Appearance before the House of Commons Standing Committee on Government Operations and Estimates (OGGO) - February 27, 2020

On this page

Opening Statement and Presentation

In this section

1. Opening Statement (SCMA)

Speech for the Honourable Jean-Yves Duclos, President of the Treasury Board

Standing Committee on Government Operations and Estimates (OGGO)

Supplementary Estimates (B), 2019-20

Ottawa

Thank you, Mr. Chair.

I would like to thank the committee for inviting me here to today discuss the 2019-2020 Supplementary Estimates (B).

This is my first appearance before this committee as President of the Treasury Board and I’m honoured to be here.

I am pleased to be joined by officials from the Treasury Board Secretariat:

- Glenn Purves, Assistant Secretary, Expenditure Management Sector, along with Darryl Sprecher, Senior Director, Expenditure Strategies and Estimates.

Supplementary Estimates (B) – Government-Wide Perspective

In all, Mr. Speaker, these Estimates describe a total of $5.6 billion in planned budgetary spending.

Of this amount, $1.8 billion is already authorized through existing legislation—thus, with these Supplementary Estimates (B), the Government seeks authority for $3.8 billion in additional voted spending.

These new budgetary spending plans will ensure the government continues to deliver on its commitments to Canadians in a number of important areas.

These include significant investments in advancing reconciliation with Indigenous peoples; in supporting the dedicated men and women of the Canadian armed forces; and in working with our partners across Canada to address climate change.

In keeping with our Budget 2019 commitment, a total of $919 million in funding to Crown-Indigenous Relations and Northern Affairs Canada will be used to forgive comprehensive land claim negotiation loans to First Nations, Inuit and Métis Nation communities.

These loans were provided to ensure First Nations and other Indigenous communities had the resources necessary to participate in land claim negotiations in a meaningful way.

In many cases, however, negotiating these so-called “modern treaties” has taken far longer than anticipated. As a result, these loans have become a severe burden for many communities—in some cases, Mr. Chair, amounting to tens-of-millions of dollars, and a significant barrier to economic and community development.

These debts will be forgiven, and communities that have repaid loans in the past will be reimbursed.

A further $588.3 million would be allocated to Indigenous Services Canada. These funds are required to support ongoing efforts to meet the critical need to improve Indigenous child and family services, including expanding prevention and early intervention programs.

As I am certain this Committee will agree, the transformation of these services is crucial to reconciliation—to righting past wrongs.

It is even more critical to a new generation of Indigenous children—when we remember that less than eight percent of Canadian children under 14 are Indigenous, yet account for more than 52 percent of children in foster care in private homes.

An additional $232 million to Indigenous Services Canada will provide for the ongoing implementation of Jordan’s Principle.

These funds help to ensure that Indigenous children have access to the same specialized health, education and social service supports that any parent in this country has a right to expect for their child – and community.

And when we speak of expectations, Mr. Chair, Canadians have made it clear, time-and-again, that they expect their governments, at all levels, to take action on climate change.

Spending plans detailed in these Estimates also include continued investment in Canada’s Climate Action Incentive Fund—a total of $109 million to support small- and medium-size businesses, municipalities, universities, schools, and hospitals as they implement carbon reduction and energy efficiency projects.

As members of this Committee may know, the Climate Action Incentive Fund is funded from the proceeds of the federal carbon pollution pricing system.

Also, as committed in Budget 2019, the Estimates include a contribution of $950 million to the Federation of Canadian Municipalities, more than doubling the capitalization of its Green Municipal Fund to drive local green innovation across the country.

Since it was established in 2000, this Fund has provided $862 million to more than 1,310 sustainability initiatives in municipalities across Canada, such as new wastewater systems in northern Manitoba—while preserving every dollar of capital supplied by government.

This new investment will enable the launch of a number of new funding streams, ranging from the Sustainable Affordable Housing Innovation Fund to the Community EcoEfficiency Acceleration Fund.

Mr. Chair, Canadians also expect that Canada’s armed forces will be there when they are needed—to protect the safety and security of Canadians in time of emergency at home and abroad, and to contribute to global security as partner in joint missions abroad.

That is the aim of the Government of Canada’s defence policy: Strong, Secure, Engaged.

To ensure our armed forces are equipped to meet these expectations, these Estimates include a planned allocation of $487.3 million to the Department of National Defence.

These funds will be invested in the equipment, infrastructure and information technology systems essential to the operation and maintenance of a modern armed service.

A further $128.5 million will support current overseas operations.

This includes the ongoing land force deployment in Latvia, as part of

NATO’s deterrence mission in Central and Eastern Europe; and in Africa, where members of the Royal Canadian Air Force are providing tactical airlift support to UN peacekeeping operations from their base in Uganda.

In terms of highlights of these Estimates, Mr. Chair, I would mention one other substantial item, that being $137.9 million to the Office of Infrastructure of Canada.

The largest part of this amount—some $105.8 million—relates to the completion of the Champlain Bridge Corridor project in Montréal, a vital regional transportation link for more than 60 million vehicles each year.

Conclusion

Of course, Mr. Chair, in the time allotted I can do no more than provide a brief overview of the highlights of the Estimates.

The Supplementary Estimates themselves and the accompanying documentation provide all Parliamentarians the opportunity to responsibly spend public dollars on important issues that matter to Canadians from all walks of life.

In keeping with our government’s commitment to raise transparency to a level that will meet the expectations of Parliamentarians and Canadians alike, I would note additional detail and context—beyond what is contained in the documents tabled here—is available online.

And not only available, Mr. Chair, but presented in accessible formats to Canadians, to ensure that they can understand the impact of our investments in people and infrastructure.

I look forward to a thorough examination of the Estimates by Parliamentarians, and to any questions they may have as we work together to invest in meeting the priorities of Canadians.

Thank you, Mr. Chair. I would now be happy to take any questions the Committee may have.

2. Deck Presentation (EMS)

Supplementary Estimates (B), 2019-20

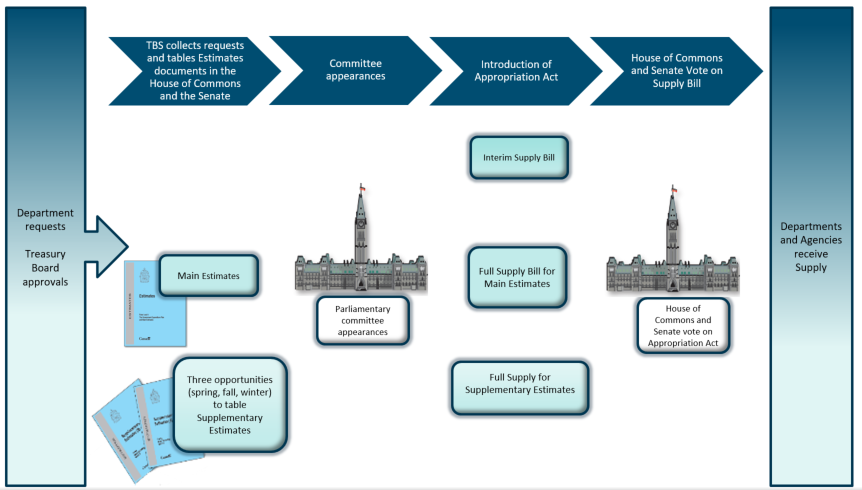

Government Expenditure Cycle at a glance

Figure 1 - Text version

The Government’s expenditure cycle at a glance includes the following steps:

The department requests spending authorities for Treasury Board approval.

Treasury Board of Canada Secretariat collects requests approved by Treasury Board and tables Estimates documents for the Main Estimates and Supplementary Estimates in the House of Commons and the Senate. There are three opportunities (spring, fall, winter) to table Supplementary Estimates.

The President of the Treasury Board, the Secretary and other senior officials appear before Parliamentary committees to answer questions about the Estimates.

The supply bill corresponding to the Estimates process is introduced in the House of Commons.

- Interim supply bill for interim supply

- Full supply bill for the Main Estimates

- Full supply for Supplementary Estimates

The House of Commons and the Senate vote on the Appropriation Act prior to the end of the supply period.

