HUMA committee briefing binder: Appearance of Minister of Labour, Study: 2022 to 2023 Supplementary Estimates (B), February 3, 2023

From: Employment and Social Development Canada

Official title: Minister of Labour appearance Standing Committee on Human Resources, Skills and Social Development and the Status of Persons with Disabilities (HUMA) Study: 2022 to 2023 Supplementary Estimates (B), February 3, 2023 – 9:45 am to 10:45 am

On this page

- Opening remarks

- Parliamentary environment

- Hot issues and background material

- Hot issues and background material Budget 2022

- The transition to a net-zero emissions economy through the creation of sustainable jobs

- Fairness – Hot issues

- Pay equity

- Pay transparency

- Modernizing Federal Contractors Program to ensure federal contractors are paying employees the federal minimum wage

- Legislation on Forced Labour in the Supply Chain

- Legislation to prevent the hiring of replacement workers (anti-scabs legislation): NDP-Liberal Supply Agreement

- Menstrual Products in federally regulated workplaces

- Supporting working women during pregnancy and while breast-feeding

- Labour Mobility Deduction for Tradespeople

- The federal minimum wage under Part III of the Canada Labour Code and inflation

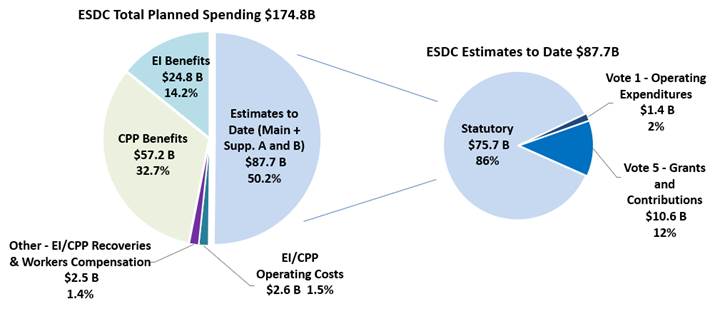

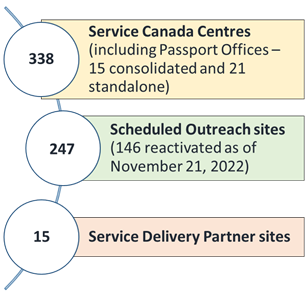

- Overview - Supplementary Estimates (B) for fiscal year ending March 31, 2023

- Mandate Letter tracker

1. Opening remarks (title included for accessibility)

Opening Remarks for The Minister of Labour, Seamus O’Regan Jr., for Appearance before the Standing Committee on Human Resources, Skills and Social Development and the Status of Persons with Disabilities (HUMA) in relation to the Supplementary Estimates B House of Commons February 3, 2023

Check against delivery

(2022 PA 006818)

Good afternoon, Mr. Chair, and members of the committee.

First, I’d like to acknowledge that the land on which we gather is the traditional unceded territory of the Algonquin Anishnaabeg People.Footnote 1

Thank you for inviting me to discuss the Supplementary Estimates B for Employment and Social Development Canada’s Labour Program.

My job, as Canada’s Minister for Labour, is to make sure that Canadian workers have workplaces that are safe, inclusive and respectful, and to make sure they have the working conditions they deserve.

With that goal in mind, I’m happy to report that we recently ratified the International Labour Organization’s Convention 190. This convention is the first-ever global treaty on ending violence and harassment in the workplace.

By ratifying C190 we have joined countries around the world to protect workers, and make sure they have the safe, respectful workplaces they deserve.

Mr. Chair, we’re working toward a number of important goals this year to support workers.

This year, we’re requesting $3.1 million, to support the implementation of ten days of paid medical leave for all federally regulated private sector employees. The legislation and regulations came into force on December 1.

We’ll use the new funding to develop training, update information technology systems, and adapt our compliance and enforcement strategies.

We’re also requesting small funds to support the completion of the Employment Equity Act Review.

This amount is comprised of operating funding to allow us to secure the skills and resources required to support the next phase of the Review, that is following the release of the Task Force report.

The Task Force’s report will provide concrete, independent and evidence-based recommendations on how to modernize and improve our employment equity framework. We’re expecting the report in the spring of 2023.

We’ll review their recommendations, and determine the feasibility, scope and processes for their implementation through targeted engagement, research, policy analysis, and communications.

Finally, we’re requesting to reprofile small lapsed funds under the Employment Equity Act review. These funds were dedicated to engaging with local and grassroots Indigenous and disability organizations as well as organizations representing Black and other racialized Canadians, which is crucial given the impact the Act has on these groups. Initially planned in 2021 to 2022, these enhanced consultations had to be delayed to 2022 to 2023 due to the review being put on hold during the federal election.

One of the available tools to ensure the modernization of the Act reflects the views and needs of the most underrepresented groups is the issuance of one-time grants and contributions funding to National Indigenous partners and Disability organizations through Engagement Protocol Agreements, and through the Social Development Partnerships Program – Disability.

Without these consultations, some communities would not have been able to participate meaningfully. It would have severely limited the completeness of the Task Force’s review, as well as hindered the achievement of policy objectives. The reprofile will secure the funds required for this activity that was crucial in accelerating the review.

Mr. Chair, there is no doubt that the adjustments we’re asking for will help us to continue our work to make federally regulated workplaces more healthy, diverse and inclusive. To help make sure every Canadian has an equal chance to succeed and have the working conditions they deserve.

I’ll leave it there, Mr. Chair. I now look forward to taking your questions.

Thank you.

-30-

2. Parliamentary environment

2.a Scenario Note

1. Overview

The Standing Committee on Human Resources, Skills and Social Development and the Status of Persons with Disabilities (HUMA) has invited you to appear in view of its study of the Supplementary Estimates (B), 2022-23.

2. Committee Proceedings

The appearance date is February 3, 2023.

You are invited to appear for 1 hour as part of a panel, in person, with the Deputy Minister of Labour and the Chief Financial Officer.

You will have up to 5 minutes for opening remarks.

HUMA has agreed that questioning of witnesses would be allocated as follows:

In round one, there are six minutes for each party in the following order:

- Conservative Party;

- Liberal Party;

- Bloc Québécois and

- New Democratic Party

For the second and subsequent rounds, the order and time for questioning is as follows:

- Conservative Party, five minutes;

- Liberal Party, five minutes;

- Bloc Québécois, two and a half minutes;

- New Democratic Party, two and a half minutes;

- Conservative Party, five minutes; and

- Liberal Party, five minutes

2.b. Anticipated questions

Anticipated questions based on the parliamentary environment

Budget 2022/FES 2022/Supplementary Estimates (B)

Topics

- Funding to Amend the Canada Labour Code to Implement the 10 Days of Paid Sick Leave for Federally Regulated Workers

- Coming into force on December 1, 2022

- National Action Plan

- Differences between Federal and Provinces/Territories on

- Paid sick leave

- Miscarriage and stillbirth leave

- Preventive leave - pregnant employees

- Support for Workers Experiencing Miscarriage or Stillbirth

- Completing the Employement Equity Act Rewiew

- Drivers INC

Anticipated questions

- Why are additional funds needed to implement the changes to the Canada Labour Code on top of what was already set out in Budget 2022? And why did this implementation take so long?

- What is the update on the implementation of the PSL-National Action Plan?

- Would you share with us how meeting with the Provinces and Territories to discuss the paid sick leave was received and what feedback will be included in the December 1 amendments?

- On the announcement related to miscarriage and stillbirth, would you please provide details?

- Prospect of provincial governments misusing C-3 against strikers: are there sufficient safeguards to ensure C-3 is not misused to affect the right to strike

- Provide highlights of the Task Force and discussions with stakeholders, members of designated groups and other communities as well as consultations

- Are you in support of the NDP’s position that the Act should include lesbian, gay, bisexual, transgender, queer and two-spirit communities are included in the designated groups for the purposes of the Act?

