Self-employed individuals and CPP2

Click on this infographic for information about self-employed individuals and CPP2.

Infographic description

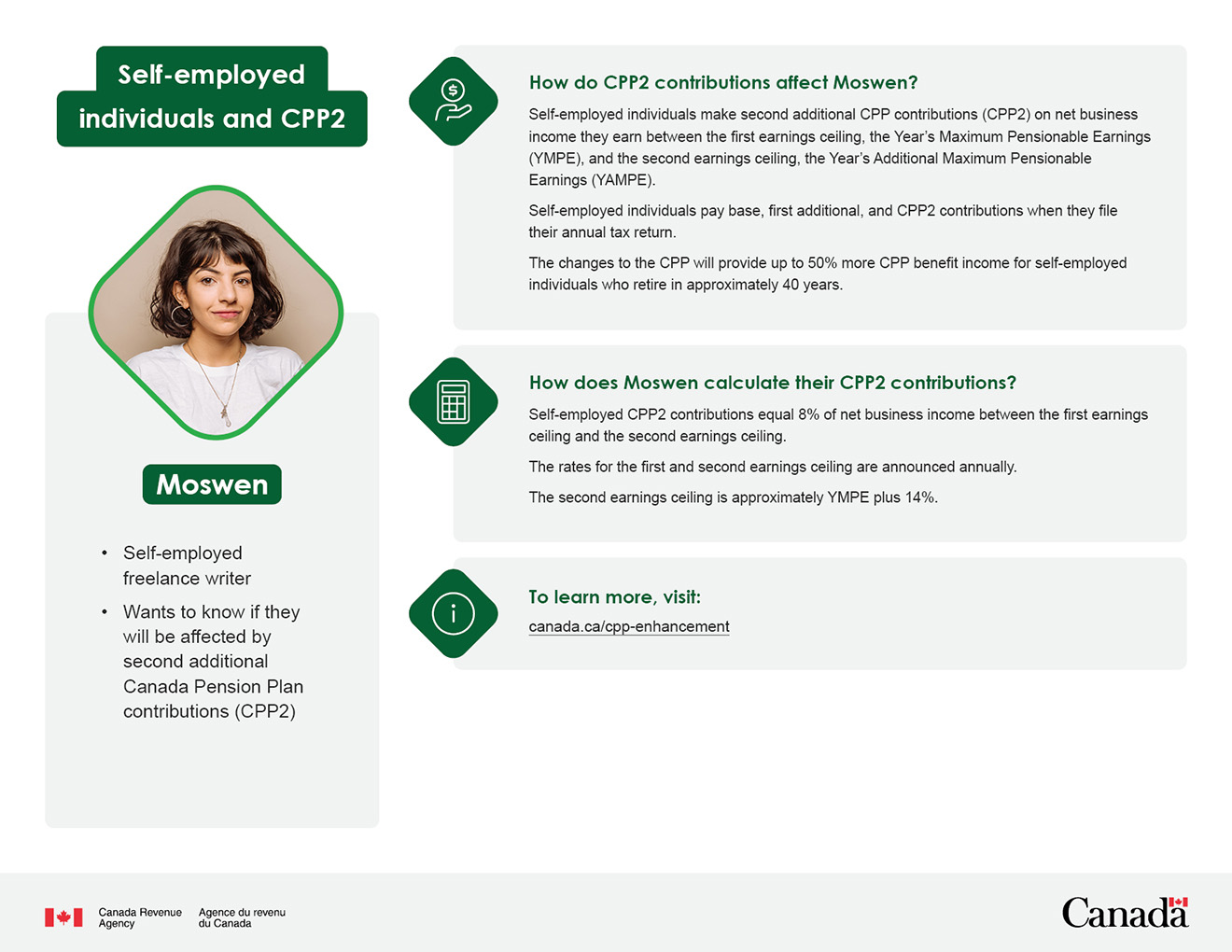

Moswen

- Self-employed freelance writer

- Wants to know if they will be affected by second additional Canada Pension Plan contributions (CPP2)

How do CPP2 contributions affect Moswen?

Self-employed individuals make second additional CPP contributions (CPP2) on net business income they earn between the first earnings ceiling, the Year’s Maximum Pensionable Earnings (YMPE), and the second earnings ceiling, the Year’s Additional Maximum Pensionable Earnings (YAMPE).

Self-employed individuals pay base, first additional, and CPP2 contributions when they file their annual tax return.

The changes to the CPP will provide up to 50% more CPP benefit income for self-employed individuals who retire in approximately 40 years.

How does Moswen calculate their CPP2 contributions?

Self-employed CPP2 contributions equal 8% of net business income between the first earnings ceiling and the second earnings ceiling.

The rates for the first and second earnings ceilings are announced annually.

The second earnings ceiling is approximately YMPE plus 14%.