HUMA committee briefing binder: Appearance by the Minister of Citizens’ Services – May 6, 2024

From: Employment and Social Development Canada

Official title: Appearance by the Minister of Citizens' Services, Standing Committee on Human Resources, Skills and Social Development and the Status of Persons with Disabilities (HUMA), Supplementary Estimates (C), 2023 to 2024 and Mains Estimates 2024 to 2025. Date: May 6, 2024.

On this page

- 1. Opening remarks

- 2. Background information

- 3. Service delivery - Hot issues

- 3.a. Benefits Delivery Modernization (BDM) costs and timeline

- 3.b. Old Age Security (OAS) on Benefits Delivery Modernization (BDM)

- 3.c. Employment Insurance (EI), Old Age Security (OAS), Guaranteed Income Supplement (GIS), Canada Pension Plan (CPP)/Canada Pension Plan Disability (CPP-D) processing and wait times

- 3.d. Service Canada point of access and outreach services

- 3.e. Passport print expansion

- 3.f. Integrity and fraud prevention

- 3.g. Termination of ESDC/Service Canada employees who claimed COVID-19 emergency Benefits

- 3.h. Passport document application process - Integrity in the business of passports

- 3.i. Passport current service standards and volumes

- 3.j. ePayroll

- 3.k. Canadian Dental Care Plan

- 3.l. Single point of access for Seniors

- 3.m. Digital services

- 3.n. SIN Processing standards

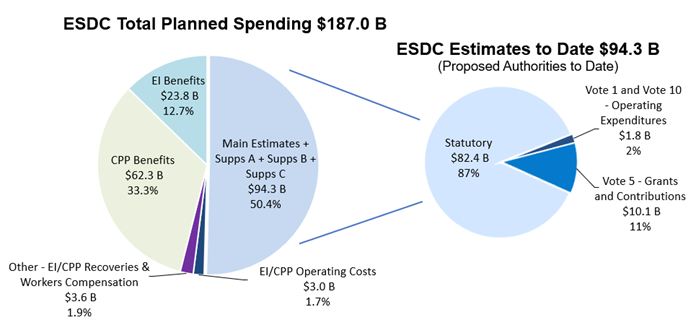

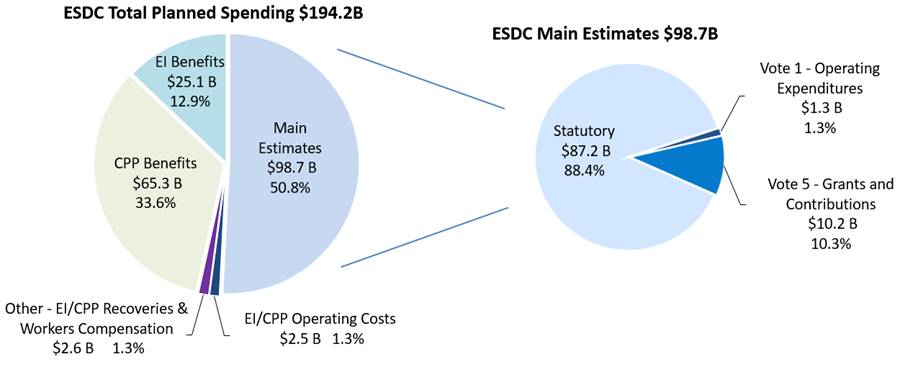

- 4. Estimates

1. Opening remarks

1.a. Minister's opening remarks

Speaking Notes

Speaking Notes for The Honourable Terry Beech, Minister of Citizens Services, for Appearance before the Standing Committee on Human Resources, Skills and Social Development and the Status of Persons with Disabilities (HUMA) On Main and Supplementary C Estimates - House of Commons

May 6, 2024

2024 PA 000020

Good morning/afternoon, Mr. Chair, and committee members.

Let me start by acknowledging that we are gathered on the traditional unceded territory of the Algonquin Anishinaabeg People. (if not already said).

I'd like to focus my remarks today on our Benefits Delivery Modernization, or BDM, and to offer this Committee some updates and greater perspective on the transformational journey we are on.

It's 2024 and I'm sure we can all agree that Canadians deserve services that are not just functional but also swift, streamlined, and responsive to their needs.

And not just in cities, or the North, but also in our homes, in transit, by laptops or by phones.

An increasing number of Canadians are paying daily expenses with their cell phones or other devices. They are comfortable with the many other examples of technological convenience that are becoming part of daily life.

They have every right to expect to see the same sort of convenient service in their dealings with their government.

It means reducing wait times, shortening lines, and spending less time or no time on hold. It means bringing services out of the legacy sluggish IT environment and into today's more efficient digital world.

Which is why I am happy to say that Budget 2024 proposes to provide a total of $2.9 billion over five years, starting in 2024-25, to ESDC to migrate Old Age Security and Employment Insurance onto a secure, user-friendly platform.

As I said on my previous appearance before this Committee, BDM is the largest IT-enabled transformation initiative ever undertaken by the Government of Canada.

It will bring Old Age Security (OAS), Employment Insurance (EI), and the Canada Pension Plan (CPP) together on to one common system.

As part of that system, Budget 2024 proposes to provide $25.1 million to ESDC over five years, starting in 2024-25, to establish a modern, single sign-in portal for federal government services.

It will provide Canadians with seamless, secure and rapid access to the benefits to which they are entitled on a modern and improved system within a transformed service delivery experience.

Mr. Chairman, we're bringing this system into the modern digital era, but we are doing it by degrees and with the utmost care.

As has been said before, large-scale multi-year projects are complex undertakings. The extent of the transformation journey is not always known at programme inception, and due diligence is required to unravel the years of technical debt that can sometimes impact schedule and costs.

Large-scale transformation projects of this nature, particularly ones of this significance and importance, require large investments to ensure successful implementation.

This cannot and should not be a rush job. We are navigating a landscape where the stakes are high and the margin for error is non-existent.

BDM is indeed very complex. All the same, it is absolutely essential that we succeed. The failure of the OAS, EI or CPP processing systems would have a catastrophic effect on Canada's most vulnerable citizens.

Our ability to approve applications, process, adjudicate and process payments accurately and on a timely basis is table stakes for any Government regardless of political affiliation.

What we're doing with BDM is not just modernizing systems and applications, but reimagining the way we deliver these services to Canadians.

Given the size and scope of the BDM Programme, a whole team of client-focused procurement, transformation, and technology specialists is working full time on this file to support ESDC in ensuring it meets the needs of Canadians across the country.

But again, it's vital that the technology behind these services is up to date, safe and trustworthy. Our number one priority and responsibility is to protect the integrity and security of our citizens' data no matter where it resides.

The imperative to address aging IT infrastructure is a priority for this Government, which is why BDM was launched in 2017 along with the Technical Debt Remediation project.

The technology needs to be updated - and that is a delicate process. We can't afford to make mistakes that could lead to disrupting current benefits.

So, through a staged and cautious approach, we are modernizing how the federal government serves all Canadians with new upgraded systems for the digital age.

And with the funding announced in Budget 2024, we will be positioned to take this critical work to the next stage and, as a result, provide Canadians with the modern service experience they deserve.

Now, I understand that committee members will be curious about the contracting side of this program and I'm happy to discuss that with you now.

First it is important to recognize that whether private or public sector, few if any organizations are equipped to undertake a program of this size and complexity, alone. We use pre-selected System Integrators to assist, all four of which qualified through a competitive process led by Public Services and Procurement Canada.

These are not Management Consultants. These partners are highly skilled in application re-platforming, modernization, and IT Infrastructure, including cloud.

While they are pre-qualified, they are still required to enter into a competitive process for contract award. The syndication of the work across multiple partners provides flexibility and contingency should any partner not perform to our expectations.

Modernizing this system demands the highest skill level available to us. It is also incredibly complex. It requires dismantling years of technical debt. Peeling back one layer can reveal unexpected challenges. This uncertainty can impact schedule and costs.

