Employees and CPP2

Click on this infographic for information about employees and CPP2.

Infographic description

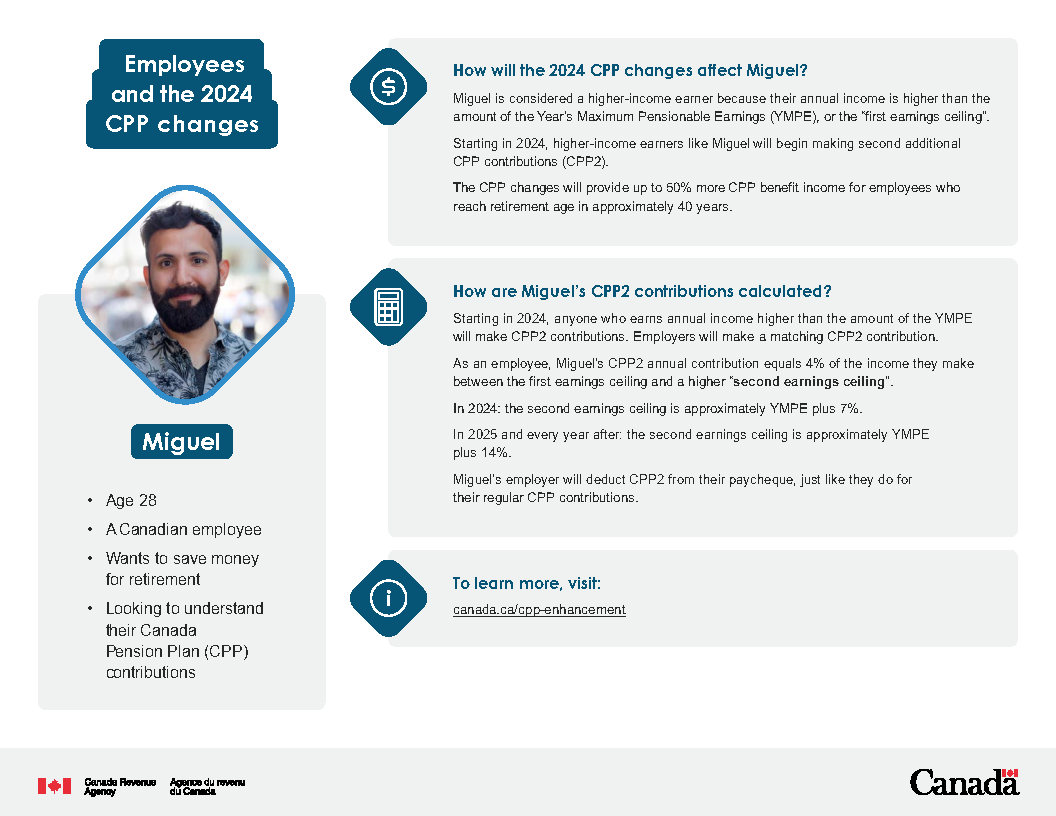

Miguel

- Age 28

- A Canadian employee

- Wants to save money for retirement

- Looking to understand their second additional Canada Pension Plan contributions (CPP2)

How do CPP2 contributions affect Miguel?

Miguel is considered a higher-income earner because their annual income is higher than the amount of the Year’s Maximum Pensionable Earnings (YMPE), or the “first earnings ceiling”.

As of 2024, higher-income earners like Miguel started to make second additional CPP contributions (CPP2).

The CPP changes will provide up to 50% more CPP benefit income for employees who reach retirement age in approximately 40 years.

How are Miguel’s CPP2 contributions calculated?

Anyone who earns annual income higher than the amount of the YMPE makes CPP2 contributions. Employers make a matching CPP2 contribution.

As an employee, Miguel’s CPP2 annual contribution equals 4% of the income they make between the first earnings ceiling and a higher “second earnings ceiling”.

The rates for the first and second earnings ceilings are announced annually.

The second earnings ceiling is approximately YMPE plus 14%.

Miguel’s employer will deduct CPP2 from their paycheque, just like they do for their regular CPP contributions.