Summary report: 2021-2022 Review of the cannabis cost recovery framework

On this page

- Introduction

- Methodology

- External engagement: What we heard from industry and licence holders

- Internal review

- Next steps

Introduction

Context and purpose

The Cannabis Act (the Act) and Cannabis Fees Order (the Order) came into force on October 17, 2018. In the Regulatory Impact Analysis Statement for the Order, Health Canada committed to monitoring the impact of the fee structure on the policy goals and on industry; assessing the progress made toward full cost recovery; and conducting a full review in 2021-2022.

This report summarizes the review that was carried out between August 2021 and March 2022. It represents a snapshot in time of an industry that is relatively new, and economic and market circumstances for licence holders at a point in time, which may have changed significantly between the completion of the review and the publication of this report.

This review, in addition to the Legislative Review of the Act that is currently underway, will help inform the progress that has been made towards meeting key policy objectives of supporting a diverse, national cannabis industry that includes smaller entities and ensuring that individuals who have the authorization of their healthcare practitioner have access to cannabis for medical purposes, as well as the progress made toward achieving full cost recovery. Both reviews will be used to inform any potential future revisions to the Cannabis Cost Recovery Framework.

Background

In November 2016, the Task Force on Cannabis Legalization and Regulation recommended that the Government of Canada (the Government) establish a legal regime for the production of cannabis that would create a diverse and national industry with small and large producers capable of displacing the illicit cannabis market and continue to ensure that individuals who have the authorization of their healthcare practitioner have access to cannabis for medical purposes. It also recommended the Government implement a fee structure to recover administrative program costs.

The goal of achieving full cost recovery was introduced in the July 2018 Consultation Document - Proposed Approach to Cost Recovery for the Regulation of Cannabis. Based on estimates of market size and the number of licensed producers at the time, it was projected that the proposed fees would allow Health Canada to recover as much as 100% of annual regulatory costs as early as 2020–2021.

Based on the Task Force's recommendations and Health Canada's public consultation, section 142 of the Act was created to provide the Minister with the authority to fix fees through a ministerial order for the recovery of the Government's costs related to the delivery of services; the use of facilities; the provision of approvals, authorizations, or regulatory processes; as well as for products, rights and privileges that are provided under the Act.

The Order was created to recover the Government's regulatory costs under the cannabis cost recovery framework by fairly charging those that benefit from the new legal market, thereby reducing costs to taxpayers. The Government has set a long-term target of recovering up to 100% of eligible regulatory costs, balanced against two important policy objectives: supporting a diverse, national cannabis industry that includes smaller entities and continuing to ensure that individuals who have the authorization of their healthcare practitioner have access to cannabis for medical purposes.

Cost recovery is a standard practice in many federal regulatory regimes.

Fee design for the Cannabis Fees Order

Under the Order, holders of cultivation, processing, nursery and sales for medical purposes licences are subject to fees, while holders of industrial hemp, research and analytical testing licences, as well as manufacturers or importers of health products containing cannabis, do not pay fees. The Order specifies three transactional fees (application screening, security clearance, and import/export permit fees), as well as an annual regulatory fee (ARF).

Transactional fees

The transactional fees were set based on their estimated full cost and are adjusted each fiscal year, based on the 12-month change in Statistics Canada's April All-Items Consumer Price Index (CPI).

Application screening fee

The application screening fee recovers the costs associated with screening new licence applications, prior to an in-depth review, for those seeking a cultivation, processing, nursery or sale for medical purposes licence.

To support the policy goal of a diverse marketplace with small and large players capable of displacing the illicit market, application screening fees for micro-cultivation, micro-processing, and nursery classes are half the amount that standard classes are required to pay. Further, if an application includes a sale for medical purposes licence with any combination of micro or nursery licence, the lower application fee applies. The Order's lower fees for micro and nursery class licences may also encourage participants in the illicit cannabis market to obtain a federal licence and transition to the legal market.

As of April 1, 2022, the application screening fee for standard cultivation, standard processing, and sale for medical purposes classes of licence applications was $3,527 and was discounted to $1,765 for micro-cultivation, micro-processing and nursery classes of licence applications.

Security clearance fee

The security clearance fee recovers the costs associated with screening, processing and issuing or refusing security clearances. As prescribed in Part 3 of the Cannabis Regulations, the Minister may, at any time, conduct checks that are necessary to determine whether an applicant for, or the holder of, a security clearance poses a risk to public health or public safety, including the risk of cannabis being diverted to an illicit market or activity. Security screening is conducted by the Royal Canadian Mounted Police (RCMP) and may involve other enforcement agencies. Such checks include, but are not limited to:

- the applicant's or holder's criminal record

- relevant files of law enforcement agencies that relate to the applicant or holder, including intelligence gathered for law enforcement purposes

As of April 1, 2022, the security clearance application fee was $1,781 for all licence holders subject to the Order.

Import and export permit fee

The import/export permit fee recovers the costs associated with screening, processing and issuing or refusing to issue a permit for the import or export of cannabis for medical or scientific purposes.

As of April 1, 2022, the import/export permit fee was $658 for all licence holders subject to the Order.

Annual regulatory fee

The annual regulatory fee recovers the aggregate costs of administering the cannabis regulatory program that are not covered by transactional fees. Holders of cultivation, processing, nursery and sale for medical purposes classes of licences are required to pay the annual regulatory fee each fiscal year (April 1 to March 31). However, to help ensure that patients continue to have reasonable access to cannabis for medical purposes, section 10 of the Order exempts licence holders who sell cannabis exclusively for medical purposes within Canada from the annual regulatory fee (provided licence holders satisfy certain documentary requirements and deadlines).

