Annual Report for the 2023 to 2024 Fiscal Year: Federal Regulatory Management Initiatives

On this page

- Message from the President of the Treasury Board

- Introduction

- Types of federal regulations

- Section 1: benefits and costs of regulations

- Section 2: implementation of the one-for-one rule

- Section 3: update on the Administrative Burden Baseline

- Section 4: regulatory modernization

- Appendix A: detailed report on cost-benefit analyses for the 2023–24 fiscal year

- Appendix B: detailed report on the one-for-one rule for the 2023–24 fiscal year

- Appendix C: administrative burden count

Message from the President of the Treasury Board

President of the Treasury Board

The President of the Treasury Board plays a key role in federal regulatory policy and oversight. As such, I am presenting this annual report on federal regulatory management initiatives.

This report highlights the government’s work to ensure that Canada’s regulatory system serves Canadians and Canadian businesses. In doing so, we are supporting our country’s economic growth while maintaining world-class protections for consumers, health, safety and the environment.

Canada’s ambitious regulatory modernization agenda continues to produce results that benefit all Canadians and solidify Canada as the very best place in the world for businesses to invest. Information on key modernization initiatives, such as the analysis of benefits and costs in federal regulations, the Red Tape Reduction Act’s one-for-one rule, and the Administrative Burden Baseline, is available in this report.

This year, the government engaged with diverse communities and businesses across the country to gather insights on the operations of the regulatory system. Using our interactive engagement platform, Let’s Talk Federal Regulations, we held consultations to obtain Canadians’ input on how the government is keeping pace with change and to gain insights on how we can make our supply chains more efficient and resilient.

The External Advisory Committee on Regulatory Competitiveness continued to bring together business leaders, academics, and civil society representatives to advise the Treasury Board. In its final advice letter, the committee made a strong statement on pursuing regulatory excellence by reducing unnecessary burdens on Canadians and Canadian businesses, while maintaining strong protections.

In keeping with our commitment to regulatory excellence and reducing burden, in March 2024, I launched a series of roundtables with Canadian and American businesses and organizations to better understand Canada-U.S. cross-border regulatory issues and identify opportunities to work with the United States through the Regulatory Cooperation Council.

Bill S-6, an Act respecting regulatory modernization, continued to progress through Parliament. The Bill will help create a more flexible regulatory system by enabling common-sense changes such as removing redundant regulatory provisions, simplifying regulatory processes, and promoting cross-border trade through more consistent and coherent rules across governments.

In Budget 2024, we committed to continue working on broadening the use of regulatory sandboxes across government, including introducing amendments to the Red Tape Reduction Act, to enable innovation. Broader use of regulatory sandboxes will help enable progress and experimentation without compromising safety.

I invite you to read this year’s report to learn more about the regulatory system and the ongoing work to modernize regulations so we can create more good jobs for Canadians and support a thriving business sector.

Original signed by

The Honourable Anita Anand, P.C., M.P.

President of the Treasury Board

Introduction

This is the eighth annual report on federal regulatory management initiatives. This report is part of regular monitoring of certain aspects of Canada’s regulatory system.

This year’s report has four main sections:

- Section 1 describes the benefits and costs of regulations that were made by the Governor in Council and that have a significantFootnote 1 cost impact

- Section 2 reports on the implementation of the one-for-one rule, fulfilling the Red Tape Reduction Act reporting requirement

- Section 3 sets out the Administrative Burden Baseline for 2023 and for previous years, providing a count of administrative requirements in federal regulations

- Section 4 provides an update on regulatory modernization initiatives underway

The regulations reported on in this document were published in the Canada Gazette, Part II, in the 2023–24 fiscal year, which covers the period from April 1, 2023, to March 31, 2024.

Types of federal regulations

Regulations are a type of law intended to change behaviours and achieve public policy objectives. They have legally binding effect and support a broad range of objectives, such as:

- health and safety

- security

- culture and heritage

- a strong and equitable economy

- the environment

Regulations are made by every order of government in Canada in accordance with responsibilities set out in the Constitution Act. Federal regulations deal with areas of federal jurisdiction, such as Employment Insurance, issuance of coins and currency, and management of fisheries and oceans.

The Cabinet Directive on Regulation is the policy instrument that governs the federal regulatory system. There are three principal categories of federal regulations. Each is based on where the authority to make regulations lies as determined by Parliament when it enacts the enabling legislation:

- Governor in Council (GIC) regulations are reviewed by a group of ministers who recommend approval to the Governor General. This role is performed by the Treasury Board.

- Ministerial regulations are made by a minister who is given the authority to do so by Parliament; considerations such as impact, permanence and scope of the measures are taken into account when providing these authorities.

- Example: Section 204(9)(d) of the Criminal Code authorizes the Minister of Agriculture and Agri-Food to make regulations respecting the prohibition, restriction or regulation of the administering of drugs or medications to horses participating in races that use a pari-mutuel system of betting.

- Regulations made by an agency, tribunal or other entity that has been given the authority by law to do so in a given area, and that do not require the approval of the GIC or a minister.

- Example: Subsection 10(1) of the Broadcasting Act authorizes the Canadian Radio-television and Telecommunications Commission to make regulations prescribing what constitutes a Canadian program for the purposes of the Act.

Section 1: benefits and costs of regulations

In this section

What is cost-benefit analysis?

In the regulatory context, cost-benefit analysis (CBA) is a structured approach to identifying and considering the economic, environmental and social effects of a regulatory proposal. CBA identifies and measures the positive and negative impacts of a regulatory proposal and any feasible alternative options so that decision makers can determine the best course of action. CBA monetizes, quantifies and qualitatively analyzes the direct and indirect costs and benefits of the regulatory proposal to determine the proposal’s overall benefit.

Since 1986, the Government of Canada has required that a CBA be done for most regulatory proposals in order to assess their potential impact on areas such as:

- the environment

- workers

- businesses

- consumers

- other sectors of society

The results of the CBA are summarized in a Regulatory Impact Analysis Statement (RIAS), which is published with proposed regulations in the Canada Gazette, Part I. The RIAS enables the public to:

- review the analysis

- provide comments to regulators before final consideration by the GIC and subsequent publication of approved final regulations in the Canada Gazette, Part II

Analytical requirements

The analytical requirements for CBA as part of a RIAS are set out in the Policy on Cost-Benefit Analysis, which was introduced on September 1, 2018, in support of the Cabinet Directive on Regulation. The policy requires both robust analysis and public transparency, including:

- reporting stakeholder consultations on CBA in the RIAS

- making the CBA available publicly

Regulatory proposals are categorized according to their expected level of impact, which is determined by the anticipated cost of the proposal:

- no-cost-impact regulatory proposals: proposals that have no identified costs

- low-cost-impact regulatory proposals: proposals that have average annual national costs of less than $1 million

- significant-cost-impact regulatory proposals: proposals that have $1 million or more in average annual national costs

The level of impact determines the degree of analysis and assessment that is required for a given regulatory proposal. This proportionate approach is consistent with regulatory best practices set out by the Organisation for Economic Co-operation and Development (OECD). Table 1 shows the minimum analytical requirements for each level of impact.

| Impact level | Description of costs | Description of benefits |

|---|---|---|

| None | Qualitative statement that there are no anticipated costs | Qualitative |

| Low | Qualitative | Qualitative |

| Significant | Qualitative, quantified and monetized (if data are readily available) |

Qualitative, quantified and monetized (if data are readily available) |

In this report, information on CBA covers GIC regulations only since they are subject to a formal challenge function and collective decision-making by Treasury Board, Part B. The information is limited to regulatory proposals that have a significant cost impact; since these proposals require that the majority of benefits and costs be monetized, the overall net impact can be described in economic terms more clearly than proposals that have low or no costs, which rely more on qualitative or quantified analysis. These three types of analysis are described in detail in this section.

