Update 2019 | Investing in Canada’s defence

1.2 Investing in Canada’s defence

The new Defence funding model introduced with the defence policy makes significant improvements to the financial transparency of the defence budget, clarifying how funds are managed and spent. Additionally, simplifying the procurement process, having the appropriate level of approval relative to the size and cost of a project, and investing in procurement professionals supports the timely delivery of capabilities.

The Capital Investment Fund (CIF), part of the new funding model, is a dedicated source of funds that matches the accrual profile of National Defence’s existing and planned capital assets. This funding can be used to mitigate risks within other projects, provide funding for new projects, or to adjust for changes in scope to existing projects. (Year-to-year management of the CIF is explained in some detail in the following section 1.2.1.)

For example, in November 2018, the Royal Canadian Navy received approval to move ahead with construction of the sixth Arctic and Offshore Patrol Ship (AOPS) that was previously optional in the contract. The decision was made possible after adequate funding was available for the acquisition of the ship.

National Defence requests funding through the Estimates process, once the appropriate project approvals have been obtained, and as it is required to deliver on policy commitments.

Arctic and Offshore Patrol Ships

The Arctic and Offshore Patrol Ships (AOPS) project is well underway. The launch of the first ship, the future HMCS Harry DeWolf, took place in September 2018. In November 2018, the government confirmed the Royal Canadian Navy will receive the sixth ship. A modified production schedule was also approved.

The Harry DeWolf-class will bolster the Navy’s presence in the Arctic and its ability to operate globally with a renewed focus on surveillance and patrol of maritime borders.

AOPS continues to create social and economic benefits for Canadians and sustains hundreds of highly-skilled jobs in shipbuilding.

As part of its prudent management of public funds, National Defence only requests funding that can be reasonably spent in a given fiscal year; additional funding, when needed, is requested through Supplementary Estimates. Moreover, capital funding that remains to be accessed is not lost to National Defence; rather, it will be drawn from the CIF when it is needed.

It is anticipated that National Defence will seek project authorities for more than 40 capital projects through the project approval process, through to the 2021-22 fiscal year.

