Chapter 3: Impact and effectiveness of Employment Benefits and support to workers and employers (Part II of the Employment Insurance Act)

Official Title: Employment Insurance Monitoring and Assessment Report for the fiscal year beginning April 1, 2023 and ending March 31, 2024 – Chapter 3: Impact and effectiveness of Employment Benefits and Support Measures to workers and employers (Part II of the Employment Insurance Act)

On this page

List of abbreviations

This is the complete list of abbreviations for the Employment Insurance Monitoring and Assessment Report for the fiscal year beginning April 1, 2023 and ending March 31, 2024.

- B/C

- Benefits-to-Contributions

- B/U

- Beneficiary-to-Unemployed (rate)

- B/UC

- Beneficiary-to-Unemployed Contributor (rate)

- CAWS

- Client Access Work Station

- CCB

- Compassionate Care Benefits

- CCDA

- Canadian Council of Directors of Apprenticeship

- CCIS

- Corporate Client Information Service

- CEEDD

- Canadian Employer-Employee Dynamics Database

- CEGEP

- College of General and Professional Teaching

- CEIC

- Canada Employment Insurance Commission

- CEIFB

- Canada Employment Insurance Financing Board

- CERB

- Canada Emergency Response Benefit

- CF

- Canadian Forces

- CFP

- Call for Proposals

- CPI

- Consumer Price Index

- CPP

- Canada Pension Plan

- CRA

- Canada Revenue Agency

- CRF

- Consolidated Revenue Fund

- EAS

- Employment Assistance Services

- EBSM

- Employment Benefits and Support Measures

- EDI

- Equity, Diversity and Inclusion

- EI

- Employment Insurance

- EI-ERB

- Employment Insurance Emergency Response Benefit

- EIACC

- Employment Insurance Appeals Consultative Committee

- EICS

- Employment Insurance Coverage Survey

- eROE

- Electronic Record of Employment

- ESDC

- Employment and Social Development Canada

- FS

- Family Supplement

- G7

- Group of Seven

- GC

- Government of Canada

- GDP

- Gross Domestic Product

- HR

- Human Resources

- IC

- Individual Counselling

- ID

- Identification

- IMP

- International Mobility Program

- ISET

- Indigenous Skills and Employment Training

- JCP

- Job Creation Partnership

- LFS

- Labour Force Survey

- LMDA

- Labour Market Development Agreements

- LMI

- Labour Market Information

- LMP

- Labour Market Partnerships

- LTU

- Long-Term Unemployed

- MSCA

- My Service Canada Account

- MIE

- Maximum Insurable Earnings

- NERE

- New Entrant and Re-Entrant

- NESI

- National Essential Skills Initiative

- NHQ

- National Headquarters

- NOC

- National Occupation Classification

- OAS

- Old Age Security

- OASIS

- Occupational and Skills Information System

- p.p.

- Percentage point

- PCIC

- Parents of Critically Ill Children

- PCS

- Post Call Survey

- PPE

- Premium Paid Eligible

- PRP

- Premium Reduction Program

- PTs

- Provinces and Territories

- QPIP

- Quebec Parental Insurance Plan

- RAIS

- Registered Apprenticeship Information System

- R&I

- Research and Innovation

- ROE

- Record of Employment

- SAT

- Secure Automated Transfer

- SCT

- Skills and Competency Taxonomy

- SD

- Skills Development

- SD-A

- Skills Development - Apprentices

- SD-R

- Skills Development - Regular

- SE

- Self-Employment

- SEAQ

- Service, Excellence, Accuracy and Quality

- SEPH

- Survey of Employment, Payrolls and Hours

- SFS

- Skills for Success

- SIN

- Social Insurance Number

- SIP

- Sectoral Initiatives Program

- SME

- Small and medium-sized enterprise

- SST

- Social Security Tribunal

- STVC

- Status Vector

- SUB

- Supplemental Unemployment Benefit

- SWSP

- Sectoral Workforce Solutions Program

- TES

- Targeted Earning Supplements

- TR

- Temporary Resident

- TRF

- Targeting, Referral and Feedback

- TFWP

- Temporary Foreign Worker Program

- TWS

- Targeted Wage Subsidies

- UV

- Unemployment-to-job-vacancy

- VBW

- Variable Best Weeks

- VER

- Variable Entrance Requirement

- WISE

- Work Integration Social Enterprises

- WWC

- Working While on Claim

List of figures

- Chart 3.1.2.1 – Canada, 2014-15 to 2023-24, key performance indicators

- Chart 3.1.2.2 – Canada, 2023-24, total EBSM expenditures, by service type

- Chart 3.1.3.1 – Canada, 2023-24, Labour Market Development Agreements at-a-glance, by service type

- Chart 3.1.4.1 – Canada, 2014-15 to 2023-24, clients served, by client type

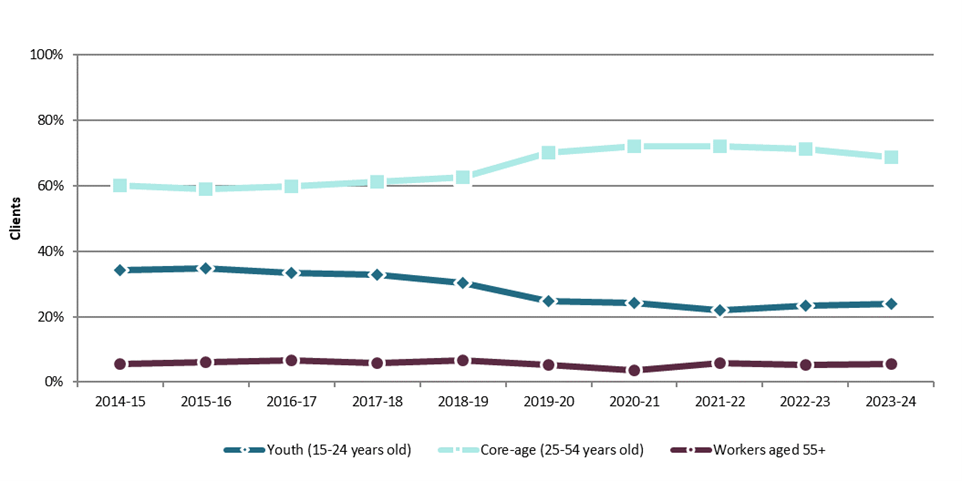

- Chart 3.1.4.2 – Canada, 2014-15 to 2023-24, clients served, by client age

- Chart 3.2.1.1 – Newfoundland and Labrador, 2014-15 to 2023-24, relative client share, by client age

- Chart 3.2.1.2 – Newfoundland and Labrador, 2014-15 to 2023-24, clients served, by client type

- Chart 3.2.1.3 – Newfoundland and Labrador, 2014-15 to 2023-24, key performance indicators

- Chart 3.2.2.1 – Prince Edward Island, 2014-15 to 2023-24, relative client share, by client age

- Chart 3.2.2.2 – Prince Edward Island, 2014-15 to 2023-24, clients served, by client type

- Chart 3.2.2.3 – Prince Edward Island, 2014-15 to 2023-24, key performance indicators

- Chart 3.2.3.1 – Nova Scotia, 2014-15 to 2023-24, relative client share, by client age

- Chart 3.2.3.2 – Nova Scotia, 2014-15 to 2023-24, clients served, by client type

- Chart 3.2.3.3 – Nova Scotia, 2014-15 to 2023-24, key performance indicators

- Chart 3.2.4.1 – New Brunswick, 2014-15 to 2023-24, relative client share, by client age

- Chart 3.2.4.2 – New Brunswick, 2014-15 to 2023-24, clients served, by client type

- Chart 3.2.4.3 – New Brunswick, 2014-15 to 2023-24, key performance indicators

- Chart 3.2.5.1 – Quebec, 2014-15 to 2023-24, relative client share, by client age

- Chart 3.2.5.2 – Quebec, 2014-15 to 2023-24, clients served, by client type

- Chart 3.2.5.3 – Quebec, 2014-15 to 2023-24, key performance indicators

- Chart 3.2.6.1 – Ontario, 2014-15 to 2023-24, relative client share, by client age

- Chart 3.2.6.2 – Ontario, 2014-15 to 2023-24, clients served, by client type

- Chart 3.2.6.3 – Ontario, 2014-15 to 2023-24, key performance indicators

- Chart 3.2.7.1 – Manitoba, 2014-15 to 2023-24, relative client share, by client age

- Chart 3.2.7.2 – Manitoba, 2014-15 to 2023-24, clients served, by client type

- Chart 3.2.7.3 – Manitoba, 2014-15 to 2023-24, key performance indicators

- Chart 3.2.8.1 – Saskatchewan, 2014-15 to 2023-24, relative client share, by client age

- Chart 3.2.8.2 – Saskatchewan, 2014-15 to 2023-24, clients served, by client type

- Chart 3.2.8.3 – Saskatchewan, 2014-15 to 2023-24, key performance indicators

- Chart 3.2.9.1 – Alberta, 2014-15 to 2023-24, relative client share, by client age

- Chart 3.2.9.2 – Alberta, 2014-15 to 2023-24, clients served, by client type

- Chart 3.2.9.3 – Alberta, 2014-15 to 2023-24, key performance indicators

- Chart 3.2.10.1 – British Columbia, 2014-15 to 2023-24, relative client share, by client age

- Chart 3.2.10.2 – British Columbia, 2014-15 to 2023-24, clients served, by client type

- Chart 3.2.10.3 – British Columbia, 2014-15 to 2023-24, key performance indicators

- Chart 3.2.11.1 – Yukon, 2014-15 to 2023-24, relative client share, by client age

- Chart 3.2.11.2 – Yukon, 2014-15 to 2023-24, clients served, by client type

- Chart 3.2.11.3 – Yukon, 2014-15 to 2023-24, key performance indicators

- Chart 3.2.12.1 – Northwest Territories, 2014-15 to 2023-24, relative client share, by client age

