HUMA committee briefing binder: Appearance of Deputy Minister Tremblay – February 7, 2023

Official title: Appearance by the Minister of Employment, Workforce Development and Disability Inclusion – Standing Committee on Human Resources, Skills and Social Development and the Status of Persons with Disabilities (HUMA) – 2022 to 2023 Supplementary Estimates (B) – Date: February 7, 2023

1. Opening remarks

Open Remarks For The Minister of Employment, Workforce Development and Disability Inclusion, Carla Qualtrough, for Appearance before the Standing Committee on Human Resources, Skills and Social Development and the Status of Persons with Disabilities (HUMA) in relation to the Supplementary Estimates B – House of Commons – February 7, 2023

Check against delivery

Good afternoon, Mr. Chair, and committee members.

Let me start by acknowledging that we are gathering on the traditional unceded territory of the Algonquin Anishinaabeg People. Footnote 1

[Thank you for inviting me to discuss the Supplementary Estimates B for Employment and Social Development Canada.]

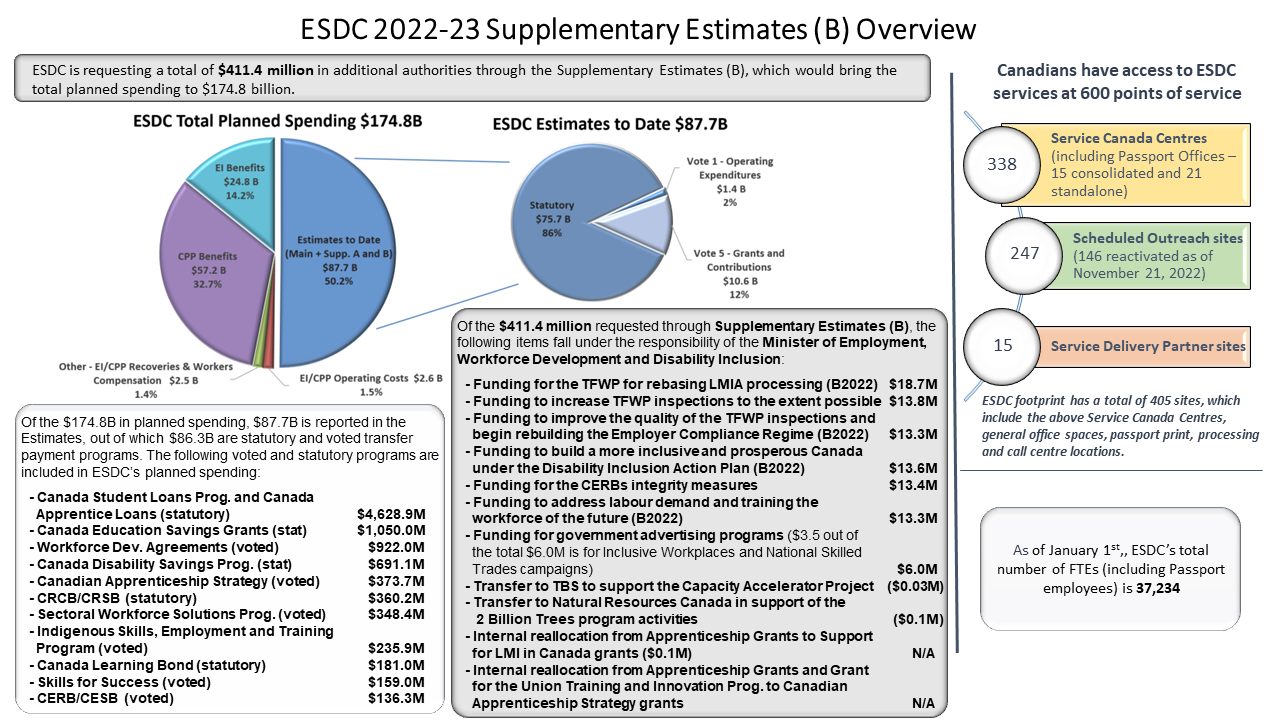

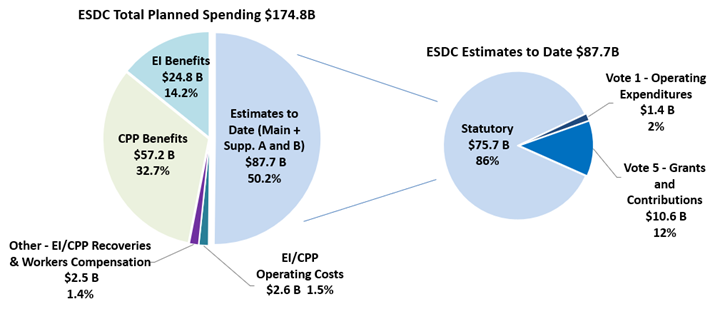

The Department is requesting a total of $411.4 million in adjustments.

In the interest of time, my focus will be on key adjustments for the Department.

Let me begin with Canada’s first Disability Inclusion Action Plan, released on October 7. The Action Plan is a blueprint to make Canada more inclusive of the 6.2 million people that identify as having a disability in our country.

[As Canada’s Minister responsible for Disability Inclusion, it is my responsibility to ensure progress on the 4 pillars of the Action Plan and its objectives, including the effective implementation of the Accessible Canada Act and the goal of reaching a barrier-free Canada by 2040.]

One of the best investments to reach that goal is in a strong, skilled workforce – one that gives everyone who can and wants to work – the opportunity and support to do so.

That is why the Department is requesting $13.6 million to implement early initiatives under the Disability Inclusion Action Plan this year. Of this, $11.4 million will go to implementing the Employment Strategy for Canadians with Disabilities through the Opportunities Fund for Persons with Disabilities, part of a larger Budget 2022 investment of $272.6 million over five years. The remaining $2.2 million will support the development of alternate format reading materials.

[This additional funding will further our efforts to help persons with disabilities find and retain jobs, and to make progress on achieving the objectives of the Disability Inclusion Action Plan.]

I will now turn to the Temporary Foreign Worker Program.

The Department is requesting $27.1 million to increase the reach – to the extent possible – of Temporary Foreign Worker Program inspections.

Over the past fiscal year, the Department refocused efforts on improving inspection quality, timeliness and responsiveness by providing supplementary guidance, training and tools for inspectors. It has also established a workload management strategy to reduce inspection backlogs. Moreover, the Department made improvements by conducting outreach and engagement sessions and furthering collaboration and information-sharing agreements with stakeholders to facilitate quicker interventions.

The additional funding will build on those efforts and support rebuilding the employer compliance regime.

The Department is also requesting $13.4 million for Canada Emergency Response Benefit integrity measures. This amount is to re-profile lapsed 2021 to 2022 funding into 2022 to 2023.

This re-profile will allow ongoing reviews and investigations to identify and address cases of error, misrepresentation, abuse and fraud in COVID-related emergency benefits.

As I bring my comments to a close, allow me to cover an important item which is under Minister Hussen’s portfolio, and supported by Employment and Social Development Canada: the Black-Led Philanthropic Endowment Fund.

The Department is requesting almost $200 million for the Black-Led Philanthropic Endowment Fund to enable one national Black-led and Black-serving recipient organization to establish and operate the Endowment Fund – beginning in the 2022 to 2023 fiscal year.

Announced in Budget 2021, this initiative seeks to create a sustainable funding source for Black-led, Black-focused and Black-serving non-profit organizations and registered charities to better serve Black communities across the country.

These initiatives demonstrate the Government of Canada's commitment to improving the quality of life of all Canadians.

[Thank you again for this opportunity, and I look forward to taking your questions.]

-30-

2. Employment Insurance – Hot issues

2.a. Employment Insurance modernization

Issue

When will the plan for Employment Insurance (EI) modernization be presented, why were the temporary measures terminated before the modernization plan was announced or put in place, and is the EI program nimble enough to provide support to Canadians should a recession come?

Background

Temporary EI measures in response to COVID-19

On September 24, 2020, a set of temporary changes to EI rules were implemented to facilitate the transition for workers from the Canada Emergency Response Benefit (CERB) to EI during the COVID-19 pandemic. These 1 year measures came to an end on September 25, 2021.

On September 26, 2021, a suite of new EI temporary measures came into force for a 1 year period to support workers during the pandemic recovery period when jobs were sporadic and scarce. These measures were announced as part of Budget 2021 and included:

- a common entrance requirement of 420 hours for regular and special benefits (with corresponding changes to fishing and special benefits for self-employed), and

- simplified treatment of reasons for separation and monies paid on separation

This second set of EI temporary measures ended on September 24, 2022, after which the program has returned to regular EI rules.

Budget 2022 announced the extension of the parameters of the EI seasonal claimant pilot project that provides up to 5 additional weeks of regular benefits to seasonal EI claimants in 13 regions, until October 2023.

Budget 2022 also announced the implementation of the extension to the duration of EI sickness benefits from 15 to 26 weeks in summer 2022. This change came into effect on December 18, 2022.

EI modernization

In Budget 2021, the Government of Canada announced $5 million over 2 years to conduct targeted consultations on designing an EI program for the future.

Budget 2022 reaffirmed the Government’s commitment to EI modernization and to continuing consultations on how to build an EI program that better meets the current and future needs of workers and employers.