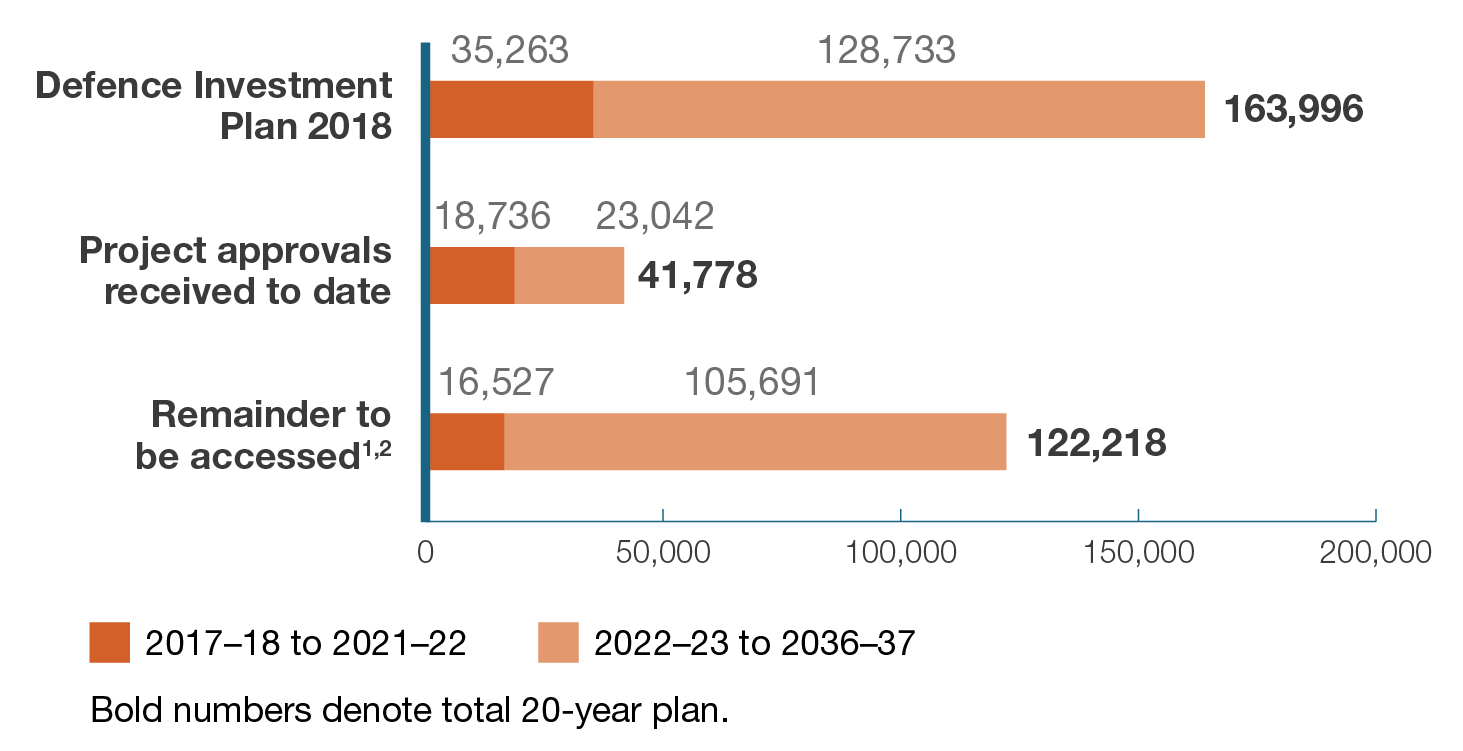

On a cash basis, the revised spending profile is based on annual funding approved through the Main Estimates. In the first two years of the defence policy, National Defence was granted project authorities totaling $41.8 billion to execute investments in capabilities. From that planning period, National Defence has $122.2 billion available to access through new project authorities, as indicated in Table 1.

Table 1: Capital Actual and Planned Spending

2017–18 through 2036–37 on a Cash Basis ($millions)

1 Funding in the fiscal framework that will be accessed once project and expenditure authorities are granted and funding is needed.

2 Funding not accessed in 2017–18 and 2018–19 will be accessed in future years.

Table 1 - Text version

This bar graph shows capital spending from 2017–18 through 2036–37 on a cash basis in millions of dollars for the 20-year, and 15-year and 5-year periods in the Investment Plan.

The horizontal axis shows the dollar thresholds ($50,000M, $100,000M, $150,000M; and $200,000M). The bars on the vertical axis show Defence Investment Plan 2018 (20 years: $163,996M; 15 years $128,733M; and 5 years: $35,263M); project approvals received to date (20 years: $41,778M; 15 years: $23,042M; and 5 years: $18,736M); and remainder to be accessed (20 years: $122,218M; 15 years: 105,691M; and 5 years: $16,527M).

There are two footnotes at the bottom of the table. The first footnote clarifies that funding in the fiscal framework will be accessed once project and expenditure authorities are granted and funding is needed.

The second footnote specifies that funding not accessed in 2017–18 and 2018–19 will be accessed in future years.

1.2.1 Capital Investment Fund management

Major capital investments, like ships and buildings, span multiple years. Defence funding reflects a life-cycle approach for both current and future major equipment and infrastructure requirements. This funding is managed on an accrual basis, taking into account the full costs of use over the expected life of the equipment.

LIFE-CYCLE APPROACH: Estimates all costs over the entire useful life of a capital asset. A life-cycle cost estimate is comprised of four types of costs: project development and acquisition, operating, sustainment, and disposal.

ACCRUAL BASIS: costs of acquiring an asset are spread over its useful life — not just at the time that bills are paid.

CASH BASIS: costs for the acquisition of capital assets and associated operating costs are booked immediately in the year the cash disbursement is made.

Accrual accounting better reflects actual fiscal impacts over time. However, reporting on a cash basis gives parliamentarians, industry, and other stakeholders a clearer sense as to the timing and estimated costs of acquisitions. National Defence plans its capital investments on an accrual basis; however, its year-to-year funding is managed on a cash basis.

Through the normal course of defence financial planning, the spending profile will change from year to year. This reflects that National Defence is using the flexibility of the new funding model to effectively manage investments, including a variety of factors that affect project costing.

