Treasury Board and Treasury Board Secretariat 101 Materials

Notice to readers

This document contains information which has been redacted in accordance with provisions of Part 1 of the Access to Information Act.

On this page

- Roles of the President of Treasury Board

- Primer: The role and powers of the Treasury Board and the President

- Treasury Board at a glance

- Treasury Board Secretariat at a glance

- The business of supply

- Primer: The business of supply

- Management of public service human resources

- Primer: People management in the federal public service

- Digital government

- Primer: Supporting the modernization of government information technology, information management and service

- Canadian Digital Service

- Federal regulations

- Primer: The Government of Canada’s regulatory system and regulatory policy initiatives

- Primer: How government manages finances and assets

- Primer: The Treasury Board Policy Suite

Roles of the President of Treasury Board

The President of the Treasury Board

- The Treasury Board was established in 1867 as the first Cabinet Committee and is the only one enshrined in legislation. It takes the final decision on expenditures and regulations

- The Treasury Board President is the Chair of the Treasury Board and also oversees the Treasury Board Secretariat, setting the management agenda for the Government of Canada in the areas of people, money and technology

- The President serves as the gatekeeper to the Board and sets its agenda, supporting the management and implementation of initiatives across government

- The President is supported by the Treasury Board Secretariat, which provides integrated advice from across the department

Overview of roles as President of the Treasury Board

Treasury Board

The President of the Treasury Board chairs Treasury Board meetings, and:

- acts as gatekeeper, deciding what is brought to the Treasury Board

- guides discussions to maintain focus on due diligence and impact

- plays a central role in Cabinet, bringing the Board’s focus on implementation and impact to Cabinet meetings

Treasury Board Secretariat

The President is responsible for the Treasury Board Secretariat. The Treasury Board Secretariat:

- establishes the management practices that dictate how finances, human resources and information technology operate across government

- approves the form and approach to tabling the Estimates in Parliament

Treasury Board Secretariat Portfolio

The President of the Treasury Board is the Minister responsible for a portfolio of 4 organizations:

- Canada School of Public Service

- Commissioner of Lobbying of Canada

- Public Sector Integrity Commissioner

- Public Sector Pension Investment Board

The Roles of the Treasury Board and its Secretariat

Treasury Board

- Authority is derived from the Financial Administration Act

- Treasury Board Ministers make the final decision on expenditures and regulations

- Sets the rules for the management of people, finances, technology and administration

- The Treasury Board is the Cabinet Committee designated by the Prime Minister to make recommendations to the Governor General:

- This means it functions as the Governor in Council for regulations and most orders in council (the Privy Council Office is responsible for orders in council for senior appointments)

- Typically meets weekly while Parliament is in session

Treasury Board Secretariat

- Key responsibilities are to provide integrated advice to Treasury Board ministers in the management and administration of government, and to fulfill the statutory responsibilities of a central government agency

- To fulfill its mandate, the Treasury Board Secretariat organizes its business and resources around 4 core responsibilities:

- Spending Oversight

- Administrative Leadership

- Employer

- Regulatory Oversight

Treasury Board

The President of the Treasury Board chairs the Treasury Board, a Cabinet Committee with responsibilities for the following:

Spending Oversight

- Providing due diligence before approving the use of new money that has been set aside in the Budget, including for major procurements, new programs and grants and contributions

- The government is responsible for almost $300 billion* in planned budgetary expenditures and the Treasury Board plays a central role in the government decision-making process

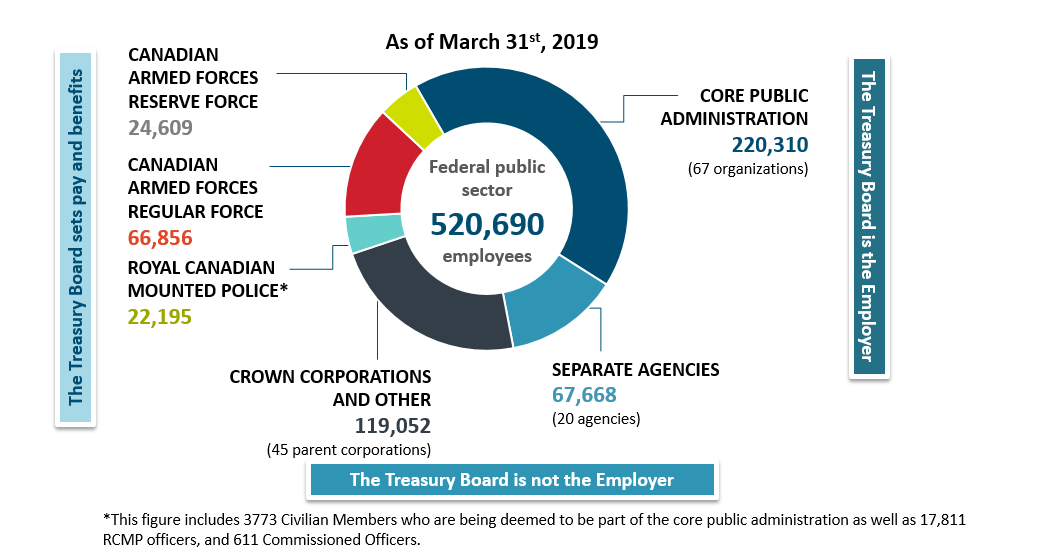

Employer

- Determining the terms and conditions of employment for the public service

- Approves collective agreements

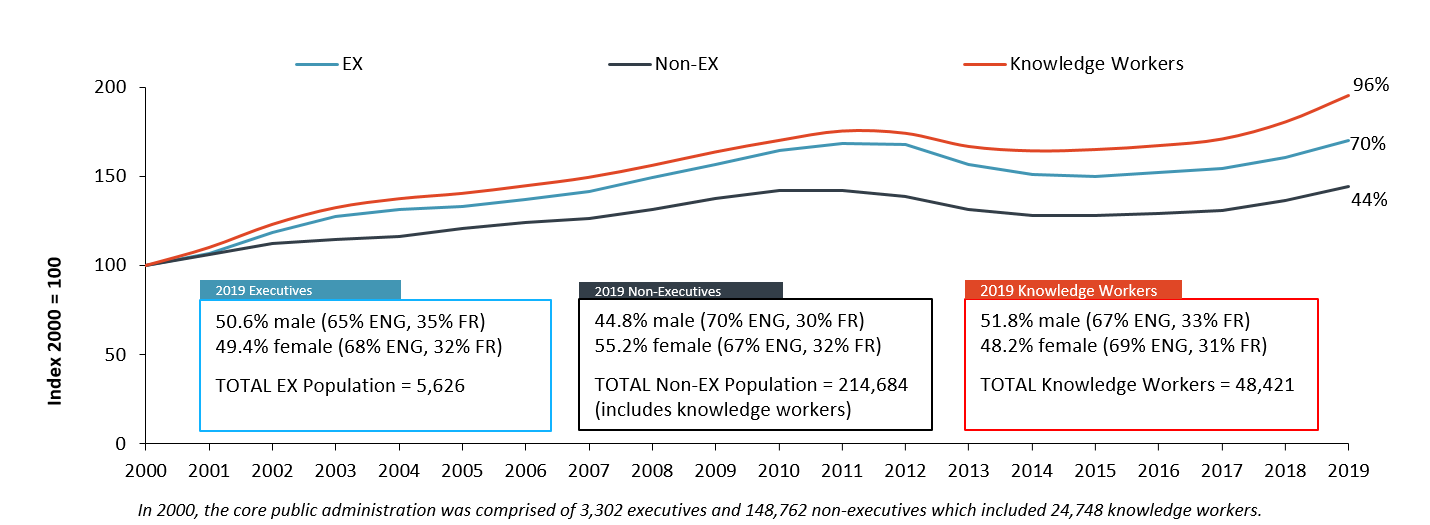

- The federal public service is Canada’s largest employer. The core public administration, which the Treasury Board employs, has close to 220,000 employees**

Administrative Leadership

- Establishing the rule sets for people, information technology, expenditure management and regulations

- Reviewing spending plans on departmental initiatives and making decisions that affect services to Canadians

Regulatory Oversight

- Establishing regulations that impact the health, safety and security of Canadians, the economy and the environment

- Over 50 government departments and agencies have regulatory responsibilities that impact the economy and lives of Canadians

* Main Estimates for the 2019 to 2020 fiscal year

** “Federal public service” refers to the collection of departments and agencies in the core public administration (for which the Treasury Board Secretariat is the employer)

Treasury Board Secretariat

The President is responsible for the Treasury Board Secretariat as a department and sets the strategic direction of the organization

Treasury Board Secretariat Key facts

- 2,125 employees*

- $3.8 billion in expenditures (2017 to 2018 fiscal year)**

- Senior Officials:

- Secretary, Peter Wallace

- Associate Secretary, Erin O’Gorman

- Chief Human Resources Officer, Nancy Chahwan

- Comptroller General, Roch Huppé

- Chief Information Officer, Francis Bilodeau

- Deputy Minister of Public Service Accessibility, Yazmine Laroche

Treasury Board Secretariat Core Responsibilities

As the administrative arm of the Treasury Board, the Treasury Board Secretariat provides leadership to help departments effectively implement government priorities and meet citizens’ evolving expectations of government

The Treasury Board Secretariat’s 4 core responsibilities mirror those of the Treasury Board, which are:

- Spending Oversight

- Administrative Leadership

- Employer

- Regulatory Oversight

Responsibilities as Minister of the Treasury Board Secretariat include:

- Provides policy direction to the Treasury Board Secretariat

- Brings forward Treasury Board submissions related to the Treasury Board Secretariat’s mandate

- Approves and presents proposals to Cabinet related to the Treasury Board Secretariat’s mandate

