Shaping the Future: A Discussion Guide for PMPRB Phase 2 Consultations on New Guidelines

Discussion Guide

Discussion Guide

Table of Contents

- Glossary

- 1. Introductory Remarks

- 2. About the PMPRB

- 3. Guideline Consultation

- 4. Valued Insights: Addressing Important Topics Beyond PMPRB’s Decision-Making Authority

- 5. Overview of the Proposed Framework

- 6. Topics for Discussion

- 7. Next Steps

- 8. Case Studies: Decision-Making Criteria for Initiating In-Depth Reviews

Glossary

These definitions are provided for general assistance only; they have no legal force and should be read in conjunction with the applicable legislation.

Patented medicine: A medicine to which at least one patent pertains pursuant to s. 79(2) of the Patent Act. A patent may be assigned to the medicinal ingredient, to a manufacturing process, or to another aspect such as a timed-release coating or inhaler mechanism.

Existing MedicineFootnote 1: Patented medicines with a maximum average potential price (MAPP) or projected non-excessive average price (NEAP) as of July 1, 2022.

New MedicineFootnote 2: Patented medicines without a MAPP or projected NEAP as of July 1, 2022.

Patent: An instrument issued by the Commissioner of Patents in the form of letters patent for an invention.

PMPRB7: France, Germany, Italy, Sweden, Switzerland, the United Kingdom, and the United States

PMPRB11: Australia, Belgium, France, Germany, Italy, Japan, the Netherlands, Norway, Spain, Sweden, and the United Kingdom.

PMPRB Staff (“Staff”): public servants responsible for carrying out the PMPRB’s day to day work.

Rights Holder: As defined by subsection 79(1) of the Patent Act, "a patentee and the person for the time being entitled to the benefit of a certificate of supplementary protection for that invention, and includes, if any other person is entitled to exercise rights in relation to the certificate, that other person in respect of those rights."

Voluntary Undertaking (VU): A written undertaking by a Rights Holder to adjust its price and/or pay an amount of money to the Receiver General. A VU represents a promise by a Rights Holder to the Patented Medicine Prices Review Board. A VU may lead to a recommendation that an in-depth review be closed. VUs do not have precedential value.

1. Introductory Remarks

In 2019, the Government proposed to amend the Patented Medicines Regulations to introduce new price review factors (pharmacoeconomic value, market size and GDP) for the PMPRB to consider when monitoring for excessive pricing, changed the schedule of countries for which Rights Holders are to report price information to the PMPRB and also required Rights Holders to file information net of all price adjustments, including rebates provided through product listing agreements.

The proposed amendments were challenged in both provincial and federal courts, resulting in new judicial guidance in two court proceedings – Merck Canada inc. c. Procureur general du CanadaFootnote 3 and Innovative Medicines Canada v. Canada (Attorney General)Footnote 4- as to the scope of the PMPRB’s mandate and authority. Subsequently, the Governor in Council, on the recommendation of the Minister of Health decided not to proceed with the amendments related to the new price review factors and the net price information filing requirements in light of the evolving pharmaceutical landscape and the result of the Merck proceeding, which found the new price review factors to be unconstitutional Footnote 5. Instead, the Government moved forward only with the implementation of the updated schedule of eleven countries (“PMPRB11”) and reduced reporting requirements for medicines believed to be at the lowest risk of excessive pricing, which were upheld as both constitutional and vires the Patent Act in the Court proceedings and which came into force on July 1, 2022.

Unlike the schedule of countries which was in place for almost three decades (also known as the “PMPRB7”), the PMPRB11 results in a more homogeneous pricing basket which excludes the United States, which had the highest prices in the world (up to 3.5 times higher than Canadian pricesFootnote 6).

Changes to the PMPRB’s Guidelines are now necessary to address our new legislative and jurisprudential reality, and to give effect to the Board’s commitment to modernize and simplify its administrative framework. As always, the Board looks forward to stakeholder feedback as we continue on to the next step of this consultation process.

2. About the PMPRB

2.1 Overview of the PMPRB

The Patented Medicine Prices Review Board (PMPRB) was created in 1987 as the response to a major set of reforms to the Patent Act (“Act”) that strengthened Canada’s patent protection for medicinesFootnote 7.

The PMPRB is an independent quasi-judicial body with a dual price review and reporting mandate. Through its price review mandate, it ensures that the prices of patented medicines sold in Canada are not excessive. It does this by reviewing the prices at which Rights Holders sell patented medicines in Canadian markets. If a price is found to be excessive at a public hearing, the Board can order price reductions and/or the offset of excess revenues.

The PMPRB’s mandate and jurisdiction are established under sections 79–103 of the Act and those sections are the responsibility of the Minister of Health. The Act identifies the factors that the PMPRB (“Board”) must consider in determining whether the price of a patented medicine is excessive, provides the PMPRB with the authority to collect information from Rights Holders, and sets out the remedial measures that may be taken by the Board to resolve excessive pricing.

The Act does not define what an “excessive” price is, and instead directs the PMPRB to consider the following factors specified in section 85(1) of the Act:

- the prices at which the medicine has been sold in the relevant market;

- the prices at which other medicines in the same therapeutic class have been sold in the relevant market;

- the prices at which the medicine and other medicines in the same therapeutic class have been sold in countries other than Canada;

- changes in the Consumer Price Index; and

- such other factors as may be specified in any regulations made for the purposes of this subsection.

The Patented Medicines Regulations (“Regulations”) set out the information that Rights Holders are to report to the PMPRB and the timeframes in which that information is to be provided. This includes baseline information such as the identity of the medicine and information related to the price and sales of the medicine.

Many of the core regulatory concepts in the Act and the Regulations have historically been further developed in the PMPRB’s Guidelines. The PMPRB is authorized to make non-binding Guidelines subject to consultation with relevant stakeholders.

2.2 Role of Guidelines

The Act specifies that the Board can only determine whether the price of a patented medicine is excessive through a hearing. However, the Board does not have the capacity to conduct hearings for each patented medicine under its jurisdiction. As a result, the Board needs a mechanism to narrow down the number of medicine prices that are subject to a hearing.

Under subsection 96(4) of the Patent Act, the PMPRB may issue non-binding guidelines (“Guidelines”) on matters within its jurisdiction. The Board intends these Guidelines to achieve two main objectives: a) enhance the Board’s administrative efficiency, and b) provide transparency and predictability to Rights Holders regarding the process typically engaged in by PMPRB staff (“Staff”) in identifying patented medicine that may be at a greater risk for excessive pricing for an in-depth review or a potential hearing. Since the Act stipulates that the Board is to only consider the factors in subsection 85(2) if it is unable to determine whether the medicine is being sold or has been sold at an excessive price after considering the factors in s. 85(1), these Guidelines are directed at only the subsection 85(1) factors and do not contemplate considerations which could only be raised pursuant to subsection 85(2).

The Guidelines do not make any presumptions or determinations of whether a given price is excessive. Only the Board, sitting in tribunal, may determine whether a price is excessive, following a hearing. The Guidelines and, by extension, Staff relying on the Guidelines do not “approve” or "set" prices for patented medicines. Staff’s role is to “review” the list price set by the Rights Holder for each patented medicine. During this phase the price is “under review”. Staff may either recommend to the Chairperson to close the review (leading to “reviewed” status) or recommend a hearing to the Chairperson (continuing “under review” status).

While the Guidelines are non-binding, the Board believes that transparent, predictable, and procedurally fair Guidelines provide an efficient way for rights-holders to manage risk. Historically, over 99% of the reviews conducted by Staff have been resolved within the scope of the Guidelines without the need for a hearingFootnote 8. To this extent, it is clear that Guidelines are an important instrument for stakeholders, and they can be an efficient tool in achieving the PMPRB’s legislative mandate.

3. Guideline Consultation

The PMPRB is in the process of updating its Guidelines to give effect to amendments to the Patented Medicines Regulations (SOR/94-688), which came into force on July 1, 2022, to reflect recent jurisprudence, and to increase efficiency. The regulatory amendments resulted in an updated schedule of eleven countries (“PMPRB11”)Footnote 9 and reduced reporting requirements for medicines believed to be at the lowest risk of excessive pricing.

The Board has implemented a three-phase Guidelines consultation process, which started in September 2023.

| Consultation Phase | Activity |

|---|---|

Phase 1 |

Scoping Paper and Policy Roundtable |

Phase 2 |

Discussion Guide |

Phase 3 |

Draft Guidelines |

In the first phase of the consultation process, the PMPRB published a Scoping Paper with six key themes designed to encourage a productive conversation between stakeholders and the PMPRB. In December 2023, the PMPRB hosted a two-day Policy Roundtable inviting stakeholders to present their feedback in person. The written feedback can be read on the PMPRB website, and a summary of the in-person feedback can be reviewed in the What We Learned Report.

The Board believes the first phase of consultation was successful in providing a rich engagement with stakeholders from many corners of Canadian society, and for helping identify and assess issues and concerns.

The PMPRB is now launching a second phase of consultation on its new Guidelines with the release of this Discussion Guide, which provides the opportunity for a continued informed, focused, and productive consultation. Stakeholders will gain insight into the Board’s perspective on issues that the Board needs to consider in addressing the upcoming Guidelines. The Discussion Guide provides a proposed framework that indicates a direction on certain issues and provides a range of options on others.

The PMPRB is now requesting stakeholder feedback on the topics set out in this Discussion Guide, via written submission, by the deadline of September 11, 2024.

The Board intends to publish new draft Guidelines by the end of 2024 after considering the feedback received on the two previous phases. These Guidelines will be open for a Notice and Comment period before finalization and implementation, which is anticipated in 2025 unless further consultation on an amended draft is necessary.

