CompassRx, 6th Edition

Annual Public Drug Plan Expenditure Report, 2018/19

ISSN 2369-0518

Cat. No.: H79-6E-PDF

December 2020

PDF - 2.4 MB

Table of Contents

- Executive Summary

- Introduction

- Methods

- Limitations

- 1. Trends in Prescription Drug Expenditures, 2013/14 to 2018/19

- 2. The Drivers of Drug Costs, 2017/18 to 2018/19

- 3. The Drivers of Dispensing Costs, 2017/18 to 2018/19

- References

- Appendix A: Drug Reviews and Approvals

- Appendix B: Distribution of New Patients on Select DMARDs by Jurisdiction

- Appendix C: Top 50 Patented Medicines by Drug Cost

- Appendix D: Top 50 Multi-Source Generic Drugs by Drug Cost

- Appendix E: Top 50 Single-Source Non-Patented Medicines by Drug Cost

- Appendix F: Top 50 Manufacturers by Drug Cost

Acknowledgements

This report was prepared by the Patented Medicine Prices Review Board (PMPRB) as part of the National Prescription Drug Utilization Information System (NPDUIS) initiative.

The PMPRB wishes to acknowledge the members of the NPDUIS Advisory Committee for their expert oversight and guidance in the preparation of this report. Please note that the statements and findings for this report do not necessarily reflect those of the members or their organizations.

Appreciation goes to Yvonne Zhang for leading this project, and to Tanya Potashnik and Jeffrey Menzies for their oversight in the development of the report. The PMPRB also wishes to acknowledge the contributions of analytical staff Nevzeta Bosnic and Ai Chau and editorial staff Sarah Parker and Shirin Paynter.

Disclaimer

NPDUIS operates independently of the regulatory activities of the Board of the PMPRB. The research priorities, data, statements, and opinions expressed or reflected in NPDUIS reports do not represent the position of the PMPRB with respect to any regulatory matter. NPDUIS reports do not contain information that is confidential or privileged under sections 87 and 88 of the Patent Act, and the mention of a medicine in a NPDUIS report is not and should not be understood as an admission or denial that the medicine is subject to filings under sections 80, 81, or 82 of the Patent Act or that its price is or is not excessive under section 85 of the Patent Act.

Although based in part on data provided by the Canadian Institute for Health Information (CIHI), the statements, findings, conclusions, views, and opinions expressed in this report are exclusively those of the PMPRB and are not attributable to CIHI.

Contact Information

Patented Medicine Prices Review Board

Standard Life Centre

Box L40

333 Laurier Avenue West Suite 1400

Ottawa, ON K1P 1C1

Tel.: 1-877-861-2350

TTY 613-288-9654

Email: PMPRB.Information-Renseignements.CEPMB@pmprb-cepmb.gc.ca

Executive Summary

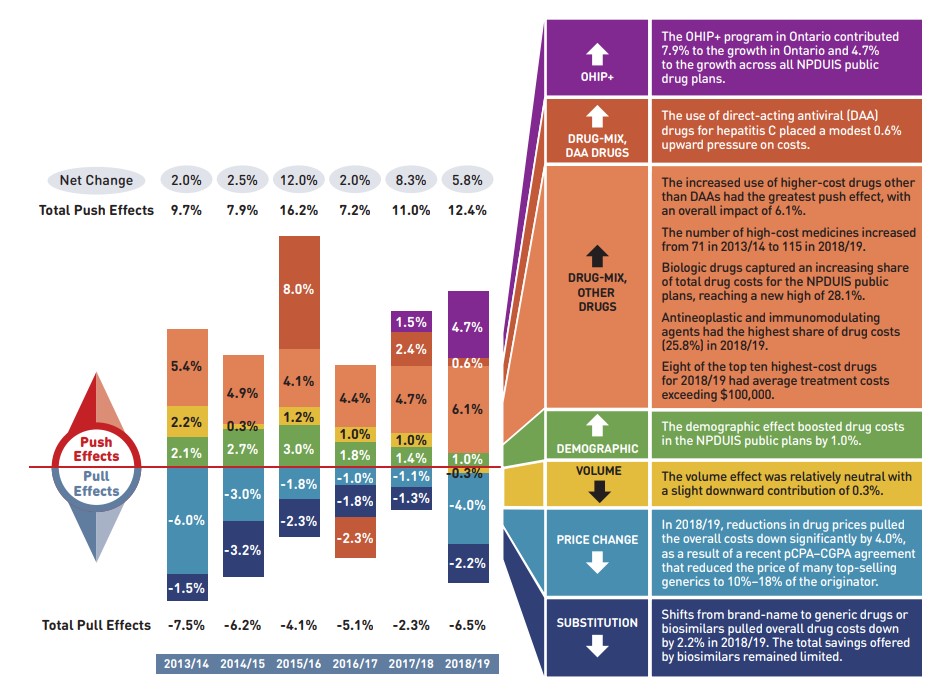

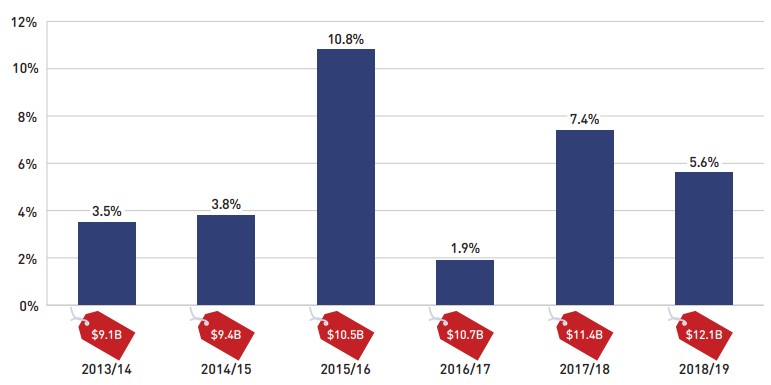

Prescription drug expenditures for the NPDUIS public drug plans increased by 5.6% in 2018/19 to reach $12.1 billion, driven primarily by a marked increase in the use of higher-cost drugs and the introduction of Ontario’s OHIP+ program.

The PMPRB’s CompassRx report monitors and analyzes the cost pressures driving changes in prescription drug expenditures in Canadian public drug plans. This sixth edition of CompassRx provides insight into the factors driving growth in drug and dispensing costs in 2018/19, as well as a retrospective review of recent trends in public drug plan costs and utilization.

The main data source for this report is the National Prescription Drug Utilization Information System (NPDUIS) Database at the Canadian Institute for Health Information (CIHI), which includes data for the following jurisdictions: British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island, Newfoundland and Labrador, Yukon, and the Non-Insured Health Benefits Program.

The findings from this report will inform policy discussions and aid decision makers in anticipating and responding to evolving cost pressures.

Key findings

Prescription drug expenditures for the NPDUIS public drug plans increased by 5.6% in 2018/19, bringing annual spending to more than $12 billion.

- Between 2013/14 and 2018/19, the total prescription drug expenditures for Canada’s public drug plans rose by $3 billion, for a compound annual growth rate of 5.5%.

- Drug costs, which represent 80% of prescription drug expenditures, grew by 5.8% from 2017/18 to 2018/19, while dispensing costs, which account for the remaining 20% of expenditures, grew by 5.1%.

- The NPDUIS public drug plans paid an average of 87% of the total prescription costs for 292 million prescriptions dispensed to almost 8 million active beneficiaries in 2018/19.

- The OHIP+ program accounted for a 7.6% increase in total prescription drug expenditures for Ontario in 2018/19 and a 4.4% push on spending for all NPDUIS public drug plans.

Drug cost growth for the NPDUIS public plans in 2018/19 was primarily driven by a greater use of higher-cost drugs as well as the introduction of the OHIP+ program in Ontario, and was offset in part by savings from generic price reduction and substitution.

- The increased use of higher-cost drugs continues to be the most pronounced driver, pushing costs upward by 6.7% in 2018/19, despite more modest impacts from the use of DAA drugs for hepatitis C.

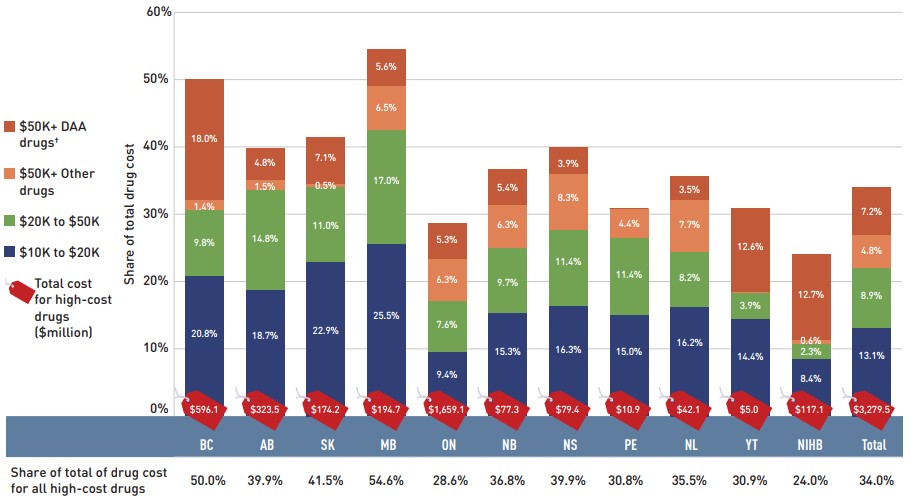

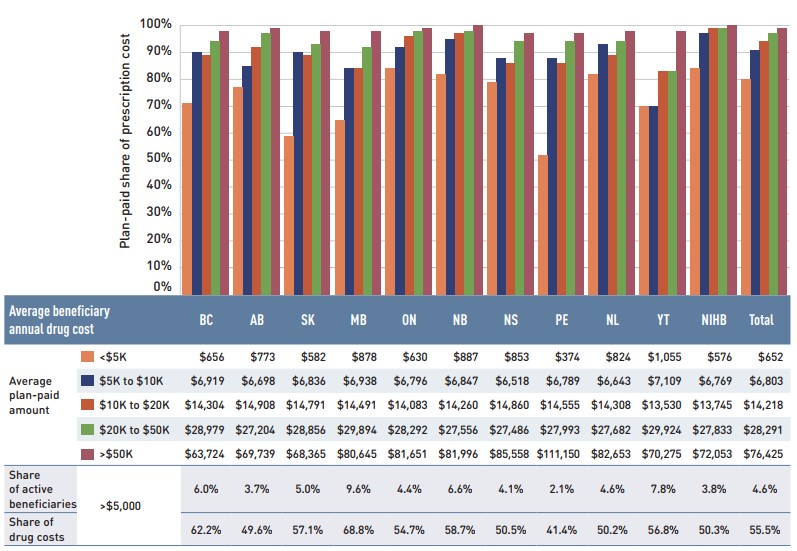

- More than half of the total drug costs in 2018/19 can be attributed to less than 5% of public drug plan beneficiaries. High-cost drugs, which were used by less than 2% of beneficiaries, accounted for over one third of costs.

- The overall increase in costs was also heavily influenced by Ontario’s universal coverage program for youth aged 24 and under. Without OHIP+, the 5.8% total drug cost growth in all NPDUIS public drug plans would have been reduced to 1.1%.

- In 2018/19, generic pricing policies and substitution had a notable -6.2% effect on costs, due in large part to recent policies reducing the maximum price of many top-selling generics to 10%–18% of the originator price.

- Other factors, including the volume of drugs and the size of the beneficiary population, had a relatively small influence on the growth in drug costs for public plans.