- Establishes the form, and tabling of, the Estimates

- Establishes the form, and tabling of, the Public Accounts

- Receives and tables a wide range of reports under legislation or Treasury Board policies

*As of March 2019

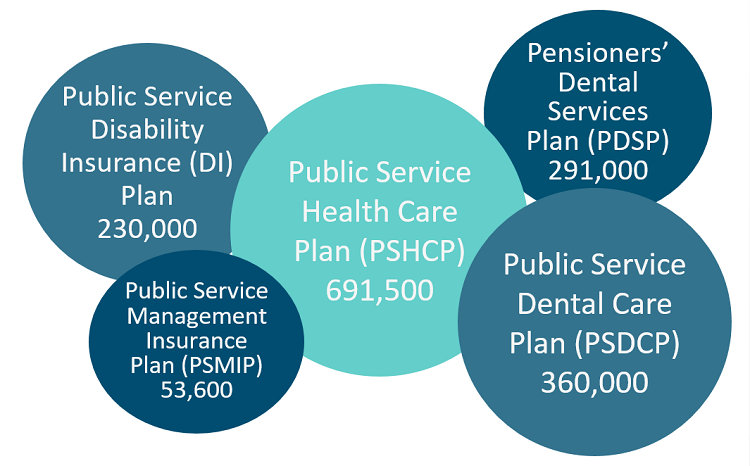

**Actual spending for 2017–18, as reported in the Public Accounts of Canada. The majority of these expenses ($3.5 billion) are allotted under the Employer role. These payments are used to fund the Employer’s share of the Public Service Health Care Plan, the Public Service Dental Care Plan and other benefit programs for the entire Government of Canada

Treasury Board Secretariat Portfolio

The President has oversight responsibilities for four portfolio agencies. This includes responsibility for the legislation governing these bodies and tabling any amendments in Parliament

Canada School of Public Service

Departmental Corporation

Taki Sarantakis,

President

Provides training and learning for the federal public administration

Reports to Parliament through the President of the Treasury Board

Commissioner of Lobbying of Canada

Agent of Parliament

Arm’s Length

Nancy Bélanger,

Commissioner

Establishes and maintains the Registry of Lobbyists, the Lobbyists' Code of Conduct and conducts investigations

Reports directly to Parliament on matters under the mandate

Reports to Parliament through the President on accountability/budgetary matters

Public Sector Integrity Commissioner

Agent of Parliament

Arm’s Length

Joe Friday,

Commissioner

Provides an independent mechanism for public servants to disclose potential wrongdoing in the workplace

Reports directly to Parliament on matters under the mandate

Reports to Parliament through the President on accountability/budgetary matters

Public Sector Pension Investment Board

Crown Corporation

Arm’s Length

Neil Cunningham,

President and CEO

The Crown corporation is tasked with managing employer and employee contributions to public service pension plans

Reports to Parliament through the President of the Treasury Board

The role and powers of the Treasury Board and the President

Treasury Board

The Treasury Board was first established as a committee of the Queen’s Privy Council for Canada on July 2, 1867, and was made a statutory committee in 1869. It is the only Cabinet committee recognized in legislation.

The Treasury Board consists of the President of the Treasury Board (the President), the Minister of Finance and four other members of the Queen's Privy Council for Canada that are designated as members by an order in council. The composition of the Treasury Board is provided for in the Financial Administration Act, which also provides for the appointment of alternates who can serve in the place of members. The Treasury Board’s quorum is three members (including alternates), except when it is acting as Governor in Council (often referred to as “Treasury Board, Part B”), in which case its quorum is 4 members.

The Treasury Board exercises authority over a range of issues and its role can generally be classified into powers of supervision, recommendation, decision, approval, reporting and regulation-making. While the primary statute setting out the role of the Treasury Board is the Financial Administration Act, there are over 20 other statutes that also establish its roles and authorities. The Treasury Board’s powers and responsibilities are also set out in regulations, orders in council, policies, guidelines and practices.

The Treasury Board has four principal roles:

- It acts as the government’s "Expenditure Manager":

- preparing the government’s expenditure plans (the Estimates) and monitoring program spending by government departments

- approving the use of new money that has been set aside in the Budget, including for major procurements, assets, new programs and grants and contributions

- It acts as the government’s "Management Board":

- setting the rules that establish how people, public funds and government assets are managed

- reviewing departmental investment plans in support of accountability of government operations

- It acts as the "Employer" of the core public administration:

- collective bargaining for the core public administration

- determining terms and conditions of employment, including pensions

- setting rules on human resources management

- It provides "Regulatory Oversight" as a committee of the Privy Council:

- reviewing and approving most regulations and orders in council was assigned to Treasury Board in December 2003 and when doing so it functions as Treasury Board (Governor in Council), more commonly referred to as Treasury Board (Part B):

- Appointment as a Treasury Board member is not required. In the absence of a sufficient number of members, other cabinet ministers may be invited to participate.

- reviewing and approving most regulations and orders in council was assigned to Treasury Board in December 2003 and when doing so it functions as Treasury Board (Governor in Council), more commonly referred to as Treasury Board (Part B):

President of the Treasury Board

Responsibilities and key accountabilities

The responsibilities assigned to the President as Chair of the Treasury Board are implicitly inseparable from the Treasury Board’s mandate: the management, expenditure and employer responsibilities that fall to the Treasury Board are also the President’s own responsibilities and form the basis for his or her key accountabilities. Appendix A provides further information about the legislative mandate and responsibilities of the Treasury Board and the President.

Specific responsibilities assigned directly to the President include:

- coordinating the activities of the Secretary, Comptroller General, Chief Human Resources Officer and the Chief Information Officer of Canada and delegating responsibility to the Secretary or other officials accordingly

- recommending external members of departmental audit committees

- establishing the form and tabling of the Public Accounts

- publishing a consolidated quarterly report on Crown corporations

- receiving and tabling a wide range of reports under legislation or Treasury Board policies

The Treasury Board may make the delegation subject to terms and conditions it considers appropriate. In turn, the Financial Administration Act provides that such delegated powers can be further delegated. Any sub-delegation is subject to the terms and conditions of the original delegation.

Other statutes assign specific authorities to either the President or the Treasury Board. For example, the President has the authority to:

- establish policies and forms with respect to the administration of the Access to Information Actand the Privacy Act

- administer substantive components of the Official Languages Act

- administer components of the Public Servants Disclosure Protection Act

The Treasury Board’s authority to act as the employer for the core public administration is established under various statutes. As the Chair of the Treasury Board, the President supports the Treasury Board’s employer responsibilities. Legislation gives the Treasury Board the authority to:

- engage in collective bargaining under the Federal Public Sector Labour Relations Act

- make rules respecting deployments, probation and promotion under the Public Service Employment Act

- set pay levels for Canadian Armed Forces members under the National Defence Act

Legislative portfolio

The President maintains overall responsibility for the statutes within his or her legislative portfolio. Should the government decide to amend these statutes, the President would be responsible for sponsoring any bills introduced in the House of Commons and tabling any required Government Response. Appendix B contains a list of statutes that fall under the President’s legislative portfolio.

Ministerial portfolioFootnote 1

The President is the Minister responsible for the Treasury Board of Canada Secretariat and the Canada School of Public Service. The Canada School of Public Service provides a common, standardized curriculum to support the learning and development of public servants.

Operating at arm’s length and reporting to Parliament through the President of the Treasury Board are the Public Sector Pension Investment Board, the Office of the Commissioner of Lobbying of Canada and the Office of the Public Sector Integrity Commissioner of Canada (see the separate briefing note on “Portfolio and Arm’s Length Organizations” for details).

Treasury Board Secretariat

The Treasury Board of Canada Secretariat was established as a department in 1966 as the administrative arm of the Treasury Board. It supports the Treasury Board by making recommendations and providing advice on program spending, regulations and management policies and directives, while respecting the primary responsibility of Deputy Heads in managing their organizations and in their roles as accounting officers before Parliament. In this way, the Secretariat helps to strengthen government performance, results and reporting and supports good governance and sound stewardship.

The business lines of the Secretariat are expressed through its Departmental Results Framework. The Departmental Results Framework sets out the core responsibilities for the organization, which are:

- Spending Oversight

- Administrative Leadership

- Employer

- Regulatory Oversight

- Internal Services

The Departmental Results Framework also focuses on the results the department is aiming to achieve in these core areas as well as how progress will be assessed. This information helps support the Treasury Board Secretariat’s reporting to Parliament through its Departmental Plan and Departmental Results Report. The Departmental Plan, tabled in the spring, describes what the Treasury Board Secretariat will do over the next three years to achieve results for Canadians and the resources that are required to do so. The Departmental Results Report, tabled in the fall, describes the Treasury Board Secretariat’s actual performance and the resources it used during the previous fiscal year.

The Secretary of the Treasury Board

The Secretary of the Treasury Board is the Deputy Head of the Treasury Board of Canada Secretariat. The Secretary is appointed by the Governor in Council.

Subsection 12(1) of the Financial Administration Act sets out the powers delegated to Deputy Heads, which include, among others:

- determining the learning, training and development requirements of public service employees

- establishing standards of discipline and setting penalties (including termination of employment, suspension, demotion or financial penalties)

- providing for the termination of employment or demotion of public service employees for disciplinary reasons, unsatisfactory performance or other non-disciplinary reasons

The Treasury Board may delegate to the Secretary any of the powers or functions it is authorized to exercise under any Act of Parliament or by any order made by the Governor in Council (section 6(4) of the Financial Administration Act). The Secretary, as are all other Deputy Heads and chief executive officers, is an accounting officer pursuant to sections 16.1 through 16.4 of the Financial Administration Act. Accounting officers are senior officials that can be called to testify before a parliamentary committee regarding the management of their department and the performance of their duties.

