Report on the Public Service Pension Plan for the Fiscal Year Ended March 31, 2014

ISSN 2291-4285

Catalogue No. BT1-13/2014E-PDF

His Excellency the Right Honourable David Johnston, C.C., C.M.M., C.O.M., C.D.,

Governor General of Canada

Excellency:

I have the honour to submit to Your Excellency the Report on the Public Service Pension Plan for the Fiscal Year Ended .

Respectfully submitted,

Original signed by

The Honourable Tony Clement,

President of the Treasury Board

Table of Contents

- Message From the President of the Treasury Board

- Message From the Chief Human Resources Officer

- Introduction to the Public Service Pension Plan

- Year at a Glance, 2013–14

- 2013–14 Highlights

- Demographic Highlights

- Financial Overview

- Communications to Plan Members

- Pension Objective

- Historical Context

- Roles and Responsibilities

- Summary of Plan Benefits

- Financial Statements Content Overview

- Further Information

- Account Transaction Statements

- Statistical Tables

- Financial Statements of the Public Service Pension Plan for the Fiscal Year Ended

- Financial Statements

- Glossary of Terms

- Footnotes

Message from the President of the Treasury Board

The Honourable Tony Clement,

President of the Treasury Board

I am pleased to present the Report on the Public Service Pension Plan for the Fiscal Year Ended . This report provides parliamentarians, public servants and Canadian taxpayers with a regular update on how the government manages the pension plan for employees of the public service of Canada.

In fiscal year 2013–14, the Government of Canada continued to ensure the strength and long-term sustainability of the public service pension plan in a way that is fair to employees and taxpayers.

As we move toward an employer-employee cost-sharing ratio of 50:50, we continue to gradually increase the employees' contribution rates. This is in addition to changing the normal age of retirement for new members to 65, which took effect in January 2013. These changes will save Canadian taxpayers billions of dollars by 2017–18, and millions of dollars every year thereafter.

The Treasury Board of Canada Secretariat continues to support these efforts and is strengthening key elements of its governance practices to help better protect employees and taxpayers.

I am pleased to note that the Auditor General in his 2014 Spring Report confirmed that the Treasury Board of Canada Secretariat is meeting its legislative obligations and is carrying out its responsibilities in respect to the public sector pension plans.

I would like to take this opportunity to thank all of our public service employees for their service to Canadians and for their ongoing support in building Canada's high-performing public service of the future.

Original signed by

The Honourable Tony Clement,

President of the Treasury Board

Message from the Chief Human Resources Officer

Daniel Watson,

Chief Human Resources Officer

I am pleased to present the Report on the Public Service Pension Plan for the Fiscal Year Ended . This report details the continuing progress of the public service of Canada toward becoming an institution that is relevant to Canadians, with modernized tools and practices for the future.

As Chief Human Resources Officer, I am responsible for providing strategic enterprise-wide leadership that supports the basics of sound people management. We are focused on delivering sustainable, holistic and centrally managed pension plans that continue to meet the needs of both employees and employer.

Furthermore, we are committed to addressing the Auditor General's recommendations in relation to the public sector pension plans.

We continue to improve the work we do to help plan members, parliamentarians and Canadians obtain the information and related services they need to make informed decisions about the public service pension plan.

Of note, this year, is the removal of the Superannuation Account from the public service pension plan's financial statements. For many years, management had reported the Superannuation Account as part of "Other Accounts Available for Benefits" in the pension plan's Statement of Financial Position. This change in presentation will provide more reliable and relevant information for the users of the financial statements. There are no financial implications for the Government of Canada or pension plan members resulting from the removal of the account, nor does it impact the government's deficit.

I would like to thank Public Works and Government Services Canada, the day-to-day administrator of the public service pension plan, for its continuing involvement in the compilation of content for the annual report.

Original signed by

Daniel Watson,

Chief Human Resources Officer

Treasury Board of Canada Secretariat

Introduction to the Public Service Pension Plan

The public service pension plan is a contributory defined benefit plan serving more than 507,000 working and retired public service employees. The plan is the largest of its kind in Canada in terms of total membership, covering substantially all of the employees of the Government of Canada, which includes 141 departments and agencies in the federal public service, certain Crown corporations and the territorial governments. The public service pension plan was originally established by the Public Service Superannuation Act of 1954, and it is still governed by that Act. The plan operates differently from a traditional pension plan, since the Government of Canada has a legal obligation to pay benefits.

Year at a Glance, 2013–14

- Total plan membership including active contributors, retired members, survivors and deferred members increased by 1.2 per cent to 570,467 members.

- Active contributors decreased by 0.3 per cent to 299,293 members.

- Retired members increased by 3.2 per cent to 207,495 members.

- Employer and employee cash contributions increased by 4.1 per cent to $4.6 billion.

- Total benefit payments to eligible pension plan members and survivors increased by 6.9 per cent to $6.3 billion.

- The value of the pension obligations increased by 2.5 per cent to $157.6 billion.

- The value of the public service pension plan net assets held by the Public Sector Pension Investment Board. Footnote 1 increased over the past year to $68.2 billion. The investment return for the year was 16.3 per cent, for an investment income of $9.2 billion after expenses.

- The net amount transferred to the Public Sector Pension Investment Board increased by 8.5 per cent to a total of $3.5 billion.

- The average annual pension for new retirees was $35,548, an increase of 5.3 per cent over 2012–13.

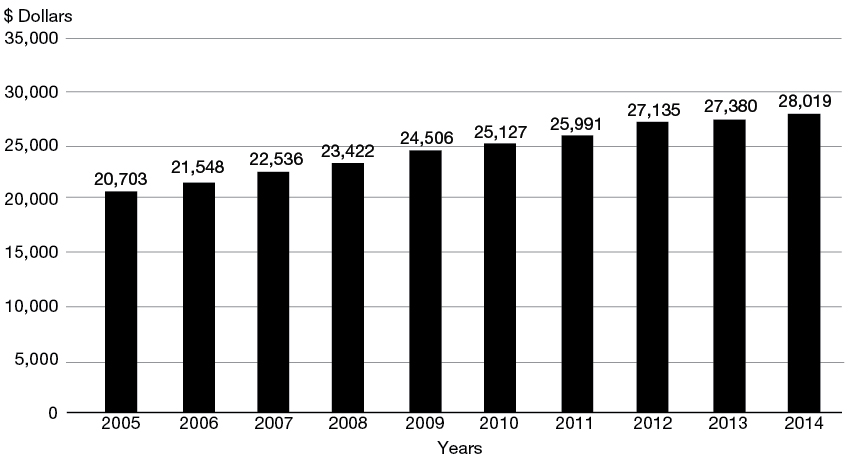

- The average pension paid to plan members in 2013–14 was $28,019, an increase of 2.3 per cent over 2012–13.

2013–14 Highlights

The fiscal year ended , included the following highlights:

- Increases to employee pension contributions continued to be phased in so as to eventually reach an employer-employee cost-sharing ratio of 50:50. By increasing employee pension contributions and changing the normal retirement age for new members to 65, which took effect in January 2013, the government ensures that the public service pension plan remains sustainable and financially responsible. These changes will save Canadian taxpayers approximately $700 million annually once they are fully implemented.

- The Office of the Auditor General of Canada conducted a performance audit of public sector pension plans with a focus on the public service pension plan, the Canadian Forces pension plan, and the Royal Canadian Mounted Police pension plan. The audit objective was to determine whether the Treasury Board of Canada Secretariat, National Defence, the Royal Canadian Mounted Police, and the Department of Finance Canada carried out selected key aspects of their governance and management responsibilities. The Auditor General's report confirmed that the government carried out its legislative responsibilities in respect of the public sector pension plans, and the government agreed with the conclusions and recommendations put forward by the Auditor General. To address the Auditor General's recommendations, the government has developed and implemented a comprehensive management action plan.

- The Superannuation Account has been removed from the public service pension plan's Financial Statements of the Public Service Pension Plan for the Fiscal Year Ended (Financial Statements), and is now disclosed by way of a note to the Financial Statements. This presentation change, which complies with Canadian accounting standards for pension plans, will provide more reliable and relevant information for the users of the Financial Statements. Supported by the Comptroller General of Canada, this change has no financial implications for the Government of Canada or the pension plan. Pension plan members and beneficiaries will continue to receive their pension benefits.

- The Transformation of Pension Administration Initiative has successfully centralized services previously provided by individual federal departments into a centre of pension expertise and has implemented a modern, commercial, off-the-shelf software product. The modernized pension processes and centralized service delivery model, coupled with an agile technology solution, have increased the effectiveness of public service operations and generated significant savings, thereby ensuring the sustainability of the pension administration. The administration of the Royal Canadian Mounted Police pension plan has been transferred to the new software product, and the Canadian Forces pension plan will be transferred in the future. This will result in a further reduction of operation costs due to economies of scale.

- In January 2014, the Annual Pensioners Statement was introduced for retired public service pension plan members and survivors. The new statement provides clear, concise and personalized pension information in an easy-to-read format.

Demographic Highlights

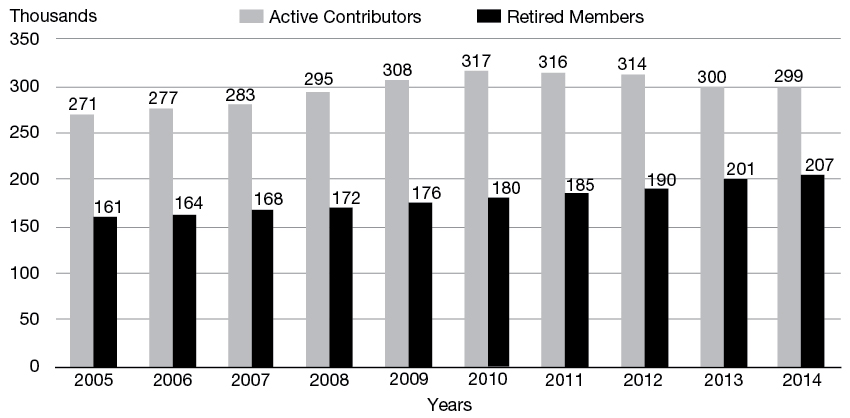

This figure shows the number of active contributors relative to the number of retired members over the last 10 years.

