Meds Entry Watch 8th Edition

Erratum

The report has been revised to include a correction to Table D1 “Medicines First Approved in Canada in 2021, Availability, Sales, and Prices as of Q4-2022”. The medicine “trientine” has been removed from the table as it was first approved in Canada in 2020, placing it outside the scope of analysis.

The following note that can be found under Table B1 and Table C1 has now been added to Table D1: “Availability and sales information refer to all forms and strengths of the medicine, while pricing and treatment costs are based on the highest-selling form and strength indicated. Sales are based on manufacturer list prices.”

ISSN 2560-6204

Cat. No.: H79-12E-PDF

May 2024

Figures

- Figure A1: New medicines approved by the US FDA, the EMA, and/or Health Canada, 2017 to 2022

- Figure A2: New medicine cumulative share of all brand-name medicine sales by year of approval (2017 to 2021), Canada and the PMPRB11*

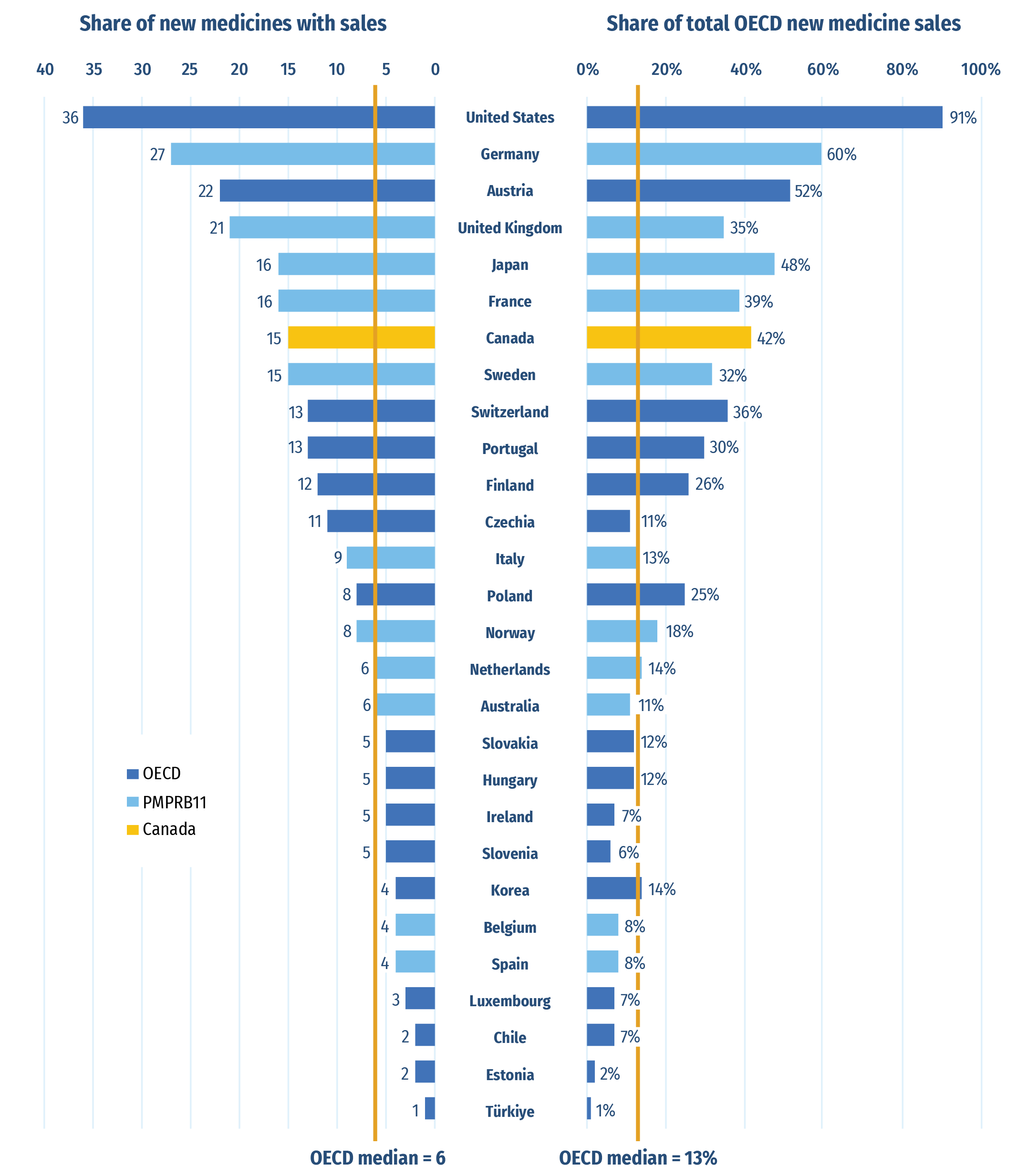

- Figure A3: Share of new medicines* from 2017 to 2021 with available sales and their respective share of OECD sales, by country, Q4‑2022

- Figure A4: Number of semaglutide claimants by age and sex, Canadian public plans, 2022

- Figure B1: Number of 2021 new medicines with market approval as of Q4‑2021 and Q4‑2022

- Figure B2: Number of 2021 new medicines with available sales and their respective share of OECD sales, by country, Q4‑2022

- Figure B3: Distribution of 2021 new approvals for specialty medicines

- Figure B4: Distribution of new medicines approved in 2021 by treatment cost

- Figure C1: Number of 2022 medicines with market approval as of Q4‑2022 and Q3‑2023

- Figure C2: Distribution of 2022 new approvals for specialty medicines

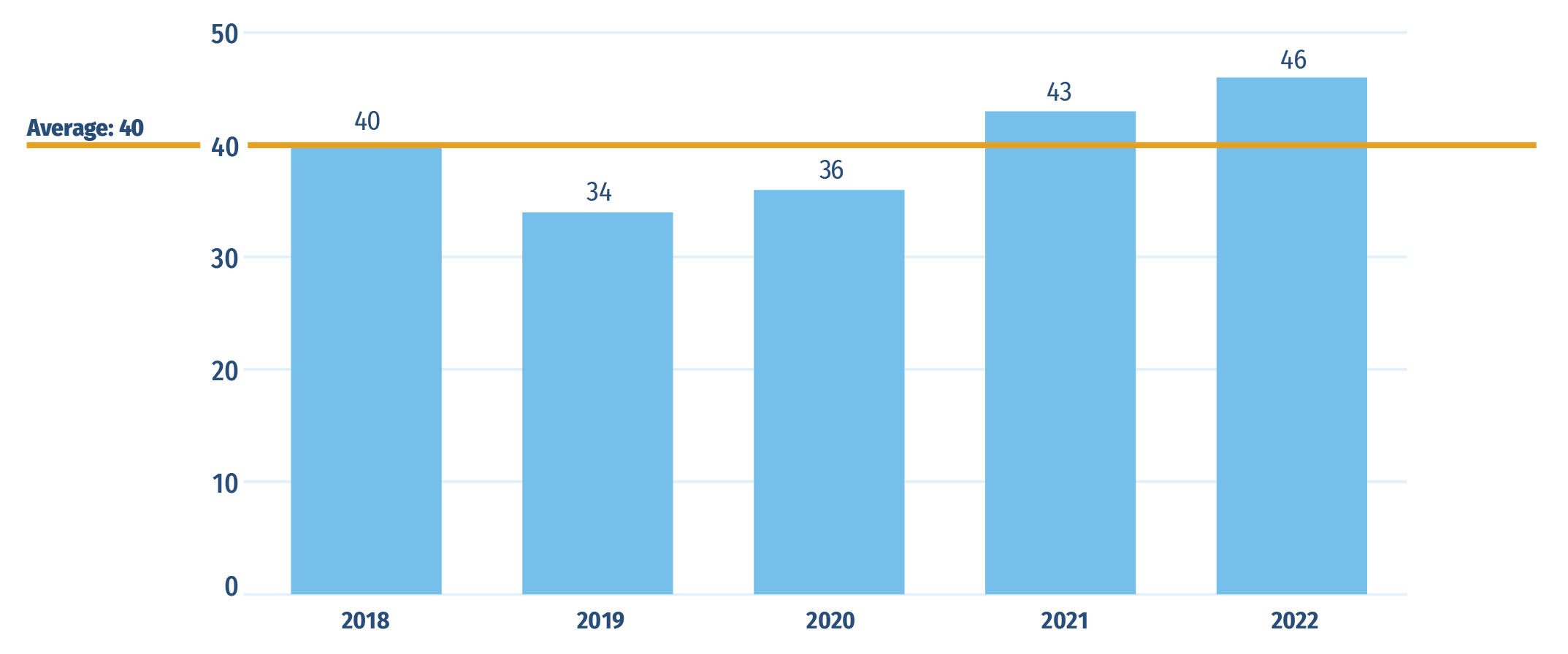

- Figure D1: Annual approvals for new medicines in Canada, 2018 to 2022

Tables

- Table B1: New medicines approved in 2021, availability, share of sales, prices, and treatment costs, ranked by therapeutic class share of sales, Q4‑2022

- Table B2: Assessments, recommendations, and reimbursement decisions for 2021 new medicines approved in Canada by Q3‑2023

- Table B3: Summary of Reimbursement Review assessments for 2021 new medicines approved in Canada by Q3‑2023

- Table C1: New medicines approved in 2022, availability, prices, and treatment costs, Q4‑2022

- Table D1: Medicines first approved in Canada in 2021, availability, sales, and prices as of Q4‑2022

About the PMPRB

The Patented Medicine Prices Review Board (PMPRB) protects and informs Canadian consumers by reviewing the prices of patented medicines sold in Canada, and by reporting on pharmaceutical trends. The PMPRB is an independent quasi-judicial body that is part of the Health portfolio, and operates at arm’s-length from the Minister of Health.

The NPDUIS Initiative

The National Prescription Drug Utilization Information System (NPDUIS) is a research initiative established by federal, provincial, and territorial Ministers of Health in September 2001. It is a partnership between the PMPRB and the Canadian Institute for Health Information (CIHI).

Pursuant to section 90 of the Patent Act, the PMPRB has the mandate to conduct analysis that provides decision makers with critical information and intelligence on price, utilization, and cost trends so that Canada’s health care system has more comprehensive and accurate information on how medicines are being used and on sources of cost pressures.

The specific research priorities and methodologies for NPDUIS are established with the guidance of the NPDUIS Advisory Committee and reflect the priorities of the participating jurisdictions, as identified in the NPDUIS Research Agenda. The Advisory Committee is composed of representatives from public drug plans in British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island, Newfoundland and Labrador, Yukon, the Non-Insured Health Benefits Program (NIHB), and Health Canada. It also includes observers from CIHI, the Canadian Agency for Drugs and Technologies in Health (CADTH), the Ministère de la Santé et des Services sociaux du Québec (MSSS), and the pan-Canadian Pharmaceutical Alliance (pCPA) Office.

Acknowledgements

This report was prepared by the Patented Medicine Prices Review Board (PMPRB) as part of the National Prescription Drug Utilization Information System (NPDUIS) initiative.

The PMPRB wishes to acknowledge and thank the members of the NPDUIS Advisory Committee for their expert oversight and guidance in the preparation of this report. Please note that the statements, findings, and conclusions do not necessarily reflect those of the members or their organizations.

Appreciation goes to Blake Wladyka for leading this project, as well as to Kevin Pothier and Brian O’Shea for their oversight in the development of the report. The PMPRB also wishes to acknowledge the contributions of Dr. Étienne Gaudette to the analysis, the editorial contributions of Shirin Paynter, and technical assistance from Lorcan Mischler.

Disclaimer

NPDUIS operates independently of the regulatory activities of the Board of the PMPRB. The research priorities, data, statements, and opinions expressed or reflected in NPDUIS reports do not represent the position of the PMPRB with respect to any regulatory matter. NPDUIS reports do not contain information that is confidential or privileged under sections 87 and 88 of the Patent Act, and the mention of a medicine in an NPDUIS report is not and should not be understood as an admission or denial that the medicine is subject to filings under sections 80, 81, or 82 of the Patent Act or that its price is or is not excessive under section 85 of the Patent Act.

Although this information is based in part on data obtained under license from the MIDAS® database proprietary to IQVIA Solutions Canada Inc. and/or its affiliates ("IQVIA"), the statements, findings, conclusions, views, and opinions expressed in this report are exclusively those of the PMPRB and are not attributable to IQVIA.

Contact Information

Patented Medicine Prices Review Board

Standard Life Centre

Box L40

333 Laurier Avenue West

Suite 1400

Ottawa, ON K1P 1C1

Tel.: 1-877-861-2350

TTY 613-288-9654

Email: PMPRB.Information-Renseignements.CEPMB@pmprb-cepmb.gc.ca

Web: https://www.canada.ca/en/patented-medicine-prices-review.html

Suggested Citation

Patented Medicine Prices Review Board. (2024). Meds Entry Watch, 8th edition. Ottawa: PMPRB.

Executive Summary

This is the eighth edition of the Meds Entry Watch report, which explores the market entry of new medicines in Canada and other countries. Building on a retrospective analysis of trends since 2017, this report focuses on medicines that received first-time market approval through the US Food and Drug Administration (FDA), the European Medicines Agency (EMA), and/or Health Canada in 2021 and 2022, and analyzes their uptake, pricing, sales, and availability as of the last quarter of 2022 (Q4‑2022).

In addition to the international analysis, a Canadian-focused section provides information on medicines that received their first Health Canada approval in 2021, as well as a retrospective review of sales from 2018 to 2022.

