Instructions for completing the utilization report

In this section

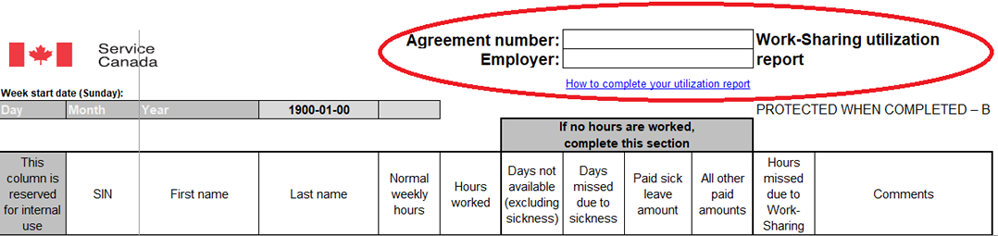

Agreement number and Employer

In the Agreement number field, enter the 7-to-10-digit number located in the File No. field at the top of your signed Work-Sharing agreement. The agreement number is not the reference code used by employees when they apply for Employment Insurance (EI) benefits.

In the Employer field, enter the company name. Make sure you use the same name as indicated on your Work-Sharing agreement and your Data Gateway account.

Week start date (Sunday)

The Week start date (Sunday) fields are greyed out. You will be able to complete them only when the Agreement number and Employer name are entered.

Enter the day, month, and year of the start date (Sunday) of the week you're reporting on. Once you enter this information correctly, the date and a 4-digit number appear in the 2 cells to the right. The 4-digit number is for internal use only.

You must complete these fields before adding any employee information to the utilization report (UR).

When you enter the date on the Week 1 sheet, the template automatically completes the Week start date (Sunday) field on the sheets for all following weeks.

Identity information fields

The SIN field is greyed out. You will be able to complete it only when the information on the Week start date (Sunday) fields is entered.

Enter each employee's social insurance number (SIN) without spaces, and first and last names in the appropriate fields.

The SIN will appear in red when entered. When you move to the next field, the SIN will turn black if it's a correctly formatted, valid SIN. If the SIN remains red, correct the information.

If the SIN is red, the other fields will remain grey, and you won't be able to enter any additional information in the row.

Once you enter the SIN, and the first and last names in the appropriate fields on the Week 1 sheet, the template will copy this information to all the following weeks.

Normal weekly hours and Hours worked

The Normal weekly hours and Hours worked fields are greyed out. You will be able to complete them only when a correctly formatted, valid SIN is entered.

Normal weekly hours

Enter each employee's normal weekly hours as indicated on the Attachment A submitted when you applied for Work-Sharing, unless otherwise advised by your program officer.

Once you enter the normal weekly hours on the Week 1 sheet, the template automatically copies this information to all following weeks.

Hours worked

Enter the number of hours the employee worked during the week, including overtime.

Round down the hours worked to the nearest whole or half number (for example, round 37.25 hours to 37 hours and 36.75 hours to 36.5 hours).

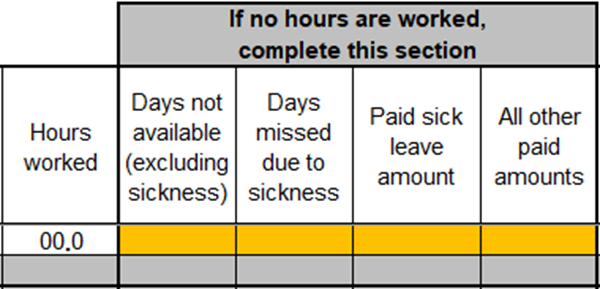

If no hours are worked

This section includes 4 fields:

- Days not available (excluding sickness)

- Days missed due to sickness

- Paid sick leave amount

- All other paid amounts

This section is greyed out. You will be able to complete it only when a 0 is entered into the Hours Worked field.

Note

"Sickness" means unable to work due to illness, injury, quarantine, or any medical condition that prevents an employee from working.

Days not available (excluding sickness)

Enter the number of days from Monday to Friday (1 to 5) the employee wasn't available to work for reasons other than sickness. Don't include half days, statutory holidays, or shutdown days. If the employee didn't miss work for reasons other than sickness, enter 0.

To protect employees' privacy, don't include the reason they weren't available in the Comments field (for example, due to lack of childcare, a medical appointment, or vacation time).

Days missed due to sickness

Enter the number of days Monday to Friday (1 to 5) the employee was unable to work due to illness, injury, or quarantine. If the employee didn't miss work for these reasons, enter 0.

To protect employees' privacy, don't include the medical reasons in the Comments field.

Paid sick leave amount

If you entered days in the Days missed due to sickness field, enter the amount paid to the employee for sick leave. If no monies were paid to the employee for sick leave, enter 0.

Include any workers' compensation benefits amounts, if known, and provide details in Comments (for example, WCB, WSIB, or CNESST).

All other paid amounts

Enter the total of all other amounts paid to the employee for the week (vacation pay, statutory holiday pay, bonuses, etc.). If no other amounts were paid to the employee, enter 0.

Detail the amount, date or date range, and reason for the payment in the Comments field for each amount included in this total.

Hours missed due to Work-Sharing

The Hours missed due to Work-Sharing field is greyed out. You will be able to complete it only when a correctly formatted, valid SIN is entered.

If the number of hours worked during the week is greater than 0, calculate Hours missed due to Work-Sharing as follows:

- Begin with the Normal weekly hours

- Subtract the number in the Hours worked field

- Subtract all hours missed for any other reason (for example, statutory holidays, vacation time, sickness or lack of childcare)

Round up the hours to the nearest whole or half number (for example, round 37.25 hours up to 37.5 hours and 36.75 hours up to 37 hours).

If the number of hours worked during the week is 0, the hours missed due to Work-Sharing must also be 0. Once you enter 0 in the Hours Worked field, the template will automatically complete the Hours missed due to Work-Sharing field with 0.

Don't leave this field blank. If the employee didn't miss any hours due to Work-Sharing, enter 0.

The sum of Hours worked and Hours missed may not equal the Normal weekly hours, due to hours missed for other reasons (sickness, vacation, etc). Don't use the Comments field to explain this situation.

Comments

The Comments field is greyed out. You will be able to complete it only when a correctly formatted, valid SIN is entered.

Enter comments in the following situations:

- employee leaves (layoff, voluntary leaving, dismissal, etc.): enter the reason, the separation date, and the amount and type of money paid on separation. Refer to Employee leaves Work-Sharing employment for guidance

- paid sick leave, wage-loss insurance or workers' compensation benefit payments: enter the payment type. Provide the dollar amount if known

- planned shutdown: enter "Planned shutdown". Refer to Planned shutdown for guidance

- other payments (performance bonus, severance, etc.): enter the amount of money paid, the date or date range, and the reason for the payment

Don't enter comments to:

- explain why an employee wasn't available (for example, lack of childcare, a medical appointment or vacation time)

- provide the medical reasons when an employee misses work due to sickness

- explain why the sum of Hours worked and Hours missed does not equal the Normal weekly hours (for example, due to statutory holidays. Refer to Week with a statutory holiday for guidance)

Declaration fields

Enter your name, phone number, position in the company, and the date you completed the report. The date entered should be on or after the Friday of the week you're reporting on. This information is used to contact you if we need more details on your UR.

You must complete these fields every week.