Guide to the Management of Real Property

Note to reader

- The Policy on Management of Real Property, the Directive on the Sale or Transfer of Surplus Real Property, the Accessibility Standard for Real Property, the Appraisals and Estimates Standard for Real Property, the Reporting Standard on Real Property, and the Fire Protection Standard were rescinded on May 13, 2022. They have been replaced by the Policy on the Planning and Management of Investments and the Directive on the Management of Real Property.

- Guides to support the implementation of the Policy on the Planning and Management of Investments and the Directive on the Management of Real Property are under development.

- Federal departments and agencies that are custodians of real property can refer to the Treasury Board of Canada Secretariat Acquired Services and Assets Sector Real Property GCpedia page for technical guides (accessible only on the Government of Canada network).

- The full technical guides can be obtained by contacting the Investment Management Directorate at TBS-SCTInvestmentManagement-Gestiondesinvestissements@tbs-sct.gc.ca.

Table of Contents

- 1. Introduction

- 2. Real Property: Description and Context

- 3. Objectives and Principles of Real Property Management

- 4. Departmental Planning and Real Property Management

- 5. Acquisition

- 6. Use and Occupancy

- 7. Disposal

- 8. General Transaction Guidelines

- 9. Enquiries

- Appendix A: References

- Appendix B: Real Property Glossary

- Appendix C: Administration

- Appendix D: Accommodation Guidance for Departments

Introduction

1.1 Purpose and scope

Federal real property managers and staff require a concise presentation of the various considerations—ranging from principles and logic to practical advice—that are needed to deliver real property services. The purpose of this guide is to meet that requirement.

The Guide is drawn from federal legislation, Treasury Board policies, directives, and standards that apply to the administration and management of real property. While the Guide does not replace any of those authoritative documents, to which access is facilitated by links that appear throughout the text, it can be relied upon to guide decision making and to assess performance at all stages of real property management. It can also serve as a monitoring tool, useful in determining departmental adherence to relevant legislative and policy requirements.

The scope of the Guide ranges from the broad conceptual issues to the day-to-day operations for which the Treasury Board is authorized to act. The guidance is also reflective of good managerial practices that go beyond Treasury Board policies. The Guide should prove useful in assisting public-sector managers in their responsibilities for the management of realty assets, whether subject to Treasury Board policies or not.

Guide organization

The information in this guide is organized with an eye to how it will be used. Some members of the real property community will be particularly interested in broader concepts and principles, either to refresh their memories or to get quickly on track if newly appointed to their positions. Others will refer to the Guide to get precise information and advice relating to the implementation phases of acquisition, use, and disposal.

The links provided throughout the text are important. If particular circumstances require information beyond what is set out in the Guide itself, the links provide a broader basis for decision making. Information provided by this guide and its links can also be supplemented by discussion with other real property officers within a department or in another department, with Department of Justice Canada legal advisors, or with officials at the Treasury Board of Canada Secretariat.

While sections 2 to 4 of the Guide describe basic concepts and overarching principles drawn from legislation and policy, sections 5 to 8 provide specific and detailed guidance on the physical life cycle phases of real property: acquisition, use and occupancy, and disposal. Specifically:

- Section 2 describes a few key terms, as well as the government structures, roles, and responsibilities that provide the context for real property management.

- Section 3 discusses management objectives and overarching principles for the effective management of real property.

- Section 4 describes departmental frameworks for real property management and planning, and addresses the link between strategic considerations, operational planning, and implementation.

- Section 5 sets out guidelines for the acquisition phase of the real property life cycle and provides an overview of acquisition choices and requirements for analysis.

- Section 6 provides guidelines for the use and occupancy phase of the real property life cycle, including discussion of the key role of performance assessment.

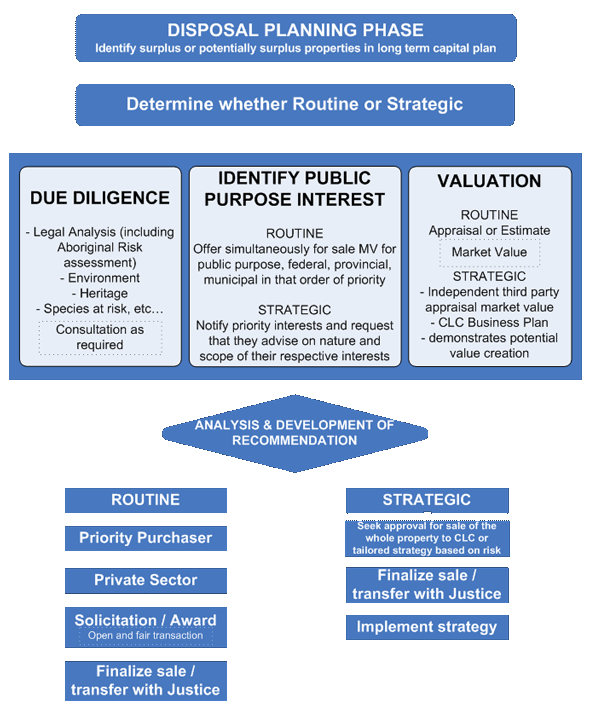

- Section 7 lays out guidelines for the disposal phase of the real property life cycle, including information on both routine and strategic disposals.

- Section 8 highlights and describes general guidelines on transactions that are relevant in all three phases of acquisition, use, and disposal.

Real Property: Description and Context

2.1 Description

According to the Federal Real Property and Federal Immovables Act, real property is lands, including mines and minerals, and buildings, structures, improvements, and other fixtures on, above, or below the surface of the land and includes an interest therein. The Act has application within and outside Canada (e.g., embassy lands and buildings). In the Province of Quebec, real property is referred to as an "immovable."

Real property is often referred to informally as "realty" or as real property "assets." It is clear that mines, minerals, buildings, land, and so on are assets that have value that can be quantified. Proper management of these assets is therefore as important as the proper management of other resources, including financial, that are administered by the federal government in the service of all Canadians.

For the purpose of Treasury Board policy and consequently this guide, consistent with the legislation just described, "real property" refers to any right, interest, or benefit in land, which includes mines, minerals, and improvements on, above, or below the surface of the land.

However, unlike the legal framework, the policy framework and this guide consider that any real property under a minister's administration or real property used by a tenant should be subject to the same management objectives and principles. The legal interest in the land, for policy purposes, is not the determinant factor in its stewardship.

2.2 Federal real property holdings

In Canada, the provincial and federal Crown holds 89 per cent of all land. Land management is primarily a provincial responsibility, with federal responsibility limited to lands required for Government of Canada operations and to public domain lands such as the territories, certain offshore interests, and land held under the Indian Act. Federal and provincial governments are responsible for lands under their respective jurisdictions and are generally not subject to each other's authority. This constitutional exclusion has required the federal Crown to self-regulate lands under its administration and control through a variety of statutes, regulations, and policies.

Canada's federal real property inventory is extremely diverse. It encompasses a variety of real property types, including land, buildings, bridges, marine navigation equipment, wharves, and monuments, among many others.

