Retirement Income Sources

When you retire, your retirement income generally comes from three sources:

- Your public service pension plan;

- The government pension plans, that is, Old Age Security (OAS) and the Canada Pension Plan or Quebec Pension Plan (CPP or QPP); and

- Your personal savings.

The Old Age Security benefit is payable to Canadian citizens who meet certain residency criteria. For details, refer to the Old Age Security (OAS) Program.

The Canada Pension Plan or Quebec Pension Plan provides basic retirement income to Canadian workers.

Table of Contents

Canada Pension Plan/Quebec Pension Plan coordination

Your public service pension plan is coordinated with the Canada Pension Plan (CPP) and Quebec Pension Plan (QPP). So, in addition to the public service pension plan, you and your employer must also pay into the CPP or QPP. You pay into CPP if you work outside Quebec and QPP if you work in Quebec.

The CPP has been gradually enhanced since 2019. The enhancement adds two additional components to the CPP. These components are not a separate benefit but a top-up to the base CPP. The current enhanced CPP now consists of:

- the base (or original) CPP

- the first additional component, which was phased in between 2019 and 2023

- the second additional component, which was phased in between 2024 and 2025

QPP has also been enhanced in a similar manner. For more details, visit Canada Pension Plan enhancement for CPP or Enhancement of the Québec Pension Plan for QPP.

It is important to note that the public service pension plan is coordinated with the original CPP/QPP, not the enhanced CPP/QPP.

Under the original CPP/QPP, you pay a portion of your salary between a set minimum and a set maximum level:

- The minimum level, called the year’s basic exemption, is set at $3,500.

- The maximum level, called the year’s maximum pensionable earnings (YMPE), is set every year by the Canada Revenue Agency. In 2026, it’s set at $74,600.

With the CPP enhancement, there’s now an additional higher limit. The higher limit is called the year's additional maximum pensionable earnings (YAMPE). In 2026, it’s set at $85,000.