Cannabis regulatory program costs recovered through the annual regulatory fee include, but are not limited to, post-screening assessments, licensing renewals and amendments, inspections, and compliance and enforcement. This includes costs incurred by Health Canada, the Public Health Agency of Canada (PHAC), Public Safety Canada (PS), the RCMP and Canada Border Services Agency (CBSA) to carry out functions related to the Act.

The annual regulatory fee payable by any one licence holder is based directly on that licence holder's cannabis revenue. Under this design, the amount recovered will gradually increase as the legal cannabis market grows and matures. As well, this design minimizes the overall administrative burden through a single fee rather than a suite of additional transactional fees. The rate was chosen so that full cost recovery would be achieved incrementally over a number of years after the coming into force of the Act rather than at the outset.

Each fiscal year, the annual regulatory fee payable by a licence holder is calculated using the Statement of Cannabis Revenue, as reported by the licence holder. The Statement of Cannabis Revenue accounts for all cannabis sales from the preceding fiscal year. The annual regulatory fee is the greater of either a percentage of a licence holder's annual cannabis revenue (the amount received from the sale of cannabis that exceeds the amount paid for the purchase of cannabis) or a minimum flat fee. The annual regulatory fee rate is based on the classes of licences held at a given site.

ARF = Statement of Cannabis Revenue x Rate

or

Minimum flat fee

Standard cultivation, standard processing and sale for medical purposes classes of licences are subject to a rate of 2.3% of cannabis revenue or $23,000, whichever is higher. Micro-cultivation, micro-processing and nursery classes of licences are subject to a discounted rate of 1% of cannabis revenue up to $1 million (and 2.3% on any revenue over $1 million), or $2,500, whichever is higher. The lower ARF rate for micro and nursery class licences is discounted between $13,000Footnote 1 and $20,500Footnote 2 per year compared to the ARF rate for standard class licences.

Methodology

The 2021-2022 review of the Order was conducted through engagement with industry in the form of a voluntary questionnaire and interviews, and an internal review of regulatory program costs and data.

Health Canada conducted external engagement with cannabis licence holders between August 2021 and March 2022. Health Canada sent out a total of 642 questionnaires to licence holders and received 72 responses, of which, two were submitted by nursery licence holders, 27 were completed by micro licence holders, and 42 were completed by standard licence holders. Due to the small respondent size of nursery licence holders, the term "micro" represents micro and nursery licence holders throughout the report, with data aggregated for comparative analysis purposes.

Questionnaires and follow-up interviews were designed to provide the cannabis industry with the opportunity to provide insights to Health Canada regarding the impact of fees against other operating costs faced by licence holders. Health Canada contracted Ernst & Young to assist with industry outreach, review the questionnaire submissions and to facilitate the follow-up interviews with a diverse sample of cannabis licence holders in November and December 2021.

A representative from Finance Canada participated in the interviews in order to receive direct feedback from industry regarding the cannabis excise duty, which falls outside of Health Canada's mandate and authority.

Health Canada then conducted an analysis of the external engagement and internal review. The internal review and analysis were completed between January and March 2022 using historical program data and public reporting.

External engagement: What we heard from industry and licence holders

Cannabis Fees Order

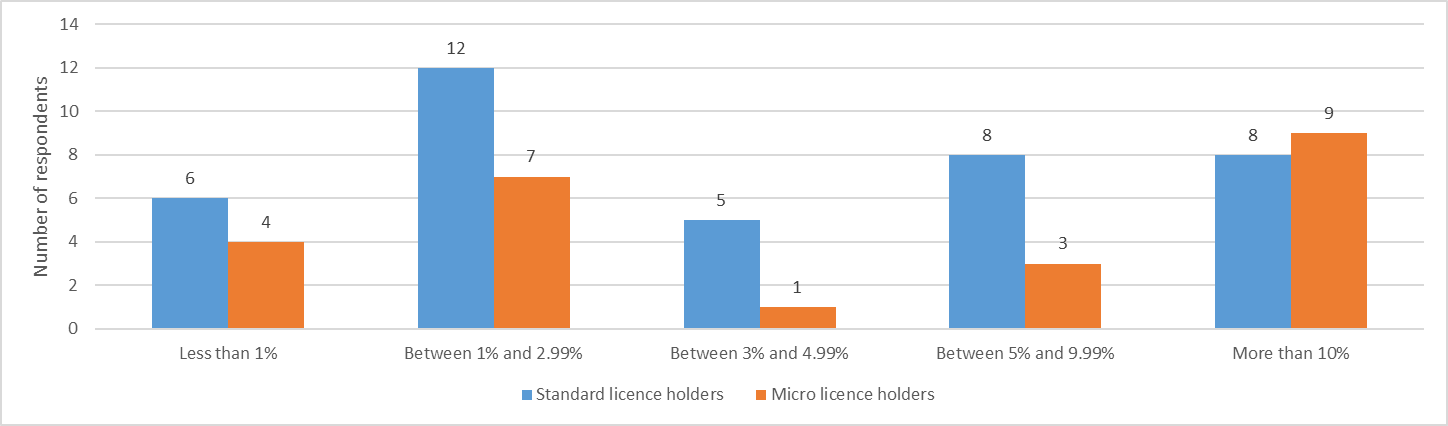

Respondents expressed that while fees do not represent a large proportion of their operating costs, they do contribute to challenges achieving profitability and positive cash flow, which are already under significant pressure.

Despite the relatively lower fees, a higher proportion of micro licence holders (37.5%) compared to standard licence holders (20.5%) reported that fees accounted for over 10% of operating costs.

