Consultation Document- Proposed Approach to Cost Recovery for the Regulation of Cannabis

Download the alternative format

(PDF format, 393 KB, 30 pages)

Organization: Health Canada

Date published: July 12, 2018

Preface

On April 13, 2017, the Government of Canada introduced Bill C-45, an Act respecting cannabis and to amend the Controlled Drugs and Substances Act, the Criminal Code and other Acts (the Cannabis Act) in the House of Commons. The passing of the Cannabis Act implements the 2015 Speech from the Throne commitment to legalize, strictly regulate and restrict access to cannabis. To support implementation of the Act, regulations have been developed in a range of areas, including establishing classes of licences; cannabis product standards; and, packaging and labelling requirements.

In its 2017 Fall Economic Statement, Progress for the Middle Class, the Government of Canada provided $546 million over five years for the implementation, administration and enforcement of the Cannabis Act. This funding has been provided to Health Canada, the Royal Canadian Mounted Police, the Canada Border Services Agency, the Public Health Agency of Canada and Public Safety Canada to ensure they have appropriate capacity to licence, inspect and enforce all aspects of the Cannabis Act and to undertake robust public education and awareness activities.

The Fall Economic Statement also confirmed that the Government of Canada would implement a cost recovery regime under the Cannabis Act. Cost recovery is based on the principle that the public should not bear the costs of government activities when private parties derive the primary benefit from these government activities and services. Based on this principle, Health Canada undertakes cost recovery in a number of areas, such as pharmaceuticals and medical devices.

The fees outlined in this proposal are consistent with the Cannabis Regulations.

The proposed fees would apply to licensed cultivators, processors, nurseries and sellers of cannabis. Given the Government of Canada's objective of supporting a diverse cannabis industry that includes smaller entities, Health Canada is proposing to discount some fees for micro-cultivation, micro-processing and nursery licence holders. Given the Government's objective of supporting access to cannabis for medical purposes, Health Canada is also proposing to waive certain fees for licence holders that sell exclusively to individuals authorized by their healthcare practitioner to access cannabis for medical purposes.

For reasons outlined in more detail in this consultation paper, it is proposed that licence or authorization holders for industrial hemp, research, analytical laboratories, and individuals (or their designate) registered with Health Canada to produce a limited amount of cannabis for their own medical purposes, would be exempt from fees under this proposal. Similarly, it is proposed that licence or authorization holders for health products containing cannabis, including health products and natural health products governed under the Food and Drugs Act, would be exempt from fees under the Cannabis Act.

The purpose of this consultation paper is to solicit public input and views on the proposed approach to recovering federal government costs under the cannabis framework. Comments received will be considered in the final design of the cost recovery regime, which is expected to be put in place through a ministerial order following the coming into force of the Cannabis Act and its regulations.

The purpose of this consultation paper is to solicit public input and views on the proposed approach to recovering federal government costs under the proposed cannabis framework. Comments received will be considered in the final design of the cost recovery regime, which is expected to be put in place through a ministerial order following the coming into force of the proposed Cannabis Act and its regulations.

It is important that interested parties provide feedback on the fee proposals in this consultation paper as it will be the only opportunity for input before the ministerial order is finalized. A summary of the input received will be included with the final ministerial order when it is published in the Canada Gazette Part II.

The proposed cost recovery regime set out in this paper is for consultation purposes only and should not be interpreted as representing the final views of the Minister of Health or the Government of Canada.

Health Canada thanks all stakeholders for the valuable contributions they have made to date in the development of the Cannabis Act and its supporting regulations, as well as their participation in these consultations regarding the proposed cost recovery regime.

Contents

- Preface

- Introduction

- Proposed Cost Recovery Regime

- Fee Administration and Transition.

- Accountability and Transparency

- Contact Us

- Annex 1: Consultation Questions

- Annex 2: Licence/Fee Scenarios

- Annex 3: Additional Cost Information

- Annex 4: Annual Regulatory Fee Scenarios

Introduction

1.1 Context

In 2016, the Government of Canada created the Task Force on Cannabis Legalization and Regulation to provide advice on the design of a new legislative and regulatory framework for cannabis. The Task Force recommended that the Government establish a legal regime that would create a diverse and competitive industry that includes small producers and is capable of displacing the illegal cannabis market. It also advised the Government to implement a fee structure to recover administrative costs of the cannabis regulatory regimeFootnote 1.

The Cannabis Act received Royal Assent on June 21, 2018. Based in large part on the advice provided by the Task Force, the Cannabis Act establishes a comprehensive national framework to provide restricted access to regulated cannabis, and to control its production, possession, distribution, sale, import and export. The Act also establishes the authority to charge fees to recover federal government costs.

