Scoping paper for the consultations on the Board's Guidelines

November 2023

Scoping paper

Table of Contents

- Introduction

- Participation in the Consultation

- Themes for Discussion

- Theme 1: Efficient Monitoring of Prices without Price Setting

- Theme 2: Transition to PMPRB11 – New versus Existing Medicines

- Theme 3: Price Reviews during Product Life Cycle

- Theme 4: Investigations and Referral to Hearing

- Theme 5: Relation to pan-Canadian Health Partners, Insurers (Private and Public); and Alignment with Broader Government Initiatives

- Theme 6: Engaging with Patients, Health Practitioners, Pharmacy, and other Stakeholders

- Conclusion and Follow-Up

Introduction

The Patented Medicine Prices Review Board (PMPRB), established by Parliament in 1987 under the Patent Act (the Act), is a quasi-judicial administrative agency with a dual price review and reporting mandate. Through its price review mandate, it ensures that the prices of patented medicines sold in Canada are not excessive.

The amendments to the Patented Medicines Regulations (“Regulations”), published in the Canada Gazette, Part II, came into force on July 1, 2022, and resulted in an updated schedule of eleven comparator countries (“PMPRB11”)Footnote 1 and reduced reporting requirements for medicines believed to be at the lowest risk of excessive pricing. Changes to the PMPRB’s Guidelines are now necessary to implement the regulatory amendments, and to give effect to the Board’s commitment to modernize and simplify its administrative framework.

This Scoping Paper is intended to serve as a catalyst for a more informed, focused, and productive consultation process in developing new Guidelines by outlining themes and specific questions the PMPRB is seeking feedback on. This paper is for discussion purposes only, and it is not intended as a definitive articulation of the PMPRB’s position on these issues.

Participation in the Consultation

Activity |

Key Dates |

Policy Roundtable – English Session |

December 5, 2023 8:45 am to 5 pm |

Policy Roundtable – French Session |

December 6, 2023 8:45 am to 3 pm |

Deadline for registration to participate in the Roundtable |

November 24, 2023 |

Deadline for Written Submissions |

December 20, 2023 |

What we Heard Report |

Early 2024 |

The PMPRB is launching the first phase of consultations on its new Guidelines by inviting stakeholders to participate in a Policy Round Table scheduled for December 5 (English session) and December 6 (French session). Both sessions will be held in person and virtually. The intent of these meetings is to foster a productive conversation, where all parties can voice their opinions and concerns regarding future Guidelines.

Interested parties are invited to make presentations to the PMPRB and/or submit written submissions on any of the questions raised in this Scoping Paper as well as on any other topics they consider to be relevant to the discussion.

Stakeholders can voice their opinions at the sessions as well as through written submissions by December 20, 2023. A What We Heard document will be released in early 2024.

Themes for Discussion

The PMPRB is interested in hearing stakeholders’ views on the following themes to inform the development of final PMPRB Guidelines. Comments on other related issues are also welcome.

- Efficient Monitoring of Prices without Price Setting

- Transition to PMPRB11 – New versus Existing Medicines

- Price Reviews during Product Life Cycle

- Investigations and Referral to Hearing

- Relation to pan-Canadian Health Partners, Insurers (Private and Public); and Alignment with Broader Government Initiatives

- Engaging with Patients, Health Practitioners, Pharmacy, and other Stakeholders

Theme 1: Efficient Monitoring of Prices without Price Setting

The purpose of the Guidelines is to explain the procedures used by staff at the PMPRB when monitoring the prices of patented medicines. In particular, the Guidelines explain the criteria staff will consider in determining whether the price of a patented medicine warrants a more in-depth review in the form of an investigation. As recently reiterated by the Courts, while the Board has the power to order that the price of a medicine be reduced to a non-excessive level following a public hearing, the Board does not set or mandate prices for patented medicines and Guidelines are not intended to be read as pricing guidelines. Board orders on excessive pricing can only be issued after a public hearing.

The PMPRB does not have the capacity nor the need to conduct hearings for each patented medicine under its jurisdiction. Therefore, the PMPRB seeks to develop an administrative review system that allows for the most efficient monitoring of cases of potential excessive pricing. The aim is to provide the transparent guidance sought by rights holders during this administrative review while clearly delineating the respective roles and responsibilities of the Board and staff. In particular, rights holders should be provided with sufficient information to allow them to evaluate their risk of being subject to a hearing by explaining how staff analyses price information and makes recommendations to the Chairperson regarding whether an investigation should be closed, closed subject to an undertaking, or lead to a Notice of Hearing.

Question 1.1: What elements of the 2010 Guidelines should be retained? Which ones and why?

Question 1.2: Should new Guidelines continue to categorize medicines by therapeutic class comparator characteristics such as the Level of Therapeutic Improvement?

Question 1.3: Should the Board accord more weight to one or more of the factors set out in s. 85 of the Act in designing the Guidelines?

In accordance with s. 85(1)(c) of the Patent Act, the PMPRB evaluates and compares the pricing of patented medicines in Canada with other international markets. International price comparisons are often the simplest and earliest type of price review that the PMPRB can perform, since all of the relevant information is provided by rights holders in their semi-annual filings, and no additional external information (e.g., scientific reviews, public prices of other medicines) is needed.

