appropriate CCM. |

||||||||

References:

TB Directive on Travel, Hospitality, Conference and Event Expenditures;

National Joint Council (NJC) Travel Directive;

TB Special Travel Authorities;

Agency’s Guideline on the Management of Travel, Hospitality, Conference and Event Expenditures;

Treasury Board’s Decision no. 828699 of February 8, 2001, renewed on October 7, 2004 - exceptions to the provisions of the National Joint Council (NJC).

A3. Relocation

This is the authority to approve requests for relocation.

Relocation is the authorized move of an employee from one place of duty to another or the authorized move of an employee from the employee's place of residence to the employee's first place of duty upon appointment to a position in the Public Service.

The National Joint Council (NJC) Relocation Directive applies to Public Service employees, employees/appointees in the Executive Group (EX) and Governor in Council appointees (GIC). Reimbursement of relocation expenses must respect the terms of this Directive.

Employee - a person employed in the federal Public Service who is performing continuing full-time duties of a position and whose salary is paid out of the Consolidated Revenue Fund (employees performing continuing full-time duties on a seasonal basis are also included). The term also means a deputy minister, or any other person appointed by the Governor in Council to a position classified within the occupational groups comprising the Senior Management, Administrative and Foreign Service, Scientific and Professional, and Technical categories.

Appointee - a person recruited from outside the Public Service and appointed or on assignment to a department or agency listed in Schedules I and IV of the Financial Administration Act. On relocation to the first place of employment, a person is deemed not to be an employee for the purposes of this Directive.

Before the process is initiated, it is important to contact the Designated Relocation Coordinator of the Agency to ensure eligibility.

The process of relocation is initiated with an approved letter of offer or equivalent staffing document that contains therein a requirement to relocate. The initiating document is an output of the staffing process and since the action relates to matters of personnel/staffing, managers must refer to and cross-reference the Agency’s Human Resources Delegation Instrument to determine and confirm that the President has delegated the specific powers, functions, or duties pursuant to various employee-employment related Acts, Regulations, directives and collective agreements, etc. to the position the manager occupies (i.e., the CCM must ensure that both the Financial and Human Resources delegation instruments are respected when considering activities and expenditures related to the relocation of an employee).

Relocation |

President |

Sector Head |

Director General |

|---|---|---|---|

Relocation costs |

Full |

Full |

Full |

References:

National Joint Council (NJC) Relocation Directive;

Agency’s Human Resources Delegation Instrument.

A4. Training and Development

This is the authority to approve requests for training and development.

The TB Directive on Travel, Hospitality, Conference and Event Expenditures defines training as: Fees paid for formal learning activities, which include a curriculum and established learning objectives, and where the primary purpose is to enable participants to maintain or acquire skills or knowledge.

Training costs normally consist of registration/admission fees and the cost of textbooks and other materials required to complete course requirements.

In cases where training and development activities are not related to core mandate or are not event-exempted,please refer to section A7 “Events” of this Guide.

All sub-delegated CCM are required to read both the Delegation of Spending and Financial Authorities Guide and the Agency’s Human Resources Delegation Instrument before exercising their authorities.

Expenditure Initiation – Authority Limits

Training and Development |

President |

Sector Head |

Director General |

Regional Director |

Director/ Executive Director |

CFO |

|---|---|---|---|---|---|---|

Training and development costs up to $10,000 |

Full |

Restricted |

Restricted |

Restricted |

Restricted |

Restricted |

Training and development costs over $10,000 |

Full |

No authority |

No authority |

No authority |

No authority |

No authority |

President’s training costs |

No authority |

No authority |

No authority |

No authority |

No authority |

Restricted |

References:

Agency’s Human Resources Delegation Instrument.

A5. Hospitality

This is the authority to approve hospitality.

Hospitality consists of the provision of meals, beverages or refreshments in events that are necessary for the effective conduct of government business and for courtesy, diplomacy or protocol purposes.

The TB Directive on Travel, Hospitality, Conference and Event Expenditures, dictates that hospitality, including with any of the following elements, is only provided to non-public servants and the minimum required number of public servants for reasons of courtesy, diplomacy or protocol:

- Alcoholic beverages;

- Entertainment activities;

- Local transportation to and from an event or activity; and

- Facility rental and associated items which are directly and inherently for hospitality purposes.

In some circumstances and within restrictions defined in the TB Directive on Travel, Hospitality, Conference and Event Expenditures, hospitality can be provided to federal government employees. When only public servants are present, hospitality can only be provided in situations where:

- Participation is required in operational meetings, training or events that extend beyond normal working hours including where:

- There are no nearby or appropriate facilities to obtain refreshments or meals; or

- Staff dispersal is not effective or efficient.

