Atlantic Canada Opportunities Agency's 2024-25 Departmental Results Report

On this page

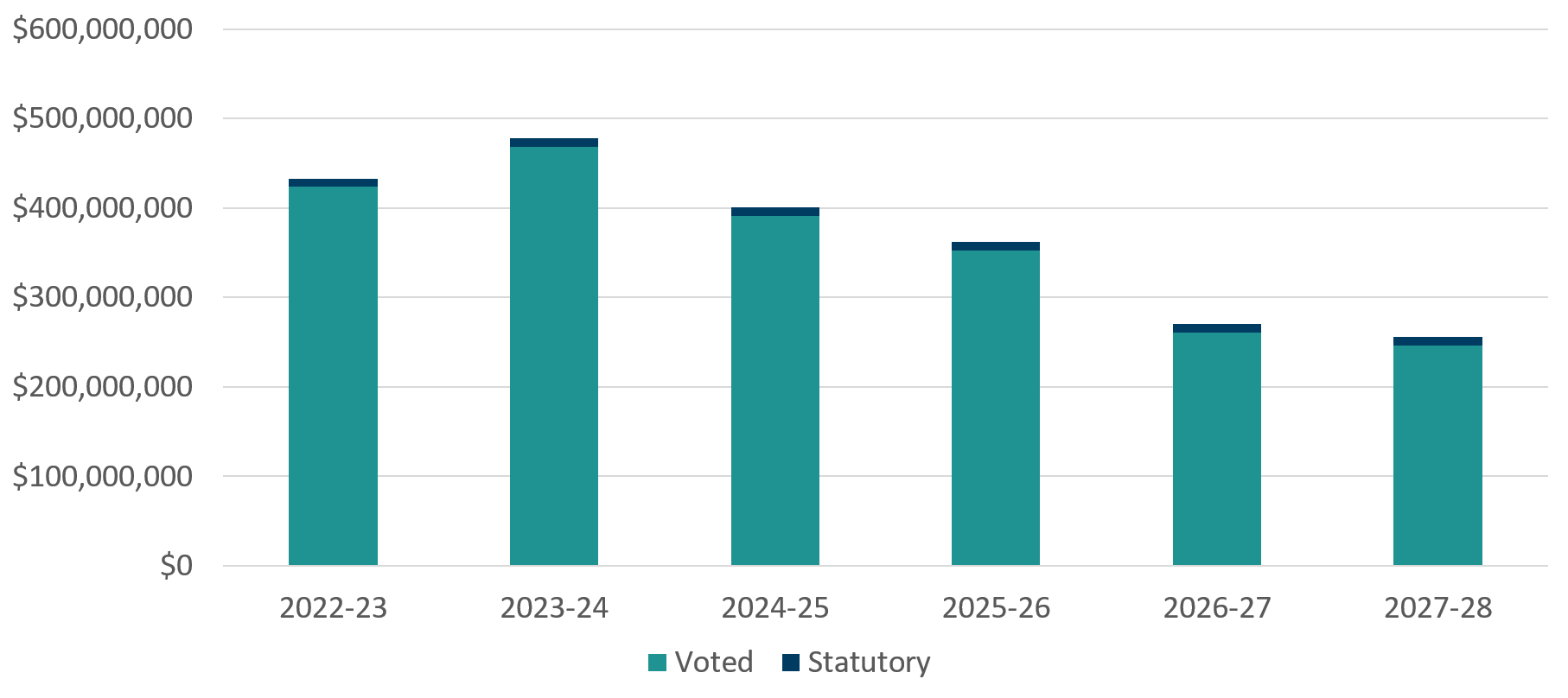

© His Majesty the King in Right of Canada, as represented by the Minister of Justice and Attorney General of Canada and Minister responsible for the Atlantic Canada Opportunities Agency, 2025., Cat. No. AC2-9E-PDF, ISSN 2560-9882. This Departmental Results Report details ACOA’s actual accomplishments against the plans, priorities and expected results outlined in its 2024-25 Departmental Plan. ACOA’s top priorities for 2024-25 were to: ACOA’s efforts directly contributed to the advancement of the Government of Canada’s plan to build a more resilient economy that serves all Canadians, as outlined in Budget 2024 and the 2021 Speech from the Throne. Activities complemented and bolstered other federal initiatives such as the 2022–2026 Federal Sustainable Development Strategy, the Tourism Growth Strategy, the Innovation and Skills Plan, and the interim Sustainable Jobs Plan. The Agency also supported the Minister responsible for ACOA in connecting with Atlantic Canadians, key stakeholders, federal colleagues and provincial governments. Efforts advanced ministerial mandate letter commitments, notably promoting short- and long-term job creation and economic development in Atlantic Canada. For complete information on ACOA’s total spending and human resources, read the Spending and human resources section of its full departmental results report. The following provides a summary of the results the department achieved in 2024-25 under its main areas of activity, called “core responsibilities.” In 2024-25, ACOA played a pivotal role in driving economic momentum across Atlantic Canada by supporting 1,927 projects that helped create or maintain over 4,400 jobs. The Agency successfully advanced its mandate by investing $314 million in strategic grants and contributions. Investments included targeted support to traditionally underserved communities and contributions to Atlantic Canada’s transition to a green, resilient and inclusive economy. Staff provide direct services to businesses and community organizations through 30 points of service across Atlantic Canada. ACOA used its programming for investments that helped Atlantic Canadians navigate headwinds in the economy, seize economic opportunities and thrive in good-paying jobs. Investments and financing supported business with particular emphasis on SMEs in their mission to grow and adopt new technologies as they started up, developed new markets or became more productive, sustainable and inclusive. These efforts also supported economic development in communities of every size to help them advance and diversify their economies so that jobs stayed close to home. Here are a few examples of how that work took shape: In 2024-25, ACOA operated in a regional economic environment marked by sustained growth, a resilient labour market, dynamic trade environments and persistent structural challenges. The region’s solid economic growth, with its gross domestic product (GDP) rising faster than the national average (2.4% vs 1.6%), was driven by strong performance in services, manufacturing and construction. The labour market remained resilient, adding over 37,000 jobs, and labour productivity reached $48.30/hour in 2024 due to faster growth in employment and hours worked than in output. Population growth slowed but stayed above historical norms, driven by immigration. Businesses reported strong revenues with opportunities to improve online sales, and retail activity supported by easing inflation and lower interest rates. The residential sector showed recovery with a 22.4% increase in housing starts, though rental vacancy rates remained low. For more information on ACOA’s economic development in Atlantic Canada, read the “Results – what we achieved” section of this Departmental Results Report. I am pleased to present the Atlantic Canada Opportunities Agency’s (ACOA) Departmental Results Report for 2024-25. The unique circumstances of the past year brought uncertainty as well as opportunity. Unsurprisingly, we saw Atlantic Canadians roll up their sleeves to meet the moment with their strong work ethic, resilience and entrepreneurial spirit. It is this resolve, and this resiliency, that truly fuels the work being done at ACOA. In 2024-25, ACOA played a pivotal role in driving economic momentum across Atlantic Canada by supporting 1,927 projects that helped create or maintain over 4,400 jobs. The Agency also successfully advanced its mandate by investing $314 million in strategic grants and contributions. With Atlantic Canada’s GDP rising faster than the national average (2.4% vs 1.6%), the region is contributing to a solid, united Canadian economy as the country builds the strongest economy in the G7. In 2024-25, ACOA surpassed multiple targets, including the value of export goods from Atlantic Canada ($38.4 billion), the amount leveraged per dollar invested by ACOA in community projects ($2.17 for every dollar invested by ACOA), and the number of high-growth firms in Atlantic Canada (1,000). These results are not just data and figures. They represent real jobs for