Meds Pipeline Monitor 2022

Contact Information

Patented Medicine Prices Review Board

Standard Life Centre

Box L40

333 Laurier Avenue West

Suite 1400

Ottawa, ON K1P 1C1

Tel.: 1-877-861-2350

TTY 613-288-9654

Email: PMPRB.Information-Renseignements.CEPMB@pmprb-cepmb.gc.ca

Acknowledgements

This report was prepared by the Patented Medicine Prices Review Board (PMPRB) as part of the National Prescription Drug Utilization Information System (NPDUIS) initiative.

The PMPRB wishes to acknowledge the members of the NPDUIS Advisory Committee for their expert oversight and guidance in the preparation of this report. Please note that the statements and findings for this report do not necessarily reflect those of the members or their organizations.

We gratefully acknowledge Patricia Carruthers-Czyzewski, BScPhm, MSc, Sintera Inc. for providing pharmaceutical expertise and for her contribution to the scientific analysis.

Appreciation goes to Allison Carey for leading this project, and Tanya Potashnik and Kevin Pothier for their oversight in the development of the report. The PMPRB also wishes to acknowledge the contribution of the editorial staff, Shirin Paynter.

Disclaimer

NPDUIS operates independently of the regulatory activities of the Board of the PMPRB. The research priorities, data, statements, and opinions expressed or reflected in NPDUIS reports do not represent the position of the PMPRB with respect to any regulatory matter. NPDUIS reports do not contain information that is confidential or privileged under sections 87 and 88 of the Patent Act, and the mention of a medicine in an NPDUIS report is not and should not be understood as an admission or denial that the medicine is subject to filings under sections 80, 81, or 82 of the Patent Act or that its price is or is not excessive under section 85 of the Patent Act.

Although this information is based in part on data obtained under license from GlobalData and the MIDAS® Database proprietary to IQVIA Solutions Canada Inc. and/or its affiliates (“IQVIA”), the statements, findings, conclusions, views, and opinions expressed in this report are exclusively those of the PMPRB and are not attributable to either GlobalData or IQVIA.

Suggested Citation

Patented Medicine Prices Review Board. (2023). Meds Pipeline Monitor, 2022. Ottawa: PMPRB.

Executive Summary

Meds Pipeline Monitor (MPM) is a horizon scanning report that features a selection of new medicines undergoing clinical evaluation or in pre-registration that may have an impact on future clinical practice and drug spending in Canada.

This edition expands the review for the selected medicine candidates in Phase III clinical trials or pre-registration to include information on other drugs in Phase II that share the same mechanism of action or indication. Having insight into other drugs under investigation (i.e., in Phase II) may provide additional information on the potential place in therapy for these pipeline candidates. Medicines in Phase III clinical trials or pre-registration are selected as candidates for the ‘new medicines’ list if they have the potential to address an unmet therapeutic need, offer a novel mechanism of action or therapeutic benefit over existing therapies, or treat a serious condition. The medicines in Phase II are also examined to identify other drugs that are in earlier phases of the pipeline that contain the same indication or mechanism of action as the selected medicine candidates.

The report collects data from two main sources: GlobalData’s Healthcare database, which identifies medicines currently undergoing clinical evaluation, and Health Canada’s Drug and Health Product Submissions Under Review Lists, which provide information on new medicines under review in Canada.

Highlights of the Meds Pipeline Monitor 2022

- In 2022, the pipeline contained over 9,000 new medicines in various stages of clinical development, compared to just under 8,500 the year before. The number of drugs in the pipeline is increasing by an average of 11% per year since 2018.

- Oncology continues to dominate the therapeutic mix in 2022, with cancer treatments representing almost one third (30%) of medicines in all phases of clinical trials. Treatments for infectious diseases held the second largest share of the pipeline, at 15%, due to the increased number of medicines for the treatment of COVID-19.

- Nearly one third (31%) of medicines in Phase III clinical trials or pre-registration had an early orphan designation approved through the US FDA or the EMA, which is consistent with the increasing trend in the prevalence of orphan-designated medicines entering the pharmaceutical market.

- Trends in the 2022 pipeline include a growing number of novel gene and cell therapies that are expanding to larger patient groups (e.g., Duchenne muscular dystrophy). The biosimilars pipeline is also expanding to therapeutic areas including asthma (omalizumab), bone health (denosumab), and myocardial infarction (tenecteplase).

- Twenty-eight new medicines including five new gene and cell therapies were selected for the 2022 MPM new medicines list based on their potential to impact the Canadian healthcare system. Nine of the medicines listed in this year’s report have forecasted global annual revenues of over US $1 billion by 2028, one of which was approved by Health Canada in February 2023.

- Of the 42 new and retained medicines listed in the previous edition (MPM 2021), six received market authorization, 25 were retained on this year’s list as they continued to satisfy the selection criteria, and 11 were removed as their clinical trials were discontinued or they no longer meet the selection criteria.

- As of September 2022, 550 vaccines and therapies were undergoing clinical evaluation globally for the prevention and treatment of COVID-19. Health Canada is reviewing 14 new and supplemental drug submissions for the prevention and treatment of COVID-19.

List of Terms

For the purpose of this report, the following terms and associated definitions apply.

- Cell therapy

- The transplantation of human cells to replace or repair damaged tissue and/or cells.

- Clinical efficacy

- The maximum response achievable from a medicine in research settings and the capacity for sufficient therapeutic effect in clinical settings.Footnote i

- Gene therapy

- A technique for the treatment of genetic disease in which a gene that is absent or defective is replaced by a healthy gene, as defined by Health Canada.Footnote ii

- Market authorization

- The process of approval for a medicine to be marketed in a given country. In Canada, market approval is granted following a substantive scientific evaluation of a product's safety, efficacy, and quality, as required by the Food and Drugs Act and Regulations.Footnote iii

- Medicinal ingredient

- A chemical or biological substance responsible for the claimed pharmacologic effect of a drug product. Sometimes referred to as a molecule, active substance, or active ingredient.Footnote iv

- Medicine

- A broad term encompassing both the final drug product and medicinal ingredient(s); this encompasses chemically manufactured active substances and biologics, including gene therapies. Medicines are reported at the medicinal ingredient level and can refer to a single ingredient or a unique combination of ingredients.

- Patent evergreening

- The acquisition of additional patents for minor modifications to an existing pharmaceutical product in order to extend the patent life of the medicine (e.g., new delivery systems, new dosages, new uses, new combinations or new forms).Footnote v

- New medicine

- A medicinal ingredient that has not previously received market authorization by a regulator.Footnote iv

- Orphan medicine

- A medicine used to treat a rare disease. For the purposes of this study, orphan medicines are defined as having an orphan designation granted by the US Food and Drug Administration (FDA) or the European Medicines Agency (EMA) for the relevant indication.

- Phase I

- These trials test an experimental medicine on a small group of people for the first time. The purpose is to look at the medicine's safety, determine a safe dosage range, and monitor if there are any side effects.

- Phase II

- In this phase, the medicine is given to a larger group of people (usually 100 or more) to gather data on how well the medicine works to treat a disease or condition, check its safety on a wider range of people, and determine the best dose.Footnote vi

- Phase III

-

These controlled or uncontrolled trials are conducted after preliminary evidence suggesting efficacy of the medicine has been demonstrated. They are intended to gather additional and confirmatory information about the clinical efficacy and safety of the medicine under the proposed conditions of use.Footnote ii Phase III trials are usually randomized with double-blind testing in several hundred to several thousand patients.

- Pre-registration

- A medicine is in the pre-registration phase once all the necessary clinical trials have been completed and it is waiting for registration or approval for use by a governing body.Footnote vi

Phases of clinical trials

Introduction

This edition of the Meds Pipeline Monitor (MPM) features a selection of new medicines in Phase III clinical trials or pre-registration that have the potential to impact clinical practice and drug spending in Canada.

The methodology, which is detailed in the next section, uses a specific set of criteria to identify a list of new medicines in the pipeline from the GlobalData Healthcare database, as well as a list of medicines currently under review from Health Canada’s Drug and Health Product Submissions Under Review (SUR) Lists. The new medicines listed in this report are selected based on a scientific review of the literature and clinical trial outcomes to determine if the medicine may impact the Canadian healthcare system by: addressing an unmet therapeutic need; offering a novel mechanism of action or therapeutic benefit over existing therapies; or treating a serious condition. Medicines reported in previous editions of the MPM are also reviewed and updated in this report. This report also provides an update on the medicines in last year’s edition that have since received market authorization by either the US Food and Drug Administration (FDA), the European Medicines Agency (EMA), or Health Canada. Likewise, the new medicines featured in this report will be monitored in future editions of the MPMto identify candidates that successfully enter the market.

To provide context for the selection of medicines, the MPM includes a snapshot of the number of drugs in each clinical phase of the pipeline year over year (2018-2022), and a breakdown of the various therapeutic areas for each phase of clinical development. This edition of the report also highlights select vaccines and other medicines undergoing clinical trials for the prevention and treatment of COVID-19, in global markets as well as in Canada. The medicines assessed for this portion of the analysis include new therapies as well as previously marketed treatments for other indications that have been repurposed for the treatment of COVID-19.

Meds Pipeline Monitor is a companion publication to Meds Entry Watch, which analyzes the market launch patterns of newly approved medicines in Canada and internationally. Together, these two PMPRB reports monitor the market continuum of late-stage pipeline medicines and new approvals, providing decision makers, researchers, patients, clinicians, and other stakeholders with information on the emerging medicines and evolving cost pressures.

Methodology

Snapshot of the Pipeline

The snapshot of the 2022 pipeline identifies the composition of medicines in various phases of clinical development. For the purpose of this analysis, a full list of pipeline medicines was retrieved from GlobalData’s Healthcare database in September 2022 and the selected medicine candidates for this year’s report have been validated as of March 30, 2023.

New medicinal ingredients are identified as those with no prior approvals through the US Food and Drug Administration (FDA), the European Medicines Agency (EMA), or Health Canada. The distribution of new medicines by therapeutic area corresponds to the indication under evaluation, as reported by GlobalData. Note that a single new medicine may be undergoing multiple clinical studies for separate indications.

Meds Pipeline Monitor

The MPM selects new medicines in Phase III clinical trials or pre-registration in Canada, the United States, and Europe. Many of the pipeline candidates are first-in-class or represent novel mechanisms for treatment in a specific therapeutic area. For this reason, this report includes additional review on other drugs undergoing Phase II clinical evaluation that share the same indication or mechanism of action. Pipeline medicines are selected for inclusion using a two-stage process (Figure 1). The initial screening stage selects medicines in the late phases of clinical evaluation, while the analytic review stage involves a more rigorous appraisal of each potential candidate to identify medicines that may have a significant clinical and budgetary impact.

* In pre-registration with the US Food and Drug Administration (FDA).

† Has Phase III clinical trials in Canada, the United States, or geographic Europe (excluding Russia and Turkey).

Figure description

This is a flowchart describing the process used to select the listed medicines. The chart consists of two steps:

1. Initial Screening

This step begins with all medicines in Phase III clinical trials or pre-registration with the US Food and Drug Administration. Of these medicines, the next step includes only those with expected clinical trial end dates within three years of the analysis and drug geography including Canada, the US, and Europe. To qualify for the drug geography, a medicine must have Phase III clinical trials in Canada, the US, and/or geographic Europe (excluding Russia and Turkey).

2. Analytic Review

The analytic review step of the process is divided into two parts: one path for new medicines and the other for gene therapies.