Under section 16.5 of the Financial Administration Act, the Secretary has a role in providing guidance on the interpretation of policies, directives or standards issued by the Treasury Board in disputes between deputy heads (as accounting officers) and ministers.

Although the Secretary oversees the Treasury Board Secretariat, 3 other senior officials, established under the Financial Administration Act, have specific government-wide leadership responsibilities within the Secretariat:

- the Comptroller General of Canada provides leadership, direction, oversight and capacity building for financial management, internal audit and the management of assets and acquired services

- the Chief Human Resources Officer provides leadership on people management through policies, programs and strategic engagements; centrally manages labour relations, compensation, pensions and benefits; and contributes to the management of executives

- the Chief Information Officer of Canada provides leadership, direction, oversight and capacity building for information management, information technology, government security, access to information, privacy and internal and external service delivery

Appendix A: Overview of the legislative mandate of the Treasury Board and the President

The Financial Administration Act is the primary statute that outlines the role of the Treasury Board and the President. Other federal laws also contain provisions that implicate the Treasury Board and the President.

Financial management and administrative policy

- General

- The Financial Administration Act provides that the Treasury Board may act for the Queen’s Privy Council for Canada on a number of items, including: general administrative policy in the federal public administration, the organization of the federal public administration, financial management and the review of departmental spending plans and programs. The Act also provides for various powers of delegation.

- The Financial Administration Act also provides important rules for the financial administration of the Government of Canada, the establishment and maintenance of the accounts of Canada and the control of Crown corporations. A variety of other statutes also grant authorities to the Treasury Board on financial matters such as presenting financial statements to the Auditor General for audit and approving rates of remuneration, travel expenses and other allowances.

- The Appropriation Acts implement the Main Estimates and Supplementary Estimates. They are approved by the Treasury Board and tabled in the House of Commons by the President.

- Management of assets

- The Federal Real Property and Federal Immovables Act provides for the authorization and regulation of the acquisition, administration and disposition of real property by or on behalf of the Crown. Under that Act, the Treasury Board is given authority to establish financial or other limits, restrictions or requirements respecting any real property transaction or class of transactions. Policies have been adopted ensuring proper stewardship of Crown property and maximization of value for any property acquired or disposed. Although the Act has delegated full authority to Ministers to complete most transactions, certain transactions are nevertheless subject to Cabinet approval (Governor in Council) on the recommendation of the Treasury Board. The President acts as the Minister responsible for this Act.

- Access to information and privacy

- The Access to Information Act provides a right of access to records under the control of government institutions, requires a range of institutions to proactively publish specified information and establishes the Office of the Information Commissioner. The President is one of the Ministers designated by the Governor in Council for the purposes of the Act. As such, the President is responsible for:

- initiating a review of the Act by June 21, 2020, and every 5 years afterwards

- providing direction and guidance (e.g. through administrative policies) to government institutions regarding the operation of the Act and for reviewing the management of records under the control of government institutions to ensure compliance with the Act

- publishing the following annually:

- a list containing the names of government institutions, their responsibilities and the classes of records kept by them

- a summary report of statistics on institutional compliance with the Act

- The Privacy Act establishes rules to protect personal information held by government institutions, provides individuals with a right to access and correct their personal information that is held by government institutions and establishes the Office of the Privacy Commissioner. The President is the Minister designated by the Governor in Council for the purposes of certain provisions of the Act. As such, the President is responsible for:

- providing direction and guidance (e.g. through administrative policies) to government institutions regarding the operation of the Act

- reviewing the use of personal information banks and for reviewing the management of such banks to ensure compliance with the Act

- publishing annually an index of:

- personal information banks, including the names of government institutions controlling the banks and the purposes for which the personal information was collected

- classes of personal information that are not contained in personal information banks

- On June 21, 2019, Bill C-58, An Act to amend the Access to Information Act and the Privacy Act and to make consequential amendments to other Acts, received Royal Assent. The amended Access to Information Act provides the Information Commissioner with a new order making power and creates a proactive publication regime for government institutions, ministers’ offices and institutions that support the superior courts and Parliament.

- The Access to Information Act provides a right of access to records under the control of government institutions, requires a range of institutions to proactively publish specified information and establishes the Office of the Information Commissioner. The President is one of the Ministers designated by the Governor in Council for the purposes of the Act. As such, the President is responsible for:

- Official languages

- The Treasury Board is responsible for the general direction and coordination of the policies and programs relating to the implementation of Part IV (Communications with and Services to the Public), Part V (Language of Work) and Part VI (Participation of English-Speaking and French-Speaking Canadians) of the Official Languages Act within all federal institutions, except:

- the Senate

- the House of Commons

- the Library of Parliament

- the Office of the Senate Ethics Officer

- the Office of the Conflict of Interest and Ethics Commissioner

- the Parliamentary Protective Services

- the Office of the Parliamentary Budget Officer

- The President must submit an annual report to Parliament concerning the implementation of these programs. The President may also be designated by the Governor in Council to undertake public consultations on proposed regulations.

- The Treasury Board is responsible for the general direction and coordination of the policies and programs relating to the implementation of Part IV (Communications with and Services to the Public), Part V (Language of Work) and Part VI (Participation of English-Speaking and French-Speaking Canadians) of the Official Languages Act within all federal institutions, except:

- Auditor General

- The Auditor General Act establishes the Auditor General, who is responsible for verifying the accuracy of the government’s financial statements and providing Parliament with independent information, assurance and advice regarding the stewardship of public funds. With respect to the Auditor General, the President:

- Tables the Public Accounts of Canada in the fall, which contain the Auditor General’s opinion on the government’s financial statements. The Auditor General also issues a Commentary on the Financial Audits which includes the observations from the financial statement audit.

- Leads the Government of Canada’s public response to performance audits conducted by the Auditor General, which determine whether the government is appropriately managing its activities and resources. The findings of performance audits are summarized in the Auditor General’s reports, which are generally tabled in Parliament twice per year (spring and fall). Prior to tabling, the Auditor General typically offers to meet with the President in order to provide an overview of the audits that implicate the Treasury Board Secretariat. The President briefs Cabinet on the findings of the Auditor General’s performance audits and discusses communications strategies. If an audit implicates the Treasury Board Secretariat, the President will also issue a specific response relating to its findings.

- Receives copies of the Auditor General’s special examinations, which determine whether Crown corporations are managed efficiently and effectively, and whether their assets are reasonably safeguarded. Special examinations must be conducted at least once every 10 years for each Crown corporation and the results are generally tabled in Parliament annually as part of the Auditor General’s spring reports.

- The Auditor General Act establishes the Auditor General, who is responsible for verifying the accuracy of the government’s financial statements and providing Parliament with independent information, assurance and advice regarding the stewardship of public funds. With respect to the Auditor General, the President:

- Red tape reduction

- The Red Tape Reduction Act provides that the President may establish policies or issue directives respecting the manner in which the One-for-One Rule is applied. The One-for-One Rule requires federal government regulators to offset the cost increases of administrative burdens on businesses and remove one regulation for every new regulation added that imposes an administrative burden. The President is also responsible for publishing an annual report and causing a review of the Act to be conducted. The Regulations provide that the Treasury Board may exempt a regulation from the one-for-one rule in certain circumstances.

- Service Fees Act

- The Service Fees Act requires responsible authorities, before certain fees are fixed, to develop fee proposals for consultation and to table them in Parliament. It also requires that performance standards and procedures for refunding certain fees be established in accordance with Treasury Board policies or directives. It adjusts certain fees on an annual basis in accordance with the Consumer Price Index. Furthermore, it requires responsible authorities to table a report on their fees in Parliament in accordance with Treasury Board policies and directives. Finally, the President is required to publish a report that consolidates the information set out in the reports tabled in Parliament.

Human resources management

- General

- The Treasury Board acts as the Employer for the core public administration and as such, the Financial Administration Act gives it general responsibility for the organization of the public service and personnel management within the public administration, including the determination of the terms and conditions of employment of persons employed in it. It further allows the Treasury Board to delegate to the Chief Human Resource Officer any of its powers and functions—other than its power to make regulations—in relation to human resources management, official languages, employment equity, values and ethics and its authorities under the Public Service Employment Act.

- The Financial Administration Act also provides direct authority for certain aspects of personnel management in the hands of deputy heads, subject to policies and directives of the Treasury Board. Deputy head responsibilities include determining learning and developmental requirements, providing awards and setting standards of discipline and imposing penalties (up to and including termination) and the termination or demotion of employees for unsatisfactory performance or other non-disciplinary reasons.

- Staffing

- The Public Service Employment Act provides for the appointment of public servants in the public service and other related matters.

- Under the Act, staffing in the public service is based on the core values of merit, excellence, non-partisanship, representativeness and the ability to serve members of the public with integrity in the official language of their choice. The Act defines merit, attributes certain functions directly to the Employer and creates arrangements for staffing recourse. The Public Service Commission continues to conduct investigations and audits on matters within its jurisdiction.

- The Federal Public Sector Labour Relations and Employment Board is responsible for the resolution of staffing complaints related to internal appointments and layoffs in the federal public service.

- Labour relations

- The Federal Public Sector Labour Relations Act establishes a labour relations regime within the public service, provides for the negotiation of collective agreements with unions representing public servants and establishes a grievance process for public servants. The Act provides for a labour relations regime based on cooperation and consultation between the Employer and bargaining agents, notably by requiring labour-management consultation committees, enabling co-development of workplace improvements and enhancing reconciliation. The Act also establishes an essential services regime whereby, although the employer determines the level at which services are to be provided during a strike, an essential services agreement must be entered between the employer and the bargaining agent prior to the bargaining agent being in a strike position. The Act provides for the establishment of informal conflict resolution within departments and for comprehensive grievance provisions.