Figures in this section are taken from the RIASs for regulations published in the Canada Gazette, Part II, in the 2023–24 fiscal year. To remove the effect of inflation, figures are expressed in 2023 dollars and, therefore, some vary from those published in the RIASs. This approach permits meaningful and consistent comparison of figures, regardless of the year in which regulatory impacts were originally measured.

Overview of benefits and costs of regulations

In the 2023–24 fiscal year, a total of 277 regulations were published in the Canada Gazette, Part II, the same number that were published in the 2022–23 fiscal year. Of these 277 regulations in 2023–24:

- 184 were GIC regulations (66.4% of all regulations)

- 93 were non-GIC regulations, that is, regulations made by a minister or an independent regulatory authority (33.6% of all regulations)

Of the 184 GIC regulations (compared with 191 in the 2022–23 fiscal year):

- 160 had no cost impact or low-cost impact (87.0% of GIC regulations)

- 24 had significant cost impact (13.0% of GIC regulations)

Figure 1 provides an overview of regulations approved and published in the 2023–24 fiscal year.

Figure 1 - Text version

Figure 1 provides an overview of the regulations published in the 2023-24 fiscal year.

During this period, 93 non-Governor in Council regulations were published, and 184 Governor in Council regulations were published.

Of the 184 Governor in Council regulations, 160 were no-cost-impact or low-cost-impact regulations, and 24 were significant-cost-impact regulations.

Of the 24 significant-cost-impact regulations, 16 included monetized costs and benefits, 8 included monetized costs only, and 0 did not include monetized costs or benefits.Qualitative benefits and costs

The most basic element of any analysis of costs and benefits is a description of the expected impacts of the regulatory proposal. This description is based on a qualitative analysis and is used to:

- provide decision makers with an evidence-based understanding of the anticipated impacts of the regulation

- provide context for further analysis that is expressed in numerical or monetary terms

Qualitative analysis should be part of the CBA of all regulatory proposals, including those that have no cost impact or low-cost impact. Most proposals that have no cost impact or low-cost impact are based entirely or almost entirely on qualitative analysis; low-cost-impact proposals include information on both benefits and costs, and those that have no cost impacts would describe only the anticipated benefits.

The following are examples of qualitative impacts identified in significant-cost-impact regulations in the 2023–24 fiscal year:

- The Regulations Amending Certain Regulations Made Under the Canada Labour Code (Menstrual Products) (SOR/2023-78) ensure that menstruating employees in federally regulated workplaces have access to clean and hygienic menstrual products at all times while working in the workplace controlled by the employer. Unrestricted access to menstrual products would better protect the physical and psychological health and safety risks for menstruating employees.

- The Regulations Amending the Canada Student Financial Assistance Regulations (SOR/2023-157) increase the amounts of available Canada Student Grants and Canada Student Loans, while also removing barriers to accessing available financial assistance faced by first-time Student Financial Assistance applicants aged 22 or older, by waiving the requirement for them to pass a credit screening. Through increasing post-secondary educational attainment, more university and college graduates will be able to experience the relatively lower unemployment rates associated with post-secondary education credentials compared to individuals with high school diplomas or less. Participation in adult education and training will allow for higher employment rates and greater labour market participation.

- The Regulations Amending the Transportation of Dangerous Goods Regulations (Site Registration Requirements) (SOR/2023-206) introduce new requirements for people involved in dangerous goods activities that are subject to these Regulations to:

- register their sites in a new online registration database administered by Transport Canada

- provide data related to their dangerous goods activities at those sites

Quantitative benefits and costs

Quantitative benefits and costs are those that are expressed as a quantity, for example:

- the number of recipients of a benefit

- the percentage reduction in pollution

- the amount of time saved

As is the case with qualitative information, quantitative benefits and costs can be used in two ways:

- on their own, they can illustrate the expected magnitude of a proposal by providing measurable figures to decision makers

- they can be used as a factor in developing cost estimates

Quantitative analysis is an element of nearly all regulatory proposals that have a significant cost impact. Such analysis provides key metrics on the frequency or number of instances of an activity and is essential for estimating benefits and costs. Quantitative analysis can also be used on its own to illustrate the overall impact of a proposal in non-monetary terms. Although quantitative analysis is not required for proposals that have no cost impact or low-cost impact, it is often included alongside qualitative information because it can be useful to decision makers.

The following are examples of quantified benefits and costs identified in significant-cost-impact regulations that were finalized in the 2023–24 fiscal year:

- The Regulations Amending the Immigration and Refugee Protection Regulations (Electronic Travel Authorization) (SOR/2023-106) extends Electronic Travel Authorization (eTA) eligibility to 13 countries whose nationals previously required a visa to enter Canada. This change will reduce the workload for visa officers by replacing temporary resident visa processing of these travellers with eTA processing, which is automated and less labour intensive. It is estimated that, over the analysis period, 795,392 applications that would have been visa applications in the absence of the regulatory amendments will become eTA applications. This change will allow officers to focus on complex applications rather than spending time on low-risk files, improving the efficiency of the process.

- The Regulations Amending the Canada Student Loans Regulations and the Canada Student Financial Assistance Regulations (SOR/2023-227) are expected to incentivize a greater number of family physicians, nurses and nurse practitioners to work and remain in rural and remote communities. It is anticipated that approximately 3,000 Canada Student Loan borrowers will benefit in the first year of implementation (2023–24) and up to 8,000 per year by 2032–33. The 50% increase in loan forgiveness is expected to attract 1,196 doctors and 4,001 nurses over a 10-year period.

- The Regulations Amending the Output-Based Pricing System Regulations and the Environmental Violations Administrative Monetary Penalties Regulations (SOR/2023-240) were developed as an integrated package with the Order Amending Schedule 4 to the Greenhouse Gas Pollution Pricing Act (SOR/2022-211) to ensure that the output-based pricing system would continue to meet its objective of creating an incentive for covered facilities to reduce emissions per unit of output while mitigating competitiveness impacts and carbon leakage risks. The set of amendments included an increasing excess emissions charge up to $170 per tonne of CO2e in 2030, the introduction of tightening rates on output-based standards, and new and updated output-based standards. Between 2023 and 2032, the cumulative greenhouse gas emissions reductions attributable to the set of amendments are estimated to be 3.3 million tonnes (megatonnes, or Mt) of CO2e.

Monetized benefits and costs

Monetized benefits and costs are those that are expressed in a currency amount, such as dollars, using an approach that considers both the value of an impact and when it occurs.Footnote 2

An analysis of monetized costs and benefits is required for all regulatory proposals that have a significant cost impact. If the benefits or costs cannot be monetized, a rigorous qualitative analysis of the costs or benefits of the proposed regulation is required, and the Treasury Board of Canada Secretariat (TBS) must be satisfied that there are legitimate obstacles to monetizing the impacts. In practice, most regulatory proposals that have significant cost impacts include both monetized benefits and costs as part of the analysis.

For costs and benefits to be considered monetized, the dollar values used in a CBA are adjusted so that values and prices that occur at different times are:

- equal to their exchange value (inflation adjustment)

- equal when they occur (discounting)

All of the 24 regulations that have significant cost impacts that were finalized in the 2023–24 fiscal year had monetized impacts, representing 13% of GIC regulations. For descriptions of detailed benefits and costs by regulation, see Appendix A.

