President of the Treasury Board’s Fees Report for the 2023–2024 Fiscal Year

On this page

President’s message

President of the Treasury Board

As President of the Treasury Board, I am pleased to present the Fees Report for Fiscal Year 2023–24.

This report provides an overview of the fees charged by federal departments for services they deliver to Canadians. It includes details on their total revenue, fee adjustments, service standards, and total remissions issued within the fiscal year. Departments are required to table their reports every year under the Service Fees Act and the Directive on Charging and Special Financial Authorities.

The 2023–24 fiscal year also saw important amendments to the Service Fees Act. These changes make it easier and more efficient to manage fees, while improving transparency and accountability, ensuring that fees are fair to Canadians and services are effective.

The Government of Canada is committed to managing fees responsibly and being transparent about how they are charged. I encourage you to read this report to learn more about how federal departments are being accountable to Canadians for the services they provide.

Original signed by

The Honourable Ginette Petitpas Taylor, P.C., M.P.

President of the Treasury Board

About this report

The Service Fees Act (SFA), which came into force on June 22, 2017, modernized the Government of Canada’s fee regime and established a solid foundation for departments,Footnote 1 while providing fee payers with information on the level of service that they can expect.

The information in this report has been extracted from Departmental Fees Reports that were tabled under section 20 of the SFA and subsection 4.2.9 of the Treasury Board Directive on Charging and Special Financial Authorities. Departmental Fees Reports contain information about all fees that are under departmental authority, even if some or all of the fees were collected by another department. Departmental Fees Reports do not contain information on fees charged by departments under the Access to Information Act (ATIA) because the SFA does not apply to these fees.

This report also outlines the various types of fee adjustments and authorities that allow departments to issue remissions.

This consolidated report provides an overview of government‑wide fees and is broken down into the following sections:

- the Fees section provides information on the types of fees that are charged and the number of fees that were reported and tabled in Parliament

- the Revenue section provides information on total revenue from fees, along with highlights for the three revenue streams

- the Fee adjustments section summarizes the different mechanisms for adjusting fees, including the SFA requirement for an automatic annual adjustment

- the Service standards and remissions section describes the purpose of a service standard, explains remissions and the types of authorities that exist, and provides a breakdown of the remissions issued by departments

- the Approvals section provides the list of approvals given by the President of the Treasury Board in 2024–25 under the SFA

Fees

Under the Directive on Charging and Special Financial Authorities, all departments that charge fees must produce a fees report, regardless of whether they are exempt from the SFA.

The Government of Canada has three mechanisms for departments to set fees for the provision of a service, the provision of the use of a facility, the conferral by the means of a licence, permit or other authorization of a right or privilege, the provision of a product, or the provision of a regulatory process:

- Fees set by contract: Ministers have the authority to enter into contracts, which are usually negotiated between the Minister and an individual or an organization, and which cover fees and other terms and conditions. In some cases, that authority may also be provided by an act of Parliament.

Example: services provided under a cost‑sharing arrangement with other orders of government.

- Fees set by market rate or auction: The authority to set these fees is pursuant to an act of Parliament or regulation, and the Minister, department or Governor in Council has no control over the fee amount.

Example: auction of a licence to the highest bidder that meets the preestablished regulatory requirements.

- Fees set by act, regulation or fees notice: An act of Parliament delegates the fee‑setting authority to a department, Minister or Governor in Council.

Example: a fixed fee for the review of an application for a licence to operate in Canada.

A total of 37,721 fees set by act, regulation or fees notice were reported in Parliament by departments in the 2023–24 fiscal year (compared to 37,674 such fees in the 2022–23 fiscal year). During the 2023–24 fiscal year, 412 new fees were introduced, 406 fees were eliminated, and 4,233 fees were under review. Table 1 shows, for the 10 departments that had the most fees set by act, regulation or fees notice, the number of fees each department had the authority to charge and the percentage of total revenue these fees represent. It also provides a total of such fees for all other departments (25) which represent 71.52% of total revenues for these types of fees.

| Rank | Department | Number of fees | Percentage of total revenue generated by fees set by act, regulation or fees noticeFootnote * Footnote † |

|---|---|---|---|

| 1 | National Film Board | 30,245 | < 0.01 |

| 2 | Transport Canada | 2,068 | 0.74 |

| 3 | Parks Canada | 1,883 | 3.33 |

| 4 | Canadian Food Inspection Agency | 834 | 1.15 |

| 5 | Innovation, Science and Economic Development Canada | 554 | 14.72 |

| 6 | Fisheries and Oceans Canada | 525 | 1.83 |

| 7 | Health Canada | 222 | 6.36 |

| 8 | National Research Council Canada | 218 | 0.07 |

| 9 | Natural Resources Canada | 211 | 0.12 |

| 10 | Canadian Heritage | 175 | 0.15 |

| Other | All other departments (25) | 786 | 71.52 |

| Total | 37,721 | 100.00 | |

Revenue

In this section

When fees are collected from fee payers, they are treated as revenue by the Government of Canada. As mentioned in the Fees section, there are three types of fees.