In all cases, the provision of food and beverages must be in accordance with the cost limits in the TB Directive on Travel, Hospitality, Conference and Event Expenditures.

In cases where hospitality is considered an Event,please refer to the section A7 “Events” of this Guide.Expenditure Initiation – Authority Limits

Hospitality |

Minister |

President |

Sector Head |

Director General |

Regional Directors |

CFO |

|---|---|---|---|---|---|---|

Hospitality costs not exceeding $1,500 |

Full |

Restricted* |

Restricted* |

Restricted* |

Restricted* |

Restricted* |

Hospitality costs over $1,500 and up to $3,000 |

Full |

Restricted* |

Restricted* |

Restricted* |

No authority |

Restricted* |

Hospitality costs over $3,000 and up to $10,000 |

Full |

Restricted* |

No authority |

No authority |

No authority |

No authority |

Hospitality costs when only federal government employees and contractors are in attendance |

Full |

Restricted* |

Restricted* |

No authority |

No authority |

Restricted* |

Hospitality for employee recognition award ceremony or National Public Service Week |

Full |

Restricted* |

No authority |

No authority |

No authority |

No authority |

Hospitality costs up to$10,000 where the President is in attendance |

Full |

No authority |

No authority |

No authority |

No authority |

Restricted* |

Hospitality costs exceed $10,000 |

Full |

No authority |

No authority |

No authority |

No authority |

No authority |

Note: Any hospitality costs that are $3,000 or more must be reviewed and validated by Finance and Administration. Restricted* means that only the Minister has the authority regardless of the dollar amount if any of the following situations apply:

Note: With the exception of the Minister, an individual who is a participant at a hospitality event may not approve the expenditure initiation for hospitality. In such circumstances, the approval of higher authority is to be obtained. |

||||||

References:

Directive on Travel, Hospitality, Conference and Event Expenditures;

National Joint Council Travel Directive;

Section 12.(1)(b) of the Financial Administration Act;

National Public Service Week: Serving Canadians Better Act.

A6. Conference Attendance and Sponsorship

This is the authority to approve attendance at a conference or the sponsorship of a conference.

A conference refers to a congress, convention, seminar, symposium or other formal gathering, which are usually organized by a third party, external to government, where participants debate or are informed of the status of a discipline (e.g., sciences, economics, technology, management). Guest speakers are often part of such conferences that involve employees and/or non-public servants. Retreats, work-planning meetings and training seminars or courses that provide training are not considered as conferences.

The objective of attending a conference will be principally to support the delivery of the Agency’s operational activities and should be specified in the applicable conference approval document. Where travel is involved the travel authorization elements (i.e., objective of the travel, category, number of travellers, mode of transportation, accommodations, meals and incidentals) will apply, as well as the rationale for the minimum number of necessary conference participants.

The number of employees attending a conference from the agency will be the minimum necessary to achieve the agency’s objective. Where multiple employees will be attending the same conference, this constitutes an event, and the total planned conference costs will be provided for approval to the most senior approval authority as defined under section A7 “Events” of this Guide.

Conferences |

President |

Sector Head |

CFO |

|---|---|---|---|

Conference costs less than $10,000 |

Full |

Restricted |

Restricted |

Conference costs over $10,000 |

Full |

No authority |

No authority |

President in attendances at the conference |

No authority |

No authority |

Restricted |

Note: Any conference costs that are $10,000 or more must be reviewed and validated by Finance and Administration. |

|||

References:

TB Directive on Travel, Hospitality, Conference and Event Expenditures

A7. Events

This is the authority to approve events.

Events involve gatherings of individuals (both public and/or non-public servants) engaged in activities other than operational activities of the department. Examples of events include, but are not limited to:

- Management and staff retreats;

- Participation in conferences;

- Awards and recognition ceremonies; and

- Departmental celebrations.

This may include participants from other levels of government or foreign governments, foreign or political dignitaries, national or international organizations, industry representatives and public interest groups.

For the purpose of an event approval, total costs include items, such as conferences fees, professional services, hospitality, accommodation, transportation, meals and other relevant costs including those for participants on travel status. Total costs exclude salary costs for Federal Government Employees, as well as other departmental fixed operating costs.

Considerations

In situations where the Agency is organizing the event with a total departmental cost in excess of $25,000 and other departments are participating, it is incumbent on the lead organizing Sector to obtain estimated costs for the total of the participants from other federal departments. The participating departments are required to provide the estimated cost information including total estimated participant costs related to travel.