Departments and Agencies receive supply.

Parliamentary Reporting and the Supply Cycle

Beginning of fiscal year - April 1

April to June

- Tabling of spring Supplementary Estimates (possible)

- Approval of appropriation bill(s)

September to December

- Tabling of Public Accounts

- Tabling of fall Supplementary Estimates

- Tabling of Departmental Results Reports

- Fall Economic Statement

- Approval of appropriation bill

January to March

- Tabling of final Supplementary Estimates

- Tabling of Main Estimates

- Tabling of Departmental Plans

- Federal Budget presentation (possible)

- Approval of appropriation bills

Other key Documents:

- Quarterly Financial Reports

- Monthly Fiscal Monitor

- Annual Debt Management Strategy* and Debt Management Report*

- Annual Tax Expenditure Report

- *Tabled in Parliament

Supplementary Estimates (B) Totals

In these Supplementary Estimates:

- A total of 61 organizations presenting additional planned budgetary voted expenditures of $3.8 billion;

- Details on a $1.8 billion increase in forecast statutory spending; and

- $2.6 billion in frozen allotments which will lapse at the end of the fiscal year.

| $ billion (budgetary) | 2019–20 Authorities to Date |

2019–20 Supplementary Estimates (B) |

|---|---|---|

| Voted appropriations | 131.3 | 3.8 |

| Statutory Items | 175.1 | 1.8 |

| Total | 306.4 | 5.6 |

Major Voted Items

There are 8 items of $125M or more in these Estimates:

- Forgiveness of comprehensive land claim negotiation loans: $919.0M

- Child and Family Services: $588.3M

- Capital investments in support of Strong, Secure, Engaged: $487.3M

- Health, social and education services and support for First Nations children: $232.0M

- Write-off of unrecoverable debts for Canada Student Loans: $180.4M

- On-reserve emergency response and recovery: $150.0M

- Heyder and Beattie class actions final settlement agreement: $148.2M

- NATO and UN peace support missions: $128.5M

Next steps

February 2020

- Tabling of the Supplementary Estimates (B), 2019–20

- Tabling of the 2020-21 Main Estimates.

March 2020

- Introduction of appropriation bills for the Supplementary Estimates (B) and Main Estimates, anticipating Parliamentary approval by March 31, 2020.

June 2020

- Introduction of appropriation bill for Main Estimates.

3. OGGO Overview and Membership (SCMA)

Standing Committee on Government Operations and Estimates (OGGO)

Mandate of the Committee

The mandate of the Standing Committee on Government Operations and Estimates focuses on the estimates process as well as on the effectiveness and proper functioning of government operations.

Pursuant to Standing Order 108(3)(c) of the House of Commons, the mandate of the Standing Committee on Government Operations and Estimates includes the study of:

- Effectiveness of government operations;

- Expenditure budgets of central departments and agencies;

- Format and content of all Estimates documents;

- Cross-departmental mandates, including programs delivered by more than one department or agency;

- New information and communications technologies adopted by government; and,

- Statutory programs, tax expenditures, loan guarantees, contingency funds and private foundations deriving the majority of their funding from the Government of Canada.

The mandate pertaining to Estimates includes:

- Review of the process for considering the Estimates and supply;

- Format and content of all Estimates documents including:

- Estimates for programs delivered by more than one department or agency;

- Estimates delivered to other standing committees; and

- Specific operational and expenditure items across all government departments and agencies.

General Mandate

- Statutory programs;

- Tax expenditures;

- Loan guarantees;

- Contingency funds and private foundations deriving the majority of their funding from the government

Cross-Departmental Responsibilities:

- Global review of supply process, including financial reporting to Parliament;

- New and emerging information and communications technologies;

- Jointly-delivered programs;

- Operational activities in all departments;

- Supplementary review of departmental expenditures considered in other committees

The Committee is specifically mandated to examine and conduct studies related to the following organizations, whose operational responsibilities extend across the government:

Central Agencies and Departments

- Privy Council Office/Prime Minister’s Office

- Treasury Board of Canada Secretariat

- Public Services and Procurement Canada

- Shared Services Canada

Organizations Related to Human Resources Matters

- Public Service Commission

- Office of the Chief Human Resources Officer (TBS)

- Canada School of Public Service

- Public Service Labour Relations Board

- Public Service Staffing Tribunal

- Public Servants Disclosure Tribunal

Other Organizations

- Office of the Secretary to the Governor General

- Office of the Public Sector Integrity Commissioner

- Office of the Procurement Ombudsman

- Canadian Intergovernmental Conference Secretariat

Crown Corporations

- Canada Lands Company

- Defence Construction (1951) Limited

- Old Port of Montréal Corporation Inc.

- Public Sector Pension Investment Board

- Parc Downsview Park Inc.

- Royal Canadian Mint

TBS-Related Committee Activity from the end of the 42nd Parliament

Reports:

-

Veterans: A Valuable Resource for the Federal Public Service (tabled: June 18, 2019)

- GR requested, but cancelled by Parliamentary dissolution

Recommendations made to TBS:- (#5) Provide veterans with the same relocation benefit as public servants, and expand the relocation policy to include veterans who served at least five years

- (#6) Amend the Public Service Employment Act definition of “veteran” to include serving reservists

- (#10) Ensure that service in the military be counted on a one-for-one basis for vacation accrual and seniority rights for shift and vacation scheduling

- GR requested, but cancelled by Parliamentary dissolution

-

An

Even Greener Government: Improving the Greening Government Strategy to Maximize its Impact (tabled: June

17, 2019)

- GR requested, but cancelled by Parliamentary dissolution

- Recommendations made to TBS:

- (#5) Include SMART objectives in the Greening Government Strategy and add targets to the sections on adaptation to climate change and oversight and performance measurement

- (#12) Require that all federal organizations under the Greening Government Strategy include their targets in their Departmental Plans and Results Reports

-

Improving the

Federal Public Service Hiring Process (tabled: June 11, 2019)

- GR requested, but cancelled by Parliamentary dissolution

Recommendations made to TBS:- (#1) Publish disaggregated data on the public service workforce by employment equity group, by employee type (indeterminate, term, casual, student) and position level, and conduct an intersectional analysis by gender.

- GR requested, but cancelled by Parliamentary dissolution

Unfinished Studies:

- Phoenix Payroll System (Last Meeting: June 7, 2018)

- Name-Blind Recruitment Pilot Project (Last Meeting April 19, 2018)

Committee Members

| Chair | |||

|---|---|---|---|

|

Tom Lukiwski |

Conservative |

Moose Jaw—Lake Centre—Lanigan |

Returning Member (Chair in 42nd Parliament) |

| Vice-Chair | |||

|

Francis Drouin |

Liberal |

Glengarry—Prescott—Russell |

Returning Member (42nd Parliament) |

|

Julie Vignola |

Bloc Québécois |

Beauport—Limoilou |

New Member New MP |

| Members | |||

|

Steven MacKinnon |

Liberal |

Gatineau |

Returning Member (Non-voting - 42nd Parliament) Parliamentary Secretary to the Minister of PSPC |

|

Ziad Aboultaif |

Conservative |

Edmonton Manning |

New Member Digital Government Critic |

|

Kelly Block |

Conservative |

Carlton Trail—Eagle Creek |

Returning Member (41st Parliament, 1st session) |

|

Kelly McCauley |

Conservative |

Edmonton West |

Returning Member (42nd Parliament) |

|

Matthew Green |

New Democratic Party |

Hamilton Centre |

New Member New MP TBS Critic Ethics Deputy Critic |

|

Majid Jowhari |

Liberal |

Richmond Hill |

Returning Member (42nd Parliament) |

|

Irek Kusmierczyk |

Liberal |

Windsor—Tecumseh |

New Member New MP |

|

Patrick Weiler |

Liberal |

West Vancouver—Sunshine Coast—Sea to Sky Country |

New Member New MP |

TBS Related Committee Activity – 43rd Parliament, 1st Session

Anticipated Business

- Election of a Chair – February 20, 2020

- Supplementary Estimates (B), 2019-20

- 2020-21 Main Estimates

Meeting Summaries

Thursday, February 20, 2020 – Election of Chair

Tom Lukiwski (CPC) was elected Chair of the Committee (Previous Chair during 42nd Parliament). Francis Drouin (LPC) was elected first vice-chair; Julie Vignola (BQ) was elected second vice-chair. The Committee will next meet on Tuesday, February 25, 2020 from 8:45 a.m. to 10:45 a.m in camera. For the first hour, the Subcommittee on Agenda and Procedure will discuss future Committee business; for the second hour, officials from TBS’ Expenditure Management Sector have been invited to provide a briefing on the Estimates process. The Committee discussed devoting its meetings on February 27, 2020 and March 10 and 12, 2020 to Supplementary Estimates B, and inviting TBS, SSC and PSPC.