This publication informs decision makers, researchers, and patients of the evolving market dynamics of emerging therapies in Canadian and international pharmaceutical markets.

The IQVIA MIDAS® database was the primary source for the sales and list prices of new medicines in Canadian and international markets, as well as for the quantity sold.

International markets examined include the Organisation for Economic Co-operation and Development (OECD) members, with a focus on Australia, Belgium, France, Germany, Italy, Japan, the Netherlands, Norway, Spain, Sweden, and the United Kingdom (UK), which will comprise the PMPRB11 comparator countries. Where appropriate, the United States (US) is included to provide additional context.

Key Findings

- Trends in New Medicine Approvals, 2017 to 2022

- From 2017 to 2022, an average of 50 new medicines were approved internationally each year. Half of these medicines received an orphan designation from the FDA or EMA.

- New medicines with Canadian sales accounted for 81% of all new medicine sales in the OECD in Q4‑2022, indicating that Canada continues to approve and sell the higher-selling medicines approved internationally.

- In 2022, Canadian sales of semaglutide generated over $1B in revenue, accounting for over a quarter of new medicine revenues. Public plans covered over 70% of this amount.

- 2021 New Medicine Approvals and Sales

- In 2021, a five-year high of 55 new medicines were approved by the FDA, the EMA, and/or Health Canada. Of those, 23 (42%) received an orphan designation, and 15 (27%) were oncology medicines. Of the 42 medicines for which a treatment cost was available, 36 (85%) had a high cost (>$10,000 annually or >$5,000 per 28-day treatment cycle).

- Canada ranked fifth among OECD countries in terms of new medicines with sales, despite fewer 2021 new medicines approved in Canada than in the US and Europe.

- Migraine medicine atogepant was the highest-selling new medicine of 2021, accounting for 17% of Q4‑2022 sales.

- 2022 New Medicine Approvals

- In 2022, 48 medicines received first-time market approval through the FDA, the EMA, and/or Health Canada. Of those, 56% received an orphan designation from the FDA and/or the EMA, and 27% were oncology treatments.

- All but one oncology medicine received an orphan designation from the FDA or EMA.

- Spotlight on Canada

- Canada approved 43 new medicines in 2021 and 46 in 2022, above the five-year average of 40.

- As of Q4‑2022, trastuzumab deruxtecan and risdiplam were the highest-selling among Canada’s 2021 newly approved medicines with 37% and 26% of new-to-Canada sales, respectively.

Introduction

Meds Entry Watch is an annual publication that explores the dynamics of new medicines entering Canadian and international markets, providing information on their availability, sales, and prices.

This report builds on the seven previous editions to provide a broad analysis of medicines that have received market approval since 2017, with a special focus on medicines approved in 2021 and 2022. New medicines are identified for each year based on the date of their first market authorization by the US Food and Drug Administration (FDA), the European Medicines Agency (EMA), and/or Health Canada.

The report consists of four main sections: Section A provides an overview of trends from 2017 to 2022; Section B focuses on new medicines that received international market approval in 2021; Section C presents a preliminary analysis of the new medicines approved internationally in 2022; and Section D spotlights Health Canada approvals in 2021.

This publication informs decision makers, researchers, and patients of emerging therapies in Canadian and international pharmaceutical markets.

Methods

This report analyzes new medicines that received first-time market approval from the FDA, the EMA, and/or Health Canada since 2017, with a focus on those approved in 2021 and 2022. A new medicine was selected for analysis if it received market authorization from any of these regulatory bodies during the calendar year for the first time, even if it was not yet listed for reimbursement or if there were no recorded sales in the available source data. For the purposes of this analysis, new medicines were identified at the medicinal ingredient level.

Using these criteria, 254 new medicines were identified as new approvals between 2017 and 2022, including the 55 new approvals in 2021 analyzed in Section B, and 48 medicines identified for the preliminary analysis in 2022 and presented in Section C. The approval of these medicines in Canadian and international markets was assessed as of the third quarter of 2023 (Q3‑2023).

The selection of medicines featured in the analysis of the Canadian market in Section D differed from the previous sections. Medicines analyzed in Section D included new and previously marketed medicinal ingredients that received their first Canadian market authorization through Health Canada in 2021. This included several medicines in the 2021 analysis in Section B, but also encompassed medicines that received initial approval through the FDA or EMA in previous years but were first approved for the Canadian market in 2021. Marketed status for Canadian approvals was sourced from Health Canada’s Drug Product database.

The international markets examined included the Organisation for Economic Co-operation and Development (OECD) countries, with a focus on Australia, Belgium, France, Germany, Italy, Japan, the Netherlands, Norway, Spain, Sweden, and the United Kingdom (UK), which comprise the 11 PMPRB Schedule Countries (“PMPRB11”) specified in the amended Patented Medicines Regulations, which came into force July 1, 2022. Results for the United States (US) were also included for comparison purposes.

The IQVIA MIDAS® database (all rights reserved) was the main data source for the sales and list prices of new medicines in Canadian and international markets, as well as the volume of units sold. MIDAS® data reflects the national retail and hospital sectors for each country, including all sales (public, private, and out-of-pocket). Sales and volume data encompass all versions of a medicine available in a particular country, produced by any manufacturer in any strength and form. For more information on MIDAS® and other NPDUIS source materials, see the Resources section of the NPDUIS Analytical Studies webpage.

Canadian prices were based on MIDAS® data, if available; otherwise, they were obtained from publicly available results of the Reimbursement Review reports published by the Canadian Agency for Drugs and Technologies in Health (CADTH). Treatment costs were calculated using Canadian list prices where possible; if not, the foreign median price was used. Information on dosing regimens was taken from the product monographs published by Health Canada, or if not available, from the FDA or EMA. All medicines were reviewed as of Q3‑2023.

Prices and foreign-to-Canadian price ratios were reported for the highest-selling form and strength of each medicine in Canada, or in the PMPRB11 if no Canadian sales were available at the time of the analysis. The foreign-to-Canadian price ratios presented in this report were expressed as an index with the Canadian price set to a value of one and the international median reported relative to this value. For more details on how foreign-to-Canadian price ratios are calculated, see the Resources section of the NPDUIS Analytical Studies webpage.

Prices and sales in foreign currencies were converted into Canadian dollars using the 12-month or 3-month average exchange rate for the year or quarter, respectively.

The FDA and EMA issue orphan designations for medicines that are intended for the treatment, prevention, or diagnosis of a rare disease or condition. The FDA considers this to be one that affects less than 200,000 persons in the US. Meds Entry Watch considers a medicine to have orphan status if it is granted by either the FDA or EMA. Health Canada does not issue orphan designations.

Limitations

New medicines reported in Sections A, B, and C are selected for analysis based on their date of market approval by the FDA, the EMA, and/or Health Canada. Some of the medicines reported may have earlier approval dates in other countries, such as Australia and Japan, which are governed by other regulatory bodies. Likewise, the medicines included in this analysis do not necessarily represent all of those introduced in 2021 and 2022, as other national regulatory bodies not examined in this report may have approved additional medicines. Nevertheless, as the FDA and EMA represent significant international markets, this is expected to have little effect on the overall results.

Market approval does not necessarily mean that the medicine is available for sale in the country or countries represented by the regulatory body granting approval. The availability of a new medicine in each country at any point in time is influenced by a variety of factors including the manufacturer’s business decision to launch, as well as the timing of that decision; the regulatory approval process in place; and the existing market dynamics. The assessment of medicine availability in Canada does not consider non-marketed medicines available through exceptional programs such as the Special Access Program (SAP) for drugs in Canada. Because this report describes the initial market penetration of new medicines, availability and uptake are expected to increase in subsequent years.

Canadian and international sales and prices are based on manufacturer list prices as reported in MIDAS®, and do not capture price rebates, managed entry agreements (also known as product listing agreements), dispensing fees, or patient access schemes. The methodology used by MIDAS® for estimating sales volumes and revenue, which are used to calculate unit prices, varies by country and data availability.

Some medicines with sales may not be reported in IQVIA MIDAS®, and thus, the sales of new medicines may be under-reported. However, as the effect is expected to be approximately consistent across all markets, this should not have an impact on the overall findings.

Aggregated international sales and pricing data are skewed towards the United States because it approved more drugs than other countries and had a larger market size. As a result, the ranking of medicines by international sales generally reflects the order of sales in the US.

Publicly available prices from the Canadian Agency for Drugs and Technologies in Health (CADTH) are based on the manufacturers’ submitted list prices, which may differ from list prices upon market entry.

While vaccines are included in the report, their sales and pricing data are not included due to inconsistent information from data sources because an important portion of sales occur through government purchasing agreements.

A: Trends in New Medicine Approvals, 2017–2022

This section presents a five-year retrospective review of new medicine approvals and sales. It reports on the number of new medicines approved from 2017 to 2022 and tracks the progress of those approved from 2017 to 2021 through the end of 2022. Sales and pricing information is reported as of Q4‑2022.

Specialty medicines such as orphan and oncology treatments made up an important share of the new medicines approved over the period. Canada ranked seventh among the PMPRB11 countries and tenth in the OECD in terms of the number of new medicines approved and sold domestically. By the end of 2022, 16% of all brand-name sales in Canada were for medicines first approved by the US FDA, the EMA, or Health Canada between 2017 and 2021.

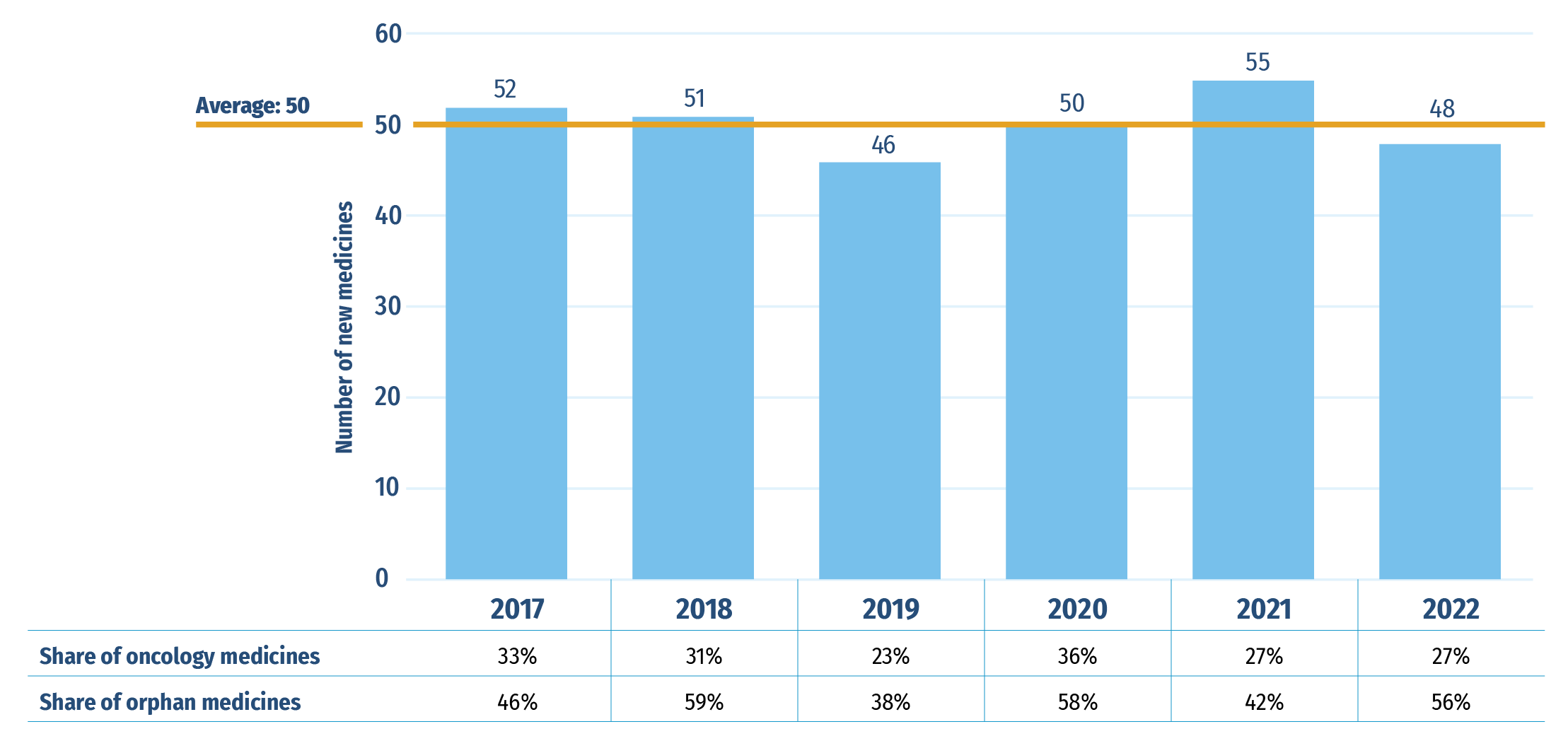

An average of 50 new medicines received first-time market approval through the FDA, the EMA, and/or Health Canada annually between 2017 and 2022 (Figure A1). In 2021, 55 new medicines were approved, of which 29 (42%) received an orphan designation for at least one indication from the FDA and/or EMA, and 15 (27%) were indicated to treat cancer.

An additional 48 new medicines were approved in 2022, including a higher share of orphan treatments and an unchanged share of oncology treatments: orphan medicines accounted for 56% of new approvals while oncology medicines represented 27%.