Figure description

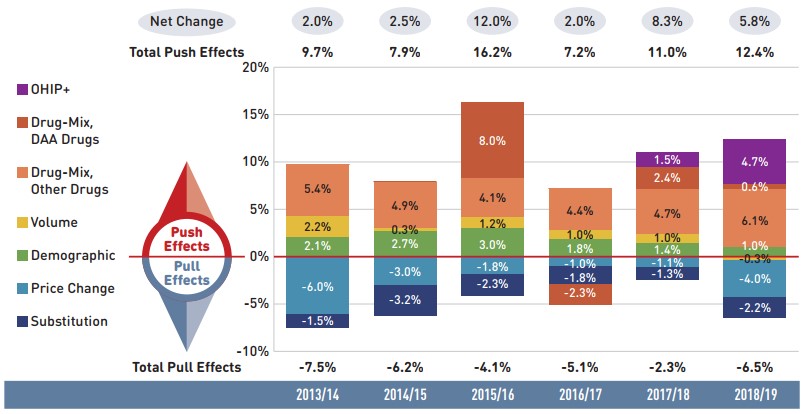

This column graph describes the key factors or effects that impacted the rates of change in drug costs across all NPDUIS public drug plans for each year from 2013/14 to 2018/19. Each column is broken out to give the positive or negative contribution of each effect: drug-mix; volume; demographic; price change; and substitution. The drug-mix effect for direct-acting antiviral (DAA) drugs for the treatment of hepatitis C is shown separately, as is the effect of the Ontario Health Insurance Plan Plus (OHIP+) initiative. Separate rows above and below the bar graph show the total positive push effect, negative pull effect and net change for each year.

| 2013/14 | 2014/15 | 2015/16 | 2016/17 | 2017/18 | 2018/19 | |

|---|---|---|---|---|---|---|

OHIP+ |

- |

- |

- |

- |

1.5% |

4.7% |

Drug-mix, direct-acting antiviral (DAA) drugs |

- |

- |

8.0% |

-2.3% |

2.4% |

0.6% |

Drug mix, other drugs |

5.4% |

4.9% |

4.1% |

4.4% |

4.7% |

6.1% |

Volume |

2.2% |

0.3% |

1.2% |

1.0% |

1.0% |

-0.3% |

Demographic |

2.1% |

2.7% |

3.0% |

1.8% |

1.4% |

1.0% |

Price change |

-6.0% |

-3.0% |

-1.8% |

-1.0% |

-1.1% |

-4.0% |

Substitution |

-1.5% |

-3.2% |

-2.3% |

-1.8% |

-1.3% |

-2.2% |

Total push effect |

9.7% |

7.9% |

16.2% |

7.2% |

11.0% |

12.4% |

Total pull effect |

-7.5% |

-6.2% |

-4.1% |

-5.1% |

-2.3% |

-6.5% |

Net change |

2.0% |

2.5% |

12.0% |

2.0% |

8.3% |

5.8% |

A table to the right of the graph provides an analysis for each effect in 2018/19.

OHIP+ |

|

Drug-mix, |

|

Drug-mix, |

|

Demographic |

|

Volume |

|

Price change |

|

Substitution |

|

Note: This analysis is based on publicly available pricing information. It does not reflect the confidential drug price discounts negotiated by the pan-Canadian Pharmaceutical Alliance on behalf of the public plans.

Values for 2016/17 onward reflect a revised methodology; previous results have not been updated, as there would have been no notable change in the relative contribution of each effect. Data for Yukon is included from 2016/17 onward.

Values may not add to totals due to rounding and the cross effect.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

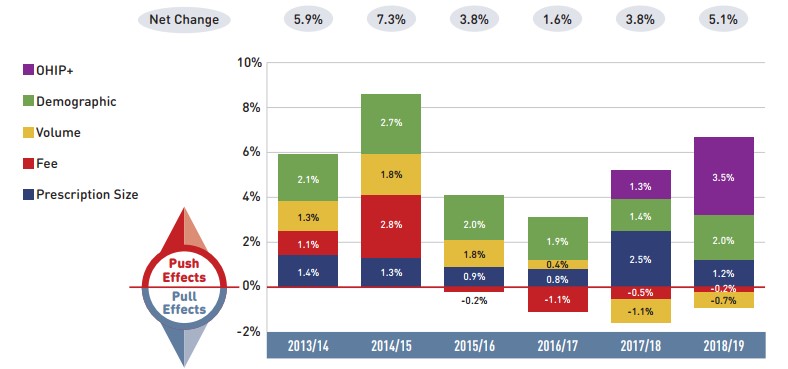

Dispensing costs in the NPDUIS public plans reached $2.4 billion in 2018/19, marking notable growth over the previous year, largely as a result of Ontario’s OHIP+ program.

- The overall growth in dispensing costs was 5.1% (or $117.4 million) in 2018/19, a steeper increase than that observed in the previous three years, though results varied among individual plans.

- The OHIP+ program had a significant impact on the growth in dispensing costs, pushing costs upward by 3.5% ($80.5 million) nationally and by 6.3% in Ontario.

- Apart from changes due to OHIP+, an increase in the number of active beneficiaries had the greatest impact on the dispensing costs in 2018/19, pushing overall costs up by 2.0%.

- The decrease in the volume of units dispensed to patients and a decline in the overall average dispensing fee per prescription pulled dispensing costs down by nearly 1%.

Introduction

Canadian public drug plan expenditures represent a significant portion of the overall healthcare budget. The Canadian Institute for Health Information (CIHI) estimated the total cost of prescription drugs in Canada to be $34.3 billion in 2019, with the largest component (43.1%) financed by the public drug plans and the remainder paid by private plans (36.9%) or out of pocket by households and individuals (19.9%).Footnote 1

CompassRx is an annual PMPRB publication that explores trends in prescription drug expenditures in Canadian public drug plans. It focuses on the shifting pressures that contribute to the annual change in drug and dispensing costs, including the switch in use between lower- and higher-priced drugs and changes in the beneficiary population, drug prices, and the volume of drugs used, as well as other key factors.

This edition of the report centres on the 2018/19 fiscal year, with a retrospective look at recent trends. The results of this study aid stakeholders in anticipating and responding to the evolving cost pressures that affect Canada’s public drug plans.

The analysis focuses on the public drug plans participating in the National Prescription Drug Utilization Information System (NPDUIS) initiative, which includes all of the provincial public plans (with the exception of Quebec), Yukon, and the Non-Insured Health Benefits (NIHB) Program. These plans account for approximately one third of the total annual spending on prescription drugs in Canada.

Each public drug plan reimburses eligible beneficiaries according to its own specific plan design and implements policies related to the reimbursement of drug prices and dispensing fees. Summaries of the plan designs and policies are available in the Resources section of the NPDUIS Analytical Studies page on the PMPRB website.

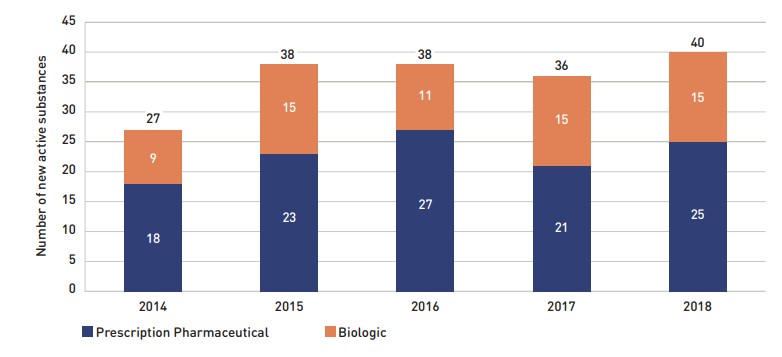

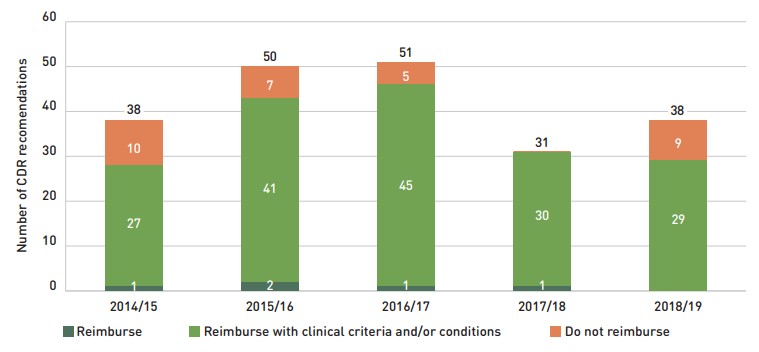

Health Canada, the PMPRB, and the Canadian Agency for Drugs and Technologies in Health (CADTH) are responsible for drug approvals, price reviews, and health technology assessments, respectively. Details of the 2018/19 approvals and reviews are provided in Appendix A of this report.

Methods

The main data source for this report is the National Prescription Drug Utilization Information System (NPDUIS) Database, developed by the Canadian Institute for Health Information (CIHI). This database houses pan-Canadian information on public drug programs, including anonymous claims-level data collected from the plans that participate in the NPDUIS initiative. Data is reported on a fiscal year basis.

Results are presented for the following public drug plans: British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island, Newfoundland and Labrador, Yukon, and the Non-Insured Health Benefits (NIHB) Program.

The analysis focuses exclusively on data for beneficiaries that met their deductible and received public reimbursement. Results reported for Saskatchewan and Manitoba include the accepted prescription drug expenditures for individuals who are eligible for coverage but have not submitted an application and, therefore, do not have a defined deductible. Results reported for New Brunswick include the number of active beneficiaries enrolled in the Medavie Blue Cross Seniors’ Prescription Drug Program and their related drug expenditures, which are offset by monthly premiums.

In Ontario, long-term care (LTC) prescriptions were separated out from the dispensing costs analysis, as their dispensing patterns may differ from those of the general beneficiary population.

As of October 2017, claims processed on behalf of the First Nation Health Authority (FNHA) in British Columbia are no longer submitted to the NPDUIS Database, including those previously captured through the NIHB Program. To mitigate the impact of this shift on the results for 2018/19, any remaining claims through the NIHB in British Columbia were excluded from the analysis in cases where the NIHB is reported individually but included in national totals.

The analysis of drug and dispensing cost drivers follows the methodological approach detailed in the PMPRB’s The Drivers of Prescription Drug Expenditures: A Methodological Report.Footnote 2 Drug costs include any associated markups. Analyses of the average prescription size, as well as pricing, are limited to oral solids to avoid data reporting inconsistencies that may exist in the days’ supply and unit reporting of other formulations. Anatomical Therapeutic Chemical (ATC) levels reported here are based on CIHI NPDUIS data and reflect the ATC classification system maintained by the World Health Organization Collaborating Centre for Drug Statistics Methodology. Vaccines and pharmacy services are not represented in this report.

The methodological approach used in CompassRx is reviewed on an annual basis and updated as required to respond to changes in the pharmaceutical landscape and data access. Thus, the scope of the report and the data analyzed may vary slightly from year to year. New changes to the methodology are detailed in Methods and Limitations sections of each edition.

For a Glossary of Terms, see the Resources section of the NPDUIS Analytical Studies page on the PMPRB website.

Limitations

Expenditure and utilization levels vary widely among the jurisdictions and cross comparisons of the results are limited by the plan designs and policies of the individual public drug plans, as well as the demographic and disease profiles of the beneficiary populations.

For example, public drug plans in British Columbia, Saskatchewan, and Manitoba provide universal income-based coverage, while other provincial public drug plans offer specific programs for seniors, income assistance recipients, and other select patient groups, and the NIHB provides universal care to its entire population.

The NPDUIS Database includes sub-plan data specific to particular jurisdictions. This further limits the comparability of results across plans. For instance, Alberta, Nova Scotia, and Prince Edward Island submit the data for a select sub-plans to NPDUIS. A comprehensive summary of the sub-plans available in the database, along with the eligibility criteria, is available in the Resources section of the NPDUIS Analytical Studies page on the PMPRB website.

Drug claims for beneficiaries in Ontario who also have coverage through the NIHB are primarily reimbursed by the Ontario Drug Benefit program, with any remaining drug costs covered by the NIHB. Therefore, claims reported for the NIHB include those coordinated with the Ontario Drug Benefit program.

Totals for the NPDUIS public drug plans are heavily skewed toward Ontario due to its size, and as such, the introduction of the OHIP+ program for Ontario residents aged 24 years or younger had a notable impact on the overall trends for 2018/19.

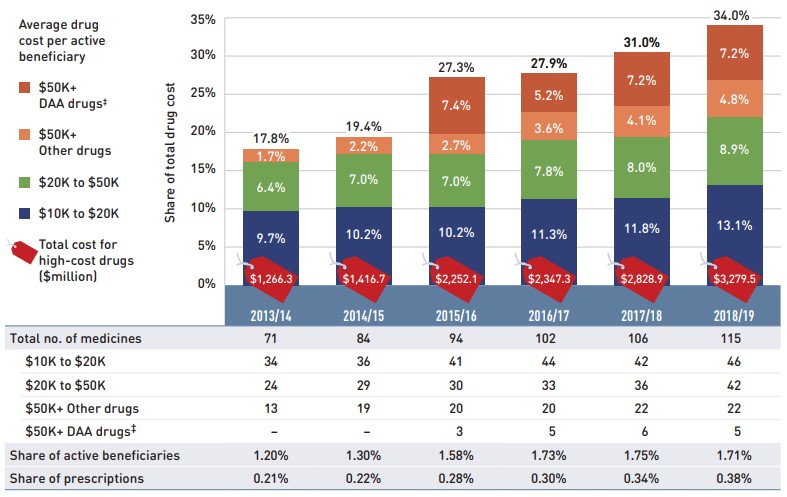

High-cost medicines are defined as having an annual treatment cost greater than $10,000. If medicines reach this threshold in any given year, they are included in the count for all other years. Thus, the number and composition of high-cost medicines in any given year may vary depending on the time of analysis.