- Why is Employment and Social Development Canada (ESDC) requesting $1.7 million for the Employment Equity Act Review (Budget 2022) in the Supplementary Estimates (B) for fiscal year ending March 31, 2023?

- What is being done to address abuse of workers’ rights in instances like Drivers Inc. and intentional employee misclassification? What is the $26.3 million outlined in the Fall 2022 Economic Statement being used for?

Right of workers

Topics

- Federal policy on the “right to disconnect.”

- Establishment of an Advisory Committee on the Right to Disconnect with representatives from federally regulated employers, unions, and others

- Vaccination of Employees

- Advancing protections for employees of digital platforms

- Mental Health included to workplace safety regulations in the Canada Labour Code

- Violence and Harassment free workplaces

- Including progress on C190 ratification

- Mediation - back to work legislation (including Port of Montreal).

Anticipated questions

- Conclusions from the Advisory Committee released earlier this year says companies are looking for a voluntary framework while workers asked for a more mandated approach. What’s your take on this?

- Why do we need a policy on the right to disconnect in the first place?

- With the establishment of the Advisory Committee on the Right to Disconnect, has the government collected data, which would provide trends on increased days of sick leave, mental health issues, etc. amongst its employees since the pandemic? Have you implemented any changes from this Advisory Committee to date?

- What is being done to further the Minister’s mandate commitment on protecting workers in the gig economy?

- Should we include mental health to workplace safety regulations in the Canada Labour Code?

- To your knowledge, how many workers have been affected in their employment relationship by the vaccination policy and are on leave without pay or have been terminated? Will there be a gender-based analysis on that data as well? Disaggregated data is so important for gender equity, and I just want to understand if that will also have a GBA on it

- Workplace Harassment and Violence Prevention Fund: how can this fund prevent unacceptable instances of harassment and violence? Do you have date on this topic and if it affects mostly women or minorities?

- Can you tell us what steps have been taken regarding the ratification of C190?

Just in transition

Topics

- Report of the Commissioner on the Environment and Sustainable Development on Just Transition: insufficient government preparation to support affected workers and communities

- Align oil and gas projects with Just Transition

Anticipated questions

- The Commissioner said it very clearly: when it comes to supporting a just transition to a low-carbon economy, the government has been unprepared and slow off the mark. Are you not failing the 50 communities and 170,000 workers in the fossil fuels sector?

- What did you hear from your counterparts at the Roundtables earlier this year in Alberta?

- How do you reconcile oil and gas projects with Just Transition

Fairness

Topics

- Pay Equity and Pay transparency

- Modernizing Federal Contractors Program to ensure federal contractors are paying employees the federal minimum wage

- Legislation on Forced Labour in the Supply Chain

- Legislation to prevent the hiring of replacement workers (anti-scabs legislation): NDP-Liberal Supply Agreement

- IBEW and LTS Solutions- CIRB decision

- Mediation / back to work legislation (Port of Montreal)

- September 16, 2022 Board decision on Oceanex Inc.

- Menstrual Products in federally regulated workplaces

- C-307, An Act to amend the Canada Labour Code (menstrual products) (Don Davies, NDP)

- Supporting working women during pregnancy and while breast-feeding

- Labour Mobility Deduction for Tradespeople in Budget 2022/Bill C-19/C-241 an Act to amend the Income Tax Act (deduction of travel expenses for tradespersons) (Chris Lewis, CPC)

Anticipated questions

- What progress has been made on your mandate letter commitment to introduce legislation to eradicate forced labour from Canadian supply chains and ensure Canadian businesses do not contribute to human rights abuses aboard?

- What are your views on Bills C-243/S-211/C-262/C-263 and calls from stakeholders to introduce comprehensive due diligence legislation?

- Considering the NDP-Liberal Agreement which outlines the anti-scabs legislation as a priority, when can we expect a proper bill or amendment to the Canada Labour Code?

- What has been done to support the modernization of the Federal Contractors Program to ensure that federal contractors are meeting minimum wage requirements?

- The topic of menstrual products previously arguing they are no different from others for biological functions that happen at work and as such to gender advocates to update the occupational health and safety regulations to have access to menstrual products for women in the workplace. NDP MP Don Davies just introduced his PMB Bill C-307 to address this issue. Will you support it if it is added to the Order of Precedence?

- What actions are you taking following CIRB’s decision on the IBEW/LTS Solutions LTD case?

- What is being done to meet the Minister’s mandate commitment on strengthen provisions to better support working women who are pregnant and/or breast-feeding?

- Do you support Bill C-241 an Act to amend the Income Tax Act (deduction of travel expenses for tradespersons)? If not, what are your plans to provide this type of assistance if any and what is the timeline?

2.c. Committee member biographies (Title included for accessibility)

House of Commons Standing Committee on Human Resources, Skills and Social Development and the Status of Persons with Disabilities (HUMA)

- Member's biographies

- Chad Collins (LPC)

- Michael Coteau (LPC)

- Wayne Long (LPC)

- Soraya Martinez Ferrada (LPC)

- Robert (Bobby) J. Morrissey (LPC)

- Tony Van Bynen (LPC)

- Rosemarie Falk (CPC)

- Michelle Ferreri (CPC)

- Tracy Gray (CPC)

- Scott Aitchison (CPC)

- Bonita Zarrillo (NDP)

- Louise Chabot (BQ)

- Liberal Party of Canada

- Chad Collins, Ontario

- Michael Coteau, Ontario

- Wayne Long, New Brunswick

- Soraya Martinez Ferrada, Québec, PS for Housing and Diversity and Inclusion (Housing)

- Robert (Bobby) J. Morrissey, Prince Edward Island

- Tony Van Bynen, Ontario

- Conservative Party of Canada

- Rosemarie Falk, Saskatchewan Associate Labour Critic

- Michelle Ferreri, Ontario Families, Children and Social Development Critic

- Tracy Gray, Vice-Chair, British Columbia Employment, Future Workforce Development and Disability Inclusion Critic

- Scott Aitchison, Ontario Housing and Diversity and Inclusion Critic

- New Democratic Party of Canada

- Bonita Zarrillo, British Columbia, Disability Inclusion Critic

- Bloc Québécois

- Louise Chabot, Québec, Employment, Workforce Development and Labour Critic

Committee members biography

Chad Collins Liberal Party Hamilton East – Stoney Creek – Ontario

Brief biography

Chad Collins was first elected to the House of Commons for Hamilton East - Stoney Creek on September 20, 2021. A lifelong resident of Hamilton East - Stoney Creek, Chad resides in the Davis Creek area with his wife Mary and 2 children, Chase and Reese. He attended Glendale Secondary School, the University of Western Ontario, and McMaster University. Chad was first elected to City Council in 1995, at the age of 24, making him one of the youngest elected representatives in the City's history.

Chad is passionate about engaging local residents and community stakeholders, focusing on revitalization of infrastructure, development of social housing and stream-lining municipal programs.

As President of City Housing Hamilton, Chad has been committed to addressing the City's aging affordable housing stock by pressuring all levels of government to invest in the much needed repair of over 7,000 publicly owned units. He continues to work on nearly a dozen new projects across the City and in the riding that will provide new affordable housing units to those in need.

From the creation and development of new community parks and trails to the opening of a new food bank, Chad knows community consultation is an integral part of improving quality of life for everyone in Hamilton East - Stoney Creek.

Of note:

- Key issues of interest:

- affordable housing

Michael Coteau Liberal Party Don Valley East – Ontario

Brief biography

Michael Coteau was first elected to the House of Commons for Don Valley East on September 20, 2021. He has served as the Member of Provincial Parliament for Don Valley East since 2011. During his time in the Ontario government, his ministerial roles include: Minister of Children and Youth Services; Minister Responsible for Anti-Racism; Minister of Tourism, Culture and Sport; Minister Responsible for the 2015 Pan/Parapan American Games; and Minister of Citizenship and Immigration.