The Cannabis ActFootnote 2 and its related regulations serve the following objectives:

- Set the general control framework for cannabis: The Act establishes a general control framework for cannabis by establishing a series of criminal prohibitions, and then providing exceptions or authorizations to permit persons to engage in otherwise prohibited activities. For example, the Act prohibits any person from selling cannabis, unless explicitly authorized to do so under the Act or its regulations. The Cannabis Act also prohibits individuals aged 18 years or older from possessing more than 30 grams of dried cannabis or its equivalent in public. Provinces and territories, together with municipalities, can also tailor certain rules in their own jurisdiction (for example, setting a higher minimum age or more restrictive limits on possession or personal cultivation, including lowering the number of plants or restricting where it may be cultivated);

- Provide a licensing scheme for a legal cannabis supply chain: The Cannabis Act, through the granting of a licence, permit or authorization, sets parameters for the operation of a legal cannabis industry. Federal and provincial/territorial governments share responsibility for the oversight and licensing of the cannabis supply chain. The federal Minister of Health is responsible for licensing, among other activities, the production of cannabis (cultivation and processing) and provincial/territorial governments have the ability to use their legislative authority to authorize the distribution and retail sale of cannabis in their respective jurisdictions, should they choose to do so; and,

- Establish national standards to protect public health and public safety: The Act sets a number of clear legal requirements intended to protect against the public health and public safety risks associated with cannabis, in line with the government's objectives. For example, the Act prohibits the sale of products appealing to youth and sets out a comprehensive framework to restrict promotion to protect young persons and others from inducements to use cannabis.

Clause 142 of the Cannabis Act provides the Minister of Health with the authority to establish fees to recover federal government costs through a ministerial orderFootnote 3, including fees for services, use of facilities, approvals, authorizations, exemptions or regulatory processes, and in respect of products, rights and privileges.

The 2017 Fall Economic Statement reaffirmed the Government of Canada's intent to implement a cost recovery regime under the Cannabis Act to reduce the costs to taxpayers for this initiative.

The Cannabis Regulations establish rules in a range of areas, including cannabis product standards; packaging and labelling; classes of licences for the production and sale of cannabis; and, security requirements. The regulations also bring together all producers of cannabis-based products under a single framework, which seeks to enable the participation of small cultivators and processors in the legal industry. The cost recovery regime described in this paper is based on the licence types and personnel security requirements under the Cannabis Act and the Cannabis Regulations.

1.2 Cost Recovery within the Government of Canada

Cost recovery is based on the principle that the public should not bear the costs of government activities in cases where private parties derive the primary benefit. This principle promotes an equitable approach to financing government programs by fairly charging individuals or organizations for the services they received or for the costs incurred to enable their activity.Footnote 4

The Government of Canada charges industries and the public fees for diverse activities and services, such as licences for the manufacturing of pharmaceuticals, staying in national parks or granting citizenship. As noted in the 2008 Auditor General report on Management of Fees in Selected Departments and Agencies, "fees differ according to the good, service, or benefit provided, and the circumstances of the individual payerFootnote 5". The Auditor General also noted that fees are different from taxes as fees are generally limited to recuperating the cost of a given activity or program and are under the purview of a Minister or the Governor-in-Council, while taxes are imposed by Parliament and the amount collected is generally not limited.

Cost recovery regimes across the Government of Canada are typically established by identifying a cost base for the relevant activity. In some cases, fees may be discounted to facilitate policy goals, such as supporting small businesses. Typical costs recovered in regulatory programs include activities such as the granting of permissions or the reviewing of applications for product market authorizations (e.g., health products, medical devices) to be sold in Canada.

Within the Health portfolioFootnote 6, over $150 million in fees and charges are collected annually to offset the costs of regulating a diverse set of products and activities, such as market authorizations for health products, importing pesticides, producing food, and handling controlled substances such as opioids. However, since the Marihuana for Medical Purposes Regulations created the conditions for Health Canada to licence the production of cannabis for medical purposes in 2013, no fees have been charged to licensed producers for services they have received or to recover costs to enable their activity.

1.3 Purpose and Scope of Consultation

This consultation paper proposes a set of fees to recover the costs of activities undertaken by Health Canada, supported by the Canada Border Services Agency, the Royal Canadian Mounted Police, Public Safety Canada and the Public Health Agency of Canada, to regulate and strictly control access to cannabis.

Consultations on the proposed fee regime will be held from July 12, 2018 to August 13, 2018.

Public feedback will serve to inform final decisions by the Minister of Health on establishing fees through a ministerial order that will coincide with the coming into force of the Cannabis Act and its regulations.

Consultation details and key questions are in the "Contact Us" section and Annex 1.

Proposed Cost Recovery Regime

2.1 Overall Approach to Cannabis Cost Recovery

The proposed cost recovery regime is guided by well-established approaches used across the Government of Canada; legal principles from cost recovery jurisprudence; the experience of other programs within Health Canada; and, is informed by Health Canada's Policy on External Charging.

In developing the cost recovery regime described in the following pages, Health Canada is proposing that fees would apply to those cannabis licence holders whose activities will create the greatest need for public expenditures and who will benefit most from the new regulatory regime. Accordingly, the proposed fees would only apply to holders of nursery, cultivation, processing and sales licences. Based on estimates of market size and the number of licensed producers, the proposed fees would allow Health Canada to recover as much as 100% of annual regulatory costs as early as 2020–21.