As the methodology for this edition of the report has been revised to exclude NIHB service providers in British Columbia, historical results for the NIHB may not match those reported in previous edition.

Drug costs reported are the amounts accepted toward reimbursement by the public plans, which may not reflect the amounts paid by the plan/program and do not reflect off-invoice price rebates or price reductions resulting from confidential product listing agreements.

The prescription drug expenditure data for the public drug plans reported in this study represents only one segment of the Canadian pharmaceutical market, and hence, the findings should not be extrapolated to the overall marketplace.

This edition of the CompassRx reports on data up to and including the 2018/19 fiscal year. Any plan changes or other developments that have taken place since then will be captured in future editions.

1. Trends in Prescription Drug Expenditures, 2013/14 to 2018/19

Prescription drug expenditures for public plans increased by 5.6% in 2018/19, following a notable rise of 7.4% the year before. The introduction of the OHIP+ program in Ontario contributed considerably to the overall annual increase in expenditures, offset in part by cost reductions resulting from recent initiatives aimed at lowering the prices of generic medicines in Canada.

Brief Insights: Drug Plan Designs

The expenditure and utilization levels reported in this study depend on the specific plan design and policies of each jurisdiction, as well as the demographic and disease profiles of the beneficiary population. This affects the comparability of results across plans.

Changes in plan designs or policies can have a significant effect on trends in any given year. In 2018/19, the introduction of universal coverage for Ontario residents aged 24 years or younger through the OHIP+ program had a notable impact on results. A brief summary of the program and its impact on the growth in provincial and overall prescription drug expenditures is given at the end of this section.

Supplementary reference documents providing information on individual public drug plan designs, policies governing markups and dispensing fees, and a glossary of terms are available on the NPDUIS Analytical Studies page of the PMPRB website.

Prescription Drug Expenditures = Drug Costs (80%) + Dispensing Costs (20%)

Between 2013/14 and 2018/19, annual prescription drug expenditures for the public drug plans grew at a compound annual growth rate of 5.5%, rising from $9.1 billion to $12.1 billion with a steady increase of $0.7 billion in each of the last two years (Figure 1.1).

Figure description

This column graph shows the trend in the annual rates of change for prescription drug expenditures from 2013/14 to 2018/19. Price tags below each bar show the annual prescription drug cost in billions of dollars.

| 2013/14 | 2014/15 | 2015/16 | 2016/17 | 2017/18 | 2018/19 | |

|---|---|---|---|---|---|---|

Rate of change |

3.5% |

3.8% |

10.8% |

1.9% |

7.4% |

5.6% |

Prescription drug expenditure (billions of dollars) |

$9.1 |

$9.4 |

$10.5 |

$10.7 |

$11.4 |

$12.1 |

Note: This analysis only includes data for beneficiaries that met their deductible and received public reimbursement.

* British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island, Newfoundland and Labrador, Yukon, and the Non-Insured Health Benefits Program.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

The prescription drug expenditures reported in this section represent the total amounts accepted for reimbursement by the NPDUIS public drug plans, including drug costs (with any associated markups) and dispensing costs. The overall growth in expenditures in 2018/19 consists of a 5.8% growth in drug costs and a 5.1% increase in dispensing costs. As both components grew at a similar rate, the drug cost and dispensing cost shares of expenditures remained consistent with the previous year, at 80% and 20%, respectively (Figure 1.2).

These amounts reflect both the plan-paid portions of the prescription costs as well as beneficiary-paid portions, such as co-payments and deductibles.

In 2018/19, public plans paid an average of 87% of the total prescription drug expenditures, while the remainder was paid by the beneficiaries either out of pocket or through a third-party private insurer. The beneficiary-paid share varied across jurisdictions, ranging from 10% to 35%.

Figure description

This stacked column graph shows the total prescription drug expenditure in 2018/19 for each NPDUIS public drug plan broken out by percent shares of drug costs and dispensing costs, along with the total costs across all plans. A table below provides absolute values for the drug and dispensing costs in millions of dollars, as well as the plan-paid shares of the total prescription costs and the rate of change since 2017/18.

| British Columbia | Alberta | Saskatchewan | Manitoba | Ontario | New Brunswick | Nova Scotia | Prince Edward Island | Newfoundland and Labrador | Yukon | Non-Insured Health Benefits | Total | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Total prescription cost (millions of dollars) |

$1,484 |

$1,041 |

$516 |

$441 |

$7,185 |

$274 |

$256 |

$48 |

$167 |

$17 |

$665 |

$12,093 |

Dispensing cost share |

20% |

22% |

19% |

19% |

19% |

23% |

22% |

27% |

29% |

6% |

27% |

20% |

Drug cost share |

80% |

78% |

81% |

81% |

81% |

77% |

78% |

73% |

71% |

94% |

73% |

80% |

Dispensing costs (millions of dollars) |

$292 |

$230 |

$95 |

$84 |

$1,381 |

$64 |

$57 |

$13 |

$48 |

$1 |

$174 |

$2,441 |

Drug costs (millions of dollars) |

$1,192 |

$811 |

$420 |

$356 |

$5,804 |

$210 |

$199 |

$35 |

$119 |

$16 |

$474 |

$9,652 |

Plan-paid amount (millions of dollars) |

$1,235 |

$874 |

$388 |

$353 |

$6,464 |

$247 |

$216 |

$31 |

$145 |

$14 |

$585 |

$10,569 |

Plan-paid share of total prescription cost |

83% |

84% |

75% |

80% |

90% |

90% |

85% |

65% |

87% |

78% |

90% |

87% |

Rate of change in prescription costs, 2017/18 to 2018/19 |

5.0% |

1.9% |

6.1% |

0.6% |

7.8% |

2.0% |

3.3% |

4.3% |

1.0% |

12.9% |

3.9% |

5.6% |

Note: This analysis only includes data for beneficiaries that met their deductible and received public reimbursement. Markup amounts are captured in the drug costs. Values may not add to totals due to rounding.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

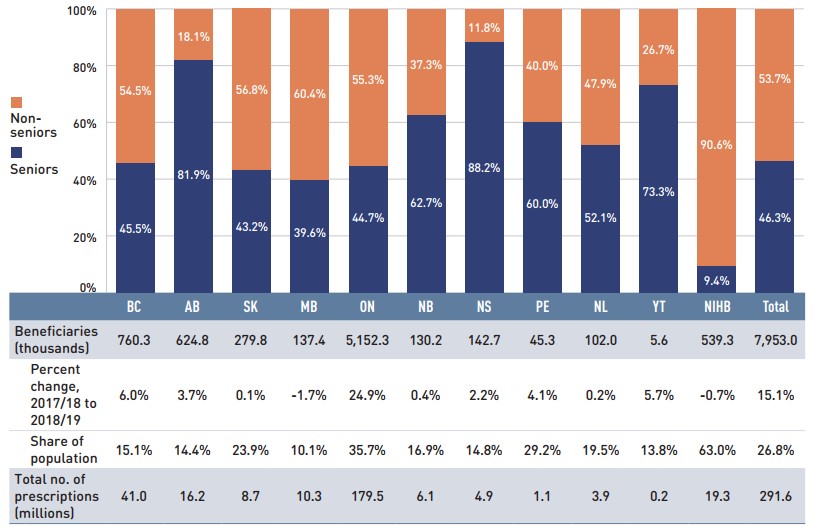

The annual growth in prescription expenditures is a function of increases in the number of active beneficiaries and their drug costs. While the size of the beneficiary population in most jurisdictions remained somewhat stable in 2018/19, the overall NPDUIS public plan beneficiary population grew by 15.1%, mainly due to a near 25% increase in Ontario following the implementation of the OHIP+ program. For more details on the impact of this change, see the program summary at the end of this section.

In 2018/19, almost 8 million active beneficiaries filled approximately 292 million prescriptions that were accepted towards a deductible or paid for (in full or in part) by the NPDUIS public drug plans. Seniors made up a slight minority of the total active beneficiaries, due to the influx of beneficiaries under 25 in Ontario, though this share varied greatly across jurisdictions as a result of differences in plan design, eligibility, and the demographics of the beneficiary population (Figure 1.3).

Figure description

This stacked column graph shows the percent share of utilization in senior and non-senior populations for each of the NPDUIS public drug plans in 2018/19, along with the totals across all plans. A table below gives the number of active beneficiaries in thousands, the change in beneficiary population from 2017/18 to 2018/19, the number of active beneficiaries as share of the population, and the total number of prescriptions, in millions.

| British Columbia | Alberta | Saskatchewan | Manitoba | Ontario | New Brunswick | Nova Scotia | Prince Edward Island | Newfoundland and Labrador | Yukon | Non-Insured Health Benefits | Total | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Seniors |

45.5% |

81.9% |

43.2% |

39.6% |

44.7% |

62.7% |

88.2% |

60.0% |

52.1% |

73.3% |

9.4% |

46.3% |

Non-seniors |

54.5% |

18.1% |

56.8% |

60.4% |

55.3% |

37.3% |

11.8% |

40.0% |

47.9% |

26.7% |

90.6% |

53.7% |

Beneficiaries (thousands) |

760.3 |

624.8 |

279.8 |

137.4 |

5,152.3 |

130.2 |

142.7 |

45.3 |

102.0 |

5.6 |

539.3 |

7,953.0 |

Percent change in the beneficiary population from 2017/18 to 2018/19 |

6.0% |

3.7% |

0.1% |

-1.7% |

24.9% |

0.4% |

2.2% |

4.1% |

0.2% |

5.7% |

-0.7% |

15.1% |

Beneficiary share of population |

15.1% |

14.4% |

23.9% |

10.1% |

35.7% |

16.9% |

14.8% |

29.2% |

19.5% |

13.8% |

63.0% |

26.8% |

Total number of prescriptions (millions) |

41.0 |

16.2 |

8.7 |

10.3 |

179.5 |

6.1 |

4.9 |

1.1 |

3.9 |

0.2 |

19.3 |

291.6 |

Note: This analysis only includes data for beneficiaries that met their deductible and received public reimbursement. Not all of the sub-plan data for the jurisdictions is reported to NPDUIS, which may impact the distribution of senior and non-senior shares.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information; Statistics Canada, CANSIM Table 051-0005; Non-Insured Health Benefits Program Annual Report, 2018/19.

Prescription Drug Expenditures = Drug Costs (80%) + Dispensing Costs (20%)

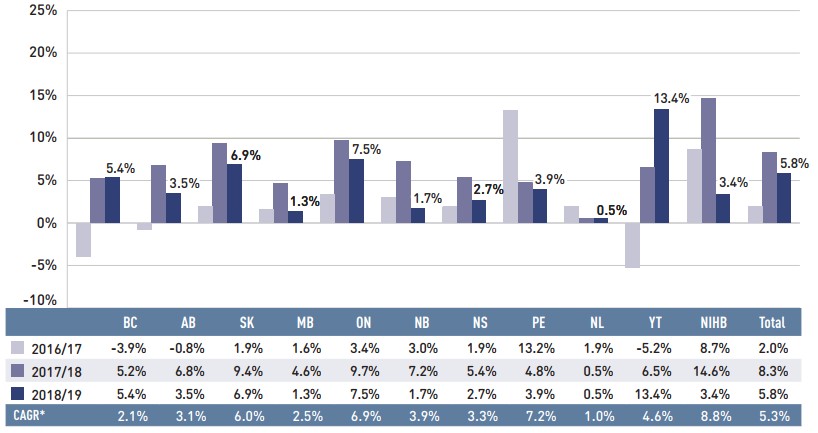

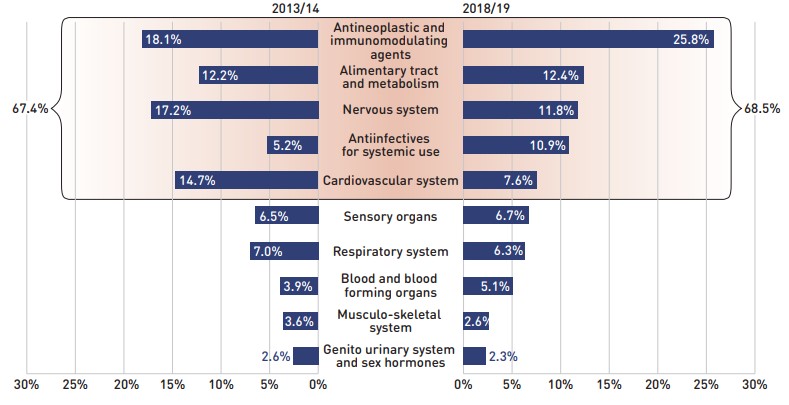

Drug costs, including markups, represent the largest component of prescription drug expenditures and have the greatest influence on overall trends. Following a notable 8.3% increase in 2017/18, drug costs rose by an additional 5.8% in 2018/19. The average rate of change over the last three years was 5.3% across the public plans.