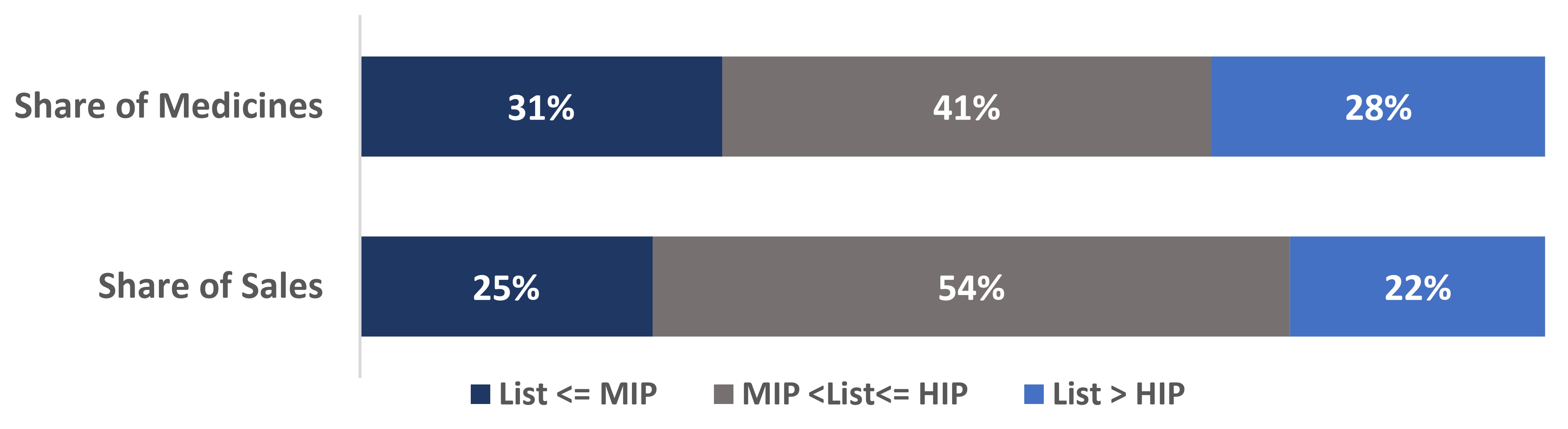

Box 1: Canadian list prices of patented medicines within the PMPRB11.

- 28% of all patented medicines had Canadian list prices higher than the highest international price (HIP) of the PMPRB11 in 2022, representing 22% of the total sales.

- 69% of all patented medicines had Canadian list prices higher than the median international price (MIP) of the PMPRB11 in 2022, representing 75% of the total sales.

Note: Values may not add to totals due to rounding.

Source: PMPRB 2022 including all the patented medicines with both Canadian and PMPRB11 prices available (N=880 Drug Identification Numbers (DINs) representing 78% of total Canadian patented DINs and 93% of the total patented sales in 2022).

Figure description

This bar chart depicts the share of all patented medicines (top) and their corresponding share of sales (bottom) in 2022. The bars are subdivided into three bands to show the shares of medicines and sales for Canadian list prices: below or equal to the MIP (dark blue); above the MIP and below or equal to the HIP (grey); and greater than the HIP (light blue).

| List <= MIP | MIP < List <= HIP | List > HIP | |

|---|---|---|---|

Share of Medicines |

31% |

41% |

28% |

Share of sales |

25% |

54% |

22% |

Question 1.4: If international prices are used as the initial triage measure for commencing investigations, what price levels within the PMPRB11 should be used as the triage measure? (e.g. HIP or MIP?)

Question 1.5: How should the PMPRB conduct an initial review and monitor the prices of patented medicines that have few or no international prices?

Question 1.6: Would an expedited price review (e.g., within 90 days after initial Form 2 submission) of a new medicine based solely on international prices being below the MIP accelerate introduction of innovative medicines?

- How soon after an expedited review should a full price review take place?

Theme 2: Transition to PMPRB11 – New versus Existing Medicines

In July of 2022, the Schedule of comparator countries in the Regulations changed from the PMPRB7 to the PMPRB11. The change did not include any grandfathering clauses; thus, all information has to be filed using the PMPRB11, regardless of the original date of introduction of the medicine.

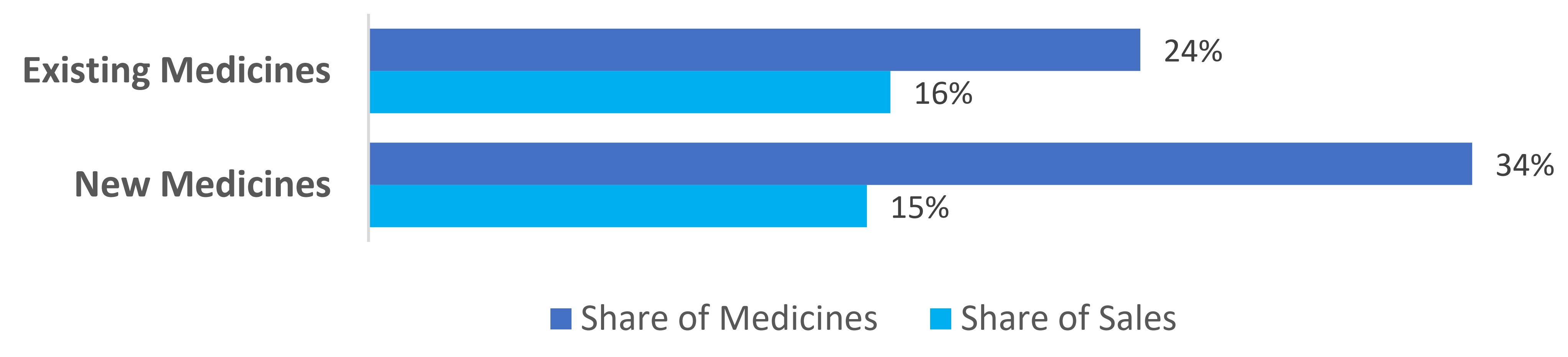

Box 2: Respective shares of Existing medicines versus New medicines with their Canadian List Prices below or equal to the Median International Price (MIP) of the PMPRB11 in January to June 2023.

- 24% of existing patented medicines had Canadian list prices below or equal to the MIP of the PMPRB11 in January to June 2023, representing 16% of the total existing medicine sales.

- 34% of new patented medicines had Canadian list prices below or equal to the MIP of the PMPRB11 in January to June 2023, representing 15% of the total new medicine sales.

Note: Values may not add to totals due to rounding.