- Chart 3.2.12.2 – Northwest Territories, 2014-15 to 2023-24, clients served, by client type

- Chart 3.2.12.3 – Northwest Territories, 2014-15 to 2023-24, key performance indicators

- Chart 3.2.13.1 – Nunavut, 2014-15 to 2023-24, relative client share, by client age

- Chart 3.2.13.2 – Nunavut, 2014-15 to 2023-24, clients served, by client type

- Chart 3.2.13.3 – Nunavut, 2014-15 to 2023-24, key performance indicators

- Chart 3.4 – Canada, 2023-24, EI Part II program expenditures for the Pan-Canadian activities, by program

- Chart 3.4.1.1 – Canada, 2023-24, clients served by the Indigenous Skills and Employment Training program and performance indicator

List of tables

- Table 3.1.2.1 – Canada, 2022-23 and 2023-24, year-over-year change in services delivered, by service type

- Table 3.1.2.2 – Canada, 2023-24, final EBSM expenditures, by province or territory

- Table 3.1.3.1 – Canada, 2023-24, services delivered, by service type

- Table 3.1.3.2 – Canada, 2023-24, Employment Benefits key facts, by service type

- Table 3.1.3.3 – Canada, 2023-24, Support Measures key facts, by service type

- Table 3.1.3.4 – Canada, 2023-24, supplemental indicators, by province or territory

- Table 3.1.4.1 – Canada, 2022-23 and 2023-24, year-over-year change in client volumes, by client type

- Table 3.1.4.2 – Canada, 2023-24, clients served and relative share, by client type

- Table 3.1.4.3 – Canada, 2023-24, clients served, by client age

- Table 3.1.4.4 – Canada, 2023-24, relative client share, by client age

- Table 3.1.4.5 – Canada, 2022-23 and 2023-24, year-over-year change in clients served, by client age

- Table 3.1.4.6 – Canada, 2022-23 and 2023-24, year-over-year change in total services provided, by client's designated group

- Table 3.1.4.7 – Canada, 2023-24, service delivered, by client's designated group

- Table 3.1.4.8 – Canada, 2023-24, official language (OL) preference for service interaction, by province and territory

- Table 3.1.4.9 – Canada, 2023-24, official Language (OL) of service delivered, by province and territory

- Table 3.1.4.10 – Canada, 2023-24,Targeting, Referral and Feedback (TRF), by province and territory

- Table 3.1.4.11 – Canada, 2023-24, clients served, by client type and province or territory

- Table 3.2 – Canada, 2023-24, Final LMDA allocation, by province and territory

- Table 3.2.1.1 – Newfoundland and Labrador, 2023-24, clients served and relative share, by client type

- Table 3.2.1.2 – Newfoundland and Labrador, 2023-24, services delivered key facts, by service type

- Table 3.2.1.3 – Newfoundland and Labrador, 2023-24, Employment Benefits key facts, by service type

- Table 3.2.1.4 – Newfoundland and Labrador, 2023-24, Support Measures key facts, by service type

- Table 3.2.2.1 – Prince Edward Island, 2023-24, clients served and relative share, by client type

- Table 3.2.2.2 – Prince Edward Island, 2023-24, services delivered key facts, by service type

- Table 3.2.2.3 – Prince Edward Island, 2023-24, Employment Benefits key facts, by service type

- Table 3.2.2.4 – Prince Edward Island, 2023-24, Support Measures key facts, by service type

- Table 3.2.3.1 – Nova Scotia, 2023-24, clients served and relative share, by client type

- Table 3.2.3.2 – Nova Scotia, 2023-24, services delivered key facts, by service type

- Table 3.2.3.3 – Nova Scotia, 2023-24, Employment Benefits key facts, by service type

- Table 3.2.3.4 – Nova Scotia, 2023-24, Support Measures key facts, by service type

- Table 3.2.4.1 – New Brunswick, 2023-24, clients served and relative share, by client type

- Table 3.2.4.2 – New Brunswick, 2023-24, services delivered key facts, by service type

- Table 3.2.4.3 – New Brunswick, 2023-24, Employment Benefits key facts, by service type

- Table 3.2.4.4 – New Brunswick, 2023-24, Support Measures key facts, by service type

- Table 3.2.5.1 – Quebec, 2023-24, clients served and relative share, by client type

- Table 3.2.5.2 – Quebec, 2023-24, services delivered key facts, by service type

- Table 3.2.5.3 – Quebec, 2023-24, Employment Benefits key facts, by service type

- Table 3.2.5.4 – Quebec, 2023-24, Support Measures key facts, by service type

- Table 3.2.6.1 – Ontario, 2023-24, clients served and relative share, by client type

- Table 3.2.6.2 – Ontario, 2023-24, services delivered key facts, by service type

- Table 3.2.6.3 – Ontario, 2023-24, Employment Benefits key facts, by service type

- Table 3.2.6.4 – Ontario, 2023-24, Support Measures key facts, by service type

- Table 3.2.7.1 – Manitoba, 2023-24, clients served and relative share, by client type

- Table 3.2.7.2 – Manitoba, 2023-24, services delivered key facts, by service type

- Table 3.2.7.3 – Manitoba, 2023-24, Employment Benefits key facts, by service type

- Table 3.2.7.4 – Manitoba, 2023-24, Support Measures key facts, by service type

- Table 3.2.8.1 – Saskatchewan, 2023-24, clients served and relative share, by client type

- Table 3.2.8.2 – Saskatchewan, 2023-24, services delivered key facts, by service type

- Table 3.2.8.3 – Saskatchewan, 2023-24, Employment Benefits key facts, by service type

- Table 3.2.8.4 – Saskatchewan, 2022-23, Support Measures key facts, by service type

- Table 3.2.9.1 – Alberta, 2023-24, clients served and relative share, by client type

- Table 3.2.9.2 – Alberta, 2023-24, services delivered key facts, by service type

- Table 3.2.9.3 – Alberta, 2023-24, Employment Benefits key facts, by service type

- Table 3.2.9.4 – Alberta, 2023-24, Support Measures key facts, by service type

- Table 3.2.10.1 – British Columbia, 2023-24, clients served and relative share, by client type

- Table 3.2.10.2 – British Columbia, 2023-24, services delivered key facts, by service type

- Table 3.2.10.3 – British Columbia, 2023-24, Employment Benefits key facts, by service type

- Table 3.2.10.4 – British Columbia, 2023-24, Support Measures key facts, by service type

- Table 3.2.11.1 – Yukon, 2023-24, clients served and relative share, by client type

- Table 3.2.11.2 – Yukon, 2023-24, services delivered key facts, by service type

- Table 3.2.11.3 – Yukon, 2023-24, Employment Benefits key facts, by service type

- Table 3.2.11.4 – Yukon, 2023-24, Support Measures key facts, by service type

- Table 3.2.12.1 – Northwest Territories, 2023-24, clients served and relative share, by client type

- Table 3.2.12.2 – Northwest Territories, 2023-24, services delivered key facts, by service type

- Table 3.2.12.3 – Northwest Territories, 2023-24, Employment Benefits key facts, by service type

- Table 3.2.12.4 – Northwest Territories, 2023-24, Support Measures key facts, by service type

- Table 3.2.13.1 – Nunavut, 2023-24, clients served and relative share, by client type

- Table 3.2.13.2 – Nunavut, 2023-24, services delivered key facts, by service type

- Table 3.2.13.3 – Nunavut, 2023-24, Employment Benefits key facts, by service type

- Table 3.2.13.4 – Nunavut, 2023-24, Support Measures key facts, by service type

Introduction: Chapter 3

Activities conducted under Part II of the Employment Insurance Act (EI Act) help individuals in Canada prepare for, find and maintain employment. These activities are conducted through the Labour Market Development Agreements (LMDAs) and the Government of Canada's pan-Canadian programming:

- LMDAs are bilateral agreements between the Government of Canada (GC) and each province and territory (PT). Each year, under the LMDAs, at least $2.1 billion is provided for individuals and employers to receive training and employment supports in the form of Employment Benefits and Support Measures (EBSMs).Footnote 1 Part II of the EI Act sets out the framework for the LMDAs, including information such as who is eligible for employment supports and the categories of programs and supports that can be delivered by PTs

- Part II of the EI Act also includes the framework for the Government of Canada's pan-Canadian programming. Pan-Canadian programming includes the National Employment Service and serves to respond to labour market challenges that surpass local and regional labour markets. In 2023-24, pan-Canadian programming saw over $184 million in investment across 3 streamsFootnote 2

This chapter presents results achieved under Part II of the EI Act during the fiscal year beginning on April 1, 2023 and ending on March 31, 2024 (2023-24):

Sections in this chapter

Section 3.1 provides economic and labour market context for EI Part II and a national overview of EBSM programs delivered through the LMDAs and pan-Canadian programming. This year's aggregated outcomes, funding and client distributions and key program delivery results are also highlighted.

Section 3.2 reviews employment programming activities carried out by each province and territory under their respective LMDAs, including an analysis of regional approaches, key outcomes, client demographics and the different types of services offered.

Section 3.3 reviews results presented in the 2022 LMDA evaluation report. Participants are compared to similar non-participants to measure the effectiveness of the interventions on labour market attachment and dependence on government income supports.

Section 3.4 details the pan-Canadian activities and initiatives responding to issues of national and strategic importance and challenges extending beyond local or regional labour markets.

Notes to readers

Data collection/sources: Data for EBSM activities presented in the document were collected from PTs and Indigenous Skills and Employment Training (ISET) agreement holders (i.e., pan-Canadian Activities) and produced using the ESDC LMDA and pan-Canadian accountability datasets, following a standardized Performance Measurement Framework.

