Guidebook for a Departmental Audit Committee

This document is intended to provide advice and guidance and to be a source of consideration and resource material on the subject of Departmental Audit Committees. This document does not constitute a departmental legal or policy requirement, nor does it establish monitoring obligations on the part of the Treasury Board of Canada Secretariat.

Table of Contents

- Message From the Comptroller General of Canada

- 1.0 Introduction

- 2.0 Overview of a Departmental Audit Committee (DAC)

- 3.0 Functioning of a DAC

- 4.0 Aides-Mémoire

- Appendix A: Suggested Departmental Support for a DAC

- Appendix B: Sample Table of Contents for a DAC Orientation/Reference Binder

- Appendix C: DAC Self-Assessment Questionnaire

- Other Comments

- Note and Acknowledgements

Message From the Comptroller General of Canada

The Office of the Comptroller General (OCG) has revised the Guidebook for a Departmental Audit Committee (DAC) with the aim of issuing an updated version in response to calls from the DAC community. In the consultations that took place with DAC members during the revision process, it became apparent that the continued utility of the guidebook would depend on more than simply pointing to recent policy changes. We also heard that the DAC community required a less introductory version of the guidebook, one that was more in keeping with the sensibilities of experienced audit committees familiar with government operations. When developing the revised guidebook, consideration was also given to the evolution of the internal audit function across government over the last several years.

The staggering of second-term appointments as recommended by the OCG has resulted in DAC retaining corporate knowledge and in some cases becoming the corporate memory for risk management, control and governance issues. This revised and updated guidebook is designed to get to the core of the new maturity of DAC and directly and succinctly provide the information they require to support them in their work. While guidance is provided, this document considers the variety of mandates of the departments and their associated DAC and attempts to include the necessary flexibilities.

DACs were in place during the global economic downturn and the subsequent entry into an environment of cost constraint in the public and private sectors. Their contribution then was significant, and the strategic value that DAC add to departments continues to appreciate. The provision of this updated guidance will coincide with the point of traction on transformative government modernization initiatives in which DAC will have an important advisory role. Our intention is that this publication will be as useful a tool to audit committees in addressing the coming challenges as its predecessor was in establishing the foundation for DAC in federal government organizations.

Bill Matthews

Comptroller General of Canada

1.0 Introduction

Departmental Audit Committees (DACs) are an essential component of the structures and processes of good governance. This Guidebook for a Departmental Audit Committee presents a framework to support the work of DACs, with the understanding that each individual committee should tailor the guidance set out here to meet its specific needs. In doing so, DAC should consider the unique circumstances of their departmentSee Footnote 1 and the expertise and experience of DAC members.

This guidebook is divided into two broad sections: an overview of how a DAC should function, and aides-mémoire and appendices on specific topics.

2.0 Overview of a Departmental Audit Committee (DAC)

The sections that follow set out the roles and responsibilities of DAC as a whole and of DAC members individually.

2.1 Roles and Responsibilities

A DAC is an advisory body. The role of the committee is defined in the Treasury Board Directive on Internal Auditing in the Government of Canada.

A DAC is expected to support the deputy head in his or her role as accounting officerSee Footnote 2, by providing the deputy head with objective advice and guidance, independent of management, in the areas of governance, risk management and control.See Footnote 3 In doing so, DAC are vital in strengthening management processes and practices in departments across the federal government.

Although the Treasury Board may modify various policy requirements from time to time, the core areas of DAC responsibility are as follows:

- Values and ethics;

- Risk management;

- Management control framework;

- The internal audit function;

- External assurance providers;

- Follow-up on management action plans;

- Financial statements and Public Accounts reporting; and

- Accountability reporting.

DACs are uniquely positioned to be an arbiter of the professionalism, quality and capacity of the internal audit function, and to provide the deputy head with advice on addressing any significant areas of concern. The aide-mémoire on the internal audit function (see section 4.4 of this guidebook) provides questions that may assist the DAC in this area of responsibility.

Given their independence from line management, combined with the wealth of experience and expertise of external members, DAC are also positioned to provide the deputy head with strategic guidance and advice in areas of management beyond those outlined in policy. The nature and extent to which the deputy head may call upon the DAC to provide advice in such areas will depend on the needs of the deputy head. These needs could include areas such as strategic planning, departmental transformation initiatives and major projects.

In fulfilling its responsibilities, it is expected that the DAC will exercise due diligence and constructive challenge in its work, while maintaining independence from line management.

2.2 Accountability Relationship

As noted, the DAC's primary role is to assist the deputy head in monitoring the department's core systems of control and accountability. As such, the DAC has a direct reporting relationship to the deputy head in order to provide him or her with objective advice and guidance, independent of management, in the areas of governance, risk management and control.

Another critical player in this relationship is the Office of the Comptroller General (OCG). In addition to being a signatory for the nomination of DAC members, the Comptroller General is responsible for providing functional direction to the internal audit community across the federal government.See Footnote 4

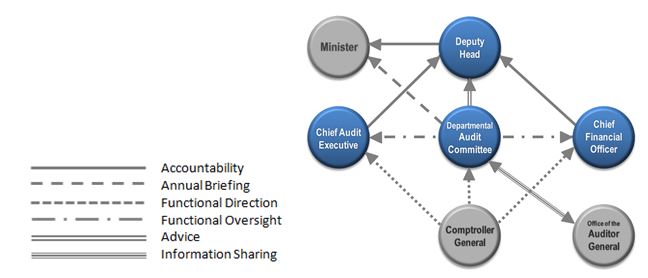

The following diagram illustrates how the DAC's accountability relationship to the deputy head fits within broader departmental relationships and accountabilities.

Figure 1: DAC Accountability Relationship - Text version

The DAC's accountability relationship to the deputy head fits within broader departmental relationships and accountabilities as follows:

- The Departmental Audit Committee provides advice to the Deputy Head, functional oversight to the Chief Audit Executive and the Chief Financial Officer, and takes part in an annual briefing with the Minister.

- The Chief Audit executive and the Chief Financial Officer are accountable to the Deputy Head.

- The Deputy Head is accountable to the Minister.

- The Comptroller General provides functional direction to the Departmental Audit Committee, the Chief Audit Executive and the Chief Financial Officer.

- The Office of the Auditor General and the Departmental Audit Committee share information.

2.3 Authority

As noted, the DAC supports the deputy head by providing objective advice and guidance, independent of management, in the areas of governance, risk management and control. It has no authority in its own right over the operations of the department.

2.4 Knowledge of the Department's Business and Relationship With Management

Since DAC were introduced to the federal government in 2006, management has recognized the unique and beneficial role that they play in strengthening management processes and practices, as well as internal audit functions, for the benefit of the department and the government as a whole. DAC have evolved from being committees where their value was not universally appreciated to being viewed as critical to a department's governance. A DAC's effectiveness depends heavily on its members understanding their responsibilities and the department's business.