Source: PMPRB January to June 2023, including all the patented medicines with both Canadian and PMPRB11 prices available (N= 812 DINs, representing 78% of total Canadian patented DINs and 96% of the total patented sales in January to June 2023; out of these 812 DINs, 68 were New DINs and 744 were Existing DINs.).

Figure description

This bar chart depicts the share of Existing (top) and New (bottom) patented medicine with their Canadian list prices below or equal to the MIP of the eleven comparator countries (PMPRB11) and their corresponding share of sales in January to June 2023.

| Share of medicines (%) | Share of sales (%) | |

|---|---|---|

Existing Medicines |

24% |

16% |

New Medicines |

34% |

15% |

Question 2.1: Should the Guidelines distinguish between medicines that existed as of July 2022 (existing medicines) and medicines introduced afterwards (new medicines)?

Question 2.2: What approach should the Board take with respect to existing medicines with prices above the HIP of the PMPRB11? Should the Board review these prices, and if so, how soon?

Theme 3: Price Reviews during Product Life Cycle

According to the Patent Act, the PMPRB’s duty to monitor excessive pricing extends during the duration of the patentFootnote 2 or certificate of supplementary protection.

It is common in many countries for the list prices of medicines to decrease over time. Canadian list prices, on the other hand, tend to remain static or increase. The combination of these trends leads Canadian prices to increase relative to their foreign counterparts, towards the higher end of the PMPRB11 basket over time. As reported in the PMRPB Annual Report, in 2021, Canadian list prices of patented medicines were the third highest in the Organisation for Economic Co-operation and Development (OECD), behind only the US and Switzerland.

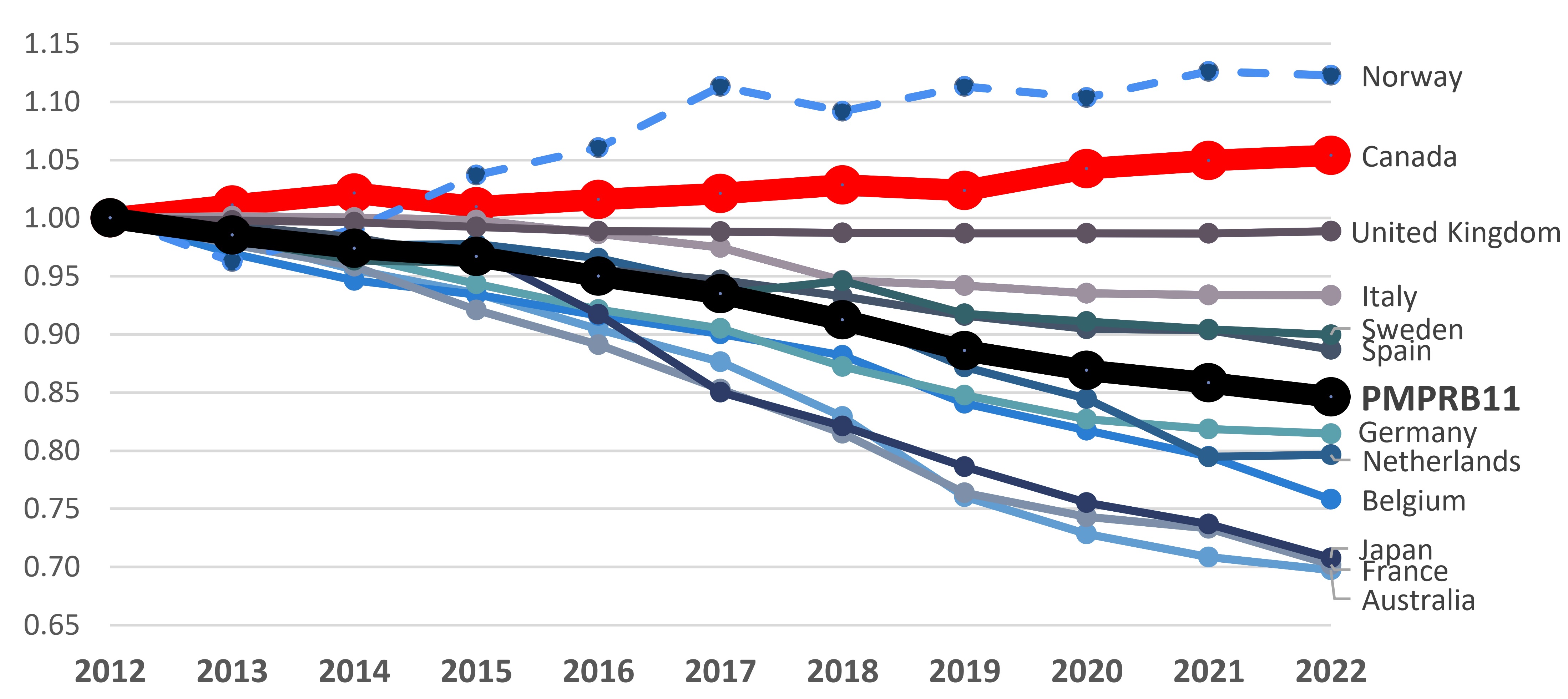

Box 3: Pricing trends in Canada versus the PMPRB11

Over the 2012 to 2022 period, list prices of patented medicines increased slightly by 5% in Canada, while the prices decreased by 15%, on average in the PMPRB11.

Patented Medicine Price Index, 2012-2022

Note: This price index measures the average year-over-year change in prices of patented medicines sold in Canada using a sales-weighted average of price changes at the level of individual medicines. This index is based on list price and sales information from the MIDAS® database.