CHAIR

Tom Lukiwski (Moose Jaw—Lake Centre—Lanigan)

Conservative

Member

- Elected as the Member of Parliament for the riding of Moose Jaw—Lake Centre—Lanigan in the 2015 federal election and re-elected in the 2019 federal election.

- Previously elected as the Member of Parliament for the riding of Regina—Lumsden—Lake Centre 2004-2011.

- Ran his own small business prior to entering politics in 2004.

- Served as Chair on the Standing Committee on Government Operations and Estimates in the 42nd Parliament.

Interest in TBS Portfolio

- 43rd Parliament

- Written Questions: Topic includes national security exception for federal procurements.

- 42nd Parliament

- Written Questions: Topics included spider sightings, the monitoring of Parliamentary Committees & federal government job advertisements on Facebook.

1ST VICE-CHAIR

Francis Drouin (Glengarry—Prescott—Russell)

Liberal

Member

- Elected as the Member of Parliament for the riding of Glengarry—Prescott—Russell in the 2015 federal election and re-elected in the 2019 federal election.

- A member of the Standing Committee on Government Operations and Estimates and the Standing Committee on Agriculture and Agri-Food. Also a previous member of both those Committees in the 42nd Parliament.

- Prior to his election, Mr. Drouin worked as a special assistant in the Office of the Ontario Premier.

2nd VICE CHAIR

Julie Vignola (Quebec – Beauport—Limoilou)

Bloc Québécois

Member

- First elected in the 43rd general election.

- BQ Critic for Public Services and Procurement and government operations.

- Former high school teacher and vice-principal.

- Interested in and involved with various community wellbeing organizations: ex: Lions Club, Canada World Youth

- Advocate for Quebec’s independence.

Interest in TBS Portfolio

- In the 43rd Parliament:

- Question Period: Issues with the Phoenix Pay System and RCMP civilian employees being transitioned to the Phoenix Pay System.

Steven MacKinnon (Gatineau)

Liberal

Member

Parliamentary Secretary to the Minister of Public Services and Procurement

- Elected as the Member of Parliament for the riding of Gatineau in the 2015 federal election and re-elected in the 2019 federal election.

- Parliamentary Secretary to the Minister of Public Services and Procurement.

- Previously a non-voting Member of the Standing Committee on Public Accounts and the Standing Committee on Government Operations and Estimates.

- Previously a Member of the Standing Committee on Finance.

- Prior to his election, Mr. MacKinnon was a senior vice president at a global consultancy firm.

- Mr. MacKinnon served as an advisor to former Prime Minister Paul Martin and former New Brunswick Premier Frank McKenna.

Ziad Aboultaif (Edmonton Manning)

Conservative

Member

- Elected as the Member of Parliament for the riding of Edmonton Manning in the 2015 federal election and re-elected in the 2019 federal election.

- Official Opposition Critic for Digital Government.

- Served as Official Opposition Critic for National Revenue from 2015-2017 and for International Development from 2017-2019.

- Previously a Member of the Standing Committee on Foreign Affairs and International Development.

Interest in TBS Portfolio

- 43rd Parliament

- February 7, 2020: Received a briefing on Digital Government from OCIO, SSC and CDS. Requested a list of possible legislative changes required to advance Digital Government and expressed interest in future briefings on the file.

- Written Questions: Topics included Government Policy on Cyberattacks & Cybersecurity testing.

- 42nd Parliament

- Written Questions: Topics included expenses for stakeholders to attend Government conferences or announcements & at-risk and bonus payments to employees

Kelly Block (Carlton Trail—Eagle Creek)

Conservative

Member

- Elected as the Member of Parliament for the riding of Carlton Trail—Eagle Creek in the 2015 federal election and re-elected in the 2019 federal election.

- Previously elected as the Member of Parliament for the riding of Saskatoon—Rosetown—Biggar in 2008 and 2011.

- Official Opposition Critic for Public Services and Procurement

- Served as Vice Chair of the Standing Committee on Transport, Infrastructure and Communities in the 42nd Parliament.

- Member of OGGO during the 41st Parliament (from June 2011 – September 2013).

- Member of ETHI during the 40th Parliament (from January 2009 – February 2011).

Interest in TBS Portfolio

- In the 43rd Parliament:

- Question Period: Questioned the contract simplification initiative and raised concern over aging government cyber infrastructure.

- In the 41st Parliament:

- Participated in OGGO’s review of the estimates consideration process. The Committee made several recommendations aimed at aligning the budgetary and estimates processes (prescribe budget timing, budget items appear in Main Estimates, Standing Committees are briefed in camera in the estimates process).

- In the 40th Parliament:

- Participated in ETHI’s reviews of the Access to Information Act and of the Privacy Act.

Kelly McCauley (Edmonton West)

Conservative

Member

- Elected as the Member of Parliament for the riding of Edmonton West in the 2015 federal election and re-elected in the 2019 federal election.

- Previously served on the Standing Committee on Government Operations and Estimates.

- Served on the Executive Committee of the Board of Northlads, the Board of Alberta Aviation Museum.

- Chairperson of the EI Board of Referres for Edmonton and Northern Alberta.

- Hospitality professional (managing hotels and convention centres).

Interest in TBS Portfolio

- In the 43rd Parliament:

- In the House of Commons: On February 7, 2020 during debate referenced OGGO’s 2017 report on the Public Servants Disclosure Protection Act and noted that he hopes the new President of the Treasury Board returns to committee to discuss the file.

- In the 42nd Parliament:

- Committee:

- Veterans in the Public Service: Questioned why veterans lose seniority rights when working in the public service.

- Bargaining: Interested in the costing for the Phoenix damages offer (5 vacation days for public servants in certain unions) – Agreements were tentative, and a response was provided later.

- Public Service Employee Survey: Concerned about harassment numbers escalating in the public service during the PCO appearance.

- Public Servants Disclosure Protection Act: Interested in the Government’s progress in implementing the recommendations from OGGO’s 2017 report on the act. Moved several motions inviting former Treasury Board Presidents to appear on the subject; the invitations were not accepted.

- Written Questions: Topics included travel expenses for departmental employees, allocations from TBS for Vote40, & Government ads on Facebook.

- Committee:

- In the 42nd Parliament:

- Written Questions: Topics included ministerial travel expenses & performance incentives or bonuses.

Matthew Green (Ontario – Hamilton Centre)

New Democratic Party

Member

- First elected in the 2019 federal election in the riding formerly held by NDP MP David Christopherson.

- NDP Critic for Treasury Board, National Revenue, Public Services and Procurement, and Deputy Critic for Ethics.

- Former Councillor for the City of Hamilton (2014 to 2018).

- Member of the House of Commons Standing Committee on Public Accounts (PACP).

- Member of the Canada-Africa Parliamentary Association (CAAF) and the Canadian Section of ParlAmericas (CPAM).

Interest in TBS Portfolio

- In the 43rd Parliament:

- February 20, 2020: Estimates Process briefing with the department (EMS).

- February 18, 2020: TBS 101 briefing with department (PP).

- Question Period: Outsourcing of government contracts & dismissal of a public servant for comments made about the Prime Minister.

- Written Questions: Topics included social media influencers, management consulting contracts.

Majid Jowhari (Richmond Hill)

Liberal

Member

- Elected as the Member of Parliament for the riding of Richmond Hill in the 2015 federal election and re-elected in the 2019 federal election.