Figure 1 - Text description

| Impact of fees on operating costs | Standard licence holders | Micro licence holders |

|---|---|---|

| Less than 1% | 6 | 4 |

| Between 1% and 2.99% | 12 | 7 |

| Between 3% and 4.99% | 5 | 1 |

| Between 5% and 9.99% | 8 | 3 |

| More than 10% | 8 | 9 |

Source: Health Canada, Questionnaire on Cannabis Fees, August 2021

Fees collected under the Order can impact smaller operations more than their larger competitors due to economies of scale. It is also important to note that licence holder respondents in both micro and standard licence classes represent licence holders in various stages of development, from start-ups with no revenue to large-scale licence holders that operate across the Canadian marketplace.

The Order's largest fee, the annual regulatory fee, was the primary focus for licence holders that provided comments in the questionnaire. Twenty-two licence holders, comprised of 10 micro licence holders and 12 standard licence holders, reported that the minimum annual regulatory fee is prohibitive, particularly for licence holders with no sales revenue. Additionally, two licence holders stated the annual regulatory fee should be pro-rated based on the month a licence holder enters or exits the market. Further, while the number of licensed medical sellers has grown from 93 in October 2018 to 325 in March 2022, licence holders indicated that the exemption from the annual regulatory fee would not be sufficient to offset the operating costs of a dedicated licensed site for medical sales.

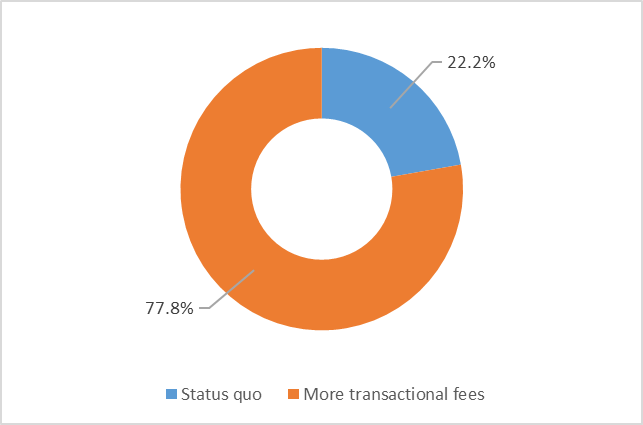

Respondents showed a strong preference (78%) for more transactional fees with a corresponding reduction in the annual regulatory fee. Transactional fees may provide more predictability and control over some costs, based on a licence holder's individual needs. However, the annual regulatory fee accounts for 90.5% of all cannabis fee revenue collected by Health Canada between 2018-2019 and 2021-2022.

Figure 2 - Text description

| Fee structure | Percentage of respondents |

|---|---|

| Status quo | 22.2 |

| More transactional fees | 78.8 |

Source: Health Canada, Questionnaire on Cannabis Fees, August 2021

When asked to assess the quality of services provided by Health Canada, relative to each of the fees outlined in the Order, the majority of respondents reported that the application screening fee (63.9%) and the import and export permit fee (60%) were priced commensurately with the services they received. However, less than half of respondents reported value for money for services provided for the security screening fee (47.7%) and the annual regulatory fee (41.8%).

Cannabis excise duty

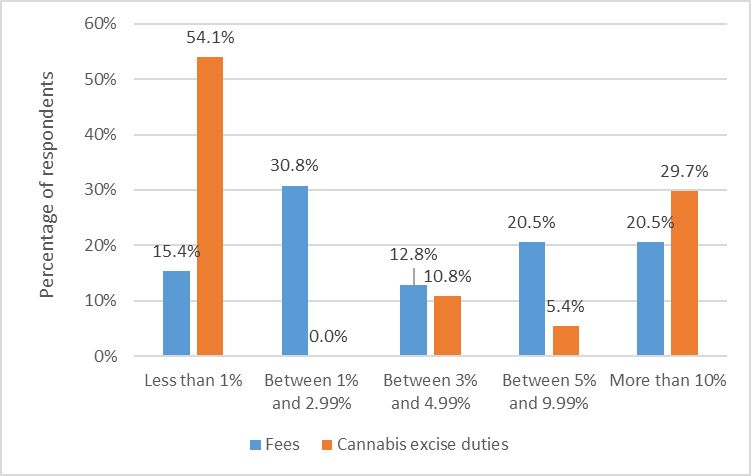

While under the exclusive authority of the Minister of Finance, respondents consistently remarked in the questionnaire that the excise duty negatively affects profitability. Licence holders also reported that the duty impedes their capacity to compete and is a physical, logistical and financial burden on their operations due to the multiple excise stamp requirements.

There are varying impacts that the excise duty and fees have on the cannabis industry, particularly among standard licence holders. For example, 54% of standard licence holders reported the excise duty represented less than 1% of their costs, while 30% reported the excise duty represented more than 10% of their costs. This reflects the diverse levels of operational development among standard licence holders, particularly as new licence holders, and some established licence holders, have no sales revenues.

Figure 3 - Text description

| Impact of fees and duty on standard licence holders | Fees | Cannabis excise duties |

|---|---|---|

| Less than 1% | 15.4 | 54.1 |

| Between 1% and 2.99% | 30.8 | 0.0 |

| Between 3% and 4.99% | 12.8 | 10.8 |

| Between 5% and 9.99% | 20.5 | 5.4 |

| More than 10% | 20.5 | 29.7 |

Source: Health Canada, Questionnaire on Cannabis Fees, August 2021

The federal government has Coordinated Cannabis Taxation Agreements in place with most provincial and territorial governments (all except Manitoba) to facilitate businesses compliance through a single federally administrated framework. The tax room is shared on a 75/25 basis, with 75% of duties going to provincial and territorial governments and the remaining 25% to the federal government. For dried cannabis, the coordinated rate is set at the greater of 10% of the wholesale price (that is, price sold to provincial distributors) or $1 per gram. For cannabis edibles, extracts and topicals (that is, cannabis 2.0 products), the excise duty coordinated rate is $0.01 per mg of THC. There are also additional duty adjustments in respect of products intended to be sold in Alberta, Saskatchewan, Ontario and Nunavut.