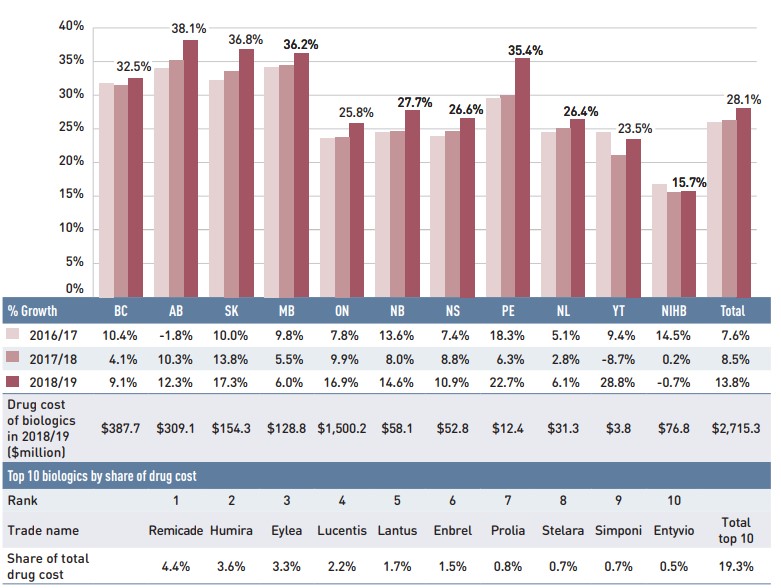

Figure 1.4 reports the annual rate of change in drug costs for each NPDUIS drug plan from 2016/17 to 2018/19. Drug costs increased in all plans in 2018/19, though the rates of change varied across jurisdictions, ranging from approximately 1% to 13%.

Figure description

This column graph illustrates the trend in annual rates of change in drug costs from 2016/17 to 2018/19 for each of the NPDUIS drug plans. Total annual results for all plans are included. The compound annual growth rates for the period are given in a table below.

| British Columbia | Alberta | Saskatchewan | Manitoba | Ontario | New Brunswick | Nova Scotia | Prince Edward Island | Newfoundland and Labrador | Yukon | Non-Insured Health Benefits | Total | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

2016/17 |

-3.9% |

-0.8% |

1.9% |

1.6% |

3.4% |

3.0% |

1.9% |

13.2% |

1.9% |

-5.2% |

8.7% |

2.0% |

2017/18 |

5.2% |

6.8% |

9.4% |

4.6% |

9.7% |

7.2% |

5.4% |

4.8% |

0.5% |

6.5% |

14.6% |

8.3% |

2018/19 |

5.4% |

3.5% |

6.9% |

1.3% |

7.5% |

1.7% |

2.7% |

3.9% |

0.5% |

13.4% |

3.4% |

5.8% |

Compound annual growth rate |

2.1% |

3.1% |

6.0% |

2.5% |

6.9% |

3.9% |

3.3% |

7.2% |

1.0% |

4.6% |

8.8% |

5.3% |

Note: This analysis only includes data for beneficiaries that met their deductible and received public reimbursement.

* Compound annual growth rate.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

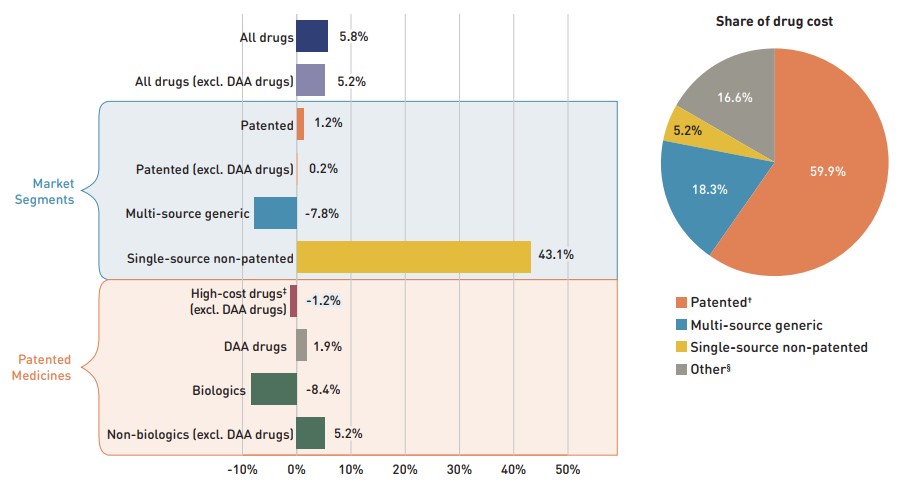

Figure 1.5 breaks down the annual rate of change in drug costs from 2017/18 to 2018/19 by market segment (bar chart) and gives the corresponding market share in 2018/19 for each (pie chart). These results provide a snapshot of how the distribution of sales across market segments has shifted over the last year. As the market status of a medicine is dynamic, the medicines contributing to any one segment may differ from year to year. This can have a significant effect on how changes are interpreted; for example, although the growth in sales for the overall Canadian patented market was -0.6% in 2018, the growth rate rose to 6.5% when previously patented medicines were included, which suggests that medicines that left the patented market continued to be strong contributors to overall spending.Footnote 3

Patented medicines represent the largest segment of the market, capturing 59.9% of public plan drug costs in 2018/19. Since 2017/18, some of the top-selling patented medicines in Canada have shifted out of the patented market segment, including the biologic medicine Remicade (infliximab), which was responsible for $420 million in annual drug costs for the public plans in 2018/19. Despite this pull, the segment still increased by a modest 1.2%, driven mainly by the use of DAA drugs. Apart from the influence of DAAs, high-cost patented medicines— those with an average annual cost per beneficiary greater than $10,000—and patented biologics both showed a negative growth rate in 2018/19 due to the change in patent status for Remicade.

Shifts in the patented market were also reflected in the single-source non-patented market, which experienced a remarkable growth rate of 43.1% as a handful of commonly used medicines changed patent status. Novorapid (insulin aspart), a diabetes treatment, moved from the patented to single-source non-patented market segment over the course of 2017/18, becoming the top medicine in the segment in 2018/19 with over $40 million in sales. The high rate of increase among single-source non-patented medicines had a limited impact on the overall growth given their relatively small 5.2% share of total drug costs. Multi-source generics, which accounted for 18.3% of drug costs, declined by -7.8% in 2018/19. The next section will further elaborate on these findings.

Figure description

This graph consists of two parts: a horizontal bar chart on the left breaks down the annual rate of change in drug costs between 2017/18 and 2018/19 by market segment and a pie chart on the right displays the market share of the total drug cost for each segment. Both represent the combined totals for NPDUIS public drug plans.

The bar chart is divided into three parts. The first gives the annual rate of change for all drugs; the second displays the growth rates for the three main market segments; and the third focuses on the patented medicine segment. Results indicate whether they include or exclude the direct-acting antiviral (DAA) drugs for the treatment of hepatitis C. High-cost drugs have an annual cost greater than $10,000 and include both biologics and non-biologics.

Annual rates of change

All drugs: 5.8%

All drugs excluding DAA drugs: 5.2%

By market segment

- Patented: 1.2%

- Patented excluding DAA drugs: 0.2%

- Multi-source generic: -7.8%

- Single-source non-patented: 43.1%

Patented medicines:

- High-cost drugs excluding DAA drugs: -1.2%

- DAA drugs: 1.9%

- Biologics: -8.4%

- Non-biologics excluding DAA drugs: 5.2%

Share of drug cost

| Market segment | Share of drug cost |

|---|---|

Patented† |

59.9% |

Multi-source generic |

18.3% |

Single-source non-patented |

5.2% |

Other§ |

16.6% |

Note: This analysis only includes data for beneficiaries that met their deductible and received public reimbursement.

DAA drugs are direct-acting antivirals used in the treatment of hepatitis C.

For a Glossary of Terms regarding each of the market segments, see the Resources section of the NPDUIS Analytical Studies page on the PMPRB website.

* British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island, Newfoundland and Labrador, Yukon, and the Non-Insured Health Benefits Program.

† The patented medicines market segment includes all medicines that had patent protection in the period of study, whether or not the patent expired during that period. As such, the rate of growth does not reflect the loss of patent exclusivity for medicines over the course of the fiscal year.

‡ High-cost drugs have an average annual treatment cost of greater than $10,000 and include both biologics and non-biologics.

§ This market segment includes devices, compounded drugs, and other products that are reimbursed by public drug plans but do not have a Health Canada assigned Drug Identification Number (DIN).

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Prescription Drug Expenditures = Drug Costs (80%) + Dispensing Costs (20%)

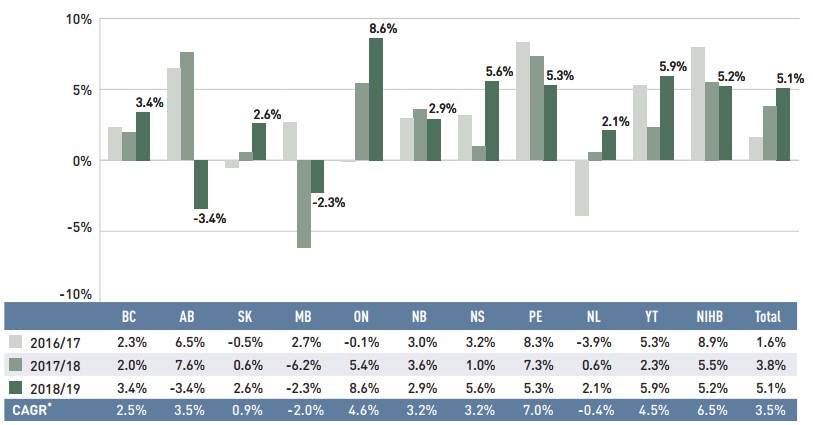

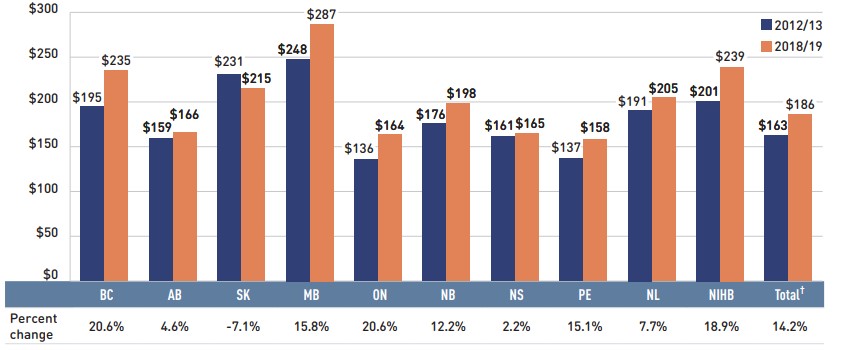

Dispensing costs make up an important part of prescription drug expenditures. Overall, dispensing costs in the NPDUIS public plans grew at a sizable rate of 5.1% in 2018/19, for a compound annual growth rate of 3.5% over the last three years. Figure 1.6 reports the annual rate of change in dispensing costs for each NPDUIS drug plan from 2016/17 to 2018/19. Jurisdictional variations may be due to changes in dispensing fee policies and plan designs, as well as changes in the number of prescriptions and their size, among other factors.

Brief Insights: Dispensing Fees

Alberta was the only public plan to launch notable changes regarding pharmacy services and fees in 2018/19: a new pharmacy funding framework came into effect including a lowered dispensing fee, limitations on dispensing frequency, and changes to other pharmacy professional fees, such as those related to medication assessment and clinical services.

For a summary of dispensing fee policies for each of the public drug plans, see the Resources section of the NPDUIS Analytical Studies page on the PMPRB website.