Data quality: The Government of Canada (GC) and PT governments strive to ensure data accuracy, reliability and consistency. However, operational or system improvements may impact the comparability of data from year to year.

Scope and limitations: The data presented are subject to limitations based on data collection methods and timing. While all efforts were made to ensure accuracy, small discrepancies may arise due to variations in data sources and reporting standards.

Performance Measurement Strategy (PMS): The PMS was collaboratively developed by Canada and PT governments through the Forum of Labour Market Ministers and implemented as part of the 2019 Labour Market Development Agreements (LMDA).

Financial data: Financial totals included in Chapter 3 and Annex 3 are based on PT-provided reports. Where final data was not available at the time of publication, expenditures are based on draft figures or previous year data.

3.1 National overview

In this section

- 3.1.1 Economic and labour market context

- 3.1.2 Main results

- 3.1.3 Interventions funded by the LMDAs

- 3.1.4 Clients served by the LMDAs

3.1.1 Economic and labour market context

Canada’s workforce is among the most highly educated in the world, yet challenges related to skill shortages, job mismatches and underemployment continue to shape the country’s labour market. As industries evolve due to technological advancements, demographic shifts and economic pressures, the ability of Canadian workers to meet changing demands is more critical than ever. Despite a strong foundation in tertiary education, gaps remain in aligning skills with labour market needs, particularly in sectors where vocational and technical training play a crucial role.

A need for vocational training and technical education

One of Canada’s most significant strengths is its high level of post-secondary attainment. In 2023, 63.3% of adults aged 25 to 64 held a post-secondary certificate or degree, placing Canada well above the OECD average of 41.0%.Footnote 3 This puts the country ahead of nations such as the United States, the United Kingdom and Germany, reaffirming Canada’s commitment to education as a driver of economic growth. However, while university and college education rates remain high, fewer Canadians pursue vocational training or technical education compared to other OECD countries.

In countries like Germany and Switzerland, strong apprenticeship systems support middle-skill occupations, ensuring that graduates are equipped with practical skills that align with industry needs. In Canada, only 30.0% of adults have completed upper secondary or post-secondary non-tertiary education, compared to the OECD average of 40.2%.Footnote 4 This reflects a tendency to prioritize academic pathways over skilled trades and applied technical fields—an imbalance that has led to skill shortages in key sectors.

Encouragingly, 2023 saw a rise in apprenticeship certifications, signaling renewed momentum in vocational education. The number of certificates granted to registered apprentices and trade qualifiers increased 7.1% to 1.6 million, reversing a small decline in 2022.Footnote 5 Trades such as heavy duty mechanics (+41.2%), automotive service (+28.1%) and food service (+18.9%) experienced the most significant growth in certifications, suggesting that demand for skilled trades workers remains strong.Footnote 6

Apprenticeship certifications in construction-related trades saw a modest 1.6% increase in 2023, driven largely by a significant 14.2% surge among plumbers, pipefitters and steamfitters. However, when excluding this group, certifications in the sector actually declined by 1.8%, highlighting uneven growth across the trades.

The growth in Red Seal certifications, which ensure national mobility for trades professionals, is another positive indicator of a strengthening workforce pipeline. However, despite these gains, persistent shortages remain in many trade professions, particularly in construction and manufacturing, where aging workers and low apprenticeship completion rates present ongoing challenges. In response, Canada’s Labour Market Development Agreements (LMDAs) play a critical role in addressing these shortages, providing funding for skills training targeted at unemployed and underemployed Canadians. These agreements help workers gain the credentials and experience necessary to enter high-demand fields, such as skilled trades, where shortages are most severe.

Skill-job mismatches and sector-specific shortages

Skill-job mismatches continue to be a pressing concern for businesses across Canada. Many industries report difficulties in finding qualified workers, with recruitment challenges particularly acute in construction, healthcare and information technology. According to results from the most recent Canadian Survey on Business Conditions conducted in early 2025, larger businesses, those with 100 or more employees, reported the greatest difficulty in hiring, with 47.6% citing recruitment of skilled employees as a major challenge. Meanwhile, retention has become a concern, as businesses compete for talent in an increasingly mobile and flexible job market.

Sector-specific skill shortages highlight deep-rooted structural challenges in Canada’s labour market. In the construction industry, 36.5%Footnote 7 of employers report difficulty recruiting skilled workers, with high demand for electricians, carpenters and other trades professionals. This shortage is further exacerbated by an aging workforce and a slower-than-expected uptake of apprenticeships. Similarly, the healthcare sector is struggling with severe staffing shortages, particularly among nurses and medical technicians, with 30.6%Footnote 8 of the sector reporting difficulty recruiting skilled employees.

In contrast, the professional, scientific and technical services sector—which includes industries like information technology, legal services and scientific research—faced the least difficulty in recruiting skilled workers, with just 17.3%Footnote 9 citing it as a challenge. Retaining talent was even less of a concern, with only 11.8%Footnote 10 reporting it as an obstacle, highlighting the sector’s relative stability in workforce management.

The LMDAs serve as a critical tool to help address these skill shortages. By funding targeted skills training, the LMDAs support workers transitioning into sectors experiencing high demand. Programs under the LMDAs have proven effective in increasing employment rates and earnings, with participants gaining an average $10,000 increase in income within 4 years after completing their training.Footnote 11 Such initiatives help fill labour gaps in key industries while ensuring that Canadian workers remain competitive in a rapidly evolving job market.

The problem of underemployment

Underemployment remains a significant challenge for the Canadian economy, particularly for younger workers. According to Statistics Canada, the underemployment rate averaged 7.6% during the 2023-24 fiscal year, marking a 60-basis-point increase from the previous year.Footnote 12 While men experienced a rate in line with the general population, women faced a higher underemployment rate of 8.6%.Footnote 13 The issue is most severe among young workers aged 15-24, with underemployment reaching 16.1% for men and 15.5% overall.Footnote 14 Many struggle to find full-time roles that match their qualifications, often resorting to part-time or temporary positions despite holding post-secondary credentials. Alarmingly, underemployment among this cohort has continued to climb in the first 10 months of the 2024-25 fiscal year, averaging 17.9%—outpacing the rise in unemployment itself.Footnote 15

In contrast, underemployment among core working-age individuals, aged25 to 54, remained significantly lower at 6.4%, indicating greater stability within this group.Footnote 16 The gender gap was also minimal, with rates of 6.3% for men and 6.5% for women.Footnote 17 However, similar to youth, underemployment in this demographic is rising, underscoring the shifting dynamics of the economic landscape.

To address underemployment, the LMDAs provide critical employment assistance services, including career counselling, résumé writing workshops and job search support. These programs help individuals—particularly youth, Indigenous peoples, persons with disabilities and racialized Canadians—overcome barriers to full-time employment and secure jobs that match their skills and experience.

Challenges for employers

The labour market challenges facing Canadian businesses are not uniform. While large firms struggle with recruitment and retention, small and medium-sized enterprises (SMEs) often experience additional difficulties in maintaining an adequate workforce due to budget constraints and competition from larger corporations offering higher wages and benefits. SMEs in sectors such as retail, hospitality and manufacturing face some of the highest turnover rates, leading to operational instability. The challenge of workforce availability is compounded by regional disparities, with certain provinces experiencing more acute shortages in key industries due to demographic and economic factors.

Challenges to participants

For labour market participants, challenges manifest in different ways depending on age, experience and industry. As indicated, many young workers struggle with underemployment, unable to secure stable, full-time jobs that match their qualifications, while older workers often face barriers to re-entering the workforce after periods of unemployment. Meanwhile, workers in high-demand industries may experience frequent job turnover, either due to better opportunities elsewhere or burnout caused by workforce shortages—a trend particularly visible in healthcareFootnote 18 and skilled trades.Footnote 19

To address these challenges, the LMDAs play an essential role in bridging gaps between employers' needs and workers' skills. These agreements provide skills development programs, wage subsidies and employment assistance services that help job seekers transition into stable, high-demand careers. Programs funded through LMDAs also support career mobility, ensuring underemployed or unemployed Canadians have the necessary resources to reskill, upskill, or enter emerging sectors.

3.1.2 Main results

LMDA evaluation results and year-over-year reporting reveal that participation in Employment Benefits and Support Measures (EBSMs) improves labour market attachment and reduces dependence on government income supports, compared to results for similar non-participants.

In 2023-24, LMDAs continued to support individuals and employers across Canada in obtaining skills training and employment support services.Footnote 20 The results of that support is evidenced through the program’s key performance indicators (KPIs).

Key performance indicators

ESDC monitors and tracks the results of EBSM programming delivered by PTs through 3 key performance indicators (KPIs). These measure the performance of the LMDAs’ basic goal of assisting EI claimants in regaining employment and thereby providing savings to the EI Part I system. Respectively, they are:

- Number of active claimant clients served: the foundational indicator, providing insight on the extent to which the LMDAs served its principal client-type

- Number of EI-insured clientsFootnote 21 who return to employment: assisting clients in returning to employment is the primary goal of the LMDAs. This indicator measures the LMDAs’ success in doing so

- Amount of unpaid EI Part I benefits resulting from returns to employment: by assisting EI claimants to return to employment before their benefits period is completed, the LMDAs help save funding for the EI Part I program. This indicator measures the savings achieved

Note: Each province and territory (PT) have their own targets for these indicators.

Results achieved

- Number of active claimant clients served: amid evolving labour market and economic conditions in FY 2023-24 across Canada, the number of active EI claimants served increased by 15.4% year-over-year, reaching 167,534

- Number of EI-insured clients who return to employment: returns to work slightly decreased by 0.3% year-over-year, with a total of 157,398 clients securing employment within 6 months of completing their services

- Amount of unpaid EI Part I benefits resulting from returns to employment: due to the rise in active EI claimants returning to work, unpaid EI Part I benefits totalled $909 million, increasing by 6.2% compared to the previous year's $856 million

Note: The average proportion of active claimants who received services within the first 12 weeks of their benefit period was 64.6%. Similarly, 53.8% of EI Part I benefit entitlements were saved because of clients returning to employment before exhausting their benefits.

