EI Monitoring and Assessment Report 2012 III. EI Fishing Benefits

Notice: Refer to the Table of contents to navigate through the EI Monitoring and Assessment Report .

EI fishing benefits are paid to self-employed fishers. These benefits provide income support to individuals who live in rural communities that rely on the fishing industry. There are two separate benefit periods for fishing benefits: a winter qualifying period, for which a benefit period can be established starting in April, and a summer qualifying period, for which a benefit period can be established starting in October.

Fishing claims represent a significant part of the economy in many coastal communities. Fishing benefits are administered either directly or indirectly by three federal organizations: Human Resources and Skills Development Canada (HRSDC)/Service Canada, Fisheries and Oceans Canada (DFO), and the Canada Revenue Agency (CRA). DFO grants fishing licences; CRA determines who is eligible as a self-employed fisher; and HRSDC/Service Canada determine eligibility for and pay EI fishing benefits, which are based on insurable earnings rather than insurable hours.

1. EI Fishing Benefits, Claims and Benefit Payments

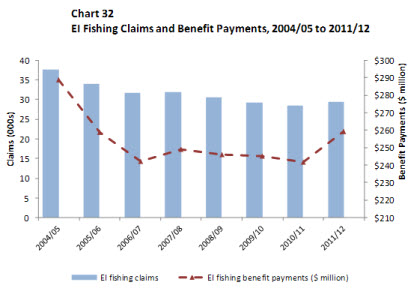

Fishing claims comprise a small proportion of total EI claims but represent a significant part of the economy in communities that rely on the fishing industry. In 2011/12, the number of new fishing claims increased by 3.4%, to 29,506 new claims (see Chart 32). Previously, there had been a downward trend in the number of new fishing claims between 2004/05 and 2010/11.

Table equivalent of Chart 32

| Year | EI fishing claims (000s) | Total fishing benefit payments ($ million) |

|---|---|---|

| 2004/05 | 37.6 | $288.7 |

| 2005/06 | 33.9 | $259.1 |

| 2006/07 | 31.1 | $242.1 |

| 2007/08 | 31.9 | $248.9 |

| 2008/09 | 30.5 | $246.2 |

| 2009/10 | 29.3 | $245.1 |

| 2010/11 | 28.5 | $241.7 |

| 2011/12 | 29.5 | $259.2 |

In 2011/12, EI fishing benefit payments comprised 1.7% of total EI benefit payments, which was 0.3 percentage points higher than in the previous year. For the majority of self-employed fishers who reside in fishing-dominated communities, EI benefits are an important part of their annual income. A total of $259.2 million in EI fishing benefit payments were paid in 2011/12, a 7.2% increase from 2010/11.

1.1 EI Fishing Benefit Claims, by Province and Territory

The Atlantic provinces accounted for 80.7% of all fishing claims established in 2011/12. Within the region, the number of new fishing claims increased in three out of four provinces, led by an increase of 10.2% in Newfoundland and Labrador. The only exception was Prince Edward Island, where the number of new fishing claims decreased by 1.6%. Quebec also showed a slight increase of 1.4% in fishing claims in 2011/12, while fishing claims in Manitoba and British Columbia decreased by 13.2% and 4.6%, respectively

Fishing claims in Newfoundland and Labrador represented 42.2% of all EI fishing claims in 2011/12, increasing from 39.6% in 2010/11. Despite the recent increase in the number of claims, fishing claims in Newfoundland and Labrador have dropped significantly (-29.9%) since their peak in 2004/05.

Fishing claims in British Columbia accounted for 10.6% of the national total, compared with 11.5% in the previous year. Despite the recent increase in the number of claims, fishing claims in this province have dropped significantly (-28.6%) since their peak in 2003/04.

Among major fishing provinces, EI fishing benefit payments decreased in Manitoba (-14.3%), British Columbia (-4.2%), and Prince Edward Island (-0.2%), while they increased in Newfoundland and Labrador (+14.3%), New Brunswick (+11.3%) and Nova Scotia (+6.3%).

1.2 EI Fishing Benefit Claims, by Gender and Age

In 2011/12, the number of fishing claims established by men increased by 2.6% (+626), while those established by women increased by 7.1% (+347). Men made 82.3% of EI fishing claims, a figure 0.6 percentage points lower than that in the previous year.

Core-aged fishers (those aged 25 to 54), who accounted for 64.1% of all new fishing claims, established 1.4% (+261) more fishing claims in 2011/12 than in the previous year. The number of new fishing claims registered by youth (aged 15 to 24) increased significantly by 11.7% (+143) in 2011/12; consequently, their share of all EI fishing claims increased by 0.3 percentage points to 4.6%.

Older workers (aged 55 and older) also made more fishing claims, filing 6.6% (+569) more claims than they did in 2010/11. Their share of fishing claims has increased consistently over the past several years, from 28.6% in 2008/09 to 31.2% in 2011/12.

