Treasury Board of Canada Secretariat 2020–21 Departmental Plan

On this page

- From the Ministers

- Plans at a glance

- Core responsibilities: planned results and resources, and key risks

- Internal Services: planned results

- Spending and human resources

- Corporate information

- Supporting information on the program inventory

- Supplementary information tables

- Federal tax expenditures

- Organizational contact information

- Appendix: definitions

From the Ministers

President of the Treasury Board

Minister of Digital Government

It is our pleasure to present the 2020-21 Departmental Plan for the Treasury Board of Canada Secretariat (TBS). The Plan sets out our performance goals for the coming fiscal year and the financial and human resources required to achieve them.

TBS plays an essential leadership role in helping departments implement government priorities to meet the evolving needs of Canadians. TBS employees have achieved a great deal and have set the foundation for important progress in the coming year.

In the 2020-21 fiscal year, TBS will continue to work with departments to:

- strengthen oversight of taxpayer dollars and the clarity and consistency of financial reporting

- improve transparency, reduce administrative burden, and harmonize regulations that maintain high safety standards to improve the competitiveness of Canadian businesses.

With the establishment of a Minister solely dedicated to Digital Government, we are strengthening our commitment to ensure that the Government of Canada is improving the way Canadians access our programs and services.

The Office of the Chief Information Officer and the Canadian Digital Service will support the transition to a more digital government by supporting departments with improved tools and methodologies. This focused effort will result in better services for Canadians – services they expect from their government.

This is only a brief snapshot of the work ahead. We look forward to continuing working with the dedicated and professional employees of the Treasury Board of Canada Secretariat, along with departments and agencies, parliamentarians and Canadians.

Original signed by:

The Honourable Jean-Yves Duclos, P.C., M.P.

The President of the Treasury Board

Original signed by:

The Honourable Joyce Murray P.C., M.P.

The Minister of Digital Government

Plans at a glance

As the administrative arm of the Treasury Board, the Treasury Board of Canada Secretariat (TBS) provides leadership in relation to the following 4 core responsibilitiesFootnote 1 to help departments effectively implement government priorities and meet citizens’ evolving expectations of government:

- spending oversight

- administrative leadership

- employer

- regulatory oversight

1. Spending oversight

TBS is responsible for overseeing how the federal government spends taxpayers’ dollars. It does this by reviewing government programs, spending proposals and spending authorities, and by reporting to Parliament and Canadians on government spending.

As part of fulfilling this responsibility in 2020–21, TBS will support the Department of Finance Canada, as appropriate, to meet the government’s commitment to undertake a comprehensive review of government spending to ensure that resources are efficiently allocated to continue to invest in people and keep the economy strong and growing.

TBS will also continue to strengthen the oversight of the expenditure of taxpayer dollars and the clarity and consistency of financial reporting, and to exercise due diligence regarding the costing analyses that departments prepare for all proposed legislation and programs.

2. Administrative leadership

TBS is responsible for developing policies and setting the strategic direction for government administration in relation to delivering services; providing access to information; and managing assets, finances, information and technology.

As part of fulfilling these responsibilities in the year ahead, TBS will work with departments to:

- make more government data available to Canadians and give Canadians more timely access to information they request

- improve the government’s digital capacity and services to Canadians

- manage government assets and projects better

- reduce the federal government’s greenhouse gas emissions

3. Employer

TBS is responsible for developing policy and providing strategic direction for managing people in the public service, including in areas such as diversity and wellness. It is also responsible for representing the government in labour relations matters.

As part of fulfilling these responsibilities in 2020–21, TBS will work with departments to:

- increase diversity in the executive levels of the federal public service, including increasing the number of women in senior decision‑making positions

- support healthy, safe and inclusive public service workplaces

- complete in good faith the round of collective bargaining started in 2018

TBS will also:

- lead the implementation of the recently passed Pay Equity Act in the public service

- lead work on the development and delivery of pilot projects for the Next Generation human resources and pay system to replace the Phoenix pay system

- support Public Services and Procurement Canada in working to eliminate the backlog of outstanding pay issues that have resulted from the Phoenix pay system

- work with the Privy Council Office, the Public Service Commission and departments to recruit and retain talented people from communities across Canada, and to reduce the time it takes to hire new public servants

4. Regulatory oversight

TBS is responsible for developing policies to promote good regulatory practices, for overseeing their implementation, for reviewing proposed regulations, and for promoting regulatory cooperation across jurisdictions.

As part of fulfilling these responsibilities in the year ahead, TBS will work with departments to:

- continue regulatory reform efforts to improve transparency, reduce administrative burden, and harmonize regulations that maintain high safety standards and make Canadian businesses more competitive

- replace completed regulatory cooperation work plans with new ones

For more information on TBS’s plans, priorities and planned results, see the “Core responsibilities: planned results and resources” section of this report.

Core responsibilities: planned results and resources, and key risks

-

In this section

This section contains the following for each of TBS’s core responsibilities:

- a description of the responsibility

- TBS’s priorities and the results it will work toward over the coming years in relation to the responsibility, and how it will measure its performance

- a description of:

- experiments that TBS is undertaking to better achieve its planned results

- how TBS will be using gender‑based analysis plus

- TBS’s contributions to the Government of Canada’s efforts to achieve the United Nations’ 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals (SDGs)

- key risks to TBS’s ability to achieve its planned results

- tables that show the financial and human resources that TBS will allocate to achieving its planned results

Spending oversight

Description

- Review spending proposals and authorities

- Review existing and proposed government programs for efficiency, effectiveness and relevance

- Provide information to Parliament and Canadians on government spending

Planning highlights (by result)

Departmental result 1 for spending oversight: Treasury Board proposals contain information that helps Cabinet ministers make decisions

The Government of Canada has committed to delivering results to Canadians, including strengthening the oversight of the expenditure of taxpayer dollars and the due diligence exercised regarding the costing analyses that departments prepare for all proposed legislation and programs.

To implement new legislation and programs, departments must have the required authorities and approvals from the Treasury Board (for example, financial and expenditure authorities, project and program approvals). Before departments submit these proposals to the Treasury Board, TBS works with departmental staff, primarily during the drafting of Treasury Board submissions, to ensure that the proposals:

- align with Treasury Board policies and government priorities

- support value for money

- clearly explain the results that will be achieved and how those results will be measured

- contain clear assessments of risk, including financial risk

- support the strategic use of information, technology, and a user-centred approach to services

Over the coming years, TBS will be strengthening its oversight of departmental expenditures and costing analyses by:

- supporting the Department of Finance Canada, as appropriate, to meet the government’s commitment to undertake a comprehensive review of government spending to ensure that resources are efficiently allocated to continue to invest in people and keep the economy strong and growing

- improving how Treasury Board submissions are structured, updating the guidelines on writing these submissions and on how to present costing information in them so that departments’ proposals contain the information ministers need

- engaging with departments earlier in project development so that TBS can help them identify and mitigate financial risks, and provide more accurate information to ministers

| Departmental result indicator | Target | Date to achieve target | 2017–18 actual result | 2018–19 actual result |

|---|---|---|---|---|

| Degree to which Treasury Board submissions transparently disclose financial risk (on a maturity scale of 1 to 5) | 75% | March 31, 2023 | 13% | 45% |

Departmental result 2 for spending oversight: reporting on government spending is clear

The Government of Canada has committed to improving the openness, effectiveness and transparency of government, including strengthening the clarity and consistency of financial reporting.