- The Federal Public Sector Labour Relations Act was amended in 2017 to include a new collective bargaining and labour relations regime for the Royal Canadian Mounted Police.

- The Federal Public Sector Labour Relations and Employment Board is responsible for administering the collective bargaining and grievance adjudication systems in the federal public service.

- Employment equity

- The Employment Equity Act aims to ensure that members of designated groups (women, Aboriginal peoples, persons with disabilities, and members of visible minorities) are equitably represented in both the federal public service and the federally-regulated private sector (which includes airlines, interprovincial rail, ship or ferry operations, radio broadcasting stations and banks). While the Minister of Labour is the responsible minister, the Treasury Board is among the largest employers to which the Act applies. Moreover, the Treasury Board plays an important role in the implementation of the Act for the Canadian Armed Forces, the Royal Canadian Mounted Police and the Canadian Security and Intelligence Service. The President is responsible for tabling in Parliament an annual report on the state of employment equity in the public service.

- Disclosure of wrongdoing and reprisal protection

- The Public Servants Disclosure Protection Act establishes a regime to enable public servants to make disclosures of information that they believe could show that a wrongdoing has occurred in relation to the public sector. The regime includes access to the Public Sector Integrity Commissioner. The Act also provides protection from reprisal to public servants who have made a disclosure under the Act.

- The Treasury Board, as required by the Act, has created a code of conduct for the public sector. The Treasury Board is also responsible for approving the procedures for handling disclosures that must be set up by certain public sector organizations that are excluded from the Act (the Canadian Armed Forces, the Canadian Security Intelligence Service and the Communications Security Establishment).

- Under the Act, the President is responsible for:

- promoting ethical practices in the public sector, fostering a positive environment for making disclosures and disseminating information about the Act and its processes

- tabling annually in each House of Parliament a report prepared by the Chief Human Resources Officer that provides an overview of activities regarding certain disclosures made under the Act

- initiating an independent review of the Act 5 years after it comes into force; in June 2017, this requirement was satisfied by the House of Commons Standing Committee on Government Operations and Estimates

- Health and safety

- Part II of the Canada Labour Code creates a regime of requirements and recourse to prevent work-related accidents and sickness that is applicable to employers and employees subject to federal jurisdiction. The Treasury Board is currently the largest employer subject to Part II of the Code.

- Pensions

- The Treasury Board and the President have responsibilities in relation to a number of legislated pension plans.

- The President is the responsible minister for:

- the Public Service Superannuation Act, which provides pension benefits to public service employees and their survivors; it is compulsory for all members of the public service (including some Crown Agencies and Crown corporations) and provides a defined benefit plan based on years of pensionable service and salary

- the Members of Parliament Retiring Allowances Act, which provides pension benefits to Senators and Members of the House of Commons and their survivors

- the Diplomatic Service (Special) Superannuation Act, an act to provide superannuation benefits for senior appointees of the Department of Foreign Affairs, Trade and Development serving outside of Canada

- certain sections of the Public Pensions Reporting Act, which require the Chief Actuary to conduct actuarial reviews and issue valuation reports in respect of stipulated pension plans

- the Public Service Pension Adjustment Act, which provides a framework to adjust for persons in receipt of more than 1 public service pension

- the Special Retirement Arrangements Act, which authorizes the establishment of retirement compensation arrangements

- the Supplementary Retirement Benefits Act, which provides for pension indexing

- the Public Sector Pension Investment Board Act, which establishes the Public Sector Pension Investment Board; since March 31, 2000, contributions made by the government and employees under the Public Service Superannuation Act, the RCMP Superannuation Act and the Canadian Forces Superannuation Act plans are invested in securities markets

- The Canadian Forces Superannuation Act, Defence Services Pension Continuation Act, RCMP Superannuation Act and the RCMP Pension Continuation Act provide pension benefits to all Canadian Armed Forces personnel, to members of the Royal Canadian Mounted Police and their survivors and to retired officers of the military/Royal Canadian Mounted Police who were part of the old Defence Services Pension Act and Royal Canadian Mounted Police Act and their survivors. The Minister of National Defence and the Solicitor General are responsible for each of their respective plans. However, the President is accountable to Parliament for funding and financial policies for these plans and thus has a shared responsibility.

- Pay Equity Act

- The Pay Equity Act received Royal Assent but is not yet in force (Bill C-86). The Act will create a proactive pay equity regime that applies to the federal public service as well as to federally-regulated businesses in Canada. The Act requires employers to establish and maintain a pay equity plan and to identify and correct differences in compensation between predominantly male and predominantly female job classes where the work performed is of equal value. As the employer, Treasury Board has a leading role in guiding the establishment and maintenance of a pay equity plan for the federal public service.

Government ethics and lobbying

- Conflict of Interest Act

- The Conflict of Interest Act establishes ethical rules for public office holders to protect the integrity of government decision-making. The Conflict of Interest and Ethics Commissioner administers the Act by reviewing confidential reports submitted to their Office, investigating possible contraventions of the Act and tabling reports to Parliament. Although the Act does not assign any specific legislative responsibilities to the President, the Act falls under the President’s legislative portfolio.

- Lobbying Act

- The Lobbying Act establishes the Office of the Commissioner of Lobbying and provides for the appointment of the Commissioner of Lobbying. The Commissioner of Lobbying is mandated to establish and maintain the registry of lobbyists, which includes information about all registered lobbyists as well as their activities. Although the Act does not assign any specific legislative responsibilities to the President, the Act falls under the President’s legislative portfolio.

Appendix B: Legislative portfolio of the President

Statutes that fall under the President’s legislative portfolio:

- Access to Information Act(note: the President’s responsibility is shared with the Minister of Justice)

- Alternative Fuels Act

- Auditor General Act

- Canada School of Public Service Act

- Conflict of Interest Act

- Diplomatic Service (Special) Superannuation Act

- Federal Real Property and Federal Immovables Act

- Government Services Act, 1999

- Government Services Resumption Act

- Lieutenant Governors Superannuation Act

- Lobbying Act

- Members of Parliament Retiring Allowances Act

- Privacy Act (note: the President’s responsibility is shared with the Minister of Justice)

- Public Pensions Reporting Act(note: the President’s responsibility is shared with the Minister of Human Resources Development)

- Public Sector Compensation Act

- Public Sector Pension Investment Board Act

- Public Servants Disclosure Protection Act

- Public Service Employment Act(note: The President’s responsibility is shared with the President of the Queen’s Privy Council for Canada and the Minister of Canadian Heritage)

- Public Service Pension Adjustment Act

- Public Service Superannuation Act

- Red Tape Reduction Act

- Special Retirement Arrangements Act

- Supplementary Retirement Benefits Act

Treasury Board at a glance

About the Treasury Board

Established in 1867, the Treasury Board is the only statutory Cabinet Committee. It has 2 distinct functions:

Part A: Management Board

Makes decisions about:

- funds (expenditure manager)

- authorities, rules and compliance (management board)

- people (employer)

Treasury Board responsibilities are delegated by the Financial Administration Act which creates the Board’s public service support: Secretary, Comptroller General, Chief Human Resources Officer and Chief Information Officer

Part B: Governor in Council

Since 2003, the Treasury Board has been designated as the Cabinet Committee responsible for considering Governor in Council matters

Makes recommendations to the Governor General about:

- regulations

- most orders in council (i.e. non-appointment orders in council)

In addition to the Financial Administration Act, over 20 other statutes establish the Treasury Board’s roles and authorities. Powers and responsibilities are also set out in regulations, Orders in Council, policies, guidelines and practices

Where Treasury Board fits

Between the genesis of a policy idea and its implementation by a department, Ministers must secure certain approvals to ensure policy alignment, affordability and feasibility

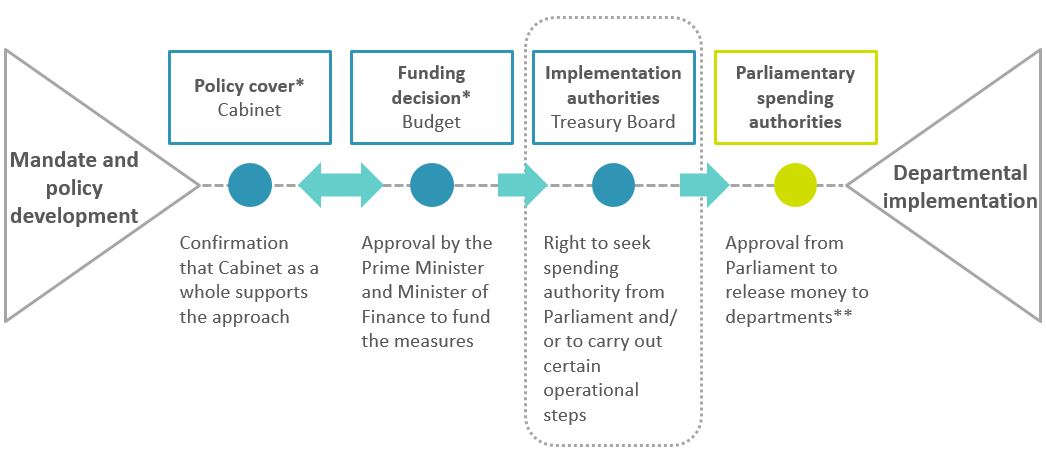

Text version

The graphic presents the process from policy idea to implementation by a department. The first step is mandate and policy development. The second step is policy cover by Cabinet, which includes confirmation that Cabinet as a whole supports the approach. The third step is a funding decision through the Budget, which includes approval by the Prime Minister and the Minister of Finance to fund the measures. The fourth step is implementation authorities by Treasury Board, which includes the right to seek spending authority from Parliament and/or to carry out certain operational steps. The fifth step is parliamentary spending authorities, which includes approval from Parliament to release money to departments. The final step is departmental implementation.