In 2021 and 2022, comprehensive consultations on the EI program were co-led by the Minister of Employment Workforce Development and Disability Inclusion (EWDDI) and the EI Commissioners for workers and employers. A phased approach was used for these consultations to support broad engagement with workers, employers, expert stakeholders and Canadians (Phase I: August 2021 to February 2022; Phase II: April 2022 to July 2022), including stakeholder roundtables, written submissions and an online survey.

Topics for the consultations included EI access and simplification, adequacy of benefits, supports for workers experiencing life events, workers in seasonal industries, supports for self-employed and gig workers, including artists and cultural workers, the Premium Reduction Program, and the financing of the EI program.

The What We Heard reports from the first and second phase of the consultations were published online (Phase 1 report – April 2022; Phase 2 report – September 2022).

The 2022 Mandate Letter for the Minister of EWDDI committed to bring forward and begin implementing a plan to modernize EI, taking into account input from consultations. This included a commitment to build a stronger and more inclusive EI program that covers all workers, including seasonal workers, new supports for the self-employed, adoptive parents, long-tenured workers and consideration of the realities of artists and cultural workers.

Work on the EI modernization plan is ongoing and changes to the EI program will be informed by what was heard during the consultations and lessons learned from the pandemic, including the EI temporary measures.

Key facts

On temporary EI measures

As a result of changing labour market and unemployment rates it is difficult to accurately estimate the number of Canadians that have been affected by the end of the temporary measures that ended in September 2022. Initial estimates indicated that:

- 241,000 new regular claims and 12,900 new special benefit claims annually could be affected by the end of the temporary 420-hour common entrance requirement

- approximately 47,000 claims annually could be affected by the end of the temporary reasons for separation measure, and

- approximately 90,000 claims annually could be affected by the end of the temporary monies on separation measure

On EI consultations

Across both phases of consultations:

- over 35 virtual Ministerial national and regional roundtables were held, co-led with the EI Commissioner for Workers and the EI Commissioner for Employers

- consultations had active participation from over 200 stakeholders: employer and labour groups, community organizations, sector groups, self-employed and gig-worker associations, parent and family associations, and academics

- over 1,900 individuals and organizations participated in the online survey

- over 160 written submissions were received, and

- additionally, a number of focused workshops with academics and experts were held on self-employed and gig-workers, seasonal work, and EI financing

On EI support during a recession

The current EI program is built to respond to changing economic conditions (for example, the entrance requirements, benefit rate, and benefit duration all vary based on the regional unemployment rate).

EI can also serve as an economic stabilizer, providing income stability and helping to maintain a certain level of consumer spending activity.

There is a suite of well-proven tools that are available within and outside of EI to support workers in case of recession, including proactive outreach to ensure individuals can quickly apply for and access their EI benefits, the Work-Sharing program, skills and training programs, etc.

Key messages

On EI temporary measures in response to COVID-19

On September 24, the EI temporary measures announced in Budget 2021 ended.

These measures were put in place for a 1-year period to address the challenges faced by many workers during the economic recovery from the COVID-19 pandemic when work was scarce or sporadic.

As of September 25, 2022, the EI program returned to the following regular rules on eligibility for benefits:

- regular benefits: Between 420 and 700 hours of insurable employment in the qualifying period, depending on the regional unemployment rate

- special benefits: 600 hours of insurable employment in the qualifying period

- fishing benefits: $2,500 to $4,200 in earnings from self-employment in fishing based on the regional unemployment rate, and

- self-employed special benefits: The earnings threshold for self-employed workers registered for special benefit coverage is $8,092 in self-employment earnings in the 2021 taxation year

The government’s overall plan for EI modernization will be informed by lessons learnt from the pandemic, including from these EI temporary measures, and what we heard during the 2 years of EI consultations.

On EI modernization

The EI program is a critical component of Canadians’ social safety net. However, it has not kept pace with the changing nature of work and the pandemic highlighted long-standing gaps with the program.

This is why we held comprehensive consultations on the modernization of the EI program with workers, employers, expert stakeholders and Canadians in 2021 and 2022. Feedback from these consultations was published in What We Heard reports.

We heard from stakeholders on how to make the program simpler, fairer, more accessible, more inclusive and more responsive, while remaining financially sustainable.

The development of a long-term plan on EI modernization is underway informed by input received during these consultations and lessons learned from the pandemic.

We have already taken important steps to modernize the program with the extension to EI sickness benefits from 15 weeks to 26 weeks for new claims as of December 18, 2022. This will provide additional weeks of income support to approximately 169,000 Canadians who need more time to recover from their illness, injury or quarantine before being able to return to work.

I understand that you are eager to see what our plan for EI modernization looks like. The Government is working hard to analyze the results of consultations to ensure that all stakeholders views are taken into consideration, and that we bring forward a plan that will make durable and meaningful reforms to the program.

However, as the consultations showed, EI is a complex program. Modernizing EI is a serious undertaking that requires significant consideration, and the Government is taking the time necessary to get it right.

EI is a complex system that services millions of Canadians each year, and modernizing it is a serious undertaking. At this stage, it would be premature to speculate on the timing of EI modernization and its content.

2.b. EI claims

Issue

What are the current service standards for Employment Insurance (EI) claims?

Background

Employment and Social Development Canada (ESDC) is the largest federal service delivery organization in Canada, delivering benefits and services to support Canadians at all stages of their lives. Since the beginning of the pandemic, ESDC has worked tirelessly to manage efficiently the processing of EI applications and call volumes and issued more than $36.4 billion in EI benefits in 2021 to 2022.

Service Canada’s key client service performance indicator for timeliness of EI claims processing is Speed of Payment (SOP). The target is to issue a payment, or notification of non-payment, to claimants within 28 days of filing their application for benefits, 80% of the time.

For 2022 to 2023 (as of January 14, 2023), Service Canada has received a total of 2.45 million new EI applications. This volume is within 1.1% of the forecast (3.05 million) for 2022 to 2023. Currently, Service Canada has 206,951 new applications pending. Of these, 65,604 (31.7 %) are 29 days or older.

For 2022 to 2023 (as of January 13, 2023), the EI Call Centre answered over 4.8 million calls. Service Canada forecast between 6.0 million and 6.5 million calls will be answered by EI Call Centre officers by the end of 2022 to 2023.

Key facts

Service Canada makes every effort to meet EI’s service standard of issuing a payment, or notification of non-payment, within 28 days of filing a new application, 80% of the time. However, there are situations that prevent the Department from meeting this objective, particularly during the annual summer and winter peak periods, or because of missing documents or incorrect information.

In 2021 to 2022, Service Canada issued 85.4% of EI payments, or notifications of non-payment, within the 28-day timeframe. This is the second highest result in the last 15 years.

So far, in 2022 to 2023, as of December 31, 2022, 76.7% of EI payments, or notifications of non-payment, were made within 28 days. The average number of days it took for a client to receive their first EI benefit payment was 24 days. For this same period, 1.81 million EI Initial and Renewal applications were processed, of which 1.47 million (81.4%) were processed within 35 days.

In 2021 to 2022, EI Call Centre officers answered 7.2 million calls, compared to 5.6 million calls in 2020 to 2021. The average wait time was 20 minutes, a significant reduction compared to the previous fiscal year, when it averaged more than an hour.

In 2022 to 2023, the year-to-date result as of January 13, 2023 is 39% of calls answered within 10 minutes and the average wait time is 19 minutes. The EI Call Centre has improved its accessibility to be near 100% for callers accessing the queue to speak to an agent, compared to 50% in 2020 to 2021.

On November 3, 2022, the Fall Economic Statement announced $1.02B for Service Canada to process EI and Old Age Security claims faster, while reducing the EI claim inventory. In addition, $574M was announced to reduce the EI and Pensions Call Centre wait times.

Key messages

The EI Program, including its Call Centres, remains at the forefront of the Government of Canada’s service to Canadians.

As Canada moves into a post-pandemic era, yearly peak periods of demand will continue to affect some Canadians as they wait longer for their claims to be processed and their calls to the EI Call Centre be answered.

Service Canada continues to put measures in place to ensure that Canadians have timely access to the EI benefits when they need it most.

If pressed

The EI program is one of the pillars of Canada’s social safety net and plays a pivotal role in the lives of Canadians, providing vital income support when they need it most.

In 2021 to 2022, Service Canada delivered $36.4 billion in direct EI benefits to ensure the economic and social well-being of Canadians.

While I cannot discuss individual cases, any clients who are waiting for a decision regarding their eligibility for EI benefits and are in an urgent or dire need situation should contact the EI Call Centre for assistance.

2.c. Employment Insurance – Sickness benefits

Issue

Will the Government grant a royal recommendation to Bill C-215 (Jacques Gourde, CPC), which proposes to amend the Employment Insurance Act (illness, injury or quarantine) to extend the number of weeks available under EI sickness benefits to 52?

Background

On November 25, 2022, Minister Qualtrough announced that the Government is permanently extending the number of weeks available under EI sickness benefits from 15 weeks to 26 weeks, as committed to in Budget 2021, to provide workers with additional time and flexibility to recover before their return to work. These extra weeks are available for new EI claims established on or after December 18, 2022.

EI sickness benefits provide workers (including self-employed workers who enroll in the program) with temporary income support when they are unable to work because of illness, injury or quarantine. The EI sickness benefit is designed to ease the financial burden on claimants so that they can focus on restoring their health and return to work.