In circumstances where multiple levels of authority are required for an event and/or provision of hospitality, a single approval approach is to be followed. The highest approval authority would therefore provide the sole approval for the elements under this directive.

Events |

Minister |

President |

Sector Head |

Director General |

Regional Directors |

CFO |

|---|---|---|---|---|---|---|

Event costs not exceeding $25,000 |

Full |

Restricted |

Restricted |

Restricted |

Restricted |

Restricted |

Event costs over $25,000 but less than $50,000 |

Full |

Restricted |

No authority |

No authority |

No authority |

No authority |

President in attendance and event costs over $10,000 but less than $50,000 or President and Sector Head in attendance and event costs less than $10,000. |

Full |

No authority |

No authority |

No authority |

No authority |

Restricted |

Event costs exceed $50,000 |

Full |

No authority |

No authority |

No authority |

No authority |

No authority |

Note: Any event costs that are $25,000 or more must be reviewed and validated by Finance and Administration. |

||||||

References:

TB Directive on Travel, Hospitality, Conference and Event Expenditures

A8. Grants and Contributions

This is the authority to approve the funding of a grant or contribution project for individuals, organizations and other levels of government to participate in any of the four Funding Programs, as follow:

- Participant Funding Program

- Policy Dialogue Program

- Research Program

- Indigenous Capacity Support Program for IA

Grants and contributions are transfer payments made in accordance with the TB Policy on Transfer Payments, and TB Directive on Transfer Payments. Treasury Board and Agency policies, directives and guides governing Transfer Payments must be consulted and respected.

Transfer payments are payments, which are made on the basis of an appropriation for which no goods, or services are directly received, but which may require the recipient to provide a report or other information subsequent to receiving payments.

A grant is a transfer payment made to an individual or organization which is not subject to accounting or audit, but for which eligibility and entitlement may be verified or for which the recipient may need to meet pre-conditions.

A contribution is a conditional transfer payment to an individual or organization for a specified purpose pursuant to a contribution agreement that is subject to accounting and audit.

The Grants and Contributions Oversight Committee is responsible for reviewing available financial resources and for recommending annual allocations to the four programs, in line with TBS agreements. Subsequently, the Gs & Cs Oversight Committee may recommend reallocations during the fiscal year. The President has the authority to sign off on these allocations/reallocations.

Based on the program budget, and following the requirements set forth in a multi-year framework, signed by the President for each program, authorization to initiate expenditure is delegated as per A8 of the Chart (Grants and Contributions). This expenditure initiation may be for a project that involves disbursement of funds to multiple recipients (e.g., participant funding for an environmental assessment). The funding allocation to recipients is based on the recommendation of the Funding Review Committee. Authority to sign agreements with recipients is specified under D2 of the Chart (Grants and Contributions (Sign Agreements)).

Grants and Contributions |

President |

Sector Head |

Director General |

Director/ Executive Director |

|---|---|---|---|---|

Grants and contribution allocations not exceeding $100,000 |

Full |

Full |

Restricted |

Restricted |

Grants and contribution allocations exceeding $100,000 |

Full |

Full |

No authority |

No authority |

Note: Funding allocations should be recommended by the Funding Review Committee |

||||

References:

TB Policy on Transfer Payments;

TB Directive on Transfer Payments.

A9. Ex Gratia Payments

This is the authority to approve ex-gratia payments under the TB Directive on Payments.

An ex-gratia payment is a benevolent payment made by the Crown used only when there is no other statutory, regulatory or policy vehicle to make such a payment. The payment is made in the public interest for loss or expenditure incurred where the Crown has no obligation of any kind or has no legal liability, or where the claimant has no right of payment or is not entitled to relief in any form. It is a discretionary payment arising from a moral obligation or policy reason on the part of the Crown. The two qualifying conditions of an ex gratia payment are that there is no legal liability (does not require issues of legal liability to be resolved) AND it must be in the public interest to make the payment (i.e., there is a connection/link between some policy, action or inaction by a public body or publicly supported authority and the harm being compensated) .

In potential ex gratia cases, a review of applicable federal or provincial statutes, private or public programs, contract provisions, commercial insurance, recovery from outside parties, Treasury Board’s program funding or grant and contribution authorities must be carried out to confirm that there are no other means of compensation. If there is no other source of funds, no liability on the part of the Crown, and no limitation or restriction imposed in existing schemes which would prohibit it, payment may be made ex gratia.

Employee claims for damaged, lost, stolen or destroyed personal effects must be treated as claims and not asex gratiapayments. Compensation for the effects (replacement or repair, whichever is most appropriate) could be authorized when the decision-maker considers that the effects are reasonably related to the performance of the employee’s duties at the time of the loss or damage.