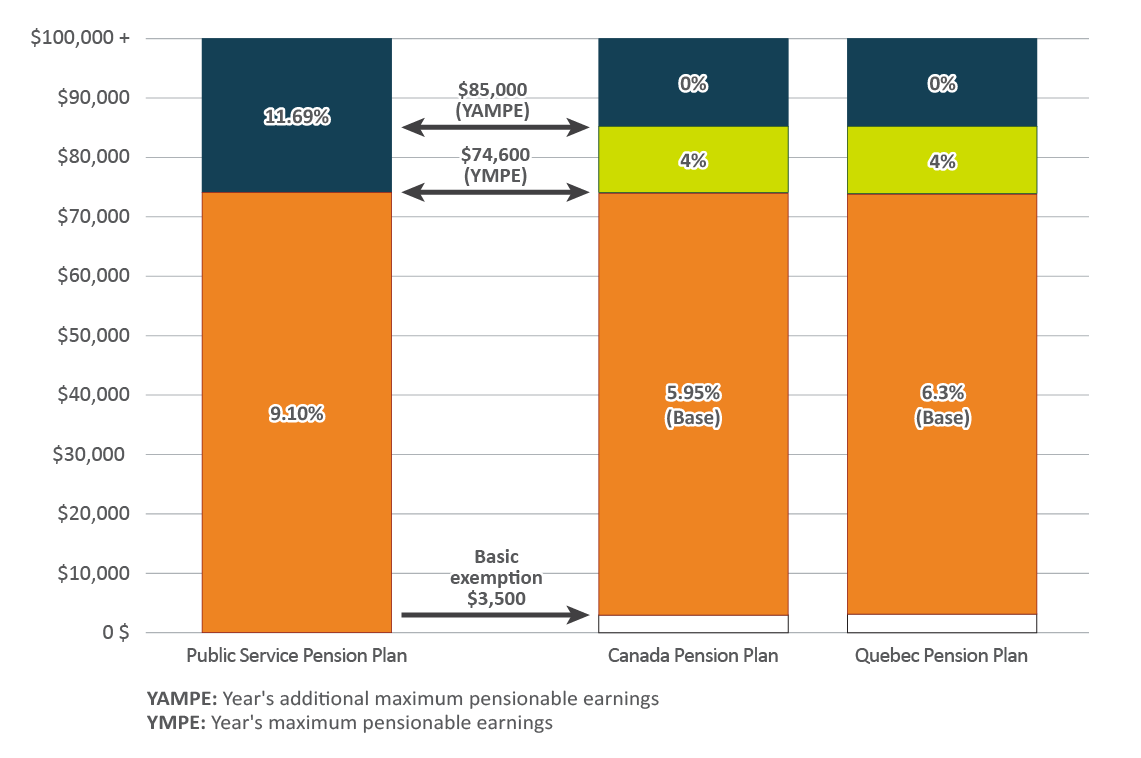

Contributions under the public service pension plan and the CPP/QPP

The rates at which you pay are based on your salary up to and above the YMPE.

On the portion of your salary up to the YMPE, you pay into your public service pension plan at a lower rate and you also contribute to the CPP/QPP.

On any salary above the YMPE, you pay into your public service pension plan at a higher rate.

Please refer to the figures below.

If you began paying into the public service pension plan before January 1, 2013, you pay at the following contribution rates in 2026:

- 9.10% - up to the YMPE

- 11.69% - above the YMPE

Figure 1 shows the contribution rates under the public service pension plan and CPP/QPP for employees who started paying into the public service pension plan before January 1, 2013.

Figure 1 - Text version

| Income | Public service pension plan Contribution rate | CPP Contribution rate | QPP Contribution rate |