4. Valued Insights: Addressing Important Topics Beyond PMPRB’s Decision-Making Authority

During its consultations to date, the Board has engaged with a diverse range of stakeholders on topics related to the Canadian pharmaceutical industry, and more broadly, to the Canadian life sciences ecosystem comprising patients and patient advocates, health care providers, pharmacy supply chains, payers (public/private), innovators, clinical trialists, and government regulators. The Board appreciated these engagements and the insights provided through written submissions and roundtable presentations.

While these insights are valued, the Board wants to state that a number of these issues fall outside of the PMPRB’s statutory authority. The Board is of the view that including concerns not directly relevant to the PMPRB’s statutory authority would limit its ability to establish transparent, predictable, and procedurally fair Guidelines.

An example is the request by a variety of stakeholders that the PMPRB should engage in a “whole of government” approach to current government policies such as the Biomanufacturing and Life Sciences Initiative, the Access to Drugs for Rare Diseases strategy, and National Pharmacare. The Board’s response is that, while it is important for Board members and Staff to be aware of such initiatives, there is no provision in section 85(1) of the Patent Act by which such initiatives can be legally factored into the Guidelines.

The Board is a statutory quasi-judicial tribunal with authority only to prevent excessive pricing of patented medicines. The Board’s view is that it is required to adhere strictly to its defined mandate.

Thus, while many issues and concerns raised in Phase 1 of our consultation cannot and will not be directly addressed in our upcoming Guidelines, they remain valued insights. Some of the valued insights that lie beyond the Board’s decision-making authority are set out below.

| Rights Holders, Industry, and Industry consultants | Rewarding innovation

|

|---|---|

| Pharmacy, Pharmacy associations, and Distributors | Supply chain

|

| Private Payers | Distribution of excess revenues

|

| Patient Groups | Access to medicines

|

Patient Perspectives

|

|

Pharmacoeconomics and cost-effectiveness

|

5. Overview of the Proposed Framework

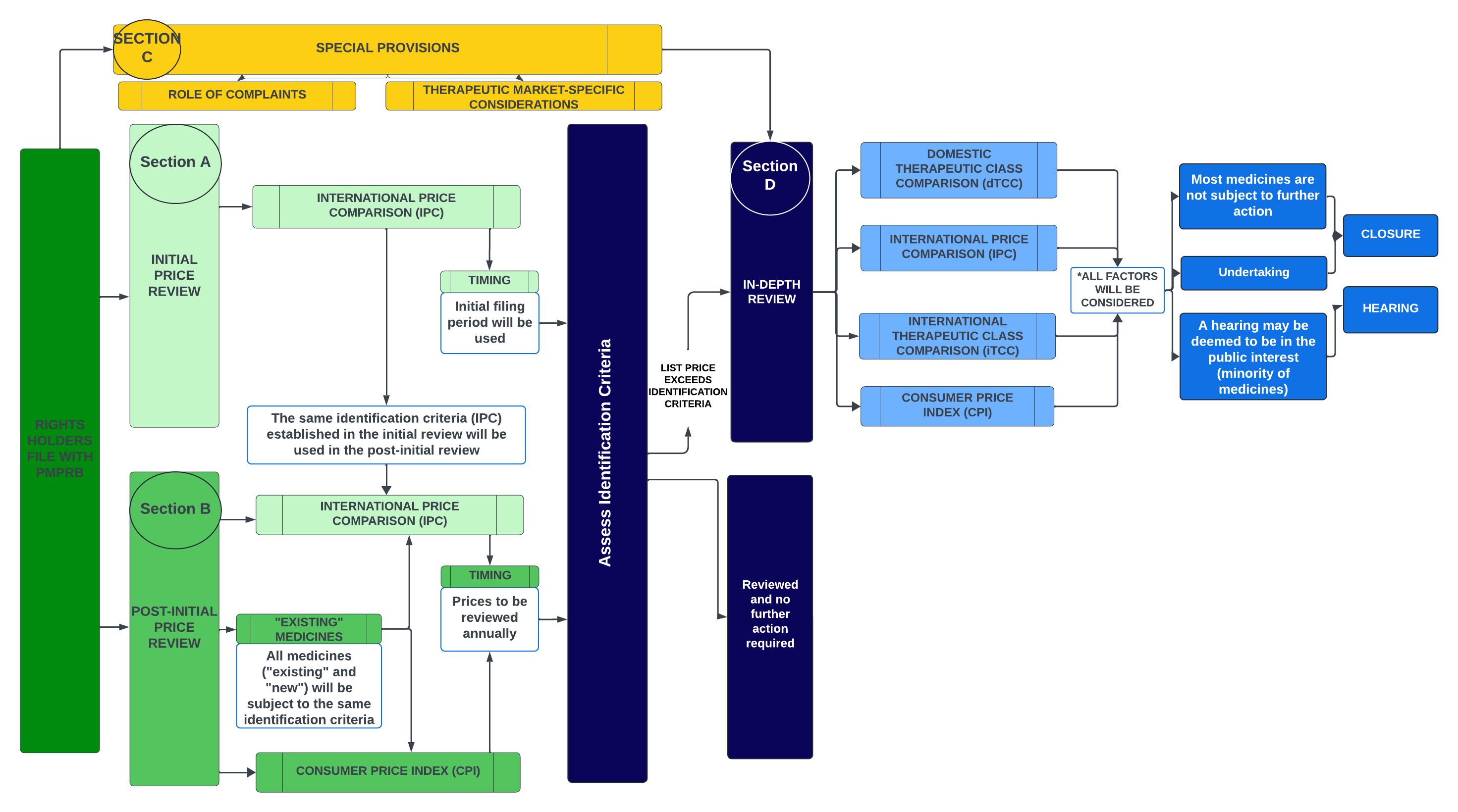

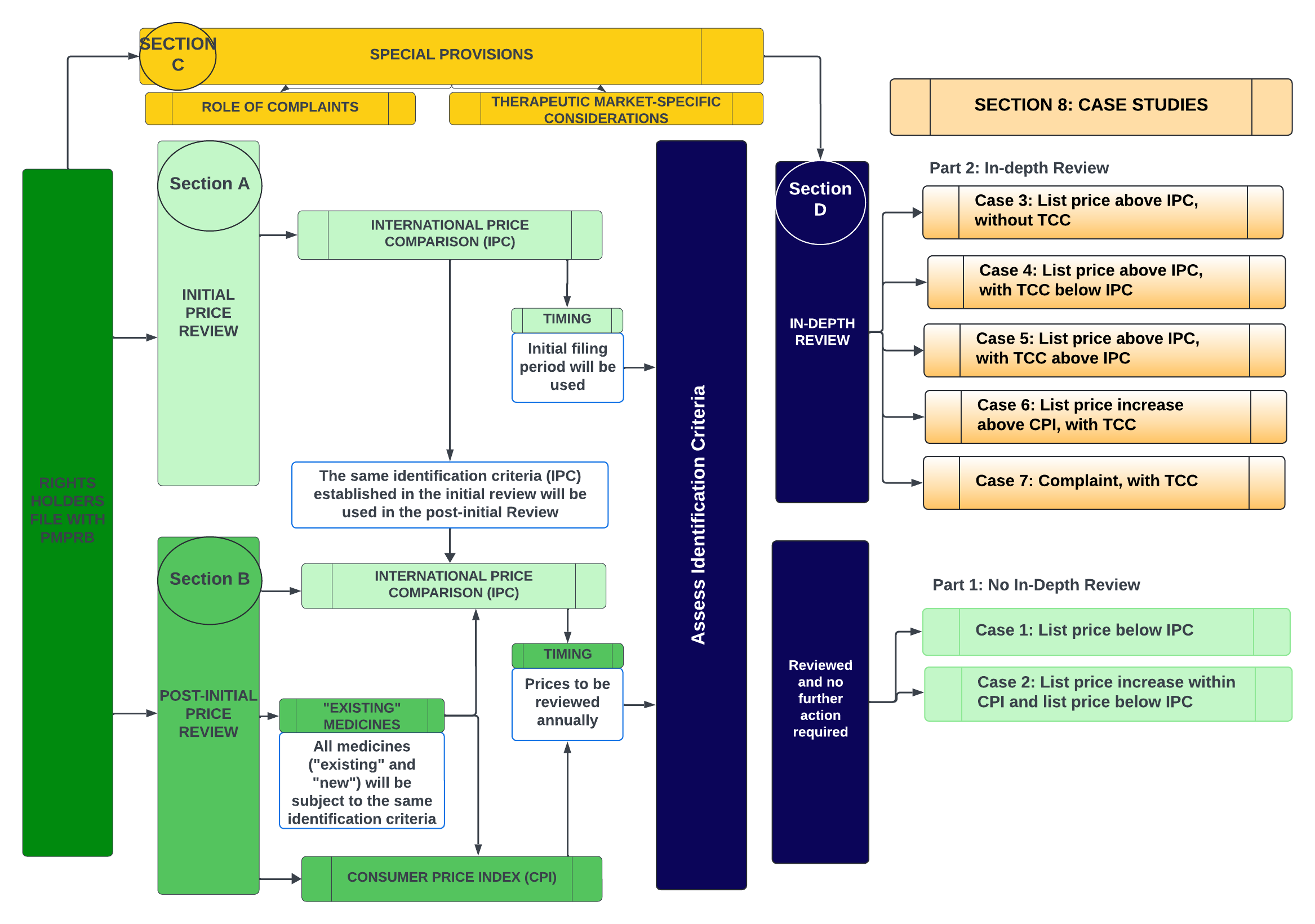

The schematic below provides a high-level overview of how and where the key issues fit in the PMPRB’s proposed price review process.

Figure - Text version

This flowchart illustrates the PMPRB's proposed price review process for patented medicines. It is divided into several sections to highlight the various steps in the process.