Ex Gratia |

President |

CFO |

|---|---|---|

Ex-Gratia payments less than $2,000 |

Full |

Restricted |

Ex-Gratia payments over $2,000 |

Full |

No authority |

Note: Legal Services must review all claims for ex gratia payments |

||

References:

A10. Claims against the Crown

This is the authority to approve payments for the settlement of liability claims against the Crown under the TB Directive on Payments.

A claim against the Crown is a claim in tort or extra-contractual claim for compensation to cover losses, expenditures or damages sustained by a claimant arising from government operations.

Claims being made that are covered by other authorities, governing instruments or policies are to be processed pursuant to those other authorities. The TB Directive on Payments does not apply to the relocation of household property and travel claims, or to the traditional remedies for settling bidding or contract performance disputes. These are treated in the NJC Relocation Directive, NJC Travel Directive, and TB Contracting Policy respectively. Claims for recovery of losses of public money are governed by the TB Directive on Public Money and Receivables.

CCM are encouraged to consult with their Financial Management Advisor (FMA) before recommending such payments.

A legal opinion from Legal Services must be obtained for all claims over $25,000.

In consideration of payment to settle a liability claim against the Crown, a release shall be obtained except where it would not be administratively expedient.

For a claim against servants of the Crown, one must ensure that the TB Policy on Legal Assistance and Indemnification is considered early in the process. Legal Services from the Department of Justice Canada advise on legal assistance at public expense and must be consulted.

All claims under the Canadian Human Rights Act, in view of their sensitive nature, shall be referred to Legal Services for their review and advice.

Claims against the Crown |

President |

CFO |

|---|---|---|

Claims payments up to $25,000 |

Full |

Restricted |

Claims payments over $25,000 |

Full |

No authority |

Note: A legal opinion from Legal Services must be obtained for all claims over $25,000. |

||

References:

TB Directive on Payments;

TB Policy on Legal Assistance and Indemnification;

TB Directive on Public Money and Receivables;

TB Contracting Policy;

NJC Relocation Directive;

NJC Travel Directive.

A11. Computers, IM/IT Equipment

This is the authority for acquisition of computers and IM/IT equipment that are not under the authority of Shared Services Canada.

Computers andIM/IT Equipment |

President |

CIO* |

CFO |

Director / Executive Director |

Manager / Chief of Staff / VP Exec Assistant |

|---|---|---|---|---|---|

Peripherals and components on the microcomputer National Master Standing Offers |

Restricted |

Restricted |

Restricted |

Restricted |

Restricted |

Printers, scanners and toners if purchased using a call-up against the Shared Services National Master Standing Offers |

Restricted |

Restricted |

Restricted |

No authority |

No authority |

Other IM/IT equipment such as docking stations, monitors, and systems such as desktops, notebooks and tablets must be purchased via Shared Services Canada |

No authority |

No authority |

No authority |

No authority |

No authority |

Note: Communicate with the Manager, IT Operations & Security for the purchase of computers and IM/IT equipment through the generic mailbox ceaa.ITServices-ServicesTI.acee@ceaa-acee.gc.ca. |

|||||

A12. All Other Expenditures

This is the authority to requisition goods and services expenditures that are not specified in the previous sections.

Expenditure Initiation – Authority Limits

Expenditure Type |

President |

Sector Head |

Director General |

Regional Director |

Director / Executive Director |

Manager/ Chief of Staff / VP Exec Assistant |

CFO |

DCFO |

Director of Communication |

|---|---|---|---|---|---|---|---|---|---|

Acquisition of goods and services not specified in other sections |

Full |

Restricted |

Restricted |

Restricted |

Restricted |

Restricted |

Full |

Full |

No authority |

Acquisition of goods and services for President and Sector Heads |

No authority |

No authority |

No authority |

No authority |

No authority |

No authority |

Full |

Full |

No authority |

Sponsorship |

Full |

No authority |

No authority |

No authority |

No authority |

No authority |

Full |

Full |

Restricted |

Memberships in private clubs (*See Note) |

No authority |

No authority |

No authority |

No authority |

No authority |

No authority |

No authority |

No authority |

No authority |

*Note: Private club membership does not include membership in a professional body, for example, the Chartered Professional Accountants of Canada, the Canadian Medical Association or the Canadian Bar Association. The Agency will not reimburse the cost for the Association for Professional Executives (APEX) membership. |

|||||||||

References:

TB Directive on Payments;

TB Directive on Public Money and Receivables.

B – Commitment Authority pursuant to FAA Section 32

This is the authority to approve FAA Section 32.