- Previously a member of thMajid Jowharie Standing Committee on Government Operations and Estimates and the Standing Committee on Industry, Science and Technology.

- A member of the Standing Committee on Government Operations and Estimates and the Standing Committee on Industry, Science and Technology.

- Prior to his election, Jowhari was a licensed Professional Engineer from 1995-1999 and founded his own boutique consulting firm to provide advice to chief financial officers.

- In 2018, the Canadian Alliance on Mental Illness and Mental Health (CAMIMH) named Majid Jowhari as a Parliamentary Mental Health Champion.

Irek Kusmierczyk (Windsor—Tecumseh)

Liberal

Member

Parliamentary Secretary to the Minister of Employment, Workforce Development and Disability Inclusion

- Elected as the Member of Parliament for the riding of Windsor—Tecumseh in the 2019 federal election.

- A member of the Standing Committee on Government Operations.

- Parliamentary Secretary to the Minister of Employment, Workforce Development and Disability Inclusion.

- Prior to his election, Mr. Kusmierczyk was a city councilor for the Windsor City Council.

Patrick Weiler (West Vancouver—Sunshine Coast—Sea to Sky Country)

Liberal

Member

- Elected as the Member of Parliament for the riding of West Vancouver—Sunshine Coast—Sea to Sky Country in the 2019 federal election.

- Member of the Standing Committee on Natural Resources.

- Environmental and natural resource management lawyer.

- Represented First Nations, municipalities, small businesses and non-profits on environmental and corporate legal matters within this riding.

- He is a champion of the Liberal government’s Pan-Canadian Framework on Clean Growth and Climate Change.

4. Overview of the Supplementary Estimates (B), 2019-20 (EMS)

Issue

What spending measures are contained in the Supplementary Estimates (B), 2019-20?

Key Facts

- Supplementary Estimates (B), 2019-20 presents $5.6 billion in budgetary expenditures:

- $3.8 billion in voted budgetary expenditures

- $1.8 billion in statutory budgetary expenditures.

- Supplementary Estimates (B), 2019-20 also presents $114.8 million in statutory non-budgetary expenditures:

Response

- Canadians and the Parliamentarians who represent them have the right to know how public funds are being spent, and to hold the government to account.

- Spending plans in the Supplementary Estimates respond to emerging priorities or contribute to measures previously identified, including in Budget 2019 and the Economic and Fiscal Update.

- These spending plans largely support on-reserve Indigenous social and emergency services, invest in military equipment and physical and technological infrastructure, forgive comprehensive land claim negotiation loans, and write-off unrecoverable Canada Student Loans.

Background

Through these Supplementary Estimates, the Government is seeking parliamentary approval for $3.8 billion in new spending for 61 organizations.

This represents a 2.9% increase over the authorities to date, bringing the total voted budgetary authorities for this fiscal year to $135.1 billion.

Roughly 75% of this new spending is for 8 items:

- $919 million for Crown-Indigenous Relations and Northern Affairs to forgive loans for comprehensive land claim negotiations

- $588 million for the Department of Indigenous Services for the First Nations Child and Family Services program

- $487 million for National Defence for capital investments in support of Canada's defence policy: Strong, Secure, Engaged

- $232 million for the Department of Indigenous Services to provide health, social and education services

- $180 million to write-off unrecoverable debts for Canada Student Loans

- $150 million for the Department of Indigenous Services to reimburse First Nations and emergency management service providers for on-reserve response and recovery activities

- $148 million for National Defence for the Heyder and Beattie class actions final settlement agreement

- $129 million for National Defence for NATO and UN peacekeeping support missions.

Supplementary Estimates (B), 2019-20

Government-Wide / Major Items

In this section

5. Department of Indigenous Services (EMS)

Issue

What spending is there in Supplementary Estimates (B), 2019-20 for Indigenous Services?

Key Facts

- Supplementary Estimates (B), 2019–20 includes $1.04 billion in voted budgetary funding for the Department of Indigenous Services, an increase of 8.2%.

Response

- The Government of Canada is committed to ensuring that consistent and high-quality services are delivered to Indigenous Peoples and communities across Canada.

- These Supplementary Estimates work to address critical on-reserve needs, such as improved access to health, social, educational and emergency management supports and services.

- In particular, and based on Jordan’s principle, new funding prioritizes the immediate needs of First Nations children to improve real-time access to health, social and education services.

Background

These Supplementary Estimates include over $1 billion for the Department of Indigenous Services:

- $588 million for First Nations Child and Family Services to improve access to prevention and early intervention programs and maintain the well-being and cultural connections of First Nation children in care.

- $232 million for a wide range of health, social and education services and support for First Nations children under Jordan’s Principle. The funding responds to increasing demand for services.

- $150 million to reimburse First Nations and emergency management service providers for on-reserve response and recovery activities. Activities can include, but are not limited to, the response and recovery of emergency events such as floods, wildfires, tornadoes, severe weather and loss of essential services.

- $52 million for Income Assistance and Infrastructure. The Income Assistance Program is similar to provincial and territorial income assistance programs and provides eligible individuals and their families with funds to cover essential needs.

- $16 million for the Community Opportunity Readiness Program which provides project-based funding for First Nation and Inuit Communities for a range of activities to support communities' pursuit of economic opportunities.

6. Department of National Defence (EMS)

Issue

What spending is there in Supplementary Estimates (B), 2019-20 for National Defence?

Key Facts

- Supplementary Estimates (B), 2019–20 includes $795 million in voted budgetary funding for the Department of National Defence, an increase of 3.7%.

Response

- The Government of Canada is committed to making sure that the Canadian Armed Forces have the tools and equipment they need to do their job.

- These new spending plans make needed investments in equipment and infrastructure, as well as in our work with our NATO and UN Peace Support Operations partners, to succeed on operations at home and abroad.

- Funding also aims to bring acknowledgement, healing and closure to our Canadian Armed Forces members who were harmed by sexual misconduct in the workplace.

- We will continue implementing Canada’s defence policy, Strong, Secure, Engaged to address the threats of the modern security environment.

Background

These Supplementary Estimates request $795 million for the Department of National Defence, including:

- $487 million for a range of capital projects under the Strong, Secure, Engaged defence policy, including military equipment, physical infrastructure and information management and technology systems.

- $148 million to fulfill immediate obligations and payments under the Heyder and Beattie class actions for current and former members the Canadian Armed Forces and current and former employees of the DND who experienced sexual misconduct. Funding is for the final settlement agreement, including payments to claimants, reimbursement of plaintiff legal fees, awareness building activities, administration and case management.

- $129 million in support of NATO assurance and deterrence measures in Central and Eastern Europe (Operation

REASSURANCE) and for UN Peace Support Operation Africa (Operation PRESENCE).

- This funding will support overseas missions, including the continued deployment of a land task force in Latvia, an air task force for patrol and training, naval vessels to work with NATO partners, transport aircraft and supporting personnel for UN operations in Uganda.

- $26 million to implement the LGBT Purge class action final settlement agreement. The settlement, signed in June 2018, includes compensation, reconciliation and memorialization measures.

- $5 million reinvestment of sales revenues from the Canada Lands Company and the disposal of a parcel of land in Nova Scotia.

7. Forgiveness of comprehensive land claim negotiation loans (EMS)

Issue

Why are comprehensive land claim negotiation loans being forgiven in Supplementary Estimates (B) 2019–20?

Key Facts

- These Supplementary Estimates include $919 million to forgive outstanding debts related to land claim negotiation loans.

Response

- The Government is committed to comprehensive land claim negotiations to give Indigenous Peoples the support they need for their communities to succeed.

- New funding plans in these Supplementary Estimates support Indigenous communities by fully forgiving all outstanding comprehensive claim negation loans.

- This spending plan responds to the unique land ownership, use and protection needs of Indigenous leadership, while also renewing the government-to-government relationship between Canada and Indigenous Peoples.

Background

Canada has been negotiating comprehensive land claims with Indigenous people since 1975. These modern treaties provide certainty regarding ownership and use of lands.

