Evaluation of Canada Student Loan Program

From: Employment and Social Development Canada

On this page

- List of abbreviations

- List of figures

- List of tables

- Executive summary

- Management response and action plan

- Introduction

- Evaluation findings

- Conclusion and recommendations

- Annex A: Evaluation questions

- Annex B: Lines of evidence

- Annex C: Methodological challenges in measuring the impact of student loans and grants

- Annex D: Supplementary figures

- Bibliography

Alternate formats

Evaluation of Canada Student Loan Program [PDF - 2.30 MB]

Large print, braille, MP3 (audio), e-text and DAISY formats are available on demand by ordering online or calling 1 800 O-Canada (1-800-622-6232). If you use a teletypewriter (TTY), call 1-800-926-9105.

List of abbreviations

- CSLP

- Canada Student Loans Program

- ESDC

- Employment and Social Development Canada

- PSE

- Post-secondary education

- PTs

- Provincial and territorial governments

List of figures

- Figure 1: Post-secondary attendance indicator

- Figure 2: Awareness of financial aid provided by the Canada Student Loans program

- Figure 3: Awareness of proportion of government student loan that comes from the federal government

- Figure 4: Likely outcomes indicated by borrowers with no access to student loans or grants, or if received only half

- Figure 5: Likelihood of enrolling in same program if never received government loan or grant, or if received only half of government loan and grant

- Figure 6: Average weekly hours spent working while attending among those who worked

- Figure 7: Impact of working on grades or academic performance

- Figure 8: Reasons for leaving school without completing their program

- Figure 9: Factors that impacted their ability to cover education and among those who dropped out before completing

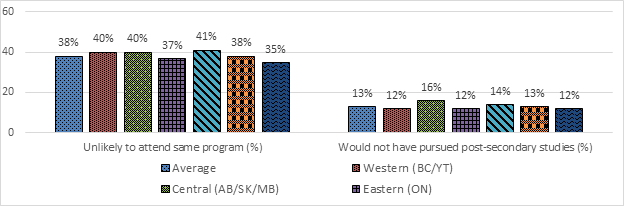

- Figure 10: Proportion (%) unlikely to attend same program or any post-secondary program with only half of their student loans and grants

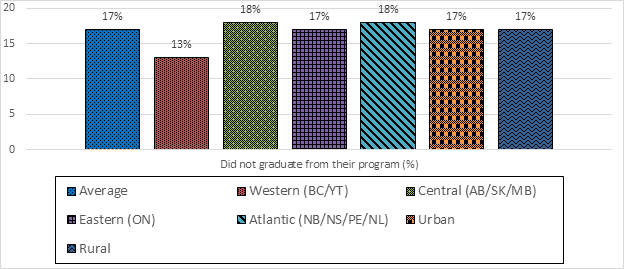

- Figure 11: Proportion that did not graduate from their program (2 years after their last student loan period)

- Figure 12: Proportion that indicated their student loans and grants were inadequate to meet their financial needs

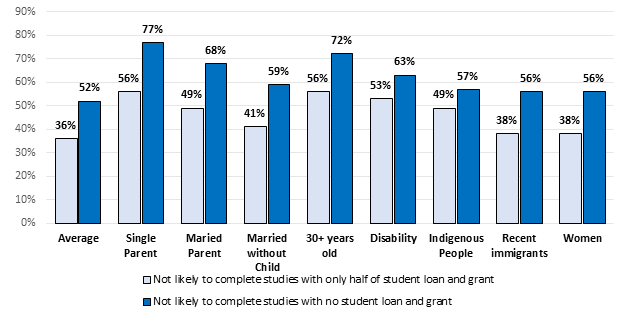

- Figure 13: Proportion (%) unlikely to have completed their post-secondary studies if they received only half or none of their student loan and grants

List of tables

- Table 1: Management action plan for recommendation 1

- Table 2: Management action plan for recommendation 2

- Table 3: Applicants’ main concerns when applying to PSE

- Table 4: Borrowers’ level of concern about student debt during studies

- Table 5: Likelihood of completing studies without government student loans and grants among those who completed their studies

- Table 6: Agreement that government student loans and grants were adequate

- Table 7: Likelihood of staying in school if Government Student Loan was larger

Executive summary

The Canada Student Loans Program provides financial assistance to students to help them access and afford post-secondary education. From 2018 to 2019, the program provided $5.2 billion in student loans and grants to 700,000 students.Footnote 1 The federal government works in partnership with participating provincial and territorial governments to deliver student loans and grants. The Canada Student Loans Program provides funding for approximately 60% of full-time students’ loans and grants. Provinces or territories cover the remaining 40%.

This report presents key findings on the impact of the loans and grants on post-secondary education and graduation. The evaluation focuses on the most recent pre-COVID period. The report also briefly underlines government efforts to support students during the COVID period. The COVID period could be further examined in a future evaluation.

Key findings

The majority of borrowers were aware of Canada Student Loans Program but many reported limited understanding of the program.

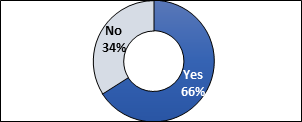

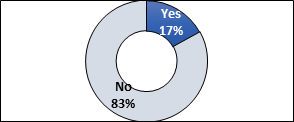

The majority (66%) of borrowers were aware that the federal government provides student loans and grants. However, few (17%) were aware of the importance of the federal government in the total financial support they received.

Many focus group participants had limited understanding of how their student loans and grants were determined, including the factors affecting the amount of their loan.

Borrowers indicated the program facilitated access to post-secondary education.

Before applying, a total of 91% survey respondents indicated they felt concerned about having enough money to cover education and living costs. For most, this sentiment changed after being informed of the amount of student loans and grants they would receive.

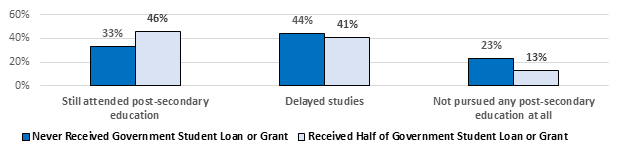

Some (13%) borrowers indicated they would not have pursued any post-secondary studies without the federal portion of their student loans and grants. Many (41%) would have delayed their studies without the federal portion. Many (39%) borrowers reported they were unlikely to have enrolled in the same program without the federal portion of their student loans and grants.

Many focus group participants indicated they would have still enrolled in post-secondary education if they were only eligible for loans and not for grants. However, grants made a difference for some, as they help offset part of the loans.

Students indicated they would have made changes to make their education more affordable if they received less in student loans and grants. For example, choosing a less expensive program or institution. Others would have sought out other sources of funds. In focus groups, many low-income parents indicated that their children had adjusted their choice of program or institution based on the amount of student loans and grants available.

Students indicated that the program helped them complete their post-secondary studies. Nevertheless, education and living costs remained a key concern for many.

Most (83%) program participants had completed a post-secondary program (2 years after their last student loan period). Among borrowers who completed their program, a third (36%) indicated it’s unlikely that they would have completed their studies without the federal portion of their student loans and grants.

Most students (74%) thought their government student loans and grants were adequate to meet their financial needs during their studies. The quarter (26%) of borrowers who disagreed indicated that they would have needed an average of $10,000 more to meet their needs.

Students had unexpected financial challenges during their studies and reported that some expenses were much higher than they anticipated. For example, most focus group participants did not expect textbooks and other mandatory course materials to be as expensive. In addition, many students had rent and food expenses that were above program allowances for these living expenses. The program uses predetermined amounts for rent and food when calculating student loan entitlements. Overall, over 40% of survey respondents indicated that they were concerned during their studies that they might not be able to complete their studies due to financial reasons.