Since the coming into force of the Act, competition among legal producers, as well as with the illicit market, has resulted in a decline in cannabis prices. Based on an estimated $4 per gram wholesale price, including the embedded cannabis excise duty, the excise rate would equate to 33% of cannabis sales revenue, whereas Health Canada's maximum rate for the annual regulatory fee is 2.3% of net cannabis sales revenue over $1 million. The decline in cannabis prices, mostly due to oversupply, has meant that most licence holders likely struggle to pass on any or all of these costs.

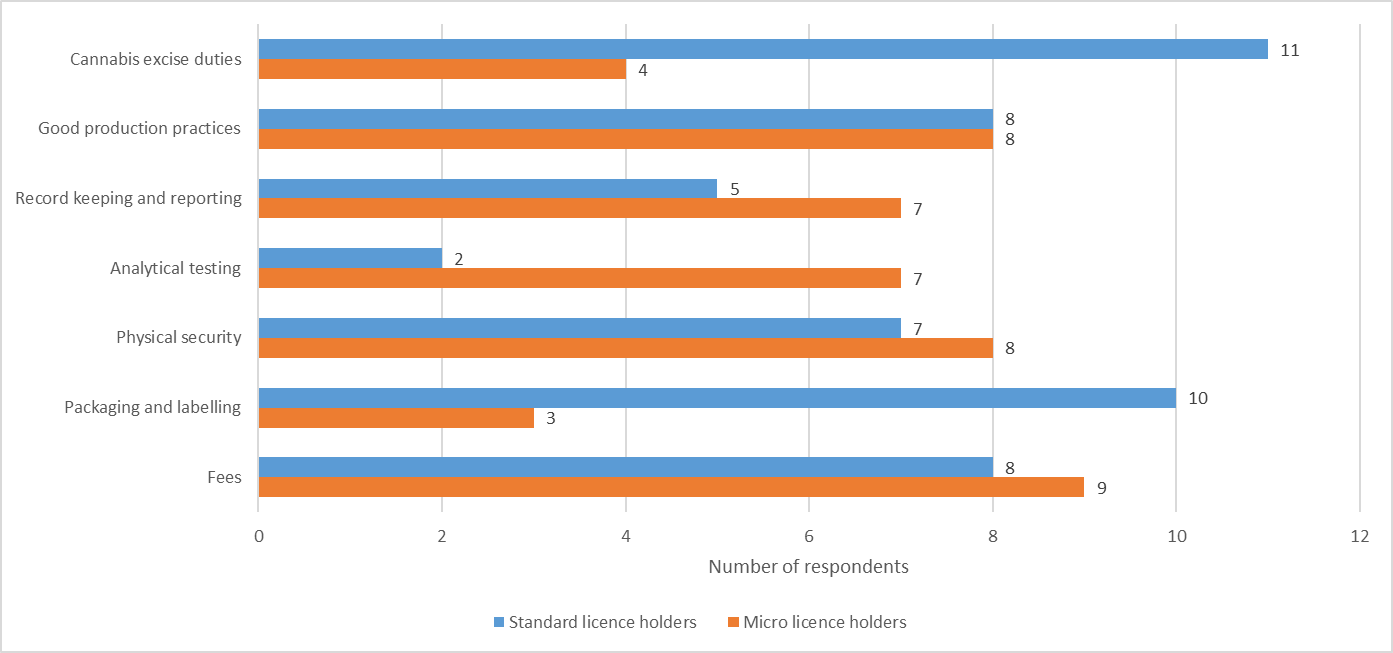

Regulatory compliance costs

Aside from cannabis fees and excise duties, licence holders are subject to regulatory requirements that impose costs, including:

- requirements related to packaging and labelling

- physical security

- analytical testing

- record keeping and reporting

- good production practices

Figure 4 - Text description

| Costs | Standard licence holders | Micro licence holders |

|---|---|---|

| Cannabis excise duties | 4 | 11 |

| Good production practices | 8 | 8 |

| Record keeping and reporting | 7 | 5 |

| Analytical testing | 7 | 2 |

| Physical security | 8 | 7 |

| Packaging and labelling | 3 | 10 |

| Fees | 9 | 8 |

Source: Health Canada, Questionnaire on Cannabis Fees, August 2021.

Respondents to the survey reported that most regulatory requirements imposed a proportionally higher cost burden on micro licence holders. Excluding packaging and labelling, good production practices and cannabis excise duties, a greater number of micro licence holders reported spending more than 10% of their total costs on each of the regulatory requirements set out in Figure 4, relative to standard licence holders in all other categories.

For example, a quarter (24.6%) of all respondents reported spending greater than 10% of their total costs on physical security. However, a higher proportion of micro licence holders (34.8%) reported spending more than 10% of their total costs on physical security compared to standard licence holders (18.4%), despite reduced physical security requirements for a micro class licence.

The same situation is true for other costs. For record keeping and reporting, twice as many micro licence holders (26.9%) reported spending greater than 10% of their total costs compared to standard licence holders (13.5%). The largest difference between the two classes of licences was for analytical testing, where 28% of micro licence holders reported spending more than 10% of their total costs compared to just 5.1% for standard licence holders.

