Fred’s story

Fred decides when to start his public pensions.

Spotlight on

If you need help or someone to talk to, visit our mental health support page.

Disclaimer

The story is fictional but inspired by common experiences to illustrate key factors to consider when planning for retirement. The story is not intended to provide financial advice, and we strongly encourage you to seek help from a financial advisor.

Overview

Fred is 60 and plans to retire soon. He worked full-time most of his life and has a private pension. He is healthy and plans his retirement until the age 86. He wants to know the best time to start his Canada Pension Plan (CPP) and Old Age Security (OAS) pensions to maximize his income.

Fred needs to decide if he wants to start collecting his CPP retirement pension as soon as he is eligible or if he should delay applying to get a higher benefit amount. He knows that at age 60 his CPP retirement pension will be lower than if he takes it at 65 or even 70. He also plans to use his Registered Retirement Savings Plan (RRSP) and other savings to retire comfortably.

Fred learns about his public pension monthly amounts

Fred signs in to his My Service Canada Account (MSCA) to review his CPP contributions and how much his monthly CPP retirement pension could be if he starts at age 60, 65, and 70.

He then uses the OAS benefits estimator for his OAS pension amount at various ages.

His CPP monthly and lifetime amounts at various ages

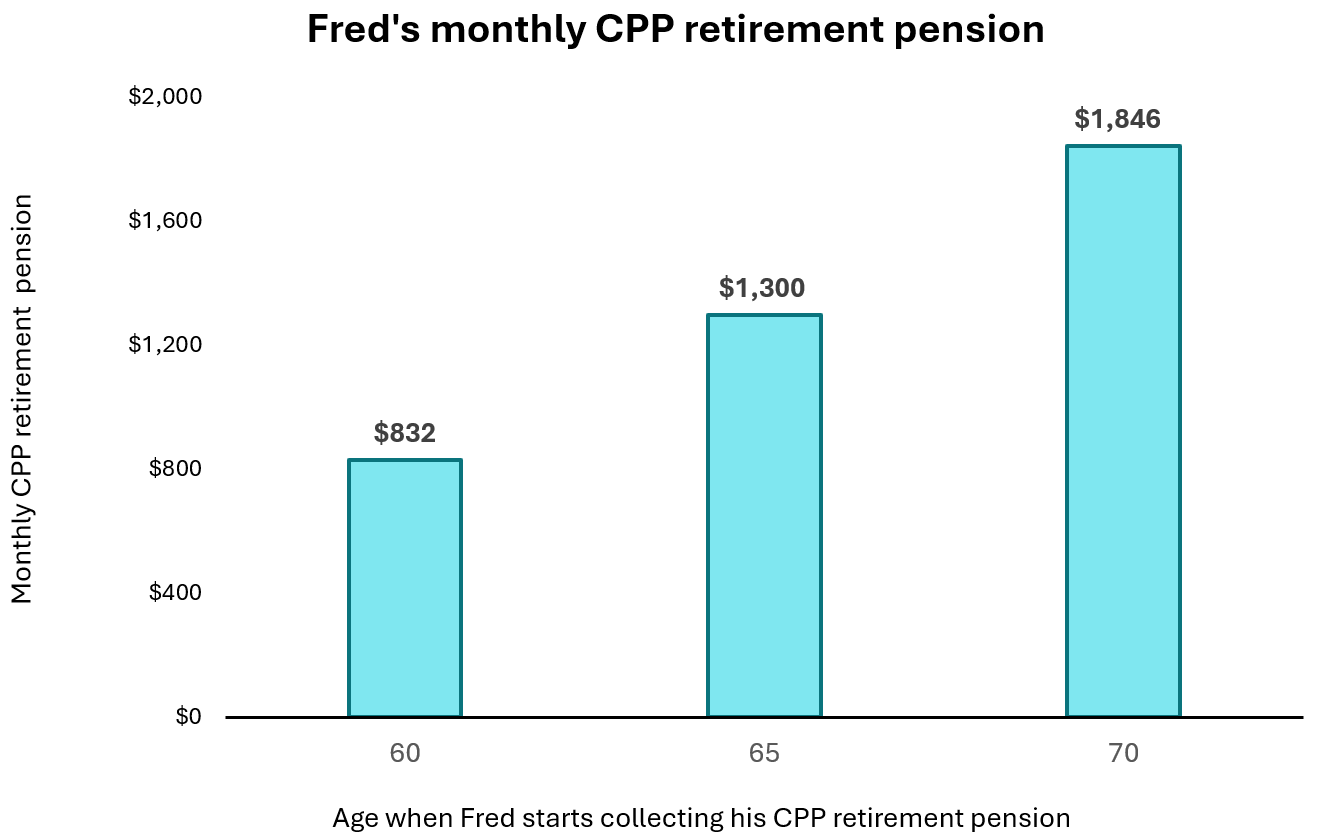

Fred compares what his monthly CPP public pension would be if he starts collecting his benefit at age 60, 65 or 70.

Text alternative for Fred's monthly CPP retirement pension

The chart shows changes in Fred's CPP pension monthly payments depending on what age he starts. It shows the longer he waits to start his pension, the more money he'll receive every month.

| Age when Fred starts collecting his CPP retirement pension | Monthly CPP retirement pension |

|---|---|

| 60 | $832 |

| 65 | $1,300 |

| 70 | $1,846 |

Fred learns that starting CPP at age 60 gives the smallest monthly amount. At age 65, the payment is higher and waiting until 70 gives more than double.

Fred likes the idea of a higher monthly payment at age 65 and 70 and wants to plan his retirement until the age of 86.

Smart tip: On average, Canadians who are age 65 today can expect to live up to 86 years for men and 88 years for women. Use the Canada Retirement Income Calculator to help plan your retirement income.