The fourth step (implementation authorities by Treasury Board) is circled to indicate where Treasury Board fits within the process.

Combined, these key decisions help ensure the Government can deliver its agenda effectively

*Policy cover and the funding decision are not always sought in the same order

**Parliamentary approval is obtained through supply bills, which include multiple spending proposals

How Treasury Board helps implement the government’s agenda

Cabinet focuses on the what...

For example:

- Helps formulate government agenda and set priorities and strategy (e.g. parliamentary, communications)

- Approves policy and legislative proposals

- Government-wide issues management and communications

- Approves most Governor in Council appointments (judicial and non-judicial)

- Reviews progress against the key commitments (in some cases)

...the Treasury Board focuses on the how

For example:

- Ensures all initiatives respect the Financial Administration Act and Government of Canada policies

- Ensures departmental implementation plans and resource requests are reasonable

- Approves changes to departmental budgets via the Estimates process

| Alignment | Design | Value | Risk | Implementation Capacity | Impact |

|---|---|---|---|---|---|

| Does the proposal align with the government’s policy goals? | How is the program or regulation designed? | Does the proposal represent good value? | Are solid risk mitigation plans in place for the overall risks of the proposal? | Does the proposal work within the department’s existing administrative capacity? | Will it achieve outcomes? How will these be measured? |

Key features of the Treasury Board

Treasury Board ensures financial and Treasury Board policy suite compliance at the program design stage.

Ministers play a corporate role as opposed to representing their own departmental priorities.

High-volume Cabinet committee with a wide scope of decision-making authority

- The Treasury Board takes approximately 1,400 decisions per year

Treasury Board Secretariat officials present proposals, unlike at Cabinet, where Ministers present their proposals

- Officials’ advice is provided to all Treasury Board Ministers, not just the Chair

The roles of the Treasury Board

| Part A | Part B | ||

|---|---|---|---|

| Expenditure Manager | Management Board | Employer | Regulatory Oversight |

|

|

|

|

| *Main Estimates | |||

Role 1: Expenditure manager

- The Treasury Board decisions on new and existing funds play a role in determining the amount of money departments can spend and how they can spend it

- The Treasury Board also plays a central role in how the government plans and reports its spending (“the business of supply”)

- This includes approving departmental requests for funds to be included in the Estimates for spending approval from Parliament

- Statutory authorities are those that Parliament has approved through existing legislation. This spending is included in the Estimates for information only

Top 3 major statutory*spending items

Main Estimates 2019-20

Old Age Security

$42.8 billion

Canada Health Transfer

$40.4 billion

Fiscal Equalization

$19.8 billion

Top 3 major non-statutory spending items

Main Estimates 2019-2020

National Defence Operations and Programs

$15.8 billion

Indigenous Services Canada Grants and Contributions

$9.5 billion

Infrastructure Canada Grants and Contributions

$5.2 billion

Source: GC InfoBase, TBS-Expenditure Management Sector. Note: total may not add up due to rounding.

Role 2: Management board

Treasury Board policies and decisions have a significant impact on how the government is managed. The majority of proposals reviewed by the Treasury Board fall within the following categories:

What we own

Assets

The government owns a wide range of assets required to fulfill its obligations and meet the needs of Canadians

These assets can range from search and rescue aircraft, international bridges and real property, such as police stations, historic sites and the Parliamentary precinct

What we buy

Procurement

The government requires goods and services to sustain its operations

Examples of goods and services can include Coast Guard vessels, military equipment, computer systems and professional services, such as physicians or engineers

What we support

Transfer payments

The government transfers funds to other orders of government, third party organizations and Canadians

Examples include transferring funds to support municipal infrastructure, Indigenous education and newcomers to Canada

Role 2: Management board and Treasury Board policy suite

In addition to assets, procurement and transfer payments, Treasury Board policies cover other areas of government:

Results, evaluation and internal audit

Measures to assess performance and support decisions, and helps ensure the public receives information on outcomes

Financial management

Outlines safeguards and ensures proper use and accountability of public funds

People management and official languages

Manages the workforce and workplace, and supports equality of English and French through communications and services

Service and digital

Supports the management of service delivery, information and data, information technology and cyber security in the digital era

Communications

Sets rules for how government communicates with the public (e.g. advertising, social media, public opinion research and web)

Government security

Supports protection of government operations and the people, information and assets that support them

Through its policy suite (51 policies), the Treasury Board has a number of levers to promote management excellence and strong stewardship

Role 3: Employer

The Treasury Board, as the employer, has an overarching responsibility for the human resources management and financial compensation of the Core Public Administration, which comprises over 220,000 federal public service employees

As Employer, The Treasury Board is responsible for:

- overseeing negotiation and authorization for approval of 28 collective agreements, with 16 different bargaining agents

- determining terms and conditions of employment, including pensions and benefits

- setting compensation and terms and conditions of employment for unrepresented employees such as executives

- setting policy direction on people management and official languages issues, such as employment equity and learning

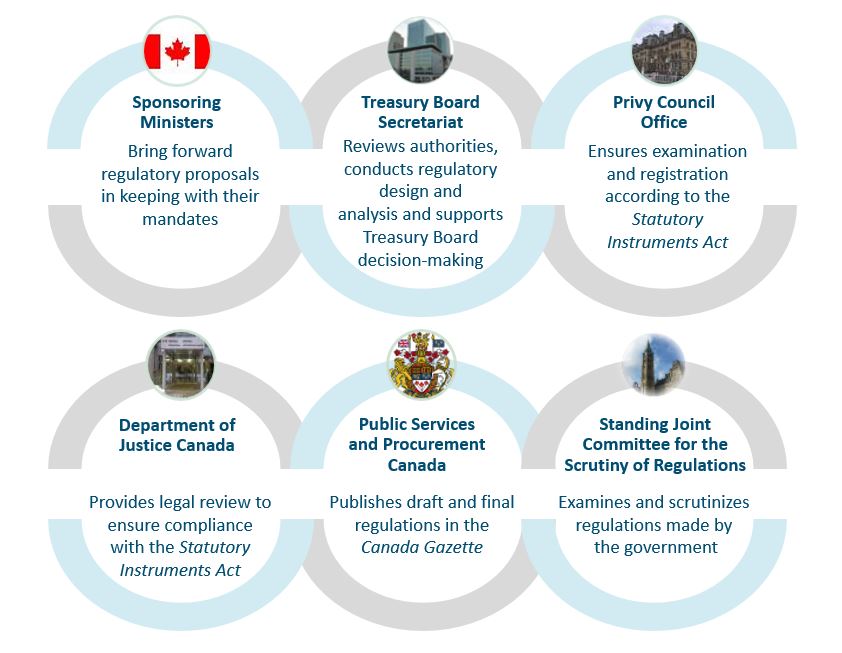

Role 4: Regulatory oversight

The Treasury Board (Part B) is responsible for considering Governor in Council matters: regulations and non-appointment orders in council

Regulations

Approximately 100 to 200 per year

- a form of law (subordinate to the broader enabling legislation)

- includes the authority to repeal regulations

- examples of regulations: food and drug safety, environmental protection and transportation safety

Orders in council

Approximately 200 to 300 per year

- a legal decision

- examples of orders in council: authority to enter into an international agreement and bringing legislation into force

Conclusion

The Treasury Board exercises 4 roles within 2 distinct functions:

Part A

- Expenditure Manager

- Management Board

- Employer

Part B

- Regulatory Oversight (including Governor in Council matters)

Treasury Board Secretariat officials support the process by presenting cases to the Board, and providing integrated advice and administrative support

Annex A: How the Treasury Board works

Due diligence

Submissions reviewed for:

- clarity, completeness and quality

- business case and value for money

- compliance with existing legal and policy requirements

- program operations and viability

- risk and mitigation

- design and implementation

- international alignment

- regulatory quality and adherence to the Cabinet Directive on Regulation

Secretariat provides advice

Treasury Board Ministers receive [redacted] in advance of the meeting that contains:

- sponsoring Ministers’ signed submissions (TBD)

- secretariat's advice

- regulatory proposals and Order in Council submissions

Cases are presented at the Treasury Board

Process:

- not all cases are formally presented or discussed

- secretariat officials present the cases flagged for discussion

- members can ask for any case to be presented

Secretariat officials answer questions on any item

Treasury Board Ministers challenge and decide

For Part A, members either:

- approve as proposed

- approve with conditions

- defer the decision

- do not approve

For Part B, members:

- consider draft regulations for public comment (beginning of process)

- consider regulations for final approval (end of process)

- Part B decisions are only to approve or not approve

Annex B: Examples of Treasury Board business

New funds

(e.g. Treasury Board submissions seeking access to funds for a department, following a funding decision in the Budget)

Corporate and business plans

(e.g. approval of corporate plans for Crown corporations)

Grants and contributions

(e.g. approval to provide transfers to people, other governments, and organizations for infrastructure)

Human resources approvals

(e.g. pension and benefits administration, creation of Assistant Deputy Minister-level positions)

Investment plans and project approvals

(e.g. a new information technology project)

Treasury Board policies

(e.g. approval, amendments, rescinding, exceptions and exemptions to any of the Treasury Board policies)

Contract and real property approvals

(e.g. purchasing a new building)

Other

(e.g. write-off and remission order, adjustments or establishment of user fees)