For more information on the administration of various categories of federal real property, see the guide titled Understanding Federal Real Property Management. This document provides a comprehensive overview of the federal real property management regimes.

In addition, the Directory of Federal Real Property, the central record and only complete listing of real property holdings of the Government of Canada, provides easy access to maps of and information on federal real property.

2.3 Federal government structure

The Treasury Board, the Treasury Board of Canada Secretariat, federal departments, and common service agencies are the key structural components of the management regime for departmental real property.

Departmental real property is the realty assets required by departments to carry out the Government of Canada's day-to-day operations. For the purpose of Treasury Board policy and this guide, a department is defined as in section 2 of the Financial Administration Act and includes agencies.

2.3.1 Treasury Board

The Financial Administration Act (FAA) authorizes the Treasury Board to act on all matters relating to the management and development of lands by departments, other than Canada Lands as defined in the Canada Lands Surveys Act. The president of the Treasury Board is the designated member of Cabinet responsible for departmental real property and as such is the individual who speaks for the federal government on issues of corporate interest that cross departmental lines.

While departments retain authority over real property required for departmental programs, the president is seen as a focal point for the coordination of departmental activities relating to specific real property issues. A key element of the Treasury Board's role is the review and approval of departmental investment plans, including assessment of the performance and cost of assets and acquired services from government-wide, horizontal, portfolio, departmental, and program perspectives.

2.3.2 Treasury Board of Canada Secretariat

The Secretariat is responsible for providing appropriate policies, directives, tools, and guidance necessary to support the government's policy direction and government-wide learning relating to real property and other administrative matters. The Secretariat monitors the implementation of Treasury Board policies in and across departments. It also performs a community leadership role by sharing information and fostering best practices.

The Treasury Board of Canada Secretariat's Assets and Acquired Services Directorate provides leadership for the overall management of departmental assets and acquired services. This involves giving direction, guidance, and advice to departments on investment planning, managing procurements, the management of real property and projects, fire protection, materiel management, and the provision of common services.

Aside from the relevant policy instruments under the Assets and Acquired Services policy framework, managers also have to be aware of and compliant with related Treasury Board policies in the areas of financial management, official languages, and occupational health and safety, to name a few.

The aim of the ensemble of policy instruments related to the management of real property is to ensure that real property supports the economic, effective, and efficient delivery of government programs through ethical, transparent, and sustainable life cycle management.

The Directorate also has responsibility for maintaining two data banks:

- the Directory of Federal Real Property (DFRP) that holds data on over 26,000 owned and leased federal properties across the country—its purpose is to maintain a contemporary record of basic information concerning the real property holdings of the Government of Canada; the Directory provides useful information to ministers, members of Parliament, and the general public concerning a specific property, or group of properties, within a particular geographic area.

- The Federal Contaminated Sites Inventory (FCSI) that contains information on all known or suspected contaminated sites, their location, and how they are being managed. Information in the FCSI forms the basis for reporting in the Public Accounts of Canada on the government's liabilities related to the contaminated sites. It also supports reporting on the implementation of the Federal Contaminated Sites Action Plan and government-wide progress in managing known contaminated sites, including remediation.

Both the DFRP and the FCSI provide useful information to parliamentarians, the media, and the general public concerning federal real property, as well as known or suspected contaminated sites for which departments and consolidated Crown corporations assume partial or full responsibility.

2.3.3 Departments

Under the Federal Real Property and Federal Immovables Act, administration of real property is assigned to individual ministers for the use of their departments, which are viewed as custodians.

Deputy heads are accountable to their respective ministers and to the Treasury Board for the management of realty assets and acquired services in their departments.

A department can be a custodian of either Crown-owned property, property in which the Crown has a leasehold (or other legal interest), or property it uses for program purposes by other means, such as a licence.

A department can also be a tenant of another government department with responsibilities for the space it occupies. There are several custodian departments that have other departments as tenants; however, Public Works and Government Services Canada, under its office accommodation program, and Foreign Affairs and International Trade Canada, under its diplomatic and consular programs, administer the vast majority of tenant arrangements.

Whether custodian or tenant, the deputy head of departments using real property are responsible for managing real property in accordance with Treasury Board policy direction. While the Treasury Board of Canada Secretariat oversees government-wide management performance, deputy heads are responsible for tracking and reporting on departmental performance and compliance for the management of real property.

2.3.4 Common service organizations

Common service organizations provide services to departments that support the effective management of real property. These organizations are responsible for contributing to the achievement of value for money for Canadians by providing professional services that are responsive to the needs of client departments in the most cost-effective way possible.

2.4 Parliamentary context

In addition to the oversight provided by the Treasury Board within the government itself, officers of the Parliament of Canada such as the Auditor General of Canada, the Information Commissioner, and the Commissioner of Official Languages provide review functions that are reported upon directly to Parliament.

Committees of Parliament have roles that include oversight but extend as well to a review of the adequacy of government laws, programs, and policies. For example, the House of Commons Standing Committee on Public Accounts focusses on the economy, efficiency, and effectiveness of government administration, as well as the quality of administrative practices in the delivery of federal programs and the government's accountability to Parliament with regard to federal spending.

2.5 Highlights of this section

As a valuable asset that enables the delivery of federal programs and benefits to Canadians, real property must be carefully managed to protect its value.

The management of departmental real property is achieved within a government structure that features the Treasury Board, the Treasury Board of Canada Secretariat, custodian and tenant departments, and common service organizations as key components.

- Treasury Board ministers, in their role of establishing a government-wide system of management and control for federal assets, have a particular interest in the effective stewardship of real property and are supported by the Treasury Board of Canada Secretariat for this purpose.

- While ministers have legal administration of real property, how deputy heads of departments manage valuable realty assets is guided by laws and by policies established by the Treasury Board and administered by its Secretariat.

- In addition to oversight of real property administration and management by the Government of Canada, through ministers of the Treasury Board supported by the Treasury Board of Canada Secretariat, parliamentary oversight is provided by agents of Parliament and by parliamentarians through the committee system of the House of Commons.

3. Objectives and Principles of Real Property Management

It is impossible to fully understand policy direction with respect to the management of real property without reference to the fundamental notion that the government exists to serve the public. Serving the public means addressing the needs and expectations of citizens, clients, and taxpayers in a balanced way.

The concepts in this section build on key objectives and management principles outlined in the Policy Framework for the Management of Assets and Acquired Services. The Framework consists of three major components: the public, the government, and departmental real property.

The public represents Canadians, defined as citizens, clients, and taxpayers, as well as their needs and expectations. Public needs and expectations are extremely diverse and often conflicting; they range from safety and security concerns, preservation of democratic values and our heritage to the amount of time citizens are willing to wait for service.

The needs and expectations of Canadians find their way to the Government of Canada’s overarching goals and priorities. For implementation purposes, these goals and priorities are in turn translated into government programs, as well as management and administrative policies.

In this context, the role of government departments can be seen as delivering programs and services in a manner that respects government policy direction.