In the spirit of open and transparent fee management, departments must:

- disclose lump‑sum amounts for fees set by contract and fees set by market rate or auction

- provide greater detail for fees set by act, regulation or fees notice

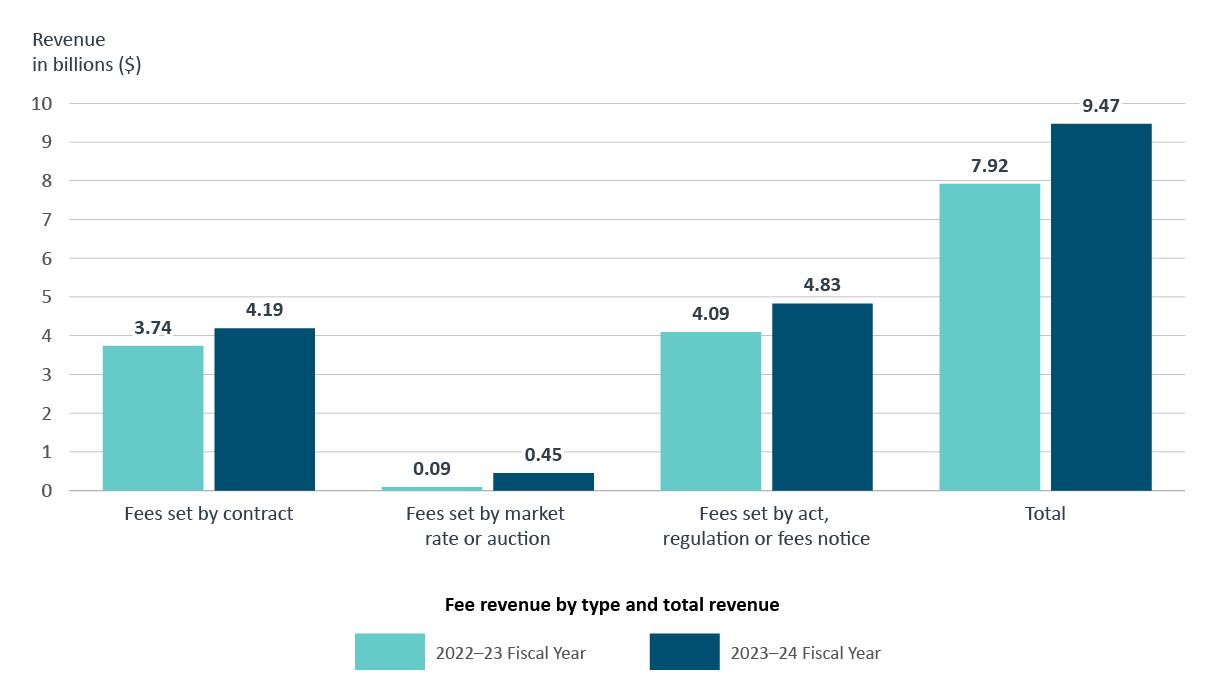

In the 2023–24 fiscal year, the Government of Canada collected approximately $9.47 billion in fees:

- fees set by contract made up 44% ($4.19B) of the fees collected

- fees set by market rate or auction made up 5% ($0.45B) of the fees collected

- fees set by act, regulation or fees notice made up 51% ($4.83B) of the fees collected

Figure 1 shows the revenue generated in fiscal years 2022–23 and 2023–24, by fee type.