BDM also relies on internal partnerships to be successful and as such it is an ‘all of Government' approach.

As such, BDM works in close partnership with PSPC throughout the procurement and contract management life-cycle, as well as with Shared Services Canada, and the Canadian Centre for Cyber Security.

As just one example of the partnership and collaboration required, ESDC has been working very closely with our CCCS, TBS and SSC partners to ensure the data we move to, and process in the cloud is secure and protected. Those agencies work with and partner with industry, governments, and investigative agencies around the world to ensure the security standards and protections are current, and importantly, proactively addressing the emerging cyber security landscape.

Rest assured we will only allow applications to go into production in the cloud once they have gone through a thorough assessment and audit to validate that the proper controls are in place.

BDM has a dedicated compliance team which works in close collaboration with departmental internal audit to ensure due diligence in all aspects of our work, including our internal controls, our contracting and file management. We have also requested independent third-party assurance to assist us in ensuring best practices.

With that in mind, this department:

- Works with TBS to develop and share approaches to support other departments, including reviewing practices and learning from similar large-scale initiatives,

- Maintains a risk log to manage and mitigate risks and unknowns, and

- Protects and prioritizes the transformation component of the BDM Programme.

We are building a world-class benefits processing platform that will support the delivery of benefits across the Government of Canada for years to come.

But while we talk about all this new technology, let's not lose sight of the Canadians who are at the heart of these programs, services, and benefits.

I'm talking about the most vulnerable Canadians-the unemployed, persons with disabilities, the impoverished, the unhoused, and the elderly.

However, at some point or another, all Canadians will need to interact with their government for these services. It's incumbent upon us to make those interactions as easy, accurate and dependable as possible.

Thank you, Mr. Chair and colleagues. I'm happy to take your questions.

-30-

2. Background information

2.a. Parliamentary environment scenario note

Overview

The Standing Committee on Human Resources, Skills and Social Development and the Status of Persons with Disabilities (HUMA) has invited you to appear in view of its study of the Supplementary Estimates (C), 2023-2024 and Main Estimates 2024-2025.

Committee proceedings

Your appearance is scheduled to take place on May 6, 2024, from 4:30 to 5:30, following the appearance of Minister Boissonnault on the first panel of the day. Other ESDC ministers (Ministers Khera and O'Regan) have appeared on April 29th and Minister Sudds will appear on May 9th.

You will be accompanied by:

- Cliff Groen, Chief Operating Officer for Service Canada

- John Ostrander, Business Lead, Benefits Delivery Modernization

- Brian Leonard, Director General and Deputy Chief Financial Officer

You have no outstanding follow up written responses due to the Committee.

HUMA has agreed that questioning of witnesses would be allocated as follows:

In round one, there are six minutes for each party in the following order:

- Conservative Party;

- Liberal Party;

- Bloc Québécois; and

- New Democratic Party.

For the second and subsequent rounds, the order and time for questioning is as follows:

- Conservative Party, five minutes;

- Liberal Party, five minutes;

- Bloc Québécois, two and a half minutes;

- New Democratic Party, two and a half minutes;

- Conservative Party, five minutes; and

- Liberal Party, five minutes

Parliamentary environment

You are expected to receive questions clustered around the two following themes:

- Benefits Delivery Modernization (BDM): this programme has been drawing substantial attention from parliamentarians. In December, Senior ESDC officials testified on this program at the Public Accounts Committee in relation to an Auditor General report. In the same vein, you received a number of related questions during your last appearance before HUMA in early February. Moreover, ESDC officials were recently before the Standing Senate Committee on National Finance where, in the context of Supplementary Estimates C, they received questions on the budget and user experience related to BDM. You may therefore be questioned on:

- Budget 2024 announcement for additional funding

- Projected timelines and costing of the programme

- Auditor General's report on information technology systems at risk of failing

- Service delivery: HUMA has in the past been focused on different issues related to service delivery, notably on passports. Also, prior to your appointment, members would question from time to time your predecessors or officials on file specific issues in EI or other benefits delivery. Therefore, you may be asked about:

- Meeting the needs of diverse groups and hard-to-reach populations

- Canada Dental Benefit

- ESDC/Service Canada employees who claimed COVID-19 emergency benefits

- Delivery of Employment Insurance benefits

- Delivery of Canadian Dental Care Plan

- Passport service standards and wait times

2.b. Mandate letter tracker

Drive the digitalization of government services, with particular emphasis on accelerating and expanding the use of Canadian Digital Service across government (a similar commitment was in 2021 mandate letter)

Drive the digitalization of government services, with particular emphasis on accelerating and expanding the use of Canadian Digital Service across government - Progress 1

The Canadian Digital Service (CDS) has implemented several recent projects to improve the adoption of digital service across government:

- In April 2023, the Canadian Digital Service launched a prototype version of a design system that will ensure that digital government service experiences across the Government of Canada (GC), such as choosing language of preference or filling out an application form, look and feel consistent and are well-tested with clients;

- This design system will make it easier for government teams building digital services to use modern technology and apply standard, user-tested Government of Canada digital branding and experiences. It will also allow recognizable and accessible GC mobile applications and websites to be developed more quickly, easily, and consistently;

- In May 2023, pilots began with the Governments of British Columbia and Nova Scotia to use GC Notify (a digital service that allows for quickly creating, and sending email and text messages to clients) for provincial services; and,

- As of January 2024, GC Notify had approximately 450 live services across more than 50 departments and agencies. GC Forms, a digital service enabling the Government to create online forms, had over 200 live forms across 48 departments.

Drive the digitalization of government services, with particular emphasis on accelerating and expanding the use of Canadian Digital Service across government - Next steps 2

The CDS will continue to scale existing platform products that address common client needs when interacting with government and products that enable government departments and agencies to design a more consistent service experience for the public.

The CDS will also play a role in improving client service through improvements to Canada.ca and other online and mobile channels.

Develop and implement a modern, resilient, secure and reliable services and benefit delivery system (this commitment was in the 2021 mandate letter)

Develop and implement a modern, resilient, secure and reliable services and benefit delivery system- Progress 1

Service Canada is currently undertaking the modernization of its benefit delivery platforms through the Benefit Delivery Modernization programme.

The first release of Old Age Security (OAS) onto the new Common Benefit Delivery Platform was successfully completed in June 2023. The accounts of over 600,000 Foreign Benefits recipients - retirement benefits that other countries pay to Canadians who have worked in those countries at some point in their lives are now being served through the Platform. A subsequent release linked the new system to our legacy system to streamline the sharing of client tombstone data.

The Beta version of the OAS Benefits Estimator was launched in July 2023 and has been used by over 800,000 Canadians with an 87% success rate, compared to 35% using the old OAS rate tables.

Public testing started for the new My Service Canada Account Dashboard in early December 2023. The Dashboard will provide clients with a simple integrated dashboard for My Service Canada 2.0.

The Government continues to invest in a Technical Debt Remediation Initiative at Employment and Social Development Canada (ESDC), so that the department's IT infrastructure and systems will be more secure and able to provide reliable services to Canadians.

Numerous network and technology upgrades are underway to ensure the IT systems supporting ESDC and Service Canada continue to function as needed.

Budget 2024 committed $2.9 billion over 5 years, starting in the 2024-2025 fiscal year, to migrate Old Age Security on to a secure, user-friendly platform.

Develop and implement a modern, resilient, secure and reliable services and benefit delivery system Next steps 2

The full onboarding of OAS on the Common Benefits Delivery system for 7.3 million OAS recipients is on track for December 2024.

By late December 2024, BDM is aiming to complete the planning and proof of concept phase for Employment Insurance on the Common Benefits Delivery Platform.

The Government continues to address the most pressing needs to reduce technology debt and minimize disruptions to service while services are modernized and transformed.