Prior to entering the provincial government, Michael was elected as a school board trustee for the Toronto District School Board (TDSB) in 2003, 2006 and 2010. As a trustee, Michael advocated for student nutrition, community use of space and the use of educational technology. He initiated the ‘Community Use of Schools’ motion that drastically cut user fees and made schools more accessible to groups that offer programs for children. He helped introduce nutritional changes in schools that supported healthy food programs and increased awareness of student hunger.

Michael worked as an ESL instructor and curriculum developer before becoming a community organizer for a United Way agency in Scarborough. He was also the Marketing Manager for ABC Life Literacy, where he was responsible for the organizing of the Family Literacy Day across Canada, and was Executive Director of Alpha Plus, a national literacy organization mandated to support adult education through the use of technology.

Michael grew up in Don Valley East and attended Don Mills Middle School and Victoria Park Collegiate Institute. He holds a degree from Carleton University in Political Science and Canadian History. He and his wife Lori live in Toronto with their 2 daughters, Maren and Myla.

Of note:

- spent 10 years in the Ontario legislature

- key issues of interest:

- low-income families

Wayne Long Liberal Party Saint John Rothesay – New Brunswick

Brief biography

Wayne Long was first elected to the House of Commons for Saint John — Rothesay in 2015 and was re-elected in 2019 and 2021. He is a member of the Saint John community with national and international business experience. Wayne currently serves as President of the Saint John Sea Dogs, and his efforts have helped turn the team into one of Canada’s most successful CHL hockey franchises winning the cherished Memorial Cup in 2011. That same year, Wayne was recognized with the John Horman Trophy, awarded to the Top Executive in the QMJHL.

Prior to his work with the Sea Dogs, Wayne was President of Scotiaview Seafood Inc. He was also a successful large-scale product manager with Stolt Sea Farm Inc. Wayne’s work has seen him travel across North America, negotiating contracts with national restaurant distributors, restaurant chains, and retail chains. He earned the North American Excellence in Sales and Marketing award twice. Wayne is a former Board Member for Destination Marketing and Salmon Marketing.

Wayne was born in the riding, and currently calls the area home alongside his wife, Denise, and their 2 children, Khristian and Konnor.

Of note:

- has been a member of HUMA since the beginning of the 42nd Parliament (2015)

- key issues of interest:

- poverty

- mental health

- outspoken support of the Energy East oil pipeline project

- previously broken ranks with party (Energy East, tax policy, SNC-Lavalin) which resulted in being kicked off House committees as punishment

- frequently makes sports parallel (hockey)

- government programs and support that benefit his constituents

Soraya Martinez Ferrada Liberal Party PS for Housing and Diversity and Inclusion (Housing) Hochelaga – Québec

Brief biography

Soraya Martinez Ferrada was first elected to the House of Commons for Hochelaga in 2019 and re-elected in 2021. She was appointed Parliamentary Secretary to the Minister of Immigration, Refugees and Citizenship in 2019 and became Parliamentary Secretary to the Minister of Transport in 2021. She has also served on the Standing Committee on Official Languages in the last Parliament.

She is a proud resident of the east end of Montréal. Originally from Chile, her family settled in the area in the 1980s. Soraya has deep roots in the community where she currently resides with her son and daughter.

Before being elected, Soraya worked for more than 20 years in the community where she specialized in communications and developed multiple cultural and political projects. Among her achievements, she created the very first cultural and socio-professional integration program at TOHU, a unique example of sustainable development in Montréal.

In 2005, she was elected as a city councillor and appointed by the mayor to the position of Associate Advisor for Culture on the City’s Executive Committee. In 2009, she became Chief of Staff to the Leader of the Official Opposition at Montréal City Hall. She transitioned to the federal government in 2015 as Chief of Staff and Senior Advisor to the Minister of Canadian Heritage.

She created the Vedette d’Hochelaga video clips in which she highlights the commitment of citizens, community organizations, and entrepreneurs in the riding of Hochelaga. She has also set up virtual roundtables and regular newsletters that present federal programs directly serving the people of her riding.

Of note:

- Parliamentary Secretary – Housing and Diversity and Inclusion (Housing)

- key issues of interest:

- poverty

- Quebec-focused

- multiculturalism

Robert (Bobby) J. Morrissey Liberal Party Egmont Prince Edward Island

Brief biography

In 2015, Bobby was elected to the House of Commons and was re-elected in 2019 and 2021. He served as a Member on the Standing Committee on Fisheries and Oceans, as well as the Standing Committee on Human Resources, Skills and Social Development and the Status of Persons with Disabilities.

Previously, he was elected to the Prince Edward Island Legislative Assembly in 1982 and has dedicated his career and volunteer life to serving the residents of PEI.

Having served as MLA for nearly 20 years, Bobby has a deep understanding of his communities’ needs. He has held a number of high-profile roles within the Assembly, such as Minister of Transportation and Public Works, Minister of Economic Development and Tourism, and Opposition House Leader. He was also responsible for the redevelopment of the Canadian Forces Base Summerside and the surrounding community following its closure by the federal government in 1989. Bobby left politics in 2000 to join the private sector as a consultant specializing in government relations, fisheries, and the labour market. Bobby has been a member of the Board of Directors for the Heart & Stroke Foundation of PEI. He was the founding member and former president of the Tignish Seniors Home Care Co-op, and Vice-Chair of Tignish Special Needs Housing.

Of note:

- Chair of HUMA

- former member of HUMA in 2019 (briefly before the general election)

Tony Van Bynen Liberal Party Newmarket – Aurora – Ontario

Brief biography

Tony Van Bynen was first elected to the House of Commons for Newmarket-Aurora in 2019 and re-elected 2021. A resident of Newmarket for over 40 years, Tony and his wife Roxanne raised their 2 daughters there.

Community service, volunteerism, and helping those who need it most is what drives Tony every day. He and Roxanne have volunteered at the Southlake Hospital, and the Inn from the Cold, for over 10 years. They also deliver food for the Newmarket Food Bank, and Tony was instrumental in creating Belinda’s Place, which is a multi-purpose facility for homeless and at-risk women.

He also had the privilege of serving as the Mayor of Newmarket for 12 years. During that time, community building is what guided Tony on his mission to revitalize Main Street, renew the historic Old Town Hall, and build the Riverwalk Commons so families and friends can enjoy great public places.

Through his previous role as the President of the Chamber of Commerce, and his 30-year career in banking, Tony understands what local businesses need to thrive and grow. He’s delivered innovative solutions to help local business owners find success, including creating the Envi broadband network, so businesses in the community have ultra-high-speed connectivity, which has been particularly crucial during the pandemic.

Of Note:

- key issues of interest:

- focused studies to help Canadians, especially getting through the pandemic

Rosemarie Falk Conservative Party Associate Labour Critic – Battlefords-Lloydminster Saskatchewan

Brief Biography

Rosemarie Falk is the Conservative candidate for Battlefords-Lloydminster. Rosemarie was born and raised in Lloydminster, Saskatchewan. Along with her husband Adam, she is now raising her children there. She has always been actively engaged in her community. Throughout her social work career and extensive volunteer work she has worked with some of the most vulnerable members of the community.

Rosemarie was first elected to the House of Commons in a by-election on December 11, 2017. Prior to this, Rosemarie worked as a registered Social Worker in Saskatchewan and has a Bachelor of Social Work from the University of Calgary. She also has experience as a legal assistant specializing in family law and as a legislative assistant in federal politics.

In October 2022, under the new Conservative Party leader, she was named to the new Official Opposition's Shadow Cabinet as the Associate Shadow Minister for Labour and Associate Labour Critic.

Of note:

- she has served as a member of the Standing Committee on Citizenship and Immigration and as a member of the Standing Committee on Human Resources, Skills and Social Development and Status of Persons with Disabilities.

- Rosemarie is committed to being a strong voice for seniors, families, taxpayers and rural communities.

