Quarterly Financial Report - Statement outlining results, risks and significant changes in operations, personnel and programs - For the quarter ended June 30, 2022

[ PDF version ]

Introduction

This quarterly report has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Directive on Accounting Standards, GC 4400 Departmental Quarterly Financial Report. This quarterly financial report should be read in conjunction with the Main Estimates, Supplementary Estimates (A) and previous Quarterly Financial Reports. For more information on PCO, please visit PCO's website.

This quarterly report has not been subject to an external audit or review but has been shared with the PCO Departmental Audit Committee and it reflects the committee members' comments.

Mandate

PCO supports the development and implementation of the Government of Canada's policy and legislative agendas, coordinates responses to issues facing the Government and the country, and supports the effective operation of Cabinet. PCO is led by the Clerk of the Privy Council, who also serves as Secretary to the Cabinet and the Head of the Public Service.

PCO serves Canada and Canadians by providing advice and support to the Prime Minister, portfolio ministers, and Cabinet.

PCO has three main roles:

- Provide professional non-partisan advice to the Prime Minister, portfolio ministers, Cabinet and Cabinet committees on matters of national and international importance.

- Support the smooth functioning of the Cabinet decision-making process and facilitate the implementation of the Government’s agenda.

- Foster a high-performing and accountable Public Service.

Basis of presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes PCO’s spending authorities granted by Parliament and those used by the department, consistent with the 2022-23 Main Estimates and Supplementary Estimates (A). This quarterly report has been prepared using a special purpose financial reporting framework (expenditure basis) designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before money can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

When Parliament is dissolved for the purposes of a general election, section 30 of the Financial Administration Act authorizes the Governor General, under certain conditions, to issue a special warrant authorizing the Government to withdraw funds from the Consolidated Revenue Fund. A special warrant is deemed to be an appropriation for the fiscal year in which it is issued.

PCO uses the full accrual method of accounting to prepare and present its annual departmental financial statements1 that are part of the departmental performance reporting process. The spending authorities voted by Parliament remain on an expenditure basis.

Highlights of fiscal quarter and fiscal year to date results

This section highlights the significant items that contributed to the net increase or decrease in authorities available for the year and actual expenditures for the quarter ended June 30, 2022.

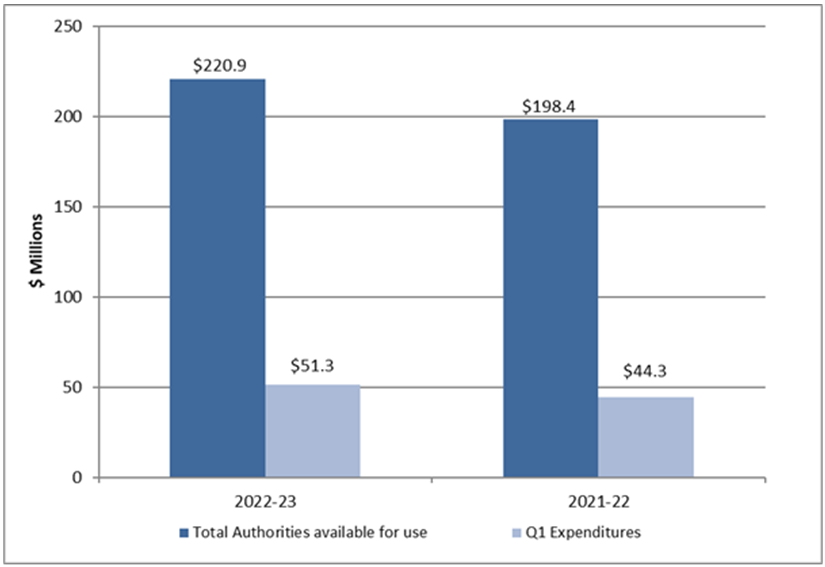

PCO spent approximately 23% of its authorities available for use by the end of the first quarter, compared to 22% in the same quarter of 2021-22 (see graph 1 below).

Graph 1: Comparison of total authorities available for use and total net budgetary expenditures as of Q1 2022-23 and 2021-22