FAA Section 32

(1) No contract or other arrangement providing for a payment shall be entered into with respect to any program for which there is an appropriation by Parliament or an item included in estimates then before the House of Commons to which the payment will be charged unless there is a sufficient unencumbered balance available out of the appropriation or item to discharge any debt that, under the contract or other arrangement, will be incurred during the fiscal year in which the contract or other arrangement is entered into.

(2) The deputy head or other person charged with the administration of a program for which there is an appropriation by Parliament or an item included in estimates then before the House of Commons shall, as the Treasury Board may prescribe, establish procedures and maintain records respecting the control of financial commitments chargeable to each appropriation or item.

In summary the delegated authority needs to:

S32 (1) Verify Unencumbered Balance: Delegated authority needs to ensure that a sufficient unencumbered balance is available in his/her own budget; and,

S32 (2) Manage Commitments: After confirmation of a sufficient unencumbered balance, a commitment is recorded and updated according to CEAA Budgeting and Commitment Control Guideline.

References:

Financial Administration Act;

CEAA Budgeting and Commitment Control Guideline.

C – Contracting Authorities (FAA Section 41)

Contracting authority is the authority to procure goods and services and sign related contracts. This authority may not be exercised without the supporting signature of the appropriate manager who has expenditure initiation authority and commitment authority.

The objective of government procurement contracting is to acquire goods and services and to carry out construction in a manner that enhances access, encourages competition and reflects fairness in the spending of public funds and results in best value and withstands the test of public scrutiny in matters of prudence and probity or, if appropriate, the optimal balance of overall benefits to the Crown and the Canadian people.

When a requirement contains a blend of goods, services and/or construction, the required authority will be based on the element constituting the largest portion of the total requirement. For example, when the goods component is ancillary to the services component of a requirement, the services authorities should be used.

Note: All dollar limits inclusive of all applicable taxes (GST, HST, PST, QST, etc).

In accordance with chapter 6 of the Public Works and Government Services Supply Manual:

- Contracts are entered into by Her Majesty the Queen as represented by a minister. The authority to enter into contracts is generally in the legislation constituting the department or agency and conferring certain powers on a minister. The Department of Public Works and Government Services Act confers the Minister's contracting authority. The Minister's authority is delegated to the Deputy Head, who then sub-delegates to officers throughout the Department in order to carry out the internal contract process.

The financial limits are established by Treasury Board pursuant to the Financial Administration Act and are set out in the Treasury Board Contracting Policy.

Contracting officers are delegated authorities to enter into contracts and to sign and amend contracts in accordance with the level of responsibility of the position they occupy.

References:

Treasury Board Contracting Policy;

Public Works and Government Services Supply Manual;

Department of Public Works and Government Services Act;

Financial Administration Act.

C1. Low Dollar Value (LDV) Procurement (Goods and Services)/Acquisition Cards (<$5K)

This is the authority to procure low dollar value goods and services. The goods and services may be acquired with an acquisition card (maximum $5,000 per transaction), a local purchase order, by using a call-up against a standing offer or by such instrument as determined by the Manager, Administration.

When identifying LDV procurement requirements and exercising LDV authorities, delegated officers must not split or artificially divide requirements to meet the LDV threshold. In addition, delegated officers should determine the most appropriate procurement strategy that would obtain best value and ensure timeliness, efficiency and cost effectiveness, and support accountability in procurement activities by documenting rationales to support the selected procurement method and the basis of valuation.

Where an acquisition card is to be used, the cardholder must ensure that they obtain expenditure initiation approval, in accordance with the Agency instrument, from an individual with the delegated spending authority in those circumstances where the cardholder does not have that authority.

Low Dollar Value Procurement / Acquisition Cards |

President |

Sector Head |

Director General / Regional Director / Director / Executive Director |

Manager / Chief of Staff / VP Executive Assistant |

Admin Assistant |

CFO |

DCFO |

CIO |

CIO / Director Comms |

Manager |

|---|---|---|---|---|---|---|---|---|---|---|

Goods and Services up to $5,000 per transaction |

Full |

Full |

Full |

Full |

Full |

Full |

Full |

Full |

Full |

Full |

Goods and Services from $5,000 to $25,000 per transaction * |

Full |

No authority |

No authority |

No authority |

No authority |

Full |

Full |

No authority |

No authority |

No authority |

* Must be justified by a note to file. |

||||||||||

References:

Supply Manual>Chapter 3 -Low Dollar Value Procurements;

Acquisitions Program Policy Suite;

Public Works and Government Services Supply Manual;

Guidelines on Contractual Arrangements.