1.3 EI Fishing Benefit Claims, by EI History

As detailed in previous sections (see Section II.1.4), the EI Regulations have been modified to define three EI claimant categories which will be used to determine claimants’ responsibilities, in terms of undertaking a reasonable job search for suitable employment. These new categories and definitions apply to claimants receiving EI fishing benefits.

The analysis of new EI fishing claims in this chapter is based on the new EI claimant categories. The number of EI fishing claims using the new EI claimant categories is only an estimate for 2011/12, as the applicable sections of the EI Regulations were not in force during the 2011/12 fiscal year. However, the number of EI fishing claims will be examined according to the new EI claimant categories to support future analysis of the Connecting Canadians with Available Jobs initiative.

In 2011/12, the number of fishing claims increased in all EI claimant categories, with long-tenured workers Footnote 84 witnessing a 13.7% increase, frequent claimants Footnote 85 witnessing a 3.2% increase and occasional claimants Footnote 86 witnessing a 5.0% increase.

Frequent claimants established the vast majority of fishing claims (89.0%) in 2011/12. The share of new fishing claims from long-tenured workers and occasional claimants were 0.5% and 10.4%, respectively.

2. Eligibility for EI Fishing Benefits

To qualify for fishing benefits, fishers need to earn between $2,500 and $4,200 from self-employment in fishing (depending on the regional unemployment rate) Footnote 87 in the 31-week period before they file their claim.

However, if an individual has just started working as a self-employed fisher, or is returning to fishing after an absence of a year or more preceding the qualifying period, he or she must earn $5,500 in insurable earnings to qualify for fishing benefits instead.

An exception to this rule is, if an individual has received one week or more of maternity or parental benefits in the 208 weeks preceding the labour force attachment period, Footnote 88 the claimant will need to earn between $2,500 and $4,200 as a self-employed fisher to qualify for fishing benefits instead.

Historically, over 90% of all fishers who claim fishing benefits have qualified with earnings above $5,500, which is the maximum eligibility requirement for fishers. In 2011/12, this figure was 98.5%, which is consistent with the figures recorded in the last four years.

3. Accessibility to EI Fishing Benefits

Among the 29,506 new fishing claims in 2011/12, there were 11,028 fishing claims established based on the winter qualifying period, a 7.3% increase over the previous year. The number of claims established based on the summer qualifying period also increased (+0.8%), to 18,478 claims.

There were 20,892 fishers who made fishing claims in 2011/12, an increase of 0.7% from 2010/11. The difference between the number of fishing claims and the number of fishers making these claims can be attributed to the fact that some fishers are active in both fishing seasons and are eligible to claim fishing benefits twice a year.

Among the major fish-producing provinces, there were declines in the number of fishers claiming benefits in British Columbia (-4.1%) and Prince Edward Island (-2.0%), while Quebec (-0.9%) registered a minor decrease. On the other hand, Newfoundland and Labrador (+3.9%), Nova Scotia (+1.8%) and New Brunswick (+1.8%) experienced increases in the number of fishers claiming benefits.

In 2011/12, a total of 8,612 (41.2%) fishers who established a claim made multiple fishing claims, while 12,280 (58.8%) fishers made one fishing claim. The number of claims made by multiple fishing claimants (17,266) accounted for over half of all fishing claims. The number of fishers who made a single claim declined by 3.8%, while the number of fishers who made multiple claims increased by 3.8%.

The Atlantic provinces represented about 90% of all fishers who made multiple fishing claims. Of these provinces, Newfoundland and Labrador (+24.6%), and New Brunswick (+3.4%) showed increases in the number of fishers who made multiple claims, while Nova Scotia (-0.7%) and Prince Edward Island (-1.1%) saw declines. Fishers in Prince Edward Island and Newfoundland and Labrador were the most likely to be active in both seasons, as 53.7% and 53.3% of claimants in these provinces, respectively, established multiple fishing claims in 2011/12.

4. Level of EI Fishing Benefits

The average weekly fishing benefit increased by 3.8%, from $423 in 2010/11 to $439 in 2011/12. With this increase, the average weekly benefit for fishing claimants was $56 higher than that for regular claimants ($384). Moreover, the average weekly benefit for fishers remained close to the maximum weekly benefit of $468 in 2011.

The proportion of fishing claimants who received the maximum weekly benefit increased from 72.7% in 2010/11 to 78.1% in 2011/12.

5. Duration of EI Fishing Benefits

In 2011/12, the average duration of all fishing claims was 21.3 weeks, a slight increase from 21.0 weeks in 2010/11. Women claimed 2.5 weeks more than men did (23.4 weeks compared with 20.9 weeks).

Fishers in British Columbia, who tend to have only one fishing season, had the longest average benefit duration, at 23.6 weeks. Benefit durations in the Atlantic provinces varied slightly between 20.4 and 21.7 weeks.

Fishers who established one claim in 2011/12 received an average of 24.5 weeks, while fishers who established two claims received an average of 20.3 weeks on their first claim and 17.8 weeks on their second claim, for an average total of 38.1 weeks of benefits.