Forgiving and reimbursing loans will allow Indigenous communities to reinvest in their priorities like governance, infrastructure and economic development that will increase health and well-being for all community members.

Budget 2019 proposed funding of $1.4 billion over seven years starting in 2018–19, to forgive all outstanding comprehensive claim negotiation loans and to reimburse Indigenous governments that have already repaid these loans.

These Supplementary Estimates include $919 million to forgive outstanding debts related to land claim negotiation loans. There are no funds in these Estimates for reimbursements.

8. Canada Student Loan Write-offs (EMS)

Issue

Why are student loans being written off in Supplementary Estimates (B) 2019–20?

Key Facts

- These Supplementary Estimates include $180.4 million to write-off 33,098 unrecoverable debts owed to the Crown for directly financed Canada Student Loans.

Response

- The Government is committed to making higher education more affordable for Canada’s hard-working students who are trying to get ahead.

- This new funding would contribute to this direction by writing off outstanding student loans that cannot be collected form borrowers over the past six years because of compromise settlements, bankruptcy, and extreme financial hardship.

- We will continue working to make education funding support more affordable and providing repayment assistance and information to those having trouble paying.

Background

These Supplementary Estimates include $180.4 million to write-off 33,098 unrecoverable debts owed to the Crown for directly financed Canada Student Loans.

The vast majority of the write-off value is comprised of loans that have not received payment or acknowledgement of debt for six years. Other reasons for write-off include bankruptcy, extreme financial hardship, and compromise settlements.

Defaulted loans are written off on a regular (annual) basis, consistent with standard accounting practices.

The Department of Employment and Social Development recognizes the importance of minimizing write-offs and works with partners like the Canada Revenue Agency to improve the repayment and collection of loans.

Only a very small proportion of loans are written off. The program issued $3.4 billion in loans to approximately 600 thousand students in 2017-18.

Amounts included in these supplementary estimates are consistent with write-offs for Canada Student Loans in recent years.

9. Statutory Expenditures (EMS)

Issue

Why is statutory spending increasing so much in the Supplementary Estimates (B), 2019-20?

Key Facts

- Supplementary Estimates (B), 2019-20 presents:

- $1.8 billion in statutory budgetary expenditures (a 1% increase)

- $115 million in statutory non-budgetary expenditures (a 5.5% increase)

Response

- The Government is committed to ensuring that all spending approved by Parliament is done appropriately, accountably and with transparency.

- Statutory expenditures in these Supplementary Estimates have already been authorized by Parliamentarians through various legislation, such as financial support to Canada’s dairy farmers and our payment to the Green Municipal Fund.

- While there is an increase in statutory expenditures from the previous Supplementary Estimates (A), this already-approved funding accelerates more green projects and climate action, increases global market access for Canada’s dairy farmers, and helps students pay for their higher education.

Background

Estimates documents include updates for significant changes in planned statutory expenditures for information purposes only.

These Supplementary Estimates show a $1.8 billion increase in budgetary statutory spending, mainly due to:

- $950 million for a payment to the Federation of Canadian Municipalities for the Green Municipal Fund which encourages investment in environmental projects;

- $345 million for grants under the Dairy Direct Payment Program which supports dairy producers as a result of market access commitments made under recent international trade agreements;

- $230 million for additional Canada Student Grants; and

- $109 million for the Climate Action Incentive Fund which supports projects to decrease energy usage and reduce carbon pollution.

These Estimates also include a $115 million increase in non-budgetary statutory spending which reflects changes in net expenditures for student and apprenticeship loans.

10. Frozen Allotments (EMS)

Issue

What do the frozen allotments report on in the Supplementary Estimates (B), 2019-20?

Key Facts

- For the fiscal year 2019–20, the total amount frozen in voted authorities is $2.6 billion as of January 21, 2020.

Response

- As spending needs evolve over the fiscal year, responsible expenditure management is at the heart of the effective operations of government.

- Frozen allotments are funds that have been approved by Parliamentarians that the Treasury Board restricts for operational reasons, such as a department’s need to reallocate or reprofile these funds, or reduced funding needs because a program or initiatives has been cancelled.

- These Supplementary Estimates detail $2.6 billion in frozen allotments for 2019-20 mainly due to reprofiling reasons.

Background

During the fiscal year, the government can take decisions to adjust priorities or the implementation of individual initiatives. These decisions are implemented by using frozen allotments to constrain appropriated authorities where necessary.

At the end of the fiscal year, these frozen allotments are included in the lapse shown in Public Accounts.

For the fiscal year 2019–20, the total amount frozen in voted authorities is $2.6 billion as of January 21, 2020.

These frozen allotments are mainly due to the planned reprofiling of $1.8 billion to future years.

Reprofiling provides for unused authorities from one fiscal year to be made available in subsequent fiscal years, to reflect changes in the expected timing of program implementation. Unused funds in the current fiscal year are put into a frozen allotment.

An additional $432 million is due to uncommitted authorities in the Treasury Board-managed central votes.

Details on frozen allotments are provided in an online annex to Supplementary Estimates (B), 2019-20.

Supplementary Estimates (B), 2019-20

TBS Perspective

11. TBS Vote 1, Program Expenditures (CSS)

Issue

How does TBS plan to spend Vote 1, Program Expenditures in the 2019-20 Supplementary Estimates (B)?

Key Facts

- Seeking parliamentary approval for a $1.9 million increase in Vote 1, Program Expenditures

- The increase is offset by a funding transfer from the Greening Government Fund

Response

- This year, in the Supplementary Estimates (B), TBS is seeking parliamentary approval to increase its Vote 1, Program Expenditures by $1.9 million.

- This money would allow TBS to continue its work on a number of initiatives, including a Financial and Materiel Management Solution, a Portfolio Management Project, a Workload Migration project, and an Online Regulatory Consultation System.

- Costs for these projects would be largely offset by a funding transfer from the Greening Government Fund to other government departments to support innovative approaches in reducing greenhouse gas (GHG) emissions in their operations.

Background

TBS will be seeking Parliamentary approval to increase its Vote 1, Program Expenditures authorities in 2019-20 by $1.9 million for the following:

- $4.3 million from contributing organizations to TBS for the Government of Canada financial and material management solution project to continue developing a solution for 18 organizations using the FreeBalance system, no longer supported by the vendor.

- $1.0 million transfer from Shared Services Canada to TBS to support the Government of Canada Portfolio Management Project. This funding will cover the work required to design the foundational capabilities for a common solution focusing on business-intake capabilities, data mapping, process mapping, and the development of common dashboards.

- $0.8 million transfer from Shared Services Canada to TBS for the Workload Migration project, which will modernize the digital citizen services and proactively address cybersecurity threats, help organizations migrate their applications from older data centres to modern data centres or cloud solutions.

- $0.5 million for an Online Regulatory Consultation System to address the growing need to conduct transparent regulatory consultations online, through a web portal or platforms, and allow for the public posting of comments.

- $4.8 million transfer from TBS’s Greening Government Fund to 13 projects in other government departments and agencies to support innovative approaches in reducing greenhouse gas (GHG) emissions in government operations.

12. Treasury Board Central Votes (EMS)

Issue

What allocations have been made from Treasury Board Central Votes since the tabling of Supplementary Estimates (A), 2019-20?

Key Facts

- Supplementary Estimates (B), 2019–20 provides details on allocations of roughly $117 million from Treasury Board central votes and $283 million from budget implementation votes.

Response

- The Government is committed to making its spending plans and allocations transparent, focussed and accountable to deliver effective programs and services to Canadians.

- The use of Treasury Board central votes helps the Government address pressing issues and responsibly expedite the implementation of programs and services.

- With these Supplementary Estimates, allocations are planned for grant payments, data centre and cloud services migration, and pay list requirements, including maternity and parental allowances, among other measures.

Background

TB Vote 5, Government Contingencies, allows Treasury Board to provide for miscellaneous, urgent or unforeseen expenditures that are not otherwise provided for in the authorities approved through departmental votes.

- $4.9 million was allocated to the Department of Canadian Heritage to provide timely grant payments to the Rideau Hall Foundation.