Upon joining a DAC, external members should be briefed by the department on the DAC's responsibilities and the department's business through management presentations and discussions, or, for more comprehensive knowledge, through visits to the department. It is important that external members continue to deepen their understanding of the department's business throughout their tenure, particularly in areas that are undergoing change. This can be done through a variety of mechanisms such as pre-briefings in advance of DAC meetings or by scheduling briefings and discussions with management as part of DAC agendas.

Strong, open relationships between the DAC and management with respect to DAC responsibilities are critical to the committee's success. Of particular importance are the relationship and dialogue between the DAC chair and the deputy head (or the vice-chair where the deputy head is the chair).

Regular engagement with the department's chief audit executive and chief financial officer is also effective in building a strong, open relationship with the management team. The DAC may also wish to invite a member of the executive team and/or members of the internal audit team to attend DAC meetings as observers, perhaps on a rotating basis. This participation can be a valuable learning opportunity for observers that strengthens their understanding of the DAC and its work.

2.5 Comparing a DAC to a Private Sector Audit Committee

The role of the DAC is different from that of an audit committee in the private sector. This section provides an overview of the key differences between the two types of committees.

In the private sector, the board of directors is responsible for governing the organization, and it has full authority to do so. Audit committees are a subcommittee of the board of directors. The board nominates members for appointment and delegates authority to the audit committee for financial oversight. The audit committee has a fiduciary role in helping the board fulfill its governance and oversight responsibilities for financial accuracy, risk management, control assessment, external auditor oversight and the effective use of internal auditing. The audit committee also has the responsibility to review and approve the audited financial statements of the organization.

By contrast, DAC in the federal government are advisory committees and are not part of a department's governance structure. DAC comprise a majority of independent members from outside the federal public administration, appointed by the Treasury Board on the recommendation of the President. DAC members have no authority to make decisions; they advise and make recommendations to the deputy head and are charged with providing advice on key areas of responsibility as defined by Treasury Board policy instruments related to internal audit.

In the Government of Canada, individual departments generally do not produce audited financial statements. Departmental financial results are consolidated into the Public Accounts and audited by the Auditor General of Canada. DAC members' responsibility over financial matters is limited to reviewing and providing advice to the deputy head on the department's key financial management reports and disclosures.

2.6 Membership

As set out in the Treasury Board Directive on Internal Auditing in the Government of Canada, a DAC must have a majority of independent, external members who are not currently in the federal public administration. These external members are jointly selected by the deputy head and the Comptroller General for approval by the Treasury Board. The collective skills, knowledge and experience of all members are to enable the DAC to competently and efficiently undertake its duties. DAC membership from within the federal public administration is to be limited to individuals at the level of deputy head.

Although they are not members of the committee by virtue of their central roles in the department, the chief financial officer and the chief audit executive are expected to attend all committee meetings. As necessary, the chair may also request other departmental officials and representatives from the Office of the Auditor General of Canada and the Treasury Board of Canada Secretariat to attend.

3.0 Functioning of a DAC

3.1 Charter or Terms of Reference

The DAC is expected to document its roles and responsibilities in a charter or terms of reference. The DAC's roles and responsibilities should be consistent with the Treasury Board Directive on Internal Auditing in the Government of Canada, with the understanding that the committee may be asked to provide advice in additional related areas where the deputy head believes he or she can benefit from the DAC's counsel.

The DAC's charter or terms of reference is to be approved by the deputy head, reviewed periodically and reaffirmed by the deputy head. Changes to relevant policies should be factored into the process for reviewing and updating the DAC's charter or terms of reference. The DAC may be called upon to continue to provide advice in areas that may no longer be required by policy, but where the deputy head believes that the DAC can continue to add value. For example, the DAC may be asked to review and provide advice on the Departmental Performance Report prior to it being finalized, even though this is not a policy requirement.

3.2 Annual Plan

To ensure that the DAC's fulfillment of its responsibilities is scheduled and fully addressed, the DAC is expected to prepare an annual plan for the deputy head's approval. DAC members and the deputy head should be actively engaged in this process. The annual plan will help utilize a risk-based approach to scheduling the core areas of responsibility as well as scheduling any additional areas for which the deputy head wishes the DAC to provide strategic advice. As part of its annual planning, the DAC may wish to review pertinent elements of this guidebook, either individually or as a committee.

Recognizing that not all core areas of responsibility may be covered in a single year, the DAC may find it beneficial to have the plan cover a two-year horizon.

3.3 Meetings

Meetings are the main working forum for the committee, and members should participate actively. Meetings provide an opportunity to review information, identify and discuss important issues, and develop informed judgments. The usefulness of meetings and the DAC's overall effectiveness depend on members' thorough preparation beforehand and their willingness to discuss key issues at meetings.

The number of meetings each year depends on the extent and nature of the DAC's work. On average, DAC meet in person four times per year; there should be no fewer than two meetings per year. The committee may find it beneficial to use teleconferencing and/or videoconferencing as a means to carry out DAC business where there is important, time-sensitive work to be done but the nature or volume of it does not warrant an in-person meeting. For example, a DAC meeting may be held via teleconference to review and provide advice on the department's financial statements, including any associated auditor's report.

In camera meetings should be a regular and integral part of each DAC meeting. The committee should meet separately in camera with the chief audit executive, the chief financial officer and the external auditor, when the latter is in attendance. A good practice is for DAC members themselves to meet in camera, either before the meeting, as part of the agenda, or both.

It is the chair's responsibility to include in camera discussions at every DAC meeting and to ensure that sufficient time is set aside for them. Regularly scheduling such meetings with the internal and external auditor (when the latter is in attendance) as part of the meeting provides an excellent opportunity for them to communicate privately and candidly with the committee. The committee is offered a similar opportunity.

3.4 Expectations of the DAC

As previously noted, in fulfilling its responsibilities, it is expected that the DAC will exercise due diligence and constructive challenge in its work while maintaining independence from line management.

3.4.1 Expectations of the DAC Chair

The Treasury Board Directive on Internal Auditing in the Government of Canada requires that either the deputy head or an external member chair the DAC. The directive recommends, however, that an external member be the chair. If the deputy head is the chair, an external member is to be the vice-chair.

Where the deputy head is the chair, he or she has the challenge of simultaneously providing and receiving independent advice and guidance on the management of his or her own department. To help strengthen the independence of the DAC in this situation, the vice-chair is expected to play a strong leadership role.

The expectations of the DAC chair include but are not limited to the following:

- Prepare a DAC annual plan

- In consultation with DAC members and the deputy head, prepare the DAC's annual plan, to be presented to the deputy head for approval. The chair should ensure that the DAC's responsibilities are scheduled and fully addressed, including areas where the deputy head is seeking strategic advice.

- Oversee DAC pre-meeting mechanics

-

This includes the following:

- Establishing the agenda, including having in camera sessions as part of each meeting;

- Ensuring the timely distribution of pre-meeting materials;

- Holding pre-meetings as required;

- Encouraging and supporting DAC members' attendance at all DAC meetings; and

- Approving the general nature and length of presentations.