Figure A1: New medicines approved by the US FDA, the EMA, and/or Health Canada, 2017 to 2022

Figure A1 - Text version

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|---|---|

| Number of new medicines | 52 | 51 | 46 | 50 | 55 | 48 |

| 2017‑2022 Average | 50 | |||||

| Share of oncology medicines | 33% | 31% | 23% | 36% | 27% | 27% |

| Share of orphan medicines | 46% | 59% | 38% | 58% | 42% | 56% |

Data source: US Food and Drug Administration, European Medicines Agency, and Health Canada databases.

Figure A2 illustrates the year-over-year uptake in sales for medicines first approved between 2017 and 2021. By Q4‑2022, these medicines collectively accounted for 15.5% of the total brand-name pharmaceutical market in Canada and internationally (Figure A2). Medicines that were approved in 2021 represented 0.4% of all branded pharmaceutical sales in Canada and the PMPRB11.

In any given year, the impact of new medicines on pharmaceutical sales depends on their number, therapeutic relevance, and treatment costs. As in the previous edition of this report, Canadian Q4‑2022 sales of new medicines were led by semaglutide, the blockbuster diabetes medicine introduced in 2017, and bictegragivir, an HIV medicine introduced in 2018. Canadian sales of semaglutide exceeded $1B in 2022, accounting for over a quarter of new medicines sales and 4% of total Canadian sales in that year.

Figure A2 New medicine cumulative share of all brand-name medicine sales by year of approval (2017 to 2021), Canada and the PMPRB11Footnote *

Figure A2a: Canada and the PMPRB11

Figure A2a - Text version

| - | Revenue year | |||||

|---|---|---|---|---|---|---|

| Year of approval | 2018 | 2019 | 2020 | 2021 | 2022 | Q4‑2022 |

| 2017 | 2.2% | 3.0% | 4.1% | 5.4% | 7.1% | 7.6% |

| 2018 | 0.1% | 0.6% | 1.5% | 2.1% | 2.8% | 3.0% |

| 2019 | 0.0% | 0.1% | 0.5% | 1.5% | 2.6% | 3.0% |

| 2020 | 0.0% | 0.0% | 0.1% | 0.5% | 1.4% | 1.6% |

| 2021 | 0.0% | 0.0% | 0.0% | 0.0% | 0.2% | 0.4% |

| New medicine shares of sales | 2.3% | 3.7% | 6.2% | 9.6% | 14.1% | 15.5% |

Figure A2b: Canada

Figure A2b - Text version

| - | Revenue year | |||||

|---|---|---|---|---|---|---|

| Year of approval | 2018 | 2019 | 2020 | 2021 | 2022 | Q4‑2022 |

| 2017 | 1.5% | 3.5% | 5.2% | 7.0% | 9.9% | 10.7% |

| 2018 | 0.0% | 0.4% | 1.1% | 1.7% | 2.2% | 2.3% |

| 2019 | 0.0% | 0.1% | 0.4% | 0.9% | 1.8% | 2.0% |

| 2020 | 0.0% | 0.0% | 0.0% | 0.2% | 0.6% | 0.7% |

| 2021 | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.1% |

| New medicine shares of sales | 1.5% | 4.0% | 6.8% | 9.8% | 14.5% | 15.7% |

Data source: IQVIA MIDAS® Database, 2022 (all rights reserved).

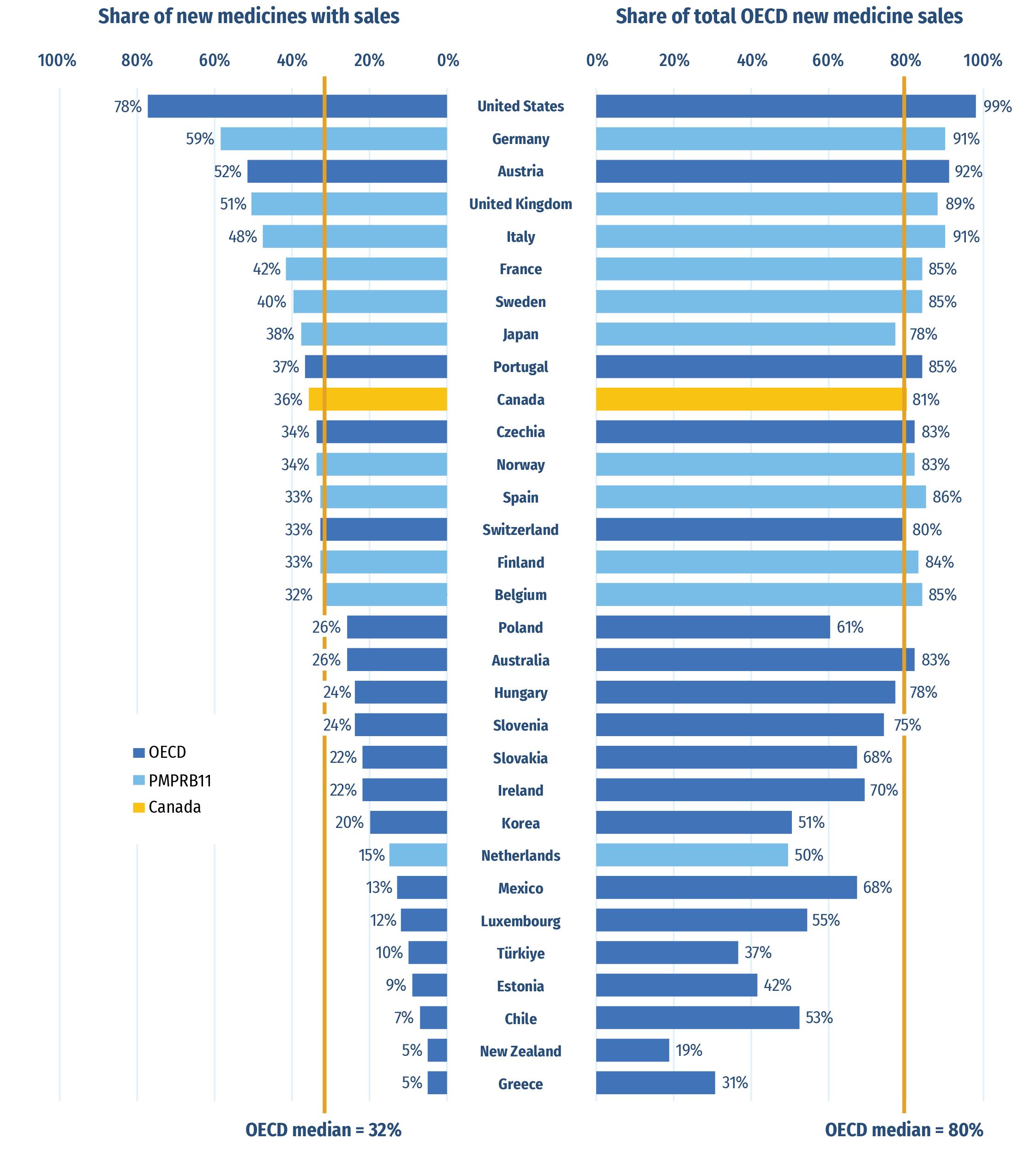

Of the 254 medicines approved from 2017 to 2021, 91 (36%) had sales in Canada by Q4‑2022 (Figure A3). While Canada’s proportion of new medicines with sales was higher than the OECD median of 32%, it ranked below six of the PMPRB11 countries, many of which have lower average list prices for patented medicines than Canada (PMPRB 2022a). The new medicines sold in Canada accounted for 81% of the OECD sales for all new medicines analyzed, representing the fifteenth-highest share in the OECD, slightly above the median of 80%. These findings are consistent with those observed in previous editions of Meds Entry Watch and show that most of the top-selling new medicines in the OECD are being sold in Canada. Similar results have also been found in targeted analyses of the expensive drugs for rare diseases and oncology market segments (PMPRB 2020; 2022b).

Figure A3: Share of new medicinesFootnote * from 2017 to 2021 with available sales and their respective share of OECD sales, by country, Q4‑2022

Figure A3 - Text version

| Country | Share of new medicines with sales | Share of total Organisation for Economic Co-operation and Development new medicine sales |

|---|---|---|

| United States | 78% | 99% |

| Germany | 59% | 91% |

| Austria | 52% | 92% |

| United Kingdom | 51% | 89% |

| Italy | 48% | 91% |

| France | 42% | 85% |

| Sweden | 40% | 85% |

| Japan | 38% | 78% |

| Portugal | 37% | 85% |

| Canada | 36% | 80% |

| Czechia | 34% | 83% |

| Norway | 34% | 83% |

| Spain | 33% | 86% |

| Switzerland | 33% | 80% |

| Finland | 33% | 84% |

| Belgium | 32% | 85% |

| Poland | 26% | 61% |

| Australia | 26% | 83% |

| Hungary | 24% | 78% |

| Slovenia | 24% | 75% |

| Slovakia | 22% | 68% |

| Ireland | 22% | 70% |

| South Korea | 20% | 51% |

| Netherlands | 15% | 50% |

| Mexico | 13% | 68% |

| Luxembourg | 12% | 55% |

| Türkiye | 10% | 37% |

| Estonia | 9% | 42% |

| Chile | 7% | 53% |

| New Zealand | 5% | 19% |

| Greece | 5% | 31% |

| OECD median | 32% | 80% |

Note: Sales are based on manufacturer list prices and include sales for all OECD countries.

Data source: IQVIA MIDAS®, 2022 (all rights reserved).

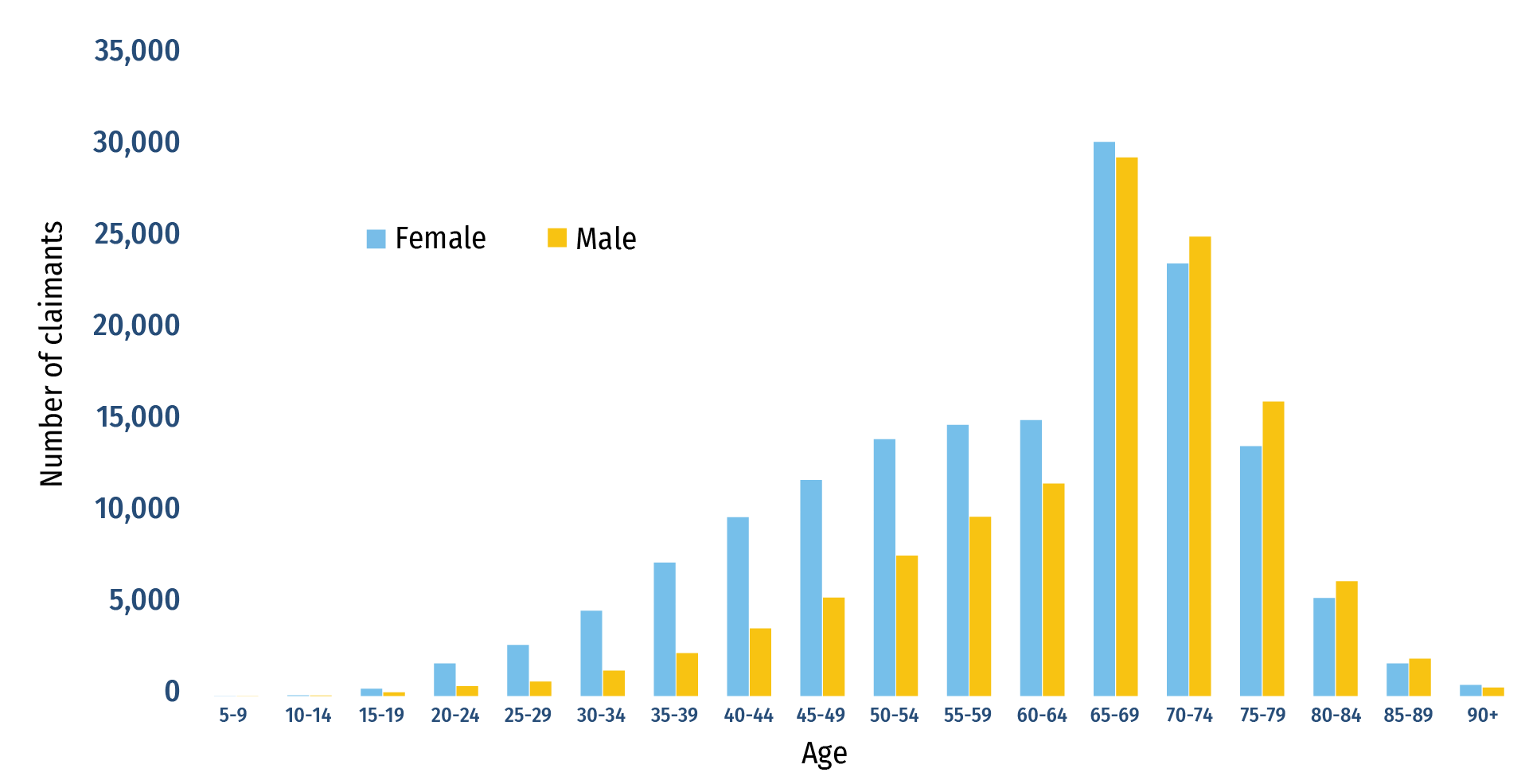

Sex- and Gender-Based Analysis Plus (SGBA Plus)Footnote *: Utilization of semiglutide by age and sex

An analysis of public claims data in 2022 showed age and sex differences in patient profiles for semaglutide, which was the top-selling drug over the five previous years. Semaglutide was first approved in 2017 and is primarily indicated for the treatment of type 2 diabetes. In early 2023, it received a second approval from Health Canada for weight management. Based on the 2022 public claims data, females were slightly more likely to use semaglutide and accounted for 56% of claimants. Age was also a factor in utilization for both sexes. Figure A4 shows that in 2022, females represented a larger segment of semaglutide claimants up to the age of 65, while claimants aged 65 and older were more likely to be male. Many factors could help explain these trends, including off-label use and the prevalence of diabetes by age category across sexes. Going forward, marked shifts in utilization could be seen across the board due to the medicine’s newly approved indication for weight management without the presence of diabetes. In total, Canadian public plans paid out over $700M for semaglutide claims in 2022.