New medicines must meet at least one of the following requirements to be included in the list:

- Demonstrates improved safety and efficacy

- Novel mechanism and/or first-in-class, with the addition of one or more of Breakthrough, Fast Track, and Priority Review designations

Gene therapies must demonstrate clinical effectiveness with an acceptable safety profile to be included in the list.

Stage 1. Initial screening

GlobalData’s Healthcare database is used to identify a list of medicines undergoing Phase III clinical trials or in pre-registration. These medicines serve as the basis for the initial screening stage.

The drug geography, defined as the geographical region or country in which the medicine is either marketed or in pipeline development, is restricted to Canada and other countries with similar regulatory and approval processes: the US and geographic Europe (excluding Russia and Turkey). Only new medicinal ingredients that have adequate data that supports increased efficacy and safety from clinical trials are considered as candidates for inclusion.

Medicines approved or sold in Canada, the US, or Europe for any other indication or in any other strength or formulation are excluded during the selection process, as are medicines whose clinical trials are inactive, suspended, withdrawn, or terminated.

Stage 2: Analytic screening

Selection criteria

Following the initial screening, the second stage of the process considers a number of selection criteria to determine the final list of pipeline candidates. These criteria are detailed in Table 1.

Earlier phases of the pipeline (i.e., Phase II) are also examined to determine if there are other medicines with the same indication or mechanism of action as the selected candidates in Phase III and pre-registration. This provides additional information on the number of novel, first-in-class medicines that are undergoing clinical evaluation in Phase II that may influence the therapeutic significance of the selected candidates in Phase III and pre-registration.

Table 1. Selection criteria for the MPM

| Selection criteria |

|---|

| Improved safety and efficacy shown in clinical trials: a medicine that demonstrates increased safety, new outcome measures, or increased life expectancy or quality of life |

Novel mechanism / First-in-class: a medicine that uses a new mechanism of biochemical interaction to produce a medical effect, or a medicine that is the first in its therapeutic class In addition, the medicine must fall into one or more of the three following FDA designations for expedited development and review:

|

Additional descriptive information

A profile of each successful pipeline candidate is provided, including the indication and mechanism of action, as well as a summary of the applicable published outcomes from clinical trials. Specific attributes that may influence the potential uptake or cost of each medicine are also identified. Table 2 provides a detailed description of these key attributes.

Table 2. Key attributes of new medicines selected for the MPM

| Attribute | Relevance | Data sources |

|---|---|---|

| Clinical trials in Canada | Medicines tested in Canada are likely to be of interest to Canadians |

GlobalData Healthcare; Health Canada Clinical Trials Database; Health Canada Drug and Health Product Submissions Under Review; National Institutes of Health (NIH) Clinical Trial Registry |

| Rare or orphan designation | Medicines used to treat rare diseases or conditions that generally have high treatment costs and may result in substantial spending | GlobalData Healthcare |

| Biologic medicine | These complex molecules produced by living organisms are expected to have high costs, resulting in substantial spending | |

| Add-on therapy | Medicines designed to be used in conjunction with existing medicines may increase the treatment cost and contribute to higher spending | |

| Potential evergreening | Modified forms of the same product in order to extend the patent life. (e.g., new delivery systems, new dosages, new uses, new combinations or new forms) |

The profile also provides details of potential cost implications, if available, which includes the forecasted global revenues reported by GlobalData.

The indications and therapeutic areas of the featured medicines correspond to their Phase III clinical trial or pre-registration stage. A single clinical trial may assess multiple indications within the same therapeutic area. These medicines may also have additional indications at various phases of clinical evaluation that are not mentioned in this report. The scientific description and key attributes provided are focused on the specified indication(s) for the selected medicines.

Medicines reported for a given year are reassessed for each following edition of the MPM. They may be retained on the MPM list if they continue to meet the selection criteria. Medicines for which clinical trials have been discontinued or for which the selection criteria is no longer met are not reported in subsequent editions.

Spotlight on Canada

Health Canada’s Drug and Health Product Submissions Under Review (SUR) Lists are assessed using a modified approach to the selection criteria to establish a list of medicines that may have the potential to impact Canadian drug spending or clinical practice.

Medicines listed in the SUR include new drug submissions containing medicinal ingredients that have not been approved in Canada for any indication, in any strength or form. Unlike the selection of medicines identified in the pipeline lists, these medicines may have previously received market authorization through the US FDA or the EMA.

Selection Criteria

Following this initial screening, the medicine must demonstrate at least one of three selection criteria to qualify for inclusion in the report. These criteria are listed in Table 3.

Table 3. Selection criteria for the list of medicines currently under review by Health Canada

| Selection Criteria |

|---|

| Improved safety and efficacy shown in clinical trials: a medicine that demonstrates increased safety, new outcome measures, or increased life expectancy or quality of life |

| Novel mechanism or First-in-class: a medicine that uses a new mechanism of biochemical interaction to produce a medical effect, or a medicine that is the first in its therapeutic class |

| Gene or cell therapy: a technique for the treatment of genetic disease in which a gene that is absent or defective is replaced by a healthy gene; or the transplantation of human cells to replace or repair damaged tissue and/or cells |

Additional descriptive information

The profile of each medicine under review includes the key attributes listed in Table 2, as well as the indication and mechanism of action, and a summary of the applicable published outcomes from clinical trials. Specific attributes that may influence the potential uptake or cost of each medicine are also identified, as well as potential cost implications, if available, which includes the forecasted global revenues reported by GlobalData.

Although FDA designations for expedited development or review are not a selection criteria for this list, relevant Breakthrough, Fast Track, and Priority Review designations are indicated where available. For a description of these designations, see Table 1.

Indications and therapeutic areas correspond to the information provided by GlobalData. The scientific description and key attributes provided are focused on the specified indication(s) for the selected medicine. For medicines under review for multiple indications, the primary indication is used.

Emerging COVID-19 Therapies

Vaccines and medicines under development globally with an indication for COVID-19 were extracted for this section of the report, based on a development stage of Phase I, II, and III clinical trials or pre-registration. All such medicines were assessed for this analysis, both new and existing. New medicines were identified as those that have not yet been marketed for any indication, while existing medicines include previously marketed therapies undergoing evaluation for new indications related to the prevention or treatment of COVID-19.

This section also highlights the COVID-19 medicines that have been approved as well as the medicines that are currently undergoing an expedited review process with Health Canada.

Data Sources

The GlobalData Healthcare database is the primary data source for the identification of pipeline medicines and their corresponding clinical information. GlobalData Healthcare tracks medicines from pre-clinical discovery, through clinical trials, to market launch and subsequent sales. The database is a comprehensive resource of medicines under various stages of clinical development. Search capabilities allow for controlled selection of specific attributes, including but not limited to the following: phase of clinical development, therapeutic area, molecule type, indication, drug geography, mechanism of action, and regulatory designations.

Health Canada’s Drug and Health Product Submissions Under Review (SUR) Lists are used to determine the featured selection of new medicines currently undergoing review by Health Canada. The SUR is a publicly available set of lists that identify pharmaceutical and biologic drug submissions containing new medicinal ingredients not previously approved in Canada that have been accepted for review. This applies to submissions accepted on or after April 1, 2015.

As this selection is restricted to new medicines, additional sources of information are cross-referenced to confirm that the candidates have not previously been approved or sold. These include recorded sales data from the IQVIA MIDAS® Database (all rights reserved); regulatory approval records from the National Institutes of Health (NIH), US FDA, the EMA, and Health Canada; and information in Health Canada’s Clinical Trials database and ClinicalTrials.org.

Limitations

This analysis captures a snapshot of the pipeline over a specific time period. Although it is assumed to be representative of the composition of medicines over the entire year, the pipeline is fairly dynamic and the share of medicines in any particular therapeutic area will vary.

This assessment is restricted to medicines under development for market in Canada and other countries with similar regulatory and approval processes: the US and Europe (excluding Russia and Turkey). Medicines that have not yet received market authorization in these countries were considered as potential pipeline candidates, even if they have been approved elsewhere in the world.

Some of the selected medicines may be undergoing clinical trials for additional indications; this analysis only reports on indications in the late stages of development—that is, in Phase III clinical trials or pre-registration with the US FDA—that satisfy the selection criteria set out in the methodology.

For each selected pipeline medicine, the primary manufacturer(s) and trade name, if available, are given along with the indication. In some cases, additional manufacturers, including subsidiaries, may also be involved in the development of the medicine with the primary companies, or other manufacturers may be developing the same medicine for other indications.

Although this report attempts to identify the most important pipeline medicines, the selection is not exhaustive and some medicines that are not included in this selection may have a significant impact on future clinical practice and drug spending in Canada.

Unless otherwise specified, the featured lists capture the composition of the pipeline as of September 2022 and are validated as of the end of March 2023. Due to the unpredictability and fast-moving nature of pipeline medicines entering the market, some of the medicines listed in this edition may have been approved or marketed in Canada, the US, or Europe following this date. Pipeline medicines that have not been included in this report due to the timing of the selection may presently meet the selection criteria; these, along with the rest of the drug pipeline, will be considered for the next edition of the report.

Snapshot of the 2022 Pipeline

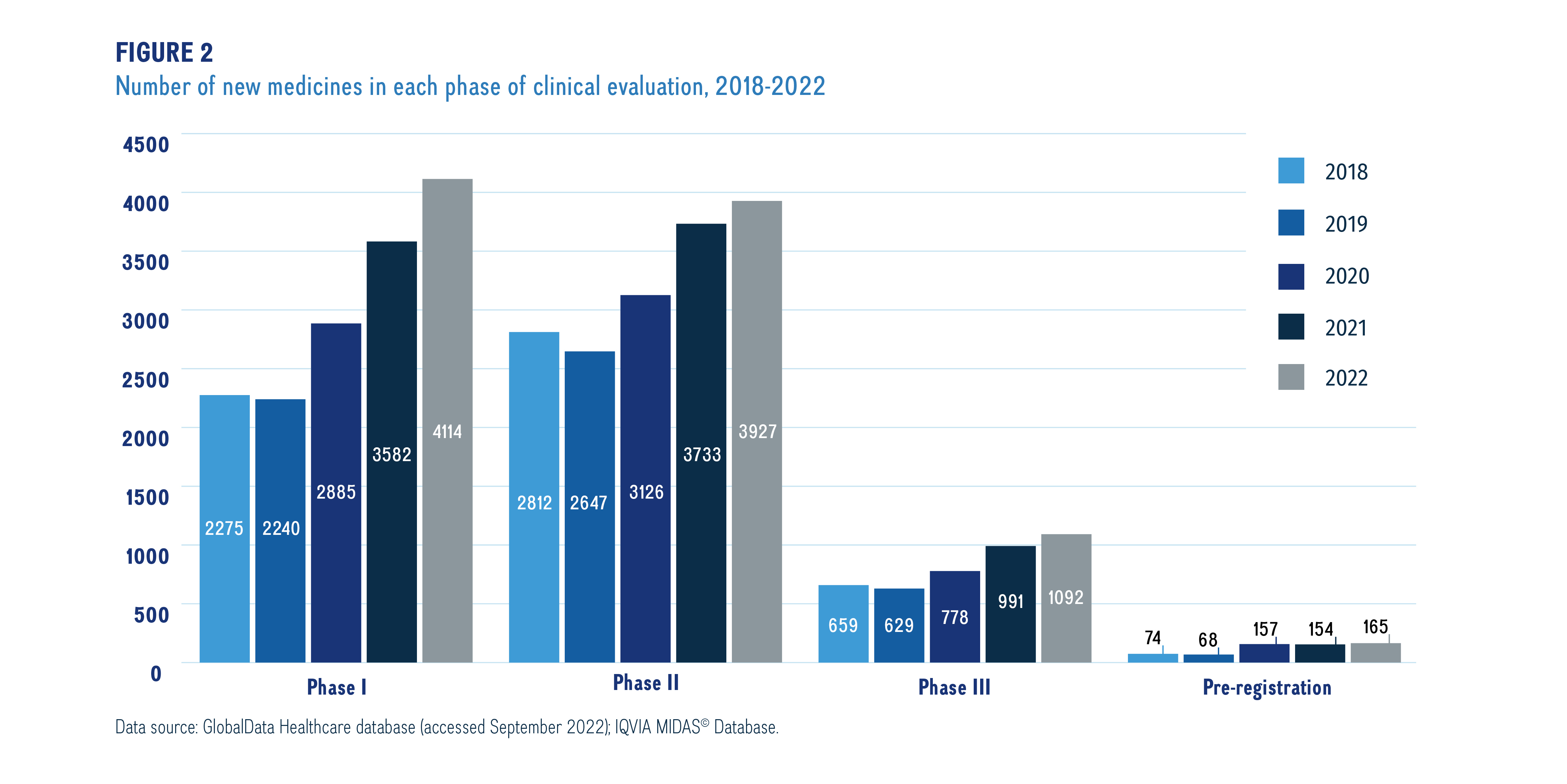

The number of new pharmaceutical developments in the pipeline is increasing year over year. In 2022, over 9,000 new medicines were undergoing clinical evaluation, which has been increasing by an average of 11% per year since 2018.