Data source: PMPRB; MIDAS® database, 2012-2022, IQVIA (all rights reserved)

Figure description

This line graph gives the indexed rate of growth of patented medicine sales for Canada and the eleven PMPRB11 comparator countries over a 2012 to 2022 period.

| Country | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|---|---|---|---|---|

Norway |

1.00 |

0.96 |

0.99 |

1.04 |

1.06 |

1.11 |

1.09 |

1.11 |

1.10 |

1.13 |

1.12 |

Canada |

1.00 |

1.01 |

1.02 |

1.01 |

1.02 |

1.02 |

1.03 |

1.02 |

1.04 |

1.05 |

1.05 |

United Kingdom |

1.00 |

1.00 |

1.00 |

0.99 |

0.99 |

0.99 |

0.99 |

0.99 |

0.99 |

0.99 |

0.99 |

Italy |

1.00 |

1.00 |

1.00 |

1.00 |

0.99 |

0.97 |

0.95 |

0.94 |

0.94 |

0.93 |

0.93 |

Sweden |

1.00 |

0.98 |

0.96 |

0.96 |

0.94 |

0.94 |

0.95 |

0.92 |

0.91 |

0.90 |

0.90 |

Spain |

1.00 |

0.99 |

0.98 |

0.96 |

0.96 |

0.95 |

0.93 |

0.92 |

0.90 |

0.90 |

0.89 |

PMPRB11 |

1.00 |

0.99 |

0.97 |

0.97 |

0.95 |

0.94 |

0.91 |

0.89 |

0.87 |

0.86 |

0.85 |

Germany |

1.00 |

1.00 |

0.97 |

0.94 |

0.92 |

0.91 |

0.87 |

0.85 |

0.83 |

0.82 |

0.81 |

Netherlands |

1.00 |

0.99 |

0.98 |

0.98 |

0.97 |

0.94 |

0.92 |

0.87 |

0.84 |

0.79 |

0.80 |

Belgium |

1.00 |

0.97 |

0.95 |

0.93 |

0.92 |

0.90 |

0.88 |

0.84 |

0.82 |

0.80 |

0.76 |

Japan |

1.00 |

0.98 |

0.97 |

0.97 |

0.92 |

0.85 |

0.82 |

0.79 |

0.76 |

0.74 |

0.71 |

France |

1.00 |

0.98 |

0.96 |

0.92 |

0.89 |

0.85 |

0.82 |

0.76 |

0.74 |

0.73 |

0.70 |

Australia |

1.00 |

0.98 |

0.96 |

0.94 |

0.90 |

0.88 |

0.83 |

0.76 |

0.73 |

0.71 |

0.70 |

As the pharmaceutical landscape continues to evolve, it is important to consider how the Guidelines and its associated price reviews remain relevant at all stages of a medicine’s life cycle. Finding a balance that allows for ongoing monitoring without undue administrative burden while maintaining predictability is essential.

Question 3.1: How often should price reviews be conducted? (1-5 years).

- Should they be different for small molecules (average 10-year exclusivity period) versus biologics (average 20+ year exclusivity period)? Should they be different for medicines for rare diseases?

Question 3.2: What criteria besides time should be used to trigger a price review?

- Approval of a significant new indication?

- Significant change to the therapeutic class comparators? Availability of new/stronger evidence related to benefit vis-à-vis therapeutic class comparators?

- Departure from identified pricing thresholds?

Question 3.3: Should the relative weighting given to different section 85 (Patent Act) factors change over the lifecycle of a medicine?

Question 3.4: How should the PMPRB treat the allowable Consumer Price Index increase in the context where international list prices are decreasing?

Question 3.5: What is the ideal timing for scientific review and therapeutic comparator identification? At what price review stage(s) should scientific review be applied?

Theme 4: Investigations and Referral to Hearing

Investigations are an administrative process that consists of an in-depth review of the information provided by the rights holders and any relevant information obtained from other sources. The purpose of these administrative investigations is to prioritize cases that may be brought to the attention of the Chairperson and could potentially lead to a hearing. Staff will recommend to the Chairperson that a hearing be commenced, or to close the investigation. The Chairperson makes the final decision to send a case to a hearing.

Since 1993, over $210 million has been collected through Voluntary Undertakings (VCUs), settlements, and Board Orders through payments to the Government of Canada.

- 162 VCUs have been accepted.

- 31 notices of hearing have been issued, 14 of which were resolved through settlements prior to the hearing on the merits and 17 of which were subject to a full public hearing on the merits (10 related to allegations of excessive pricing and 7 related to allegations of failure to file).

The Board previously used a combination of Guidelines price ceilings along with additional criteria to determine whether an investigation should be opened. The publication of these criteria in the Guidelines improved transparency and provided rights holders with greater certainty as to their risk of being considered for a hearing. For example, investigations were only triggered where prices exceeded the Guidelines ceiling by a set percentage, where potential excess revenues were above a set amount, or where complaints were received.

As previously mentioned, the PMPRB does not have the capacity to conduct hearings for each patented medicine under its jurisdiction. As a result, the PMPRB has historically relied on voluntary action by rights holders by providing them an opportunity to take remedial action (e.g., voluntary price reductions and repayment of potential excess revenues) that could result in the closure of an investigation instead of being sent to a hearing.

Box 4: Patented medicines for human use sold in 2012 to 2021 – Status of price review as of March 31 in the following reported year.

- Over the past decade, the vast majority of patented medicines were within Guidelines thresholds.

- Over the last 5 years, on average, approximately 11% of patented medicines reported to the PMPRB were subject to investigation (2017-2021). During this period, on average, only 0.9% of patented medicines were brought before a Hearing.

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|---|---|---|---|---|

Total |

1328 |

1343 |

1363 |

1359 |

14351 |

1391 |

1403 |

1364 |

1289 |

1177 |

Within Guidelines Thresholds |

1090 |

1098 |

1038 |

960 |

901 |

950 |

968 |

948 |

892 |

783 |

Under Review |

7 |

2 |

34 |

30 |

66 |

25 |

51 |

60 |

54 |

43 |

Does Not Trigger Investigation |

139 |

164 |

227 |

265 |

267 |

239 |

232 |

205 |

169 |

165 |

Under Investigation |

59 |

66 |

61 |

93 |

101 |

122 |

128 |

128 |

166 |

169 |

VCU |

31 |

13 |

2 |

10 |

60 |

54 |

21 |

19 |

5 |

12 |

Hearing |

2 |

0 |

1 |

1 |

1 |

1 |

2 |

2 |

2 |

4 |

Subject to Price Reduction Order (Stayed) |

- |

- |

- |

- |

- |

- |

1 |

1 |

1 |

1 |

1 The compliance status was not reported for 39 DINs as of 2016.

Source: Annual Report 2012- 2021.