Bill C-215 was introduced by Jacques Gourde (CPC) on November 22, 2021 and proposes to extend EI sickness benefits to 52 weeks. The bill passed at Second Reading in the House of Commons on June 15, 2022 and was referred to the Standing Committee on Human Resources, Skills and Social Development and the Status of Persons with Disabilities (HUMA) for consideration. Departmental officials appeared as witnesses before HUMA on October 19, 2022. At that meeting, the CPC, NDP and BQ all indicated support for the bill, arguing that 26 weeks of sickness benefits is not enough in the case of cancer or certain other serious illnesses.

On December 12, 2022, the bill proceeded to Third Reading in the House of Commons, where its status is ‘in progress’. The Speaker reminded members that a Royal Recommendation is required for Bill C-215 before the House proceeds to the debate at third reading since the bill appropriates part of the public revenue.

Given the Government announced the implementation as of December 18, 2022, of the extension of EI sickness benefits from 15 to 26 weeks.

Currently, the bill does not specify any date for its coming into force, which means that if passed by Parliament it would come into force on the day it receives Royal Assent. This would have systems implications and also impact the sequencing and implementation of other EI modernization measures.

Key facts

As a short-term income replacement, a 26-week benefit duration for the EI sickness benefit aligns with its policy intent of providing short-term income support and supporting labour force attachment for eligible claimants who are unable to work temporarily due to illness or injury.

The extension of EI sickness benefits from 15 weeks to 26 weeks will provide additional weeks of income support to approximately 169,000 Canadians who need more time to recover from their illness, injury or quarantine before being able to return to work. In 2020/2021, there were 450,350 claims for EI sickness benefits for a total amount of $2 billion paid in benefits.

In 2020/2021, on average, EI sickness benefits claimants collected 9.1 weeks of sickness benefits. However, one-third (33.3%) of claimants used the maximum entitlement of 15 weeks.

In 2020/2021, women received a slightly larger share of the amount paid in EI sickness benefit than men, with 55.5% and 44.5%, respectively. Women (36.2%) were generally more likely than men (30.0%) to use the maximum number of sickness weeks for claims completed in FY2021. This trend is expected to continue with the extension of EI sickness benefits from 15 weeks to 26 weeks.

The 2020 Evaluation Report of EI Sickness Benefits indicated that claimants are much less likely to return to work after taking more than 26 weeks of sick leave, close to half do not return to work. A majority of those who do return to work do so within 10 weeks of exhausting their EI sickness benefits.

In 2018, the Government extended the Working While on Claim provisions to the EI sickness benefit, which provides greater flexibility to workers experiencing an illness to keep more of their EI benefits if they choose to gradually return to work.

The Parliamentary Budget Officer (PBO) has released multiple legislative costing notes on EI sickness extensions, including on the 26 weeks extension announced by the Government in Budget 2021; the proposal in Bill C-265 to extend EI sickness to 50 weeks; the proposal in Bill C-215 to extend EI sickness to 52 weeks.

| Number of weeks of EI sickness benefits | PBO costing estimates | Details of PBO estimate |

|---|---|---|

| 26 Weeks | $622 million in 2022 to 2023, increasing to $1.033 billion in 2025-26 | Released in May 2021, following Budget 2021 announcement on EI Sickness benefits extension. Costs are relatively aligned. |

| 50 Weeks | $1.4 billion in 2022 to 2023, increasing to 2.3 billion in 2025-26 | Released in May 2021 with regards to Bill C-265 which proposed extension to 50 weeks |

| 52 Weeks | $1.092 billion in 2022 to 2023, increasing to $1.9 billion in 2026 to 2027 | Released in March 2022 with regards to Bill C-215 proposal to extend to 52 weeks. |

The March 29, 2022, PBO’s estimate that an extension of EI sickness benefits to 52 weeks would cost approximately $1.9 billion per year ongoing is roughly double the Government’s estimated cost of $1 billion for an extension to 26 weeks, as announced in Budget 2021.

Key messages

Extending EI sickness benefits from 15 weeks to 26 weeks will provide additional weeks of income support to approximately 169,000 Canadians who need more time to recover from their illness, injury or quarantine before being able to return to work.

The EI sickness benefit complements a range of other supports that are available for longer-term illnesses and disabilities in Canada, including benefits offered through employer-sponsored group insurance plans, private coverage plans held by individuals, long-term disability benefit available under the Canada Pension Plan, as well as provincial and territorial support programs.

For many years, stakeholder groups representing cancer patients and people with disabilities, such as Multiple Sclerosis, have been recommending an extension to EI sickness benefits and have welcomed the extension from 15 weeks to 26 weeks.

These extra weeks are available for new EI claims established on or after December 18, 2022.

2.d. Employment Insurance – Premiums

Issue

What is the Government doing to ensure that employment insurance (EI) premium rates remain stable and predictable for workers and employers and will the Government credit the EI Operating Account (EIOA) for costs of EI temporary measures during the pandemic?

Background

EI premium rate setting

The EI program is financed by premium contributions from employees engaged in insurable employment in Canada and their employers. Employers pay 1.4 times this rate and Quebec residents receive a premium reduction to account for the Quebec Parental Insurance Plan (QPIP) replacing EI maternity and parental benefits.

The EI premium rate setting process is carried out by the Canada Employment Insurance Commission (Commission), a tripartite organization representing business and labour groups along with the Government of Canada.

Since 2017, the Commission has set the EI premium rate according to a 7-year forecast break-even rate, determined by the EI Senior Actuary. This mechanism ensures that EI premiums collected are equal to the total amounts charged to that account at the end of a 7-year period.

The EI financing mechanism also limits annual changes to the EI premium rate to 5-cents. This, along with the 7-year break-even period, ensures affordability for premium payers while offering ongoing predictability and stability.

Given the economic impact of the COVID-19 pandemic, the Government used its authority under the EI Act to freeze the EI premium rate for 2021 and 2022 at the 2020 level.

On September 14, 2022, the Commission set the 2023 EI premium rate at $1.63 per $100 of insurable earnings. This represents the maximum 5-cent increase to the premium rate permitted under the Act (from $1.58 in 2022 to $1.63 in 2023). Thereby ending the 2-year freeze on premium rate increases.

In the 2023 Actuarial Report on the EI Premium Rate, released in August 2022, the EI Senior Actuary forecasted the 7-year break-even rate at $1.74 per $100 of insurable earnings.

Premium rates are expected to continue to increase in 2024 to reach a break-even rate that will pay down the costs of the current cumulative deficit in the EI Operating Account.

The costs stemming from the COVID-19 temporary measures total approximately $23.2 billion, with projected costs going into 2023 and 2024.

The Fall Economic Statement (FES) 2022, released by the Department of Finance in November 2022, revised the break-even premium rate projection for 2024 at $1.66.

IRPP report

The Institute for Research on Public Policy (IRPP) led a workshop on EI Financing on June 29 and 30, 2022, as part of phase 2 consultations on EI modernization. The workshop brought together various stakeholder groups representing workers and employers as well as academics to discuss how the EI program can remain financially sustainable through economic downturns all while increasing the generosity of the program.

The IRPP released a report: “Financing Employment Insurance Reform: Finding the Right Balance” and commentary: “Building a Package of Compromise Solutions for EI Reform” on December 7th, 2022.

The Report highlights several longstanding issues with the program and notes that there is no perfect solution to achieving the following 3 objectives:

- expanded coverage and generosity

- low, stable, and predictable premium rates, and

- ensuring the program breaks even without government contribution

On EI financing the IRPP recommends:

- shifting the break-even period from 7 to 10 years

- limiting the decrease in premium rates while the EIOA is in deficit

- crediting the EIOA from the Consolidated Revenue Fund (CRF) for the costs of the COVID-19 temporary measures

- increasing the Maximum Insurable Earnings threshold, and

- a trigger for future government contributions to the EI program

Key facts

The 2023 EI premium rate of $1.63 is at a historical low. It is 10-cents lower than it was between 2008 and 2010 and 25-cents lower than the 2015 EI premium rate of $1.88 per $100 of insurable earnings, having reached its lowest levels ($1.58) in 2020, 2021, and 2022.

With the 5-cent increase in 2023, workers earning at or above the maximum insurable earnings threshold are paying $49.71 more in premiums than they did in 2022, while employers are paying $69.59 more for each of their employees.

While the premium rate for 2024 will be determined by the EI Actuarial Report that will be released in August 2023, the latest public figures from the 2022 FES projected the EI break-even premium rate for 2024 at $1.66 per $100 of insurable earnings. If premiums were held at this rate, the EIOA would be brought to near cumulative balance by 2030. This is 8-cents lower than the forecast break-even rate of $1.74 per $100 of insurable earnings calculated by the EI Senior Actuary in the 2023 EI Actuarial Report.

These revised figures are due to several updated economic and labour market projections reported in the 2022 FES. For example, EI premium revenues are projected to grow at 11.7 per cent in 2022 to 2023. This is due to continued strength in the labour market, with the unemployment rate expected to be near pre-pandemic rates. Premium revenues from 2023 to 2024 to 2027 to 2028 are also expected to grow at an average of 4.2%, reflecting earnings growth and expected future increases to the EI premium rate.

The 2022 FES also projected a cumulative deficit of $26.7 billion in the EIOA by the end of 2022, $0.6 billion lower than what the EI Senior Actuary forecasted.