- Chair DAC meetings

-

Responsibility for chairing meetings includes the following:

- Facilitating discussion among DAC members and management;

- Leading discussions in a manner that reinforces reasonable expectations, encouraging meaningful and respectful participation;

- Ensuring that all DAC members who wish to address a matter are provided with the opportunity to do so;

- Attempting to achieve consensus where members express conflicting positions, views or advice; and

- As appropriate, invite representatives from external assurance providers to attend DAC meetings to discuss plans, findings and other matters of mutual concern.

- Lead the DAC's accountability reporting and self-assessment process

- The chair should manage the development of the DAC's annual self-assessment process and its annual report.

- Support a positive DAC culture

-

A positive

DAC culture is characterized by the following:

- The DAC's acceptance of its accountabilities;

- Respect and trust among DAC members;

- Open, candid and direct communication between management and the DAC;

- Acceptance of the right of each DAC member to hold and express dissenting opinions;

- A genuine commitment by DAC members to good governance practices; and

- A willingness of DAC members to act as a team.

3.4.2 Expectations of DAC Members

In discharging their responsibilities, DAC members are each expected to:

- Act honestly and in good faith, with a view to the best interests of the department;

- Comply with the terms and conditions of appointment, including disclosing any activity, interest or appointment that may affect a member's ability to discharge his or her DAC responsibilities independently and objectively;

- Accept the responsibility to make their best efforts in carrying out their duties;

- Be prepared for DAC meetings, including reviewing information, reports and background material provided in advance of each meeting;

- Attend all DAC meetings;

- Ask probing questions and expect, encourage and elicit reasonable answers;

- Encourage a culture of open, candid, respectful and direct communication between management and the committee;

- Provide sound counsel while respecting management's authority to make decisions; and

- Help the deputy head prepare to be held to public account by periodically subjecting executive decisions to constructive challenge, and by encouraging the deputy head to demonstrate that the best possible decisions have been made, considering all available information and evidence.

3.5 Support From the Department

To perform its work, the DAC requires the support and cooperation of the department's management. The DAC depends on management for information, knowledge and insight about the department's practices and the issues it faces. There is no set model for providing this support, nor is there a set lead within departments. In some departments, support is provided by the corporate secretariat; in others, it is provided by a member of the internal audit function. Where support is provided by internal audit, the chief audit executive should keep the DAC secretariat separate from other internal audit business to maintain the internal audit function's actual and perceived independence and objectivity.

Support provided to the DAC can cover many activities, including administrative, strategic and logistic support—booking meeting rooms and travel arrangements, identifying issues, preparing reports, researching topics and liaising with management. The department should also support external members in developing a sound understanding of their roles and responsibilities, and those of the department, and in complying with their terms and conditions of appointment. This guidebook can be used to help the department in such support work.

Appendix A provides examples of the kinds of support that departments could provide to help the DAC work effectively. A sample table of contents for an orientation/reference binder for new DAC members is provided in Appendix B.

3.6 DAC Annual Report

At the end of the year, external members of the DAC are to prepare an annual report to the deputy head. It is recommended that the DAC's external members develop and produce this report. Where the DAC secretariat assists in this process, the external members must play an active role to ensure that the views expressed in the report are entirely and exclusively those of the external members.

There is no standard format for a DAC annual report. The key is for the report to reflect the realities of the DAC's work over the preceding year. Certain elements, however, are expected to be included:

- A summary of the DAC's activities undertaken and the results of its reviews;

- The DAC's assessment of the department's system of internal controls;

- Any significant concerns the DAC may have regarding the department's risk management, controls and accountability processes;

- The DAC's assessment of the capacity and performance of the internal audit function; and

- As applicable, recommendations for improving risk management, controls and accountability processes, including recommendations for improving the department's internal audit function.

Members may wish to share the annual report with departmental management. This can be done electronically, and the deputy head and external members may find it beneficial to present the report to the executive team and periodically to the broader management team. This will give management the opportunity to better understand the DAC's work and the nature of its advice.

The DAC annual report must also be provided to the Office of the Comptroller General in a timely manner, normally within one to two months of the report being provided to the deputy head.

3.7 Self-Assessment

A formal, external assessment of the DAC's performance is part of a department's practice inspection of internal audit to be carried out every five years. The DAC should also undertake a periodic self-assessment of its performance.

Self-assessments help ensure that the DAC delivers on its charter or terms of reference and continually enhance its contribution to the deputy head. Self-assessment can take many different forms, involve a number of participants and use diverse techniques. The format of the self-assessment is the decision of the department. Appendix C contains a sample DAC Assessment Questionnaire, which sets out the kinds of questions that can help members gain insight into the DAC's performance.

To obtain more comprehensive insight into the DAC's performance and to determine opportunities for improvement, attendees of DAC meetings and members of management who have extensive interactions with the committee may be included in the assessment process. Tools that facilitate this broader participation in the committee's assessment are available from the Office of the Comptroller General.

Regardless of the tools used, the critical element of a DAC self-assessment is the dialogue and discussion among DAC members about the committee's results to identify and address any areas for improvement in a timely manner.

4.0 Aides-Mémoire

How to Use the Aides-Mémoire

This section contains eight aides-mémoire, one for each of the DAC's core areas of responsibility:

- 4.1 Values and ethics

- 4.2 Risk management

- 4.3 Management control framework

- 4.4 The internal audit function

- 4.5 External assurance providers

- 4.6 Follow-up on management action plans

- 4.7 Financial statements and Public Accounts reporting

- 4.8 Accountability reporting

The specifics of each of these core areas may vary due to changes in Treasury Board policy and the department's specific needs. For this reason, each aide-mémoire should be reviewed in the context of the DAC's charter or terms of reference.

These interrelated aides-mémoire are intended to support the DAC as a whole, and members individually, in performing their due diligence. Each aide-mémoire reflects a series of prompts or questions that members can ask themselves when reviewing materials, reports and information provided by management. There is no requirement for the DAC to use these aides-mémoire; however, they can help stimulate meaningful discussion on each of the DAC's key areas of responsibility. They should also help DAC members ask the necessary probing questions and consider the reasonableness of responses with greater knowledge and understanding.

In addition to a set of questions, each aide-mémoire provides a list of guidance material that is pertinent to the particular subject matter. Departments should make this guidance available to DAC members, as required.

4.1 Values and Ethics

This aide-mémoire is designed to help DAC members consider values and ethics when reviewing materials, participating in discussions or receiving presentations from senior management.

Overview of DAC Responsibilities

Specific DAC responsibilities in this area are expected to be outlined in the DAC's charter or terms of reference. In general, it is expected that the DAC's work in this area will include reviewing and advising the deputy head on departmental systems and practices established to monitor compliance with laws, regulations, policies and standards regarding ethical conduct, and to identify and deal with any legal or ethical violations. Work may also include a review of procedures and feedback mechanisms established to monitor conformance with the department's code of conduct and ethics policies, as well as how the department's processes encourage and maintain high ethical standards.