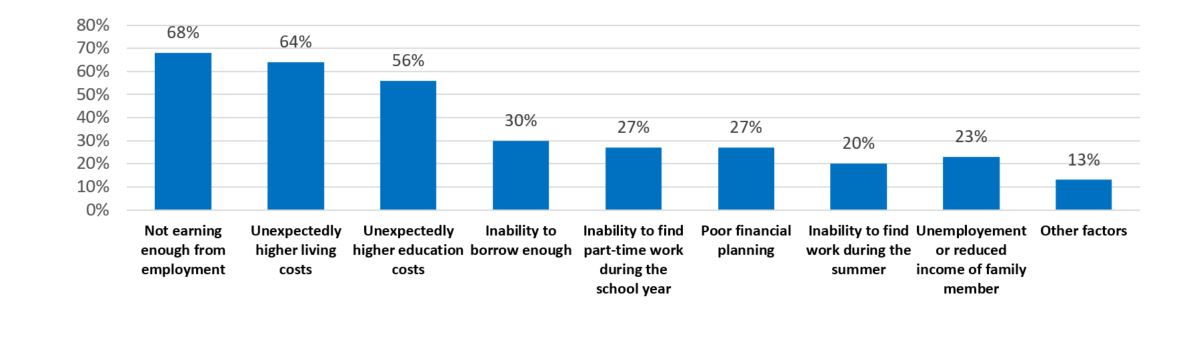

Many of those who dropped out of their program before completing did so for financial reasons (47%). The most common reasons cited were not earning enough from employment (68%), unexpectedly higher living costs (64%), and unexpectedly higher education costs (56%). Over half (58%) of those who dropped out indicated they would have continued their studies with a larger student loan.

Some vulnerable groups further rely on the program to access post-secondary education and graduate.

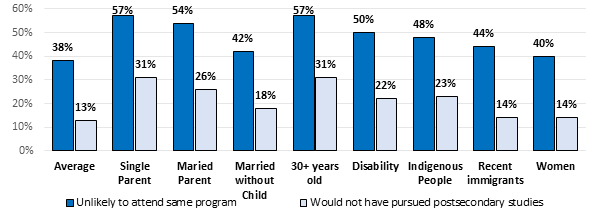

Students from some groups were more likely to indicate that they would not have attended the same program, not pursued any post-secondary studies or not graduated, without the federal portion of their student loans and grants. For example, over half of single parents (57%) would not have attended the same program and 31% would not have pursued any post-secondary education without the federal portion of the student loans and grants. Other groups, such as students with disabilities, Indigenous students, older students (30 years old and above), married students, and recent immigrants also indicated this more often than average.

Among those who graduated, about 40% to 55% of students with children (single or not), married students without children, students with a disability, Indigenous students and older students indicated that they would not have graduated without the federal portion of their student loans and grants. This highlights the importance of the Canada Student Loans Program for these groups.

Two recommendations:

- examine student financial need with a view to identify funding gaps faced by students

- further enhance awareness and understanding of the program among Canada Student Grant and Loan recipients

Management response and action plan

The Learning Branch would like to thank the Evaluation Directorate and all parties involved in the Evaluation of the Canada Student Loans Program (CSLP). In particular, we would like to thank all stakeholders, key informants, and program officials consulted.

The Government of Canada helps Canadians’ access to post-secondary education (PSE). Through the CSLP, grants and loans are provided to eligible Canadians pursuing a PSE degree, diploma or certificate at a designated educational institution.

The CSLP provides grants, loans, and repayment assistance to help make PSE more affordable for Canadians. In 2018 to 2019, the program provided $5.2 billion in student grants and loans to 700,000 students. The federal government works in partnership with participating provincial and territorial governments (PTs) to deliver grants and loans to students. The federal government provides about 60% of full-time students’ grants and loans under the CSLP. PTs cover the remaining 40%.

The evaluation found that many CSLP borrowers felt that the program helped provide access to, and helped them complete their PSE. The majority of CSLP borrowers were aware of the student financial assistance. However, many reported a limited understanding of the program and had key concerns about costs related to their PSE. The findings of this report will help the CSLP improve awareness of the program. In addition, it will also help the CSLP continue to find ways to make PSE more accessible for all Canadians.

Recommendation #1

Examine student financial need with a view to identify funding gaps faced by students.

Management response

The Learning Branch agrees with this recommendation.

The findings highlight the importance of the CSLP and the impact of student financial assistance in helping students attend and complete their PSE.

The CSLP provides eligible students with grants and loans to help them pay for their tuition, books, mandatory fees, living costs and transport. The Program calculates a student’s financial need by subtracting their resources from their allowable costs. The Program views the cost of PSE as a shared responsibility and does not cover all expenses. Rather, the Program is designed to supplement funds students have from other sources. These include their own income and assets, parental or spousal contributions, and PT programs. Students contribute to their educational costs by paying up to $3,000 per loan year. The Program determines the exact amount using student’s gross family income and family size.

The CSLP works closely with PTs to find ways to better meet student financial needs. The findings of this report have highlighted the impact of financial concerns faced by students, both before they apply and during their studies. Students cited financial concerns more often than academic concerns, when asked about their main concerns when applying for PSE.

Most students indicated that their loans and grants were adequate to meet their financial needs. However, many still noted being unable to complete their studies due to financial reasons. Many expressed concerns over living costs, such as rent and food. The CSLP will work with PTs to examine student’s financial need and funding gaps faced by students.

| Management action plan | Completion date |

|---|---|

| 1.1 Engage PTs on a workplan to examine student’s financial need and identify funding gaps faced by CSLP recipients. | Fall 2021 |

| 1.2 Assess the need to update the treatment of costs and resources, including students who face additional barriers. | Fall 2022 |

Recommendation #2

Further enhance awareness and understanding of the program among Canada Student Grant and Loan recipients.

Management response

The Learning Branch agrees with this recommendation and is committed to enhancing recipients’ awareness and understanding of the program. In collaboration with the Financial Consumer Agency of Canada, the CSLP has already made progress in making more resources available:

- the National Student Loans Service Centre website and student portal were enhanced so that students can better understand the loan process. For example, in November 2019, the Program put in place a Virtual Repayment Counsellor. This is an interactive tool that advises students entering repayment of debt management measures for them, based on their personal situation

- in 2020, the Program introduced a new financial literacy web page

- in 2021, the Program also introduced new email communications to reach students before they enter their loan repayment. The Program also added frequently asked questions and YouTube videos on topics such as repayment

- the Program plans for further financial literacy communications to ensure that students understand the program and their loan obligations

In addition, the CSLP is planning an awareness campaign to shift the focus from a primarily loans-based program to one that that offers a range of student financial assistance options. The CSLP is actively consulting stakeholders on raising awareness of CSLP supports, as well as opportunities for increasing financial literacy among recipients. This includes consulting stakeholders on the feasibility of financial literacy modules, and other ways to increase recipients’ understanding of the program.

| Management action plan | Completion date |

|---|---|

| 2.1 The Program is working with the Public Affairs and Stakeholder Relations Branch to develop and implement a plan to raise awareness of the program. This would include proving more information on student grants and repayment assistance, with a focus on targeting vulnerable groups. | Spring 2023 |

| 2.2 Work with stakeholders and PTs to develop and implement initiatives to improve understanding of the program. | Fall 2022 |

| 2.3 Continue developing online tools to provide student borrowers with easy access to information. | Summer 2022 |

Introduction

The Canada Student Loans Program provides student financial assistance to students to help them access and afford post-secondary education. In 2018 to 2019, the program provided $5.2 billion in student loans and grants to about 700,000 students.Footnote 2

The Government of Canada works collaboratively with participating provincial and territorial governments Footnote 3 to deliver student financial assistance to Canadian students.

Applicants in participating jurisdictions are assessed for federal and provincial loans and grants through a single application process through their application to their provincial or territorial program. The Government of Canada provides approximately 60% of their loans and grants, while their province or territory covers the remaining 40%Footnote 4.