However, none of the projections for EI premiums and the EIOA cumulative deficit account for costs (expenditures and revenues) of any future measures that may be implemented as part of EI modernization, or future economic downturns. Implementing EI modernization will require additional premium rate increases at a time when many economists are predicting a recession. This could be mitigated by other measures to support the financial sustainability of the EIOA.

Key messages

The Commission sets the EI premium rate according to a 7-year forecast break-even rate, determined by the EI Senior Actuary. Annual adjustments to the premium are limited to 5 cents. This mechanism ensures affordability for premium payers while offering ongoing predictability and stability.

On September 14, 2022, the Commission set the 2023 EI premium rate at $1.63 per $100 of insurable earnings. This represents the maximum 5-cent increase to the premium rate permitted under the Act (from $1.58 in 2022 to $1.63 in 2023).

This rate remains at a historical low and is based on forecasts and estimates prepared by the EI Senior Actuary.

During consultations on EI modernization, stakeholders and experts raised the importance of ensuring the program remains affordable and identified various approaches to modernize EI financing. Keeping EI financially sustainable is 1 of the objectives of EI modernization.

The Government is currently developing a plan for EI modernization that is informed by input from the EI consultations, including on EI financing.

The Government remains committed to ensuring that the EI program is accessible, adequate, and affordable for employees and employers while remaining financially sustainable in the long-term.

If a question is raised on the difference between the projections in the Chief Actuary’s Report and the FES:

- the 2023 Actuarial Report on the EI Premium Rate, released in August 2022 forecasted the 7-year break-even rate at $1.74 per $100 of insurable earnings

- the 2022 FES, released in November 2022, revised this projected break-even rate at $1.66. This updated projection was based on the newest available information on the economic and labour market projections available at the time, and

- the 2024 rate will be set based on the information available in summer 2023 and these projections will be released by the EI Senior Actuary in August 2023

If question is raised on IRPP report on EI financing:

- on December 7, 2022, the IRPP released a report titled “Financing Employment Insurance Reform: Finding the Right Balance”. The report provides a summary of a workshop held in June 2022 with experts and stakeholders to discuss ways to modernize EI financing, as part of ESDC’s EI Modernization consultations

- the report looks at various proposals to reform the EI financing mechanisms to address concerns about the deficit in the account, prepare against future recessions and support modernization. The conclusions of the IRPP report are consistent with key messages heard during consultations about providing greater access to EI and adequate supports for workers, while remaining financially sustainable, and

- evidence and insights from research and academic experts help inform the policy development work underway on the modernization of the program, combined with the results of consultations with Canadians and stakeholders

2.e. One EI zone for Prince Edward Island

Issue

Should Prince Edward Island (PEI) be a single economic region for the purpose of the Employment Insurance (EI) program?

Background

In 2014, PEI was split into 2 EI economic regions: a capital region (Charlottetown) and a non-capital region to better reflect labour market conditions between the 2 areas. Since then, a number of stakeholders have commented on the change, including some calling for its reversal.

Bill S-236, An Act to amend the EI Act and the EI Regulations (Prince Edward Island), was introduced in the Senate on February 21, 2022 by former Senator Diane F. Griffin (Independent) to amend the Employment Insurance Act (EI Act) and the Employment Insurance Regulations (EI Regulations) so PEI becomes 1 region again for the purpose of the EI program.

ESDC Officials appeared twice before the Senate Committee on Agriculture and Forestry that is in charge of studying the Bill:

- on June 16, 2022, ESDC officials responded to general questions about EI economic regions and the 2014 changes made in PEI. No question was asked about the financial impact of amalgamating the 2 PEI regions

- the Senate referred the Bill back to committee after the Office of the Parliamentary Budget Officer (PBO) released its legislative costing note for the Bill in August 2022, estimating a reduction in EI benefits paid to PEI of approximately $15 million per year if the current 2 EI regions in the province were amalgamated into a single region

- on November 17, 2022, ESDC officials appeared in front of the committee a second time to respond to questions related to the estimated impacts of merging the 2 PEI regions

The Canada Employment Insurance Commission (Commission) is required to initiate a review of the boundaries of the EI regions every 5 years to determine if it is appropriate to make changes to them. This requires extensive analysis of labour market and geographic data. ESDC supports the Commission in that role.

EI regional boundaries are based on Statistics Canada’s Census geography. EI regional boundaries generally separate large metropolitan areas from rural areas, and group together rural regions that have similar labour market conditions so that people residing in similar labour markets face comparable EI rules.

The last boundaries review began in 2018 and was completed in 2021. The analysis for the review was done by the Department on behalf of the Commission, which issued a resolution in 2021 that the analysis was complete.

In July 2021 the Minister was provided with a copy of the report including findings from both phases of this boundaries review. Copies of this report were provided to the Senate Standing Committee for Agriculture and Forestry in December 2022, following their request to the Minister regarding Bill S-236.

Key facts

For the period of January 8, 2023 to February 11, 2023, the unemployment rate that will be used for the purposes of the EI program for Charlottetown is 4.5%, while the unemployment rate for the rest of PEI is 8.2%, representing a 3.7 percentage point difference in the unemployment rate between the 2 regions. If the 2 EI regions had been combined, the resulting unemployment rate for the entire province would have been around 6.3% for that period, impacting claimants’ eligibility, benefit rate and duration of benefits calculation.

Given the labour market differences between Charlottetown and the rest of PEI, amalgamating the 2 EI economic regions would result in less EI benefits paid to claimants residing outside of Charlottetown, while minimal gains would be made for claimants residing in Charlottetown.

Analysis done by ESDC estimates that, if the 2 regions in PEI had been amalgamated in 2022, it would have resulted in a net loss of about $12.6 million in EI benefits paid in the province in that year. This is generally consistent with the Office of the PBO analysis.

The Bill currently debated in the Senate would circumvent the existing regulatory process that allows the Commission, with the approval of the Governor in Council (GIC), to make changes to regions, taking into account impacts on all regions.

The most recent EI regional boundary review concluded in June 2021. Results of the assessment will help inform the Government on whether regions should be modified to better reflect regional labour market characteristics. The next review is expected to start in 2023.

Key messages

The purpose of the EI economic regions is to ensure that people living in areas with similar labour market conditions are treated the same in terms of eligibility, benefit rate and length of benefit entitlement.

The Commission is responsible for establishing the boundaries of the EI regions and, according to EI regulations, they must be reviewed at least once every 5 years to ensure they continue to reflect regional labour market characteristics.

Employment and Social Development Canada supports the Commission in undertaking the review using Statistics Canada data and other labour market information. The analysis assesses whether or not the current EI economic regions continue to reflect regional labour market characteristics.

The Commission may make recommendations to the Minister responsible for EI regarding changes.

Amalgamating PEI into a single EI economic zone, as proposed by Bill S-236, would replace the 2 regional unemployment rates with a single unemployment rate for the province. This alternate configuration of EI boundaries in PEI was analysed as part of the most recent EI boundary review completed by the Commission and the 2021 report indicates that it would result in less labour market homogeneity in the region than what exists in the current 2 regions. For some claimants in the Charlottetown area, a single EI region in PEI would mean less hours to qualify and higher benefit rates and duration, while it would be the opposite for claimants in rural areas due to the lower unemployment rate of the combined region.

The department will continue to monitor and analyze labour market trends as they arise throughout the country. The next boundary review is expected to start in 2023.

If pressed, did ESDC officials purposefully mislead Senators when discussing S-236

I would like to thank the officials from my department who appeared in front of the Senate Committee on Agriculture and Forestry to support the discussion on Bill S-236.

I am confident that these officials responded to the questions asked by Senators to the best of their knowledge and with the information they had at their disposal at the time.

2.f. EI regions and boundaries – Questions and answers

EI Economic regions

- Q1: What are Employment Insurance (EI) economic regions?

- Q2: What is the purpose of EI economic regions?

- Q3: How are EI boundaries determined?

- Q4: Under regular EI rules, how does an individual’s eligibility, entitlement and the benefit rate for EI benefits vary based on the EI economic region?

EI Boundary review

- Q5: What is the EI Boundary Review?

- Q6: When was the last boundary review conducted?

- Q7: How does the boundary review consider seasonal workers?

- Q8: What approach and data sources are used to analyse the boundaries and determine if changes should be made?

- Q9: Why were changes made to the boundaries of Prince Edward Island (PEI) in 2014?

- Q10: Why were changes made to boundaries in 2014 outside of a formal boundary review?

Impacts of amalgamating Prince Edward Island

- Q11: What were the costing impacts published in the Regulatory Impact Analysis Statement (RIAS) in 2014 for the creation of the 2 EI economic regions in PEI?

- Q12: What is the Department’s current analysis of the costing impacts of amalgamating PEI into a single EI region?

- Q13: What explains the difference between the 2014 RIAS estimate and the 2022 estimates?

- Q14: How does the initial 2022 ESDC estimate compare to the Office of the Parliamentary Budget Officer (PBO) fiscal analysis of the bill?

- Q15: How would amalgamating the 2 regions result in changes to EI benefits for claimants?

- Q16: How does ESDC estimate the costing of EI measures?

- Q17: What were the 2018-2021 Boundary Review Results for PEI?

- Q18: How is the unemployment rate calculated for EI purposes?

Other

- Q19: How many EI claimants were there in Prince Edward Island pre-pandemic?

- Q20: What is the Canada Employment Insurance Commission (CEIC)?

EI economic regions

Q1: What are Employment Insurance (EI) economic regions?