Figure 1 - Text version

| 2022-2023 fiscal year | 2023-2024 fiscal year | |

|---|---|---|

| Fees set by contract | 3,742,444,802 | 4,190,410,922 |

| Fees set by market rate or auction | 88,944,160 | 453,270,867 |

| Fees set by act, regulation or fees notice | 4,088,454,931 | 4,827,178,077 |

| Total | 7,919,843,893 | 9,470,859,867 |

Fees set by contract

Table 2 shows, for the 2023–24 fiscal year, the 10 departments that had the most revenue generated by fees set by contract and the total revenue generated by these fees for all other departments.

| Rank | Department | 2023–24 revenue ($)Footnote * | Percentage of total revenueFootnote * Footnote † |

|---|---|---|---|

| 1 | Royal Canadian Mounted Police | 3,279,683,607 | 78.27 |

| 2 | Public Services and Procurement Canada | 346,735,216 | 8.27 |

| 3 | National Research Council Canada | 151,502,674 | 3.62 |

| 4 | Canada Revenue Agency | 148,130,838 | 3.54 |

| 5 | Environment and Climate Change Canada | 81,547,921 | 1.95 |

| 6 | Global Affairs Canada | 53,191,843 | 1.27 |

| 7 | Parks Canada | 41,215,541 | 0.98 |

| 8 | Statistics Canada | 25,847,385 | 0.62 |

| 9 | National Defence | 18,108,652 | 0.43 |

| 10 | Natural Resources Canada | 13,543,151 | 0.32 |

| Other | All other departments (17) | 30,904,094 | 0.73 |

| Total | 4,190,410,922 | 100.00 | |

In the 2022–23 fiscal year, the Government of Canada collected $3,742,444,802 in fees set by contract, whereas in the 2023–24 fiscal year, $4,190,410,922 in such fees were collected, which represents an increase of $447,966,120 (11.97%).

Fees set by market rate or auction

Table 3 lists the department that reported revenue generated by fees set by market rate or auction during the 2023–24 fiscal year.

| Rank | Department | 2023–24 revenue ($) | Percentage of total revenueFootnote * |

|---|---|---|---|

| 1 | Innovation, Science and Economic Development Canada | 453,270,867 | 100.00 |

| Total | 453,270,867 | 100.00 | |

In the 2023–24 fiscal year, Innovation, Science and Economic Development Canada reported revenue of $453,270,867 in fees set by market rate or auction, which is $364,326,707 (410%) more than the $88,944,160 in total revenue that was reported in the 2022–23 fiscal year. This increase from last year is due to revenue generated from the spectrum licences auction in 2023–24, which did not occur in the previous fiscal year.

Fees set by act, regulation or fees notice

In the 2023–24 fiscal year, the Government of Canada collected $4,827,178,077 in revenue from fees set by act, regulation or fees notice. This represents an increase of $738,723,146 (18.07%) from the 2022–23 fiscal year. The following section provides departmental explanations of the variances highlighted for departments listed in Table 4 below which include, among others, increased demand or volume and increases to amounts collected as a result of annual adjustments.

Table 4 highlights, for fees set by act, regulation or fees notice:

- the top 10 departments for revenue generated during the 2023–24 fiscal year, which accounted for 92% of all revenue collected

- the consolidated data for all other departments

- the variances between the last two fiscal years

| Rank | Department | 2022–23 revenue ($) | 2023–24 revenue ($)Footnote * | Variance in revenue from 2022–23 to 2023–24 ($)Footnote * | Percentage of total revenue generated in 2023–24Footnote * |

|---|---|---|---|---|---|

| 1 | Immigration, Refugees and Citizenship Canada | 1,796,519,929 | 2,342,644,667 | 546,124,738 | 48.53 |

| 2 | Innovation, Science and Economic Development Canada | 622,149,750 | 710,134,160 | 87,984,410 | 14.71 |

| 3 | Health Canada | 268,369,104 | 307,041,206 | 38,672,102 | 6.36 |

| 4 | Office of the Superintendent of Financial Institutions Canada | 227,171,224 | 293,129,529 | 65,958,305 | 6.07 |

| 5 | Employment and Social Development Canada | 138,274,900 | 165,757,100 | 27,482,200 | 3.43 |

| 6 | Parks Canada | 146,576,536 | 160,670,550 | 14,094,014 | 3.33 |

| 7 | Canadian Nuclear Safety Commission | 126,474,024 | 134,264,255 | 7,790,231 | 2.78 |

| 8 | Canada Energy Regulator | 129,299,306 | 133,175,727 | 3,946,421 | 2.76 |

| 9 | Global Affairs Canada | 55,359,537 | 91,805,443 | 36,445,906 | 1.90 |

| 10 | Fisheries and Oceans Canada | 90,287,681 | 88,417,040 | −1,870,641 | 1.83 |

| Subtotal | 3,600,411,991 | 4,427,039,676 | 826,627,685 | 91.71 | |

| Other | All other departments (24) | 488,042,940 | 400,138,401 | −87,904,539 | 8.30 |

| Total | 4,088,454,931 | 4,827,178,077 | 738,723,146 | 100.00 | |

Following are explanations of the variances indicated in Table 4, as provided by the departments.