Figure A4: Number of semaglutide claimants by age and sex, Canadian public plans, 2022

Figure A4 - Text version

| Age range | Female | Male |

|---|---|---|

| 5‑9 | 1 | 0 |

| 10‑14 | 32 | 20 |

| 15‑19 | 398 | 199 |

| 20‑24 | 1,779 | 530 |

| 25‑29 | 2,782 | 781 |

| 30‑34 | 4,656 | 1,382 |

| 35‑39 | 7,284 | 2,338 |

| 40‑44 | 9,770 | 3,692 |

| 45‑49 | 11,804 | 5,372 |

| 50‑54 | 14,025 | 7,665 |

| 55‑59 | 14,812 | 9,790 |

| 60‑64 | 15,068 | 11,607 |

| 65‑69 | 30,278 | 29,431 |

| 70‑74 | 23,627 | 25,099 |

| 75‑79 | 13,652 | 16,080 |

| 80‑84 | 5,346 | 6,267 |

| 85‑89 | 1,776 | 2,031 |

| 90+ | 597 | 454 |

Data source: CIHI National Prescription Drug Utilization Information System.

B: New Medicine Approvals and Sales, 2021

This section reports on new medicines approved in 2021 and tracks their international sales through the calendar year following approval. Sales and pricing data are provided as of Q4‑2022, while assessments, recommendations, and reimbursement decisions are reported as of Q3‑2023.

None of the 2021 new medicines showed dominant sales as of Q4‑2022. The highest-selling medicine (atogepant) accounted for 17% of revenues in the last quarter of 2022.

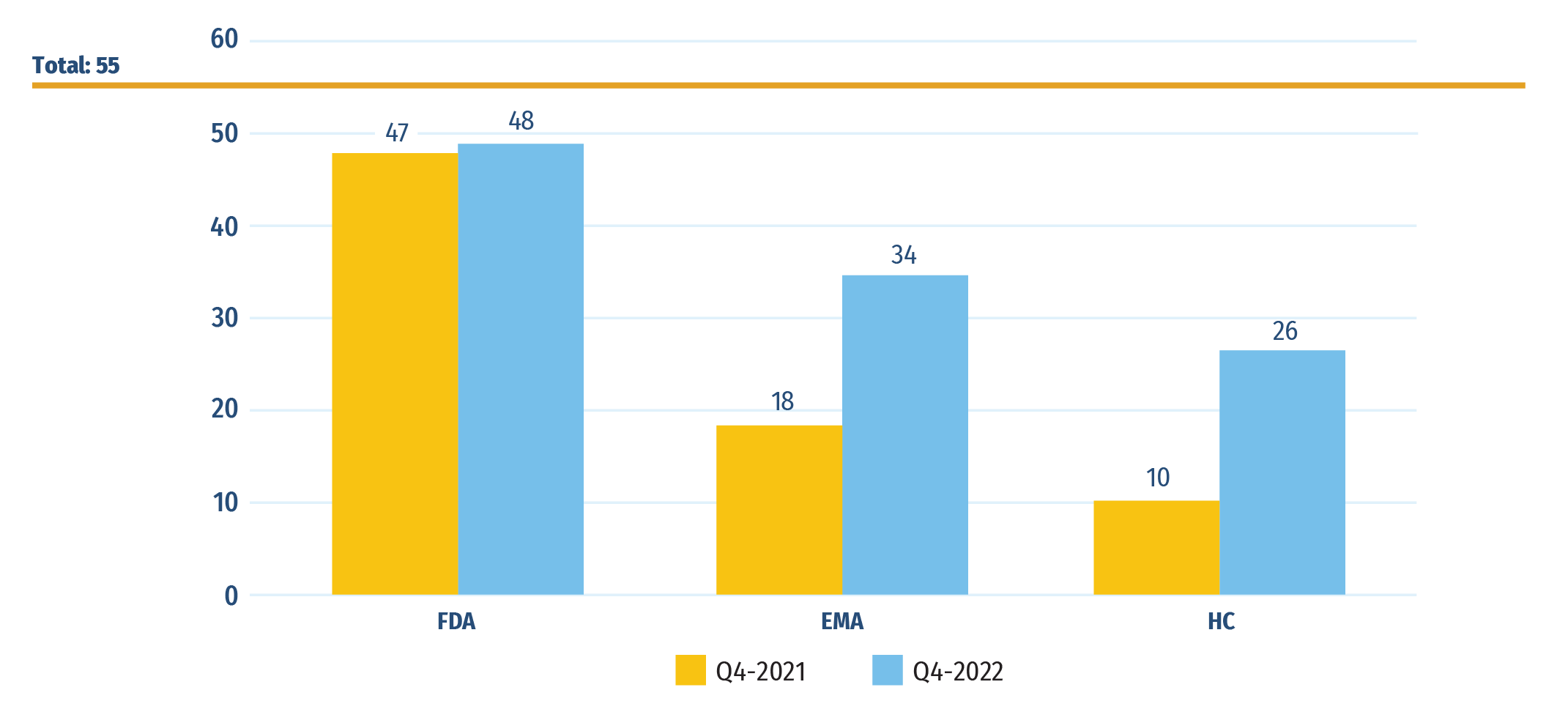

Fifty-five new medicines received their first market approval from Canada, Europe, and the US in 2021. By the end of 2022, 48 of these medicines had been approved by the US FDA, 34 by the EMA, and 26 by Health Canada (Figure B1).

Figure B1: Number of 2021 new medicines with market approval as of Q4‑2021 and Q4‑2022

Figure B1 - Text version

| US Food and Drug Administration | European Medicines Agency | Health Canada | |

|---|---|---|---|

| Total approved in 2021 | 55 | ||

| Approved as of Q4‑2021 | 47 | 18 | 10 |

| Approved as of Q4‑2022 | 48 | 34 | 26 |

Data source: US Food and Drug Administration (FDA), European Medicines Agency (EMA), and Health Canada databases.

Of the 26 medicines approved in Canada, 15 had sales data available in MIDAS® by Q4‑2022 (Figure B2). This placed Canada seventh in the OECD and fifth in the PMPRB11 in terms of the number of new medicines sold. The US was the only country to report sales of top-selling 2021 new medicine atogepant which accounted for 17% of OECD new medicine sales in Q4‑2022. This partially explains the gap between the US and other countries on the right side of the figure, where Canada ranked third across the PMPRB11 and fifth in the OECD. Of the PMPRB11, only Germany and Japan had higher shares of total new medicine sales.

These results are representative of the initial market penetration of new medicines. The longer-term availability and uptake in sales for these new medicines are expected to increase in subsequent years.

Figure B2: Number of 2021 new medicines with available sales and their respective share of OECD sales, by country, Q4‑2022

Figure B2 - Text version

| Country | Number of new medicines with available sales | Corresponding share of total Organisation for Economic Co-operation and Development sales for new medicines |

|---|---|---|

| United States | 36 | 91% |

| Germany | 27 | 60% |

| Austria | 22 | 52% |

| United Kingdom | 21 | 35% |

| Japan | 16 | 59% |

| France | 16 | 39% |

| Canada | 15 | 42% |

| Sweden | 15 | 32% |

| Switzerland | 13 | 36% |

| Portugal | 13 | 30% |

| Finland | 12 | 26% |

| Czechia | 11 | 11% |

| Italy | 9 | 13% |

| Poland | 8 | 25% |

| Norway | 8 | 18% |

| Netherlands | 6 | 14% |

| Australia | 6 | 11% |

| Slovakia | 5 | 12% |

| Hungary | 5 | 12% |

| Ireland | 5 | 7% |

| Slovenia | 5 | 6% |

| South Korea | 4 | 14% |

| Belgium | 4 | 8% |

| Spain | 4 | 8% |

| Luxembourg | 3 | 7% |

| Chile | 2 | 7% |

| Estonia | 2 | 2% |

| Türkiye | 1 | 1% |

| OECD median | 6 | 13% |

Note: Based on medicines that received market approval through the US Food and Drug Administration (FDA), the European Medicines Agency (EMA), and/or Health Canada in 2021 with recorded sales data as of Q4‑2022.

Sales are based on manufacturer list prices and include sales for the selected new medicines in all OECD countries. The following countries did not register sales for any new medicines and have been omitted in the graph: Greece, Mexico and New Zealand. All countries were used to calculate the OECD median.

Data source: IQVIA MIDAS®, 2022 (all rights reserved); US Food and Drug Administration, European Medicines Agency, and Health Canada databases.

Table B1 provides detailed information on the new medicines approved in 2021. For each medicine, the country with the first reported sales is given, along with the availability in Canada, the share of sales in Q4‑2022, and the prices and corresponding treatment costsFootnote 1. Prices are reported for the highest-selling form and strength of each medicine at the time of the analysis.

In total, the list of 2021 new medicines spanned 22 therapeutic classes. Antineoplastics accounted for the greatest number of new medicines in 2021, with 15 medicines approved. It was also the highest-selling therapeutic class in Q4‑2022, accounting for one quarter of all new medicine sales. Of the antineoplastics which recorded sales, sotorasib was the greatest contributor with almost 7% of new medicine sales, making it the second highest-selling new medicine overall. Sotorasib is sold under the brand name Lumakras and Health Canada has approved it for the second-line treatment of advanced non-small-cell lung cancer.

The second highest-selling therapeutic class, analgesics, was comprised of a single medicine: atogepant. It accounted for 17% of Q4‑2022 new medicine sales and it was also the top-selling new medicine of 2021. Sold under the brand name Qulipta, atogepant is indicated for the treatment of migraines, an indication for which multiple new medicines have been approved in recent editions of Meds Entry Watch.

Immunosuppressants ranked third in therapeutic class sales and counted 6 new medicines. Belumosudil led the class with 5% of new medicine sales. The medicine is sold most commonly under the brand name Rezurock and is indicated for the treatment of chronic graft-versus-host disease (GVHD).

Two new medicines and a vaccine indicated for the treatment and prevention of COVID‑19 are shown in Table B1. Casirivimab and regdanvimab both show limited sales, with the latter not yet registering a sale within the PMPRB11, and the sales of Janssen Pharmaceuticals’ non-replicating vector COVID‑19 vaccine, like other vaccines, are omitted from the table.

Although sales of 2021 new medicines were distributed more evenly than in previous years, the top three therapeutic classes accounted for over half of all new medicine sales across the OECD by Q4‑2022. While some vaccines and diagnostic agents are included in this year’s list, sales data on these classes is absent from Table B1 due to lack of reliable data.

Table B1: New medicines approved in 2021, availability, share of sales, prices, and treatment costs, ranked by therapeutic class share of sales, Q4‑2022

| Rank | Therapeutic classFootnote * | Medicine (trade name, form, strength, volume) | Availability | Share of new medicine sales across the OECD | No. of countries with salesFootnote ‡ | Canadian price (CAD)Footnote § | PMPRB11 price (CAD) | US price (CAD) | Treatment costFootnote ** | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| First sale in Canada, US, or PMPRB11Footnote † | First sale in Canada | Medicine | Therapeutic class | Min. | Median | Max. | Treatment cost (CAD) | Annual / Course | |||||||

