Evaluation study – Electronic services – Individual compliance behaviour – Tax return filing

Final Report

Audit, Evaluation, and Risk Branch

November 2017

Table of contents

- Executive summary

- Introduction

- Background

- Functional Authority

- Evaluation methodologies and approach

- Study limitations and constraints

- Findings

- Electronic tax return processing volumes have increased significantly since 2005

- Electronic tax return filing is the most frequently used method for individuals to meet their tax filing obligations

- Certain groups profiled showed a lower take-up rate of electronic tax return filing and higher use of registered tax preparers

- Compliance validation activities have increased and adjusted to the shift in electronic tax return filing

- Organizational structures, work processes and systems have been aligned with advancements in electronic tax return filing

- Conclusion

- Acknowledgement

- Appendices

Executive summary

The Canada Revenue Agency (CRA) promotes and enhances its electronic services as a key component of its commitment to excellence in service delivery. Achieving this goal means keeping pace with the trends that are shaping our environment and transforming the tax administration to align with advancements in electronic services.

The CRA has supplemented the traditional method of paper tax return filing with several paperless electronic options. This provides taxpayers with the ability to use third party software to prepare and file their own tax return using NETFILE or to have their tax return prepared and filed by a registered tax preparer using EFILE. The shift from paper to electronic tax return filing has required the CRA to anticipate, plan, and adjust to the changing nature of the way that Canadians choose to file their tax returns while ensuring that information is protected and used for the purpose for which it was intended.

In June 2016, the Management Audit and Evaluation Committee of the CRA approved the evaluation framework for the Electronic Services – Individual Compliance Behaviour – Tax Return Evaluation Study. The Department of Finance Canada develops and evaluates federal tax policies and legislation, while the CRA is the agency responsible for the administration of tax laws, including the Income Tax Act (ITA) of Canada. As such, the scope of this evaluation was limited to CRA's administration of the provisions of the ITA.

The central focus of this study was to provide CRA senior management with information on the growth and characteristics of T1 individual income tax returns (tax return); and the current state of CRA's tax administration in relation to the shift to electronic tax return filing.

The CRA's administration of tax return filing and compliance validation activities spans multiple programs. The Assessment, Benefit, and Service Branch (ABSB) is responsible for receiving and processing both paper and electronic tax returns and issuing a Notice of Assessment (NoA) or Notice of Reassessment (NoR) to the taxpayer advising them of their tax situation. They are also responsible for the registration and monitoring of tax preparers, and providing service and support to tax preparers, software developers, and taxpayers. The Collections and Verification Branch (CVB) is responsible for the validation of information presented in the tax returns, both before and after a NoA or a NoR has been issued. Through the delivery of a national compliance validation program, CVB validates tax returns and benefit entitlements, and promotes compliance with Canada's tax laws for filing, declaring, withholding, registering, and remitting. These activities support CRA's compliance efforts to ensure that individuals meet their tax obligations in fairness to all Canadians.

This evaluation study has confirmed a major shift from paper to electronic tax return filing occurred from 2005 to 2014 with individuals most frequently using registered tax preparers. The number of electronic tax returns processed has increased by 86% from 11.9 million in 2005 to 22.1 million in 2014. During this same period the number of individuals who filed using a registered tax preparer increased by 91% from 7.8 million in 2005 to 14.9 million in 2014. For compliance activities, there has been an increased emphasis on early compliance validation interventions since fiscal year 2005 to 2006 due to the business intelligence gathered in consideration of taxpayer behaviour. In fiscal year 2005 to 2006, $689 million in additional taxes were assessed in the Confidence Validity, Processing Review and T1 matching programs compared to $1.3 billion assessed in fiscal year 2014 to 2015. This represents a 100% increase in total dollars assessed.

For the most part, no administrative constraints, within the CRA's control, were identified as having negatively impacted individuals from using the electronic tax return filing methods. The CRA has transformed its tax administration – organization, work processes and systems - to align with advancements in electronic tax return filing.

It was also observed that individuals consulted as part of this study, both in headquarters and the regions, are professional; resilient; able to adapt to change; and most importantly demonstrate their commitment to excellence in service delivery.

The 2014 tax return profile and compliance validation analysis are positive with no major constraints identified with the shift from paper to electronic tax return filling. However, to better understand how registered tax preparers impact CRA's tax administration and the individuals who pay for their service, an independent study could provide additional insight on the effectiveness of the EFILE tax return filing method. In addition, with the electronic systems working as intended an opportunity exists to promote electronic tax return filing for certain groups as well as to explore the transmission of data on certain tax forms and schedules to support compliance activities and interactions with Canadians. Employees are the cornerstone of CRA's administration and have strongly voiced the need to take stock of system maintenance upgrades in place as a part of the T1SR project. The goal is to mitigate unintended impacts on employees' health and wellness and to ensure a functional work environment that provides accurate and efficient service to Canadians.

Management responses have been developed for the following three recommendations:

- ABSB, in consultation with CRA stakeholders, undertake a comprehensive analysis to identify ways to promote electronic tax return filing and increase take-up rate for those groups showing a slower transition from paper to electronic tax return filing.

- ABSB, in consultation with CRA stakeholders, explore and assess the feasibility to have data on certain tax forms and schedules transmitted to support compliance activities and interactions with Canadians.

- ABSB, in consultation with CRA stakeholders, take stock of system maintenance upgrades and address employee concerns with the T1SR project.

Introduction

In June 2016, the Management Audit and Evaluation Committee of the Canada Revenue Agency (CRA) approved the evaluation framework for the Electronic Services – Individual Compliance Behaviour – Tax Return Evaluation Study. This study was included in the Audit, Evaluation, and Risk Branch (AERB) 2015 to 2018 Risk-Based Audit and Evaluation Plan which was approved by the Board of Management on June 9, 2015.

The Department of Finance Canada develops and evaluates federal tax policies and legislation, while the CRA is the agency responsible for the administration of tax laws, including the Income Tax Act (ITA) of Canada. As such the scope of this evaluation was limited to CRA's administration of the provisions of the ITA.

The evaluation framework identified the following three evaluation issues:

Issue 1: What is the profile and compliance behaviour of individual taxpayers who file paper and electronic tax returns?

- What is the growth and profile of tax return filers?

- What are the constraints, if any, which impact electronic filing?

- What are the impacts of electronic filing, if any, on compliance activities?

Issue 2: To what extent has the CRA transformed its tax administration to align with advancements in electronic tax return filing for individuals?

- Have the organizational structures and work processes been aligned to support advancements in electronic filing?

- Have systems been aligned to support horizontal tax compliance efforts with advancements in electronic filing?

Issue 3: Are there alternatives or modifications that could enhance the CRA's administration of electronic tax return filing for individuals?

- What changes, if any, could improve the CRA's administration of tax return filing?

- What alternative approaches or modifications could be adopted from strategies or best practices of other tax administrations with a similar form of tax?

- What strategies are in place or planned that could enhance the CRA's administration of tax return filling?

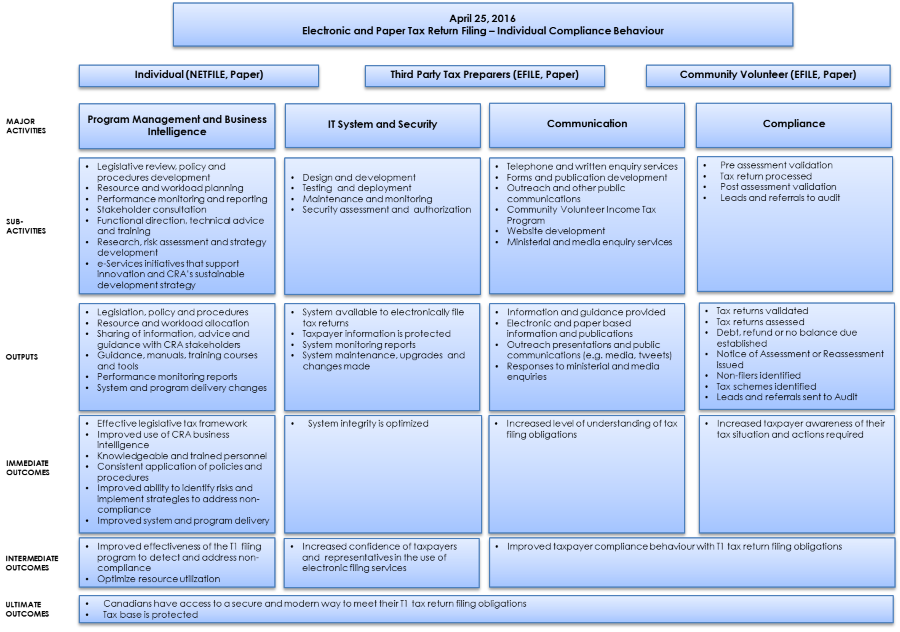

This report summarizes the findings related to these issues and research questions. Findings are to provide CRA senior management with information on the growth and characteristics of T1 individual income tax returns (tax return); and the current state of CRA's tax administration in relation to the shift to electronic tax return filing. The study also identified potential alternatives or modifications that could improve CRA's tax administration. The logic model in Appendix A illustrates the outputs and outcomes related to paper and electronic tax return filing. Appendix E provides definitions of key terms.

Background

Canada's tax system is based on self-assessment. Canada levies personal income tax on the worldwide income of individual residents of Canada and on certain types of Canadian-sourced income earned by non-residents or deemed residents. This means that individuals complete a tax return to report their annual income and claim all deductions or credits that apply to their situation in accordance with the ITA and regulations. Appendix B provides the situations when a tax return is required or when it may benefit an individual to file a tax return.