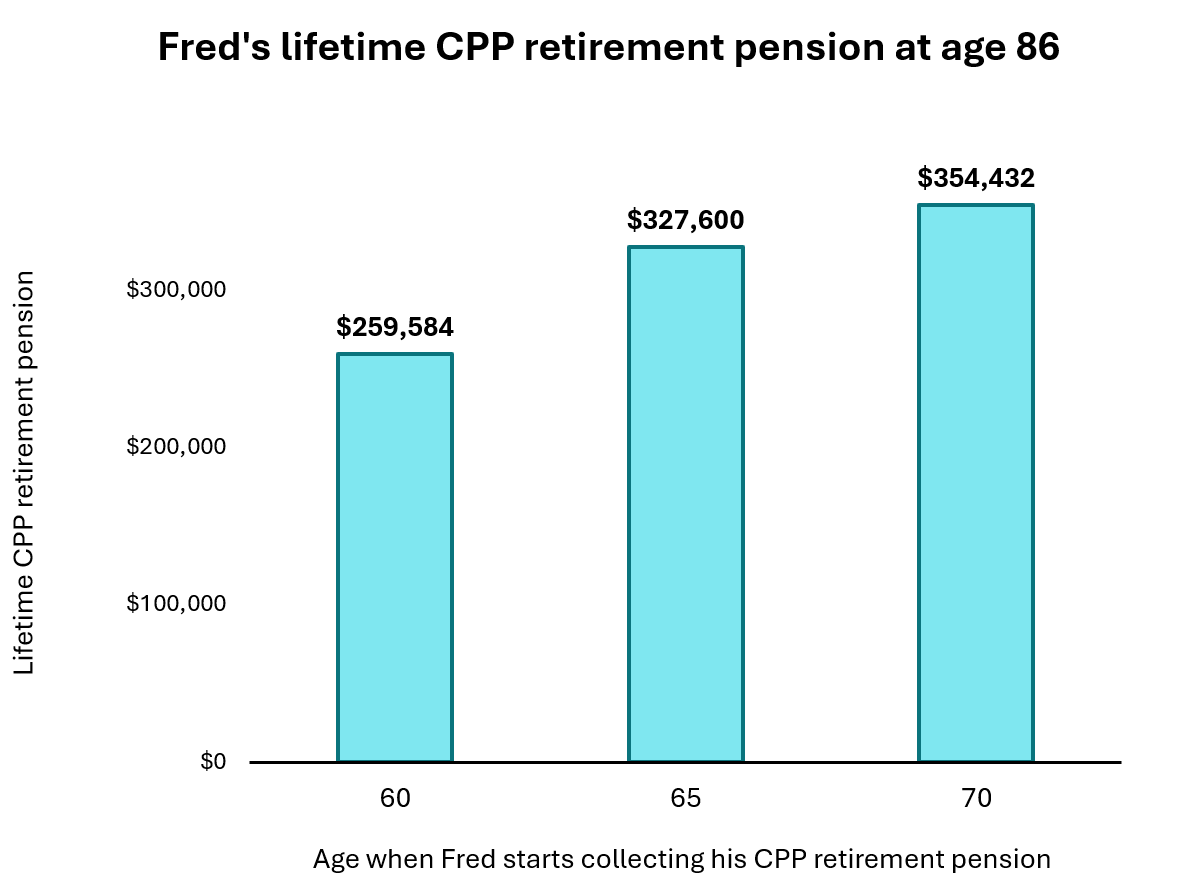

Fred talks to his friends about his decision and many of them point out how he's giving up income early in retirement to get that higher monthly payment. Fred decides to look at how much he'll collect in total from his CPP pension over his lifetime. He sees that with a normal life expectancy, he'll get more money over time by waiting.

Text alternative for Fred's lifetime CPP retirement pension at age 86

This chart shows the different total amount of Fred's CPP pension depending on his age. Fred sees that the longer he waits to start his CPP retirement pension, the more money he'll receive for life.