1 |

L1-Antineoplastics |

Sotorasib (Lumakras, film-ctd tab, 120 mg)C,O |

US |

Jun-21 |

Oct-21 |

7% |

25% |

9 |

49 |

17 |

37 |

49 |

97 |

145,051 |

Annual |

2 |

Asciminib (Scemblix, film-ctd tab, 40 mg)C,O |

US |

Nov-21 |

Sep-22 |

5% |

7 |

88 |

80 |

94 |

152 |

384 |

62,092 |

Annual |

||

3 |

Idecabtagene vicleucel (Abecma, infus. bag)B,C,G,O |

FRA |

May-21 |

– |

3% |

3 |

– |

245,622 |

365,437 |

485,252 |

– |

545,000 |

Treatment course |

||

4 |

Belzutifan (Welireg, film-ctd tab, 40 mg)O |

US |

Sep-21 |

– |

3% |

2 |

– |

185 |

185 |

185 |

388 |

396,481 |

Annual |

||

5 |

Amivantamab (Rybrevant, infus. vial/bottle, 50 mg/ml, 7ml)B,C |

US |

Jun-21 |

Apr-22 |

2% |

6 |

1,739 |

1,397 |

2,024 |

2,028 |

3,979 |

1,019,480 |

Annual |

||

6 |

Lisocabtagene maraleucel (Breyanzi, infus. vial/bottle)B,C,G |

JPN |

May-21 |

– |

2% |

2 |

– |

245,622 |

361,971 |

478,320 |

- |

501,900 |

One-time |

||

7 |

Tepotinib (Tepmetko, film-ctd tab, 225 mg)C,O |

JPN |

Jun-20 |

Nov-21 |

1% |

6 |

159 |

167 |

181 |

196 |

476 |

9,340 |

Monthly course |

||

8 |

Dostarlimab (Jemperli, infus. vial/bottle, 50 mg/ml, 10 ml)B,C |

FRA |

Nov-20 |

- |

1% |

6 |

- |

6,696 |

8,400 |

8,746 |

13,274 |

7,380 to 11,070 |

28-day course |

||

9 |

Trilaciclib (Cosela, infus. dry bottle, 300 mg)C |

US |

Mar-21 |

- |

<1% |

1 |

- |

- |

- |

- |

1,805 |

3,286 |

One-time |

||

10 |

Mobocertinib (Exkivity, capsule, 40 mg)C,O |

US |

Sep-21 |

- |

<1% |

2 |

- |

98 |

98 |

98 |

254 |

373,088 |

Annual |

||

11 |

Infigratinib (Truseltiq, capsule)C,O |

US |

Jul-21 |

– |

<1% |

1 |

- |

- |

- |

- |

748 |

14,264 |

28-day course |

||

12 |

Tisotumab vedotin (Tivdak, infus. dry bottle, 40 mg)C,O |

US |

Mar-22 |

- |

<1% |

1 |

- |

- |

- |

- |

7,880 |

273,159 |

Annual |

||

13 |

N2-Analgesics | Atogepant (Qulipta, tab, 60 mg) |

US |

Oct-21 |

– |

17% |

17% | 1 |

- |

- |

- |

- |

42 |

2,408 – 14,450 |

Annual |

14 |

L4-Immunosuppressants | Belumosudil (Rezurock, film-ctd tab, 200 mg)O |

US |

Aug-21 |

– |

5% |

14% | 1 |

- |

- |

- |

- |

680 |

425,946 |

Annual |

15 |

Anifrolumab (Saphnelo, infus. vial/bottle, 75 mg/ml, 2 ml)B |

FRA |

Jul-21 |

Mar-22 |

4% |

6 |

1,775 |

- |

- |

- |

- |

74,441 |

Annual |

||

16 |

Efgartigimod alfa (Vyvgart, infus. vial/bottle, 20 mg/ml, 20 ml)B |

US |

Sep-21 |

- |

3% |

2 |

- |

10,711 |

10,711 |

10,711 |

7,820 |

278,488 |

Annual |

||

17 |

Avacopan (Tavneos, capsule, 10 mg)O |

US |

Oct-21 |

Nov-22 |

1% |

6 |

34 |

0 |

28 |

54 |

96 |

97,223 |

Annual |

||

18 |

Pegcetacoplan (Aspaveli, infus. vial/bottle, 54 mg/ml, 20 ml)O |

US |

Jul-21 |

– |

<1% |

5 |

- |

3,886 |

4,327 |

4,894 |

- |

36,381 |

Annual |

||

19 |

Voclosporin (Lupkynis, capsule, 7.9 mg) |

US |

Apr-22 |

- |

<1% |

1 |

- |

- |

- |

- |

97 |

70,447 |

Annual |

||

20 |

R3-Anti-asthma and COPD products | Tezepelumab (Tezspire, prefill autoinj, 110 mg/ml, 1.91 ml)C,O |

US |

Jan-22 |

Oct-22 |

7% |

13% | 4 |

1,895 |

- |

- |

- |

- |

25,200 |

Annual |

21 |

Tralokinumab (Adtralza, prefill syrng sc, 150 mg/ml, 1 ml)B |

NLD |

Jun-21 |

Mar-22 |

5% |

9 |

453 |

293 |

382 |

400 |

1,051 |

22,802 / 21,633 |

First / subsequent years |

||

22 |

Bimekizumab (Bimzelx, prefill autoinj, 160 mg/ml, 1 ml)B |

SWE |

Aug-21 |

Mar-22 |

1% |

9 |

1,687 |

1,063 |

1,180 |

1,705 |

- |

30,631 / 22,921 |

First / subsequent years |

||

23 |

Abrocitinib (Cibinqo, film-ctd tab, 100 mg) |

UK |

Oct-21 |

Sep-22 |

<1% |

9 |

48 |

38 |

48 |

53 |

207 |

16,993 |

Annual |

||

24 |

N7-Other central nervous system drugs |

Viloxazine (Qelbree, retard cap, 200 mg) |

US |

May-21 |

- |

5% |

11% | 1 |

- |

- |

- |

- |

14 |

2,195 to 8,780 |

Annual |

25 |

Ponesimod (Ponvory, film-ctd tab, 20 mg) |

US |

Apr-21 |

- |

1% |

10 |

- |

35 |

51 |

73 |

355 |

27,724 |

Annual |

||

26 |

Aducanumab (Aduhelm, infus. vial/bottle, 100 mg/ml, 3 ml)B |

US |

Jun-21 |

- |

0.0% |

1 |

- |

- |

- |

- |

1,121 |

67,926 |

Annual |

||

27 |

Avalglucosidase alfa (Nexviazyme, infus. dry bottle, 100 mg)B,O |

Us |

Sep-21 |

Feb-22 |

4.8% |

4 |

- |

1,482 |

1,631 |

1,650 |

2,082 |

534,563 |

Annual |

||

28 |

C3-Diuretics | Finerenone (Kerendia, film-ctd tab, 10 mg) |

US |

Jul-21 |

Nov-22 |

6% |

6% | 8 |

3 |

1 |

2 |

4 |

26 |

16,605 |

Annual |

29 |

M5-Other drugs for disorders of the musculo-skeletal system |

Vosoritide (Voxzogo, vial dry, 560 mcg)O |

FRA |

Jul-21 |

- |

3% |

5% | 5 |

- |

835 |

923 |

988 |

1,069 |

201,411 |

Annual |

30 |

Casimersen (Amondys-45, infus. vial/bottle, 50 mg/ml, 2 ml)O |

US |

Apr-21 |

- |

<1% |

1 |

- |

- |

- |

- |

1,701 |

1,856,207 |

Annual |

||

31 |

Serdexmethylphenidate (Azstarys, capsule, 7.8 mg + 39.2 ml) |

US |

Jul-21 |

- |

3% |

1 |

- |

- |

- |

- |

17 |

5,681 |

Annual |

||

32 |

N5-Psycholeptics |

Samidorphan (Lybalvi, layered tab, 10 mg + 10 mg) |

US |

Oct-21 |

- |

3% |

3% | 1 |

- |

- |

- |

- |

61 |

20,169 |

Annual |

33 |

H4-Other hormones |

Lonapegsomatropin (Skytrofa, dry cartridge, 9.1 mg)B,O |

US |

Nov-21 |

- |

1% |

1% | 1 |

- |

- |

- |

- |

2,363 |

37,517 |

Annual |

34 |

Somatrogon (Ngenla, prefill pen, 50 mg/ml, 1.2 ml)B,O |

CAN |

Feb-22 |

Feb-22 |

<1%

|

5 |

855 |

612 |

807 |

1,693 |

- |

5,681 |

Annual |

||

35 |

Dasiglucagon (Zegalogue, prefill autoinj, 1 mg/ml, 0.6 ml) |

US |

Jun-21 |

- |

<1% |

1 |

- |

- |

- |

- |

393 |

368 |

Per utilization |

||

36 |

C6-Other cardiovascular products |

Vericiguat (Verquvo, film-ctd tab, 2.5 mg) |

US |

Feb-21 |

- |

1% |

1% |

9 |

- |

2 |

4 |

5 |

26 |

4,167 / 4,467 |

First / subsequent years |

37 |

G3-Sex hormones and products with similar desired |

Estetrol (Nextstellis, film-ctd tab, 3 mg + 15 mg) |

NLD |

May-21 |

Jun-21 |

1% |

1% |

12 |

18 |

21 |

21 |

21 |

- |

16 |

28-day course |

38 |

J5-Antivirals for systemic use |

Maribavir (Livtencity, tab, 200 mg) |

US |

Dec-21 |

- |

<1% |

<1% | 2 |

- |

- |

- |

- |

298 |

412,541 |

Annual |

39 |

Regdanvimab (Regkirona, infus. vial/bottle, 60 mg/ml, 16 ml)B |

CZEFootnote †† |

Dec-21 |

- |

<1% |

0 |

- |

- |

- |

- |

- |

27,724 |

Annual |

||

40 |

Casirivimab (Casiriv/Imdev roch, infus. vial/bottle, 120 mg/ml + 120 mg/ml, 6 ml)O |

US |

Nov-20 |

- |

<1% |

2 |

- |

0 |

0 |

0 |

- |

1,856,207 |

Annual |

||

41 |

Sotrovimab (Xevudy, infus. vial/bottle, 62.5 mg/ml, 8 ml)B |

US |

Jun-21 |

- |

<1% |

2 |

1 |

1,779 |

2,431 |

3,083 |

- |

2,603 |

One time |

||

42 |

B3-Haematinics, iron and all combinations |

Roxadustat (Evrenzo, film-ctd tab, 50 mg) |

JPN |

Nov-19 |

- |

<1% |

<1% |

6 |

- |

6 |

17 |

24 |

- |

8,182 |

Annual |

43 |

G1-Gynaecological anti-infectives | Ibrexafungerp (Brexafemme, film-ctd tab, 150 mg) |

US |

Jul-21 |

- |

<1% |

<1% | 1 |

- |

- |

- |

- |

160 |

572 |

Per treatment |

44 |

A5-Cholagogues and hepatic protectors |

Odevixibat (Bylvay, capsule, 1.2 mg)O |

UK |

May-21 |

- |

<1% |

<1% |

2 |

- |

873 |

950 |

1,027 |

- |

373,088 |

Annual |

45 |

C10-Lipid-regulating/anti-atheroma preparations |

Evinacumab (Evkeeza, infus. vial/bottle, 150 mg/ml, 8 ml)B,O |

US |

May-21 |

- |

<1% |

<1% |

1 |

- |

- |

- |

- |

52,863 |

4,349,097 |

Annual |

| 46 | D4-Anti-pruritics | Difelikefalin (Kapruvia, vial IV, 50 mcg/ml, 1ml) | SWE | Apr-22 | - | <1% | <1% | 2 | - | 52 | 53 | 55 | - | 368 | Per utilization |

47 |

J7-Vaccines |

Vaccine, SARS-CoV-2 nonreplicating vector (vial IM, 0.5 ml)B |

UK |

Dec-20 |

Mar-21 |

<1% |

<1% |

3 |

1 |

- |

- |

- |

- |

213,104 |

Annual |

48 |

Not assigned as of Q3‑2023 |

Allogeneic processed thymus tissue (Rethymic)B |

FDA |

Oct-21 |

No sales data in MIDAS® as of Q4‑2022 – date of approval by FDA, EMA, and/or Health Canada. |

||||||||||

49 |

P01-Antiprotozoals |

Fexinidazole (Fexinidazole)O |

FDA |

Jul-21 |

|||||||||||

50 |

A16-Other alimentary tract and metabolism products |

Fosdenopterin (Nulibry) |

FDA |

Feb-21 |

|||||||||||

51 |

L1-Antineoplastics |

Loncastuximab tesirine (Zynlonta)B,C,O |

FDA |

Apr-21 |

|||||||||||

| 52 | A05-Bile and liver therapy | Maralixibat (Livmarli)O | FDA | Sep-21 | |||||||||||

| 53 | V04-Diagnostic agents | Pafolacianine (Cytalux)C | FDA | Nov-21 | |||||||||||

| 54 | L1-Antineoplastics | Melphalan flufenamide (Pepaxto)C,O | FDA | Feb-21 | |||||||||||

55 |

L1-Antineoplastics |

Umbralisib (Ukoniq)C,O |

FDA |

Feb-21 |

|||||||||||

Note: A medicine was considered to be new in 2021 if it received initial market authorization through the US Food and Drug Administration (FDA), the European Medicines Agency (EMA), and/or Health Canada during the calendar year.

Availability and sales information refer to all forms and strengths of the medicine, while pricing and treatment costs are based on the highest-selling form and strength indicated. Sales are based on manufacturer list prices.

Specialty medicines are indicated using the following abbreviations: B: biologic; C: cancer; G: gene therapy; O: orphan.

Data source: IQVIA MIDAS®, 2022 (all rights reserved); US Food and Drug Administration Novel Drugs 2021; European Medicines Agency Human Medicines Highlights 2021; Health Canada databases.

