Quarterly Financial Report - For the quarter ended June 30, 2025

1. Introduction

This quarterly financial report should be read in conjunction with the Main Estimates and Supplementary Estimates for fiscal year 2025 to 2026. It has been prepared by management, as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Directive on Accounting Standards, GC 4400 Departmental Quarterly Financial Report. It has been reviewed by the Internal Audit Committee of the Public Service Commission of Canada.

This quarterly report has not been subject to an external audit or review.

1.1 Authority and objectives

The Public Service Commission of Canada (PSC) is an independent agency established under the Public Service Employment Act and listed in schedules I.1 and IV of the Financial Administration Act.

A summary description of the PSC’s programs can be found in its 2025 to 2026 departmental plan.

1.2 Basis of presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes the PSC’s spending authorities granted by Parliament and those used by the PSC consistent with the Main Estimates for the 2025 to 2026 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before money can be spent by the government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

The PSC uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

1.3 Financial structure

The PSC has a financial structure comprised of voted budgetary authorities for program expenditures and statutory authorities for contributions to employee benefit plans.

In addition, the PSC has the authority to re-spend certain revenues received from other government departments and agencies in a fiscal year to offset expenditures incurred in that same year, for the provision of assessment and counselling products and services.

2. Highlights of fiscal quarter and fiscal year-to-date results

This section highlights the significant items that contributed to the change in resources available for the current year and in the actual expenditures for the quarter ended June 30, 2025.

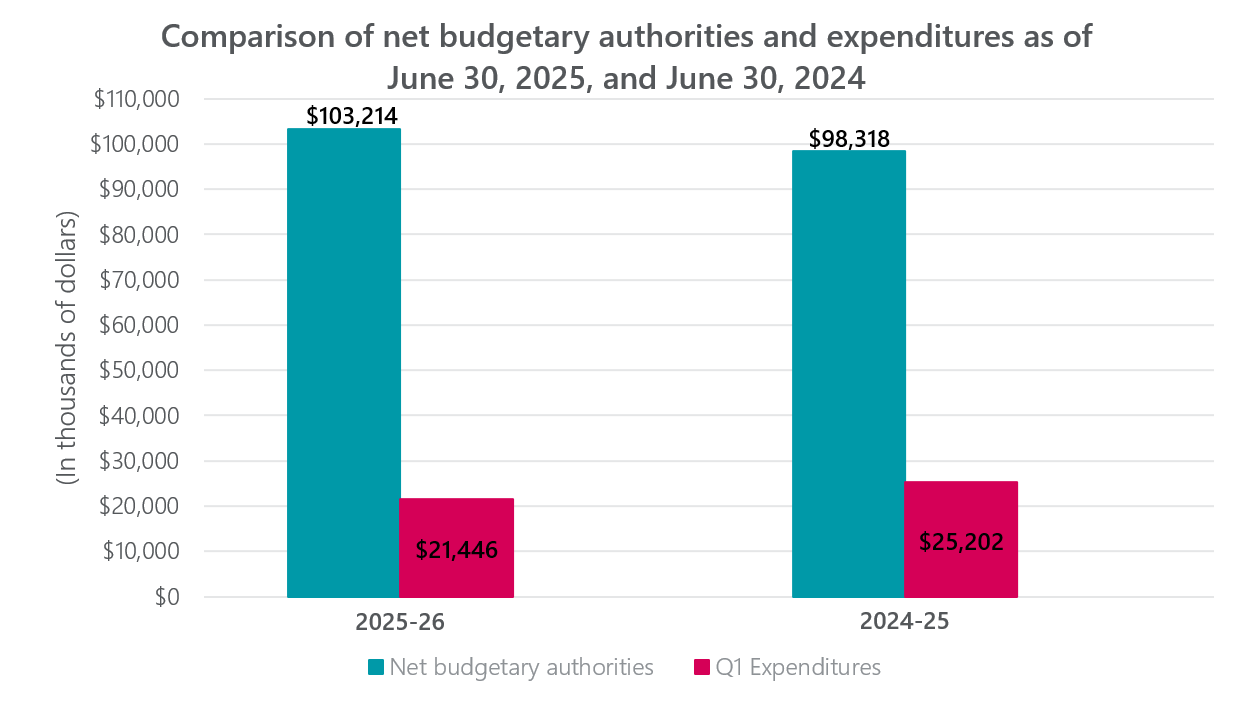

The following graph provides a comparison of the net budgetary authorities available for spending and the expenditures for the quarters ended June 30, 2025, and June 30, 2024, for the PSC’s combined Vote 1 – Program Expenditures and Statutory Authorities.

