Keith’s story

Keith plans to work while receiving his CPP retirement pension.

Spotlight on

If you need help or someone to talk to, visit our mental health support page.

Disclaimer

The story is fictional but inspired by common experiences to illustrate key factors to consider when planning for retirement. The story is not intended to provide financial advice, and we strongly encourage you to seek help from a financial advisor.

Overview

At age 60, Keith started a new job. He worked his entire life, has savings, and plans to keep working while receiving his Canada Pension Plan (CPP) retirement pension. He wants to know what options are available to him at various ages.

Keith learns about the CPP Post-Retirement Benefit (PRB)

Keith signs in to his My Service Canada Account to review his CPP contributions and know how much his monthly CPP retirement pension could be if he starts at various ages.

He learns that if he keeps working while receiving his CPP retirement pension, he can still contribute to the Plan.

Each year he contributes, he earns CPP Post-Retirement Benefits (PRB), which increases his monthly CPP payment the next year. This means, working a little longer can give him a higher amount when he fully retires.

Learn more about CPP Post-Retirement Benefits (PRBs).

He compares his work and CPP options

- Option 1:

- Start CPP retirement pension at age 60, at the lowest amount.

- Keep contributing until age 70.

- Keith gets his CPP earlier and collects 10 PRBs at age 70.

- Option 2:

- Start CPP retirement pension at age 60, at the lowest amount.

- Stop contributing at age 65.

- Keith gets his CPP earlier and collects 5 PRBs at age 70.

- Option 3:

- Start CPP retirement pension at age 65, at the higher amount.

- Keep contributing until age 70.

- Keith waits a little longer for his CPP but still collects 5 PRBs at age 70.

- Option 4:

- Start CPP retirement pension at age 70, at the highest amount.

- No extra contributions.

- Keith waits for the highest monthly payment but does not collect any PRBs.