Treasury Board Secretariat at a glance

-

In this section

- Central agency and departmental functions

- Senior Management Team

- Treasury Board Secretariat

- Office of the Chief Human Resources Officer

- Office of the Comptroller General

- Office of the Chief Information Officer

- Office for Public Service Accessibility

- Supporting the Treasury Board directly

- Enabling functions

The Treasury Board Secretariat has approximately 2,125 employees and plays a central coordinating function for the Government of Canada, promoting coherence across programs and services

| Central agency | Department |

|---|---|

| Sets the government-wide management agenda and provides guidance to departments on a wide range of management issues | As a department, is subject to this agenda and guidance |

| Performs a challenge function and advises Ministers on proposals brought forward by departments (e.g. on Memoranda to Cabinet, Budget items, and Treasury Board submissions) | Submits proposals to Cabinet for the President’s own initiatives |

Central agency and departmental functions

Central agency

The central agency function supports the Treasury Board’s mandate. This role is generally carried out by the following groups:

- Office of the Comptroller General

- Office of the Chief Human Resources Officer

- Office of the Chief Information Officer

- Expenditure Management Sector

- Regulatory Affairs

- Program Sectors

Department

Enabling functions support the smooth operation of the Treasury Board Secretariat. These functions are carried out mainly by the following groups:

- Priorities and Planning

- Strategic Communications and Ministerial Affairs

- Legal Services

- Human Resources

- Corporate Services

- Internal Audit and Evaluation

Senior Management Team

Jean-Yves Duclos

President of the Treasury Board

Dora Benbaruk

Senior General Counsel

Peter Wallace

Secretary of the Treasury Board

Erin O’Gorman

Associate Secretary

Kathryn Holmes

Chief of Staff to the Secretary

Gemma Boag

Departmental Assistant

Program Sectors & Expenditure Management

Siobhan Harty

Government Operations

Tina Green

Regulatory Affairs

Françoise Ducros

Social & Cultural

Glenn Purves

Expenditure Management

Kerry Buck

Economic

Denis Stevens

International Affairs, Security & Justice

Office of the Chief Information Officer

Francis Bilodeau

A/Chief Information Officer

Sonya Read

A/Digital Policy and Services

Marc Brouillard

Chief Technology Officer

Canadian Digital Service

Aaron Snow

Chief Executive Officer

Centre for Greening Government

Nick Xenos

Executive Director

Office for Public Service Accessibility

Yazmine Laroche

DM, Public Service Accessibility

Alfred MacLeod

ADM, Public Service Accessibility

Enabling Functions

Doreen Gagnon

Human Resources

Kelly Acton

Strategic Comms. & Ministerial Affairs

Karen Cahill

Corporate Services Chief Financial Officer

Nathalie Lalonde

Internal Audit & Evaluation

Samantha Tattersall

Priorities & Planning

Office of the Chief Human Resources Officer

Nancy Chahwan

Chief Human Resources Officer

Sandra Hassan

Employment Conditions & Labour Relations

Marie-Chantal Girard

Pensions & Benefits

Jean-Francois Fleury

Research, Planning & Renewal

Tolga Yalkin

Workplace, Policies & Services

Paule Labbé

Executive & Leadership Development

Fred Begley

A/People Management Systems and Processes

Office of the Comptroller General

Roch Huppé

Comptroller General

Kathleen Owens

Acquired Services & Assets

Yves Bacon

Financial Mgmt. Transformation

Diane Orange

Fixed Assets Review

Mike Milito

Internal Audit

Roger Ermuth

Financial Mgmt

Treasury Board Secretariat

Peter Wallace, Secretary of the Treasury Board

Deputy Head of the Treasury Board Secretariat

Supported by an Associate Secretary and four other Deputy Ministers

Erin O’Gorman, Associate Secretary

Works with the Secretary, providing leadership on the management of the Treasury Board Cabinet Committee

The Secretary and Associate Secretary lead the Treasury Board Secretariat, which is divided into six thematic areas:

- Human Resources

- Comptrollership

- Information (including digital)

- Accessibility

- Direct support to the Treasury Board

- Enabling functions

Office of the Chief Human Resources Officer

The Chief Human Resources Officer is responsible for government-wide direction and leadership on people management to support a competent, inclusive and healthy public service

Nancy Chahwan

Chief Human Resources Officer

The Office of the Chief Human Resources Officer supports the Treasury Board’s mandate by:

- developing policies and providing strategic direction for people and workplace management in the public service

- leading negotiations with bargaining agents and managing total compensation to ensure fair and sustainable terms for collective agreements, pensions and benefits

- establishing terms and conditions of employment, including the management of talent and performance for the executive cadre

- monitoring the conditions of the workplace and workforce through data acquisition and analysis

- leading the heads of the Human Resources community to foster collaboration, innovation and coherence across the Government of Canada

Key policies

- The Policy on People Management sets expectations for Deputy Heads and managers in the core public administration to create a high-performing workforce and a modern, healthy and respectful work environment

- The Policy on the Management of Executives sets the expectations specific to the management of the executive cadre in the core public administration

- Policies for Ministers’ Offices provides coherence and transparency for financial, personnel and administrative management

Office of the Comptroller General

The Comptroller General is responsible for government-wide direction and leadership on comptrollership, including in the areas of financial management, internal audit, public accounts, liaison with the Attorney General and acquired services and assets

Correction

The original version of this document contains an error that states: “The Comptroller General is responsible for government-wide direction and leadership on comptrollership, including in the areas of financial management, internal audit, public accounts, liaison with the Attorney General and acquired services and assets”. The document should state: “The Comptroller General is responsible for government-wide direction and leadership on comptrollership, including in the areas of financial management, internal audit, public accounts, liaison with the Auditor General and acquired services and assets.”

Roch Huppé

Comptroller General

The Office of the Comptroller General supports the Treasury Board’s mandate by:

- developing policies and providing government-wide coordination and strategic direction for comptrollership in the public service, including internal audit, project management and the management of real property and materiel

- providing strategic direction and oversight for Chief Financial Officers across the Government of Canada

- providing proactive analysis and recommendations on management and policy issues such as departmental management and spending authorities and contributing to government-wide oversight by providing assurance and advice

- providing analysis and advice on Treasury Board submissions, including on cost estimates and financial risks

Key policies:

- The Policy on Financial Management, which provides key responsibilities for Deputy Heads, Chief Financial Officers, and other senior managers in exercising effective financial management

- The Policy on Transfer Payments, which explains the roles and responsibilities for the delivery and management of transfer payment programs

- The Policy on the Planning and Management of Investments, which sets the direction for the planning and management of assets and acquired services to ensure that these activities provide value for money and demonstrate sound stewardship in program delivery

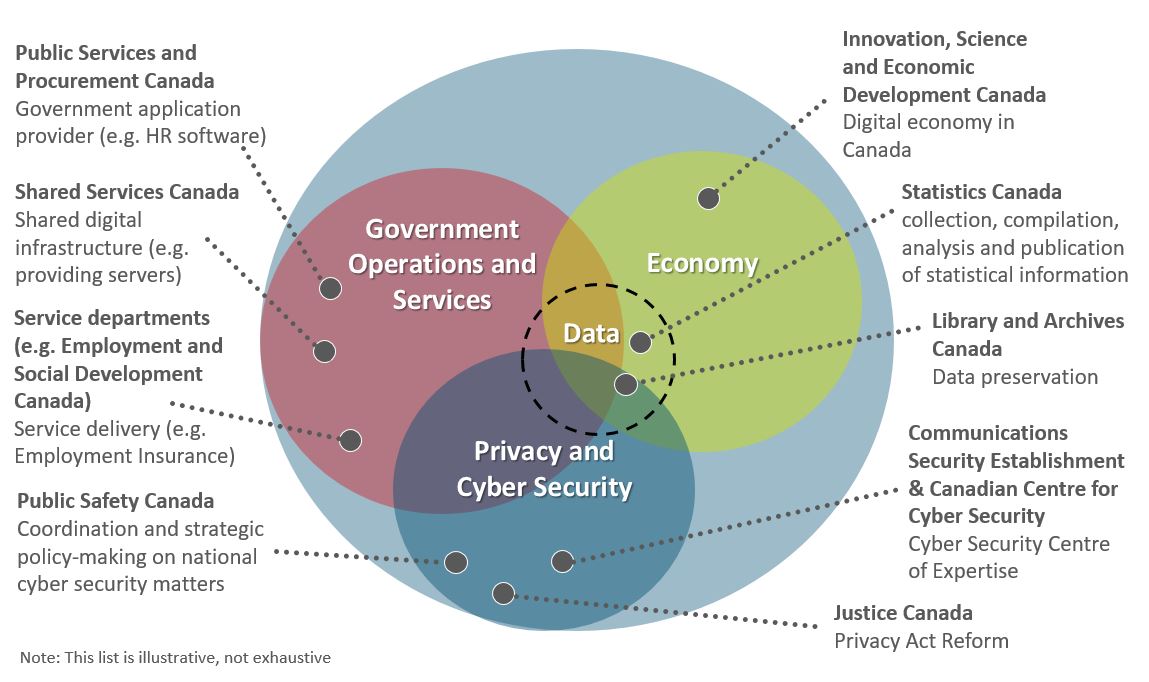

Office of the Chief Information Officer

The Chief Information Officer is responsible for the planning and management of technology and the stewardship of information and data for the Government of Canada

Francis Bilodeau

Chief Information Officer (Acting)

The Office of the Chief Information Officer of Canada supports Treasury Board’s mandate by:

- developing policies and strategic direction on digital transformation, service delivery, security, information management and information technology in the public service

- providing analysis and advice on Treasury Board submissions, including on the use of digital technology and issues related to privacy

- working with departments and agencies to improve their digital service capacity, support the use of digital approaches in government operations and develop tools and resources to meet users’ needs