Figure 2 provides a snapshot of the pipeline including the number of new medicinal ingredients in each phase of clinical development over the last 5 years.

Figure description

This bar graph illustrates a snapshot of the total number of new medicines in each phase of the pipeline by their highest phase of development from 2018 to 2022. Totals are given for each year and phase.

| Phase I | Phase II | Phase III | Pre-registration | |

|---|---|---|---|---|

2018 |

2,275 |

2,812 |

659 |

74 |

2019 |

2,240 |

2,647 |

629 |

68 |

2020 |

2,885 |

3,126 |

778 |

157 |

2021 |

3,582 |

3,733 |

991 |

154 |

2022 |

4,114 |

3,927 |

1,092 |

165 |

Data source: GlobalData Healthcare database (accessed September 2022); IQVIA MIDAS© Database.

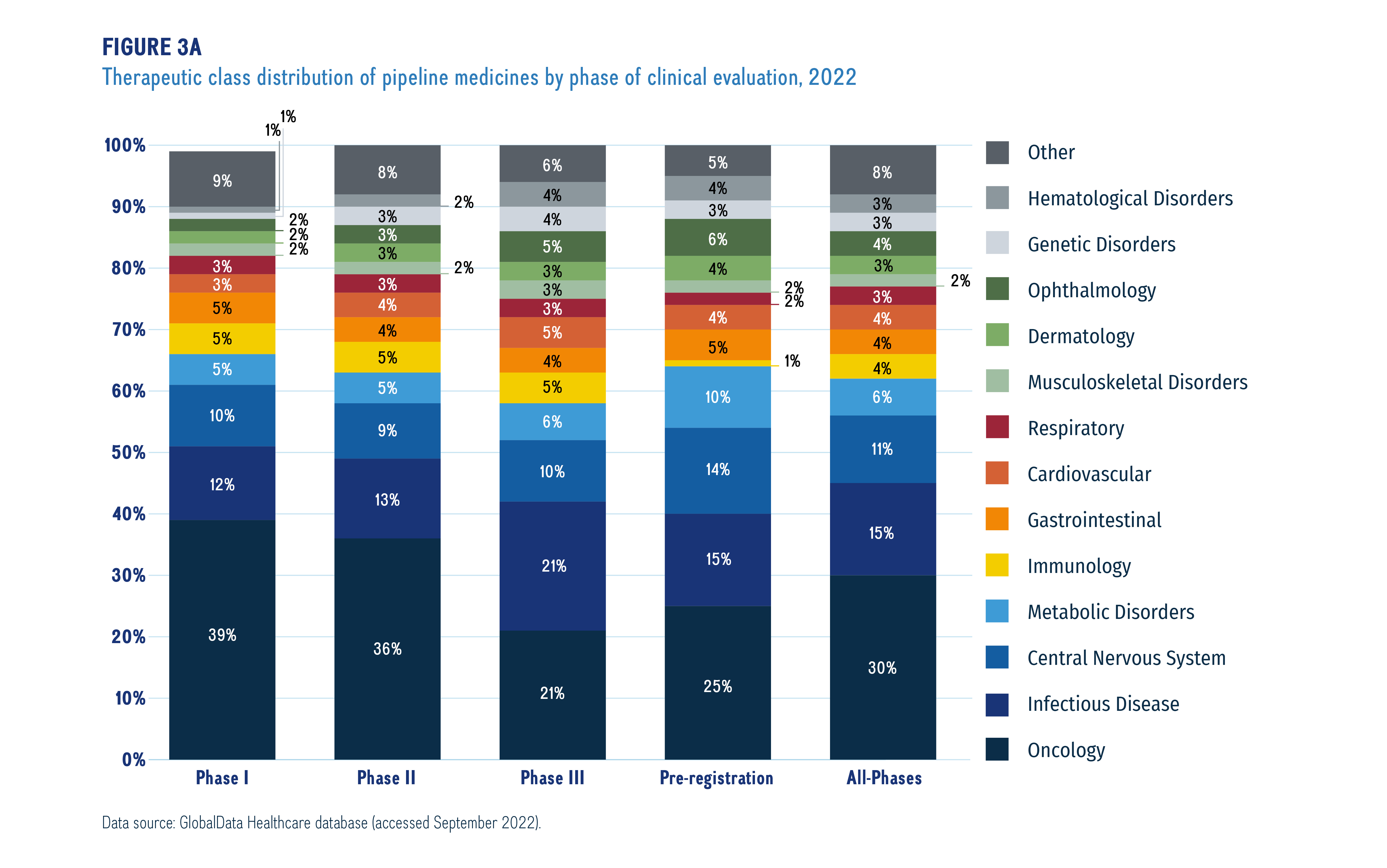

Figure 3a illustrates the distribution of new medicines by therapeutic area from Phase I through to pre-registration. Although the findings show that pipeline medicines represented a wide range of therapeutic areas in 2022, cancer treatments dominated the therapeutic mix in each phase of the pipeline, accounting for nearly one third (30%) of medicines in all phases of clinical evaluation. Other important pipeline therapies include those for infectious diseases (such as COVID-19) and central nervous system therapies.

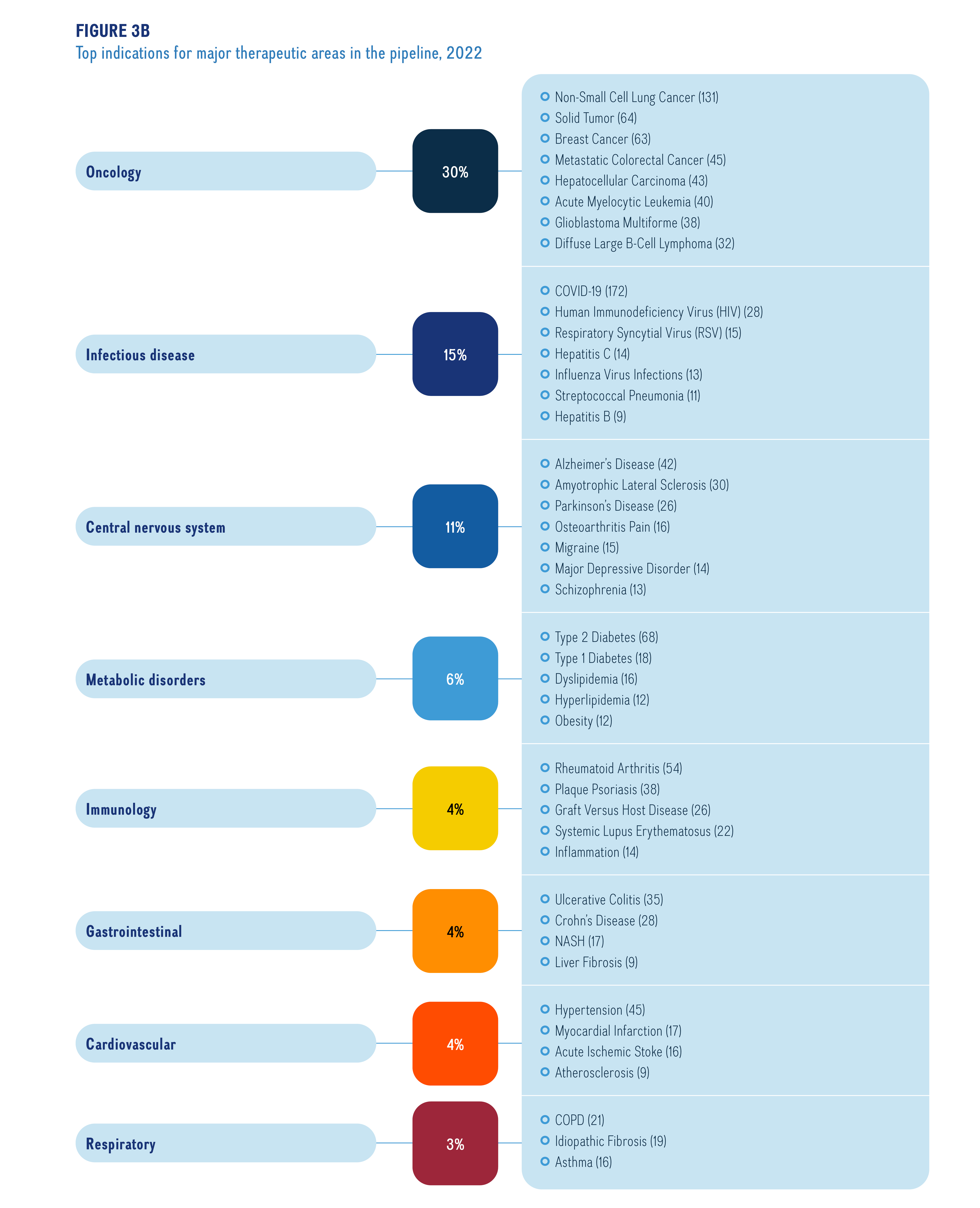

Figure 3b illustrates the top indications and number of medicines undergoing Phase II, Phase III or pre-registration in the major therapeutic areas in the pipeline in 2022

Figure description

A stacked bar graph gives the distribution of new medicines by therapeutic rea from Phase I through to pre-registration.

| Therapeutic Area | Phase I | Phase II | Phase III | Pre-registration | All Phases |

|---|---|---|---|---|---|

Oncology |

39% |

36% |

21% |

25% |

30% |

Infectious disease |

12% |

13% |

21% |

15% |

15% |

Central Nervous System |

10% |

9% |

10% |

14% |

11% |

Metabolic disorders |

5% |

5% |

6% |

10% |

6% |

Immunology |

5% |

5% |

5% |

1% |

4% |

Gastrointestinal |

5% |

4% |

4% |

5% |

4% |

Cardiovascular |

3% |

4% |

5% |

4% |

4% |

Respiratory |

3% |

3% |

3% |

2% |

3% |

Musculoskeletal disorders |

2% |

2% |

3% |

2% |

2% |

Dermatology |

2% |

3% |

3% |

4% |

3% |

Ophthalmology |

2% |

3% |

5% |

6% |

4% |

Genetic disorders |

1% |

3% |

4% |

3% |

3% |

Hematological disorders |

1% |

2% |

4% |

4% |

3% |

Other |

9% |

8% |

6% |

5% |

8% |

Data source: GlobalData Healthcare database (accessed September 2022).