The proposed framework is described below:

- Rights Holders file with the PMPRB

- Section A - Initial Price Review:

- The PMPRB will use a medicine’s initial filing period (first semi-annual filing) to conduct an initial price review, with the identification criteria based on the International Price Comparison (IPC).

- Section B – Post-initial Price Review:

- The PMPRB will conduct an annual post-initial review of prices for all patented medicines under its jurisdiction, with the identification criteria based on the IPC and changes in the Consumer Price Index (CPI).

- The same International Price Comparison (IPC) identification criteria established in the initial review will be used in the post-initial review.

- All medicines (“existing” and “new”) will be subject to the same identification criteria.

- Section C – Special Provisions:

- Complaints will serve as a separate process by which medicines can be identified for an in-depth review. Special provisions for certain therapeutic markets are also being considered.

- Assess Identification Criteria:

- Patented medicines that do not meet any identification criteria in either the initial or annual price review would be considered as being reviewed at that time, and no additional action by Staff would be conducted until the medicine is reviewed again the following year or a complaint is received.

- Medicines that meet the identification criteria will undergo an in-depth review (Section D: In-Depth Review).

- Section D: In-Depth Review:

- All s. 85(1) factors will be considered.

- The in-depth review will assess the domestic Therapeutic Comparison (dTCC), the International Price Comparison (IPC), the International Therapeutic Class Comparison (iTCC), and changes in the Consumer Price Index (CPI).

- The results of the in-depth review may result in a recommendation to the Chairperson that it be closed (with or without an undertaking) or proceed to a Notice of Hearing.

The basic structure of the price review process envisioned by the Board can be described through four main parts (“Sections”): Section A: Initial Price Review; Section B: Post-Initial Price Review; Section C: Special Provisions; and Section D: In-Depth Review.

Section A: Initial Price Review: Outlines the process and identification criteria Staff will use to flag medicines that may be at a greater risk for excessive pricing for an in-depth review. Under the proposed framework, the PMPRB will:

On this basis, list prices which are at low risk of excessive pricing will receive initial review from the Board within 60 days and require no further consideration until Post-Initial Price Review on an annual basis (Section B) or complaint basis (Section C). |

Section B: Post-Initial Price Review: Outlines the ongoing monitoring of medicines that have already undergone the initial price review. Under the proposed framework, the PMPRB will:

Patented medicines that do not meet any identification criteria in either the initial or annual price review would be considered as being reviewed at that time, and no additional action by Staff would be conducted until the medicine is reviewed again the following year or if a complaint is received. |

Section C: Special Provisions - role of complaints: outlines the role of complaints as a separate process by which medicines can be identified for an in-depth review. Under the proposed framework, the PMPRB will:

|

Section D: In-depth Review: A Staff-led analytical process that considers all the factors outlined in Section 85(1). At the conclusion of the process, Staff will recommend to the Chairperson whether the in-depth review should be closed or lead to a Notice of Hearing. The Chairperson will then decide whether a hearing should be initiated, or whether the in-depth review should be closed without proceeding to a hearing. Under the proposed framework the PMPRB will:

While the in-depth review criteria will be compared against the list price of the medicine, the Board will continue to use the average price per package and/or net revenues filed by the Rights Holder when the Chairperson is considering a potential excess revenue amount in a voluntary undertaking submitted by the Rights Holder. |

5.1 Section A: Initial Price Review of Patented Medicines

As soon as a patented medicine has sales in Canada, that medicine is subject to the PMPRB’s price review jurisdiction. Pursuant to Subsection 4(2) of the Regulations, Rights Holders are required to report price and sales data to the PMPRB within 30 days after the day on which the medicine is first sold in Canada, and on a semi-annual basis moving forward. Under the proposed framework, the PMPRB will use a medicine’s initial filing period (first semi-annual filing) to conduct an initial review based on the International Price Comparison (IPC) (based on s. 85(1)(c) of the Act). The review will compare the list price of a medicine in Canada with the list price in the PMPRB11 basket of countries to identify medicines that may need a more in-depth review.

The use of IPC as the identification criteria is a logical starting point for efficiently identifying cases that may need a more in-depth review. Its use has many advantages:

- The first is that the IPC is based on information Rights Holders provide in their filings to the PMPRB and thus is known in advance.

- Also, it is understood that the international prices of medicines may already reflect, to some extent, the availability of comparator medicines in those markets.

- This makes the IPC transparent and predictable for Rights Holders and the earliest type of price review that the PMPRB can perform, as it does not rely on scientific reviews or public prices of other medicines.

In contrast to previous Guidelines, the Board has decided to reserve the use of the domestic Therapeutic Class Comparison (dTCC) (based on s. 85(1)(b) of the Act) and the international Therapeutic Class Comparison (iTCC) (based on s. 85(1)(c) of the Act) (collectively, the “TCC”) only as part of an in-depth review. This approach aligns with the PMPRB's objective of achieving a balance between ensuring that instances of potential excessiveness are identified and managing the Board’s resources.

The Board recognizes that the application and relevance of the TCC can vary based on the individual circumstances of each medicine, including its primary indication and the comparators available at the time of assessment. Unlike the IPC, the TCC does not enable a direct price comparison with the same medicine. Consequently, the Board’s position is that Staff should consider the TCC in combination with other factors, such as the IPC and CPI, as part of an in-depth review.

5.2 Section B: Post-Initial Price Review of Patented Medicines

According to the Patent Act, the PMPRB's mandate extends beyond conducting an initial price review at introduction; rather, it encompasses the continuous monitoring of prices throughout the life of the patent to ensure they are not excessive at any stage of the medicine’s patent life cycle. This is facilitated by the filing requirements stipulated by the Regulations which require Rights Holders to submit pricing information semi-annually.

Under the proposed framework, the PMPRB will conduct an annual post-initial review of prices for all patented medicines under its jurisdiction.

- For greater clarity, there will be no distinction between “New medicines”Footnote 14 or “Existing medicines”Footnote 15 with regard to the price review process. The only difference with Existing medicines is that those above IPC identification criteria chosen by the Board will be given a period of time to adapt to the Guidelines after they are implemented before an assessment based on IPC which could lead to an in-depth review is be commenced.

- This annual monitoring will apply the same IPC identification criteria used during the initial review for all subsequent post-initial reviews.

- If an IPC cannot be conducted due to a lack of PMPRB11 price (e.g. Canada is the first launch country in the PMPRB11), it will not lead to an in-depth review.

- Additionally, Staff will compare price changes of medicines against changes in the CPI as an identification criterion to identify medicines that warrant an in-depth review.

The use of the IPC and CPI as identification criteria continues to provide the same amount of transparency and predictability to Rights Holders as provided in the initial review, as these criteria are based on either publicly available information (e.g., CPI) or are directly within the control of Rights Holders (e.g. IPC). The Board believes this process ensures an appropriate balance that allows for ongoing monitoring without undue administrative burden while maintaining predictability for Rights Holders.

5.3 Section C: Special Provisions

5.3.1 Role of Complaints

Under the previous guidelines, a full review (using both international prices and therapeutic price comparisons) was conducted for all medicines, regardless of whether a complaint had been made. Consequently, the receipt of a complaint did not have a material impact on the type or level of review being conducted (the “price tests”).

Under the proposed approach, all medicines would be subject to initial review (using international prices only), and only medicines which progress to the in-depth review stage would be subject to a full review (using international prices, CPI, and therapeutic price comparisons). The Board is considering using the receipt of a pricing complaint as an additional pathway to an in-depth review.

Under the proposed framework, an approved individual/group (See Topic 4, below) who believes that the price of a patented medicine in any market in Canada is excessive may submit a complaint to the PMPRB. The receipt of the complaint will lead to an in-depth review.

The PMPRB has long used a complaint-based process to achieve two main objectives:

1. As a stopgap to ensure that case-specific situations not captured by the initial and post-initial price review process can be considered when needed.

While the identification criteria in the initial and post-initial review process provide an important initial step to identifying cases for an in-depth review, they may not capture all cases that warrant it. There may be cases where the guideline identification criteria do not identify case-specific situations where an in-depth review should take place. As a result, the Board views the role of complaints as a crucial mechanism to ensure that unexpected scenarios are not missed.

2. To recognize that certain medicines, due to their unique market characteristics, have a lower likelihood of excessive pricing.

The PMPRB has long used the complaints-based process to reduce scrutiny of medicines in areas with a lower risk excessive pricing and to focus PMPRB’s resources on the most likely cases of price excessivity. Under the amended Regulations, patented over-the-counter (OTC) medicines, certain non-prescription controlled substances, generic and veterinary medicines are not required to file pricing and other information with the PMPRB unless specifically requested to do so by the PMPRB.

Under the proposed framework, the Board will operationalize this by requiring that, for medicines subject to reduced reporting obligations, an in-depth review will only be commenced if a complaint is received.

5.4 Section D: In-Depth Review

An in-depth review will consider all of the factors outlined in Section 85(1), including comparing prices to the IPC, changes in CPI, and TCC. Consequently, the in-depth review will include an analysis of both scientific and pricing information.

The therapeutic comparators will be established during the scientific analysis outlined in the figure below Subsequently, prices will be identified for the comparators and Staff will consider the relevance of the comparators based on the context provided by the scientific review. Staff will then consider the strength of the therapeutic comparators, the relevant IPC, and the CPI on a case-by-case basis.

For example, if the therapeutic comparators are highly similar, the TCC may carry more weight during the analysis vis a vis the IPC, whereas the opposite may be true when the comparators are less similar. The balancing of all the price comparisons based on the 85(1) factors will determine whether Staff recommends that the in-depth review be closed or proceed to a Notice of Hearing. The final decision to close the in-depth review or issue a Notice of Hearing will remain with the Chairperson.