C2. Goods

This is the authority to procure goods with the use of local purchase orders.

The following types of goods must be purchased through Standing Offers:

- Administrative and Management Support Services

- Clothing, Accessories and Insignia

- Fuels, Lubricants, Oils and Waxes

- Furniture

- General Purpose Automatic Data Processing Equipment (including Firmware), Software, Supplies and Support Equipment

- Ground Effect Vehicles, Motor Vehicles, Trailers, and Cycles

- Information Processing and Related Telecommunication Services

- Office Supplies and Devices

- Personnel Recruitment

- Professional Services

- Office Machines, text processing systems and visible recording equipment

- Court Reporting

- Translation Services

Goods |

President |

Sector Head |

Director General / Regional Director / Director / Executive Director |

CFO |

DCFO |

Manager |

|---|---|---|---|---|---|---|

Procurement of goods with the local purchase orders up to $25,000 (total contract value, including amendments) |

Restricted |

Restricted |

Restricted |

Restricted |

Restricted |

Restricted |

Note: IM/IT Equipment must be purchased via Shared Services Canada except for equipment listed under A11. |

||||||

References:

Public Works and Government Services Supply Manual;

Acquisitions Program Policy Suite;

Guidelines on Contractual Arrangements.

C3. Services – Competitive Electronic Bidding System

This is the authority to procure services through contracts placed if proposals have been solicited through:

- A public notice by means of an approved electronic information service of procurement opportunities (e.g., the Government Electronic Tendering Service); or

- A public notice in the “Government Business Opportunities” publication, or such other procurement methods as may be approved by the Treasury Board.

Services – Competitive Electronic Bidding System |

President |

Sector Head |

CFO |

DCFO |

Manager |

|---|---|---|---|---|---|

Contract not to exceed $1M for the original or $0.5M for the total of all amendments |

Restricted |

Restricted |

Restricted |

Restricted |

Restricted |

Contracts not to exceed $2M for the original contract or $1M for the total of all amendments |

Restricted |

Restricted |

Restricted |

Restricted |

No authority |

References:

Supply Manual>Chapter 3 -Low Dollar Value Procurements;

Acquisitions Program Policy Suite;

Public Works and Government Services Supply Manual;

Guidelines on Contractual Arrangements.

C4. Services – Competitive

This is the authority to procure services where the process used for the solicitation of bids assures that a reasonable and representative number of suppliers are given an opportunity to bid, by one of two scenarios:

- First Scenario

- Giving public notice, in a manner consistent with generally accepted trade practices, of a call for bids with respect to a proposed contract; or

- Inviting bids on a proposed contract from at least three qualified suppliers on a suppliers’ list, and where at least two valid bids were received, the lowest or the bid offering the best value, as determined by the contracting authority, was accepted.

- Second Scenario

- Giving public notice, in a manner consistent with generally accepted trade practices, of a call for bids respecting a proposed contract; or

- Inviting bids on a proposed contract from at least three qualified suppliers on a suppliers’ list, and only one valid bid is received, and fair value to the Crown will be obtained as determined by the contracting authority.

Services – Competitive |

President |

Sector Head |

CFO |

DCFO |

Manager |

|---|---|---|---|---|---|

Contract not to exceed $200K for the original or $100K for the total of all amendments |

Restricted |

Restricted |

Restricted |

Restricted |

Restricted |

Service Contracts which total value, including all amendments, is $100,000 or less with Former Public Servants in Receipt of a Pension* |

Restricted |

Restricted |

Restricted |

Restricted |

Restricted |

Contracts not to exceed $400K for the original contract or $200K for the total of all amendments |

Restricted |

Restricted |

Restricted |

Restricted |

No authority |

* Treasury Board approval is required to enter into any contract which total value exceeds $100,000 with Former Public Servants in Receipt of a Pension, and Treasury Board approval is required to amend any contract which total value exceeds $100,000 with Former Public Servants in Receipt of a Pension. |

|||||

References:

Supply Manual>Chapter 3 -Low Dollar Value Procurements;

Acquisitions Program Policy Suite;

Public Works and Government Services Supply Manual;

Guidelines on Contractual Arrangements.

C5. Services – Non-Competitive

This is the authority to procure services where a bid/proposal is solicited from single source or where the conditions of a competitive solicitation are not met.