Figure description

A horizontal bar graph indicates the top indications by number of medicines in all phases of the pipeline.

| Therapeutic Area | All Phases | |

|---|---|---|

Oncology |

30% |

Non-Small Cell Lung Cancer (131) Solid Tumor (64) Breast Cancer (63) Metastatic Colorectal Cancer (45) Hepatocellular Carcinoma (43) Acute Myelocytic Leukemia (40) Glioblastoma Multiforme (38) Diffuse Large B-Cell Lymphoma (32) |

Infectious disease |

15% |

COVID-19 (172) Human Immunodeficiency Virus (HIV) (28) Respiratory Syncytial Virus (RSV) (15) Hepatitis C (14) Influenza Virus Infections (13) Streptococcal Pneumonia (11) Hepatitis B (9) |

Central Nervous System |

11% |

Alzheimer’s Disease (42) Amyotrophic Lateral Sclerosis (30) Parkinson’s Disease (26) Osteoarthritis Pain (16) Migraine (15) Major Depressive Disorder (14) Schizophrenia (13) |

Metabolic disorders |

6% |

Type 2 Diabetes (68) Type 1 Diabetes (18) Dyslipidemia (16) Hyperlipidemia (12) Obesity (12) |

Immunology |

4% |

Rheumatoid Arthritis (54) Plaque Psoriasis (38) Graft Versus Host Disease (26) Systemic Lupus Erythematosus (22) Inflammation (14) |

Gastrointestinal |

4% |

Ulcerative Colitis (35) Crohn’s Disease (28) NASH (17) Liver Fibrosis (9) |

Cardiovascular |

4% |

Hypertension (45) Myocardial Infarction (17) Acute Ischemic Stoke (16) Atherosclerosis (9) |

Respiratory |

3% |

COPD (21) Idiopathic Fibrosis (19) Asthma (16) |

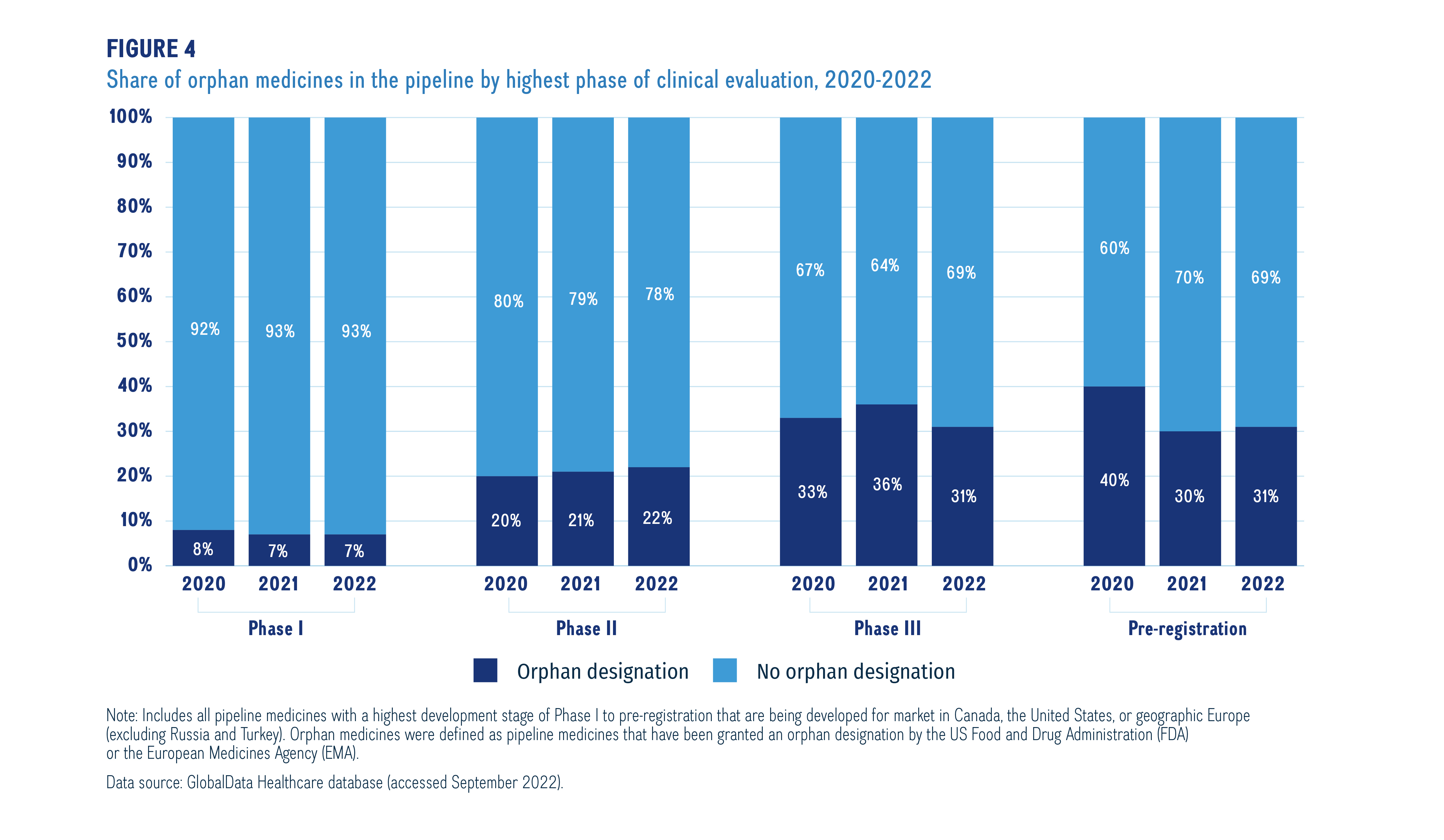

Orphan medicines, as designated by the US Food and Drug Administration (FDA) or the European Medicines Agency (EMA), accounted for a notable proportion of medicines in the 2022 pipeline. Figure 4 provides the shares of orphan designated medicines for all phases in the pipeline from 2020-2022. Orphan designated medicines make up a greater share in the later stages of the pipeline, increasing from 7% in Phase I to 31% in pre-registration in 2022. This has been a consistent trend since 2020.

Figure description

A stacked bar graph gives the proportion of orphan designated medicines to non-orphan designated medicines in the pipeline by phase of development from 2020 to 2022.

| Phase of Development | 2020 | 2021 | 2022 | |

|---|---|---|---|---|

Orphan designation |

Phase I |

8% |

7% |

7% |

Phase II |

20% |

21% |

22% |

|

Phase III |

33% |

36% |

31% |

|

Pre-registration |

40% |

30% |

31% |

|

No Orphan designation |

Phase I |

92% |

93% |

93% |

Phase II |

80% |

79% |

78% |

|

Phase III |

67% |

64% |

69% |

|

Pre-registration |

60% |

70% |

69% |

Note: Includes all pipeline medicines with a highest development stage of Phase I to pre-registration that are being developed for market in Canada, the United States, or geographic Europe (excluding Russia and Turkey). Orphan medicines were defined as pipeline medicines that have been granted an orphan designation by the US Food and Drug Administration (FDA) or the European Medicines Agency (EMA).

Data source: GlobalData Healthcare database (accessed September 2022).

Trend Watch 2022

The drug development landscape has been evolving over the last few years, from an earlier emphasis on blockbuster drugs developed in-house by large pharmaceutical companies, to niche markets and “personalized medicine”Footnote viii including various orphan drugs for rare disease, expanding therapeutic areas in gene and cell therapies, and the growing biosimilars pipeline.

Orphan drug approvals

Approvals for specialty medicines continue to increase, with orphan designated medicines accounting for 58% (29) of approved medicines in 2020 in Canada.Footnote ix This upward trend is ongoing: nearly half (49%) of the novel specialty medicines in the pipeline are indicated for orphan conditions. When including orphan cancer drugs, an estimated 80% of specialty drug development in 2022 was for orphan conditions.Footnote xi Aside from cancer drugs, another leading class of pipeline specialty drugs are novel anti-inflammatory therapeutics, including tumor necrosis factor inhibitors and targeted synthetic disease-modifying antirheumatic drugs (DMARDs).Footnote xi

Gene and cell therapies

The gene and cell therapy pipeline is growing rapidly, with more than 600 gene and cell therapies in various phases of development in 2022.Footnote x According to market analysis forecasts from GlobalData, gene therapy will be a $25 billion per year market by 2034.Footnote xi Among the many therapies undergoing clinical evaluation are novel therapies for Duchenne muscular dystrophy (6 drugs in Phase III and one in pre-registration), epidermolysis bullosa (3 drugs in preclinical evaluation, one in Phase II and one in pre-registration), and β thalassemia/sickle cell disease (10 drugs in preclinical evaluation and discovery).Footnote xii

Biosimilars pipeline

Biosimilars can provide patients and doctors with more affordable treatment options, which have the potential to provide savings and contribute to drug coverage sustainability. As of March 2023, 51 biosimilars of 16 innovator reference products have been approved in Canada. By comparison, there have been 40 approvals in the United States and 69 biosimilars approved by the European Medicines Agency.Footnote xiii The global pipeline is growing with over 140 biosimilars in Phase III and pre-registration, including new therapeutic areas such as growth hormone, infertility, bone health, and immunosuppressants. As of March 2023, Health Canada is reviewing 8 biosimilars, two of which (eculizumab and ustekinumab) are the first biosimilar submissions for the reference product.

Meds Pipeline Monitor 2022

The following tables include: selected new medicine candidates for 2022 (Table 4), retained medicines from previous editions of the Meds Pipeline Monitor (Table 5), and medicines from previous editions that have gained market authorization (Table 6).

Medicines in Phase III clinical trials or pre-registration are considered as candidates for the Meds Pipeline Monitor (MPM) if they have the potential to impact future clinical practice and drug spending in Canada (e.g., address an unmet therapeutic need, offer a novel mechanism of action or therapeutic benefit over existing therapies, or treat a serious condition).

Screening new medicine candidates

Of the 1,257 pipeline medicines in Phase III and pre-registration in 2022, twenty-eight (28) new medicines were selected for inclusion in the new medicines list (Table 4). Many of the pipeline candidates are first-in-class or represent novel mechanisms for the treatment of specific therapeutic areas. Having insight into other drugs under clinical evaluation (i.e., in Phase II) may provide additional information on the potential place in therapy of these pipeline candidates. The medicines in Phase II were examined to identify other drugs in the pipeline that have the same indication or mechanism of action as those listed in the 2022 new medicines list. The description for each new medicine listed in the 2022 new medicines list includes a statement indicating if there are any other drugs in Phase II development with the same indication or mechanism of action. Appendix A (Table A3) provides some further insights into the other drugs identified in Phase II for the indications targeted by the pipeline candidates. It is important to keep in mind that not all drugs in Phase II development will progress to Phase III. According to an industry analysis, Phase II clinical programs experience the lowest success rate of the development phases, with only 30.7% of developmental candidates advancing to Phase III. 1

Of the new medicines featured in previous reports, 25 were retained as recent evidence continues to support promising clinical benefit and satisfies the selection criteria (Table 5). Six of the 2021 pipeline medicines have received market authorization in the US, Europe, or Canada as of March 30, 2023 (Table 6), while 11 were removed from the list as their clinical trials were discontinued or they no longer fulfill the selection criteria.