Text version

| Year | Net budgetary authorities | Q1 Expenditures |

|---|---|---|

| 2025-26 | $103,214 | $21,446 |

| 2024-25 | $98,318 | $25,202 |

2.1 Significant changes to authorities

As shown in Section 6: Statement of Authorities, at June 30, 2025, there was an increase of $4,896,000 in authorities available for use in the current year, as compared to the previous year.

The variance is due mainly to the following:

- a $2,633,000 increase in funding from Treasury Board of Canada Secretariat to cover higher current and retroactive salary rates following the implementation of collective agreements in the previous and current year

- a $1,811,000 increase in funding due to adjustments in employer contributions to employee benefit plans

- a $695,000 increase in funding from the Treasury Board of Canada Secretariat submission to cover expenses from the Public Service Employment Act initiative

- a $588,000 increase in funding received from 3 other government departments for the Public Service Resourcing System platform for managing staffing and related activities

- a $634,000 decrease in funding related to frozen allotment for refocusing government spending

- a $197,000 decrease in funding as a result of transfers to support the realignment of digital services responsibilities

2.2 Significant variances in net expenditures from prior year

As shown in Section 7: Budgetary expenditures by standard object, total net budgetary expenditures during the quarter decreased from $25,202,000 in 2024 to 2025 to $21,446,000 in 2025 to 2026, a variance of $3,756,000 or 14.9%.

The variance is due mainly to the following:

- a decrease of $2,985,000 in personnel, mainly due to a timing issue:

- the Employee Benefit Plan, superannuation, Quebec Pension Plan, death benefits and employment insurance were paid in a different quarter compared to the fiscal year 2024 to 2025

- these benefit payments were delayed due to late invoicing as a result of the dissolution of Parliament

- a decrease of $308,000 in operating and maintenance spending, resulting from the following:

- a decrease of $449,000 mainly due to a one-time cost paid in 2024 to 2025 for transition licences required to modernize the IT infrastructure

- an increase of $159,000 in professional and special services, resulting mainly from an increase in information technology consultants

- a decrease of $ 18,000 in miscellaneous expenses

- an increase of $463,000 in revenues netted against expenditures, due mainly to:

- the reorganization of billing services and more efficient invoicing processes

- an increase in prices of various PSC products

3. Risks and uncertainties

The PSC operates in a dynamic, complex and fast-changing environment that requires it to be efficient, agile and innovative to support representative, non-partisan and merit-based hiring in federal departments and agencies across Canada. As part of its departmental planning and reporting cycle, the PSC reviews its organizational risks annually and conducts regular monitoring. This monitoring includes a strategic analysis of external risk factors and internal vulnerabilities, as well as opportunities to be leveraged, that may have an impact on the PSC’s results.

The PSC’s key risks can be found in its 2025 to 2026 departmental plan, which describes these risks in its operating context. The PSC actively mitigates the key risks identified to ensure sound program and service delivery, while enhancing the information technology tools used to provide these programs and services. Also, the PSC’s operational risks are identified in its 3-year strategic plan, along with corresponding mitigation strategies. The PSC is also required by the Treasury Board of Canada Secretariat to participate in a newly launched risk and compliance process covering prescribed areas of focus. This process supports the President of the PSC in verifying that the PSC has controls and practices in place to meet its accountabilities under legislation and Treasury Board policy.

To address a potential shift in the federal public service staffing environment as departments and agencies continue to refocus government spending to deliver results for Canadians, the PSC will:

- work with communities of practice to strengthen partnerships to maintain the competitiveness of the public service

- advance digital adoption, modernize recruitment, finance and procurement systems

- maintain outreach efforts to colleges and universities to further promote high-quality employment opportunities in the federal public service

At the same time, the PSC continues to actively mitigate risk to public trust in the political impartiality and non-partisanship of the federal public service by:

- investigating allegations of improper political activity and imposing corrective measures

- raising awareness among public servants of their rights and responsibilities related to political activities, and reminding them of related rules and processes

The PSC will review requests from employees seeking permission to run for public office, identify risks to political neutrality and impose conditions to address the risks. As well, to address the quickly evolving landscape of information technology and artificial intelligence, the PSC will actively leverage technical upgrades, enhance technological solutions and implement pilot test cases to improve user experience, both for internal and external stakeholders.