Encourage more agile, open and user-focused methods when designing services for Canadians (a similar commitment was in 2021 mandate letter)

Encourage more agile, open and user-focused methods when designing services for Canadians - Progress 1

To date this year, the Canadian Digital Service has completed 12 federal partnership engagements, providing hands-on help to improve the user experience for Government of Canada services and accelerate project timelines.

Based on lessons learned, the Canadian Digital Service is piloting User Experience Reviews as a tool to help departments identify usability problems in digital services. Pilot partners this year have included the Canadian Human Rights Commission, the Courts Administration Service and Public Safety Canada.

Encourage more agile, open and user-focused methods when designing services for Canadians - Next steps 2

The Canadian Digital Service will continue to review and refine how it supports departments to ensure they are delivering the greatest public value.

Provide seniors with a single point of access to a wide range of government services and benefits

Provide seniors with a single point of access to a wide range of government services and benefits - Progress 1

The Retirement Hub was launched in June 2023. It is a new user-friendly online tool that helps seniors, near-seniors and those who support them to learn about the benefits available to them as they plan for their retirement. The tool enhances retirement planning and empowers Canadians to make informed decisions.

The Retirement Hub is welcoming over 1,000 visitors each day. Since its launch, over 240,000 unique visitors have visited the site.

Visitors to the Retirement Hub are exploring the various planning tools, services and benefits related to retirement. These include: the Retirement Ready Quiz, the Old Age Security Benefits Estimator and the Canadian Retirement Income Calculator, which provide Canadians with personalized results tailored to their unique situation.

Provide seniors with a single point of access to a wide range of government services and benefits - Next steps 2

Efforts are ongoing to explore how to improve access to services for all Canadians, including seniors.

Serve as our government's champion for service delivery excellence, placing Canadians at the core of how we design and deliver their services

Serve as our government's champion for service delivery excellence, placing Canadians at the core of how we design and deliver their services - Progress 1

The Government of Canada is working to rebuild and maintain the public's trust as a service delivery organization.

In an effort to continue to improve services, Service Canada is working with Immigration, Refugees and Citizenship Canada (IRCC) to modernize the delivery of the Passport Program. This will increase Canadians' access to passport services (including secure online renewals); increase the efficiency of the Passport Program; and strengthen the overall integrity and security of the Passport Program.

Service Canada also aspires to be a leader in public service accessibility and to date, it has exceeded its hiring target for persons with disabilities that was set in the 2020 Accessibility Strategy for the Public Service of Canada. The following accessibility measures have been implemented to enhance accessible and inclusive in-person service:

- Since 2020, 62 Service Canada Centres (SCCs) have been equipped with Wayfinder Beacons that help clients who have a visual impairment to navigate indoor spaces independently. All in-person offices are equipped with portable induction loops and microphones that facilitate communication between Citizen Service Officers (CSOs) and clients through Plexiglass, especially for clients wearing hearing aids.

- In 2023, Citizen Access Work Station Services in Service Canada Centres were updated to include new accessibility features and equipped with accessible keyboards and audio cable extensions. As of September 23, 2022, Video Remote Interpretation (VRI) that facilitates communication between members of the Deaf community and CSOs, is available at all SCCs across Canada.

In response to the Office of the Auditor General's report on Access to Benefits for Hard-to-Reach Populations, the Government has implemented initiatives in cooperation with the Canada Revenue Agency to coordinate and improve outreach and services to marginalized and underserved individuals. The following are key measures advanced to facilitate access to benefits and services for hard-to-reach populations:

- A protocol whereby CRA and Service Canada employees across Canada identify and directly transfer any individuals in need of assistance to the other department.

- Better coordination of ESDC and CRA outreach activities, including joint collaborative mailings and sign-up events. These joint events offered multiple Government of Canada services to clients, such as CLB sign-up, Service Canada SIN sign-up clinics, as well as the CRA's Community Volunteer Income Tax Program (CVITP) clinics.

Service Canada is leading the design of an interdepartmental and multijurisdictional (Municipality of Peel and the Province of Ontario) service delivery model for newcomers, in particular asylum seekers.

Serve as our government's champion for service delivery excellence, placing Canadians at the core of how we design and deliver their services - Next steps 2

Service Canada will work to enhance service delivery excellence by:

- Developing a consultation approach to ensure persons with disabilities are included in the design of new programs and services.

- Making it easier for clients requiring assistance to access services by implementing consistent approaches to third party access, particularly for clients requiring telephone video relay services.

- Working with programs to make online information easier to find and understand and improve the accessibility of online forms.

- Developing a framework to support addressing accessibility feedback and integrate client feedback into decision-making and program and service improvements.

Service Canada continues to collaborate with other Government organizations, in particular provinces and territories, to review and refine how it delivers tailored support to hard-to-reach individuals to ensure they are aware of, and accessing, Government of Canada benefits and programs for which they may be eligible.

Develop a whole-of-government Cabinet directive that outlines our objectives, expectations, and plans with respect to the delivery of federal services

Develop a whole-of-government Cabinet directive that outlines our objectives, expectations, and plans with respect to the delivery of federal services - Progress 1

Conversations are taking place to ensure the directive can be implemented effectively across the many departments that deliver critical services to Canadians.

Develop a whole-of-government Cabinet directive that outlines our objectives, expectations, and plans with respect to the delivery of federal services - Next steps 2

Conversations and the work to develop the Cabinet directive will continue with government departments and central agencies.

Bolster Service Canada's leadership role in delivering services to Canadians, including identifying high-impact service improvements and supporting the delivery of priority initiatives, like the Canadian Dental Care Plan

Bolster Service Canada's leadership role in delivering services to Canadians, including identifying high-impact service improvements and supporting the delivery of priority initiatives, like the Canadian Dental Care Plan - Progress 1

The Government is collaborating with community organizations across the country to identify individuals at-risk of not receiving their benefits and refer them directly to Service Canada staff for tailored support through various channels within each region.

The Government has developed national standards, built an external portal for community partners to input client referral information, and deployed a new workload management system to improve tracking and reporting.

Since its launch in November 2023, 409 organizations have access to the referral portal, and 58 organizations have submitted 204 referral requests resulting in the provision of 227 services offerings to clients.

Collaboration with the United Way / 211 program has resulted in 103 warm transfers to Service Canada from April 1, 2023, to January 12, 2024 (a warm transfer is when a call line representative initiates the call for the client to another call line and stays on the call with the client as needed).

Reciprocal warm transfers between Service Canada Outreach Support Centre and CRA's Individual Tax Filing Assistance line is a high-impact service improvement that has resulted in 98 warm transfers between its inception in April 2023 to January 2024.

In an effort to continue to improve services, Service Canada is working with Immigration, Refugees and Citizenship Canada (IRCC) to modernize the delivery of the Passport Program including through secure online renewals. Several actions have been taken to improve passport services to Canadians:

- Expanded the delivery of passport services to scheduled outreach sites to help meet the passport needs of rural and remote communities.

- Increased access to passport services, with 21 Service Canada Centres offering passport delivery in 10 days.

- An online Passport Application Status Checker was launched to allow Canadians to check the status of their applications. This, in turn, reduces wait times for Canadians who call the contact centre or visit a passport office.

- The Government also launched an appointment-booking tool that directs clients to the right location for service. Additionally, wait times are now available in passport offices and new webpages with up-to-date passport statistics have been launched.

Uptake of programs and services, such as the Canadian Dental Care Plan, is being improved through targeted outreach activities. This outreach ensures that eligible Canadians, many of whom face barriers to accessing services, receive the benefits to which they are entitled.

Bolster Service Canada's leadership role in delivering services to Canadians, including identifying high-impact service improvements and supporting the delivery of priority initiatives, like the Canadian Dental Care Plan - Next steps 2

Service Canada will continue to onboard community organizations to the client referral portal so that they can refer clients directly for tailored support. To support this work, Service Canda will use client experience surveys to identify barriers and gaps that may keep clients from accessing the benefits they are entitled to and to identify areas of improvement.