1.1 Evaluation context

The last evaluation of the program was completed in June 2016, and it examined the measures introduced in Budget 2008 such as grants, the Repayment Assistance Plan, and enhancements to loan access for part-time and married/common-law students. The evaluation underlined the importance to offer student grants alongside student loans, grants helping make post-secondary education more accessible for disadvantaged students such as students from lower income families, students with children and those with disabilities. A survey of grant recipients indicated that 17.6% of them would not have continued with their studies if grants were eliminated immediately and replaced by student loans. More details on the 2016 evaluation can be found online.

The current evaluation focuses on the impact of loans and grants on access to post-secondary education, persistence in studies and graduation (evaluation questions are presented in Annex A).

The objective of the evaluation was to examine the impact of the program in the most recent pre-COVID period. A brief discussion of federal government efforts to support students during the COVID period is presented in section 1.3. The COVID period could be further examined in a future evaluation, given it may warrant a separate discussion.

The evaluation gathered evidence throughout 2020 with new program applicants, students in the last year of their program and with former program participants, in order to have the perspective of students at different moments in their studies.

When gathering evidence from students, the evaluation focused on the period before the COVID-19 pandemic, even if the surveys and some focus groups took place during the pandemic. This ensured results of the evaluation were representative of the normal operation of the program, and not the result of the special circumstances brought by the COVID pandemic.

Nevertheless, participation to the surveys or focus groups and results were likely somewhat affected by the pandemic. It is not possible to know the extent to which participation and results were affected.

The evaluation drew on 5 lines of evidence (Annex B provides more details on these lines of evidence):

- a literature review of over 100 studies

- 2 surveys

- a new applicant survey with 4,800 students who were at the end of their first year

- a post-study survey with 3,400 former program participants (surveyed 2 years after their last student loan or grant year in 2017 to 2018)

- 16 focus groups

- 8 in-person focus groups with new program applicants (who were at the end of their first year) and with parents of new applicants

- 8 online focus groups with borrowers who were in the last year of their program

1.2 Program context

1.2.1 Program outcomes and post-secondary indicators

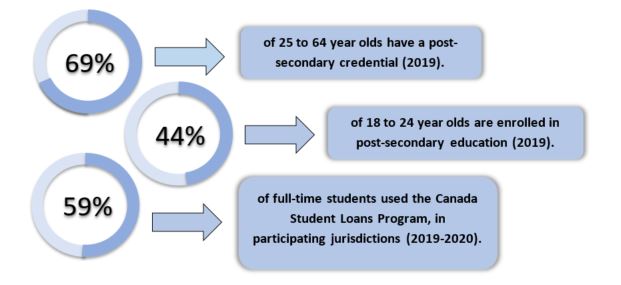

One of the Government of Canada’s goals is to help Canadians access post-secondary education and get the skills and training they need to succeed in the labour market.Footnote 5 Offering student loans and grants to low- and middle-income Canadians aims to mitigate financial constraints for them to access post-secondary education and get the training they seek.Footnote 6 Having a post-secondary education is common in Canada (Figure 1) and important for many Canadians. For example, one focus group participant mentioned:

“I knew I needed to go to post-secondary to get a good career and make a life.”

Focus group participant

Sources: Statistics Canada (2020) and ESDC (2020c).

Figure 1 – Text version

| Attendance indicators | Percentage |

|---|---|

| 25 to 64 year olds have a post-secondary credential (2019) | 69% |

| 18 to 24 year olds are enrolled in post-secondary education (2019) | 44% |

| Full-time students used the Canada Student Loans Program, in participating jurisdictions (2019 to 2020) | 59% |

1.2.2 Education costs, student aid and program recipients

The cost of attending university is estimated at $20,000 per year for students living away from home, and $9,000 for students living at home.Footnote 7 Costs for those attending college should be similar, with discrepancies due to the different levels of tuition fees and length of studies.

Given the significance of costs of attending post-secondary education, most students rely on different sources of funding that can include: their work earnings and savings, student loans and grants, money from parents and scholarships.

The Canada Student Loans Program provides help to almost 60% of full-time students in participating provinces and territories.Footnote 8 The program is not meant to cover all post-secondary study expenses; rather, it is intended to supplement funds available to students from other sources mentioned above.

The average loan of the Canada Student Loans Program was $6,000 in 2018 to 2019 for full-time students. The average grant was $3,000.Footnote 9 The average financial support received by program recipients was $8,000, as not everyone receives a grant.Footnote 10

Grants are targeted to different groups: low-income students, middle-income students, students with dependants, students who have been out of school for 10 years and students with a disability.

Financial needs of students differ greatly depending on their family and financial situation. The program takes this into account in its needs assessment processFootnote 11, which helps determine eligibility and the amount of loans and grants each student receives.

- Half (46%) of program recipients are considered financially dependant on their parents (half of whom live away from home)

- 39% are single, considered independent financially and without children

- 7% are married (or common-law) with children, 5% are single parents and 4% are married with no childrenFootnote 12

Therefore, the amount of financial aid provided and its importance for each beneficiary can vary significantly, as it is needs-based (some receive low amounts, some high amounts). The impact of the program should therefore vary from participant to participant.

1.3 Government support to students during the COVID pandemic

The Government of Canada introduced several measures to financially support students during the COVID pandemic, so that those facing challenges due to COVID can access and afford post-secondary education.

During the summer of 2020, the Canada Emergency Student Benefit provided financial support to post-secondary students, and recent graduates from post-secondary or high school, who were unable to work or to find work due to COVID.

Applicants received $1,250 for each 4-week period, for a maximum of 16 weeks. Applicants could also get an extra $750 (total benefit amount of $2,000) for each 4-week period, if they had a disability or dependants. Over 700,000 students benefited from this measure.Footnote 13

For the 2020 to 2021 school year, there were significant enhancements to the grant and loan support of the Canada Student Loans Program. These changes included:

- the doubling of grant amounts to up to $6,000 for full-time students and up to $3,600 for part-time students; additional grants for students with disabilities and students with dependants were also doubled to a maximum of $4,000

- the elimination of the student contribution and the spousal contribution in the student financial resources taken into account in the calculation of student loans; this increases the amount of financial aid students are eligible for and helps make more students eligible

- the weekly maximum loan limit was increased from $210 to $350 per week, allowing students with greater financial needs to qualify for higher loan amounts

Finally, the Government introduced a 6-month freeze on repayments of federal student loans and interest accrual from April to September 2020. Furthermore, the 2020 Fall Economic Statement announced the interest on federal student loans would also be eliminated for the entire 2021 to 2022 school year.

Evaluation findings

2.1 Awareness and understanding of the Canada Student Loans Program

The majority of borrowers were aware that the federal government provides student loans and grants. However, only a minority were aware of its weight in the total government student financial aid they received.

- Overall, two thirds (66%) of survey respondents indicated that, before the survey, they were aware of the financial aid provided by the federal government through the Canada Student Loans Program (Figure 2)

- However, only about 17% of respondents knew the approximate share of government student loans and grants that come from the federal program (Figure 3)Footnote 14

- Varying levels of awareness of the federal program was a challenge for the evaluation when asking students about the impact of the program on their studies

Sources: Post-study survey and new applicant survey (2020).

Figure 2 - Text version

| Awareness of financial aid provided by Canada Student Loans Program | Percentage |

|---|---|

| Yes | 66% |

| No | 34% |

Sources: Post-study survey and new applicant survey (2020).

Figure 3 – Text version

| Awareness of proportion of government student loans and grants that comes from the federal government | Percentage |

|---|---|

| Yes | 17% |

| No | 83% |

Many borrowers had limited understanding of how their student loans and grants were determined.

Focus group participants indicated that they became aware of various factors affecting the calculation of loans and grants mostly through the application process. When prompted about their knowledge of the different factors on which loan and grant amounts are based, manyFootnote 15 participants mentioned that they did not really understand all the factors that came into play. Many reported that they were not aware of how the amount of loans and grants are actually calculated.