Time waiting for reviews and approvals

During interviews, licence holders reported that service delays increased indirect costs on industry while waiting for approvals. For example, time waiting for security clearance reviews was frequently cited. Not having a sufficient number of security-cleared personnel could delay a start-up or increase costs to licence holders in the form of overtime pay due to having fewer security cleared personnel. The RCMP treat each security review on a case-by-case basis and there is no established administrative service standard as each security application will vary in complexity, depending on an applicant's history.

Licence holders also identified delays in receiving export permits as a risk to revenue. Licence holders must meet time limits established by the country of destination's import permit, and any delay receiving an export permit can lead to higher shipping costs.

Difficulties accessing provincial distribution networks

Licence holders also cited challenges navigating the various provincial and territorial supply networks and contracting obligations, which is outside of the federal government's purview. Each province and territory, with the exception of Saskatchewan and Nunavut, operate a provincially owned wholesale monopoly that licence holders are obligated to contract with in order to access the retail market. Survey respondents reported that provincial distributors give preference to low-cost, high delta-9-tetrahydrocannabinol (THC) products that have a history of selling. Further, payment schedules, recall insurance and return policies imposed on licence holders by wholesalers increase costs.

Limited access to capital

Finally, respondents also cited difficulties in accessing capital from financial institutions or government grants and contributions programs as a significant challenge to maintaining liquidity before earning revenue, impeding their ability to pay fees and meet other financial obligations. Liquidity is also reduced due to the lag between seeding crops to selling product.

Internal review

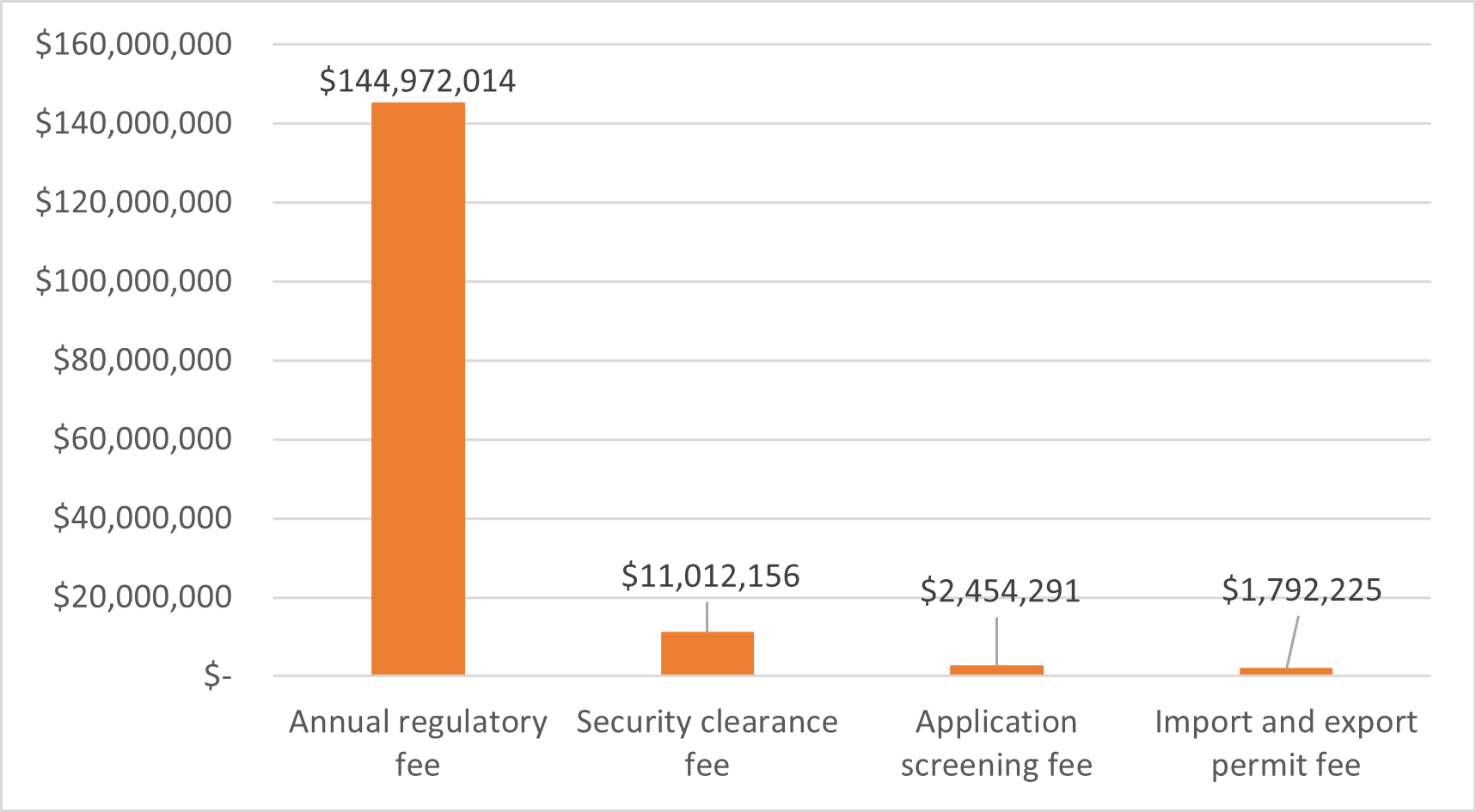

Progress toward full cost recovery

The regulatory impact analysis statement that accompanied the publication of the Order in 2018, included lower, middle and upper bound projections for fee revenue and associated cost recovery rates:

- the lower bound projection estimate was $129 million over four years

- the middle-bound projection estimate was $204 million over four years with $86 million of eligible annual regulatory costs being recovered in 2021–2022

- the upper bound projection estimate was $295 million over four years with $124 million or 100% of eligible annual regulatory costs recovered in 2021-2022

| Fee | Fiscal year | Total | ||||

|---|---|---|---|---|---|---|

| 2018-2019 | 2019-2020 | 2020-2021 | 2021-2022 | |||

| Application screening fee | Revenues | $383,406 | $908,576 | $664,184 | $498,125 | $2,454,291 |

| Security screening fee | Revenues | $322,530 | $4,012,191 | $3,210,875 | $3,466,560 | $11,012,156 |

| Import/Export permit fee | Revenues | $156,160 | $492,511 | $546,214 | $597,340 | $1,792,225 |

| Annual regulatory fee | Revenues | $3,323,652 | $45,033,278 | $25,493,217 | $71,121,867 | $144,972,014 |

| Total | Revenues | $4,185,748 | $50,446,556 | $29,914,490 | $75,683,891 | $160,230,685 |

| Costs | $92,268,533 | $110,242,063 | $112,728,368 | $114,949,669 | $430,188,633 | |

| Percent recovered | 4.5% | 45.8% | 26.5% | 65.8% | 37.2% | |

Source: Health Canada's 2018-2019, 2019-2020, 2020-2021 and 2021-2022 Report on Fees

In 2021-2022, Health Canada reached a cost recovery rate of 65.8%, in part due to deferred payments from 2020-2021 being collected in 2021-2022. In 2020-2021, Health Canada provided short-term economic relief to the cannabis industry as a result of the COVID-19 pandemic by extending the ARF payment deadline from September 30, 2020, to March 31, 2021. As a result, annual regulatory fee revenues decreased in 2020-2021 by approximately $18.5 million and those deferred payments were later collected and reported in 2021-2022.

Over the first four fiscal years of cannabis legalization (2018-2019 to 2021-2022), Health Canada collected $160.2 million in cannabis fees or recovered 37.2% of total cannabis regulatory program costs. Excluding 2018-2019, which was only a partial fiscal year for the legal cannabis market, the Government's cost recovery rate from 2019-2020 to 2021-2022 was 46.2% of total cannabis regulatory program costs. However, total revenues collected remained above the lower bound but below the middle-bound projection estimates every fiscal year since legalization.

Figure 5 - Text description

| Cannabis fees | Cannabis revenues |

|---|---|

| Annual regulatory fee | $144,972,014 |

| Security clearance fee | $11,012,156 |

| Application screening fee | $2,454,291 |

| Import/export permit fee | $1,792,225 |

Source: Health Canada, Fees Report, fiscal years 2018-2019 to 2021-2022

Annual regulatory fee revenues can deviate from projections based on factors including:

- the number of licence holders by fiscal year

- the volume of cannabis sold by licence holders

- the prices realized by licence holders

- the number of micro or nursery classes of licences held that will be subject to the lower ARF rate

- the number of licence holders that qualify for the medical exemption

Impact on policy objectives

The review included an assessment of the impact of the cannabis cost recovery framework on key policy objectives, namely:

- displacing the illicit market

- supporting a diverse and national industry that includes small and large producers

- ensuring that individuals continue to have access to cannabis for medical purposes

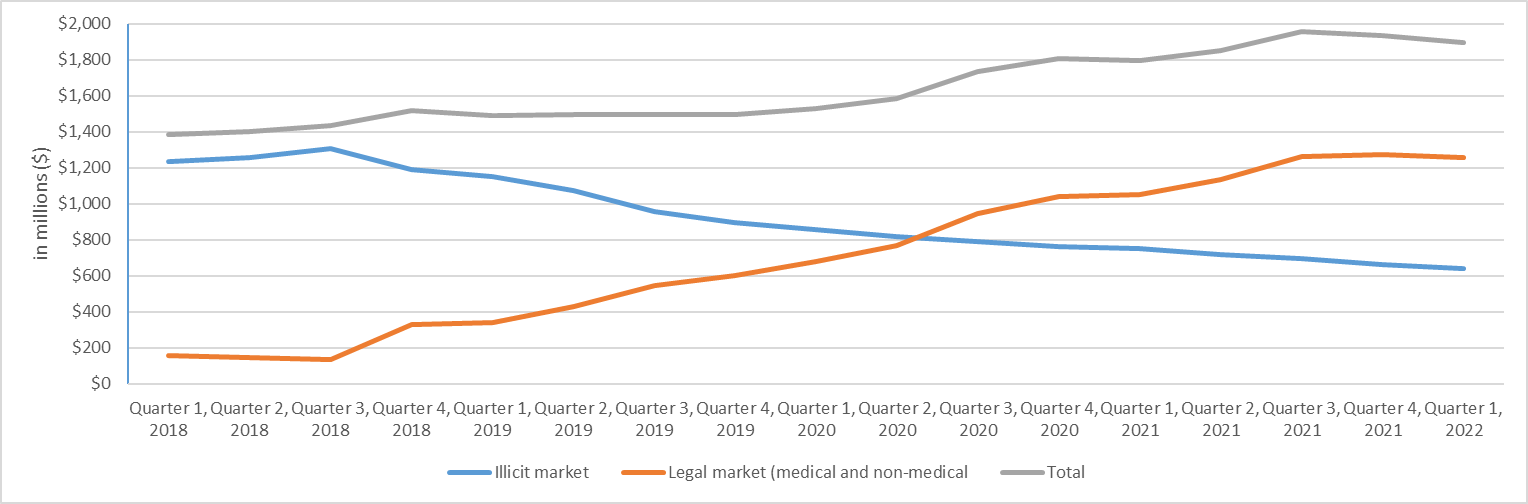

Displacement of the illicit market

To support the policy objective of displacing the illicit market, Health Canada designed its fees to not overburden the legal industry at the outset of legalization, but to gradually achieve a higher cost recovery rate as the industry matured and revenue increased.