Service Canada will continue to work with other departments to implement the Online Renewals process that will allow Canadians to renew their passport online, including the ability to pay their fees, and upload their photograph securely and conveniently.

Create a trusted digital identity platform to support seamless service delivery to Canadians across the country

Create a trusted digital identity platform to support seamless service delivery to Canadians across the country - Progress 1

The Canadian Digital Service is working towards implementing a GC sign-in service to support a common digital front door to government services and enable a seamless service delivery experience for Canadians.

In support of this goal, the Government is working to procure world-class technology which will form the foundation for this GC sign-in service.

Create a trusted digital identity platform to support seamless service delivery to Canadians across the country - Next steps 2

The Canadian Digital Service is working with departmental partners to identify a series of pilots and early adopters to test and launch the GC sign-in service.

Drive government-wide coordination and focus to ensure that the full suite of government -services are delivered in a more efficient, timely, and accessible manner for Canadians

Drive government-wide coordination and focus to ensure that the full suite of government -services are delivered in a more efficient, timely, and accessible manner for Canadians - Progress 1

Budget 2024 announced $25.1 million over 5 years, starting in 2024-2025, with $13.5 million in remaining amortization, to establish a modern, single sign-in portal for federal government services.

Drive government-wide coordination and focus to ensure that the full suite of government -services are delivered in a more efficient, timely, and accessible manner for Canadians - Next steps 2

The Cabinet Sub-Committee on Service Delivery, chaired by the Minister of Citizens' Services, will continue to act as a forum to coordinate the government's service delivery efforts and implement improvements.

Explore opportunities to organize the delivery of services in more convenient ways for Canadians, including by life events

Explore opportunities to organize the delivery of services in more convenient ways for Canadians, including by life events - Progress 1

The Government continues to explore opportunities to organize the delivery of services in more convenient ways.

Service Canada is exploring the feasibility to expand Video Remote Interpretation services (VRI) within the service delivery network, as part of efforts to achieve the goals of the Accessible Canada Act in the area of programs and services. Expansion of VRI to serve outreach clients with disabilities will increase service access to Service Canada's most vulnerable clients.

A life event approach is being used for developing service delivery solutions with a goal of making it easier for Canadians to access the information, services and benefits they need at different life events. This approach has been developed using feedback from clients when testing solutions and has been used when recently developing the Retirement Hub, which helps provide seniors with the information need for their retirement life stage.

Explore opportunities to organize the delivery of services in more convenient ways for Canadians, including by life events - Next steps 2

The Department will pilot international and Indigenous language interpretation services for 1 800 O-Canada starting in the spring 2024. The pilot will make phone service more convenient for clients who prefer to receive information in these languages.

The life event approach for service delivery is being used to develop services for additional life events, such as losing a loved one and starting or expanding a family). Each will be completed and launched by end of the 2024-2025 fiscal year.

Take steps to proactively identify potential service delivery challenges and develop mitigation plans

Take steps to proactively identify potential service delivery challenges and develop mitigation plans - Progress 1

Service Canada continues to identify service delivery challenges and will continue to develop better ways to identify early problems in service delivery.

Take steps to proactively identify potential service delivery challenges and develop mitigation plans - Next steps 2

Through Ministerial and Deputy Minister committees, the Government will continue to examine and act on key service delivery issues, including those concerning OAS, EI, CPP, and Passports.

2.c. Questions and answers on Employment and Social Development Canada (ESDC) contracting

Question 1

ESDC reports (OPQ 2364) that since 2015, it has awarded over $835M in contracts for consulting services to the following companies:

- (i) McKinsey & Company

- (ii) Deloitte

- (iii) PricewaterhouseCoopers

- (iv) Accenture

- (v) KPMG

- (vi) Ernst and Young

- (vii) GC Strategies

- (viii) Coredal Systems Consulting Inc.

- (ix) Dalian Enterprises Inc.

- (x) Coradix Technology Consulting Ltd

- (xi) Dalian and Coradix in joint venture.

Are contracting amounts reasonable?

ESDC awarded contracts to these consulting companies for high-level advisory services, specialized technical skills, as well as business intelligence. ESDC sought guidance on decreasing implementation risks, achieving sustainable results and bringing rapid performance improvements to the department for transformation projects including the Benefits Delivery Modernization (BDM) programme, a multi-year, multi-phase modernization to our benefits delivery systems.

Additionally, the pandemic saw an increase in ESDC's need for consultant services to support the increased delivery of benefits and other services rendered directly to Canadian citizens during exceptional times. ESDC acquired the services of resources with application maintenance skills that were not part of the core skillset of internal employees. In some instances, supplier resources and skillsets were retained to transfer knowledge to employees, thereby increasing the benefits obtained from the contract by increasing the public service's skillset and maturing the department's capabilities in the realm of Information Management (IM) and Information Technology (IT) solutions. Furthermore, ESDC major initiatives (i.e., BDM) also leveraged vendors with extensive global experience in executing large-scale business transformations and engaged external firms for independent third-party assessments.

Question 2

What percentage of the Department's budget was spent on these companies and what has been the contracting trends since 2015?

Trend over past years:

- Fiscal years 2015-16 to 2018-19 remained relatively stable in contract values for the suppliers listed in the question, with a slight increase of 13% between 2017-18 and 2018-19.

- Fiscal Year 2019-20 had a 100% increase over the previous year, this can be attributed to an increase in awards geared towards the design phase of the BDM programme, with several contracts awarded to Deloitte and PricewaterhouseCoopers for support with programme and technical analysts, software architects, and project management.

- Fiscal Year 2020-21 had a 192% increase over the previous year. Consideration should be given to the unpredictable effect of the pandemic on departmental contracting activities, which saw a marked increase in ESDC's need for external consultant services to support the delivery of programmes, benefits, and services to Canadians in the face of the rapidly changing public health landscape. 44% of the total value for 2020-21 consultant services are COVID-19 related contracts.

- Fiscal Year 2021-22 had a 44% decrease over the previous year.

- Fiscal Year 2022-23 had a 235% increase over the previous year, which can be attributed to an increase in awards geared towards the BDM Programme, which saw a major multi-year contract awarded to Deloitte to support ESDC through the modernization of Old Age Security (OAS) benefits delivery.

Percentage (%) of the Department's total budget

| Fiscal Year | Value of Contracts Awarded to Consulting Companies (McKinsey & Co., Deloitte, PricewaterhouseCoopers, Accenture, KPMG, Ernst & Young, GC Strategies, Coredal Systems Consulting Inc., Dalian Enterprises Inc, Coradix Technology Consulting Ltd, Dalian and Coradix in Joint Venture) |

ESDC Authorities Available for Use (Operating and Statutory) | Percentage of Departmental Budget |

|---|---|---|---|

| 2015-2016 | $26,896,693.98 | $3,073,684,687 | 0.88% |

| 2016-2017 | $25,782,483.90 | $3,294,334,843 | 0.78% |

| 2017-2018 | $25,366,225.80 | $3,551,344,895 | 0.71% |

| 2018-2019 | $28,711,947.25 | $3,492,395,646 | 0.82% |

| 2019-2020 | $57,506,302.45 | $3,637,240,451 | 1.58% |

| 2020-2021 | $167,696,239.98 | $4,660,947,009 | 3.6% |

| 2021-2022 | $93,090,430.03 | $5,342,967,694 | 1.74% |

| 2022-2023 | $311,801,882.25 | $5,596,852,689 | 5.57% |

Question 3

What is the rationale for hiring consultants?

Consultants provide a flexible and rapid deployment of resources with specialized skills and expertise to support ESDC's operational requirements and internal systems, specifically providing guidance for the department's transformation efforts, and to help ensure ESDC programs and services are delivered efficiently, effectively, and prudently. The contracts awarded to the aforementioned consulting companies (see question 1) provided resources with specialized skills and expertise to support ESDC operational requirements and internal systems, such as the Job Bank, Employment Insurance (EI), Old Age Security (OAS), Canada Student Loans and Grants, and 1-800-O-Canada.