- leading the Government of Canada Chief Information Officers community to advance the adoption of best practices for information management and digital and service delivery

Key policies:

- The Policy on Service and Digital serves as an integrated set of rules on how the Government of Canada manages service delivery, information and data, information technology and cyber security

- The Policy on Government Security, which provides direction to manage government security in support of the trusted delivery of Government of Canada programs and services and the protection of information

Office for Public Service Accessibility

The Deputy Minister of Public Service Accessibility is responsible for supporting the Canadian public service in meeting the requirements of the Accessible Canada Act

Yazmine Laroche

Deputy Minister, Public Service Accessibility

The Office for Public Service Accessibility supports the Treasury Board Secretariat’s mandate by:

- providing strategic advice to government departments and agencies regarding issues related to accessibility and inclusion through:

- equipping public servants with knowledge on how to better design and deliver accessible programs and services

- providing practical guidance and tools for removing barriers through initiatives such as the Centralized Enabling Workplace Fund and online via an Accessibility Hub

- providing strategic advice, informed by engagement with persons with disabilities, to government departments and agencies

- improving recruitment, retention and promotion of persons with disabilities

- enhancing the accessibility of the physical workspace

- making technology usable by all

Supporting the Treasury Board directly

Expenditure Management Sector

The Expenditure Management Sector plays a central role in the planning and coordination of federal spending

The Expenditure Management Sector supports the Treasury Board by:

- ensuring that Parliament has oversight and approval of how money is spent following the funding decision

- providing transparency in expenditures to Parliament and Canadians

Program Sectors

Program sectors are the interface with departments preparing proposals for the Treasury Board

There are four program sectors:

- Government Operations

- Social and Cultural

- Economic

- International Affairs, Security and Justice

Program sectors support the Treasury Board by:

- reviewing Memoranda to Cabinet and Treasury Board submissions from federal organizations

- providing advice, guidance and support to federal organizations in their implementation and application of policies

- Providing advice on and presenting proposals to Treasury Board Ministers

Regulatory Affairs Sector

Regulatory Affairs Sector establishes policies and strategies to support the federal regulatory system by:

- supporting and coordinating efforts to foster regulatory cooperation with key domestic and international partners

- leading horizontal regulatory modernization efforts

- undertaking targeted regulatory reviews

Regulatory Affairs Sector supports the Treasury Board in its role as a Committee of the Privy Council by:

- providing advice on and presenting regulatory submissions and non-appointment orders in council to Treasury Board Ministers

Enabling functions

Enabling functions support the internal operations of the Treasury Board Secretariat. In some cases, they may also work with other departments to advance the Treasury Board Secretariat’s mandate for good management

Strategic Communications and Ministerial Affairs

Manages and provides support for Treasury Board meetings, parliamentary affairs, Cabinet business and dealings with other government departments. It is also responsible for developing internal and external communications products and for the development of policies to oversee government communications, including advertising

Internal Audit and Evaluation

Provides independent, objective assurance and evaluation services that are designed to improve the management of the Treasury Board Secretariat’s programs and operations

Human Resources

Provides human resources advice and services to the Treasury Board Secretariat

Priorities and Planning

Works with other sectors to ensure that departmental policy advice is coordinated and consistent. It also leads key activities supporting government-wide management excellence as well as corporate governance within the Treasury Board Secretariat

Departmental Legal Services

Provides legal advice to the Treasury Board and the Treasury Board Secretariat

Corporate Services and Chief Financial Officer

Assists the Secretary of the Treasury Board in the internal administration of the Treasury Board Secretariat, including in financial management, security, information management, information technology and facilities and material management

Functions supporting other departments

Centre for Greening Government

Provides leadership toward low-carbon, climate-resilient and green operations across the Government of Canada

Canadian Digital Service

Works with departments to improve service delivery

The business of supply

-

In this section

Supply

By law, Parliament must approve all government spending

The “business of supply” is the process by which the government asks Parliament to authorize its intended expenditures through legislation, i.e. the Appropriation Acts

- The Estimates are a series of reports that provide supporting detail to supply legislation by setting out the government’s spending plans

The Treasury Board President, supported by the Treasury Board Secretariat, has a number of roles and responsibilities in supply:

Chairs the Treasury Board, a Cabinet committee responsible for reviewing and approving ministerial proposals for expenditures and other authorities

Tables the Estimates (spending plans) and introduces the related supply bills in Parliament

Appears at parliamentary committees to be accountable for the contents of the Estimates and supply bills

Tables departmental planning and results (performance) reports and Public Accounts in Parliament (actual expenditures)

Required authorities for government spending

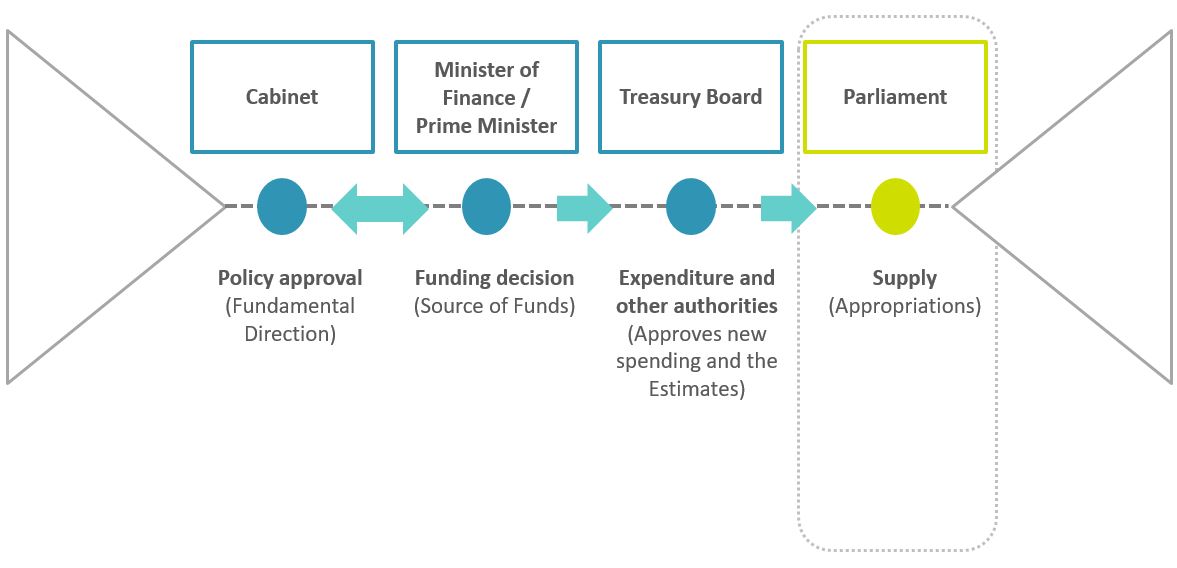

Text version

This graphic presents the process to obtain authorities for government spending. The first step is policy approval, which covers the fundamental direction, from Cabinet. The second step is funding decision, which includes source of funds, from the Minister of Finance or Prime Minister. The third step is expenditure and other authorities, which approves new spending and the Estimates, by Treasury Board. The final step is Supply, or Appropriations, by Parliament.

Roles and responsibilities in seeking supply

The Treasury Board:

- Has a central decision-making role in the government’s business of supply, including expenditure plans and reporting

- Approves ministerial requests for adjustments to voted funds as requested in Treasury Board submissions or other proposals

The Treasury Board Secretariat:

Supports the Treasury Board in its roles and responsibilities noted above, which involves:

- reviewing spending and implementation plans for program efficiency and alignment with government priorities

- supporting the supply process by preparing the Estimates and overseeing centrally managed expenditures (e.g. central votes for spending authorities that can be carried forward from one fiscal year to the next)

Key steps in securing supply

Treasury Board approval of Treasury Board submissions / “Aide-mémoire”

- The approval by Treasury Board allows inclusion of approved funding/authorities into the Estimates

Tabling of the Estimates document

- In the House of Commons during each of 3 supply periods, usually 3 or more weeks before introducing the appropriation legislation

Committee appearances

- In the weeks after tabling, the President appears on behalf of the government before parliamentary committees; other Ministers and officials may also be called to appear

Introduction of Appropriation Acts

- After Committee review, Estimates are introduced, voted in the House of Commons on the last allotted day of the supply period, and the Senate (likely) the following week

Royal Assent

- Usually formalized within a week or so after the bill has passed the House of Commons, followed by the release of supply to departments

Reports tabled in Parliament as part of the business of supply

The President typically tables 4 different documents each year related to the supply process:

Parts I and II of the Main Estimates (the Government Expenditure Plan and the departmental Main Estimates): tabled by March 1

Supplementary Estimates: there is no set number per year, but can be tabled in May, late October or early November, and February of a year

Departmental Plans (Part III of the Main Estimates): usually tabled in March (a few weeks following the Main Estimates), which describe departmental program and expenditure plans and expected results for the year

Departmental Results Reports: usually tabled in late October or early November and describe the departments’ performance against their Departmental Plan

The public and parliamentarians can access the information presented across these various reports in GC InfoBase (www.canada.ca/GCInfoBase)