Figure description

This column graph illustrates the trend in annual rates of change for dispensing costs from 2016/17 to 2018/19 for each of the NPDUIS public drug plans. Total annual results for all plans are included. Compound annual growth rates for the period are given in a table below.

| British Columbia | Alberta | Saskatchewan | Manitoba | Ontario | New Brunswick | Nova Scotia | Prince Edward Island | Newfoundland and Labrador | Yukon | Non-Insured Health Benefits | Total | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

2016/17 |

2.3% |

6.5% |

-0.5% |

2.7% |

-0.1% |

3.0% |

3.2% |

8.3% |

-3.9% |

5.3% |

8.9% |

1.6% |

2017/18 |

2.0% |

7.6% |

0.6% |

-6.2% |

5.4% |

3.6% |

1.0% |

7.3% |

0.6% |

2.3% |

5.5% |

3.8% |

2018/19 |

3.4% |

-3.4% |

2.6% |

-2.3% |

8.6% |

2.9% |

5.6% |

5.3% |

2.1% |

5.9% |

5.2% |

5.1% |

Compound annual growth rate |

2.5% |

3.5% |

0.9% |

-2.0% |

4.6% |

3.2% |

3.2% |

7.0% |

-0.4% |

4.5% |

6.5% |

3.5% |

Note: This analysis only includes data for beneficiaries that met their deductible and received public reimbursement.

* Compound annual growth rate.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

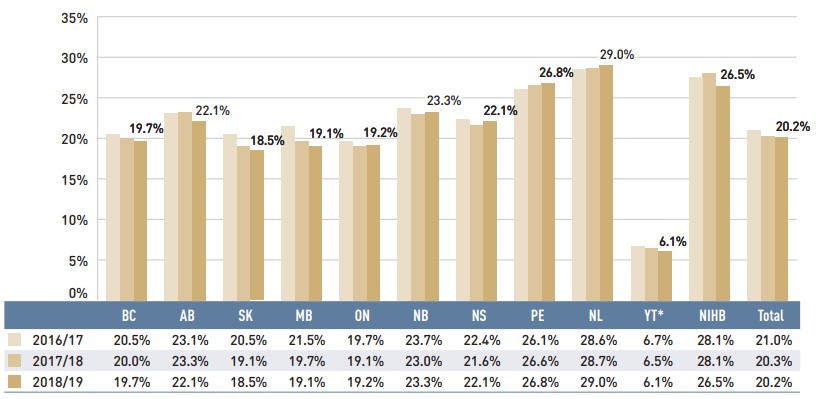

As dispensing costs have grown at a slower rate than drug costs over the last three years, their share of overall prescription drug expenditures has declined slightly from 21.0% in 2016/17 to 20.2% in 2018/19.

Figure 1.7 depicts the trend in the dispensing cost share of total prescription expenditures for each NPDUIS drug plan from 2016/17 to 2018/19.

Figure description

This column graph shows the trend in annual dispensing costs as a share of the total prescription expenditures from 2016/17 to 2018/19 for each of the NPDUIS public drug plans. Total annual results for all plans are included.

| British Columbia | Alberta | Saskatchewan | Manitoba | Ontario | New Brunswick | Nova Scotia | Prince Edward Island | Newfoundland and Labrador | Yukon | Non-Insured Health Benefits | Total | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

2016/17 |

20.5% |

23.1% |

20.5% |

21.5% |

19.7% |

23.7% |

22.4% |

26.1% |

28.6% |

6.7% |

28.1% |

21.0% |

2017/18 |

20.0% |

23.3% |

19.1% |

19.7% |

19.1% |

23.0% |

21.6% |

26.6% |

28.7% |

6.5% |

28.1% |

20.3% |

2018/19 |

19.7% |

22.1% |

18.5% |

19.1% |

19.2% |

23.3% |

22.1% |

26.8% |

29.0% |

6.1% |

26.5% |

20.2% |

Note: This analysis only includes data for beneficiaries that met their deductible and received public reimbursement.

* Yukon allows for markups of up to 30%; as such, dispensing costs account for a smaller share of their total expenditures.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Brief Insights: OHIP+

On January 1, 2018, the Ontario government introduced the OHIP+ program, which offered prescription drug coverage to all children and youth aged 24 and under, regardless of family income.

This coverage was provided from January 1, 2018, to March 31, 2019, and as such is reflected in the full course of fiscal year 2018/19. The program was subsequently redesigned to focus exclusively on children and youth not covered by a private plan.

For the 2018/2019 period, the significant impact of the OHIP+ program extended not only to results for Ontario, but also to the total drug expenditures for all NPDUIS public drug plans, given Ontario’s relative size. These effects were assessed by measuring the difference between inclusion and exclusion of the program; as this analysis does not distinguish between new beneficiaries and those who were previously covered by other public drug programs in Ontario, the results may overestimate the program’s impact.

- The prescription drug expenditure of the OHIP+ program in 2018/19 totalled $658 million, accounting for 9.2% of the prescription drug expenditures for Ontario and 5.4% of the total expenditures for the NPDUIS public drug plans over the entire fiscal year.

- More than 2 million active beneficiaries filled nearly 12 million prescriptions accepted for reimbursement by the OHIP+ program in 2018/19. If OHIP+ were excluded from the analysis, the overall beneficiary population would have declined by 3.6% in Ontario and 1.6% in all NPDUIS public plans, compared to the 24.9% and 15.1% increases reported in Figure 1.3.

- The implementation of the OHIP+ program resulted in an increase in the share of the non-senior beneficiary population in the Ontario public drug plan from 23% to 55%. In addition, due to the less frequent use of chronic medicines among those aged 24 and under, the average number of claims per beneficiary decreased in 2018/19.

- Without OHIP+, total prescription drug expenditures would have risen by only 0.2% in Ontario and 1.2% in all NPDUIS public drug plans, in contrast to the actual growth rates of 7.8% and 5.6%, respectively. Using the same scenario, drug costs in Ontario would have had no growth, compared to the actual rate of 7.5%, while the drug cost growth in all NPDUIS public drug plans would have been 1.1% instead of 5.8%.

Changes to OHIP+ beginning on April 1, 2019, will be reflected in the next edition of this report.

2. The Drivers of Drug Costs, 2017/18 to 2018/19

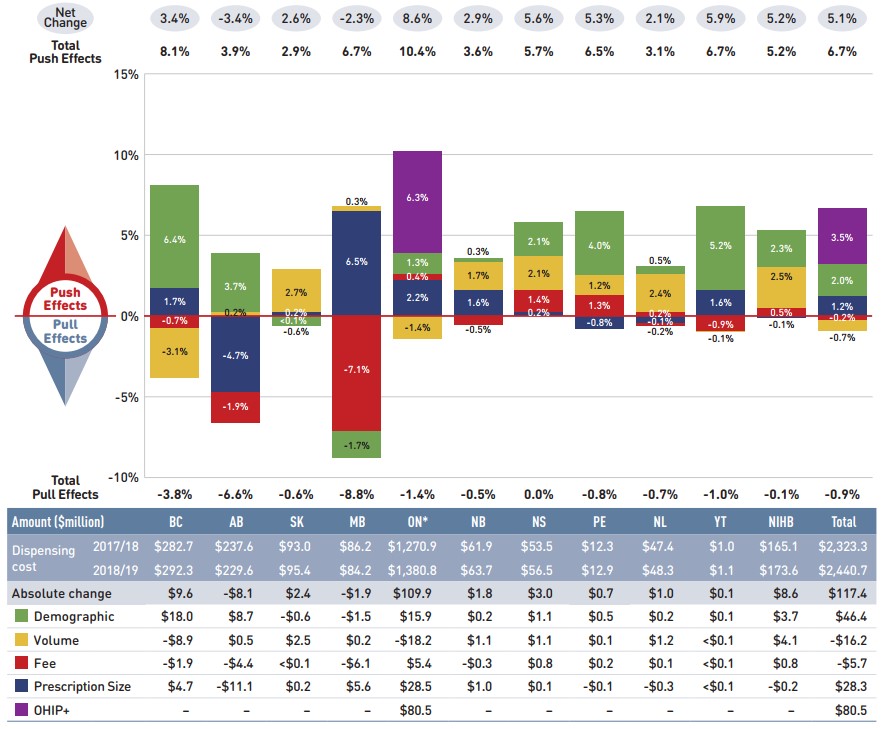

Drug cost increases in the NPDUIS public plans in 2018/19 were primarily driven by a continued rise in the use of higher-cost medicines, counterbalanced by significant savings from generic price reductions and substitution. Plan design changes in Ontario accounted for a 4.7% upward push on drug costs, resulting in an overall increase of 5.8%.

Changes in drug costs are driven by a number of “push” and “pull” effects. The net effect of these opposing forces yields the overall rate of change.

Price change effect: Changes in the prices of both brand-name and generic drugs, determined at the molecule, strength, and form level.

Substitution effect: Shifts from brand-name to generic drugs, as well as shifts to biosimilar use.

Demographic effect: Changes in the number of active beneficiaries, as well as shifts in the distribution of age or gender.

Volume effect: Changes in the number of prescriptions dispensed to patients, the average number of units of a drug dispensed per prescription, and/or shifts in the use of various strengths or forms of a medicine.

Drug-mix effect: Shifts in use between lower- and higher-cost drugs, including those entering, exiting, or remaining in the market during the time period analyzed.

In this section, a comprehensive cost driver analysis is used to determine how much public plan drug costs would have changed between 2017/18 and 2018/19 if only one factor (e.g., the price of drugs) was considered while all the others remained the same.Footnote i

In addition to the standard annual effects, Ontario's OHIP+ program is treated as a separate factor in the cost driver analysis, encompassing all effects associated with the program (e.g., volume and demographic changes). As such, the OHIP+ effect isolates the overall impact from the significant plan design changes.

Figure 2.1 provides insight into the pressures driving the rates of change in drug costs from 2013/14 to 2018/19.

In any given year, changes in the patient population and the volume of drugs will typically exert a slight to moderate upward pressure on drug costs. In 2018/19, these costs were significantly impacted by the addition of the OHIP+ program in Ontario, which extended drug coverage to all Ontario residents aged 24 and younger. The combined effect from this change resulted in an upward push of 4.7% on total drug costs for the NPDUIS public plans. Excluding OHIP+, the impact of the demographic effect has declined in recent years, from between 2% and 3% prior to 2016/17 to 1% in 2018/19, indicating a slower rate of growth in the number of active beneficiaries. The volume effect, which has steadily contributed an increase of approximately 1% to drug costs over the last few years, marked no significant change in 2018/19.

The most pronounced upward push on costs can be attributed to the use of higher-cost medicines. The drug-mix effect exerted a significant 6.7% pressure on drug costs in NPDUIS public plans in 2018/19. While the use of DAA drugs for hepatitis C made up a smaller portion of this effect, the use of other higher-cost medicines jumped from a consistent 4% to 5% push on annual costs in recent years to a high of 6.1% in 2018/19.

Counterbalancing these upward cost pressures, generic substitutions and price reductions generally exert a downward pull on costs. The magnitude of these effects can vary from year to year depending on the timing of generic market entries and the implementation of policies lowering maximum generic prices. Cost savings from price reductions were more significant in 2018/19 with an impact of -4.0%, largely due to a wide-reaching generic pricing initiative introduced in April 2018. Generic and biosimilar substitution pulled costs down by an additional 2.2% over the course of the fiscal year, for a combined total pull of -6.2%. In the absence of these cost-saving effects, drug costs in NPDUIS public plans would have increased by 12% in 2018/19.

Figure description

This column graph describes the key factors or effects that impacted the rates of change in drug costs across all NPDUIS public drug plans for each year from 2013/14 to 2018/19. Each column is broken out to give the positive or negative contribution of each effect: drug-mix; volume; demographic; price change; and substitution. The drug-mix effect of direct-acting antiviral (DAA) drugs for hepatitis C is shown separately, as are the effects of the Ontario Health Insurance Plan Plus (OHIP+) initiative. The total positive push effect, negative pull effect, and net change are given for each year.

| 2013/14 | 2014/15 | 2015/16 | 2016/17 | 2017/18 | 2018/19 | |

|---|---|---|---|---|---|---|

OHIP+ |

– |

– |

– |

– |

1.5% |

4.7% |

Drug-mix, direct-acting antiviral (DAA) drugs |

– |

– |

8.0% |

-2.3% |

2.4% |

0.6% |

Drug mix, other drugs |

5.4% |

4.9% |

4.1% |

4.4% |

4.7% |

6.1% |

Volume |

2.2% |

0.3% |

1.2% |

1.0% |

1.0% |

-0.3% |

Demographic |

2.1% |

2.7% |

3.0% |

1.8% |

1.4% |

1.0% |

Price change |

-6.0% |

-3.0% |

-1.8% |

-1.0% |

-1.1% |

-4.0% |

Substitution |

-1.5% |

-3.2% |

-2.3% |

-1.8% |

-1.3% |

-2.2% |

Total push effect |

9.7% |

7.9% |

16.2% |

7.2% |

11.0% |

12.4% |

Total pull effect |

-7.5% |

-6.2% |

-4.1% |

-5.1% |

-2.3% |

-6.5% |

Net change |

2.0% |

2.5% |

12.0% |

2.0% |

8.3% |

5.8% |

Note: Historic values are reported for 2013/14 to 2015/16.