- Many indicated they could not estimate the amount of student loans and grants they would receive before its confirmation by the program

- Many estimated the amount they would receive based on the amount that they had received the previous year, but a few of them indicated that had been incorrect since their circumstances had changed in ways that affected the calculation

Many focus group participants indicated that they found information about student loans and grants online. Many also received information at their high school or post-secondary institution. Many mentioned they received information primarily on how to apply. Some focus group participants indicated that information about student loans and grants is difficult to find and too complicated. For instance, a few:

- suggested that the student loans and grants application website be improved to be more user-friendly in terms of navigating and finding information, and that it should be fully mobile friendly

- indicated that the Ontario and British Colombia student aid websites were more user-friendly or more easily searchable than the ones of the Government of Canada and of the National Student Loans Service Center

- would like more detailed information to be readily accessible on the calculation of loans and grants, as well as the various factors on which it is based

It should be noted that the Department is working on an extensive financial literacy and awareness campaign on student loans and grants, in order to enhance the program’s existing suite of information and tools.

2.2 Impact of student loans and grants on access to post-secondary education

Before they applied for post-secondary education, new student loan applicants were concerned about having enough money to cover their education and living expenses during their studies. For most, this sentiment changed after being informed of the amount of student loans and grants they would receive.

A total of 91% of new student loan applicants indicated that before they applied for post-secondary education, they were concerned about having enough money to cover their education and living expenses during their studies (including 54% that were very concerned). About 7% indicated they were not very concerned and only 1% indicated they were not at all concerned.

Financial concerns were cited more often than academic concerns, when students were asked specifically about their main concerns when applying for post-secondary education (Table 3).

After being informed about the amount of their student loan and grant, 80% of new applicants indicated they were confident they would have enough money to cover their education and living expenses. However, 16% of new applicants were not very confident and 4% not at all confident they would have enough money to cover their expenses.

| Concern when applying | Percentage |

|---|---|

| Paying for tuition, books, and course-related equipment | 82% |

| Paying for living costs (for example, rent, food) | 64% |

| Dealing with possible unexpected expenses | 57% |

| Difficulty of coursework and maintaining grades | 52% |

| Gaining admission to your program of choice | 44% |

| Balancing school and paid work | 41% |

| Balancing school and social life | 39% |

| Commuting to and from school | 30% |

| Making friends or fitting in | 30% |

| Changing where you live | 18% |

| Health or personal issues | 15% |

Source: New applicant survey (2020).

Some borrowers would not have pursued post-secondary studies without the federal portion of their student loans and grants. Many would have delayed their studies.

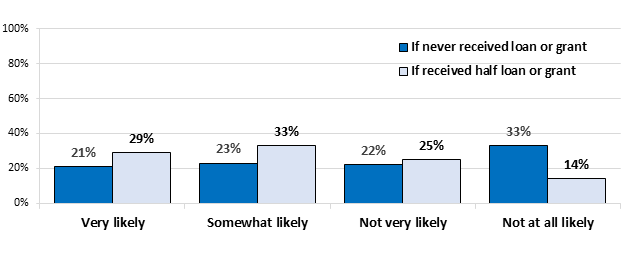

Overall, 13% of borrowers indicated that they would not have pursued post-secondary education at all if they had received only half of their government student loans or grants (Figure 4). Half approximates the federal portion – see Box 1. Almost half (41%) of borrowers indicated they would have delayed their studies in this case. At the same time, half (46%) indicated they would have still attended without delaying.

Sources: Post-study survey and new applicant survey (2020).

Figure 4 - Text version

| Likely outcomes indicated by borrowers with no access to government student loans or grants, or if received only half | Never received government student loan or grant | Received half of government student loan and grant |

|---|---|---|

| Still attended post-secondary education | 33% | 46% |

| Delayed studies | 44% | 41% |

| Not pursed any post-secondary education at all | 23% | 13% |

Without access to any government loans and grants, 23% of borrowers indicated they would not have pursued post-secondary education at all. Almost half (44%) of borrowers indicated that they would have delayed their studies, while a third would have still attended post-secondary education without delaying.

Some focus group participants indicated they would have delayed their studies or not pursued any studies without government loans and grants.

Some indicated that not having access to government student loans and grants would have also meant giving up on a path to better employment prospects, as they would not be able to pursue their education. A few low-income students mentioned that they might have faced depression for not being able to study and improve their employment prospects.

Some others would have postponed their decision to enroll in post-secondary education by a year or even several years, without government student loans and grants. They indicated that they would have had to work longer in order to save enough money to consider enrolling.

Without government student loans and grants, “I would have tried to do it on my own but it would have taken a longer amount of time to get there. I would have deferred enrolling.”

Focus group participant

Box 1 – Self-assessed impacts of government student loans and grants

To assess the impact of government student loans and grants, borrowers were asked to think about what most likely would have happened in 2 different hypothetical situations:

- if they had never received a government student loan or grant

- if they received only half of the government student loans or grants

- the second scenario aims to understand what would have happened without the Canada Student Loans Program, given that on average, the program represents 60% of full-time student loans and grants

Self-assessments of program impacts provide imperfect estimates of program impacts, but are the best source of information available in this case. Methodological challenges in measuring the impact of student loans and grants programs are discussed further in Annex C.

The literature indicates that student loans and grants increase access to post-secondary education.

The international and Canadian empirical literature examined how increases in student loans and grants can affect access to post-secondary education. Results indicate that enrolment has increased with student loans and grants.

There is broad evidence that grants increase enrollment. Estimates point to an increase of 1 to 4 percentage points for an additional $1,000 in grants.

There is evidence that student loans increase enrollment, particularly among those from low-income backgrounds. However, the magnitude of the impact seems smaller than that of grants. Too few reliable studies have measured the impact of loans to provide a quantifiable estimate of their impact.

Many students indicated they would have still enrolled in post-secondary education if they were only eligible for government student loans and not for grants as well. However, grants made a difference for some.

Grants were perceived as “a bonus” by many focus group participants. Some were surprised to receive grants; some were unsure whether they received a grant. For these students, grants did not affect their decision to enroll.

Many focus group participants indicated that the availability of grants “eased their minds” as their debt load was a concern, and grants offset part of the loans. For some, grants also made a difference in their decision to pursue their studies.

Most borrowers indicated they were concerned about their student debt. More than half of borrowers indicated that it affected their education decisions.

Before their studies, most (90%) new borrowers indicated they were concerned about taking on student debt (Table 4), with more than half (57%) indicating they were very concerned. However, most (81%) new borrowers were confident they would be able to pay back their loans after they finished school.

During their studies, concerns about student debt were almost as widespread (84% indicated they were concerned). More than half of borrowers indicated that the concern about their student debt level affected their education decisions such as their choice of program or institution, reduced course load, decision to start another program.

Increasing awareness about the Repayment Assistance Program could potentially help diminish students’ concerns about their student debt.

| Concern before applying to PSE | Very concerned or Somewhat concerned | Very concerned | Somewhat concerned | Not very concerned | Not at all concerned | Not very concerned or Not at all concerned |

|---|---|---|---|---|---|---|

| Concern about taking on debt while in college or university | 90% | 57% | 33% | 8% | 2% | 10% |

| While receiving government student loan or grant, how concerned about taking on debt while in college or university | 84% | 50% | 34% | 11% | 5% | 16% |

| Confidence of new applicants will earn enough money to pay back student loans after you have left school | 81% | 32% | 50% | 16% | 3% | 19% |

Source: Post-study and new applicant survey (2020).

Almost 40% of borrowers indicated they were unlikely to have enrolled in the same program without the federal portion of their student loans and grants. Moreover, the majority of borrowers indicated they were unlikely to have enrolled in the same program without any government student loans and grants.

Overall, the majority (55%) of surveyed borrowers indicated it was not likely that they would have enrolled in the same program of studies if they had never received a government student loan or grant (33% “not at all likely” and 22% “not very likely”) (Figure 5). The focus groups supported this finding.