- This allocation will be reimbursed following Royal Assent of Supplementary Estimates (B).

TB Vote 10, Government-Wide Initiatives, supports strategic management initiatives of the federal public administration.

- $3.5 million was allocated to the Canada Revenue Agency as part of the Application Modernization Initiative.

- This funding will support the Canada Revenue Agency's efforts to migrate at-risk business applications into more secure modern data centres or cloud services.

TB Vote 30, Paylist requirements, allocates funds to departments for maternity and parental allowances, severance pay, and other payments related to changes to the terms and conditions of employment.

- $109 million has been allocated to 19 organizations to reimburse them for eligible expenditures.

An additional $283 million has been allocated to departments from their Budget 2019 measure-specific votes since the tabling of Supplementary Estimates (A), 2019-20. Further information regarding these allocations can be found online.

Hot Issues for TBS

In this section

- Implementation of Budget 2019 (EMS)

- Estimates Reform and Implementation of Budget 2020 (EMS)

- Coronavirus (EMS)

- Greening Government (Greening)

- Mental Health in the Public Service (OCHRO)

- Public Service Culture – Workplace Wellbeing (OCHRO)

- Public Service Employment Survey (OCHRO)

- Regulatory Modernization (RAS)

- Funding for the Office of the Auditor General (SCMA)

- Royal Canadian Mounted Police Deeming (OCHRO)

- Communications Policy and Advertising (SCMA)

- Hiring Veterans for Public Service Positions (OCHRO)

- Security Breaches (OCIO)

- Conflict of Interest Act (PP)

- Lobbying Act (PP)

- Public Servant Disclosure Protection Act Review (OCHRO)

13. Implementation of Budget 2019 (EMS)

Issue

Do these Supplementary Estimates B include funding for Budget 2019 measures?

Key Facts

- Funding for Budget 2019 measures has already been approved by Parliament.

Response

- With Budget 2019, the Government committed to investing in the middle class and to grow Canada’s economy for the long term, in a fiscally responsible way.

- Nearly 12 months later, roughly 90% of all Budget 2019 measures have or are being implemented.

- To date, millions of Canadians have benefited from the Government’s many budget measures.

Background

New funding for Budget 2019 measures was included in each department's 2019-20 Main Estimates, through budget implementation votes.

This approach allowed for alignment and reconciliation of the Budget and Main Estimates. It also reduced the time required for departments to obtain Parliamentary authority for new spending.

Monthly online reporting ensured transparency on timing of Treasury Board approvals and the disposition of funds.

To date, roughly 90% ($5.2 billion) of Budget 2019 measures are being implemented.

$4.8 billion has been allocated from the budget implementation votes to the regular departmental votes. Another $400 million will be spent through other authorities, such as statutory expenditures for Employee Benefits Plans, reprofiles to subsequent fiscal years, or amounts set aside to cover the costs of office accommodation and information technology services.

Roughly $600 million (10%) has not yet been allocated.

14. Estimates Reform and Implementation of Budget 2020 (EMS)

Issue

How does the Government plan to implement new spending announced in Budget 2020?

Key Facts

- The 2020-21 Main Estimates do not include any spending related to Budget 2020.

- New voted spending for Budget 2020 will be included in an Estimates after the Treasury Board has approved the detailed program proposals.

Response

- The House of Commons Standing Order 81(4) requires the Government to table the Main Estimates on or before March 1; the Budget is often tabled after March 1.

- As a result of the provisional standing orders, the Main Estimates were tabled after the federal Budget in the fiscal years 2018–19 and 2019–20. The provisional standing orders have now expired.

- As a result, the Main Estimates do not include any spending related to forthcoming Budget 2020 measures.

- Supplementary Estimates will address additional spending needs not covered within the Main Estimates, including Budget 2020 measures.

Background

As a result of the provisional standing orders, the Main Estimates were tabled after the federal Budget in the fiscal years 2018–19 and 2019–20.

During this two-year pilot project, the Main Estimates included Budget implementation votes to present new funding associated with Budget 2018 and 2019.

The pilot lasted until the end of the previous Parliament. There is no plan to extend the pilot or the use of budget implementation votes in the current Parliament.

New voted spending for Budget 2020 will be included in an Estimates after the Treasury Board has approved the detailed program proposals.

The Government may table up to three Supplementary Estimates during the 2020‑21 fiscal year.

15. Coronavirus (EMS)

Issue

Why isn't there any funding in these Estimates to address the 2019 Novel Coronavirus outbreak?

Key Facts

- No funding is included in these Estimates specifically to address the Canadian government's response to the coronavirus.

Response

- The health and safety of Canadians are priorities for the Government of Canada.

- The Government is actively contributing to the global response to the 2019 Novel Coronavirus outbreak.

- Foreign Affairs, Health Canada, National Defence and Public Safety have been working together and with international partners on the Coronavirus response, including the actions to bring Canadians home from affected areas and prevent and limit the spread of the virus.

- These departments are using existing resources to mobilize and respond, both at home and abroad.

Background

No funding is included in these Estimates specifically to address the Canadian government's response to the coronavirus.

The Public Health Agency of Canada is currently working with the provinces and territories, and international partners, including the World Health Organization, to actively monitor the situation.

Global Affairs Canada is also providing assistance to Canadians currently in the Hubei province of China, where travel restrictions have been imposed.

Departments have existing programs and resources to address urgent requirements, such as relocation of Canadians.

Should additional resources be required, they will be included in future Estimates.

16. Greening Government (Greening)

Issue

The government is transitioning to low-carbon and climate-resilient operations, while also reducing environmental impacts beyond carbon. Led by the Centre for Greening Government in TBS, the government will ensure that our government operations are low-carbon, resilient and green.

Key Facts

- As of fiscal year 2018-19, departments have reduced emissions by 32.6% below 2005 levels. These reductions have come from Government of Canada facilities and its administrative fleet.

Response

- Our government is committed to leading on climate change, which includes taking action on reducing the greenhouse gas emissions generated from its own operations.

- We must lead by example. Our Greening Government Strategy aims to reduce greenhouse gas emissions from federal operations by 80% below 2005 levels, striving to be carbon neutral, by 2050. As of fiscal year 2018-19, emissionswere down 32.6%.

- The Government is also committed to taking action to reduce plastic waste, and by 2030, at least 75% of plastic waste generated by federal operations will be diverted away from landfills.

Background

Through the Greening Government Strategy, the Government will reduce greenhouse gas emissions from its operations to demonstrate its leadership on climate change. It committed to reducing its own greenhouse gas emissions by 40% by 2030 (with an aspiration to achieve this target by 2025) and 80% below 2005 levels by 2050 (with an aspiration to be carbon neutral).

In 2018-19, the government’s greenhouse gas reporting was extended to include all departments that own significant numbers of vehicles and buildings. Although additional departments were included, the federal government was able to maintain its course on emissions reduction. In fact, the government showed an overall reduction of over 32% below 2005 levels, the same as the previous year. The result also indicates that departments took tangible steps to further reduce their emissions, because Canada experienced a hotter-than-average summer and a colder-than-average winter in 2018-19.

The Greening Government Fund provided financial support for 13 projects in 2019-2020. The Fund promotes innovative approaches to reducing greenhouse gas emissions and provides funding for projects in departments and agencies to reduce greenhouse gases in their operations. The next round of project funding will be announced in Spring 2020.

In addition to the focus on reducing greenhouse gas emissions, the Greening Government Strategy includes commitments related to water consumption, waste, including new commitments on better managing the use and disposal of plastics, green procurement and resilience to the impacts of climate change.

In 2018, the Government announced new commitments to divert at least 75% of plastic waste generated by federal operations by 2030 by reducing unnecessary use of single-use plastics, increasing the reuse and recycling of plastic in government operations, buying more products made from recycled plastics, and reducing packaging waste.

17. Mental Health in the Public Service (OCHRO)

Issue

Update on the Mental Health in the Public Service.

Key Facts

- Budget 2018 committed $71.9 million over six years and $3.6 million ongoing for Wellness, Inclusion and Diversity. This includes funding for the Centre of Expertise on Mental Health in the Workplace.