Figure 1 - Text version

| Years | Active Contributors (in thousands) | Retired Members (in thousands) |

|---|---|---|

| 2005 | 271 | 161 |

| 2006 | 277 | 164 |

| 2007 | 283 | 168 |

| 2008 | 295 | 172 |

| 2009 | 308 | 176 |

| 2010 | 317 | 180 |

| 2011 | 316 | 185 |

| 2012 | 314 | 190 |

| 2013 | 300 | 201 |

| 2014 | 299 | 207 |

The 10-year annual average growth rate Footnote 2 for active contributors was 1.1 per cent (1.2 per cent in 2013) compared with 2.6 per cent for retired members (2.4 per cent in 2013).

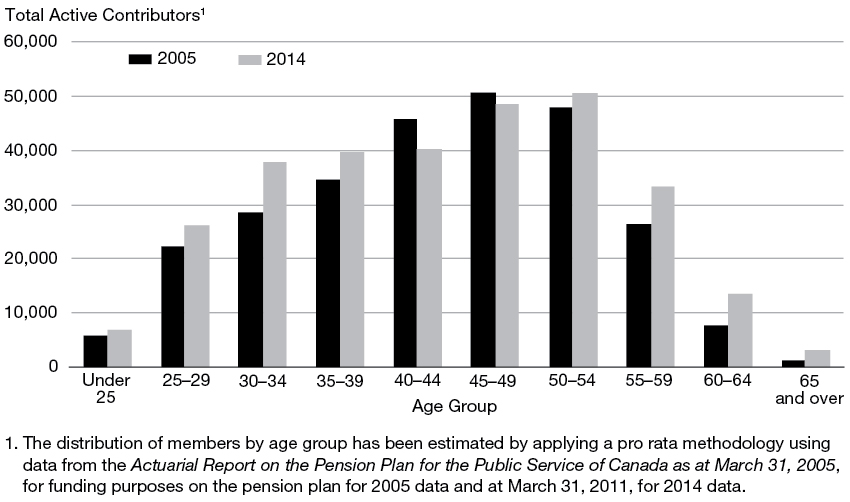

Figure 2 shows the number of active contributors by age group in 2014 relative to the number of active contributors in 2005.

Figure 2 - Text version

| 2005 | 2014 | ||

|---|---|---|---|

| Age Group | Total Active Contributors table note 1 * | Age Group | Total Active Contributors table note 1 * |

Table 1 Notes

|

|||

| Under 25 | 6,040 | Under 25 | 6,997 |

| 25–29 | 22,371 | 25–29 | 26,075 |

| 30–34 | 28,573 | 30–34 | 37,766 |

| 35–39 | 34,477 | 35–39 | 39,575 |

| 40–44 | 45,554 | 40–44 | 40,191 |

| 45–49 | 50,538 | 45–49 | 48,239 |

| 50–54 | 47,911 | 50–54 | 50,444 |

| 55–59 | 26,325 | 55–59 | 33,276 |

| 60–64 | 7,746 | 60–64 | 13,581 |

| 65 and over | 1,300 | 65 and over | 3,149 |

| Total | 270,835 | Total | 299,293 |

The number of active contributors has increased from 2005 to 2014 for each group, except for the 40–44 and 45–49 age categories in the centre of the distribution.

| Membership Profile | Number of Members 2005 |

Percentage of Total 2005 |

Number of Members 2014 |

Percentage of Total 2014 |

Per cent Change 2005–14 |

|---|---|---|---|---|---|

| Active contributors | 270,835 | 54.5 | 299,293 | 52.4 | 10.5 |

| Retired members | 161,468 | 32.5 | 207,495 | 36.4 | 28.5 |

| Survivors | 59,060 | 11.9 | 59,331 | 10.4 | 0.5 |

| Deferred annuitants | 5,552 | 1.1 | 4,348 | 0.8 | (21.7) |

| Total | 496,915 | 100.0 | 570,467 | 100.0 | 14.8 |

The public service pension plan operates in a challenging and changing environment. Today, it is facing the challenge of an aging membership and longer retirements. The ratio of active-to-retired members (including survivors and deferred annuitants) under the public service pension plan has declined over the years. The decline in the proportion of active members, coupled with the fact that members are living longer, increases the cost of the pension plan. Over the period from 2005 to 2014, the number of active contributors increased by 10.5 per cent, and the number of retired members increased by 28.5 per cent. Over the same period, the number of survivors increased by 0.5 per cent, and the number of deferred annuitants decreased by 21.7 per cent.

Financial Overview

Contributions

Members' contribution rates were raised following the Government of Canada's commitment to increase contribution rates to reach an employer-employee ratio of 50:50 over the next few years.

Generally, if an employee was participating in the plan on or before , the contribution rates for Group 1 (members with a normal retirement age of 60) are applied. If an employee began participating in the plan on or after , contribution rates for Group 2 (members with a normal retirement age of 65) are applied.

As illustrated in Table 2, Group 2 plan members pay lower contribution rates than Group 1 members because they must wait five years longer than Group 1 members before they are eligible to receive a pension benefit. Since they receive a benefit that has a lower overall value and cost, they do not pay as much as those who are eligible for an unreduced pension at age 60.

| 2014 | 2013 | |

|---|---|---|

| Members who were participating in the plan on or before (Group 1) | ||

| On earnings up to the year's maximum pensionable earnings | 7.50% | 6.85% |

| On any earnings over the year's maximum pensionable earnings | 9.80% | 9.20% |

| Members who began participating in the plan on or after (Group 2) | ||

| On earnings up to the year's maximum pensionable earnings | 6.62% | 6.27% |

| On any earnings over the year's maximum pensionable earnings | 7.89% | 7.63% |

The year's maximum amount of pensionable earnings in 2013 and 2014 is $51,100 and $52,500 respectively.

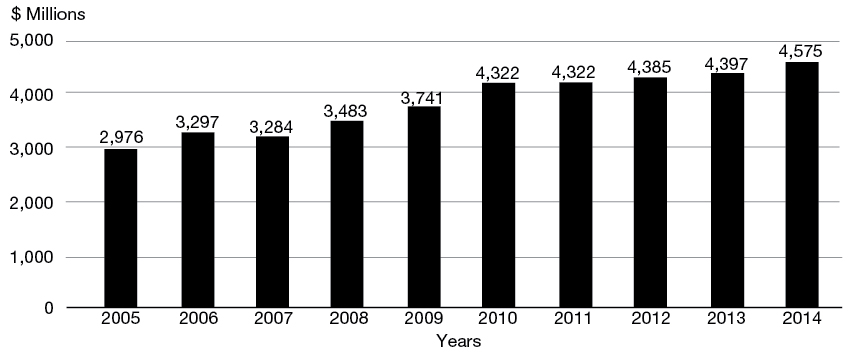

Figure 3 shows the total amount of cash contributions from both the employer and plan members over the period from 2005 to 2014.

Figure 3 - Text version

| Years | Contributions on a cash basis ($ millions) |

|---|---|

| 2005 | 2,976 |

| 2006 | 3,297 |

| 2007 | 3,284 |

| 2008 | 3,483 |

| 2009 | 3,741 |

| 2010 | 4,322 |

| 2011 | 4,322 |

| 2012 | 4,385 |

| 2013 | 4,397 |

| 2014 | 4,575 |

The annual growth rate in cash contributions from both the employer and plan members over the past 10 years averaged 4.9 per cent. The contributions do not include year-end accrual adjustments, which are reported in the Financial Statements of this report.

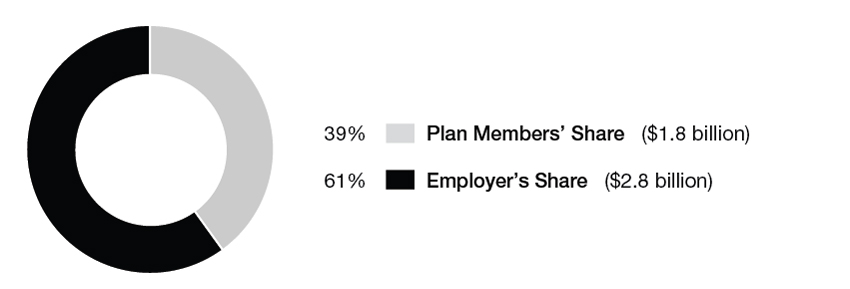

Figure 4 shows the share of total cash contributions between the employer and plan members as at .

Figure 4 - Text version

| Current and Past Cash Contributions ($ billion) | Per cent | |

|---|---|---|

| Plan Members Share | 1.80 | 39 |

| Employer's Share | 2.80 | 61 |

| Total | 4.60 | 100 |

Public service pension plan benefits are funded through compulsory contributions from the employer and the plan members, as well as from investment earnings. Cash contributions received in 2013–14 totalled $4.6 billion ($4.4 billion in 2012–13), excluding year-end accrual adjustments. The employer contributed $2.8 billion ($2.7 billion in 2012–13), Footnote 3 and the plan members contributed $1.8 billion ($1.7 billion in 2012–13). As shown in Figure 4, the employer paid approximately 61 per cent of total contributions during the fiscal year (61 per cent in 2012–13), compared with 39 per cent for the plan members (39 per cent in 2012–13). Cash contributions in Figure 4 include both current service and past service (e.g., service buybacks, pension transfers). The contributions presented in the Financial Statements of this report include year-end accrual adjustments.

