My GC Pension: Public Service Pension Plan

The My GC Pension portal is only available for active federal employee with access to Compensation and pension portal on the Government of Canada network.

It is essential that government of Canada employees have a myKEY or a department-issued smart card/token in order to gain access to the Compensation and pension portal applications. Compensation and pension portal users are required to enter their Personal Record Identifier (PRI) to sign in to the applications (first-time users are required to confirm their date of birth).

Service interruption

The My GC Pension portal will be unavailable due to scheduled system maintenance:

From Saturday, January 31 at 7 am to Sunday, February 1st at 8 pm Eastern time.

Possible Slower Performance on My GC Pension Portal

Due to higher than usual volumes, you may experience slower performance when using the My GC Pension portal. Thank you for your patience as we work to resolve this.

Instructions to sign in to your My GC Pension Portal

- Have your MyKey to Sign in

- users are required to use their myKey file name and password or a departmental issued smart card or token

- You will get 1 of the following 3 options

- if you get a pop-up asking you to select a certificate, select your name in the “Subject field” (that’s your myKey) – Enter your myKey password, if required, and select “OK”

- if you get a pop-up asking you to login to Entrust, select your myKey under “Name”, then enter your myKey password and select “OK”

- if you get a “Session Time-out” page: Run the Browser to select your myKey file name, enter your myKey password and Select “Sign in”

- You will get to an “Identifier Validation” page

- Enter your PRI and select “Validate”

- You will get a “Sign in successful” message

- Select “Continue” to get to your Pension Portal main dashboard

Early Retirement Incentive calculation instructions

Budget 2025 proposes amendments to the Public Service Superannuation Act and the Income Tax Regulations. This is to introduce a temporary, voluntary Early Retirement Incentive Program through the federal public service pension plan. While the program is not yet available, you can use the Pension estimator in the My GC Pension Portal to review your current pension estimates and explore potential scenarios.

The My GC Pension Portal “Pension estimate calculation instructions” allow you to calculate your pension estimates, without a reduction, due to the Early Retirement Incentive program.

Pension estimate calculation

The My GC Pension Portal is intended solely to provide estimated pension amounts. It cannot be used to determine eligibility for any pension reduction waivers based on the Early Retirement Incentive program.

Pension estimate calculation instructions

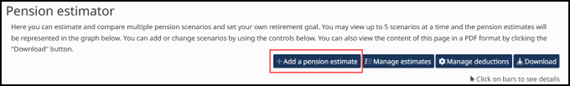

- From the menu at the top of the page, select the “Pension estimator” tab

- Select the “+ Add a pension estimate” button

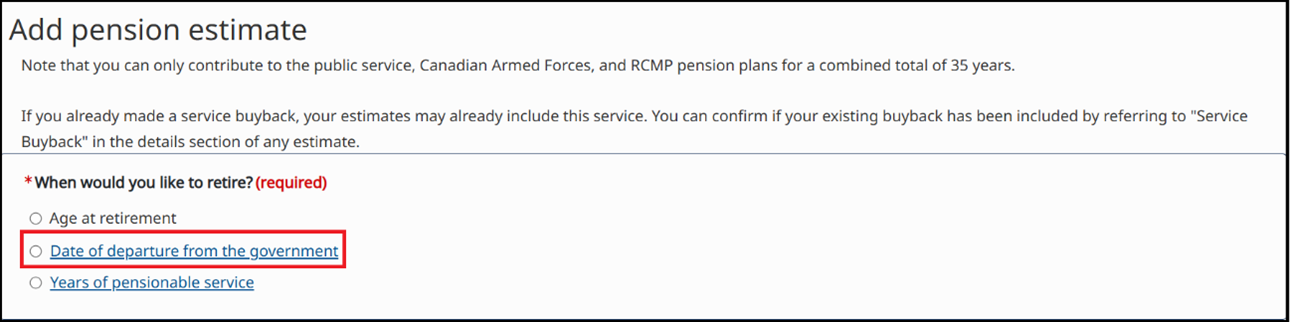

- Following “When would you like to retire?”, select the circle for the option “Date of departure from the government”

- Enter the desired Date of departure by either manually typing in the box or using the calendar icon

- Select the “Estimate” button

- The 2 graph options with stars will be the newest pension estimates created, based on the information you entered (the Deferred pension is the one you’ll want to consider)

Note: If you return to the pension estimator, the stars may disappear beside the newest options.

Note: If you return to the pension estimator, the stars may disappear beside the newest options.

- The emphasized “Monthly total before deductions” line provides your estimated pension without reduction (this is the amount that may be payable on the departure date you input, if you’re eligible for an unreduced pension on that date)

- To check your estimated Net pension amount, select the “Manage deductions” button, preceding the graph, and enter any anticipated deductions from your pension