Generally, tax returns must be filed by April 30 of the year following the tax year. However, in circumstances where an individual, their spouse, or common-law partner carried on a business during the tax year, the tax return must be filed on or before June 15 if there was tax payable or if the individual is claiming a tax credit or benefit. It is important to note that any balance owing is due on or before April 30 regardless of the date the tax return was due to be filed.

The traditional method of paper tax return filing has been supplemented by several paperless electronic options. This provides taxpayers with the ability to use third party software to prepare and file their own tax return using NETFILEFootnote 1 or to have their tax return prepared and filed by a registered tax preparerFootnote 2 using EFILEFootnote 3 . However, certain exclusions for EFILE and restrictions for NETFILE prevent the use of electronic tax return filing (Appendix C).

A Community Volunteer Income Tax Program, which is a collaboration between community organizations and the CRA, also supports tax return filing for individuals who have a modest income and a simple tax situation. The CRA may also file a tax return on behalf of an individual if they were issued a formal request to file and did not do so. This supports compliance with Canada's ITA and regulations.

The CRA promotes and enhances its electronic services as a key component of its commitment to excellence in service delivery. Achieving this goal means keeping pace with the trends that are shaping our environment and transforming the administration to align with advancements in electronic services. This includes allowing Canadians to choose how they file their tax return. This shift from paper to electronic tax return filing has required the CRA to adjust systems and processes to accept and validate electronic returns while ensuring the confidentiality of taxpayer information.

Functional Authority

The filing, processing, and validation of tax returns are primarily the responsibilities of the Assessment, Benefit, and Service Branch (ABSB), and the Collections and Verification Branch (CVB). All tax returns submitted to the CRA are subject to varying degrees of validation and are processed with a notification of the result in the form of a notice of assessment (NoA) or a notice of reassessment (NoR) being issued to the taxpayer.

Within the CRA, the ABSB is responsible for receiving and processing of both paper and electronic tax returns and for issuing a NoA or NoR to the taxpayer advising them of their tax situation. They are also responsible for the registration and monitoring of tax preparers, and for providing service and support to tax preparers, software developers, and taxpayers. The ABSB was previously responsible for the validation of information submitted on tax returns; however this responsibility was transferred to the CVB in fiscal year 2015 to 2016.

The CVB is responsible for the validation of information presented in the tax returns, both before and after a NoA or a NoR has been issued. Through the delivery of a national compliance validation program, CVB validates tax returns and benefit entitlements, and promotes compliance with Canada's tax laws for filing, declaring, withholding, registering, and remitting. These activities support CRA's compliance efforts to ensure that individuals meet their tax obligations in fairness to all Canadians.

Evaluation methodologies and approach

- A Working Committee was formed with representatives from ABSB, CVB, the Strategy and Integration Branch (SIB) and the Public Affairs Branch (PAB). This committee supported the gathering of branch specific information and the review of preliminary findings and recommendations.

- Internal interviews were conducted with CRA managers and staff. Participants were selected from ABSB, CVB, SIB, PAB, AERB, the Information Technology Branch (ITB), the Appeals Branch and regional personnel in the Atlantic, Ontario and Prairie regions.

- An examination of CRA policies, procedures, business rules and systems was undertaken with responsible branches.

- A series of macro analyses was undertaken on trends in the volume of paper and electronic tax returns, a profile analysis of the 2013 and 2014 tax returns, an analysis of the exclusions and restrictions to electronic filing, trends in validation activities (pre and post assessment), and estimated costs related to tax return processing and compliance validation activities.

- An examination of best practices and emerging trends in electronic tax return filing from other countries – United States of America (USA), United Kingdom (UK), Australia and Denmark.

Study limitations and constraints

As this study focused on a macro analysis of CRA's administration, the CRA risk assessment and scoring processes for compliance validation activities were not reviewed as they are closely guarded to protect the integrity of Canada's tax administration. ABSB and CVB programs have also evolved from 2005 to 2014, which impacted the ability to provide a comprehensive cost analysis related to the processing and validation of tax returns. Therefore, the cost analysis in this report is intended to provide information on whether the cost to process or validate a tax return has increased or decreased, and should be considered as a baseline estimate. The costs related to operations and maintenance, capitalFootnote 4 and systems were also not included as they could not be isolated to a specific program activity.

Findings

This study has confirmed a major shift from paper to electronic tax return filing occurred from 2005 to 2014 with individuals most frequently using registered tax preparers. For the most part, no administrative constraints, within the CRA's control, were identified that inhibited individuals from using the available electronic tax return filing methods. The CRA has also transformed its tax administration – organization, work processes and systems – to align with advancements in electronic tax return filing. Compliance activities continue to be an integral part of Canada's self-assessment tax system. It was also observed that individuals consulted as part of this study, both in headquarters and the regions, are professional, resilient, able to adapt to change, and most importantly are committed to ensuring that all taxpayers meet their tax obligations and pay their fair share of tax.

The next section of the report outlines the results of the evaluation study as well as opportunities that could support CRA's tax administration and improve client service.

1. Electronic tax return processing volumes have increased significantly since 2005

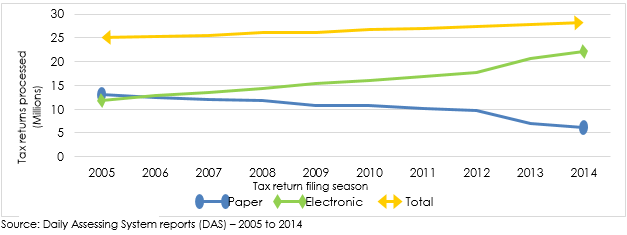

Each year individual taxpayers are required to file their tax returns to report their income and deductions to the CRA. In analyzing processing statistics from the 2005 to 2014 tax return filing seasons, it was confirmed that there has been a major shift from paper to electronic tax return filing.

For the 2005 tax return filing season, 25.0 million tax returns were processedFootnote 5 compared to 28.3 million in 2014. This represents a 13% increase in the total volume of tax returns processed. (Figure 1)

Figure 1 – Trend in paper versus electronic tax returns processed – 2005 to 2014 tax return filing season

Image description

Figure 1 – Trend in paper versus electronic tax returns processed – 2005 to 2014 tax return filing season

Tax returns processed in 2005 is 13,083,855 paper returns, 11,908,238 electronic returns for a total of 24,992,093 returns processed

Tax returns processed in 2006 is 12,508,322 paper returns, 12,848,238 electronic returns for a total of 25,356,560 returns processed

Tax returns processed in 2007 is 12,045,807 paper returns, 13,452,488 electronic returns for a total of 25,498,295 returns processed

Tax returns processed in 2008 is 11,737,209 paper returns, 14,411,108 electronic returns for a total of 26,148,317 returns processed

Tax returns processed in 2009 is 10,777,830 paper returns, 15,308,948 electronic returns for a total of 26,086,778 returns processed

Tax returns processed in 2010 is 10,747,649 paper returns, 16,127,647 electronic returns for a total of 26,875,296 returns processed

Tax returns processed in 2011 is 10,167,493 paper returns, 16,873,899 electronic returns for a total of 27,041,392 returns processed

Tax returns processed in 2012 is 9,767,536 paper returns, 17,647,347 electronic returns for a total of 27,414,883 returns processed

Tax returns processed in 2013 is 7,074,741 paper returns, 20,762,373 electronic returns for a total of 27,837,114 returns processed

Tax returns processed in 2014 is 6,162,087 paper returns, 22,134,593 electronic returns for a total of 28,296,680 returns processed

Tax returns processed by the CRA can be electronically filed in several different ways. Individuals can choose free NETFILE software depending on their tax situation or can purchase third party software to prepare and file their own tax return using NETFILE. They may also choose to have their tax return prepared and filed by a registered tax preparer and pay the associated cost. In certain circumstances, individuals with modest incomes and simple tax situations can have their tax return prepared through the Community Volunteer Income Tax Program. To better understand the usage of electronic filing by individuals, a review of the electronic tax return filing methods of NETFILE and EFILE was undertaken for the 2005 and 2014 tax return filing seasons.

This analysis revealed that the number of electronic tax returns processed has increased by 86% from 11.9 million in 2005 to 22.1 million in 2014. During this same period the number of individuals who filed using NETFILEFootnote 6 increased by 76% from 4.1 million to 7.2 million, while EFILE with a registered tax preparer increased by 91% from 7.8 million to 14.9 million.

2. Electronic tax return filing is the most frequently used method for individuals to meet their tax filing obligations

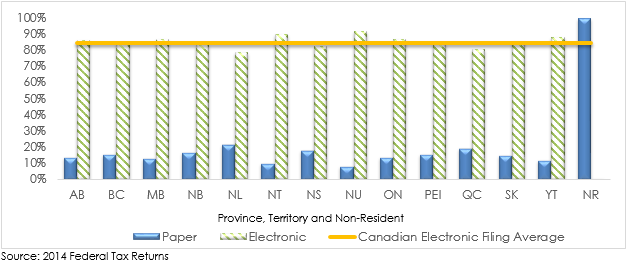

To better understand whether electronic tax return filing was consistent across all provinces and territories in Canada, and to ensure that no one segment of the population had been negatively impacted by the shift to electronic filing, the 2014 tax returns were selected from the Agency Data WarehouseFootnote 7 and reviewed.