Question 4

Does hiring consultants amount to using "replacement workers" instead of public servants?

ESDC retained the services of consultants where it was deemed that no employee was available, or that certain skillsets or specialized knowledge were lacking. Some contracts were awarded to supplement ESDC's in-house capacity to manage large projects for the department, specifically during the development and deployment of programmes related to social services and support required during the early stages of the pandemic, which saw an unprecedented and unpredictable increase in demand for services for Canadians. The department continues to ensure that contracts include a knowledge-transfer component or plans for sustained management of solutions to be less reliant on consultants as we move from the building and implementation stages to the management of solutions.

Question 5

What is the difference between contracts with companies that have global expertise and "staff augmentation" companies?

At times, ESDC engages with major multinational firms (Accenture, PwC, Deloitte, KPMG, etc.) to support large-scale transformations and implementations. These contracts provide ESDC with access to comprehensive skill sets essential for navigating the complexities of modernization projects across all phases. Leveraging the extensive expertise of these firms ensures that ESDC's initiatives are equipped with the necessary resources and capabilities to achieve success.

Additionally, ESDC collaborates with "staff augmentation" companies when consultants with specific skill sets or experiences are required to complement the capabilities of internal public servants. These contracts are typically awarded using Public Services and Procurement Canada's (PSPC) methods of supply for professional services, ensuring a streamlined and transparent procurement process.

By strategically leveraging the strengths of both large multinational firms and consulting companies with specialized skillsets, ESDC can effectively address diverse project requirements while optimizing resource allocation and fostering innovation.

Question 6

How does ESDC ensure integrity of its contracting process?

ESDC follows all applicable policies, directives, laws, and trade agreements, in all its procurement activities. Notably, ESDC, conducts procurements inline with the key principles found in Treasury Board's Directive on the Management of Procurement, the Government Contracts Regulations (GCRs), and the guidance provided in PSPC's Supply Manual. Furthermore:

- Per the requirements outlined in the Guide to the Proactive Publication of Contracts, ESDC proactively discloses all contracts/amendments valued over $10,000.00, on a quarterly basis.

- The Procurement Review Committee (PRC) at ESDC provides ongoing procurement oversight to ensure that ESDC's contracting activities are carried out in accordance with the applicable legislation, policies, and procedures, while considering national and departmental priorities. The PRC provides oversight of high-risk procurement activities for the department and provides a challenge function aimed at upholding the principles of fairness, openness, transparency, and sound contract management.

- ESDC utilizes Public Services and Procurement Canada (PSPC) mandatory government-wide vehicles for its professional services contracts. PSPC is developing new processes for its methods of supply for professional services requirements for all GoC departments. ESDC is updating internal processes and working with PSPC to ensure conformity.

Question 7

Investigations by PSPC found that 3 subcontractors for professional services undertook contract work across 36 Government of Canada departments and agencies. These individuals fraudulently billed the Government of Canada by an estimated $5 million by billing multiple organizations for the same period under multiple separate contracts. Is ESDC one of those 36 Departments?

Yes. The contracts in question are:

- Contract no. 2000126 with Eagle Professional Services;

- Contract no. 2000160 (G9292-201781/001/ZM) with IPSS Cyber Solutions; and

- Contract no. 2000065 (G9321-130001-010-ZM) with Veritaaq Technology House.

Will ESDC recover overpayments under these contracts?

Yes, the restitution process is centralized and led by PSPC on behalf of all affected departments. PSPC has the authority to seek restitution from suppliers.

Question 8

What does ESDC do to detect and prevent fraud?

ESDC performs integrity checks on suppliers and verifies the security clearance of resources, when applicable, and consults the Ineligible and suspended suppliers under the Ineligibility and Suspension Policy list maintained by PSPC prior to contract award. The department also relies on the Treasury Board's Directive on Delegation of Spending and Financial Authorities to ensure a scaffolded, risk-based approach by financial delegations in every step of the procurement process. Finally, ESDC's procurement operations are routinely audited and reviewed by the department's Internal Audit branch, which serves as an accountability measure as required in the Financial Administration Act.

Question 9

Can you confirm that you have had contracts with GC Strategies Inc. and if so:

What was the amount?

ESDC awarded three contracts to GC Strategies Inc. for a combined total of $3,132,343.05.

Will you be getting that money back?

ESDC did not find GC Strategies Inc. to be in violation of any contractual clauses and we have not contested any work delivered. As such there are no grounds to seek restitution. ESDC has no active contracts with GC Strategies Inc. Additionally, the PSPC Contract Security Program (CSP) has revoked the organization security clearance held by GC Strategies Inc. effective April 3, 2024. As a result, no further contracts will be awarded by or on behalf of ESDC to this supplier.

Did you get value for money?

The competitive procurement process enabled us to maximize value for money by leveraging vendor competition, which drove down costs while maintaining stringent quality standards and ensuring the suitability of the chosen vendor. The resources provided under each contract were retained for the duration of the contract and provided expertise that was otherwise not available through internal public servants at ESDC.

What did they do and why couldn't that have been done in house?

These contracts provided resources with specialized technical skills in the areas of Microsoft Project Server and Business Intelligence. These specialized resources were needed to support decision making within the organization by analysing, developing, testing, and deploying key IT solution modules for ESDC's Project Management Information Solutions (PMIS). These professional services were acquired to perform the work and transfer of knowledge to ESDC employees. The details for each contract are listed below:

- Contract 1 signed December 2, 2015: The purpose of this contract was to support implementation of PMIS Phase 2.

- Contract 2 signed July 11, 2017: The purpose of this contract was to support PMIS Phase 3.

- Contract 3 signed April 1, 2022: The purpose of this contract was to continue support and further enhance PMIS to support the ESDC investment initiatives and improve the current functionalities of the PMIS product to align with departmental Project and Programme Management Maturity.

Details deposed to Parliament regarding GC Strategies Inc.

Statement: Employment and Social Development Canada (ESDC) has reviewed the information available in its financial system and found 3 contracts for GC Strategies Inc. since November 4, 2015.

Amount of GC Strategies Inc. contracts: $3,132,343.05

Due diligence practices and status of contracts: All three contracts were awarded following competitive procurement processes under a PSPC method of supply. One contract was awarded on December 2, 2015; another on July 11, 2017; and a third on April 1, 2022. All contracts have expired - ESDC has no active contracts with GC Strategies Inc.

3. Service delivery - Hot issues

3.a. Benefits Delivery Modernization (BDM) costs and timeline

Issue

BDM Costs and Timeline

Background

The Benefits Delivery Modernization (BDM) Programme is critical to ensuring the ongoing delivery of Old Age Security (OAS), Employment Insurance (EI) and the Canada Pension Plan (CPP).

BDM is the core initiative that will deliver on the Minister of Citizens' Services 2023 mandate letter commitment to lead the ongoing "development and implementation of modern, resilient, secure and reliable services and benefit delivery systems for Canadians and ensure those services and benefits reach all Canadians regardless of where they live".

Key facts - Costs

As of the end of March 2024, the Programme has spent $1.1 billion (including taxes).

In 2020, BDM's programme authority was set at $2.2 billion (including taxes).

Given the recent Budget 2024 announcement, to date, the Federal Government has committed $4.4 billion dollars (excluding taxes) to the Benefits Delivery Modernization programme.

This represents the evolving costs based on the experience and further clarity on the scope, timeline, and dependencies.

Key facts - Timeline

BDM was originally announced in Budget 2017, and this commitment was reiterated in Budgets / off-cycle requests in 2018, 2019, 2020, 2022, 2023 and 2024.

In spring 2021, BDM started its implementation phase and switched to OAS as the first benefit to onboard.

In autumn 2022, the Common Benefits Delivery Platform was built, and the OAS re-plan was approved.

In June 2023, the first OAS release went live with over 600,000 foreign benefit recipients now being served through the new platform. OAS on BDM, is at this time, on track to onboard all remaining OAS accounts by December 2024.