In their basic form, the principles and objectives contained in Treasury Board policies fall into one of two broad categories or types:

- those concerned with how efficiently real property is managed in support of departmental programs—they include such management constructs as for example the value-for-money principle, life cycle costing, a portfolio-based approach, and the integration of real property management and planning with broader departmental management and planning frameworks; and

- those whose primary focus is on government objectives such as security, health and safety, environmental protection, heritage conservation, accessibility, and Aboriginal matters that relate to public interests that are broader than departmental program objectives.

The management of real property is therefore very much a balancing act. It requires departments to fulfil program objectives while balancing financial and efficiency-related asset considerations with broader public interest considerations. This may and in fact often does create tensions. These tensions are inevitable in that they reflect existing pressures within the public sphere, where the interests of taxpayers do not necessarily align with those of clients and/or citizens.

The current real property policy direction is premised on departments managing real property in support of efficient and effective program and service delivery. While supporting programs and services, real property must be managed in a manner that achieves value for money and demonstrates sound stewardship.

In this context, high-level objectives of federal real property management can be summarized as follows:

- supporting programs;

- achieving value for money and demonstrating sound stewardship; and

- fulfilling other government objectives.

3.1 Supporting programs

Departments hold and use real property only to support their department’s program objectives. This fundamental notion and underlying assumption forms the basis for the real property management regime and applies to every stage of real property life cycle management. Accordingly, departments:

- acquire or occupy real property only if it is required to support the achievement of departmental objectives;

- maintain real property in a state that does not jeopardize their capacity to deliver programs and services; and

- dispose of or vacate real property that no longer fulfils program objectives.

3.2 Value for money and sound stewardship

To achieve best value for Canadians, departments have to exercise due diligence in managing their real property assets, having regard for the principle of value for money. Key elements of sound stewardship and value for money in the management of real property include:

- a life cycle management approach reflecting the whole life cost of real property;

- integration of real property investment strategies with department-wide decision making, and strategic management and planning;

- a portfolio management approach to achieve efficiencies from a program and management perspective;

- effective governance, involving clear delegations of authority based on need, capacity, and a supporting regime of accountabilities and responsibilities;

- performance information and reporting; and

- risk management.

3.2.1 Life cycle management

The inherent feature of real property that distinguishes it from other asset types is its extended lifespan, which can reach a few decades and in some instances, such as in the case of heritage buildings, even a few centuries.

Traditionally, the physical life cycle of real property has been divided into three distinct phases: acquisition; use and operation; and disposal. For management purposes, however, a fourth phase is added: investment planning, which is a continuous process wherein the information outputs from each of the other three phases are used as inputs to planning.

Investment planning processes thus apply during all other phases in the real property management life cycle.

In addition, managing effectively requires that an appropriate level of management oversight and control be maintained through all phases in the property life cycle. Monitoring and reporting, while not associated with an asset's physical life, are key management functions to achieve continuous improvement.

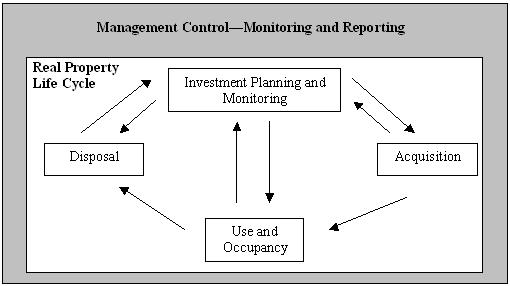

The management phases are summarized in the following diagram:

The Management Control - Monitoring and Reporting - Text version

The Management Control - Monitoring and Reporting Chart illustrates the relationship between the four real property life cycle management phases. The four phases include: investment planning and monitoring, acquisition, use and occupancy, and disposal. Investment planning and monitoring feeds into and incorporates processes from all three of the other phases. While, the final three phases follow a logical approach where acquisition related management processes feed into use and occupancy, while use and occupancy processes feed into disposal.

Life cycle costing

The extended life of real property has important implications for decision makers. For instance, an acquisition decision that is based on the lowest purchase price but that ignores potential operating and maintenance costs may result in a higher overall cost.

By using life cycle costing techniques, the total costs to the Crown of owning or leasing real property can be evaluated prior to acquisition. This is accomplished by taking into account such factors as the present value of future operation, maintenance, and disposal costs, in addition to initial and ongoing capital costs. Estimating life cycle costs also creates standards by which costs can be monitored and controlled after acquisition. By adopting this approach throughout, departments can move towards ensuring that their real property decisions represent the best value to the Crown.

In addition, the principle of best value to the Crown and value for money means, in part, that real property is managed in a financially responsible and prudent manner to maximize the long-term economic advantage to the government.

Maximum economic advantage means that departments seek to maximize the value or benefit of holding real property while minimizing the cost.

At the end of the asset's life cycle, one of the considerations of a disposal decision is how best to maximize the final return to the taxpayer while balancing myriad other interests.

3.2.2 Integration with strategic planning

Decisions about investing in real property cannot be made in isolation; rather they have to be an integral part of the overall departmental decision-making framework and be considered along with strategic planning for other physical assets, as well as for human and financial resources that support program and service delivery. The inclusion of real property investment considerations in a departmental strategic planning process provides an opportunity to examine and improve real property performance, as well as to explore solutions that may not require real property ownership.

The full cost of providing, operating, maintaining, and disposing of real property has to be reflected in departmental budgets.

At the strategic planning level, a rule of thumb is emerging in the public and private sectors that ascribes a notional amount that should be invested annually for the proper care of built assets (buildings, facilities, or public works such as roads and sewers). The informal rule of thumb is that a minimum 2 per cent of what it would cost to rebuild an asset is what should be invested annually for its maintenance and repair. Assuming that a built asset will last about 50 years, an additional 2 per cent should be invested in capital projects that renew the life of the asset. The rule of thumb for a minimum level of annual investment to maintain real property in good condition is therefore thought to be 4 per cent of replacement value.

Real property planners can use this informal rule of thumb when estimates of annual resource allocation for the proper care of the department's real property inventory are factored into departmental management and planning frameworks for all of the department's programs and operations.

Whether a department's budget allows for an allocation and expenditure in the order of 4 per cent of replacement cost will depend upon competing departmental and government priorities of various kinds. If an annual investment in this order of magnitude is not available for the care of a department's real property inventory, assets may deteriorate faster than life cycle forecasts would predict.

3.2.3 Portfolio-based approach

Effective management incorporates a horizontal and government-wide perspective when planning investments in real property. In addition, efficiencies are attained by embracing a portfolio approach to managing real property holdings rather than managing the inventory on an asset-by-asset basis. Thinking beyond the singular asset and beyond the department, where feasible, allows a department to maximize the level of utilization, minimize the need for new assets, and share associated costs.