Under the EI program, Canada is currently divided into 62 economic regions. The regional unemployment rate within each region determines EI eligibility, benefit rate and length of benefit entitlement.

However, as part of the temporary 1-year measure that came into effect on September 26, 2021, a common entrance requirement of 420 hours was introduced for EI benefits for all EI economic regions. This measure ended on September 24, 2022.

Q2: What is the purpose of EI economic regions?

The purpose of the EI economic regions is to ensure that people residing in areas with similar labour market conditions are treated the same under the EI program in terms of eligibility, benefit rate and length of benefit entitlement.

Q3: How are EI boundaries determined?

Under the Employment Insurance Act (EI Act), EI regional boundaries are based on Statistics Canada’s Census geography. EI regional boundaries generally separate large metropolitan areas from rural areas, and group together rural regions that have similar labour market conditions so that people residing in similar labour markets face comparable EI rules.

Q4: Under regular EI rules, how does an individual’s eligibility, entitlement and the benefit rate for EI benefits vary based on the EI economic region?

Depending on their regional rate of unemployment, insured individuals require between 420 and 700 hours of insurable employment in the 52 weeks preceding their claim, or since their last claim, whichever is shorter, to qualify for EI regular benefits. Eligible individuals are entitled to between 14 and 45 weeks of EI regular benefits, depending on the rate of unemployment in the EI economic region and the number of hours worked in the qualifying period.

When a region’s unemployment rate rises, the entrance requirement is reduced and the duration of benefits increases. Therefore, the amount of assistance provided increases and support adjusts to the changing needs of regions and communities.

The calculation of weekly benefit rates for both EI regular and special benefits also takes into account differences in regional labour market conditions. It is based on the regional rate of unemployment. Specifically, EI benefits are calculated using the best (highest) weeks of earnings during the qualifying period (generally 52 weeks). The number of weeks used ranges from 14 to 22 depending on the unemployment rate in a particular EI economic region.

EI boundary review

Q5: What is the EI Boundary Review?

EI Regulations require that the boundaries for EI economic regions be reviewed at least once every 5 years to ensure they continue to reflect regional labour market characteristics.

The Government provides its analysis to the Canada Employment Insurance Commission (CEIC) which is responsible for reviewing the EI boundaries to determine if changes are needed.

The Commission reviews the boundaries of the EI economic regions every 5 years to determine if changes would be appropriate. They may make recommendations to the Minister responsible for EI regarding the changes that could be made.

The EI regional boundary review uses a variety of methods to examine and compare the labour markets within a regional EI boundary. Statistics Canada data and other labour market information is analyzed and compared with labour market conditions across the country. The analysis assesses whether or not the current EI economic regions continue to reflect regional labour market characteristics.

Q6: When was the last boundary review conducted?

The most recent review commenced in the fall of 2018 and concluded in June 2021. The next review will start in 2023.

Q7: How does the boundary review consider seasonal workers?

The purpose of the EI economic regions is to ensure that people residing in similar labour markets are treated similarly by the EI program.

The latest boundary review considered numerous factors, such as the unemployment rate, the industry mix and the seasonality.

Q8: What approach and data sources are used to analyse the boundaries and determine if changes should be made?

The EI economic regions must be based on Statistics Canada geographic units. Large urban areas, currently defined as census metropolitan areas, are designated as their own EI region. The remaining areas are grouped into relatively homogeneous, contiguous areas with similar economic conditions based on economic variables such as unemployment and employment rates, average wages, average weeks worked, low-income incidence, and seasonality.

The data for these variables comes from the Labour Force Survey, the Census of Population, and income tax and benefit returns.

Q9: Why were changes made to the boundaries of Prince Edward Island (PEI) in 2014?

When the change to the regions in PEI was made in 2014, the difference in the unemployment rate between the new Charlottetown economic region (8.0%) and the new economic region of PEI (11.7%) was 3.7 percentage points. As a result, a similarly placed EI claimant in the new PEI region was entitled to more EI than a claimant in the new Charlottetown region.

By comparison the rate for the old (aggregate) PEI region in the month preceding the change was 9.8% which was applied to all claimants in PEI at that time.

As of January 8, 2023 the EI unemployment rate in the EI economic region of Charlottetown was 3.7 percentage points lower than that in the EI region that consists of the rest of PEI.

Q10: Why were changes made to boundaries in 2014 outside of a formal boundary review?

The change to EI economic regions occurred in 2014, outside of a boundary review.

Improvements in data availability allowed for the introduction of a new unemployment rate methodology in the territories to better reflect labour market conditions. Prior to this, the unemployment rate in each of the territories was administratively set at 25 percent for the purpose of the EI program.

As a result of analysis done with the newly available data, the territories were each split into capital and non-capital regions, effective October 12, 2014.

Recognizing capital and non-capital differences in the territories would have left Charlottetown as the only provincial or territorial capital without EI economic region status, PEI was also assessed.

Given that Charlottetown had at the time a significantly lower unemployment rate than the rest of the province, PEI Island was also divided into a capital and non-capital region on October 12, 2014.

Impacts of amalgamating Prince Edward Island

Q11: What were the costing impacts published in the Regulatory Impact Analysis Statement (RIAS) in 2014 for the creation of the 2 EI economic regions in PEI?

Analysis done for the 2014 RIAS estimated that, had the 2 regions been in effect in 2014, the change would have increased benefits for 9,150 EI claimants in the non-capital region of PEI (+$15 million), and decreased benefits for 5,450 EI claimants in Charlottetown (-$14 million), for a net difference of about $1 million.

Q12: What is the Department’s current analysis of the costing impacts of amalgamating PEI into a single EI region?

Recent initial analysis done by Employment and Social Development Canada (ESDC) estimates that, if the 2 regions in PEI were amalgamated in 2022, the payment of EI benefits would have decreased for 9,085 claimants residing in the rural, non-capital region of PEI (-$15.3 million) and increased for 2,635 claimants residing in Charlottetown ($2.7 million), for a net loss of about $12.6 million.

Q13: What explains the difference between the 2014 RIAS estimate and the 2022 estimates?

Three factors explain the difference in the estimates:

- the relative number of claimants in each of the 2 regions. Amalgamating the regions would increase benefits paid in Charlottetown and decrease benefits paid to the rural region of PEI. The percentage of EI claimants in the province that live in the rural PEI region has increased since 2014. The analysis done for the 2014 RIAS estimated that 69.7% of EI claimants in the province would live in the rural region. In the 2019/20 fiscal year, 77.7% of EI claimants in the province lived in the rural region

- the average gap in the EI unemployment rates in the 2 regions has fluctuated significantly since 2014, with monthly gaps ranging between 0.1 percentage points and 8.6 percentage points. A larger unemployment gap between the 2 regions increases the magnitude of the increases and decreases in benefits from the amalgamation of regions

- the EI maximum insurable earnings have increased by 24% since 2014, from $48,600 (max weekly benefit rate of $514) to $60,300 (max weekly benefit rate of $638). Increasing the maximum insurable earnings increases the average weekly benefit rate claimants can receive, which in turn increases the dollar value of any change to benefit qualification or duration

These 3 changes, taken together, would increase the percentage of claimants who are expected to experience a reduction in EI benefits if the 2 PEI regions are amalgamated into a single region. It would also increase the magnitude of these reductions in terms of qualifying and weeks of benefits, and increase the average dollar value of these lost weeks of benefits.

Q14: How does the initial 2022 ESDC estimate compare to the Office of the Parliamentary Budget Officer (PBO) fiscal analysis of the bill?

In its Legislative Costing Note, the Office of the PBO estimated the bill would generate around $76.6 million in savings for the Federal government between 2021 to 2022 and 2025-26. This represents, on average, approximately $15 million annually over that period.

This is generally consistent with analysis done by ESDC in 2022 found that, had the 2 regions been amalgamated during 2022, benefits would have decreased for 9,085 claimants (-$15.3 million), and increased for 2,635 claimants ($2.7 million), for a net loss in EI benefits paid to the province of PEI of about $12.6 million.

ESDC and the Office of the PBO use different models and assumptions. The costing from ESDC was performed by comparing 2 scenarios in a microsimulation model. The underlying sample used for the model is based on the calendar year 2018. Results are projected for 2022 using the Department of Finance forecasting variables for unemployment and weekly earnings.

Q15: How would amalgamating the 2 regions result in changes to EI benefits for claimants?

The EI program uses the unemployment rate in an EI economic region to determine the entrance requirements, duration of benefits, and, through the Variable Best Weeks’ provision, the calculation of weekly benefit rate.

EI regions with higher unemployment rates have lower entrance requirements and provide a longer duration of benefits.