- Associate Critic- Labour in the Official Opposition's shadow cabinet

Michelle Ferreri Conservative Party for Families, Children and Social Development Critic Peterborough Kawatha – Ontario

Brief Biography

Michelle is the Member of Parliament for Peterborough-Kawartha and was elected in the 2021 federal election. Michelle was appointed as Shadow Minister for Tourism as part of the Conservative Shadow Cabinet for the 44th Parliament. In October 2022, under the new Conservative Party leader, she was named to the new Official Opposition's Shadow Cabinet as the Minister for Families, Children and Social Development.

Prior to being elected, Michelle was a well-known community advocate, an award-winning entrepreneur, a committed volunteer, and a highly sought-after public speaker and social media marketer.

Michelle has over 20 years’ experience in media, marketing and public speaking. During her time as a reporter, one of Michelle’s most memorable experiences was when she had the opportunity to visit the Canadian Forces Base, Alert and fly to the station on a C-17 Globemaster.

Michelle is a graduate of Trent University (Biology/Anthropology) and Loyalist College (Biotechnology). Her education in science has led her to be a passionate advocate for physical and mental health.

She is a proud mother of 3 children, between the ages of 12 and 17, and shares her life with her supportive partner, Ryan, and his 3 daughters.

Of note:

- she is a member of the Standing Committee on the Status of Women since December 9, 2021

- Michelle is interested in physical and mental health, housing, the economy and food security

- Critic- Families, Children and Social Development in the Official Opposition's shadow cabinet

Tracy Gray Conservative Party Employment, Future Workforce Development and Disability Inclusion Critic Calgary Midnapore – Kelowna- Lake Country- British Columbia

Brief biography

Tracy was elected to serve as Member of Parliament for the riding of Kelowna-Lake Country in October 2019. In October 2022, under the new Conservative Party leader, she was named to the new Official Opposition's Shadow Cabinet as the Shadow Minister for Employment, Future Workforce Development and Disability Inclusion. She previously served as Shadow Minister for Interprovincial Trade and as the Shadow Minister for Export Promotion and International Trade.

Tracy has extensive business experience and worked most of her career in the BC beverage industry. She founded and owned Discover Wines VQA Wine Stores, which included the number 1 wine store in BC for 13 years. She is has been involved in small businesses in different sectors including financing, importing, oil and gas service and a technology start-up.

The daughter of a firefighter and Catholic School teacher, Tracy grew up around service and a strong work ethic. She has 1 son and been married for 27 years.

Tracy has received many accolades including RBC Canadian Woman Entrepreneur of the year, Kelowna Chamber of Commerce Business Excellence Award and 100 New Woman Pioneers in BC.

Tracy served with many organisations over the years. She was appointed to serve by BC Cabinet to the Passenger Transportation Board and elected to the Board of Prospera Credit Union for 10 years. In addition, she served on the Okanagan Film Commission, Clubhouse Childcare Society, Okanagan Regional Library Trustee and Chair of the Okanagan Basin Water Board.

Of note:

- Critic – Employment, Future Workforce Development and Disability Inclusion in the Official Opposition's shadow cabinet.

- Sponsor: Bill C-283, An Act to amend the Criminal Code and the Corrections and Conditional Release Act (addiction treatment in penitentiaries) and M-46 National Adoption Awareness Month (outside order of precedence).

Scott Aitchison Conservative Party Housing and Diversity and Inclusion Critic –Parry Sound – Muskoka - Ontario

Brief biography

Scott Aitchison was born and raised in Huntsville, Ontario. After leaving home at 15, Scott was raised by the character of his hometown. In October 2022, under the new Conservative Party leader, he was named to the new Official Opposition's Shadow Cabinet as the Shadow Minister for Housing and Diversity and Inclusion.

Scott was first elected at the age of 21 to Huntsville Town Council. After serving as Town Councillor, District Councillor and Deputy Mayor, he was elected as Mayor of Huntsville in 2014 on a promise of fiscal discipline, responsible governance and excellent customer service. As Mayor, he built a reputation as a consensus-builder relentlessly focused on breaking down barriers and finding solutions.

Of note:

Critic – Housing and Diversity and Inclusion in the Official Opposition's shadow cabinet

Bonita Zarrillo New Democratic Party Disability Inclusion Critic Port Moody –Coquitlam British Columbia

Brief biography

Bonita Zarrillo was first elected as Member of Parliament for Port Moody-Coquitlam in 2021. She is known to be a voice for equality and drives systemic change that puts people first. She entered public service so she could advocate for working people and to support the needs of the most vulnerable in the community. She championed buy-local as a tool for small businesses to thrive and to enable them to hire locally, challenged pipeline corporations to pay their fair share, and completed a successful housing affordability strategy that generated the most rental housing starts in her region.

On Coquitlam Council, Bonita served on the following: Fraser Health Municipal Government Advisory Council, Multiculturism Advisory Committee, Metro Vancouver Indigenous Relations Committee, Universal Access Ability Advisory Committee, and past Board Member for the Federation of Canadian Municipalities. She sat on the board of 2 local Not-For-Profits that advocate for gender equality and speaks regularly at The Commission on the Status of Women at the United Nations.

Before being elected to municipal government, Bonita worked in consumer products as a Business Analyst for companies across North America and Europe. She has a B.A. in Sociology from the University of Manitoba, a Human Resource Management Certificate from the University of Calgary and has a Computer Science Degree from CDI Montreal.

Of note:

- Critic – Disability Inclusion

- pledged to help Canadians through collaborative committee work

- key issues of interest:

- mental health and suicide prevention

- women’s issues and gender equality

- workers’ conditions

- care economy

Louise Chabot Bloc Québecois Employment, Workforce Development and Labour Critic Thérèse-De Blainville – Quebec

Brief biography

Louise Chabot was first elected as Member of Parliament in 2019 and was re-elected in 2021. She was born in 1955 in Saint-Charles-de-Bellechasse, Quebec, is a Quebec trade unionist and politician. She was president of the Centrale des Syndicates du Québec (CSQ) from 2012 to 2018. The organization initially represented nearly 200,000 members, including 130,000 in the education and early childhood sector. She coordinated a major unionization project that resulted in the consolidation of more than 15,000 family day care managers, a first in the union world in Canada.

Of note:

- Critic – Employment, Workforce Development & Labour Critic

- sponsored the Committee’s study on the Review of the EI Program in 2021; critical of the EI program in general and very outspoken about seasonal workers’ trou noir and inadequate sickness benefits

- interested in seniors’ financial security and their purchasing power

- seek to enact federal anti-scab legislation

- supporter of labour unions – Former president of Centrale des syndicats du Québec (CSQ)

- member of the consultative committee for Quebec’s Pay Equity Commission

- advocate for increase in health transfers

- respect for provincial jurisdictions

- labour shortages

- nurse by profession

3. Budget 2022/FES 2022/Supplementary Estimates (B) – Hot issues

3.a. Supporting implementation of 10 days of paid medical leave for federally regulated workers

Issue

The Government is supporting the implementation of paid medical leave provisions, which were introduced under an Act to Amend the Criminal Code and the Canada Labour Code (Bill C-3).

Background

Ten days of paid medical leave

The Minister of Labour’s 2021 mandate letter includes a commitment to “Secure passage of amendments to the Canada Labour Code to provide 10 days of paid sick leave for all federally regulated workers.”

Bill C-3, which received Royal Assent on December 17, 2021, provides that employees in the federally regulated private sector (FRPS) are entitled to earn and take up to 10 days of medical leave with pay per calendar year.