The rule of thumb just described for annual investment in real property, for example, is best suited to a portfolio-based approach. This is because, whereas the 4 per cent target may be the right one over the life cycle of all assets in the portfolio, in any one year, the care of a particular asset, especially if recapitalization or reconstruction is required, may be far greater than the annual investment amount calls for. A portfolio-based approach enables recapitalization amounts to be concentrated where they are most needed.

Another benefit of the portfolio-based approach relates to risk management. Risks such as fire, defective components, damage from weather, or accidents of various kinds will, unfortunately, be realized from time to time. A portfolio-based approach allows for the reallocation of investment funds, within the amount planned for the whole portfolio, to respond to risk events that have actually occurred or to mitigate risks that have unexpectedly become very high (e.g. neighbouring forest fires or weather warnings).

3.2.4 Governance

Given the life cycle of real property, it may be that those responsible for acquisition activities and decisions within a department are not the same ones responsible for operating and use or disposal activities. This fragmentation of management responsibility over the real property life cycle can be problematic. A clear governance regime that communicates who is responsible for what and who is accountable overall is key to sound stewardship.

Responsible delegations of authority are based on need, organizational capability, and capacity and are subject to an effective internal control regime that calls for an understanding and clarity of departmental accountabilities and responsibilities, effective communications, and established competency standards.

The governance structure that supports real property management needs to be such that real property managers and staff have the information and confidence they need to report honestly to senior management on the performance of the assets. Those in senior positions in the structure need to have the authority and influence that ensures real property imperatives will be appreciated, even if those imperatives cannot always be accommodated and trade-offs must be made.

3.2.5 Performance information and reporting

Accurate, complete, timely and, most importantly, relevant information is a critical component of good management. A department that does not have requisite asset and associated financial information cannot hope to make informed, optimal decisions in support of program and service delivery.

An effective information system is also a key element of management control by enabling asset performance measurement, the accounting for and assignment of administrative and transaction costs associated with a property and the program it supports. A department with sound information management practices is able to collect relevant asset, financial, and program information to inform decision making and is able to report on the usage, maintenance, and overall performance of the real property it uses.

Reporting on the performance of realty assets should take into account what was proposed, what was intended, and what was ultimately achieved.

An effective information system provides the basis for reporting on how planned investment funds may have had to be reallocated to quickly mitigate or respond to risks.

Funds that were planned for a portfolio of assets and that had to be reallocated away from real property investment to other departmental program purposes will need to be recovered at some point in future years to avoid deterioration at a rate faster than life cycle predictions.

Real property practitioners are not required to be experts in financial matters, but because of the financial value of real property assets, good real property management includes a basic knowledge of the financial framework, as well as the accounting practices of the federal government.

Accrual accounting

Prior to April 2001, departments accounted for capital assets, including real property, on what is called a “cash” basis. The costs of land acquisition and building construction were written off, usually through a capital vote, in the year(s) during which related expenditures were made. The fact that the government owned billions of dollars in real property was not evident from the balance sheets of departments. The operating statements of departments reflected no amounts for amortization (also called “depreciation”) of the capital costs of buildings; essentially, the capital cost seemed to be a free good once construction was complete.

As a result, decisions about real property investments were significantly influenced by short-term deficit management requirements of the government. For example, a lease option would be preferred over capital construction because the immediate impact on the deficit (or surplus) is considerably less, despite the fact that proper economic analysis would indicate that construction maximizes the long-term economic advantage to the Crown and provides best value to the Canadian taxpayer.

Since April 2001, departments have been required to account for capital assets, including real property, on an accrual basis. Rather than being written off as they are incurred, capital expenditures are charged to, and accumulated as, capital assets on the balance sheet, and these costs are amortized to the operating statement on a monthly basis over the estimated useful life of the each asset, such as a building.

It is important to note that the costs being amortized are historical costs, so that the amounts charged to operations are not indicative of current values. Nevertheless, the fact that significant assets are owned is reflected on the balance sheet and the need to steward those assets well is evident. In addition, the amortization cost, which is essentially the cost of consuming the capital asset, shows on the operating statement so managers have a more complete understanding of the costs of programs and activities.

Accrual accounting values promote a life cycle view of the costs of capital assets. Given that the federal budget (usually tabled in Parliament in February) reports asset values calculated on an accrual basis, it is now more likely that decisions on investments in real property will reflect sound economic analysis and therefore maximize the long term economic advantage to the Crown.

3.2.6 Risk management

Risk management is a powerful tool that will assist decision makers at every step of real property life cycle management.

Risk analysis involves the stages of assessment, mitigation, monitoring, and reporting. Because risks, by their nature, are certain to occur from time to time (e.g., fire, storm damage) the management framework with regard to risk should provide a capacity to redirect funds within the real property framework or from other departmental programs to undertake urgent mitigation or repairs.

Risk identification should be undertaken in the planning stages, encompass the total expected lifetime of a property, and be integrated with an organization-wide risk management process. An accurate lifetime costing of real property assets will include an estimate of the cost to mitigate potential risk and/or deal with its consequences.

While risk identification and management are activities that must be responsive to particular circumstances, all officers of the federal public service must be attentive to the risk that government objectives may be compromised if real property assets do not perform as well as intended.

Risk in the real property sector should therefore be considered in terms of both departmental program and broader government objectives.

3.3 Fulfilling government objectives

Treasury Board policy and direction on the management of real property incorporate public service values and ethics, and reflect the government's objectives in such areas as security (relating to location, design, and condition), health and safety (relating to condition), protection of the environment, legal obligations (including Aboriginal rights), heritage conservation, and accessibility. Risk identification and risk management, in addition to departmental program risks, should also address these broader government objectives.

3.3.1 Security

The Government of Canada depends on its personnel and assets to deliver services that ensure the security of Canadians. It must manage these resources with due diligence and take appropriate measures to safeguard them from injury that might result from lapses in security.

Threats that can cause injury, in Canada and abroad, include unauthorized access, vandalism, fire, natural disasters, technical failures, and accidental damage. The threat of cyber attack and malicious activity through the Internet is prevalent and can cause severe injury to electronic services and critical infrastructures.

The Treasury Board policy instruments on security prescribe the application of safeguards to reduce the risk of injury. Many elements, some mandatory and some not, apply to the management of real property. Treasury Board policies on fire protection and related health and safety standards also ensure the protection of assets. From the earliest planning phase, departments ensure that real property under consideration or being designed meet the technical requirements of the National Building Code of Canada, the National Fire Code of Canada, and the National Farm Building Code of Canada.

Accordingly, managers must be aware of and understand the policy direction and guidance related to security, and health and safety matters.

3.3.2 Condition

The condition of real property bears directly upon concerns about security, and also upon health and safety. A real property asset that is in good condition is less likely to be one where a person may fall and be hurt, where loose materials may become dislodged, where drinking water may be unsafe because of contaminants in the pipes, and so on.

The condition of an asset will be impacted upon by its location. The location of an asset, of course, is in the full control of departments only at the acquisition stage. As the nature of threats changes over time (including the possible effects of climate change), built assets may require changes in design and construction in order to serve program objectives in ways that are secure and safe.