The goal of achieving full cost recovery is balanced against two important policy objectives for the Government of Canada: supporting a diverse, national cannabis industry that includes smaller entities and continuing to ensure that individuals who have the authorization of their healthcare practitioner have access to cannabis for medical purposes. As such, Health Canada is proposing to discount some fees for nurseries and those holding micro class licences, and provide exemptions for licence holders who sell cannabis exclusively for medical purposes.

As mentioned in the Preface, no fees are being proposed for industrial hemp producers, analytical laboratories or cannabis researchers or individuals (or their designate) registered with Health Canada to produce a limited amount of cannabis for their own medical purposes. Moreover, licence or authorization holders for health products containing cannabis, which include natural health products containing cannabis, will not be subject to fees under the Cannabis Act. These licence classes are being exempted for a variety of reasons, including:

- More limited regulatory costs to administer these licence classes;

- More limited benefits from the regulatory regime for these licence classes than for the licence classes subject to cost recovery;

- There is a policy interest in supporting some of these activities with cannabis (e.g. research and laboratory services); and,

- Some of these licence classes may also be governed by other regulatory regimes with different regulatory requirements, costs, and cost recovery frameworks.

2.2 Proposed Fees

Four proposed fees are described below. Three of these fees, namely the Application Screening Fee, Import/Export Permit Fee, and Security Screening Fee, are based on the costs of specific regulatory activities and are described in sections 2.2.1, 2.2.2 and 2.2.3 respectively. In each of these three cases, Health Canada has sufficient data from past operations under the Access to Cannabis for Medical Purposes Regulations (ACMPR) to fairly estimate the cost of these activities, consistent with the Treasury Board Secretariat's Guidelines on CostingFootnote 7.

Fees of this nature also typically have an associated service standard. Service standards provide clear expectations for regulated parties and make the department or agency accountable. They are also an important factor in establishing costs as faster services typically require additional resources and cost more.

While service standards are not required under the Cannabis Act, Health Canada is proposing to establish administrative (non-binding) service standards for the Application Screening Fee and the Import/Export Permit Fee based on the experience of operating under the ACMPR. Health Canada can adequately forecast the costs of these activities; however, it cannot yet predict the volume or demand with a high degree of certainty. As such, these administrative service standards are based on anticipated business conditions and should the volume exceed Health Canada's capacity to process applications, service standards may not be sustained.

For the third activity-based fee, the Security Screening Fee, which consists of research and analysis by Health Canada, the Royal Canadian Mounted Police (RCMP), and other law enforcement agencies, it is not possible to establish service standards at this time. Experience under the ACMPR has shown high variations in the time to process security clearances in a significant percentage of cases as the process involves verification with third party law enforcement agencies whether an individual has associations with organized crime. In addition, the impact on processing times of the regulatory changes on who will be required to hold a security clearance is not yet known.

Health Canada intends to monitor its administration of the regulatory program closely with a view to establishing service standards in a variety of areas such as licensing and licence amendments to support transparency and predictability for regulated parties over the next few years as the requirements on the cannabis regulatory program normalize.

The fourth fee, the Annual Regulatory Fee, is designed to recover general regulatory program costs and has a distinct approach described in section 2.2.4. As a general charge, it is not tied to a specific regulatory process or activity, therefore, no performance standard is proposed at this time.

To assist prospective licence holders in reviewing this proposal, a table in Annex 2 illustrates the potential financial implications of fees in different scenarios. In addition, more details on the costing of each of the fees is available in Annex 3.

2.2.1 Application Screening Fee

This fee would recover the costs associated with screening new licence applications for nursery, cultivation, processing and sales of cannabis for medical purposes activities. Screening is the activity that occurs when an application for a licence is first received; it determines the completeness of information being provided to Health Canada before it proceeds to the next stage of review.

Health Canada is proposing a discounted Application Screening Fee for the micro-cultivation, micro processing and nursery licence classes. The proposed discounted fee is intended to help support a diverse national cannabis industry that includes the participation of small cultivators and processors and encourages the availability of diverse strains of cannabis.

2.2.2 Import/Export Permit Fee

This fee would recover the costs associated with the screening, processing and issuance or refusal of an import or export permit for medical or scientific purposes. This fee would be applicable to licence holders for nursery, cultivation, processing and sales of cannabis for medical purposes activities under the Cannabis Act.

2.2.3 Security Screening Fee

This fee would recover the costs associated with the screening, processing and issuance or denial of security clearances for applicants and licence holders for nursery, cultivation, processing and sales of cannabis for medical purposes activities under the Cannabis Act. Organizations would be required to obtain a security screening for key individuals under the conditions set out in the Cannabis Act and its regulations.