Departments report on their spending in different ways including by:

- adding information to the GC InfoBase, an interactive, publicly accessible tool for finding the latest information on government finances, people and results

- tabling Departmental Expenditure Plans (Departmental Plans and Departmental Results Reports), which describe departments’ plans, priorities, expected results and associated resource requirements, as well as the actual results achieved

TBS will improve the clarity of reporting on government spending by:

- updating the GC InfoBase to make it easier to find similar or related information across departments

- exploring ways to add new datasets to the GC InfoBase in areas where users have expressed interest (for example, services, horizontal initiatives, transfer payments, people management)

- working with departments to make the structure and content of Departmental Plans and Departmental Results Reports more useful based on feedback from readers

- collecting and sharing information on how departments are measuring their performance

- assessing and providing feedback on the quality of performance information that departments collect

| Departmental result indicator | Target | Date to achieve target | 2017–18 actual result | 2018–19 actual result |

|---|---|---|---|---|

| Degree to which GC InfoBase users found the spending information useful (on a scale of 1 to 5) | Average rating: 3.5 out of 5 | March 31, 2021 | 3.9 out of 5 | Average rating: 3.2 out of 5 |

| Degree to which visitors to online departmental planning and reporting documents found the information useful (on a scale of 1 to 5) | Average rating: 3.5 out of 5 | March 31, 2021 | Not assessed (User survey implemented with the tabling of the 2018–19 Departmental Plans) | Average rating: 3.3 out of 5 |

Gender‑based analysis plus and spending oversight

The Government of Canada is committed to applying gender-based analysis plus (GBA+) when making spending decisions. TBS helps meet this commitment as part of reviewing of Treasury Board submissions, implementing the Canadian Gender Budgeting Act, and assessing the impacts of innovation-related programs.

When they seek Treasury Board approval for new spending proposals or authorities, departments must identify any relevant gender issues and the steps they will take to meet the needs of men, women, and gender‑diverse individuals. TBS reviews the information and analysis that departments provide and advises Treasury Board ministers, where appropriate, on the gender implications of approving proposals.

As part of implementing the Canadian Gender Budgeting Act, TBS will make the analysis of the impacts of existing Government of Canada expenditure programs on gender and diversity available to the public. To help improve the quality of the analyses provided, TBS is working with departments to strengthen their data collection, performance measurement, and evaluation activities.

In Budget 2018, the government announced an Innovation and Skills Plan. As part of this plan, TBS formed a team to improve performance and impact assessments for innovation‑related programs. This team will apply GBA+ considerations to data collection; and to policy, performance, and evaluation activities. It will then delve deeper into the data and experiment with disaggregating information based on GBA+ characteristics.

United Nations’ 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals (SDGs) and spending oversight

In their Treasury Board submission packages, departments must demonstrate that any proposed spending initiative meets strategic environmental assessment requirements. They must also demonstrate that they have taken into account the initiative’s potential impacts on climate change and must indicate any need to adapt as a result of those impacts. When TBS program sectors review these packages, they contribute to achieving SDG 13.3: improve education, awareness‑raising and human and institutional capacity on climate change mitigation, adaptation, impact reduction and early warning.

Key risk(s) to spending oversight

The federal government has limited capacity to accurately estimate project costs. The public service has fewer than 50 certified cost estimators,Footnote 2 and not all departments have the data and tools they need to do robust cost estimates. Although TBS’s Costing Centre of Expertise reviews cost estimates when major proposals come to the Treasury Board for approval, the limited capacity means that there is a risk that not all major program and project proposals will have robust cost estimates.

In response, the centre of expertise is looking at ways it could provide better review of departmental costing, for example, by engaging with departments earlier in project development to help them identify and mitigate financial risks, and to help them provide higher‑quality information to ministers.

| 2020–21 budgetary spending (as indicated in Main Estimates) | 2020–21 planned spending | 2021–22 planned spending | 2022–23 planned spending |

|---|---|---|---|

| 3,622,079,027 | 3,622,079,027 | 3,598,531,693 | 3,594,638,554 |

Planned spending of $3.6 billion in 2020–21 for spending oversight relates largely to the government‑wide funds central vote. Once the Treasury Board approves this planned spending, TBS transfers money from this vote to supplement the appropriations of other federal organizations for items such as government contingencies, government-wide initiatives, compensation requirements, operating and capital budget carry‑forward, and paylist expenditures.

About $41.0 million of this planned spending is to cover program expenditures for TBS to fulfill this core responsibility.

| 2020–21 planned full‑time equivalents | 2021–22 planned full‑time equivalents | 2022–23 planned full‑time equivalents |

|---|---|---|

| 302 | 302 | 302 |

Financial, human resources and performance information for TBS’s program inventory is available in the GC InfoBase.

Administrative leadership

Description

- Lead government‑wide initiatives

- Develop policies and set the strategic direction for government administration related to:

- service delivery

- access to government information

- the management of assets, finances, information, and technology

Planning highlights (by result)

Departmental result 1 for administrative leadership: Canadians have timely access to government information

The Government of Canada has committed to improving the openness, effectiveness and transparency of government, and to being open by default.

As part of fulfilling this commitment, TBS is working with federal government organizations to add datasets to open.canada.ca, the open government portal. It is also supporting their efforts to provide Canadians with information that they specifically request.

In pursuit of open government in the coming year and beyond, TBS will:

- explore potential amendments to the Directive on Open Government and create new guidelines to support federal government organizations in adding content to open.canada.ca

- continue to lead the implementation of Canada’s 2018–2020 National Action Plan on Open Government

- work with citizens and stakeholders to develop the country’s next open government action plan for 2020 to 2022

- continue to support the offices in government institutions that respond to access to information and personal information requests by, for example, providing online tools and information to help institutions administer the Access to Information Act and the Privacy Act

- expand the use of the Access to Information and Privacy Online Request ServiceFootnote 3 with the goal of having all government institutions that are subject to the Access to Information Act and the Privacy Actsupported by this service by 2021–22

- continue to support government institutions as they implement the amendments to the Access to Information Act that were enacted in June 2019 by, for example, providing guidance and tools to help them implement new requirements to proactively publish key government informationFootnote 4

- support the President of the Treasury Board in fulfilling the requirement to begin a full review of the updated Access to Information Act within 1 year of the coming into force of the amendments, or by June 21, 2020

| Departmental result indicator | Target | Date to achieve target | 2017–18 actual result | 2018–19 actual result |

|---|---|---|---|---|

| Number of datasets available to the public | At least 2,000 new non‑geospatial datasets | March 31, 2021 | 1,807 new datasets published (12,039 total non‑geospatial datasets available in 2017–18 on open.canada.ca) |

3,168 new datasets published (11,340 total non‑geospatial datasets available in 2018–19 on open.canada.ca)table 1 note * |

| Percentage of personal information requests responded to within legislated timelines | At least 85% | March 31, 2021 | 75% | 77% |

| Percentage of access to information requests responded to within legislated timelines | At least 90% | March 31, 2021 | 76% | 73% |

Table 1 Notes

|

||||

Departmental result 2 for administrative leadership: government service delivery is digitally enabled and meets the needs of Canadians

The Government of Canada has committed to improving its services and digital capacity for Canadians.

The Treasury Board has set out the requirements and expectations for government services in the Policy on Service and Digital, which will take effect on April 1, 2020. The policy aims to:

- make services easier to use and more responsive to the needs of Canadians

- increase the number of services available online

- ensure that these services are secure and accessible to all Canadians

TBS also works with departments to help them improve their services. For example, the Canadian Digital Service, housed at TBS, partners with departments to design, test and build easy‑to‑use services.

To support results in the area of service delivery, TBS will:

- work with departments, provinces, and territories to develop a pan‑Canadian approach to digital identityFootnote 5 so that the public has seamless access to government services

- provide departments with documents, tools, and information sessions to help them make their web sites more secure and to help them implement the new Treasury Board Policy on Service and Digital, which requires that departments:

- maximize the number of services that are available online end‑to‑end and make them easier to use to complement all service delivery channels

- ensure that client feedback is collected and used to improve services

- review each of their services regularly with clients, partners and stakeholders, to identify opportunities for improvement, including redesign for client‑centricity, digital enablement, online availability and uptake, efficiency, partnership arrangements, and alternate approaches to service delivery

- develop, manage and regularly review the service standards, related targets and performance information, for all their services and service delivery channels in use

- report real‑time performance information on their service standards

- help develop and improve government services through the Canadian Digital Service, including:

- improving the application process for Canada Pension Plan benefits for Canadians with disabilities with Employment and Social Development Canada

- building a new service to help low-income Canadians file their taxes, enabling them to receive benefits and refunds, with the Canada Revenue Agency

- building, with the Royal Canadian Mounted Police, a new service that makes it easier for Canadians and businesses to report when they encounter or are victims of a cybercrime, and that helps police analyze and investigate reports

- building common applications that, for example, send notifications and book appointments, which all departments can use to create consistent, efficient, user‑centred digital services