Between 2024 and 2028, BDM will turn its attention to the implementation of EI, the continuous improvement of OAS, and planning for CPP.

Between 2027 and 2030, BDM will focus on the implementation of CPP, the continuous improvement of OAS and the continuous improvement of EI.

As a pathfinder Programme in the GC, estimates can only be assessed with what is known at a point in time. This means that costs will continue to evolve as the complexity of unravelling the current legacy systems is further assessed.

Key messages

BDM is first and foremost a business-led change that in addition to replacing the underlaying technology platforms, will modernize, evolve and ultimately transform how Canadians interact with Service Canada. In June 2023, the first OAS release went live with over 600,000 foreign benefit recipients now served through the new platform and OAS on BDM is, at this time, on track to onboard all remaining OAS accounts by December 2024.

While the BDM programme is a very sizable investment, during the 10-year life of the programme, over $1.5 trillion in EI, OAS and CPP benefits will be paid out, and the current and projected costs are consistent with similar transformations undertaken in other jurisdictions.

The projects are meticulously planned and governed with ongoing project reviews conducted on a regular basis by internal audit and third-party assurance, with findings and actions reviewed by Programme governance.

BDM has a single responsible Deputy Minister solely accountable for the Programme, and BDM's governance structure includes both partner vendors and partner departments such as Treasury Board, Public Services and Procurement Canada and Shared Services Canada.

Since EI is onboarding second, BDM will have valuable firsthand experience with the onboarding process and well-documented lessons learned from OAS on BDM.

The BDM procurement plan for each stage of the Programme is carefully developed, in accordance with the roadmap, project plans and input from TBS, PSPC and SSC. Contracts are competitively procured based on business and technical requirements led by PSPC.

3.b. Old Age Security (OAS) on Benefits Delivery Modernization (BDM)

Issue

What is the status of OAS on BDM?

Background

The Benefits Delivery Modernization (BDM) Programme will introduce modern and responsive applications and incorporate leading-edge technologies and methods to enable the delivery of Old Age Security (OAS) benefits initially, followed by Employment Insurance (EI) and then Canada Pension Plan (CPP). BDM is on track to modernize OAS, EI, and CPP over three phases, with an expected completion date of 2030.

OAS will be the first benefit onboarding to the BDM Common Benefits Delivery platform, and we are at this time on track to deliver the full OAS benefits implementation by December 2024.

OAS-on-BDM will be implemented across three (3) releases:

- Release 1 (June 2023) - is a case management solution which supports International Agreement Foreign Benefit clients.

- Release 2 - which is essentially a full Non-Production Pilot is a full end-to-pilot to test the functionality of the solution and ensure the business is prepared to use the new solution.

- Release 3 (December 2024) - is the implementation of the full end-to-end solution supporting all new and existing OAS clients.

Key facts

The BDM Programme supports the Minister's mandate to develop and implement modern, resilient, secure, and reliable services and benefit delivery systems for Canadian citizens.

OAS Release 1 went live on June 12, 2023, and enables 600,000 OAS Foreign Benefits clients to be served through the modernized system. The successful deployment of Release 1 demonstrated that we have a stable and secure solution for the delivery of benefits to Canadians.

The subsequent OAS on BDM milestone was Release 1.1, which went live on October 30, 2023. Release 1.1 built upon the Release 1 capabilities adding a platform upgrade, bug fixes, enhanced features, and integration with the Pension legacy system.

The next release is a non-production release of the OAS solution. This will be a fully simulated office pilot which will test the end-to-end functionality of the system and not directly impact clients. A dry run is scheduled for August, after which the Business Pilot will begin on September 3.

OAS Release 3 is currently on track for December 2024, and will transition the rest of the 7.3 million OAS clients to the Common Benefit Delivery platform. It will introduce a redesigned OAS/GIS application, life event reporting (e.g., marital and legal status changes), and other self-service features (e.g., requests for reconsideration and voluntary tax deduction) for our OAS benefit recipients.

[Redacted, 4 sentences]

Key messages

The Department recognizes the critical need to get the OAS implementation right. Putting vulnerable seniors' payments at risk is not an option.

OAS-on-BDM is focused on delivery of a solution that meets the quality expectations of Canadians, safeguards their information, and ensures the continuity of services to clients.

The BDM programme successfully implemented Phase 1 of Old Age Security (OAS) bringing the first group of OAS clients onto the new Common Benefits Delivery platform in June 2023. The implementation included Case Management Support for over 600,000 Foreign Benefit Clients.

This release was the first step towards fully modernizing and delivering digital services to citizens and is a key affirmation of the Government's capacity to transform and modernize technology.

The next phases of the OAS migration, scheduled to be completed in December 2024, will see approximately 7.3 million new and existing OAS clients transitioned onto the new platform.

There will be no disruption to benefit payments, and Canadians can expect a seamless transition from the legacy system to the new platform.

Once complete, Canadians will benefit from a modern, stable OAS system deployed on current technology that can be more quickly modified to adapt to changes in policy or legislation. It will feature a new user experience that will be easily adapted to changes in user preferences, and will be safe and secure, ensuring that benefits will be properly managed and paid for years to come.

3.c. Employment Insurance (EI), Old Age Security (OAS), Guaranteed Income Supplement (GIS), Canada Pension Plan (CPP)/Canada Pension Plan Disability (CPP-D) processing and wait times

Employment Insurance (EI) Processing

- In 2024-25, as of the week ending April 20, 2024, 86.3% of Employment Insurance (EI) payments, or notifications of non-payment, were made within 28 days, compared to 74.24% for the same period in 2023-24.

- In 2023-24, the average number of days it took for a client to receive their first EI benefit payment was 18 days, compared to an average of 24 days over the same period in 2022-23.

- In 2024-25, as of the week ending April 20, 2024, 45,975 EI Initial and Renewal applications have been received and 49,315 have been processed.

EI Call Centre Wait Times

- On November 3, 2022, the Fall Economic Statement announced $483 million to reduce EI Call Centre wait times.

- In 2024-25, as of the week ending April 19, 2024, the EI Call Centre answered 337.1 thousand calls with an average annual wait time of 5.8 minutes, compared to an average of 4.1 minutes for the same period in 2023-24 and an average of 30.6 minutes for the same period in 2022-23.

Pensions Processing and Wait Times

Old Age Security (OAS) Processing

In fiscal year 2023-24, as of March 31, 2024, Service Canada paid 86.6% of OAS benefits within the first month of entitlement, compared to 87.6% for the same period last year. The target is 90%.

Pensions Call Centre Wait Times

- On November 3, 2022, the Fall Economic Statement announced $574 million to reduce the Employment Insurance and Pensions Call Centre wait times.

- For 2024-25, as of week ending April 19, 2024, the Pensions Call Centre answered 172.7 thousand calls with an average wait time of approximately 19.3 minutes, compared to an average of 23.8 minutes for the same period in 2023-24 and an average of 62.8 minutes for the same period in 2023-24.

- Clients may experience above average wait times of over an hour every year between both February and April, as well as July and September corresponding to the tax slip season and the Guaranteed Income Supplement renewal period.

Canada Pension Plan / Canada Pension Plan Disability

Canada Pension Plan (CPP)

- In 2023-24, as of March 31, 2024, 94.3% of CPP retirement benefits were paid within the first month of entitlement, compared to 94.3% for the same period last year. The target is 90%.

- As of March 31, 2024, 79.7% of CPP Death Benefit decisions were made within 45 days, which is below the 80% target. For the same period in 2023, 84.2% CPP Death Benefit decisions were made within 45 days, which is above the 80% target.

- As of March 31, 2024, 78.6% of CPP Survivor Benefit decisions were made within 45 days, which is below the 80% target. For the same period in 2023, 83.5% of CPP Survivor Benefit decisions were made within 45 days, which is above the 80% target.