Role of Undertakings

If Staff recommends a Notice of Hearing, the Rights Holder may choose to submit a voluntary undertaking (VU) before the Notice of Hearing issues. Any proposed voluntary undertakings will be referred to the Chair. The Chair will determine whether a hearing is in the public interest or whether the in-depth review should be closed by considering the strength of the Staff’s recommendation based on the factors, and any proposed voluntary undertaking from the Rights Holder.

As a reminder, after a Notice of Hearing issues, neither the staff nor the Chairperson is permitted to consider a voluntary undertaking. If the Rights Holder seeks a settlement after a Notice of Hearing has been issued, it must be presented to the hearing panel, who has exclusive authority to decide to discontinue the hearing based on the terms of the proposed settlement.

Excess revenues

While Staff will not calculate potential excess revenues as part of the in-depth review, potential excess revenues included in voluntary undertaking submitted by the Rights Holder will continue to be based on the average price per package and/or net revenue (ATP) information filed by the Rights Holder pursuant to the Regulations, and not on list prices.

Transparency and Ongoing Communication with Rights Holders

Staff will ensure that Rights Holders are kept informed of the status of their reviews and receive appropriate notice and opportunities to provide input at key moments in the review process. In particular, the following process timelines and notification steps are being considered:

Figure - Text version

This schematic outlines the proposed timelines and notification steps that are being considered. The information demonstrated in this schematic is fully described in the text below.

Steps 1 to 2 - Assess Identification Criteria: Staff will send a letter to Rights Holders within 60 days of receipt of their semi-annual filings indicating whether any of their medicines will be subject to an in-depth review. This 60-day timeframe applies to the completion of both initial and post-initial reviewsFootnote 16.

If an in-depth review is initiated it could be completed relatively quickly (within approximately 12 months) in certain circumstances (e.g. products where the scientific review quickly determines there are no comparators and IPC is relatively simple and non-controversial), or could take longer (up to approximately 28 months) for very complex cases.

Steps 2 to 3 - Scientific and Price Review: Once an in-depth review is initiated, the scientific team will identify the comparators for the purpose of conducting a potential TCC. Rights holders will be notified within 6-8 months (potentially longer if the Human Drug Advisory Panel (HDAP) is required). If a Rights Holder wishes to provide additional information for reconsideration of the scientific review, they will have 90 days to do so. Such a reconsideration will make the review process return to step 2 - the scientific review.

In parallel, Staff will commence its price review of the medicine in anticipation of the results of the scientific review. At this stage, the Staff may also hear comments from Rights Holders on a case-by-case basis.

Steps 3 to 4 - Price Review: Once the scientific review has been concluded, Staff will assess 85(1)(b) by adding pricing information to the TCC analysis. The process for TTC selection and analysis is set out in the in-depth review Section 6.3 below.

After the s.85(1) factors have been individually assessed, Staff will then balance all the factors together and submit a recommendation to the Chairperson that the in-depth review be closed (with or without an undertaking) or proceed to a Notice of Hearing.

The balancing of the factors is not defined by legislation or regulation. As in the past, when crafting recommendations to the Chairperson, Staff will set out how the balancing is affected by the available evidence, and its recommended weight, which can vary on a case-by-case basis (see section 8 for case study examples), while also ensuring that it is applying its balancing methodology consistently to ensure fairness between all Rights Holders.

If the result of the in-depth review is a recommendation to the Chair to issue a Notice of Hearing, Staff will provide the Rights Holder with notice of that recommendation. The Rights Holder will have 3 months to respond before the Chair decides whether to issue the Notice of Hearing.

Rights Holders may submit a Voluntary Undertaking (VU) at any point following notice that Staff will be initiating an in-depth review, and all VUs will be presented to the Chairperson alongside analysis and a recommendation from PMPRB Staff.

6. Topics for Discussion

6.1 Initial and Post-Initial Price Review

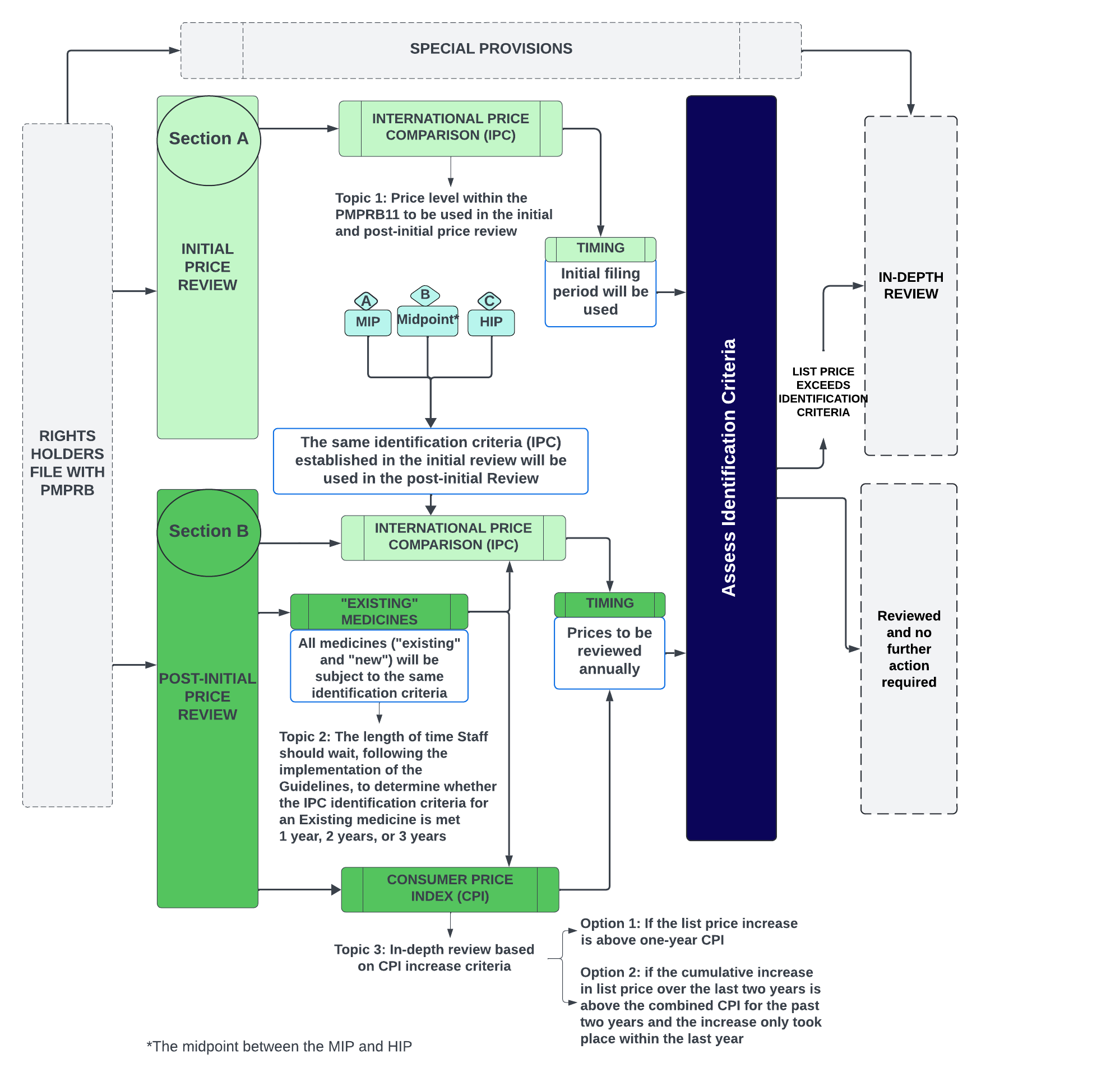

Figure - Text version

This flowchart shows the PMPRB's proposed price review process for patented medicines. It focuses on the initial and post-initial price review (Sections A and B) and highlights specific discussion topics. The flowchart also indicates where these topics fit within the proposed framework, with greyed-out sections showing their place.

Topic 1: Price level within the PMPRB11 to be used in the initial and post-initial price review

- The Board is considering the following options:

- MIP (Median International Price)

- Midpoint (the midpoint between the MIP and HIP)

- HIP (Highest International Price)

Topic 2: The length of time Staff should wait, following the implementation of the Guidelines, to determine whether the IPC identification criteria for an Existing medicine is met

- The Board is considering the following options:

- One year

- Two years

- Three years

Topic 3: In-depth review based on CPI increase criteria

- The Board is considering the following options:

- Option 1: if the list price increase is above one-year CPI

- Option 2: if the cumulative increase in list price over the last two years is above the combined CPI for the past two years and the increase only took place within the last year

6.1.1 Price level within the PMPRB11 to be used in the initial and post-initial price review

As per s. 85(1)(c) of the Act, the Board is required to consider the prices at which the medicine and other medicines in the same therapeutic class have been sold in countries other than Canada, to the extent that information is available. As described in the framework above, the Board will use the IPC comparison for the same medicine alone (not including the medicines in the same therapeutic class) as the primary criterion for identifying cases for an in-depth review.

The Board is seeking feedback on the price level within the PMPRB11 that should be used for this initial review. The Board aims to achieve a balance between identifying instances of potential excessiveness and managing the Board’s resources.

The Board has identified three IPC criteria which could enhance the Board’s administrative efficiency and provide transparency and predictability for Rights Holders. These three options are:

- Median International Price (MIP)

- Highest International Price (HIP)

- The midpoint between the MIP and HIP

The Board recognizes that many Rights Holders took the position during Phase 1 of the consultation that the highest international price filed by the Rights Holder (“HIP”) is the most appropriate price level for the Guidelines to use because it is not possible for a price below the HIP to be excessive. Nevertheless, the Board notes that in some instances it is possible for a price below the HIP to be excessive, just like there are instances in which it is possible for a price above the HIP to not be excessive. In particular, where the TCC is significantly below the IPC, as was the case in the Shire BioChem Inc. (Adderall XR, 2008) and Horizon Pharma (Procysbi, 2022) hearings, the Board found that a price above the midpoint between the TCC and the median international price was excessive.