Of the 24 regulations that have significant cost impacts:

- 16 had monetized benefits and costs

- 8 had monetized costs only

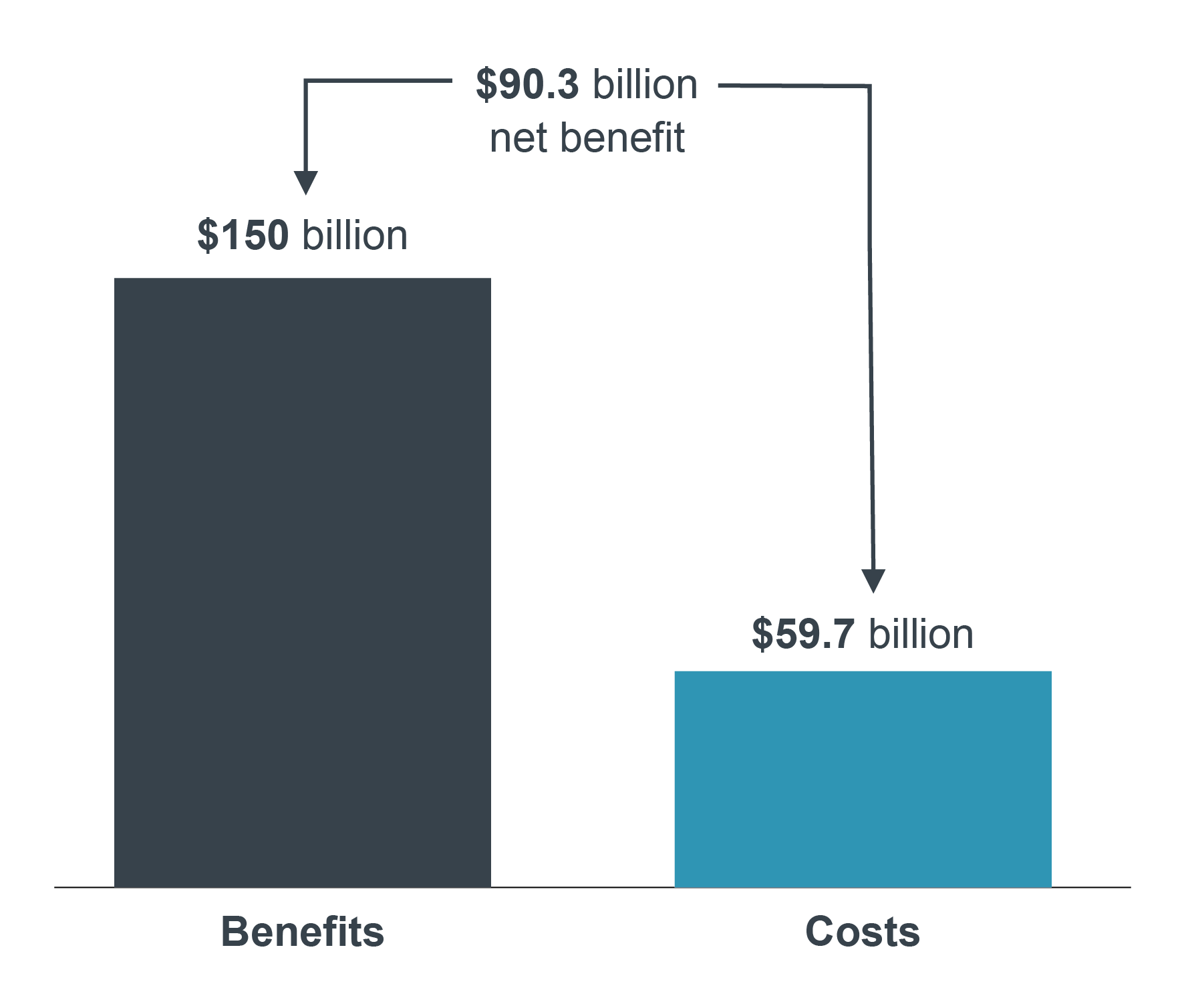

For the 16 regulations that have significant cost impacts that had monetized estimates of both benefits and costs, expressed as total present value (see Figure 2):Footnote 3

- total benefits were $149,932,765,102

- total costs were $59,651,740,033

- net benefits were $90,281,025,069

Figure 2 - Text version

Figure 2 depicts the benefits and costs of significant-cost-impact regulations published in the 2023-24 fiscal year.

The benefits associated with significant-cost-impact regulations totalled $150.0 billion.

The costs associated with significant-cost-impact regulations totalled $59.7 billion.

The difference between the benefits and the costs is a net benefit of $90.3 billion.The following three significant-cost-impact regulatory proposals had the greatest net benefit of all proposals that were finalized in the 2023–24 fiscal year and that had monetized benefits and costs:

- The Regulations Amending the Passenger Automobile and Light Truck Greenhouse Gas Emission Regulations (SOR/2023-275) require that a specified percentage of manufacturers’ and importers’ fleets of new light-duty vehicles offered for sale in Canada are zero-emission vehicles; these sales targets will begin with model year 2026 and reach full stringency by model year 2035. The amendments also modify flexibilities and fix provisions related to the pre-2026 model year fleet average greenhouse gas emission standards. It is estimated that the amendments will generate monetized net benefits of $81,710,702,381 between 2024 and 2050.

- The Regulations Amending the Immigration and Refugee Protection Regulations (Electronic Travel Authorization) (SOR/2024-34) are intended to facilitate the legitimate travel of Mexican nationals to and through Canada while maintaining the integrity of Canada’s immigration and asylum systems. The amendments remove Mexico from the schedule of countries and territories whose nationals are exempt from the temporary resident visa requirement for travel to Canada under the Regulations. The amendments also add Mexico to the list of countries and territories whose nationals may be eligible to travel to Canada on an eTA if they are travelling by air and have held a Canadian temporary resident visa in the last 10 years or hold a valid US non-immigrant visa. It is estimated that the amendments will generate monetized net benefits of $5,558,491,850 between 2024 and 2033.

- The Regulations Amending Certain Regulations Administered and Enforced by the Canada Border Services Agency (SOR/2024-41) and the Financial Security (Electronic Means) Regulations (SOR/2024-42) introduce a modernized way for the Canada Border Services Agency (CBSA) and various trade chain partners to communicate and interact with each other, simplifying and standardizing billing cycles, and protecting import revenues. The regulatory amendments and new regulations benefit businesses by:

- eliminating paper processes for commercial registration and enrolment programs

- replacing paper-based accounting processes with electronic versions, thereby reducing the costs for trade chain partners to visit a CBSA office in person

- allowing correction of errors prior to a payment due date, thereby reducing the need for additional processes to make adjustments and facilitate the payment or return of incorrectly assessed duties and interest

- allowing customs brokers to move more of their operations to an electronic format, thereby removing the obligation to work only with a CBSA office for which they have been authorized

The purpose of CBA is to determine whether the expected benefits of a proposal are greater than the expected costs. This determination, however, is not based entirely on monetized benefits and costs. CBAs frequently include quantitative and qualitative analysis, in addition to monetized analysis, and the overall analysis must consider this broader range of evidence. In the 2023–24 fiscal year:

- One regulationFootnote 5 with a significant cost impact had monetized costs that were greater than monetized benefits, which typically indicates that some benefits, such as broader societal benefits, could not be monetized and were stated qualitatively alongside benefits that were monetized.

- Similarly, one regulationFootnote 6 with a significant cost impact had monetized costs that were equal to monetized benefits. This result is sometimes associated with a direct transfer from one party to another, although in this case there were broader economic benefits stated qualitatively, which supplemented the monetized benefits and costs.

For detailed benefits and costs by regulation, see Appendix A.

Section 2: implementation of the one-for-one rule

The one-for-one rule

To comply with the annual reporting requirements of the Red Tape Reduction Act, this report also provides an update on the implementation of the one-for-one rule.

The one-for-one rule, which was instituted in the 2012–13 fiscal year, seeks to control the administrative burden that regulations impose on businesses.