Benefits

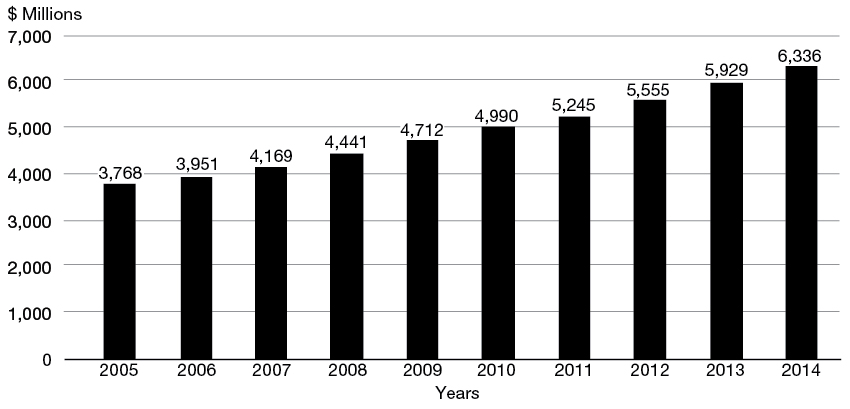

In 2013–14, the public service pension plan paid out $6.3 billion in benefits, an increase of $407 million over the previous year.

Benefits were paid to 266,826 retired members and survivors, compared with 259,098 in 2012–13. Of the 10,839 newly retired members in 2013–14:

- 8,078 were entitled to immediate annuities (9,659 in 2012–13);

- 1,657 received annual allowances (2,737 in 2012–13);

- 616 were eligible to receive disability retirement benefits (681 in 2012–13); and

- 488 were entitled to deferred annuities (269 in 2012–13).

In 2013–14, 2,552 plan members left the public service before the age of 50 (1,990 in 2012–13) and withdrew approximately $348 million ($262 million in 2012–13) in lump-sum amounts (i.e., the present value of their future benefits), excluding return of contributions for non-vested Footnote 4 members. These sums were transferred to other pension plans or to locked-in retirement vehicles.

The average annual pension for newly retired members in 2013–14 was $35,548, compared with $33,773 in 2012–13 an increase of 5.3 per cent. The average pension paid to all plan members was $28,019 in 2013–14 ($27,380 in 2012–13).

This figure presents the average pension paid to plan members from 2005 to 2014. In 2013–14, the average pension was $28,019 ($27,380 in 2012–13).

Figure 5 - Text version

| Years | Average Pension ($ Dollars) |

|---|---|

| 2005 | 20,703 |

| 2006 | 21,548 |

| 2007 | 22,536 |

| 2008 | 23,422 |

| 2009 | 24,506 |

| 2010 | 25,127 |

| 2011 | 25,991 |

| 2012 | 27,135 |

| 2013 | 27,380 |

| 2014 | 28,019 |

Pensions under the public service pension plan are indexed annually to take into account the cost of living, which is based on increases in the Consumer Price Index. In 2014, the indexation rate was 0.9 per cent (1.9 per cent in 2013).

This figure presents the total amount of benefits paid to plan members and survivors each year from 2005 to 2014.

Figure 6 - Text version

| Years | Benefits Payments ($ millions) |

|---|---|

| 2005 | 3,768 |

| 2006 | 3,951 |

| 2007 | 4,169 |

| 2008 | 4,441 |

| 2009 | 4,712 |

| 2010 | 4,990 |

| 2011 | 5,245 |

| 2012 | 5,555 |

| 2013 | 5,929 |

| 2014 | 6,336 |

Benefit payments, on average, have increased by 5.8 per cent annually over the past 10 years. Benefit payments are indexed annually to take into account the cost of living.

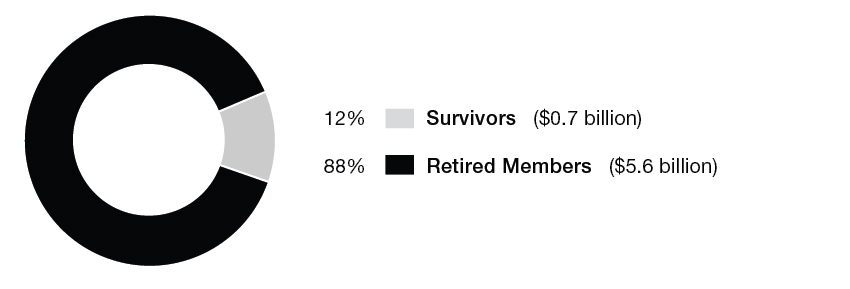

This figure presents the total amount of benefits paid to retired members and to survivors.

Figure 7 - Text version

| Benefit Payments ($ billions) | Per cent | |

|---|---|---|

| Survivors | 0.7 | 12% |

| Retired Members | 5.6 | 88% |

| Total | 6.30 | 100% |

Benefits paid to retired members ($5.6 billion), including benefits paid to plan members who retired on grounds of disability, represented 88 per cent of the 2013–14 pension payments (88 per cent in 2012–13); benefits paid to survivors ($0.7 billion) represented 12 per cent (12 per cent in 2012–13).

Investment Returns

The Public Sector Pension Investment Board has generated above-benchmark returns in eight of the past ten years. It has accomplished this by pursuing a strategy of increasing the internal active management of its investments and by diversifying its asset classes. The internal active management of assets allows for better control in terms of investment risks and costs. The Public Sector Pension Investment Board has moved from being once fully invested in public markets into private market areas such as private equity, real estate, infrastructure and renewable resources. These private market areas all recorded above-benchmark returns in 2013–14, with the overall portfolio being driven primarily by public and private equities, as well as by the real estate and infrastructure portfolios.

This figure shows the rate of return on the assets held by the Public Sector Pension Investment Board against its comparative benchmark.

Figure 8 - Text version

| Years | Portfolio Returns | Benchmark Returns |

|---|---|---|

| 2005 | 7.9% | 7.2% |

| 2006 | 19.1% | 18.0% |

| 2007 | 11.3% | 10.1% |

| 2008 | -0.3% | 1.2% |

| 2009 | -22.7% | -17.6% |

| 2010 | 21.5% | 19.8% |

| 2011 | 14.5% | 12.7% |

| 2012 | 3.0% | 1.6% |

| 2013 | 10.7% | 8.6% |

| 2014 | 16.3% | 13.9% |

The Public Sector Pension Investment Board reported a rate of return of 16.3 per cent for the 2013–14 fiscal year (10.7 per cent in 2012–13), compared with the benchmark rate of return of 13.9 per cent (8.6 per cent in 2012–13). Over the past 10 years, the Public Sector Pension Investment Board has recorded an annualized rate of return of 7.3 per cent, Footnote 5 compared with the benchmark rate of return of 7.0 per cent over the same period.

Additional information concerning the rate of return on assets held by the Public Sector Pension Investment Board and comparative benchmarks is available on the PSP Investments website.

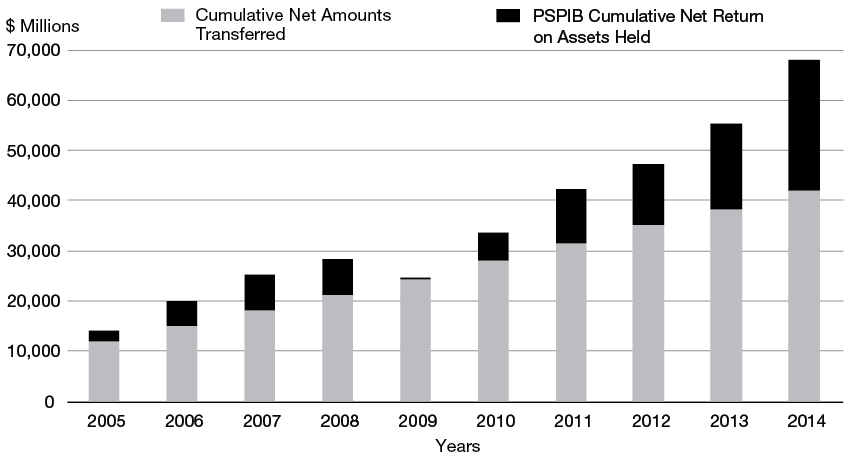

This figure presents the total value of public service pension plan assets held by the Public Sector Pension Investment Board each year over the last 10 years for the years ended March 31. Amounts include the cumulative net amounts transferred from the Government of Canada and the cumulative net return on assets held. In 2014, the total value of assets reached $68.2 billion. To date, $42.0 billion (61.6 per cent) of the total value has been transferred from the Government of Canada.

Figure 9 - Text version

| Years | PSPIB Cumulative Net Return on Assets Held | Cumulative Net Amounts Transferred |

|---|---|---|

| 2005 | 1,958 | 1,2017 |

| 2006 | 4,892 | 15,105 |

| 2007 | 7,334 | 18,076 |

| 2008 | 7,131 | 21,133 |

| 2009 | 184 | 24,312 |

| 2010 | 5,642 | 28,019 |

| 2011 | 10,689 | 31,610 |

| 2012 | 11,962 | 35,166 |

| 2013 | 17,059 | 38,424 |

| 2014 | 26,209 | 41,959 |

Administrative Expenses

The legislation provides for the pension-related administrative expenses of government organizations to be charged to the public service pension plan, namely, those of the Treasury Board of Canada Secretariat, Public Works and Government Services Canada, Health Canada and the Office of the Chief Actuary. Administrative expenses also include Public Sector Pension Investment Board operating expenses.