our friends, families and neighbours – and the real and measurable impact of the Agency’s great work. Much of that work in 2024-25 was framed around the priority of productivity and growth. ACOA is all in on productivity and growth, and is working to ensure all clients have access to the tools and resources they need to boost productivity and seize growth opportunities. When it comes to growth, Atlantic Canada’s Indigenous peoples and communities are leading by example and investing in culturally significant experiences, environmentally mindful businesses, and community-building initiatives. As part of the Agency’s commitment toward reconciliation and the continued vitality of Indigenous communities, ACOA invested in 81 Indigenous economic development projects with expenditures of $15 million in 2024-25. I invite you to read ACOA’s 2024-25 Departmental Results Report and learn about the Agency’s achievements and the enduring strength of Atlantic Canada’s economy. ACOA supports Atlantic Canada’s economic growth, wealth creation and economic prosperity through inclusive clean growth and by building competitive regional strengths. It helps businesses grow, with particular emphasis on SMEs, through direct financial assistance and, indirectly, through business support organizations. SMEs become more innovative by adopting new technologies and processes, and by pursuing new avenues for expansion and market diversification to compete and succeed in a global market. This core responsibility most closely relates to the “Prosperity” domain of the Quality of Life Framework for Canada and the indicators of GDP per capita, productivity, investment in in-house research and development (R&D), and firm growth and employment. This core responsibility will also support the “Environment” domain. This section details the department’s performance against its targets for each departmental result under the core responsibility of economic development in Atlantic Canada. Table 1 shows the target, the date to achieve the target and the actual result for each indicator under Businesses are innovative and growing in Atlantic Canada in the last 3 fiscal years. Table 2 shows the target, the date to achieve the target and actual result for each indicator under Businesses invest in the development and commercialization of innovative technologies in Atlantic Canada in the last 3 fiscal years. Table 3 shows the target, the date to achieve the target and the actual result for each indicator under Communities are economically diversified in the last 3 fiscal years. The Results section of the Infographic for ACOA on GC Infobase provides additional information on results and performance related to ACOA’s program inventory. The following section describes the results for economic development in Atlantic Canada in 2024-25 compared with the planned results set out in ACOA’s Departmental Plan for the year. In 2024, the Government of Canada, through ACOA, played a pivotal role in driving undeniable economic momentum across Atlantic Canada and in positioning the region as a strong contributor to the overarching goal of unlocking Canada’s full economic potential. By supporting businesses, with particular emphasis on SMEs, and transformative projects, ACOA paved the way for sustainable economic development and strengthened regional resilience, helped build a diversified economy, and set the stage for long-term prosperity. The Agency’s vision for productivity and growth in Atlantic Canada was defined under 3 key enablers: workforce development, technology adoption and growth sectors. These framed ACOA’s activities to help businesses grow, to strengthen local economies and to build vibrant communities. Atlantic Canada’s 2024 economic momentum The Public Policy Forum, a leading national think tank, published the second edition of The Atlantic Canada Momentum Index in September 2024. It found that Atlantic Canada showed considerable points of strength, with growth in 15 of 20 social and economic indicators examined between 2015 and 2023. The region’s forward momentum continues to transform its economy thanks to growth in areas such as population, median age, employment and labour productivity. However, the report highlighted the need for concerted and coordinated effort to better spur and manage growth in key areas such as housing supply and affordability. Complementary reports highlight many opportunities, including the significant economic benefits for the region and the country of reducing internal trade barriers. Between April 1, 2024 and March 31, 2025, the Agency supported 1,927 projects, investing $314 million to help create or maintain more than 4,400 jobsFootnote 3. ACOA also leveraged funding partners to maximize impact, generating $1.78 for every dollar approved overall in fiscal year 2024-25. Beyond funding, the Agency provided tailored advice to business owners and community leaders, ensuring they could access the tools and resources needed to adapt to economic challenges, boost productivity and seize growth opportunities. As outlined in the “Progress on Results” section, the Agency met or surpassed most of its targets, showing encouraging signs for