Question 4.1: Are the criteria published in the 2010 Guidelines for commencing an investigation still appropriate (assuming adjustment to PMPRB11)?

Question 4.2: How much detail should the Guidelines set out regarding what happens once an investigation is opened?

Question 4.3: Should the PMPRB continue to use Undertakings as an investigation closure mechanism?

Theme 5: Relation to pan-Canadian Health Partners, Insurers (Private and Public); and Alignment with Broader Government Initiatives

The PMPRB strives to align with and complement the priorities and objectives of other health partners in the Canadian pharmaceutical landscape including broader healthcare and innovation objectives.

The PMPRB’s role is part of a larger complex system that governs how medicines are approved, regulated, and distributed to Canadians across the country. The development of new guidelines presents an opportunity for the PMPRB to reduce the uncertainty of the path to market for innovators, and to coordinate with and offer better support to existing regulatory and pricing bodies, as well as support initiatives of federal, provincial, and territorial activities within the pharmaceutical sector.

Question 5.1: What efficiencies could be gained by co-ordinating decisions and timelines of the PMPRB with those of the Canadian Agency for Drugs and Technologies in Health (CADTH), Institut national d'excellence en santé et services sociaux (INESSS) and pan-Canadian Pharmaceutical Alliance (pCPA) or insurers (public and private)?

Question 5.2: How can the PMPRB optimize its presence within the Canadian bio/pharmaceutical ecosystem to support a whole of government approach to issues relating to patented medicines?

Theme 6: Engaging with Patients, Health Practitioners, Pharmacy, and other Stakeholders

The objective is to seek feedback from stakeholders who are not rights holders.

The PMPRB acknowledges the importance of soliciting input from a range of non-industry and non-institutional stakeholders who represent diverse voices in the broader consumer community that is affected by the PMPRB. This discussion is essential for gaining insight into public perspectives on patented medicines and their pricing, especially in the context of rare diseases and evolving clinical evidence.

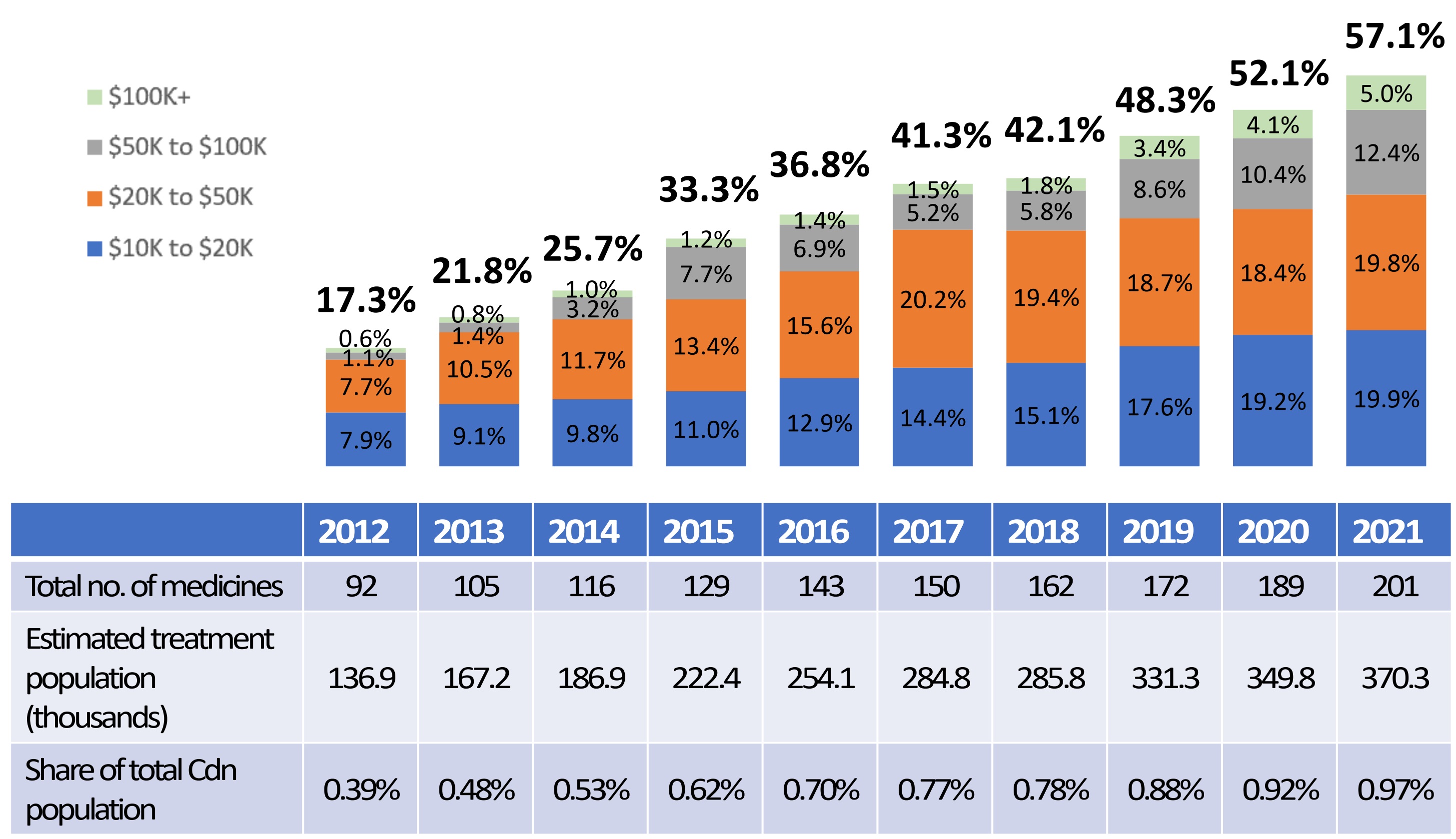

Box 5: High-cost medicines dominate the pharmaceutical landscape.