In March 2022, the Labour Program held consultation sessions with employer and employee representative organizations, as well as representatives from specific sectors, on the implementation of paid medical leave and the development of supporting regulations. Employer representatives were generally supportive of the importance of paid medical leave. However, some concerns were raised regarding:

- an early coming into force of the leave - employers need substantial advance warning to implement changes to their record-keeping programs, to assess the impact that the leave would have on their workforce, to hire and train employees in key operating positions, and to provide additional time to hardest hit businesses until revenues are back to pre-pandemic levels

- the complexity of the paid medical leave provisions (that is, how days are earned and carried forward), and

- the interaction of the new provisions with the paid medical leave programs (for example, short-term and long-term disability) already provided in their organizations

Employee representatives and worker advocacy groups were very supportive of the proposed paid medical leave provisions. However, they were concerned about the delay of the coming into force of these provisions; these organizations urged the government to bring these into force as soon as possible. They also opposed the medical certificate requirement and the monthly accrual method of the leave, which could leave workers with few paid medical days during peak flu and cold season. They proposed instead to provide 10 days at the start of each calendar year.

On March 22, 2022, the Government announced an agreement with the New Democratic Party that includes, “ensuring that the 10 days of paid sick leave for all federally regulated workers starts as soon as possible in 2022.” In Budget 2022, the Government proposed to “introduce minor amendments to [Bill C-3] to support timely and effective implementation of 10 days of paid medical leave for workers in the federally-regulated private sector.”

On June 23, 2022, Bill C-3 was amended via Bill C-19, the Budget Implementation Act, 2022, No.1 to ensure paid medical leave comes into force no later than December 1, 2022. The amendments also respond to certain stakeholder concerns and correct minor technical issues. These amendments:

- simplify the rate at which employees earn the days of paid medical leave

- align the medical certificate requirements for paid and unpaid medical leave

- protect employees’ earned days if a contract retendering process or a transfer of business affects them

- allow the Governor in Council to make regulations modifying how employees earn days of paid medical leave, and

- allow the Governor in Council to delay the coming into force for small employers

Final regulations that support the implementation of paid medical leave were published in the Canada Gazette, Part II on November 23, 2022. The legislation and the regulations came into force on December 1, 2022. Employees in federally regulated workplaces have begun accumulation days of paid medical leave.

The Labour Program secured 8.9 million dollars over 3years starting in 2022 to support the implementation of paid medical leave. This funding ensures that the Labour Program has sufficient capacity enforce the new paid medical leave provisions.

National action plan

The Minister of Labour’s 2021 mandate letter also includes a commitment to “convene provinces and territories to develop a national action plan to legislate sick leave across the country while respecting provincial-territorial jurisdiction and the unique needs of small business owners.”

On February 25, 2022, the Minister of Labour met with his provincial and territorial counterparts to share information and advance work on priority issues in workplaces across the country. Paid medical leave was a topic of discussion. Ministers noted the importance of protecting workers and preventing the spread of illness in the workplace, with several ministers sharing updates on changes in their jurisdictions.

Federal-Provincial-Territorial Ministers responsible for Labour met again on June 28, 2022 to discuss paid medical leave, labour shortages and better support for workers. The discussion regarding paid medical leave highlighted a range of current approaches with some jurisdictions considering implementing paid medical leave legislation, while others are prioritizing economic recovery from the impacts of COVID-19. Ministers expressed a continued interest in sharing information on this topic.

Key facts

Part III of the Canada Labour Code sets labour standards for employees in the FRPS, including about, 945,000 employees (roughly 6% of the Canadian employees) and 19,000 employers.

Bill C-3 will benefit about 582,700 employees, representing 63.3% of all employees employed in federally regulated industries, who have access to fewer than 10 days of paid leave to treat a personal illness or injury.

Key messages

Bill C-3, which received Royal Assent on December 17, 2021, provides employees in the federally regulated private sector with 10 days of paid sick leave per calendar year.

Not only is this an important step toward continuing the fight against COVID-19, but these amendments to the Canada Labour Code also represent a permanent change that will empower employees to prioritize their health and the health and safety of their workplaces.

Final regulations to support the implementation of paid sick leave were published in the Canada Gazette, Part II, on November 23, 2022.

Bill C-3 and the regulations to support the implementation of paid sick leave came into force on December 1, 2022. Employees have started accumulating days of paid sick leave.

Funding was secured over 3 years starting in 2022 to ensure the compliance and enforcement of the new paid sick leave provisions.

If asked about consultations with provinces and territories

I met with my provincial and territorial counterparts twice so far and made the case both times in favour of legislating paid sick leave because it’s good public policy and the right thing to do for both workers and employers.

Now that federally regulated workers have access to paid sick leave, I am looking forward to sharing results on its implementation with my provincial and territorial colleagues so they are aware of its success and may encourage them to follow our example.

3.b. Completing the Employment Equity Act review

Issue

The mandate commitment to accelerate the review of the Employment Equity Act and ensure timely implementation of improvements, with the support of the President of the Treasury Board, the Minister of Housing and Diversity and Inclusion and the Minister for Women and Gender Equality and Youth.

Background

Since its introduction in 1986, the Act was reviewed in 1992, 1995 and a Parliamentary review was conducted in 2001 to 2002.

Over that period, continued progress has been made in federally regulated workplaces for the 4 designated groups under the Act – women, Indigenous peoples, persons with disabilities and members of visible minorities. However, many workers are still facing barriers to employment. Canada has also undergone important economic, demographic and sociocultural changes resulting in increased diversity and an evolution of the meaning of equity, diversity and inclusion.

The Employment Equity Act Review Task Force was launched on July 14, 2021, with a mandate to advise the Minister of Labour on how to modernize and strengthen the federal employment equity framework, by studying the Act and consulting with stakeholders, equity communities and Canadians on issues related to equity.

The Task Force consists of 12 members from various backgrounds and fields of expertise, including the Chairperson, Professor Adelle Blackett, and the Vice-Chairperson, Professor Dionne Pohler.

On July 15, 2021, the Task Force members held their first meeting. In August 2021, further to the call of the 2021 federal election, the Task Force’s work was suspended due to the Caretaker Convention requirements.

On December 16, 2021, the Minister of Labour’s mandate letter called for an acceleration of the review of the Act to ensure the timely implementation of proposed improvements.

The Task Force resumed work in January 2022 and heard from hundreds of individuals representing stakeholder and partner organizations from public, private and non-profit sectors, including employers, unions, professional associations and members of designated groups and other communities, such as women, 2SLGBTQIA+ Canadians, Indigenous peoples, Black and racialized Canadians, persons with disabilities and other under-represented groups, including faith-based networks. Overall, the Task Force held 109 meetings over 51 days and these meetings involved a total of 337 attendees representing 176 organizations. The Task Force also received over 400 written submissions covering the full scope of the Employment Equity Act review, and an additional 350 expression of views shared via electronic correspondence.

The Task Force is completing its final report, which will include recommendations to the Minister of Labour on modernizing the Act. The report is expected to be submitted in the spring of 2023.

Key facts

According to the 2021 Employment Equity Act Annual Report, in federally regulated private sector employers covered under the Employment Equity Act:

- Women accounted for 39.1% of the workforce, compared to 48.2% labour market availability

- Indigenous peoples accounted for 2.4% of the workforce, compared with 4.0% labour market availability

- Persons with disabilities accounted for 3.9% of the workforce, compared with 9.1% labour market availability; and

- Members of visible minorities accounted for 26.0% of the workforce, compared with 21.3% labour market availability

According to Employment Equity in the Public Service of Canada for Fiscal Year 2020 to 2021, within the core public administration:

- The representation rate of women (55.6%) exceeded the labour market availability (48.2%)

- Indigenous peoples accounted for 5.2% of the workforce, compared with 4.0% labour market availability

- Persons with disabilities accounted for 5.6% of the workforce compared with 9.1% labour market availability; and

- Members of visible minorities accounted for 18.9% of the workforce, compared to 21.3% labour market availability

Key messages

Diversity of people and ideas is Canada’s strength. One of the ways the Government of Canada promotes equality and diversity is through the Employment Equity Act. Removing barriers to employment helps build a country where every Canadian has a fair and equal chance to reach their full potential.