For this reason, and others, the Board is continuing to consider whether a price level below the HIP of the PMPRB11 may be more appropriate as a screening tool to identify medicines for an in-depth review, given that the Board is proposing not to use the TCC in the initial price review. Regarding administrative efficiency, the Board is aware that it is constrained in the amount of yearly in-depth reviews Staff can perform and that the number of in-depth reviews increases as the IPC identification criteria moves below the HIP. Some important data on the number of medicines in each category are provided in Figure 1, below.

Finally, some of the comments made by stakeholders during Phase 1 suggest that at least some of them view the application of identification criteria as an adjudication of whether a price is excessive. In this regard, the Board reiterates that the use of identification criteria is not intended to be and should not be misconstrued as a decision regarding whether a price is excessive. Whether a price is excessive is a determination that can only be made by the Board in the context of assessing the specific circumstances of a patented medicine’s price in a public hearing and is not something that can be decided in the Guidelines. Indeed, it is possible that an in-depth review commenced because the price of a medicine is above the IPC be closed upon further analysis with or without the receipt of a voluntary undertaking.

Topic 1: Price level within the PMPRB11 to be used in the initial and post-initial price review

The Board is considering the following options:

- Option 1: Median International Price*

- Option 2: Highest International Price

- Option 3: the midpoint* between the MIP and HIP

*Notes on Prices:

- The median would only be calculated for medicines with prices reported in at least two PMPRB11 countries. If the medicine is sold in an even number of countries, the median will be calculated as the simple average between the middle two prices. If the medicine is sold in an odd number of countries, the median is the middle price.

- For midpoint, the Board proposes that the midpoint between the MIP and HIP would be a simple average between those two prices.

- Where there is one international price comparator, it will be considered the HIP. Where there is a lack of international price comparators (e.g. Canada is the first launch country in the PMPRB11), the IPC identification criterion will not be used to commence an in-depth review.

Canadian list prices of patented medicines within the PMPRB11

Figure 1. Distribution of Canadian list prices of patented medicines within the PMPRB11Footnote 17

Figure - Text version

This bar chart depicts the share of all patented medicines in 2023 (top) and new medicines at introduction (bottom) during their introductory period in 2022 and 2023.

The bars are subdivided into four bands to show the shares of medicines for Canadian list prices: below or equal to the MIP (dark green); above the MIP and below or equal to Midpoint (light green); above the Midpoint and below or equal to the HIP (light blue); and above the HIP (dark blue).

| List <= MIP | MIP-Mid | Mid-HIP | List > HIP | |

|---|---|---|---|---|

All DINs |

22% |

25% |

21% |

32% |

Intro DINs |

63% |

15% |

13% |

8% |

All medicines:

- 32% of all patented medicines had Canadian list prices higher than the highest international price (HIP) of the PMPRB11 in 2023.

- 53% of all patented medicines had Canadian list prices higher than the midpoint of the MIP and HIP of the PMPRB11 in 2023.

- 78% of all patented medicines had Canadian list prices higher than the MIP in 2023.

New medicines in the initial filing period (at introduction):

- 8% of new medicines had Canadian list prices higher than the highest international price (HIP) of the PMPRB11 in their initial filing period.

- 21% of new medicines had Canadian list prices higher than the midpoint of the MIP and HIP of the PMPRB11 in their initial filing period.

- 37% of new medicines had Canadian list prices higher than MIP of the PMPRB11 in their initial filing period.

6.1.2 Transitional provisions for Existing Medicines

As described in section 5.2, Existing Medicines with list prices above the IPC identification criteria chosen by the Board will be given time to adapt to the Guidelines before an in-depth review will be commenced. Such a review would be based on the most recently available list prices filed by the Rights Holder.

Topic 2: The length of time Staff should wait, following the implementation of the Guidelines, to determine whether the IPC identification criteria for an Existing medicine is met

The Board is considering the following options:

Option 1: one year

Option 2: two years

Option 3: three years

6.1.3 The CPI factor

As per s. 85(1)(d) of the Act, the Board is required to consider changes in the Consumer Price Index (CPI). According to the proposed framework, the CPI factor will be assessed during the annual post-initial price review. During this review, Staff will compare price changes of medicines against changes in the CPI to identify medicines that warrant an in-depth review.

The Board is proposing to use CPI as a criteria that can lead to in-depth review. In that regard, the Board is considering two options to better reflect how price increases have historically evolved in Canada.

Topic 3: In depth review based on CPI increase criteria

The Board is considering the following options:

Option 1: if the list price increase is above one-year CPI.

- Predictable and transparent: the assessment is based on the list prices reported by Rights Holders (previous year and current year list prices), and the one-year actual CPI as reported by Statistics Canada.

Option 2: if the cumulative increase in list price over the last two years is above the combined CPI for the past two years and the increase only took place within the last year (i.e. no increase in price in the first of the two years, followed by an increase on the second year)

6.2 Special Provisions

Figure - Text version

This flowchart illustrates the PMPRB's proposed price review process for patented medicines, with a focus on the special provisions section. This section covers the role of complaints and therapeutic market-specific considerations. The flowchart highlights specific discussion topics for which the Board seeks feedback and shows how they fit within the proposed framework. Greyed-out sections indicate their place within the entire proposed framework.

Topic 4: The individuals/groups permitted to submit a complaint

The PMPRB is considering limiting complaints to:

- Option 1: The Federal Minister of Health or any of his/her Provincial or Territorial counterparts

- Option 2A: Option 1 above plus public payors only; or

- Option 2B: Option 1 plus private and public payors

- Option 3: Everyone except for Rights Holders

- Option 4: No limits/restrictions

Topic 5: Expanding the list of products that would only be subject to an in-depth review following a complaint to include biosimilars and/or vaccines

The Board is considering the following options:

- Option 1: The PMPRB will treat biosimilars and/or vaccines the same as other medicines

- Option 2: The PMPRB will only open and in-depth review for biosimilars and/or vaccines when a complaint is received

6.2.1 Complaints

As per the proposed framework, complaints will serve as a key mechanism to identify medicines that may warrant an in-depth review. A primary goal of the complaints process, as described in section 5.3.1 of this discussion guide, is to serve as a stopgap, ensuring that case-specific situations not captured by PMPRB's price review process can be identified for an in-depth review when needed.

The Board seeks to balance inclusivity and transparency with the need to prevent misuse and ensure that instances of potential excessiveness can be identified. Achieving this balance is crucial for ensuring effective ongoing monitoring, reducing administrative burden, and maintaining predictability for Rights Holders.

To this end, the Board is considering a range of options for defining who can submit a complaint that automatically leads to an in-depth review, ranging from limiting complaints to the Federal Minister of Health or any of their Provincial or Territorial counterparts to having no limits to who can complain to the PMPRB.

Topic 4: The individuals/groups permitted to submit a complaint

The Board is considering the following options:

Option 1: limit complaints to the Federal Minister of Health or any of his/her Provincial or Territorial counterparts

- helps ensure that key government officials with a vested interest in public health bring the most pertinent cases of potential price excessivity to the PMPRB's attention.

- Consistent with s. 86(2) of the Patent Act.

- Members of the public can contact their elected officials if they are concerned that the price of a patented medicine may be excessive.

Option 2A: limit complaints to option 1 above plus public payors only; or

Option 2B: limit complaints to option 1 above plus private and public payors

- allows for a broader range of complaints from relevant payors.

Option 3: limit complaints to everyone except for Rights Holders

- opens the complaints process to a wide range of stakeholders who may have legitimate complaints while excluding those with a direct commercial interest, preventing any misuse of the process.

Option 4: no limits/restrictions

- treats all parties equally and ensures the broadest range of complaints. The PMPRB recognizes the potential for a high volume of complaints under this scenario and, if needed, would consider measures to minimize the possibility that some complaints may be inappropriate.

6.2.2 Therapeutic Market Considerations

Another main objective of the complaints process has been to recognize that certain medicines have a lower likelihood of excessive pricing due to their unique market characteristics. As described in section 5.3.1 of this discussion guide, for medicines that have reduced reporting requirements under the Regulations, the Board has opted to only open an in-depth review when a complaint is received. The Board acknowledges that additional therapeutic categories may also pose a lower risk of excessive pricing and is considering expanding the list of medicines eligible for the complaint-only based process to prioritize higher-risk cases.

Topic 5: Expanding the list of products that would only be subject to an in-depth review following a complaint to include biosimilars and/or vaccines

The Board is considering the following options:

Option 1: The PMPRB will treat patented biosimilars and/or vaccines the same as other medicines.

Option 2: The PMPRB will only open an in-depth review for biosimilars and/or vaccines when a complaint is received.

It should be noted that all the foregoing products remain subject to the Board’s jurisdiction, provided they are patented. A complaint in respect of any one of them would automatically result in the commencement of an in-depth review, which may or may not result in a recommendation to commence an excessive price hearing.

