Tax rates and income brackets for individuals

Change in individual income tax rate

The Government of Canada has tabled legislation proposing to reduce the lowest income tax rate effective July 1, 2025. For more information: Government tables a Motion to bring down costs for Canadians.

The Government of Canada sets the federal income tax rates for individuals. Each province and territory determines their own income tax rates.

Provincial or territorial income tax rates apply in addition to federal income tax rates.

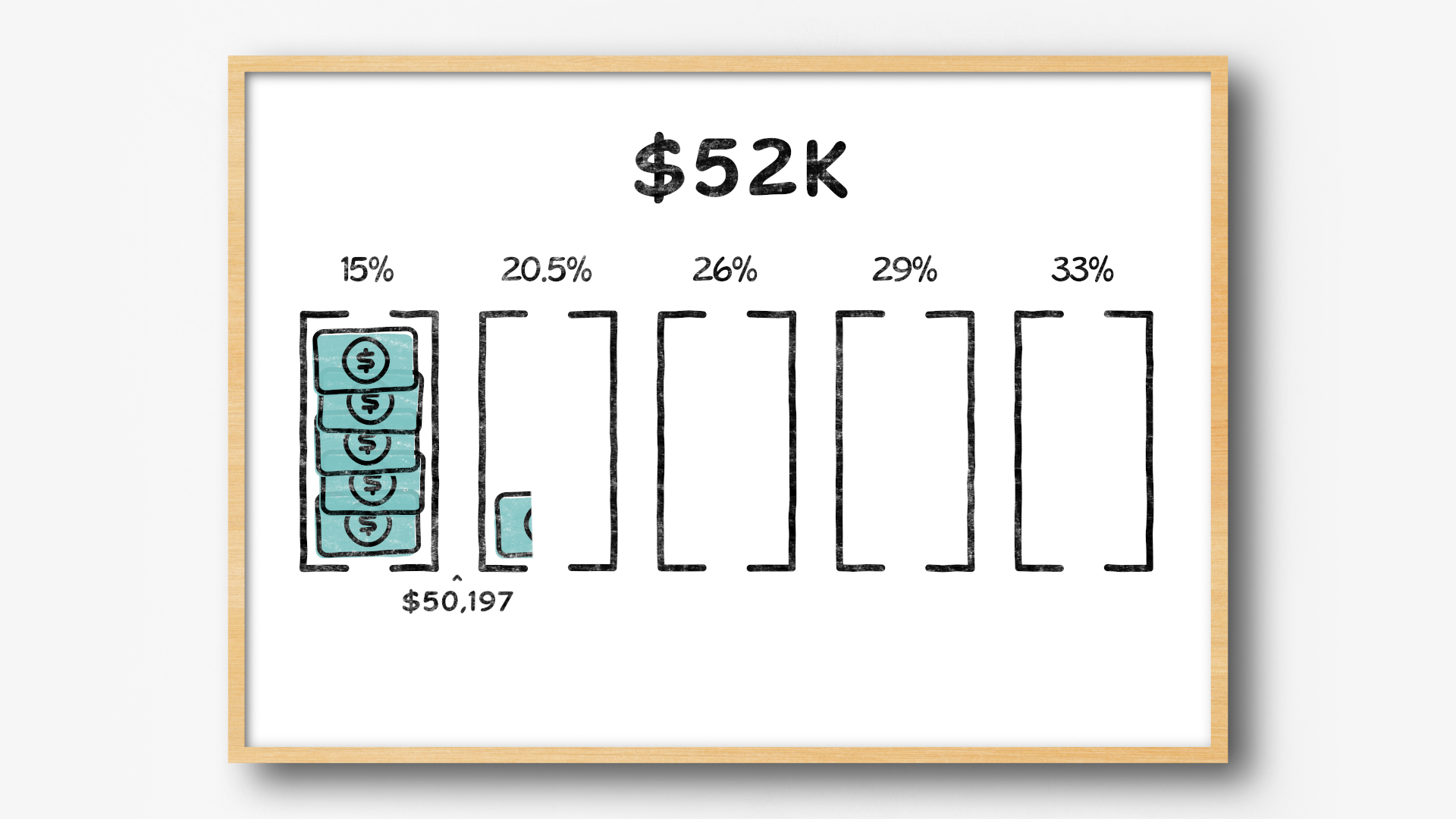

2025 federal income tax rates

These rates apply to your taxable income. Your taxable income is your income after various deductions, credits, and exemptions have been applied.

There are also various tax credits, deductions and benefits available to you to reduce your total tax payable.

Video: How rates and brackets work

Learn how you are taxed at different rates based on your income level.

2025 provincial and territorial income tax rates

Provincial and territorial tax rates vary across Canada; however, your provincial or territorial income tax (except Quebec) is calculated in the same way as your federal income tax.

-

Newfoundland and Labrador

-

Prince Edward Island

-

Nova Scotia

-

New Brunswick

-

Quebec

-

Ontario

-

Manitoba

-

Saskatchewan

-

Alberta

-

British Columbia

-

Yukon

-

Northwest Territories

-

Nunavut