Factsheet: The Underused Housing Tax (UHT) - How to file and pay

Any amounts owing for the Underused Housing Tax must be paid in Canadian dollars using one of the following methods found in this factsheet.

Factsheet description

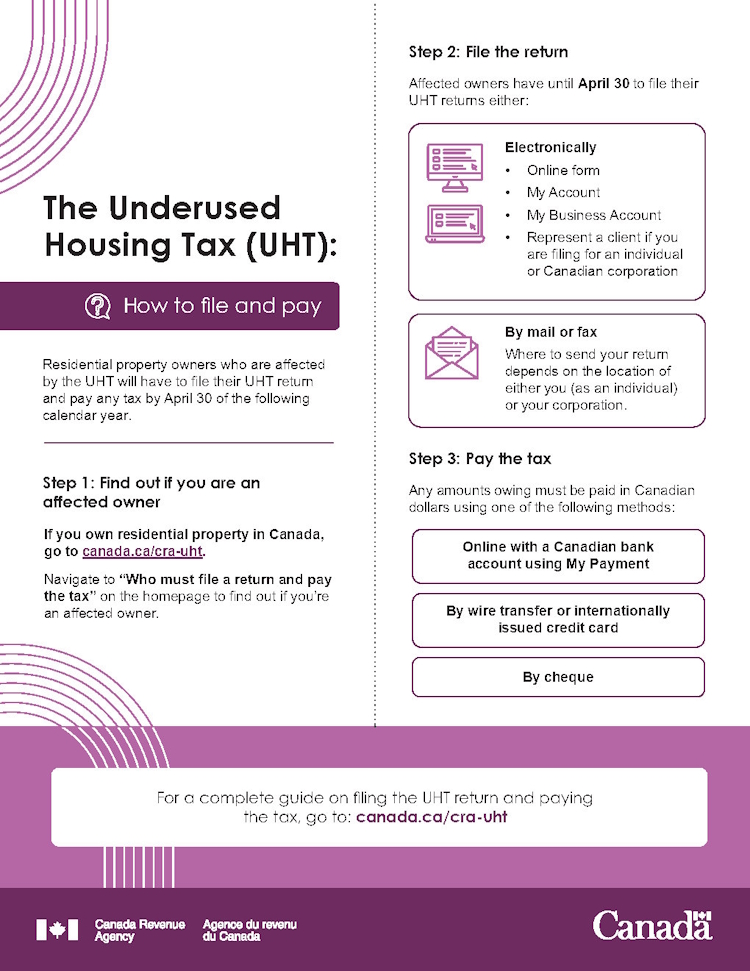

The Underused Housing Tax (UHT): How to file and pay

Residential property owners who are affected by the UHT will have to file their UHT return and pay any tax by April 30 of the following calendar year.

Step 1: Find out if you are an affected owner

If you own residential property in Canada, go to canada.ca/cra-uht.

Navigate to “Who must file a return and pay the tax” on the homepage to find out if you’re an affected owner.

Step 2: File the return

Affected owners have until April 30 to file their UHT returns either:

- Electronically

- Online form

- My Account

- My Business Account

- Represent a client if you are filing for an individual or Canadian corporation

- By mail or fax

- Where to send your return depends on the location of either you (as an individual) or your corporation.

Step 3: Pay the tax

Any amounts owing must be paid in Canadian dollars using one of the following methods:

- Online with a Canadian bank account using My Payment

- By wire transfer or internationally issued credit card

- By cheque

For a complete guide on filing the UHT return and paying the tax, go to: canada.ca/cra-uht.