Administrative burden includes:

- planning, collecting, processing and reporting of information

- completing forms

- retaining data required by the federal government to comply with a regulation

Under the rule, when a new or amended regulation increases the administrative burden on businesses, the cost of this burden must be offset through other regulatory changes. The rule also requires that an existing regulation be repealed each time a new regulation imposes new administrative burden on business.

The rule applies to all regulatory changes made or approved by the GIC or a minister that impose new administrative burden on business, including those with low-cost impacts and significant cost impacts. Under the Red Tape Reduction Regulations, the Treasury Board can exempt three categories of regulations from the requirement to offset burden and regulatory titles:

- regulations related to tax or tax administration

- regulations where there is no discretion regarding what is to be included in the regulation (for example, treaty obligations or the implementation of a court decision)

- regulations made in response to emergency, unique or exceptional circumstances, including where compliance with the rule would compromise the Canadian economy, public health or safety

Regulators are required to monetize and report on:

- the change in administrative burden

- feedback from stakeholders and Canadians on regulators’ estimates of administrative burden costs or savings to business

- the number of regulations created or removed

The Red Tape Reduction Regulations require that dollar values used in estimating administrative burden be expressed in 2012 dollars and discounted to 2012 using a 7% discount rate. This requirement ensures that values and prices that occur at different times are equal in their exchange value (inflation adjustment) and when they occur (discounting). In this report, all figures related to the one-for-one rule are adjusted in this way to permit meaningful and consistent comparison of regulations, regardless of the fiscal year in which they were introduced.

In 2015, the Red Tape Reduction Act enshrined the existing policy requirement for the one-for-one rule in law. Section 9 of the Red Tape Reduction Act requires that the President of the Treasury Board prepare and make public an annual report on the application of the rule.

The Red Tape Reduction Regulations state that the following must be included in the annual report:

- a summary of the increases and decreases in the cost of administrative burden that results from regulatory changes that are made in accordance with section 5 of the Act within the 12-month period ending on March 31 of the year in which the report is made public

- the number of regulations that are amended or repealed as a result of regulatory changes that are made in accordance with section 5 of the Act within that 12-month period

Key findings on the implementation of the one-for-one rule

The main findings on changes in administrative burden and the overall number of regulations for the 2023–24 fiscal year are as follows:

- system-wide, the federal government remains in compliance with the requirement in the Red Tape Reduction Act to offset administrative burden and titles within 24 months

- $26,084,392 more in annual net administrative burden was removed in the 2023–24 fiscal year than was introduced; since the 2012–13 fiscal year, annual net burden has been reduced by approximately $81.9 millionFootnote 7

- 22 more regulatory titles were taken off the books than were added, with a total net reduction of 238 titles since the 2012–13 fiscal year

A detailed report on regulations that had implications under the one-for-one rule is in Appendix B.

Under the one-for-one rule, regulatory changes in the 2023–24 fiscal year resulted in the following increases and decreases in the cost of administrative burden on businesses:

- $8,372,235 of new burden introduced

- $34,456,627 of existing burden removed

- net decrease of $26,084,392 of burden

The rule allows individual portfolios 24 months to offset any new burden introduced. As well, portfolios are allowed to bank burden reductions for future offsets within that portfolio. As a result, some of the $8,372,235 of new burden introduced in the 2023–24 fiscal year was immediately offset by previously removed burden:

- $518,038 of new burden was offset immediately by previously removed burden

- $7,854,197 of new burden had not yet been offset as of March 31, 2024, but is within the 24-month reconciliation period

The changes introduced by the following three regulations represented the largest changes in administrative burden in the 2023–24 fiscal year:

- The Regulations Amending Certain Regulations Administered and Enforced by the Canada Border Services Agency (SOR/2024-41) and the Financial Security (Electronic Means) Regulations (SOR/2024-42) introduce an electronic system for trade chain partners to submit information to the CBSA. Once implemented,Footnote 8 the majority of paper forms will be eliminated, and many activities will be simplified for clients, resulting in a significant reduction in administrative burden on business. In addition, trade chain partners will no longer need to provide CBSA with copies of security agreements, and CBSA could request a copy by exception. These measures will result in an estimated net annual reduction of $34,378,200 of administrative burden on business.

- The Retail Payment Activities Regulations (SOR/2023-229) and the Retail Payment Activities Act introduce a new retail payment supervisory regime for payment service providers’ retail payment activities, such as payment processors and digital wallets. Payment service providers will experience new administrative requirements, namely that they prepare and submit reports to the Bank of Canada, as well as the costs to meet new operational risk management and safeguarding measures of end-user funds. The Regulations will result in an estimated annualized incremental increase of $7,771,887 in administrative burden on business.

- The Regulations Amending the Transportation of Dangerous Goods Regulations (Site Registration Requirements) (SOR/2023-206) introduce new requirements for persons involved in dangerous goods activities that are subject to these Regulations to register their sites in a new online registration database administered by Transport Canada, and to provide data related to their dangerous goods activities at those sites. It is estimated that the annualized additional administrative costs imposed would be $366,461 for all affected businesses.

Under the one-for-one rule, regulatory changes in the 2023–24 fiscal year resulted in the following increases and decreases in the stock of federal regulations:

- three new regulatory titles imposing administrative burden on business were introduced

- 14 regulatory titles were repealed

- 15 existing titles were repealed and replaced with four new titles

Although seven new titles were introduced over the course of the year, the rule allows individual portfolios 24 months to offset these titles. As is the case with administrative burden, portfolios are allowed to bank title repeals for future offsets within the portfolio. As a result, all but one of these new titles have already been offset:

- six were offset immediately by previously removed titles

- one was not yet offset as of March 31, 2024, but is within the 24-month reconciliation period

The Treasury Board is responsible for ensuring compliance with the one-for-one rule across government and for addressing situations of non-compliance. System-wide, the federal government remains in compliance with the requirement in the Red Tape Reduction Act to offset new administrative burden and titles within 24 months.

TBS supports the Treasury Board in its oversight function by tracking offsetting requirements by portfolio. During the 2023–24 fiscal year, the Natural Resources portfolio was briefly out of compliance in relation to two regulatory titles that exceeded the 24-month offset period. Before the end of the fiscal year, the portfolio achieved the required offsets by repealing existing regulatory titles:

- The Canada–Newfoundland and Labrador Offshore Area Occupational Health and Safety Regulations (SOR/2021-247) were published on December 13, 2021, and were offset by the repeal of the Newfoundland Offshore Area Oil and Gas Operations Regulations (SOR/88-347) on February 19, 2024.

- The Canada–Nova Scotia Offshore Area Occupational Health and Safety Regulations (SOR/2021-248) were published on December 13, 2021, and were offset by the repeal of the Newfoundland Offshore Certificate of Fitness Regulations (SOR/95-100) on February 19, 2024.

Fisheries and Oceans Canada has had a negative balance of administrative burden and regulatory titles that has been referenced in previous reports since 2017. This balance currently stands at $184,893 of administrative burden and one regulatory title, relating to the following regulations:

- $23,190 overdue since June 28, 2017, related to the Aquaculture Activities Regulations (SOR/2015-177), which introduced $409,513 in administrative burden on business, of which the department has already offset $386,323

- $738 overdue since June 21, 2020, related to the Regulations Amending the Marine Mammal Regulations (SOR/2018-126)

- $173 overdue since February 24, 2021, related to the Banc-des-Américains Marine Protected Area Regulations (SOR/2019-50)

- $232 overdue since August 7, 2021, related to the Authorizations Concerning Fish and Fish Habitat Protection Regulations (SOR/2019-286); this regulation also introduced one new regulatory title that has not yet been offset and is also past due as of August 7, 2021

- $160,560 overdue since November 23, 2022, related to the Regulations Amending the Atlantic Fisheries Regulations, 1985 and the Maritime Provinces Fishery Regulations (SOR/2020-246)

Officials from TBS and Fisheries and Oceans Canada continue to work together to identify opportunities to achieve these outstanding offsets.