To support results in the area of digital capacity, TBS will, through the Canadian Digital Service:

- identify and share current digital practices and tools with departments and help departments adopt them

- form interdisciplinary teams with departments to help them build and maintain in-house digital expertise

- support training and development for public servants by, for example, researching training needs and contributing to and participating in training delivered by the Digital Academy at the Canada School of Public Service

- help change government rules, processes, and guidance to make it easier for departments to adopt the same methods, tools, and ways of working

| Departmental result indicator | Target | Date to achieve target | 2017–18 actual result | 2018–19 actual result |

|---|---|---|---|---|

| Percentage of Government of Canada websites that deliver digital services to citizens securelytable 2 note * | 100% | March 31, 2021 | Not available | 44% (November 2019) |

| Percentage of Government of Canada priority services available onlinetable 2 note † | At least 80% | March 31, 2021 | 62% | 74% |

| Degree to which clients are satisfied with the delivery of Government of Canada services, expressed as a score from 1 to 100 | At least 60 | March 31, 2022 | 58 | Clients not surveyed in 2018–19 Results of next survey expected by March 2022 |

| Percentage of priority services that meet service standards | At least 80% | March 31, 2021 | 70% | 69% |

Table 2 Notes

|

||||

Departmental result 3 for administrative leadership: government has good asset and financial management practices

The Government of Canada is committed to improving the effectiveness of government. The sound stewardship of government assets and finances plays an important role in delivering on this commitment, as does improving project management capabilities so that all major projects are well run.

As part of fulfilling this commitment, TBS works to:

- put sound policies, standards and practices in place

- oversee performance and compliance across the government

- maintain and build professional communities

With respect to asset management, in 2020–21, TBS will focus on:

- updating departments on asset management issues and best practices by hosting interdepartmental forums such as the TBS Advisory Committee on Real Property

- making recommendations for improving the management of fixed assets based on the results of the Horizontal Fixed Asset Review

- finalizing updates to Treasury Board policy instruments and guidance that contain new requirements for departments to make asset management decisions more strategically and to increase accountability in this area

With respect to financial management, in the year ahead, TBS will focus on:

- helping departments establish mechanisms for ongoing monitoring of internal controls over financial reporting by running internal control working groups twice a year, by providing guidance, and by sharing best practices

- continuing to review the practices of the department that is not testing its internal controls until it starts ongoing monitoring

With respect to project management, in 2020–21, TBS will work with departments to:

- improve their capabilities so that all major projects are led by a certified professional who has at least 5 years’ experience

- create a centre of expertise that brings together professionals who have the technical, procurement, legal and other expertise needed to effectively run major transformation projects across government

- fully implement lessons learned from previous information technology projects (particularly lessons relating to sunk costs and major multi‑year contracts)

- act transparently by sharing successes and difficulties in government, with the aim of improving the delivery of projects large and small

- implement the new Directive on the Management of Projects and Programmes so that government projects are effectively planned, implemented, monitored, controlled and closed

| Departmental result indicator | Target | Date to achieve target | 2017–18 actual result | 2018–19 actual result |

|---|---|---|---|---|

| Percentage of departments that continuously monitor and improve their internal financial controlstable 3 note * | 97% | March 31, 2021 | 97% | 97% |

| Percentage of departments that maintain and manage their assets over their lifecycletable 3 note † | 60% | March 31, 2023 | 80% | 55% |

Table 3 Notes

|

||||

Departmental result 4 for administrative leadership: government demonstrates leadership in making its operations low‑carbon

The Government of Canada has committed to fighting climate change.

Through the Greening Government Strategy, TBS sets the direction for the federal government’s transition to low‑carbon, climate‑resilient, and green operations; and for the reduction of the government’s greenhouse gas (GHG) emissions. This work aligns with the Federal Sustainable Development Strategy goal of greening government.

In 2020–21 and beyond, TBS will work with departments to implement the Greening Government Strategy and to reduce GHG emissions by:

- prioritizing low‑carbon investments for major retrofits

- constructing new federal buildings to be net‑zero carbon readyFootnote 6

- considering green or zero‑emission options when buying new vehicles

- purchasing clean electricity

Under the Greening Government Fund, TBS will:

- fund innovative projects aimed at reducing GHG in departmental operations

- share with departments innovative approaches to reducing GHG emissions

TBS will also continue to consult with and provide guidance to departments to help them reduce their GHG emissions.

| Departmental result indicator | Target | Date to achieve target | 2017–18 actual result |

2018–19 actual result |

|---|---|---|---|---|

| The level of overall government greenhouse gas emissions | 40% below 2005 levels | 2030 | 32% below 2005 levels | 32% below 2005 levels |

Experimentation and administrative leadership

In November 2018, in partnership with Public Services and Procurement Canada (PSPC) and the Department of National Defence (DND), TBS launched a pilot project to assess the impact of using risk-based contracting approvals rather than dollar-based thresholds set in the Treasury Board Contracting Policy.

Normally, PSPC has to seek Treasury Board approval for all defence contracts above its contracting limits, regardless of the risk and complexity of a particular contract. Under the pilot project, the Minister of Public Services and Procurement can enter into and amend defence contracts and contractual arrangements if they have low risk and low or medium complexity but exceed the minister’s current approval limits.

The results of the pilot project will help determine what changes need to be made to the Contracting Policy.

The pilot will run until April 2020.

Gender‑based analysis plus and administrative leadership

In November 2018, the Clerk of the Privy Council approved a policy direction that covers how departments collect, use and display sex and gender information.

The policy direction has the following objectives:

- promote the respect, inclusion and safety of gender-diverse people who live in Canada, including federal public servants

- support the collection of accurate data on sex and gender for government operations, analysis and evidence-based decision making.

- protect the personal information of individuals

All departments and agencies in the core public administration are responsible for implementing the policy direction. TBS has allocated resources for a limited period of time to support departments’ implementation efforts.

So that the policy direction will have the greatest impact in a short timeframe, TBS is providing additional support to the top 40 high‑volume, high-impact government services that involve sex or gender information.

Implementing this policy direction will make federal programs and services more inclusive, and make Canada a world leader in gender diversity.

In 2019–20, TBS supported a healthy, diverse, inclusive, and accessible public service by launching Nothing Without Us, an accessibility strategy for the public service. The strategy has 5 goals:

- improve recruitment, retention and promotion of persons with disabilities

- enhance the accessibility of the built environment

- make communications technology usable by all

- equip public servants to design and deliver accessible programs and services

- build an accessibility‑confident public serviceFootnote 7,

TBS will continue to apply and monitor GBA+ to support more inclusive outcomes as part of its administrative leadership responsibilities.

United Nations’ 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals (SDGs) and administrative leadership

Through the Federal Sustainable Development Strategy and TBS’s Departmental Sustainable Development Strategy for 2017 to 2020, TBS has supported the advancement of multiple UN SDGs. For example, TBS is working to reduce the government’s overall greenhouse gas emissions by 40% below 2005 levels by 2030, with an aspiration to achieve that reduction by 2025. These efforts align with SDG 13.3: to improve education, awareness‑raising and human and institutional capacity on climate change mitigation, adaptation, impact reduction, and early warning.

TBS has also supported the transition to a low‑carbon economy by:

- updating the Canada School of Public Service green procurement training course for acquisition card holders

- launching an interdepartmental green procurement solutions team

- incorporating green considerations into the new Treasury Board Policy on the Planning and Management of Investments, which now requires departments to ensure that investment decisions consider opportunities to advance government environmental objectives

TBS is now developing green procurement guidance for real property and fleet management. This work supports SDG 12.7: to promote public procurement practices that are sustainable, in accordance with national policies and priorities.

Finally, TBS is working with departments to improve government service delivery. For example, it is working with them to accelerate progress on creating a single online window for all government services with new performance standards. These efforts support SDG 16: to promote just, peaceful, and inclusive societies.

Key risk(s) to administrative leadership

The number of access to information and personal information requests continues to increase. Although the number of access to information requests that were closed within legislated timelines, including extensions, increased from 74,453 in 2017–18 to 91,402 in 2018–19, there is a risk that institutions will find it increasingly difficult to keep pace with demand and to answer requests within legislated timeframes.

