Fatima’s story

Fatima works while receiving the Guaranteed Income Supplement (GIS).

Spotlight on

If you need help or someone to talk to, visit our mental health support page.

Disclaimer

The story is fictional but inspired by common experiences to illustrate key factors to consider when planning for retirement. The story is not intended to provide financial advice, and we strongly encourage you to seek help from a financial advisor.

Overview

Fatima moved to Canada 15 years ago and worked part-time to help support her family as a single mother. At age 65, she retired and started receiving her Canada Pension Plan (CPP) retirement pension.

She learns she qualifies for the Old Age Security (OAS) pension because she has lived in Canada for over 10 years. Because her income is low, she also qualifies for a Guaranteed Income Supplement (GIS).

Even with her CPP, OAS and GIS, Fatima struggles to cover her monthly expenses.

She thinks about returning to work part-time. She is worried that the extra income could affect her GIS eligibility and lower her payments.

Smart Tip: The GIS is a tax-free monthly payment available to Old Age Security pensioners with low income. The Supplement is based on your income. In many cases, we will let you know by letter, the month after you turn 64, when you could start receiving the first payment. In other cases, you may have to apply. Learn more about Guaranteed Income Supplement.

Fatima learns about her work options while receiving GIS

She visits her local Service Canada office and learns that she can earn up to a certain amount while still receiving her GIS. This is called the GIS earnings exemption.

She can earn up to $5,000 a year without reducing her GIS benefit amount. For earnings between $5,000 and $15,000, only 50% of the income she receives will reduce her GIS benefit amount.

Fatima can now supplement her retirement income by working part-time and keep more of her GIS payment.

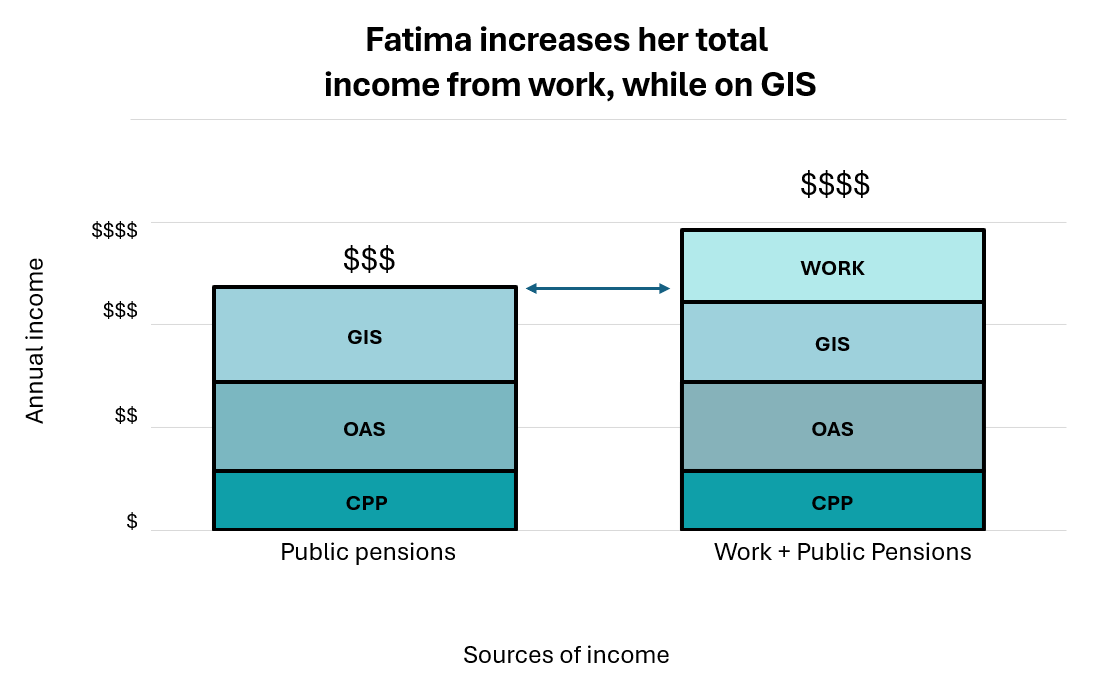

Text alternative for Fatima increases her total income from work, while on GIS

The graph shows two stacked bars comparing annual sources of income. The left bar shows CPP, OAS and GIS from public pensions. The right bar adds WORK on top of CPP, OAS, and GIS, showing higher total income.

Fatima’s decision

Fatima decides to return to work part-time. By working a few hours a week, she earns the extra money she needs to cover her monthly expenses. She feels more confident in her retirement, with time to staying active and connected in her community.

With her decision, Fatima now receives income from the following sources:

- Part-time earnings

- Canada Pension Plan (CPP) retirement pension

- Old Age Security (OAS) pension

- Guaranteed Income Supplement (GIS), based on her earnings after applying the GIS earnings exemption.

Smart tip: If you are employed or self-employed and receive the GIS, learn about the earnings exemption and how to determine your income on the GIS application page.