Screening biosimilars

Biosimilars differ from pipeline candidates in that their efficacy and safety is similar to originator biologics. However, their introduction can substantially impact drug spending in specific therapeutic areas. Of the 21 biosimilars identified in Phase III trials in 2022, 14 (67%) would be, if approved, the first biosimilars marketed for the originator biologic. Examples include: cetuximab (for specific cancers), denosumab (for post-menopausal osteoporosis), eculizumab (for paroxysmal nocturnal hemoglobinuria), ocrelizumab (for relapsing remitting multiple sclerosis), omalizumab (for urticaria), romiplostim (for idiopathic thrombocytopenic purpura), tenecteplase (for myocardial infarction), and ustekinumab (for plaque psoriasis).

The availability of these biosimilars could significantly impact costs in a wide range of therapeutic areas. Of note, as of March 30, 2023, a biosimilar for eculizumab and ustekinumab are under review by Health Canada.2 Appendix A (Table A1) provides a list of the identified biosimilars in Phase III clinical trials and indicates whether a biosimilar currently exists for the originator biologic.

Table 4. Selected new medicines for 2022

Cardiovascular

| Medicine (Trade name) Company | Indication(s) | Description and Key Attributes |

|---|---|---|

Abelacimab Anthos Therapeutics Inc

|

Deep vein thrombosis (DVT); Pulmonary embolism; Atrial fibrillation

|

Clinical trials

Forecasted revenue

|

Aprocitentan Idorsia Pharmaceutical Ltd

|

Resistant hypertension

|

Clinical trials

Forecasted revenue

|

Etripamil Milestone Pharmaceuticals Inc Canada

|

Paroxysmal supraventricular tachycardia (PSVT)

|

Clinical trials

Forecasted revenue

|

Obicetrapib NewAmsterdam Pharma BV

|

Dyslipidemia; Heterozygous familial hypercholesterolemia (heFH); Atherosclerosis

|

Clinical trials

Forecasted revenue

|

Sotatercept Acceleron Pharma Inc

|

Pulmonary arterial hypertension (PAH) |

Clinical trials

Forecasted revenue

|

Central Nervous System

| Medicine (Trade name) Company | Indication(s) | Description and Key Attributes |

|---|---|---|

Evobrutinib Merck KGaA

|

Relapsing multiple sclerosis (RMS); Secondary progressive multiple sclerosis (SPMS) |

Clinical trials

Forecasted revenue

|

Reldesemtiv Cytokinetics Inc

|

Amyotrophic lateral sclerosis (ALS) |

Clinical trials

Forecasted revenue

|

Soticlestat Takeda Pharmaceutical Co Ltd

|

Lennox-Gastaut syndrome; Dravet syndrome (severe myoclonic epilepsy of infancy) |

Clinical trials

Forecasted revenue

|

Ulotaront (SEP-363856) Sunovion Pharmaceuticals Inc

|

Schizophrenia |

Clinical trials

Forecasted revenue

|

Dermatology

| Medicine (Trade name) Company | Indication(s) | Description and Key Attributes |

|---|---|---|

Beremagene geperpavec Krystal Biotech Inc

|

Epidermolysis bullosa

|

Clinical trials

Forecasted revenue

|

Gastrointestinal Disorders

| Medicine (Trade name) Company | Indication(s) | Description and Key Attributes |

|---|---|---|

Resmetirom Madrigal Pharmaceuticals Inc

|

Non-alcoholic steatohepatitis (NASH); Non-alcoholic fatty liver disease (NAFLD) |

Clinical trials

Forecasted revenue

|

Seladelpar lysine CymaBay Therapeutics Inc

|

Primary biliary cholangitis (primary biliary cirrhosis) |

Clinical trials

Forecasted revenue

|

Genetic disorders

| Medicine (Trade name) Company | Indication(s) | Description and Key Attributes |

|---|---|---|

Delandistrogene moxeparvovec Sarepta Therapeutics Inc

|

Duchenne muscular dystrophy

|

Clinical trials

Forecasted revenue

|

REC-2282 Recursion Pharmaceuticals Inc

|

Neurofibromatosis type II (NF2)-mutated meningiomas |

Clinical trials

Forecasted revenue

|

Immunological disorders

| Medicine (Trade name) Company | Indication(s) | Description and Key Attributes |

|---|---|---|

Garadacimab CSL Ltd

|

Hereditary angioedema (HAE) (C1 esterase inhibitor [C1-INH] deficiency |

Clinical trials

Forecasted revenue

|

Omidubicel Gamida Cell Ltd

|

Hematopoietic stem cell transplantation |

Clinical trials

Forecasted revenue

|

Infectious Diseases

| Medicine (Trade name) Company | Indication(s) | Description and Key Attributes |

|---|---|---|

Posoleucel AlloVir Inc

|

Herpesviridae infections |

Clinical trials

Forecasted revenue

|

Zoliflodacin Entasis Therapeutics Holdings Inc

|

Uncomplicated cervical and urethral gonorrhea |

Clinical trials

Forecasted revenue

|

Metabolic Disorders

| Medicine (Trade name) Company | Indication(s) | Description and Key Attributes |

|---|---|---|

Insulin human, oral (ORMD-0801) Oramed Pharmaceuticals Inc

|

Type 2 Diabetes

|

Clinical trials

Forecasted revenue

|

Insulin icodec Novo Nordisk AS

|

Type 1 diabetes (juvenile diabetes); Type 2 diabetes

|

Clinical trials

Forecasted revenue

|

Oncology

| Medicine (Trade name) Company | Indication(s) | Description and Key Attributes |

|---|---|---|

Bemarituzumab Amgen Inc

|

Adenocarcinoma of the gastroesophageal junction; Gastric cancer; Bladder cancer; Gastroesophageal (GE) junction carcinomas |

Clinical trials

Forecasted revenue

|

Iberdomide hydrochloride Bristol-Myers Squibb Co

|

Refractory multiple myeloma; Relapsed multiple myeloma |

Clinical trials

Forecasted revenue

|

Imetelstat sodium Geron Corp

|

Myelodysplastic syndrome; Post-essential thrombocythemia myelofibrosis (post-ET MF); Post-polycythemia vera myelofibrosis (PPV-MF) |

Clinical trials

Forecasted revenue

|

Navitoclax dihydrochloride AbbVie Inc

|

Myelofibrosis |

Clinical trials

Forecasted revenue

|

Relacorilant Corcept Therapeutics Inc

|

Epithelial ovarian cancer |

Clinical trials

Forecasted revenue

|

Rusfertide acetate Protagonist Therapeutics Inc

|

Polycythemia vera (PV)

|

Clinical trials

Forecasted revenue

|

Zolbetuximab Astellas Pharma Inc

|

Adenocarcinoma of the gastroesophageal junction; Gastric cancer

|

Clinical trials

Forecasted revenue

|

Ophthalmology

| Medicine (Trade name) Company | Indication(s) | Description and Key Attributes |

|---|---|---|

Lenadogene nolparvovec GenSight Biologics SA

|

Leber’s hereditary optic neuropathy (Leber optic atrophy)

|

Clinical trials

Forecasted revenue

|

* Consensus forecasts for global revenue data were collected from GlobalData, Q4-2022, and are given in US dollars.

Data source: GlobalData Healthcare database.

Table 5. Update on pipeline medicines retained from the 2021 Meds Pipeline Monitor

Cardiovascular

| Medicine (Trade name) Company | Indication(s)* | Description and Key Attributes |

|---|---|---|

Apabetalone Resverlogix Corp.

|

Coronary artery disease (CAD) (ischemic heart disease) |

Clinical trials

Forecasted revenue

|

CSL112 CSL Ltd

|

Acute coronary syndrome (ACS) |

Clinical trials

Forecasted revenue

|

Central Nervous System

| Medicine (Trade name) Company | Indication(s)* | Description and Key Attributes |

|---|---|---|

Latozinemab Alector Inc

|

Frontotemporal dementia (FTD) |

Clinical trials

Forecasted revenue

|

Valiltramiprosate Alzheon Inc

|

Alzheimer's disease (AD) |

Clinical trials

Forecasted revenue

|

Midomafetamine (MDMA) Multidisciplinary Association for Psychedelic Sudies

|

Post-traumatic stress disorder (PTSD) |

Clinical trials

Forecasted revenue

|

ND-0612 Mitsubishi Tanabe Pharma Corp

|

Parkinson's disease (PD) |

Clinical trials

Forecasted revenue

|

Gastrointestinal disorders

| Medicine (Trade name) Company | Indication(s)* | Description and Key Attributes |

|---|---|---|

Brazikumab AstraZeneca Plc

|

Crohn's disease (regional enteritis) |

Clinical trials

Forecasted revenue

|

RBX-2660 Rebiotix Inc

|

Clostridium difficile infections (C. difficile associated disease) |

Clinical trials

Forecasted revenue

|

Genito urinary system and sex hormones

| Medicine (Trade name) Company | Indication(s)* | Description and Key Attributes |

|---|---|---|

Gepotidacin mesylate GlaxoSmithKline Plc

|

Cystitis; Urinary tract infections (UTI) |

Clinical trials

Forecasted revenue

|

Hematological disorders

| Medicine (Trade name) Company | Indication(s)* | Description and Key Attributes |

|---|---|---|

Bentracimab PhaseBio Pharmaceuticals Inc

|

Bleeding and clotting disorders |

Clinical trials

Forecasted revenue

|

Danicopan Alexion Pharmaceuticals Inc

|

Paroxysmal nocturnal hemoglobinuria (PNH) |

Clinical trials

Forecasted revenue

|

Fidanacogene Pfizer Inc

|

Hemophilia B |

Clinical trials

Forecasted revenue

|

Fitusiran Sanofi

|

Hemophilia A; |

Clinical trials

Forecasted revenue

|

Hormonal disorders

| Medicine (Trade name) Company | Indication(s)* | Description and Key Attributes |

|---|---|---|

Palopegteriparatide (TransCon PTH) Ascendis Pharma AS

|

Hypoparathyroidism |

Clinical trials

Forecasted revenue

|

Infectious diseases

| Medicine (Trade name) Company | Indication(s)* | Description and Key Attributes |

|---|---|---|

V-7 Immunitor Inc

|

Tuberculosis (TB) |

Clinical trials

Forecasted revenue

|

Male health

| Medicine (Trade name) Company | Indication(s)* | Description and Key Attributes |

|---|---|---|

Fexapotide triflutate Nymox Pharmaceutical Corp

|

Benign prostatic hyperplasia (BPH) |

Clinical trials

Forecasted revenue

|

Metabolic Disorders

| Medicine (Trade name) Company | Indication(s)* | Description and Key Attributes |

|---|---|---|

Birtamimab Prothena Corp Plc

|

Primary systemic amyloidosis |

Clinical trials

Forecasted revenue

|

Donislecel (Lantidra) CellTrans Inc

|

Type 1 diabetes (T1D; juvenile diabetes) |

Clinical trials

Forecasted revenue

|

Pegunigalsidase alfa Chiesi Farmaceutici SpA

|

Fabry disease |

Clinical trials

Forecasted revenue Forecasted annual global revenue unknown. |

Oncology

| Medicine (Trade name) Company | Indication(s)* | Description and Key Attributes |

|---|---|---|

Arfolitixorin Isofol Medical AB

|

Metastatic colorectal cancer |

Clinical trials

Forecasted revenue

|

SGX-301 (HyBryte) Soligenix Inc

|

Cutaneous T-cell lymphoma (CTCL) |

Clinical trials

Forecasted revenue

|

Ipatasertib Genentech, Inc

|

Metastatic |

Clinical trials

Forecasted revenue

|

Motixafortide (BL-8040; Aphexda) BioLineRx Ltd

|

Multiple myeloma (Kahler disease) |

Clinical trials

Forecasted revenue

|

Ophthalmology

| Medicine (Trade name) Company | Indication(s)* | Description and Key Attributes |

|---|---|---|

Avacincaptad pegol sodium (Zimura) Iveric Bio Inc

|

Geographic atrophy (GA) |

Clinical trials

Forecasted revenue

|

Women’s health

| Medicine (Trade name) Company | Indication(s)* | Description and Key Attributes |

|---|---|---|

Fezolinetant Astellas Pharma Inc

|

Vasomotor symptoms of menopause (hot flashes) |

Clinical trials

Forecasted revenue

|

* Consensus forecasts for global revenue data were collected from GlobalData, Q4-2022, and are given in US dollars.