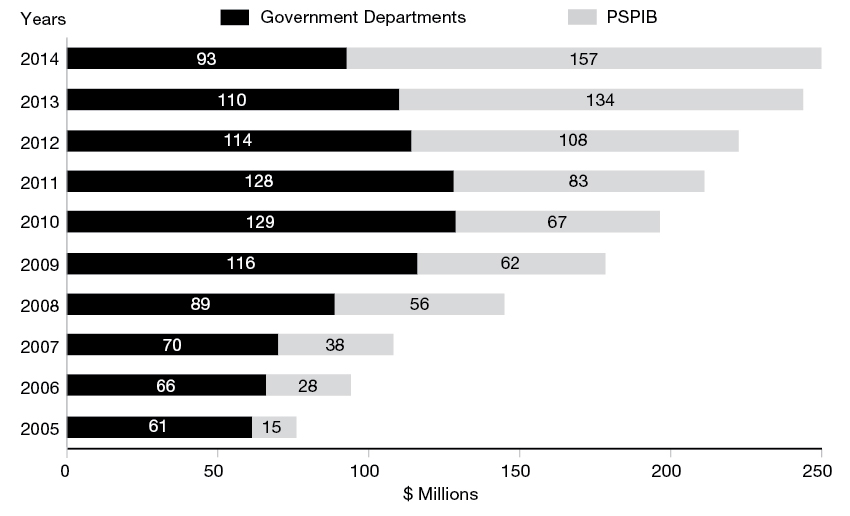

This figure presents the administrative expenses charged to the public service pension plan each year from 2005 to 2014 as shared between government departments and the Public Sector Pension Investment Board.

Figure 10 - Text version

| Expenses ($ Millions) | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 |

|---|---|---|---|---|---|---|---|---|---|---|

| Government Departments | 61 | 66 | 70 | 89 | 116 | 129 | 128 | 114 | 110 | 93 |

| PSPIB | 15 | 28 | 38 | 56 | 62 | 67 | 83 | 108 | 134 | 157 |

| Total | 76 | 94 | 108 | 145 | 178 | 196 | 211 | 222 | 244 | 250 |

The increase in administrative expenses for government departments from 2008 to 2010 was due in large part to the capital expenditure requirements related to the pension modernization project started in 2007–08. This project was completed in January 2013. The decrease in administration expenses for government departments from 2011 to 2014 was due to the completion of the centralization of pension services that started in 2006–07.

The Public Sector Pension Investment Board's increase in expenses from 2011 to 2014 is due in part to the growth in assets managed by the Crown corporation, and in part to its management's ongoing strategy to increasingly manage the investment portfolio internally. Managing assets internally increases operating expenses while reducing external management expenses. As a result, over the past five fiscal years, internally managed assets allocated to the public service pension plan increased by approximately $36 billion, while associated operating expenses grew by $95 million.

Based on available market data related to the investment implementation style, it is estimated that the increase in internally managed assets has resulted in savings ranging from $131 million to $193 million for fiscal year 2013–14, compared to what costs would have been had the Public Sector Pension Investment Board employed external investment managers to manage these funds. As a result of these savings, the Public Sector Pension Investment Board's cost ratios have declined each year for the past five fiscal years. Cost ratios are operating expenses plus asset management expenses as a percentage of average net investment assets. In 2013–14, the average cost per 100 dollars of invested assets was 59.3 cents; in 2008–09, the average cost was 86.9 cents per 100 dollars, an overall decrease of 32 per cent.

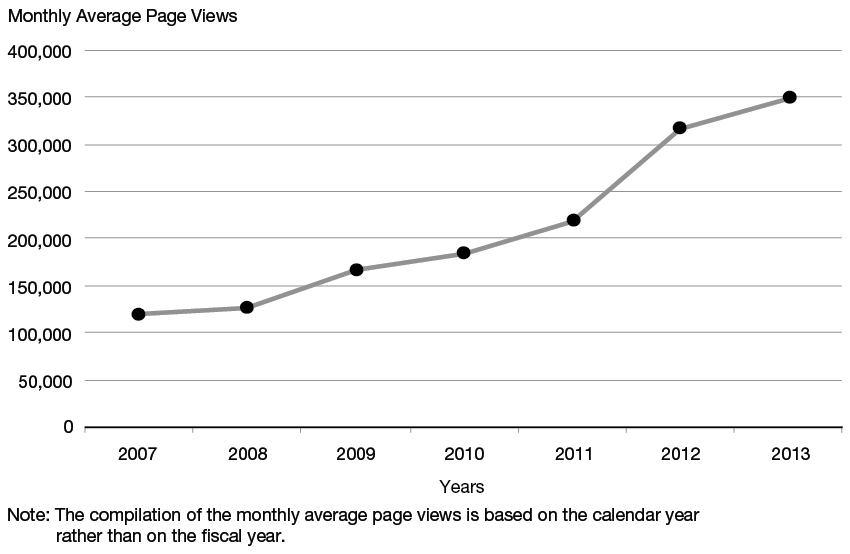

Communications to Plan Members

The Government of Canada recognizes that the public service pension plan is an integral part of the public service workforce recruitment, retention and renewal strategy and is committed to providing timely and accurate information about the plan to plan members. To fulfill this commitment, the government has focused on a number of initiatives, including Your Public Service Pension and Benefits web portal and the Pensions section of the Treasury Board of Canada Secretariat website. Outreach events were undertaken to promote the web portal and answer questions to plan members.

This figure presents the monthly average page views each year from 2007 to 2013.

Figure 11 - Text version

| Year | Monthly Average Page Views |

|---|---|

| 2007 | 118,891 |

| 2008 | 126,564 |

| 2009 | 166,438 |

| 2010 | 183,994 |

| 2011 | 217,782 |

| 2012 | 315,514 |

| 2013 | 348,201 |

Your Public Service Pension and Benefits web portal continues to be one of the main sources of information for both active and retired plan members. Since its launch in 2006, the web portal has almost tripled its number of page views.

Pension Objective

The objective of the Public Service Superannuation Act and related statutes is to provide a source of lifetime retirement income for retired and disabled public service pension plan members. Upon a plan member's death, the pension plan provides an income for eligible survivors and dependants. Pension benefits are directly related to a plan member's salary and public service pensionable service.

Historical Context

The first Act entitling certain public service employees to retirement income came into effect in 1870. Over the years, the public service pension plan took many forms until the Public Service Superannuation Act came into effect on . The Public Service Superannuation Act introduced an important change in 1954 whereby pension coverage was broadened to include substantially all public service employees.

With the introduction of the Canada Pension Plan and the Québec Pension Plan in 1966, major amendments were made to the Public Service Superannuation Act to include the coordination of public service pension plan contribution rates and benefits with those of the Canada Pension Plan and the Québec Pension Plan.

Other amendments were made to the Public Service Superannuation Act over the years, including changes in 1999 that dealt primarily with improving plan management and introducing the Public Sector Pension Investment Board Act. This Act provided for the creation of the Public Sector Pension Investment Board in April 2000. Prior to April 2000, employer and plan member contributions under the public service pension plan had been credited to an account that formed part of the Public Accounts of Canada (Public Accounts); these contributions were not invested in capital markets (e.g., in bonds and stocks). Starting in April 2000, the government began transferring to the Public Sector Pension Investment Board amounts equal to pension contributions net of benefit payments and departmental administrative expenses for the plan.

The Public Service Superannuation Act was amended in 2006 to lower the factor used in the Canada Pension Plan or Québec Pension Plan coordination formula to calculate a pension at age 65. This change increased public service pension benefits for members reaching age 65 in 2008 or later.

In 2010–11, following amendments to the Income Tax Act that increased the maximum age to accrue pension benefits under a registered pension plan, the Public Service Superannuation Regulations were amended to allow members of the public service pension plan who reached age 70 or 71 in 2007 to buy back up to two years of pensionable service and increase their annual pension upon retirement.

Further amendments to the Public Service Superannuation Act were enacted by Parliament in 2012 to allow for public service pension plan member contribution rates to be gradually increased to reach an employer-employee cost-sharing ratio of 50:50. In addition, the age of eligibility for an unreduced pension benefit was increased from age 60 to age 65 for new public service employees who began participating in the plan on or after .

Roles and Responsibilities

On behalf of the Government of Canada, the overall responsibility of the public service pension plan rests with the President of the Treasury Board, supported by the Secretariat as the administrative arm of the Treasury Board and Public Works and Government Services Canada as the day-to-day administrator.

The President of the Treasury Board is also responsible for ensuring that the public service pension plan is adequately funded to fully meet plan member benefits. To determine the plan's funding requirements, the President enlists the help of the Office of the Chief Actuary, to provide advice and a range of actuarial services, and the Public Sector Pension Investment Board to manage the pension assets for the public sector pension plans. The Public Service Pension Advisory Committee advises the President on the administration, design and funding of the benefits and on other pension-related matters referred to it by the President.

The roles and responsibilities of each organization are as follows:

Treasury Board of Canada Secretariat

The President of the Treasury Board is responsible for the overall management of the public service pension plan on behalf of the Government of Canada, the plan sponsor. In support of the Treasury Board's role as employer for the public service, the Secretariat is responsible for policy development in respect of the funding, design and governance of the public service pension plan and other retirement programs and arrangements. In addition, the Secretariat is responsible for providing strategic direction, program advice and interpretation; developing legislation; communicating to plan members; and liaising with stakeholders.

Public Works and Government Services Canada

Public Works and Government Services Canada is responsible for the day-to-day administration of the public service pension plan. This includes developing and maintaining the public service pension systems, books of accounts, records, and internal controls, as well as preparing the Account Transaction Statements for reporting in the Public Accounts.

In addition, Public Works and Government Services Canada processes payments and carries out all accounting and financial administrative functions. Through its pay and pension services, Public Works and Government Services Canada's Pay and Pension Services for Government Employees ensures that federal government employees and retired pension plan members receive their pay and pension benefit payments accurately and on time. In total, this involves payments of approximately $29 billion annually.

Public Sector Pension Investment Board

The Public Sector Pension Investment Board is a Canadian Crown corporation established by the Public Sector Pension Investment Board Act and is governed by an 11-member board of directors, accountable to Parliament through the President of the Treasury Board. Its legislative mandate is to maximize returns without undue risk of loss, having regard to the funding, policies and requirements of the public service pension plan, the Royal Canadian Mounted Police pension plan, and the Canadian Forces Regular Force and Reserve Force pension plans. The Public Sector Pension Investment Board has been investing on behalf of the pension plans the amounts transferred by the Government of Canada since . The relevant financial results of the Public Sector Pension Investment Board are included in the pension plan's Financial Statements.