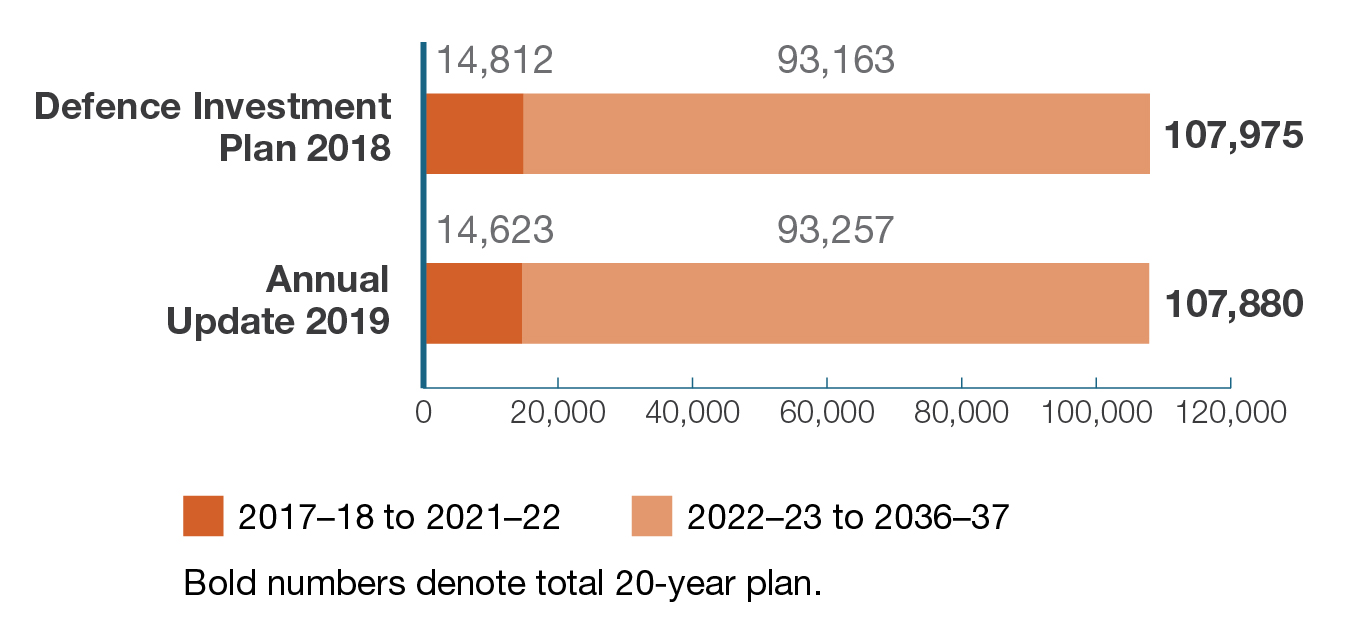

On an accrual basis, both the 20-year plan and the 5-year plan for the CIF remain relatively stable at $108 billion and approximately $15 billion respectively. Table 2 shows the updated 20-year and 5-year plans.

Table 2: Capital Actual and Planned Spending

2017–18 through 2036–37 on an Accrual Basis ($millions)

Table 2 - Text version

This bar graph shows capital spending 2017–18 through 2036–37 on an accrual basis in millions of dollars for the 20-year, 15-year and 5-year periods in the Investment Plan.

The horizontal axis shows the dollar thresholds ($20,000M, $40,000M, $60,000M, $80,000M, $100,000M, and $120,000M). The bars on the vertical axis show Annual Update 2019 (20 years: $107,880M; 15 years 93,257; 5 years: $14,623); and Defence Investment Plan 2018 (20 years: $107,975M; 15 years: 93,163; 5 years: $14,812M).

1.2.2 Defence Capabilities Blueprint

The Defence Capabilities Blueprint (DCB) is an interactive online tool that provides industry access to information about defence investment opportunities needed to support planning for research and development, and to develop strategic partnerships based on projected needs of the Forces.

Automatic Identification Technology

National Defence continually analyzes the future security environment to identify capabilities that the Forces will need to meet Canada’s defence needs.

Since the publication of Defence Investment Plan 2018, the Automatic Identification Technology (AIT) project has been identified as a key capability. AIT will support the timely and accurate input of materiel management data for the acquisition, storage, maintenance, and consumption of assets. It will also drastically reduce manual data entry, improve data accuracy, enable timely and in-situ processing of transactions, and support a reduction in inventory levels over time by avoiding the purchase of excess stock or running out of critical stock.

The AIT project completed the identification phase in November 2018, and moved into options analysis in early 2019. The project is now identified in the Defence Capabilities Blueprint in the range of $100 million to $249 million. Funding from the Capital Investment Fund was secured for this project as a result of efficiencies in National Defence’s contract performance, contingency demand, and expenditures. This new capability will enhance operational support and improve the accuracy of National Defence corporate reporting by improving near real-time asset visibility.

The DCB includes approximately 240 projects and contracts for major capital equipment, information technology, and infrastructure investments over $5 million and support contracts over $20 million. The DCB focuses on planning and implementation for funded projects. The funding ranges shown in the DCB are based on the acquisition costs for projects, which also includes project management, infrastructure, contracts, and contingency.

Since the release of Defence Investment Plan 2018, the DCB has been updated to provide the latest available information. Several additional updates have added value to the database and improve the user experience. These include a What’s New feature with recent DCB updates, listing Canada’s Key Industrial Capabilities (KICs) on project pages, and links to applicable project websites.