Pertinent Government Policies and Related Guidance

- Treasury Board of Canada Secretariat values and ethics web page

- Values and Ethics Code for the Public Sector

- Policy on Conflict of Interest and Post-Employment

- Public Servants Disclosure Protection Act

- Criminal Code, Part IV

- Management Accountability Framework and related methodology and findings

- The department's values and ethics code and related guidance

To fulfill their responsibilities, DAC members need to be able to review, reflect on, and discuss the issues and materials brought before them. The questions that follow are intended as general guidance to support the DAC in this work. The questions are offered as high-level prompts and are not meant to be exhaustive or restrictive in any way; they should be tailored to meet the particular circumstances of each department.

Leadership and people management

- What support does the deputy head provide to set the required "tone from the top" for the department's ethics program?

- How does the department ensure that its leadership and management practices reflect public service values and ethics?

- Does the department have a senior official for values and ethics?

- Does the department have a senior official to receive and investigate disclosures of wrongdoing, including alleged breaches of the Values and Ethics Code for the Public Sector?

- Is the quality of values and ethics leadership regularly assessed internally and externally?

- Is performance information on public service values and ethics, including people management, integrated into hiring, promotion and performance management?

- What processes or structures does the department have in place to ensure active dialogue on values and ethics among departmental senior management?

Departmental culture

- How does the department maintain an ongoing dialogue on public service values and ethics as they pertain to specific departmental challenges?

- How does the department ensure that values and ethics are embedded in what staff does every day?

Policies and guidelines

- Does the department have its own values and ethics code that is consistent with the Values and Ethics Code for the Public Sector and the Policy on Conflict of Interest and Post-Employment?

- If so:

- Does it clearly state what behaviour is acceptable and unacceptable, particularly in areas of significant ethical risk; and

- Does it identify which departmental programs and functions may be of highest risk for conflict of interest?

- How does the department communicate its own values and ethics code and the Values and Ethics Code for the Public Sector to staff to ensure they understand their responsibilities and expectations of them regarding ethical behaviour and the consequences of non-compliance?

- How does the department communicate recourse and disclosure mechanisms to staff?

- How does the department ensure that employees are aware of its disclosure procedures and are encouraged to expose wrongdoing without fear of reprisal? In other words, how does the department ensure a safe environment?

- How does the department ensure that public service employees who are intending to leave the public service are aware of the post-employment obligations of the departmental code and the Values and Ethics Code for the Public Sector?

Values and ethics program

- Does the department have a values and ethics program in place?

- If so, is there a plan that sets out the expected benefits, results and performance measures of the program, including the applicable sections of the Public Service Disclosure Protection Act?

- How do employees obtain advice when facing difficult ethical decisions?

- How does the department respond to the results of the Public Service Employee Survey?

- How does the department identify, assess and manage values and ethics risks, including the risk of fraud?

- How does the department investigate complaints of wrongdoing, harassment and conflicts of interest?

- What are the processes and mechanisms in place to ensure that investigations proceed promptly, fairly and objectively, with due regard for confidentiality?

- What procedures and mechanisms does the department have in place to establish, promote and manage disclosures made under the Public Service Disclosure Protection Act as it applies to the department?

- How does the deputy head ensure:

- The confidentiality of those involved in the disclosure process;

- Security of information collected through disclosures; and

- Prompt public access to information if wrongdoing, as described by the Act, is found?

Values and ethics learning

- What training on the Values and Ethics Code for the Public Sector and on recourse and disclosure do new and existing employees and managers receive? Is this training mandatory? Is it provided on an ongoing basis?

- How frequently are training materials updated to ensure that they remain relevant?

- How does the department measure the effectiveness of its values and ethics learning activities?

- What other mechanisms or approaches are in place to share lessons learned and best practices, e.g., sharing examples of ethical dilemmas and how they were handled?

Values and ethics monitoring and reporting

- How does the department monitor compliance with its own code of conduct and the Values and Ethics Code for the Public Sector?

- How does the department measure and report on employees' and managers' understanding of the Values and Ethics Code for the Public Sector and their confidence in the department's recourse and disclosure mechanisms?

- How does the deputy head know that behaviour throughout the department is consistent with the expectations and standards of the department's code and the Values and Ethics Code for the Public Sector?

- What role does internal audit play in providing assurance on values and ethics, including departmental compliance with the department's code, the Values and Ethics Code for the Public Sector and relevant sections of the Public Service Disclosure Protection Act?

- How are unlawful activities (known or potential) reported in the department and to whom?

- What reports does the deputy head receive on ethics concerns and investigations, including findings and recommended actions?

- What processes are in place to monitor the implementation of required actions to ensure that they are implemented on a timely basis and address the reported findings?

4.2 Risk Management

This aide-mémoire is designed to help DAC members consider risk management when reviewing materials, participating in discussions or receiving presentations from senior management.

Overview of DAC Responsibilities

Specific DAC responsibilities in this area are expected to be outlined in the DAC's charter or terms of reference. In general, it is expected that the DAC's work in this area will include reviewing and advising the deputy head on the department's risk management arrangements.

Pertinent Government Policies and Related Guidance

- Treasury Board of Canada Secretariat guides and tools on risk management

- Framework for the Management of Risk

- Management Accountability Framework and related methodology and findings

- Guide to Integrated Risk Management

- The department's own values and ethics code and related guidance

To fulfill their responsibilities, DAC members need to be able to review, reflect on, and discuss the issues and materials brought before them. The questions that follow are intended as general guidance to support the DAC in this work. The questions are offered as high-level prompts and are not meant to be exhaustive or restrictive in any way; they should be tailored to meet the particular circumstances of each department.

Risk management responsibility

- Is there a senior management risk champion (assistant deputy minister level or above) who is responsible for the department's risk management framework and related activities and the department's corporate risk profile?

- How is the champion held to account for his or her risk management responsibilities?

- Is it clear that senior managers are responsible for managing and mitigating risks in their programs, functions and areas?

Risk management strategy

- Does the department have a risk management policy or framework?

- If so, does this policy or framework:

- Establish an approach for integrating risk management into the department's decision-making processes?

- Link with the department's strategic documents, such as the Report on Plans and Priorities, the Departmental Performance Report and others?

- Reflect departmental roles and responsibilities for implementing and practicing risk management?

- Include reporting and monitoring requirements to ensure compliance with the policy or framework?

- What are the key elements of the department's risk management approach (e.g., annual risk assessment that includes assessing risk of fraud; business continuity planning; disaster recovery planning; and all significant departmental changes, projects and programs), and how are these coordinated?

- How is staff informed of the department's approach to risk management?

Corporate risk profile

- Does the department have a current corporate risk profile approved by senior management?

- If so, does this profile:

- Identify the department's key strategic risks?

- Include an assessment of the key risks identified?

- Reflect the risk tolerance of key clients and other stakeholders?

- Outline the strategies to mitigate or manage key strategic risks?

- How does the department identify and assess strategic and business risks, including new and emerging risks?

- What controls are in place to manage or mitigate the highest inherent risks? (See section 4.3 for the aide-mémoire on management control frameworks.)

- How are opportunities for innovation and risk mitigation identified, assessed and prioritized?

- How is the corporate risk profile communicated across the department?

- What processes are in place to ensure that risk management strategies outlined in the corporate risk profile are implemented?

- How often does management review and update its corporate risk profile?