- High-cost medicines represent an increasing share of the total sales of patented medicines, rising from 17.3% in 2012 to 57.1% in 2021.

- Despite accounting for over half of all sales in 2021, less than 1% of the population use these medicines.

Share of Sales for High-Cost Patented Medicines by Annual Treatment Cost, 2012 to 2021

Note: The methodology for this analysis was revised in 2018, and as such, historical results may not match those reported in earlier editions.

Source: Modified from Figure 10 of the 2021 Annual Report. PMPRB; IQVIA Private Pay Direct Drug Plan database, 2012–2021

Figure description

This bar graph depicts the high-cost medicine share of total patented medicine sales per year by annual treatment cost from 2012 to 2021. The bars are subdivided into four bands based on average annual treatment cost: $10 to $20 thousand; $20 to $50 thousand; $50 to $100 thousand; and greater than $100 thousand.

| Year | Share of sales for medicines costing $10 to $20 thousand | Share of sales for medicines costing $20 to $50 thousand | Share of sales for medicines costing $50 to $100 thousand | Share of sales for medicines costing greater than $100 thousand | Total share of sales of high-cost medicines |

|---|---|---|---|---|---|

2012 |

7.9% |

7.7% |

1.1% |

0.6% |

17.3% |

2013 |

9.1% |

10.5% |

1.4% |

0.8% |

21.8% |

2014 |

9.8% |

11.7% |

3.2% |

1.0% |

25.7% |

2015 |

11.0% |

13.4% |

7.7% |

1.2% |

33.3% |

2016 |

12.9% |

15.6% |

6.9% |

1.4% |

36.8% |

2017 |

14.4% |

20.2% |

5.2% |

1.5% |

41.3% |

2018 |

15.1% |

19.4% |

5.8% |

1.8% |

42.1% |

2019 |

17.6% |

18.7% |

8.6% |

3.4% |

48.3% |

2020 |

19.2% |

18.4% |

10.4% |

4.1% |

52.1% |

2021 |

19.9% |

19.8% |

12.4% |

5.0% |

57.1% |

Question 6.1: What is your experience with innovative medicines and their list prices in Canada?

Question 6.2: What role do the PMPRB Guidelines play in your decision-making process in Canada and globally (if applicable)?

Question 6.3: Canada and the world are facing a generation of new high-priced drugs for the treatment of rare diseases.

- Should the PMPRB view the question of whether the prices of these medicines are “excessive” through a different lens than other types of medicines?

- What quality of evidence should the Board consider when conducting its scientific review of these medicines?

Question 6.4: How can the PMPRB better engage with you?

Conclusion and Follow-Up

The PMPRB thanks all parties for their interest and engagement with this Policy Roundtable.

It is our ambition to finalize new Guidelines during 2024, again following an appropriate consultation process.

Submissions

Submissions

Below are the submissions the PMPRB received during consultation period.

Roundtable

Activity |

Key Dates |

Policy Roundtable – English Session |

December 5, 2023 8:45 am to 5 pm |

Policy Roundtable – French Session |

December 6, 2023 8:45 am to 3 pm |

Deadline for registration to participate in the Roundtable |

November 24, 2023 |

Deadline for Written Submissions |

December 20, 2023 |

What we Heard Report |

Early 2024 |

The PMPRB is launching the first phase of consultations on its new Guidelines by inviting stakeholders to participate in a Policy Roundtable scheduled for December 5 (English session) and December 6 (French session). Both sessions will be held in person and virtually. The intent of these meetings is to foster a productive conversation, where all parties can voice their opinions and concerns regarding future Guidelines.

'What we learned' Report

'What we learned' Report

Policy Roundtable held December 5th and 6th, 2023, in Ottawa

January 2024

1. Introduction

Phoenix Strategic Perspectives Inc. (Phoenix SPI) was commissioned by the Patented Medicine Prices Review Board (PMPRB) to facilitate a consultation with stakeholders, a Policy Roundtable, and to write a report on the presentations and discussions. This report presents a summary of what was learned from the Policy Roundtable.

1.1 Background

The PMPRB is a quasi-judicial administrative agency with a dual price review and reporting mandate. Through its price review mandate, the PMBRB ensures that the prices of patented medicines sold in Canada are not excessive. Changes to the PMPRB’s Guidelines are now necessary to implement regulatory amendments, and to give effect to the Board’s commitment to modernize and simplify its administrative framework.

On November 10, 2023, the PMPRB released the Scoping PaperFootnote 1 for the consultations on the Board's Guidelines which outlines themes and questions to inform the upcoming industry consultation on the development of new Guidelines. Interested stakeholders were invited to participate in a Policy Roundtable and/or prepare submissions in response to the themes and questions raised.

The Policy Roundtable was held December 5th and 6th, 2023, in Ottawa. Stakeholders from across the country participated in the two-day (in person and virtual) consultation hosted by the PMPRB. While in-person attendance was limited, all interested stakeholders were able to register to participate online. The purpose of the consultation was to engage stakeholders in a face-to-face session to explore themes important and relevant to the development of a new set of PMPRB Guidelines. Participating stakeholders included representatives from Rights Holders and Industry Associations, patient groups, pharmacies and distributors, civil society, academia, and a research funding organization, as well as a health practitioner and an individual.

In addition to the Policy Roundtable sessions, stakeholders were also invited to submit written submissions on any of the questions raised in the Scoping Paper as well as on any other topics they considered to be relevant to the discussion. The closing date for submissions was December 20th, 2023.