Office of the Chief Actuary

The Office of the Chief Actuary, an independent unit within the Office of the Superintendent of Financial Institutions Canada, provides a range of actuarial services and advice to the Government of Canada that includes the public service pension plan. The Office of the Chief Actuary is responsible for conducting an annual actuarial valuation of the pension plan for accounting purposes as well as a triennial (i.e., once every three years) funding valuation.

Public Service Pension Advisory Committee

The Public Service Pension Advisory Committee, established under the Public Service Superannuation Act, provides advice to the President of the Treasury Board on matters relating to the public service pension plan's administration, benefit design, and funding.

The committee is composed of 13 members: 1 pensioner, appointed from pensioners nominated by the public servant pensioner associations; 6 members representing employees, appointed from the employees nominated by the National Joint Council of the Public Service of Canada; and 6 members nominated by the President of the Treasury Board, who are traditionally chosen from the executive ranks of the public service. All members are appointed by the Governor in Council to hold office for a term not exceeding three years and are eligible for reappointment for one or more additional terms.

Summary of Plan Benefits

The following presents an overview of the main benefits offered under the public service pension plan as of . If there is a discrepancy between this information and information contained in the Public Service Superannuation Act, the Public Service Superannuation Regulations or other applicable laws, the legislation prevails at all times.

Types of Pension Benefits

The benefits that pension plan members are entitled to when they leave the public service depend on their age and the number of years of pensionable service to their credit.

Table 3. Types of Benefits Based on Age and Pensionable Service

| If a member is… | And leaves the public service with pensionable service of… | The member would be entitled to… |

|---|---|---|

Table 3.1 Notes

|

||

| Age 60 or over | At least 2 years | An immediate annuity |

| Age 55 or over | At least 30 years | An immediate annuity |

| Age 50 up to age 60 | At least 2 years | A deferred annuity payable at age 60; or An annual allowance payable as early as age 50 |

| Under age 50 | At least 2 years | A deferred annuity payable at age 60; or An annual allowance payable as early as age 50; or A transfer value |

| Under age 60 | At least 2 years and retiring because of disability | An immediate annuity |

| Any age | Less than 2 years | A return of contributions with interest |

| If a member is… | And leaves the public service with pensionable service of… | The member would be entitled to… |

|---|---|---|

Table 3.2 Notes

|

||

| Age 65 or over | At least 2 years | An immediate annuity |

| Age 60 or over | At least 30 years | An immediate annuity |

| Age 55 up to age 65 | At least 2 years | A deferred annuity payable at age 65; or An annual allowance payable as early as age 55 |

| Under age 55 | At least 2 years | A deferred annuity payable at age 65; or An annual allowance payable as early as age 55; or A transfer value |

| Under age 65 | At least 2 years and retiring because of disability | An immediate annuity |

| Any age | Less than 2 years | A return of contributions with interest |

Protection From Inflation

Pensions under the public service pension plan are indexed annually to take into account the cost of living, which is based on increases in the Consumer Price Index. In 2014, the indexation rate was 0.9 per cent (1.9 per cent in 2013).

Survivor Benefits

If a member is vested upon death (i.e., has at least two years of pensionable service), then the eligible survivor and children are entitled to the following:

- Survivor benefit

- A monthly allowance equal to half of the pension the member would have received before age 65, payable immediately to the eligible survivor.

- Child allowance

- An allowance equal to one fifth of the survivor benefit (two fifths if the member has no eligible survivor), payable until age 18, or age 25 if the child is a full-time student. The maximum allowance for all children combined is the equivalent of four children's benefits.

- Supplementary death benefit

- A lump-sum benefit equal to twice the member's annual salary, payable to the designated beneficiary or to the estate. Coverage decreases by 10 per cent each year starting at age 66 to a minimum of $10,000 by age 75. If the member is still employed in the public service after age 65, minimum coverage is the greater of $10,000 or one third of his or her annual salary.

If the member has no eligible survivor or children, the designated beneficiary of the supplementary death benefit or the estate will receive an amount equal to the greater of the return of contributions with interest, or five years of pension payments less any payments already received.

If death occurs before a member becomes vested (i.e., before a member has completed two years of pensionable service), contributions with interest are refunded to any eligible survivor or children, or to the designated beneficiary or the estate if the member has no eligible survivors.

Financial Statements Content Overview

Financial and Performance Audits

The Office of the Auditor General audits federal government operations and provides Parliament with independent information, advice and assurance to help hold the government to account for its stewardship of public funds. The Office of the Auditor General is responsible for performance audits and studies of federal departments and agencies. It conducts financial audits of the government's financial statements (i.e., the Public Accounts) and performs special examinations and annual financial audits of Crown corporations including the Public Sector Pension Investment Board. With respect to the public service pension plan, the Office of the Auditor General acts as the independent auditor.

Actuarial Valuation

Pursuant to the Public Pensions Reporting Act, the President of Treasury Board directs the Chief Actuary of Canada to conduct an actuarial valuation for funding purposes at least every three years. The purpose of the actuarial review is to determine the state of the pension account and pension fund as well as to assist the President of the Treasury Board in making informed decisions regarding the financing of the government's pension obligations. The last funding valuation was conducted as at , with an update as of , to reflect the pension changes from the Jobs and Growth Act, 2012.

In addition, the Office of the Chief Actuary performs an annual actuarial valuation for accounting purposes, which serves as the basis for determining the government's pension obligations and expenses reported in the Public Accounts and in the public service pension plan's Financial Statements included in this annual report. The economic assumptions used in the annual actuarial valuation represent management's best estimate.

Net Assets Available for Benefits

As at , the Statement of Financial Position shows that net assets were $69.6 billion compared with $56.9 billion last year. The net assets comprise primarily the assets managed by the Public Sector Pension Investment Board on behalf of the pension plan and contributions receivable for past service elections.

The Statement of Changes in Net Assets Available for Benefits shows that credits come from a number of different sources, including the following:

- Contributions from pension plan members and employers;

- Income from investments; and

- Transfers to the public service pension plan from other pension plans when employees leave an outside organization and join an employer covered under the Public Service Superannuation Act.

Amounts are debited from the public service pension plan to cover:

- Benefits;

- Administrative expenses; and

- Transfers or refunds from the public service pension plan to other registered pension plans.

Detailed information can be found in the Financial Statements.

Investment Management

Contributions relating to service since , are recorded in the Public Service Pension Fund Account in the accounts of Canada. An amount equal to contributions net of benefit payments and government departments' administration expenses is transferred regularly to the Public Sector Pension Investment Board and invested in capital markets.

The Public Sector Pension Investment Board's statutory objectives are to manage the funds transferred to it in the best interests of the contributors and beneficiaries, and to invest its assets with a view to achieving a maximum rate of return without undue risk of loss, having regard to the funding, policies and requirements of the pension plan. Accordingly, the Public Sector Pension Investment Board's board of directors has established an investment policy whereby the expected real rate of return is at least equal to the long-term valuation discount rate assumption. This rate is the same as that used in the most recently tabled actuarial valuation for funding purposes of the public service pension plan (4.1 per cent as reported in the Actuarial Report on the Pension Plan for the Public Service of Canada as at ).

As noted in the Public Sector Pension Investment Board's 2014 Annual Report, the investments allocated to the public service pension plan during the year ended , 2014, were in compliance with the Public Sector Pension Investment Board Act and the statement of investment policies, standards and procedures approved by its board of directors.

Pension Obligations

The Statement of Changes in Pension Obligations shows the present value of benefits earned for service to date that will be payable in the future. For the year ended , the value of pension obligations was $157.6 billion ($153.7 billion in 2013), an increase of $3.9 billion from the previous fiscal year. The increase is due primarily to an increase in accrued pension benefits.

Rate of Return on Assets Held by the Public Sector Pension Investment Board

In 2013–14, the assets held by the Public Sector Pension Investment Board earned a rate of return of 16.3 per cent (10.7 per cent in 2012–13). In accordance with the current investment policy, the assets are invested with a long-term target weight of 54.0 per cent in world equity, 33.0 per cent in real return assets, and 13.0 per cent in nominal fixed income. Refer to Note 6 and Note 8 of the Financial Statements or to the PSP Investments website for more details.

Interest Credited on the Public Service Superannuation Account

The Public Service Superannuation Account is credited quarterly with interest at rates calculated as though amounts recorded in this account were invested quarterly in a notional portfolio of Government of Canada 20-year bonds held to maturity. No formal debt instrument is issued to this account by the government in recognition of the amounts therein. The reduction in interest credited to the account relates to declining bond interest rates. The interest credited on the Public Service Superannuation Account is no longer recognized as "interest income" in the Statement of Changes in Net Assets Available for Benefits and is only reported in the Account Transaction Statements section of this report.

Table 4. Annualized Interest Rate Credited to the Superannuation Account (year ended March 31)

Table 4 shows the annualized interest rate credited.

| 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | |

|---|---|---|---|---|---|---|---|---|---|---|

Table 4 Notes

|

||||||||||

| Percentage Interest Rate on Account table 4 note 1 * | 8.0 | 7.8 | 7.5 | 7.3 | 7.0 | 6.7 | 6.5 | 6.0 | 5.6 | 5.4 |

Administrative Expenses

The legislation provides for the pension-related administrative expenses of government organizations to be charged to the public service pension plan, namely, those of the Treasury Board of Canada Secretariat, Public Works and Government Services Canada, Health Canada and the Office of the Chief Actuary. Administrative expenses also include Public Sector Pension Investment Board operating expenses. Investment management fees are paid either directly by the Public Sector Pension Investment Board or offset against distributions received from the investments. In 2013–14, total expenses recorded by the pension plan were $93 million ($110 million in 2012–13) for government departments and $157 million ($134 million in 2012–13) for the Public Sector Pension Investment Board.