1. Immigration, Refugees and Citizenship Canada

Immigration, Refugees and Citizenship Canada’s increase in revenues from immigration service fees in 2023–24 is mainly attributable to:

- the surge in passport renewal applications following the expiration of the first set of 10‑year passports in 2023

- increased demand and issuance of immigration documents for temporary residents

2. Innovation, Science and Economic Development Canada

Innovation, Science and Economic Development Canada’s revenues for fees set by act, regulations or fees notices increased by 14% from the previous year, mostly due to the recategorization of the Superintendent of Bankruptcy’s Levy ($41 million) under the Bankruptcy and Insolvency General Rules, which was previously reported as fees set by market or auction.

Other notable revenue variances are from the increase of $16 million in spectrum and telecommunication licences and from new equipment certification and registration fees introduced mid‑year.

The Support and Financing for Small Business program, which is market-driven, saw an increase in revenue of $15 million due to an increase in new loans registered and outstanding loan balances.

Finally, intellectual property revenues saw an increase in revenue ($14 million) as a result of patent maintenance and trademark renewals fees.

3. Health Canada

Health Canada’s increase in revenues is mainly due to scheduled fee increases under the Fees in Respect of Drugs and Medical Devices Order.

4. Office of the Superintendent of Financial Institutions Canada

The Office of the Superintendent of Financial Institutions (OSFI) adjusts fees each year to fully recover its actual costs, so any variance in OSFI’s fees revenue is mainly due to increases in its operating costs. Although OSFI’s total number of assessments remained stable, the cost per individual assessment increased in 2023–24.

5. Employment and Social Development Canada

Employment and Social Development’s increase in revenue is primarily due to the introduction of the Temporary Foreign Worker Program Workforce Solutions Road Map in April 2022 to help employers deal with labour shortages. The ongoing impact of measures under the road map, alongside tight labour market conditions and strong employer demand, led to a significant increase in the number of labour market impact assessments the department processed in 2023–24, resulting in higher fee revenues.

6. Parks Canada

Parks Canada’s increase in revenue is attributed to legislative fee adjustments based on a two-year cumulative increase in the Consumer Price Index (CPI) and a continued increase in the number of visitors to Parks Canada places. Despite increases in visitors, revenue has not returned to pre-pandemic levels and the tourism industry is still recovering.

7. Canadian Nuclear Safety Commission

The Canadian Nuclear Safety Commission’s higher revenue in 2023–24 was mainly due to increases in salaries and expenses.

8. Canadian Energy Regulator

The Canada Energy Regulator is funded through parliamentary appropriations. The government recovers most of these appropriations from the regulated industry. Revenues are deposited to the Receiver General for Canada’s account and credited to the Consolidated Revenue Fund. This process is regulated by the National Energy Board Cost Recovery Regulations. Revenues shown are based on the actual costs incurred in the fiscal year.

9. Global Affairs Canada

Global Affairs Canada’s increase in revenue is a result of an increase in revenue from the consular services fee, which is part of the fee for every passport issued to individuals 16 years of age or older. The increase in consular fee revenue directly links to the higher demand for passports in 2023–24 than in previous years.

10. Fisheries and Oceans Canada

Fisheries and Oceans Canada’s variations in revenues are mostly due to a change in the business model for hydrography fees, changes to quota allocations, fisheries closures, and other occurrences relating to fisheries management licensing fees. Revenues for the other fees have remained stable.

Fee adjustments

In this section

Before 2017, when the SFA came into force, certain fees set by act, regulation or fees notice had periodic adjustments to keep up with inflationary increases; however, many fees had no mechanism for keeping pace with the impact of inflation on the cumulative cost of delivering the service or product.

To make sure departments can keep up with inflation for delivering services, the SFA introduced an automatic annual adjustment. All fees set by act, regulation or fees notice are subject to this annual adjustment by default.

Certain fees are not subject to the annual adjustment set out in the SFA because they are fixed in a manner that takes inflation into account, another act of Parliament prescribes a periodic adjustment, or because they are exempt from the SFA. Fees that are considered to be low-materiality fees under the Low-Materiality Fees Regulations are also not subject to the SFA’s annual adjustment.

