Factsheet: The Underused Housing Tax (UHT) - Who is exempt from paying the tax?

If you’re an affected owner you must file a UHT return for that calendar year. You must also pay the tax unless you qualify for an exemption. Learn more about exemptions with this factsheet.

Factsheet description

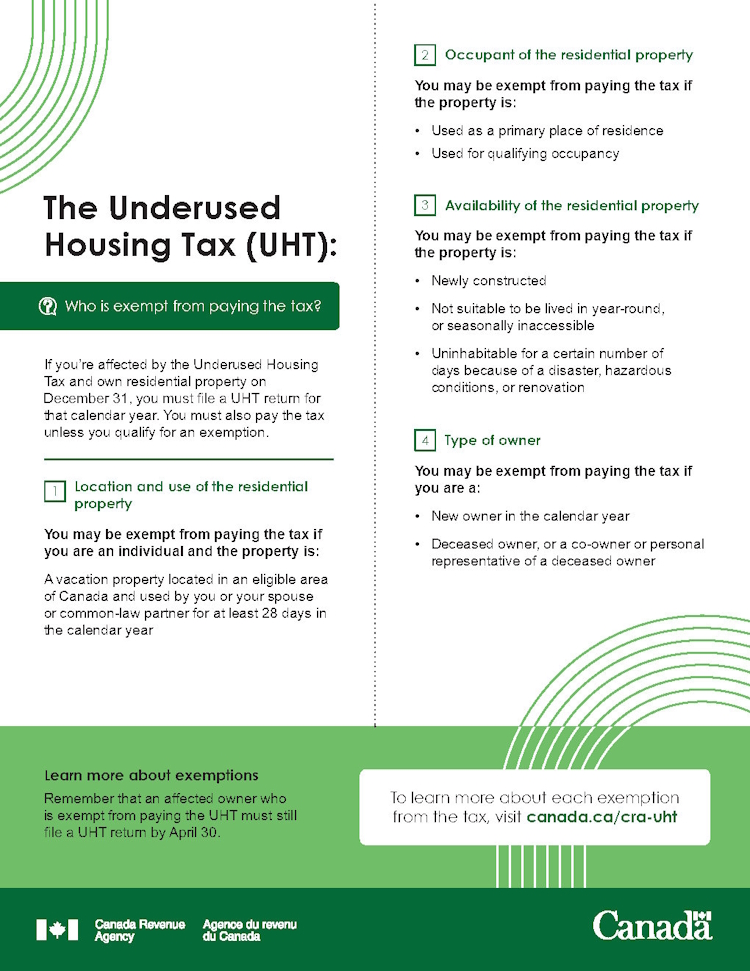

The Underused Housing Tax (UHT): Who is exempt from paying the tax?

If you’re affected by the Underused Housing Tax and own residential property on December 31, you must file a UHT return for that calendar year. You must also pay the tax unless you qualify for an exemption:

1) Location and use of the residential property

You may be exempt from paying the tax if you are an individual and the property is:

- A vacation property located in an eligible area of Canada and used by you or your spouse or common-law partner for at least 28 days in the calendar year

2) Occupant of the residential property

You may be exempt from paying the tax if the property is:

- Used as a primary place of residence

- Used for qualifying occupancy

3) Availability of the residential property

You may be exempt from paying the tax if the property is:

- Newly constructed

- Not suitable to be lived in year-round, or seasonally inaccessible

- Uninhabitable for a certain number of days because of a disaster, hazardous conditions, or renovation

4) Type of owner

You may be exempt from paying the tax if you are a:

- New owner in the calendar year

- Deceased owner, or a co-owner or personal representative of a deceased owner

Learn more about exemptions

Remember that an affected owner who is exempt from paying the UHT must still file a UHT return by April 30.

To learn more about each exemptions from the tax, visit: canada.ca/cra-uht.