|---|---|---|---|

| $0 | 9.10% | 0% | 0% |

| $3,500 (Basic exemption) | 9.10% | 5.95% | 6.3% |

| $10,000 | 9.10% | 5.95% | 6.3% |

| $20,000 | 9.10% | 5.95% | 6.3% |

| $30,000 | 9.10% | 5.95% | 6.3% |

| $40,000 | 9.10% | 5.95% | 6.3% |

| $50,000 | 9.10% | 5.95% | 6.3% |

| $60,000 | 9.10% | 5.95% | 6.3% |

| $70,000 | 9.10% | 5.95% | 6.3% |

| $74,600 (YMPE) | 11.69% | 4% | 4% |

| $80,000 | 11.69% | 4% | 4% |

| $85,000 (YAMPE) | 11.69% | 0% | 0% |

| $90,000 | 11.69% | 0% | 0% |

| $100,000+ | 11.69% | 0% | 0% |

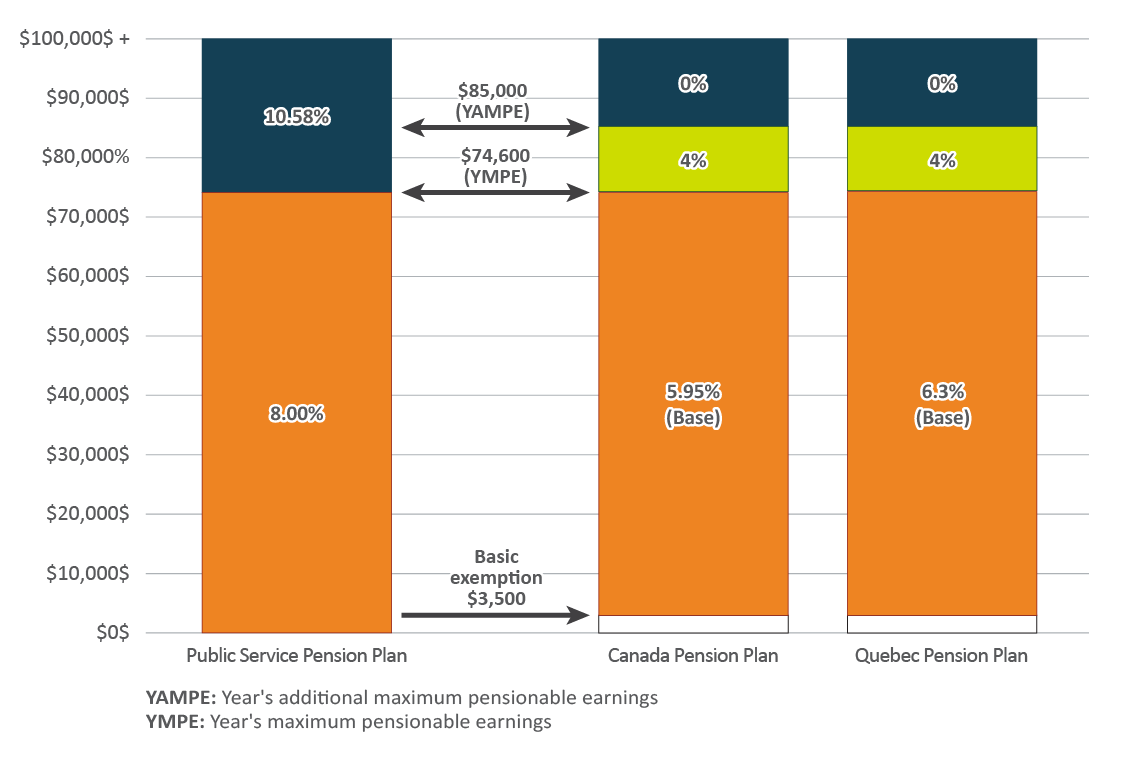

If you began paying into the public service pension plan after December 31, 2012, you pay at the following contribution rates in 2026:

- 8.00% - up to the YMPE

- 10.58% - above the YMPE

Figure 2 shows the contribution rates for employees who started paying into the public service pension plan after December 31, 2012.

Figure 2 - Text version

| Income | Public service pension plan Contribution rate | CPP Contribution rate | QPP Contribution rate |

|---|---|---|---|

| $0 | 8.00% | 0% | 0% |

| $3,500 (Basic exemption) | 8.00% | 5.95% | 6.3% |

| $10,000 | 8.00% | 5.95% | 6.3% |

| $20,000 | 8.00% | 5.95% | 6.3% |

| $30,000 | 8.00% | 5.95% | 6.3% |

| $40,000 | 8.00% | 5.95% | 6.3% |

| $50,000 | 8.00% | 5.95% | 6.3% |

| $60,000 | 8.00% | 5.95% | 6.3% |

| $70,000 | 8.00% | 5.95% | 6.3% |

| $74,600 (YMPE) | 10.58% | 4% | 4% |

| $80,000 | 10.58% | 4% | 4% |

| $85,000 (YAMPE) | 10.58% | 0% | 0% |

| $90,000 | 10.58% | 0% | 0% |

| $100,000+ | 10.58% | 0% | 0% |

Pension formula: lifetime pension and bridge benefit

The public service pension plan provides for the payment of a lifetime pension payable until your death and a temporary bridge benefit payable until age 65.

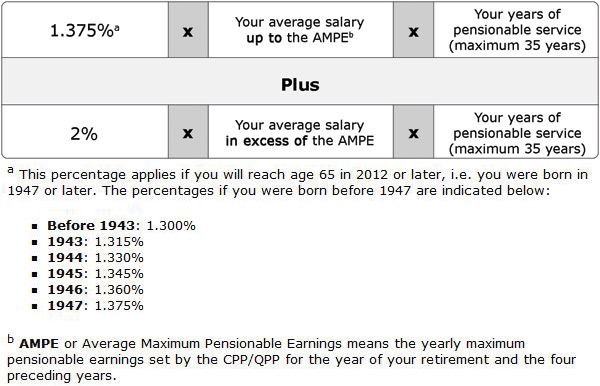

Generally, the formula for calculating your pension is as follows:

Lifetime pension

Your annual lifetime pension payable from the public service pension plan is based on:

- Your average salary, that is, your salary during your five consecutive years of highest paid service. It includes any salary you earned after completing 35 years of service, if that salary is the highest. Your salary is converted to equivalent full-time salary for periods during which you worked less than full time; and

- Your years of pensionable service–that is, the complete or partial years of service credited to you at retirement–including the service buyback (whether or not it has been fully paid).

The following table illustrates how your annual lifetime pension is calculated.

Figure 3 - Text version

1.375 percentFigure 3 - Note a multiplied by your average salary up to the Average Maximum Pensionable EarningsFigure 3 - Note b multiplied by your years of pensionable service (maximum 35 years)

plus

2 percent multiplied by your average salary in excess of the Average Maximum Pensionable Earnings multiplied by your years of pensionable service (maximum 35 years)

Figure 3 - Notes

- Figure 3 Note a

-

This percentage applies if you will reach age 65 in 2012 or later, i.e. you were born in 1947 or later. The percentages if you were born before 1947 are indicated below:

- Before 1943: 1.300%

- 1943: 1.315%

- 1944: 1.330%

- 1945: 1.345%

- 1946: 1.360%

- 1947: 1.375%

- Figure 3 Note b

-

AMPE or Average Maximum Pensionable Earnings means the yearly maximum pensionable earnings set by the CPP/QPP for the year of your retirement and the four preceding years.