Transfer Agreements

The pension plan has transfer agreements with approximately 90 employers, including other levels of government, university and private sector employers. In 2013–14, $96 million ($135 million in 2012–13) was transferred into the public service pension plan, and $59 million ($49 million in 2012–13) was transferred out of the public service pension plan under these agreements.

Retirement Compensation Arrangements

Under the authority of the Special Retirement Arrangements Act, separate Retirement Compensation Arrangements No. 1 and No. 2 have been established to provide supplementary benefits to some employees. Since these arrangements are covered by separate legislation, the balance and corresponding value of their accrued pension benefits is not consolidated in the public service pension plan's Financial Statements. A summary of these arrangements is provided in the notes to the Financial Statements.

Retirement Compensation Arrangement No. 1 provides for benefits in excess of those permitted under the Income Tax Act for registered pension plans. In 2014, this primarily included benefits on salaries over $155,000 ($150,900 in 2013) plus some survivor benefits.

Retirement Compensation Arrangement No. 2 provides for pension benefits to public service employees declared surplus as a result of the three-year Early Retirement Incentive Program that ended on , which allowed eligible employees to retire with an unreduced pension.

Contributions and benefit payments in excess of limits permitted under the Income Tax Act for registered pension plans are recorded in the Retirement Compensation Arrangements Account in the Public Accounts. The balance in the Retirement Compensation Arrangements Account is credited with interest at the same rate as that of the Public Service Superannuation Account.

Further Information

Additional information concerning the public service pension plan is available at the following sites:

- Your Public Service Pension and Benefits Web Portal

- Pensions on Treasury Board of Canada Secretariat website

- Pay and Pension Services for Government Employees on Public Works and Government Services Canada website

- Public Service Superannuation Act

- PSP Investments

- Office of the Chief Actuary

Account Transaction Statements

Public Service Superannuation Account and Public Service Pension Fund

Prior to April 2000, all pension transactions accumulated in relation to the pension plan were accounted for, and recorded in, the Public Service Superannuation Account in the accounts of Canada (to the extent that any funds held in the Consolidated Revenue Fund have been earmarked specifically for the pension plan). The Superannuation Account does not consist of cash or marketable securities. The account is used to record transactions, such as contributions, benefit payments, interest, administrative expenses and other charges, which pertain to service prior to . The interest is credited quarterly at rates calculated as though the amounts recorded in the account were invested quarterly in a notional portfolio of Government of Canada 20-year bonds held to maturity.

All pension transactions related to service accrued since , are recorded in the Public Service Pension Fund Account in the accounts of Canada. An amount equal to contributions in excess of benefit payments and government organizations' administrative expenses is transferred regularly to the Public Sector Pension Investment Board and invested in capital markets. The balance in the Public Service Pension Fund Account at year-end represents amounts awaiting imminent transfer to the Public Sector Pension Investment Board.

The treatment of any actuarial excess or surplus and shortfall or deficit for both the Superannuation Account and the Pension Fund is outlined in the Financial Statements of the Public Service Pension Plan for the Fiscal Year Ended . As a result of the latest actuarial valuation as at , no actuarial adjustment was made to the Superannuation Account (nil in 2012–13) during the year ended March 31, 2014. Starting with the year ended , an annual adjustment of $435 million will be made to the Pension Fund for a period of 13 years ending in 2025. The Public Service Superannuation Act requires that any actuarial deficit be dealt with by transferring equal instalments to the Pension Fund over a period of up to 15 years, commencing in the year in which the actuarial report is tabled in Parliament.

| 2014 | 2013 | |

|---|---|---|

| The account transaction statement above is unaudited. | ||

| Opening Balance (A) | $96,648,001,666 | $96,441,820,180 |

| Receipts and Other Credits | ||

| Employee contributions | ||

|

Government employees

|

3,974,740 | 4,421,468 |

|

Retired employees

|

17,027,791 | 18,497,273 |

|

Public service corporation employees

|

261,641 | 275,357 |

| Employer contributions | ||

|

Government

|

17,233,070 | 18,502,069 |

|

Public service corporations

|

242,123 | 232,460 |

| Transfers from other pension funds | 391,468 | 592,964 |

| Interest | 5,061,490,938 | 5,317,729,059 |

| Total—Receipts and Other Credits (B) | $5,100,621,772 | $5,360,250,650 |

| Payments and Other Charges | ||

| Annuities | $5,163,832,473 | $4,996,538,068 |

| Minimum benefits | 16,775,306 | 13,781,359 |

| Pension division payments | 29,996,061 | 24,497,994 |

| Pension transfer value payments | 45,395,025 | 38,019,592 |

| Returns of contributions | ||

|

Government employees

|

154,484 | 16,920 |

|

Public service corporation employees

|

141,859 | 31,997 |

| Transfers to other pension funds | 10,651,878 | 9,757,823 |

| Administrative expenses | 57,897,383 | 71,425,411 |

| Total—Payments and Other Charges (C) | $5,324,844,467 | $5,154,069,164 |

| Receipts Less Payments (B - C) = (D) | $(224,222,695) | $206,181,486 |

| Closing Balance (A + D) | $96,423,778,971 | $96,648,001,666 |

| 2014 | 2013 | |

|---|---|---|

| The account transaction statement above is unaudited. | ||

| Opening Balance (A) | $550,792,204 | $142,589,690 |

| Receipts and Other Credits | ||

| Employee contributions | ||

|

Government employees

|

1,586,029,379 | 1,462,879,048 |

|

Retired employees

|

36,906,148 | 36,849,984 |

|

Public service corporation employees

|

151,031,744 | 135,731,961 |

| Employer contributions | ||

|

Government

|

2,519,014,713 | 2,492,724,245 |

|

Public service corporations

|

242,823,824 | 226,119,081 |

| Actuarial liability adjustment | 435,000,000 | 435,000,000 |

| Transfers from other pension funds | 91,526,497 | 131,267,992 |

| Transfer value election | 3,754,438 | 3,514,694 |

| Total—Receipts and Other Credits (B) | $5,066,086,742 | $4,924,087,005 |

| Payments and Other Charges | ||

| Annuities | $1,143,851,882 | $909,173,984 |

| Minimum benefits | 11,418,925 | 9,426,009 |

| Pension division payments | 27,576,454 | 19,792,756 |

| Pension transfer value payments | 302,264,857 | 224,367,506 |

| Returns of contributions | ||

|

Government employees

|

9,638,772 | 15,392,927 |

|

Public service corporation employees

|

3,505,117 | 2,736,087 |

| Transfers to other pension funds | 48,803,326 | 38,846,919 |

| Administrative expenses | 35,110,461 | 38,442,934 |

| Total—Payments and Other Charges (C) | $1,582,169,796 | $1,258,179,122 |

| Receipts Less Payments (B - C) | $3,483,916,946 | $3,665,907,883 |

| Transfers to Public Sector Pension Investment Board (D) | $(3,534,765,812) | $(3,257,705,370) |

| Closing Balance (A + B - C + D) | $499,943,338 | $550,792,203 |

Retirement Compensation Arrangements

Supplementary benefits for certain federal public service employees are provided under the Retirement Compensation Arrangements Regulations, No. 1, Parts I and II (public service portion), and the Retirement Compensation Arrangements Regulations, No. 2 (Early Retirement Incentive Program). The Special Retirement Arrangements Act authorized these regulations and established the Retirement Compensation Arrangements for the payment of benefits.

Transactions pertaining to Retirement Compensation Arrangement No. 1 and Retirement Compensation Arrangement No. 2, such as contributions, benefits and interest credits, are recorded in the Retirement Compensation Arrangements Account in the accounts of Canada. The Retirement Compensation Arrangements Account earns interest quarterly at the same rate as that credited to the Public Service Superannuation Account. The Retirement Compensation Arrangements Account is registered with the Canada Revenue Agency, and a transfer debit or credit is made annually between the Retirement Compensation Arrangements Account and the Canada Revenue Agency either to remit a 50-per-cent refundable tax for the net contributions and interest credits or to be credited a reimbursement based on the net benefit payments.

Actuarial shortfalls found between the balance in the Retirement Compensation Arrangements Account and the actuarial liabilities are credited to the Retirement Compensation Arrangements Account in equal instalments over a period of up to 15 years. As a result of the triennial valuation of , no adjustment was made to Retirement Compensation Arrangement No. 1 (nil in 2012–13), but a credit adjustment of $8 million was made to cover an actuarial deficiency in Retirement Compensation Arrangement No. 2 during the year ($8.0 million in 2012–13).