Service Fees Act annual adjustment

Subsection 17(1) of the SFA requires responsible authorities to adjust their applicable fees each fiscal year by the percentage change over 12 months in the April CPI for all items for Canada, as published by Statistics Canada.

The 2023–24 Departmental Fees Reports include a CPI adjustment, based on the CPI for April 2022 of 6.8% for applicable fees.

Periodic adjustment

A periodic fee adjustment is made pursuant to an act of Parliament or a regulation and is applied according to an established frequency, based on a specific rate, formula or other factor, other than the adjustment rate set out in subsection 17(1) of the SFA.

Service standards and remissions

In this section

Service standards

To improve services to fee payers, the SFA requires that applicable fees have an established service standard. A service standard is a public commitment to provide a service in a way that is measurable and relevant to fee payers under normal circumstances.

The Low-Materiality Fees Regulations establish criteria that define what low-materiality fees are and which fees are not required by the SFA to establish service standards to provide a more cost-effective way for departments to administer low-materiality fees.

Table 5 shows the number of fees set by act, regulation or fees notice in 2023–24, broken down by the application of sections 4 to 7 of the SFA and whether a service standard applies.

| Breakdown of fees | Number of feesFootnote * |

|---|---|

| Fees subject to sections 4 to 7 of the SFA that require a service standard | 3,544 |

| Fees subject to sections 4 to 7 of the SFA that are not required to have a service standard (the fee is set by contract, the person or body that fixes the fee does so by fixing a manner for determining the amount of the fee over which that person or body has no control, the fee is for the provision of a product; refer to section 3 of the SFA) | 31,314 |

| Fees subject to sections 4 to 7 of the SFA that are considered to be low-materiality pursuant to section 22 of the SFA and the Low-Materiality Fees Regulations and that therefore do not have service standards | 2,656 |

| Fees not subject to the SFA and that may have service standards under other instruments | 207 |

| Total | 37,721 |

Of the 3,544 fees that require service standards under the SFA, departments reported that, as of March 31, 2024, 3,066 (87%) fees had existing service standards. Departments continue to work toward establishing service standards for their remaining fees to comply with the SFA. For departments that charge fees set by act, regulation or fees notice, information about service standards and corresponding performance results can be found in the “Details on each fee set by act, regulation or fees notice” section of their Departmental Fees Reports.

Remissions

To ensure accountability for departmental service standards, the SFA introduced a requirement for remissions which is a partial or full return of a fee to a fee payer when a department deems that the relevant service standard was not met. Departments must issue the remission before July 1 of the following fiscal year, in accordance with their remission policy.

Departments are required to develop policies and procedures to determine whether a service standard has been met and how much of a fee will be remitted to a fee payer when a service standard is deemed not met, according to the Directive on Charging and Special Financial Authorities. Departmental remission policy and procedures must be available to the public.

Other Treasury Board policies and directives may require fees to have an established service standard; however, those fees may not be subject to remissions under the SFA because they may have qualified for a non-application of certain sections of the SFA.

Authorities to remit

With regard to fees, three authorities allow departments to remit fees under different circumstances. They are as follows.

Authority to remit pursuant to the Service Fees Act

Subsection 7(2) of the SFA provides the authority to remit the appropriate portion of a fee only when a service standard in relation to that fee has been deemed not met. The remission is to be made in accordance with the Treasury Board Directive on Charging and Special Financial Authorities and the departmental remission policy.

Authority to remit pursuant to the Financial Administration Act

Departments may submit a Treasury Board submission to the Governor in Council in order to obtain an authority to remit pursuant to the Financial Administration Act (FAA). If granted, the authority may be provided for a specific fee or for a designated period. This type of authority is sought for matters other than the authority provided by the SFA. In other words, it could be for reasons other than a service standard that was deemed not met.

Authority to remit pursuant to other acts of Parliament

Certain departments have received an authority to remit fees pursuant to their enabling act or acts and may remit depending on the context and the wording in the act and related regulations, which may be for reasons other than a service standard that was deemed not met.

The 2023–24 Departmental Fees Reports include remissions issued under departments’ enabling legislation, the FAA or remissions issued under the authority of the SFA.

Remissions issued

Table 6 shows the 10 departments that had the largest reported amounts in remissions issued in 2023–24 and total remissions issued by all other departments. The amounts include remissions from the authority delegated pursuant to the SFA, FAA and other acts of Parliament.