Services –Non-Competitive |

President |

Sector Head |

CFO |

DCFO |

Manager |

|---|---|---|---|---|---|

Contract not to exceed $25,000 for the original and the total of all amendments |

Restricted |

Restricted |

Restricted |

Restricted |

Restricted |

Service Contracts, for which total value, including all amendments, is $25K or less, with Former Public Servants in Receipt of a Pension* |

Restricted |

Restricted |

Restricted |

Restricted |

Restricted |

Contracts exceeding $25,000 |

Restricted |

No authority |

Restricted |

No authority |

No authority |

* Treasury Board approval is required to enter into any contract for which total value exceeds $25,000 with Former Public Servants in Receipt of a Pension; the fee component in any contract must be abated if the individual has been retired for less than one year and is in receipt of a pension; Treasury Board approval is required to amend any contract whose total value exceeds $25,000. |

|||||

References:

Supply Manual>Chapter 3 -Low Dollar Value Procurements;

Acquisitions Program Policy Suite;

Public Works and Government Services Supply Manual;

Guidelines on Contractual Arrangements.

C6. Call-up against Standing Offer or Supply Arrangement (including Temporary Help Services)

This is the authority to enter into contracts for the acquisition of goods or services within the terms of a standing offer or supply arrangement.

A Standing Offer is an offer from a potential supplier to supply goods, services or both, on the pricing basis and under the terms and conditions stated in the standing offer. Standing offers are established by competitive bidding or negotiation. A separate contract is entered into each time a call-up is made against a standing offer.

A Supply Arrangement is a method of supply used by Public Works and Government Services Canada (PWGSC) to procure goods and services. Like standing offers, it is not a contract and neither party is legally bound as a result of signing a supply arrangement alone. Supply arrangements include a set of predetermined conditions that will apply to bid solicitations and resulting contracts. They allow client departments to solicit bids from a pool of pre-qualified suppliers for specific requirements. This differs from standing offers that only allow client departments to accept a portion of a requirement already defined and priced. Many supply arrangements include ceiling prices which allow client departments to negotiate the price downward based on the specific requirement.

Call-up against Standing Offer or Supply Arrangement |

President |

Sector Head |

CFO |

DCFO |

Manager |

|---|---|---|---|---|---|

Standing Offers |

Full |

Full |

Full |

Full |

Full |

Supply Arrangements |

Full |

Full |

Full |

Full |

Full |

References:

Supply Manual>Chapter 3 -Low Dollar Value Procurements;

Acquisitions Program Policy Suite;

Public Works and Government Services Supply Manual;

Guidelines on Contractual Arrangements.

C7. Emergency Contracting

This is the authority to enter into contract in cases of pressing emergency.

Treasury Board defines a pressing emergency as a situation where delay in taking action would be injurious to the public interest. Emergencies are normally unavoidable and require immediate action that would preclude the solicitation of formal bids. An emergency may be an actual or imminent life-threatening situation, a disaster which endangers the quality of life or has resulted in the loss of life, or one that may result in significant loss or damage to Crown property.

Emergency Contracting |

President |

Sector Head |

Director General |

Director Regional |

CFO |

DCFO |

Manager |

|---|---|---|---|---|---|---|---|

Total contract value not to exceed $500K |

Restricted |

Restricted |

Restricted |

Restricted |

Restricted |

Restricted |

Restricted |

Total contract value not to exceed $1M |

Restricted |

Restricted |

No authority |

No authority |

Restricted |

No authority |

No authority |

Note: A report must be sent to the Treasury Board Secretariat within 30 days of authorization or beginning of the work. |

|||||||

References:

Guidelines on Contractual Arrangements;

Acquisitions Program Policy Suite;

Public Works and Government Services Supply Manual.

C8. Terms and Conditions of Appointment for Panel Members

This authority is given solely for the purpose of determining the terms and conditions of appointment for the services of ministerial appointed panel members or mediators in support of the Canadian Environmental Assessment Act, 2012.

Appointment for Panel Members |

President |

|---|---|

Determining the terms and conditions |

Full |

References:

Canadian Environmental Assessment Act, 2012.

D – Other Transaction Authorities

This is the authority to enter into agreements, MOU, real property agreements, etc.

D1. Memorandum of Understanding (MoU, ILA, Collaborative Arrangements, Revenue Agreements)

This is the authority to enter into and sign Memorandum of Understanding, collaborative arrangements, and revenue related agreements when the Agency is providing goods or services, paying or receiving money, or there is an explicit agreement to work cooperatively to achieve public policy objectives with other government departments (OGDs), other levels of government, non-governmental organizations, the private sector, universities, as well as individual Canadians, in order to advance the Agency’s objectives. In doing so, the Agency is extending its own capacity beyond the public good by recovering from those who directly benefit from activities that relate specifically to the Agency’s mandate (as described within the Canadian Environmental Assessment Act, 2012).