Integrated risk management

- How are risk management practices integrated into the management of programs throughout the department?

- How is risk management aligned with the department's expected results and performance measurement practices?

- How is risk integrated into the department's key business planning and decision-making processes?

- How does the department demonstrate that it is performing in accordance with the approved business plan and risk tolerance limits?

Continuous risk management learning

- What training in risk management, including training to mitigate risk, does staff receive?

- To what extent does management review lessons learned from major departmental events, surprises and disasters, and how has it responded to these occurrences?

- How are lessons learned and best practices communicated across the department?

- How are lessons learned and best practices built into risk management practices?

Risk management reporting and monitoring

- How are risk or control failures escalated within the department (e.g., risk and incident reporting and tracking)? To whom and through what mechanisms are they reported?

- To what extent does senior management receive reports on risk management plans and take corrective action as required?

- What reports or information does the deputy head receive on departmental risk management?

- What role does internal audit play in providing assurance on risk management practices, key risks and controls that mitigate the highest inherent risks?

4.3 Management Control Framework

This aide-mémoire is designed to help DAC members consider the department's management control framework when reviewing materials, participating in discussions or receiving presentations from senior management.

Overview of DAC Responsibilities

Specific DAC responsibilities in this area are expected to be outlined in the DAC's charter or terms of reference. In general, it is expected that the DAC's work in this area will include reviewing and advising the deputy head on departmental internal control arrangements, and that its work will be informed on all significant matters that arise from work performed by others who provide assurances to senior management and the deputy head.

Pertinent Government Policies and Related Guidance

- Policy on Internal Control

- Guideline for the “Policy on Internal Control”

- Policy Framework for Financial Management

- Management Accountability Framework and related methodology and findings

- Financial Administration Act

- Department-specific management or internal control policy or framework

To fulfill their responsibilities, DAC members need to be able to review, reflect on, and discuss the issues and materials brought before them. The questions that follow are intended as general guidance to support the DAC in this work. The questions are offered as high-level prompts and are not meant to be exhaustive or restrictive in any way; they should be tailored to meet the particular circumstances of each department.

Management controls: Roles and responsibilities

- Is it clearly articulated and understood that the deputy head has overall responsibility for the department's systems of internal control?See Footnote 5

- Is it clearly articulated and understood that management has a fundamental responsibility to identify, document and monitor controls?

- Are delegations of authority and responsibility to individuals documented, properly approved and kept up to date?

- Are delegations of authority communicated to all departmental staff?

Management controls: Control framework and departmental systems

- Does the department have a control framework that:

- Includes, but is broader than, internal controls over financial reporting?

- Reflects the department's key controls to ensure sound management practices, consistent with the Management Accountability Framework and Treasury Board policies and legislative requirements?

- Reflects other key controls that help mitigate the department's key strategic and business risks?

- Reflects departmental roles and responsibilities for developing, reviewing, implementing and sustaining key controls?

- Includes reporting and monitoring requirements to ensure compliance with the framework?

- If not, what is the department's strategy for developing a sound management control framework in support of the ongoing effectiveness of internal controls across the department, including internal controls over financial reporting?

- How does management identify and implement required controls to mitigate, manage and monitor new or emerging risks?

- How is staff informed of the department's control framework and held to account for ensuring sound controls in their area?

- Are processes in place to review and strengthen the adequacy of internal controls for significant new departmental systems, projects or programs?

- What training in management or in internal controls do employees receive?

Management controls: Control certifications

- As part of the financial statements, does the department produce a Statement of Management Responsibility Including Internal Controls Over Financial Reporting each year that is signed off by the deputy head and chief financial officer?

- If so, what evidence underpins this statement?

- Do assistant deputy ministers or their equivalents provide the deputy head and/or chief financial officer with internal control certifications?

- If so, how often are they provided, and what evidence underpins these certifications?

Reporting and monitoring of controls

- How are responses to risk and to control failures escalated within the department?

- How are required changes to the design or implementation of key controls identified and implemented in a timely manner?

- What performance information does each level of management receive that compares actual performance against budget and performance targets? How often does such a comparison occur?

- In addition to control certifications, what arrangements are in place to periodically assess the effectiveness of the department's control framework (e.g., internal audits, management review and sign-offs)?

- How does management report detection of fraud to the deputy head and the DAC? Once it is determined what corrective action needs to be taken, how is it reported?

4.4 The Internal Audit Function

This aide-mémoire is designed to help DAC members consider the department's internal audit function when reviewing materials, participating in discussions or receiving presentations from senior management. Given the DAC's independence from line management and its responsibilities in this area, the DAC is positioned to influence the professionalism, quality and capacity of the internal audit function, and to provide the deputy head with advice on addressing areas of concern. This aide-mémoire provides questions for consideration to assist the DAC in this work.

Overview of DAC Responsibilities

The specific DAC responsibilities in this area are expected to be outlined in the DAC's charter or terms of reference. In general, it is expected that the DAC's work in this area will include reviewing and advising the deputy head on the department's internal audit policy or charter, the sufficiency of internal audit resources, the department's Risk-Based Internal Audit Plan and progress against this plan, the performance of the internal audit function (including the results of external practice inspections), the recruitment and performance of the chief audit executive, and internal audit reports.

It is also generally expected that DAC members will be informed of any internal audit engagements or tasks that do not result in a report to the DAC, including all matters of significance that arise from such work.

Pertinent Government Policies and Related Guidance

- Policy on Internal Audit

- Directive on Internal Auditing in the Government of Canada

- Internal Auditing Standards for the Government of Canada

- International Professional Practices Framework (The Institute of Internal Auditors)

- Treasury Board of Canada Secretariat methodologies for oversight of internal audit

To fulfill their responsibilities, DAC members need to be able to review, reflect on, and discuss the issues and materials brought before them. The questions that follow are intended as general guidance to support the DAC in this work. The questions are offered as high-level prompts and are not meant to be exhaustive or restrictive in any way; they should be tailored to meet the particular circumstances of each department.

Internal audit policy or charter

- Does the department have an internal audit policy or charter?

- Is so, does this policy or charter:

- Reflect the purpose, authority and responsibility of the internal audit function?

- Reflect the focus on the provision of assurance services to the department?

- Have periodic reviews and revision, as required?

Independence and objectivity

- Does the chief audit executive report to the deputy head?

- Is internal audit free from interference in determining the scope of internal auditing, in performing the work, and in communicating the results?

- Does internal audit have unencumbered access to all departmental information, records and locations, as required?

- Does internal audit receive the necessary cooperation and assistance from departmental staff and management?

Internal audit planning

- What is the process for developing the Risk-Based Audit Plan (RBAP )?

- How does the RBAP link with the department's corporate risk profile and key strategic and operational risks?

- How are the proposed audit projects determined and prioritized (i.e., are they linked to the department's risk management strategy or to internal audit's own risk assessment process)?

- Are the proposed audit projects assurance engagements? If not, why not?

- Does the plan adequately detail the objectives, scope, timing and resource requirements (money and staffing resources) for each audit project?