Amalgamating the 2 EI regions in PEI would replace the 2 current regional unemployment rates in PEI with 1 single rate for the province:

- for claimants in the current rural PEI region, this new unemployment rate would be lower than their current regional rate of 10% (in effect as of November 6, 2022), resulting in a higher entrance requirement of insurable hours for these claimants. This could mean that some claimants residing in this rural PEI region may not have sufficient hours to qualify for benefits in an amalgamated region. Eligible claimants would also have fewer weeks of EI entitlement, and, for some claimants, a reduction in the weekly benefit rate:

- for example, a claimant who lives in the current rural PEI region and who files an EI regular benefits claim between January 8 and February 11, 2023, would require a minimum of 595 hours of insurable employment to qualify. If the 2 regions in PEI were amalgamated, under the revised EI unemployment rate of 6.3% for the new single region, this claimant would require at least 665 hours to qualify and would be entitled to 4 fewer weeks of benefits than they would have received with the current EI regions. Their benefits would be calculated based on their 19 best weeks of earnings, whereas if the regions were amalgamated, under the new rate their benefits would be calculated using their best 21 weeks, which could result in a lower weekly benefit rate, depending on their work pattern

- for claimants in the current Charlottetown region, the new unemployment rate would be higher than their current regional rate of 4.5% (in effect as of January 8, 2023), resulting in a reduced entrance requirement of insurable hours for these claimants. This could mean that some claimants residing in Charlottetown who might not have qualified under the current regions could have sufficient hours to qualify for benefits in an amalgamated region. Eligible claimants would also have more weeks of EI entitlement, and for some claimants, an increase in weekly benefit rate

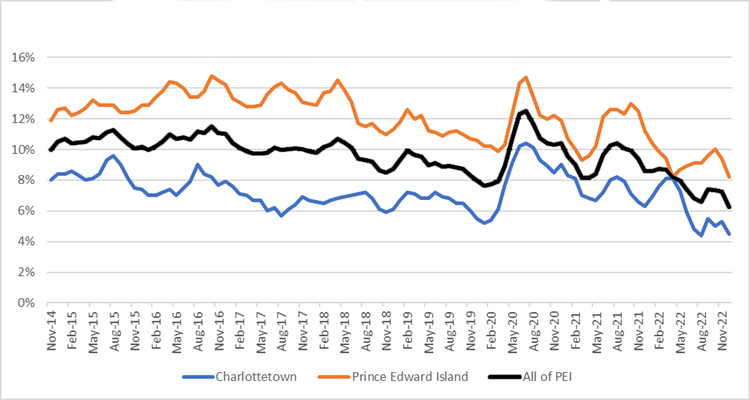

- see graph in annex for historical rates of the 2 EI regions in PEI and the amalgamated rate for the province, and for further details

Q16: How does ESDC estimate the costing of EI measures?

ESDC has developed an EI Micro-Simulation Model to assess policy options and their impact on the current EI program. This model allows ESDC to analyze the effects of complex interactions between changes to a single or multiple policy parameters and estimate program costs.

The Model supports a broad range of policy work. Almost every aspect of EI Part I benefits can be analyzed using this tool. In general terms, work could be done on the following program parameters:

- boundaries of EI economic regions

- entrance requirement, qualifying and pre-qualifying period

- entitlement received by qualified claimants

- calculation of the weekly benefit rate

- processing of weekly benefits (including allowable earnings and working while on claim)

- benefit supplements

- benefit repayment provisions; and

- employee’s penalties

Q17: What were the 2018-2021 Boundary Review Results for PEI?

The most recent EI boundary review analyzed the homogeneity of the unemployment rates and labour market conditions in all EI regions. These homogeneities were determined by comparing the unemployment rates and labour market conditions in the Statistics Canada census geographic units that comprise each EI region.

The results of this analysis were used to assess the impact of amalgamating the 2 regions on the unemployment rate and labour market condition homogeneities. Results found that an amalgamation of the 2 regions would result in a significant reduction in unemployment rate and labour market condition homogeneity compared to the current boundaries.

Q18: How is the unemployment rate calculated for EI purposes?

The regional rates of unemployment used by the EI program are produced by Statistics Canada using data from their monthly Labour Force Survey.

The monthly regional unemployment rates for EI purposes (except for the territories) are seasonally adjusted 3-month-moving averages.

The monthly regional unemployment rates for EI purposes in the territories are subject to the greater of a seasonally adjusted 3-month-moving average or 12-month-moving average.

Other

Q19: How many EI claimants were there in Prince Edward Island pre-pandemic?

For the 2019/20 fiscal year, PEI accounted for 1.2% of total EI claims (21,770).

PEI had average weekly benefits (all benefits under EI Part I combined) of $455, compared with $480 for Canada, and PEI claimants received $226 million in total benefits, which represents 1.3% of total EI income benefits.

EI regular claimants in PEI received $446 per week on average, while the average for regular benefits for all Canadians was $483 in 2019/20.

Q20: What is the Canada Employment Insurance Commission (CEIC)?

The CEIC is a tripartite organization with representatives from business, labour and the Government of Canada. The CEIC plays a leadership role, with ESDC, in overseeing the EI program.