Figure 6 shows that the legal cannabis market has made steady progress in displacing the illicit market since the coming into force of the Act. By the end of the 2021-2022, Statistics Canada estimated that around 66% of household expenditures on cannabis were made in the legal market.

Figure 6 - Text description

| By quarter and year | Illicit market | Legal market (medical & non-medical) | Total |

|---|---|---|---|

| Quarter 1, 2018 | 1,232 | 154 | 1,386 |

| Quarter 2, 2018 | 1,254 | 147 | 1,401 |

| Quarter 3, 2018 | 1,304 | 133 | 1,437 |

| Quarter 4, 2018 | 1,190 | 328 | 1,518 |

| Quarter 1, 2019 | 1,152 | 340 | 1,492 |

| Quarter 2, 2019 | 1,072 | 426 | 1,498 |

| Quarter 3, 2019 | 954 | 544 | 1,498 |

| Quarter 4, 2019 | 894 | 602 | 1,496 |

| Quarter 1, 2020 | 855 | 676 | 1,531 |

| Quarter 2, 2020 | 820 | 766 | 1,586 |

| Quarter 3, 2020 | 788 | 947 | 1,735 |

| Quarter 4, 2020 | 764 | 1,040 | 1,804 |

| Quarter 1, 2021 | 749 | 1,049 | 1,798 |

| Quarter 2, 2021 | 716 | 1,134 | 1,850 |

| Quarter 3, 2021 | 694 | 1,261 | 1,955 |

| Quarter 4, 2021 | 660 | 1,275 | 1,935 |

| Quarter 1, 2022 | 639 | 1,257 | 1,896 |

Source: Statistics Canada. Table 36-10-0124-01 Detailed household final consumption expenditure, Canada

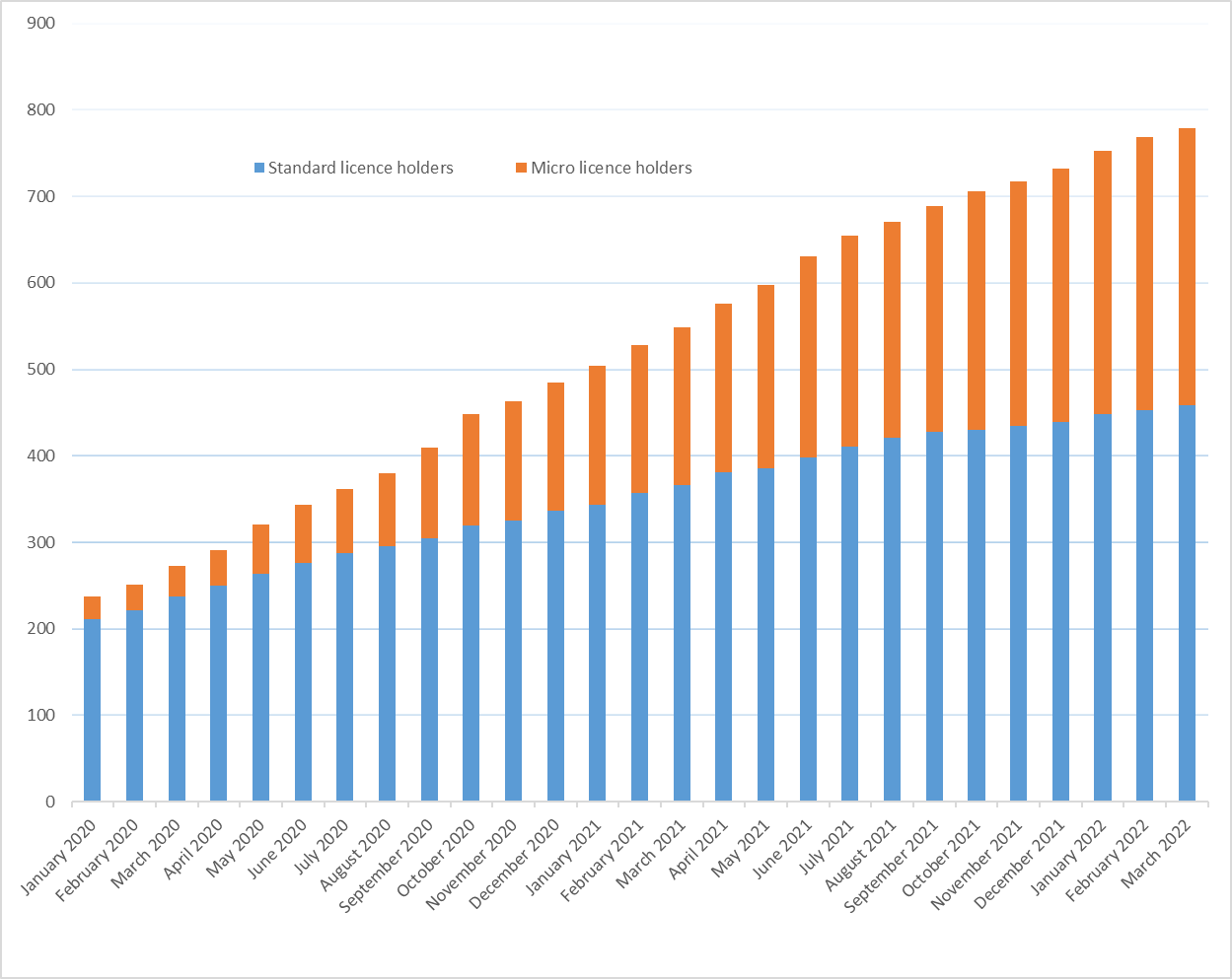

Market diversity

Health Canada has a policy objective to support a diverse, national cannabis industry that includes small and large entities. To that end, micro class licence applicants pay a lower application screening fee, and licence holders pay a lower annual regulatory fee rate.