Since the introduction of the Act in 1986, continued progress has been made in federally regulated workplaces for the 4 designated groups under the Act – women, Indigenous peoples, persons with disabilities and members of visible minorities.

However, many workers are still facing barriers to employment. Economic and social changes have also occurred, and the understanding of equity, diversity and inclusion has evolved.

That’s why we launched an independent Task Force to conduct the most extensive review of the Act since its introduction.

The Task Force has a mandate to study, consult and advise on how to modernize the federal employment equity framework.

The Task Force has now completed its engagement with stakeholders and partners, where it heard about their lived experiences, needs and views on issues related to equity. It also collected recent statistical information about various designated groups, including their distribution by occupation, employment income, gender and education level.

The Task Force will submit a report in the spring that includes concrete, independent and evidence-based recommendations on how to modernize the Act.

3.c. Support for workers experiencing miscarriage or stillbirth

Issue

The Government of Canada committed to amending the Canada Labour Code (Code) to provide up to 5 new paid leave days for federally regulated employees who experience a miscarriage or stillbirth.

Background

Government’s commitments and Bill C-3

The Minister of Labour’s mandate letter includes a commitment to “amend the [Code] to provide up to 5 new paid leave days for federally regulated employees who experience a miscarriage or still birth.”

An Act to amend the Criminal Code and the Canada Labour Code (Bill C-3), which received Royal Assent on December 17, 2021, includes amendments to the bereavement leave provisions in the Code that will provide up to 8 weeks of unpaid leave for employees who lose a child or experience a stillbirth. The first 3 days will be with pay for employees with 3 months of continuous employment with their employer. No amendments were introduced to address pregnancies that end in a miscarriage. These new leave provisions are not in effect; they will come into force on a day to be fixed by order of the Governor in Council.

In Budget 2022, the government announced “its intention to amend the [Code] in the coming year to further support federally regulated employees who experience a miscarriage or stillbirth.”

Leave available in circumstances of pregnancy loss

In all jurisdictions in Canada, employees who experience a pregnancy loss could have access to a combination of sick and/or maternity leaves. Under Part III of the Code, employees in the federal jurisdiction who experience a pregnancy loss may be eligible for the following leaves:

- Maternity leave: Employees could be eligible for up to 17 weeks of unpaid maternity leave should the pregnancy end during or after the 20th week of pregnancy (available in the event of a stillbirth).

- Medical leave: Since December 1, 2022, employees can earn and take up to 10 days of medical leave with pay per year. They can also be eligible for up to 27 weeks of unpaid medical leave.

- Personal leave: If an employee has not taken any days of personal leave over the calendar year, they could be eligible for up to 5 days of leave, including 3 paid days if they completed 3 consecutive months of continuous employment with their employer. The leave could be taken for reason(s) related to providing care to a family member or addressing an urgent matter.

Protections in the provinces and territories

Similar to the federal jurisdiction, provinces and territories provide a combination of sick and/or maternity leave(s) to employees who experience a pregnancy loss. Three provinces provide additional leave to support employees who experience a pregnancy loss:

- Prince Edward Island provides 3 days of leave (the first day with pay) for a loss at any point during their pregnancy. An employee who is the spouse, partner, or an intended parent of a child born as a result of a surrogacy agreement, is also entitled to this leave;

- Alberta provides 3 days of unpaid leave that can be taken in any situation where a pregnancy ends other than with a live birth. The leave can be taken by the person who was pregnant, and any other person who would have been a parent as the result of the pregnancy (for example, adoption or surrogate parents); and

- Quebec provides 5 days of leave (the first 2 days with pay) where a stillbirth occurs during or after the 20th week of pregnancy. Both parents may be eligible for the leave.

Consultations

In October 2022, the Labour Program held consultations with stakeholders on how a paid leave related to miscarriage or stillbirth should be effectively implemented, and the development of supporting regulations under Part III of the Code.

Stakeholders were generally positive and supportive of expanding the leave to include all types of pregnancy loss. Discussions mostly centered on the management of the leave, including the timeframe employees would be able to take the leave, potential documentation requirements to support the leave, and considerations for a minimum period of employment to be eligible for the leave with pay.

Key facts

Approximately 15% to 25% of pregnancies end in miscarriageFootnote 2 and over 3,000 stillbirths are reported in Canada each year.Footnote 3

These experiences are prevalent, and the emotional or physical impact they have varies from person to person. Depending on the circumstances of the event, some people may experience profound feelings of grief while others may feel mixed emotions (for example, guilt, anger, anxiety).Footnote 4

Without proper rest and recovery, some individuals could be at risk of developing prolonged mental health problems, such as clinical depression, anxiety disorders, and post-traumatic stress disorder.Footnote 5

Key messages

The Government of Canada recognizes that a significant portion of Canadian families experience a miscarriage or a stillbirth each year and the profound emotional impact it can have on them.

Such loss can present a very challenging moment in the working lives of parents as they may be faced with considerable mental and/or physical stress.

This is why our Government has committed to establish a paid leave to help workers cope in these situations and to destigmatize these experiences.

In October 2022, we consulted stakeholders on how a paid leave related to miscarriage or stillbirth should be effectively implemented, and received largely positive feedback.

4. Right of workers – Hot issues

4.a. Federal policy on the “right to disconnect”

Issue

Completing the development of a right to disconnect policy, in consultation with federally regulated employers and labour groups.

Background

The Minister of Labour has a mandate commitment to complete the development of a right to disconnect policy, in consultation with federally regulated employers and labour group.

The Right to Disconnect Advisory Committee was formed in 2020 with representatives from federally regulated employers, unions and non-governmental organizations. The mandate of the Committee was to recommend how to support federally regulated workers’ “right to disconnect.” The Committee’s final report was published in February 2022 and is available online.

Among Committee members, there was substantial divergence on how the government should proceed. This included debate about whether or not a legal requirement for the right to disconnect should be pursued.

- Ontario is the first jurisdiction in Canada to pass right to disconnect legislation. As of June 2022, provincially regulated employers in Ontario with 25 or more employees must have a policy on disconnecting from work

- Evidence shows that the ability to remain connected to work, while beneficial in certain ways, carries risks for employees, including stress due to disrupted work-life balance, burnout, and health-related absenteeism from work. It also creates uncertainty around the application of labour standards to new workplace realities such as telework and electronic communication outside of scheduled working hours, especially through digital devices

Key facts

According to Statistics Canada, in December 2022, about 15.8% of Canadians aged 15 to 69 worked exclusively from home, while another 9.6% had a hybrid work arrangement. For many Canadians, working from home means working longer hours. Overall, 35% of all new teleworkers reported working longer hours per day while only 3% reported working shorter hours.

A June 2022 report by the Environics Institute, the Future Skills Centre and the Diversity Institute noted that about 1 in 3 employed Canadians always or often continue to work after their regular working hours. Another 30% of workers report that this happens at least some of the time.

Similarly, in March 2022, LifeWorks found that 28% of Canadians are experiencing challenges disconnecting from work after regular working hours. These workers had a mental health score that was nearly 9 points below the national average.

Key messages

I have a mandate commitment to complete the development of a right to disconnect policy, in consultation with federally regulated employers and labour groups.

Remote and hybrid work is here to stay for many employees, and right to disconnect policies can support work-life balance while maintaining the flexibility required in many 24/7 industries.

The Right to Disconnect Advisory Committee consulted stakeholders and experts on the benefits and challenges of remaining connected to work outside of regular working hours. Employers and workers agreed that work-life balance is important but had different perspectives on how the government should proceed when developing a right to disconnect policy.

We are taking these perspectives into account as we move forward with this important initiative.

4.b. Vaccination of employees

Issue

To provide an update on the Labour Program’s current vaccination status.

Background

On October 6, 2021, the Government of Canada announced that all employees of the Core Public Administration, including the Royal Canadian Mounted Police, must be vaccinated. This requirement applied whether employees were teleworking, working remotely or working on-site. Contracted personnel who required access to federal government worksites to perform work for the Government of Canada also needed to be vaccinated.