The key management tools addressing real property condition at the strategic level are the planning and reporting tools that are used in the context of departmental management and planning frameworks. A record of underinvestment, especially in the category of maintenance and repair for built assets, is a sure sign that the risks to health and safety associated with real property condition are on the rise.

At the operational and implementation levels, there are a number of additional tools that can be used to record and report upon the condition of assets.

3.3.3 Environment

The Government of Canada has special stewardship responsibilities in the area of environmental protection. Government policy requires departments to manage their real property in an environmentally responsible manner, consistent with the principle of sustainable development. The proper design, construction (including construction components), and good condition of built assets will help to mitigate risks of negative environmental impacts.

The environmental stewardship of real property is largely directed by legislation and regulations covering a wide range of environmental protection and conservation issues such as hazardous waste, Canadian wildlife, fish habitats, species at risk, etc.

In their everyday management of real property, departments strive for sustainable development by avoiding contamination, by promoting the efficient use of energy, improving resource utilization, reducing waste, creating efficient and effective designs, and preserving special natural spaces.

Each department should ensure that the environmental component of their real property management strategy is in line with any related objectives set out in its Sustainable Development Strategy and incorporates mechanisms to address any established environmental targets.

3.3.4 Legal obligations

Managers of real property must be fully knowledgeable about all legal issues that may impact the acquisition, ongoing use, and eventual disposal of the asset. The legislative regime is exhaustive and a list of the most relevant laws and regulations are included in the Policy on the Management of Real Property.

Two legal issues of particular note are title and legal obligations with respect to Aboriginal peoples.

Whether obtained at the time of acquisition or during the phase of use and occupancy, real property managers must ensure that federal title to the assets in their custody is clear or, if restricted in some way, that any cloud on title or legal burdens (such as rights of way) are fully understood. In addition to rights of way, there may be rights of first refusal applicable at the time of disposal. There may be restrictions on type of construction possible on a property being held by the federal Crown such as in the vicinity of airports.

Also of note are legal obligations with respect to Aboriginal groups and the requirement to ensure that the honour of the Crown is upheld where federal-Aboriginal relations are concerned.

Past decisions of the Supreme Court of Canada have the combined effect of imposing on the federal government a legal duty to consult and, if appropriate, to accommodate Aboriginal interests when the Crown has knowledge of the potential existence of Aboriginal rights, title, or treaty rights and contemplates conduct that might adversely affect them.

These Supreme Court decisions on Aboriginal rights have major implications for the management of real property. Although, to date, the most high-profile pressure points have been in the context of the sale of surplus strategic properties, the Court's direction potentially impacts all aspects of land management, such as purchase, change of use, licences and permits, as well as sales and transfers.

At its core, federal policy direction is about how to manage real property used for program purposes in accordance with principles of good stewardship. However, it is not divorced from the larger policy environment of government.

Therefore, in the context of Aboriginal issues, when making management decisions, departments need to assess whether or not Aboriginal rights, title, or treaty rights exist and, where they continue to exist, whether they could be negatively impacted. Given the convergence of legal obligations with respect to Aboriginals, real property policy, and treaty negotiation policy, departments should consult with departmental legal advisors, and Indian and Northern Affairs Canada in developing this assessment.

3.3.5 Heritage

The Government of Canada has special stewardship responsibilities with regard to the preservation of Canadian cultural heritage. Heritage buildings: The Minister of the Environment is responsible for approving the heritage designation of federal buildings while individual deputy heads, under Treasury Board policy, are responsible for respecting and conserving the heritage character of federal Crown-owned buildings and for all decisions affecting their heritage character.

To meet their responsibilities with respect to heritage buildings, departments work with the Federal Heritage Buildings Review Office (FHBRO) of Parks Canada to evaluate all Crown-owned buildings 40 years of age or older. This evaluation is done by the Federal Heritage Buildings Committee, which includes representation of the custodian department.

FHBRO Evaluation criteria are based on international conservation principles. Federal buildings are evaluated against the following criteria:

- historical associations;

- architecture; and

- environment.

Any building evaluated by the Committee is designated as either a classified, recognized, or a non-designated federal building. These categories are defined as follows:

- A classified federal heritage building is any building to which the Minister of the Environment has assigned the highest heritage designation. These buildings are the best examples of built heritage in Canada based on their heritage character and have scored between 75 and 135 points in the evaluation.

- A recognized federal heritage building is any building to which the Minister of the Environment has assigned the second-highest heritage designation. These buildings represent some of the best buildings in the country that have significant heritage elements that require protection, as defined in the heritage character statement, and have scored from 50 to 74 points in the FHBRO evaluation.

- A non-designated federal building is any building that has been evaluated by FHBRO and scored below 50 points, and was determined not to have enough heritage significance to rate a heritage designation. There are no special heritage obligations.

It should be noted that departments are not precluded from seeking an evaluation for buildings less than 40 years old. Departments can seek advice from FHBRO on whether or not an earlier evaluation is warranted in a particular instance.

Departments managing heritage buildings can seek advice from conservation specialists and consult with FHBRO, which assists federal departments in the protection of heritage buildings.

While Treasury Board policy is focussed on heritage buildings, real property managers also deal with issues concerning national historic site designation on property they use. Departments should consult with Parks Canada when planning any interventions, including disposals, at national historic sites. Departments are guided by various standards and best practices developed by Parks Canada on the conservation of historic places in Canada, including engineering works, landscapes, heritage buildings, national historic sites, and archaeological resources contained on lands departments administer.

There are other obligations related to the protection and conservation of heritage. The Government of Canada Archaeological Policy Framework establishes the importance of archaeological resources. In addition to outlining departments' responsibilities, the framework engages the federal government to ensure that archaeological resources under its authority are protected and managed and that appropriate instruments are in place to achieve this objective.

For more information about archaeology in Canada, please consult the Parks Canada's Managing Archaeology Web page.

For more information about policies, tools, the permit system or the research center at Parks Canada, please consult the Resources for Professionals page and take advantage of the links provided.

You can also contact the Archaeological Resource Management section by email at information@pc.gc.ca.

3.3.6 Accessibility

Accessibility to federal real property by persons with disabilities is a legal as well as a policy imperative. Under the Canadian Human Rights Act, it is a discriminatory practice for federal organizations to deny persons with disabilities access to federal real property, customarily available to the general public. The Treasury Board Accessibility Standard for Real Property addresses the basic needs of employees and the public using or receiving services on federal property. It cannot, however, practically address full accessibility for all potential disabled employees. These special needs are addressed in the Policy on the Duty to Accommodate Persons with Disabilities in the Federal Public Service.

It should be noted that the accessibility standard requires the application of most but not all elements of the technical standard found in the publication entitled Accessible Design for the Built Environment (CAN/CSA-B651-04).

3.3.7 Values and ethics

The policy direction on the management of real property reflects the Code of Values and Ethics for the Public Service.

The concepts discussed above are consistent with the democratic, professional, ethical, and people values of the public service.