This analysis is based on publicly available pricing information. It does not reflect the confidential price discounts negotiated by the pCPA on behalf of the public plans.

Values may not add to totals due to rounding and the cross effect. Results for Yukon were included from 2016/17 onward.

* British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island, Newfoundland and Labrador, Yukon, and the Non-Insured Health Benefits Program.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

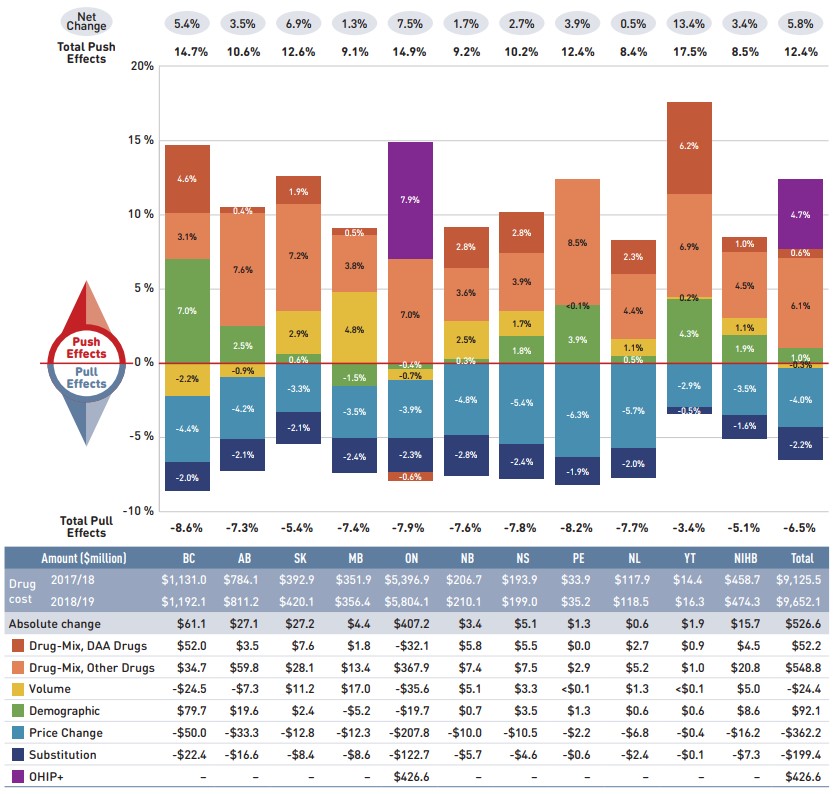

The overall 5.8% increase in drug costs in 2018/19 represents an absolute growth of $527 million, with varying rates of growth among the public drug plans ranging from approximately 1% to 13% (Figure 2.2). These variations were mainly driven by differences in the magnitude of the opposing components of change. Jurisdictions with higher overall growth rates included Yukon (13.4%), Ontario (7.5%), and Alberta (6.9%).

The increased use of higher-cost drugs other than DAAs had the greatest push effect, with an overall impact of 6.1% ($549 million) ranging from 3.1% to 8.5% across jurisdictions. The pressure from DAA drugs for hepatitis C increased drug costs by an additional 0.6% ($52 million). Differences in the drug-mix effect across public drug plans may be related to plan designs, formulary listing decisions, or the disease profiles of the population, among other determinants. The impact of DAA drugs also varied, with the largest upward push in the Yukon (6.2%), followed British Columbia (4.6%), Nova Scotia (2.8%), and New Brunswick (2.8%). The use of DAAs declined slightly in Ontario, pulling costs downward by -0.6%.

The OHIP+ program in Ontario generated $427 million in drug cost growth over 2017/18, pushing costs upward by 7.9% in Ontario and 4.7% across all NPDUIS plans.

The demographic effect boosted drug costs in the NPDUIS public plans by 1.0% ($92 million) in 2018/19. The increase in the active beneficiary population may be the result of growth in the overall population of a jurisdiction, an increase in the number of Canadians eligible for senior coverage (65+), and/or plan design changes that expanded coverage to new population or patient groups. Note that demographic changes due to OHIP+ are presented separately.

The volume effect, which has been relatively stable over the past few years, pulled costs downward by a slight 0.3% ($24 million) in 2018/19. However, this effect was an important driver in Manitoba (4.8%), Saskatchewan (2.9%), and New Brunswick (2.5%).

The cost-saving effects of generic and biosimilar substitution (-2.2% or -$199 million) and price reductions (-4.0% or -$362 million) were more pronounced in all jurisdictions. Together they represented 6.2% ($562 million) in savings for the NPDUIS public plans in 2018/19, compared to just 2.3% the year before.

The key effects for 2018/19—price change, substitution, and drug-mix—are explored in more detail in the following section.

Figure description

This column graph and table describe the key factors or effects that impacted the rates of change in drug costs for each of the NPDUIS public drug plans from 2017/18 to 2018/19. Each column is broken out to give the positive or negative contribution of each effect: drug-mix; volume; demographic; price change; and substitution. The drug-mix effect of direct-acting antiviral (DAA) drugs for hepatitis C is shown separately, as are the effects of the Ontario Health Insurance Plan Plus (OHIP+) initiative. The total positive push effect, negative pull effect and net change are given for each year. Total results for all plans are also included.

| British Columbia | Alberta | Saskatchewan | Manitoba | Ontario | New Brunswick | Nova Scotia | Prince Edward Island | Newfoundland and Labrador | Yukon | Non-Insured Health Benefits | Total | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

OHIP+ |

– |

– |

– |

– |

7.9% |

– |

– |

– |

– |

– |

– |

4.7% |

Drug-mix, direct-acting antiviral (DAA) drugs |

4.6% |

0.4% |

1.9% |

0.5% |

-0.6% |

2.8% |

2.8% |

- |

2.3% |

6.2% |

1.0% |

0.6% |

Drug-mix, other drugs |

3.1% |

7.6% |

7.2% |

3.8% |

7.0% |

3.6% |

3.9% |

8.5% |

4.4% |

6.9% |

4.5% |

6.1% |

Volume |

-2.2% |

-0.9% |

2.9% |

4.8% |

-0.7% |

2.5% |

1.7% |

<0.1% |

1.1% |

0.2% |

1.1% |

-0.3% |

Demographic |

7.0% |

2.5% |

0.6% |

-1.5% |

-0.4% |

0.3% |

1.8% |

3.9% |

0.5% |

4.3% |

1.9% |

1.0% |

Price change |

-4.4% |

-4.2% |

-3.3% |

-3.5% |

-3.9% |

-4.8% |

-5.4% |

-6.3% |

-5.7% |

-2.9% |

-3.5% |

-4.0% |

Substitution |

-2.0% |

-2.1% |

-2.1% |

-2.4% |

-2.3% |

-2.8% |

-2.4% |

-1.9% |

-2.0% |

-0.5% |

-1.6% |

-2.2% |

Total push effect |

14.7% |

10.6% |

12.6% |

9.1% |

14.9% |

9.2% |

10.2% |

12.4% |

8.4% |

17.5% |

8.5% |

12.4% |

Total pull effect |

-8.6% |

-7.3% |

-5.4% |

-7.4% |

-7.9% |

-7.6% |

-7.8% |

-8.2% |

-7.7% |

-3.4% |

-5.1% |

-6.5% |

Net change |

5.4% |

3.5% |

6.9% |

1.3% |

7.5% |

1.7% |

2.7% |

3.9% |

0.5% |

13.4% |

3.4% |

5.8% |

An accompanying table gives the corresponding changes in millions of dollars, as well as the total drugs costs in 2017/18 and 2018/19 and the absolute change for each plan.

| British Columbia | Alberta | Saskatchewan | Manitoba | Ontario | New Brunswick | Nova Scotia | Prince Edward Island | Newfoundland and Labrador | Yukon | Non-Insured Health Benefits | Total | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Drug cost 2017/18 |

$1,131.0 |

$784.1 |

$392.9 |

$351.9 |

$5,396.9 |

$206.7 |

$193.9 |

$33.9 |

$117.9 |

$14.4 |

$458.7 |

$9,125.5 |

Drug cost 2018/19 |

$1,192.1 |

$811.2 |

$420.1 |

$356.4 |

$5,804.1 |

$210.1 |

$199.0 |

$35.2 |

$118.5 |

$16.3 |

$474.3 |

$9,652.1 |

Absolute change |

$61.1 |

$27.1 |

$27.2 |

$4.4 |

$407.2 |

$3.4 |

$5.1 |

$1.3 |

$0.6 |

$1.9 |

$15.7 |

$526.6 |

Drug-mix, direct-acting antiviral (DAA) drugs |

$52.0 |

$3.5 |

$7.6 |

$1.8 |

-$32.1 |

$5.8 |

$5.5 |

$0.0 |

$2.7 |

$0.9 |

$4.5 |

$52.2 |

Drug-mix, other drugs |

$34.7 |

$59.8 |

$28.1 |

$13.4 |

$367.9 |

$7.4 |

$7.5 |

$2.9 |

$5.2 |

$1.0 |

$20.8 |

$548.8 |

Volume |

-$24.5 |

-$7.3 |

$11.2 |

$17.0 |

-$35.6 |

$5.1 |

$3.3 |

<$0.1 |

$1.3 |

<$0.1 |

$5.0 |

-$24.4 |

Demographic |

$79.7 |

$19.6 |

$2.4 |

-$5.2 |

-$19.7 |

$0.7 |

$3.5 |

$1.3 |

$0.6 |

$0.6 |

$8.6 |

$92.1 |

Price change |

-$50.0 |

-$33.3 |

-$12.8 |

-$12.3 |

-$207.8 |

-$10.0 |

-$10.5 |

-$2.2 |

-$6.8 |

-$0.4 |

-$16.2 |

-$362.2 |

Substitution |

-$22.4 |

-$16.6 |

-$8.4 |

-$8.6 |

-$122.7 |

-$5.7 |

-$4.6 |

-$0.6 |

-$2.4 |

-$0.1 |

-$7.3 |

-$199.4 |

OHIP+ |

– |

– |

– |

– |

$426.6 |

– |

– |

– |

– |

– |

– |

$426.6 |

Note: This analysis is based on publicly available pricing information. It does not reflect the confidential drug price discounts negotiated by the pCPA on behalf of the public plans. Values may not add to totals due to rounding and the cross effect.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Price Change Effect

This effect captures changes in the prices of both brand-name and generic medicines. In 2018/19, reductions in drug prices generated significantly greater savings than the year before, pulling the overall cost levels downward by 4.0% ($362 million). An analysis by market segment suggests that the downward pull was mainly due to the reduction in the average unit costs reimbursed in the multi-source generic category, as the average unit costs of patented medicines remained relatively stable while the costs of single-source non-patented medicines increased.

The price change effect in 2018/19 was heavily influenced by the pan-Canadian Pharmaceutical Alliance (pCPA) and Canadian Generic Pharmaceutical Association (CGPA) joint five-year pricing agreement initiated on April 1, 2018, which reduced the prices of 67 of the most commonly prescribed generic medicines in Canada to approximately 10% to 18% of their equivalent brand name product. This initiative alone accounted for a -3.7% impact on the growth in overall drug costs in 2018/19. As the agreement consisted of a one-time reduction in costs, it is not expected to further impact cost growth in coming years.