- The Treasury Board of Canada Secretariat is the policyholder for vaccination requirements for all federal public sector employees.

- On December 7, 2021, the Government of Canada announced its intention to develop regulations under Part II (Occupational Health and Safety) of the Canada Labour Code to make vaccination mandatory in federally regulated workplaces

- In December 2021, the Labour Program consulted with federally regulated stakeholders, including representatives of small- and medium-sized employers from different sectors

- On June 14, 2022, the Government of Canada announced the suspension of vaccination mandates for domestic and outbound travel, federally regulated transportation sectors and federal government employees effective June 20, 2022

- As part of this announcement, the Government confirmed that it is no longer moving forward with proposed regulations under Part II (Occupational Health and Safety) of the Canada Labour Code to make vaccination mandatory in all federally regulated workplaces

Effective October 1, 2022, the Government of Canada announced the removal of all COVID-19 entry restrictions, including vaccination, testing, quarantine, and isolation requirements for anyone entering Canada.

Key facts

As of June 20, 2022, federal government employees are no longer required to be fully vaccinated.

At the Labour Program, 90% of employees had completed vaccination attestations as of June 2022.

Based on the Labour Program’s available data, 810 employees (99%) were fully vaccinated and seven employees (1%) were requesting accommodations.

Prior to the end of the vaccination mandate for federal government employees, 5 Labour Program employees were on leave without pay for vaccination purposes.

Gender disaggregated data on vaccination status is not available at this time.

Key messages

Throughout the pandemic, the Government of Canada’s response has been informed by expert advice and sound science and research. As the COVID-19 pandemic has evolved, so too have public health measures and advice, which includes vaccination requirements that were always meant to be a temporary measure.

That’s why, on June 14, 2022, the Government announced the suspension of vaccination mandates for domestic and outbound travel, federally regulated transportation sectors and federal government employees effective June 20, 2022.

As part of this announcement, the Government confirmed that it is no longer moving forward with proposed regulations under Part II (Occupational Health and Safety) of the Canada Labour Code to make vaccination mandatory in all federally regulated workplaces.

Vaccination continues to be one of the most effective tools to protect Canadians, including younger Canadians, our health care system and our economy. Everyone in Canada needs to keep up to date with recommended COVID-19 vaccines, including booster doses.

The Government will not hesitate to make adjustments based on the latest public health advice and science to keep Canadians safe. This could include an up-to-date vaccination mandate at the border, the reimposition of public service and transport vaccination mandates, and the introduction of vaccination mandates in federally regulated workplaces, if needed.

4.c. Advancing protections for gig workers and digital platform workers

Issue

Entitling digital platform workers to job protections under the Canada Labour Code (Code).

Background

The Minister of Labour has a 2021 mandate letter commitment to “advance amendments that entitle workers employed by digital platforms to job protections under the Canada Labour Code. This work will also include collaborating with the Minister of Employment, Workforce Development and Disability Inclusion to ensure better benefits and supports for these workers.”

Digital platform workers are gig workers who use electronic intermediaries (that is, platforms) like a smartphone application (for example, Uber and Lyft) to connect with clients who pay them through the platform to provide a service.

As demand for gig work increases, more Canadians are relying on jobs that do not come with the same level of job protection as is enjoyed by other employees in the economy.

Gig workers are often classified as self-employed independent contractors rather than employees, a status that is not covered by most job protections, including:

- union and collective bargaining rights

- occupational health and safety protections

- minimum labour standards (for example, minimum wage, paid sick leave, overtime pay, severance pay); and

- regular Employment Insurance benefits

This is often the result of misclassification, a process through which employees are wrongfully – and often intentionally – classified as independent contractors and denied job protections.

As a result of a lack of job protections, gig workers often experience precarious working conditions and economic vulnerability, including low and unpredictable earnings, unpredictable schedules, and unpaid work time.

Three phases of consultations with stakeholders and the public were conducted between 2021 and 2022 to better understand how current federal labour protections could be updated to better protect gig and digital platform workers.

Key facts

Gig and platform work in Canada

The share of Canadian workers who engage in gig work at some point during a given year increased from 5.5% to 8.2% between 2005 and 2016, with this share expected to have risen to about 10% over the last few years.Footnote 6

About 250,000 Canadians provided ride or delivery services through digital platforms in 2022. Many other services were offered by Canadians through platforms, such as videos, blogs, or podcasts (58,000 workers), programming, coding, web or graphic design (42,000 workers) and teaching or tutoring (41,000 workers).Footnote 7

Gig work and platform work generally falls under provincial and territorial labour jurisdiction. This includes the most well-known forms of gig work, such as driving for Uber and Lyft, or delivering food for SkipTheDishes.

Gig and platform work in federal sectors

It is estimated that there may be up to 41,000 federally regulated gig workers. The majority of these workers operate in the road transportation sector (63%), with significant pockets of gig workers in the courier and postal services (15%) and the telecommunication and broadcasting sector (10%).Footnote 8

Examples of federally regulated gig workers include transport-truck drivers, parcel-delivery persons, and television and radio broadcasting artists and freelancers hired as independent contractors but who often do not have all the characteristics of a true entrepreneur (for example, high level of control over their work, chance of profit or loss, significant investment in and ownership of tools).

Federally regulated gig workers earned an average annual income of $20,300 in 2016 from gig work, and some earning as low as $11,500 annually in the telecommunications and broadcasting sector.

Over 1 in every 3 (36%) federally regulated gig workers had another wage-earning job (that is, work for which they filed a T4 tax form), meaning that gig work is a secondary source of income for some workers.

Key messages

We have seen gig and digital platform work rapidly expand to cover more segments of the economy, and this is changing the way we work.

Our Government is committed to ensuring that workers in the gig economy are treated fairly and have access to greater labour protections.

To make sure that we get things right, 3 phases of consultations with stakeholders and the public were conducted between 2021 and 2022 to better understand how current federal labour protections could be updated to better protect gig and digital platform workers.

The results of these consultations are being taken into account as the Government develops ways to improve job protections for workers in the gig economy.

4.d. Improving mental health protection in federal workplaces

Issue

Amending the Canada Labour Code to explicitly include mental health as a specific element of occupational health and safety, and requiring federally regulated employers to take preventative steps to address workplace stress and injury.

Background

The Minister of Labour has a mandate commitment to move forward with a secure passage of amendments to the Canada Labour Code (Code) to include mental health as a specific element of occupational health and safety and to require federally regulated employers to take preventative steps to address workplace stress and injury.

Occupational health and safety is covered by Part II of the Code and its related regulations. These apply to federally regulated private sector employers, Crown corporations, the federal public service and parliamentary workplaces, including the House of Commons and the Senate.

In the context of occupational health and safety, protecting mental health is known as psychological health and safety.

While the focus has historically been placed on the physical aspect of health and safety in the workplace, recent Court decisions have interpreted the obligations of employers under Part II of the Code and related regulations as implicitly including psychological health and safety.

Bill C-65, An Act to amend the Canada Labour Code (harassment and violence), the Parliamentary Employment and Staff Relations Act and the Budget Implementation Act, 2017, No. 1, which came into force on January 1, 2021, amended the Code to create a single, integrated regime that will protect federally regulated employees from harassment and violence in the workplace. It also amended the purpose statement of Part II to include a specific reference to “psychological injuries and illnesses.” This is expected to strengthen the view that prevention of psychological illnesses and injuries is part of the employer’s obligation.

Consultations with employers, employees, unions and advocacy/expert stakeholders were conducted between 2020 and 2021 to better understand barriers to preventing psychological illnesses and injury in the workplace.

Key facts

According to the Mental Health Commission of Canada, even before the pandemic 500,000 employees were unable to work each week due to a mental health issue or illness.