In the 2023–24 fiscal year, the Treasury Board approved the exemption of 32 regulations from the requirement to offset burden and titles:

- one was related to tax and tax administration

- one was related to non-discretionary obligations

- 30 were related to emergency, unique or exceptional circumstances

The total number of exemptions in 2023–24 is significantly lower than the 2022–23 total of 55, although it is still comparatively higher relative to previous years, as is the proportion of exemptions that cite emergency, unique or exceptional circumstances relative to the two other categories. This situation is a result of the volume of regulations that impose sanctions associated with several ongoing international conflicts, including the Russian invasion of Ukraine; these regulations typically cited “emergency circumstances” to justify exemption from the requirement to offset new administrative burden introduced.

Figure 3: overview of the implementation of the one-for-one rule for regulations published in the 2023–24 fiscal year

22

fewer regulations in the regulatory stock

- 7 regulations added

- 29 regulations repealed

32

exemptions to the one-for-one rule

- 1 exemptions for tax or tax administration

- 1 non-discretionary obligations

- 30 emergency, unique or exceptional circumstances

$26,084,392

net decrease in administrative burden costs

- 15 regulations increased burden by $8,372,235

- 8 regulations decreased burden by $34,456,627

Section 3: update on the Administrative Burden Baseline

In this section

The Administrative Burden Baseline

The Administrative Burden Baseline (ABB) provides Canadians with a count of the total number of administrative requirements on businesses in all federal regulations (GIC, ministerial and independent regulatory authorities) and associated forms.

For the purposes of the ABB, an administrative requirement is a compulsion, obligation, demand or prohibition placed on a business, its activities or its operations through a GIC or non-GIC regulation. A requirement may also be thought of as any obligation that a business must satisfy to avoid penalties or delays. Regulatory requirements generally use directive words or phrases such as “shall,” “must” and “is to,” and the ABB counts these references in the regulatory text or other documents such as forms or program materials that explain obligations of the regulated party.

The ABB does not consider the costs that businesses incur when fulfilling administrative requirements; the cost impacts of these requirements are instead calculated as part of the CBA and one-for-one rule analysis in individual regulatory proposals. As a result, an increase or decrease in the ABB count does not necessarily indicate a change in the overall burden on business.

The ABB was first publicly reported on in September 2014, providing a baseline count of administrative requirements by regulator. Since then, regulators continue to:

- count their administrative requirements occurring from July 1 to June 30 each year

- publicly post updates to their ABB count by September 30 each year

Key findings on the Administrative Burden Baseline

The baseline provides Canadians with information on 39 regulators that are responsible for GIC and non-GIC regulations that were identified as containing administrative requirements on business when the ABB was initiated in 2014.Footnote 9

As of June 30, 2023:

- the total number of administrative requirements was 149,401, an increase of 631 (or 0.42%) from the 2022 count of 148,770

- there were 605 regulations identified by regulators as having administrative requirements, an increase of 4 (or 0.67%) from the 2022 figure of 601; for reference, there are approximately 3,000 federal regulations currently in place

- the average number of administrative requirements per regulation was 246.9, a decrease of 0.6 (or 0.24%) from the 2022 average of 247.5

The top three changes in the ABB in 2023 were:

- The Canadian Food Inspection Agency’s count decreased by 620 requirements. This reduction results from several measures, including modernizing the regulatory framework for hatcheries and introducing an outcome-based approach that provides producers with flexibility to develop personalized plans to meet regulatory requirements. Other reductions related to:

- the replacement and revision of forms that reduced administrative burden

- the removal from the count of 432 requirements related to a list of invasive aquatic species that ultimately did not include administrative requirements

- Health Canada’s count increased by 555 requirements, due primarily to the introduction of the Vaping Products Reporting Regulations, which provide Health Canada with information related to vaping products.

- The Canada Energy Regulator’s count increased by 468 requirements as a result of updates to the web-based Online Event Reporting System (OERS), which is an interactive reporting system that provides companies with greater clarity and efficiency in reporting and provides a single window for reporting of events to the Canada Energy Regulator and the Transportation Safety Board. Four new online reporting forms were introduced, and an Incident Reporting form was updated to clarify the information required. The 333 requirements in these reporting forms should have been part of the 2022 count and are now included in this update. Other increases are found in the Incident Reporting form, which was updated to clarify the information required.

A detailed summary of the ABB count for 2023 and for previous years can be found in Appendix C.

Section 4: regulatory modernization

In this section

Regulatory modernization initiatives enhance economic growth by creating a more attractive business environment and encourage innovation by promoting partnership between regulators and Canadians to support new ideas and approaches for improving regulations. This year, the government launched several regulatory modernization initiatives to promote efficiency and streamline processes. Transparent and responsive engagement with stakeholders through regulatory reviews, consultations and cooperation initiatives advance regulations that are fit for purpose to make the system work better for the benefit of Canadians and Canadian businesses.

Working with partners domestically and internationally to reduce barriers to trade

The Government of Canada works with provinces, territories, foreign jurisdictions such as the United States, and international organizations such as the OECD. This cooperative work aims to reduce unnecessary regulatory barriers to trade and competitiveness while continuing to protect the health and safety of citizens and the environment.

TBS was active this year in facilitating regulatory cooperation and alignment domestically and internationally through its leadership in the Government of Canada’s three formal regulatory cooperation committees:

- the Canada-European Union Regulatory Cooperation Forum

- the Canadian Free Trade Agreement’s Regulatory Reconciliation and Cooperation Table

- the Canada-United States Regulatory Cooperation Council

In November 2023, Canada and the European Union launched the Green Alliance and the Digital Partnership to establish frameworks for voluntary bilateral cooperation in combatting climate change and deepening digital engagement. Both agreements recognized the importance of regulatory cooperation and identified the Regulatory Cooperation Forum as a mechanism to support shared priorities.

Following the conclusion of the Regulatory Reconciliation and Cooperation Table’s five-year review, the committee made progress in implementing the review’s recommendations. This work included enhanced reporting on implementation and strengthening transparency and communications with stakeholders.

In March 2024, the President of the Treasury Board launched a series of roundtables across Canada to discuss Canada-US regulatory cooperation with Canadian business leaders, industry representatives and associations. Issues surfaced through these discussions are informing ongoing work to chart a path forward for the Canada–United States Regulatory Cooperation Council, which promotes economic growth, job creation, and benefits to consumers and businesses.

Annual Regulatory Modernization Bill

The second Annual Regulatory Modernization Bill (ARMB) continued to move through the parliamentary process and Bill S-6, An Act respecting regulatory modernization, was introduced in the House of Commons following Senate review. The amendments stemming from Bill S-6 will help:

- reduce the administrative burden for business

- facilitate digital interactions with government

- simplify regulatory processes

- make exemptions from certain regulatory requirements to test new products

- make cross-border trade easier through more consistent and coherent rules across governments

The government has also been working to develop the next iteration of the ARMB. In spring 2023, TBS launched a consultation that invited stakeholders to:

-

Propose legislative amendments that could improve the regulatory system.

Responses from the consultation included over 40 specific recommendations from industry representatives supporting efforts to modernize the legislative and regulatory frameworks by:

- enabling the use of digital technologies

- harmonizing requirements across jurisdictions

- increasing flexibility and agility in the system

-

Provide feedback on the possibility of granting all federal regulators authority to set up regulatory sandboxes.

Regulatory sandboxes are tools that allow regulators to learn how to incorporate or best regulate innovation before making permanent regulatory changes. They allow for temporary, limited authorizations of innovation and must demonstrate how regulatory regimes could be modernized while continuing to uphold protections for health, safety and the environment. Evidence gathered in the regulatory sandbox can be used to support the regulatory life cycle, including helping to examine and analyze regulations through all stages. Most submissions were supportive of the proposed criteria to establish regulatory sandboxes and stressed the importance of having safeguards in place. Budget 2024 has since announced the government’s intention to enable broader use of regulatory sandboxes across government.