The Security Screening Fee would be required for all applications for new or renewed security clearances once the Cannabis Act comes into force. Individuals who currently hold a valid security screening would only be subject to the fee at the time of renewal.

| Fees | Description | Applicable To | Cost | Administrative Service Standard |

|---|---|---|---|---|

Application Screening Fee |

The recovery of costs associated with the intake, screening, acceptance or rejection of new applications for certain licensed activities |

All new applications related to the following licences and authorizations:

Not Applicable to:

|

$3,277 per application for the following licences:

$1,638 per application for the following licences:

The Application Screening Fee is non-refundable for applications that are incomplete or are rejected at this stage of the licencing process |

Complete screening within 30 business days from receipt of the payment for the application, under normal business circumstances |

Import/Export Permit Fee |

The recovery of costs associated with the screening, processing and issuance or refusal of an import or export permit for medical or scientific purposes |

Persons licensed or permitted to conduct activities involving cannabis who seek to obtain an import or export permit for medical or scientific purposes. |

$610 per permit request The Import/Export Permit Fee is non-refundable for those requests that are refused |

Issuance or rejection of the permit within 30 business days from receipt of the payment for the application, under normal business circumstances |

Security Screening Fee |

The recovery of costs associated with the screening, processing and issuance or refusal of a security clearance |

Each individual required to possess a valid security clearance; both for the processing of a new security screening request and the renewal of an existing security clearance |

$1,654 per security screening request The Security Screening Fee is non-refundable for applications that are refused |

Not applicable at this time (see explanation in section 2.2) |

2.2.4 Annual Regulatory Fee

Health Canada is proposing to implement the Annual Regulatory Fee to recover the costs of the cannabis regulatory program that are not covered under one of the previously described fees. The Annual Regulatory Fee aims to minimize the overall administrative burden, both on the licence holder and on Health Canada, by recovering the majority of regulatory costs through one fee as opposed to a more complex set of fees. The Fee would be payable when a licence is originally granted and then annually for as long as the licence is held.

Establishing this fee requires two steps. The first is to establish the cost base of the regulatory program across the federal government. The second is to allocate those costs to the regulated industry.

Annual Regulatory Fee: Cost Base

The regulatory costs are associated with a range of regulatory activities undertaken by Health Canada, the Canada Border Services Agency, the Public Health Agency of Canada and Public Safety Canada to deliver on policy objectives to legalize, strictly regulate and control access to cannabis.

As detailed in Annex 3, the approach used to establish the cost base is:

Identify total costs for the cannabis program, then subtract non-regulatory costs, as well as regulatory costs recovered through the other three fees outlined in this proposal. The result equals the Annual Regulatory Fee cost base.

The 2017 Fall Economic Update identified funds for cannabis legalization and regulation in the amount of $546 million over five years. Beyond this, an additional $6 million was identified, meaning that the total forecasted expenditures for the Government of Canada to strictly regulate and restrict access to cannabis is $553 million over five yearsFootnote 8. Of this, $383 million is the total amount of eligible regulatory costs that are not already being recovered through one of the three proposed activity-based fees (as outlined above). Table 2 outlines the basis of the Annual Regulatory Fee.

| 2017-2018 | 2018-2019 | 2019-2020 | 2020-2021 | 2021-2022 | 5-Year Total | |

|---|---|---|---|---|---|---|

| Total Forecasted Costs to Regulate and Restrict Access to Cannabis | 63 | 108 | 115 | 126 | 141 | 553 |

| Less Costs linked to the three proposed activity-based Fees | 7 | 9 | 10 | 12 | 38 | |

| Less Ineligible Costs Footnote 9 | 63 | 19 | 16 | 17 | 17 | 132 |

| Annual Regulatory Fee: Eligible Regulatory Costs | - | 82 | 90 | 99 | 112 | 383 |

Allocating the Cost Base amongst Licence Holders

The proposal to recover costs through the Annual Regulatory Fee aims to keep the total amount recovered modest during the initial implementation of the new legislation, and then increase it over time as the legal industry matures and stabilizes and as the legal industry's share of the overall market grows. This approach is designed to support the government's objective of displacing the illegal market by moderating the impact of regulatory fees on the price of legal cannabis when fees are introduced.

A number of options were considered to apportion the costs amongst licence holders. Most were found to have drawbacks in terms of fairness to different sizes of organizations or business models and/or complexity. Gross revenue generated from legal cannabis sales was identified as the most appropriate metric upon which to allocate the eligible regulatory costs:

- It is simple to administer and uses information that licence holders will already be tracking;

- It measures the size of the licence holder's operations in the legal cannabis market and thereby provides a proxy for the level of effort required to regulate the licence holder's activities; and,

- It provides a proxy for financial capacity to afford a fee.

Financial metrics are used in the administration of fees in a number of programs. For instance, Health Canada charges an annual fee for registered pest control products based on revenues and Parks Canada charges fees based on revenues from businesses that operate within certain park boundaries. The National Energy Board recovers its operating costs from the companies it regulates based on the volume of oil, gas and electricity that they transport.