Response

A healthy workplace is the foundation of an effective, productive and engaged federal public service that is best able to serve Canadians.

The Federal Public Service Workplace Mental Health Strategy is an important part of the government’s efforts to build a healthy, respectful and supportive work environment.

In support of the Strategy, and the broader National Standard for Psychological Health and Safety in the Workplace, the Centre of Expertise on Mental Health in the Workplace helps federal organizations implement their action plans.

The Government will continue to work with bargaining agents and other stakeholders to address mental health issues in the workplace and make sure we have the best possible system in place.

Background

In January 2013, the Mental Health Commission of Canada, the Canadian Standards Association and the Bureau de normalisation du Québec launched the National Standard of Canada for Psychological Health and Safety in the Workplace (the Standard)—the first of its kind in the world.

The standard itself is voluntary, intended as a framework that provides tools, not rules, to help organizations in establishing a psychological health and safety management system contextualized to their workplace.

In March 2015, the former President of the Treasury Board and the Public Service Alliance of Canada (PSAC) reached an agreement to establish a Joint Task Force to address mental health in the federal public service.

Between December 2015 and January 2018, the Joint Task Force produced three reports, which include recommendations and guidance for federal organizations on culture change, leadership and engagement, education, training and workplace practices, communication and promotion, and measurement and accountability.

The third report is a roadmap to establish and maintain a Psychological Health and Safety Management System (PHSMS) in the federal public service, in alignment with the standard. The Centre of Expertise on Mental Health in the Workplace (CoE) provides advice, guidance and support to federal organizations in their efforts to implement a PHSMS aligned with the standard.

In October 2019, the Quebec Coroner’s Office issued a report relating to the death of a former public servant, Linda Deschâtelets, in 2017. The report made two recommendations for the Treasury Board Secretariat (TBS): (1) that each federal institution apply the National Standard for Psychological Health and Safety in the Workplace; and (2) that TBS work with unions to ensure employees’ pay-related issues are quickly resolved to improve workplace wellbeing and eliminate psychological stress. TBS is currently reviewing the coroner's recommendations.

The CoE is a collaborative initiative between departmental officials and bargaining agents, and was a key recommendation from the Joint Task Force and employee consultations. Two co-chairs oversee the work of the CoE: one representing the Employer, the other Bargaining Agents.

Established in 2017, the CoE was initially supported through TBS internal reallocations; Budget 2018 confirmed funding for Wellness, Inclusion and Diversity ($71.9 million over six years and $3.6 million ongoing), the envelope through which the CoE is now funded.

18. Public Service Culture – Workplace Wellness (OCHRO)

Issue

Workplace wellness continues to be a priority for the federal public service. What actions is TBS taking to promote workplace wellness?

Response

- The government is committed to promoting workplace wellness across the federal public service, notably through the Centre for Wellness, Inclusion, and Diversity, and the Centre of Expertise on Mental Health in the Workplace.

- Some specific actions include the Harassment Prevention Action Plan and the activities under the Wellness, Inclusion, and Diversity Strategy which help to raise awareness of mental health, wellness and prevent workplace harassment and violence.

- While the 2019 Public Service Employee Survey has indicated that harassment and discrimination continue to be areas of concern, we are advancing policy to prevent harassment through the implementation of Bill C-65 and guidance on preventing domestic violence.

- Changing behaviours will help create a public service culture where wellness, diversity and inclusion are embraced and recognized for the benefits they provide to organizations.

Background

Budget 2018 announced the creation of, and funding for, a Centre on Diversity, Inclusion and Wellness. It has since been rebranded as the Centre for Wellness, Inclusion and Diversity (CWInD) and was launched in June 2019.

The core focus of CWInD is to support departments and agencies in creating safe, healthy, diverse and inclusive workplaces.

Specifically, CWInD provides advice and leadership on policy issues related to wellness, diversity and inclusion and is a central body to bring increased coherence to activities being carried out across the enterprise. It does this by:

- Conducting Smart Dive research analysis, which aims to generate a better understanding of long-standing issues related to wellness, inclusion and diversity, and to provide leaders at all levels with clear roadmaps to shape actions and change behaviours; and

- Designing and operating an online platform and providing related support to policy centres and partner organizations in launching and implementing initiatives in support of wellness, inclusion and diversity.

Furthermore, the Wellness, Inclusion, and Diversity Strategy provides an overall framework for the ongoing implementation of public service initiatives in these areas and integrates the recommendations and initiatives of a number of reports, including: the Final Report of the Joint Union/Management Task Force on Diversity and Inclusion; Many Voices, One Mind: A Pathway to Reconciliation; and Safe Workspaces' report on harassment.

The Centre of Expertise (CoE) on Mental Health in the Workplace - was launched in 2017 to facilitate easy access to resources and tools for organizations, managers and employees. The CoE is intended to guide organizational efforts to build a healthy, respectful and supportive federal public service, provide access to documents and tools, and collect and share leading practices.

The Federal Workplace Mental Health Checklist is a tool to evaluate the implementation of the Federal Public Service Workplace Mental Health Strategy. The objectives of the 2019 Checklist are to gather intelligence on the relative maturity of each federal organization vis-à-vis their implementation of the Strategy, provide data to organizations so they can baseline and evaluate their own progress, and inform the CoE on Mental Health on where to focus its efforts to best support organizational needs moving forward.

The Public Service Employee Survey, in its 2019 annual cycle, indicated that 14% of respondents reported they had been a victim of harassment on the job in the past 12 months. The rate for discrimination was 8%. These results are higher for several diverse groups.

Bill C-65 received Royal Assent on October 25, 2018 and will come into force in 2020. Bill C-65 expands the current violence prevention requirements under Part II of the Canada Labour Code (occupational health and safety) to ensure that employers take the necessary steps to prevent and protect against both harassment and violence in the workplace. Bill C-65 will require significant changes to the current TBS framework related to the prevention and resolution of harassment, as well as to the separate departmental violence prevention policies at play across the system.

In preparation for the coming info force of Bill C-65, OCHRO is developing a Treasury Board Directive on harassment and violence prevention that will flow from the Policy on People Management (ECLR lead). The ADM Tripartite Committee on the Root Causes of Harassment has developed a tool kit to support deputies in their efforts to address the challenges in their organizations. In addition, OCHRO has develop a draft Policy template outlining a consistent understanding of the requirements. The template would be easily adaptable for all departments; other tools and guides are being considered. Bargaining agents have been involved in this work.

19. Public Service Employee Survey (OCHRO)

Issue

The annual Public Service Employee Survey (PSES) measures federal government employees’ opinions about their engagement, leadership, workforce and workplace. The release of the 2019 PSES results has drawn media attention in the National Capital Region.

Key Facts

- Advanis, a Canadian market and social research firm, conducted the 2019 PSES from July 22 to September 6, 2019, on behalf of the Treasury Board of Canada Secretariat (TBS).

- The results of the 2019 PSES for the overall public service and for each participating department and agency, with demographic breakdowns, were released on January 13, 2020, and posted on the Public Service Employee Survey web page.

Response

- Canadians depend on our world-class federal public service to deliver a wide range of services.

- The Government is committed to ensuring that ongoing workplace improvements are founded on careful study and strong evidence, including information gathered through employee surveys.

- Conducting an annual survey speaks to the importance we give to reinforcing a culture of respect within the public service, and to continue building an energized, innovative and inclusive public service.

- Results from this year’s survey are generally more positive compared to those from 2018, and indicate that the majority of public service employees like their job and with their organization.

- There is still work to do on workplace well-being and compensation, and we will continue our efforts to build a healthy, respectful and supportive work environment for all employees.

- For example, the new Centre for Wellness, Inclusion and Diversity within the public service, announced in Budget 2018, is supporting departments and agencies in these efforts.

Background

Generally, 2019 PSES results are more positive compared to results from the 2018 survey. The areas that showed most improvement include:

- Perceptions on Senior Management

- Employee Empowerment

68% of employees said that senior managers in their organization lead by example in ethical behavior, an increase from 63% in 2018. Also, 63% of employees felt that they would be supported by their department or agency if they proposed a new idea, up from 57% in 2018.