When considering whether they would have enrolled in the same program of studies if they received only half their government student loan or grant, 39% said it was not likely (14% “not at all likely” and 25% “not very likely”). Half approximates the federal portion – see Box 1.

Sources: Post-study survey and new applicant survey (2020).

Figure 5 –Text version

| Likelihood of enrolling in same program if never received government loan or grant, or if received only half of government loan and grant | Very likely | Somewhat likely | Not very likely | Not at all likely |

|---|---|---|---|---|

| If never received loan or grant | 21% | 23% | 22% | 33% |

| If received half loan or grant | 29% | 33% | 25% | 14% |

Many students indicated that the availability of student loans and grants played an important role in selecting which program or institution to attend.

Many focus group participants indicated that with a lower amount of student loans or grants, they may have chosen:

- a college program instead of attending university

- a less expensive program or institution

- a less intensive program or a shorter program in order to reintegrate into the labour market faster

Survey respondents also mentioned they would have changed program or institution to make their studies more affordable if they had received less in student loans and grants.Footnote 16

A few low-income students indicated in the focus groups that the overall amount of funding available was a crucial part of choosing a program or institution, as it determined which institution they could afford to attend.

Many low-income parents indicated in the focus groups that their children had adjusted their choice of program and institution based on the amount of funding available from student loans and grants. A few indicated that, if the amount had been lower, they would have encouraged their children to consider a college program instead of university.

Middle-income parents reported that the overall amount of loans and grants available did not affect their children’s decision about their program, but some indicated it was a consideration when choosing an institution further away from home.

Many students would have made changes to make their education more affordable and to get other sources of funds, if they received less in student loans and grants

Many focus group and survey participants were asked how they would have adapted if they received less in student loans and grants. Many students indicated they would have:

- taken more time to finish their studies and/or worked more during their studiesFootnote 17

- changed their program of study, as indicated previously

- reduced their expenses

- used other sources to finance their studies, such as:

- taking out more private loans

- ask family for loans

- asking family for money that would not need to be paid backFootnote 18

2.3 Impact of student loans and grants on persistence in studies and graduation

Most program participants completed a post-secondary program. However, many would not have completed their program without the federal portion of their student loans and grants.

Most (83%) borrowers had completed their post-secondary program (2 years after their last student loan period).

Among borrowers who completed their post-secondary program:

- half (52%) indicated it was not likely that they would have completed their studies if they had never received a government student loan or grant (Table 5)

- when considering whether they would have completed their studies if they received only half their government student loan and grant, a third (36%) indicated it was not likely (half of their government loan and grant approximates the federal portion)Footnote 19

- half (49%) of borrowers felt concerned during their studies that they might not be able to complete their program due to financial reasons

| Likelihood of completing studies | Very likely or somewhat likely | Very likely | Somewhat likely | Not very likely | Not at all likely | Not very likely or not at all likely |

|---|---|---|---|---|---|---|

| Likelihood of completing studies if you had not received a government student loan or grant | 48% | 23% | 25% | 26% | 27% | 52% |

| Likelihood of completing studies if you had received half of your government student loan or grant | 64% | 27% | 36% | 24% | 12% | 36% |

| While a student, how concerned were you that you might not be able to complete your education due to financial reasons? | 49% | 20% | 29% | 30% | 21% | 51% |

Source: Post-study survey (2020).

The literature indicates that grants increase persistence in studies and graduation rates.

The international and Canadian empirical literature has broad evidence that grants increase persistence in studies and graduation rates. An average estimate would be an increase in year-to-year persistence, or graduation rates, by 1 percentage point for every additional $1,000 in grants.

Evidence is not conclusive as to whether additional loans influence completion or graduation rates. However very few studies have been able to examine this.

2.3.1 Adequacy of student financial aid

Most students thought their government student loans and grants were adequate to meet their financial needs during their studies, but some did not feel this way.

When taking into account all sources of money available to them, approximately three quarters (74%) of borrowers agreed that their government student loan and grant were adequate to meet their financial needs while studying (Table 6).

The quarter (26%) of borrowers who disagreed indicated that they would have needed an average of $10,000 more to meet their needs. Some focus group participants felt that it was an ongoing challenge to find ways to cover their living expenses during their studies.

| Considering all sources of money available | Strongly agree or agree | Strongly agree | Agree | Disagree | Strongly disagree | Disagree or strongly disagree |

|---|---|---|---|---|---|---|

| Government student loan and grant were adequate to meet financial needs while studying | 74% | 21% | 53% | 19% | 7% | 26% |

Sources: Post-study survey and new applicant survey (2020).

Half (52%) of borrowers made changes to their education and work plans because they did not receive enough government student loans and grants. Some students had expected that student loans and grants would cover more of their expenses.

- A third (32%) had to do more paid work during their studies than they planned

- Some reduced their course load for financial reasons (12%), took a semester off to work and save (9%) or changed their program of study for financial reasons (7%)

Many students had rent and food expenses that were above program allowances for these living expenses.

New program applicants reported paying on average $1,083 for monthly housingFootnote 20 (median of $925). Those without children indicated they spent an average of $957.Footnote 21

The program has a monthly allowance for housingFootnote 22 of up to $871 per month for single students living away from home. This is the amount used by the program to assess the financial need of students and determine the amount of their loan. In Ontario, this amount is $600.Footnote 23

Housing costs in university residences in Ottawa and Toronto significantly exceeds this amount. Housing costs in a university residence at the University of Ottawa starts at $951 per month. At the University of Toronto, it starts at $893 per month.Footnote 24

Some focus group participants also indicated that program allowances for rent did not take into account the high cost of living in Vancouver compared to other cities.

Students reported spending $446 per month for food (median of $375). Those without children indicated they spent an average of $383 per month on food.Footnote 14 The program had a monthly allowance of up to $310 per month for food for single students living away from home. In Ontario, this amount is $270.Footnote 25

In addition, the program had a local public transportation allowance of up to $108 per month for single students living away from home, $86 per month in Ontario. While these amounts appear to cover the price of student public transit passes in most citiesFootnote 26, amounts may not be sufficient to cover the cost of using a car.

Many students had unexpected financial challenges during their studies and some had expenses that were much higher than they anticipated.

Overall, over 40% of survey respondents indicated that they were concerned during their studies that they might not be able to complete their studies due to financial reasons (42% of new applicants and 49% of former borrowers who successfully graduated from their program).

Focus group participants reported that they had to take care of a number of additional and unexpected costs during their studies. The most commonly underestimated and/or unanticipated costs were mandatory course material and transportation costs.

Most students did not expect textbooks and other mandatory course materials to be as expensive. This information was not shared with them prior to or when they registered for their program. Parents also indicated that they had been surprised by the high cost of textbooks and other mandatory course materials.

Amounts of allowances for textbooks and school materials that are included in borrowers’ student loans needs assessment can vary by program of study and post-secondary institution.Footnote 27 However, this amount is not communicated to students in the student loan application process.

Many students indicated that they had underestimated the costs related to their transportation such as fuel, parking, and transit. This was due to either the distance between their home and their institution, inability to use public transit, costly parking at the institution, or because public transit was more costly than expected.

Some students indicated their basic living expenses such as groceries and rent were higher than they expected, or that their tuition was more expensive than they thought. Others had planned on working part-time during their studies but had to forego working because of the course load to more fully focus on their studies. Others also reported unexpected changes in personal circumstances such as job loss, need to support family financially, or the need to provide care for a family member that impacted their ability to cover the costs of their education.

Most students did paid work while studying to help cover their education and living expenses. For many, this had negative impacts on their grades.

Overall, 55% of borrowers worked during weeks when they also attended classes.Footnote 28 Their main reason for working was paying for their education and living expenses (87% of those who worked).

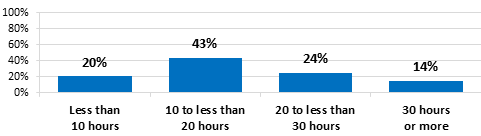

Among those who worked, 20% worked less than 10 hours a week, 43% worked 10 to 20 hours, and 38% worked more than 20 hours a week (Figure 6).