Text version - Graph 1

| 2022-23 | 2021-22 | |

|---|---|---|

| Total authorities available for use | 220.9 | 198.4 |

| Q1 expenditures | 51.3 | 44.3 |

Significant changes to authorities

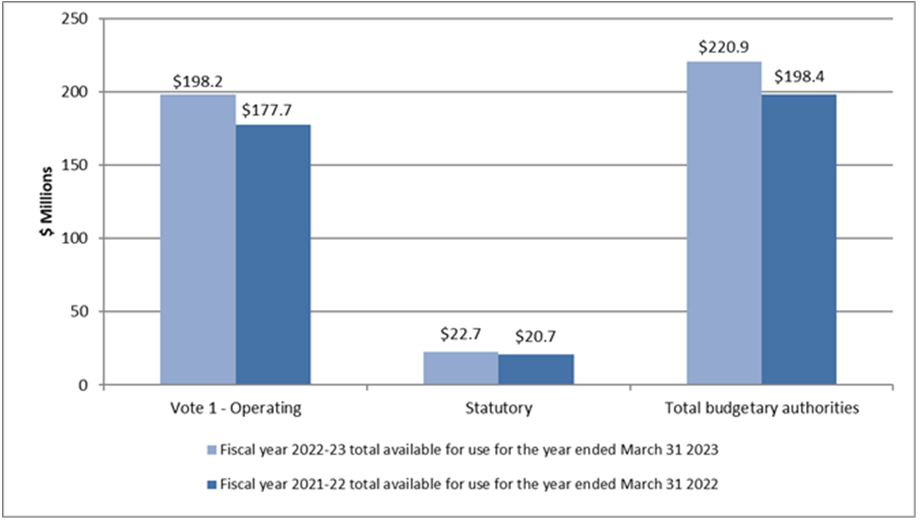

As per graph 2 below as at June 30, 2022 and Annex A, presented at the end of this document, PCO has authorities available for use of $220.9 million in 2022-23 compared to $198.4 million as of June 30, 2021, for a net increase of $22.5 million or 11%.

Graph 2: Variance in authorities as at June 30, 2022

Text version - Graph 2

| Vote 1 - Operating | Statutory | Total budgetary authorities | |

|---|---|---|---|

| Fiscal year 2022-23 total available for use for the year ended March 31, 2023 | 198.2 | 22.7 | 220.9 |

| Fiscal year 2021-22 total available for use for the year ended March 31, 2022 | 177.7 | 20.7 | 198.4 |

The net increase in authorities of $22.5 million is mainly explained by:

- Authorities increase:

- PCO funding has increased in 2022-23 to include amounts approved to enhance departmental capacity and to support emergency management and preparedness and for the Public Order Emergency Commission.

- Authorities decrease:

- Increased authorities are offset by a reduction in funding due to the substantial completion of the enhancement of secure communication technologies for senior officials across government and a transfer of funds to Shared Services Canada related to the IT Enterprise Service Model.

Significant changes to quarter expenditures

Year-to-date expenditures recorded to the end of the first quarter increased by $7.0 million, or 16%, from the same period of the previous year (from $44.3 million for 2021-22 to $51.3 million for 2022-23). Table 1 below presents budgetary expenditures by standard object.

Table 1

| Variances to Expenditures by Standard Object | Fiscal year 2022-23 Expended during the quarter ended June 30, 2022 |

Fiscal year 2021-22 Expended during the quarter ended June 30, 2021 |

Variance $ | Variance % |

|---|---|---|---|---|

| Personnel | 38,480 | 36,265 | 2,215 | 6% |

| Transportation and communications | 1,211 | 767 | 444 | 58% |

| Information | 1,338 | 974 | 364 | 37% |

| Professional and special services | 4,640 | 3,137 | 1,503 | 48% |

| Rentals | 3,411 | 837 | 2,574 | 308% |

| Repair and maintenance | 90 | 75 | 15 | 20% |

| Utilities, materials and supplies | 110 | 54 | 56 | 104% |

| Acquisition of machinery and equipment | 1,025 | 1,849 | (824) | (45%) |

| Transfer payments | 411 | - | 411 | 0% |

| Other subsidies and payments | 585 | 352 | 233 | 66% |

| Total gross budgetary expenditures | 51,303 | 44,310 | 6,993 | 16% |

| Less revenues netted against expenditures | 0 | (2) | 2 | (100%) |

| Total budgetary expenditures* | 51,303 | 44,309 | 6,995 | 16% |

| * Details may not add to totals due to rounding | ||||

Personnel:

The overall increase of $2.2 million in personnel spending is mainly due to the timing of salary recoveries from other government departments and for activities relating to the Joint Public Inquiry into the Nova Scotia April 2020 Tragedy.

Transportation and communications:

The increase of $0.4 million is mainly attributed to increasing travel as COVID-19 restrictions lessen as compared to 2021-22.

Professional and special services:

The increase of $1.5 million in professional and special services relates to increased activities relating to the Joint Public Inquiry into the Nova Scotia April 2020 Tragedy and the earlier receipt of invoices for annual costs for information technology services in 2022-23.

Rentals:

The increase of $2.6 million is mainly attributed to invoices received earlier in 2022-23 for computer equipment rentals and additional software license applications, as well as for the rental of video communications equipment for the Joint Public Inquiry into the Nova Scotia April 2020 Tragedy.

Acquisition of machinery and equipment:

The decrease of $0.8 million is attributed to a large purchase of computer equipment delivered in the first quarter of 2021-22.

Transfer payments:

Transfer payments increased by $0.4 million due to spending for the activities of the Joint Public Inquiry into the Nova Scotia April 2020 Tragedy.

Risks and uncertainties

The dominant financial risks to PCO lie in the need to reallocate departmental resources to deal with issues that may emerge unexpectedly. As part of its coordinating role, PCO must be able to address emerging issues on short notice, and either manage the necessary expenditures within its own spending authorities, or cash manage until increased spending authorities are approved.