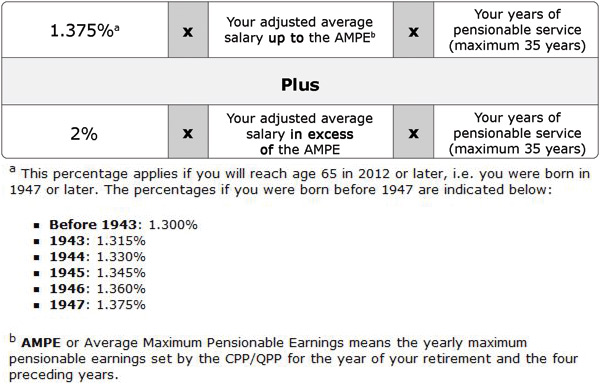

Figure 4 - Text version

1.375 percentFigure 4 Note a multiplied by your adjusted average salary up to the Average Maximum PensionableFigure 4 Note b multiplied by your years of pensionable service (maximum 35 years)

plus

2 percent multiplied by your adjusted average salary in excess of the Average Maximum Pensionable Earnings multiplied by your years of pensionable service (maximum 35 years)

Figure 4 - Notes

- Figure 4 Note a

-

This percentage applies if you will reach age 65 in 2012 or later, i.e. you were born in 1947 or later. The percentages if you were born before 1947 are indicated below:

- Before 1943: 1.300%

- 1943: 1.315%

- 1944: 1.330%

- 1945: 1.345%

- 1946: 1.360%

- 1947: 1.375%

- Figure 4 Note b

-

AMPE or Average Maximum Pensionable Earnings means the yearly maximum pensionable earnings set by the CPP/QPP for the year of your retirement and the four preceding years.

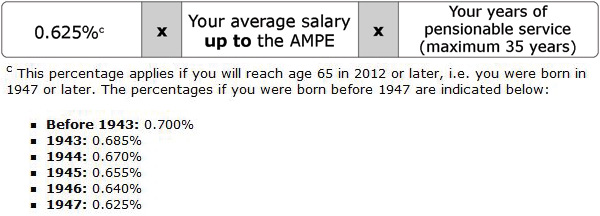

Bridge benefit

If you retire before age 65, you will also receive a bridge benefit. This temporary benefit helps “bridge” your pension until age 65, when CPP/QPP is expected to begin. However, the bridge benefit will stop immediately if you become entitled to CPP/QPP disability pension.

The following table illustrates how your bridge benefit is calculated.

Figure 5 - Text version

0.625 percentFigure 5 - Note c multiplied by your average salary up to the Average Maximum Pensionable Earnings multiplied by your years of pensionable service (maximum 35 years)

Figure 5 - Notes

- Figure 5 Note c

-

This percentage applies if you will reach age 65 in 2012 or later, i.e. you were born in 1947 or later. The percentages if you were born before 1947 are indicated below:

- Before 1943: 0.700%

- 1943: 0.685%

- 1944: 0.670%

- 1945: 0.655%

- 1946: 0.640%

- 1947: 0.625%

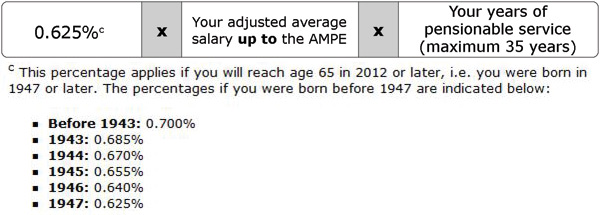

Figure 6 - Text version

0.625 percentFigure 6 Note c multiplied by your adjusted average salary up to the Average Maximum Pensionable Earnings multiplied by your years of pensionable service (maximum 35 years)

Figure 6 - Notes

- Figure 6 Note c

-

This percentage applies if you will reach age 65 in 2012 or later, i.e. you were born in 1947 or later. The percentages if you were born before 1947 are indicated below:

- Before 1943: 0.700%

- 1943: 0.685%

- 1944: 0.670%

- 1945: 0.655%

- 1946: 0.640%

- 1947: 0.625%

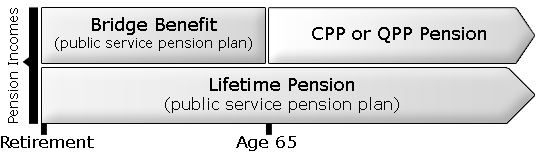

At age 65

At age 65, you will receive your lifetime pension. If you were in receipt of the bridge benefit, it will end on the first of the month following your 65th birthday and your CPP/QPP pension begins.

Your total pension income (your public service plan lifetime pension plus your CPP/ QPP pension) at age 65 will be approximately the same as the amount you received from the lifetime pension and bridge benefit before age 65.

The following graph illustrates retirement before age 65 and applying for a CPP/QPP pension at age 65 (age when CPP/QPP normally begins)

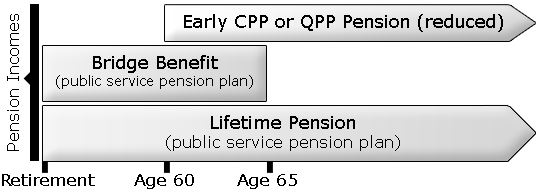

Choosing an early, reduced CPP/QPP benefit

If you retire before age 65 you can also choose to begin receiving your CPP/QPP pension before age 65; however, it is a reduced pension that continues to be paid at the reduced rate after age 65. As a result, you will notice a decrease in your total pension income at age 65 because you are in receipt of an early CPP/QPP benefit.

The following table illustrates what happens if you retire before age 65 and apply for an early CPP or QPP (60 to 64).

How to calculate your pension

A pension benefit calculation for someone who worked full-time

For example, if:

- You retire in 2023 at age 63.

- You worked 30 years full-time.

- Your average annual salary is $90,000.

- You will reach age 65 in 2025.

- The average maximum pensionable earnings (AMPE) in 2023 is $61,840.

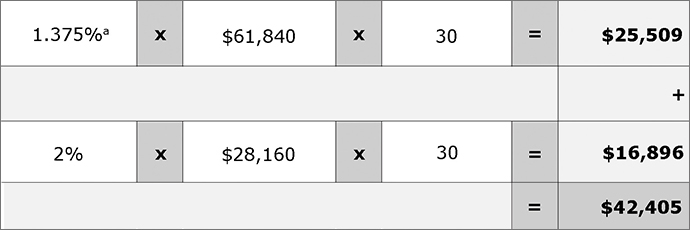

Step 1: The following table illustrates how your annual lifetime pension would be calculated.

Figure 9 - Text version

1.375 percent a multiplied by 61,840 dollars multiplied by 30 equals 25,509 dollars

plus

2 percent multiplied by 28,160 dollars multiplied by 30 equals 16,896 dollars.

This is a total of 42,405.00 dollars (25,509 plus 16,869 equals 42,405 dollars).

Figure 9 - Notes

- Figure 9 Note a

-

This percentage applies if you will reach age 65 in 2012 or later (meaning you were born in 1947 or later). The percentages if you were born before 1947 are indicated below:

- Before 1943: 1.300%

- 1943: 1.315%

- 1944: 1.330%

- 1945: 1.345%

- 1946: 1.360%

- 1947: 1.375%

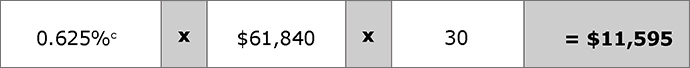

Step 2: The following table illustrates how your annual bridge benefit is calculated.

Figure 10 - Text version

0.625 percentFigure 10 Note c multiplied by 61,840 dollars multiplied by 30 equals 11,595 dollars.