To mitigate the risk that the 2020–21 targets will not be met, TBS will explore ways to support departmental offices that respond to access to information and personal information requests. It will also continue to phase in the Access to Information and Privacy Online Request Service until all institutions that are subject to the Access to Information Act and the Privacy Act receive requests through this service. This service will reduce the administrative burden on institutions so that they can focus more on responding to requests.

| 2020–21 budgetary spending (as indicated in Main Estimates) | 2020–21 planned spending | 2021–22 planned spending | 2022–23 planned spending |

|---|---|---|---|

| 86,245,749 | 86,245,749 | 82,334,486 | 67,032,313 |

| 2020–21 planned full‑time equivalents | 2021–22 planned full‑time equivalents | 2022–23 planned full‑time equivalents |

|---|---|---|

| 500 | 491 | 443 |

Financial, human resources and performance information for TBS’s program inventory is available in the GC InfoBase.

Employer

Description

- Develop policies and set the strategic direction for people management in the public service

- Manage total compensation (including pensions and benefits) and labour relations

- Undertake initiatives to improve performance in support of recruitment and retention

Planning highlights (by result)

Departmental result 1 for employer: public service attracts and retains a skilled and diverse workforce

The recruitment and retention of a skilled and diverse workforce that reflects the population it serves is a cornerstone of effective people management in the public service and helps build Canadians’ trust in government. The Government of Canada has committed to recruiting and retaining talented people from communities across Canada, and to increase the number of women in senior decision-making positions across government, particularly in central agencies and in our security services.

TBS works with key stakeholders, including the Public Service Commission of Canada and the Canada School of Public Service, to support the Treasury Board as the employer of the public service. Although deputy heads manage human resources in their own department, TBS monitors their progress against the policy objectives set by the employer and strives to ensure consistency in people management practices across the public service.

In pursuit of attracting and retaining a skilled and diverse workforce, TBS sets strategic direction for and supports departments in:

- promoting inclusive recruitment and talent management practices

- delivering services that fully comply with the Official Languages Act, including communicating with Canadians in the official language of their choice in designated bilingual offices

- improving accessibility in the public service by supporting the identification, prevention, and addressing of barriers to participation for employees, especially persons with disabilities

TBS will continue to lead progress in these areas in 2020–21 by:

- providing advice and guidance to departments, and facilitating exchanges on best practices with respect to inclusive hiring practices

- implementing talent management strategies for executives, for example, continuing to support the Minority Groups in Positions of Leadership Initiative to increase the representation of women and members of other minority groups in leadership positions, and introducing new talent management discussions for heads of human resources

- raising awareness among hiring managers, through the Centre for Wellness, Inclusion and Diversity and the Centre of Expertise on Mental Health in the Workplace, about the benefits of inclusive hiring practices

- developing a Career Pathway Initiative for Indigenous employees to address barriers to career progression and to support managers in promoting culturally supportive workplaces

- sharing the lessons learned from a Smart DiveFootnote 8 research exercise on Indigenous representation in the executive cadre

- promoting the new accessibility strategy for the public service, which includes the Centralized Enabling Workplace Fund to support workplace adjustments for employees with disabilities

- providing advice and guidance to federal institutions on official languages, particularly to those whose services do not all fully comply with the Official Languages Act

- sharing best practices for official languages, including through learning events and online platformsFootnote 9

| Departmental result indicator | Target | Date to achieve target | 2017–18 actual result | 2018–19 actual result |

|---|---|---|---|---|

| Percentage of institutions where communications in designated bilingual offices “nearly always” occur in the official language chosen by the public | At least 90% | Annually | 92.5% | 83%table 4 note * |

| Percentage of executive employees (compared with workforce availability) who are members of a visible minority group | At least 10.6% | Annually | 10.1% | 11.1% |

| Percentage of executive employees (compared with workforce availability) who are women | At least 48% | Annually | 49.1% | 50.2% |

| Percentage of executive employees (compared with workforce availability) who are Indigenous personstable 4 note † | At least 5.1% | March 31, 2023 | 3.7% | 4.1% |

| Percentage of executive employees (compared with workforce availability) who are persons with a disability | At least 5.3% | March 31, 2023 | 4.8% | 4.6% |

Table 4 Notes

|

||||

Departmental result 2 for employer: the workplace is healthy, safe and inclusive

In a healthy, safe and inclusive workplace, inappropriate behaviours are never tolerated and employees are highly engaged and high‑performing.

TBS works with key stakeholders, including deputy heads, to create a public service workplace that is healthy, safe, respectful and inclusive.

In pursuit of this result in 2020–21, TBS will focus on:

- enabling deputy heads to build capacity in their departments to address mental health issues in the workplace, specifically by supporting them through the Centre of Expertise on Mental Health in the Workplace in:

- identifying, assessing, and responding to psychosocial hazards

- developing guidance and resources to address gaps in capacity and skills

- enhancing data and analysis on mental health in the workplace

- expanding support for departments to help them prevent harassment and violence in the workplace, including by providing examples of initiatives that are considered best practices and by providing guidance to departments on how to address incidents of harassment and violence

- updating Treasury Board policies on harassment and violence in the workplace to align them with changes to the Canada Labour Code

| Departmental result indicator | Target | Date to achieve target | 2017–18 actual result | 2018–19 actual result |

|---|---|---|---|---|

| Percentage of employees who believe their workplace is psychologically healthy | Year‑over‑year increase | Annually | 56% | 59% |

| Percentage of employees who indicate that they have been the victim of harassment on the job in the past 12 months | Year‑over‑year decrease | Annually | 18% (past 2 years) | 15% (past 12 months) |

| Percentage of employees who indicate that they have been the victim of discrimination on the job in the past 12 months | Year‑over‑year decrease | Annually | 8% (past 2 years) | 8% (past 12 months) |

| Percentage of employees who indicate that their organization respects individual differences (for example, culture, workstyles and ideas) | Year‑over‑year increase | Annually | 78% | 78% |

Departmental result 3 for employer: terms and conditions of employment are fairly negotiated

The Government of Canada is committed to maintaining a respectful relationship with Canada’s public service. This includes bargaining in good faith with Canada’s public sector bargaining agents and working with them to fairly negotiate modern terms and conditions of employment in the federal public service.

The government’s goal in collective bargaining and when renewing collective agreements is to ensure fair compensation for employees and, at the same time, fulfill its overall fiscal responsibilities and commitments to Canadians.

As part of fulfilling the government’s commitments, TBS will take steps to address issues with the government’s pay system, by:

- working with bargaining agents to complete negotiations on damages for employees who have experienced hardships

- supporting Public Services and Procurement Canada in its work to eliminate the backlog of outstanding pay issues for public servants as a result of the Phoenix pay system

- continuing to advance the definition of requirements and co-design the Next Generation human resources and pay solution

- continuing to work with stakeholders such as bargaining agents, employees and human resource and pay practitioners to ensure that a new system will address the needs of a modern public service and its employees

TBS will also:

- advance the implementation of the recently passed Pay Equity Act within the public service by supporting the Labour Program (at ESDC) as the overall lead on regulatory development in an effort to establish the necessary pay equity regulations to bring the act into force

- build a relationship and bargaining in good faith with the National Police Federation, which represents RCMP members and reservists

| Departmental result indicator | Target | Date to achieve target | 2017–18 actual result | 2018–19 actual result |

|---|---|---|---|---|

| Percentage of Public Service Labour Relations and Employment Board outcomes that confirm that the Government of Canada is bargaining in good faith | 100% | Annually | 100% | 100% |

Experimentation and core responsibility of employer

The Talent Cloud is an initiative run by a group of TBS employees who test language, best practices, behavioural nudges, and other tactics. The initiative has 2 goals:

- reduce the time it takes to staff a position

- improve applicants’ job fit

The Talent Cloud uses data from staffing processes that are posted on the Talent Cloud site to test hypotheses, identify good practices and then adjust business processes. For example, tests conducted on different job posters showed that postings for jobs that allow remote work attract 70% more applicants than those that require the employee to be in the same geographic area as the office.