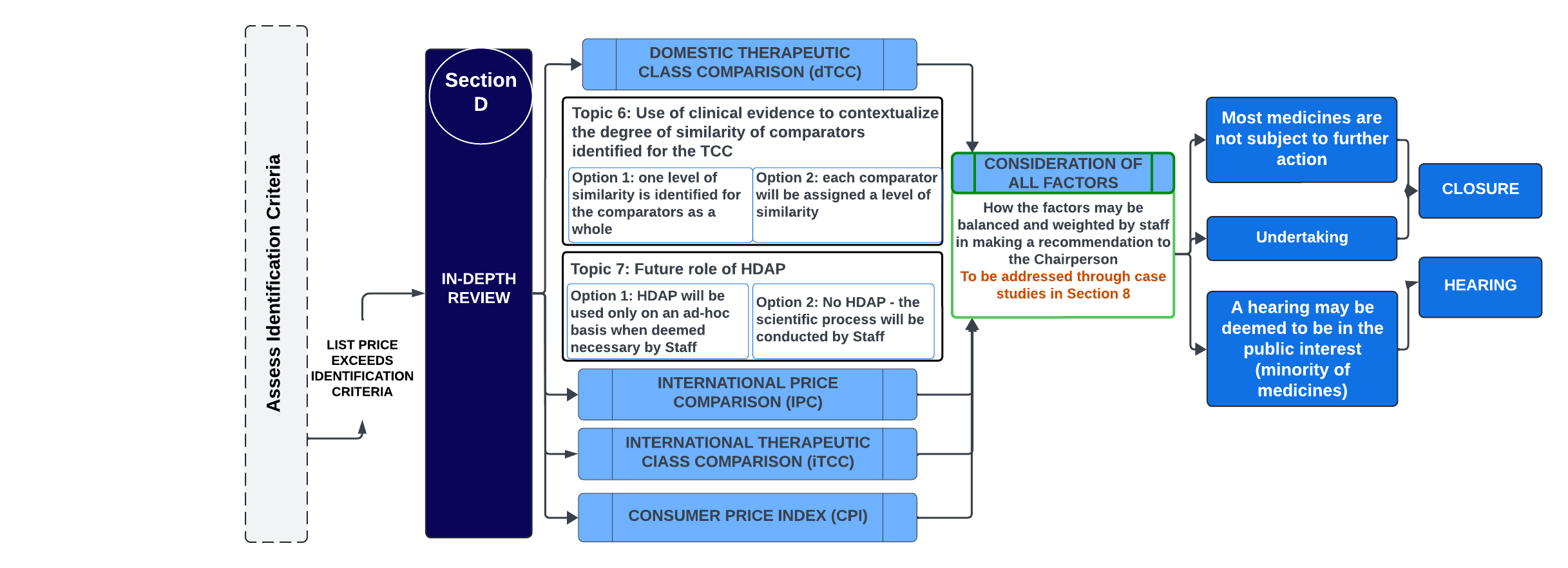

6.3 In-Depth Review: Therapeutic Class Comparison and the Scientific Review Process

Figure - Text version

This flowchart illustrates the PMPRB's proposed price review process for patented medicines. It focuses on the in-depth review section in Section D, which involves considering all factors and making a recommendation to the Chairperson. The flowchart also outlines the discussion topics for which the Board is seeking feedback and shows where they fit into the proposed framework. Greyed-out sections indicate their place within the entire framework.

Topic 6: Use of clinical evidence to contextualize the degree of similarity of comparators identified for the TCC

The Board is considering the following options:

- One level of similarity is identified for the comparators as a whole

Each comparator will be assigned a level of similarity

Topic 7: Future role of HDAP

The Board is considering the following options:

- Option 1: HDAP will be used only on an ad-hoc basis when deemed necessary by Staff

- Option 2: No HDAP – the scientific process will be conducted by Staff.

As per s. 85(1)(b) and (c) of the Act, the Board is required to consider the prices at which other medicines in the same therapeutic class have been sold in the relevant market and in countries other than Canada (to the extent that information is available) when assessing whether the price of a patented medicine is excessive. This comparison is limited to identifying comparators and understanding their context, from a pricing perspective. This process is not meant to replicate or replace a therapeutic value or clinical performance assessment. Health Technology Assessments (HTA), cost-effectiveness analyses and other similar detailed comparative clinical performance assessments are not included in the s.85(1) factors, nor in the implementing regulations. By contrast, other organizations in the life sciences ecosystem are authorized, enabled and resourced to conduct HTAs using a full suite of best practices. These include Canada’s health technology assessment agencies, namely the Canada’s Drug Agency (CDA-AMC, formerly CADTH) and the Institut national d'excellence en santé et services sociaux (INESSS), and a variety of provincial ministries and pharmaceutical price review bodies.

As described in the framework above, the Board will wait until the medicine has been identified for an in-depth review before conducting a TCC.

Establishing Comparators for a TCC

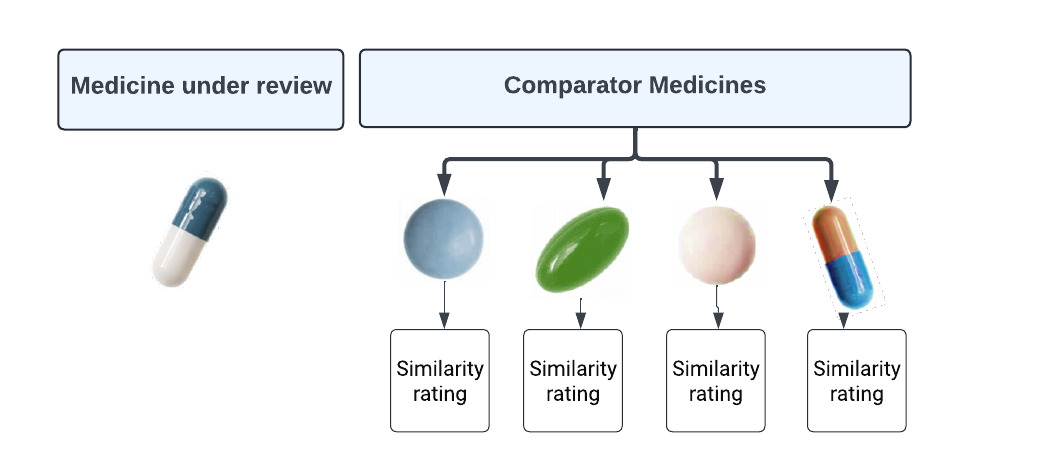

The first step is a scientific review, which is an evidence-based process that results in a recommended list of potential therapeutic comparators for a patented medicine. The list is created by the scientific Staff at the Board independently from any pricing information. The list is then provided along with relevant scientific context to the pricing review Staff who adds the relevant pricing information (list prices) so that they can perform list-to-list price comparisons.

The Board is not contemplating changes to how medicines will be identified by scientific review for comparison purposes and will continue to use previously applied methods. The scientific review of a new patented medicine will continue to be based on information from a variety of sources:

- Research by a Drug Information Centre (DIC) – Staff uses the services of various drug information centres to obtain scientific information, such as clinical trial information, clinical practice guidelines, etc. The basis of the review by the DIC is the indication outlined in the product monograph or, in the case of a medicine not yet granted a Notice of Compliance (NOC), information similar to that contained in a product monograph.

- Research by PMPRB scientific Staff –Staff may also update research and supplement data and evidence from the DIC using other sources.

- Rights Holder comments

- Research by external experts (contractors), as identified by the PMRPB.

After the potential comparators are identified by scientific review group, the list is returned to the pricing group with relevant scientific context to allow the pricing group to understand key points of comparison so that it may determine the relative strength of the comparator in the 85(1)(b) assessment, and can contextualize the potential TCC as set out in the next section.

6.3.1 Contextualization of potential TCC

The Board recognizes that previous PMPRB frameworks were centered on an innovation value-based assessment (level of therapeutic improvement) as the keystone of its price review process. While innovation is a central consideration in the Patent Act as a whole, it is not in itself a factor in s. 85(1). Rather, s. 85(1) focuses on price comparisons at various levels, including comparing the prices of therapeutic class comparators.

In this regard, the PMRPB acknowledges that while a medicine may have the same approved indication or use as a new patented medicine under in-depth review and may be selected as a potential comparator for the purposes of a potential TCC analysis, there may be variations in the degree of comparability between medicines.

The Board believes that there should be a mechanism in place, other than the previously used level of therapeutic improvement, to evaluate and recognize these variations as part of the scientific review process. Recognizing these differences provides essential context for PMPRB Staff in considering how to weigh the TCC versus the other 85(1) factors in the context of an in-depth review when drafting their recommendations to the Chairperson.

For example, if the therapeutic comparators are highly similar, the IPC may carry less weight during the analysis vis a vis the TCC, whereas the contrary may be true when the comparators are less similar.

Topic 6: Use of clinical evidence to contextualize the degree of similarity of comparators identified for the TCC.

The Board is considering the following options:

Option 1: one level of similarity is identified for the comparators as a whole

Option 2: each comparator will be assigned a level of similarity

The PMPRB is currently considering two options to assess the degree of similarity between the new patented medicine under in-depth review and the medicine(s) chosen as comparator(s) for the purposes of a potential TCC analysis.

Under both options, if the new patented medicine is the only medicine sold in Canada that effectively treats a particular illness or indication, no comparators will be identified and a TCC test will not be conducted.

Option 1 – one level of similarity is identified for the comparators as a whole.

This approach involves assessing the degree of similarity of the medicine under review with the group of comparators as a whole and assigning the medicine under review a single similarity grade.

The approach for defining a level of similarity would evaluate clinical evidence such as efficacy, safety, adverse event profile, route of administration, and patient convenience, among other possible considerations. Evidence would be considered based on recognized standards of quality, with information from high-quality peer-reviewed publications, including phase III head-to-head clinical trials, high-quality networked meta-analysis or health technology assessment given the greatest weight.

Figure - Text version

This diagram is a visualization of an approach for assessing the degree of level of similarity of the medicine under review with the group of comparators as a whole. The medicine under review is evaluated and given a rating that characterizes its overall level of similarity to the group of comparator medicines as a whole.

Option 2 – each comparator will be assigned a level of similarity.

This approach for defining the level of similarity would consider the same evidence noted in option 1; however, each potential comparator would be assigned an individual similarity grade, allowing for a ranking of the individual comparators. This option provides a more granular level of comparability, with the goal of providing a more sensitive reflection of the strengths or weaknesses of individual comparators when making an assessment under s. 85(1)(b).