Data source: GlobalData Healthcare database.

Table 6. Pipeline medicines from the 2021 Meds Pipeline Monitor that have gained market authorization

Central Nervous System

| Medicine (Trade name) Company | Indication(s)* | Description and Key Attributes |

|---|---|---|

Lecanemab (Leqembi) Eisai Co Ltd

|

Alzheimer's disease (AD) |

Approval

Forecasted revenue

|

Ublituximab (Briumvi) TG Therapeutics, Inc.; LFB S.A.

|

Relapsing multiple sclerosis (RMS) |

Approval

Forecasted revenue

|

Hematological disorders

| Medicine (Trade name) Company | Indication(s)* | Description and Key Attributes |

|---|---|---|

Etranacogene dezaparvovec (Hemgenix) CSL Ltd

|

Hemophilia B (factor IX deficiency) |

Approval

Forecasted revenue

|

Infectious Disease

| Medicine (Trade name) Company | Indication(s)* | Description and Key Attributes |

|---|---|---|

Oteseconazole (Vivjoa) Mycovia Pharmaceuticals Inc.

|

Recurrent vulvovaginal candidiasis (RVVC) |

Approval

Forecasted revenue

|

Metabolic Disorders

| Medicine (Trade name) Company | Indication(s)* | Description and Key Attributes |

|---|---|---|

Teplizumab (Tzield) Provention Bio Inc and Sanofi

|

Type 1 diabetes |

Approval

Forecasted revenue

|

Oncology

| Medicine (Trade name) Company | Indication(s)* | Description and Key Attributes |

|---|---|---|

Elacestrant (Orserdu) Stemline Therapeutics Inc.

|

Human epidermal growth factor receptor 2 negative breast cancer (HER2- Breast Cancer); Metastatic breast cancer |

Approval

Forecasted revenue

|

* Consensus forecasts for global revenue data were collected from GlobalData, Q4-2022, and are given in US dollars.

Data source: GlobalData Healthcare database.

Spotlight on Canada

This section includes a list of select medicines currently under review by Health Canada that may have a significant impact on future clinical practice and drug spending. Medicines included on this list may be new to Canada but have been approved in other jurisdictions.

Health Canada’s Drug and Health Product Submissions Under Review (SUR) Lists include biosimilars. Although they do not have improved safety and efficacy, their availability could have a potential impact on drug spending. The biosimilars under review, as of September 2022 are: aflibercept, bevacizumab, eculizumab, enoxaparin, pegfilgrastim, and trastuzumab. To date, there are no biosimilars for aflibercept or eculizumab. Their availability could have a potential impact on the costs set aside in drug budgets for the use of these therapies. Appendix A (Table A2) lists the biosimilars currently under review with Health Canada.

Table 7 highlights five new medicines currently on Health Canada’s Drug and Health Product SUR Lists that have a novel mechanism of action or have demonstrated improved safety and efficacy in clinical trials. Of the four medicines reported in the 2021 edition, all have since received market authorization from Health Canada.

The SUR Lists are publicly available sources that identify pharmaceutical and biologic drug submissions with new medicinal ingredients that have been accepted for review in Canada.

Table 7. Selected new medicines currently under review by Health Canada, 2022

Central Nervous System

| Medicine (Trade name) Company | Indication(s)* | Description and Key Attributes |

|---|---|---|

Masitinib mesylate AB Science S.A.

|

Amyotrophic lateral sclerosis (ALS) |

Clinical trials

Forecasted revenue

|

Hematological disorders

| Medicine (Trade name) Company | Indication(s)* | Description and Key Attributes |

|---|---|---|

Concizumab Novo Nordisk Canada Inc

|

Haemophilia B |

Clinical trials

Forecasted revenue

|

Immunology

| Medicine (Trade name) Company | Indication(s)* | Description and Key Attributes |

|---|---|---|

Spesolimab Boehringer Ingelheim (Canada) Ltd Ltee

|

Generalized pustular psoriasis (GPP) |

Clinical trials

Forecasted revenue

|

Oncology

| Medicine (Trade name) Company | Indication(s)* | Description and Key Attributes |

|---|---|---|

Ciltacabtagene autoleucel (Carvykti) Janssen Inc

|

Relapsed or refractory multiple myeloma |

Clinical trials

Forecasted revenue

|

Glofitamab Hoffmann-La Roche Limited

|

Diffuse large B-cell lymphoma |

Clinical trials

Forecasted revenue

|

* Consensus forecasts for global revenue data were collected from GlobalData, Q4-2022, and are given in US dollars.

† Health Canada’s Drug and Health Product Submissions Under Review Lists provide the therapeutic area for the medicine under review but do not specify the indication. The indication listed in Table 7 is based on the information about the medicine in the literature and/or approvals in other jurisdictions. When there is an aligned review, in some cases the indication was confirmed by the CADTH Reimbursement Review report.

Data source: GlobalData Healthcare database.

Emerging COVID-19 Therapies

This section of the Meds Pipeline Monitor includes an overview of new and existing pipeline medicines that are under clinical evaluation for indications related to the prevention and treatment of COVID-19. An analysis of global markets provides information on COVID-19 medicines in all phases of clinical trials and pre-registration.

Global markets

The COVID-19 drug pipeline has developed at unprecedented rates over the past 3 years. Published information confirming the safety and efficacy of the various treatments for COVID-19 is continuously evolving.

In addition to the wide variety of vaccines under development, many novel and repurposed medicines are currently being evaluated in clinical trials for their potential benefits in the treatment of COVID-19. These include antivirals, monoclonal antibodies, synthetic peptides and cell therapies.273

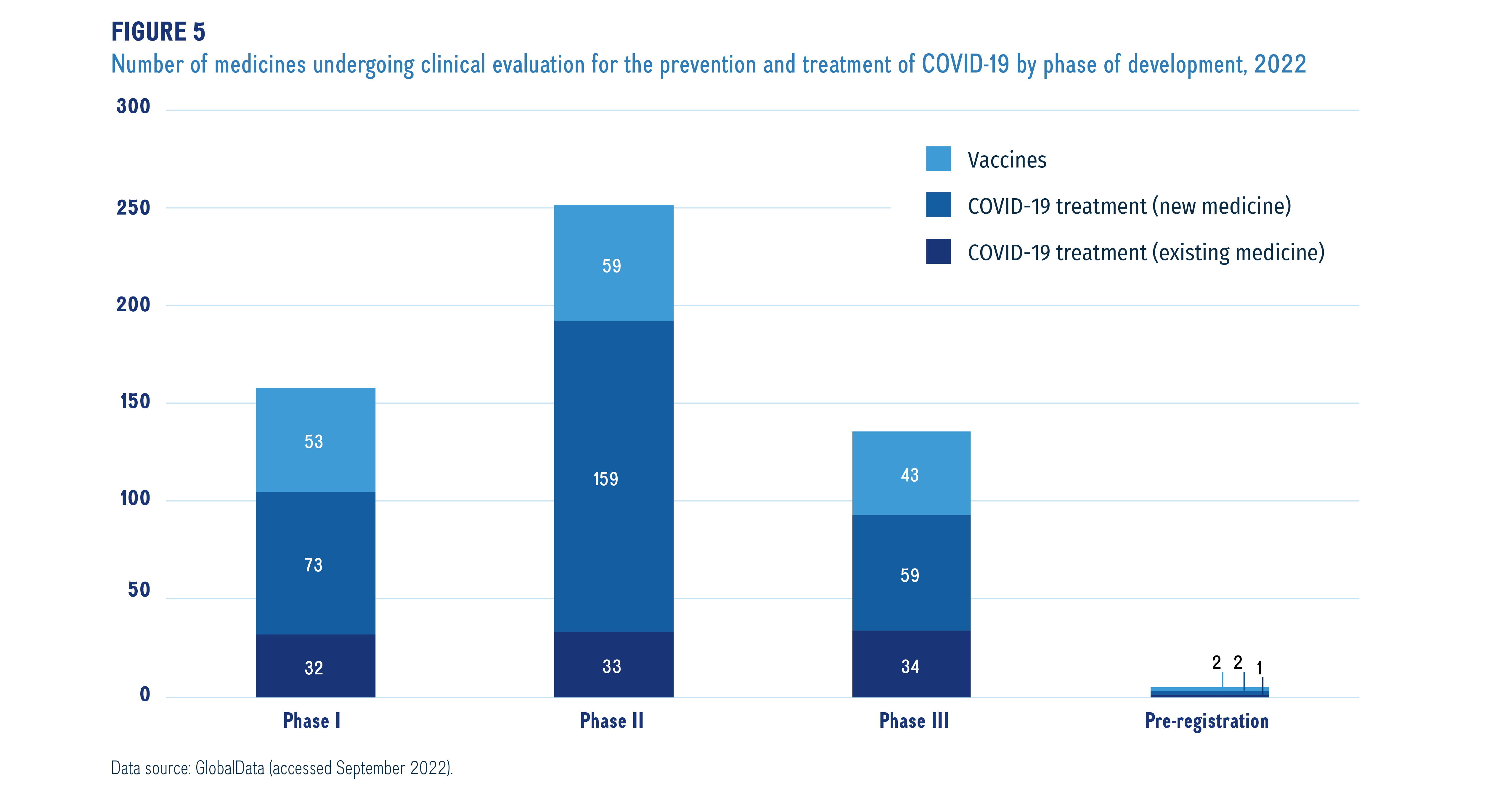

A breakdown of the COVID-19 pipeline vaccines and treatments by phase of clinical evaluation is shown in Figure 5. For this snapshot, data was extracted for medicines indicated for the treatment of COVID-19 with a development stage of Phase I, II, III, or pre-registration. These medicines are presented in three categories: vaccines, which are used to prevent infection of the novel coronavirus; treatments (new medicines), which are new medicines used for the prevention or reduction of some of the complications associated with COVID-19 (e.g., pneumonia or respiratory complications and hyperinflammation); and treatments (existing medicines), which are previously marketed medicines that have been repurposed to treat COVID-19 or its symptoms.

Brief Insights

The pipeline for COVID-19 medicines continues to grow, with clinical investigations of novel and existing drugs. The following are some of the most significant advancements in 2022:

- In 2022, over 400 novel medicines were undergoing clinical evaluation for the treatment and prevention of COVID-19. This is a 10% increase from last year.

- Advances in vaccine technology have allowed for rapid updates and approvals for existing vaccines to protect against new strains of COVID-19.

- Bivalent vaccines that target the BA.4 and BA.5 subvariants of Omicron have been approved in many countries worldwide.

- Nasal vaccines are a growing alternative approach to preventing the infection of COVID-19. In 2022, there were 20 nasal vaccines in various phases of the pipeline. Currently there are two nasal or inhaled vaccines approved in China and India.

- More effective treatment options in the pipeline include oral antivirals and new monoclonal antibodies that have shown positive results in clinical trials.

- Stem cell therapy and stem cell-derived organoid models are a growing new treatment option and research method for COVID-19. As of February 2023, there were 53 cell therapies undergoing clinical evaluation in various phases of the pipeline.