the economy and ACOA’s impact. Indicators such as the number of high-growth firms in the region and the value of business expenditures in R&D by firms receiving ACOA funding have shown steady progress in the last 3 years. However, the target for the revenue growth rate of firms supported by ACOA programs was not met between 2019 and 2023, primarily due to the negative impacts of the COVID-19 pandemic on the economy. In 2024-25, ACOA operated in a regional economic environment marked by sustained growth, a resilient labour market, dynamic trade environments and persistent structural challenges. The region’s solid economic growth, with its GDP rising faster than the national average (2.4% vs 1.6%), was driven by robust performance in services, manufacturing and construction. The labour market remained resilient, adding over 37,000 jobs, and labour productivity reached $48.30/hour in 2024 due to faster growth in employment and hours worked than in output. Population growth slowed but stayed above historical norms, driven by immigration. Businesses reported strong revenues with opportunities to improve online sales and retail activity boosted by easing inflation and lower interest rates. The housing sector improved, though rental vacancy rates remained low. ACOA’s investments drove growth in key sectors such as cybersecurity, biosciences, aerospace and defence, ocean technology, artificial intelligence and advanced manufacturing – fostering a vibrant, sustainable economy. Through its advocacy efforts, ACOA promoted regional businesses by facilitating engagements with national and international aerospace and defence companies to help secure investments and supply-chain opportunities. In a survey of ACOA clients conducted during an evaluation of the Regional Economic Growth through Innovation (REGI) program, approximately 95% of respondents said that the program is tailored to the needs of the region and that there is a continued need for the program. The REGI evaluation also found that, nationally, the program helps offset the major barriers of access to labour, access to financing and the high cost of conducting business faced by companies in Canada, maximizing its benefits to the regions. Through its programs, ACOA spentFootnote 4 a total of $314 million on 1,927 projects, helping to maintain or create 4,400 jobsFootnote 5 in the region. ACOA approvedFootnote 6 $324 million in contributions toward 1,106 projects valued at $902 million, leveraging $577 million from partners or an average of $1.78 in partner funding for every dollar ACOA approved. Regular programs supported 1,728 projects and 4,263 estimated jobs with $255 million in spending, while targeted and temporary initiatives spent $60 million on 221 projects that maintained or created an estimated 145 jobs. Targeted support included the following: RHII, a new 2-year initiative providing support to pursue new approaches for building houses ($1,287,669 in expenditures for 5 projects; in design and early implementation phases in 2024-25); RAII, a new 5-year initiative to help bridge the gap between cutting-edge AI research and broader marketplace consumption with support for Atlantic Canadian businesses ($1.8 million in expenditures for 7 projects; in design and early implementation phases in 2024-25); NICI Fund, a renewed and expanded 3-year fund to support food-related initiatives that strengthen and diversify economic activity in the territories and throughout Inuit Nunangat, which is now available in the Nunatsiavut region of northern Labrador (in design and early implementation phases in 2024-25); and the Elevate Tourism Initiative, a 2-year initiative to boost investment in private-sector tourism businesses to elevate their offerings and grow revenues (in design and early implementation phases in 2024-25). The Agency is also continuing to deliver the Aerospace Regional Recovery Initiative ($28,041 in expenditures for 2 projects); the Tourism Growth Program ($4.7 million in expenditures for 66 projects); the Black Entrepreneurship Program’s National Ecosystem Fund ($2.3 million in expenditures for 2 projects); the Hurricane Fiona Recovery Fund ($30.6 million in expenditures for 83 projects) and the final year of the Canada Coal Transition Initiative – Infrastructure Fund ($17.8 million in expenditures for 25 projects). Projects were developed and delivered collaboratively with Atlantic businesses, community stakeholders and business support organizations such as the Community Business Development Corporations. The Agency played important advocacy and pathfinding roles with other federal departments, the 4 provincial governments in Atlantic Canada and other stakeholders whenever possible to improve access to federal investments for Atlantic businesses and communities. This included supporting the Minister’s engagements and sharing regional perspectives on economic items such as energy, the fisheries, critical minerals, regional air access, investment in sustainable job training, fair trade, and the Indigenous Loan Guarantee Program. Agency officials also collaborated with partners to ensure short-term supports were complementary in areas such as trade