-

Provide feedback on the possibility of granting all federal regulators authority to incorporate by reference internal documents on an ambulatory basis.

Incorporation by reference allows a document (such as a policy document) that is not in the text of the regulations to be made a part of the regulations. With this mechanism, regulations can be automatically updated in response to changes in the referenced document. Comments were provided by 38 individuals and 25 organizations, including industry, some professional and public associations, and provincial organizations. Although most organizations supported the authority, most individuals did not. Those that were supportive noted that the authority was appropriate with proper safeguards in place.

TBS published a summary of the feedback received from the consultation in the What We Heard Report Consultation on the Annual Regulatory Modernization Bill: Keeping Pace With Change.

Targeted regulatory reviews

TBS advanced work over the year on two regulatory reviews aimed at supporting economic growth and innovation: the Supply Chain Regulatory Review and the Blue Economy Regulatory Review. The Blue Economy Regulatory Review was led by Fisheries and Oceans Canada in collaboration with partner departments and TBS. The review explored regulatory and operational challenges and innovative approaches to seize emerging opportunities in the blue economy. TBS reviewed input received from partners and stakeholders and supported the development of the Blue Economy Regulatory Roadmap, published by Fisheries and Oceans Canada in June 2024.

In November 2023, as part of the Supply Chain Regulatory Review, TBS launched a public consultation through the Let’s Talk Federal Regulations platform on regulatory opportunities to improve the efficiency and resiliency of Canada’s supply chains. The consultation sought feedback on supply chain issues, with a particular focus on critical minerals, transportation and border operations. The consultation closed in February 2024, with hundreds of ideas and recommendations provided by partners and stakeholders.

TBS also reported on previous regulatory reviews during the year. In November 2023, TBS published a progress report to provide stakeholders with updates on commitments from earlier reviews. The report:

- included reviews focused on health and biosciences, transportation, and other sectors

- highlighted that almost 40% of the more than 100 initiatives put forward by departments and agencies under earlier rounds of reviews were complete, with progress made to advance almost all other initiatives

Strengthening capacity to understand and drive innovation

The Centre for Regulatory Innovation assists federal regulators in addressing new challenges by adopting innovative regulatory methods. It embodies the government’s approach to regulatory modernization by providing tools, guidance and funding to enhance the regulatory environment, fostering innovation and economic growth.

This year, the Centre funded three pilot projects in two departments through the Regulatory Experimentation Expense Fund to explore new regulatory approaches. The supported projects are:

- a Health Canada project to develop tailored requirements for manufacturing personalized advanced therapeutic products at the point of care through a co-creation process

- an extension of a Transport Canada project to assess the use of light-sport aircraft in pilot training

- a second phase of a Transport Canada project to develop and evaluate the feasibility of electronic personnel licences for the aviation sector

Seven new projects were also approved through the Regulators’ Capacity Fund. These projects aim to identify regulatory barriers to innovation, trade and economic growth in specific sectors and to develop tools to modernize regulatory administration. The Regulators’ Capacity Fund supports projects across various sectors, including transportation, health, environment, agriculture and finance, to address these barriers and modernize regulatory practices.

In spring 2023, as part of the consultation on the ARMB, TBS sought public feedback on the proposal to provide all federal regulators the authority to set up regulatory sandboxes.

Striving for regulatory excellence

The renewed External Advisory Committee on Regulatory Competitiveness was launched in October 2022 to provide the President of the Treasury Board with external advice to advance system-wide regulatory excellence by promoting strong protections for the public while minimizing unnecessary burdens that can limit economic opportunity. With the support of TBS, the committee met 10 times between January 2023 and February 2024 to discuss:

- regulatory excellence

- stakeholder engagement

- consultation on the ARMB

- the United Nations Declaration on the Rights of Indigenous Peoples

- performance measurement

At their meetings, the committee heard perspectives from various sources such as:

- industry

- municipal, provincial and federal government departments

- international governments

- academics

The committee combined the insights gained from stakeholders, government and experts from other jurisdictions with their own knowledge and experiences to develop practical advice for advancing regulatory excellence in Canada.

In June 2023, the committee provided its first advice letter. The letter included five recommendations along three themes:

- making regulatory excellence a priority

- equipping regulators to be world-class

- modernizing regulatory engagement

Increasing engagement with stakeholders

Transparent and responsive engagement with Canadians is foundational to ensure that regulatory modernization benefits everyone. This year, TBS expanded the reach of the Inside Regulatory Affairs newsletter and issued three editions to approximately 500 stakeholders across Canada. The newsletter provides interested stakeholders with information on recent regulatory announcements and activities. Additionally, TBS used its dynamic engagement platform Let’s Talk Federal Regulations to lead two public consultations:

- The ARMB consultation closed in June 2023. A total of 69 stakeholders took part in this consultation, including 30 organizations and 39 individuals.

- The Supply Chain Regulatory Review consultation closed in February 2024. A total of 93 stakeholders took part in this consultation, including 86 organizations and seven individuals.

Now in the second year since its 2022 launch, the Let’s Talk Federal Regulations platform had approximately 23,000 unique visitors in 2023–24. This number marks significant growth of over 250% from the previous year.

Appendix A: detailed report on cost-benefit analyses for the 2023–24 fiscal year

Figures in this appendix are taken from the RIASs in final federal regulations published in the Canada Gazette, Part II, in the 2023–24 fiscal year. To permit meaningful and consistent comparison of regulations, regardless of the fiscal year in which they were introduced, figures are expressed in 2023 dollars and vary from those published in the RIASs.

Table A1 lists GIC regulations finalized in the 2023–24 fiscal year that had significant cost impacts and that included both monetized benefits and monetized costs. These regulations may also include quantitative and qualitative data from a CBA to supplement the monetized CBA.

| Department or agency | Regulation | Benefits (total present value) | Costs (total present value) | Net present value |

|---|---|---|---|---|

| Employment and Social Development Canada | Regulations Amending Certain Regulations Made Under the Canada Labour Code (Menstrual Products) (SOR/2023-78) | $93,413,042 | $148,148,930 | -$54,735,888 |

| Transport Canada | Regulations Amending the Canadian Aviation Regulations (Part I – 104, Aeronautical Product Approvals) (SOR/2023-99) | $37,056,073 | $24,974,018 | $12,082,055 |

| Immigration, Refugees and Citizenship Canada | Regulations Amending the Immigration and Refugee Protection Regulations (Electronic Travel Authorization) (SOR/2023-106) | $165,626,117 | $20,624,528 | $145,001,590 |

| Innovation, Science and Economic Development Canada | Rules Amending the Patent Rules (SOR/2023-113)

|

$322,702,442 | $72,373,508 | $250,328,934 |

| Employment and Social Development Canada | Regulations Amending the Canada Student Financial Assistance Regulations (SOR/2023-157) | $1,648,000,000 | $891,000,000 | $757,000,000 |

| Employment and Social Development Canada | Regulations Amending the Canada Student Loans Regulations and the Canada Student Financial Assistance Regulations (SOR/2023-227) | $22,600,000 | $22,600,000 | $0 |

| Environment and Climate Change Canada | Regulations Amending the Output-Based Pricing System Regulations and the Environmental Violations Administrative Monetary Penalties Regulations (SOR/2023-240) | $1,221,042,087 | $556,185,834 | $664,859,253 |

| Employment and Social Development Canada | Regulations Amending the Employment Insurance Regulations (Pilot Project No. 22) (SOR/2023-272) | $64,242,679 | $51,712,083 | $12,530,595 |

| Environment and Climate Change Canada | Regulations Amending the Passenger Automobile and Light Truck Greenhouse Gas Emission Regulations (SOR/2023-275) | $137,939,410,714 | $56,228,708,333 | $81,710,702,381 |

| Immigration, Refugees and Citizenship Canada | Regulations Amending the Immigration and Refugee Protection Regulations (Electronic Travel Authorization) (SOR/2024-34) | $6,560,786,672 | $1,002,294,822 | $5,558,491,850 |

| Canada Border Services Agency | Regulations Amending Certain Regulations Administered and Enforced by the Canada Border Services Agency (SOR/2024-41) | $1,857,885,275 | $633,120,977 | $1,224,764,299 |

| Totaltable A1 note * | $149,932,765,101 | $59,651,740,033 | $90,281,025,068 | |

Table A1 Notes

|

||||

Table A2 lists GIC regulations finalized in the 2023–24 fiscal year that had significant cost impacts and that included monetized costs but not monetized benefits. If it is not possible to quantify the benefits or costs of a proposal that has significant cost impacts, a rigorous qualitative analysis of costs or benefits of the proposed regulation is required, with the concurrence of TBS.