The analysis of 27.8 million tax returns filed for the 2014 tax year was undertaken recognizing that the non-resident (NR) filing population, of just over 200,000 individuals, were excluded as they must file their tax returns by paper. This analysis revealed that electronic tax return filing was the most frequently used method in all provinces and territories in Canada with a national level of 84%. (Figure 2)

Figure 2 – Percentage of 2014 tax returns filed by provinces, territories and non-residents and by filing method

Image description

Figure 2 – Percentage of 2014 tax returns filed by provinces, territories and non-residents and by filing method

Percentage of tax returns filed in Alberta in 2014 is 13.70% paper returns and 86.30% electronic returns

Percentage of tax returns filed in British Columbia in 2014 is 15.67% paper returns and 84.33% electronic returns

Percentage of tax returns filed in Manitoba in 2014 is 13.10% paper returns and 86.90% electronic returns

Percentage of tax returns filed in New Brunswick in 2014 is 16.59% paper returns and 83.41% electronic returns

Percentage of tax returns filed in Newfoundland and Labrador in 2014 is 21.44% paper returns and 78.56% electronic returns

Percentage of tax returns filed in the Northwest Territories in 2014 is 10.07% paper returns and 89.93% electronic returns

Percentage of tax returns filed in Nova Scotia in 2014 is 17.75% paper returns and 82.25% electronic returns

Percentage of tax returns filed in Nunavut in 2014 is 8.26% paper returns and 91.74% electronic returns

Percentage of tax returns filed in Ontario in 2014 is 13.45% paper returns and 86.55% electronic returns

Percentage of tax returns filed in Prince Edward Island in 2014 is 15.74% paper returns and 84.26% electronic returns

Percentage of tax returns filed in Quebec in 2014 is 19.52% paper returns and 80.48% electronic returns

Percentage of tax returns filed in Saskatchewan in 2014 is 14.79% paper returns and 85.21% electronic returns

Percentage of tax returns filed in Yukon is 12.01% paper returns and 87.99% electronic returns

Percentage of tax returns filed by Non-Residents in 2014 is 99.52% paper returns and 0.48% electronic returns

Canadian electronic filing average in 2014 is 84%

The national average of 84% for the 2014 electronic tax return filing method, is for the most part, consistent with other countries with similar non-mandatory electronic tax return filing. For exampleFootnote 8, in 2013 the USA achieved an electronic tax return filing rate of 83% and the UK 85%. Literature research also suggests that the introduction of "auto-fill my return" has increased the level of electronic tax return filing as other countries with this capability have reached beyond 90%. For example Australia achieved 93% and Denmark 98%. Canada introduced this capability for the 2015 tax year which may further support the shift to electronic tax return filing.

As Revenu Quebec administers their own provincial tax, a review was undertaken from statistics on their website to determine how they compared with the federal tax returns that are administered by the CRA. This analysis revealed that 79% of Quebec provincial tax returns were filed electronically in 2014, while 81% of the Quebec federal tax returns were filed electronically with the CRA.

The exclusions and restrictions that are in place that prevent an individual from electronically filing a tax returnFootnote 9 have also decreased considerably. In 2016, multiyear tax return filing, pre-bankruptcy, amendments, and newcomersFootnote 10 can file electronically. What this means for Canadians is that more individuals have the option to use the service and file tax returns electronically. The CRA estimatedFootnote 11 that these system modifications will allow 95% of individuals to electronically file their tax return if they choose to do so. The CRA continues to review these exclusions and restrictions to make electronic tax return filing available to more and more Canadians and will make system changes when it makes good business sense to do so.

To understand if the move to electronic tax return filing had an impact on CRA resources for processing of tax returns, a cost analysis was undertaken. This analysis was based on the direct and indirect salary costs according to CRA administrative data that were in existence in 2014 which were then tracked back to 2005. This analysis revealed that the estimated cost of processing a tax return was $1.41 in fiscal year 2005 to 2006 and has decreased to $1.00 in fiscal year 2014 to 2015 or by 29%. This baseline estimate suggests that the tax return processing costs have decreased with the shift to electronic tax return filingFootnote 12.

3. Certain groups profiled showed a lower take-up rate of electronic tax return filing and higher use of registered tax preparers

Profiling of individuals serves as a guide to better understand any variables impacting CRA's tax administration in relation to the shift from paper to electronic tax return filing. For the purposes of this study, seven groups were established and profiled based on the 2014 tax return filing population, CRA interviews and literature research.

Overall the profiled groups were consistent, for the most part, with the national 2014 tax return filing results with electronic at 84% and the use of registered tax preparers at 56%. However, certain groups profiled showed a lower take-up rate of electronic filing and higher use of registered tax preparers. The main observations by group and potential reasons for choosing to use a registered tax preparer are detailed below. Figure 3 provides a summary of the profile analysis for tax year 2014 while Appendix D provides details by province and territory.

Low income

The established Working Income Tax Benefit income values were used to define and segment the low income group from the 2014 tax returns. This program defines low net income thresholds as $37,195 for Nunavut, $20,072 for Quebec, $19,721 for British Columbia, $19,139 for Alberta, and $17,986 for the rest of Canada.

The low income group represented 10 million individuals or 36% of the 2014 tax return filing population. This group had a higher use of paper tax return filing at 22% compared to the national average of 16%; most frequently chose to file electronically at 78% and used a registered tax preparer 55% of the time.

The analysis of the low income group by province and territory revealed that the highest rates for filing a tax return using registered tax preparers were Nunavut (81%) and the Northwest Territories (74%). This may be due to the fact that the northern residence deductions may require more expertise to ensure that the claim is entered correctly which may be preferable to the taxpayer.

Geographic area - Rural and Urban

For the rural and urban group, the postal code, as assigned by Canada PostFootnote 13, was used to define and segment these two groups from the 2014 tax returns.

The rural group represented 4.6 million individualsFootnote 14 or 16% of the 2014 tax return filing population, while the urban group represented 22.4 million individuals or 81%. Both the rural and urban groups most frequently chose to file electronically at 85% and 84% respectively. They also used a registered tax preparer at 62% and 55% respectively.

It is recognized that the availability of broadband internet access, of which the CRA has no control over, has an impact for some Canadians. The Canadian Radio, Television and Telecommunication Commission (CRTC) reportedFootnote 15 that 2 million Canadian households or 18% do not have broadband internet access. The CRTC aims to improve availability of broadband internet access by 8% by 2021 which may further support an increase in electronic tax return filing.

Persons with disabilities

The persons with disabilities group was created by selecting individuals who received a Disability Tax Credit (DTC) on their 2014 tax return.

Persons with disabilities represented 1.1 million individuals or 4% of the 2014 tax filing population. This group most frequently chose to file electronically at 81% and used a registered tax preparer 62% of the time. This may be a result of limitations with a particular disability, the complexity of the DTC, associated medical expense claims, or their need to have the tax return completed by someone having more familiarity with this type of deduction.

Youth and seniors

Youth were defined as those who had filed a 2014 tax return and who were under the age of 20 while seniors were defined as 65 years or older.

Youth represented 1.1 million individuals or 4% and seniors represented 5.8 million or 21% of the 2014 tax return filing population. Both the youth and seniors have a higher use of paper tax return filing at 21% and 22% respectively compared to the national paper tax return filing average of 16%. Youth and seniors most frequently chose to file electronically at 79% and 78%, and also used a registered tax preparer at 56% and 58% respectively.

Reasons for the use of paper tax return filing by seniorsFootnote 16 may be due to computer literacy, access to the internet, or from years of completing paper returns to meet their tax obligations. For the youths it may be because a family member, potentially a senior, are completing their tax return for them, they may not have a permanent address, or if they were filing for the first time and not in the T1 master database they would have to file by paper.

Self-Employed

The self-employed group was created by using the major source of income as reported on the 2014 tax return.

The self-employed group represented 6.6 million individuals or 24% of the 2014 tax return filing population. This group most frequently chose to file electronically at 87% and used a registered tax preparer 68% of the time, the highest of the groups profiled. Within the self-employed group, the analysis also noted that 30% of the individuals who claimed gross rental income over $125,000 filed using paper. This could be the result of the fact that for electronic tax return filing they are only permitted to file a maximum of six (6) T776 - Statement of real-estate rental forms. This population was relatively low with 47,188 tax returns, and modifications to system capability to increase the number of individuals that can electronically file, are regularly reviewed and updated when it makes good business sense to do so.

Newcomers to Canada

For income tax purposes, an immigrant is considered a newcomer to Canada only for the first year that they are a new resident of Canada. The newcomer group was created from data reported on the tax returns in 2013 and the same group was tracked in 2014 to assess any change to their tax return filing behaviour.

The newcomer group represented 217,262 individuals or 0.8% of the 2014 tax filing population. This analysis revealed that 49% of newcomers electronically filed their tax return for their first tax year (2013)Footnote 17, while in their second tax year (2014) this figure rose to 82%, and they used a registered tax preparer 61% of the time. This in part may be due to the fact that they are not familiar with the Canadian tax system or available filing methods, and require assistance to accurately report their income to meet their tax obligations as well as receive all the benefits and credits that they are entitled to.

Gender

The gender group was identified by the gender field in the T1 master database of the 2014 tax return filing population.

This analysis revealed almost a 50-50 split between women and men in the 2014 tax filing population. Within this group, both genders most frequently chose to file electronically at 84% and used a registered tax preparer 56% of the time. This analysis therefore revealed that gender has no impact on the tax return filing method.