Gender‑based analysis plus and core responsibility of employer

As part of helping departments and agencies to implement the Policy Direction to Modernize the Government of Canada’s Sex and Gender Information Practices, TBS is changing some of the forms and templates that departments have to complete, which will help improve the quality of the analysis.

TBS launched the Centre for Wellness, Inclusion, and Diversity in June 2019. Through this Centre, TBS is supporting departments in their efforts to create healthy, safe and inclusive workplaces by raising awareness of best practices.

United Nations’ 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals (SDGs) and core responsibility of employer

TBS is working with departments to increase representation of women and members of other minority groups in leadership positions. This work supports SDG 5: to ensure women’s full and effective participation and equal opportunities for leadership at all levels of decision-making in political, economic and public life.

TBS is also working with departments to better address and prevent harassment and violence in the public service, which is helping advance:

- SDG 10: to ensure equal opportunity and reduce inequalities of outcome, including through eliminating discriminatory laws, policies and practices and promoting appropriate legislation, policies and actions in this regard

- SDG 16: to significantly reduce all forms of violence

Key risk(s) to core responsibility of employer

Problems with the Phoenix pay system continue to affect employees and the government’s ability to pay them accurately and on time. They also continue to impact labour relations, talent management, and employee wellness.

Efforts to identify options for a new human resources and pay solution, and at the same time stabilize the Phoenix system, are continuing. In parallel, TBS will help departments prepare to transition to a new human resources and pay solution, by redesigning processes, managing change, and training the human resources community to successfully test and implement a new platform.

| 2020–21 budgetary spending (as indicated in Main Estimates) | 2020–21 planned spending | 2021–22 planned spending | 2022–23 planned spending |

|---|---|---|---|

| 2,230,326,777 | 2,230,326,777 | 2,231,446,893 | 2,235,818,142 |

TBS’s planned spending for 2020–21 in relation to the core responsibility of employer is $2.2 billion. Most of it is to cover the following:

- payments under the public service pension, benefit and insurance plans, including the employer’s share of health, income maintenance, and life insurance premiums

- payments to or in respect of provincial health insurance plans

- payments of provincial payroll taxes and Québec sales tax on insurance premiums

About $59.1 million of the planned spending is to cover program expenditures for TBS to fulfill this core responsibility.

| 2020–21 planned full time equivalents | 2021–22 planned full time equivalents | 2022–23 planned full time equivalents |

|---|---|---|

| 430 | 392 | 389 |

Financial, human resources and performance information for TBS’s program inventory is available in the GC InfoBase.

Regulatory oversight

Description

- Develop and oversee policies to promote good regulatory practices

- Review proposed regulations to ensure they adhere to the requirements of government policy

- Advance regulatory cooperation across jurisdictions

Planning highlights (by result)

Departmental result 1 for regulatory oversight: government regulatory practices and processes are open, transparent, and informed by evidence

The Government of Canada has committed to continuing regulatory reform efforts to improve transparency, reduce administrative burden, and to leading efforts to harmonize regulations that maintain high safety standards and that make Canadian businesses more competitive.

TBS promotes open, transparent, and evidence‑based regulatory practices and processes to:

- protect the health, safety, security, social and economic well-being of Canadians, and the environment

- support and promote inclusive economic growth, entrepreneurship, and innovation for the benefit of Canadians and businesses

It also works to:

- promote the Cabinet Directive on Regulation, which sets out the requirements and expectations for the development, management, and review of federal regulations

- modernize Canada’s regulatory policy framework to be more efficient and agile, and less burdensome for business

In pursuit of the Government of Canada’s regulatory objectives in 2020–21, TBS will:

- continue to implement the Cabinet Directive on Regulation, which sets out requirements for open, transparent, and evidence‑based regulatory practices and processes that are based on internationally recognized practices in stakeholder engagement, regulatory impact analysis, and regulatory review. These practices include identifying stakeholders who are impacted by regulations, including Indigenous peoples, and meaningfully consulting and engaging with them when developing, managing, and reviewing regulations

- finalize the second round of targeted reviews in the areas of clean technology, digitalization and technology neutrality, and international standards; initiate a third round of targeted regulatory reviews that will continue into 2021

- continue to provide secretariat support to the External Advisory Committee on Regulatory Competitiveness, which helps the Treasury Board identify ways to modernize Canada’s regulatory system and improve regulatory competitiveness

- enable regulatory experimentation, through the Centre for Regulatory Innovation, by building capacity and providing support to departments and agencies for testing new products and processes

- work with PSPC to develop an online consultation system for departments to use to consult with Canadians on proposed regulations. The purpose of this system will be to make the overall rule‑making process more transparent and efficient. The system will allow Canadians to submit comments on regulatory proposals online through a single web portal and to view comments submitted by other respondents

- continue to perform a rigorous challenge function when reviewing regulatory proposals being presented to the Treasury Board, to work with departments to analyze the costs and benefits of regulatory proposals, and to ensure compliance with the Cabinet Directive on Regulation

| Departmental result indicator | Target | Date to achieve target | 2017–18 actual result | 2018–19 actual result |

|---|---|---|---|---|

| Percentage of regulatory initiatives that report on early public consultation undertaken prior to first publication | At least 95% | March 31, 2021 | 97% | 97% |

| Percentage of regulatory proposals that have an appropriate impact assessment (for example, cost‑benefit analysis) | At least 95% | March 31, 2021 | 99% | 100% |

| Ranking of Canada’s regulatory system by the Organisation for Economic Co‑operation and Development (OECD) | Canada to rank in the top 5 in the next issue of the report | December 2021 | In the 2018 report, out of 38 OECD jurisdictions, and the European Union, Canada ranked:

|

In the 2018 report, out of 38 OECD jurisdictions, and the European Union, Canada ranked:

|

Departmental result 2 for regulatory oversight: regulatory cooperation among jurisdictions is advanced

Regulatory cooperation benefits Canadians in many ways. For example, consumers benefit from timely access to products with consistent quality and safety standards, and businesses benefit from the removal of unnecessary costs and duplicate requirements, and from better market access. The Government of Canada has committed to continuing to lead efforts to harmonize regulations that maintain high safety standards and to improve the competitiveness of Canadian businesses.

In support of regulatory cooperation, in 2020–21, TBS will replace completed work plans with new ones, in collaboration with domestic and international regulatory partners including the following:

- the Canada‑U.S. Regulatory Cooperation Council (RCC), which was established in 2011 to promote economic growth, job creation, and benefits to consumers and businesses through increased regulatory transparency and coordination between Canada and the United States

- the Canada‑E.U. Regulatory Cooperation Forum (RCF), which was established in 2018 under the Canada‑European Union Comprehensive Economic Trade Agreement

- the Regulatory Reconciliation and Cooperation Table (RCT), which was established in 2017 under the Canadian Free Trade Agreement to address regulatory barriers to trade, investment, and labour mobility within Canada

In addition, TBS will continue to:

- implement the Cabinet Directive on Regulation, which sets out requirements for regulators to seek opportunities for regulatory cooperation and to consider the development of aligned regulations wherever possible

- perform a rigorous challenge function when reviewing regulatory proposals being presented for approval to the Treasury Board. This function includes working with departments to limit rules unique to Canada, which create barriers to trade, and to ensure that opportunities to cooperate are fully considered

| Departmental result indicator | Target | Date to achieve target | 2017–18 actual result | 2018–19 actual result |

|---|---|---|---|---|

| Number of federal regulatory programs that have a regulatory cooperation work plan | At least 37 | March 31, 2021 | 23 | 38 |

| Percentage of significant regulatory proposals (for example, high and medium impact) that promote regulatory cooperation considerations, when relevant | 100% | March 31, 2021 | 100% | 100% |

Gender‑based analysis plus and regulatory oversight

In 2018–19, TBS published the new Cabinet Directive on Regulation. The directive requires that departments and agencies undertake an assessment of social and economic impacts of each regulatory proposal on diverse groups of Canadians, in accordance with the government’s commitment to implementing GBA+. TBS will continue to support departments by providing guidance and tools on how to undertake the assessment.

United Nations’ 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals (SDGs) and regulatory oversight

TBS will continue to help departments implement the Cabinet Directive on Regulation. The directive has increased analytical rigour by strengthening environmental impact analysis requirements in regulatory development. This aligns with SDG target 13.3: to improve education, awareness‑raising and human and institutional capacity on climate change mitigation, adaptation, impact reduction, and early warning.