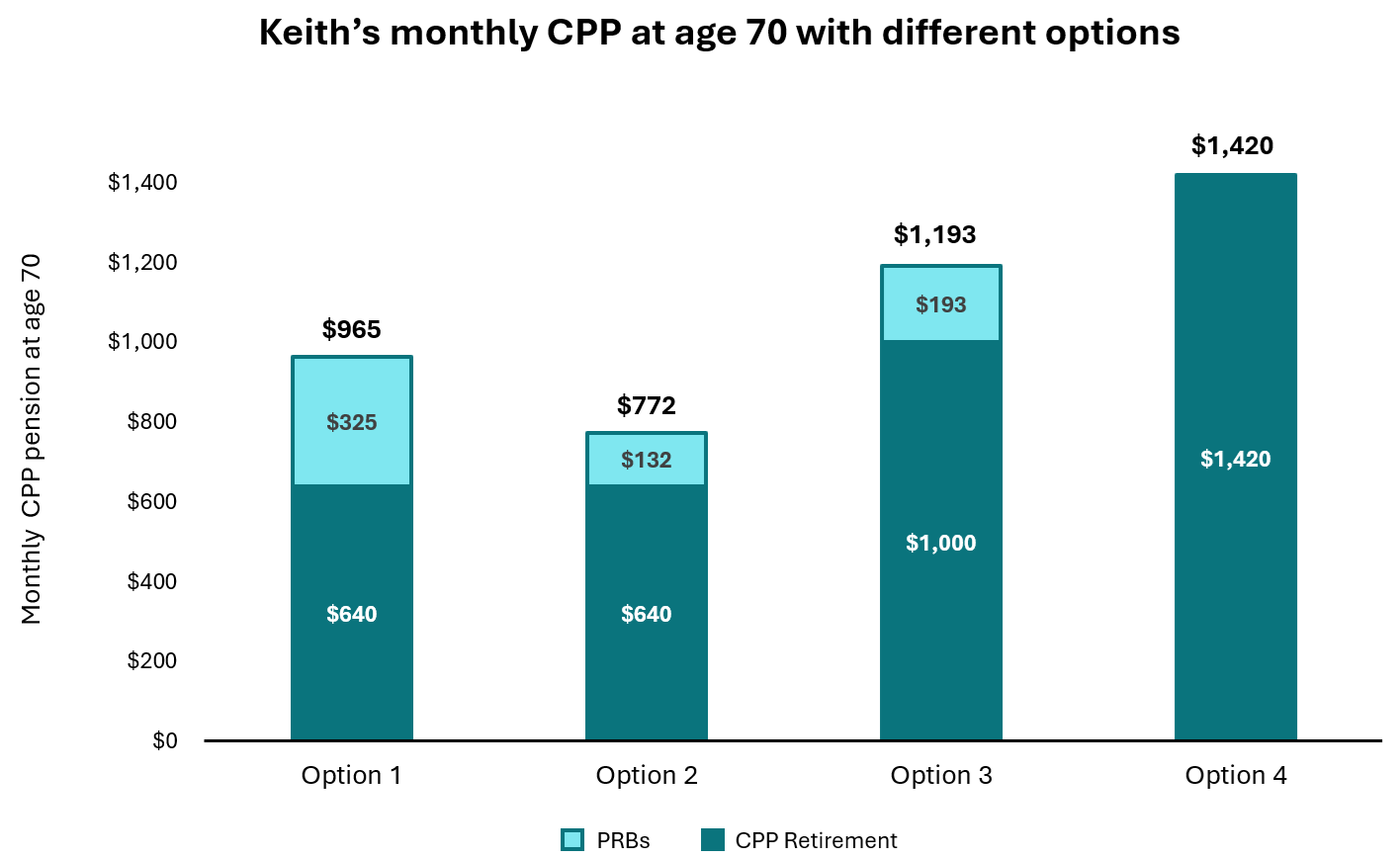

Text alternative for Keith’s monthly CPP at age 70 with different options

The graph compares Keith’s CPP monthly pension at age 70, based on when he starts CPP and whether he keeps contributing with PRBs.

| Choices Keith is considering | Base CPP retirement pension based on starting age | Amount for added PRBs | Total monthly amount |

|---|---|---|---|

| Option 1: Take CPP at 60, contribute to PRBs until 70. | $640 | $325 | $965 |

| Option 2: Take CPP at 60, contribute to PRBs until 65. | $640 | $132 | $772 |

| Option 3: Take CPP at 65, contribute to PRBs until 70. | $1,000 | $193 | $1,193 |

| Option 4: Take CPP at 70, no contributions to PRBs. | $1,420 | $1,420 |

Keith’s monthly CPP retirement at age 70 will depend on which option he chooses. When he applies for CPP, the amount will be based on his CPP contributions.

Each year Keith works and contributes to the plan; it gives him a higher amount for the following year.

Smart tip: On average, Canadians who are age 65 today can expect to live up to 86 years for men and 88 years for women. Use the Canada Retirement Income Calculator to help plan your retirement income.

Keith starts planning his retirement income

When deciding when to start his CPP retirement pension, Keith:

- considers his monthly amount

- compares how much he’ll get over his lifetime

- plans his income until the age of 87

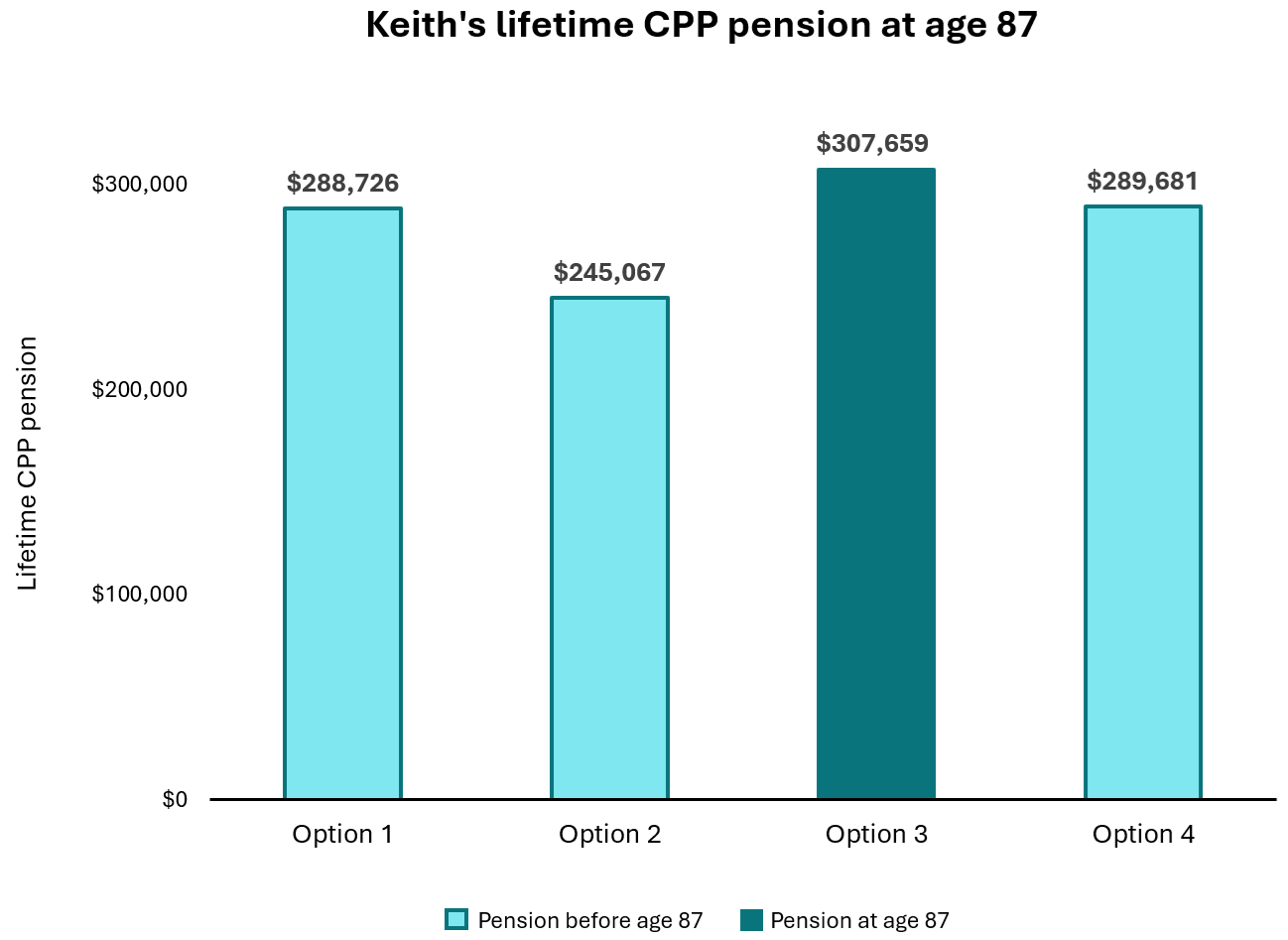

Text alternative for Keith’s lifetime CPP pension at age 87

This graph compares Keith’s lifetime CPP pension amount by age 87, depending on which the option he chooses.

| Choices Keith is considering | Lifetime CPP retirement pension amount at age 87 |

|---|---|

| Option 1: Take CPP at 60, contribute to PRBs until 70. | $288,726 |

| Option 2: Take CPP at 60, contribute to PRBs until 65. | $245,076 |

| Option 3: Take CPP at 65, contribute to PRBs until 70. | $307,659 |

| Option 4: Take CPP at 70, no contributions to PRBs. | $289,681 |

Keith’s decision

Keith decides to start his CPP retirement pension at age 65. He will keep contributing to the CPP through the Post-Retirement Benefits (PRBs) until age 70. By choosing this option, he earns PRBs for five more years and gets the highest possible CPP income over his lifetime pension.