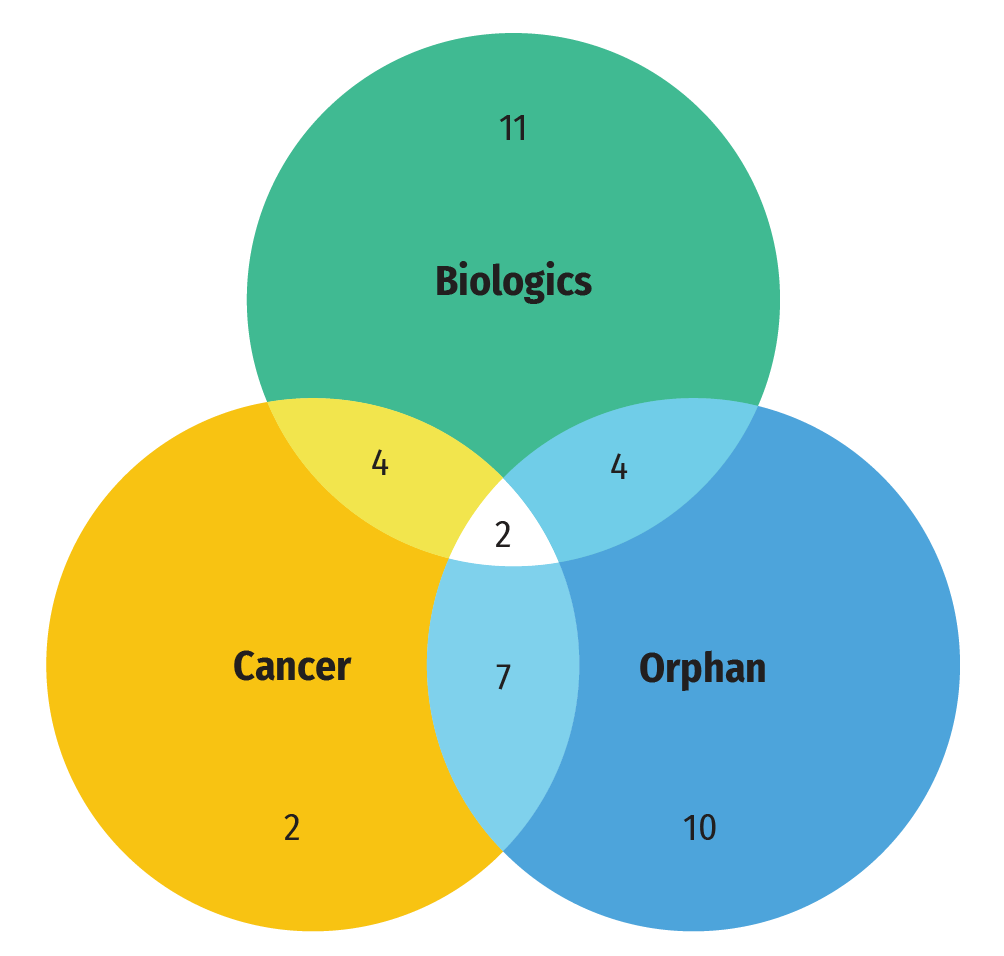

A large share of the medicines approved in 2021 were specialty medicines. A proportion of 42% (23) received an orphan designation from the FDA and/or the EMA, 27% (15) were for the treatment of cancer, and 38% (21) were biologics. As shown in Figure B3, the greatest overlap between these categories was between cancer and orphan medicines. The Venn diagram illustrates that almost 60% (9 of 15) of new cancer medicines received an orphan designation from either the FDA or EMA. In total, cancer medicines accounted for 40% of new orphan designations despite representing roughly 25% of new medicine approvals. Approximately one quarter of biologic medicines (24%) received an orphan designation. Lisocabtagene maraleucel, indicated for the treatment of large B-cell lymphoma and idecabtagene vicleucel, indicated for the treatment of multiple myeloma, were the only gene therapies in the group.

Figure B3: Distribution of 2021 new approvals for specialty medicines

Figure B3 - Text version

- 40 new approvals for specialty medicines in 2021

- 23 medicines with an orphan designation

- 21 biologic medicines

- 15 cancer medicines

- 9 cancer medicines with an orphan designation

- 6 biologic medicines with an orphan designation

- 6 biologic cancer medicines

- 2 biologic cancer medicines with an orphan designation

Data source: US Food and Drug Administration, European Medicines Agency, and Health Canada databases.

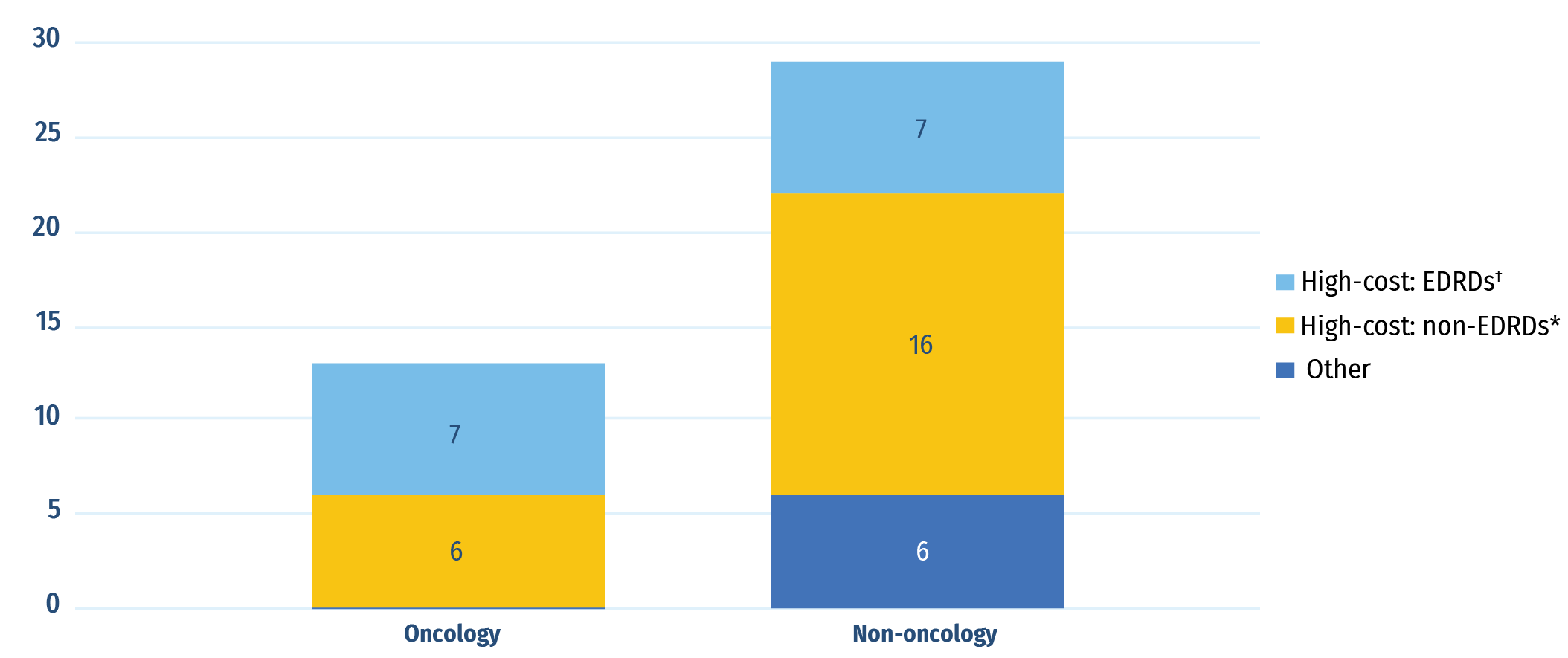

Of the 42 new medicines with available treatment costs, 36 (85%) cost over $10,000 per year or $5,000 per 28-day cycle for oncology. Of 13 new oncology medicines, 6 fell into this “high-cost” category and the remaining 7 were identified as expensive drugs for rare diseases (EDRDs)—orphan-designated therapies exceeding $100,000 in annual treatment costs, or $7,500 per 28-day cycle for oncology. Every single oncology medicine fell into one of these two high-cost categories. Sixteen of 29 non-oncology medicines were categorized as high-cost and an additional 7 were identified as EDRDs. In total, 14 EDRDs accounted for 28% of new medicine sales in Q4‑2022.

Figure B4: Distribution of new medicines approved in 2021 by treatment cost

Figure B4 - Text version

| High‑cost medicines: Expensive drugs for rare diseases† | High‑cost medicines*, Other than EDRDs | Other | Total | |

|---|---|---|---|---|

| Oncology medicines | 7 | 6 | 0 | 13 |

| Non‑oncology medicines | 7 | 16 | 6 | 29 |

Note: This analysis considers the 42 new medicines approved in 2021 with treatment costs available as of Q3‑2023.

Data source: IQVIA MIDAS®, 2022 (all rights reserved); Canadian Agency for Drugs and Technologies in Health (CADTH) reports.

Prior to being marketed in Canada, medicines must be reviewed and authorized by Health Canada. However, to be considered for listing on the formulary of public insurers, medicines must also be assessed and recommended for listing by the Canadian Agency for Drugs and Technologies in Health (CADTH), an independent, not-for-profit health technology assessment organization. This process may also rely on health technology assessments by the Institut national d’excellence en santé et en services sociaux (INESSS) in Quebec. Depending on the results of these assessments, the pan-Canadian Pharmaceutical Alliance (pCPA)—an alliance of public drug plans that conducts joint negotiations for brand-name and generic drugs in Canada—may then choose to enter price negotiations with pharmaceutical manufacturers prior to the drugs being considered for listing on public formularies.

Table B2 provides an overview of the CADTH recommendation and pCPA negotiation status for the 30 medicines approved in Canada by Q3‑2023, as well as information on whether these medicines have recorded sales through private drug plans in Canada. Of this group, 21 had been reviewed through CADTH's Reimbursement Review process, with 15 receiving a recommendation to "reimburse with conditions" and 6 receiving a "do not reimburse" recommendation. As of Q3‑2023, six more medicines were under review by CADTH and four did not have an active or planned review. Eleven of the 30 new medicines approved in Canada had completed pCPA negotiations by Q3‑2023 and eight others had negotiations underway. Negotiations were not conclusive in two cases and the remaining two medicines had no record of negotiation.

A review of private drug plan data shows that 11 of the 30 new medicines had been reimbursed by a private drug plan in Canada by Q3‑2023. These are early results and the rates of reimbursement for new medicines can be expected to increase in the coming years.

Table B3 provides further details on the pharmacoeconomic assessments conducted by CADTH including the indications assessed, the recommended condition for reimbursement, the primary evaluation, the incremental cost-effectiveness ratios (ICER) reported, and the price reduction required for the medicine to achieve an ICER of $50,000 per quality-adjusted life year (QALY). The assessments suggest that none of the new medicines reviewed by CADTH were cost-effective at the submitted price. Fifteen of the 20 assessments (75%) resulted in recommendations to be approved on the condition that their price be reduced, while the other five medicines (25%) were not recommended for reimbursement. Price reductions needed to reach the $50,000/QALY level were estimated in 16 of the 20 available reports, ranging from approximately 1% to over 99% of the submitted price. Of the 16 assessments, none resulted in an ICER below $50,000/QALY and 2 resulted in an ICER over $1 million.

Table B2: Assessments, recommendations, and reimbursement decisions for 2021 new medicines approved in Canada by Q3‑2022

| ATCFootnote * | Medicine (trade name)Footnote † | Health Canada approval | CADTH recommendation | pCPA negotiation status | Private plans | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Notice of Compliance | Reimburse | Reimburse with conditions | Do not reimburse | Review in progress | Active | Completed and closed | Concluded without agreement | No negotiations | Covered | ||

D5-Nonsteroidal products for inflammatory skin |

Abrocitinib (Cibinqo) |

Jun-22 |

- |

X |

- |

- |

- |

X |

- |

- |

- |

L1-Antineoplastics |

Amivantamab (Rybrevant)B,C |

Mar-22 |

- | X |

- | - | - |

- | X |

- | - |

L4-Immunosuppressants |

Anifrolumab (Saphnelo)B |

Nov-21 |

- | X |

- | - | - |

X |

- | - | X |

L1-Antineoplastics |

Asciminib (Scemblix)C,O |

Jun-22 |

- | X |

- | - | - | X |

- | - | X |

N2-Analgesics |

Atogepant (Qulipta) |

Dec-22 |

- | X |

- | - | - | X |

- | - | - |

L4-Immunosuppressants |

Avacopan (Tavneos)O |

Apr-22 |

- | - |

X |

- | X |

- |

- | - | X |

A16-Other alimentary tract and metabolism products |

Avalglucosidase alfa (Nexviazyme)B,O |

Nov-21 |

- | X |

- | - | - | - |

X |

- | - |

L4-Immunosuppressants |

Belumosudil (Rezurock)O |

Mar-22 |

- | - |

- | X |

- | - |

- | - | - |

| L1-Antineoplastics | Belzutifan (Welireg)O | Jul-22 | - | X |

- | - | X |

- | - | - | - |

| D5-Nonsteroidal products for inflammatory skin disorders |

Bimekizumab (Bimzelx)B | Feb-22 | - | X |

- | - | - | X |

- | - | X |

D4-Anti-pruritics |

Difelikefalin (Kapruvia) |

Aug-22 |

- | - | X |

- | X |

- |

- | - | - |

L1-Antineoplastics |

Dostarlimab (Jemperli)B,C |

Dec-21 |

- | - |

X |

- | - | - | - | X |

- |

L4-Immunosuppressants |

Efgartigimod alfa (Vyvgart)B |

Sep-23 |

- | - |

- | X |

X |

- | - | - | - |

G3-Sex hormones and products with similar desired |

Estetrol (Nextstellis) |

Mar-21 |

- | - |

- | - | - | - | - | - | X |

C10-Lipid-regulating/anti-atheroma preparations |

Evinacumab (Evkeeza)B,O |

Sep-23 |

- | - |

- | X |

X |

- | - | - | - |

C3-Diuretics |

Finerenone (Kerendia) |

Oct-22 |

- | X |

- | - | - | X |

- | - | X |

L1-Antineoplastics |

Idecabtagene vicleucel (Abecma)B,C,G,O |

May-21 |

- | - |

X |

- | X |

- | - | - | - |

L1-Antineoplastics |

Infigratinib (Truseltiq)C,O |

Sep-21 |

- | - | - | - | - | - | - | - | - |

L1-Antineoplastics |

Lisocabtagene maraleucel (Breyanzi)B,C,G |

May-22 |

- | X |

- | - | - | X |

- | - | - |

J5-Antivirals for systemic use |

Maribavir (Livtencity) |

Jul-23 |

- | X |

- | - | X |

- |

- | - | - |

A5-Cholagogues and hepatic protectors |

Odevixibat (Bylvay)O |

Oct-23 |

- | - | - | X |

- | - | - | - | - |

L4-Immunosuppressants |

Pegcetacoplan (Aspaveli)O |

Dec-22 |

- | X |

- | - | - | X |

- | - | - |

N7-Other central nervous system drugs |

Ponesimod (Ponvory) |

Apr-21 |

- | - | - | - | - | - | - | - | - |

H4-Other hormones |

Somatrogon (Ngenla)B,O |

Oct-21 |

- | X |

- | - | - | X |

- | - | X |

L1-Antineoplastics |

Sotorasib (Lumakras)C,O |

Sep-21 |

- | - | - | X |

- | - | - | - | X |

L1-Antineoplastics |

Tepotinib (Tepmetko)C,O |

May-21 |

- | - | X |

- | - | X |

- | - | X |

| R3-Anti-asthma and COPD products | Tezepelumab (Tezspire)C,O | Jul-22 | - | X |

- | - | - | X |

- | - | X |

| D5-Nonsteroidal products for inflammatory skin disorders |

Tralokinumab (Adtralza)B | Oct-21 | - | - | - | X |

- | - | - | X |

X |

| J7-Vaccines | Vaccine, SARS-CoV-2 non-replicating vector (VAC COV2 NRV J.J.)B | Aug-22 | - | - | - | - | - | - | - | - | - |

C6-Other cardiovascular products |

Vericiguat (Verquvo) |

Apr-23 |

- | X |

- | - |

X |

- | - | - | - |

Note: Medicines were assessed through CADTH’s Reimbursement Review process.