In selecting revenue as the basis for the application of the Annual Regulatory Fee, it is clear that the definition of revenue and how it is applied is critical. The legal market is expected to be dynamic, with notable changes in prices market participants, market size and market share in the next few years. Health Canada is considering options to charge the Fee based on forecasted revenues for any given year, past year actual revenues or a combination of the two. Feedback on this point is encouraged and will be assessed in balancing the goals of full cost recovery and a regime that is simple, fair, and affordable.

The fee authorities in the Cannabis Act limit the amount collected through cost recovery to the cost to the Government of Canada to administer the program. Given the unknowns about the operation of the legal market under the Cannabis Act, the amount recovered through the Annual Regulatory Fee is difficult to forecast with a high degree of certainty. For instance, the overall size of the market, the number of licence holders and the prices that will be realized at different stages of the supply chain are all important factors that have only been estimated thus far.

As such, a sensitivity analysis was undertaken to estimate the amount that could be recovered through the Annual Regulatory Fee in different scenarios and to minimize the risk that the amount collected could exceed regulatory costs. While the likelihood that the amount recovered would exceed the regulatory cost base is very low, the risk would increase over time. This underlines the need to monitor the Annual Regulatory Fee on an ongoing basis and to make adjustments as required to ensure that up to one hundred percent of eligible regulatory costs are recovered without exceeding the total.

Annual Regulatory Fee - Application

Based on the sensitivity analysis, Health Canada estimates that an Annual Regulatory Fee rate of 2.3% of cannabis revenue would achieve the government’s objective of full regulatory cost recovery. Table 3 describes the calculation of the Annual Regulatory Fee for each licence class.

The rate of 2.3% may need to be adjusted upward depending on the final decision to apply the fee based on forecasted or previous year’s actual revenue or a combination of the two.

To support a diverse cannabis industry that includes smaller entities, a lower fee is proposed for micro-cultivators, micro-processors and nursery licence holders with less than $1 million in gross revenue.

Furthermore, given the Government of Canada’s objective of supporting access to cannabis for medical purposes following the implementation of the new legislation, Health Canada is proposing to waive the Annual Regulatory Fee for licence holders that sell exclusively to individuals who are authorized by their healthcare practitioner to access cannabis for medical purposes. This exemption from the Annual Regulatory Fee would be reviewed once the market demonstrates the capacity to provide a stable supply of cannabis for medical purposes.

| Licence | Annual Regulatory Fee |

|---|---|

Standard Cultivation |

|

Micro-Cultivation |

|

Nursery |

|

Standard Processing |

|

Micro-Processing |

|

Sale of Cannabis for Medical Purposes |

|

Industrial Hemp |

|

Analytical Testing |

|

Research |

|

Please see Annex 4 for further details on how the proposed Annual Regulatory Fee would be calculated in scenarios where licence holders are vertically integrated (e.g. individuals or entities that hold cultivation, processing and sales licences) and where they are specialized in one licensed activity.

Fee Administration and Transition

3.1 Annual Regulatory Administration

Once in force, the Annual Regulatory Fee will oblige all applicable licence holders to pay this fee as set out in Table 3 (on the previous page). The Annual Regulatory Fee will be a condition of licence and new and existing licence holders will not be permitted to begin or continue operations until the fee has been paid in full.

The Annual Regulatory Fee would be calculated based on the licence holder’s defined gross revenue for a given year. This includes those licensed for a portion of a year, including those previously regulated under the ACMPR.

Revenues would be verified against revenue reported to the Canada Revenue Agency. Any under- or over-charge by Health Canada of the Annual Regulatory Fee would be corrected in the form of an adjustment to their subsequent year’s Annual Regulatory Fee.

In the unlikely event that the Annual Regulatory Fee results in the Government of Canada collecting more overall gross revenue than the overall cost of the cannabis regulatory program, Health Canada would assess the cost recovery regime and report on any resulting actions as part of the annual fee reporting process as required by the Treasury Board SecretariatFootnote 10 .

3.2 Administrative Provisions for the Application Screening Fee, the Security Screening Fee, and the Import/Export Fee

Consistent with the approach taken by other departments and agencies, Health Canada is proposing that the Application Screening Fee, the Import/Export Fee and the Security Screening Fee be adjusted annually based upon the Consumer Price Index to ensure that these fees keep pace with the costs to deliver these activities.

The Application Screening Fee, the Import/Export Fee and the Security Screening Fee would all be payable when an application is submitted. No work on any of these services will commence until Health Canada receives payment in full.

Accountability and Transparency

Health Canada will be responsible for undertaking annual public reporting on the funds collected through fees and performance against service standards, where applicable. There are a number of legislative and government policy requirements to ensure proper accountability and transparency when fees and charges are introduced through a ministerial order.

Under section 143 of the Cannabis Act, the Minister must consult with interested parties before fixing fees. In addition, fees for services or regulatory processes must not exceed the related cost.

The ministerial order for fees and charges is subject to the Statutory Instruments Act and review by the Standing Joint Committee for the Scrutiny of Regulations, which has the power to initiate revocation of a given user fee or regulatory charge.