Annex – Historical unemployment rates (3MMA) and labour force

Figure 1 – Text version

| Year-Month | Charlottetown | Prince Edward Island | All of PEI |

|---|---|---|---|

| 2014/11 | 8.1% | 11.9% | 10.0% |

| 2014/12 | 8.4% | 12.7% | 10.5% |

| 2015/01 | 8.5% | 12.9% | 10.7% |

| 2015/02 | 8.5% | 12.3% | 10.4% |

| 2015/03 | 8.3% | 12.5% | 10.4% |

| 2015/04 | 8.0% | 12.8% | 10.5% |

| 2015/05 | 8.1% | 13.3% | 10.8% |

| 2015/06 | 8.4% | 12.9% | 10.8% |

| 2015/07 | 9.2% | 12.8% | 11.1% |

| 2015/08 | 9.6% | 12.9% | 11.3% |

| 2015/09 | 9.0% | 12.5% | 10.8% |

| 2015/10 | 8.1% | 12.5% | 10.4% |

| 2015/11 | 7.4% | 12.6% | 10.1% |

| 2015/12 | 7.3% | 13.0% | 10.2% |

| 2016/01 | 6.9% | 12.9% | 10.0% |

| 2016/02 | 6.9% | 13.4% | 10.2% |

| 2016/03 | 7.2% | 13.8% | 10.5% |

| 2016/04 | 7.5% | 14.4% | 11.0% |

| 2016/05 | 7.0% | 14.3% | 10.7% |

| 2016/06 | 7.5% | 14.0% | 10.8% |

| 2016/07 | 7.8% | 13.4% | 10.6% |

| 2016/08 | 8.9% | 13.4% | 11.2% |

| 2016/09 | 8.4% | 13.8% | 11.1% |

| 2016/10 | 8.2% | 14.8% | 11.5% |

| 2016/11 | 7.7% | 14.4% | 11.1% |

| 2016/12 | 7.9% | 14.2% | 11.0% |

| 2017/01 | 7.5% | 13.3% | 10.4% |

| 2017/02 | 7.1% | 13.1% | 10.1% |

| 2017/03 | 6.9% | 12.8% | 9.9% |

| 2017/04 | 6.7% | 12.8% | 9.8% |

| 2017/05 | 6.6% | 12.9% | 9.7% |

| 2017/06 | 6.0% | 13.6% | 9.8% |

| 2017/07 | 6.2% | 14.1% | 10.1% |

| 2017/08 | 5.7% | 14.3% | 10.0% |

| 2017/09 | 6.2% | 13.9% | 10.0% |

| 2017/10 | 6.4% | 13.7% | 10.1% |

| 2017/11 | 6.9% | 13.1% | 10.0% |

| 2017/12 | 6.6% | 13.0% | 9.9% |

| 2018/01 | 6.6% | 12.9% | 9.8% |

| 2018/02 | 6.6% | 13.6% | 10.2% |

| 2018/03 | 6.8% | 13.8% | 10.3% |

| 2018/04 | 6.8% | 14.4% | 10.7% |

| 2018/05 | 6.9% | 13.9% | 10.4% |

| 2018/06 | 7.0% | 13.2% | 10.1% |

| 2018/07 | 7.1% | 11.8% | 9.4% |

| 2018/08 | 7.2% | 11.5% | 9.3% |

| 2018/09 | 6.8% | 11.6% | 9.2% |

| 2018/10 | 6.1% | 11.2% | 8.7% |

| 2018/11 | 5.9% | 11.0% | 8.5% |

| 2018/12 | 6.1% | 11.3% | 8.8% |

| 2019/01 | 6.7% | 11.8% | 9.3% |

| 2019/02 | 7.2% | 12.6% | 9.9% |

| 2019/03 | 7.2% | 12.1% | 9.7% |

| 2019/04 | 6.9% | 12.2% | 9.5% |

| 2019/05 | 6.8% | 11.2% | 9.0% |

| 2019/06 | 7.1% | 11.1% | 9.1% |

| 2019/07 | 6.9% | 11.0% | 8.9% |

| 2019/08 | 6.7% | 11.2% | 8.9% |

| 2019/09 | 6.5% | 11.2% | 8.8% |

| 2019/10 | 6.5% | 11.1% | 8.8% |

| 2019/11 | 6.0% | 10.7% | 8.3% |

| 2019/12 | 5.5% | 10.6% | 8.0% |

| 2020/01 | 5.2% | 10.2% | 7.6% |

| 2020/02 | 5.3% | 10.2% | 7.7% |

| 2020/03 | 6.0% | 9.9% | 7.9% |

| 2020/04 | 7.7% | 10.3% | 9.0% |

| 2020/05 | 9.1% | 12.3% | 10.7% |

| 2020/06 | 10.2% | 14.3% | 12.3% |

| 2020/07 | 10.3% | 14.7% | 12.5% |

| 2020/08 | 10.1% | 13.3% | 11.7% |

| 2020/09 | 9.3% | 12.2% | 10.7% |

| 2020/10 | 8.9% | 12.0% | 10.4% |

| 2020/11 | 8.5% | 12.2% | 10.3% |

| 2020/12 | 9.0% | 11.9% | 10.4% |

| 2021/01 | 8.4% | 10.7% | 9.5% |

| 2021/02 | 8.1% | 10.0% | 9.0% |

| 2021/03 | 7.0% | 9.3% | 8.1% |

| 2021/04 | 6.8% | 9.6% | 8.2% |

| 2021/05 | 6.6% | 10.2% | 8.4% |

| 2021/06 | 7.2% | 12.1% | 9.6% |

| 2021/07 | 8.0% | 12.6% | 10.2% |

| 2021/08 | 8.2% | 12.7% | 10.4% |

| 2021/09 | 8.0% | 12.3% | 10.1% |

| 2021/10 | 7.1% | 13.0% | 9.9% |

| 2021/11 | 6.6% | 12.5% | 9.4% |

| 2021/12 | 6.3% | 11.1% | 8.6% |

| 2022/01 | 6.9% | 10.4% | 8.6% |

| 2022/02 | 7.7% | 9.8% | 8.7% |

| 2022/03 | 8.1% | 9.3% | 8.7% |

| 2022/04 | 8.2% | 8.3% | 8.2% |

| 2022/05 | 7.3% | 8.7% | 8.0% |

| 2022/06 | 5.9% | 9.0% | 7.4% |

| 2022/07 | 4.8% | 9.1% | 6.8% |

| 2022/08 | 4.4% | 9.1% | 6.6% |

| 2022/09 | 5.5% | 9.6% | 7.4% |

| 2022/10 | 5.0% | 10.0% | 7.4% |

| 2022/11 | 5.3% | 9.4% | 7.3% |

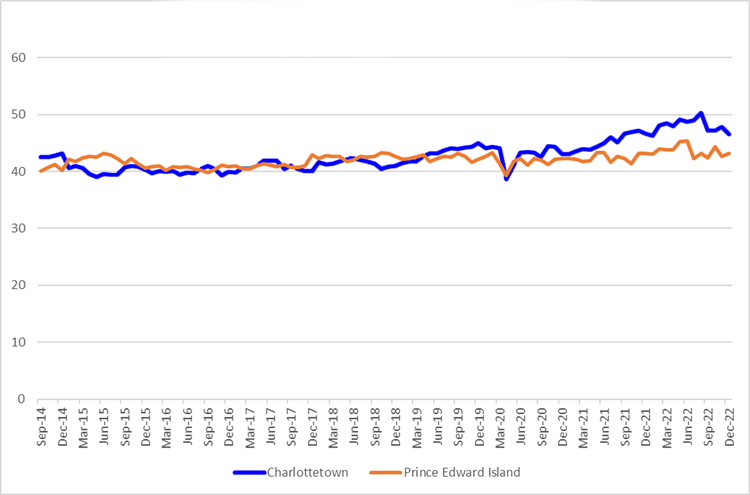

Figure 2 – Text version

| Year-Month | Charlottetown | Prince Edward Island |

|---|---|---|

| 2014/09 | 42.5 | 40.0 |

| 2014/10 | 42.5 | 40.7 |

| 2014/11 | 42.8 | 41.2 |

| 2014/12 | 43.2 | 40.2 |

| 2015/01 | 40.6 | 42.1 |

| 2015/02 | 40.9 | 41.7 |

| 2015/03 | 40.6 | 42.4 |

| 2015/04 | 39.6 | 42.6 |

| 2015/05 | 39.0 | 42.5 |

| 2015/06 | 39.5 | 43.2 |

| 2015/07 | 39.4 | 42.9 |

| 2015/08 | 39.4 | 42.2 |

| 2015/09 | 40.7 | 41.4 |

| 2015/10 | 40.9 | 42.2 |

| 2015/11 | 40.8 | 41.4 |

| 2015/12 | 40.3 | 40.6 |

| 2016/01 | 39.7 | 40.8 |

| 2016/02 | 40.0 | 40.9 |

| 2016/03 | 39.9 | 40.2 |

| 2016/04 | 40.0 | 40.8 |

| 2016/05 | 39.4 | 40.7 |

| 2016/06 | 39.8 | 40.8 |

| 2016/07 | 39.7 | 40.5 |

| 2016/08 | 40.4 | 40.2 |

| 2016/09 | 41.0 | 39.8 |

| 2016/10 | 40.4 | 40.3 |

| 2016/11 | 39.3 | 41.1 |

| 2016/12 | 39.9 | 40.8 |

| 2017/01 | 39.8 | 41.0 |

| 2017/02 | 40.6 | 40.4 |

| 2017/03 | 40.6 | 40.5 |

| 2017/04 | 41.0 | 40.9 |

| 2017/05 | 41.9 | 41.4 |

| 2017/06 | 41.9 | 41.1 |

| 2017/07 | 41.9 | 40.8 |

| 2017/08 | 40.4 | 41.2 |

| 2017/09 | 41.0 | 40.7 |

| 2017/10 | 40.5 | 40.7 |

| 2017/11 | 40.1 | 41.0 |

| 2017/12 | 40.1 | 42.9 |

| 2018/01 | 41.6 | 42.2 |

| 2018/02 | 41.2 | 42.8 |

| 2018/03 | 41.3 | 42.6 |

| 2018/04 | 41.8 | 42.6 |

| 2018/05 | 42.1 | 41.8 |

| 2018/06 | 42.2 | 42.0 |

| 2018/07 | 42.0 | 42.7 |

| 2018/08 | 41.7 | 42.5 |

| 2018/09 | 41.3 | 42.6 |

| 2018/10 | 40.5 | 43.3 |

| 2018/11 | 40.8 | 43.2 |

| 2018/12 | 40.9 | 42.7 |

| 2019/01 | 41.5 | 42.1 |

| 2019/02 | 41.7 | 42.2 |

| 2019/03 | 41.8 | 42.5 |

| 2019/04 | 42.7 | 42.9 |

| 2019/05 | 43.1 | 41.7 |

| 2019/06 | 43.2 | 42.3 |

| 2019/07 | 43.7 | 42.6 |

| 2019/08 | 44.1 | 42.5 |

| 2019/09 | 43.9 | 43.1 |

| 2019/10 | 44.2 | 42.7 |

| 2019/11 | 44.3 | 41.6 |

| 2019/12 | 45.0 | 42.1 |

| 2020/01 | 44.1 | 42.7 |

| 2020/02 | 44.3 | 43.3 |

| 2020/03 | 44.1 | 41.3 |

| 2020/04 | 38.7 | 39.3 |

| 2020/05 | 41.1 | 41.8 |

| 2020/06 | 43.3 | 42.2 |

| 2020/07 | 43.4 | 41.1 |

| 2020/08 | 43.3 | 42.3 |

| 2020/09 | 42.5 | 42.0 |

| 2020/10 | 44.4 | 41.2 |

| 2020/11 | 44.3 | 42.1 |

| 2020/12 | 43.0 | 42.3 |

| 2021/01 | 43.0 | 42.3 |

| 2021/02 | 43.6 | 42.1 |

| 2021/03 | 43.9 | 41.7 |

| 2021/04 | 43.8 | 41.9 |

| 2021/05 | 44.3 | 43.3 |

| 2021/06 | 45.0 | 43.3 |

| 2021/07 | 46.0 | 41.6 |

| 2021/08 | 45.1 | 42.6 |

| 2021/09 | 46.7 | 42.3 |

| 2021/10 | 46.9 | 41.4 |

| 2021/11 | 47.2 | 43.2 |

| 2021/12 | 46.7 | 43.1 |

| 2022/01 | 46.2 | 43.0 |

| 2022/02 | 48.1 | 43.9 |

| 2022/03 | 48.4 | 43.8 |

| 2022/04 | 48.0 | 43.8 |

| 2022/05 | 49.1 | 45.2 |

| 2022/06 | 48.7 | 45.3 |

| 2022/07 | 49.0 | 42.2 |

| 2022/08 | 50.3 | 43.2 |

| 2022/09 | 47.2 | 42.4 |

| 2022/10 | 47.1 | 44.3 |

| 2022/11 | 47.8 | 42.7 |

| 2022/12 | 46.5 | 43.2 |

Estimated impacts of amalgamating the PEI EI economic regions – EI regular benefit access, duration and entitlement

| Characteristics | Range between October 2014 and January 2023 | Current rates (January 8, 2023 to February 11, 2023) |

|---|---|---|

| Unemployment rateFootnote 1 | 4.4% to 10.4% | 4.5% |

| Number of insured hours required to qualify for regular benefits | 525 to 700 | 700 |

| Minimum number of weeks payable for regular benefits | 14 to 21 | 14 |

| Maximum number of weeks payable for regular benefits | 36 to 45 | 36 |

| Characteristics | Range between October 2014 and January 2023 | Current rates (January 8, 2023 to February 11, 2023) |

|---|---|---|

| Unemployment rateFootnote 2 | 8.2% to 14.8% | 8.2% |

| Number of insured hours required to qualify for regular benefits | 420 to 595 | 595 |

| Minimum number of weeks payable for regular benefits | 18 to 28 | 18 |

| Maximum number of weeks payable for regular benefits | 42 to 45 | 42 |

| Characteristics | Range between October 2014 and January 2023 | Current rates (January 8, 2023 to February 11, 2023) |

|---|---|---|

| Unemployment rate Footnote 2 | 6.3% to 12.5% | 6.3% |

| Number of insured hours required to qualify for regular benefits | 455 to 665 | 665 |

| Minimum number of weeks payable for regular benefits | 15 to 24 | 15 |

| Maximum number of weeks payable for regular benefits | 38 to 45 | 38 |

At the time of the boundary changes in 2014, the difference in the unemployment rate between the new Charlottetown EI economic region (8.0%) and the new EI economic region of PEI (11.7%) was 3.7 percentage points. Currently (January 8, 2023 to February 11, 2023), the difference between the unemployment rates for the 2 regions is the same, at 3.7 percentage points.