Data source: IQVIA Private Drug Plan database, 2022; Health Canada Notice of Compliance database; Canadian Agency for Drugs and Technologies in Health (CADTH) reports; pan-Canadian Pharmaceutical Alliance (pCPA) reports; and IQVIA MIDAS® (all rights reserved).

Table B3: Summary of Reimbursement Review assessments for 2021 new medicines approved in Canada by Q3‑2023

| Medicine (trade name)Footnote * | Date of recommendationFootnote † | Indication(s) | Conditional on priceFootnote ‡ | Type of evaluation (primary)Footnote § | Incremental cost-effectiveness ratio (ICER) ($ per QALY) | Price reduction range ($50,000 per QALY) |

|---|---|---|---|---|---|---|

Abrocitinib (Cibinqo) |

Sep-23 |

Severe atopic dermatitis |

Yes |

CUA |

$156,735 |

52% |

Amivantamab (Rybrevant)B,C |

Mar-23 |

Non-small cell lung cancer |

Yes |

CUA |

$253,131 |

77% |

Anifrolumab (Saphnelo)B |

Jan-23 |

Systemic lupus erythematosus |

Yes |

CUA |

$224,736 |

78% |

Asciminib (Scemblix)C,O |

Aug-22 |

Philadelphia chromosome-positive chronic myeloid leukemia |

Yes |

CUA |

$207,406 |

26% |

Atogepant (Qulipta) |

Jun-23 |

Migraine, prevention |

Yes |

CUA |

DominatedFootnote ** |

N/A |

Avalglucosidase alfa (Nexviazyme)B,O |

Jul-22 |

Pompe disease |

Yes |

CMA |

N/A |

N/A |

Belzutifan (Welireg)O |

Sep-23 |

Von Hippel-Lindau disease-associated tumours |

Yes |

CUA |

$360,193 |

83% |

Bimekizumab (Bimzelx)B |

Mar-22 |

Psoriasis, moderate to severe plaque |

Yes |

CUA |

$2,475,397 |

41% |

Difelikefalin (Korsuva/Kapruvia) |

Jul-23 |

Chronic kidney disease |

Do not reimburse |

CUA |

$582,515 |

92% |

Dostarlimab (Jemperli)B,C |

Aug-22 |

Endometrial cancer |

Do not reimburse |

CUA |

$185,452 |

83% |

Finerenone (Kerendia) |

Mar-23 |

Chronic kidney disease |

Yes |

CUA |

$70,052 |

23% |

Idecabtagene vicleucel (Abecma)B,C,G,O |

Nov-21 |

Multiple myeloma |

Do not reimburse |

CUA |

$286,142 |

83% |

Lisocabtagene maraleucel (Breyanzi)B,C,G |

Jun-22 |

Relapsed or refractory large B‑cell lymphoma |

Yes |

CUA |

$115,000 |

N/A |

Maribavir (Livtencity) |

Nov-22 |

Post-transplant cytomegalovirus infection |

Yes |

CUA |

$403,089 |

5% |

Pegcetacoplan (Aspaveli)O |

Mar-23 |

Paroxysmal nocturnal hemoglobinuria |

Yes |

CUA |

$62,144 |

1% |

| Somatrogon (Ngenla)B,O | Mar-22 | Growth hormone deficiency | Yes | CUA | $107,714 | 11% |

| Tepotinib (Tepmetko)C,O | Aug-22 | Locally advanced or metastatic non-small cell lung cancer | Do not reimburse | CUA | $551,240 | >99% |

| Tezepelumab (Tezspire)C,O | Nov-22 | Asthma | Yes | CUA | $1,334,178 | 95% |

| Tralokinumab (Adtralza)B | Mar-22 | Atopic dermatitis | Do not reimburse | CMA | N/A | N/A |

Vericiguat (Verquvo) |

Jun-23 |

Heart failure |

Yes |

CUA |

$62,778 |

14% |

Note: The type of evaluation and the incremental cost-effectiveness ratio (ICER) are based on the Reimbursement Review reports. The table reports the low‑bound and high‑bound range estimated for all comparators and conditions analyzed. Cost-utility analysis (CUA) evaluations are provided as a range per quality‑adjusted life year (QALY). Additional information can be accessed at https://www.cadth.ca.

Data source: Canadian Agency for Drugs and Technologies in Health (CADTH) reiumbursement reviews reports.

C: New Medicine Approvals, 2022

This section provides an analysis of the new medicines approved internationally in 2022, including information on approval status as of Q3‑2023 and pricing as of Q4‑2022. Forty‑eight new medicines were approved in 2022 and over two thirds of these were designated as high‑cost.

In 2022, 48 medicines received first-time market approval through the FDA, the EMA, and/or Health Canada. As of the third quarter of 2023, the US FDA had approved 41 of these new medicines, the EMA had approved 32 and Health Canada had approved 19 (Figure C1). Manufacturers may choose to submit new medicines for approval in the US, Europe, and Canada at different times, which can affect the number of medicines approved by each regulator.

Figure C1: Number of 2022 medicines with market approval as of Q4‑2022 and Q3‑2023

Figure C1 - Text version

| US Food and Drug Administration | European Medicines Agency | Health Canada | |

|---|---|---|---|

| Total approved in 2021 | 48 | ||

| Approved as of Q4‑2022 | 37 | 24 | 11 |

| Approved as of Q3‑2023 | 41 | 32 | 19 |

Note: Based on medicines that received market approval through the US Food and Drug Administration (FDA), the European Medicines Agency (EMA) and/or Health Canada in 2022.

Data source: US Food and Drug Administration, European Medicines Agency, and Health Canada databases.

Table C1 provides a full list of the 48 new medicines approved in 2022 along with the country with first reported sales, availability in Canada, and price and treatment cost where availableFootnote 2. Prices are reported for the highest‑selling form and strength of each medicine. Similarly to Table B1, prices for COVID‑19 vaccines have been omitted from Table C1. It should be noted that this information reflects the early availability and uptake of these medicines in the markets analyzed.

As of Q4‑2022, 18 (38%) of the drugs with a first approval in 2022 had not recorded sales in any country and 12 (25%) had only recorded sales in the US. The diffusion of two drugs which showed sales in more than half of PMPRB11 countries stood out: faricimab, indicated for age-related macular degeneration and nirmatrelvir, indicated for the treatment of COVID-19. Both recorded sales in Canada. Over two thirds (20) of the medicines that did record sales in Canada, the US, and/or the PMPRB11 had treatment costs exceeding $10,000 per year or $5,000 per 28-day course for oncology medicines, placing them in the high-cost category. Of these medicines, 12 had treatment costs over $100,000 per year.

Table C1: New medicines approved in 2022, availability, prices, and treatment costs, Q4‑2022

| Medicine (trade name, form, strength, volume) | Therapeutic classFootnote * | Availability | No. of countries with salesFootnote ‡ | Canadian priceFootnote § (CAD) | PMPRB11 price | US price (CAD) | Treatment costFootnote ** | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| First sale in Canada, US, or PMPRB11Footnote † | First sale in Canada | Min. | Median | Max. | Treatment cost (CAD) | Annual / Course | ||||||