Retirement Compensation Arrangement No. 1

For tax purposes, financial transactions related to pension plan members' pensionable earnings over $155,000 in 2014 are recorded separately. As at , there were 5,556 public service employees (3,925 in 2013) and 9,544 retired members (7,527 in 2013) in this category.

| 2014 | 2013 | |

|---|---|---|

| The account transaction statement above is unaudited. | ||

| Opening Balance (A) | $975,251,232 | $910,164,231 |

| Receipts and Other Credits | ||

| Employee contributions | ||

|

Government employees

|

10,588,750 | 8,546,868 |

|

Retired employees

|

264,330 | 403,206 |

|

Public service corporation employees

|

1,721,296 | 1,627,632 |

| Employer contributions | ||

|

Government

|

83,641,858 | 75,927,626 |

|

Public service corporations

|

13,501,115 | 14,460,096 |

| Interest | 54,134,392 | 52,872,701 |

| Transfer from other pension funds | 24,072 | 92,262 |

| Transfer value election | 773 | 10,632 |

| Total—Receipts and Other Credits (B) | $163,876,586 | $153,941,023 |

| Payments and Other Charges | ||

| Annuities | $26,098,541 | $20,598,427 |

| Minimum benefits | 165,922 | 212,169 |

| Pension division payments | 903,333 | 252,898 |

| Pension transfer value payments | 324,334 | 745,370 |

| Returns of contributions | ||

|

Government employees

|

18,401 | 2,989 |

|

Public service corporation employees

|

5,809 | 3,918 |

| Transfers to other pension plans | 1,747,052 | 154,474 |

| Refundable tax | 69,699,727 | 66,883,777 |

| Total—Payments and Other Charges (C) | $98,963,118 | $88,854,022 |

| Receipts Less Payments (B - C) = (D) | 64,913,468 | 65,087,001 |

| Closing Balance (A + D) | $1,040,164,700 | $975,251,232 |

Retirement Compensation Arrangement No. 2

During the three year period starting , a number of employees between the ages of 50 and 54 left the public service under the Early Retirement Incentive Program, which waived the pension reduction under the Public Service Superannuation Act for employees who were declared surplus.

| 2014 | 2013 | |

|---|---|---|

| The account transaction statement above is unaudited. | ||

| Opening Balance (A) | $749,295,712 | $766,225,994 |

| Receipts and Other Credits | ||

| Government contributions and interest | ||

|

Contributions

|

0 | 0 |

|

Interest

|

38,383,183 | 41,350,683 |

| Actuarial liability adjustment | 8,000,000 | 8,000,000 |

| Total—Receipts and Other Credits (B) | $46,383,183 | $49,350,683 |

| Payments and Other Charges | ||

| Annuities | $84,639,840 | $84,001,208 |

| Refundable tax | (18,797,103) | (17,720,243) |

| Total—Payments and Other Charges (C) | 65,842,737 | 66,280,965 |

| Receipts Less Payments (B - C) = (D) | $(19,459,554) | $(16,930,282) |

| Closing Balance (A + D) | $729,836,158 | $749,295,712 |

Supplementary Death Benefit

As at , there were 287,563 active participants (292,713 in 2013) and 166,827 retired elective participants (159,545 in 2013) entitled to a Supplementary Death Benefit under Part II of the Public Service Superannuation Act. In 2013–14, 3,263 claims (4,419 in 2013) for Supplementary Death Benefits were paid.

| 2014 | 2013 | |

|---|---|---|

| The account transaction statement above is unaudited. Notes: Table 10 Notes

|

||

| Opening Balance (A) | $3,208,242,034 | $3,080,791,499 |

| Receipts and Other Credits | ||

| Contributions | ||

|

Employees (government and public service corporation)

|

96,660,263 | 95,496,841 |

|

Government

|

||

|

General

|

11,456,742 | 9,806,738 |

|

Single premium for $10,000 benefit

|

2,793,056 | 2,684,589 |

|

Public service corporations

|

1,315,296 | 1,264,435 |

| Interest | 170,131,983 | 172,062,762 |

| Total—Receipts and Other Credits (B) | $282,357,340 | $281,315,365 |

| Payments and Other Charges | ||

| Benefit payments | ||

|

General

table 10 note 1 1

|

$137,143,304 | $117,525,672 |

|

$10,000 Benefit

table 10 note 2 2

|

43,106,804 | 36,183,978 |

|

Other death benefit payments

|

337,605 | 155,180 |

| Total—Payments and Other Charges (C) | $180,587,713 | $153,864,830 |

| Receipts Less Payments (B - C) = (D) | $101,769,627 | $127,450,535 |

| Closing Balance (A + D) | $3,310,011,661 | $3,208,242,034 |

Statistical Tables

Statistical Table 1. Pensions in Pay

| Year | Pensions statistical table 1.1 note 1 1 | Survivor Pensions statistical table 1.1 note 2 2 | Total |

|---|---|---|---|

| Notes: Statistical Table 1.1 Notes

|

|||

| 2014 | 207,495 | 59,331 | 266,826 |

| 2013 | 200,975 | 58,123 | 259,098 |

| 2012 | 189,743 | 56,423 | 246,166 |

| Pensions statistical table 1.2 note 2 2 | Survivor Pensions | ||||||

|---|---|---|---|---|---|---|---|

| Year | Men | Women | Total | Spouse / Common- Law Partner | Children | Students | |

| Notes: Statistical Table 1.2 Notes

|

|||||||

| 2014 | Average annual amount | $31,882 | $22,974 | $28,019 | $13,031 | $2,038 | $3,471 |

| Average age | 71.3 | 68.5 | 70.1 | 80.1 | N/A | N/A | |

| Average pensionable service (years) | 25.4 | 22.7 | 24.2 | 22.3 | N/A | N/A | |

| 2013 | Average annual amount | $31,277 | $22,084 | $27,380 | $12,802 | $2,043 | $3,472 |

| Average age | 71.1 | 68.5 | 70.0 | 79.4 | N/A | N/A | |

| Average pensionable service (years) | 25.3 | 22.5 | 24.1 | 22.2 | N/A | N/A | |

| 2012 | Average annual amount | $31,063 | $21,498 | $27,135 | $12,555 | $1,991 | $2,794 |

| Average age | 71.1 | 68.7 | 70.1 | 78.5 | N/A | N/A | |

| Average pensionable service (years) | 25.7 | 22.5 | 24.4 | 22.2 | N/A | N/A | |

Statistical Table 2. Pensions That Became Payable

| Year | Men | Women | Total | Total Amount Paid | Average Pension |

|---|---|---|---|---|---|

| Notes: Statistical Table 2.1 Notes

|

|||||

| 2014 | 4,811 | 6,028 | 10,839 | $385,271,381 | $35,548 |

| 2013 | 6,033 | 7,313 | 13,346 | $450,740,734 | $33,773 |

| 2012 | 5,066 | 5,580 | 10,646 | $384,398,234 | $36,107 |

| Year | Spouse / Common-Law Partner | Children and Students | Total | Total Amount Paid | Average Pension Spouse / Common-Law Partner | Average Pension Children and Students |

|---|---|---|---|---|---|---|

| Notes: Statistical Table 2.2 Notes

|

||||||

| 2014 | 2,285 | 628 | 2,913 | $36,505,401 | $15,091 | $3,349 |

| 2013 | 2,557 | 363 | 2,920 | $38,025,675 | $15,850 | $2,930 |

| 2012 | 2,640 | 249 | 2,889 | $38,935,387 | $14,488 | $2,757 |

Statistical Table 3. Unreduced Pensions, Immediate Annuities statistical table 3 note 1 1 (year ended March 31)

| Year | 50– 54 statistical table 3 note 2 2 |

55 | 56 | 57 | 58 | 59 | 60 statistical table 3 note 3 3 |

61 | 62 | 63 | 64 | 65 | 66 and over | Total | Average Age statistical table 3 note 4 4 | Average Unreduced Pension statistical table 3 note 5 5 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Notes: Statistical Table 3 Notes

|

||||||||||||||||

| 2014 | 69 | 1,521 | 614 | 563 | 478 | 451 | 1,227 | 576 | 494 | 435 | 397 | 486 | 767 | 8,078 | 60 | $39,273 |

| 2013 | 57 | 1,668 | 755 | 679 | 609 | 537 | 1,624 | 702 | 617 | 482 | 465 | 561 | 903 | 9,659 | 60 | $36,668 |

| 2012 | 62 | 1,508 | 556 | 499 | 484 | 403 | 1,300 | 603 | 481 | 386 | 399 | 480 | 689 | 7,850 | 60 | $40,079 |

Statistical Table 4. Reduced Pension (Annual Allowances) and Lump-Sum Payments That Became Payable (year ended March 31)

| Reduced Pensions statistical table 4 note 1 1 | Lump-Sum Payments statistical table 4 note 2 2 | |||||

|---|---|---|---|---|---|---|

| Year | Number for Men | Number for Women | Total Number | Average Allowance | Number | Amount |

| Notes: Statistical Table 4 Notes

|

||||||

| 2014 | 592 | 1,065 | 1,657 | $29,536 | 9,071 | $478,127,833 |

| 2013 | 1,027 | 1,710 | 2,737 | $29,224 | 11,767 | $373,460,521 |

| 2012 | 654 | 1,066 | 1,720 | $29,648 | 4,811 | $249,328,748 |

Statistical Table 5. Changes in Number of Active Contributors, Retired Members, and Survivors on Pension

| Men | Women | Total | |

|---|---|---|---|

| Notes: Statistical Table 5.1 Notes

|

|||

| Number of Active Contributors, | 132,764 | 167,405 | 300,169 |

| Additions | 8,754 | 11,358 | 20,112 |

| Deletions statistical table 5.1 note 1 1 | 10,108 | 13,498 | 23,606 |

| Adjustments statistical table 5.1 note 2 2 | 1,257 | 1,361 | 2,618 |

| Number of Active Contributors, | 132,667 | 166,626 | 299,293 |

| Total | |

|---|---|

| Notes: Statistical Table 5.2 Notes

|

|

| Number of Retired Members, | 200,975 |

|

Additions

|

10,839 |

|

Deletions

|

3,644 |

| Adjustments statistical table 5.2 note 2 2 | (675) |

| Number of Retired Members, | 207,495 |

| Total | |

|---|---|

| Notes: Statistical Table 5.3 Notes

|

|

| Number of Survivors on Pension, | 56,789 |

|

Additions

|

2,285 |

|

Deletions

|

383 |

| Adjustments statistical table 5.3 note 1 1 | (717) |

| Number of Survivors on Pension, | 57,974 |

| Total | |

|---|---|

| Notes: Statistical Table 5.4 Notes

|

|

| Number of Children and Students on Pension, | 1,334 |

|

Additions

|

628 |

|

Deletions

|

222 |

| Adjustments statistical table 5.4 note 1 1 | (383) |

| Number of Children and Students on Pension, | 1,357 |

Statistical Table 6. Number and Amount of Transfer Value Payments by Years of Pensionable Service and Age at Termination (year ended )