| Age when Fred starts collecting his CPP retirement pension | Lifetime CPP retirement pension |

|---|---|

| 60 | $259,584 |

| 65 | $327,600 |

| 70 | $354,432 |

By age 86, if Fred starts his CPP retirement pension at age 70, he could receive $95,000 more than if he started at age 60.

His OAS monthly and lifetime amounts at various ages

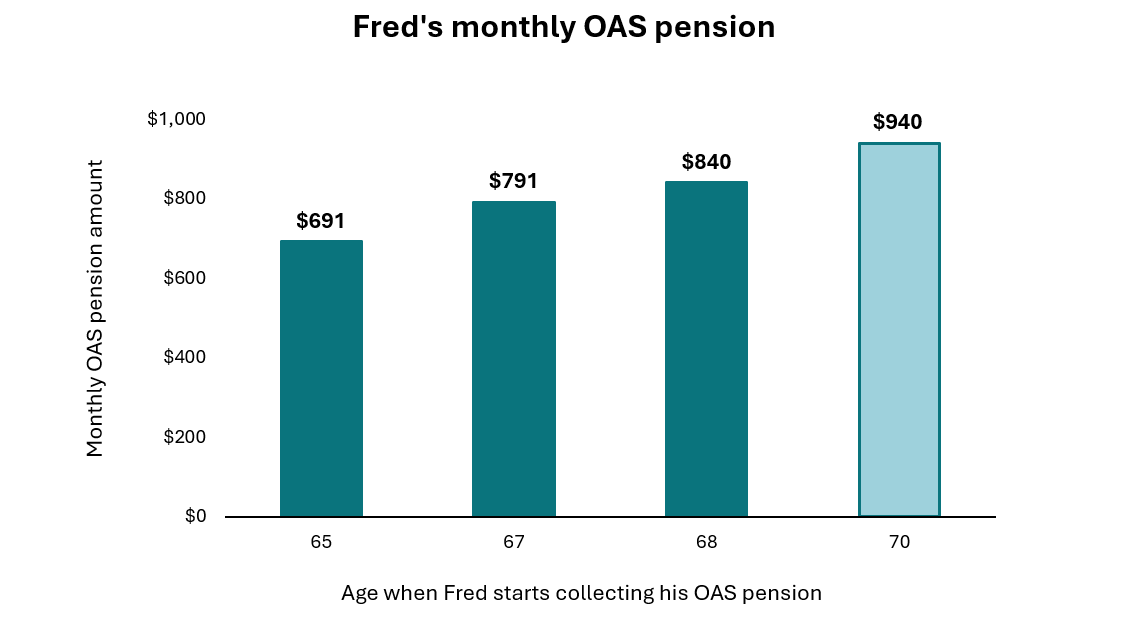

Similar to what he did with his CPP pension, Fred compares his OAS monthly pension amount if he starts at various ages.