Termination of an Agreement

In cases where the Agency invokes a termination clause to terminate an agreement before the original end-date, approval from the delegated authority that provided the Transactional Authority approval would normally be required. Note that the Sector Head, at their discretion, may provide approval to terminate an agreement in lieu of the President. In addition, in cases of termination, advice from Legal Services usually should be sought.

Finally, should there be the potential for negative publicity or other implications to the Agency or Government of Canada resulting from the termination of the agreement, senior management and/or Communications should be advised, in advance, accordingly.

All agreements or MOUs in this section are subject to CEAA Budgeting and Commitment Control Guideline. Sector Heads may refer to their Financial Management Advisor (FMA) for further guidance.

Memorandum of Understanding (MoU, ILA, Collaborative Arrangements, Revenue Agreements) |

President |

Sector Head |

CFO |

DCFO |

Agreements |

Full |

Full |

Full |

Full |

References:

Canadian Environmental Assessment Act, 2012;

CEAA Budgeting and Commitment Control Guideline.

D2. Grants and Contributions (Sign Agreement)

This is the authority to sign grants and contributions agreements and amendments.

This authority cannot be exercised unless the expenditure initiation authority (A8) and FAA Sec.32 for this Grant or Contribution project has already been exercised.

Treasury Board and Agency policies, directives and guides governing Grants and Contributions must be consulted and respected.

Termination of an Agreement

In cases where the Agency invokes the Termination clause (in the G&C agreement) to terminate an agreement before the original end-date, approval from the delegated authority that provided expenditure initiation normally would be required.

In addition, in cases of Termination, advice from Legal Services usually would be sought before advising the recipient of the Termination pursuant to the termination clause of the agreement.

Finally, should there be the potential for negative publicity or other implications to the Agency or Government of Canada resulting from the Termination of the agreement, Senior Management and/or Communications should be advised in advance, accordingly.

Grants and Contributions |

President |

Sector Head |

Director General |

Director/ Executive Director |

Manager/ Chief of Staff / VP Executive Assistant |

CFO |

|---|---|---|---|---|---|---|

Agreements and Amendments |

Full |

Full |

Full |

Full |

Full |

Full |

References:

TB Policy on Transfer Payments;

TB Directive on Transfer Payments;

CEAA Budgeting and Commitment Control Guideline.

D3. Real Property Service Agreements

This is the authority to enter into real property agreements such as Specific Services Agreements (SSA), Tenant Direct Requests with Public Services and Procurement Canada (PSPC) service providers and Tenant Requirement Packages.

An SSA is a funding agreement between the Agency and PSPC where the Agency will be paying PSPC to undertake a project on the Agency's behalf (often real property or engineering services projects). A "SSA" is the written agreement between Agency (the "client") and PSPC that defines the scope, terms and conditions of a project and the work to be undertaken, details about invoicing/payment - basically it is the client's (the Agency’s) financial authority approval for the project.

Only certain functional positions in the Agency have the authority to negotiate and approve an "SSA" with PSPC. PSPC uses a form, usually referred to as an "SSA", to obtain the financial approval from the agency to commence the project. This form is available online PWGSC-TPSGC 5031-v2.

A Tenant Direct Request is a written agreement between a client department occupying space in a PSPC managed facility and PSPC’s service provider to provide certain real property services within the terms set out in the contract between PSPC and the provider.

A Tenant Requirement Package is a written agreement between a client department and PSPC outlining a department’s accommodation requirements when PSPC is acquiring new or expansion space on behalf of a tenant department.

Real Property |

President |

CFO |

DCFO |

Manager |

|---|---|---|---|---|

Service Agreements |

Full |

Full |

Full |

Full |

References:

TB Policy on Service;

TB Guideline on Service Agreements: An Overview;

Public Works and Government Services Supply Manual; and

TB Guidelines on Contractual Arrangements.

D4. Occupancy Instrument

This is the authority to sign Occupancy Agreements.

An Occupancy Instrument (OI) is a written agreement between PSPC’s Real Property Branch and a tenant department that defines the amount and type of space occupied by a tenant in a PSPC managed building, including the related rental costs. The OI also identifies the funding accountabilities of both PSPC and the Agency. Where the Agency has funding responsibilities (e.g., reimbursing arrangements, additional services), the OI serves as the agreement used for invoicing and payment.

Occupancy Instrument |

President |

CFO |

|---|---|---|

Occupancy Agreements |

Full |

Full |

References:

TB Policy on Management of Real Property;

Guide to the Management of Real Property.

2. Financial Authorities

Includes FAA Section 34 (Certification Authorities) and FAA Section 33 (Payment Authorities).

E – Certification pursuant to FAA Section 34