Historical view

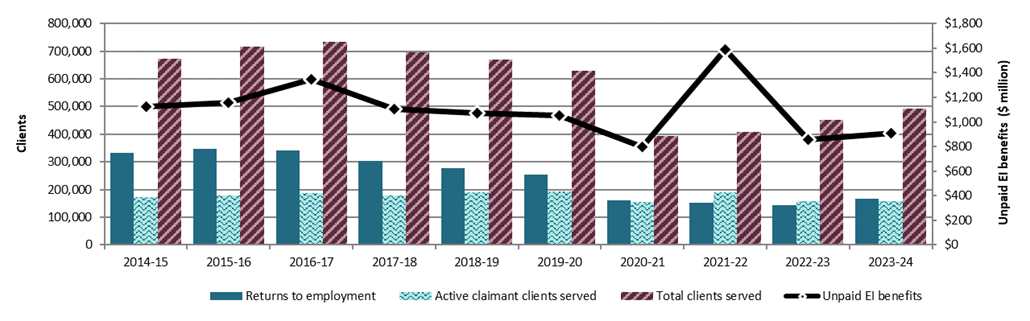

The chart below compares results for each of the 3 KPIs outlined above from 2014-15 through to 2023-24, providing a snapshot comparison of this fiscal year’s KPI results against those of the last 9 fiscal years:

Text description

| Year | Unpaid EI benefits | Active claimant clients served | Returns to employment | Total clients served |

|---|---|---|---|---|

| 2014-15 | $1,121,978,736 | 332,099 | 173,593 | 674,081 |

| 2015-16 | $1,154,581,388 | 348,392 | 178,556 | 717,896 |

| 2016-17 | $1,344,613,965 | 341,262 | 187,172 | 734,309 |

| 2017-18 | $1,103,167,911 | 304,339 | 177,335 | 695,911 |

| 2018-19 | $1,070,684,378 | 277,337 | 190,717 | 670,431 |

| 2019-20 | $1,054,344,499 | 254,553 | 194,120 | 630,425 |

| 2020-21 | $800,239,777 | 160,072 | 155,183 | 394,285 |

| 2021-22 | $1,588,456,667 | 153,689 | 190,919 | 409,459 |

| 2022-23 | $856,401,107 | 145,153 | 157,861 | 451,350 |

| 2023-24 | $909,578,874 | 167,534 | 157,398 | 491,279 |

Comparing LMDA and pan-Canadian programming

In 2023-24, a combined 871,769 pan-Canadian and non-pan-Canadian training and employment support services were provided under Part II of the EI Act, for a net increase of 8.4% from the previous year. However, the Indigenous Skills and Employment Training (ISET) program under pan-Canadian programming saw a slight decrease, with participation dropping by 2.3% to 51,740 in 2023-24:

| National level data | 2022-23 | 2023-24 | Year-over-year change |

|---|---|---|---|

| Total Employment Benefits Services | 188,144 | 192,365 | +2.2% |

| Total Support Measures: Employment Assistance Services | 562,987 | 627,664 | +11.5% |

| Total EBSM | 751,131 | 820,029 | +9.2% |

| Indigenous pan-Canadian | 52,973 | 51,740 | -2.3% |

| Total EBSM and Indigenous pan-Canadian services delivered | 804,104 | 871,769 | +8.4% |

- Notes:

- 1 This table reflects all new services started between April 1, 2023 and March 31, 2024.

- 2 LMDA data for YT and NU are estimated figures; YT data for 2023-24 are estimates based on last year's estimated figures.

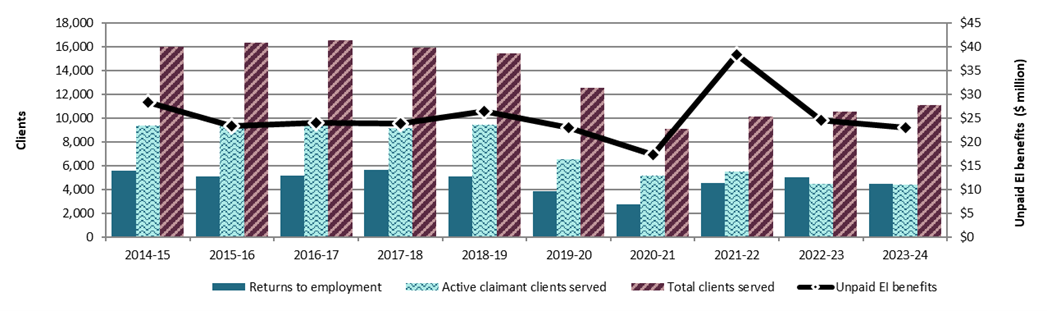

Pan-Canadian changes

Along with participation, key performance indicators for the EI-funded portion of the ISET program declined slightly compared to 2022-23 as well. The program served 26,275 clients (active EI claimants, former EI claimants and Premiums Paid Eligible clients) which was 4.1% fewer than in the previous year. A total of 13,243 EI-funded ISET clients secured employment during 2023-24 within 6 months of their participation - 6.8% fewer than the previous year. The amount of EI Part I money saved as a result of active EI claimant ISET clients returning to work before exhausting their EI Part I benefits was $20,399,924 - 15.6% less than in 2022-23.

Summary of spending

Total expenditures under Part II of the EI Act were $2.5 billion in 2023‑24, which included EBSM programming and pan-Canadian activities. This represented an increase of 1.3% compared to the previous year.

Under the LMDAs, Employment Benefits remained the largest investment at $1.3 billion, representing the majority of expenditures by PTs. Compared to 2022‑23, spending on Employment Benefits increased by $1.2 billion (-0.7%). Employment Assistance Services expenditures increased as well, up 5.8%, to a total of $645.9 million. Other key areas of investment included $227.5 million for Labour Market Partnerships, $185.2 million for Research and Innovation and $150.6 million for Indigenous pan-Canadian programming.

Text description

| Employment Benefits | Employment Assistance Services | Labour Market Partnerships | Research and Innovation | Indigenous Pan-Canadian |

|---|---|---|---|---|

| $1,245,920,657 | $712,275,888 | $227,464,997 | $185,222,335 | $150,632,090 |

- Notes:

- 1 Figures expressed in thousands of dollars by service.

- 2 Totals may not add due to rounding.

- 3 The financial totals in the MAR are based on finalized reports provided by PTs. At the time of publication, final audited financial statements for YT, NT and NU had not been received. As such, expenditures for these jurisdictions are based on draft reports or the previous-year financial statements.

Spending by province and territory

A breakdown of spending by each high-level service type (Employment Benefits, Support Measures, Indigenous pan-Canadian) as well as associated total administrative costs are presented in the table below:

| Province/Territory | Employment Benefits | Support Measures | Over-contributions | Indigenous Pan-Canadian | Adjustments5 | Subtotal | Administrative costs6 | Total |

|---|---|---|---|---|---|---|---|---|

| Newfoundland and Labrador | $80,511 | $56,904 | $0 | $2,615 | $1,267 | $141,297 | $8,937 | $150,234 |

| Prince Edward Island | $19,449 | $6,650 | $0 | $281 | -$1 | $26,379 | $2,695 | $29,074 |

| Nova Scotia | $41,598 | $49,081 | $0 | $2,324 | $3,173 | $96,175 | $10,149 | $106,324 |

| New Brunswick | $58,498 | $43,116 | $0 | $1,712 | -$4 | $103,321 | $8,922 | $112,243 |

| Quebec | $414,175 | $226,515 | $0 | $12,356 | $1,183 | $654,229 | $58,920 | $713,149 |

| Ontario | $211,388 | $523,084 | $0 | $26,221 | $12,939 | $773,632 | $57,277 | $830,909 |

| Manitoba | $34,633 | $21,324 | $54 | $18,521 | $73 | $74,605 | $7,259 | $81,864 |

| Saskatchewan | $27,440 | $21,903 | $0 | $15,380 | $1,204 | $65,927 | $6,022 | $71,949 |

| Alberta | $123,201 | $81,925 | $0 | $16,633 | $2,798 | $224,557 | $9,594 | $234,151 |

| British Columbia | $229,537 | $89,435 | $2,882 | $17,921 | $4,040 | $343,815 | $20,263 | $364,078 |

| Yukon | $1,824 | $2,510 | $0 | $1,180 | -$2 | $5,511 | $389 | $5,900 |

| Northwest Territories | $2,072 | $1,110 | $0 | $3,568 | -$402 | $6,348 | $1,450 | $7,798 |

| Nunavut | $1,595 | $1,408 | $0 | $4,255 | -$136 | $7,122 | $787 | $7,909 |

| NHQ7 | n/a | $0 | $0 | $27,665 | -$27,665 | $0 | n/a | n/a |

| Totals by category | $1,245,921 | $1,124,965 | $2,936 | $150,632 | -$1,533 | $2,522,919 | $192,664 | $2,715,582 |

- Source: Provincial/Territorial Audited Statements

- Notes:

- 1 Figures expressed in thousands of dollars by service.

- 2 Totals may not add due to rounding.

- 3 For NL, NB, MB and NU, where spending exceeded federal allocated funding, proration was done for the expenses in each category.

- 4 The financial totals in the MAR are based on finalized reports provided by PTs. At the time of publication, final audited financial statements for YT, NT and NU had not been received. As such, expenditures for these jurisdictions are based on draft reports or previous-year financial statements.

- 5 This adjustment reflects overpayments established, refunds of previous years' expenditures and other accounting adjustments.

- 6 Net Administrative costs include salary and non-salary to administer LMDAs and $11 million for rent.