Adagrasib (Krazati, film-ctd tab, 200 mg)C,O |

L1-Antineoplastics |

US |

Dec-22 |

- |

1 |

- |

- |

- |

- |

144 | 157,404 |

Annual |

Daridorexant (Quviviq, film-ctd tab, 50 mg) |

N5-Psycholeptics |

US |

Apr-22 |

- |

3 |

- |

3 |

5 |

8 |

10 | 3,808 |

Annual |

Deucravacitinib (Sotyktu, film-ctd tab, 6 mg) |

D5-Nonsteroidal products for inflammatory skin |

US |

Sep-22 |

- |

2 |

- |

21 |

21 |

21 |

266 | 14,409 |

Annual |

Eflapegrastim (Rolvedon, prefill syr sc ret, 22 mg/ml, 0.6 ml)B |

L3-Immunostimulating agents |

US |

Oct-22 |

- |

1 |

- |

- |

- |

- |

5,300 | 5,300 |

21-day cycle |

Faricimab (Vabysmo, ophth. vial, 120 mg/ml, 0.24 ml)B |

S1-Ophthalmologicals |

US |

Feb-22 |

Jul-22 |

8 |

1,415 |

1,008 |

1,068 |

1,213 |

- | 8,100 / 4,050 |

First / subsequent years |

Mavacamten (Camzyos, capsule, 5 mg)O |

C1-Cardiac therapy |

US |

Jun-22 |

- |

1 |

- |

- |

- |

- |

313 | 22,484 |

Annual |

Mosunetuzumab (Lunsumio, infus. vial/bottle, 1 mg/ml, 30 ml)B,C,O |

L1-Antineoplastics |

GER |

Jul-22 |

- |

1 |

- |

9,726 |

9,726 |

9,726 |

- | 9,726 to 19,451 |

21-day cycle |

Nirmatrelvir (Paxlovid, film-ctd tab, 150 mg + 100 mg) |

J5-Antivirals for systemic use |

US |

Dec-21 |

Jan-22 |

11 |

1 |

0 |

1 |

42 |

- | 15 |

5-day course |

Olipudase alfa (Xenpozyme, infus. dry bottle, 20 mg)B,O |

A16-Other alimentary tract and metabolism products |

FRA |

May-22 |

- |

4 |

- |

3,822 |

4,291 |

4,677 |

8,606 | 1,227,352 |

Annual (maintenance phase) |

Olutasidenib (Rezlidhia, capsule, 150 mg)C,O |

L1-Antineoplastics |

US |

Dec-22 |

- |

1 |

- |

- |

- |

- |

735 | 536,708 |

Annual |

Omidenepag (Eybelis, eye drops, 20 mcg/ml, 2.5 ml) |

S1-Ophthalmologicals |

JPN |

Nov-18 |

- |

1 |

- |

0 |

0 |

0 |

- | 3 |

Annual |

Oteseconazole (Vivjoa, capsule, 150 mg) |

G1-Gynaecological anti-infectives |

US |

Aug-22 |

- |

1 |

- |

- |

- |

- |

199 | 3,575 |

12-week course |

Pacritinib (Vonjo, capsule, 100 mg)O |

L1-Antineoplastics |

US |

Mar-22 |

- |

1 |

- |

- |

- |

- |

229 | 334,276 |

Annual |

Relatlimab (Opdualag, infus. vial/bottle, 12 mg/ml + 4 mg/ml, 20 ml)B,C,O |

L1-Antineoplastics |

US |

Mar-22 |

- |

1 |

- |

- |

- |

- |

16,998 | 441,958 |

Annual |

Spesolimab (Spevigo, infus. vial/bottle, 60 mg/ml, 7.5 ml)B,O |

D5-Nonsteroidal products for inflammatory skin disorders |

US |

Sep-22 |

- |

2 |

- |

- |

- |

- |

33,595 | 67,190 |

One-time |

Sutimlimab (Enjaymo, vial IV, 50 mg/ml, 22 ml)B,O |

B3-Haematinics, iron and all combinations |

US |

Feb-22 |

- |

2 |

- |

- |

- |

- |

2,254 | 399,630 |

Annual |

Tapinarof (Vtama, cream, 1 %, 60 g) |

D5-Nonsteroidal products for inflammatory skin disorders |

US |

May-22 |

- |

1 |

- |

- |

- |

- |

28 | 171 |

Annual |

Tebentafusp (Kimmtrak, infus. vial/bottle, 200 mcg/ml, 0.5 ml)B,C,O |

L1-Antineoplastics |

US |

Feb-22 |

- |

4 |

- |

17,646 |

18,018 |

18,390 |

23,114 | 74,260 |

28-day cycle |

Teclistamab (Tecvayli, vial sc, 90 mg/ml, 1.7 ml)B,C,O |

L1-Antineoplastics |

FRA |

Sep-22 |

- |

2 |

- |

0 |

0 |

0 |

12,049 | 460,704 |

Annual |

Terlipressin (Terlivaz, vial dry, 850 mcg)O |

H4-Other hormones |

US |

Oct-22 |

- |

1 |

- |

- |

- |

- |

1,278 | 63,900 |

14-day treatment |

Teplizumab (Tzield, infus. vial/bottle, 1 mg/ml, 2 ml)B |

A10-Drugs used in diabetes |

US |

Dec-22 |

- |

1 |

- |

- |

- |

- |

18,421 | 257,898 |

14-day treatment |

Tirzepatide (Mounjaro, prefill autoinj, 10 mg/ml, 0.5 ml) |

A10-Drugs used in diabetes |

US |

Jun-22 |

- |

1 |

- |

- |

- |

- |

315 | 16,395 |

Annual |

Tixagevimab (Evusheld, vial IM, 100 mg/ml + 100 mg/ml)B |

J6-Sera and gamma-globulin |

FRA |

Dec-21 |

May-22 |

6 |

1 |

2,547 |

2,547 |

2,547 |

- | 10,189 |

Annual |

Tremelimumab (Imjudo, infus. vial/bottle, 20 mg/ml, 15 ml)B,C,O |

L1-Antineoplastics |

US |

Nov-22 |

- |

1 |

- |

- |

- |

- |

50,505 | 50,505 |

One-time |

Ursodoxicoltaurine (Relyvrio, dep oral u-d pwdr, 3 g/dose + 1 g/dose)O |

N7-Other central nervous system drugs |

US |

Sep-22 |

- |

1 |

- |

- |

- |

- |

234 | 170,617 |

Annual |

Vaccine, dengue fever (Dengvaxia, vial dry)B |

J7-Vaccines |

MEXFootnote†† |

Sep-16 |

- |

0 |

- |

- |

- |

- |

- | N/A |

- |

Vaccine, SARS-CoV-2 (Nuvax, vial IM, 5 ml)B |

J7-Vaccines |

GER |

Sep-21 |

- |

2 |

- |

- |

- |

- |

- | N/A |

- |

Vaccine, SARS-CoV-2 subunit (Nuvaxovid, vial IM, 10 mcg/ml, 0.5 ml)B |

J7-Vaccines |

SWE |

Dec-21 |

Apr-22 |

4 |

- |

- |

- |

- |

- | N/A |

- |

Vonoprazan (Takecab, film-ctd tab, 10 mg) |

A2-Antacids, antiflatulents and anti-ulcerants |

JPN |

Feb-15 |

- |

1 |

- |

1 |

1 |

1 |

- | 231 |

8-month treatment |

Vutrisiran (Amvuttra, prefill syrng sc, 50 mg/ml, 0.5 ml)O |

N7-Other central nervous system drugs |

US |

Jul-22 |

- |

3 |

- |

58,765 |

104,743 |

150,721 |

138,283 | 418,972 |

Annual |

| Ciltacabtagene autoleucel (Carvykti)B,C,O | L01-Antineoplastics | FDA | Feb-22 | No sales data in MIDAS® as of Q4‑2022 – date of approval by FDA, EMA, and/or Health Canada. |

||||||||

| DaxibotulinumtoxinA (Daxxify)B | Not assigned as of Q3-2023 | FDA | Sep-22 | |||||||||

| Eladocagene exuparvovec (Upstaza)B,G,O | Not assigned as of Q3-2023 | EMA | May-22 | |||||||||

Etranacogene dezaparvovec (Hemgenix)B,O |

A16-Alimentary tract and metabolism |

FDA |

Nov-22 |

|||||||||

Fecal microbiota (live) (Rebyota)B,O |

Not assigned as of Q3-2023 |

FDA |

Nov-22 |

|||||||||

Futibatinib (Lytgobi)C,O |

L01-Antineoplastics |

FDA |

Sep-22 |

|||||||||

Ganaxolone (Ztalmy)O |

N03-Antiepileptics |

FDA |

Mar-22 |

|||||||||

Lenacapavir (Sunlenca) |

J05-Antivirals for systemic use |

EMA |

Aug-22 |

|||||||||

Lutetium (177Lu) vipivotide tetraxetan (Pluvicto)C |

V10-Therapeutic radiopharmaceuticals |

FDA |

Mar-22 |

|||||||||

Mirvetuximab soravtansine (Elahere)B,C,O |

L01-Antineoplastics |

FDA |

Nov-22 |

|||||||||

Mitapivat (Pyrukynd)O |

B06-Other hematological agents |

FDA |

Feb-22 |

|||||||||

Nadofaragene firadenovec (Adstiladrin)B,C,O |

L01-Antineoplastics |

FDA |

Dec-22 |

|||||||||

Nirsevimab (Beyfortus)B |

J06-Immune sera and immunoglobulins |

EMA |

Oct-22 |

|||||||||

Palovarotene (Sohonos)O |

M09-Other drugs for disorders of the musculo-skeletal system |

HC |

Jan-22 |

|||||||||

Tabelecleucel (Ebvallo)C,O |

L01-Antineoplastics |

EMA |

Dec-22 |

|||||||||

Ublituximab (Briumvi)B,O |

L04-Immunosuppressants |

FDA |

Dec-22 |

|||||||||

Valoctocogene roxaparvovec (Roctavian)B,G,O |

B02-Antihemorrhagics |

EMA |

Aug-22 |

|||||||||

Virus-like particles (VLP) of SARS-CoV-2 spike protein (Covifenz)B |

J07-Vaccines |

HC |

Feb-22Footnote‡‡ |

|||||||||

Note: A medicine was considered to be new in 2022 if it received market approval through the US Food and Drug Administration (FDA), the European Medicines Agency (EMA), and/or Health Canada during the calendar year.

Availability and sales information refers to all forms and strengths of the medicine while pricing and treatment costs are based on the highest‑selling form and strength indicated. Sales are based on manufacturer list prices. Specialty medicines are indicated using the following abbreviations: B: biologic; C: cancer; G: gene therapy; O: orphan.

Data source: IQVIA MIDAS®, 2022 (all rights reserved); US Food and Drug Administration Novel Drugs 2021; European Medicines Agency Human Medicines Highlights 2021; Health Canada Notice of Compliance database.

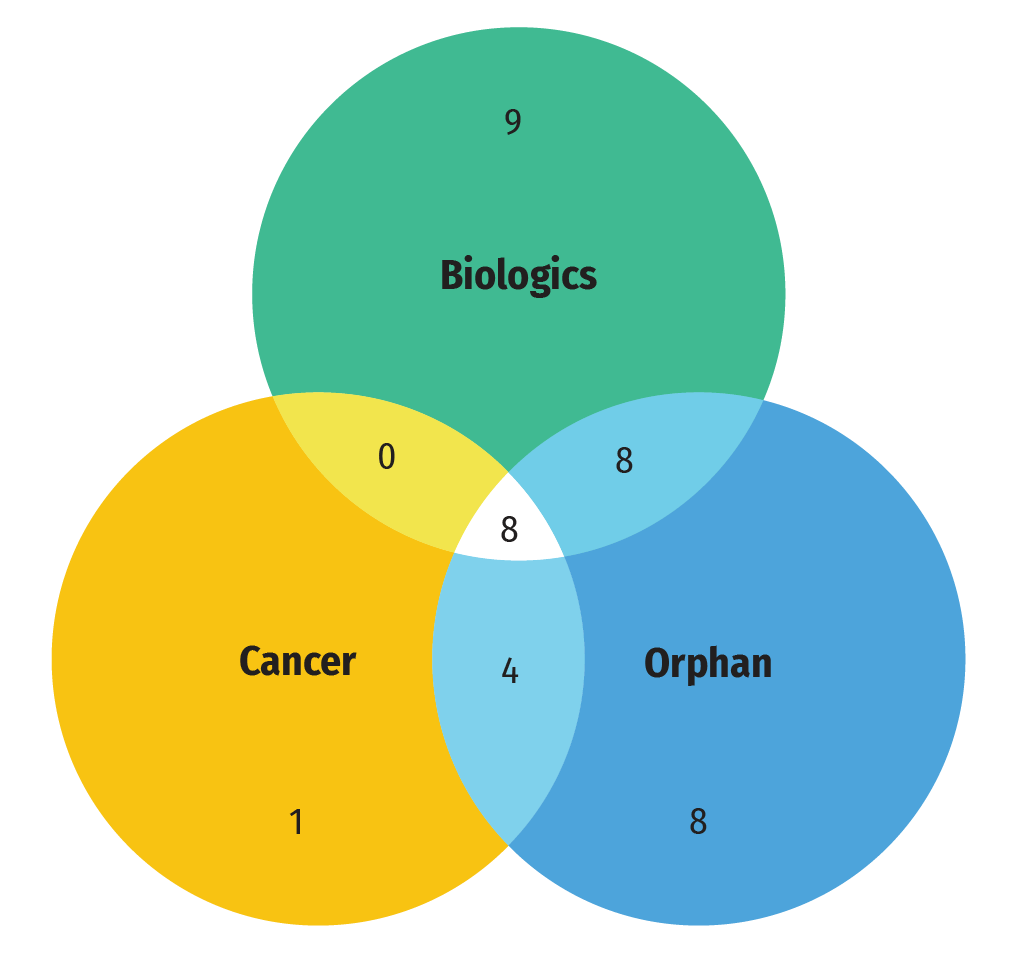

Figure C2 illustrates the overlap between the number of new specialty medicines authorized for market in 2022. Of the 48 new medicines approved in 2022, 56% (28) had received an orphan designation from the FDA and/or the EMA, 27% (13) were oncology treatments, and 52% (25) were biologic medicines. Orphan and oncology medicines showed an important overlap, with 12 of 13 (92%) new cancer medicines having received an orphan designation.

Figure C2: Distribution of 2022 new approvals for specialty medicines

Figure C2 - Text version

- 38 new approvals for specialty medicines in 2021

- 28 medicines with an orphan designation

- 25 biologic medicines

- 13 cancer medicines

- 4 cancer medicines with an orphan designation

- 8 biologic medicines with an orphan designation

- 8 biologic cancer medicines

- 8 biologic cancer medicines with an orphan designation

Data source: US Food and Drug Administration Novel Drugs 2022; European Medicines Agency Human Medicines Highlights 2022; Health Canada Notice of Compliance database.

D: Spotlight on Canada

While Sections B and C reported new medicines approved internationally, this section reports on Canadian approvals between 2018 and 2022, with a focus on the 43 medicines that received their first Canadian market authorization in 2021. As of Q4‑2022, trastuzumab deruxtecan, and risdiplam were the highest-selling among Canada’s 2021 newly approved medicines with 37% and 26% of new‑to‑Canada sales, respectively.

In 2021, Health Canada granted initial market authorization to 43 medicines, above the 2018‑2022 average of 40 new medicines approvals (Figure D1). Approvals continued to rise in 2022 to 46.

Figure D1: Annual approvals for new medicines in Canada, 2018 to 2022

Figure D1 - Text version

| Annual approvals for new medicines in Canada | |

|---|---|

| 2018 | 40 |

| 2019 | 34 |

| 2020 | 36 |

| 2021 | 43 |

| 2022 | 46 |

| Average | 40 |

Data source: Health Canada Notice of Compliance database.

Table D1 reports on the therapeutic class, availability, sales, and pricing for the 36 of the 43 new-to-Canada medicines approved in 2021 which had recorded sales by the end of 2022. Those medicines collectively accounted for less than 1% of branded pharmaceutical sales in Canada in Q4‑2022. The two top‑selling new‑to‑Canada medicines were trastuzumab detruxtecan, used in the treatment of various cancers, and risdiplam, indicated for the treatment of spinal muscular atrophy. Combined, these two medicines accounted for almost two thirds of 2021 new-to-Canada medicine sales. Both medicines were sold in all but one PMPRB11 country. Among the new-to-Canada medicines with both Canadian and international sales, Canadian sales occurred on average within 24 months of a first international saleFootnote 3.

Table D1 also provides foreign‑to‑Canadian price ratios, which compare the median price of medicines in the PMPRB11 countries and the US price with the Canadian price. The price of the medicine in Canada is set to a value of one and the corresponding foreign prices are reported relative to this value. The resulting ratios reflect how much more or less Canadians would have paid for a new medicine if they had paid the median international price or the US price. The median PMPRB11-to-Canadian price ratio reported across new medicines was 0.84, indicating that international prices in Q4‑2021 were approximately 16% lower than Canadian prices at introduction. In contrast, the median US price ratios show that the US pays 40% more than Canada for the same medicines. For the top-selling medicines, Canada’s prices were close to those of PMPRB11 countries. The Canadian prices of both tastuzumab deruxtecan and risdiplam were within 10% of the PMPRB11 median.

Table D1: Medicines first approved in Canada in 2021, availability, sales, and prices as of Q4‑2022

| Medicine (trade name, form, strength, volume) | Therapeutic classFootnote * | Availability | No. of months from first international to Canadian sale | Share of Canadian new medicine sales | No. of countries with salesFootnote ‡ | Price (CAD) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|