The Deputy Minister of Health, as an Accounting Officer under the Financial Administration Act, is accountable before the appropriate Parliamentary committees for duties assigned to him by the Minister, including those under a ministerial order for fees.

At the same time, the Directive on Charging and Special Financial Authorities, which details the accountabilities of the Chief Financial Officer and senior departmental managers, is currently under review by the Treasury Board Secretariat. Administration of and reporting on these fees will be done in accordance with the Treasury Board policy in force when the cannabis cost recovery ministerial order comes into force.

All cost-recovered programs are subject to departmental evaluation as well as internal and external audits to ensure fees are consistent with Government of Canada legal obligations and policies.

All fees outlined in this proposal would be monitored on an ongoing basis and be adjusted to reflect changes in regulatory costs, and industry and regulatory developments (such as the introduction of edible and concentrate products).

Finally, consistent with Government of Canada practices, Health Canada will undertake the required work to establish a dispute resolution mechanism under the proposed fee regime to provide licence holders with a mechanism to address disputes.

Contact Us

The consultation period will be between July 12, 2018 and August 13, 2018.

Interested stakeholders are encouraged to provide written comments and responses to Health Canada by no later than August 13, 2018.

To facilitate public input, Health Canada has established an online consultation portal. Alternatively, written submissions (Microsoft Word or Adobe PDF) may be emailed to: cannabis@canada.ca or mailed to:

Cannabis Legalization and Regulation Branch

Health Canada

Address locator: 0602E

Ottawa, Ontario

K1A 0K9

Annex 1: Consultation Questions

- Do you think the approach will be fair for both licence holders and the government? Please explain why or why not.

- Will the proposed fees affect your ability to compete in the Canadian cannabis market? If yes, please provide an explanation.

- Will the proposed fees support the development of a diverse industry that includes small business? Does the proposal help maintain access to cannabis for medical purposes?

- With regards to the Annual Regulatory Fee, do you think that prior year actual revenue or current year projected revenue would be a better base for this fee? Are there alternative approaches Health Canada should consider for allocating general regulatory costs? Please explain why.

- What do you think of the service standards (Table 1, page 8)? Are they set at appropriate levels considering the context of the new legal regime? What is your biggest priority for Health Canada in establishing additional service standards?

- Health Canada plans to review its fee structure in the future. What would be an appropriate time frame in which to review the fees relating to the regulation of cannabis? Please elaborate.

- Is there any additional feedback that you would like to share on the proposed approach to cost recovery for the regulation of cannabis?

Annex 2: Licence/Fee Scenarios

| Micro Class Site | Standard Class Site | |||

|---|---|---|---|---|

| Medium | Medium – Medical Sales Only | Large | ||

| Initial Fees | - | - | - | - |

| Application Screening Fee | $1,638 | $3,277 | $3,277 | $3,277 |

| Security Screening Fee (1) | $4,962 | $41,350 | $41,350 | $66,160 |

| Annual Regulatory Fee (2) | $2,500 | $23,000 | $0 | $23,000 |

| Total - Initial Fees | $9,100 | $67,627 | $44,627 | $92,437 |

| Ongoing Fees | - | - | - | - |

| Security Screening Fee (3) | $992 | $8,270 | $8,270 | $13,232 |

| Annual Regulatory Fee (4) | $5,000 | $230,000 | $0 | $1,150,000 |

| Total - Ongoing Fees | $5,992 | $238,270 | $8,270 | $1,163,232 |

Notes

- The Security Screening Fee assumes the following number of requests: Micro = 3; Medium = 25; Large = 40.

- The initial Annual Regulatory Fee assumes that no cannabis gross revenue is recorded in the first year of operations; therefore, the licence holder will be required to pay the minimum fee of $2,500 for the "micro" class of licence, and $23,000 for the "standard" class of licence.

- Security clearances could be granted for up to five years. The ongoing Security Screening Fee assumes one fifth of security clearances would be renewed each year.

- The ongoing Annual Regulatory Fee assumes the following cannabis revenue: Micro = $0.5M; Medium = $10M; Large = $50M. The ongoing Annual Regulatory Fee is calculated as follows: Micro class of licence = 1% of gross revenue; Standard class of licence = 2.3% of gross revenue.

- Financial impacts of the import/export fee are expected to be nominal.

Annex 3: Additional Cost Information

Methodology

The fees outlined in this proposal were developed in accordance with the Treasury Board Secretariat's Guide to Establishing the Level of a Cost-Based User Fee or Regulatory Charge and Guidelines on Costing.

Application, Security Screening and Import/Export Fees

Each of the following three fees draws upon the experience, data and costs from past regulatory operations under the Access to Cannabis for Medical Purposes Regulations (ACMPR) to establish a cost base for each fee. These fees include both program and corporate support costs, which represent the full cost to the Government of Canada to undertake these activities.