The results for the profile analysis suggest that no major variables exist for the groups profiled with the shift from paper to electronic tax return filing however rural, persons with disability, seniors, self-employed and newcomers to Canada (in their second year of filing), had a higher use of a registered tax preparer compared to the national total of 56%. CRA interviews revealed that the choice by all groups to use registered tax preparers may point to a lack of expertise or familiarity with the increasing complexity of the ITA, and an individual's desire to ensure they accurately report their income to obtain all deductions and credits to which they are entitled. The ITA and corresponding legislation is developed by the Department of Finance while the CRA is responsible for the administration of the ITA. The CRA recognizes that the ITA is complex and supports individuals in meeting their income tax return filing obligations by providing:

- telephone and written enquiry services;

- tax guides, forms and publications; and

- Community Volunteer Income Tax Program, outreach and other public communications.

Figure 3 – Summary of the profile analysis for tax year 2014

| Groups | Population | Paper | Electronic - Total | Electronic - NETFILE | Electronic - EFILE |

|---|---|---|---|---|---|

| Low Income | 10,042,303 | 22% | 78% | 23% | 55% |

| Rural | 4,567,697 | 15% | 85% | 23% | 62% |

| Urban | 22,382,169 | 16% | 84% | 29% | 55% |

| Invalid or missing postal code | 885,725 | 36% | 64% | 12% | 52% |

| Persons with Disability | 1,111,064 | 19% | 81% | 19% | 62% |

| Youth | 1,120,329 | 21% | 79% | 23% | 56% |

| Seniors | 5,774,836 | 22% | 78% | 20% | 58% |

| Self-Employed | 6,592,861 | 13% | 87% | 19% | 68% |

| Newcomers to Canada 2013 | 235,434 | 51% | 49% | 7% | 42% |

| Same newcomers to Canada in 2014 | 217,262 | 18% | 82% | 21% | 61% |

| Female | 14,235,942 | 16% | 84% | 28% | 56% |

| Male | 13,511,285 | 16% | 84% | 28% | 56% |

| Null and Blank | 88,364 | 91% | 9% | 2% | 7% |

| National Total | 27,835,591 | 16% | 84% | 28% | 56% |

Source: 2014 Tax Returns

An opportunity exists to increase the take-up rate of the electronic tax return filing within certain groups from the profile analysis who show a slower transition from paper to electronic tax return filing. In particular, low income, persons with disabilities, youth and seniors all file paper tax returns at a higher rate than the national total of 16%. It is recognized that ABSB is undertaking initiatives to improve the take-up rate of electronic tax return filing; however a comprehensive analysis to identify ways to promote electronic tax return filing and increase take-up rate for these three groups may improve service to Canadians and help to close the gap between the number of people who can electronically file their tax return and those who choose to do so.

4. Compliance validation activities have increased and adjusted to the shift in electronic tax return filing

Given that the Canadian tax system functions on the basis of self-assessment, the CRA is obliged to review a number of tax returns each year to ensure that taxpayers are entitled to the claims which they have made, and that the amounts have been correctly calculated. These reviews are an important part of CRA's compliance activities to maintain the integrity of and Canadians' confidence in Canada's tax system.

Some tax returns are chosen for review at random, but the majority are selected based on a sophisticated scoring system. This scoring system is designed to incorporate multiple factors to identify those tax returns that carry the highest potential for inaccuracy of certain claims. The CRA neither targets nor excludes any specific category of people or filing method when reviewing tax returns. It treats all Canadians equally by using fair and non-discriminatory criteria in selecting tax returns for review.

Compliance activities serve to validate taxpayer information, at the earliest possible moment and at the lowest possible cost, which supports the assessment and collection of tax in Canada's self-assessment tax system. For issues of non-compliance, the CRA works with individuals to ensure they understand their tax obligations, educate them to accurately file their tax returns by correcting errors, and also identify and take enforcement measures, where necessary, for individuals who choose to avoid the full extent of their tax obligations.

Since 2005 the CRA has had to anticipate, plan, and adjust to the changing nature of the way that Canadians choose to file their tax returns while ensuring that information is protected and used for the purpose for which it was intended.

This section of the report outlines the major compliance activities of the pre and post validation programs related to Confidence Validity (CV), Processing Review (PR), and T1 Matching.

To determine if electronic tax return filing had an impact on compliance validation activities, a trend analysis of the overall CV and PR compliance activitiesFootnote 18 by filing method for fiscal year 2010 to 2011 to fiscal year 2014 to 2015 was undertaken.

The CV program (pre-assessment) selects tax returns for review that have higher risk claims while the remainder are ranked for possible selection by the PR program (post-assessment). This analysis revealed that the PR and CV programs have, for the most part, aligned with the shift from paper to electronic tax return filing. It was noted that the CV activities were not at a level of the PR program; however it is moving in that direction. This may be due in part to the nature of the tax returns selected by CV, and differences in the type of non-compliance identified. This has been recognized by CVB as an area to be addressed as part of their fiscal year 2016 to 2017 planning guidelinesFootnote 19 . (Figure 4)

Figure 4 – Percentage of tax returns processed in relation to compliance verification activity and by filing method – fiscal year 2010 to 2011 to fiscal year 2014 to 2015

| Fiscal Year | T1Returns Processed (DAS) - Paper | T1 Returns Processed (DAS) - Electronic | CV - Paper | CV - Electronic | PR - Paper | PR - Electronic |

|---|---|---|---|---|---|---|

| 2010 to 2011 | 40% | 60% | 56% | 44% | 28% | 72% |

| 2011 to 2012 | 38% | 62% | 54% | 46% | 31% | 69% |

| 2012 to 2013 | 36% | 64% | 53% | 47% | 27% | 73% |

| 2013 to 2014 | 25% | 75% | 40% | 60% | 19% | 81% |

| 2014 to 2015 | 22% | 78% | 36% | 64% | 16% | 84% |

Source: CVB internal program data

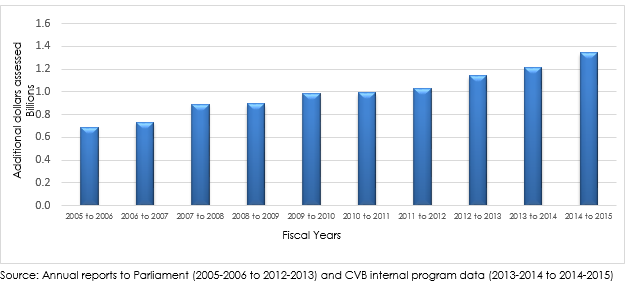

CRA interviews revealed that there has been an increased emphasis on early compliance interventions since fiscal year 2005 to 2006 due to the business intelligence gathered with respect to taxpayer behaviour.

In fiscal year 2005 to 2006, $689 million in additional taxes were assessed in the CV, PR and T1 matching programs compared to $1.3 billion assessed in fiscal year 2014 to 2015. This represents a 100% increase in total dollars assessed through early compliance interventions. (Figure 5)

Figure 5 – Compliance results – CV, PR and T1 Matching – additional dollars assessed, fiscal year 2005 to 2006 to fiscal year 2014 to 2015

Image description

Figure 5 – Compliance results – CV, PR and T1 Matching – additional dollars assessed, fiscal year 2005 to 2006 to fiscal year 2014 to 2015

The additional dollars assessed for fiscal year 2005 to 2006 is 688,500,000$

The additional dollars assessed for fiscal year 2006 to 2007 is 734,700,000$

The additional dollars assessed for fiscal year 2007 to 2008 is 889,600,000$

The additional dollars assessed for fiscal year 2008 to 2009 is 895,000,000$

The additional dollars assessed for fiscal year 2009 to 2010 is 986,200,000$

The additional dollars assessed for fiscal year 2010 to 2011 is 994,000,000$

The additional dollars assessed for fiscal year 2011 to 2012 is 1,034,000,000$

The additional dollars assessed for fiscal year 2012 to 2013 is 1,141,000,000$

The additional dollars assessed for fiscal year 2013 to 2014 is 1,217,000,000$

The additional dollars assessed for fiscal year 2014 to 2015 is 1,344,000,000$

To better understand the individual contribution of the compliance activities of CV, PR and T1 matching results, each program was analyzed separately to determine if there was any impact with the shift to electronic tax return filing. The analysis was undertaken at the macro level as the CRA risk assessment and scoring processes in relation to compliance verification results were not reviewed as part of this study as they are closely guarded to protect the integrity of Canada's tax administration.

Confidence Validity (CV)

The CV program uses various methods to identify high risk claims before the tax return is assessed, and prevents taxpayers from receiving unwarranted refunds. Preventing taxpayers from receiving unwarranted refunds reduces the cost of post assessment compliance activities. Furthermore it sends a strong message to both the taxpayer and their representative that addressing non-compliance is a high priority for the CRA.

The analysis of CV program results from fiscal year 2010 to 2011 to fiscal year 2014 to 2015 revealed that the volume of work and the additional dollars assessed has increased over this five year period. For the fiscal year 2010 to 2011 program, 222,680 returns were reviewed and $162 million assessed which increased to 230,581 returns and $224 million assessed in fiscal year 2014 to 2015. This represents an increase of 4% in the number of tax returns reviewed and a 38% increase in dollars assessed. (Figure 6)

Figure 6 – Confidence Validity Production – number of returns validated for fiscal year 2010 to 2011 to fiscal year 2014 to 2015

Image description

Figure 6 – Confidence Validity Production – number of returns validated for fiscal year 2010 to 2011 to fiscal year 2014 to 2015

For the Confidence validity production, the number of tax returns validated for fiscal year 2010 to 2011 is 222,680

For the Confidence validity production, the number of tax returns validated for fiscal year 2011 to 2012 is 226,831

For the Confidence validity production, the number of tax returns validated for fiscal year 2012 to 2013 is 223,129

For the Confidence validity production, the number of tax returns validated for fiscal year 2013 to 2014 is 229,114

For the Confidence validity production, the number of tax returns validated for fiscal year 2014 to 2015 is 230,581

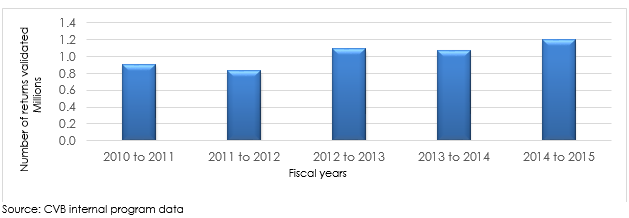

Processing Review (PR)

The PR program reviews the credits and the deductions claimed on tax returns after a NoA has been issued to the taxpayer. The PR program uses a scoring system to calculate a risk value for each tax return assessed and determines the return's ranking for a possible review. Tax returns selected for review are reassessed, where necessary, and taxpayers are notified of their results through a NoR.