- Does the RBAP make appropriate provision for the work of external assurance providers (i.e., horizontal audit activities to be undertaken by the Office of the Comptroller General and the Office of the Auditor General)?

- Does the plan reflect the impact of any resource limitations?

Internal audit delivery

- Does the internal audit service delivery modelSee Footnote 6 meet the department's needs?

- Where the internal audit delivery is outsourced, what processes are in place to manage the engagement of external suppliers and ensure compliance with the Internal Auditing Standards for the Government of Canada?

Internal audit reports

- Are internal audit reports clear and concise, and do they satisfactorily address audit objectives?

- Do audit reports include a statement of conformance?

- Are internal audit reports issued on a timely basis (i.e., what is the elapsed time from the start of the engagement to issuing the final report)?

- Are the recommendations relevant and practical?

- Do audit reports include management's response and action plan to address all agreed-upon recommendations? Does the response and the action plan appear to effectively respond to the problems and issues outlined in the report?

Internal audit capacity and resources

- Does the internal audit team have sufficient resources (full-time equivalents and/or money) to carry out its responsibilities, including delivering on the approved risk-based internal audit plan?

- Is there a human resources strategy for the department's internal audit function?

- Does the internal audit team have the necessary complement of required skills and expertise? If not, what is the internal audit team's plan to acquire these skills and expertise?

- Is internal audit able to access specialist skills, where and when required?

Performance of the internal audit function

- Does internal audit have a sound understanding of the department's business, including key strategic and operational risks?

- Does internal audit have a performance framework to monitor and report on the performance of the function, and to support innovation and the growth of the function?

- To what extent does the internal audit team complete its engagements on time?

- What quality assurance processes are in place to ensure that internal audit work complies with the Internal Auditing Standards for the Government of Canada?

- Has internal audit undergone an external practice inspection within expected time frames? If not, why not?

- If so:

- What were the results of the external practice inspection?

- Has an action plan been prepared to address noted areas for improvement, and has this report been provided to the DAC?

- Are periodic reports provided to the DAC to monitor the implementation of actions that result from the external practice inspection?

- Does internal audit liaise effectively with the Office of the Comptroller General, the Office of the Auditor General and other central agencies, as required?

- Does internal audit have a professional relationship with departmental management?

4.5 External Assurance Providers

This aide-mémoire is designed to help DAC members consider reports from external assurance providers and accompanying materials when participating in discussions and receiving presentations from senior management.

Overview of DAC Responsibilities

Specific DAC responsibilities in this area are expected to be outlined in the DAC's charter or terms of reference. In general, it is expected that the DAC's work in this area will include being informed of, and advising the deputy head on, management's response to the work of external assurance providers,See Footnote 7 and providing advice on audit-related issues or priorities raised by external assurance providers.

To fulfill their responsibilities, DAC members need to be able to review, reflect on, and discuss the issues and materials brought before them. The questions that follow are intended as general guidance to support the DAC in this work. The questions are offered as high-level prompts and are not meant to be exhaustive or restrictive in any way; they should be tailored to meet the particular circumstances of each department.

Leadership and support

- Is there a senior lead for monitoring and reporting on the work of external assurance providers in the department?

- How does the department support external assurance providers that undertake audit work in the department?

Office of the Auditor General and central agency audits, and management improvement initiatives

- What are the processes in place to ensure that management and the DAC are kept up to date on audit work being carried out by external assurance providers?

- What processes are in place to review and develop the necessary management responses to audit issues raised by external assurance providers?See Footnote 8 If there are no such processes, what needs to be put in place to facilitate management responses?

- What processes are in place to review, assess and report on audit-related issues and priorities raised by external assurance providers?

- Does the DAC receive external assurance provider reports on a timely basis? If not, what processes are in place to support DAC members in providing the deputy head with advice on management's response and any noted audit-related issues or priorities?

- What is the process and time frame for monitoring, assessing and briefing the deputy head and the DAC on the departmental impacts of government-wide initiatives to improve management practices

4.6 Follow-Up on Management Action Plans

This aide-mémoire is designed to help DAC members consider follow-up of management action plans when reviewing materials, participating in discussions or receiving presentations from senior management.

Overview of DAC Responsibilities

Specific DAC responsibilities in this critical area of oversight are expected to be outlined in the DAC's charter or terms of reference. In general, it is expected that the DAC's work in this area will include regularly reviewing and advising the deputy head on the progress of implementing approved management action plans resulting from the work of internal audit and external assurance providers.

Pertinent Government Policies and Related Guidance

- International Professional Practices Framework (The Institute of Internal Auditors)

- Practice Advisory 2500.A1-1: Follow-Up Process (PDF)

To fulfill their responsibilities, DAC members need to be able to review, reflect on, and discuss the issues and materials brought before them. The questions that follow are intended as general guidance to support the DAC in this work. The questions are offered as high-level prompts and are not meant to be exhaustive or restrictive in any way; they should be tailored to meet the particular circumstances of each department.

Roles and responsibilities

- Is the senior manager responsible for implementing agreed-upon management action plans articulated in departmental internal audit reports, internal responses to Office of the Auditor General audits, or audits from other sources?

- Is it clearly understood that the chief audit executive (CAE ) is responsible for monitoring and following up on management action plans, including plans that result from the work of external assurance providers?

Monitoring and reporting

- What procedures does the CAE have in place for monitoring the implementation of management action plans, including plans that arise from audits conducted by external assurance providers?

- What methodology and process does the CAE have in place to follow up on whether management actions have been effective?

- How often does the CAE report to the DAC on management follow-up?

- Does management attend the follow-up segment of the DAC meeting to discuss delays in implementing management action plans?

- What is the nature of the CAE 's reporting to the DAC on management follow-up (i.e., a verbal or written report)? Does this report:

- Reflect the extent to which management action plans are being implemented within the specified time frame and adequately explain delays for completion?

- Indicate the extent to which actions that have been implemented are effective (if not, why not)?

- Indicate why the CAE believes that management has accepted a level of risk that is unacceptable to the department or to the government, as applicable?

4.7 Financial Statements and Public Accounts Reporting

This aide-mémoire is designed to help DAC members consider departmental financial statements and Public Accounts reporting when reviewing materials, participating in discussions or receiving presentations from senior management.

Overview of DAC Responsibilities

Specific DAC responsibilities in this area are expected to be outlined in the DAC's charter or terms of reference. In general, it is expected that the DAC's work in this area will include reviewing and advising the deputy head on key departmental financial reports and disclosures of the department, including quarterly financial reports, annual financial statements and Public Accounts, the annual Statement of Management Responsibility, and associated plans and assessments with respect to internal controls over financial reporting.

If the financial statements are audited, it is generally expected that the DAC will review the financial statements with the external auditor and senior management, discussing any significant accounting estimates and adjustments, as well as any difficulties or disputes the external auditors encountered with management during the course of the audit. It is also generally expected that the DAC will review any management letters that arise from the external audit and the auditor's findings and recommendations relating to internal controls over financial reporting, and consider their impact on departmental governance, risk management and control processes.