Figure - Text version

This diagram is a visualization of an approach for assessing the degree of level of similarity of the medicine under review with each comparator separately. The medicine under review is evaluated and each potential comparator will be assigned a level of similarity.

How the level of similarity will be used in the Price Review Process

Unlike the previous level of therapeutic improvement, the level of similarity (either Option 1 or Option 2) would not be used to directly determine pricing tests, but rather to give Staff insight into the degree of comparability of the information contained in the TCC, as outlined in the description of the in-depth review process found in section 5.4.6.3.2 Human Drug Advisory Panel (HDAP)

The Human Drug Advisory Panel (HDAP) is an advisory body comprised of independent health professionals who are contracted by the PMPRB to assist with scientific evaluations in view of their broad general knowledge of drug therapy, drug evaluation, drug utilization and clinical research methodology. The HDAP historically provides impartial advice to PMRPB Staff as part of the scientific review process. HDAP members are not asked to review the materials as specific subject-matter clinical experts and may seek the input of clinical experts from time to time.

However, the Board recognizes that PMPRB scientific review Staff have much of the necessary expertise to provide recommendations on comparators and comparable dosage regimens for the purposes of a TCC analysis. The scientific review team operates independently of the price review process, and does not look at pricing information, engaging in detailed evidence-based evaluations, and advising only on scientific issues that require elucidation.

Going forward, the Board seeks feedback on whether HDAP should be optionally engaged at the request of Staff in cases where Staff seeks additional advice on the TCC, or whether HDAP could be eliminated altogether.

Topic 7: Future role of HDAP

The Board is considering two options:

Option 1: HDAP will be used only on an ad hoc basis when deemed necessary by Staff.Footnote 18

Option 2: No HDAP – the scientific process will be conducted by Staff.

Should the Board opt to utilize HDAP recommendations on an ad hoc basis, it will do so only when PMPRB’s scientific review team identifies specific issues or questions necessitating additional advice. Aiming for increased efficiency, this marks a change from the previous process where HDAP reviewed every medicine subject to PMPRB’s jurisdiction.

7. Next Steps

In the coming weeks, the PMPRB will be hosting a multi-stakeholder webinar where the PMPRB will provide an overview of the proposed framework and address any questions.

It is expected that a first draft of the PMPRB’s new Guidelines will be made public by the end of 2024.

The PMPRB requests stakeholder feedback on the topics set out in this Discussion Guide, via written submission, by the deadline of September 11, 2024. While stakeholders may comment on any aspect of this Discussion Guide, our primary interest is views of stakeholders on the impacts and consequences of the following 7 topics as presented elsewhere herein:

Topic 1: Price level within the PMPRB11 to be used in the initial and post-initial price review:

Option 1: MIP

Option 2: HIP, or

Option 3: midpoint between the MIP and HIP

Topic 2: The length of time Staff should wait, following the implementation of the Guidelines, to determine whether the IPC identification criterion for an Existing medicine is met:

Option 1: one year

Option 2: two years

Option 3: three years

Topic 3: In-depth review based on CPI increase criteria:

Option 1: if the list price increase is above one-year CPI

Option 2: if the cumulative increase in list price over the last two years is above the combined CPI for the past two years and the increase only took place within the last year (i.e. no increase in price in the first of the two years, followed by an increase on the second year)

Topic 4: The individuals/groups permitted to submit a complaint:

Option 1: limit complaints to the Federal Minister of Health or any of his/her Provincial or Territorial counterparts

Option 2A: limit complaints to option 1 above plus public payors only; or

Option 2B: limit complaints to option 1 above plus private and public payors

Option 3: limit complaints to everyone except for Rights Holders.

Option 4: no limits/restrictions.

Topic 5: Expanding the list of products that would only be subject to an in-depth review following a complaint to include biosimilars and/or vaccines.

Option 1: The PMPRB will treat patented biosimilars and/or vaccines the same as other medicines.

Option 2: The PMPRB will only open an in-depth review for biosimilars and/or vaccines when a complaint is received.

Topic 6: Use of clinical evidence to contextualize the degree of similarity of comparators identified for the TCC.

Option 1: one level of similarity is identified for the comparators as a whole.

Option 2: each comparator will be assigned a level of similarity.

Topic 7: Future role of HDAP

Option 1: HDAP will be used only on an ad hoc basis when deemed necessary by Staff.

Option 2: No HDAP – the scientific process will be conducted by Staff.

8. Case Studies: Decision-Making Criteria for Initiating In-Depth Reviews

Figure - Text version

This flowchart depicts the PMPRB's proposed price review process for patented medicines, highlighting the case studies intended to demonstrate how Staff may consider the factors during the in-depth review process to arrive at a recommendation for the Chairperson. The case studies are divided into two parts: Part 1 includes scenarios where the identification criteria are not met and thus no in-depth reviews were commenced. Part 2 covers scenarios where an in-depth review is initiated.

No In-depth Review:

- Case Study 1: List price below IPC

- Case Study 2: List price increase within CPI and list price below IPC

In-depth Review:

- Case Study 3: List price above IPC, without TCC

- Case Study 4: List price above IPC, with TCC below IPC

- Case Study 5: List price above IPC, with TCC above IPC

- Case Study 6: List price increase above CPI, with TCC

- Case Study 7: Complaint, with TCC

To help stakeholders understand how Staff may weigh the factors during the in-depth review process in order to arrive at a recommendation to the Chairperson, several case studies have been prepared for discussion.

The case studies are distinguished into two parts: Part 1 represents scenarios where the identification criteria are not met and thus no in-depth reviews were commenced. Part 2 includes scenarios where an in-depth review is initiated. In these scenarios, the case studies illustrate the decision-making framework that may be applied by PMPRB Staff in their recommendation to the Chairperson based on how the available information about the relevant factors from s. 85(1) may appear in a given situation.

These case studies are not exhaustive and are not intended to cover all possible permutations of scenarios that may appear in in-depth reviews. They are for illustration purposes only. In particular, the magnitude differential represented by the lines and the distance between them should be ignored, as the examples only seek to represent the relative positions of the lines, not the distance between them or specific weight.

Part |

Case Study |

1. No In-Depth Review |

Case Study 1: List price below IPC |

Case Study 2: List price increase within CPI and list price below IPC |

|

2. In-Depth Review |

Case Study 3: List price above IPC, without TCC |

Case Study 4: List price above IPC, with TCC below IPC |

|

Case Study 5: List price above IPC, with TCC above IPC |

|

Case Study 6: List price increase above CPI, with TCC |

|

Case Study 7: Complaint, with TCC |

These examples are not intended to bind the Staff or the Board in any in-depth review or hearing and the analytical approach may be departed from based on the facts available during the review. All recommendations from the Staff and decisions from the Chairperson/Board will depend on the particular circumstances of the matter in question.

Part 1 (No in-depth reviews)

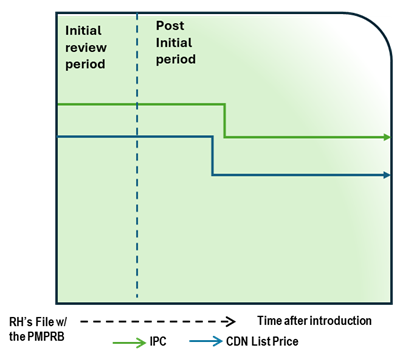

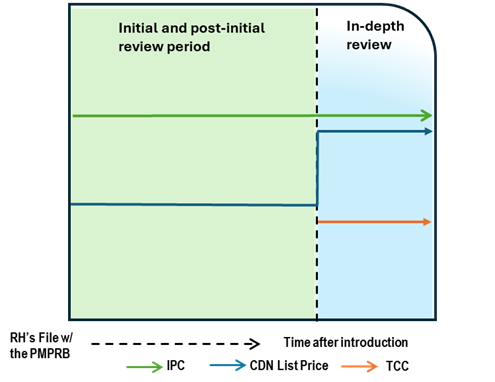

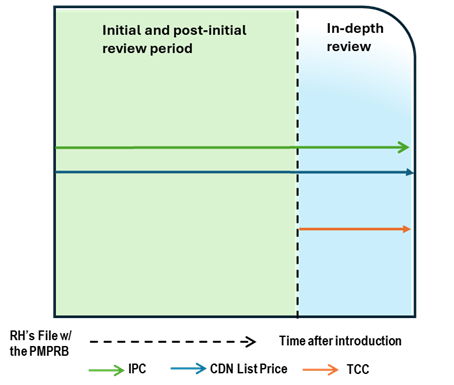

Case Study 1: List price below IPC

Figure - Text version

This chart illustrates the case where, during the initial review, the Canadian list price is below the International Price Comparison (IPC). During the post-initial period, the Canadian list price and the IPC decrease over time. The Canadian list price remains below the IPC, which does not lead to an in-depth review. The chart is divided into two sections, separated by a dashed line: the left represents the initial price review period, and the right represents the post-initial review period. The blue line represents the Canadian list price, and the green line represents the IPC.

Issue/Facts:

- During the initial review, the Canadian list price is less than the IPC.

- The IPC trends downward with time, but the Canadian list price also decreases.

- With no list price increases occurring, changes in CPI are not a consideration.

- No complaint is received regarding this medicine.

Analysis:

- No additional analysis is required, as the medicine does not trigger an in-depth review.

Potential Recommendation:

- N/A – medicine not subject to in-depth review.