According to national polling data collected by Mental Health Research Canada in 2021, 1 in 4 Canadians believe their work is having a significant impact on their psychological health and only about half (53%) would describe their workplace as being psychologically safe. About one third (35%) feel burned out at work. This is even more prevalent among women (39%), racialized workers (41%) and the 2SLGBTQIA+ community (43%).

In recent years, work-related psychological injuries and illnesses resulting in time away from work have been increasing across Canada, along with costs to employers, in both the private and public sectors.

The Mental Health Commission of Canada (MHCC) estimates that mental health problems cost the Canadian economy over $50 billion per year, including the costs of health care, social services and income support. The MHCC also estimates that more than one third (35%) of these overall societal costs are related to work, and that mental health problems in the workplace cost the Canadian economy approximately $6 billion per year in lost productivity (MHCC, 2010; 2013).

Key messages

Mental health is a concern for all Canadians and became even more prominent as a result of the COVID-19 pandemic due to its impact on our work and personal lives.

Mental and physical well-being are inseparable. Including mental health as an explicit element of occupational health and safety and requiring employers to take preventative steps is good for workers and good for productivity.

We heard from experts, unions, employees and employers on the issue at hand and were able to identify barriers that need to be removed to help prevent psychological illness and injury in the workplace.

We are working on a path forward towards improving mental health labour protections for federally regulated employees and fostering psychologically healthy and safe workplaces, and this is informed by the consultations held in 2020 and 2021.

4.e. Violence and harassment free workplaces

Issue

The Minister of Labour’s December 2021 mandate letter included a commitment to continue to support employers and unions to strengthen harassment and violence prevention measures in federally regulated workplaces.

Background

The Government strengthened harassment and violence provisions in the Canada Labour Code (the Code) and introduced the Work Place Harassment and Violence Prevention Regulations (the Regulations) on January 1, 2021.

These amendments create a single, integrated regime that protects federally regulated employees from harassment and violence in the workplace. More specifically:

- prevents and protects against both harassment and violence in the workplace

- requires employers to investigate, record and report occurrences of harassment and violence; and

- protects the privacy of employees who report occurrences of harassment and violence to encourage potential victims to come forward

Starting in 2018-2019, the Government committed $34.9 million over 5 years with $7.4 million per year ongoing to support the implementation of the regime. The funding supported regulatory development, the creation of an outreach hub to support employees as well as the development of educational material and tools along with an awareness campaign to support implementation.

There is also $3.5 million in grants and contributions each year available through the Workplace Harassment and Violence Prevention Fund (WHVPF). This fund aims to support workplace culture change and prevent harassment and violence by funding partner organizations to co-develop specific tools and resources.

The Labour Program also worked closely with the Canadian Centre for Occupational Health and Safety (CCOHS) to establish a Roster of Investigators (Roster).The Roster serves as an online repository of qualified, professional investigators who may be selected by employers or their designated recipients to investigate unresolved occurrences of workplace harassment and violence.

Key facts

In the past 3 years, the Labour Program has seen an overall decrease in both the number of inquiries to its Harassment and Violence Prevention Hub (the Hub) and the number of formal complaints addressed by the Hub.

- In 2019 to 2020, the Hub addressed 1,717 inquiries. For 2020 to 2021, this decreased to 1,279. For 2021 to 2022, this increased slightly to 1,538.

- In 2019 to 2020, the Hub considered 367 formal complaints. For 2020 to 2021, this decreased to 296. For 2021 to 2022, this decreased again to 283.

| Fiscal Year | Hub Inquiries | Formal Complaints Processed |

|---|---|---|

| 2019 to 2020 | 1717 | 367 |

| 2020 to 2021 | 1279 | 296 |

| 2021 to 2022 | 1538 | 283 |

For 2021 to 2022, the formal complaints received through the Hub by sector are broken down as follows:

- 25% from the Road Transport – Trucking sector

- 15% from the Federal Public Service

- 16% from employees employed by First Nations employer

- 9% from the Postal Service sector; and

- 7% from the Banking sector

On January 30, 2023, the Government of Canada officially ratified International Labour Organization (ILO) Convention No. 190, the Violence and Harassment Convention, 2019 (C190), aimed at eliminating violence and harassment in the world of work.

Governments who ratify C190 are required to, among other things, adopt laws, regulations, policies and programs to define, prohibit and prevent violence and harassment, including gender-based violence and harassment, at work.

Key messages

The Regulations are a robust and integrated framework to protect employees, including those in parliamentary workplaces, from harassment and violence in federal workplaces.

Under this integrated regime, federal employers have key obligations to:

- conduct workplace risk assessments

- develop workplace harassment and violence prevention policie

- develop or identify training on harassment and violence

- follow specific steps and timelines in a resolution process when responding to notice of occurrences of harassment and violence; and

- report annually to the Head of Compliance and Enforcement with data on all occurrences as outlined in the Regulations

The legislation requires a review of the harassment and violence provisions every 5 years, starting January 1, 2026. This will provide an opportunity for the Minister to evaluate the success of the regime and identify any potential changes that may be needed for improvement.

The Workplace Harassment and Violence Prevention Fund was created to provide $3.5 million annually in grants and contributions to help partner organizations create tools and resources that can both prevent harassment and violence and guide cultural change.

Since 2018, seven projects have received funding. These projects have focused on developing tools, resources and training materials for a variety of workplaces across Canada, including workplaces in the marine, trucking, and banking sectors, and also within First Nations communities.

On January 4, 2023, the Department approved 8 new projects that will be announced in the coming weeks. Selected projects will support workplaces through:

- the creation and development of tools and resources to prevent harassment and violence

- providing guidance to workers on harassment and violence regulations; and

- supporting employer and union collaboration, where expected outcomes will be clearly linked to the elimination of harassment and violence in the workplace

Supporting harassment and violence prevention projects across Canada will help make workplaces safer and more welcoming to new and diverse employees, ensuring that everyone feels safe and valued.

Ratification of C190 demonstrates the Government of Canada’s commitment to ending workplace violence and harassment, both at home and abroad.

4.f. Arbitration/Back to work legislation at the Port of Montréal

Issue

Overview of the collective bargaining situation at the Port of Montréal following the coming into force of back to work legislation and the subsequent appointment of a mediator-arbitrator.

Background

The Maritime Employers Association (MEA) and the Syndicat des débardeurs, Canadian Union of Public Employees (CUPE), Local 375, were negotiating the renewal of their collective agreement. This agreement expired on December 31, 2018, and covers all the employees (approximately 1,110) of all the employers engaged in the loading and unloading of vessels, and in other related work, in the territory of the Port of Montréal.

The Labour Program’s Federal Mediation and Conciliation Service began working with the parties in October 2018. Federal mediators and conciliators worked with the parties for more than two and a half years. In spite of this, the parties were unable to reach an agreement.

On May 1, 2021, following multiple work stoppages, escalating job action and 2 general unlimited strikes, the Act to provide for the resumption and continuation of operations at the Port of Montreal (Act) came into force. The Act established a neutral mediation-arbitration process to resolve the issues in dispute between the parties and conclude a new collective agreement.

On May 12, 2021, Mr. André G. Lavoie was appointed as mediator-arbitrator pursuant to the Act. All matters remaining in dispute at that time were referred to him for resolution and he issued his final report on December 9, 2022.

Key facts

On May 25, 2021, the union filed an application with the Superior Court of Quebec. The application alleges that the Act violates their members’ rights to freedom of association protected under section 2(d) of the Canadian Charter of Rights and Freedoms and asks that the court rule the law unconstitutional. The Attorney General of Canada is defending the constitutionality of the Act. The case is still before the Court and no decision on the merits of the application has yet been rendered.

Given the complexity of the issues in dispute between the parties, mediator-arbitrator Lavoie sought and was granted 2 extensions to his mandate.

Mr. Lavoie’s ruling of December 9, 2022, serves as the basis for the new collective agreement between the parties. The new 5-year collective agreement will expire on December 31, 2023.

Key messages