Canada Pension Plan - Disability (CPP-D)

- In 2023-24, as of March 31, 2024, 53.2% CPP-D Initial Application decisions were made within 120 days, compared to 78.7% for the same period last year. The target is 80%.

- In 2023-24, as of March 31, 2024, 91.4% CPP-D Terminal Illness Application decisions were made within 5 business days, compared to 91.3% for the same period last year. The target is 95%.

- In 2023-24, as of March 31, 2024, 85.1% CPP-D Grave Condition Application decisions were made within 30 days, compared to 84.5% for the same period last year. The target is 80%.

- In 2023-24, as of March 31, 2024, 85.1% CPP-D Grave Condition Application decisions were made within 30 days, compared to 84.5% for the same period last year. The target is 80%.

3.d. Service Canada point of access and outreach services

Issue

Service Canada maintains a network of in-person points of service across the country to support Canadians with personalized access to a wide range of government services and benefits and provides support to Indigenous communities and vulnerable client segments through community outreach.

Background

- 96% of Canadians have access to various services from Service Canada within a 50-kilometer radius of where they live.

- The in-person service delivery network consists of 600 points of service across the country.

- Service Canada's Community Outreach and Liaison Service builds relationships and provides support to Indigenous communities and vulnerable client segments to increase access to programs, services, and benefits, for clients who face distinct barriers to program access.

- The Service Canada Outreach Support Centre is a toll-free telephone service that ensures access to service for Indigenous communities and other vulnerable clients, such as seniors and persons with disabilities, facing barriers to accessing Government of Canada programs and benefits.

- Service Canada's Service Referral Initiative enables organizations to refer vulnerable clients who may require additional support directly to a Service Canada employee for tailored assistance.

- Service Canada Centre locations and office sizes are strategically determined after a detailed analysis of community needs and client demand; consideration of forecasted volumes and stakeholder engagement; and are dependent on real property market availability.

Key facts

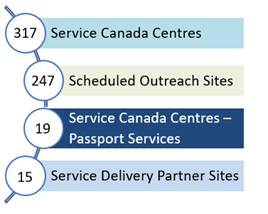

- The in-person network consists of 317 Service Canada Centres; 249 scheduled outreach sites; 15 service delivery partner sites; and 19 passport service sites.

- Scheduled Outreach sites offer, on a scheduled basis, all the services available at a Service Canada Centre in rural and remote locations.

- The Community Outreach and Liaison Service has well-established relationships with 740 Indigenous communities.

- Between April 1, 2023, and March 31, 2024, Community Outreach and Liaison Service staff completed 12,536 engagements with 53,886 service delivery partners and employers. They also conducted 9,261 outreach activities in FY 2023-24, providing 205,233 clients with a tailored access to services and benefits.

- In FY 2023-24, 20,825 clients called the Outreach Support Centre to receive support for 25,515 service requests.

- Information about Service Canada programs, services and benefits are available online at www.canada.ca or via online services, such as My Service Canada Account, Social Insurance Number online and the Service Canada online request form (eServiceCanada), which are accessible 24 hours a day, 7 days a week,

- Services by phone are accessible from 8:00 a.m. to 5:00 p.m. local time at 1 800 O-Canada (1-800-622-6232)

| Volumes | Fiscal year 2022-23 | Fiscal year 2023-24 |

|---|---|---|

| Clients served in-person | 6,335,455 | 8,366,709 |

| eServiceCanada | 853,993 | 469,363 |

| Outreach Support Centre |

|

|

| eSocial Insurance Number (applications completed) | 800,385 | 818,663 |

Key messages

- Service Canada provides access to a wide range of programs and services through its in-person network including, Service Canada Centres, Service Canda Centre Passport Service, Scheduled Outreach, and Community Outreach and Liaison Service

- Community Outreach and Liaison Service provides access to programs, services, and benefits to clients where they live and/or spend time, with a focus on vulnerable and underserved clients facing barriers to accessing benefits and services.

- As part of our commitment to reconciliation, we continue to find ways to improve access to government services and benefits by working collaboratively with Indigenous communities and other key partners.

- Service Canada continually assesses the needs of its clients and communities to ensure that its services align with client demand and remain responsive to the needs of Canadians.

- Canadians who require in-person services should consult the find a Service Canada office webpage to find services close to their home.

- Community organizations who would like to request information on Community Outreach and Liaison Service or an Outreach activity can do so on the Service Canada Community Outreach and Liaison Service Canada.ca webpage.

3.e. Passport print expansion

Issue

Some clients have to travel significant distances in order to obtain passport services. Road access and weather conditions can impact access to services.

Key facts

- Service Canada's Passport Service Delivery model has evolved significantly through the years, continually expanding access to clients and in alignment with the modernization plans of the Program. Following the passport surge in 2022 and to help distribute the passport volumes across the network, expedited services with a 10-day service standard were introduced in several Service Canada Centres

- At this time, clients can apply for and receive their passport within 20 business days (plus mailing time) at Service Canada Centres and Scheduled Outreach sites, while a 10-business day service is available in all Passport Offices and select Service Canada Centres (including consolidated sites and expedited service sites)

- Canadians can obtain urgent pick-up services in 1-2 days and express services in 2-9 days in offices that have a printer on site or within close proximity to the site. There are 28 Service Canada Centres Passport Service that currently offer urgent and express services across Canada. When a client requires a passport urgently, they are required to go to directly to these offices.

Key messages

- Service Canada continuously assesses how services are delivered across the country. Offering passport services to meet Canadians' need is a priority.

- Expanding urgent and express services in some cases requires the installment of new printers and associated real property costs. Service Canada is diligently working with its partners from Immigration, Refugee, and Citizenship Canada to assess feasibility and opportunities to enhance and expand services currently being offered.

- Passport services are funded through the Passport Revolving Fund, which operates on a cost recovery basis from revenues generated through service delivery fees. It is therefore important to work with Immigration, Refugee, and Citizenship Canada as program owner to balance service delivery and cost of expanding services.

- Service Canada recognizes that some communities could benefit from expanded passport services. Alternate service delivery options are being assessed to determine what additional service delivery improvements may be possible and feasible.

- Service Canada is currently undergoing major transformation initiatives specific to passport service delivery. Deploying additional printers is also tied to a successful deployment of these modernization initiatives.

3.f. Integrity and fraud prevention

Issue

In recent years, the department's programs have increasingly become the target of fraud. Both the nature and volume of fraud have expanded, including cyber-based fraud. The schemes are more sophisticated and organized.

Background

- Globally, public sector institutions are dealing with increasingly sophisticated and complex cyber attacks. Fraudsters are leveraging stolen personal information to access social benefits.

- Service Canada takes the integrity of its programs very seriously and remains committed to the financial stewardship of its programs.

- Service Canada must balance the protection of public funds against the need to put clients into pay as quickly and seamlessly as possible.

- Integrity activities at ESDC focus primarily on detection, with the most significant of these activities being directed towards investigations. The department uses a variety of tools and processes to help identify and address instances of error, abuse, and fraud. In 2023-24, ESDC conducted more than 183,900 investigations relating to the EI, CPP/OAS and SIN programs.

Key facts

- The department leverages data analytics and intelligence capabilities to identify fraud vectors/patterns and proactively take action to prevent payments from being issued to fraudsters.

- The department has enhanced its security posture in an effort to mitigate ongoing threats. These include:

- Enhancing firewalls to screen out certain kinds of inappropriate access;

- Protection from automated / scripted / robotic accesses to systems ("bots");

- Behaviour pattern analysis to flag suspicious activity in our systems; and

- Some internal activity and access monitoring to screen for internal threats.

- Furthermore, between April 2023 and April 2024, more than 5,400 stop-pays were imposed. These stop-pays have detected over $18.7 million in overpayments and prevented an estimated $28 million in payments from being issued to fraudsters.

- In Volume III of the Public Accounts of Canada 2022-2023, ESDC reported an amount of $96.5 million ($53.3 million in 2021-2022) in losses of public money due to an offence, illegal act or accident. The majority of this amount ($95.8 million) is related to fraudulent claims for Employment Insurance.