diversification, skills development and workforce, and transitioning to a greener economy. ACOA advanced its 3 departmental results with the following initiatives, activities and actions. The Agency worked with businesses, with particular emphasis on SMEs, to capitalize on sector strengths and capacities, develop and diversify markets, and scale their businesses. Results achieved: ACOA Support in Action: Success Stories The Agency contributed to businesses, with particular emphasis on SMEs, investing in new technologies to improve their efficiency, productivity, competitiveness and growth. This was accomplished through key programs such as REGI, which includes specific support for Black-led businesses. Results achieved: ACOA Support in Action: Success Stories The Agency will invest in inclusive growth, support the launch and growth of businesses, with particular emphasis on SMEs, and invest in community capacity to plan, attract, hire and retain skilled talent to support a clean and sustainable economy. Results achieved: ACOA Support in Action: Success Stories ACOA faced 2 main risks to fulfilling its mandate. The first is that the Agency’s economic development programming could potentially be affected by external factors impacting economic growth, such as the implications of the United States’ tariffs and climate-related events. The 2nd is related to the capacity of ACOA’s stakeholders – other governments, partners, communities and clients – to identify, develop and successfully implement strategic projects. ACOA capitalized on the flexibility of its programs, advocated on behalf of Atlantic Canada in various spheres, including federal and regional tables, and collaborated with partners to exchange valuable information and best practices. It supported analysis on regional economic issues and collaborated with stakeholders to foster client and community capacity to target key federal priorities. Table 4 provides a summary of the planned and actual spending and FTEs required to achieve results. The Finances section of the Infographic for ACOA on the GC Infobase page and the People section of the Infographic for ACOA on the GC Infobase page provide complete financial and human resources information related to ACOA’s program inventory. This section highlights government priorities that are being addressed through this core responsibility. ACOA investments reflected the Government of Canada’s commitment to grow a more inclusive economy and a stronger future for all Canadians during this time of economic recovery from the pandemic. Across the Agency’s suite of programs and initiatives, ACOA spent $59.2 million on 440 projects that supported gender-based analysis plus (GBA Plus) objectives or entrepreneurs from under-represented groups in 2024-25. This includes support for clients in the following groups: $20.3 million for women; $15.2 million for Indigenous people; $13.2 million for official language minority community members; $15.9 million for Black, racialized and visible minorities; $1.5 million for persons with disabilities; $3.4 million for recent immigrants; and $7.6 million for youth. In addition to these groups, the Agency, recognizing that a person’s place of residence may be a limiter to accessing government support, delivered a significant portion of its support – over 40% – to rural and coastal communities, representing $128.9 million in spending on more than 870 projects. The Agency’s activities and initiatives under its sole core responsibility of supporting economic development in Atlantic Canada advanced objectives related to 5 United Nation’s sustainable development goals (SDGs) as outlined in the 2022–2026 Federal Sustainable Development Strategy. They included: More information on ACOA’s contributions to Canada’s Federal Implementation Plan on the 2030 Agenda and the Federal Sustainable Development Strategy can be found in our Departmental Sustainable Development Strategy. In 2024-25, ACOA pursued high-impact innovations and made them an integral part of its operations. For example, the 31st Annual Report to the Prime Minister on the Public Service of Canada highlighted a number of initiatives where ACOA helped advance innovative solutions: Economic Development in Atlantic Canada is supported by the following programs: Additional information related to the program inventory for economic development in Atlantic Canada is available on the Results page on GC InfoBase. Internal services refer to the activities and resources that support a department in its work to meet its corporate obligations and deliver its programs. The 10 categories of internal services are: Outside of these services, ACOA has an Office of Workplace Culture and Employee Engagement. This office is a neutral entity that provides leadership, strategic direction, policy advice, professional development, and expertise with respect to diversity and inclusion. This section presents details on how the department performed to achieve results and meet targets for internal services. In 2024-25, ACOA continued its efforts to maintain the Agency’s standard of excellence for Atlantic Canadians by supporting sustainable change. These efforts included