The analysis of PR program results from fiscal year 2010 to 2011 to fiscal 2014 to 2015 revealed that the volume of tax returns reviewed and the additional dollars assessed increased over the five year period. For the fiscal year 2010 to 2011 program, 903,435 returns were reviewed and $232 million was assessed which increased to 1.1 million tax returns being reviewed and $323 million assessed in fiscal year 2014 to 2015. This represents an increase of 22% in the number of tax returns reviewed and a 39% increase in dollars assessed. (Figure 7)

Figure 7 – Processing Review Production – number of returns validated for fiscal year 2010 to 2011 to fiscal year 2014 to 2015

Image description

Figure 7 – Processing Review Production – number of returns validated for fiscal year 2010 to 2011 to fiscal year 2014 to 2015

For the Processing review production, the number of tax returns validated for the fiscal year 2010 to 2011 is 903,435

For the Processing review production, the number of tax returns validated for the fiscal year 2011 to 2012 is 831,821

For the Processing review production, the number of tax returns validated for the fiscal year 2012 to 2013 is 1,089,627

For the Processing review production, the number of tax returns validated for the fiscal year 2013 to 2014 is 1,070,239

For the Processing review production, the number of tax returns validated for the fiscal year 2014 to 2015 is 1,194,686

T1 Matching

The T1 Matching program compares information filed on tax returns with third party information from employers, government departments, and financial institutions as well as with the tax return of their spouse. This allows for the identification of errors or omissions such as:

- under-reported income and benefits

- over-claimed tax deductions withheld at source

- over-claimed credits

- over-claimed deductions

- net income for the purposes of Canada Child Benefit and Goods and Services Tax Credit, and incorrect Registered Retirement Savings Plan Contribution Limit statements

The T1 Matching program begins in the latter part of the fall to allow for the compilation of all third-party information. Once matches have been found, discrepancies are identified between the amounts claimed by the taxpayer and those provided by the taxpayer's third-parties. For discrepancy cases that are clearly identified, an automatic reassessment may be performedFootnote 20 . For discrepancies meeting certain criteria, but having variable conditions requiring further review, cases are identified for manual review and possible reassessment.

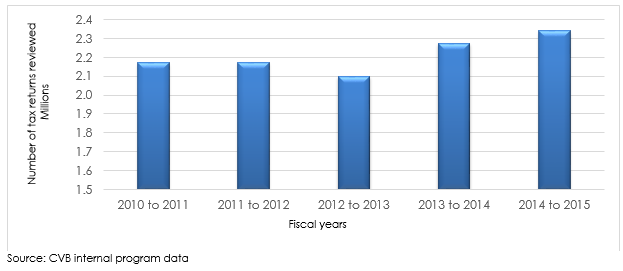

The analysis of T1 Matching program results from fiscal year 2010 to 2011 to fiscal year 2014 to 2015 revealed that the volume of work and the additional dollars assessed increased over the five year period. For the fiscal year 2010 to 2011 program, 2.2 million returns were reviewed and $600 million was assessed which increased to 2.3 million returns and $797 million being assessed in fiscal year 2014 to 2015. This represents an increase of 5% in the number of tax returns reviewed and a 33% increase in dollars assessed. (Figure 8)

Figure 8 – T1 Matching Production - number of returns validated for fiscal year 2010 to 2011 to fiscal year 2014 to 2015

Image description

Figure 8 – T1 Matching Production - number of returns validated for fiscal year 2010 to 2011 to fiscal year 2014 to 2015

For the T1 matching production, the number of tax returns validated for the fiscal year 2010 to 2011 is 2,170,986

For the T1 matching production, the number of tax returns validated for the fiscal year 2011 to 2012 is 2,174,630

For the T1 matching production, the number of tax returns validated for the fiscal year 2012 to 2013 is 2,101,025

For the T1 matching production, the number of tax returns validated for the fiscal year 2013 to 2014 is 2,274,034

For the T1 matching production, the number of tax returns validated for the fiscal year 2014 to 2015 is 2,341,261

To understand if the shift to electronic tax return filing has had an impact on CRA resources for compliance validation activities, a cost analysis was undertaken. This analysis was based on the salary costs and the activity codes for the CV, PR and T1 Matching from CRA administrative data and compared to program production volumes.

The compliance validation activities costs, have for the most part, been stable from fiscal year 2010 to 2011 to fiscal year 2014 to 2015Footnote 21 . CV decreased from $21.74 to $19.54 (-$2.20 or 10%), PR increased from $16.22 to $16.29 ($0.07 or 0.4%) and T1 Matching increased from $5.58 to $6.26 ($0.68 or 12.1%). However as previously noted in Figure 4, the dollars assessed has substantially increased by 35% from $994 million assessed in fiscal year 2010 to 2011 to $1.3 billion in fiscal year 2014 to 2015Footnote 22 .

This analysis has confirmed that both overall and individual results for the CV, PR and T1 Matching programs have adjusted to the shift to electronic tax return filing, and are integral to CRA's tax administration and support Canada's self-assessment tax system.

With respect to changes that could improve compliance activities, regional interviews with CVB and the Appeals Branch strongly expressed that having certain tax forms and schedules transmitted at the time of tax return filing could enhance the taxpayer experience and support compliance activities.

Prior to electronic tax return filing, tax forms and schedules were included with the tax return when filed on paper; however this is not the case with the move to electronic tax return filing. EFILE and NETFILE software provides tax forms and schedules that supports taxpayers in completing and filing their tax return, however they are not transmitted to the CRA. The absence of this information has had an unintended impact on the taxpayer and on CRA's administration of compliance validation activities.

From a taxpayer's perspective they are often confused when the CRA asks them for a form or schedule that they completed and understood was already submitted to the CRA as part of their electronic tax return filing transmission. The inclusion of certain forms or schedules could result in more tailored communication with a taxpayer and improve client service as a result.

From a compliance perspective, including the collection of outstanding amounts, the additional information contained in tax forms and schedules could provide for better business intelligence and risk scoring of taxpayer returns to identify errors and omissions. The availability of this information at the time of tax return filing, would assist CRA with early intervention measures which are the most cost effective methods to address non-compliance.

It is recognized that the CRA can request receipts at any time; thus the decision to not include all data on forms and schedules was based on the low volume of compliance activities that are undertaken in relation to the overall volume of tax returns filed. Now that the system has been working as intended, and there is no issue with electronic storage, an opportunity exists to explore the transmission of data on certain tax forms and schedules to support CRA's tax administration as well as to potentially improve interactions with taxpayers. More importantly, this would send a strong message to both taxpayers and their representatives on the importance of having receipts to support their deductions.

5. Organizational structures, work processes and systems have been aligned with advancements in electronic tax return filing

With the advancements in electronic tax return processing, the CRA recognized the need to modify its organizational structure, work processes and systems.

Organizational Structures

No major organizational restructuring occurred from the period 2005 to 2015; however recognizing the advancements in electronic tax return filing, a CRA renewal initiative was introduced in November 2016. This resulted in the consolidation of tax processing sites and the establishment of new National Verification and Collections Centres (NVCC). This means the CRA went from nine processing centres and two specialized Ottawa sites (International Tax Services Office and the Ottawa Technology Centre) to seven processing centres of which four will remain processing centres and three will become NVCCs.

This service renewal is relatively new, thus was not measureable as part of this study. However, the expected benefits are that it would:

- create a more efficient organization, which maximizes economies of scale;

- modernize internal operations to improve service and deliver better results;

- increase capacity to verify returns and collect tax debts;

- provide greater certainty to a continued presence in all regions;

- better reflect the increasingly digital nature of business processes; and

- fully leverage people.

Work processes

CRA interviews with employees and review of documents revealed that modifications have occurred to work processes with the shift to electronic tax return filing. First and foremost, the protection of taxpayer information is paramount, thus the CRA restricts changes to addresses, banking and direct deposit information through EFILE or NETFILE to minimize identity theft. Programs are also in place, such as the Special Assessment Program to prevent identity theft and fraud through the review of electronically transmitted tax returns prior to processing.

The CRA also developed and implemented work processes to register, and monitor tax preparers as well as a directory of the registered tax preparers for use by Canadians. CRA interviews revealed some concerns with the practices of registered tax preparers, and how they support CRA's tax administrationFootnote 23 and individuals who pay for this service. Concerns were raised on the competencies of the registered tax preparers to complete tax returns in accordance with the ITA and regulations. Others mentioned that some of the registered tax preparers do not use the system as intended. For example, they will file a tax return on behalf of their client as self-employed in order to meet the tax return filing deadline and to avoid a late filing penalty. The registered tax preparer will then follow-up and correct the tax return through a reassessment request once they have time to review the income and receipts. For the CRA, this could result in the need for reassessment of the tax return, additional scrutiny of income, expenses and receipts, and may also result in interest and penalty being charged to a taxpayer if a balance is outstanding as a result of the reassessment.