Key messages

- Service Canada takes the integrity of its programs very seriously.

- The department leverages data analytics and intelligence capabilities to disrupt, detect and prevent fraud.

- New IT solutions have been implemented to identify fraud patterns earlier in the application process and prevent fraudulent applications from being submitted online.

- Allegations of fraud or illegal acts are fully investigated and could be referred to law enforcement agencies as appropriate. Debts are established and penalties imposed when allegations are founded.

- Measures are in place to support clients impacted by identity theft/fraud on a priority basis.

- Service Canada also works closely with the Canadian Anti-Fraud Centre, the Canadian Centre for Cyber Security, other government departments, law enforcement and financial institutions to help defeat fraudsters.

3.g. Termination of ESDC/Service Canada employees who claimed COVID-19 emergency Benefits

Issue

ESDC/Service Canada terminated the employment of departmental employees upon finding that they had misrepresented their circumstances in order to obtain COVID-19 Emergency Benefits to which they were not eligible.

Background

- As part of its mandate to develop and implement a modern, resilient, secure and reliable service and benefit delivery system for Canadians, ESDC/Service Canada continues to strengthen and enhance its control mechanisms to prevent, detect and address fraud, error and abuse. To preserve the integrity of the program and maintain the trust of Canadians, ESDC/Service Canada promotes early detection and resolution.

- ESDC/Service Canada remains committed to the protection of its information holdings, its assets and people, including from insider risks.

- Due to the urgency in getting money in the hands of eligible Canadians as quickly as possible, the rollout of COVID-19 Emergency Benefits programs provided for post payment rather than prepayment eligibility verification, thus increasing the potential for fraud, error and abuse. However, the questions were written in plain language requiring the applicant to answer with "Yes/No" answers to all questions in order to be eligible and to certify to the truthfulness of their answers.

- The Minister of Employment and Social Development is responsible for COVID-19 Emergency Benefit Programs, as per the applicable Acts. Departmental employees are expected to support ministers in their responsibilities.

- Every day, ESDC/Service Canada provides numerous services and benefits to Canadians in accordance with the provisions of various Acts governing those services and benefits. In general, departmental employees have better knowledge and a greater understanding of eligibility requirements than the ordinary applicants.

Key facts

- While conducting administrative investigations pertaining to other allegations, ESDC/Service Canada discovered that some departmental employees were in receipt of COVID-19 Emergency Benefits while continuing to receive their full pay from employment with the department.

- Persuant to the Department of Employment and Social Development Act, ESDC/Service Canada compared data from its human resources and pay systems with COVID-19 Emergency Benefits program data to identify employees who received benefit payments as well as pay from employment with the department for the same periods.

- ESDC/Service Canada conducted administrative investigations and, in accordance with the Treasury Board Secretariat's Standard on Security Screening, reviewed the reliability status of employees who misrepresented their circumstances in order to obtain COVID-19 Emergency Benefits to which they were not eligible.

- As of April 1, 2024, 54 employees had their reliability status revoked and were terminated following a review of their Security status. Ongoing diligence continues.

- The recovery of ineligible payments occurs following the completion of the investigative process. All cases were referred to program administrators for post-payment verification and ESDC has taken action to recover ineligible payments.

Key messages

- Protecting the integrity of its programs and departmental information holdings, its assets and people is of the utmost importance and requires that ESDC/Service Canada maintains rigorous security practices, including taking proactive measures against the risks posed by departmental employees.

- ESDC/Service Canada actively promotes a strong ethical culture by providing all employees with resources, tools, training, communications, and support on values and ethics. This includes a cyclical requirement to recertify specific training, such as the Stewardship of Information and Workplace Behaviours training.

- In all 54 cases, ESDC/Service Canada's Chief Security Officer found that the employees misrepresented their circumstances in order to obtain COVID-19 Emergency Benefits they were not eligible to receive. In doing so, they lost the employer's trust and were terminated as they no longer met their terms of employment.

3.h. Passport document application process - Integrity in the business of passports

Issue

Integrity of the Canadian passport and application processing.

Background

- The integrity of the Canadian passport is internationally recognized and respected and is a key factor in maintaining safe, secure, and visa-free access to over 180 countries for Canadians.

- The Canadian Passport Order (CPO) dictates who is entitled to a regular (blue) passport, how it is issued, and when a passport can be refused, cancelled, or revoked.

- As part of the passport issuance process, all required documentation is reviewed to ensure accuracy and determine applicant eligibility. Security checks are performed against Immigration, Refugees and Citizenship Canada's Central Index file, which are used as a decision support mechanism for either issuing or refusing a passport to an individual.

- There are multiple Government of Canada departments involved in the delivery of the Passport Program:

- Immigration, Refugees, and Citizenship Canada (IRCC): Accountable for the overall Passport Program. Is mandated by the Canadian Passport Order to issue, cancel, revoke, withhold and recover Canadian passports

- Minister of Public Safety: Responsible for passport cancellation, refusal, and revocation in cases of terrorism and national security

- Employment and Social Development Canada (ESDC): Provides domestic service delivery (through Service Canada)

- Global Affairs Canada (GAC): Provides passport services abroad through its consular service network

Key facts

- Canadians can submit completed paper applications for a passport by going to any of the 317 Service Canada Centres, 19 passport offices or by mail.

- As of March 28, 2024, 249 Scheduled Outreach sites offer passport services.

- Passport Officers or Citizen Service Officers review and validate the information provided by applicants to ensure completeness, including photos, documentary evidence of citizenship, supporting documents, signature, and payment information.

- First-time applicants completing a general application must obtain a guarantor to confirm their identity. A verification is completed with a guarantor and/or references when applicable.

- If needed, applications may be referred to IRCC for further review.

Key messages

- The Passport Program follows an established process for identity management. Applicants must submit supporting documents, photos, guarantors, and references information to obtain a passport in accordance with Program requirements. These elements are key to ensuring the integrity of Canadian passports.

- The Passport Program utilizes documents previously issued by other governmental authorities to determine identity.

- Employees are trained to identify fraudulent documents. Processes are in place for employees to inform Immigration, Refugees and Citizenship Canada of any suspicious patterns or irregularities they may come across in the course of their daily duties.

- When evidence of suspected fraudulent activity is found or reported, IRCC launches an investigation where Service Canada may provide support and information. Investigations may result in passport refusal and/or revocation.

- Service Canada, in collaboration with Immigration, Refugees and Citizenship Canada, continuously works to review and improve processes to ensure passport misuse and/or entitlement fraud does not occur.

- Service Canada is committed to protecting personal information and understands the importance that Canadians place on the protection of their personal information. As responsible stewards of client information, Service Canada has well established procedures and processes around the management of personal information and the reporting of privacy breaches.

3.i. Passport current service standards and volumes

Issue

Current passport service delivery service standards and volumes.

Background

- Beginning in July 2013, Canadians were given a choice between a 5-year validity passport and a 10-year validity passport. Early applicants for the 10-year validity passports have begun to apply for new passports before their passports began to expire starting in July 2023.

- To coordinate delivery of the Passport Program, ESDC/Service Canada's service delivery approach is based on forecasts received from Immigration, Refugees and Citizenship Canada (IRCC). These forecasts are broken down by month and by the predicted channel (Service Canada Centre - Passport Office, Service Canada Centre or mail) that applicants will use to apply for their passport.

- ESDC/SC uses the mid-range forecast to determine the workforce needed to handle the volumes. During some peak periods, ESDC/SC leverages alternate methods (e.g. overtime) to manage through the short period increase.

- Over the last year, ESDC/Service Canada has taken several actions to improve passport services to Canadians:

- Aligned the operational passport workforce to meet the forecasted surge in passport applications starting in 2023-24.

- Maintained the appointment-booking tool that directs clients to the right location for service.

- Applied line management strategies to provide all clients in line with a service solution.