| Years of Pensionable Service | Age at Termination | ||||||

|---|---|---|---|---|---|---|---|

| Under 30 | 30–34 | 35–39 | 40–44 | 45–49 | Total | Total ($) | |

| Under 5 | 430 | 319 | 181 | 172 | 177 | 1,279 | |

| 5–9 | 69 | 162 | 162 | 115 | 108 | 616 | |

| 10–14 | 1 | 40 | 104 | 121 | 123 | 389 | |

| 15–19 | 0 | 0 | 12 | 50 | 76 | 138 | |

| 20–24 | 0 | 0 | 1 | 26 | 77 | 104 | |

| 25–29 | 0 | 0 | 0 | 0 | 18 | 18 | |

| 30–35 | 0 | 0 | 0 | 0 | 8 | 8 | |

| Overall Total | 500 | 521 | 460 | 484 | 587 | 2,552 | $347,659,882 |

| Total Women | 1,490 | ||||||

| Total Men | 1,062 | ||||||

Statistical Table 7. Supplementary Death Benefit—Number of Participants and Number of Benefits Paid (year ended March 31)

| Active Participants statistical table 7 note 1 1 | Retired Participants statistical table 7 note 2 2 | Death Benefits Paid | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Year | Men | Women | Total | Men | Women | Total | Men | Women | Total | Amount Paid |

| Notes: Statistical Table 7 Notes

|

||||||||||

| 2014 | 126,151 | 161,412 | 287,563 | 94,655 | 72,172 | 166,827 | 2,358 | 905 | 3,263 | $180,587,713 |

| 2013 | 128,150 | 164,563 | 292,713 | 92,445 | 67,100 | 159,545 | 3,097 | 1,322 | 4,419 | $153,864,830 |

| 2012 | 133,878 | 172,041 | 305,919 | 90,057 | 61,648 | 151,705 | 3,421 | 1,493 | 4,914 | $164,082,537 |

Financial Statements of the Public Service Pension Plan for the Fiscal Year Ended

Statement of Responsibility

Responsibility for the integrity and fairness of the financial statements of the public service pension plan (the pension plan) rests with Public Works and Government Services Canada (PWGSC) and the Treasury Board of Canada Secretariat (TBS). TBS carries out responsibilities in respect of the overall management of the pension plan, while PWGSC is responsible for the day-to-day administration of the pension plan and for maintaining the books of accounts.

The financial statements of the pension plan for the year ended , have been prepared in accordance with the government's stated accounting policies for the pension plan set out in Note 2 of the financial statements, which are based on Canadian accounting standards for pension plans. The presentation and results using the stated accounting policies do not result in any significant differences from Canadian accounting standards for pension plans. The financial statements include management's best estimates and judgments where appropriate.

To fulfill its accounting and reporting responsibilities, PWGSC has developed and maintains books, records, internal controls, and management practices designed to provide reasonable assurance as to the reliability of the financial information and to ensure that transactions are in accordance with the Public Service Superannuation Act (PSSA) and regulations, as well as the Financial Administration Act (FAA) and regulations.

Additional information, as required, is obtained from the Public Sector Pension Investment Board (PSPIB). PSPIB maintains its own records and systems of internal control to account for the funds managed on behalf of the pension plan in accordance with the Public Sector Pension Investment Board Act, regulations and by-laws.

These statements have been audited by the Auditor General of Canada, the independent auditor for the Government of Canada.

Approved by:

George Da Pont

Deputy Minister and Deputy Receiver

General for Canada

Public Works and Government

Services Canada

Original signed by

Yaprak Baltacıoğlu

Secretary of the Treasury Board

Treasury Board of Canada Secretariat

Original signed by

Independent Auditor's Report

To the President of the Treasury Board and the Minister of Public Works and Government Services

Report on the Financial Statements

I have audited the accompanying financial statements of the public service pension plan, which comprise the statement of financial position as at , and the statement of changes in net assets available for benefits and statement of changes in pension obligations for the year then ended, and a summary of significant accounting policies and other explanatory information.

Management's Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in accordance with the stated accounting policies set out in Note 2 of the financial statements, which conform with Canadian accounting standards for pension plans, and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

Auditor's Responsibility

My responsibility is to express an opinion on these financial statements based on my audit. I conducted my audit in accordance with Canadian generally accepted auditing standards. Those standards require that I comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor's judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity's preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity's internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.

I believe that the audit evidence I have obtained is sufficient and appropriate to provide a basis for my audit opinion.

Opinion

In my opinion, the financial statements present fairly, in all material respects, the financial position of the public service pension plan as at , and the changes in its net assets available for benefits and changes in its pension obligations for the year then ended in accordance with Canadian accounting standards for pension plans.

Report on Other Legal and Regulatory Requirements

In my opinion, the transactions of the public service pension plan that have come to my notice during my audit of the financial statements have, in all significant respects, been in accordance with the Public Service Superannuation Act and regulations, the Public Sector Pension Investment Board Act and regulations and the by-laws of the Public Sector Pension Investment Board.

Original signed by

Nancy Y. Cheng, FCPA, FCA

Assistant Auditor General

for the Auditor General of Canada

Ottawa, Canada

Financial Statements

| As at | As at (Note 3) | As at (Note 3) | |

|---|---|---|---|

| Assets | |||

| Commitments (Note 24) The accompanying notes are an integral part of these financial statements. |

|||

|

Public Service Pension Fund (

Note 5)

|

$500 | $551 | $142 |

|

Investments (

Note 6)

|

73,869 | 59,610 | 51,345 |

|

Investment-related assets (

Note 6)

|

1,408 | 1,612 | 919 |

|

Contributions receivable (

Note 9)

|

910 | 896 | 1,011 |

|

Other assets (

Note 10)

|

111 | 70 | 66 |

| Total Assets | $76,798 | $62,739 | 53,483 |

| Liabilities | |||

|

Investment-related liabilities (

Note 6)

|

$7,110 | $5,709 | 5,120 |

|

Accounts payable and other liabilities

|

111 | 101 | 82 |

| Net Assets Available for Benefits | $69,577 | $56,929 | 48,281 |

| Pension Obligations | |||

|

Unfunded (

Note 14)

|

$92,064 | $93,783 | $93,018 |

|

Funded (

Note 14)

|

65,522 | 59,965 | 52,907 |

| Total Pension Obligations | $157,586 | $153,748 | $145,925 |

| Deficit – To be Financed by the Government of Canada (Note 15) | $(88,009) | $(96,819) | $(97,644) |

| 2014 | 2013 (Note 3) | |

|---|---|---|

| The accompanying notes are an integral part of these financial statements. | ||

| Net Assets Available for Benefits, Beginning of Year | $56,929 | $48,281 |

| Increase in Net Assets Available for Benefits | ||

|

Investment income, excluding changes in fair values of investment assets and investment liabilities (

Note 17)

|

1,603 | 1,293 |

|

Changes in fair values of investment assets and investment liabilities – realized and unrealized gains and losses (

Note 17)

|

7,704 | 3,938 |

|

Contributions

|

||

|

From Plan Members (

Note 16)

|

1,796 | 1,660 |

|

From Employers (

Note 16)

|

2,753 | 2,579 |

|

Actuarial adjustment (

Note 18)

|

435 | 435 |

|

Transfers from other pension plans

|

96 | 135 |

| Total Increase in Net Assets Available for Benefits | $14,387 | $10,040 |

| Decrease in Net Assets Available for Benefits | ||

|

Benefits paid with respect to service after

(

Note 19)

|

$1,155 | $919 |

|

Refunds and transfers (

Note 19)

|

392 | 301 |

|

Administrative expenses

|

192 | 172 |

| Total Decrease in Net Assets Available for Benefits | $1,739 | $1,392 |

| Net Increase in Net Assets Available for Benefits | $12,648 | $8,648 |

| Net Assets Available for Benefits, End of Year | $69,577 | $56,929 |

| 2014 Funded |

2014 Unfunded |

2014 Total |

2013 Funded |

2013 Unfunded |

2013 Total |

|

|---|---|---|---|---|---|---|

| The accompanying notes are an integral part of these financial statements. | ||||||

| Pension Obligations, Beginning of Year | $59,965 | $93,783 | $153,748 | $52,907 | $93,018 | $145,925 |

| Increase in Pension Obligations | ||||||

|

Interest on pension obligations

|

2,891 | 4,921 | 7,812 | 3,058 | 5,155 | 8,213 |

|

Benefits earned

|

4,561 | 0 | 4,561 | 4,532 | 0 | 4,532 |

|

Changes in actuarial assumptions (gains)/losses (Note 14) |

(19) | (878) | (897) | 898 | 1,029 | 1,927 |

|

Transfers from other pension plans

|

95 | 0 | 95 | 134 | 1 | 135 |

| Total Increase in Pension Obligations | $7,528 | $4,043 | $11,571 | $8,622 | $6,185 | $14,807 |

| Decrease in Pension Obligations | ||||||

|

Benefits paid (

Note 19)

|

$1,155 | $5,181 | $6,336 | $919 | $5,010 | $5,929 |

|

Experience gains

|

389 | 437 | 826 | 306 | 266 | 572 |

|

Refunds and transfers (

Note 19)

|

392 | 86 | 478 | 301 | 72 | 373 |

| 35 | 58 | 93 | 38 | 72 | 110 | |

| Total Decrease in Pension Obligations | $1,971 | $5,762 | $7,733 | $1,564 | $5,420 | $6,984 |

| Net Increase (Decrease) in Pension Obligations | $5,557 | $(1,719) | $3,838 | $7,058 | $765 | $7,823 |

| Pension Obligations, End of Year | $65,522 | $92,064 | $157,586 | $59,965 | $93,783 | $153,748 |

Notes to the Financial Statements

Year Ended (Canadian $)

1. Description of the Public Service Pension Plan

The public service pension plan (the pension plan), governed by the Public Service Superannuation Act (PSSA), provides pension benefits for federal public service employees. While the PSSA has been in effect since , federal legislation has been providing pensions for public servants since 1870.

The main provisions of the pension plan are summarized below.

(A) General