promoting inclusivity, equity and accessibility, and aimed to eliminate racism, harassment and discrimination. Specifically, Internal Services undertook the following activities: Collectively, these initiatives reflect ACOA’s commitment to delivering modern, accessible and secure digital services that meet the evolving expectations of Canadians and enhanced the Agency’s ability to deliver high-quality programs and services to the region. Table 5 provides a summary of the planned and actual spending and FTEs required to achieve results for internal services this fiscal year. The Finances section of the Infographic for ACOA on GC Infobase and the People section of the Infographic for ACOA on GC Infobase provide complete financial and human resources information related to the Agency’s program inventory. Government of Canada departments are required to award at least 5% of the total value of contracts to Indigenous businesses every year. ACOA results for 2024-25: Table 6 shows that ACOA awarded 12% of the total value of all contracts to Indigenous businesses for the fiscal year. 1For the purposes of measuring performance against the minimum 5% target for FY 2024-25, the data in this table is based on how Indigenous Services Canada defines “Indigenous business,” which is one that is owned and operated by Elders, band and tribal councils; registered in the Indigenous Business Directory; or registered on a modern treaty beneficiary business list. 2Includes contract amendments with Indigenous businesses. ACOA was part of the Phase 2 cohort of departments and agencies that were mandated to meet this minimum target in fiscal year 2023-24 and ongoing. As a member of the Atlantic Indigenous Development Initiative Committee, ACOA collaborates with Indigenous Services Canada, Procurement Assistance Canada, as well as key Indigenous partners from all provinces in Atlantic Canada. This committee oversees the planning, co-development and implementation of an Atlantic Indigenous business development strategy to facilitate access to federal procurement for Indigenous businesses. This collaborative effort provides a mechanism to engage with Indigenous people and businesses in the Atlantic region to increase federal procurement opportunities and build capacity for Indigenous businesses. In its 2024-25 Departmental Plan, ACOA forecasted that by the end of 2024-25, it would award 5% of the total value of its contracts to Indigenous businesses. ACOA has exceeded the 5% target on the value of its procurement activity and every effort will be made to continue to do so over the next 2 years. This section presents an overview of the department's actual and planned expenditures from 2022-23 to 2027-28. In Budget 2023, the government committed to reducing spending by $14.1 billion over 5 years, starting in 2023-24, and by $4.1 billion annually after that. As part of meeting this commitment, ACOA identified the following spending reductions. Table 7 shows the money that ACOA spent in each of the past 3 years on its core responsibilities and on internal services. For 2024-25, planned spending of $385.6 million increased by $19.6 million, resulting in total authorities available for use of $405.2 million. This was due to the following additional authorities received during the fiscal year: From 2024-25 total authorities of $405.2 million, actual spending was $400.5 million. This resulted in a surplus of $4.7 million. Of that amount, $3.5 million was reprofiled into the next fiscal years for support to the biomanufacturing and life sciences sector, and the remaining balance lapsed. The Finances section of the Infographic for ACOA on GC Infobase offers more financial information from previous years. Table 8 shows ACOA’s planned spending for each of the next 3 years on its core responsibilities and on internal services. In 2026-27, planned spending is $270.6 million, a decrease of $91.4 million from the $362.0 million in 2025-26 as a result of the following. In 2027-28, planned spending is $256.2 million, a decrease of $14.4 million from the $270.6 million in 2026-27 planned spending as a result of the following. The Finances section of the Infographic for ACOA on GC Infobase offers more detailed financial information related to future years. This section provides an overview of the department's voted and statutory funding for its core responsibilities and for internal services. Consult the Government of Canada budgets and expenditures for further information on funding authorities. Graph 1 summarizes ACOA's approved voted and statutory funding from 2022-23 to 2027-28. Approved funding (statutory and voted) over a 6-year period. Graph 1 includes the following information in a bar graph: Actual spending: 2022-23, 2023-24, 2024-25. Planned spending: 2025-26, 2026-27, 2027-28. Planned spending for 2025-26, 2026-27 and 2027-28 does not include amounts stemming from Budget 2025, funding for the recently approved Commerce and Purchasing collective agreement, and the replacement of the recycling mechanism. In 2024-25, the Agency’s spending was $78.0 million less than the previous fiscal year, mainly due to the following changes in authorities. The decrease in