- 7 Represents Pan-Canadian (ISET) funding for Indigenous organizations that operate nationally rather than within a specific province or territory. A dedicated NHQ row ensures these funds are properly accounted for.

3.1.3 Types of services funded by the LMDAs

A variety of service types or Employment Benefit and Support Measures (EBSMs) are supported under the LMDAs. This subsection describes the various iservice types, the patterns and trends seen in 2023-24 and breaks down related expenditures. Also presented are supplemental performance indicators, which help demonstrate the impact of these services.

Types of services

Under the LMDAs, provinces and territories deliver programs and services that are reported according to the Employment Benefit and Support Measures (EBSM) categories established under Part II of the EI Act. The 8 EBSM categories first break down into either Employment Benefits (EBs), of which there are 5 intervention types and then Support Measures (SMs), of which there are 3 intervention types:

The 8 Employment Benefit and Support Measure (EBSM) categories:

Employment Benefits (EB): Employment Benefits are longer-term training and employment support, providing individuals with the skills or work experience required to regain employment. Through the LMDAs, PTs provide Employment Benefits consistent with the 5 benefits categories outlined in the EI Act:

- Targeted Wage Subsidies (TWS): assists participants to obtain on-the-job work experience by providing employers with financial assistance toward the wages of participants

- Targeted Earnings Supplements (TES)Footnote 22: encourages unemployed persons to accept employment through financial incentives

- Self-Employment (SE): provides financial assistance and business planning advice to eligible participants to help Canadians start their own business

- Job Creation Partnerships (JCP): provides participants with opportunities to gain work experience that will lead to ongoing employment

- Skills Development - Regular (SD-R): helps participants obtain employment skills by giving direct financial assistance that enables them to select, arrange for and pay for training

Skills Development - Apprentices (SD-A): apprentices are paid by their employer during periods of practical training. During the classroom portion of their training, apprentices are eligible for regular benefits under Part I of the EI Act if approved by their PT government. Depending on the regional and local priorities of the province or territory, the apprentice may receive EI Part II support to cover classroom-related expenses

Support Measures (SM): Support Measures fall into the subcategories of either (a) Employment Assistance Services (EASs) or (b) Other Support Measures (EASs):

- Employment Assistance Services (EAS): provides individual counselling that provides 1-on-1 job seeking support; action planning; job search skills; job-finding clubs; job placement services; and more

- Labour Market Partnerships (LMP): helps employers, employee and employer associations and communities to improve their capacity to deal with human resource requirements and to implement labour force adjustments

- Research and Innovation (R&I): supports activities that identify better ways of helping people to prepare for or keep employment and to be productive participants in the labour force

Expenditures by service type

Necessarily, spending on services and choices over whether to deploy more or fewer of one kind of service versus another will vary from one province or territory (PT) to the next. Accordingly, the national, aggregated picture will reflect this variation. See below a visual breakdown of the different intervention types deployed in 2023-24, their average duration and the overall amount spent on each type:

Text description

- Employment Benefits ($1.2B)

- Targeted Wage Subsidies (avg duration: 192 days) ($0.2B)

- Self Employment Benefit (avg duration: 217 days) ($0.1B)

- Job Creation Partnerships (avg duration: 60 days) ($0.02B)

- Skills Development - Regular (avg duration: 84 days) ($1.0B)

- Skills Development - Apprentices (avg duration: 55 days) ( Expenditure is included under SD - Regular)

- Targeted Earning Supplements (not currently used)

- EBSM

- Support Measures ($1.1B)

- Other Support Measures ($0.4B)

- Labour Market Partnerships ($0.2B)

- Research and Innovation ($0.2B)

- Employment Assistance Services ($0.7B)

- Employment Services (avg duration: 1 day)

- Individual Counselling (avg duration: 1 day)

- Other Support Measures ($0.4B)

- Notes:

- 1 This table reflects all new services started between April 1, 2023 and March 31, 2024.

- 2 LMDA data for NU and YT are excluded due to lack of information on start and end dates of services provided.

- 3 The financial totals in the MAR are based on finalized reports provided by PTs. At the time of publication, final audited financial statements for YT, NT and NU had not been received. As such, expenditures for these jurisdictions are based on draft reports or previous-year financial statements.

- 4 Expenditure totals may not add due to rounding.

2023-24 service trends and patterns

There was a 9.2% increase to total Employment Benefit and Support Measures (EBSM), resulting in 820,029 services provided to Canadians (excluding pan-Canadian services provided to Indigenous people). In 2019-20, there were 968,632 services, as compared to 641,656 in 2020-21. However, participation increased in each subsequent year, reaching 751,131 in 2022-23. This signals a strong recovery and growing demand for EBSMs. In 2023‑24, 519,184 clients benefited from EBSMs, marking an increase of 8.4% from the 478,744 clients served in 2022-23.

- Employment Benefits (EBs) services were provided to 192,365 Canadians in 2023-24 for a 2.2% increase from 188,144 in 2022-23. EBs are typically more expensive, more involved and have more stringent eligibility criteria, but can deliver a deeper and longer-lasting result for clients. In 2023-24, EBs made up 28% of total intervention services provided

- Employment Assistance Services (EAS), classed as Support Measures (SMs), consistently make up the majority of EBSM services provided. In 2023-24, 72% of total EBSM services were EASs. A client will first receive an EAS to determine what other benefits and services would be beneficial for labour market reattachment. In 2023-24, this intervention type saw a substantial increase, rising by 11.5% to reach 627,664 participants, compared to 562,987 the previous year

The distribution of EAS to EBs (72% to 28%) highlights the broader deployment of accessible assistance services as clients seek pathways to employment and stability, as well as higher costs associated with delivering Employment Benefits, which are tailored to direct job placement and skills development.

| Service type | Services delivered | Year-over-year change | Share of total | Year-over-year change (p.p.) |

|---|---|---|---|---|

| Total Employment Benefits | 192,365 | +2.2% | 22.1% | -1.3 |

| Total Support Measures: Employment Assistance Services | 627,664 | +11.5% | 72.0% | +2.0 |

| Total EBSM | 820,029 | +9.2% | 94.1% | +0.7 |

| Indigenous pan-Canadian | 51,740 | -2.3% | 5.9% | -0.7 |

| Total EBSM and Indigenous pan-Canadian services delivered | 871,769 | 8.4% | 100.0% | n/a |

- Notes:

- 1 This table reflects all new services started between April 1, 2023 and March 31, 2024.

- 2 LMDA data for YT and NU are estimated figures.

- 3 LMDA YT data for 2023-24 are estimates, based on last year's estimated figures.

A more detailed view of delivery of each intervention type in fiscal year 2023-24 follows below:

Delivery of Employment Benefits (EBs) services in 2023-24

In 2023-24, Employment Benefits training and employment supports totaled 192,365, reflecting a 2.2% year-over-year increase. Total expenditures for Employment Benefits amounted to $1.25 billion, a 0.7% decrease from the previous year.

Skills Development (SD) programs continued to provide the skills needed for the demanding Canadian workforce, accounting for 79.9% of all Employment Benefits delivered, with total SD expenditures reaching $995.3 million, a 3.2% decline from the previous year. Skills Development - Regular (SD-R) services (includes services such as occupational skills training and programs focused on literacy, essential skills and language training) grew by 3.0% to reach 99,806 services. This represented 51.9% of all Employment Benefits. Skill Development - Apprentices (SD-A) services saw a 5.6% rise to 77,857 and accounted for 40.5% of the total Employment Benefits, reflecting a sustained emphasis on equipping workers with specialized skills to meet labour market demands.

In contrast, Targeted Wage Subsidies (TWS) which represents a 5.7% of total Employment Benefits, experienced a sharp 15.4% decline, dropping to 11,037 services. This reduction suggests a reduced focus on wage subsidies, potentially due to stronger labour market conditions, changes in employer hiring strategies, or a resource reallocation favoring skill-based training programs. However, expenditures on TWS grew by 16.5%, reaching $179.2 million. Similarly, Self-Employment (SE) supports which makes up of 1.1% of all Employment Benefits, totaling 2,141 services also fell by 27.2%, which may indicate a decline in demand for Self-Employment (SE) assistance among participants. Despite this decline, expenditures increased by 7.3% to $56.2 million.

Job Creation Partnerships (JCPs) experienced a slight decline of 3.8%, totalling 1,524 and accounting for 0.8% of the Employment Benefits. Despite this reduction, Job Creation Partnerships (JCPs) remains a valuable resource for providing work experience, even though they represent a relatively small portion of the overall services. However, JCP expenditures declined by 28.7% to $15.2 million.

| Employment Benefits | Services | Year-over-year change | Share of employment benefits total | Expenditures | Year-over-year change |

|---|---|---|---|---|---|

| Targeted Wage Subsidies | 11,037 | -15.4% | 5.7% | $179,241,672 | +16.5% |

| Self-Employment | 2,141 | -27.2% | 1.1% | $56,190,017 | +7.3% |

| Job Creation Partnerships | 1,524 | -3.8% | 0.8% | $15,226,998 | -28.7% |

| Skills Development-Regular | 99,806 | +3.0% | 51.9% | $955,262,971 | -3.2% |

| Skills Development-Apprentices | 77,857 | +5.6% | 40.5% | Included above | Included above |

| Targeted Earning Supplements | 0 | 0.0% | 0.0% | n/a | n/a |

| Totals | 192,365 | 2.2% | 100.0% | $1,245,920,657 | -0.7% |

- Notes:

- 1 This table reflects all new services started between April 1, 2023 and March 31, 2024.

- 2 LMDA data for YT and NU are estimated figures.

- 3 LMDA YT data for 2023-24 are estimates, based on prior year's estimated figures.