With 56% of individuals using registered tax preparers to file their tax returns, an opportunity exists to undertake an in-depth review to provide insight on how they support individuals in meeting their tax obligations as well as CRA's tax administration.

Systems

CRA tax administration systems are built, based on Agency IT best practices, to allow for the receipt, verification, processing, validation, third party matching and the assessment or reassessments of individual tax returns. This information also supports collection, appeal and audit activities. As stated earlier, protecting taxpayer information is paramount and all threats to government systems – real or perceived – are taken seriously and responded to with established protocols. This includes suspension of service when warranted.

To ensure systems meets the operational needs of the future, the CRA is also undertaking a T1 system redesign (T1SR) which is a multi-year project that will mitigate the risks associated with an aging T1 Suite by modernizing its software, data and technology components.

Interviews with CRA personnel revealed some strong opinions about the T1SR project and the unintended impacts on employees. A reoccurring comment was that the font on the computer screen is extremely small and many are worried about the impact on their vision and ability to process or validate tax returns accurately and efficiently. ABSB was under the impression that this was an issue with older computers; however the Information Technology Branch advised that this issue resides in the application coding. It was also strongly voiced that the CRA needs to address the current problems with the system prior to further releases, and most importantly increase consultation with the end users. It is recognized that the T1SR is a multi-year project and that system changes are based on system conversion timelines and implications with tax legislative modifications.

The AERB undertook an independent reviewFootnote 24 of business analyst capacity which revealed that the CRA requires significant improvements in this area which may have attributed to the unintended impacts identified as part of this study. The AERB also plans to undertake an independent review of the T1SR project in fiscal year 2017 to 2018 to provide assurance that controls are in place to support the successful implementation of the project phases.

To mitigate the unintended impacts on employee's accuracy, efficiency, health and wellness identified as part of this study, an opportunity exists to take stock of system maintenance upgrades in place as part of the T1SR project, and ensure that application coding provides a sufficient font size for employees.

Conclusion

The 2014 tax return profile and compliance validation analysis are positive with no major constraints identified with the shift from paper to electronic tax return filling. Considering the higher use of registered tax preparers, and to better understand how the registered tax preparers support CRA's tax administration, an independent study would provide additional insight on the EFILE tax return filing method and the individuals who pay a fee to use this service. This study will be considered in the development of the AERB 2018 to 2021 Risk-based Audit and Evaluation Plan.

In addition, with the electronic systems working as intended an opportunity exists to promote electronic tax return filing for certain groups as well as to explore the transmission of data on certain tax forms and schedules to support compliance activities and interactions with Canadians. Employees are the cornerstone of CRA's administration and have strongly voiced the need to take stock of system maintenance upgrades in place as a part of the T1SR project, and to ensure that application coding provides a sufficient font size for employees. The goal is to mitigate unintended impacts on employee's health and wellness while ensuring accurate, efficient service is provided to Canadians.

Recommendation 1

ABSB, in consultation with other stakeholders, undertake a comprehensive analysis to identify ways to promote electronic tax return filing and increase take-up rate for those groups showing a slower transition from paper to electronic tax return filing.

Management Response:

The CRA's success in promoting and enhancing electronic filing has allowed us to reach an 86% electronic filing rate to date. However, it is understood that some taxpayers may never switch from paper to electronic filing due to many factors, including complexity of their tax situation, technological limitations or socio-economic situation. ABSB is working with Agency stakeholders and gathering information related to the remaining groups of paper filers to ensure we are doing what we can to help those that wish to electronically file, as well as support taxpayers who chose to continue to paper file. We will complete this analysis by Q1 of fiscal year 2018 to 2019. A report detailing the results of this analysis and proposed action plan will be shared with senior management by Q2 of fiscal year 2018 to 2019.

Recommendation 2

ABSB, in consultation with CRA stakeholders, explore and assess the feasibility to have data on certain tax forms and schedules transmitted to support compliance activities and interactions with Canadians.

Management Response:

ABSB actively participates, on an ongoing basis, on an inter-branch working group and DG steering committee (DISC) that formally reviews data that is captured and transmitted on the T1 Return. The working group (led by SIB) balances the value of obtaining and holding tax data vs. the cost, burden and impact of collecting that data. At the next working group meeting, ABSB will work with other CRA stakeholders to assess the feasibility and impacts of transmitting more data to support compliance activities and interactions with Canadians. ABSB will provide an update in June 2018, following the May 2018 DISC meeting.

Recommendation 3

ABSB, in consultation with CRA stakeholders, take stock of system maintenance and upgrades and address employee concerns with the T1SR project.

Management Response:

ABSB recognizes that field users are adapting to new technological tools and will continue to support them by working with local management to identify improvements and corrections that will assist them with the transition. As display irritants remain for some users, specifically with the T1 Case system, ABSB, in consultation with CRA stakeholders, will reassess the instructions provided to the field, modify if necessary, and reissue to field users by Q4 of fiscal year 2017 to 2018. We will also continue to support regional management in implementing local ergonomic improvements as identified in a study by the National Health and Safety Committee.

Moving forward, after assessing the impact of display changes included in the February 2018 release, ABSB will work with ITB and other CRA stakeholders to prioritize further enhancements for the February 2019 and if necessary, the February 2020 release. This is the earliest possible timing as these system releases are aligned with the release calendar for the T1 Suite of programs which occurs once a year in February. ABSB will provide status updates on the February 2019 T1 Case system enhancements in Q1 of fiscal year 2019 to 2020 and Q1 of fiscal year 2020 to 2021, if necessary.

Acknowledgement

We would like to acknowledge and thank all CRA stakeholders interviewed for their support during the evaluation study. We observed that employees, both in headquarters and the regions, are professional, resilient, able to adapt to change, and most importantly are committed to providing quality service to Canadians and to ensuring that all taxpayers meet their tax obligations and pay their fair share of tax.

Appendices

Appendix A: Logic model

Image description

Appendix A – Logic Model

April 25, 2016

Electronic and Paper Tax Return Filing – Individual Compliance Behaviour

Individual (NETFILE, Paper)

Third Party Tax Preparers (EFILE, Paper)

Community Volunteer (EFILE, Paper)

Major Activities

- Program Management and Business Intelligence

- Sub-Activities

- Legislative review, policy and procedures development

- Resource and workload planning

- Performance monitoring and reporting

- Stakeholder consultation

- Functional direction, technical advice and training

- Research, risk assessment and strategy development

- e-Services initiatives that support innovation and CRA’s sustainable development strategy

- Outputs

- Legislation, policy and procedures

- Resource and workload allocation

- Sharing of information, advice and guidance with CRA stakeholders

- Guidance, manuals, training courses and tools

- Performance monitoring reports

- System and program delivery changes

- Immediate Outcomes

- Effective legislative tax framework

- Improved use of CRA business intelligence

- Knowledgeable and trained personnel

- Consistent application of policies and procedures

- Improved ability to identify risks and implement strategies to address non-compliance

- Improved system and program delivery

- Intermediate Outcomes

- Improved effectiveness of the T1 filing program to detect and address non-compliance

- Optimize resource utilization

- Ultimate Outcomes

- Canadians have access to a secure and modern way to meet their T1 tax return filing obligations

- Tax base is protected

- Sub-Activities

- IT System and Security

- Sub-Activities

- Design and development

- Testing and deployment

- Maintenance and monitoring

- Security assessment and authorization

- Outputs

- System available to electronically file tax returns

- Taxpayer information is protected

- System monitoring reports

- System maintenance, upgrades and changes made

- Immediate Outcome

- System integrity is optimized

- Intermediate Outcome

- Increased confidence of taxpayers and representatives in the use of electronic filing services

- Ultimate Outcomes

- Canadians have access to a secure and modern way to meet their T1 tax return filing obligations

- Tax base is protected

- Sub-Activities

- Communication

- Sub-Activities

- Telephone and written enquiry services

- Forms and publication development

- Outreach and other public communications

- Community Volunteer Income Tax Program

- Website development

- Ministerial and media enquiry services

- Outputs

- Information and guidance provided

- Electronic and paper based information and publications

- Outreach presentations and public communications (e.g. media, tweets)

- Responses to ministerial and media enquiries

- Immediate Outcome

- Increased level of understanding of tax filing obligations

- Intermediate Outcome

- Improved taxpayer compliance behaviour with T1 tax return filing obligations

- Ultimate Outcomes

- Canadians have access to a secure and modern way to meet their T1 tax return filing obligations

- Tax base is protected

- Sub-Activities

- Compliance

- Sub-Activities

- Pre assessment validation

- Tax return processed

- Post assessment validation

- Leads and referrals to audit

- Outputs

- Tax returns validated

- Tax returns assessed

- Debt, refund or no balance due established

- Notice of Assessment or Reassessment issued

- Non-filers identified

- Tax schemes identified

- Leads and referrals sent to Audit

- Immediate Outcome

- Increased taxpayer awareness of their tax situation and actions required

- Intermediate Outcome

- Improved taxpayer compliance behaviour with T1 tax return filing obligations

- Ultimate Outcomes

- Canadians have access to a secure and modern way to meet their T1 tax return filing obligations