The PMPRB received 70 written submissions from a range of stakeholders. Most submissions were put forth by Rights Holders and Industry Associations (n=36, 51%), followed by patient advocacy groups (n=15, 21%) and pharmacy and distributors (n=7, 10%). The remaining submissions (n=12) were from civil society / unions (n=2), a private payer (n=2), pan-Canadian health agencies which includes the federal and provincial/territorial governments, Canadian Agency for Drugs and Technologies in Health (CADTH) and the pan-Canadian Pharmaceutical Alliance (pCPA) (n=4), a provider/physician (n=1), an academic / policy researcher (n=1), and two individuals (n=2). The submissions can be found at the following links: English and French.

The report does not include any analysis on the written submissions; the PMPRB will be reviewing these separately.

1.2 The consultation

The event was structured as a roundtable and designed to allow stakeholders to voice opinions and concerns regarding the Guidelines and the consultation process. Parties interested in taking part in the event were invited to complete and submit a registration form by November 24th, 2023. In advance of the event, the PMPRB circulated a Scoping Paper outlining themes and specific questions on which the PMPRB was seeking feedback.

The sessions were held in-person and virtually. Presentations could focus on any of the questions raised in the Scoping Paper as well as on any other topics considered to be relevant to the discussion. One session was conducted in English and one in French. The English session took place on December 5th and continued during the second part of the morning session and during the afternoon session on December 6th. The French session took place during the first part of the morning session on December 6th.

All parties who wished to make a presentation were given the opportunity to do so. In total, 34 stakeholder presentations were made over the course of the two-day consultation. Presenters represented a diverse group of stakeholders.

| Stakeholder Group | Number of Presentations |

|---|---|

Rights holder, Industry, Industry Association |

15 |

Patient, Patient Advocacy |

5 |

Distributor, Pharmacy, Pharmacy Association |

5 |

Civil Society, Union |

3 |

Academia |

3 |

Health Practitioner |

1 |

Individual |

1 |

Research funding organization |

1 |

Total |

34 |

The time allotted for each presentation, including questions and comments from members of the PMPRB, was 15 minutes.

2. What was learned

Over the course of the two-day consultation, stakeholders discussed a range of issues, expressed a variety of opinions, and made numerous recommendations, both general and specific, related to themes and questions considered relevant and important to a discussion about Guidelines and the consultation process. Issues, opinions, and recommendations identified by stakeholders routinely dealt with the following topics:

- The PMPRB mandate

- Assessing excessive pricing

- Considerations for PMPRB Guidelines

- Understanding the life sciences ecosystem

- Alignment of PMPRB Guidelines with broader government initiatives

- Stakeholder engagement

What was learned from stakeholder input regarding each of these topics is presented below.

2.1 The PMPRB mandate

In identifying and discussing topics or issues considered important and relevant, stakeholders often referred to the PMPRB’s statutory mandate. While the PMPRB has a dual mandateFootnote 2, the focus was usually on its regulatory role. The Board’s mandate to protect against misuse of market exclusivity through excessive pricing was routinely noted, with stakeholders emphasizing that PMPRB deliberations and Guidelines should be aligned with this mandate. Two apprehensions were voiced by stakeholders in relation to the PMPRB carrying out its regulatory mandate: the PMPRB exceeding the scope of its mandate, and the PMPRB falling short of its mandate.

Stakeholders who focused on the PMPRB exceeding its mandate emphasized that the PMPRB mandate is narrow and specific. Consequently, the Board would be exceeding its mandate by engaging in consumer protection, price setting, price regulation, price control, or any activity with the purpose of lowering drug prices. Such activities were described as beyond the jurisdiction of the PMPRB because pricing control and regulations fall under the constitutional authority of provincial and territorial governments.Footnote 3 On the other hand, there were expressions of concern from stakeholders about the PMPRB not doing enough to limit or control the price of drugs in Canada. By not taking steps to ensure the prices of patented medicines are not excessive, these stakeholders said the PMPRB would be falling short of its mandate.

2.2 Excessive pricing

Highest international price or median international price

There was agreement that the PMPRB’s mandate is to protect against excessive pricing, but there were differences of opinion about how to interpret ‘excessive’. In particular, there were different points of view concerning the threshold for reviewing prices. Using international pricing as their point of reference, specifically the 11 comparator countriesFootnote 4 identified in the amendments to the Patented Medicines Regulations(Regulations), stakeholders were divided about which price should constitute the basic reference point, or triage measure, for price reviews: the highest international price or the median international price.

Advocacy for using the highest international price as the initial triage measure was based on the perception that it is the reference point most consistent with the PMPRB’s mandate. From this standpoint, prices equivalent to, or lower than, the prices of comparative countries in the Regulations should be deemed compliant and not be subject to pricing review. Stakeholders cautioned the PMPRB about using the median international price as a reference point because this goes beyond the regulation of excessive pricing and into price setting, which exceeds the Board’s mandate.

Advocacy for using the median international price as the initial triage measure was based on the view that international trends within the 11 comparative countries should be used to determine excessive pricing. If international prices are trending downward and Canadian prices are stable or increasing, then Canadian prices could be considered excessive relative to international prices. From this perspective, drugs in Canada with prices above the median international price could be subject to price reviews.

In addition to the question of what price level should be used as the initial triage measure, stakeholders routinely commented on two other pricing-related issues: the distinction between ‘new’ and ‘existing’ medicines and the categorization of drugs by therapeutic level of improvement.

New vs. existing medicines

Stakeholders held differing views on whether PMPRB Guidelines should distinguish between medicines that existed as of July 2022 (existing medicines) and medicines introduced after this date (new medicines). The basic consideration is whether products should be assessed based on the pricing regime under which they were launched. Both positions would have potential implications for pricing. If this distinction was accepted, prices of existing patented medicines deemed to be non-excessive under the previous pricing regime could continue to be accepted as compliant under any subsequent regime. If the distinction was not accepted, existing medicines could be subject to pricing reviews based on the new regime.