Pertinent Government Policies and Related Guidance

- Treasury Board Accounting Standards

- Policy Framework for Financial Management

- CPA Canada Public Sector Accounting Handbook (Chartered Professional Accountants Canada)

- Management Accountability Framework and related methodology and findings

To fulfill their responsibilities, DAC members need to be able to review, reflect on, and discuss the issues and materials brought before them. The questions that follow are intended as general guidance to support the DAC in this work. The questions are offered as high-level prompts and are not meant to be exhaustive or restrictive in any way; they should be tailored to meet the particular circumstances of each department.

Accounting policies and practices

- Are the department's accounting policies and practices consistent with Treasury Board Accounting Standards? If not, why not?

- What is the process for obtaining advice on proper accounting treatment when significant accounting issues arise (e.g., during consultation with the Office of the Comptroller General or the Office of the Auditor General)?

- Are the department's significant accounting policies cited in the financial statements, including changes in accounting policies from the previous year?

Financial statement presentation

- Do the financial statements comply with Treasury Board Accounting Standards? If not, why not?

- To what extent are there significant departmental legal matters, contingencies, claims or assessments that could have a material impact on the financial statements (i.e., the departments and/or the government as a whole)? How have these issues been reflected in the department's financial statements?

- What processes are in place to estimate significant accounting accruals, reserves and other estimated liabilities?

- What is the support for significant valuations, assumptions or judgments reflected in the financial statements?

- Do the financial statements show any significant or unusual transactions that occurred during the year?

- Have significant financial statement variances from the budget and the prior year's statements been satisfactorily explained?

Review and sign-off

- Is there a process in place for the chief financial officer (CFO) to review the financial statements on a timely basis with the deputy head and with management?

- Is there a process in place to inform the deputy head, senior management and the DAC throughout the year of significant issues that impact the department's financial statements?

- Has the deputy head and the CFO signed off on or certified the financial statements?

- If not, why not?

- If so, what processes are in place to support the deputy head and the CFO in signing off on or certifying the financial statements (i.e., the key procedures, systems, resources and tasks for preparing and reviewing the financial statements to ensure they do not contain any material errors or omissions)?

Audited financial statements and the Public Accounts

- Have the deputy head and the CFO signed off on the Management Representation Letter required as part of the audited financial statements?

- If not, why not?

- If so, what processes are in place to support the deputy head's and the CFO's sign-off?

- Were there any breakdowns in controls that impacted the audit of the financial statements or the Public Accounts? What adjustments, if any, to the financial statements or the Public Accounts were required as a result of the audit?

- What was the nature of any significant disagreements between management and the external auditors, and to what extent were these disagreements satisfactorily resolved?

- Did the department receive an unmodified audit opinion? If not, what action is being taken to address the reasons for the modified or denied opinion on a timely basis?

4.8 Accountability Reporting

This aide-mémoire is designed to help DAC members consider accountability reporting when reviewing materials, participating in discussions and receiving presentations from senior management.

Overview of DAC Responsibilities

Specific DAC responsibilities in this area are expected to be outlined in the DAC's charter or terms of reference. In general, it is expected that the DAC's work in this area will include receiving copies of departmental accountability reports (i.e., the Report on Plans and Priorities (RPP) and the Departmental Performance Report (DPR)). Regardless of the timing and focus of the DAC's review of actual accountability reports, it is generally expected that through this area of responsibility or the management control framework, the DAC will generally review and provide advice to the deputy head on the underlying processes that support effective accountability reporting, consistent with requirements of the Treasury Board of Canada Secretariat.

The DAC may also receive plans and reports prepared by the department's evaluation function.

Pertinent Government Policies and Related Guidance

- Policy on Management, Resources and Results Structures

- Management Accountability Framework and related methodology and findings

To fulfill their responsibilities, DAC members need to be able to review, reflect on, and discuss the issues and materials brought before them. The questions that follow are intended as general guidance to support the DAC in this work. The questions are offered as high-level prompts and are not meant to be exhaustive or restrictive in any way; they should be tailored to meet the particular circumstances of each department.

Process and timing

- Does the DAC receive the accountability reports on a timely basis following their review? If not, why not?

- When the DAC is reviewing and providing advice to the deputy head on the draft RPP and DPR:

- What process is in place to facilitate members' review of the reports electronically, recognizing the tight time frame for these reports' preparation, review and approval?

- Do DAC members receive the reports in sufficient time to allow them to carry out a meaningful review and discussion prior to the reports' approval?

- If the process or timing is not effective, what modifications can the department and DAC members make to improve this in the future?

Presentation and linkage between the RPP and DPR

- Do the RPP and DPR reflect key performance measures and targets that are clearly linked to expected outcomes, such that the basis upon which performance has been or will be assessed is understood?

- Is the performance information provided in the DPR consistent with the performance metrics and targets outlined in the RPP, with explanations for significant changes or variances?

- What processes and procedures ensure the completeness and reliability of the performance information contained in the RPP and DPR?

- Do the RPP and DPR include a brief explanation as to why the reader can have confidence in the methodology and data used to substantiate the department's performance?

- Does the narrative in the RPP clearly identify the expected results and the progress the department intends to make toward achieving its strategic outcomes?

- Does the narrative on departmental performance in the DPR facilitate understanding of the department's actual performance against its expected results, as articulated in the RPP, and the progress made toward achieving its strategic outcomes?

- Does the department clearly and candidly acknowledge performance shortfalls, together with planned actions to improve performance?

- Are DAC members confident that the performance information reported in the DPR is consistent with the results of the department's review, analysis and certification processes, and with the DAC's understanding of the actual state of departmental performance generally?

Review and certification

- What is the underlying process and support for the Management Representation Letter signed by the deputy head (i.e., that ensures the representations made contain no material misstatements)?

Appendix A: Suggested Departmental Support for a DAC

In order for a DAC to effectively carry out its duties, it requires assistance and support from the department. The leadership for this support may be provided by the department's internal audit function or by another area in the department (e.g., departmental corporate secretariat). There is no set model for providing this support, and it is up to the department to determine the model that most suits its needs. Where support is provided by internal audit, the chief audit executive should keep the DAC secretariat separate from other internal audit business so as to maintain the actual and perceived independence and objectivity of the internal audit function.