Among other things, managers of real property exercise due diligence in the discharge of their responsibilities, follow the rule of law, transact openly in a way that provides equitable opportunity and treatment of interested parties. They collaborate, consult, and consider the government's broad agenda while managing the asset base and meeting operational and strategic needs. They are mindful of the security, health, and safety of government employees, clients, and the general public. They manage in a manner consistent with the principle of sustainable development, conscious of their responsibilities toward the environment and cultural heritage.

Their values influence their actions; their ethics guide them to do the right thing.

3.4 Highlights of this section

- For every real property asset used by a department, it should be possible to describe the ways in which that asset relates to, or directly supports, the departmental programs being delivered.

- Real property assets are valuable resources and must be managed effectively in order to maintain their value and maximize their performance in support of departmental programs.

- Effective management of real property entails the key elements of a life cycle and portfolio approach; integration with department-wide strategic management and decision making; strong governance structures appropriately designed for the oversight and delivery of real property services within the department's overall management structures; performance measurement and reporting; and risk identification and management.

- In addition to effective delivery of departmental programs, real property managers must meet broader government objectives such as security, health and safety, protection of the environment, heritage conservation, and so on. This means that some assets may require a higher standard of maintenance than the operational requirement alone may dictate.

- Risk assessment, mitigation, monitoring, and reporting must relate not only to the performance of real property in supporting the successful delivery of departmental programs but also to the broader government objectives inherent in the policy direction of managing realty assets.

4. Departmental Planning and Real Property Management

Effective real property management requires decision-making frameworks for investment planning and management that link real property to the delivery of departmental programs.

Achieving the integration of real property management with the management of all other departmental business may lie outside the scope of duties of most real property managers and staff. All real property staff, however, can play a part in informing other departmental officers-at all levels-of what is required in order to provide effective and efficient real property support.

4.1 Real property management framework

A real property management framework is a control structure set up by a department to operationalize Treasury Board policy direction to effectively and efficiently manage its real property inventory and associated responsibilities. In its most basic form, the real property management framework is the departmental master plan for managing real property in an integrated fashion with other departmental resources to meet operational needs, i.e. it is a corporate activity. As a corporate activity, the real property management framework will typically provide a central role to senior managers at the assistant deputy minister level.

A good master plan provides a comprehensive, coherent, and cohesive departmental approach to the stewardship of real property. Controls ensure the objectives of effectiveness and efficiency are met. At a minimum, a management framework consists of appropriate accountability and decision-making structures, planning structures and process, clearly communicated authorities, segregation of responsibilities, appropriate policies and practices, and financial and real property information systems that support informed decision making and allow for timely monitoring of performance targets and results.

A real property management framework is premised, in part, on the consideration of the real property as one input to program delivery; the recognition of its financial and service values; life cycle management; sustainability; risk management; performance measurement; and linkages between senior-level and operational planning. The framework will evolve over time to continually reflect the optimal approach to managing real property responsibilities in an integrated fashion as program objectives and external circumstances change.

4.1.1 Accountability and decision making

A clear governance regime that communicates who is responsible for what and who is accountable overall is key to sound stewardship.

Responsible delegations of authority are based on need, organizational capability, and capacity and are subject to an effective internal control regime that calls for an understanding and clarity of departmental accountabilities and responsibilities, effective communications, and established competency standards.

4.1.2 Departmental policies, processes, and procedures

Internal policies, processes, and procedures articulate a department's policy direction and management expectations, how to meet those expectations, and how the department will monitor and assess its management performance. The absence of internal real property direction, or the existence of outdated direction, is generally an indicator that departmental controls are weak and not as effective as they could be.

Departmental policy direction flows from the management principles and expectations of the Treasury Board and must respect applicable legislative and regulatory regimes.

Departmental real property policy direction addresses both strategic and operational issues to ensure cohesion and integration of departmental real property management with the department's business and strategic plans.

Effective policy direction:

- addresses all aspects of a real property's life cycle;

- is communicated to all relevant staff;

- is updated regularly; and

- is supported by appropriate systems.

Real property information system

An appropriate information system is an important element of any real property management framework, as historical, current, and reliable information is vital to informed decision making and to the forecasting of future trends and needs.

The size and complexity of a department's real property information system will depend on the extent and diversity of the real property used.

To ensure informed decision making, the information system should allow for integrating real property information, including performance information, with information required for financial accounting and any necessary reporting.

In addition to maintaining an internal real property information system, custodian departments support a whole-of-government approach to information by recording and updating information in the Directory of Federal Real Property and the Federal Contaminated Sites Inventory.

Financial system

A financial system that addresses the needs and complexity of a department's real property inventory must also be part of the department's management framework. Effective departmental planning and investment are impossible without a system that incorporates information captured in the real property information system and relates it to the program obligations and funding capacities of the department.

4.2 Investment Planning

4.2.1 Planning framework

A framework for real property planning is required to ensure that departments make balanced real property investments that meet program needs within existing reference levels, while fulfilling other federal policy requirements. In addition, it is critical that departments provide for and monitor implementation and take corrective action as appropriate. Creating and maintaining an investment planning framework for real property is typically led within departments by an official at the director general level.

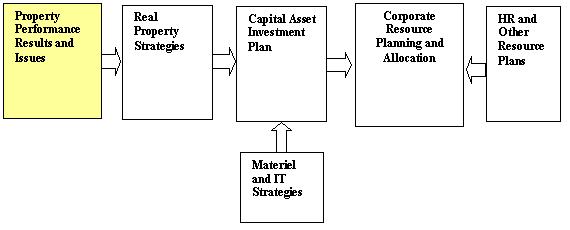

Policy direction concerning long-term capital plans dictates requirements for planning investments in all capital asset classes (including materiel, information management/information technology, and real property). This guide elaborates on the requirements for investment planning for real property only. This includes investments being made both as a custodian and as a tenant. Real property has significant strategic, public policy, operational, risk, and financial implications and merits the full attention and diligence of departmental managers. Real property strategies, developed as a result of the performance assessment of the existing asset base, as well as ongoing and new requirements, inform the higher-level departmental investment planning activity.

The following key elements of planning make the link between strategic-level considerations and regional or local ongoing planning:

- Real property planning strategies - Departments require cost-effective investment strategies that reflect departmental goals and the government's management agenda. In order to do this, there is a need to focus on the following:

- User requirements and needs: Consideration of these ensures that plans are based on essential needs for departmental programs and activities, and that the emerging real property portfolio is responsive and cost-effective.

- Demand management: This ensures the judicious use of available assets to meet evolving requirements within existing reference levels and even to achieve savings.

- Service posture: This addresses cost-effective options for real property ownership, optimal location, levels of service, asset sharing, etc. and helps link demand and supply management.

- Supply management: This encompasses the range of strategies and options that departmental managers consider and implement in meeting their stewardship obligations, including strategies to address health and safety, and other compliance requirements such as accessibility, heritage, and environment.

- Life cycle management: This involves the need to continually assess acquisition, use, reinvestment, and disposal strategies and to consider all related costs of continuing involvement of an asset over time.

- Compliance: This is an essential element and key theme of all plans. Related costs should be identified in the plans.

- Risk management: This requires departments to define risks and explain how the proposed strategies manage and mitigate these risks.

- Performance monitoring: This is a key contributor to cost-effective management. By continuously measuring real property performance against established targets, departments have quality information to inform the development of real property strategies.

- Processes - Investment planning processes should be fully integrated within existing departmental strategic, corporate planning and risk, and resource management functions. Examples of key processes are as follows:

- Annual planning and budgeting cycle: This enables the annual allocation of resources for real property investments in a systematic, rational, and transparent manner.

- Priority determination process: This ensures that all proposals under consideration are assigned a priority ranking in a manner that is objective, transparent, and based on sound business cases.

- In-year resource reallocation process: This enables the annual reallocation of resources for real property investments in a systematic, rational, and transparent manner as the fiscal year evolves.

- Program creation and expansion process: As new programs are created and as existing programs expand, departments need to ensure all resourcing inputs are taken into account.

- Information - Effective investment planning requires information that is relevant and timely, complete and accurate, consistent, and readily available. This includes:

- planning and budgeting information: allocation of funding;

- capitalization of assets information: consistent with accrual accounting;

- maintenance planning and repair information: effective maintenance planning is a cornerstone for sustaining real property in a cost-effective manner;

- in-year accounting and forecasting information; and

- performance information: the result of the required performance assessments.

- Governance - A sound governance regime for real property investment planning needs to be integrated into the department's business model and is usually based on senior management engagement, a well-defined regime of roles, responsibilities, and accountabilities for asset and related funding management, and internal delegations of authority for project/proposal approvals and real property transaction approvals that are appropriate to the complexities and risks being addressed.

- Decision making - Effective decision making will include attention to the following categories:

- Real property plan: This includes prioritized acquisition, maintenance, re-capitalization, and disposal strategies. It also includes tenant investments in properties under the administration of other federal departments.

- Project: A project defines the nature and scope of a proposed investment and is linked to expenditure authority. Acquisition of real property is normally only one of numerous activities being managed as part of an overall project and, as such, needs to be fully integrated into the governance, management, and oversight of projects. Project proposals must be supported by an investment analysis based on life cycle costing.

- Real property transaction: A real property transaction is effected when a decision is made to acquire an interest in real property (e.g., purchase, lease, lease/purchase) or acquire the right to use it (e.g., licence).

- Directing and monitoring implementation: Departmental managers must provide direction, expertise, tools, and capacity to implement and monitor the implication of real property investment decisions and take corrective action where necessary.

4.2.2 Investment analysis

All investment decisions must be supported by an investment analysis based on life cycle costing to be able to demonstrate that the option selected, whether for acquisition, ongoing use, or to prepare for disposal, is in the best interests of the department and the Crown. An investment analysis should include:

- the expected duration and changing needs of the program, including the effects of information technology and security considerations on service delivery and program needs;

- trade-offs between different investment options, such as construction versus lease, capital investment versus operations and maintenance;

- opportunity costs and the value of money over time;

- costs associated with the location of the real property;

- disinvestments or disposal opportunities;

- the highest and best use of the property;

- the maximum program use;

- broader policy and government objectives and priorities;

- security considerations; and

- stakeholders-departments, organizations, and individuals inside and outside the federal government that will be directly or indirectly affected by the proposed investment.

Life cycle costing is a logical, systematic process for estimating the total cost of real property through its whole life, from the initial planning to acquisition, use, and disposal. Life cycle costing considers all known current and future real property costs, to provide a coherent view of the true overall cost of the property to the government.

Often, the option or alternative with the lowest initial cost may not represent the solution that generates value for money. This is because long-term costs over the life of real property are more reliable indicators of value for money than initial acquisition costs, which typically represent only a small percentage of whole life costs. Through the life cycle costing process, trade-offs between different investment options, such as capital versus operations and maintenance, can be evaluated. By spending time and effort at the planning stage to assess all life cycle costs, value can be achieved by generating a higher-quality project at lower life cycle costs.

The final product in life cycle costing should be a summary of all relevant real property costs over the expected life of a given property, put into present value terms.

4.2.3 Payments in lieu of taxes (PILT)

The full cost of an asset to the department includes amounts that are paid to local governments in lieu of taxes.

Under section 125 of the Constitution Act, 1982, the Government of Canada is exempt from taxes of every kind. However, since 1950, the government has chosen to pay its share of taxes to Canadian municipalities and taxing authorities by making payments in lieu of taxes. The minister of Public Works and Government Services, under the authority of the Payments in Lieu of Taxes Act, determines the PILT amounts, makes the payments to municipalities, and is accountable to Parliament for the administration of the Act.

Custodian departments are responsible for funding the payments and assume the risks and rewards associated with PILT budgets and expenditures. As such, departments should be conscious of how real property requirements, uses, and activities impact PILT levels; understand how to potentially realize PILT savings and know how the program is managed by Public Works and Government Services Canada (PWGSC). A memorandum of understanding between PWGSC and custodian departments should be in place to outline the working relationship of the parties involved and to ensure financial and operational accountability while promoting efficient program delivery. Custodians must ensure that PWGSC is making PILT payments only for properties that they own-a complete and accurate real property inventory is essential to achieving this.

The PILT program is based on equity with other property owners and fairness to municipal governments. Departments should receive the same level of services provided to other property taxpayers. If municipalities are unable or unwilling to provide these services, departments can request that the minister of Public Works and Government Services consider reducing the amount of PILT paid. A department cannot demand a higher standard of service than that provided to other taxpayers unless it is prepared to pay for it.

4.3 Highlights

The following highlights summarize the material covered in this section:

- The departmental management framework for implementing the department's mandate from the government should include elements specific to real property that demonstrate the link between program delivery and the real property that supports those programs.

- Real property management includes a governance structure within which accountabilities and responsibilities are well defined, commonly understood, and communicated widely.

- Decision-making structures and processes are in place and functioning well.

- Roles, responsibilities, and accountabilities have been assigned for all activities associated with real property management, including for the performance of the asset:

- they are clearly defined and understood throughout the organization;

- staff members have access to tools to enable them to meet their responsibilities; and

- managers and staff have had requisite training to meet their accountabilities and responsibilities.

- There is segregation of responsibilities where a conflict or perceived conflict of interest could arise.

- Departmental policies, processes, and procedural documentation exist:

- they provide clear direction that links operational and strategic real property management activities; and

- they are readily available to staff.

- Real property management information is maintained on the portfolio and its operating activities:

- it is readily accessible, is easy to use, and enables informed decision making; and

- it includes all costs associated with the assets, including PILT.

- The control structure that ensures performance against targets and plans is regularly measured and reported to those staff with real property management responsibilities, to departmental and portfolio senior management, and to external organizations, as applicable.