Therapeutic level of improvement

Among stakeholders who raised the issue of categorizing drugs according to therapeutic improvement, there was general agreement that this practice should continue, with the implication being that the price of drugs could be increased or decreased based on their level of improvement. Stakeholders emphasized that such assessments should be made by independent agencies, and that any price adjustments consider the nature and degree of improvement.

2.3 Considerations for PMPRB Guidelines

Certain expressions were used repeatedly by stakeholders to identify features considered to be of fundamental importance to any future PMPRB Guidelines. These included ‘predictability’, ‘stability’, ‘clarity’, ‘transparency’, and ‘consistency’. They tended to be used to convey the message that what is needed in terms of compliance expectations and requirements is as much certainty as is reasonably possible over the entire lifecycle of patented products. Stakeholders considered certainty important to help achieve the following:

- Make Canada an attractive place for companies in the life sciences industry to invest, build a presence and undertake research and development.

- Create an environment that will allow the Canadian health care system to be an early beneficiary of new medical innovations and product launches.

- Support better business planning by pharmacies which will facilitate their ability to provide a stable access of products to patients.

The fundamental importance stakeholders assigned to ensuring a reasonable degree of certainty informed advocacy for the two pricing recommendations identified above, one related to new medications and the other related to existing medications.

- The recommendation to use the highest international price as the reference price for new medications included the argument that it is clear, easy to apply, and provides a predictable maximum non-excessive price over the lifecycle of a patented product. By contrast there are significant predictability concerns about using the median international price given that, in the context of a basket that consists of 11 countries, the median can fluctuate greatly over the lifecycle of a patented product.

- The recommendation that existing patented medicines should continue to be accepted as compliant included the argument that patentees and other supply chain stakeholders made investment decisions and/or executed business plans under the previous Guidelines regime. To subject them to the new pricing regime could be destabilizing, e.g. jeopardize existing product listing agreements (PLAs), and disrupt access to and/or availability of medications.

2.4 The life sciences ecosystem

The life sciences environment in Canada was often described by stakeholders as an ecosystem characterized by a multiplicity of constituents and a complex regulatory framework that includes different levels of government and different agencies, each with their respective roles, responsibilities, and mandates. As with any ecosystem, what happens in any part of it can affect the whole.

Stakeholders noted that the PMPRB needs to understand and consider the potential impacts and repercussions of its Guidelines throughout the life sciences ecosystem because unintended consequences can reverberate both ‘upstream’ and ‘downstream’ in this ecosystem. The main message from stakeholders was that PMPRB Guidelines and decisions can affect the life sciences ecosystem in Canada both positively and negatively, particularly in relation to the following:

- Development of the life sciences sector, e.g., investment, innovation, clinical trials, research and development, commercialization of products, and product launches.

- Service to consumers and patient care including the security of drug supply chains.

- Access to, and the availability of, existing and new drugs.

Considering the impact of PMPRB Guidelines and decisions also includes looking at their impact on the lives of Canadians. In assessing these impacts, stakeholders emphasized both affordability and availability as important considerations. The focus on affordability drew attention to the high cost of medications in Canada and the real-life consequences that follow from this. The focus on availability also highlighted real-life consequences, with stakeholders noting that timely access to new medicines has life changing consequences and reduces health care costs. Stakeholders contended that both issues should be taken into consideration because a singular focus on one can have unintended and potentially adverse effects on the other.

2.5 Alignment with broader government initiatives

Aligning PMPRB Guidelines with broader government of Canada initiatives and priorities with the goal of nurturing and supporting a vibrant and sustainable life sciences and biomanufacturing sector was explicitly endorsed by some stakeholders. This included alignment with the government of Canada’s Biomanufacturing and Life Sciences Strategy, National Strategy for Drugs for Rare Diseases, and the national pharmacare strategy.

At the same time, a cautionary approach was recommended when considering the alignment of PMPRB Guidelines with broader government of Canada initiatives and priorities. Stakeholders suggested that in probing relations between the PMPRB and pan-Canadian health agencies, particularly related to coordinating decisions and timelines with other actors in the Canadian pharmaceutical landscape, the board should be mindful that such considerations might take it beyond its mandate. In this regard, it was also noted that the regulatory landscape is complicated and that the mandates of various agencies are separate and distinct.Footnote 5 Consequently, the view of stakeholders was that the PMPRB should carry out its specific mandate irrespective of other agencies but that it should be attuned to what other agencies are doing and recognize that efficiencies can be made in this regard.

2.6 Stakeholder engagement

Going forward, meaningful stakeholder engagement is considered essential. Stakeholders advised that such engagement includes soliciting input from them, consulting and collaborating with them, and making information and resources available to them. Engagement comprises a broad range of activities that includes recognizing and taking advantage of stakeholder knowledge and expertise, providing meaningful access to such knowledge and expertise, understanding what stakeholder organizations do and how they operate, and engaging with members of groups represented by organizations via appropriate communication channels to gain insight into their lived experience.

Concrete examples of meaningful engagement offered by stakeholders included:

- Creating working or advisory groups that consider both technical expertise and lived experience.

- Conducting impact analyses and case studies, making them available, and meeting with stakeholders to discuss them.

- Monitoring performance of the PMPRB in meeting stakeholder needs.

- Engaging in effective knowledge translation and mobilization by providing information and resources that are appropriate and meaningful, in clear language and accessible formats.

- Auditing for discriminatory ideas and practices in the functioning and/or assumptions of the PMPRB.

While meaningful engagement with stakeholders is considered essential, stakeholders also emphasized that the PMPRB must maintain its independence, be mindful of its mandate, and be vigilant in avoiding any possibility of conflict of interest, as this could adversely affect its credibility.

PDF version (496 KB)

PDF version (496 KB)