4. Significant changes in relation to operations, personnel and programs

There were no significant changes to programs or activities in the PSC during the first quarter, which ended on June 30, 2025.

5. Approved by senior officials

Approved by:

Marie-Chantal Girard

President

Farhat Khan, CPA

Chief Financial Officer

Gatineau, Canada

August 29, 2025

6. Statement of authorities (unaudited)

| Fiscal year 2025 to 2026 (in thousands of dollars) | |||

|---|---|---|---|

| Total available for use for the year ending March 31, 2026 1 | Used during the quarter ended December 31, 2025 | Year-to-date used at quarter-end |

|

| Vote 1 – Program Expenditures | 89,427 | 21,442 | 21,442 |

| Statutory – Refund of Previous Year Revenue | 0 | 3 | 3 |

| Statutory-Spending Proceed Disposal Crown Assets | 0 | 1 | 1 |

| Statutory – Employer Contributions to Employee Benefit Plans | 13,787 | 0 | 0 |

| Total Budgetary Authorities | 103,214 | 21,446 | 21,446 |

- Includes only authorities available for use and granted by Parliament at quarter-end.

6. Statement of authorities (unaudited) (continued)

| Fiscal year 2024 to 2025 (in thousands of dollars) | |||

|---|---|---|---|

| Total available for use for the year ending March 31, 20251 | Used during the quarter ended December 31, 2024 | Year-to-date used at quarter-end |

|

| Vote 1 – Program Expenditures | 86,342 | 22,208 | 22,208 |

| Statutory – Refund of Previous Year Revenue | 0 | 0 | 0 |

| Statutory-Spending Proceed Disposal Crown Assets | 0 | 0 | 0 |

| Statutory – Employer Contributions to Employee Benefit Plans | 11,976 | 2,994 | 2,994 |

| Total Budgetary Authorities | 98,318 | 25,202 | 25,202 |

- Includes only authorities available for use and granted by Parliament at quarter-end.

7. Budgetary expenditures by standard object (unaudited)

| Fiscal year 2025 to 2026 (in thousands of dollars) | |||

|---|---|---|---|

| Planned expenditures for the year ending March 31, 2026 | Expended during the quarter ended December 31, 2025 |

Year-to-date used at quarter-end | |

| Personnel | 99,658 | 20,144 | 20,144 |

| Transportation and telecommunications | 181 | 32 | 32 |

| Information | 235 | 20 | 20 |

| Professional and special services | 14,069 | 704 | 704 |

| Rentals | 1,721 | 1,089 | 1,089 |

| Repair and maintenance | 72 | 5 | 5 |

| Utilities, materials and supplies | 150 | 23 | 23 |

| Acquisition of machinery and equipment | 1,231 | 18 | 18 |

| Other subsidies and payments | 149 | 70 | 70 |

| Total gross budgetary expenditures | 117,466 | 22,105 | 22,105 |

| Less: Revenues netted against expenditures | (14,252) | (659) | (659) |

| Total net budgetary expenditures | 103,214 | 21,446 | 21,446 |

7. Budgetary expenditures by standard object (unaudited) (continued)

| Fiscal year 2024 to 2025 (in thousands of dollars) | |||

|---|---|---|---|

| Planned expenditures for the year ending March 31, 2025 | Expended during the quarter ended December 31, 2024 |

Year-to-date used at quarter-end | |

| Personnel | 96,274 | 23,129 | 23,129 |

| Transportation and telecommunications | 114 | 9 | 9 |

| Information | 235 | 7 | 7 |

| Professional and special services | 13,153 | 545 | 545 |

| Rentals | 1,388 | 1,537 | 1,537 |

| Repair and maintenance | 61 | 1 | 1 |

| Utilities, materials and supplies | 112 | 15 | 15 |

| Acquisition of machinery and equipment | 1,123 | 37 | 37 |

| Other subsidies and payments | 110 | 119 | 119 |

| Total gross budgetary expenditures | 112,570 | 25,399 | 25,399 |

| Less: Revenues netted against expenditures | (14,252) | (197) | (197) |

| Total net budgetary expenditures | 98,318 | 25,202 | 25,202 |