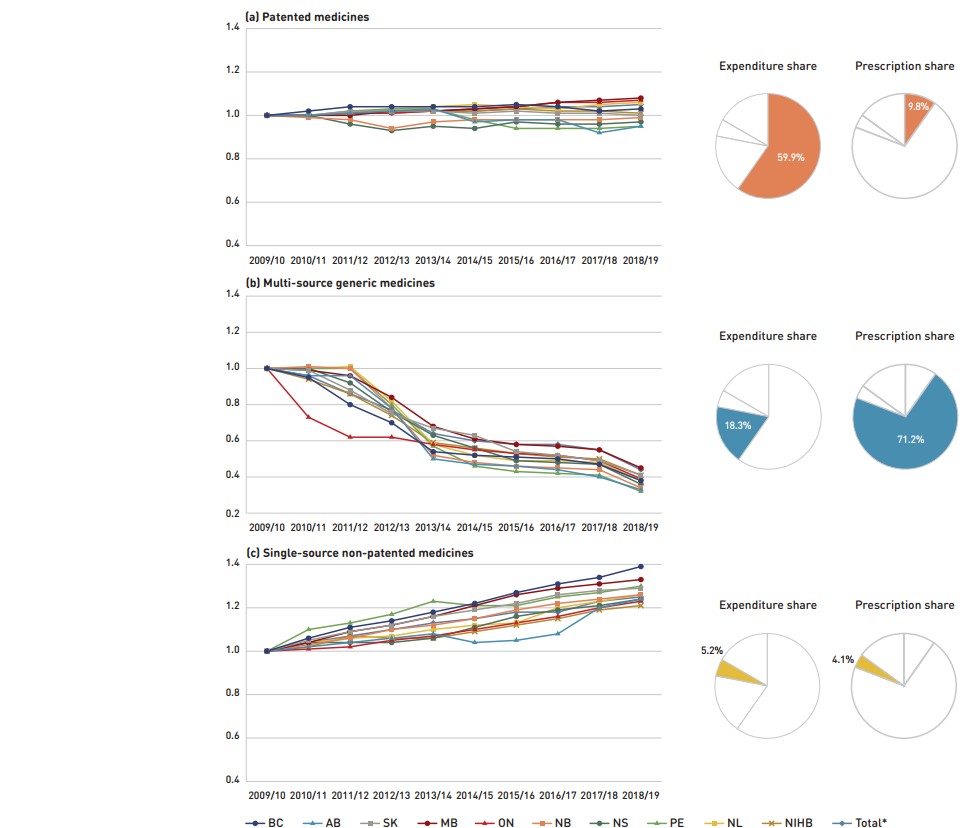

Figure 2.3 reports long-term trends in average unit costs from 2009/10 to 2018/19 by market segment for (a) patented medicines; (b) multi-source generic medicines; and (c) single-source non-patented medicines, along with their corresponding 2018/19 market shares. The results are presented as an index, with the base year (2009/10) set to one and subsequent years reported relative to this value. The findings were calculated using the cost-weighted average of the average reimbursed unit cost changes at the individual medicine level. The analysis was restricted to oral solid formulations to ensure unit consistency.

From 2009/10 to 2018/19, the prices of patented medicines, which represent the largest market segment (59.9%), were relatively stable, while the prices of single-source non-patented medicines, the smallest market segment (5.2%), increased by an average of 25%. Despite this significant rise, the impact of the single-source non-patented market segment was limited due to its small size.

The multi-source generic market segment shows a similar trend across all NPDUIS public drug plans: a rapid decline in the first few years after generic price reforms, followed by a more gradual decline from 2014/15 to 2016/17 as generic prices stabilized. Following the most recent price reforms, prices declined by an average of 3% in 2017/18 followed by a more notable 11% drop in 2018/19. As a result, the average multi-source generic unit cost across all jurisdictions in 2018/19 was less than half of the 2009/10 average.

Brief Insights: pCPA Initiatives

Through the pan-Canadian Pharmaceutical Alliance (pCPA), the provinces, territories, and federal government have been working collectively to achieve greater value for generic and brand-name medicines for Canada’s publicly funded drug programs.

Generic medicines:

Between April 1, 2015, and April 1, 2016, the prices of 18 commonly used generic medicines were reduced to 18% of their brand-name reference products. In addition, a one-year bridging period was initiated on April 1, 2017, which further reduced the prices of six of the molecules to 15% of the brand reference price.

As of April 1, 2018, a five-year joint agreement between the pCPA and the Canadian Generic Pharmaceutical Association (CGPA) reduced the prices of 67 of the most commonly prescribed generic medicines in Canada by 25% to 40%, resulting in overall discounts of up to 90% off the price of their brand-name equivalents.

Brand-name medicines:

As of September 30, 2020, 383 joint negotiations or product listing agreements (PLAs) for brand-name drugs had been completed by the pCPA, with another 30 negotiations underway. The impact of the negotiated prices is not reflected in this analysis.

For more details, see the overview of generic pricing policies and pCPA initiatives available in the Resources section of the NPDUIS Analytical Studies page on the PMPRB website.

Figure description

This figure has three sections, each with a line graph depicting the average unit cost index from 2009/10 to 2018/19 for (a) patented medicines, (b) multi-source generic medicines, and (c) single-source non-patented medicines. Results are given for each NPDUIS drug plan, as well as the total for all plans. Expenditure and prescription shares for 2018/19 are shown in pie charts beside each graph.

(a) Patented medicines

Expenditure share: 59.9%

Prescription share: 9.8%

| 2009/10 | 2010/11 | 2011/12 | 2012/13 | 2013/14 | 2014/15 | 2015/16 | 2016/17 | 2017/18 | 2018/19 | |

|---|---|---|---|---|---|---|---|---|---|---|

British Columbia |

1.00 |

1.02 |

1.04 |

1.04 |

1.04 |

1.04 |

1.05 |

1.04 |

1.02 |

1.03 |

Alberta |

1.00 |

1.00 |

1.01 |

1.02 |

1.03 |

0.97 |

0.98 |

0.98 |

0.92 |

0.95 |

Saskatchewan |

1.00 |

1.00 |

1.02 |

1.02 |

1.02 |

1.01 |

1.02 |

1.01 |

1.01 |

1.02 |

Manitoba |

1.00 |

1.00 |

1.00 |

1.02 |

1.02 |

1.03 |

1.04 |

1.06 |

1.07 |

1.08 |

Ontario |

1.00 |

1.00 |

1.01 |

1.01 |

1.02 |

1.03 |

1.04 |

1.06 |

1.06 |

1.07 |

New Brunswick |

1.00 |

0.99 |

0.98 |

0.94 |

0.97 |

0.98 |

0.98 |

0.98 |

0.98 |

0.99 |

Nova Scotia |

1.00 |

1.00 |

0.96 |

0.93 |

0.95 |

0.94 |

0.97 |

0.96 |

0.96 |

0.97 |

Prince Edward Island |

1.00 |

1.00 |

1.02 |

1.03 |

1.03 |

0.98 |

0.94 |

0.94 |

0.94 |

0.95 |

Newfoundland and Labrador |

1.00 |

1.00 |

1.01 |

1.03 |

1.04 |

1.05 |

1.04 |

1.03 |

1.05 |

1.06 |

Non-Insured Health Benefits |

1.00 |

1.00 |

1.01 |

1.02 |

1.02 |

1.02 |

1.03 |

1.02 |

1.02 |

1.01 |

Total* |

1.00 |

1.00 |

1.01 |

1.01 |

1.02 |

1.02 |

1.03 |

1.04 |

1.04 |

1.05 |

(b) Multi-source generic medicines

Expenditure share: 18.3%

Prescription share: 71.2%

| 2009/10 | 2010/11 | 2011/12 | 2012/13 | 2013/14 | 2014/15 | 2015/16 | 2016/17 | 2017/18 | 2018/19 | |

|---|---|---|---|---|---|---|---|---|---|---|

British Columbia |

1.00 |

0.95 |

0.80 |

0.70 |

0.54 |

0.52 |

0.51 |

0.50 |

0.47 |

0.38 |

Alberta |

1.00 |

0.96 |

0.96 |

0.78 |

0.50 |

0.47 |

0.46 |

0.44 |

0.40 |

0.33 |

Saskatchewan |

1.00 |

0.99 |

0.88 |

0.75 |

0.67 |

0.63 |

0.54 |

0.52 |

0.49 |

0.41 |

Manitoba |

1.00 |

0.99 |

0.96 |

0.84 |

0.68 |

0.61 |

0.58 |

0.57 |

0.55 |

0.45 |

Ontario |

1.00 |

0.73 |

0.62 |

0.62 |

0.58 |

0.55 |

0.53 |

0.52 |

0.49 |

0.39 |

New Brunswick |

1.00 |

1.01 |

1.00 |

0.78 |

0.52 |

0.48 |

0.46 |

0.45 |

0.44 |

0.34 |

Nova Scotia |

1.00 |

1.00 |

0.92 |

0.76 |

0.63 |

0.56 |

0.49 |

0.48 |

0.47 |

0.36 |

Prince Edward Island |

1.00 |

1.00 |

1.00 |

0.80 |

0.57 |

0.46 |

0.43 |

0.42 |

0.41 |

0.32 |

Newfoundland and Labrador |

1.00 |

1.00 |

1.01 |

0.82 |

0.58 |

0.52 |

0.49 |

0.49 |

0.48 |

0.38 |

Non-Insured Health Benefits |

1.00 |

0.94 |

0.86 |

0.74 |

0.59 |

0.56 |

0.53 |

0.51 |

0.50 |

0.41 |

Total* |

1.00 |

0.96 |

0.86 |

0.77 |

0.64 |

0.60 |

0.58 |

0.58 |

0.55 |

0.44 |

(c) Single-source non-patented medicines

Expenditure share: 5.2%

Prescription share: 4.1%

| 2009/10 | 2010/11 | 2011/12 | 2012/13 | 2013/14 | 2014/15 | 2015/16 | 2016/17 | 2017/18 | 2018/19 | |

|---|---|---|---|---|---|---|---|---|---|---|

British Columbia |

1.00 |

1.06 |

1.11 |

1.14 |

1.18 |

1.22 |

1.27 |

1.31 |

1.34 |

1.39 |

Alberta |

1.00 |

1.02 |

1.04 |

1.06 |

1.08 |

1.04 |

1.05 |

1.08 |

1.20 |

1.24 |

Saskatchewan |

1.00 |

1.05 |

1.09 |

1.12 |

1.16 |

1.19 |

1.22 |

1.26 |

1.28 |

1.29 |

Manitoba |

1.00 |

1.04 |

1.09 |

1.12 |

1.16 |

1.21 |

1.26 |

1.29 |

1.31 |

1.33 |

Ontario |

1.00 |

1.01 |

1.02 |

1.05 |

1.07 |

1.10 |

1.13 |

1.16 |

1.20 |

1.23 |

New Brunswick |

1.00 |

1.03 |

1.06 |

1.10 |

1.12 |

1.15 |

1.19 |

1.22 |

1.24 |

1.26 |

Nova Scotia |

1.00 |

1.04 |

1.04 |

1.04 |

1.06 |

1.11 |

1.16 |

1.19 |

1.21 |

1.24 |

Prince Edward Island |

1.00 |

1.10 |

1.13 |

1.17 |

1.23 |

1.21 |

1.21 |

1.25 |

1.27 |

1.30 |

Newfoundland and Labrador |

1.00 |

1.04 |

1.06 |

1.07 |

1.10 |

1.12 |

1.13 |

1.20 |

1.23 |

1.26 |

Non-Insured Health Benefits |

1.00 |

1.02 |

1.07 |

1.06 |

1.06 |

1.09 |

1.12 |

1.15 |

1.19 |

1.21 |

Total* |

1.00 |

1.04 |

1.07 |

1.10 |

1.13 |

1.15 |

1.18 |

1.18 |

1.23 |

1.25 |

Note: This analysis only includes data for beneficiaries that met their deductible and received public reimbursement.

Yukon is not reported due to data limitations. The findings were calculated using the cost-weighted average of the average reimbursed unit cost changes at the individual drug level. The analysis was limited to data for oral solid formulations. The remaining share of prescriptions and expenditures includes devices, compounded drugs, and other products that are reimbursed by public drug plans but do not have a Health Canada assigned Drug Identification Number (DIN).

* Total results for the drugs plans captured in this figure.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Substitution Effect

Shifts from brand-name to generic or biosimilar medicines pulled overall drug costs down by 2.2% in 2018/19, translating to a savings of $199 million for the NPDUIS public plans. Three medicines—two ACE inhibitors and one antipsychotic—were responsible for the majority of the savings from generic substitution: perindopril (-0.8%), aripiprazole (-0.3%), and perindopril/diuretics (-0.2%). The total savings offered by biosimilars remained limited, with two immunosuppressants, one immunostimulant, and one insulin making a small but growing difference in overall drug costs: Inflectra/Renflexis (-0.1%), Brenzys/Erelzi (-0.07%), Grastofil (-0.04%), and Basaglar (-0.02%).