Figure 6 – Average weekly hours spent working while attending classes among those who worked

Sources: Post-study survey and new applicant survey (2020).

Figure 6 – Text version

| Average weekly hours spent working while attending classes among those who worked | Percentage |

|---|---|

| Less than 10 hours | 20% |

| 10 to less than 20 hours | 43% |

| 20 to less than 30 hours | 24% |

| 30 hours or more | 14% |

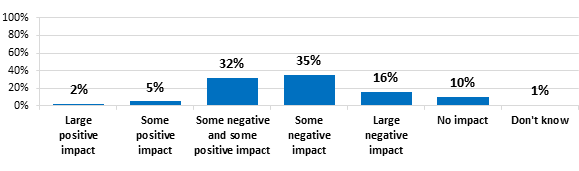

Half (51%) of those working reported negative impacts on their grades and academic performance (Figure 7). Only 7% reported positive impacts and a third (32%) reported some negative and some positive impacts. Negative impacts were more common among those who worked more hours.

Many focus group participants also reported negative impacts, indicating they were unable to devote sufficient time to their studies, their grades suffered, their stress level and their fatigue increased. Most indicated they would have worked less if they could afford to.

Sources: Post-study survey and new applicant survey (2020).

Figure 7 – Text version

| Average weekly hours spent working while attending classes among those who worked | Percentage |

|---|---|

| Large positive impact | 2% |

| Some positive impact | 5% |

| Some negative and some positive impact | 32% |

| Some negative impact | 35% |

| Large negative impact | 16% |

| No impact | 10% |

| Don’t know | 1% |

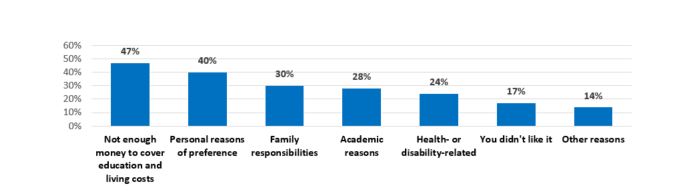

Many of those who dropped out of their program before completing did so for financial reasons, many would have continued their studies with a larger student loan.

About 17% of borrowers dropped out and had not completed their post-secondary program (2 years after their last student loan period).

The most common reason for dropping out of their program was not having enough money to cover education and living costs (47%) (Figure 8). Other reasons cited included personal reasons or preference, family responsibilities, academic reasons, health- or disability-related reasons, and not liking it.

Source: Post-study survey (2020).

Figure 8 – Text version

| Reasons for leaving school without completing their program | Percentage |

|---|---|

| Not enough money to cover education and living costs | 47% |

| Personal reasons of preference | 40% |

| Family responsibility | 30% |

| Academic reasons | 28% |

| Health-or-disability-related | 24% |

| You don’t like it | 17% |

| Other reasons | 14% |

Among the borrowers who left school without completing a credential, over half (58%) indicated they were likely to have stayed in school had they received a larger government student loan. While others (42%) indicated that it was not likely that they would have stayed in school had they been given a larger loan (Table 7).

| Likelihood of staying in school | Very likely or somewhat likely | Very likely | Somewhat likely | Not very likely | Not at all likely | Not very likely or not at all likely |

|---|---|---|---|---|---|---|

| If you had received a larger government student loan | 58% | 30% | 29% | 26% | 16% | 42% |

Source: Post-Study survey (2020).

Half (50%) of borrowers who left school without completing a credential said they had firm plans to return to post-secondary education within the next 2 years. The remaining half did not have plans to return.

Many different situations led borrowers to drop out of school because they did not have enough money to cover their education and living costs.

The most common reason mentioned was not earning enough from employment (68%), followed by unexpectedly higher living costs (64%), and unexpectedly higher education costs (56%) (Figure 9).Footnote 29

Others indicated the inability to borrow enough or to find a job, poor financial planning or unemployment of a family member were factors that had a negative impact on their ability to cover their education and living costs. Further research on the financial planning skills of students and ways to support them with this would be useful.

Source: Post-study survey (2020).

Figure 9 – Text version

| Factors that impacted their ability to cover education and living costs among those who dropped out before completing | Percentage |

|---|---|

| Not earning enough from employment | 68% |

| Unexpectedly higher living costs | 64% |

| Unexpectedly higher education costs | 56% |

| Inability to borrow enough | 30% |

| Inability to find part-time work during the school year | 27% |

| Poor financial planning | 27% |

| Inability to find work during the summer | 20% |

| Unemployment or reduced income of family | 23% |

| Other factors | 13% |

2.4 Impact of the Canada Student Loans Program for different groups

Students from some groups were more likely to indicate that they would not have attended the same program or pursued post-secondary studies, without the federal portion of their student loans and grants

The groups that most often indicated they would not have attended the same program or pursued any post-secondary studies if they had received only half of their student loans and grants were (Figure 10):

- single parents (57% would not have attended the same program and 31% would not have pursued any post-secondary studies)

- marriedFootnote 30 students with children

- older students (30 years old and over)

- students with a disability

- Indigenous students

Source: Post-study survey and new applicant survey (2020).

Note: Average represents the average among all recipients.

Figure 10 – Text version

| Proportion (%) unlikely to attend same program or any post-secondary program with only half of their student loans and grants | Unlikely to attend same program | Would not have pursued post post-secondary studies |

|---|---|---|

| Average | 38% | 13% |

| Single parent | 57% | 31% |

| Married parent | 54% | 26% |

| Married without child | 42% | 18% |

| 30 years old and above | 57% | 31% |

| Disability | 50% | 22% |

| Indigenous people | 48% | 23% |

| Recent immigrants | 44% | 14% |

| Women | 40% | 14% |

Married students without children, students who were recent immigrants (less than 10 years) and women also indicated this more often than average.Footnote 31

This outlines the vulnerability of all these groups, but also the importance of the Canada Student Loans Program for these groups, to accomplish their plans to pursue post-secondary studies.

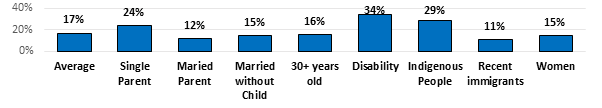

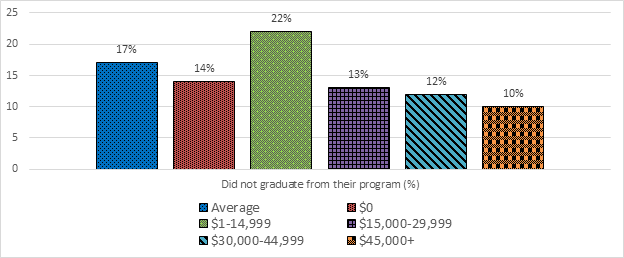

Students from some groups were more likely not to have graduated from their program (2 years after their last student loan period).

Single parents, students with a disability and Indigenous students were the groups that were most likely to not have graduated from their program (2 years after their last student loan period). A quarter to a third of students from these groups had not graduated from their program, while the overall average is 17% (Figure 11).Footnote 32 This is another indication of the vulnerability of these groups.

Source: Post-study survey (2020).

Figure 11 – Text version

| Proportion that did not graduate from their program (2 years after their last student loan period | Percentage |

|---|---|

| Average | 17% |

| Single parent | 24% |

| Married parent | 12% |

| Married without child | 15% |

| 30 years old and above | 16% |

| Disability | 34% |

| Indigenous people | 29% |

| Recent immigrants | 11% |

| Women | 15% |

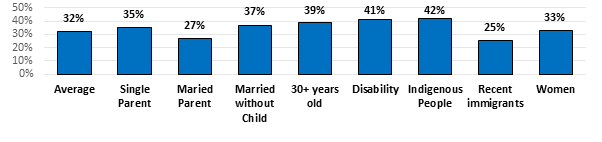

These groups were also more likely to indicate that their government student loans and grants were inadequate to meet their financial needs while studying.