From October 2014 to January 2023, the monthly unemployment rate used for EI purposes has always been higher in the rural region of PEI than in Charlottetown:

- The smallest difference observed between the unemployment rates in the 2 regions was 0.1 percentage point, which was in effect in May 2022 (8.1% in Charlottetown vs 8.2% in PEI)

- The largest difference observed between the unemployment rates in the 2 regions was 8.6 percentage points, which was in effect in September 2017 (5.7% in Charlottetown vs 14.3% in PEI)

- In 2021, the average difference in the unemployment rates of the 2 regions was 3.8 percentage points, while the average was 3.2 percentage points during 2022

2.g. Bill C-37, Employment Insurance Board of Appeal

Issue

An Act to amend the Department of Employment and Social Development Act and to make consequential amendments to other Acts (Employment Insurance Board of Appeal) to enable the creation of the Employment Insurance (EI) Board of Appeal (BOA) was tabled by the Minister of Employment, Workforce Development and Disability Inclusion on December 14, 2022

Background

In August 2019, the Government announced significant changes to the EI and Income Security recourse processes. These changes included client-centric improvements within the Social Security Tribunal (SST) and a return to a locally-based tripartite decision-making model for first-level EI appeals (EI BOA) outside of the SST.

As the Government’s key priority was to support Canadians during the COVID-19 pandemic, the EI BOA and other legislative changes associated with the EI recourse process were delayed from the expected implementation date of April 2021.

As part of Budget Implementation Act, 2022, No. 1, legislative amendments were proposed to the Department of Employment and Social Development Act (DESDA) and consequential amendments were proposed to related legislation.

After hearing concerns from several stakeholders on the proposed legislation, the EI BOA related clauses of the proposed legislation were removed from the Budget Implementation Act, 2022 at the Standing Committee on Finance (FINA) on May 31, 2022.

At that time, the Minister of Employment, Workforce Development and Disability Inclusion committed to undertake further consultations and that new proposed legislation would be introduced in fall 2022.

The Government of Canada has committed to ensuring that reforms to the EI appeals process are informed by feedback from Canadians and stakeholder groups. The Government has undertaken several rounds of stakeholder consultations since 2017.

In summer 2022, the Government undertook another round of consultations with Canadians and stakeholder groups across Canada. Participants shared their views on the design of a new process to appeal an EI benefits decision and how an EI appeal hearing takes place.

These stakeholder consultations reviewed five main issues raised by stakeholders, examined possible solutions, and identified remaining concerns of the proposed legislation. In parallel, consultations in the form of an online survey open to the public was launched to review aspects of the EI appeal process. The outcome of these consultations informed the drafting of the proposed legislation.

Key facts

Departmental resources, Department of Justice drafters, and Privy Council Office finalized the drafting of the EI BOA legislation and received ministerial approval on December 12, 2022.

The first reading of the Bill occurred on December 14, 2022. The bill is eligible to be debated at second reading as early as January 30, 2023.

Key messages

The Bill entitled “An Act to amend the Department of Employment and Social Development Act and to make consequential amendments to other Acts (Employment Insurance Board of Appeal)” was tabled on Wednesday, December 14, 2022.

Through this Bill, it is proposed that the EI BOA would become responsible for hearing first-level EI appeals, which are currently heard by the Social Security Tribunal, EI General Division.

The EI BOA will operate as a tripartite decision-making tribunal comprised of representatives for the government, workers and employers, helping put first-level EI appeal decisions back into the hands of those who pay into the EI system.

Until the EI BOA is operational, the SST will continue to hear first level EI appeals. To ensure smooth operations following the launch of the EI BOA, there will be a transition period during which the new EI BOA and the SST will run in parallel.

3. Labour shortage – Hot issues

3.a. Labour shortages and skills training

Issue

Canada’s labour market faces the simultaneous challenge of labour shortages in some sectors and regions, and skills shortages in others.

Background

The resurgence of the economy has exacerbated labour and skills shortages but the underlying drivers predate the pandemic. Canada’s rapidly aging population, global shifts toward greener, digital economies, and evolving skills requirements are long-term trends transforming its labour market and causing downward pressure on labour force growth, and skills gaps and mismatches.

Canada’s efforts to bolster and support the workforce are based on a human capital approach, which seeks to maximize four sources of labour supply:

- supporting the transition of new entrants to the labour market, principally youth

- welcoming talent from around the world – particularly immigrants, international students, and temporary foreign workers

- increasing the participation of groups underrepresented in the labour market (that is, women, persons with disabilities, Indigenous peoples, youth, racialized Canadians, etc.), and

- helping individuals already working who need upskilling and reskilling to adapt and stay in the labour force longer

Employment and Social Development Canada (ESDC) has a robust suite of programs and partnerships to help address labour shortages and skills gaps, and ensure that Canada has an inclusive and agile workforce that can thrive in a rapidly evolving labour market. For instance:

- Youth Employment and Skills Strategy (YESS), the Student Work Placements, and Canada Summer Jobs programs help young Canadians build job-relevant skills and connect with employers. These investments have benefited hundreds of thousands of youth, in particular those from underrepresented groups

- Indigenous Skills and Employment Training Program funds a network of over 110 Indigenous service delivery organizations with over 650 points of service to provide Indigenous peoples with training and supports to improve skills and secure employment

- Women’s Employment Readiness Pilot Program funds organizations to provide and test pre-employment and skills development supports for women in four groups: racialized and/or Indigenous women; women with disabilities; women from the LGBTQ2 community; and women with prolonged labour force detachment

- Sectoral Workforce Solutions Program funds projects that will help thousands of employers and connect Canadians with the training needed to access good jobs in sectors seeking skilled workers

- Community Workforce Development Program was also created to pilot and test innovative community-based approaches to connect employers and training providers as part of economic development efforts to upskill and reskill jobseekers to fill in-demand jobs in local communities

Collectively, these programs along with recent investments through Budget 2021 are bolstering the labour market participation of underrepresented groups and helping young Canadians build job-relevant skills and connect with employers.

Key facts

In Canada, training is a shared responsibility between the federal and provincial/territorial governments. The Government of Canada’s largest investment in training is through bilateral labour market transfer agreements (LMTA) with the provinces and territories (PTs). Each year, over $3 billion is provided to assist more than one million individuals and employers with training and employment supports.

As of November 2022, there were 823,485 job vacancies nationally, with shortages most acute in Ontario (308,490), Quebec (196,095), and British Columbia (134,070). Sectors with the highest job vacancies included health care and social assistance (134,040), accommodation and food services (107,535), retail trade (101,465), construction (73,980), and manufacturing (68,905).

To help address current and future labour shortages, and tackle skills gaps and mismatches, ESDC is leveraging and realigning existing tools, targeting new investments and working with all partners, including employers, unions, Indigenous communities, and PTs by:

- modernizing the LMTAs, the federal government’s most powerful lever for upskilling and reskilling workers, to support inclusive economic growth

- creating a simpler and fairer EI program that better meets the needs of the 21st century economy to provide a social safety net for Canadians as they go through career transitions, in times of economic growth or downturn

- redesigning and implementing the Canada Training Benefit to encourage a culture of lifelong learning and facilitate upskilling among Canadians

Building on these changes, the 2022 Fall Economic Statement recently announced investments that will also help job seekers and workers obtain the skills they need to thrive in a changing economy, including:

- $250 million over 5 years, starting in 2023 to 2024, for a Sustainable Jobs Training Centre, a new sustainable jobs stream under the Union Training and Innovation Program, and a Sustainable Jobs Secretariat to help Canadians acquire the skills to thrive in a net-zero economy; and

- $802.1 million over 3 years, starting in 2022 to 2023, to invest in jobs for young Canadians via the YESS. This will help young Canadians gain valuable skills and work experience, setting them up for a lifetime of success in the job market

Further details on all these measures will be provided in the first half of 2023.

Key messages

Labour market pressures are affecting practically all sectors of the economy and most regions of the country.

- In November, there were just over 820 thousand job vacancies in Canada with shortages most acute in Ontario, Quebec, and British Columbia. Sectors with the highest job vacancies included health care and social assistance, accommodation and food services, retail trade, construction, and manufacturing

As the economy evolves, addressing skills gaps, reducing skills mismatches and better utilizing available talent pools, will be critical to meet employment needs.

While market forces may reduce some labour market pressures in the short-term, the federal government has a role to play in supporting partners to address shortages, build our economy and prepare the workforce for the labour market of the future.

To this end, ESDC is positioned with tools and partnerships to support Canada’s labour market as it evolves, in times of economic growth or downturn, and according to the diversity of contexts that exist across the country. The department also continues to roll out investments that will support workers and businesses, and help build an agile and more inclusive workforce.

3.b. Labour shortages – Temporary Foreign Worker Program

Issue