Appendix B: detailed report on the one-for-one rule for the 2023–24 fiscal year

| Department or agency | Regulation | Publication date | Net burden in | Net burden out |

|---|---|---|---|---|

| Environment and Climate Change Canada | Regulations Amending the Wildlife Area Regulations (SOR/2023-100) | June 7, 2023 | $0 | $42 |

| Health Canada | Regulations Amending the Pest Control Products Regulations (Exclusive Rights and Compensable Data) (SOR/2023-104) | June 7, 2023 | $7 | $0 |

| Department of Finance Canada | Order Amending the Ukraine Goods Remission Order (SOR/2023-121) | June 21, 2023 | $0 | $387 |

| Health Canada | Vaping Products Reporting Regulations (SOR/2023-123) | June 21, 2023 | $84,911 | $0 |

| Environment and Climate Change Canada | Order Amending Part 2 of Schedule 1 to the Greenhouse Gas Pollution Pricing Act (SOR/2023-148) | July 5, 2023 | $0 | $63,490 |

| Environment and Climate Change Canada | Regulations Amending the Migratory Birds Regulations, 2022 (SOR/2023-149) | July 5, 2023 | $0 | $138 |

| Department of Finance Canada | Regulations Amending Certain Regulations Made Under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (SOR/2023-193) | October 11, 2023 | $5,323 | $0 |

| Transport Canada | Regulations Amending the Transportation of Dangerous Goods Regulations (Site Registration Requirements) (SOR/2023-206) | October 25, 2023 | $366,461 | $0 |

| Department of Finance Canada | Retail Payment Activities Regulations (SOR/2023-229) | November 22, 2023 | $7,771,887 | $0 |

| Environment and Climate Change Canada | Regulations Amending the Output-Based Pricing System Regulations and the Environmental Violations Administrative Monetary Penalties Regulations (SOR/2023-240) | November 22, 2023 | $0 | $7,373 |

| Environment and Climate Change Canada | Regulations Amending the Wild Animal and Plant Trade Regulations (SOR/2023-241) | November 22, 2023 | $0 | $54 |

| Transport Canada | Vessel Construction and Equipment Regulations (SOR/2023-257) | December 20, 2023 | $0 | $3,169 |

| Environment and Climate Change Canada | Order Amending Schedule 1 to the Species at Risk Act (SOR/2023-263) | December 20, 2023 | $65,814 | $0 |

| Environment and Climate Change Canada | Regulations Amending the Passenger Automobile and Light Truck Greenhouse Gas Emissions Regulations (SOR/2023-275) | December 20, 2023 | $47,811 | $0 |

| Canadian Heritage | Online News Act Application and Exemption Regulations (SOR/2023-276) | January 3, 2024 | $801 | $0 |

| Health Canada | Regulations Amending the Medical Devices Regulations (Medical Devices for an Urgent Public Need) (SOR/2023-277) | January 3, 2024 | $0 | $1,901 |

| Canadian Food Inspection Agency | Regulations Repealing the Hatchery Exclusion Regulations (SOR/2024-20) | February 28, 2024 | $0 | $1,873 |

| Natural Resources Canada | Canada–Newfoundland and Labrador Offshore Area Petroleum Operations Framework Regulations (SOR/2024-25) | February 28, 2024 | $14,439 | $0 |

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Russia) Regulations (SOR/2024-39) | March 13, 2024 | $14,781 | $0 |

| Canada Border Services Agency | Regulations Amending Certain Regulations Administered and Enforced by the Canada Border Services Agency (SOR/2024-41) | March 13, 2024 | $0 | $22,011,238 |

| Canada Border Services Agency | Financial Security (Electronic Means) Regulations (SOR/2024-42) | March 13, 2024 | $0 | $12,366,962 |

| Total | $8,372,235 | $34,456,627 | ||

| Department or agency | Regulation | Net title change |

|---|---|---|

| New regulatory titles that have administrative burden | ||

| Health Canada | Vaping Products Reporting Regulations (SOR/2023-123) | 1 |

| Department of Finance Canada | Retail Payment Activities Regulations (SOR/2023-229) | 1 |

| Canadian Heritage | Online News Act Application and Exemption Regulations (SOR/2023-276) | 1 |

| Subtotal | 3 | |

| Repealed regulatory titles | ||

| Impact Assessment Agency of Canada | Regulations Amending and Repealing Certain Department of the Environment Regulations (Miscellaneous Program) (SOR/2023-60) repealed:

|

(10) |

| Health Canada | Regulations Amending the Tobacco Products Regulations (Plain and Standardized Appearance) (SOR/2023-97) repealed:

|

(2) |

| Canadian Food Inspection Agency | Regulations Repealing the Hatchery Exclusion Regulations (SOR/2024-20) repealed:

|

(1) |

| Transport Canada | Regulations Amending the Marine Safety Fees Regulations (Vessel Registry Fees) (SOR/2024-29) repealed:

|

(1) |

| Subtotal | (14) | |

| New regulatory titles that simultaneously repealed and replaced existing titles | ||

| Global Affairs Canada | Northwest Atlantic Fisheries Organization Privileges and Immunities Order, 2023 (SOR/2023-63) replaced:

|

(1) |

| Transport Canada | Vessel Construction and Equipment Regulations (SOR/2023-257) replaced:

|

(3) |

| Natural Resources Canada | Canada–Newfoundland and Labrador Offshore Area Petroleum Operations Framework Regulations (SOR/2024-25) replaced:

|

(4) |

| Natural Resources Canada | Canada–Nova Scotia Offshore Area Petroleum Operations Framework Regulations (SOR/2024-26) replaced:

|

(3) |

| Subtotal | (11) | |

| Total net impact on regulatory stock in the 2023–24 fiscal year | (22) | |

| Department or agency | Regulation | Publication date | Exemption type |

|---|---|---|---|

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Haiti) Regulations (SOR/2023-56) | April 12, 2023 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Iran) Regulations (SOR/2023-57) | April 12, 2023 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Belarus) Regulations (SOR/2023-71) | April 26, 2023 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Russia) Regulations (SOR/2023-72) | April 26, 2023 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Iran) Regulations (SOR/2023-81) | May 10, 2023 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Russia) Regulations (SOR/2023-92) | June 7, 2023 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Russia) Regulations (SOR/2023-93) | June 7, 2023 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Special Economic Measures (Moldova) Regulations (SOR/2023-109) | June 21, 2023 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Special Economic Measures (Moldova) Permit Authorization Order (SOR/2023-110) | June 21, 2023 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Ukraine) Regulations (SOR/2023-119) | June 21, 2023 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Haiti) Regulations (SOR/2023-126) | July 5, 2023 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Iran) Regulations (SOR/2023-127) | July 5, 2023 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Haiti) Regulations (SOR/2023-143) | July 5, 2023 | Emergency, unique or exceptional circumstance |

| Department of Finance Canada | Certain Russian Goods Remission Order (SOR/2023-160) | July 19, 2023 | Tax or tax administration |