Figure 10 - Notes

- Figure 10 Note c

-

This percentage applies if you will reach age 65 in 2012 or later (meaning you were born in 1947 or later). The percentages if you were born before 1947 are indicated below:

- Before 1943: 0.700%

- 1943: 0.685%

- 1944: 0.670%

- 1945: 0.655%

- 1946: 0.640%

- 1947: 0.625%

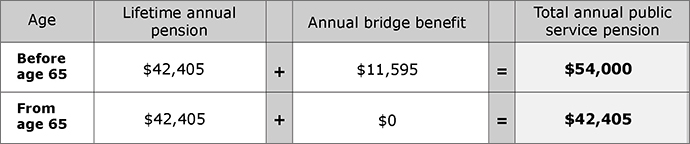

Step 3: The following table illustrates the calculation of your total public service pension before and after age 65.

Figure 11 - Text version

Your lifetime pension before age 65 of 42,405 dollars plus 11,595 dollars of bridge benefit equals a total public service pension of 54,000 dollars.

Your lifetime pension from age 65 of 42,405 dollars plus 0 dollars of bridge benefit equals a total public service pension of 42,405 dollars.

A pension benefit calculation for someone who worked part-time

For pension benefit eligibility purposes (at retirement, termination of employment or death), a year of part-time service counts as one year of pensionable service.

For pension calculation purposes, the benefits are adjusted to reflect the assigned hours of part-time work compared with the full-time hours of the position.

For example, if:

- You retire in 2023 at age 63.

- You worked 30 years.

- You worked 18.75 hours a week instead of 37.5 hours.

- Your average annual salary is $90,000 (based on full-time salary rate).

- Your adjusted average annual salary is $45,000 (based on part-time hours).

- The average maximum pensionable earnings (AMPE) in 2023 is $61,840.

- As $45,000 is less than the AMPE, the amount calculated at the 2% rate is $0.

- You will reach age 65 in 2025.

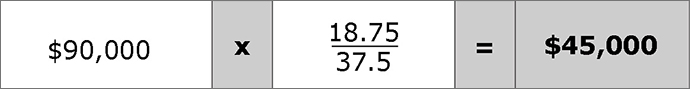

Step 1: The following table illustrates how your adjusted average annual salary would be calculated.

Figure 12 - Text version

90,000 dollars multiplied by 18.75 hours divided by 37.5 hours equals 45,000 dollars.

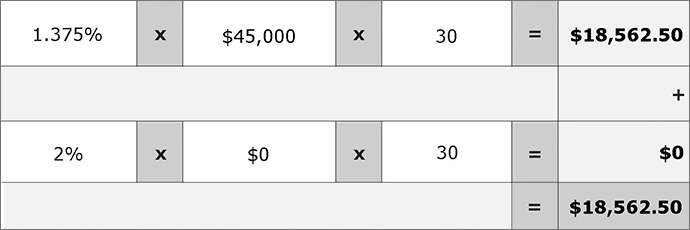

Step 2: The following table illustrates how your annual lifetime pension would be calculated.

Figure 13 - Text version

1.375 percent multiplied by 45,000 dollars multiplied by 30 equals 18,562.50 dollars

plus

2 percent multiplied by 0 dollars multiplied by 30 equals 0 dollars.

This is a total of 18,562.50 dollars (18,562.50 plus 0 equals 18,562.50 dollars).

Step 3: The following table illustrates how your annual bridge benefit is calculated.

Figure 14 - Text version

0.625 percent multiplied by 45,000 dollars multiplied by 30 equals 8,437.50 dollars.

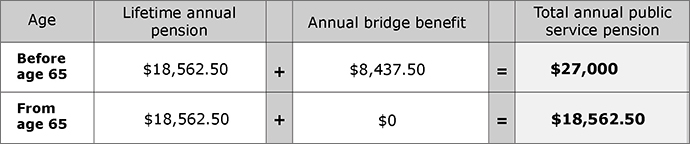

Step 4: The following table illustrates the calculation of your total public service pension before and after age 65.

Figure 15 - Text version

Your lifetime pension before age 65 of 18,562.50 dollars plus 8,437.50 dollars of bridge benefit equals a total public service pension of 27,000.00 dollars.

Your lifetime pension from age 65 of 18,562.50 dollars plus 0 dollars of bridge benefit equals a total public service pension of 18,562.50 dollars.

Note:

Indexation amounts are not included in these examples. Since the indexation payable is calculated based on your total pension benefits (lifetime pension and bridge benefit), when your bridge benefit ends, your indexation will also decrease.

OAS, CPP or QPP payments are not included in these examples.