- Tax base is protected

- Sub-Activities

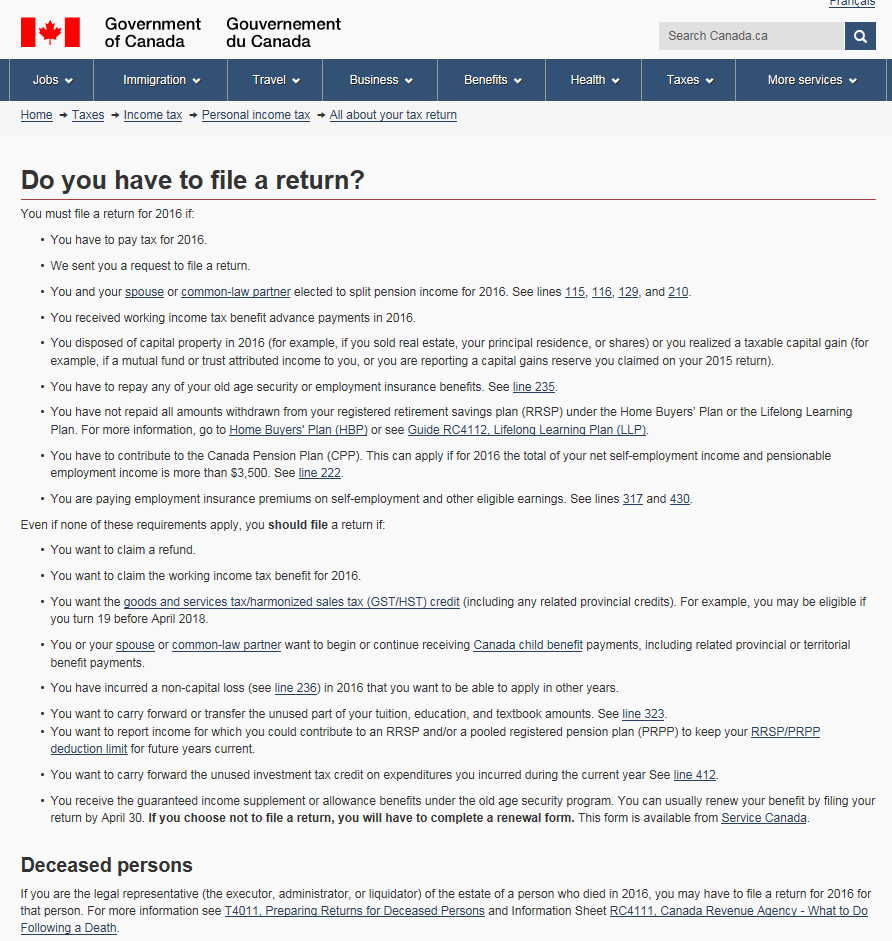

Appendix B: Reasons to file a tax returnFootnote 25

Image description

Appendix B: Reasons to file a tax return

Do you have to file a return?

You must file a return for 2016 if:

- You have to pay tax for 2016.

- We sent you a request to file a return.

- You and your spouse or common-law partner elected to split pension income for 2016. See lines 115, 116, 129, and 210.

- You received working income tax benefit advance payments in 2016.

- You disposed of capital property in 2016 (for example, if you sold real estate, your principal residence, or shares) or you realized a taxable capital gain (for example, if a mutual fund or trust attributed income to you, or you are reporting a capital gains reserve you claimed on your 2015 return).

- You have to repay any of your old age security or employment insurance benefits. See line 235.

- You have not repaid all amounts withdrawn from your registered retirement savings plan (RRSP) under the Home Buyers’ Plan or the Lifelong Learning Plan. For more information, go to Home Buyers’ Plan (HBP) or see Guide RC4112, Lifelong Learning Plan (LLP).

- You have to contribute to the Canada Pension Plan (CPP). This can apply if for 2016 the total of your net self-employment income and pensionable employment income is more than $3,500. See line 222.

- You are paying employment insurance premiums on self-employment and other eligible earnings. See lines 317 and 430.

Even if none of these requirements apply, you should file a return if:

- You want to claim a refund.

- You want to claim the working income tax benefit for 2016.

- You want the goods and services tax/harmonized sales tax (GST/HST) credit (including any related provincial credits). For example, you may be eligible if you turn 19 before April 2018.

- You or your spouse or common-law partner want to begin or continue receiving Canada child benefit payments, including related provincial or territorial benefit payments.

- You have incurred a non-capital loss (see line 236) in 2016 that you want to be able to apply in other years.

- You want to carry forward or transfer the unused part of your tuition, education, and textbook amounts. See line 323.

- You want to report income for which you could contribute to an RRSP and/or a pooled registered pension plan (PRPP) to keep your RRSP/PRPP deduction limit for future years current.

- You want to carry forward the unused investment tax credit on expenditures you incurred during the current year See line 412.

- You receive the guaranteed income supplement or allowance benefits under the old age security program. You can usually renew your benefit by filing your return by April 30. If you choose not to file a return, you will have to complete a renewal form. This form is available from Service Canada.

Deceased persons

If you are the legal representative (the executor, administrator, or liquidator) of the estate of a person who died in 2016, you may have to file a return for 2016 for that person. For more information see T4011, Preparing Returns for Deceased Persons and Information Sheet RC4111, Canada Revenue Agency - What to Do Following a Death.

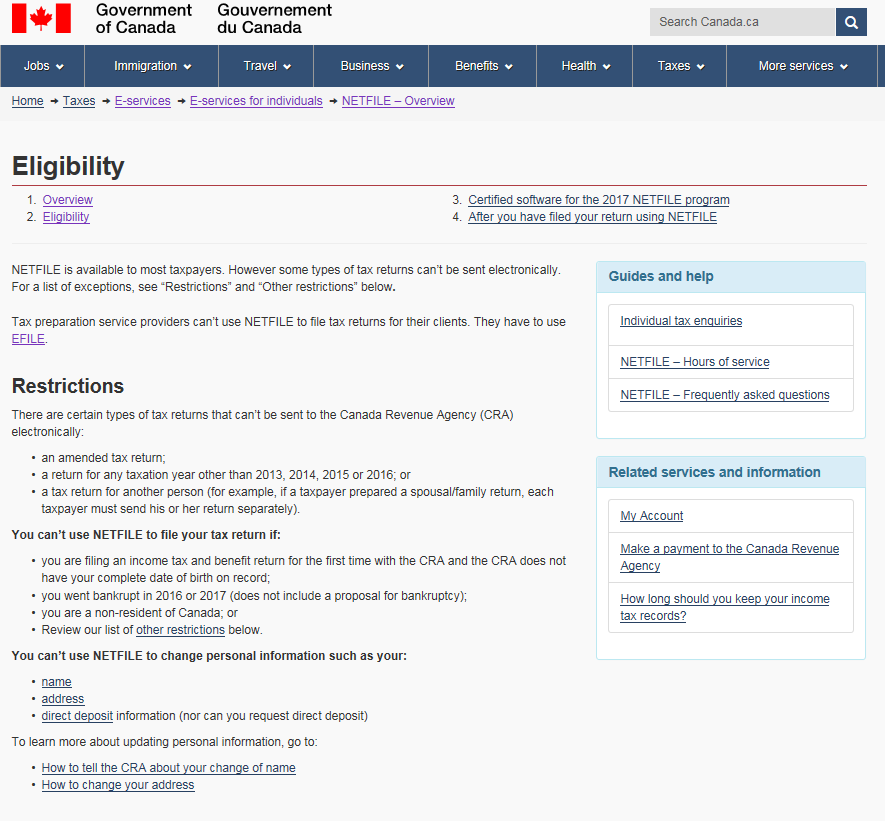

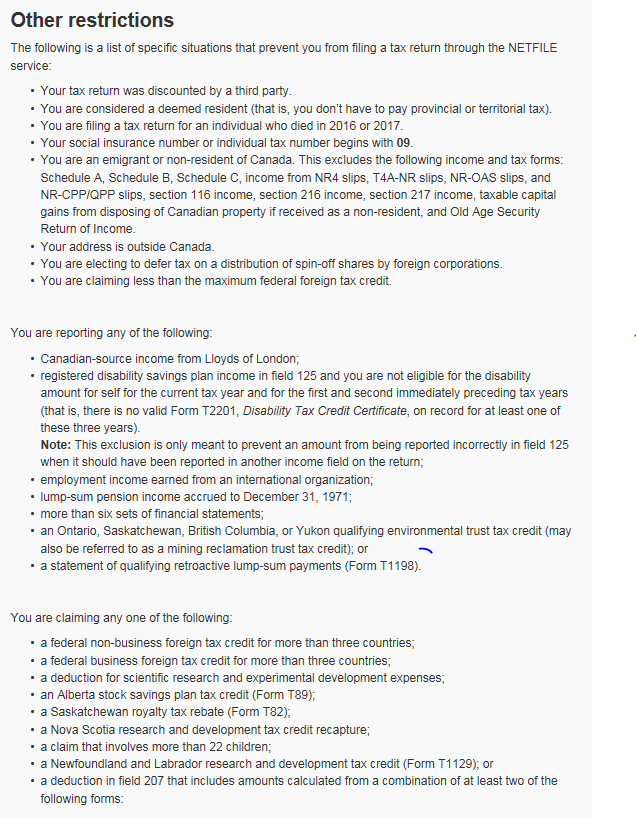

Appendix C: Restrictions and exclusionsFootnote 26

Image description

Appendix C: Restrictions and exclusions

Eligibility

NETFILE is available to most taxpayers. However some types of tax returns can’t be sent electronically. For a list of exceptions, see “Restrictions” and “Other restrictions” below.

Tax preparation service providers can’t use NETFILE to file tax returns for their clients. They have to use EFILE.