PCO is closely monitoring pay transactions to identify and address over and under payments in a timely manner and continues to apply ongoing mitigating controls which were implemented in 2016.

Significant changes in relation to operations, personnel and programs

Operations and programs

On April 25, 2022, the Government of Canada established the Public Order Emergency Commission to inquire into the circumstances that led to the declaration of emergency that was in place from February 14-23, 2022, and the measures taken for dealing with the emergency.

Approval by senior officials:

Janice Charette

Clerk of the Privy Council and

Secretary to the Cabinet

Matthew Shea

Assistant Deputy Minister

Corporate Services Branch and Chief

Financial Officer

Ottawa, Canada

Monday, August 29, 2022

Annexes A and B

Annex A

Statement of authorities (unaudited) (note 2)

| Expenditures/Authorities | Fiscal year 2022-2023 | Fiscal year 2021-2022 | ||||

|---|---|---|---|---|---|---|

| Total available for use for the year ending March 31, 2023 (note 1) |

Used during the quarter ended June 30, 2022 |

Year-to-date used at quarter–end | Total available for use for the year ending March 31, 2022 (note 1) |

Used during the quarter ended June 30, 2021 |

Year-to-date used at quarter–end | |

| Vote 1 - Net operating expenditures | 198,210 | 46,159 | 46,159 | 177,711 | 39,259 | 39,259 |

| Budgetary statutory authorities | ||||||

| Contributions to employee benefits plans | 22,352 | 5,026 | 5,026 | 20,348 | 4,927 | 4,927 |

| Prime Minister - Salary and motor car allowance | 190 | 48 | 48 | 188 | 47 | 47 |

| Leader of the Government in the House of Commons - Salary and motor car allowance | 93 | 23 | 23 | 91 | 23 | 23 |

| President of the Queen's Privy Council for Canada and the Minister of Emergency Preparedness - Salary and motor car allowance | 93 | 23 | 23 | - | - | - |

| President of the Queen's Privy Council for Canada and the Minister of Intergovernmental Affairs - Salary and motor car allowance | - | - | - | 91 | 23 | 23 |

| Deputy Prime Minister and Minister of Finance - Salary and motor car allowance | - | - | - | - | 8 | 8 |

| Minister and Special Representative for the Prairies - Salary and motor car allowance | - | - | - | - | 23 | 23 |

| Minister of Intergovernmental Affairs, Infrastructure and Communities - Salary and motor car allowance | - | 23 | 23 | - | - | - |

| Total budgetary authorities | 220,937 | 51,303 | 51,303 | 198,427 | 44,309 | 44,309 |

| Total authorities | 220,937 | 51,303 | 51,303 | 198,427 | 44,309 | 44,309 |

| Note 1: Includes authorities available for use and granted by Parliament at quarter-end for each respective fiscal year. Note 2: Details may not add to totals due to rounding. |

||||||

Annex B

Departmental budgetary expenditures by Standard Object (unaudited) (note 2)

| Departmental budgetary expenditures | Fiscal year 2022-2023 | Fiscal year 2021-2022 | ||||

|---|---|---|---|---|---|---|

| Planned expenditures for the year ending March 31, 2023 (note 1) |

Expended during the quarter ended June 30, 2022 |

Year-to-date used at quarter–end | Planned expenditures for the year ending March 31, 2022 (note 1) |

Expended during the quarter ended June 30, 2021 |

Year-to-date used at quarter–end | |

| Budgetary expenditures | ||||||

| Personnel | 165,085 | 38,480 | 38,480 | 156,254 | 36,265 | 36,265 |

| Transportation and communications | 3,926 | 1,211 | 1,211 | 5,095 | 767 | 767 |

| Information | 4,636 | 1,338 | 1,338 | 3,466 | 974 | 974 |

| Professional and special services | 27,889 | 4,640 | 4,640 | 25,715 | 3,137 | 3,137 |

| Rentals | 6,452 | 3,411 | 3,411 | 2,138 | 837 | 837 |

| Repair and maintenance | 3,135 | 90 | 90 | 3,289 | 75 | 75 |

| Utilities, materials and supplies | 548 | 110 | 110 | 717 | 54 | 54 |

| Acquisition of machinery and equipment | 12,970 | 1,025 | 1,025 | 8,410 | 1,849 | 1,849 |

| Transfer payments | 443 | 411 | 411 | - | - | - |

| Other subsidies and payments | 1,296 | 585 | 585 | - | 352 | 352 |

| Total gross budgetary expenditures | 226,381 | 51,303 | 51,303 | 205,084 | 44,310 | 44,310 |

| Less revenues netted against expenditures Revenues |

(5,444) | - | - | (6,657) | (2) | (2) |

| Total revenues netted against expenditures | (5,444) | - | - | (6,657) | (2) | (2) |

| Total budgetary expenditures | 220,937 | 51,303 | 51,303 | 198,427 | 44,309 | 44,309 |

| Note 1: Includes authorities available for use and granted by Parliament at quarter-end for each respective fiscal year. Note 2: Details may not add to totals due to rounding. |

||||||