planned spending in future years as detailed in the Table 6 description is attributable mainly to the conclusion of temporary funding received as well as the replacement of the recycling mechanism. Consult the Public Accounts of Canada for further information on ACOA’s departmental voted and statutory expenditures. ACOA’s Financial Statements (Unaudited) for the Year Ended March 31, 2025. Table 9 summarizes the expenses and revenues for 2024-25, which are net to the cost of operations before government funding and transfers. The 2024-25 planned results information is provided in ACOA’s Future-Oriented Statement of Operations and Notes 2024-25. Table 10 summarizes actual expenses and revenues and shows the net cost of operations before government funding and transfers. Difference (2024-25 minus 2023-24) A significant portion of the Agency’s expenditures pertains to grants and contributions (G&Cs), which are disbursed to clients with the objective of fostering economic development across Atlantic Canada. The remaining expenditures are attributed to the Agency’s internal services. Illustrative examples of these expenditures are provided in the “Results – What We Achieved” section of this document. With respect to revenues, the amounts recorded by the Agency primarily reflect gains realized from the disposal of tangible capital assets during the fiscal year. The variance in actual results between fiscal years 2023-2024 and 2024-2025 is largely explained by the conclusion of several Programs initiatives in 2023-2024. Table 11 provides a brief snapshot of the amounts ACOA owes or must spend (liabilities) and its available resources (assets), which helps to indicate its ability to carry out programs and services. A significant majority of the total net liabilities is comprised of regular accounts payable and accrued liabilities, including Payables at Year-End (PAYEs). The remaining portion primarily consists of obligations such as vacation pay and employee future benefits. Net financial assets are largely represented by amounts receivable from the Consolidated Revenue Fund. Both assets and liabilities are adjusted to exclude transactions that the Government attributes to departments acting on its behalf. Specifically, collections from the Agency’s loan portfolio are remitted to the Consolidated Revenue Fund and contribute to Canada’s overall financial position; as such, they are not reflected in the Agency’s total assets and liabilities. The year-over-year variance in net liabilities and net financial assets is mainly attributable to a reduction in PAYEs required for fiscal year 2024-25. This decrease results from efforts to normalize G&C expenditures throughout the year, which led to a more accelerated utilization of allocated budgets. This section presents an overview of the department’s actual and planned human resources from 2022-23 to 2027-28. Table 12 shows a summary in FTEs of human resources for ACOA’s core responsibilities and for its internal services for the previous 3 fiscal years. The human resource levels at ACOA in 2022-23 reflect the additional temporary staffing required to support the Government of Canada’s COVID-19 emergency response efforts. In the following years, the number of FTEs declined due to several factors, including the phasing out of COVID-19 emergency initiatives and the reduction outlined in Budget 2023 as part of the Refocusing Government Spending to Deliver for Canadians initiative, effective in 2024-25. Table 13 shows the planned FTEs for each of ACOA’s core responsibilities and for its internal services for the next 3 years. Human resources for the current fiscal year are forecast based on year-to-date. Human resource levels at ACOA show a decrease to the total FTE base, reflecting the reduction announced in Budget 2023 related to the Refocusing Government Spending to Deliver for Canadians Initiative. The Agency will continue to achieve its results by allocating its human resources to best support its priorities and programs. The following supplementary information tables are available on ACOA’s website: The tax system can be used to achieve public policy objectives through the application of special measures such as low tax rates, exemptions, deductions, deferrals and credits. The Department of Finance publishes cost estimates and projections for these measures each year in the Report on Federal Tax Expenditures. This report also provides detailed background information on tax expenditures, including descriptions, objectives, historical information and references to related federal spending programs as well as evaluations and GBA Plus of tax expenditures. The Honourable Sean Fraser, PC, KC, MP Laura Lee Langley, President Minister of Justice and Attorney General of Canada and Minister responsible for the Atlantic Canada Opportunities Agency Part I of the Government Organization Act, Atlantic Canada, 1987, R.S.C., 1985, c. 41 (4th Supp.), also known as the Atlantic Canada Opportunities Agency Act. See the Department of Justice Canada website for more information. 1987 Atlantic Canada Opportunities Agency General inquiries: 506-851-2271 7-1-1 General: 506-851-7403Copyright information