Delivery of Employment Assistance Services (EASs) in 2023-24

Employment Assistance Services (EAS), as part of the Support Measure service type, are the first service an individual receives to determine what further training and employment supports would be beneficial for labour market reattachment. EAS is essential in providing support to individuals who have been disconnected from the labour market for an extended period or who have low job attachment. These services, which range from Employment Services (ES) to Individual Counselling, aim to help clients regain stable employment though various supports and personalized strategies.

In 2023-24, 627,664 EAS were provided to Canadians, marking an increase of 11.5% year-over-year. General ES, which includes services such as job search assistance, remained the most frequent accessed support, totalled 425,656 services, accounting for 67.8% of all EAS services. This represents an 11.3% year-over-year increase, highlighting the ongoing focus on engaging clients early through needs assessments and personalized employment strategies. In 2023‑24, EAS expenditures amounted to $712.3 million, increased by 7.9% year-over-year.

There was a notable increase in individual counselling, rising 11.8% to reach 202,008 services, accounting for 32.2% of all EAS delivered. This growth highlights a continued emphasis on providing tailored, in-depth support to address barriers and facilitate a successful return to work, meeting the evolving needs of job seekers in a dynamic labour market.

Delivery of other support measures in 2023-24

Other support measures include Labour Market Partnerships (LMP) and Research and Innovation (R & I), both of which play a critical role in strengthening the labour market and supporting workforce development.

The Labour Market Partnerships (LMP) offer crucial support to employers, assisting them in managing workforce adjustments and addressing human resources needs and challenges. These supports are also extended to employee and employer associations, community organizations and local communities, enabling them to develop and implement strategic workforce solutions. In 2023‑24, LMP expenditures amounted to $227.5 million, decreased by 26.0% year-over-year.

Research and Innovation (R & I) initiatives seek to identify better ways of helping people prepare for, return to, or keep employment and be productive participants in the labour force. In 2023‑24, Research and Innovation ( R & I)expenditures amounted to $185.2 million, compared to $268.8 million in the previous year. The outcomes of Research and Innovation (R & I) projects are reviewed through evaluations, where applicable and impactful approaches are shared as best practices to inform and enhance other employment programs.

| Support Measures | Services | Year-over-year change | Share of support measures total | Expenditures | Year-over-year change |

|---|---|---|---|---|---|

| Employment Assistence Services (EAS) | 425,656 | 11.3% | 67.8% | $712,275,888 | +7.9% |

| Individual Counselling (IC) | 202,008 | 11.8% | 32.2% | Included above | Included above |

| Labour Market Partnerships (LMP) | n/a | n/a | n/a | $227,464,997 | -26.0% |

| Research & Innovation (R&I) | n/a | n/a | n/a | $185,222,335 | -31.1% |

| Totals | 627,664 | 11.5% | 100.0% | $1,124,963,220 | -9.0% |

- Notes:

- 1 This table reflects all new services started between April 1, 2023 and March 31, 2024.

- 2 LMDA data for YT and NU are estimated figures.

- 3 LMDA YT data for 2023-24 are estimates, based on prior year's estimated figures.

- 4 LMP and R&I data is unavailable. only expenditure amounts are provided by Chief Financial Officer Branch.

Supplemental performance indicators

Terminology guide

Unpaid EI benefits: is a success indicator that refers to the amount of EI Part I benefits not paid to EI claimants, based on the difference between their maximum entitlement to regular income benefits and the actual payout of such benefits to them.

To determine these unpaid benefits, the EI Part I data of all LMDA Clients who were actively receiving EI Part I funds when they began an Action Plan under the LMDA program are examined. For the subset who became employed between April 1, 2023 and March 31, 2024 (determined by a premature and consistent cessation of requesting EI funds), the amount of EI money they were entitled to, but did not claim, is their Unpaid Benefits amount.

In 2023-24, there was a total of $909,578,874 in Unpaid Benefits as a result of LMDA programs and services.

The table in this section highlights additional EI performance metrics across Canadian provinces and territories (PTs)Ts, showcasing significant regional variations. For the percentage of active claimant clients who started action plans within 12 weeks of their benefit period commencement, Alberta leads with 73.8%, followed by Manitoba at 71.2% and British Columbia at 69.2%, reflecting efficient processes in these provinces.

The returns-to-work metric, measured as a proportion of the total size of the PTs labour force, remains generally low across most regions, with values under 1.0%. However, PEI is an outlier with a significantly higher rate of 5.7%. This can be attributed, at least in part, to the province serving a higher proportion of its labour force participants-their EI-insured client served count is 4.9% of their labour force count, compared to 1.5% at national level.

For the proportion of unpaid EI benefits due to active claimants returning to work before exhausting their EI benefits, the Northwest Territories leads with 66.5%, followed by Saskatchewan at 65.2% and Alberta at 64.2%, reflecting a strong trend of claimants resuming employment early.

At the national level, 64.6% of claimants start action plans within 12 weeks, 0.7% returns to work as a percentage of Canada's total labour force population and 53.8% of the EI benefits amount remains unpaid due to early return to work. These findings underscore regional disparities in EI program performance and claimant behaviour.

| Province/Territory | % of active claimant clients whose action plan started within 12 weeks of their benefit period commencement | Returns to work/total PTs labour force4 | Unpaid EI benefits due to active claimant clients having returned to work as a proportion of the total benefits they would have received had they not returned to work. |

|---|---|---|---|

| Newfoundland and Labrador | 47.9% | 0.7% | 49.7% |

| Prince Edward Island | 59.6% | 5.7% | 30.9% |

| Nova Scotia | 69.0% | 0.5% | 47.8% |

| New Brunswick | 61.9% | 1.1% | 42.7% |

| Quebec | 64.7% | 0.7% | 39.4% |

| Ontario | 57.0% | 0.7% | 56.9% |

| Manitoba | 71.2% | 0.8% | 61.6% |

| Saskatchewan | 65.3% | 0.8% | 65.2% |

| Alberta | 73.8% | 0.9% | 64.2% |

| British Columbia | 69.2% | 0.6% | 59.0% |

| Yukon | n/a | n/a | n/a |

| Northwest Territories | 52.0% | 0.6% | 66.5% |

| Nunavut | n/a | n/a | n/a |

| Canada | 64.6% | 0.7% | 53.8% |

- Notes:

- 1 This table excludes Indigenous pan-Canadian client data.

- 2 LMDA data for YT and NU are unavailable.

- 3 Return to work/total labour force represents the percentage of Active claimant clients, Former claimant clients and PPE clients who successfully re-entered employment between April 1, 2023 and March 31, 2024, after participating in a LMDA service, measured against the total labour force.

- 4 These indicators reflect outcomes influenced by multiple factors beyond the scope of the LMDAs and should not be solely attributed to LMDA services.

3.1.4 Clients served by the LMDAs

Under the LMDAs, EBSMs continue to support individuals in acquiring skills and work experience through various services. These services benefit active and former EI claimant clients, as well as individuals who have contributed EI premiums in at least 5 of the last 10 years.

This section identifies the various types of client served by the LMDAs. Included too are socio-demographic breakdowns of client types as well as a breakdown of client types by province and territory.

Terminology guide

A client is a person who has received at least 1 training and employment support that started in fiscal year 2023-24 and was funded by the LMDAs or by Indigenous organizations. As per the KPI measuring the number of active claimant clients served, there are multiple client types.

A training and/or employment support or service is a discrete program or service in which a client participates. Each service is attributed to the fiscal year in which it started.

Any reference to participants is the number of unique training and employment supports provided, where information on designated groups is collected at the training and employment supports level. Participant counts can be higher than client counts, as 1 client can receive multiple supports or benefits.

Types of client

Broadly, LMDA client types are as follows:

- Active claimant clients are those who were receiving EI Part I regular benefits when they requested labour market supports. Typically, they have stronger and more recent job attachment. They tend to return to work more quickly than those with weaker ties to employment

- Former claimant clients are those who received EI benefits in the previous 5 years

- Premiums Paid Eligible (PPE) are unemployed individuals who have made EI premium contributions on $2,000 or more in earnings in at least 5 of the last 10 years. This particularly benefits individuals with weaker labour force attachment

- Non-insured clients are those who are not eligible for Employment Benefits under EI Part II, but access Employment Assistance Services. This includes new labour force participants and individuals who were formally self-employed without paid employment earnings

2023-24 client trends and patterns

In 2023-24, the percentage of active claimant clients (including Indigenous pan-Canadian clients) as a proportion of overall clients served rose to 34.0% from 31.9% in 2022-23 (+2.1 percentage points). This growth suggests that more current EI recipients are seeking LMDA services, possibly due to economic shifts, including a recent rise in the national unemployment rate following historically low levels between late 2022 and early 2023.

The percentage of former claimant clients served (including Indigenous pan-Canadian clients) as a share of total clients decreased to 22.4% from 23.7% (-1.3 percentage points). This reduction continues a shift back toward pre-pandemic norms, given the proportion of former claimant clients served was considerably lower in the years prior to the pandemic.

Since former claimant clients are individuals who completed an EI claim within the past 5 years, the elevated levels stemming from pandemic-related job loss are expected to influence this category for up to 5years. As these claimants gradually transition out of the system, a return to historical trends-that more closely resembles a pre-pandemic distribution of client groups-is expected.