Protection from inflation

Why protection from inflation is important

It is difficult to evaluate future pricing of goods and services. In other words, it is not easy to anticipate inflation through your retirement years and to plan your retirement savings accordingly.

An item that costs $1 today may cost more in a few years. If your pension is not indexed, you will have the same dollar amount of pension income in 10, 15 or 20 years. Since the cost of living will undoubtedly be higher, your purchasing power will diminish.

Pension indexing is an important feature of the public service pension plan that helps protect your purchasing power.

How the plan counteracts inflation

To counteract the effect of inflation on your pension, the public service pension plan provides for full indexing of pensions in payment and deferred pensions.

Once you have retired, your pension (immediate annuities and annual allowances) as well as survivor benefits and child allowances are increased on January 1 of each year to take into account the cost of living, based on increases in the Consumer Price Index (CPI).

For employees of Correctional Service Canada whose pension benefits are based on operational service, benefits are indexed when the combination of the plan member's age and number of years of service equals 85. Indexing will not be received before age 55 but will not be delayed past age 60. Additional information on special benefits related to operational service is available in Operational Service Provisions.

How the indexation rate increase is determined

The indexation rate increase is determined by taking the average Consumer Price Index (CPI) for goods and services of a 12-month period ending in September and comparing it to the previous 12-month average CPI.

In any given year, if there is no change in the CPI, or if it drops, your pension will not be adjusted for that year.

Note: If you become re-employed in the public service after retirement and begin contributing to the public service pension plan again, the indexing increase will be based on your last retirement date.

Effects of re-employment on indexing benefits

If you become re-employed in the public service and begin to make contributions to the public service pension plan the payment of your benefit, including indexing, will cease. When you cease to be employed again, your indexing benefit will be based on the amount of your basic pension at that time. Your retirement date for determining the annual percentage increase will be the most recent retirement date.

The new combination of benefits - that is, your new annuity plus the increase based on the later year of retirement - could be lower than the previous total entitlement. If you are thinking of taking a job in a contributory position, carefully consider if it would affect your total pension benefits.

If you are re-employed past age 71, you cannot contribute to the public service pension plan. However, if you are in a position that would normally require you to contribute to the pension plan, your monthly pension (including indexing) will cease to be paid until you stop working, even if you are past age 71.

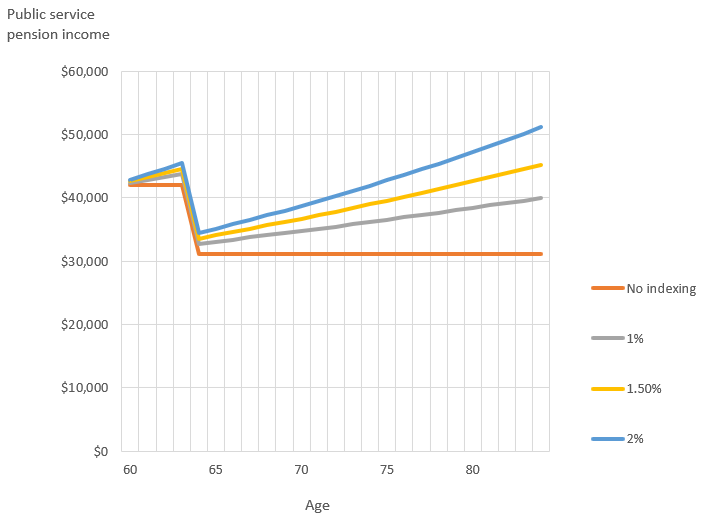

Example of the effect of indexing on your pension

The following chart shows how indexing can affect your pension. You will notice a pension decrease at age 65. That's when the bridge benefit stops. At age 65, you are entitled to apply for a pension under the Canada Pension Plan or Quebec Pension Plan.