5. Acquisition

Tenant responsibilities in the management of real property are primarily addressed under the planning function in the previous section of the Guide and under the “use” phase of the asset's physical life cycle. However, a custodian that habitually has other federal organizations as tenants is reminded of the need to consider tenant requirements when determining the optimal acquisition decision.

5.1 The acquisition decision

The fundamental policy principle underlying any acquisition of real property by the government is that the property is needed to support the delivery of government programs. Departmental investment planning and real property strategies will identify the need for additional real property investment when there is a new requirement or there is a gap between existing supply, and by extension its performance, and the real property required to fulfil ongoing program needs (i.e. demand).

Before bringing new assets into a department's—and therefore into the government's—real property inventory, priority should be given to maintaining and preserving long-term assets and reducing operating expenses unless these are inconsistent with program priorities or not in the best economic interest of the Crown. Other alternatives may include increasing the utilization of existing real property or redesigning program requirements to reduce the demand on real property.

Prior to acquiring real property, departments should consider whether the public or private sector is best equipped to finance, design, build, own, or operate the required asset.

Basic models for real property investments, which are predicated on different levels of risk being transferred or allocated to the private sector, are listed below. As the list goes down, models incorporate increasingly higher degrees of both private-sector involvement and private-sector risk:

- Traditional procurement: The government buys real property or designs, finances, builds, and operates a real property facility.

- Design-Build: The government finances a real property project and engages a private-sector partner to design and build the facility; the government owns and operates the facility.

- Lease: The government leases a real property, using either a capital lease or operating lease.

- Design-Build-Operate: The government finances a project, sets performance objectives, and engages a private-sector partner to design, build, and operate the facility for a specified period (typically including such services as building maintenance); the government retains ownership.

- Build-Lease-Operate-Transfer: The government sets performance objectives and engages a private-sector partner to design, finance, build, and operate a new facility (on public land) under a long-term lease; ownership is transferred to the government at the end of the lease.

- Build-Own-Operate: The government sets objectives and constraints in agreement with the private sector and through ongoing regulatory authority; a private-sector partner finances, builds, owns, and operates the facility in perpetuity.

The above models have a wide range of implications for issues such as risk transfer, real property ownership, operations, accounting, and debt reporting. To aid with decision-making, departments should develop screening criteria through which to identify projects that may be appropriate for public-private partnerships. Seven basic criteria are as follows:

- Financial: Can the selected model for acquisition accommodate financial terms acceptable to both parties?

- Technical: Can the selected model for acquisition result in a technical solution to meet project needs?

- Operational: Could operational hurdles undermine the selected model for acquisition?

- Public policy: Will the public sector accept private involvement? Is this public policy?

- Implementation: Could implementation barriers prevent the use of the selected model for acquisition?

- Timing and schedule: Could time constraints pre-empt the selected model for acquisition?

- Organizational capacity: Does the organization have the skills, resources, and track record to execute the project?

Once the investment model in support of the acquisition is chosen, departments then have to determine which policies, legislation, and regulations must be followed, given that a project may involve a number of activities. If the option analysis leads to a decision to make a new investment that does not involve acquiring an interest in real property, such as Crown construction on existing federal property, or to seek an alternative service provider (i.e. ASD), guidance on these real property-related issues is available through the Investment, Project Management and Procurement Policy Directorate (IPMPPD) of the Secretariat for project management and procurement advice.

5.2 Crown ownership or other option

Acquisitions must be supported by market analysis. As a first step, departments should determine whether or not there is any available federal property (transfer of administration from another department) that would meet the requirement. Another consideration would be the renewal of an existing lease. However, in considering a lease renewal as a possible option, it needs to be assessed as a new acquisition that meets all current obligations, e.g., accessibility and security. Lease renewals are not grandfathered should policies or standards change during the original lease term.

Whatever option is chosen, if the public sector is involved in fulfilling the real property requirements, open and fair solicitation processes must be used to ensure the public is given a reasonable opportunity to respond to any opportunity to sell or lease property to the government.

The department must be able to demonstrate that the acquisition option that was selected is in the best interests of both the department and the Crown.

Leases versus Crown ownership

In addition to using life cycle costing tools, when deciding whether to lease or “own” real property, departments should consider the following.

In general, a lease is more appropriate:

- when there are only short- or medium-term requirements or when the term is uncertain, in order to avoid the costs and uncertainties of acquisition and disposal of owned real property; or

- for very small space requirements that are usually available only as part of a larger facility.

In general, Crown ownership is more appropriate:

- when extensive fit-up and relocation costs are anticipated;

- when program requirements demand long-term, secure tenure;

- when there is a requirement to control the use of the land, particularly when the control is protective in nature and it extends for some time into the future;

- for uses that may otherwise cause problems when the reversionary interest returns to the lessor on the expiry of the lease;

- when market conditions such as limited supply preclude other options, e.g., a lease; or

- when private-sector supply cannot meet federal policy requirements, i.e. fire protection, accessibility, and security.

The cost of borrowing money is typically higher for the private sector than it is for the federal government. Thus, real property costs would be higher for the private sector in this respect. In their decision-making processes, departments should identify the extent to which the purchase price, construction cost, or rental rate reflects this additional cost (the cost of capital).

When considering whether to own or lease, departments should also take the following factors into account:

- Prices and rental rates fluctuate; thus, departments should take advantage of market conditions.

- Certain facilities are normally available in the market or become available in response to demand; others can generally be produced only through construction or extensive renovation.

- The funds for capital projects may not be available.

If a decision is taken to lease, the terms of the lease should be kept to the shortest reasonable period supported by program needs.

5.2.2 Types of lease

Operating leases: In their analysis, departments should take into consideration the fact that the life of operating leases is less than the economic life of real property assets. Nonetheless, since operating leases are generally short term, they provide greater flexibility to adapt to change. Other advantages of operating leases include:

- a reduced need for large capital outlays; and

- isolation from short-term fluctuations in market supply and values.

However, significant disadvantages of operating leases include:

- penalty clauses for early termination of leases;

- higher implicit interest costs in leases compared to the cost of funds to the government; and

- dependence on the market to supply real property leading to long-term exposure to market cycles and values.

Operating leases have traditionally been the most common form of lease used by the federal government. However, there is a growing interest in capital leasing.

Capital leases are effectively a vehicle for financing the purchase of an asset. From this viewpoint, the use of a capital lease is not significantly different to Crown ownership. In a capital lease, the risks and benefits of ownership are primarily transferred to the lessee, as opposed to an operating lease, wherein the lessor retains all the risks and benefits associated with real property ownership.

Leases are defined as capital leases when at least one of the following criteria applies:

- the lease transfers ownership to the lessee by the end of the term of the lease;

- the lessee can purchase the real property at a price below fair market value when the lease expires;

- the lease term is 75 per cent or more of the estimated economic life of the real property; or

- the present value of the lease payments is at least 90 per cent of the fair market value of the real property at the start of the lease.

The principle distinction between outright purchase of real property and a capital lease is that the capital cost involved in the project can be spread out over time. This is typically argued as a benefit of capital leases.