The greater representation of active claimant clients compared to former claimant clients confirms that services are able to quickly support individuals who recently started an EI claim. While the proportion of former claimant clients has remained stable across fiscal years, the growth in active claimant clients highlights increased demand for employment support services. The proportion of Premiums Paid Eligible (PPE) individuals, who are not currently on EI but have paid EI premiums contributions in the past, decreased from 10.5% to 9.6% (-0.9 percentage points). This decline highlights the ongoing challenge of engaging individuals with weaker labour market ties. Meanwhile, the share of non-insured clients, showed a slight increase from 33.9% to 34.0% (+0.1 percentage points).

| National level data | 2022-23 | 2023-24 | Year-over-year change (p.p.) |

|---|---|---|---|

| Active claimant clients (including Indigenous pan-Canadian clients) | 31.9% | 34.0% | +2.1 |

| Former claimant clients (including Indigenous pan-Canadian clients) | 23.7% | 22.4% | -1.3 |

| Premiums-paid eligible (PPE) individuals (including Indigenous pan-Canadian clients) | 10.5% | 9.6% | -0.9 |

| Non-insured | 33.9% | 34.0% | +0.1 |

- Notes:

- 1 This table reflects clients served between April 1, 2023 and March 31, 2024.

- 2 LMDA data for YT and NU are excluded due to insufficient client type information.

The distribution of clients remains similar when excluding Indigenous pan-Canadian clients: active claimant clients made up 34.1% of total clients (167,534 individuals), former claimant clients accounted for 21.0% (103,144 individuals), PPE clients represented 9.1% (44,656 individuals) and non-insured clients were the largest segment at 35.8% (175,945 individuals).

Indigenous pan-Canadian clients represented 5.1% of total clients, totalling 26,275 individuals, with a breakdown of 8,634 active claimants, 12,854 former claimants and 4,787 PPE clients.

In total, LMDA programs served 517,554 clients across Canada in 2023-24, excluding data from Yukon and Nunavut where access to client-type information is limited.

| Indicator | Active claimant clients | Former claimant clients | PPE clients | Non-insured clients | Total |

|---|---|---|---|---|---|

| Number served under the LMDAs (excluding Indigenous pan-Canadian clients) | 167,534 | 103,144 | 44,656 | 175,945 | 491,279 |

| Indigenous pan-Canadian clients | 8,634 | 12,854 | 4,787 | n/a | 26,275 |

| Total | 176,168 | 115,998 | 49,443 | 175,945 | 517,554 |

| Share of total (including Indigenous pan-Canadian clients) | 34.0% | 22.4% | 9.6% | 34.0% | 100.0% |

| Share of total (excluding Indigenous pan-Canadian clients) | 34.1% | 21.0% | 9.1% | 35.8% | 100.0% |

- Notes:

- 1 This table reflects clients served between April 1, 2023 and March 31, 2024.

- 2 LMDA data for YT and NU are excluded due to insufficient client type information. Total clients served, including YT and NU estimates is 519,184.

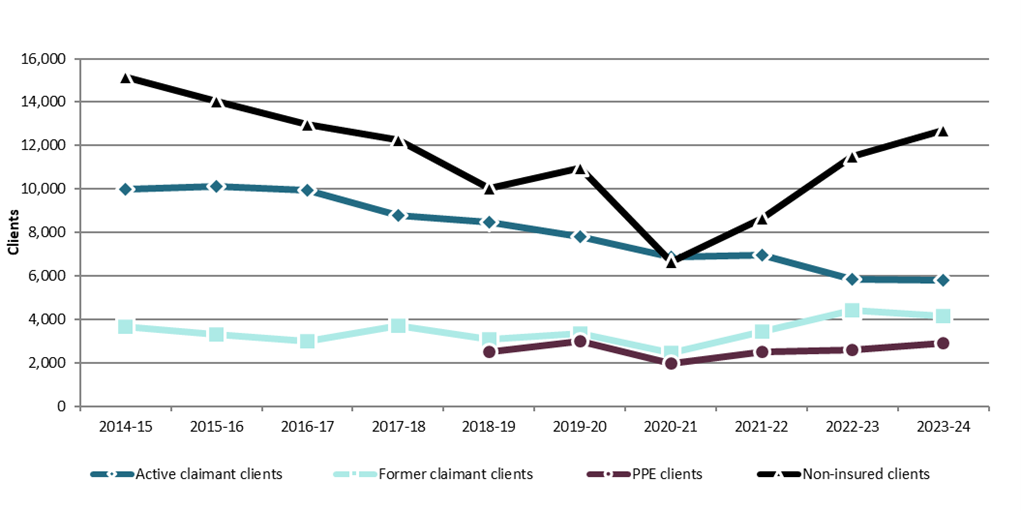

Since 2016-17, the number of active claimant clients (including Indigenous pan-Canadian clients) served under the LMDAs has been on a downward trend. This is largely attributed to improved labour market conditions. The decline accelerated in 2020, when COVID-19 public health protections were in place, leading to an even greater decrease in claimant numbers from 2020-21 to 2022-23. This trend reversed in 2023-24, with active claimant clients (including Indigenous pan-Canadian clients) rising from 153, 909 in 2022-23 to 176,168. This is thought to have been influenced by rising unemployment rates. Similarly, former claimant clients (including Indigenous pan-Canadian clients) also saw an increase from 114,468 to 115,998 in 2023-24, reinforcing the ongoing role of LMDAs in supporting individuals who are no longer receiving EI benefits but still need employment assistance.

The number of non-insured clients-individuals not linked to the EI system-increased to 175,945 in 2023-24, up from 158,321 the previous year. This rise reflects the number of non-insured individuals needing assistance, underscoring the broad reach of LMDAs in supporting employment needs beyond those with EI connections. In contrast, PPE clients (including Indigenous pan-Canadian clients) saw a slight decrease from 50,653 in 2022-23 to 49,443 in 2023-24, highlighting the continued challenge of providing assistance to people who have neither received EI in the preceding 5 years nor the current year.

Text description

| Year | Active claimant clients (including pan-Canadian clients) | Former claimant clients (including pan-Canadian clients) | PPE clients (including pan-Canadian clients) | Non-insured clients | Unemployment Rate |

|---|---|---|---|---|---|

| 2014-15 | 339,795 | 91,999 | n/a | 257,665 | 7.0% |

| 2015-16 | 356,828 | 92,689 | n/a | 284,607 | 7.0% |

| 2016-17 | 351,362 | 95,583 | n/a | 304,927 | 7.1% |

| 2017-18 | 313,998 | 115,927 | n/a | 285,733 | 6.4% |

| 2018-19 | 286,197 | 96,243 | 73,095 | 240,075 | 5.8% |

| 2019-20 | 262,196 | 98,633 | 73,088 | 218,350 | 5.7% |

| 2020-21 | 169,514 | 68,708 | 44,053 | 132,104 | 7.5% |

| 2021-22 | 163,672 | 90,005 | 45,900 | 134, 321 | 5.3% |

| 2022-23 | 153,909 | 114,468 | 50,653 | 158,321 | 5.4% |

| 2023-24 | 176,168 | 115,998 | 49,443 | 175,945 | 6.3% |

- Notes:

- 1 This chart reflects clients served between April 1, 2014 and March 31, 2024.

- 2 2022-24 LMDA data for YT and NU are excluded due to insufficient client type information.

- 3 Indigenous pan-Canadian clients are included.

- 4 Historical data has been adjusted to enhance accuracy.

This shift in 2023-24 signals renewed activity in LMDA programs, with an increased demand for services among active and former claimant clients, as well as non-insured individuals. The overall growth in client volumes highlights the responsiveness of LMDAs in adapting to changing economic conditions and their continuing relevance in helping a wide range of individuals re-enter or remain in the workforce. The slight decline in PPE clients, while small, suggests a need to further explore how to better engage this group in future labour market programs.

Clients by socio-demographic group

Breakdowns and details of clients by (1) age distribution, (2) designated and/or under-represented groups and (3) official languages are provided below:

Age distribution

The age distribution of clients under the LMDAs showed slight shifts in 2023-24, compared to the previous year. The percentage of youth clients (15-24 years old) decreased from 22.1% to 20.9%, (-1.2 percentage points). On the other hand, the percentage of core age clients (25-54 years old) who form most clients, increased from 65.3% in 2022-23 to 66.1% in 2023-24, (+0.8 percentage points). Additionally, the proportion of clients aged 55 and older increased slightly from 12.3% to 12.6% (+ 0.3 percentage points). See further details in the tables below:

| Age group | Number | Share of total |

|---|---|---|

| 15 to 19 | 28,503 | 5.5% |

| 20 to 24 | 79,381 | 15.4% |

| 25 to 29 | 80,919 | 15.7% |

| 30 to 34 | 75,227 | 14.6% |

| 35 to 39 | 61,958 | 12.0% |

| 40 to 44 | 50,716 | 9.8% |

| 45 to 49 | 39,024 | 7.6% |

| 50 to 54 | 32,768 | 6.4% |

| 55 and older | 65,213 | 12.6% |

| Unknown | 1,824 | 0.4% |

- Notes:

- 1 This table reflects clients served between April 1, 2023 and March 31, 2024.

- 2 LMDA data for YT and NU are excluded due to their data not being broken down by age groups.

| Youth (15-24) | Core age workers (25-54) | Clients aged 55 or older | Unknown |

|---|---|---|---|

| 20.9% | 66.1% | 12.6% | 0.4% |

- Notes:

- 1 This table reflects clients served between April 1, 2023 and March 31, 2024.

- 2 LMDA data for YT and NU are estimated figures.

- 3 LMDA YT data for 2023-24 are estimates, based on last year's estimated figures.

- 4 This table includes Indigenous pan-Canadian clients.

| National level data | 2022-23 | 2023-24 | Year-over-year change (p.p.) |

|---|---|---|---|

| Youth clients (15-24 years old) | 22.1% | 20.9% | -1.2 |

| Core age clients (25-54 years old) | 65.3% | 66.1% | +0.8 |

| Workers aged 55+ | 12.3% | 12.6% | +0.3 |

| Unknown Age | 0.3% | 0.4% | +0.1% |

- Notes:

- 1 This table reflects clients served between April 1, 2023 and March 31, 2024.

- 2 Reported counts may be lower than actual numbers due to reliance on self-identification PPE-categorized data.

- 3 LMDA data for YT and NU are estimated figures.