Key risk(s) to regulatory oversight

The government announced new regulatory modernization initiatives in its Fall Economic Statement 2018 and continued them in Budget 2019. These initiatives put added pressure on human resources at TBS because they had to be completed in a short timeframe and because a number of reform activities and regulatory cooperation efforts were already underway. To help alleviate this pressure, TBS will continue to hire additional staff to add capacity where needed.

Successful implementation of these initiatives also relies on regulators and on external stakeholders. Regulators must participate in review and cooperation activities, and external stakeholders must participate in consultations. Without the participation of these parties, TBS will not obtain quality feedback from them, and particularly from underrepresented groups. To mitigate this risk, TBS is coordinating engagement strategically and is developing requirements for a stakeholder management tool that will better track and record engagements.

There is also a risk that TBS will not deliver on the online regulatory consultation system on time and on budget. TBS will continue to work with PSPC to outline the details of the proposal, ensure strong governance, and work on different project steps concurrently in order to keep the project on schedule.

| 2020–21 budgetary spending (as indicated in Main Estimates) | 2020–21 planned spending | 2021–22 planned spending | 2022–23 planned spending |

|---|---|---|---|

| 11,084,418 | 11,084,418 | 8,940,136 | 9,370,582 |

| 2020–21 planned full time equivalents | 2021–22 planned full time equivalents | 2022–23 planned full time equivalents |

|---|---|---|

| 71 | 57 | 58 |

Financial, human resources and performance information for TBS’s program inventory is available in the GC InfoBase.

Internal Services: planned results

-

In this section

Description

Internal Services are those groups of related activities and resources that the federal government considers to be services in support of Programs and/or required to meet corporate obligations of an organization. Internal Services refers to the activities and resources of the 10 distinct services that support Program delivery in the organization, regardless of the Internal Services delivery model in a department. These services are:

- Management and Oversight Services

- Communications Services

- Legal Services

- Human Resources Management Services

- Financial Management Services

- Information Management Services

- Information Technology Services

- Real Property Management Services

- Materiel Management Services

- Acquisition Management Services

Planning highlights

TBS allocates 30% of its planned operating spending and 32% of its planned full-time equivalents to internal services, which support the department’s 4 core responsibilities.

TBS is a knowledge‑based organization and is committed to supporting its professional workforce. In 2020–21, Internal Services will help manage and support the TBS workforce by:

- enhancing TBS’s financial planning and reporting functions by expanding the use of data analytics and dashboards to support senior management decision‑making

- introducing technology that will help TBS employees manage their information and work together (for example, SharePoint, the Teams collaboration tool, desktop video-conferencing, instant messaging, and process flow automation)

- collecting and analyzing operational data to enhance client services and better inform decision‑making in procurement, accommodations and translation services

- developing and maintaining a high‑performing workforce by, for example, establishing formal mechanisms to identify employees who have leadership potential, and by identifying training and development that could close skills gaps

- fostering a healthy and respectful workplace by:

- helping employees deal with pay issues by:

- providing information and advice to employees who are dealing with pay issues

- sending clear messages to employees regularly

- monitoring and assessing progress on pay issues

- issuing emergency salary advancements in severe cases

- working closely with the Pay Centre to address urgent employee pay issues

- implementing departmental action plans on wellness and on harassment prevention that include training on mental health awareness, stress management, resilience, emotional intelligence and inclusion

- helping employees deal with pay issues by:

- cultivating a diverse, inclusive and representative workforce by, for example:

- advising managers on the different staffing options and emphasizing targeted recruitment to close representation gaps

- developing a Departmental Accessibility Plan, which will outline specific actions and steps to be taken in order to meet the requirements of the Accessible Canada Act

- putting supports in place to help managers and employees foster and thrive in an inclusive and diverse workplace

TBS will use data from various sources (for example, its administrative systems, the Public Service Employee Survey) to continue to monitor the state of its workforce and whether its Internal Services initiatives are effectively supporting employees.

| 2020–21 budgetary spending (as indicated in Main Estimates) | 2020–21 planned spending | 2021–22 planned spending | 2022–23 planned spending |

|---|---|---|---|

| 86,000,814 | 86,000,814 | 85,466,332 | 85,700,766 |

| 2020–21 planned full time equivalents | 2021–22 planned full time equivalents | 2022–23 planned full time equivalents |

|---|---|---|

| 614 | 611 | 611 |

Spending and human resources

Planned spending

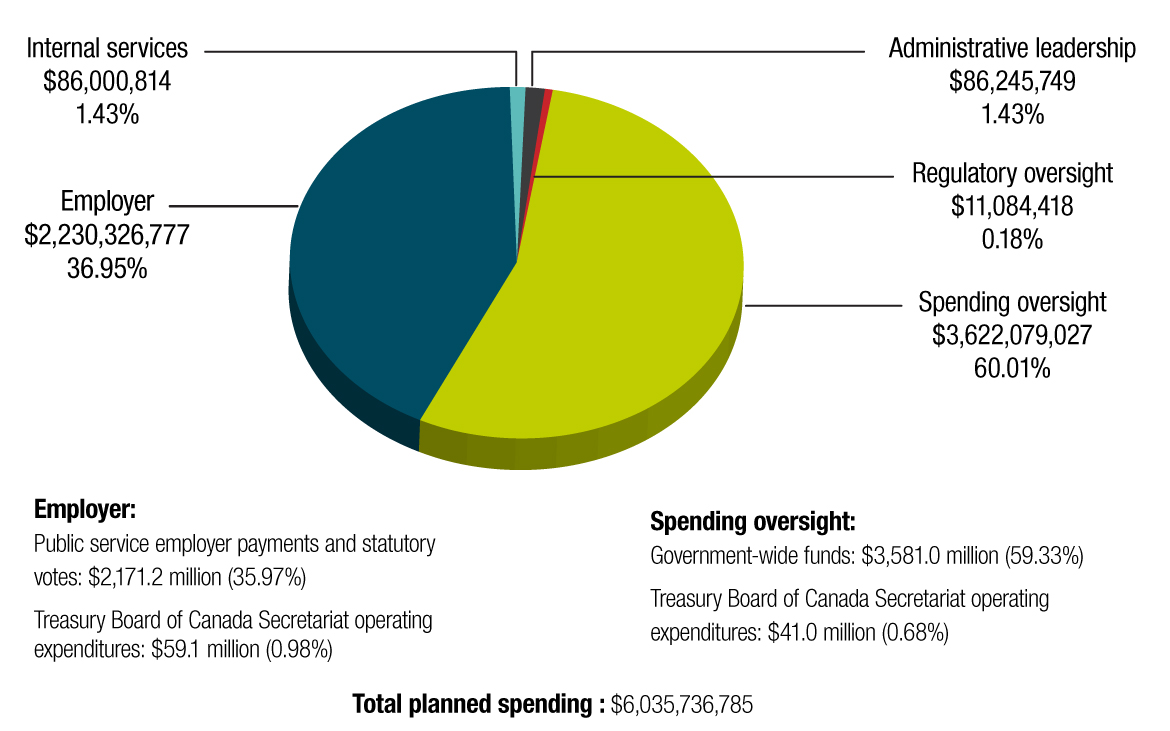

Figure 1 shows the breakdown of TBS’s planned spending of $6.0 billion for 2020–21.

Figure 1 - Text version

| Core Responsability | $ | % |

|---|---|---|

| Spending oversight | $3,622 079,027 | 60.01% |

| Employer | $2,230,326,777 | 36.95% |

| Internal services | $86,000,814 | 1.43% |

| Administrative leadership | $86,245,749 | 1.43% |

| Regulatory oversight | $11,084,418 | 0.18% |

| Grand Total | 6,035,736,785 | 100.00% |

| Statutory | 29,324,931 | |

| Voted | 6,006,411,854 |

Overall, TBS’s total planned spending consists of its operating budget (4.7%) and government‑wide funds and public service employer payments (95.3%).