Text alternative for Fred's monthly OAS pension

The chart shows changes in Fred's monthly OAS pension payments depending on what age he starts. It shows that the longer he waits to start his pension, the more money he'll collect every month.

| Age when Fred starts collecting his OAS pension | Monthly OAS pension amount |

|---|---|

| 65 | $691 |

| 67 | $791 |

| 68 | $840 |

| 70 | $940 |

If Fred delays his OAS pension from age 65 to 68, he only gets about $150 more per month. The increase is smaller than delaying his CPP.

Since the increase is small, he now wants to know if it will also increase his total lifetime OAS amount.

Text alternative for Fred's lifetime OAS pension, at age 86

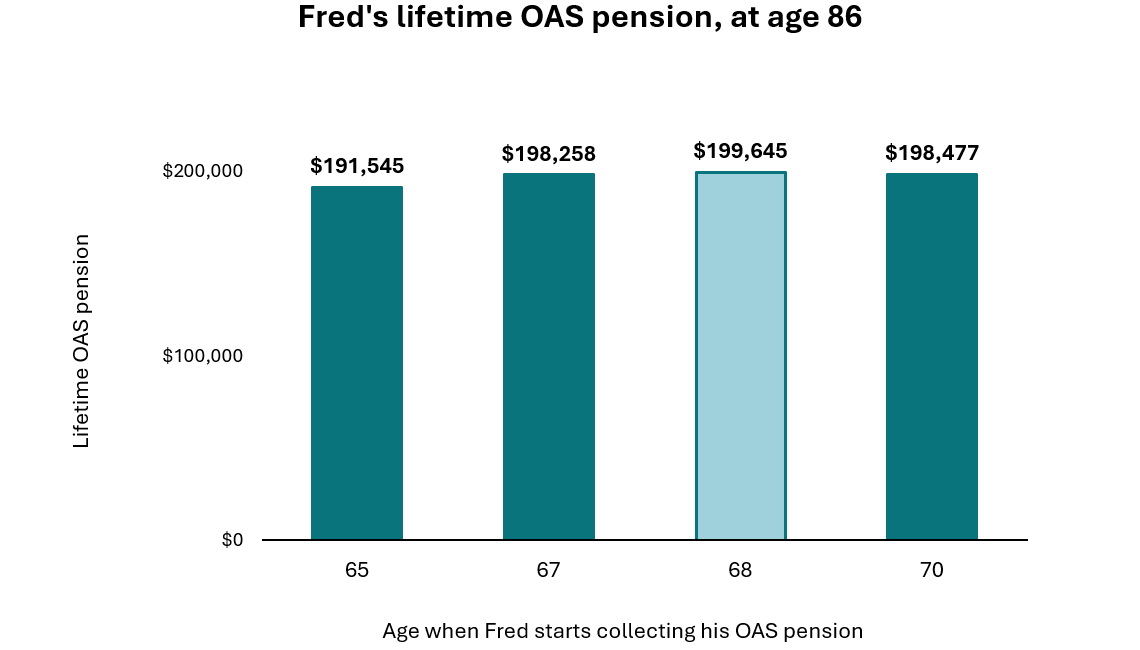

The chart shows changes in Fred's lifetime OAS pension payments depending on what age he starts. By age 86, the lifetime OAS pension is higher, if Fred starts his OAS at age 68.

| Age when Fred starts collecting his OAS pension | Lifetime OAS pension |

|---|---|

| 65 | $191,545 |

| 67 | $198,258 |

| 68 | $199,645 |

| 70 | $198,477 |

If Fred starts his OAS at age 68, his lifetime OAS pension will be higher at age 86.

Fred’s decision

Fred wants to take the most money available to him from the CPP and OAS pensions. To live comfortably in retirement, he looked at both his monthly and lifetime amounts to the age of 86.

Considering all factors, including his private pension and savings, Fred decides to delay his CPP retirement pension until age 70 and his OAS pension until age 68. This would provide him with the highest monthly and lifetime benefit amounts.