About 35 to 40% of single parents, students with a disability and Indigenous students indicated that the student loans and grants they received were inadequate to meet their financial needs (Figure 12). Close to 40% of older students (30 years old and above) and of married students without children indicated this.

Source: Post-study survey (2020).

Figure 12 – Text version

| Proportion that indicated their student loans and grants were inadequate to meet their financial needs | Percentage |

|---|---|

| Average | 32% |

| Single parent | 35% |

| Married parent | 27% |

| Married without child | 37% |

| 30 years old and above | 39% |

| Disability | 41% |

| Indigenous people | 42% |

| Recent immigrants | 25% |

| Women | 33% |

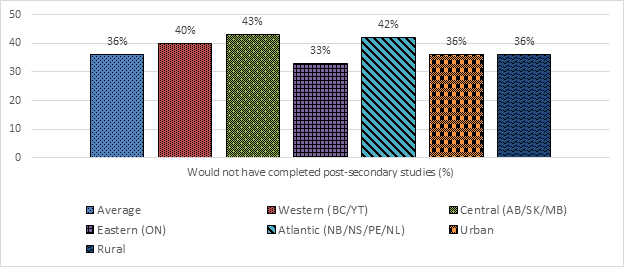

Students from these same groups were more likely to indicate that they would have not graduated if they had not received the federal portion of their student loans and grants.

Among those who graduated, students with children (single or not), married students without children, students with a disability, Indigenous students and older students were all more likely to indicate that they would not have graduated if they received only half of their student loans and grants (Figure 13). About 40% to 55% of these groups indicated this, outlining the importance of the federal portion of student loans and grants for these students.Footnote 33

Source: Post-study survey (2020).

Figure 13 – Text version

| Proportion (%) unlikely to have completed their post-secondary studies if they received half of their student loans and grants | Not likely to complete studies with only half of student loan and grant | Not likely to complete studies with no student loan and grant |

|---|---|---|

| Average | 36% | 52% |

| Single parent | 56% | 77% |

| Married parent | 49% | 68% |

| Married without child | 41% | 59% |

| 30 years old and above | 56% | 72% |

| Disability | 53% | 63% |

| Indigenous people | 49% | 57% |

| Recent immigrants | 38% | 56% |

| Women | 38% | 56% |

Note that some students qualify for very limited amounts of student loans and grants. Loans and grants should therefore have more limited impacts for these individuals. For example, survey results indicate that 12% of program recipients received less than $5,000 in student loans and grants overall.

Conclusion and recommendations

Evaluation results outlined the importance of the Program, and student loans and grants in general, to facilitate access to post-secondary education, and to help students persist during their studies and graduate. Many students indicated they would not have attended post-secondary education or graduated without the federal portion of their student loans and grants.

Students from some groups were more likely to indicate that they would not have attended the same program, not pursued any post-secondary studies or not graduated, without the federal portion of their student loans and grants. These groups included single parents, students with disabilities, Indigenous students and older students (30 years old and above). This highlights the importance of the federal portion of student loans and grants for these groups.

Even though most (74%) students indicated their loans and grants were adequate to meet their financial needs, the evaluation also found that many students had expenses for rent and food that were above the figures used by the program in their needs assessment calculation (determining the student loan amount a student would receive).

In addition, many focus group participants indicated that they had to face some unanticipated and underestimated costs during their studies. The most common one was the higher than expected cost of mandatory school supplies.

Overall, over 40% of survey respondents indicated that they were concerned during their studies that they might not be able to complete their studies due to financial reasons.

Finally, many borrowers had limited understanding of how their student loans and grants were determined and of the different features of the program.

Given this, the evaluation recommends to:

- examine student financial need with a view to identify funding gaps faced by students

- further enhance awareness and understanding of the program among Canada Student Grant and Loan recipients

Annex A: Evaluation questions

- What impact do student loans and grants have on access to post-secondary education?

- How do outcomes differ by the following groups?

- gender, age, parental income

- family status (such as married, parent)

- recent immigrant status

- disability status

- region or Census Metropolitan Area

- How do outcomes differ by the following groups?

- What impact do student loans and grants have on the likelihood of a student completing their post-secondary education?

- Do graduation outcomes differ by the following groups?

- gender, age, parental income

- family status (such as married, parent)

- recent immigrant status

- disability status

- region or Census Metropolitan Area

- field of study or student loan debt levels *

- How do individual circumstances differ between program recipients and non-recipients during their studies in terms of having to work, having enough time for studying, etc.?

- Do graduation outcomes differ by the following groups?

*The evaluation was not able to examine this last sub-question given challenges to 2 lines of evidence experienced during the COVID-19 pandemic (Data analysis and Focus groups with students in the last year of their program). See Annex B for more details on these lines of evidence and challenges faced in the context of COVID-19.

Annex B: Lines of evidence

Description

Literature review

A review of the literature on the impact of student loans and grants on access to post-secondary education, persistence in studies and graduation. The review covers over 100 studies. No challenges due to the COVID-19 pandemic.

Focus groups with new program participants and their parents

Eight focus groups on access to post-secondary education were conducted in Winnipeg (4), Ottawa (2) and Fredericton (2) in February 2020 with 54 participants (29 students and 25 parents of students).

New program participants and parents of program participants were assigned to different focus groups, as were low-income and middle-income participants. The participants discussed their experience in deciding to enroll for post-secondary education and how student loans and grants helped them.

No challenges due to the COVID-19 pandemic as these focus groups took place before the onset of the pandemic in Canada.

Survey of new applicants

A survey of 4,800 new program applicants at the end of their first year. The survey examined program awareness, study choices, the financial situation of program recipients, their financial concerns, their need for the program and what they would have done if they did not receive student loans and grants. The response rate was 32%.

There were challenges due to the COVID-19 pandemic. The survey took place between July and October 2020 (during the pandemic). Participation to the survey and responses to some of the survey questions may have been affected by students’ experience during the pandemic. In order to mitigate the effect of the pandemic on survey responses, respondents were asked to answer questions thinking of their situation before the pandemic.

Post-study survey

A survey with 3,400 former program participants (surveyed 2 years after their last student loan or grant year in 2017 to 2018). The survey examined program awareness, the financial situation of program recipients, program completion, their need for the program and what they would have done if they did not receive student loans and grants, and repayment. The response rate was 23%.

There were challenges due to the COVID-19 pandemic. The survey took place between July and October 2020 (during the pandemic). Participation to the survey and responses to some of the survey questions may have been affected by students’ experience during the pandemic. In order to mitigate the effect of the pandemic on survey responses, respondents were asked to answer questions thinking of their situation before the pandemic.

Focus groups with borrowers in the last year of their program

Eight online focus groups with borrowers in the last year of their program with 56 participants in total. Separate focus groups were conducted with low-income and middle-income participants, in British Colombia and Ontario. The participants discussed their experience in post-secondary education, with a specific emphasis on their financial situation, and how student loans and grants helped them.

There were challenges due to the COVID-19 pandemic. The recruitment of participants was initially planned to take place in-person on-campus in March 2020. The recruitment had to stop because of the COVID-19 situation. Focus groups were postponed to the Fall. Recruitment resumed in the Fall but was conducted over the phone (for program participants) and using Facebook (to recruit student not participating in the program). The Facebook recruitment didn’t work, so focus groups with students not participating in the program could not be conducted. Focus groups with program participants took place online in October and November 2020 (during the pandemic). Participation in the focus groups and responses to some of the questions may have been affected by students’ experience during the pandemic.

Administrative data analysis

The analysis was planned to compare borrowers and non-borrower students, to compare their work income and examine the contribution of the program to graduation outcomes of student loan recipients. The study planned to use a new linked education database including program administrative data, the T1 Family File (T1FF) and data from the Post-Secondary Education Information System (PSIS).