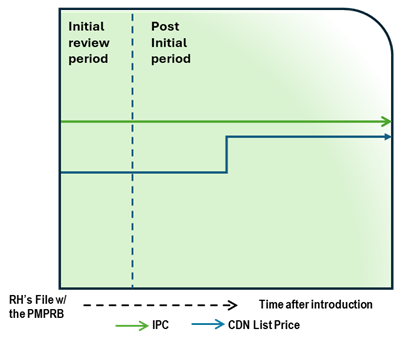

Case Study 2: List price increase within CPI and list price below IPC

Figure - Text version

This chart illustrates the case where, during the initial review, the Canadian list price is below the IPC. During the post-initial period, the Canadian list price increase is less than CPI and thus does not lead to an in-depth review. The chart is divided into two sections, separated by a dashed line: the left represents the initial price review period, and the right represents the post-initial review period. The blue line represents the Canadian list price, and the green line represents the IPC.

Issue/Facts:

- During the initial review, the Canadian list price is less than the IPC.

- The IPC is constant over time, but the Canadian list price increases.

- The list price increase is less than CPI.

- No complaint is received regarding this medicine.

Analysis:

- No additional analysis is required, as the medicine does not trigger an in-depth review.

Potential Recommendation:

- N/A – medicine not subject to in-depth review.

Part 2 (In-depth review)

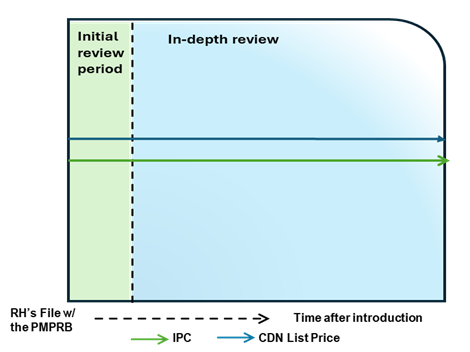

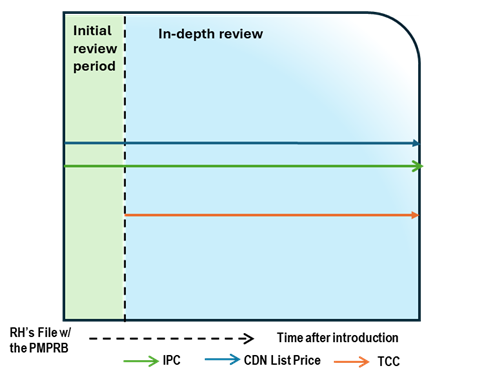

Case Study 3: List price above IPC, without TCC

Figure - Text version

This chart illustrates the case where the Canadian list price is above the IPC, resulting in an in-depth review. The chart is divided into two sections: the green section for the initial price review period and the blue section for the in-depth review period. The blue line represents the Canadian list price, and the green line represents the IPC.

Issue/Facts:

- During the initial review, the Canadian list price is greater than the IPC. This results in an in-depth review.

Analysis:

- The commencement of an in-depth review prompts a scientific review; however, there are no therapeutic comparators and a TCC analysis cannot be conducted.

- During the in-depth review, it is observed that the Canadian list price continues to be greater than the IPC, but no list price increases are taken by the Rights Holder.

- With no TCC and no list price increase to measure against CPI, the only 85(1) factor available for consideration is the IPC. PMPRB Staff may consider the difference between the Canadian list price and the IPC, the number of countries with a reported price for the medicine, as well as the range in prices across the PMPRB11.

Potential Recommendation:

- This case could result in a recommendation for closure or Notice of Hearing, depending upon how the Canadian list price is positioned relative to the more comprehensive analysis of the international market.

Case Study 4: List price above IPC, with TCC below IPC

Figure - Text version

This chart illustrates the case where the Canadian list price is above the IPC, resulting in an in-depth review. During the in-depth review, the TCC is conducted and is below both the list price and IPC. The chart is divided into two sections: the green section for the initial price review period and the blue section for the in-depth review period. The blue line represents the Canadian list price, the green line represents the IPC, and the orange line represents the TCC.

Issue/Facts:

- During the initial review, the Canadian list price is greater than the IPC. This results in an in-depth review.

Analysis:

- The commencement of the in-depth review prompts a scientific review. This review identifies a therapeutic class containing multiple comparators. This list price of the medicine is greater than the result of the TCC analysis.

- While no list price increase has been taken by the Rights Holder, the analysis suggests that the Canadian list price is above both the IPC and TCC.

- PMPRB Staff may consider the strength of the TCC (including the level of comparability and the number of comparators), as well as the difference between the Canadian list price and the IPC, the number of countries with a reported price for the medicine, and the range in prices across the PMPRB11.

Potential Recommendation:

- With the Canadian list price above both the IPC and TCC, the case-specific context within those factors would need to be supportive of the price of the medicine for PMPRB Staff to recommend closure of this in-depth review. More likely, this case would result in the recommendation for a Notice of Hearing.

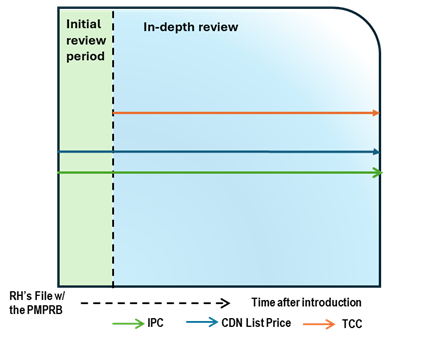

Case Study 5: List price above IPC, with TCC above IPC

Figure - Text version

This chart illustrates the case where the Canadian list price is above the IPC, resulting in an in-depth review. During the in-depth review, the TCC is conducted and is above both the list price and IPC. The chart is divided into two sections: the green section for the initial price review period and the blue section for the in-depth review period. The blue line represents the Canadian list price, the green line represents the IPC, and the orange line represents the TCC.

Issue/Facts:

- During the initial review, the Canadian list price is greater than the IPC. This results in an in-depth review.

Analysis:

- The commencement of the in-depth review prompts a scientific review. This review identifies a therapeutic class containing multiple comparators. This result of the TCC analysis of the medicine is greater than the list price.

- No list price increase has bee taken by the Right Holder, as a result the CPI factor is not taken into consideration.

- PMPRB Staff may consider the strength of the TCC (including the level of comparability and the number of comparators), as well as the difference between the Canadian list price and the IPC, the number of countries with a reported price for the medicine, and the range in prices across the PMPRB11.

Potential Recommendation:

- With the Canadian list price above the IPC but below TCC, the case-specific context within those factors would need to be considered. If TCC has a high degree of comparability, Staff will likely recommendation a closure of the in-depth review. If the TCC has a low degree of comparability, Staff will likely recommend a Notice of Hearing.

Case Study 6: List price increase above CPI, with TCC

Figure - Text version

This chart illustrates the case where, after a period of time on the market, the Canadian list price increases greater than CPI, resulting in an in-depth review. During the in-depth review, the TCC is conducted and is below the list price and IPC. The chart is divided into two sections: the green section for the initial price review period and post-initial period prior to the price increase and the blue section for the in-depth review period. The blue line represents the Canadian list price, the green line represents the IPC, and the orange line represents the TCC.

Issue/Facts:

- After a period of time on the market, the List Price increases greater than CPI.

Analysis:

- The commencement of the in-depth review prompts a scientific review. This review identifies a therapeutic class containing multiple comparators. This list price of the medicine is greater than the result of the TCC analysis.

- PMPRB Staff may consider the strength of the TCC (including the level of comparability and the number of comparators), as well as the difference between the Canadian list price and the IPC, the number of countries with a reported price for the medicine, and the range in prices across the PMPRB11.

Potential Recommendation:

- The Canadian list price is below the IPC. Given the increase above CPI and the lower TCC the case-specific context within these factors would need to be considered, including the difference between the Canadian list price and the IPC, the extent of the price increase and the relative comparability of the TCC.

- Where the TCC consists of high degree comparable medicines, PMPRB Staff may make a recommendation for a Notice of Hearing.

Case Study 7: Complaint, with TCC

Figure - Text version

This chart illustrates the case where the Canadian list price is below the IPC and remain unchanged. After a period of time on the market, a complaint is received, resulting in an in-depth review. During the in-depth review, the TCC is conducted and is below both the list price and IPC. The chart is divided into two sections: the green section for the initial price review period and post-initial period prior to the receipt of a complaint and the blue section for the in-depth review period. The blue line represents the Canadian list price, the green line represents the IPC, and the orange line represents the TCC.

Issue/Facts:

- Over time on the market, the Canadian List Price and the IPC remain unchanged.

- A complaint is received. This will result in an in-depth review.

Analysis:

- The commencement of the in-depth review prompts a scientific review. This review identifies a therapeutic class containing multiple comparators. This list price of the medicine is greater than the result of the TCC analysis.

- Staff must take the TCC into account and weigh it against the IPC and the fact that the Canadian List Price has not changed. Staff’s recommendation will depend heavily on the TCC context and price differential magnitude.

Potential Recommendation:

- In a situation where the IPC has considerably more weight than the TCC given the context, Staff may recommend that the in-depth review be closed. If the reverse is the case, Staff may recommend that a notice of hearing be issued.

Written submissions

Written submissions

Below are the submissions the PMPRB received during consultation period.

Webinar

Webinar

This presentation was delivered at the webinar on August 12, 2024, providing further details and information on the Discussion Guide.

Virtual Stakeholder Meetings

Virtual Stakeholder Meetings

Based on requests from stakeholders, the PMPRB invited those who provided feedback to elaborate on their submissions in a series of virtual meetings, where Board Members asked for more information. The PMPRB thanks those who participated.

Interested members of the public were invited to watch the meetings, which took place on the following dates:

- Friday, September 20, 1 – 3 p.m.

- Monday, September 23, 10 a.m. – noon

- Wednesday, September 25, 1 – 3 p.m.

- Wednesday, October 2, 10 a.m. – noon

- Wednesday, October 2, 1 – 3 p.m.

PDF version (1.6 MB)

PDF version (1.6 MB)