Figure 16 - Text version

| Age | No Indexing | 1% Indexing | 1.5% Indexing | 2% Indexing |

|---|---|---|---|---|

| 60 | $42,000.00 | $42,000.00 | $42,000.00 | $42,000.00 |

| 61 | $42,000.00 | $42,630.00 | $42,420.00 | $42,840.00 |

| 62 | $42,000.00 | $43,269.45 | $42,844.20 | $43,696.80 |

| 63 | $42,000.00 | $43,918.49 | $43,272.64 | $44,570.74 |

| 64 | $42,000.00 | $44,577.27 | $43,705.37 | $45,462.15 |

| 65 | $31,166.25 | $33,574.90 | $32,756.04 | $34,410.06 |

| 66 | $31,166.25 | $34,078.53 | $33,083.60 | $35,098.26 |

| 67 | $31,166.25 | $34,589.70 | $33,414.44 | $35,800.22 |

| 68 | $31,166.25 | $35,108.55 | $33,748.58 | $36,516.23 |

| 69 | $31,166.25 | $35,635.18 | $34,086.07 | $37,246.55 |

| 70 | $31,166.25 | $36,169.71 | $34,426.93 | $37,991.48 |

| 71 | $31,166.25 | $36,712.25 | $34,711.20 | $38,751.31 |

| 72 | $31,166.25 | $37,262.93 | $35,118.91 | $39,526.34 |

| 73 | $31,166.25 | $37,821.88 | $35,470.10 | $40,316.87 |

| 74 | $31,166.25 | $38,389.21 | $35,824.80 | $41,123.20 |

| 75 | $31,166.25 | $38,965.05 | $36,183.05 | $41,945.67 |

| 76 | $31,166.25 | $39,549.52 | $36,544.88 | $42,784.58 |

| 77 | $31,166.25 | $40,142.76 | $36,910.33 | $43,640.27 |

| 78 | $31,166.25 | $40,744.91 | $37,279.43 | $44,513.08 |

| 79 | $31,166.25 | $41,356.08 | $37,652.23 | $45,403.34 |

| 80 | $31,166.25 | $41,976.42 | $38,028.75 | $46,311.41 |

| 81 | $31,166.25 | $42,606.07 | $38,409.04 | $47,237.64 |

| 82 | $31,166.25 | $43,245.16 | $38,793.13 | $48,182.39 |

| 83 | $31,166.25 | $43,893.83 | $39,181.06 | $49,146.04 |

| 84 | $31,166.25 | $44,552.24 | $39,572.87 | $50,128.96 |

| 85 | $31,166.25 | $45,220.53 | $39,968.60 | $51,131.54 |

For example, if you retire at age 65 with an annual pension of $31,166.25 and the inflation rate is:

- 1% per annum (which means that your pension would be increased by 1% every year):

- The next year, at age 66, your pension would total: $31,477.91.

- Ten years later, you would receive: $34,426.93.

- 2% per annum (which means that your pension would be increased by 2% every year):

- The next year, at age 66, your pension would total: $31,789.58.

- Ten years later, you would receive: $37,991.48.

Separation or divorce

If your marriage or conjugal relationship ends, the pension benefits you have acquired during the course of that marriage or during the period of cohabitation in a conjugal relationship may be divided according to the terms of the Pension Benefits Division Act (PBDA).

If you are divorced, your former spouse is not entitled to a survivor benefit. If you are separated from your legal spouse, but not divorced, your spouse is entitled to a survivor benefits.

Who is eligible for pension benefits division

If you were married and have separated or divorced, or if you have lived in a conjugal relationship for at least one year and have separated, you are eligible for the division of your pension benefits.

Either you, your former spouse or a third party can apply for a division by making a formal application, which must be accompanied by a court order or agreement between the parties providing for the division of benefits. If the application is based on an agreement, you must have been separated for at least one year.

What happens if the division is approved

If the division is approved, the share of the benefit value being divided will be transferred either to a locked-in registered retirement savings vehicle chosen by the party receiving the value, or to a life insurance company to purchase a life annuity.

This amount can never exceed 50% of the value of the benefits being divided.

Your pension benefits will be reduced to reflect the division.

Objecting to the division

You will be notified of any application made to divide your benefits, after which you can file an objection with the Minister of Public Services and Procurement Canada. You have 90 days after the notice of application is sent out to file your objection.

Valid grounds for objection are:

- The court order or agreement between the parties has been changed or is no longer valid;

- The terms of the court order or agreement between the parties have been satisfied, or are being satisfied, by some other means; or

- The court order has been appealed or the terms of the agreement between the parties are being challenged in court.

Additionally, the Minister may refuse to approve a division if he or she is satisfied, based on evidence submitted, that it would not be just to do so.

For more information about the division of pension benefits, contact the Government of Canada Pension Centre for federal employees.