Current supply cycle at a glance

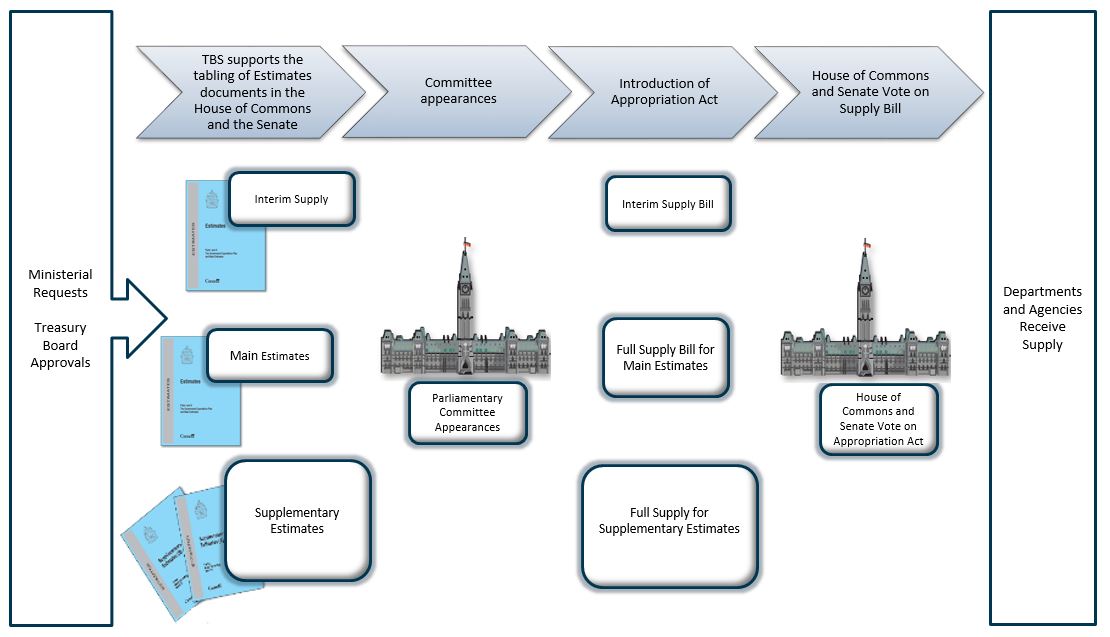

Text version

The Government’s expenditure cycle at a glance includes the following steps:

The department requests spending authorities for Treasury Board approval.

Treasury Board of Canada Secretariat collects requests approved by Treasury Board and tables Estimates documents for interim supply, the Main Estimates and Supplementary Estimates in the House of Commons and the Senate.

The President of the Treasury Board, the Secretary and other senior officials appear before Parliamentary committees to answer questions about the Estimates.

The supply bill corresponding to the Estimates process is introduced in the House of Commons.

- Interim supply bill for interim supply

- Full supply bill for the Main Estimates

- Full supply for Supplementary Estimates

The House of Commons and the Senate vote on the Appropriation Act prior to the end of the supply period.

Appendix 1: snapshot of government spending

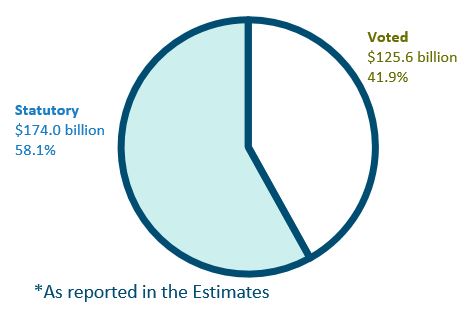

Text version

This pie chart shows that budgetary expenditure authorities in the 2019 to 2020 fiscal year were $299.6 billion as of Main Estimates for the 2019 to 2020 fiscal year, including $174.0 billion in statutory authorities (or 58.1%) and $125.6 billion (or 41.9%) in voted authorities.

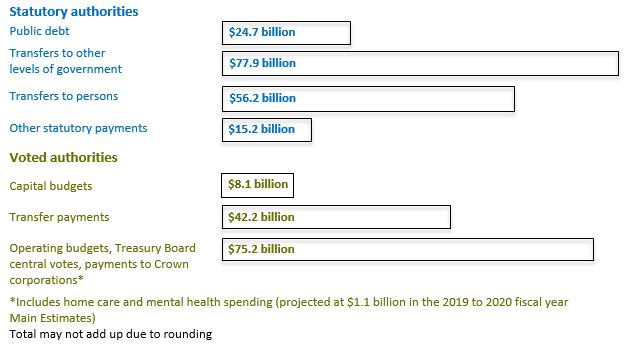

Text version

This bar chart shows the composition of budgetary authorities in the 2019 to 2020 fiscal year as of Main Estimates for the 2019 to 2020 fiscal year.

Of statutory authorities:

- public debt was $24.7 billion

- transfers to other levels of government was $77.9 billion

- transfers to persons was $56.2 billion

- other statutory payments were $15.2 billion

Of voted authorities:

- capital budgets were $8.1 billion

- transfer payments were $42.2 billion

- operating budgets, Treasury Board central votes, and payments to Crown corporations (which included projected expenditures of $1.1 billion in home care and mental health spending) were $75.2 billion

Note that the bars of the graph may not add to totals due to rounding.

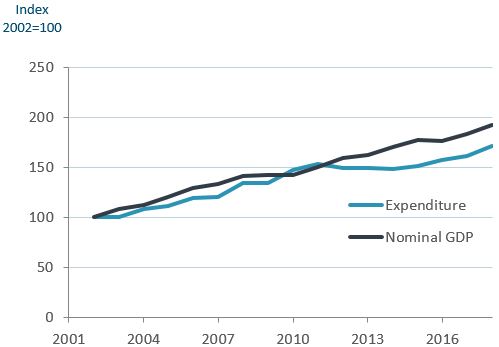

Text version

A line graph shows that the growth in budgetary expenditure authorities was outpaced by the growth in nominal GDP from the 2001 to 2002 fiscal year to the 2017 to 2018 fiscal year with the exception of late 2009 to 2011. The result is that budgetary expenditure authorities were about 70% greater in 2017 than in 2001 as compared to nominal GDP, which was about 90% greater. (Source: Public Accounts and CANSIM table 380-0064)

Source: Public Accounts and CANSIM 380-0064

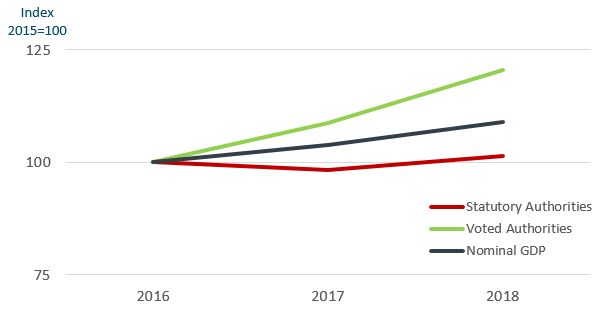

Text version

A line graph shows that the growth in voted budgetary expenditure authorities since the 2015 to 2016 fiscal year has been notably higher (at 21%) than growth in nominal GDP (at 9%), whereas statutory expenditure authorities fell from the 2015 to 2016 fiscal year to the 2016 to 2017 fiscal year and returned to slightly above the 2015 to 2016 fiscal year levels in the 2017 to 2018 fiscal year (up 1% over the period).

Source: Public Accounts and CANSIM 380-0064

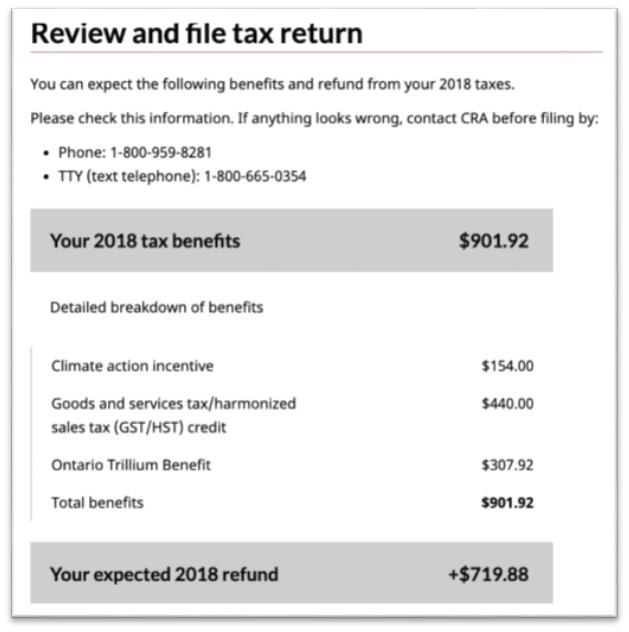

Appendix 2: GC InfoBase

A one-stop reference for the public and parliamentarians on government, finances, people and results data

The web tool contains years’ worth of federal government data, bringing together information previously scattered across over 500 government reports such as the Public Accounts, Main Estimates and Departmental Plans

The InfoBase is a key vehicle for displaying departmental results information under the Policy on Results, helping improve transparency to Parliament and Canadians

The Budget Tracker makes it possible to track certain Budget items, from approvals to delivering services

Primer: The business of supply

-

In this section

- Executive summary

- Introduction

- Background and context

- Pilot to align the federal Budget with Estimates (“Budget-Estimates Alignment,” 2018 to 2019 fiscal year and 2019 to 2020 fiscal year)

- How the Treasury Board Secretariat supports the business of supply

- Conclusion

- Appendix

- Appendix: The Estimates calendar, from November 2019 to June 2021

Executive summary

The following explains the “business of supply,” by which the government asks Parliament to authorize the funds required to meet its financial obligations. The document summarizes:

- the key steps involved in transmitting to Parliament the government’s projected annual spending (called the Estimates) for review and approval, which “supplies” the government with the funds required for its operations

- the supporting role of the Treasury Board Secretariat regarding the Estimates and the parliamentary approval of spending

Introduction

The Expenditure Management System sets out the framework for how we prioritize, plan, allocate and oversee the expenditure of public funds across the government. The business of supply, the process by which Parliament’s authorization is sought for the government’s expenditures through legislation (the Appropriation Acts), is one part of that broader system. Parliament has sole authority to grant supply, which constitutes the amounts and objects (or destination) of all public spending.