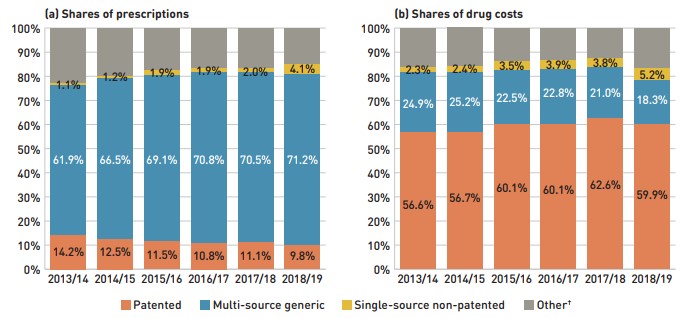

The share of prescriptions for multi-source generic medicines in public plans increased to 71.2% in 2018/19, a significant rise over 61.9% in 2013/14, while their corresponding share of total drug costs decreased over the same time period, from 24.9% to 18.3%. This six-year trend reflects the implementation of generic pricing policies, as well as the genericization of a number of commonly used medicines that lost patent protection over the past decade.

Patented medicines accounted for a decreasing share of prescriptions in 2018/19, dropping from 14.2% to 9.8% since 2013/14. However, their share of costs rose from 56.6% to 62.6% of total public plan drug costs between 2013/14 and 2017/18, remaining near 60% in 2018/19 despite the change in patent status of a few top-selling medicines. This trend has been primarily driven by the increased use of high-cost drugs such as biologics, oral oncology medicines, and the DAA drugs for hepatitis C.

Figure 2.4 reports the 2013/14 to 2018/19 trends in market shares by market segment: patented, multi-source generic, and single-source non-patented medicines.

Brief Insights: Biosimilars

In April 2016, the pCPA issued the First Principles for Subsequent Entry Biologics to guide negotiations and inform expectations for biologics and biosimilars. This was followed by the creation of the Biologics Policy Directions in September 2018 to further guide and define the process by which biologic and biosimilar products are negotiated and considered for reimbursement by Canada’s public drug plans.

Additionally, the pCPA has recently partnered with Cancer Care Ontario on a joint oncology biosimilars initiative that recognizes the unique considerations in the implementation of oncology biosimilars. Effective June 2019, biosimilars will no longer be subject to CADTH review and will instead be filed directly with the jurisdictions and pCPA.

Recently, Canadian payers including public plans in Manitoba, British Columbia, and Alberta have undertaken a number of initiatives to increase biosimilar uptake. For more information, see the Biologics in Canada, 2018 chartbook series on the PMPRB website.

Figure description

This figure shows two complementary stacked column graphs. Graph (a) shows the share of prescriptions by market segment from 2013/14 to 2018/19 for all NPDUIS public drug plans. Graph (b) shows the share of drug costs by market segment for the same period.

(a) Share of prescriptions

| Market segment | 2013/14 | 2014/15 | 2015/16 | 2016/17 | 2017/18 | 2018/19 |

|---|---|---|---|---|---|---|

Patented |

14.2% |

12.5% |

11.5% |

10.8% |

11.1% |

9.8% |

Multi-source generic |

61.9% |

66.5% |

69.1% |

70.8% |

70.5% |

71.2% |

Single-source non-patented |

1.1% |

1.2% |

1.9% |

1.9% |

2.0% |

4.1% |

Other† |

22.7% |

19.8% |

17.5% |

16.5% |

16.4% |

14.9% |

(b) Share of drug costs

| Market segment | 2013/14 | 2014/15 | 2015/16 | 2016/17 | 2017/18 | 2018/19 |

|---|---|---|---|---|---|---|

Patented |

56.6% |

56.7% |

60.1% |

60.1% |

62.6% |

59.9% |

Multi-source generic |

24.9% |

25.2% |

22.5% |

22.8% |

21.0% |

18.3% |

Single-source non-patented |

2.3% |

2.4% |

3.5% |

3.9% |

3.8% |

5.2% |

Other† |

16.2% |

15.8% |

13.9% |

13.2% |

12.6% |

16.6% |

Note: This analysis only includes data for beneficiaries that met their deductible and received public reimbursement.

* British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island, Newfoundland and Labrador, Yukon, and the Non-Insured Health Benefits Program.

† This market segment includes devices, compounded drugs, and other products that are reimbursed by public drug plans but do not have a Health Canada assigned Drug Identification Number (DIN).

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Compared to traditional generic drug markets, the savings from biosimilars are limited by a slower initial uptake and lower price reductions. The biosimilar market is a more complex space; unlike generics, biosimilars are not identical to their reference products, but are rather highly similar versions, making it more difficult to exchange one drug for another.Footnote ii Table 2.1 provides an overview of the biosimilars recently approved in Canada.

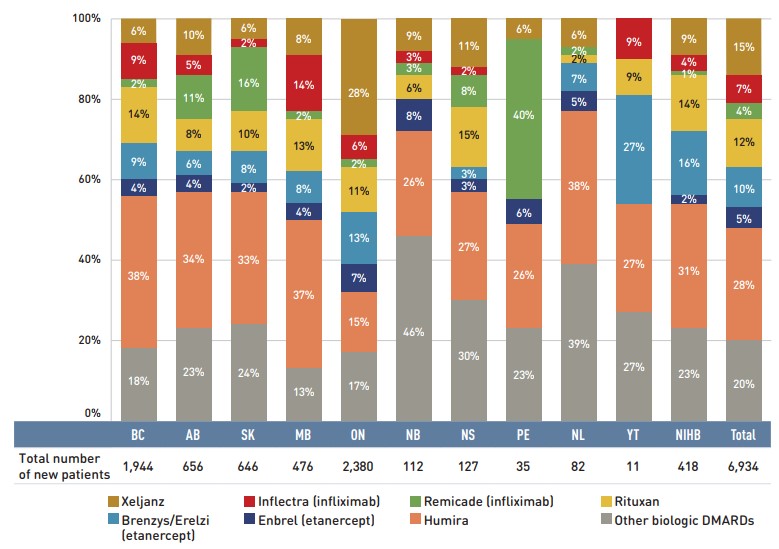

Inflectra, which was approved in Canada in 2014 and became available in the public market in 2016, was one of the first biosimilars available on the Canadian marketFootnote iii and has the highest list price discount. Inflectra and Renflexis, which was approved in 2017, were both approved for most of the same autoimmune inflammatory disease indications as their reference product Remicade. But despite having list prices set at approximately half that of Remicade, their market uptake has been slow, acquiring just 8.9% of the infliximab market by 2018/19. For more information on the market distribution of biologic disease-modifying antirheumatic drugs in the public drug plans, see Appendix B.

It was observed that biosimilars with an acute indication had significantly higher rate of uptake than biosimilars with a chronic indication. Grastofil, a biosimilar of the white blood cell stimulator Neupogen, has the highest uptake in the public plans, at 92.4% in 2018/19. However, its 25% discount from the reference product list price places it at the bottom of the biosimilars in terms of price reductions. Brenzys and Erelzi, biosimilars of the anti-TNF drug Enbrel, were approved for market in Canada in 2016 and 2017, respectively. At approximately two thirds of the list price of their reference biologic, they had captured 11.9% of the prescription share of the etanercept market by 2018/19.

Table 2.1 Biosimilars recently approved in Canada, NPDUIS public drug plans*, 2018/19

| Reference biologic | Biosimilar | |||||

|---|---|---|---|---|---|---|

| Trade name (medicinal ingredient) | Drug cost, $million (% share) | Trade name | Market approval | First reimbursement | Price discount† from reference biologic | Share of prescriptions for medicinal ingredient |

Remicade (infliximab) |

$419.9 (4.4%) |

Inflectra |

15-Jan-14 |

Q1-2016 |

46.8% |

8.9% |

Renflexis |

01-Dec-17 |

Q3-2018 |

50.1% |

|||

Lantus (insulin glargine) |

$148.2 (1.5%) |

Basaglar |

01-Sep-15 |

Q3-2017 |

25.0% |

6.2% |

Neupogen (filgrastim) |

$6.1 (0.1%) |

Grastofil |

07-Dec-15 |

Q4-2016 |

25.0% |

92.4% |

Enbrel (etanercept) |

$145.6 (1.5%) |

Brenzys |

31-Aug-16 |

Q3-2017 |

33.7% |

11.9% |

Erelzi |

06-Apr-17 |

Q4-2017 |

37.2% |

|||

* British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island, Newfoundland and Labrador, Yukon, and the Non-Insured Health Benefits Program.

† Based on Ontario Drug Benefit formulary listing price at the time of the biosimilar entry. This price may change over time; for example, the list price for Brenzys was recently lowered to match Erelzi.

Data source: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information.

Recently, Canadian payers including public drug plans in Manitoba, British Columbia, and Alberta have undertaken or proposed a number of initiatives to increase biosimilar uptake. Future editions of this report will include the impact of these initiatives as they are implemented.

Drug-Mix Effect

Shifts in use between lower- and higher-cost drugs pushed overall cost levels for the NPDUIS drug plans up by 6.1% or $549 million in 2018/19. While the drug-mix effect was more pronounced in 2018/19 than in 2017/18, the impact of direct-acting antiviral (DAA) drugs for the treatment of hepatitis C, which is reported separately in this analysis, was less significant than previous years, adding 0.6% ($52 million) to the total push effect.

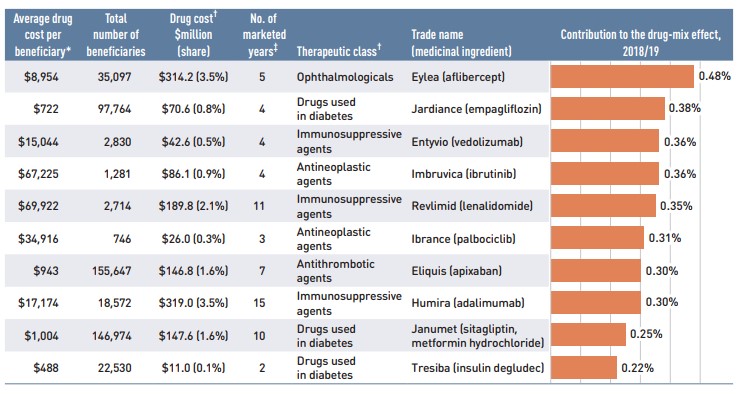

Figure 2.5 reports the 10 drugs that made the greatest contribution to the drug-mix effect in 2018/19, together accounting for an upward push of 3.3% on overall drug costs. The three drugs that made their first appearance on this list in 2018/19—Entyvio, Ibrance, and Tresiba—received their market authorization from Health Canada as little as two to four years before. Ophthalmological drug Eylea had an appreciable uptake in 2018/19 and topped the list of high-impact drugs with a 0.5% contribution to the growth in drug costs. Five of the major contributors were oral oncology products and immunosuppressants with average annual treatment costs exceeding $10,000, two of which exceeded $50,000. The remaining four drugs were used by larger beneficiary populations to treat more common conditions.

The share of total drug costs for each of the top contributors is reported in the accompanying table. Note that this value differs from the contribution to the drug-mix effect, which measures the growth (increase or decrease in costs over time) rather than the costs themselves.

Spotlight on DAA drugs for hepatitis C

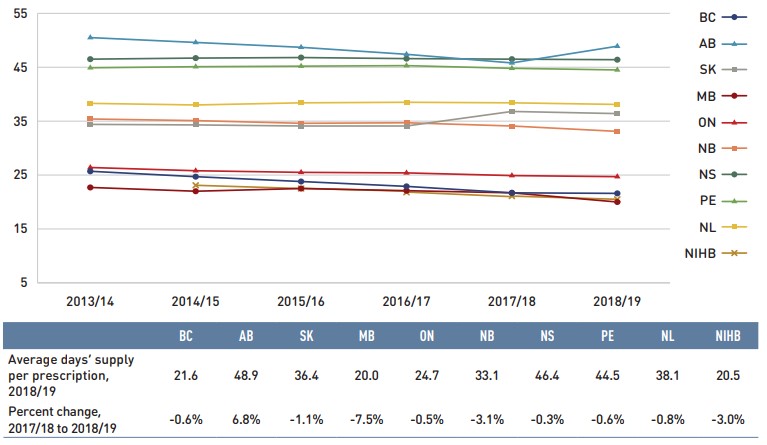

Direct-acting antiviral (DAA) drugs for hepatitis C have had a significant but variable impact on public plan drug costs over the last few years. With the entry of newer DAA drugs and expanded treatment criteria in 2017/18, the number of active beneficiaries increased by nearly 60% to reach 11,920. In 2018/19, the number of active beneficiaries using DAA drugs continued to increase at a slower pace, rising by 9% to 13,019 with a corresponding increase of $52 million in overall costs.