Source: GlobalData Healthcare Database (February, 2023); Health Canada (February, 2023).

Figure 5 illustrates the number of clinical trials for COVID-19 treatments and vaccines by latest development phase as of September 2022. The majority of vaccines in the pipeline (97%) are new medicines intended to prevent COVID-19 infection. Antivirals are the most common therapy used to treat COVID-19 symptoms, with 74% new medicines in the pipeline. Other treatment options include monoclonal antibodies, cell therapies and synthetic peptides, that have a larger percentage of redirected and repurposed medicines in the pipeline.

Figure description

This stacked bar graph illustrates the number of COVID-19 treatments and vaccines in the pipeline in 2022. Totals are given for vaccines and treatments, with separate totals for new treatments and repurposed or redirected treatments.

| Phase I | Phase II | Phase III | Pre-registration | |

|---|---|---|---|---|

Vaccine |

53 |

59 |

43 |

2 |

New treatment |

73 |

159 |

59 |

1 |

Repurposed / Redirected treatment |

32 |

33 |

34 |

2 |

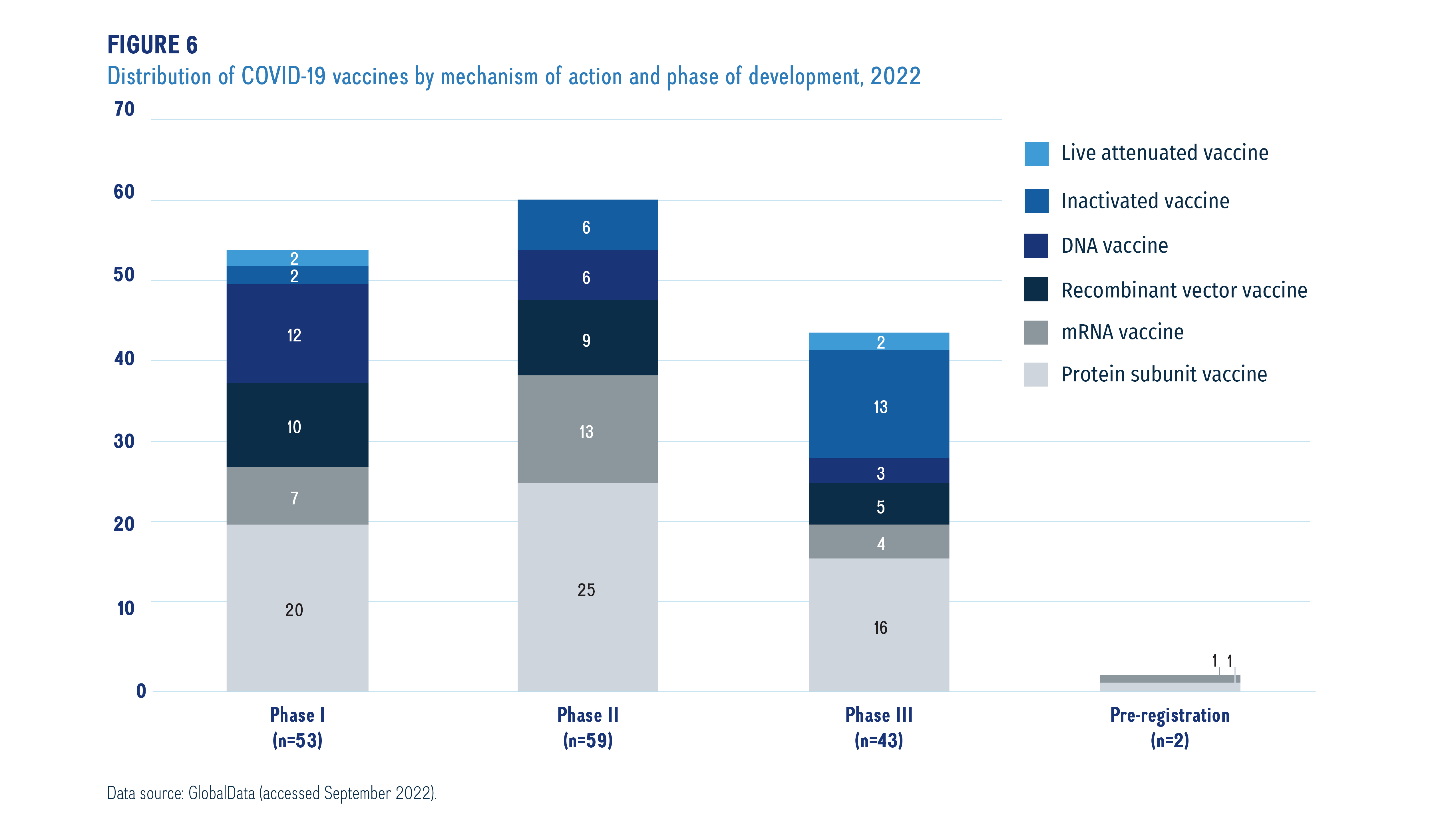

Figure 6 breaks down the COVID-19 vaccines by mechanism of action and highest development phase.Footnote xiv Vaccines are categorized into various vaccine types based on their mechanism of action; for example, while live attenuated vaccines target the whole virus, protein subunit and recombinant vector vaccines target one specific part of the virus.

Data source: GlobalData (accessed September 2021).

Figure description

A stacked bar graph gives the distribution of coronavirus vaccines in each phase of clinical evaluation by vaccine type, as of September 2022.

| Protein Subunit Vaccine | Inactivated Vaccine | mRNA Vaccine | Recombinant Vector Vaccine | DNA Vaccine | Live Attenuated Vaccine | Total | |

|---|---|---|---|---|---|---|---|

Phase I |

20 |

2 |

7 |

10 |

12 |

2 |

53 |

Phase II |

25 |

6 |

13 |

9 |

6 |

0 |

59 |

Phase III |

16 |

13 |

4 |

5 |

3 |

2 |

43 |

Pre-registration |

1 |

0 |

1 |

0 |

0 |

0 |

2 |

Canada

COVID-19 continues to impact Canadians, with approximately 182,000 hospitalizations and over 52,000 deaths as of March 2023. Footnote xv Over 85% of Canadians have completed their primary series of vaccinations (two doses). Footnote xvi Health Canada’s most recently approved vaccines are bivalent vaccines that target two different strains of the virus. The updated Moderna Spikevax and Pfizer-BioNTech Comirnaty vaccines target the original SARS-CoV-2 virus as well as the Omicron BA.4 and BA.5 subvariants, which were known to be resistant to previous versions of the vaccines. The vaccines are produced using the same methods as previous COVID-19 vaccines, except that they contain two mRNA components instead of one, which allows them to target more than one strain of the virus.

Health Canada is prioritizing reviews of all COVID-19 vaccine submissions. As of March 2023, Health Canada has approved 6 vaccines, including two mRNA vaccines (Comirnaty and Spikevax), two viral vector-based vaccines (Jcovden and Vaxzevria), one plant-based vaccine (Covifenz), and one protein-based vaccine (Nuvaxovid). Table 8 provides the number of medicines approved by Health Canada for the prevention and treatment of COVID-19, while Table 9 gives the number of COVID-19 medicines under review with Health Canada as of March 2023.

Table 8. COVID-19 treatments and vaccines approved by Health Canada, 2022

| Therapeutic area | Applicant | Medicinal ingredient(s) | Outcome of application | Date of decision/outcome |

|---|---|---|---|---|

Antivirals for systemic use |

Veklury |

Remdesivir (solution for injection) |

Approved under: Food and Drug Regulations; Notice of Compliance issued under the NOC/c Guidance |

27-Jul-20 |

Expanded indication: Food and Drug Regulations; authorized |

22-Apr-22 |

|||

Antivirals for systemic use |

Paxlovid |

Nirmatrelvir and ritonavir (tablets for oral administration) |

Approved under: Food and Drug Regulations; authorized with terms and conditions |

17-Jan-22 |

Immune sera and immunoglobulins |

Evusheld |

Cilgavimab and tixagevimab solution for injection |

Approved under: Food and Drug Regulations; authorized with terms and conditions |

14-Apr-22 |

Expanded indication: Food and Drug Regulations; authorized |

18-Oct-22 |

|||

Immune sera and immunoglobulins |

Casirivimab and imdevimab |

Casirivimab and imdevimab (solution for injection) |

Approved under: Interim order;* authorized with terms and conditions |

09-Jun-21 |

Immune sera and immunoglobulins |

Bamlanivimab |

Bamlanivimab (solution for injection) |

Approved under: Interim order;* authorized with terms and conditions |

20-Nov-20 |

Immune sera and immunoglobulins |

Sotrovimab |

Sotrovimab (solution for injection) |

Approved under: Interim order;* authorized with terms and conditions |

30-Jul-21 |

Immune sera and immunoglobulins |

Actemra |

Tocilizumab solution for injection |

Expanded indication: Food and Drug Regulations; authorized |

13-Oct-22 |

Vaccines |

Covifenz |

Virus-like particles of SARS-CoV-2 spike protein |

Approved under: Food and Drug Regulations; authorized with terms and conditions |

24-Feb-22 |

Vaccines |

Nuvaxovid |

SARS-CoV-2 recombinant spike protein |

Approved under: Adolescent dose (ages 12-17 years) |

06-Dec-22 |

First booster dose |

17-Nov-22 |

|||

Food and Drug Regulations; authorized with terms and conditions |

17-Feb-22 |

|||

Vaccines |

Vaxzevria |

ChAdOx1-S [recombinant] |

Approved under: |

19-Nov-21 |

| Interim order* |

26-Feb-21 |

|||

Vaccines |

Comirnaty |

Tozinameran [mRNA vaccine, BNT162b2] (suspension for injection) |

Approved under: |

09-Dec-22 |

Bivalent booster (ages 12 years and over) |

07-Oct-22 |

|||

Pediatric indication (ages 6 months-5 years) |

09-Sep-22 |

|||

| First booster dose (ages 5-11 years) |

19-Aug-22 |

|||

First booster dose (ages 16-17 years) |

01-Jun-22 |

|||

Food and Drug Regulations; pediatric indication (ages 5-11) |

19-Nov-21 |

|||

Food and Drug Regulations; first booster dose |

09-Nov-21 |

|||

| Food and Drug Regulations; authorized with terms and conditions |

16-Sept-21 |

|||

Interim order;* pediatric indication (ages 12-15) |

05-May-21 |

|||

| Interim order* |

09-Dec-20 |

|||

Vaccines |

Spikevax |

Elasomeran |

Approved under: First booster dose (ages 12-17 years) |

12-Jan-23 |

| Bivalent booster (ages 18 years and over) |

03-Nov-22 |

|||

Bivalent booster (ages 18 years and over) |

01-Sep-22 |

|||

Pediatric indication (ages 6 months-5 years) |

14-Jul-22 |

|||

Pediatric indication (ages 6-11 years) |

17-Mar-22 |

|||

First booster dose |

12-Nov-21 |

|||

Food and Drug Regulations; authorized with terms and conditions |

16-Sept-21 |

|||

Interim order;* pediatric indication (ages 12-17) |

27-Aug-21 |

|||

Interim order* |

23-Dec-20 |

|||

Vaccines |

Jcovden |

AD26.COV2.S [recombinant] |

Approved under: First booster dose |

11-May-22 |

Food and Drug Regulations; authorized with terms and conditions |

23-Nov-21 |

|||

| Interim order* |

05-Mar-21 |

|||

Vaccines |

Covishield |

ChAdOx1-S (recombinant) |

Approved under: Interim order;* authorized with terms and conditions |

26-Feb-2021 (expired 16-Sept-21) |

* The Interim Order Respecting the Importation, Sale and Advertising of Drugs for Use in Relation to COVID-19, approved on May 23, 2020, introduced an alternate pathway to facilitate clinical trials for potential COVID-19 drugs and medicinal devices, while upholding strong patient safety requirements and validity of trial data.