- 4 LMDA YT data for 2023-24 are estimates, based on last year's estimated figures.

- 5 Indigenous pan-Canadian clients are included.

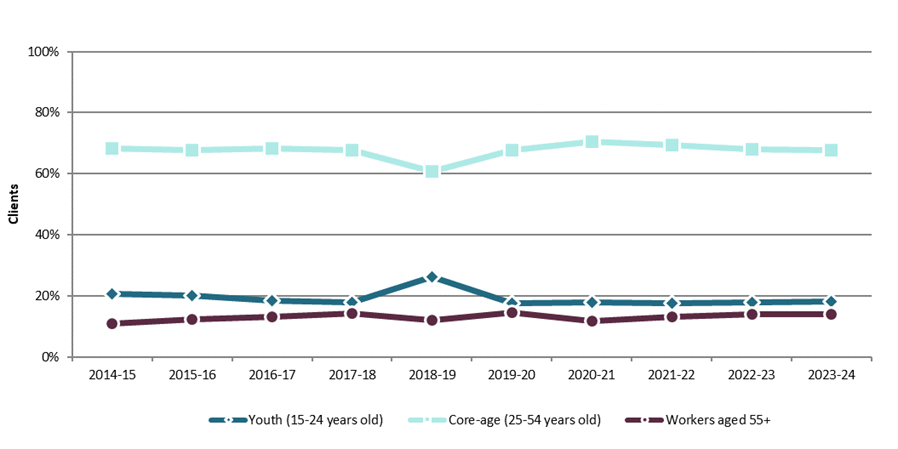

The data from 2014-15 to 2023-24 indicates consistent engagement from core-age clients (25-54 years old), who make up the majority of LMDA clients. Over the years, participation rates for core-age clients have fluctuated slightly, starting at 68.1% in 2014-15 before dipping to 63.1% in 2018-19 and gradually climbing back to 66.1% in 2023-24.

Youth client participation saw a notable increase, rising from 19.4% in 2014-15 to a peak of 24.6% in 2021-22. This spike reflects the economic impact of the ongoing pandemic, which reduced the LMDA services among older age cohorts, while driving higher reliance among youth, whose unemployment rate peaked at 24.5% in 2020-21. Since then, the proportion of youth clients has declined to 20.9%. These figures suggest that, while LMDA services remain a vital resource for young people, demand is stabilizing among other age groups.

Finally, the increasing participation of workers aged 55+ over time underscores the growing importance of LMDA programs for older Canadians. Their engagement rose from 12.5% in 2014-15 to 13.9% in 2019-20, before a notable dip to 9.5% in 2020-21. However, recovery has occurred, with participation increasing to 12.6% in 2023-24.

Text description

| Client type | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 |

|---|---|---|---|---|---|---|---|---|---|---|

| Youth (15-24 years old) | 19.4% | 20.6% | 20.4% | 21.0% | 22.3% | 20.9% | 24.5% | 24.6% | 22.1% | 20.9% |

| Core age (25-54 years old) | 68.1% | 66.9% | 66.7% | 65.5% | 63.1% | 65.1% | 65.9% | 65.4% | 65.3% | 66.1% |

| Workers aged 55+ | 12.5% | 12.4% | 12.9% | 13.5% | 13.4% | 13.9% | 9.5% | 10.0% | 12.3% | 12.6% |

- Notes:

- 1 This chart reflects clients served between April 1, 2014 and March 31, 2024.

- 2 Reported counts may be lower than actual numbers due to reliance on self-identification PPE-categorized data. As a result, totals may not precisely add to 100%.

- 3 LMDA data for YT and NU are estimated figures.

- 4 LMDA YT data for 2023-24 are estimates, based on last year's estimated figures.

- 5 Indigenous pan-Canadian clients are included.

Designated and under-represented groups

The table in this section shows year-over-year changes in representation for various designated and/or under-represented groups from 2022-23 to 2023-24. Notably, persons with disabilities saw an increase in representation from 16.6% to 17.7% (+1.1 percentage points), possibly reflecting progress in inclusivity efforts for this group.Footnote 23 Racialized people experienced a more substantial increase, with representation rising from 16.6% to 20.2% (+3.6 percentage points). This increase in representation for services corresponded to an increase in representation among the broader labour force for racialized people within the same fiscal period (an approximate 1.5 percentage points increase from 28.5% in 2022-23 to 2023-24).Footnote 24

In contrast, the proportion of clients who identified as Indigenous peoples declined, with representation dropping from 15.8% to 14.1% (-1.7 percentage points). In the broader labour force, by contrast, the representation of Indigenous workers remained stable (3.9% in 2022-23 to 3.8% in 2023-24).Footnote 25 The proportion of youth (15-24 years old) declined slightly, dropping from 21.6% to 20.3% (-1.3 percentage points). The representation of youth in the labour market at large remained constant between the 2 years (14.1%).Footnote 26

Older workers (aged 55 and older) had stable representation as clients (increasing from 11.8% to 12.0%) and within the broader labour force (decreasing from 21.5% to 21.3%).Footnote 27

The proportion of women that received supports declined slightly from 44.9% to 43.5% (-1.4 percentage points), where there was little change in the broader labour force (decreasing from 47.6% to 47.4%)Footnote 28.

| Designated and/or under-represented groups | 2022-23 Service provided | 2022-23 Representation (%) of total services | 2023-24 Service provided | 2023-24 Representation (%) of total services | Year-over-year (p.p.) |

|---|---|---|---|---|---|

| Persons with disabilities | 133,102 | 16.6% | 154,570 | 17.7% | +1.1 |

| Racialized people | 133,394 | 16.6% | 176,262 | 20.2% | +3.6 |

| Indigenous peoples | 126,968 | 15.8% | 122,930 | 14.1% | -1.7 |

| Youth (15-24 years old) | 173,779 | 21.6% | 176,583 | 20.3% | -1.3 |

| Older workers (aged 55+) | 95,253 | 11.8% | 104,248 | 12.0% | +0.2 |

| Women | 361,072 | 44.9% | 379,027 | 43.5% | -1.4 |

- Notes:

- 1 This table reflects services provided between April 1, 2023 and March 31, 2024.

- 2 Reported counts to designated groups may be lower than actual numbers due to reliance on voluntary self-identification.

- 3 LMDA data for YT and NU are estimated figures.

- 4 Indigenous pan-Canadian clients are included in all rows except Racialized people, which is an identity that these clients are not asked about.

- 5 Data for 2022-23 has been adjusted to enhance accuracy.

The table below highlights the distribution of services accessed by different demographic groups among LMDA clients, illustrating the levels of engagement in Employment Benefits versus Support Measures. Notably, Indigenous pan-Canadian programs do not separate services into these categories, instead providing a more integrated approach. Overall, for all LMDA clients, 192,365 services (23.5%) fell under Employment Benefits, while 627,664 services (76.5%) were Support Measures (i.e. EAS).

Some differences emerge for designated groups in accessing Employment Benefits compared to the general benchmark of 23.5%. While all groups accessed more Support Measures, youth accessed a higher proportion of Employment Benefits services, 27.9% (73,504 services), than any other designated group. Support Measures accounted for 72.1% (190,233 services) of services accessed by youth. This higher engagement in Employment Benefits may reflect fewer eligibility constraints or greater openness to training and wage subsidy programs compared to other groups. Older workers, in contrast, may be less inclined to participate in training programs that require a "return to school" later in life, while youth are more willing to take advantage of these opportunities.

One contributing factor may be eligibility requirements, as only active claimant clients, former claimant clients or PPE clients are eligible to receive Employment Benefits under LMDA. These eligibility criteria can limit Employment Benefits access for certain groups. Additionally, preferences and life stage considerations may play a role, particularly for older workers and women, who may prioritize Support Measures over training-based Employment Benefits.

Persons with disabilities accessed 26,554 Employment Benefits services (17.9%) and 122,141 Support Measures services (82.1%), while racialized people accessed 26,379 Employment Benefits services (15.0%) compared to 149,883 Support Measures services (85.0%). Similarly, older workers accessed 25,349 Employment Benefits services (16.7%) and 126,166 Support Measures services (83.3%) and women accessed 62,853 Employment Benefits services (17.8%) alongside 290,790 Support Measures services (82.2%). Indigenous peoples received 15,149 Employment Benefits services (21.3%) and 56,041 Support Measures services (78.7%), aligning more closely with the benchmark but still demonstrating a higher use of Support Measures.

| Designated and/or under-represented groups | Employment Benefit (EB) services | Employment Benefit % of the total services | Support Measures (SM) (i.e. EAS) | Support Measures % of the total services |

|---|---|---|---|---|

| All LMDA clients (for reference) | 192,365 | 23.5% | 627,664 | 76.5% |

| Persons with disabilities | 26,554 | 17.9% | 122,141 | 82.1% |

| Racialized people | 26,379 | 15.0% | 149,883 | 85.0% |

| Indigenous peoples | 15,149 | 21.3% | 56,041 | 78.7% |

| Youth (15-24 years old) | 73,504 | 27.9% | 190,233 | 72.1% |

| Older workers (aged 55+) | 25,349 | 16.7% | 126,166 | 83.3% |

| Women | 62,853 | 17.8% | 290,790 | 82.2% |

- Notes:

- 1 This table reflects services provided between April 1, 2023 and March 31, 2024.

- 2 This table excludes Indigenous pan-Canadian data because their services do not align with the Employment Benefits / Support Measures categorization.

- 3 Reported counts to designated groups may be lower than actual numbers due to reliance on voluntary self-identification.

- 4 LMDA data for YT and NU are estimated figures.

Official languages

To foster full recognition and use of English and French in Canadian society and to help ensure that labour market programs and services are delivered in both official languages, all LMDAs contain commitments by PTs to have programs and services delivered in both official languages where there is significant demand.