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Russia) Regulations (SOR/2023-162) | August 2, 2023 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Russia) Regulations (SOR/2023-163) | August 2, 2023 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Russia) Regulations (SOR/2023-176) | August 16, 2023 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Iran) Regulations (SOR/2023-177) | August 16, 2023 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Belarus) Regulations (SOR/2023-178) | August 16, 2023 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Regulations Amending the Justice for Victims of Corrupt Foreign Officials Regulations (SOR/2023-179) | August 16, 2023 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Russia) Regulations (SOR/2023-184) | August 30, 2023 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Russia) Regulations (SOR/2023-185) | September 13, 2023 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Iran) Regulations (SOR/2023-189) | September 27, 2023 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Russia) Regulations (SOR/2023-191) | October 11, 2023 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Haiti) Regulations (SOR/2023-192) | October 11, 2023 | Emergency, unique or exceptional circumstance |

| Department of Finance Canada | Regulations Amending the Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations and the Proceeds of Crime (Money Laundering) and Terrorist Financing Administrative Monetary Penalties Regulations (SOR/2023-194) | October 11, 2023 | Non-discretionary obligations |

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Moldova) Regulations (SOR/2023-218) | October 25, 2023 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Regulations Amending the Regulations Implementing the United Nations Resolutions on Iran (SOR/2023-219) | November 8, 2023 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Iran) Regulations (SOR/2023-220) | November 8, 2023 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Burma) Regulations (SOR/2023-228) | November 8, 2023 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Russia) Regulations (SOR/2023-235) | November 22, 2023 | Emergency, unique or exceptional circumstance |

| Global Affairs Canada | Regulations Amending the Special Economic Measures (Russia) Regulations (SOR/2023-264) | December 20, 2023 | Emergency, unique or exceptional circumstance |

Appendix C: administrative burden count

| Department or agencytable C1 note 1 | 2014 (baseline count) | 2021 | 2022 | 2023 | ||||

|---|---|---|---|---|---|---|---|---|

| Requirements | Regulations | Requirements | Regulations | Requirements | Regulations | Requirements | Regulations | |

| Agriculture and Agri-Food Canada | 134 | 4 | 133 | 4 | 133 | 4 | 133 | 4 |

| Canada Border Services Agency | 1,426 | 30 | 1,284 | 31 | 1,284 | 31 | 1,284 | 31 |

| Canada Energy Regulator | 1,298 | 14 | 5,181 | 16 | 5,167 | 16 | 5,635 | 16 |

| Canada Revenue Agency | 1,776 | 30 | 1,824 | 31 | 1,824 | 31 | 1,824 | 31 |

| Canadian Dairy Commission | 4 | 2 | 4 | 2 | 4 | 2 | 4 | 2 |

| Canadian Food Inspection Agency | 10,989 | 34 | 5,174 | 11 | 5,508 | 11 | 4,888 | 10 |

| Canadian Grain Commission | 1,056 | 1 | 1,053 | 1 | 1,050 | 1 | 1,050 | 1 |

| Canadian Heritage | 797 | 3 | 684 | 3 | 678 | 3 | 678 | 3 |

| Canadian Intellectual Property Office | 569 | 6 | 592 | 5 | 592 | 5 | 592 | 5 |

| Canadian Nuclear Safety Commission | 8,169 | 10 | 6,993 | 10 | 6,993 | 10 | 6,630 | 10 |

| Canadian Pari-Mutuel Agency | 731 | 2 | 557 | 2 | 305 | 2 | 303 | 2 |

| Canadian Transportation Agency | 545 | 7 | 458 | 8 | 482 | 9 | 482 | 9 |

| Competition Bureau Canada | 444 | 3 | 444 | 3 | 444 | 3 | 444 | 3 |

| Copyright Board Canada | 16 | 1 | 17 | 1 | 17 | 1 | 17 | 1 |

| Crown-Indigenous Relations and Northern Affairs Canadatable C1 note 2 | 0 | 0 | 244 | 11 | 244 | 11 | 244 | 11 |

| Department of Finance Canada | 1,818 | 42 | 2,029 | 45 | 2,033 | 45 | 2,045 | 44 |

| Employment and Social Development Canada | 2,791 | 7 | 3,122 | 6 | 3,121 | 6 | 3,121 | 6 |

| Environment and Climate Change Canada | 9,985 | 53 | 16,852 | 56 | 15,093 | 55 | 15,270 | 58 |

| Farm Products Council of Canada | 47 | 3 | 47 | 3 | 47 | 3 | 47 | 3 |

| Fisheries and Oceans Canada | 5,350 | 30 | 5,370 | 30 | 5,370 | 30 | 5,370 | 30 |

| Global Affairs Canada | 2,809 | 55 | 3,149 | 67 | 3,149 | 67 | 3,180 | 72 |

| Health Canada | 15,649 | 95 | 20,526 | 40 | 20,479 | 35 | 21,034 | 36 |

| Immigration, Refugees and Citizenship Canada | 14 | 1 | 59 | 1 | 59 | 1 | 60 | 1 |

| Impact Assessment Agency of Canada | 89 | 1 | 325 | 2 | 325 | 2 | 325 | 2 |

| Indigenous and Northern Affairs Canadatable C1 note 2 | 288 | 12 | 0 | 0 | 0 | 0 | 0 | 0 |

| Indigenous Services Canadatable C1 note 2 | 0 | 0 | 148 | 1 | 148 | 1 | 148 | 1 |

| Innovation, Science and Economic Development Canada | 1,693 | 8 | 1,388 | 8 | 1,388 | 8 | 1,484 | 9 |

| Labour Program | 21,468 | 32 | 31,371 | 20 | 31,491 | 22 | 31,498 | 22 |

| Measurement Canada | 335 | 2 | 359 | 2 | 359 | 2 | 359 | 2 |

| Natural Resources Canada | 4,507 | 28 | 4,390 | 26 | 4,200 | 26 | 4,208 | 26 |

| Office of the Superintendent of Bankruptcy Canada | 799 | 4 | 799 | 3 | 799 | 3 | 791 | 3 |

| Office of the Superintendent of Financial Institutions Canada | 2,875 | 33 | 2,618 | 24 | 2,669 | 25 | 2,751 | 23 |

| Parks Canada | 773 | 25 | 773 | 25 | 767 | 25 | 830 | 25 |

| Patented Medicine Prices Review Board Canada | 59 | 1 | 63 | 2 | 63 | 2 | 63 | 1 |

| Public Health Agency of Canada | 42 | 2 | 189 | 2 | 189 | 2 | 189 | 2 |

| Public Safety Canada | 229 | 6 | 229 | 6 | 233 | 7 | 239 | 7 |

| Public Services and Procurement Canada | 388 | 1 | 498 | 1 | 507 | 1 | 507 | 1 |

| Statistics Canada | 157 | 1 | 157 | 1 | 157 | 1 | 157 | 1 |

| Transport Canada | 29,695 | 94 | 31,453 | 93 | 31,386 | 91 | 31,504 | 90 |

| Treasury Board of Canada Secretariat | 46 | 1 | 13 | 1 | 13 | 1 | 13 | 1 |

| Grand total | 129,860 | 684 | 150,569 | 604 | 148,770 | 601 | 149,401 | 605 |

Table C1 Notes

|

||||||||

© His Majesty the King in Right of Canada, represented by the President of the Treasury Board, 2024,

Catalogue No. BT1-51E-PDF, ISSN: 2561-4290