TBS’s planned spending for 2020–21 consists of the following allocations:

- $3.6 billion for the core responsibility of spending oversight to top up the government‑wide funds central vote funding held in TBS’s reference levels. This funding is approved by Parliament, and TBS transfers it to individual departments and agencies once specific criteria are met. This funding includes:

- Vote 5, Government contingencies: Provides federal departments and agencies with temporary advances for urgent or unforeseen departmental expenditures between Parliamentary supply periods

- Vote 10, Government-wide initiatives: Supports the implementation of strategic management initiatives across the federal public service

- Vote 15, Compensation adjustments: Provides funding for adjustments made to terms and conditions of service or employment in the federal public administration as a result of collective bargaining

- Vote 25, Operating budget carry forward: Used to carry forward unused operating funds from the previous fiscal year, up to 5% of the gross operating budget in an organization’s Main Estimates

- Vote 30, Paylist requirements: Covers the cost of meeting the government’s legal requirements as employer for items such as parental benefits and severance payments

- Vote 35, Capital budget carry forward: Used to carry forward unused capital funds from the previous fiscal year, up to 20% of an organization’s capital vote

- $2.1 billion for the core responsibility of employer, which relates to TBS’s role in supporting the Treasury Board as employer of the core public administration. These funds are used for:

- payments under the public service pension, benefits, and insurance plans, including payment of the employer’s share of health, income maintenance, and life insurance premiums

- payments in respect of provincial health insurance

- payments of provincial payroll taxes and Quebec sales tax on insurance premiums

- addressing actuarial deficits in the Public Service Pension Fund

- $0.3 billion for program expenditures (Vote 1), which is used to run TBS and to deliver on the President’s mandate commitments related to TBS’s core responsibilities and to internal services

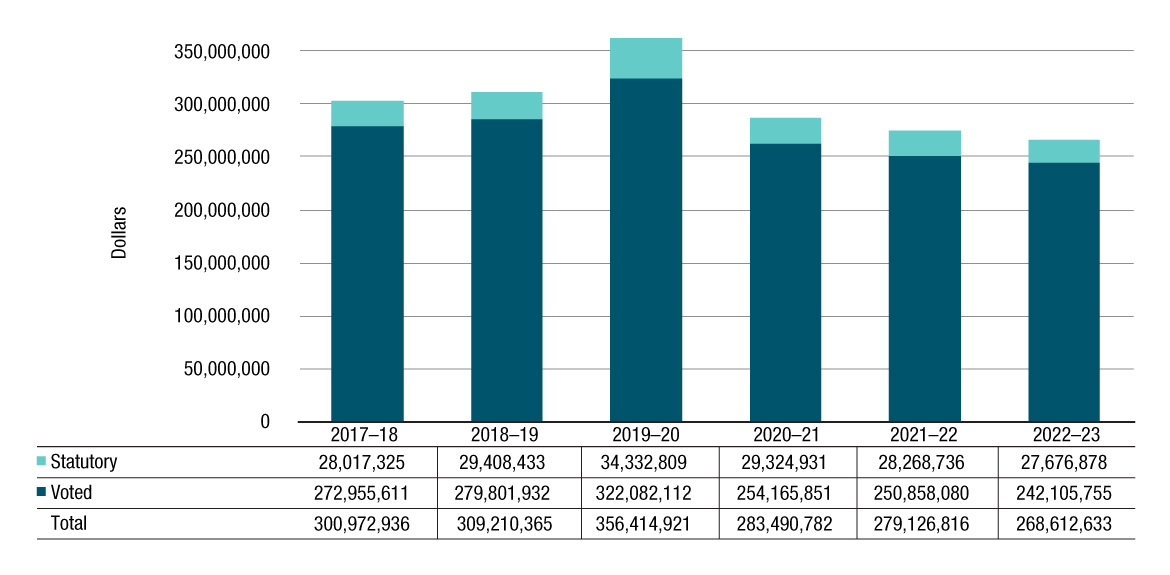

Departmental spending 2017–18 to 2022–23

This section provides an overview of the department’s planned spending and human resources for the next 3 consecutive fiscal years, and compares planned spending for the upcoming year with the current and previous years’ actual spending.

Figure 2 - Text version

| Fiscal year | Total | Voted | Statutory |

|---|---|---|---|

| 2017–18 | 300,972,936 | 272,955,611 | 28,017,325 |

| 2018–19 | 309,210,365 | 279,801,932 | 29,408,433 |

| 2019–20 | 356,414,921 | 322,082,112 | 34,332,809 |

| 2020–21 | 283,490,782 | 254,165,851 | 29,324,931 |

| 2021–22 | 279,126,816 | 250,858,080 | 28,268,736 |

| 2022–23 | 268,612,633 | 242,105,755 | 27,676,878 |

TBS’s program expenditures include salaries, non-salary costs to deliver programs, and statutory items related to the employer’s contributions to TBS’s employee benefit plans.

TBS’s program expenditures increased by $8.2 million in 2018–19 due to the implementation of Budget 2017 and Budget 2018 initiatives. These initiatives include:

- Canadian Digital Service

- Next Generation Human Resources and Pay

- Improvement to Access to Information

As shown in Figure 2, forecast spending for TBS’s program expenditures increased by $47.2 million in 2019–20 as the implementation of Budget 2018 and Budget 2019 initiatives continued. These initiatives include:

- Stabilization of the Government of Canada’s Pay System (Phoenix)

- Funding to support a healthy, diverse, inclusive and accessible public service

- Centre for Regulatory Innovation

- Funding to increase the participation of Inuit firms in the bidding process for government contracts and business opportunities in the Nunavut Settlement Area

- Funding for the implementation of the proactive pay equity in the federal public service

- Funding for the Office of Public Service Accessibility and the Centralized Enabling Workplace Fund

Total planned spending for TBS’s core responsibilities in 2020–21 represents a decrease of $72.9 million from planned spending for 2019–20 because the following programs will sunset at the end of 2019–20 and are subject to the renewal process:

- Classification Program

- Fixed Asset Review

- Canadian Digital Service

- Next Generation Human Resources and Pay

- Stabilization of the Government of Canada’s Pay System (Phoenix)

- Open Government Partnership Global Summit in Canada

The budgetary planning summary for core responsibilities and internal services table outlines:

- actual spending for 2017–18 and 2018–19, as reported in the Public Accounts of Canada

- forecast spending for 2019–20

- planned spending for 2020–21 to 2022–23 as per approved budgetary authorities in the 2020–21 Main Estimates

| Core responsibilities and internal services | 2017–18 expenditures | 2018–19 expenditures | 2019–20 forecast spending | 2020–21 budgetary spending (as indicated in Main Estimates) | 2020–21 planned spending | 2021–22 planned spending | 2022–23 planned spending |

|---|---|---|---|---|---|---|---|

| Spending oversight | 42,055,064 | 42,146,978 | 3,438,165,009 | 3,622,079,027 | 3,622,079,027 | 3,598,531,693 | 3,594,638,554 |

| Administrative leadership | 103,822,405 | 106,239,277 | 126,446,761 | 86,245,749 | 86,245,749 | 82,334,486 | 67,032,313 |

| Employer | 3,568,437,380 | 5,915,647,071 | 2,752,606,444 | 2,230,326,777 | 2,230,326,777 | 2,231,446,893 | 2,235,818,142 |

| Regulatory oversight | 5,983,551 | 7,725,977 | 9,317,096 | 11,084,418 | 11,084,418 | 8,940,136 | 9,370,582 |

| Subtotal | 3,720,298,400 | 6,071,759,303 | 6,326,535,310 | 5,949,735,971 | 5,949,735,971 | 5,921,253,208 | 5,906,859,591 |

| Internal services | 86,603,603 | 84,098,142 | 95,946,688 | 86,000,814 | 86,000,814 | 85,466,332 | 85,700,766 |

| Total | 3,806,902,003 | 6,155,857,445 | 6,422,481,998 | 6,035,736,785 | 6,035,736,785 | 6,006,719,540 | 5,992,560,357 |

Expenditures increased by $2.3 billion from 2017–18 to 2018–19. The increase is mainly attributed to statutory payments of $3.1 billion to the Public Service Superannuation Account. The increase is offset by decreased spending of $340 million related to the elimination of the special annual payment to the Public Service Pension Fund Account and the top-up payments to the Service Income Security Insurance Plan.