At a glance

Key priorities

Highlights for ACOA in 2024-25

Summary of Results

Core responsibility: economic development in Atlantic Canada

From the Minister

Results – what we achieved

Core responsibilities and internal services

Core responsibility: economic development in Atlantic Canada

In this section

Description

Quality of life impacts

Progress on results

Table 1: Businesses are innovative and growing in Atlantic Canada

Departmental Result Indicators

Target

Date to achieve target

Actual Results

Number of high-growth firms in Atlantic Canada

650

March 31, 2025

Value of export goods from Atlantic Canada

$33 billion

March 31, 2025

Value of exports of clean technologies from Atlantic Canada

$560 million

March 31, 2025

Revenue growth rate of firms supported by ACOA programs

8.0%

March 31, 2025

Table 2: Businesses invest in the development and commercialization of innovative technologies in Atlantic Canada

Departmental Result Indicators

Target

Date to achieve target

Actual Results

Value of business expenditures in R&D by firms receiving ACOA program funding

$110 million

March 31, 2025

Percentage of businesses engaged in collaborations with higher-education institutions in Atlantic Canada

16.0%

March 31, 2025

Table 3: Communities are economically diversified in Atlantic Canada

Departmental Result Indicators

Target

Date to achieve target

Actual Results

Percentage of Atlantic Canadian SMEs majority owned by women, Indigenous people, youth, visible minorities and persons with disabilities

17.0% female owned

1.0% Indigenous

10.0% youth

4.0% visible minorities

1.0% persons with disabilitiesMarch 31, 2025

Percentage of professional, science and technology-related jobs in Canada’s economy

33.0%

March 31, 2025

Amount leveraged per dollar invested by ACOA in community projects

$1.15 for every dollar invested by ACOA

March 31, 2025

Details on results

Departmental Result 1: Businesses are innovative and growing in Atlantic Canada

Departmental Result 2: Businesses invest in the development and commercialization of innovative technologies in Atlantic Canada

Departmental Result 3: Communities are economically diversified in Atlantic Canada

Key risks

Resources required to achieve results

Table 4: Snapshot of resources required for economic development in Atlantic Canada

Resource

Planned for 2024-25

Actual for 2024-25

Spending

$357,057,686

$368,846,946

FTEs

378

364

Related government priorities

Gender-based Analysis Plus

United Nations 2030 Agenda for Sustainable Development and the Sustainable Development Goals

Innovation

Program inventory

Internal services

In this section

Description

Progress on results

Resources required to achieve results

Table 5: Resources required to achieve results for internal services this fiscal year

Resource

Planned

Actual

Spending

$28,585,667

$31,621,353

FTEs

195

205

Contracts awarded to Indigenous businesses

Table 6: Total value of contracts awarded to Indigenous businesses1 in 2024-25

Contracting performance indicators

2024-25 Results

Total value of contracts awarded to Indigenous businesses2 (A)