Restrictions

There are certain types of tax returns that can’t be sent to the Canada Revenue Agency (CRA) electronically:

- an amended tax return;

- a return for any taxation year other than 2013, 2014, 2015 or 2016; or

- a tax return for another person (for example, if a taxpayer prepared a spousal/family return, each taxpayer must send his or her return separately).

You can’t use NETFILE to file your tax return if:

- you are filing an income tax and benefit return for the first time with the CRA and the CRA does not have your complete date of birth on record;

- you went bankrupt in 2016 or 2017 (does not include a proposal for bankruptcy);

- you are a non-resident of Canada; or

- Review our list of other restrictions below.

You can’t use NETFILE to change personal information such as your:

- name

- address

- direct deposit information (nor can you request direct deposit)

To learn more about updating personal information, go to:

- How to tell the CRA about your change of name

- How to change your address

Image description

Other restrictions

The following is a list of specific situations that prevent you from filing a tax return through the NETFILE service:

- Your tax return was discounted by a third party.

- You are considered a deemed resident (that is, you don’t have to pay provincial or territorial tax).

- You are filing a tax return for an individual who died in 2016 or 2017.

- Your social insurance number or individual tax number begins with 09.

- You are an emigrant or non-resident of Canada. This excludes the following income and tax forms: Schedule A, Schedule B, Schedule C, income from NR4 slips, T4A-NR slips, NR-OAS slips, and NR-CPP/QPP slips, section 116 income, section 216 income, section 217 income, taxable capital gains from disposing of Canadian property if received as a non-resident, and Old Age Security Return of Income.

- Your address is outside Canada.

- You are electing to defer tax on a distribution of spin-off shares by foreign corporations.

- You are claiming less than the maximum federal foreign tax credit.

You are reporting any of the following:

- Canadian-source income from Lloyds of London;

- registered disability savings plan income in field 125 and you are not eligible for the disability amount for self for the current tax year and for the first and second immediately preceding tax years (that is, there is no valid Form T2201, Disability Tax Credit Certificate, on record for at least one of these three years).

Note: This exclusion is only meant to prevent an amount from being reported incorrectly in field 125 when it should have been reported in another income field on the return; - employment income earned from an international organization;

- lump-sum pension income accrued to December 31, 1971;

- more than six sets of financial statements;

- an Ontario, Saskatchewan, British Columbia, or Yukon qualifying environmental trust tax credit (may also be referred to as a mining reclamation trust tax credit); or

- a statement of qualifying retroactive lump-sum payments (Form T1198).

You are claiming any one of the following:

- a federal non-business foreign tax credit for more than three countries;

- a federal business foreign tax credit for more than three countries;

- a deduction for scientific research and experimental development expenses;

- an Alberta stock savings plan tax credit (Form T89);

- a Saskatchewan royalty tax rebate (Form T82);

- a Nova Scotia research and development tax credit recapture;

- a claim that involves more than 22 children;

- a Newfoundland and Labrador research and development tax credit (Form T1129); or

- a deduction in field 207 that includes amounts calculated from a combination of at least two of the following forms:

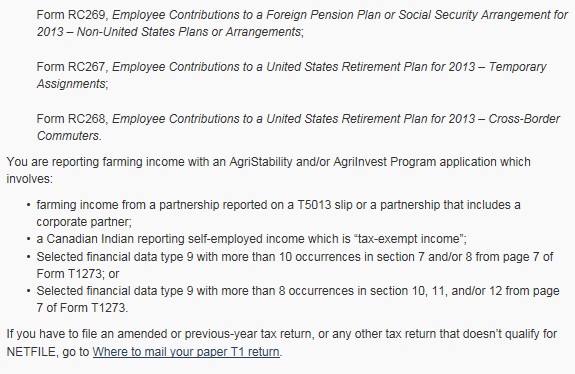

Image description

- Form RC269, Employee Contributions to a Foreign Pension Plan or Social Security Arrangement for 2013 – Non-United States Plans or Arrangements;

- Form RC267, Employee Contributions to a United States Retirement Plan for 2013 – Temporary Assignments;

- Form RC268, Employee Contributions to a United States Retirement Plan for 2013 – Cross-Border Commuters.

You are reporting farming income with an AgriStability and/or AgriInvest Program application which involves:

- farming income from a partnership reported on a T5013 slip or a partnership that includes a corporate partner;

- a Canadian Indian reporting self-employed income which is "tax-exempt income";

- Selected financial data type 9 with more than 10 occurrences in section 7 and/or 8 from page 7 of Form T1273; or

- Selected financial data type 9 with more than 8 occurrences in section 10, 11, and/or 12 from page 7 of Form T1273.

If you have to file an amended or previous-year tax return, or any other tax return that doesn’t qualify for NETFILE, go to Where to mail your paper T1 return.

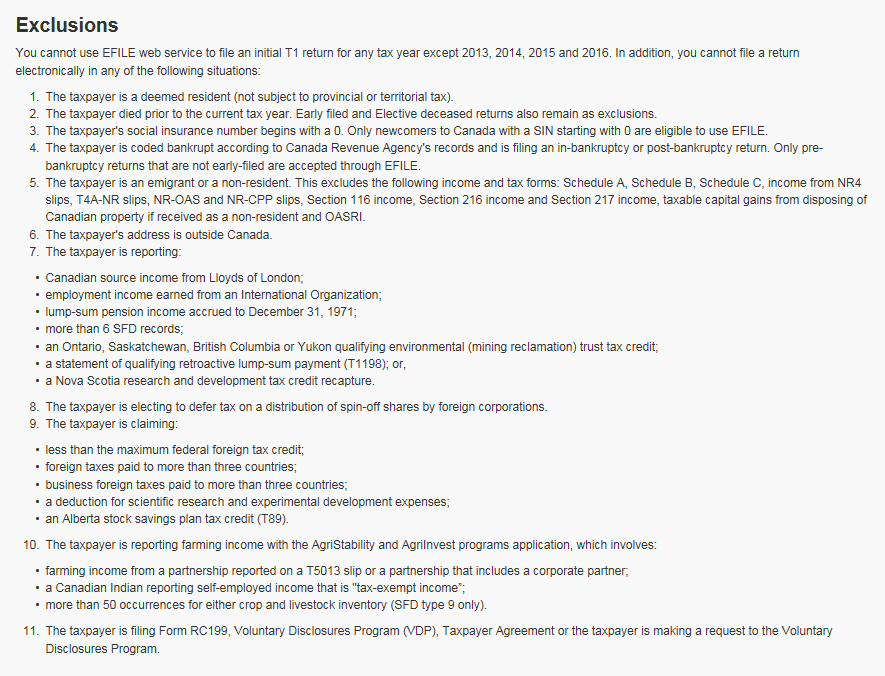

Image description

Exclusions

You cannot use EFILE web service to file an initial T1 return for any tax year except 2013, 2014, 2015 and 2016. In addition, you cannot file a return electronically in any of the following situations:

- The taxpayer is a deemed resident (not subject to provincial or territorial tax).

- The taxpayer died prior to the current tax year. Early filed and Elective deceased returns also remain as exclusions.

- The taxpayer's social insurance number begins with a 0. Only newcomers to Canada with a SIN starting with 0 are eligible to use EFILE.

- The taxpayer is coded bankrupt according to Canada Revenue Agency's records and is filing an in-bankruptcy or post-bankruptcy return. Only pre-bankruptcy returns that are not early-filed are accepted through EFILE.

- The taxpayer is an emigrant or a non-resident. This excludes the following income and tax forms: Schedule A, Schedule B, Schedule C, income from NR4 slips, T4A-NR slips, NR-OAS and NR-CPP slips, Section 116 income, Section 216 income and Section 217 income, taxable capital gains from disposing of Canadian property if received as a non-resident and OASRI.

- The taxpayer's address is outside Canada.

- The taxpayer is reporting:

- Canadian source income from Lloyds of London;

- employment income earned from an International Organization;

- lump-sum pension income accrued to December 31, 1971;

- more than 6 SFD records;

- an Ontario, Saskatchewan, British Columbia or Yukon qualifying environmental (mining reclamation) trust tax credit;

- a statement of qualifying retroactive lump-sum payment (T1198); or,

- a Nova Scotia research and development tax credit recapture.

- The taxpayer is electing to defer tax on a distribution of spin-off shares by foreign corporations.

- The taxpayer is claiming:

- less than the maximum federal foreign tax credit;

- foreign taxes paid to more than three countries;

- business foreign taxes paid to more than three countries;

- a deduction for scientific research and experimental development expenses;

- an Alberta stock savings plan tax credit (T89).

- The taxpayer is reporting farming income with the AgriStability and AgriInvest programs application, which involves:

- farming income from a partnership reported on a T5013 slip or a partnership that includes a corporate partner;

- a Canadian Indian reporting self-employed income that is "tax-exempt income”;

- more than 50 occurrences for either crop and livestock inventory (SFD type 9 only).

- The taxpayer is filing Form RC199, Voluntary Disclosures Program (VDP), Taxpayer Agreement or the taxpayer is making a request to the Voluntary Disclosures Program.

Appendix D: Profile analysis - methodology and data results by province and territory

Low Income

The established WITB income values were used to define and segment the low income group from the 2014 tax returns. This program defines low net income thresholds as $37,195 for Nunavut, $20,072 for Quebec, $19,721 for British Columbia, $19,139 for Alberta, and $17,986 for the rest of Canada. (Figure D.1)

Figure D.1 – Number and percentage of tax returns filed for low income by filing method and by province and territory for tax year 2014