Program Costs

Program costs include both direct and indirect costs. Direct costs are those costs incurred as a direct cost of the provision of the service. These include the salaries of the employees who deliver the program and relevant operating costs that directly contribute to the provision of the service. Direct costs are calculated as follows:

Direct Cost = (Hours Spent per Employee x Employee Hourly Salary Rate) + Relevant Operating Costs

Indirect costs are those costs that are incurred in connection with providing a number of services, such as supervisory costs. These costs are allocated to each fee based upon the activity undertaken and a predetermined rate.

Both direct and indirect program costs include Employee Benefit Package costs calculated as 20% of program salary costs.

Corporate Support Costs

Corporate support costs include those costs related to the services provided by corporate branches, including management and oversight for Access to Information requests; audits and evaluations; communications; human resources; financial management; information management and technology; real property and security; and, legal services.

Allocation of corporate costs is determined by taking a percentage of program costs and adding Employee Benefit Package costs and Accommodation costs calculated as 20% and 13% respectively of total salary costs.

A description of the activities and costs associated with each fee for a regulatory process is provided in the following section.

Application Screening Fee

When an application is received, it undergoes an assessment for completeness. Application screening includes an assessment of the proposed business plan; the Security Screening Application Form; and, the record-keeping methods pertaining to security, Good Production Practices, inventory, and destruction methods. As part of this process, Health Canada also verifies that applicants have provided notices to local government where their proposed site is located.

The Application Screening Fee includes the direct costs associated with screening a licence application for completeness and it includes a portion of supervisory costs associated with this function. The Application Screening Fee is calculated as follows:

Text equivalent

| Type of cost | Dollar amount |

|---|---|

| Health Canada program costs | $2,410 |

| Health Canada corporate support costs | $867 |

| Total costs (sum of program and support costs) | $3277 |

Note: For a micro (cultivation or processing) or nursery licence application, the application screening fee would be $1,638. The application screening fee would not be applicable to applications for renewals or amendments of existing licences.

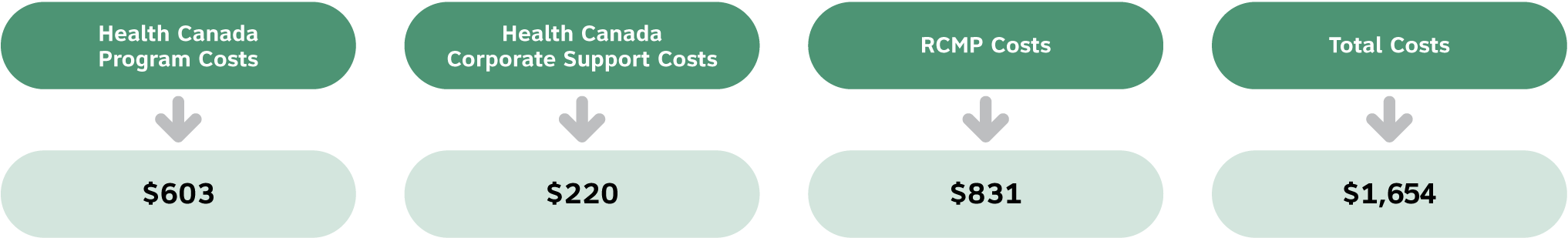

Security Screening Fee

The Security Screening Fee includes costs for both Health Canada and the Royal Canadian Mounted Police to screen, process and issue a security clearance.

The Health Canada portion of these costs includes the direct costs associated with receiving and reviewing the security screening application for completeness; completing Law Enforcement Record Checks (LERCs) requests that are submitted to the RCMP; and, assessing the responses from the RCMP. It also includes preparing letters to applicants granting a security screening or notices of intent to refuse or notices of refusal to grant a security clearance. The Security Screening Fee includes a portion of the supervisory costs associated with this function.

The Security Screening Fee is calculated as follows:

Text equivalent

| Type of cost | Dollar amount |

|---|---|

| Health Canada program costs | $603 |

| Health Canada corporate support costs | $220 |

| RCMP costs | $831 |

| Total costs (sum of program, support and RCMP costs) | $1654 |

Import/Export Permit Fee

Direct costs associated with the Import/Export Permit Fee include screening the application for completeness; reviewing the application in detail; and, either issuing an Import/Export permit or issuing a notice of refusal.

The Import/Export Permit Fee includes a portion of the supervisory and oversight costs associated with this function and is calculated as follows:

Text equivalent

| Type of cost | Dollar amount |

|---|---|

| Health Canada program costs | $447 |

| Health Canada corporate support costs | $163 |

| Total costs (sum of program and support costs) | $610 |

Annual Regulatory Fee

Cost Basis

Excluded Activities

As indicated in section 2.2.4, certain cannabis program costs were deemed to be out of scope for the purposes of the Annual Regulatory Fee. For Health Canada, costs deemed out of scope include the costs of registering an individual (or their designate) to produce a limited amount of cannabis for their own medical purposes. For Public Safety Canada, the Royal Canadian Mounted Police and the Canada Border Services Agency, excluded activities relate to enforcing criminal law.