$411,537

Total value of contracts awarded to Indigenous and non‑Indigenous businesses (B)

$3,416,328

Value of exceptions approved by deputy head (C)

$0

Proportion of contracts awarded to Indigenous businesses [A / (B−C) × 100]

12.05%

Spending and human resources

In this section

Spending

Refocusing Government Spending

Budgetary performance summary

Table 7: Actual 3-year spending on core responsibilities and internal services (dollars)

Core responsibilities and internal services

2024-25 Main Estimates

2024-25 total authorities available for use

Actual spending over 3 years (authorities used)

Economic Development in Atlantic Canada

$357,057,686

$373,960,674

Internal services

$28,585,667

$31,227,666

Total

$385,643,353

$405,188,340

Analysis of the past 3 years of spending

Table 8: Planned 3-year spending on core responsibilities and internal services (dollars)

Core responsibilities and internal services

2025-26 planned spending

2026-27 planned spending

2027-28 planned spending

Economic development in Atlantic Canada

$333,256,478

$241,991,966

$227,596,202

Internal services

$28,767,878

$28,610,499

$28,610,283

Total

$362,024,356

$270,602,465

$256,206,485

Analysis of the next 3 years of spending

Funding

Text version of graph 1

Fiscal year

Statutory

Voted

Total

2022-23

$9,266,243

$423,859,785

$433,126,028

2023-24

$9,479,725

$468,950,861

$478,430,586

2024-25

$9,343,840

$391,124,459

$400,468,299

2025-26

$9,497,319

$352,527,037

$362,024,356

2026-27

$9,405,376

$261,197,089

$270,602,465

2027-28

$9,405,376

$246,801,109

$256,206,485

Analysis of statutory and voted spending over a 6-year period

Financial statement highlights

Table 9: Condensed Statement of Operations (unaudited) for the year ended March 31, 2025 (dollars)

Financial information

2024-25 actual

results2024-25 planned results

Difference (actual results minus planned)

Total expenses

$298,758,532

$281,682,002

$17,076,530

Total revenues

$33,865

$30,435

$3,430

Net cost of operations before government funding and transfers

$298,724,667

$281,651,567

$17,073,100

Analysis of Expenses and Revenues for 2024-2025

Table 10: Condensed Statement of Operations (unaudited) for 2023-24 and 2024-25 (dollars)

Financial information

2024-25 actual results

2023-24 actual results

Total expenses

$298,758,532

$335,455,964

$(36,697,432)

Total revenues

$33,865

$39,861

$(5,996)

Net cost of operations before government funding and transfers

$298,724,667

$335,416,103

$(36,691,436)

Analysis of differences in expenses and revenues between 2023-2024 and 2024-2025

Table 11 Condensed Statement of Financial Position (unaudited or audited) as of March 31, 2025 (dollars)

Financial information

Actual fiscal year (2024-25)

Previous fiscal year (2023-24)

Difference (2024-25 minus 2023-24)

Total net liabilities

$58,271,330

$68,914,329

$(10,642,999)

Total net financial assets

$52,077,226

$62,305,371

$(10,228,145)

Departmental net debt

$6,194,104

$6,608,958

$(414,854)

Total non-financial assets

$5,318,878

$6,174,632

$(855,754)

Departmental net financial position

$(875,226)

$(434,326)

$(440,900)

Analysis of department’s liabilities and assets since last fiscal year

Human resources

Table 12: Actual human resources for core responsibilities and internal services

Core responsibilities and internal services

2022-23 actual FTEs

2023-24 actual FTEs

2024-25 actual FTEs

Economic development in Atlantic Canada

386

371

364

Internal services

210

199

205

Total

596

570

569

Analysis of human resources for the last 3 years

Table 13: Human resources planning summary for core responsibilities and internal services

Core responsibilities and internal services

2025-26 planned FTEs

2026-27 planned FTEs

2027-28 planned

FTEsEconomic development in Atlantic Canada

379

373

373

Internal services

193

190

190

Total

572

563

563

Analysis of human resources for the next 3 years

Supplementary information tables

Federal tax expenditures

Corporate information

Departmental profile

Appropriate minister(s):

Institutional head:

Ministerial portfolio:

Enabling instrument(s):

Year of incorporation / commencement:

Departmental contact information

Mailing address:

P.O. Box 6051

Moncton, New Brunswick E1C 9J8Telephone:

Toll free (Canada and United States): 1-800-561-7862TTY:

Fax:

Secure: 506-857-1301Email:

Website(s):

Definitions

List of terms

Page details