There were challenges due to the COVID-19 pandemic. This line of evidence was not done due to the temporary closure of Statistics Canada data centers during the pandemic.

Annex C – Methodological challenges in measuring the impact of student loans and grants

The empirical literature has only examined changes in student loan and grant programs such as enhancements to programs, estimating the impact of this variation, or has examined the impact for the marginal student aid recipients such as those who barely qualified for a student loan or grant, which are not necessarily representative of student financial assistance recipients. The empirical literature did not examine impacts of whole student financial assistance programs, such as the Canada Student Loans Program. By showing the positive effects of enhancements to student loan and grant programs, the literature has been able to infer that student financial assistance programs as a whole have a positive impact on access to post-secondary education.

Methodologically, it is difficult to empirically measure the impact of whole student loan and grant programs like the Canada Student Loans Program, given the difficulty in finding an appropriate control group.

Alternative ways of exploring the impact of these programs is surveying students and asking about their self-assessment of the impact of the program on their own study path. Self-assessments are much less reliable indicators of program impacts, but offer some additional insights on this topic.

Annex D – Supplementary figures

Source: Post-study survey and new applicant survey (2020).

Figure A1 – Text version

| Proportion (%) Unlikely to Attend the Same Program or any Post-secondary Program with only Half of their Student Loans and Grants | Unlikely to attend same program (%) | Would not have pursued post-secondary studies (%) |

|---|---|---|

| Average | 38% | 13% |

| Western (BC/YT) | 40% | 12% |

| Central (AB/SK/MB) | 40% | 16% |

| Eastern (ON) | 37% | 12% |

| Atlantic (NB/NS/PE/NL) | 41% | 14% |

| Urban | 38% | 13% |

| Rural | 35% | 12% |

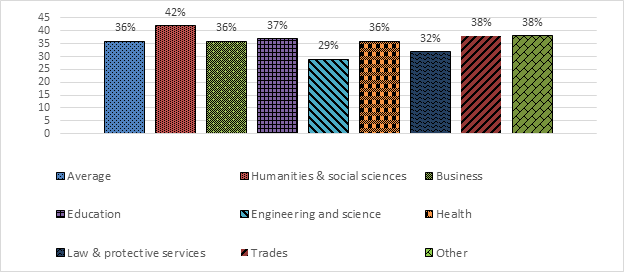

Proportion of program participants that did not complete their program by region, by field of study and by student debt level

Source: Post-study survey (2020).

Figure A2 –Text version

| Proportion (%) that did not complete their program by region | Percentage |

|---|---|

| Average | 17% |

| Western (BC/YT) | 13% |

| Central (AB/SK/MB) | 18% |

| Eastern (ON) | 17% |

| Atlantic (NB/NS/PE/NL) | 18% |

| Urban | 17% |

| Rural | 17% |

Source: Post-study survey (2020).

Figure A3 – Text version

| Proportion (%) that did not complete their program by field of study | Percentage |

|---|---|

| Average | 17% |

| Humanities and social sciences | 22% |

| Business | 18% |

| Education | 14% |

| Engineering and science | 16% |

| Health | 11% |

| Law and protective services | 11% |

| Trades | 17% |

| Other | 19% |

Source: Post-study survey (2020).

Figure A4 – Text version

| Proportion (%) that did not complete their program by student debt level when left school | Percentage |

|---|---|

| Average | 17% |

| $0 | 14% |

| $1 to 14,999 | 22% |

| $15,000 to 29,999 | 13% |

| $30,000 to 44,999 | 12% |

| $45,000 and above | 10% |

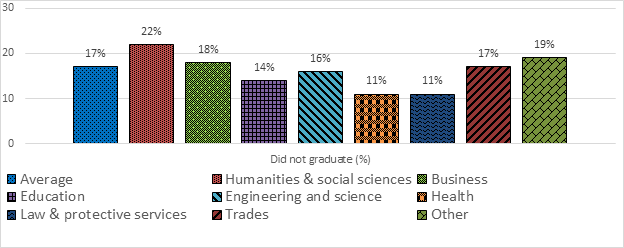

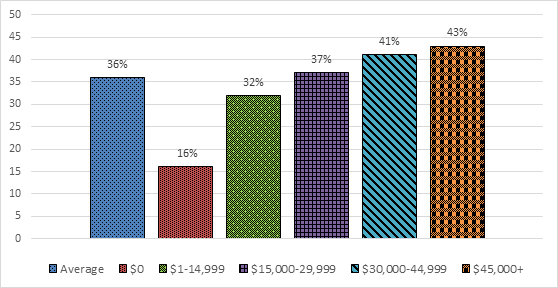

Proportion that indicated they would not have completed their studies with only half of their student loans and grants: by region, by field of study and by student debt level

Source: Post-study survey (2020).

Figure A5 – Text version

| Proportion (%) that indicated they would likely not have completed their studies with only half of their student loans and grants | Percentage |

|---|---|

| Average | 36% |

| Western (BC/YT) | 40% |

| Central (AB/SK/MB) | 43% |

| Eastern (ON) | 33% |

| Atlantic (NB/NS/PE/NL) | 42% |

| Urban | 36% |

| Rural | 36% |

Source: Post-study survey (2020).

Figure A6 – Text version

| Proportion (%) that indicated they would likely not have completed their studies with only half of their student loans and grants by field of study | Percentage |

|---|---|

| Average | 36% |

| Humanities and social sciences | 42% |

| Business | 36% |

| Education | 37% |

| Engineering and science | 29% |

| Health | 36% |

| Law and protective services | 32% |

| Trades | 38% |

| Other | 38% |

Source: Post-study survey (2020).

Figure A7 – Text version

| Proportion (%) that indicated they would likely not have completed their studies with only half of their student loans and grants by student debt level when they left school | Percentage |

|---|---|

| Average | 36% |

| $0 | 16% |

| $1 to 14,999 | 32% |

| $15,000 to 29,999 | 37% |

| $30,000 to 44,999 | 41% |

| $45,000 and above | 43% |

Bibliography

Brown, Mark. (2018). “The cost of a Canadian university education in six charts”, Maclean’s. Retrieved from https://www.macleans.ca/education/the-cost-of-a-canadian-university-education-in-six-charts/

CCI Research. (2020a). “Survey of New Applicants for the Evaluation of the Canada Student Loans Program”.

CCI Research. (2020b). “Post-study Survey for the Evaluation of the Canada Student Loans Program”.

ESDC. (2020a). “Literature Review on the Impact of Student Financial Aid on Access to Post-Secondary Education and Persistence”.

ESDC. (2020b). “Employment and Social Development Canada 2020 to 2021 Departmental Plan”. Retrieved from https://www.canada.ca/en/employment-social-development/corporate/reports/departmental-plan/2020-2021.html

ESDC. (2020c). “Employment and Social Development Canada Departmental Results Report 2019 to 2020”. Retrieved from https://www.tbs-sct.gc.ca/ems-sgd/edb-bdd/index-eng.html#orgs/gov/gov/infograph/results/.-.-(panel_key.-.-'gov_drr)

ESDC. (2021). “2018 to 2019 Canada Student Loans Program Statistical Review”. Retrieved from https://www.canada.ca/en/employment-social-development/programs/canada-student-loans-grants/reports/cslp-statistical-2018-2019.html

Government of Canada. (2020). “Applications to date - Canada Emergency Student Benefit”. Retrieved from https://open.canada.ca/data/en/dataset/dd09b357-79b1-444b-8503-37b7eb244a1e#wb-auto-6

Prairie Research Associates (PRA). (2020). “Focus Groups on Access for the Evaluation of the Canada Student Loans Program”.

Prairie Research Associates (PRA). (2021). “Focus Groups on Persistence in Studies for the Evaluation of the Canada Student Loans Program”.

Statistics Canada. (2020). “Education Indicators in Canada: An International Perspective 2020”. Retrieved from https://www150.statcan.gc.ca/n1/pub/81-604-x/2020001/intro-eng.htm