Approvals

As part of amendments to the SFA in June 2023, new authorities were granted to the President of the Treasury Board, effective April 1, 2024, to improve consistency in the non-application of requirements related to:

- performance standards (sections 4 to 7)

- consultation and parliamentary review (sections 10 to 15)

- annual adjustment (sections 17 and 18)

The President of the Treasury Board must now approve when these sections do not apply, based on three criteria:

- The person or body that fixes the fee does so by fixing a manner for determining the amount of the fee over which that person or body has no control, such as an auction or a method that is based on the market rate

- The fee is fixed in a manner that takes inflation into account

- The fee is adjusted periodically by operation of an act of Parliament other than the SFA or by operation of an instrument made under such an act

Departments seeking to apply these non-application sections, and therefore requiring approval as of April 1, 2024, were asked to submit business cases to the Treasury Board of Canada Secretariat (TBS) for consideration. TBS staff analyzed the business cases to confirm they met the criteria for non-application before recommending them to the President for approval.

To make sure approvals are communicated, effective April 1, 2024, section 21 of the SFA requires that all approvals given by the President be listed in the annual fees report for the corresponding fiscal year. Table 7 lists the approvals given in 2023–24.

| Section of Service Fees Act | Criteria | Department, fee or program, and fee-setting authority |

|---|---|---|

Section 3(b) – non‑application of performance standards (sections 4 to 7) Section 9(b) – non‑application of consultation and parliamentary review (sections 10 to 15) Section 16(2)(a) – non‑application of annual adjustment (sections 17 and 18) |

The person or body that fixes the fee does so by fixing a manner for determining the amount of the fee over which that person or body has no control, such as an auction or a method that is based on the market rate |

Innovation, Science and Economic Development Canada |

| Section 16(2)(b) non‑application of annual adjustment (sections 17 and 18) | The fee is fixed in a manner that takes inflation into account. |

Canadian Heritage Transport Canada Innovation, Science and Economic Development Canada |

| Section 16(2)(c) – non‑application of annual adjustment (sections 17 and 18) | The fee is adjusted periodically by operation of an act of Parliament other than this Act or by operation of an instrument made under such an act |

Parks Canada Public Services and Procurement Canada Fisheries and Oceans Canada Health Canada Innovation, Science and Economic Development Canada Immigration, Refugees and Citizenship Canada |

Appendix: links to Departmental Fees Reports for the 2023–24 fiscal year

Listed below are links to the Departmental Fees Reports for the 2023–24 fiscal year. Each report contains information on specific departmental fee regimes, including:

- financial information about the total costs, total revenues generated by and any remissions of:

- fees set by contract

- fees set by market rate or auction

- fees set by act, regulation or fees notice

- for each fee set by act, regulation or fees notice, detailed information about:

- the date the fee was introduced and last amended, if applicable

- the dollar amount of the fee in the 2023–24 fiscal year

- the adjusted dollar amount of fees for the 2025–26 fiscal year, if applicable

- service standards, if applicable

- performance results against these standards

- total remissions issued for the fee, if applicable

Links to Departmental Fees Reports for the 2023–24 fiscal year:

- Agriculture and Agri‑Food Canada

- Canada Border Services Agency

- Canada Energy Regulator

- Canada School of Public Service

- Canada Revenue Agency

- Canadian Centre for Occupational Health and Safety

- Canadian Food Inspection Agency

- Canadian Grain Commission

- Canadian Heritage

- Canadian Nuclear Safety Commission

- Canadian Radio‑television and Telecommunications Commission

- Canadian Space Agency

- Crown‑Indigenous Relations and Northern Affairs Canada

- Department of Justice Canada

- Employment and Social Development Canada

- Environment and Climate Change Canada

- Financial Consumer Agency of Canada

- Fisheries and Oceans Canada

- Global Affairs Canada

- Health Canada

- Immigration, Refugees and Citizenship Canada

- Impact Assessment Agency of Canada

- Indigenous Services Canada

- Innovation, Science and Economic Development Canada

- Library and Archives Canada

- National Defence

- National Film Board

- National Research Council Canada

- Natural Resources Canada

- Office of the Auditor General of Canada

- Office of the Secretary to the Governor General

- Office of the Superintendent of Financial Institutions Canada

- Parks Canada

- Parole Board of Canada

- Privy Council Office

- Public Health Agency of Canada

- Public Services and Procurement Canada

- Royal Canadian Mounted Police

- Shared Services Canada

- Statistics Canada

- The National Battlefields Commission

- Transport Canada