Eligible Regulatory Costs

| Function | Activities and Key Assumptions |

|---|---|

Licencing |

Activities:

Assumptions:

|

Compliance, Enforcement and Inspections |

Activities:

Assumptions:

|

Program Management and Oversight |

Activities:

Assumptions:

|

Public Education and Awareness |

Activities:

Assumptions:

|

Annex 4: Annual Regulatory Fee Scenarios

The graphic below outlines a possible scenario, which Health Canada is considering regarding the application of the Annual Regulatory Fee. This scenario is not intended to be all encompassing, but rather to highlight the difference between how the fee is collected for a vertically integrated licence holder, versus a licence holder that chooses to focus on a single step in the federally licensed supply chain.

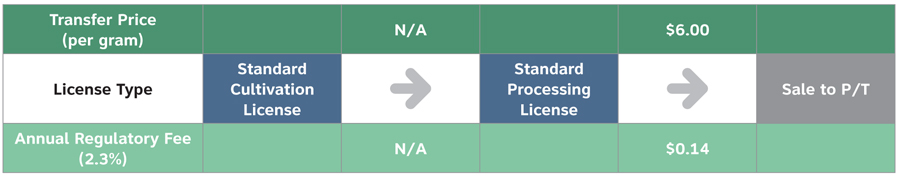

Scenario 1: Vertically Integrated Standard Licence– Sale to P/T Wholesaler for Non-Medical Market

Text equivalent

| License type | Transfer price (per gram) | Annual regulatory fee (2.3%) |

|---|---|---|

| Standard cultivation license | Not applicable | Not applicable |

| Standard processing license | $6.00 | $0.14 |

- For an entity that possesses a Standard Cultivation Licence and a Standard Processing Licence, the Annual Regulatory Fee would be calculated based upon the final sales to a provincial / territorial wholesaler.

- In this scenario, assuming that there are no input costs from other federally licensed entities, the Annual Regulatory Fee of 2.3% would be calculated based upon the sales price of $6.00/gram and would equal $0.14.

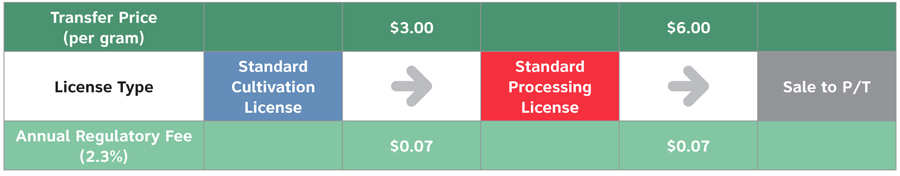

Scenario 2: Specialized Licence Scenario - Sale to P/T Wholesaler for Non-Medical Market

Text equivalent

| License type | Transfer price (per gram) | Annual regulatory fee (2.3%) |

|---|---|---|

| Standard cultivation license | $3.00 | $0.07 |

| Standard processing license | $6.00 | $0.07 |

- In a scenario where an entity specializes in one step of the supply chain, the following Annual Regulatory Fee would apply:

- Standard Cultivation Licence: Based on the sales / transfer price to the Processor from the Cultivator of $3.00/gram, the Cultivator would be required to pay the Annual Regulatory Fee of $0.07 ($3.00 * 2.3% = $0.07)

- Standard Processor Licence: Based on the final sales / to a provincial / territorial wholesaler from the Processor of $6.00/gram, the Processor would deduct the input costs from the Cultivator of $3.00/gram, and the Processor would be required to pay the Annual Regulatory Fee of $0.07 ($6.00 - $3.00 = $3.00*2.3% = $0.07)

Footnotes

- Footnote 1

A Framework for the Legalization and Regulation of Cannabis in Canada, p.33

- Footnote 2

This section of the consultation paper provides a general, plain language overview of the Cannabis Act. As a result, it does not reflect all elements of the legislation. [A more detailed overview of Bill C-45 is available at www.justice.gc.ca/eng/cj-jp/marijuana/c45]

- Footnote 3

A ministerial order is the mechanism whereby a Minister can bring into force ministerial regulations based on the authority set out in a given act such as the Cannabis Act

- Footnote 4

Health Canada External Charging Policy, Section 3, Policy Objectives

- Footnote 5

May 2008 Report of the Auditor General of Canada to the House of Commons: Management of Fees in Selected Departments and Agencies

- Footnote 6

Organizations in the Health Portfolio that collect fees include Health Canada, the Canadian Food Inspection Agency, the Patented Medicine Prices Review Board and the Public Health Agency of Canada

- Footnote 7

Please see the Treasury Board Secretariat's Guidelines on Costing at https://www.tbs-sct.gc.ca/pol/doc-eng.aspx?id=30375

- Footnote 8

Numbers may not add due to rounding

- Footnote 9

Ineligible costs include the costs to register an individual or designated person to produce a limited amount of cannabis for their own medical purposes, or costs relating to enforcing criminal law

- Footnote 10

Please see the Treasury Board Directive on Charging and Special Financial Authorities www.tbs-sct.gc.ca/pol/doc-eng.aspx?id=32502 for further details