Data source: Drug and vaccine authorizations for COVID-19: List of authorized drugs, vaccines and expanded indications (accessed March 2023):

https://www.canada.ca/en/health-canada/services/drugs-health-products/covid19-industry/drugs-vaccines-treatments/authorization/list-drugs.html

Table 9. COVID-19 treatments and vaccines under review by Health Canada, as of March 2023

| Therapeutic area | Applicant | Medicinal ingredient(s) | Date submission accepted |

|---|---|---|---|

Vaccines |

Pfizer Canada ULC/ BioNTech SE |

Tozinameran |

Feb-22 |

Vaccines - Booster dose |

AstraZeneca Canada Inc. |

[ChAdOx1-S; [recombinant] |

Dec-21 |

Vaccines - Booster dose |

Janssen Inc. |

Ad26.COV2.S |

Dec-21 |

Vaccines - Pediatric dose (ages 6-11) |

ModernaTX, Inc. |

Elasomeran |

Nov-21 |

Vaccines |

Medicago Inc. |

Coronavirus-like particle [CoVLP] |

Aug-21 |

Vaccines |

Novavax Inc. |

NVX-CoV2373 |

Aug-21 |

Vaccines |

Sanofi Pasteur Ltd |

SARS-CoV-2 prefusion spike delta TM protein [recombinant] |

Jul-21 |

Vaccines |

Vaccigen Ltd |

Whole virion inactivated coronavirus |

Jul-21 |

Immune sera and immunoglobulins |

AstraZeneca Canada Inc. |

Cilgavimab, tixagevimab |

Nov-21 |

Immune sera and immunoglobulins |

Celltrion HealthCare Co. Ltd |

Regdanvimab |

May-21 |

Immune sera and immunoglobulins |

Eli Lilly Canada Inc. |

Bamlanivimab* |

Jun-21 |

Immune sera and immunoglobulins |

Hoffmann-La Roche Ltd |

Casirivimab, imdevimab* |

Sept-21 |

Immune sera and immunoglobulins |

GlaxoSmithKline Inc. |

Sotrovimab* |

Oct-21 |

Immune sera and immunoglobulins |

Eli Lilly Canada Inc. |

Etesevimab |

Sept-21 |

Immunosuppressants |

Eli Lilly Canada Inc |

Baricitinib |

Sep-21 |

Antivirals for systemic use |

Gilead Sciences Canada Inc |

Remdesivir |

Apr-21 |

Antivirals for systemic use |

Dr Reddys Laboratories Ltd |

Favipiravir |

Sept-21 |

Antivirals for systemic use |

Merck Canada Inc |

Molnupiravir |

Aug-21 |

| Ceased reviews | |||

Immune sera and immunoglobulins |

CytoDyn Inc. |

Leronlimab |

Mar-21 (Expired) |

Antigout preparations |

Pendopharm Division of Pharmascience Inc |

Colchicine |

Jan-21 |

Other nervous system drugs |

Sanotize Research & Development Corp. |

Nitric oxide |

Jun-21 |

* The applicant has filed a new drug submission under the Food and Drug Regulations to transition this product from the interim order. The product continues to be approved for sale in Canada during this transition period.

Data source: Drug and vaccine authorizations for COVID-19: List of applications received, Health Canada (accessed March 2023): https://www.canada.ca/en/health-canada/services/drugs-health-products/covid19-industry/drugs-vaccines-treatments/authorization/applications.html

Appendix A

Table A1: Biosimilars in Phase III (based on data extract from 2022-09)

| Medicine | Reference product (Manufacturer) | Other biosimilars (Y/N) | Manufacturers developing biosimilars | Indication(s) |

|---|---|---|---|---|

Adalimumab

|

Humira (Abbvie Corp)

|

Y |

Enzene Biosciences Ltd |

Ankylosing spondylitis (Bekhterev's disease) |

Wuhan Institute of Biological Products Co Ltd |

Plaque psoriasis (psoriasis vulgaris) |

|||

Aflibercept

|

Eylea (Bayer Inc)

|

N |

Amgen Inc Alteogen Inc Alvotech SA Celltrion Inc Formycon AG Hexal AG Johnson & Johnson Sam Chun Dang Pharm Co Ltd Samsung Bioepis Co Ltd |

Wet (neovascular/exudative) macular degeneration |

Bevacizumab |

Avastin (Hoffmann-La Roche Limited) |

Y |

Aurobindo Pharma Ltd Prestige BioPharma Ltd SinoCelltech Group Ltd

Centrion† |

Non-small cell lung cancer

N/A |

Cetuximab |

Erbitux |

N |

Ampo Biotechnology Inc Cinnagen Co Enzene Biosciences Ltd R-Pharm |

Head and neck cancer squamous cell carcinoma; Lip cancer; Locally recurrent or locoregional solid malignancies; Oral cavity (mouth) cancer; Pharyngeal neoplasm; Metastatic colorectal cancer |

Darbepoetin alfa |

Aranesp (Amgen Canada Inc) |

N |

Biocad

|

Anemia in chronic kidney disease (renal anemia) |

Denosumab

|

Prolia / Xgeva (Amgen Canada Inc) |

N |

Mabwell Shanghai Bioscience Co Ltd |

Diabetes |

Celltrion Inc Eden Biologics Inc Fresenius Kabi SwissBioSim GmbH Gedeon Richter Plc Mabxience Holding SL Samsung Bioepis Co Ltd Sandoz International GmbH Teva Pharmaceutical Industries Ltd |

Postmenopausal osteoporosis |

|||

Sandoz International GmbH |

Bone metastasis; Giant cell tumour of bone |

|||

Eculizumab |

Soliris (Alexion Pharma GmbH) |

N |

Amgen Inc† Samsung Bioepis Co Ltd |

Paroxysmal nocturnal hemoglobinuria |

Enoxaparin |

Lovenox (Sanofi-Aventis Canada Inc) |

Y |

Baxter Corporation† Fresenius Kabi Canada Ltd† |

N/A |

Etanercept |

Enbrel (Immunex Corporation) |

Y |

Mycenax Biotech Inc

|

Rheumatoid arthritis |

Follitropin alfa |

Gonal-F / Pergoveris (EMD Serono, a division of EMD Inc., Canada) |

N |

Amega Biotech |

Female infertility |

Golimumab |

Simponi (Janssen Inc) |

N |

Bio-Thera Solutions Ltd

|

Psoriatic arthritis |

Liraglutide |

Victoza / Saxenda (Novo Nordisk Canada Inc) |

N |

Shanghai Fosun Pharmaceutical (Group) Co Ltd |

Obesity |

Ocrelizumab

|

Ocrevus (Hoffmann-La Roche Limited) |

N |

Cinnagen Co |

Relapsing remitting multiple sclerosis (RRMS) |

Omalizumab |

Xolair (Novartis Pharmaceuticals Canada Inc)

|

N |

Synermore Biologics Co Ltd |

Allergic asthma |

Celltrion Inc Synermore Biologics Co Ltd Teva Pharmaceutical Industries Ltd |

Chronic urticaria or hives |

|||

Synermore Biologics Co Ltd |

Nasal polyps (nasal polyposis); Rhinosinusitis |

|||

Pegfilgrastim |

Neulasta (Amgen Canada Inc) |

Y |

Lupin Pharma Canada Limited† Nora Pharma Inc† |

Febrile neutropenia |

Pertuzumab |

Perjeta (Hoffmann-La Roche Limited) |

N |

Zydus Lifesciences Ltd |

Human epidermal growth factor receptor 2-positive breast cancer (HER2+ breast cancer) |

Ranibizumab |

Lucentis (Novartis Pharmaceuticals Canada Inc)

|

Y* |

Aurobindo Pharma Ltd Enzene Biosciences Ltd Generium Jecho Biopharmaceuticals Co Ltd Lupin Ltd PharmaResearch BIO Co Ltd |

Wet (neovascular/exudative) macular degeneration |

Romiplostim |

Nplate (Amgen Canada Inc) |

N |

Generium

|

Idiopathic thrombocytopenic purpura (immune thrombocytopenic purpura) |

Tenecteplase |

TNKase (Hoffmann-La Roche Limited) |

N |

Hetero Drugs Ltd

|

Myocardial infarction |

Trastuzumab |

Herceptin (Hoffmann-La Roche Limited) |

Y |

Aprogen Inc Hetero Drugs Ltd Tanvex BioPharma Inc Prestige BioPharma Ltd. (HC)† |

Human epidermal growth factor receptor 2-positive breast cancer (HER2+ Breast Cancer) |

Ustekinumab |

Stelara (Janssen Inc) |

N |

DM Bio Ltd Samsung Bioepis Co Ltd |

Psoriatic arthritis |

Amgen Inc Alvotech SA Bio-Thera Solutions Ltd Celltrion Inc DM Bio Ltd Formycon AG Samsung Bioepis Co Ltd |

Plaque psoriasis (psoriasis vulgaris) |

|||

DM Bio Ltd |

Crohn's disease (regional enteritis); Ulcerative colitis |

|||

JiangSu Qyuns Therapeutics Co Ltd |

Inflammatory bowel disease |

* Approved but not marketed as of December 5, 2022.

† Biosimilar currently under review by Health Canada.

Table A2: New drug submissions under review by Health Canada (February 2023)

| Medicinal ingredient | Therapeutic area | Manufacturer | Date submission accepted for review |

|---|---|---|---|

Aflibercept |

Ophthalmologicals |

BGP Pharma ULC |

2022-05 |

Bevacizumab |

Antineoplastic agents |

Celltrion Healthcare Co Ltd |

|

Eculizumab |

Immunosuppressants |

Amgen Canada Inc |

2022-07 |

Enoxaparin sodium |

Antithrombotic agents |

Baxter Corporation |

2022-09 |

Pegfilgrastim |

Immunostimulants |

Lupin Pharma Canada Limited |

2022-05 |

Pegfilgrastim |

Immunostimulants |

Nora Pharma Inc |

|

Ranibizumab |

Ophthalmologicals |

Teva Canada Limited |

2022-12 |

Trastuzumab |

Antineoplastic agents |

Prestige BioPharma Ltd. |

2021-08 |

Table A3: Drugs in Phase II for indications targeted by pipeline candidates

| Pipeline candidate | Indication(s) | Drugs in Phase II and mechanism of action (MOA)* |

|---|---|---|

Abelacimab |

Deep vein thrombosis (DVT); Pulmonary embolism |

There are no other drugs for this indication with the same MOA as abelacimab (a dual Factor XI and Factor Xia inhibitor) in Phase II development at this time. |

Aprocitentan and Firibastat |

Resistant hypertension |

There are no other drugs for this indication with the same MOA as aprocitentan (a dual endothelin-receptor antagonist) or firibistat (a centrally-acting, aminopeptidase A inhibitor) in Phase II development at this time. |

Bemarituzumab and Zolbetuximab |

Adenocarcinoma of the gastroesophageal junction; Gastric cancer; bladder cancer; Gastroesophageal (GE) junction carcinomas |

There is another drug (MAX-4) with a similar MOA to bemarituzumab (a fibroblast growth factor receptor inhibitor) and others (BNT-141, LM-302) with a similar MOA to zolbetuximab (a claudin-18 inhibitor) in Phase II development at this time. |

Ciltacabtagene autoleucel* and Iberdomide hydrochloride |

Refractory multiple myeloma; Relapsed multiple myeloma |