Forecast spending for 2019–20 is $266.6 million higher than actual spending for 2018–19. This variance stems from the fact that most government-wide funds relating to the spending oversight core responsibility, will not be allocated to departments until year-end 2019–20. The variance is offset by the decrease in spending for the employer core responsibility as a result of the one‑time $3.1 billion payment to the Public Service Superannuation Account in 2018–19.

Planned human resources

The following table shows actual, forecast and planned full‑time equivalents (FTEs) for each core responsibility in TBS’s departmental results framework and to Internal Services for the years relevant to the current planning year.

| Core responsibilities and internal services | 2017–18 actual full‑time equivalents | 2018–19 actual full‑time equivalents | 2019–20 forecast full‑time equivalents | 2020–21 planned full‑time equivalents | 2021–22 planned full‑time equivalents | 2022–23 planned full‑time equivalents |

|---|---|---|---|---|---|---|

| Spending oversight | 302 | 309 | 293 | 302 | 302 | 302 |

| Administrative leadership | 589 | 669 | 660 | 500 | 491 | 443 |

| Employer | 435 | 469 | 564 | 430 | 392 | 389 |

| Regulatory oversight | 40 | 52 | 57 | 71 | 57 | 58 |

| Subtotal | 1,366 | 1,499 | 1,574 | 1,303 | 1,242 | 1,192 |

| Internal services | 605 | 612 | 630 | 614 | 611 | 611 |

| Total | 1,971 | 2,111 | 2,204 | 1,917 | 1,853 | 1,803 |

Table 5 Notes

|

||||||

Estimates by vote

Information on TBS’s organizational appropriations is available in the 2020–21 Main Estimates

Condensed future-oriented statement of operations

The condensed future oriented statement of operations provides an overview of TBS’s operations for 2019–20 to 2020–21.

The amounts for forecast and planned results in this statement of operations were prepared on an accrual basis. The amounts for forecast and planned spending presented in other sections of the Departmental Plan were prepared on an expenditure basis. Amounts may therefore differ.

A more detailed future-oriented statement of operations and associated notes, including a reconciliation of the net cost of operations to the requested authorities, available on TBS’s website.

| Financial information | 2019–20 forecast results | 2020–21 planned results | Difference (2020–21 planned results minus 2019–20 forecast results) |

|---|---|---|---|

| Total expenses | 3,051,014,736 | 2,486,159,184 | (564,855,552) |

| Total net revenues | 13,285,559 | 14,355,035 | 1,069,476 |

| Net cost of operations before government funding and transfers | 3,037,729,177 | 2,471,804,149 | (565,925,028) |

Total expenses comprise public service employer payments ($2.7 billion in 2019–20 and $2.2 billion in 2020–21) and departmental program expenses ($0.4 billion in 2019–20 and $0.3 billion in 2020–21). Public service employer payments are used to fund the employer’s share of the Public Service Health Care Plan, the Public Service Dental Care Plan and other insurance and benefit programs provided to federal public service employees.

Total planned expenses for 2020–21 are $565 million (18.5%) less than the forecast results for 2019–20 due to decreases in public service employer payments and in TBS’s program expenses associated with the sunsetting of funds that are subject to the renewal process. The breakdown is as follows:

- Planned public service employer payments for 2020–21 are $518 million less than forecast results for 2019–20 because of the sunsetting of funding received in 2019–20 for employee benefit programs, such as the Public Service Health Care Plan

- TBS’s planned program expenses for 2020–21 are $47 million less than forecast results for 2019–20, mostly because of the sunsetting of funding received in 2019–20 for various initiatives, such as Stabilization of the Federal Government’s Pay System, Canadian Digital Service and Next Generation Human Resources and Pay

Total net revenues include recoveries from other government departments for costs associated with the provision of internal support services related to financial and human resources management systems, as well as the information technology infrastructure that supports these systems. Other internal support services for which TBS recovers costs include accounting services (part of financial management) and mail services (part of information management). Net revenues also include the recovery of costs incurred by TBS for the administration of the Public Service Pension Plan.

The increase of $1.1 million (8.0%) in total net revenues from 2019–20 to 2020–21 is due to minor increases expected in internal support services and pension administration cost recoveries.

Corporate information

Organizational profile

Appropriate minister(s): The Honourable Jean‑Yves Duclos, President of the Treasury Board, and the Honourable Joyce Murray, Minister of Digital Government

Institutional head: Peter Wallace, Secretary of the Treasury Board

Ministerial portfolio: The ministers’ portfolio consists of the Treasury Board of Canada Secretariat and the Canada School of Public Service, as well as the following organizations, which operate at arm’s length and report to Parliament through the President of the Treasury Board: the Public Sector Pension Investment Board, the Office of the Commissioner of Lobbying of Canada, and the Office of the Public Sector Integrity Commissioner of Canada.

Enabling instrument(s): The Financial Administration Act is the act that establishes the Treasury Board itself and gives it powers with respect to the financial, personnel and administrative management of the public service, and the financial requirements of Crown corporations.

Year of incorporation / commencement: 1966

Raison d’être, mandate and role: who we are and what we do

“Raison d’être, mandate and role: who we are and what we do” is available on TBS’s website.

For more information on the department’s organizational mandate letter commitments, see the President of the Treasury Board’s mandate letter and the Minister of Digital Government’s mandate letter.

Operating context

As the administrative arm of the Treasury Board, TBS is expected to provide oversight, guidance and leadership on a number of complex and evolving horizontal issues (for example, modernization of the pay system) and to do so in short timeframes and with limited financial resources. TBS must therefore continually plan for, and respond to, changes in its operating environment.

TBS is playing an increasingly prominent leadership role in government‑wide initiatives. This role is particularly challenging because many of them involve major government‑wide changes. For example, TBS continues to work with internal and external stakeholders on various fronts to address the problems caused by the Phoenix pay system. These problems continue to affect the government’s ability to pay employees accurately and on time, which in turn continues to impact labour relations, talent management, and employee wellness.

TBS recognizes the pressures that its employees feel as they carry out TBS’s leadership role on these complex, high‑priority initiatives. TBS as a department will continue to strive to provide its employees with a healthy work environment and to attract, develop and retain a diverse and high‑performing workforce that is fully committed to the success of the organization. In addition, TBS will continue to closely monitor its environment and operations in order to reallocate resources to key priorities and to ensure that resources are being managed effectively.

Many of the results and performance targets outlined in TBS’s Departmental Plan are government‑wide results and targets that require action on the part of individual departments, as well as individual managers and employees in them. TBS supports the achievement of results in a number of ways, including developing policies, providing guidance to departments, and working with functional communities to identify and promote sound management practices. However, since TBS does not directly control departments and the managers and employees in them, it is difficult to identify when and to what degree government‑wide results and performance targets will be achieved.

Reporting framework

TBS’s approved departmental results framework and program inventory for 2020–21 are as follows.

Core responsibility 1: spending oversight

Departmental Results Framework

Departmental Result: Treasury Board proposals contain information that helps Cabinet ministers make decisions

- Indicator: Degree to which Treasury Board submissions transparently disclose financial risk (on a maturity scale of 1 to 5)

Departmental Result: Reporting on government spending is clear

- Indicator: Degree to which visitors to online departmental planning and reporting documents found the information useful (on a scale of 1 to 5)

- Indicator: Degree to which GC InfoBase users found the spending information they useful (on a scale of 1 to 5)

Program Inventory

- Oversight and Treasury Board Support

- Expenditure Data, Analysis, and Reviews

- Government Wide Funds

Core responsibility 2: administrative leadership

Departmental Results Framework

Departmental Result: Canadians have timely access to government information

- Indicator: Number of datasets available to the public

- Indicator: Percentage of personal information requests responded to within legislated timelines

- Indicator: Percentage of access to information requests responded to within legislated timelines

Departmental Result: Government service delivery is digitally enabled and meets the needs of Canadians

- Indicator: Percentage of Government of Canada priority services available online

- Indicator: Degree to which clients are satisfied with the delivery of Government of Canada services, expressed as a score from 1 to 100

- Indicator: Percentage of priority services that meet service standards