Suggested departmental support to be provided to the DAC includes the following:

Administrative duties

- Booking the DAC meeting room

- Arranging audiovisual equipment and simultaneous translation, as required

- Arranging hospitality for DAC meetings

- Developing a critical path for the timely preparation of DAC materials, and communicating this to management on a timely basis

- Gathering, preparing and collating meeting materials

- Liaising with presenters at the meeting to ensure they arrive at their scheduled time

- Sending meeting materials, including the agenda, to members sufficiently in advance of the meeting

- Developing and implementing mechanisms to support DAC members in disclosing any activity that may raise a real or perceived conflict of interest

- Assisting members with travel arrangements and the reimbursement of travel expenses consistent with Treasury Board policy

- Processing members' invoices for DAC services rendered at approved per diem rates

- Preparing and distributing minutes of meetings

Assisting the DAC in executing its work

- Assisting the DAC in developing and delivering on its annual plan

- Liaising with the chair to develop and finalize the agenda for each meeting

- Periodically reminding DAC members to consult this guidebook as a general reference or for guidance in a specific area under discussion (e.g., values and ethics, financial statements)

- Acting as an advisor to the chair

- Tracking bring-forward and follow-up items to ensure their timely consideration

- Identifying issues through discussions with the chair, management and other senior officials

- Researching and analyzing assigned issues or topics

- Liaising with senior management to seek its input on issues that should be addressed or are being addressed by the DAC, and to keep senior management informed of the issues, views and preferences that the DAC is considering

Assisting the DAC in assessing its performance

- Working with the chair to develop the DAC's self-assessment process and tools

- Providing support or assistance with the self-assessment process

- Following up on outstanding issues or required changes resulting from the assessment process

Assisting the DAC in its accountability reportingSee Footnote 9

- Developing an annual report template

- Tracking the DAC's actual performance against its approved plan

- Tracking significant risk management, controls and accountability findings arising from internal and external audits or other reviews

- Providing information to assist the DAC in assessing the performance and capacity of the department's internal audit function

Supporting orientation of new members

- Preparing DAC orientation materials and arranging orientation sessions to brief new members

- Developing a comprehensive orientation/reference binder that DAC members can refer to on an ongoing basis (see Appendix C for a sample table of contents for an orientation/reference binder for new DAC members)

Supporting DAC succession planning

- Liaising with the OCG to facilitate continuity in DAC membership

- Providing guidance and assistance in appointment of members, renewal of terms and changes in roles

- Completing all required activities, including providing documentation to the OCG, to support DAC member appointments approved by the Treasury Board

Appendix B: Sample Table of Contents for a DAC Orientation/Reference Binder

The following is a sample table of contents of suggested material for departments to include in an orientation/reference binder for new DAC members.

1) Departmental Corporate Information

- Organization charts

- Executive profiles

- Departmental corporate risk profile

- Business plans for key lines of business

- Key ministerial briefing notes

- Departmental legislation (i.e., the Act that governs the department)

- Values and Ethics Code for the Public Sector and the departmental code of conduct

2) Reporting of Departmental Accountability to Government

- Program Activity Architecture (PAA) schematic

- PAA external performance measures reporting (i.e., the departmental Performance Measurement Framework)

- Report on Plans and Priorities

- Departmental Performance Report

- Departmental financial statements, including the annex to the Statement of Management Responsibility Including Internal Controls Over Financial Reporting

3) Treasury Board Policy on Internal Audit and Related Directives and Standards

4) Key Documents Related to the Department's Internal Audit Function

- Policy on Internal Audit requirements and internal assessment of the department's compliance with these requirements (gap analysis and implementation plan)

- Internal Audit Charter

- Approved Risk-Based Audit Plan

- List of internal audit reports for the past year

- Recent annual report of the chief audit officer

5) Management Accountability Framework

- Management Accountability Framework documents and details

- The department's most recent Management Accountability Framework or oversight assessment by the Office of the Comptroller General

6) List of Recent Reports of External Assurance Providers

Appendix C: DAC Self-Assessment Questionnaire

The sample questions provided in this questionnaire may be used as a starting point for DAC external members in conducting their functional evaluation of the committee. Fifty questions are provided so that departments can obtain the broadest possible view of what could be assessed. These questions can be adapted to suit departmental needs, and departments may not find it necessary to use them all.

The questions are formulated to closely examine the DAC's functionality and the importance that members attach to specific areas of query. Each question also provides an opportunity for comments.

The first part of the template pertains to the competencies, abilities and responsibilities of the DAC as a whole.

The second part of the template pertains to infrastructure and operations. This is where DAC members assess the level of support provided.

The third part of the template deals with the administration of DAC meetings. DAC members will assess the mechanical aspects of the meeting process and back office procedures.

DAC members provide a response for each question by selecting "Yes," "Somewhat," "No" or "Insufficient Knowledge." Selecting "Insufficient Knowledge" indicates that a member does not have enough information to respond to the question. Questions that are not applicable should not be included.

Members choose the degree of importance (high, medium or low) they feel is appropriate for each query and corresponding response.

In the last section, there are three questions and a request for general comments. These are included to gather insight and opinions on issues that are pertinent to all DACs.

Members are strongly encouraged to support their responses by providing comments.

| Questions | Importance: High, Medium or Low | Yes | Somewhat(when applicable) | No | Insufficient Knowledge | Comments |

|---|---|---|---|---|---|---|

1. Do DAC members support a positive culture by:

|

|

|

|

|

|

|

2. Does the DAC have the appropriate number of members (three to five) to effectively discharge its responsibilities? |

|

|

|

|

|

|

3. Do the collective skills, knowledge and experience of the members allow the DAC to competently and efficiently undertake its duties? |

|

|

|

|

|

If not, what skills or expertise are required? |

4. Has the DAC been sufficiently probing and challenging in its activities? |

|

|

|

|

|

|

5. Is internal audit independent from line management within the department, and is it perceived as such? |

|

|

|

|

|

|

6. Is the DAC aware of the line between its role and that of management to retain its independence and objectivity, and does it respect that line? |

|

|

|

|

|

|

7. Is there a need for the DAC's role to expand to further support the deputy head in an advisory capacity? |

|

|

|

|

|

|

8. Historically, has the DAC taken on additional duties? |

|

|

|

|

|

|

9. Does the DAC demonstrate an understanding of the department and key areas such as governance, risk management and management control frameworks? |

|

|

|

|

|

|

10. Do all members communicate and respond effectively by offering feedback that is frank, timely and appropriate? |

|

|

|

|

|

|

11. Do all members demonstrate integrity and high ethical standards in professional and personal dealings concerning the DAC? |

|

|

|

|

|

|

12. Do all members participate in all DAC teleconferences, attend in-person meetings, and stay for the duration of the meetings? |

|

|

|

|

|

|

13. Do all members come to meetings well prepared, having read pre-briefing materials beforehand? |

|

|

|

|

|

|

14. Do members give sufficient time to others to discuss issues, and are they willing to consider their opinions? |

|

|

|

|

|

|

15. Do all members participate fully in discussions and ask challenging and relevant questions in a manner that encourages robust dialogue? |

|

|

|

|

|

|

16. Does the DAC work as a cohesive team in trying to reach consensus on issues in a constructive manner, and does it demonstrate an understanding of the importance of collective solidarity in DAC decisions? |

|

|

|

|

|

|

17. Are all members actively involved in decision making and drafting recommendations? |

|

|

|

|

|

|

18. Does the DAC's involvement in reporting activities strain the process for such reporting, given tight timelines (e.g., the RPP and DPR)? |

|

|

|

|

|

|

19. Has the DAC met its obligations as outlined in the Directive on Internal Auditing in the Government of Canada? |

|

|

|

|

|

|

20. Have DAC members fully respected the Terms and Conditions of Appointment for Audit Committee Members? |

|

|

|

|

|

|

21. Has the DAC supported the independence of the internal audit function and the strengthening of internal audit? |

|

|

|

|

|

|