As of March 31, 2022, there were 320 micro class licences out of 816 total active licences. Total fees charged to micro classes of applicants and licence holders is estimated to be $1.3 millionFootnote 3, which represented a total discount of $7.1 millionFootnote 4 relative to fees applied to standard licence holders, or 6.1%Footnote 5 of total cannabis regulatory program costs.

Figure 7 - Text description

| Month and year | Standard licence holders | Micro licence holders | Total licence holders |

|---|---|---|---|

| January 2020 | 211 | 26 | 237 |

| February 2020 | 221 | 30 | 251 |

| March 2020 | 237 | 36 | 273 |

| April 2020 | 250 | 41 | 291 |

| May 2020 | 264 | 56 | 320 |

| June 2020 | 276 | 67 | 343 |

| July 2020 | 287 | 75 | 362 |

| August 2020 | 295 | 85 | 380 |

| September 2020 | 305 | 104 | 409 |

| October 2020 | 319 | 129 | 448 |

| November 2020 | 325 | 138 | 463 |

| December 2020 | 336 | 149 | 485 |

| January 2021 | 343 | 161 | 504 |

| February 2021 | 357 | 171 | 528 |

| March 2021 | 366 | 182 | 548 |

| April 2021 | 381 | 195 | 576 |

| May 2021 | 386 | 211 | 597 |

| June 2021 | 398 | 233 | 631 |

| July 2021 | 411 | 244 | 655 |

| August 2021 | 421 | 250 | 671 |

| September 2021 | 428 | 261 | 689 |

| October 2021 | 430 | 276 | 706 |

| November 2021 | 435 | 282 | 717 |

| December 2021 | 439 | 293 | 732 |

| January 2022 | 448 | 305 | 753 |

| February 2022 | 453 | 315 | 768 |

| March 2022 | 459 | 320 | 779 |

Source: Health Canada. Graph excludes licence holders who only possess a licence for sale for medical purposes.

Access to cannabis for medical purposes

In response to patient concerns that producers would prioritize recreational cannabis sales over medical cannabis sales after legalization, the Order exempts eligible licence holders who sell cannabis exclusively for medical purposes from the annual regulatory fee. Data from the Cannabis Tracking System for April 1, 2021, to March 31, 2022, indicates that it is extremely rare for a medical order not to be fulfilled for a patient. During 2021-2022, only 0.1% of medical orders were not fulfilled due to product being out of stock, which indicates that the current supply of cannabis for medical purposes is sufficient to meet current demand.

In 2021-2022, only 5.8% or 19 out of 325 sale for medical purposes licence holders met the regulated criteria to qualify for the medical exemption from the annual regulatory fee, for a total fee exemption of $2.4 million, or 0.8% of the value of sales for medical purposes that fiscal year. The vast majority of licence holders that possess a sale for medical purposes licence do not apply for the exemption, as they are not selling exclusively for medical purposes. Sale for medical purposes licence holders who sell cannabis for non-medical purposes from the same site, including intra-industry sales, do not qualify for the exemption.

All licence holders who sell cannabis for medical purposes receive the full retail price for their products, as opposed to the wholesale price they would receive from sales of cannabis for non-medical purposes (for example, to provincial or territorial wholesale distributors, retailers). As such, there are financial incentives for licence holders to sell cannabis exclusively for medical purposes.

Next steps

This review, in addition to the Legislative Review of the Act that is currently underway, will help inform the progress that has been made towards meeting key policy objectives of supporting a diverse, national cannabis industry that includes smaller entities and ensuring that individuals who have the authorization of their healthcare practitioner have access to cannabis for medical purposes, as well as the progress made toward achieving full cost recovery. Both reviews will be used to inform any potential future revisions to the Cannabis Cost Recovery Framework.

Footnotes

- Footnote 1

-

The minimum $13,000 discount is calculated using $23,000 (a standard licence fee rate of 2.3% up to $1 million) minus $10,000 (a micro licence fee rate of 1% up to $1 million).

- Footnote 2

-

The maximum $20,500 discount is calculated using $23,000 (a standard licence fee rate of 2.3% up to $1 million) minus $2,500 (a micro licence fee rate of 1% up to $250,000 minimum).

- Footnote 3

-

This number is derived using the following formulas added together: $1,706 application screening fee for micro licence holders for 2021-2022 multiplied by 320 micro licence holders equals $545,920 and $2,500 minimum annual regulatory fee for micro licence holders multiplied by 320 licence holders equals $800,000.

- Footnote 4

-

This number is derived using the following formulas added together: $3,411 standard class screening fee for 2021-22 minus $1,706 micro class screening fee for 2021-2022 multiplied by 320 micro licence holders equals $545,600 and $23,000 standard class minimum fee minus $2,500 micro class minimum fee multiplied by 320 micro licence holders equals $6,560,000.

- Footnote 5

-

This number is derived using the following formula: $7,105,600 (total estimated discount) divided by $114,949,669 (total department costs from the 2021-2022 Fees Report) multiplied by 100.