Employees continue to have compensation issues. In 2019, 74% of employees indicated that their pay or other compensation had been affected by issues with the Phoenix pay system, an increase from 2018 (70%). Of these employees, more than half indicated that they have experienced new pay or compensation issues in the last 12 months.

Results for questions pertaining to workplace wellbeing have been improving slightly. More than half of employees consider their workplace to be psychologically healthy: 61% in 2019 compared to 59% in 2018, and 56% in 2017.

According to the 2019 PSES results, 14% of employees indicated that they experienced harassment in the past 12 months, slightly lower than in 2018 (15%), and 8% indicated that they experienced discrimination, unchanged from 2018.

These results underscore the need to have the right tools, policies, and supports in place. Harassment has no place in the public service. We must all continue to work together to create a healthy, harassment-free, diverse, and inclusive workplace.

Following an official Request for Proposal (RFP) process, TBS awarded the contract to administer the 2018 PSES to Advanis, a Canadian market and social research firm. The one-year contract provided for two, one-year renewal options for 2019 and 2020.

20. Regulatory Modernization (RAS)

Issue

In response to stakeholders and businesses, Canada is working to improve its regulatory system.

Key Facts

- The Government announced a series of new initiatives through Budget 2018, the 2018 Fall Economic Statement, and Budget 2019, focused on enhancing agility in the regulatory system and innovation in Canada.

Response

- The Government of Canada is committed to modernizing Canada’s regulatory framework to increase business competitiveness and economic growth, while protecting Canadians’ health, safety, security and the environment.

- We have taken steps to simplify regulations, eliminate barriers, and encourage innovation to help Canadian businesses grow and be more competitive.

- Through our collaborative work with domestic and foreign partners, and ongoing feedback from stakeholders and business, we continue to identify opportunities to make efficiency and economic growth a permanent part of regulators’ mandates.

Background

The Government introduced the first annual Regulatory Modernization Bill, through the Budget Implementation Act 2019, to eliminate outdated legislative requirements that are barriers to regulatory modernization.

- In May 2019, the Government established the External Advisory Committee on Regulatory Competitiveness (as first outlined in the 2018 Fall Economic Statement) with business leaders, academics and consumer representatives from across Canada.

- To date, this committee has provided 2 recommendation letters to the President of Treasury Board, including the second round of Targeted Regulatory Reviews.

Budget 2019 announced the completion of the first round of targeted regulatory reviews in key economic sectors and provided permanent funding to TBS to continue its leadership in promoting regulatory cooperation.

- Regulatory Roadmaps were released shortly thereafter with the results of the reviews, with over $200 million in funding allocated in support of the Roadmaps. The second round of targeted regulatory reviews is focussing on: clean technology; digitalization and technology neutrality; and international standards.

In its 2018 Fall Economic Statement, the Government announced a set of new initiatives focused on enhancing agility in the regulatory system:

- exploring making competitiveness part of regulators' mandates;

- announced the review of the Red Tape Reduction Act;

- introducing an annual Regulatory Modernization Bill;

- establishing an External Advisory Committee on Regulatory Competitiveness;

- launching a Centre for Regulatory Innovation; and

- $10 million fund to build regulatory capacity within the Government.

Budget 2018 provided funding for an online regulatory consultation portal, for regulatory cooperation work with provinces and territories, and three years of funding for targeted regulatory reviews in key economic sectors. It also set out reviews in the health and biosciences, agri-food and aquaculture, and transportation and infrastructure sectors.

21. Funding for the Office of the Auditor General (SCMA)

Issue

Why does the Government not provide adequate funding for the Office of the Auditor General?

Response

- The Government of Canada is committed to supporting the important and ongoing work of the Auditor General.

- Where an officer of Parliament, such as the Auditor General, identifies the need for additional resources, the government considers such a request, to ensure that the Office can continue to fulfill its mandate efficiently and effectively.

Background

The OAG’s reference levels were increased in 2018-19 to improve the Office’s financial audit capacity to respond to an increase in the volume and complexity of government operations and transactions. This funding contributed to ensuring that the Office continues to meet service standards, provide accurate and timely audit information, and renew its self-managed IT systems. As a result, the OAG’s FTEs increased by 7% or 38 FTEs. Of the 38 new FTEs, 28 were for audit operations, and 10 were IT technical staff.

To receive additional funding, the Office of the Auditor General would need to make a request through the Minister of Finance. The Office would then work with the Treasury Board Secretariat to develop a submission to seek the necessary authorities to access the funding approved.

The AG has been vocal in committee during the last session and there was a media call from Post Media in May 2019.

On January 29, 2020, the House of Commons passed a Conservative Opposition Motion calling on the Auditor General of Canada to conduct an audit of the Government’s “Investing in Canada Plan.” Since then, Conservative MPs have made a number of interventions during Question Period asking the Government to ensure that the Auditor General’s Office is adequately resourced.

There is a decrease of roughly $300K from the 2019-20 Main Estimates to the 2020-21 Main Estimates. This decrease of less than 0.5% is related to a (non-material) reduction in the forecast of statutory employee benefit payments. Voted amounts are identical to 2019-20.

22. Royal Canadian Mounted Police Deeming (OCHRO)

Issue

Does the President support moving RCMP civilian members to the Phoenix pay system?

Key Facts

- Approximately 3,500 RCMP civilian members will be deemed to be appointed under the Public Service Employment Act (PSEA) as of May 21, 2020, under the RCMP Category of Employee (COE).

- This initiative will eliminate inconsistencies in the terms of employment and among many RCMP employees, improve human resources management and expand career opportunities for these employees.

- Deeming will establish two distinct categories of employees at the RCMP: RCMP regular members appointed under the Royal Canadian Mounted Police Act (RCMP Act) and paid through the RCMP pay system, and other public service employees appointed under the PSEA and paid through the Phoenix pay system.

- Civilian members have expressed concern regarding their transfer into the Phoenix pay system

Response

- Deeming will only proceed when the Government can assure a seamless transition of RCMP civilian members to the Government of Canada’s pay system.

- We have established a rigorous framework to evaluate system readiness. There have been extensive consultations with union representatives and civilian members on this matter.

- Should they proceed, the RCMP, Public Services and Procurement Canada, Shared Services Canada, and the Treasury Board Secretariat of Canada have been developing measures to support the smooth transition of RCMP civilian members into the federal public service.

If pressed on when a decision will be made

- The RCMP, Public Services and Procurement Canada, Shared Services Canada, the Treasury Board Secretariat of Canada, along with the bargaining agents, are working together closely on this decision. Deeming will only proceed when we can assure a smooth transition to the pay system.

Background

In 2013, Parliament passed the Enhancing Royal Canadian Mounted Police Accountability Act, which along with other changes, determined that civilian members of the Royal Canadian Mounted Police would eventually be “deemed” to be appointed under the Public Service Employment Act (PSEA), like most other federal public servants.

Civilian members of the Royal Canadian Mounted Police (RCMP), currently appointed under the Royal Canadian Mounted Police Act (RCMP Act), were to be deemed to be appointed under the em>Public Service Employment Act (PSEA) as of April 26, 2018. [redacted] the original deeming date of April 26, 2018 was amended to May 21, 2020.

23. Government of Canada Advertising (SCMA)

Issue

Why does the government advertise to Canadians and how does it ensure it is non-partisan?

Key Facts

- Non-partisan reviews of advertising are conducted by Ad Standards, the organization that administers the Canadian Code of Advertising Standards.

- Government ads undergo a two-step review based on a 10-point checklist.

- Since 2016 Ad Standards has performed approximately 600 reviews of Government ads for non-partisanship.

- 14 ads were flagged as not fully aligning with the definition of non-partisan communications during the initial review but were corrected before being made public.

- TBS is not aware of any public complaints about partisanship in Government of Canada advertising since these measures were put in place.

Response

- The government uses advertising to inform Canadians about its programs, services, policies, and decisions.

- Advertising is one of the ways the government informs Canadians about: