Secretary Transition 2022 Briefing Book 2: Background

Notice to readers

This document contains information which has been redacted in accordance with provisions of Part 1 of the Access to Information Act and has been formatted to comply with the Canada.ca Content Style Guide and the Standard on Web Accessibility.

On this page

- Governance

- Backgrounder: The COVID-19 pandemic and the Treasury Board Secretariat

- Workplan status update: Treasury Board Secretariat Hybrid Workplace

- Treasury Board of Canada Secretariat: Financial Overview

- Summary of Hot Issues, [redacted]

- [redacted]

- Upcoming Auditor General Reports

- The Treasury Board Policy Suite

- Data Pack

Governance

In this section

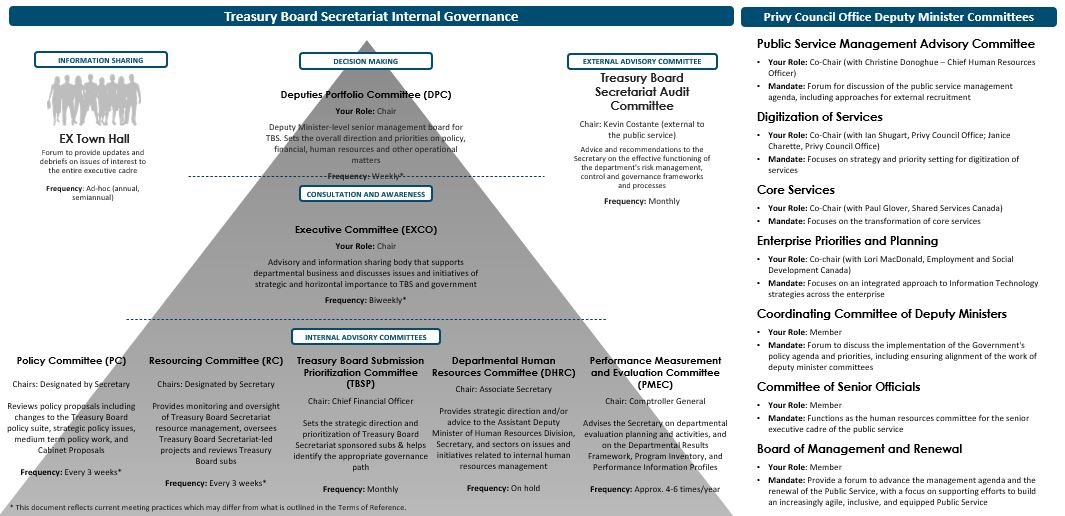

Governance: Treasury Board Secretariat and Privy Council Office Deputy Minister Committees

Text version

This infographic shows the committee structure that supports the Treasury Board Secretariat and Privy Council Office Deputy Committees. The infographic shows a pyramid describing the hierarchy of Treasury Board Secretary committees. At the base of the pyramid are the five internal advisory committees: Policy Committee, Resourcing Committee, Treasury Board Submission Prioritization Committee, Departmental Human Resources Committee and Performance Measurement and Evaluation Committee.

The Policy Committee reviews policy proposals including changes to the Treasury Board policy suite, strategic policy issues, medium term policy work, and Cabinet Proposals. It occurs every three weeks

The Resourcing Committee provides monitoring and oversight of Treasury Board Secretariat resource management, oversees Treasury Board Secretariat-led projects and reviews Treasury Board subs. It occurs every three weeks.

The Treasury Board Submission Committee sets the strategic direction and prioritization of Treasury Board Secretariat sponsored subs & helps identify the appropriate governance path. It occurs every month.

The Departmental Human Resources Committee provides strategic direction and/or advice to the Assistant Deputy Minister of Human Resources Division, Secretary, and sectors on issues and initiatives related to internal human resources management. It is currently on hold.

The Performance Measurement and Evaluation Committee advises the Secretary on departmental evaluation planning and activities, and on the Departmental Results Framework, Program Inventory, and Performance Information Profiles. It meets 4-6 times a year.

Above these internal advisory committees sits Executive Committee, which serves in the Consultation and Awareness capacity. It is the advisory and information sharing body that supports departmental business and discusses issues and initiatives of strategic and horizontal importance to TBS and government. It meets biweekly.

Above Executive Committee is the decision-making body, called the Deputies Portfolio Committee, which is the Deputy Minister-level senior management board for Treasury Board Secretariat. It sets the overall direction and priorities on policy, financial, human resources and other operational matters. It meets weekly.

To the left of Deputy Portfolio Committee is the Information Sharing EX Town Hall, which is a forum to updates and debriefs on issues of interest to the entire executive cadre. It meets on an ad-hoc basis.

To the right of Deputy Portfolio Committee is the External Advisory Committee, the Treasury Board Secretarial Audit Committee, which provides advice and recommendations to the Secretary on the effective functioning of the department's risk management, control and governance frameworks and processes. It meets monthly.

Privy Council Office Deputy Minister Committees

Public Service Management Advisory Committee

- Your Role: Co-Chair (with Christine Donoghue – Chief Human Resources Officer)

- Mandate: Forum for discussion of the public service management agenda, including approaches for external recruitment

Digitization of Services

- Your Role: Co-Chair (with Ian Shugart, Privy Council Office; Janice Charette, Privy Council Office)

- Mandate: Focuses on strategy and priority setting for digitization of services

Core Services

- Your Role: Co-Chair (with Paul Glover, Shared Services Canada)

- Mandate: Focuses on the transformation of core services

Enterprise Priorities and Planning

- Your Role: Co-chair (with Lori MacDonald, Employment and Social Development Canada)

- Mandate: Focuses on an integrated approach to Information Technology strategies across the enterprise

Coordinating Committee of Deputy Ministers

- Your Role: Member

- Mandate: Forum to discuss the implementation of the Government's policy agenda and priorities, including ensuring alignment of the work of deputy minister committees

Committee of Senior Officials

- Your Role: Member

- Mandate: Functions as the human resources committee for the senior executive cadre of the public service

Board of Management and Renewal

- Your Role: Member

- Mandate: Provide a forum to advance the management agenda and the renewal of the Public Service, with a focus on supporting efforts to build an increasingly agile, inclusive, and equipped Public Service

Terms of Reference of Deputies Portfolio Committee (DPC)

Mandate

- The Deputies Portfolio Committee will function as the executive management board for the Treasury Board Secretariat. As the key corporate decision-making body, it will set overall direction and priorities on policy, financial, human resources, and other operational matters.

Scope of Activities

- It provides direction and sets priorities related to the issues and initiatives of the highest importance implicating the Treasury Board of Canada Secretariat (TBS). It also monitors the implementation of departmental priorities and ensures a coordinated approach on key issues, and engagement with partners.

- Deputies Portfolio Committee activities include but are not limited to:

- Departmental operational, human resource, and financial decisions (including review of federal budget asks and reallocation decisions);

- Monitoring implementation of departmental priorities and mandate commitments, with a view to timely implementation of key deliverables and to make necessary course corrections; and

- Setting an agenda and ensuring integrated approaches for key Treasury Board Secretariat policy initiatives (e.g., Treasury Board Policy Suite Reset, Medium-Term Planning).

Authorities

- The Deputies Portfolio Committee is the most senior committee with corporate decision-making authority.

- Items brought forward for consideration are considered approved with the endorsement of the Chair.

Relationship to Other Committees

- Executive Committee (EXCO) is both an advisory and information sharing body that supports departmental business. It can provide advice to the Secretary on issues and initiatives of strategic and horizontal importance to the department and government. In most instances, the Executive Committee will also be the final body to review presentations related to departmental priorities or mandate commitments before they leave the department (e.g., Cabinet, Treasury Board, or Deputy Ministers’ Committee presentations). The Deputies Portfolio Committee may request items be brought to the Executive Committee for discussion as required.

- Resourcing Committee (RC) plays a critical role in the monitoring and oversight of financial management within Treasury Board Secretariat, including reviewing quarterly financial statements and the department’s integrated investment and business plan. It oversees Treasury Board Secretariat-led projects at key gates. The Resourcing Committee also reviews major departmental Treasury Board submissions with resource implications, in particular, those referred to by the Treasury Board Submission Prioritization Committee, before they are reviewed by the Government Operations Sector (GOS).

- TB Submission Prioritization Committee (new committee): brings together implicated Assistant Deputy Ministers to agree on the strategic direction and prioritization of Treasury Board Secretariat sponsored submissions. The Committee will advise the Chair of the Resourcing Committee of submissions that require a deeper examination by the Resourcing Committee. The Prioritization Committee will report to the Deputies Portfolio Committee periodically to provide updates.

- Policy Committee is responsible for reviewing Treasury Board Secretariat-led policy proposals. This includes changes to the Treasury Board policy suite, strategic policy issues, medium term policy work, and Cabinet proposals. The Policy Committee supports the Deputies Portfolio Committee by working with sponsoring sectors early-on in the development of major policy initiatives, acting as a sounding board for proposals and helping connect related efforts. As required, the Policy Committee will provide summaries of the considerations of the committee to the Deputies Portfolio Committee and may flag policy issues that require the consideration of the Deputies Portfolio Committee.

- Departmental Human Resources Committee (DHRC) provides strategic direction to the Director General of the Human Resources Division (DG HRD), Secretary, and sectors on issues and initiatives related to internal human resources management, including departmental policies, the departmental human resources plan, recruitment strategies, and talent management, ensuring a consistent approach across the Treasury Board Secretariat. The Departmental Human Resources Committee also reviews key Human Resource (HR) issues before they are presented to the Deputies Portfolio Committee for decision. This would include advice on items such as the Treasury Board Secretariat Human Resources Plan, Human Resources-related strategies (e.g., Analyst Learning and Development, Talent Acquisition), major policy changes, high-risk Human Resources transactions, and other strategic issues, (e.g., Talent Management Approach, etc.). The Chair of the Departmental Human Resources Committee will advise the Director General of Human Resources Division whether items should be referred to the Deputies Portfolio Committee.

- Ad hoc informal committees, created by the Secretary of the Treasury Board, for specific initiatives, may be required to debrief the Deputies Portfolio Committee on their activities, at the discretion of the Chair.

Membership

- The Deputies Portfolio Committee is chaired by the Secretary of the Treasury Board, or his/her delegate.

- Membership comprises the Associate Secretary, the Comptroller General of Canada, the Chief Human Resources Officer, the Chief Information Officer of the Government of Canada, and the Deputy Minister for Public Service Accessibility.

- The Chief Financial Officer, the Senior General Counsel, the Director General of Human Resources, the Assistant Secretary of Strategic Communications and Ministerial Affairs the Assistant Secretary of Priorities and Planning (as Secretary to the Committee), and the Chief Executive Officer of the Canadian Digital Service are ex officio members.

- The Director General of Internal Audit and Evaluation will attend Deputies Portfolio Committee as required.

Meeting Frequency

- The Deputies Portfolio Committee will meet bi-weekly, or as required at the call of the Chair.

Secretariat Support

- The Treasury Board Secretariat’s Committee Secretariat, Priorities and Planning, provides support to the Deputies Portfolio Committee, including: agenda management, advice to the Chair, document distribution, meeting logistics, InfoSite maintenance, tracking and monitoring, and information management.

Terms of Reference of the Executive Committee (EXCO)

Mandate

- The Executive Committee is the key forum for consultation and collaboration on policy and internal management issues.

Scope of Activities

- Provides advice to the Secretary of the Treasury Board on the issues and initiatives of highest strategic and horizontal importance to the Government of Canada and to the Treasury Board of Canada Secretariat (TBS).

- Is informed and consulted on key corporate initiatives and business (e.g., Government of Canada Charitable Workplace Campaign, Public Service Employment Survey results and action plans, financial updates, corporate risk profiles, etc.).

- Receives debriefs on the broad directions and operations of the Treasury Board on a quarterly basis, as well as debriefs from other formal governance committees, as required.

- Undertakes an annual self-assessment of performance, in support of accountability and continuous improvement.

- In most cases, Executive Committee review is required before items are presented to Deputy Minister Committees (the Public Service Management Advisory Committee (PSMAC)), Cabinet Committees or the Treasury Board.

Relationship to Other Committees

The Executive Committee is the main information sharing body for the department’s senior executives. Items will come to it from the Treasury Board Secretariat’s other advisory and decision making bodies including Resourcing Committee, Policy Committee and Deputies Portfolio Committee when required.

- Deputies Portfolio Committee (DPC) members decide what items and decisions made at the senior decision making committee, will be communicated with the Executive Committee.

- Resourcing Committee (RC) plays a critical role in the monitoring and oversight of financial management within Treasury Board Secretariat, including reviewing quarterly financial statements and the department’s integrated investment and business plan. It oversees TBS-led projects at key gates. RC also reviews major departmental Treasury Board submissions with resource implications before they are reviewed by the Government Operations Sector (GOS). As required, the Resourcing Committee will provide updates on the work of the committee to the Executive Committee.

- Policy Committee (PC) is responsible for reviewing Treasury Board Secretariat-led policy proposals, including changes to the Treasury Board policy suite, strategic policy issues, medium term policy work, and Cabinet proposals. For policy proposals proceeding to Public Service Management Advisory Committee or other external bodies, the Policy Committee will consider items before they are shared for information to the Executive Committee. As required, the Policy Committee will provide summaries on the work of the committee to the Executive Committee.

- Departmental Human Resources Committee (DHRC) provides strategic direction to the Director General of the Human Resources Division (DG HRD), Secretary, and sectors on issues and initiatives related to internal human resources management, including departmental policies, the departmental human resources plan, recruitment strategies, and talent management, ensuring a consistent approach across the Treasury Board Secretariat. The Departmental Human Resources Committee also reviews key Human Resource (HR) issues before they are presented to the Deputies Portfolio Committee for decision. This would include advice on items such as the Treasury Board Secretariat Human Resources Plan, Human Resources-related strategies (e.g., Analyst Learning and Development, Talent Acquisition), major policy changes, high-risk Human Resources transactions, and other strategic issues, (e.g., Talent Management Approach, etc.). The Chair will advise the Director General of the Human Resources Division whether items should be referred to the Deputies Portfolio Committee or the Executive Committee.

- Performance Measurement and Evaluation Committee (PMEC) is encouraged to debrief the Executive Committee on its activities.

- Ad hoc informal committees, created by the Secretary of the Treasury Board, for specific initiatives, are encouraged to debrief the Executive Committee on their activities, at the discretion of the Chair.

Membership

- The Executive Committee is chaired by the Secretary of the Treasury Board, or his/her delegate.

- Membership comprises of all Treasury Board Secretariat Deputies, Sector Heads (Assistant Secretaries, Assistant Comptrollers General, Assistant Deputy Ministers), as well as other direct reports to Treasury Board Secretariat Deputies.

- Replacements are permitted only when the member is away for three consecutive days. The Treasury Board Secretariat Committees Secretariat must be advised of any replacements.

Presentation Requirements

- The purpose of Executive Committee engagement must be clear. Presentations to the Executive Committee should also address: risks, financial, and horizontal considerations, as well as outcomes of prior consultations.

- Draft presentation material should be submitted to the Treasury Board Secretariat Committees Secretariat in one official language two weeks prior to the planned Executive Committee meeting date.

- The Treasury Board Secretariat Committees Secretariat will work to review presentation material to ensure appropriate framing of issues and will communicate decision as to whether the item will be considered by the Executive Committee.

- Final presentation material must be submitted to the Treasury Board Secretariat Committees Secretariat in both official languages one week prior to the planned meeting date.

- The Treasury Board Secretariat Committees Secretariat reserves the right to defer items if presentation material is submitted late.

- Presentations (for decision or discussion) are limited to 5-7 minutes to allow up to 25 minutes for discussion.

- Updates (for information) are limited to 10 minutes, including time for questions.

- The Assistant Secretary, Priorities and Planning, reserves the right to circulate information items secretarially rather than allocate time on the agenda.

Official Languages

- Executive Committee meetings are bilingual.

- Debriefs, presentations, and updates must be delivered in both official languages; members may ask questions and presenters may respond to questions in the official language of their choice.

- The Treasury Board Secretariat Committees Secretariat will monitor the extent to which both Official Languages are used and report to the Secretary annually.

Meeting Frequency

- The Executive Committee meets bi-weekly, or as required at the discretion of the Chair.

Secretariat Support

- The Treasury Board Secretariat Committees Secretariat, Priorities and Planning, provides support to the Executive Committee, including: agenda management, advice to the Chair, document distribution, meeting logistics, InfoSite maintenance, tracking and monitoring, and information management.

- The Executive Director, Priorities and Planning, is the Secretary to the Executive Committee.

Backgrounder: The COVID-19 pandemic and the Treasury Board Secretariat

In this section

Executive Summary

The COVID-19 pandemic demanded a rapid pivot for Government of Canada decision makers, departments and agencies. The Treasury Board and Treasury Board Secretariat (TBS) acted to support this pivot and enable government operations, changing how they and the public service functioned. The pandemic pushed the Treasury Board and TBS to streamline decision-making processes and focus more strongly on outcomes. It placed new demands on TBS’ function as an enabling and advice-giving organization, while driving a digital transformation of operations and services, the development of new forms of partnership and mobility, and new challenges to people management in the public service.

As the public service moves towards a new “steady state,” TBS has a role to play in retaining and advancing pandemic-era changes that have made the public service more digital, more flexible and more effective.

To do this, TBS should explore the following opportunities for action:

- Increase TBS’ support for outcomes-based decision making.

- Balance TBS’ role as an oversight and enabling organization, by strengthening its advisory capacity and clarifying departmental authorities.

- Do more to support effective partnerships between federal departments and with other jurisdictions and sectors of society, including in sharing data.

- Strengthen supports for front-line management in the Government of Canada.

- Keep digital and process changes from the pandemic; extend those that require extending.

Scope and Context

This backgrounder focuses on Treasury Board and TBS actions undertaken from the beginning of the pandemic in March 2020 to the spring of 2021, when governments in Canada and around the world began planning for a new “steady state” following the roll-out of vaccines. It does not include later developments, such as the COVID-19 vaccination requirement for federal public servants, nor does it examine planning for a return to federal worksites or a digitally-supported “future of work.”

This work contributes to wider efforts to reflect on the Government of Canada’s pandemic experience, such as audits by the Office of the Auditor General of Canada, whole-of-government work led by the Board of Management and Renewal, and the Management Accountability Framework Adapting in Response to the COVID-19 Pandemic report.Footnote 1

This backgrounder also complements much other work going on across TBS related to specific areas of the TBS mandate. This includes an in-progress study of key Treasury Board policy suite lexibilities supporting the government’s COVID-19 response (hereafter, “Exemptions Report”). The Exemptions Report will examine how to advance greater preparedness for future crises as well as improved Treasury Board and TBS operations outside of the heightened risk environment of the pandemic, and propose future actions TBS could consider to strengthen and adapt the

Treasury Board

policy suite.Footnote 2

Introduction

"Where Treasury Board policies present a barrier to necessary action, Deputy Heads should default to the urgent need."

On 19 March 2020, soon after the World Health Organization declared COVID-19 a global pandemic, the Secretary of the Treasury Board wrote to his senior colleagues to encourage an adaptive and outcomes-focused pandemic response. The Secretary asked Deputy Heads to “focus on achieving the intended results of the Government’s response measures, and to use your sound judgment for maximum flexibility in applying Treasury Board policies and exercising your authorities.”

Recognizing the need for timely action, the Secretary advised that “where Treasury Board policies present a barrier to necessary action, Deputy Heads should default to the urgent need.” The Secretary asked Deputies to document the “circumstances, rationale and processes” of their decisions to support accountability, and added that he had informed the Office of the Auditor General of “the flexible approaches required for departments to be responsive in this crisis”.

The Secretary’s guidance to Deputy Heads both reflects and helped drive a broader change in the federal government during the pandemic.

While federal departments and agencies have always sought to implement the policy objectives of the Government of Canada, internal accountabilities have traditionally placed a greater emphasis on process and administrative compliance than on outcomes. This includes the assessment of risk, in which policy makers have often focused on the risk associated with proposed action rather than the risk of inaction, including risks to social, economic and health outcomes.

This changed with the COVID-19 pandemic. The sheer scale and immediacy of the challenges posed by the pandemic necessitated a focus on outcomes, as can be seen for example in the rapid roll-out of new programs such as the Canada Emergency Response Benefit.

"Urgency and gravity provided federal organizations with the impetus needed to make a significant shift away from a process focus and toward a service mindset."

The Auditor General of Canada observed this change in a March 2021 message, noting the Secretary’s guidance to Deputies and describing a new “service mindset” that “prioritized and focused on outcomes."Footnote 3. This transformation, she wrote, was driven by crisis:

In my view, the urgency and gravity of the pandemic pushed federal organizations in directions they might not have gone of their own accord, nor as quickly. This urgency and gravity provided federal organizations with the impetus needed to make a significant shift away from a process focus and toward a service mindset.Footnote 4

This backgrounder captures key actions of the Treasury Board and the Treasury Board Secretariat (TBS) during the pandemic that demonstrate the shift from process to outcomes. It also identifies opportunities for action for TBS, with the aim of supporting a public service that is more resilient, more flexible and empowered to act in the best interests of Canadians.

The below considers three key areas of TBS action during the pandemic:

- Decision making

- People managment and employee wellbeing

- Digital operations and services*

*During the period covered in this backgrounder (March 2020 to spring 2021), Shared Services Canada (SSC) was included in the portfolio of the Minister of Digital Government, who was also responsible for the Office of the Chief Information Officer (OCIO) and the Canadian Digital Service (CDS) at TBS. With the swearing-in of a new Cabinet on 26 October 2021, SSC was moved to the portfolio of the Minister of Public Services and Procurement, while OCIO and CDS were returned to the portfolio of the President of the Treasury Board.

Decision Making

Actions to support flexible decision making

With the sudden shift to distributed work, the Treasury Board began to meet virtually and on a more flexible, ad-hoc schedule. This allowed the Treasury Board to consider and approve pandemic-related measures on an expedited basis. To support this “virtual” Treasury Board and expedite access to COVID-19-related funding, TBS adopted flexibilities related to Treasury Board submissions, such as permitting electronic signatures and submissions, clarifying classification requirements, and additional format and context-related flexibilities.

To support Treasury Board’s function as the Cabinet committee responsible for approving federal regulations, TBS and the Privy Council Office agreed on an approach to prioritize COVID-19-related regulatory proposals for consideration by the Treasury Board.

Treasury board decision making during the pandemic

During the pandemic, the Treasury Board was faced with a high volume of decisions to be made, related both to COVID-19 and to other government business. [redacted]

In addition, to expedite response efforts and prevent its own policies from unintentionally impeding the government’s COVID-19 response, the Treasury Board delegated to its President a number of authorities that it would normally exercise collectively. Under this new delegation (or “extraordinary authority”), the President could grant departmental requests for exemptions and exceptions to Treasury Board policies and forego the resource-intensive process of developing, submitting and considering a formal Treasury Board submission. This was not a blanket authority: it was time bound, limited in scope and its use was reported to the other members of the Treasury Board.Footnote 5 TBS also made use of existing delegations from the Treasury Board to the President and senior departmental officials to allow for expedited decision making and increase flexibility where appropriate. These flexibilities extended not only to the approval of new programs, but also reduced administrative and reporting burdens to allow departments to focus on the pandemic response.

In addition to these changes, the Treasury Board introduced specific authorities to support flexible decision-making by departments. For instance, on 20 March 2020, the Treasury Board approved temporary amendments to emergency contracting limits, including an unlimited emergency contracting limit for the Minister of Public Services and Procurement for COVID-19 vaccines.Footnote 6

Guidance and advice to support flexible decision making

To support their pandemic response, TBS provided departments with guidance on Treasury Board policy requirements as well as advice on the implementation of new measures, such as the extension of contract limits. In some cases, existing policy instruments still applied, but guidance was necessary to advise departments on how they applied in the pandemic context.

TBS also mobilized government-wide functional communities to provide expertise and assistance. For instance, the Office of the Comptroller General (OCG) encouraged early engagement by departments of Chief Audit Executives and internal audit functions, who were able to advise on how best to document decisions and weigh risks in the light of probable future audits.

During the crisis, departments looked to TBS for much more guidance than is the case in ordinary circumstances. As a result, TBS shifted towards a stronger “advise and support” role than it has traditionally played. These expectations for guidance increased pressure on TBS. The development and provision of guidance is resource intensive, and there are inherent challenges in crafting guidance that is relevant and useful for departments and agencies that vary widely in terms of size and mandate. Given ongoing departmental expectations for guidance, TBS sectors have sought to distinguish between situations when whole-of-government advice from the centre is required and when tailor-made responses led by departments are called for.

Experiences of Departments and Agencies

"The feedback...on these flexibilities was overwhelmingly positive and uniform across departments and agencies."

According to the 2020-21 Management Accountability Framework Adapting in Response to the COVID-19 Pandemic report:

The feedback...on these flexibilities was overwhelmingly positive and uniform across departments and agencies. Most departments and agencies reported that the temporary policy flexibilities were very helpful in obtaining the human and financial resources needed to focus on the COVID-19 pandemic response. Organizations also stated that the temporary policy flexibilities allowed key business processes, such as hiring and onboarding, to continue smoothly during the COVID-19 pandemic.Footnote 7

Similarly, TBS’ Exemptions Report found that “Despite the higher relative risk involved, departments have indicated that these [policy] exemptions and exceptions were crucial for maintaining departmental operations and found that TBS was responsive in putting the exemptions and exceptions in place."Footnote 8 Given the relief afforded by these flexibilities, it is unsurprising that many departments have been eager to see them continue.Footnote 9 More broadly speaking, some have suggested a further simplification of the Treasury Board policy suite. As one department put it in a survey on TBS’ performance in 2019-20:

Overall, our feeling is that there is still value in reducing the 'web of rules' and placing more emphasis on the quality of leadership, management and the consequent results of our people, including both outcomes for citizens and also the way that they affect staff wellness and innovation.… It also means creating more mechanisms for non-compliance with rulesets when they are not in the public interest.Footnote 10

Departments were appreciative of TBS guidance during the pandemic, with some pointing to the positive impact of ongoing calls with functional leaders at TBS. As OCG had advised, some departments integrated their internal audit function into their governance and decision-making processes.Footnote 11 When asked how to improve the implementation of Treasury Board policies and related instruments, departments called for increased access to TBS advice and for increased capacity at TBS to provide that advice.Footnote 12

People Management and Employee Wellbeing

Actions to Support People Management and Wellbeing

As the employer, Treasury Board played an important role in responding to the impacts of COVID-19 on federal personnel. The Treasury Board, its President and TBS undertook a number of actions to support public servants and people management during the pandemic. Perhaps the most significant of these was the President’s 13 March 2020 announcement that public servants should work from home wherever possible. This facilitated a massive shift in the everyday working lives of public servants and the creation, overnight, of a largely distributed federal public service.

Through the Office of the Chief Human Resource Officer (OCHRO), TBS has assisted departments and employees in adapting to this new reality. Over 50 pieces of guidance in areas such as equipping employees remotely, the use of “Other Leave with Pay” (under leave code 699) and performance management in a remote context were issued by OCHRO over the course of the pandemic. OCHRO also developed resources related to mental health challenges for the public service, and put in place temporary measures for public service health care plans, including widening employee access to mental health care. In July 2020, OCHRO also released a guidebook to assist departments in preparing for an eventual return to federal worksites, recognizing that the situation was still in flux.

Responding to the pandemic required new approaches to mobilizing and deploying staff. Public servants volunteered to support new pandemic-related functions, such as call centres, and federal employees were also seconded to assist with provincial and territorial response efforts. This increased mobility was also reflected at TBS, where a number of executives and employees were seconded to the COVID-19 Task Force at Health Canada and the Public Health Agency of Canada.

Managing During a Pandemic

The 2020-21 Management Accountability Framework report found that some departments saw burnout – especially amongst supervisors, managers and executives – as a heightened risk during the pandemic. With the sudden shift to remote work, managers were pushed to adopt new ways to lead their teams, including strengthening their results-based management approach. Learning how to manage remotely required new guidance and resources for managers. A 2020-21 National Managers’ Community survey on learning needs found managers most interested in learning about managing a virtual and flexible team; self-care, setting boundaries, working from home; better communication and engagement within teams and finding effective and safe ways to prevent bullying, intimidation, and favouritism in the workplace; and, how to improve team performance and maintain employee engagement while working from home.Footnote 13 Departments, the National Managers’ Community, and TBS have provided resources to support managers and their wellbeing. TBS is also experimenting with new tools to support managing a distributed workforce, such as time blocking and team charters, which can help articulate shared expectations regarding availability and support a “right to disconnect.”

Talent mobility and surge capacity : TBS staff on the COVID-19 task force

From the beginning of the COVID-19 pandemic, federal departments mobilized talent to support the government’s pandemic response. At TBS, a number of executives and employees were seconded to the COVID-19 Task Force at Health Canada and the Public Health Agency of Canada. There, TBS staff supported a variety of pandemic response measures, including the procurement of personal protective equipment and the development of digital services, such as Get Updates on COVID-19.

Experiences of Departments and Agencies

The sudden shift to distributed work created new opportunities and challenges for people management in the Government of Canada. Distributed work arrangements have offered new flexibilities for employees, though concerns have been raised regarding the impacts of the pandemic and distributed work on mental health. According to the 2020 Public Service Employee Survey, “11% of employees indicated that the stress of the pandemic was negatively impacting their ability to carry out day‑to‑day work responsibilities,” and 21% of employees reported balancing work and caregiving responsibilities during the pandemic as a source of stress. At the same time, 68% of employees saw their workplace as psychologically healthy, up from 61% in 2019.Footnote 14

A number of departments have called for timelier guidance from TBS on people management issues, including on the use of paid leave (under leave code 699) and the provision of equipment for teleworking employees. The development of advice on these types of people management issues was time and resource-intensive; as observed in the Exemptions Report, this process

required engagement with bargaining agents and departmental heads of HR and others. The specificity of guidance needs to recognize the challenge of developing guidance for a very heterogenous public service that was geographically dispersed across the country and hence, across several public health jurisdictions.Footnote 15

Further, as this study notes, “Issuance of clarified guidance in November 2020 [on 699 leave] took time, particularly given the level of rigor, governance, and approvals.”Footnote 16 This suggests the potential value of iterative and ongoing guidance in future crisis situations.

Mental Halth in the Public Service

Approximately 1 in 10 respondents to the 2020 Public Service Employee Survey indicated that the stress of the pandemic was negatively impacting their ability to carry out work responsibilities, while approximately 1 in 5 reported stress caused by trying to balance work and caregiving. At the same time, 68% of respondents see their workplace as psychologically healthy, up from 61% in 2019.

Digital Operations and Services

Actions to support Digital Operations and Services

To support the shift to a “virtual” government created by the pandemic, the Office of the Chief Information Officer (OCIO) at TBS provided whole-of-government leadership to promote the communication of key information related to the pandemic, the effective delivery of digital services and the equipping of departments to maintain operations. OCIO assisted in managing the government’s legislative and policy responsibilities by providing guidance related to Access to Information and personal information requests, proactive publication and information management.

"Since March 2020, SSC increased SRA [secure remote access] capacity by 111% to support 290,000 simultaneous connections. As a result, public servants were able to continue delivering services to Canadians and maintain operations following the work from home order."

In response to the pandemic, the Government of Canada accelerated a digital shift previously underway that enabled continuity of government operations and of services to the public. OCIO and Shared Services Canada (SSC) worked together to strengthen and expand the Government of Canada’s network capacity and introduced tools, including Microsoft Teams, which supported distributed and collaborative work by public servants. The transition to distributed work also required that SSC increase the bandwidth and IT support structure to ensure that the government’s digital infrastructure could support a high volume of internet traffic. OCIO and SSC also worked closely to support departments on the front-line of the pandemic response, such as the Canada Revenue Agency and Employment and Social Development Canada, to ensure that the critical services offered by these departments were supported by reliable, secure IT infrastructure.

TBS leveraged internal and external relationships to support government-wide initiatives and deliver expedited results. For example, TBS collaborated across the federal government, with other Canadian jurisdictions and sectors, and across national borders, to establish a coordinated digital response to COVID-19. The Canadian Digital Service (CDS) worked with private sector partners, as well as provincial and territorial jurisdictions, to design, repurpose, and deliver products and services including the COVID Alert exposure notification app, which was launched using open-source code.

CDS worked with Health Canada and the Public Health Agency of Canada to help introduce a new notification service called “Get Updates on COVID-19,” which was built using open-source code from the U.K. Digital Service. This work was also led by TBS employees on secondment to Health Canada. This email notification system provides updates and pertinent information to millions of people in Canada on a regular basis. This tool is, by design, easily scalable and has been adopted by other governments across Canada.

TBS also worked closely with digital partners and engaged with federal departments and agencies to accelerate publication and improve the usability and discoverability of open data and open information related to COVID-19 to support greater transparency.

Federal Microsoft Teams Rollout

With the overnight transition to distributed work, public servants made creative use of digital tools such as Slack and videoconferencing to maintain contact and business continuity. These tools were an important stopgap measure that were soon replaced by the rapid rollout of Microsoft Teams. SSC deployed Microsoft Teams to 40 departments and 290,000 employees in the Government of Canada. In addition, SSC provided additional teleconference licences, leading to a more than 200% increase in teleconference usage. Federal public servants have also increased their use of WebEx accounts by 100%.

Experiences of Departments and Agencies

The transition to distributed work significantly increased the need for and demands on network capacity and collaborative tools. OCIO and SSC played a significant role in supporting operational continuity and the shift to a distributed workforce. In interviews conducted to support the 2020-21 Management Accountability Framework assessment, “The support SSC provided to its GC partner organizations was the most frequently cited enabling factor to overcoming challenges departments and agencies faced as a result of the COVID-19 pandemic and the immediate need to move to a remote workforce."Footnote 18

The rollout of Microsoft Teams was foundational to supporting a new digital workspace for public servants. Microsoft Teams enabled increased engagement with employees in fora such as digital town halls; it was used by departments to support hiring practices, onboarding and training, and sessions on mental health. Microsoft Teams also allowed for closer communication with regional employees. One department noted that the pre-pandemic adoption of Microsoft Teams had smoothed its transition to a distributed workforce, and departments that had already invested in and embraced a “digital first” mindset and related tools found it often made the transition more straightforward.

The shift to distributed work meant many employees did not have access to the Secret Network. In some cases, this led to documents being correctly reclassified as not secret and dealt with on the normal network, but in other cases this limited the ability of departments to deal with secret material. While OCIO worked with SSC and functional communities to develop guidance on how to appropriately manage classified information while working remotely, some departments reported risk-managing the “safe handling of sensitive and secret information” while awaiting guidance from TBS.Footnote 19

Departments have raised concerns regarding barriers to sharing data between federal departments and agencies, across jurisdictions and with other key stakeholders. Even when data is shared, there are challenges regarding interoperability and standardization, as well as a lack of understanding as to what data exists or is being collected by different levels of government. Some federal departments, including Statistics Canada, are supporting data communities of practice. Others have recommended that the government invest in enabling platforms to allow for the exchange of data across the public service.

The Experience Elsewhere: Other Jurisdictions

The experiences at TBS were largely reflected in other sectors and jurisdictions. The COVID-19 pandemic caused or accelerated significant changes in government operations worldwide. From remote work to digital transformation, Canadian and foreign governments, as well as organizations in other sectors, have re-engineered their structures, tools and processes to respond to the ongoing crisis. Many jurisdictions adopted remote work to support business continuity, employee health and respect for public health guidelines. The crisis also sparked an increased need for surge capacity and employee mobility. Peer countries such as the United States instituted rotational opportunities related to the COVID-19 pandemic, and Australia developed a multi-jurisdictional National Framework for Public Sector Mobility and is considering the establishment of a permanent “surge reserve” for civil servants.

The pandemic also revealed that governments can shift to digital service formats when emergencies drive necessity. From deploying new social programs to creating virtual parliaments and virtual courts of justice, the pandemic caused governments to accelerate digital transformation. As noted in a case study by the Public Policy Forum, Ontario’s Minister of the Attorney General shifted quickly from a dependence on in-person and paper-based processes to a digital environment. One official suggested that the change imposed on the Ministry by the pandemic actually allowed public servants to overcome the low risk tolerance, slow approvals and the tendency to seek largescale “ultimate” solutions that had previously plagued efforts to digitize.Footnote 20

Finally, in the areas of expenditure management and procurement, governments were pushed to deliver new programs and services in an expedited manner while also ensuring financial transparency and accountability to their citizens. Many countries exercised increased fiscal flexibility by granting new spending powers to the executive; the Portuguese parliament, for example, granted the Portuguese government that power to “transfer appropriations across programmes within the budget."Footnote 21 Additionally, jurisdictions relaxed and streamlined rules to facilitate rapid procurement while ensuring the use of public resources remained transparent and linked to results.

As at TBS, the experience elsewhere shows governments and organizations of all stripes exercising new flexibilities and adapting to the pandemic by quickly mobilizing resources – human, digital and financial – to respond to the new emergency context. A similar willingness to temporarily streamline processes in favour of achieving outcomes in the short-term is also evident.

Conclusion

The Covid-19 pandemic required governments to pivot and adapt in order to best respond to the crisis.

TBS, and the broader public service, were no exceptions to this rule. The flexibilities, guidance and hands-on support provided by TBS helped departments focus their efforts on the pandemic and protect and support the public. The experience also suggests several opportunities for action for TBS as it continues to support the public service in future challenges. TBS should aim to:

- Increase its support for outcomes-based decision making.

- Balance its role as an oversight and enabling organization, by strengthening its advisory capacity and clarifying departmental authorities.

- Do more to support effective partnerships between federal departments and with other jurisdictions and sectors of society, including in sharing data.

- Strengthen supports for front-line management in the Government of Canada.

- Keep digital and process changes from the pandemic; extend those that require extending.

1. Increase TBS' support for outcomes-based decision making.

Decision making in large organizations can sometimes be skewed by the habit of looking to pre-existing levers and processes and allowing these to determine outcomes, rather than focusing on desired outcomes and determining how best to achieve them. While progress has been made at TBS to become more principles-based and focused on outcomes rather than process, more can be done by TBS to support outcomes-based decision making. Departments should be held accountable for what they achieve or fail to achieve.

TBS should continue efforts to reframe government rulesets to encourage outcomes-based decision making, as well as revising TBS-imposed forms of oversight and process that impede departmental efforts to be more creative, innovative and agile. This could include, as proposed in the Exemptions Report, a focus on risk- and results-based information requirements placed by TBS on departments.Footnote 22

Supporting outcomes-based decision making should also include learning from the government’s experience with risk management and mitigation during the pandemic, including how to make processes and oversight lighter and provide departments with more flexibility, when appropriate and within a framework of responsible controls.

2. Balance TBS' role as an oversight and enabling organization, by strengthening its advisory capacity and clarifying departmental authorities.

During the pandemic, TBS has continued its oversight function but has also focused on responding to departmental requests for advice and guidance. The extent to which departments have turned to TBS for support demonstrates that this enabling role is as – and perhaps more – important to the federal system as TBS’ traditional challenge function role. Offering timely, applicable and expert advice is resource intensive, which TBS will have to take into account in the development of its plans and priorities as a department.

"It would be useful … to identify clear boundaries between the roles and responsibilities of the TBS and that of departments and agencies in the development and implementation of projects, programs and policies."

COVID-19 also highlighted that departments need more clarity on areas in which they have the authorities to act, and when they need to wait for central agency guidance. Greater clarity around delegated authorities for departments implies not only an emphasis on departmental responsibilities but also the need for TBS to accept that departments will sometimes make unexpected choices and that those choices should be respected if they fall within the broader frame set out by Cabinet and the Treasury Board.

3. Do more to support effective partnerships between federal departments and with other jurisdictions and sectors of society, including in sharing data.

Canada’s response to COVID-19 has required extensive collaboration between federal departments, jurisdictions and other sectors of society, such as the private sector, academia and non-governmental organizations. Within government, TBS could do more to support effective and intensive interdepartmental collaboration, including through enabling secure data sharing and standardization as well as effective governance.

Stronger external partnerships, including government-to-government relationships and digital partnerships, could also help in addressing future problems. Open-source code enabled the rapid deployment of digital solutions, including the COVID Alert app and the “Get Updates on COVID-19” e-mail notification service. The Government of Canada can continue to build upon open-source code and “work in the open” by publishing code from its own products where possible. In supporting the Treasury Board’s role as employer of the public service, TBS could encourage greater permeability between the public service and external organizations (e.g. through talent mobility), which would help ensure that the Government of Canada has the capacities required to respond to future crises.

4. Strengthen supports for front-line management in the Government of Canada.

COVID-19 and the transition to widespread distributed work has increased the pressure on front-line managers. Management of a distributed team requires managers to adapt and adjust, and TBS has a role to play in better supporting managers and improving the quality of management skills and training, along with partners across the public service.

5. Keep digital and process changes from the pandemic; extend those that require extending.

Many flexibilities have been introduced during the pandemic to permit the use of new digital tools and approaches (e.g. digital signatures and approvals, electronic submission of Treasury Board submissions). TBS should work to solidify and extend those flexibilities, where appropriate. Equipping public servants with the tools to work from home has also offered new flexibilities to employees and has removed significant barriers for some employees with disabilities. TBS should support departments in consolidating and building upon gains made through the “forced experiment” of widespread distributed work.

New challenges will no doubt emerge in the years to come. The more TBS can do to support and enable departments, helping them focus on and deliver concrete outcomes while ensuring that the appropriate controls are in place and risks are managed, the better prepared the public service will be for those future challenges.

Workplan status update: Treasury Board Secretariat’s hybrid workplace

In this section

- Presentation Objectives

- Enterprise-Wide Context

- Treasury Board Secretariat’s current work environment

- Planning for a future hybrid work environment

- Short- and medium-term actions

- Considerations

- Next steps

- Annex A: Progress against the Treasury Board Secretariat Hybrid Workforce Plan

- Annex B: Governance

Presentation Objectives

Provide an overview of the Treasury Board of Canada Secretariat’s (TBS) departmental approach to hybrid work including work to-date and the path forward

Enterprise-Wide Context

- As the federal employer, the Treasury Board Secretariat is continuing work on the future of work and post-pandemic planning with key partners (e.g., Privy Council Office, Public Services and Procurement Canada, Shared Services Canada)

- The Chief Human Resources Officer has provided departments guidance for an optimal hybrid workplace to ensure a consistent and coherent approach

- All departments, including the Treasury Board Secretariat, have been encouraged to filter their plans through the following core principles:

Principles to Guide Departmental Hybrid Workplans Across Government

Flexibility

Openness to exploring and experimenting with different approaches to work

Arrangements

A foundational practice, including flexibility in work locations (where operationally feasible)

Transparency

How decisions are made and communicated

Equity

Ensuring employees are treated fairly in decisions, with a view to creating diverse and inclusive workplaces

Excellence

Underpinning the design and delivery of public sector policy, programs and services

Treasury Board Secretariat’s current work environment

The majority of Treasury Board Secretariat employees have been operating under “remote by default” in response to the COVID-19 pandemic since March 2020

Work is underway to understand Treasury Board Secretariat’s hybrid work context including:

- Operational requirements

- Evolving needs and demands on office space and IT

- Human element (e.g., needs and supports to be productive and outcomes focused regardless of role / level / personal circumstances)

Collectively these elements can provide Treasury Board Secretariat’s Deputies with evidence to support the path forward

Key Facts on Current Status

- All Treasury Board Secretariat employees are fully equipped to work remotely

- Worksite capacity is significantly lower than the Treasury Board Secretariat’s staff complement (1591 worksites vs. 2276 employees) due to social distancing requirements

- 95% of staff working from home by default; onsite workstation bookings remain extremely low

- Some executives have reported on reasons their employees may work on site, and include

- Operational requirements (e.g., access to data bases, the secret network, critical work and deadlines, on-site interactions)

- Personal reasons

- A home environment that is not secure or conducive to working

- Secret network access and onsite bandwidth are not yet ready to support a fully hybrid workforce

Planning for a future hybrid work environment

The Treasury Board Secretariat’s plan takes a phased approach to supporting a long-term hybrid work environment*

Pandemic phase / controlled

Where we started

March 2020

Gradual shift to on-site

Conditional on public health restrictions

Short-term

Fall 2021 / Winter 2022

Engagement and Assessment Phase

Medium term

Spring 2022

Optimized Hybrid Model Implementation

Long term

Fall 2022 and beyond

In addition to the Office of the Chief Human Resources Officer-issued guidance, the plan is underpinned by:

Treasury Board Secretariat’s Easing of Restrictions Plan

- Work done in Summer 2020

- Committed to protecting employee health and safety; respecting public health measures; consulting employees; flexibility and iteration

Data collection

- Data collection from the Treasury Board Secretariat office booking system will provide insights into when and how the worksite is being used

- Use of an Employee Status Reporting Tool seen as a best practice to support health and safety

Departmental Governance**

- Governance is in place to guide the work

- Assistant Deputy Ministers committee co-chaired by the heads of Human Resources liision and Corporate Services Sector

- Recommendations made to the Deputy Portfolio Committee

*Details of progress made against each element included in Annex A

**Further details on governance included as Annex B

Short- and medium-term actions

Work is underway to…

Determine how to best prepare the department operationally for a post- pandemic context*

- Assess operational requirements: Examine position duties, accountabilities, and responsibilities

- Determine infrastructure requirements: Assess Information Technology capacity to support a hybrid workforce

- Engage employees: Potentially through workshops, surveys, and interviews to inform opportunities and challenges in an evolving environment. This includes staff, managers, and senior officials

*The original document provided to the Secretary contained an asterisk at this point corresponding to a note stating “See Annex C.” However, the original document did not contain an Annex C. Therefore, for the publication version, we have omitted the note.”

Work will need to be done to…

- Review internal policies for flexibilities to facilitate the hybrid model

- Determine the optimal hybrid model for the Treasury Board Secretariat that leaves flexibility between sectors

- Update Information Technology capacity and invest in workspace and building redesign

Work is ongoing to…

- Provide executives guidance for managing in a hybrid environment as public health measures evolve

Considerations

- Progress towards a post-pandemic work environment may not be linear

- Health guidelines are ever-evolving and this plan may need to be revised given ongoing uncertainty

- Opportunity to sequence, test ideas, seek reactions and determine feasibility

- Regular communication from leaders at all levels can serve to decrease uncertainty

- Treasury Board Secretariat’s plan is gradual and iterative; it is positioned to:

- Provide a framework to managers and employees to continue being productive in delivering the Treasury Board Secretariat mandate

- Consider what employees need to support their mental health and avoid burnout amidst constant changes

- Align to the enterprise-wide direction on people management

- Support a competitive advantage for recruitment, retention and development

- Focus on good implementation and allow for course corrections and flexibility

- The department is working with other departments (OGDs)

- Engaging with other departments, including the Privy Council Office and Finance Canada, on lessons learned and ensuring the Treasury Board Secretariat takes a balanced approach given its Central Agency role

- Working with Public Services and Procurement Canada to explore opportunities to condense Treasury Board Secretariat real estate and prepare for the future workplace

- Engaging with co-tenants, in particular Finance, to coordinate approaches and share best practices

- Returning too quickly to the workplace, without the right enabling environment, may impact productivity and mandate delivery

- Circumstances remain unpredictable (e.g. impacts of new variants)

- Real risk of burnout which could be exacerbated by sudden even small changes to the work environment

- Gender Based Analysis+ considerations must be closely examined

- Employees will need time to adjust to any changes and make necessary arrangements such as childcare, having children vaccinated, and transportation

- At-risk, vulnerable employees may need accommodation, as well as employees with young children not eligible for vaccination

- Partnerships with Bargaining Agents will help inform the process

Next steps

Governance

The Assistant Deputy Ministers Committee will be briefing the Deputies Portfolio Committee regularly on this plan

Engagement

Planning for employee engagement and assessment of operational requirements will continue

Annex A: Progress against the Treasury Board Secretariat Hybrid Workforce Plan

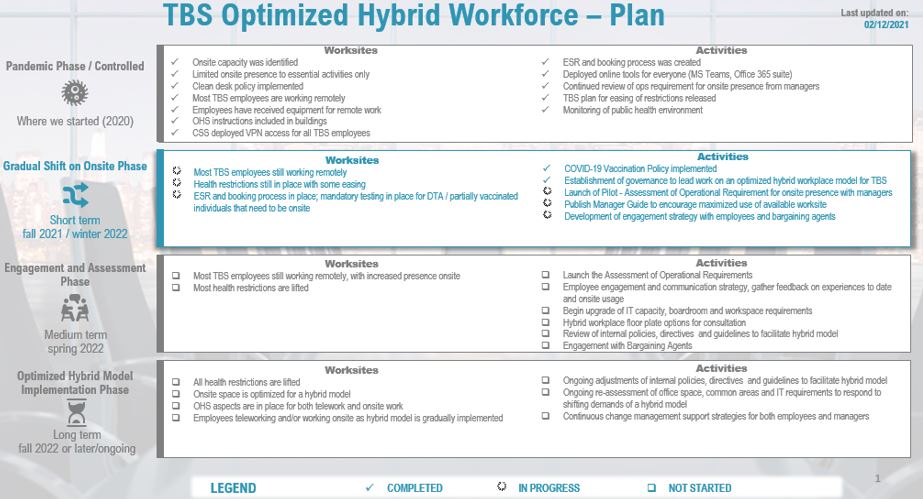

Text version

TBS’ plan for an optimized hybrid workforce. The plan shows the status of TBS worksites during each phase of the plan as well as activities undertaken as part of the plan. Plan items are identified as “completed,” “in progress” or “not started.” The plan indicates that we are currently in the “Gradual Shift on Onsite – Short Term” phase, with a time frame of fall 2021/winter 2022. The plan was last updated on December 2, 2021.

| Plan phase | Worksites | Activities |

|---|---|---|

| Pandemic Phase/Controlled – Where we started (2020) |

|

|

| Gradual Shift on Onsite Phase – Short term (fall 2021 / winter 2022) |

|

|

| Engagement and Assessment Phase – Medium term (spring 2022) |

|

|

| Optimized Hybrid Model Implementation Phase – Long Term (fall 2020 or later/ongoing) |

|

|

Annex B: Governance

- The Deputies Portfolio Committee (DPC) is the ultimate deciding committee for all reintegration and hybrid workplace plans for the Treasury Board Secretariat

- The Assistant Deputy Ministers Committee, called the Optimized Hybrid Workplace Modernization Centre, is co-chaired by Human Resources and Corporate Services

- It is responsible for:

- Providing prompt advice to the Deputies Portfolio Committee on the optimized hybrid model for the Treasury Board Secretariat, including considerations such as capacity, health measures, etc.

- Providing direction to the associated Optimized Hybrid Workplace Working Group, as well as approving and challenging recommendations provided by the Working Group

- Supported by a number of other players in the department, including Priorities & Planning, Strategic Communications and Ministerial Affairs, Office of the Chief Human Resources Officer, etc. to ensure that key perspectives are captured

Treasury Board of Canada Secretariat: Financial Overview

In this section

Purpose

Overview

Provide an overview of the operating vote and central votes of the Treasury Board of Canada Secretariat (TBS)

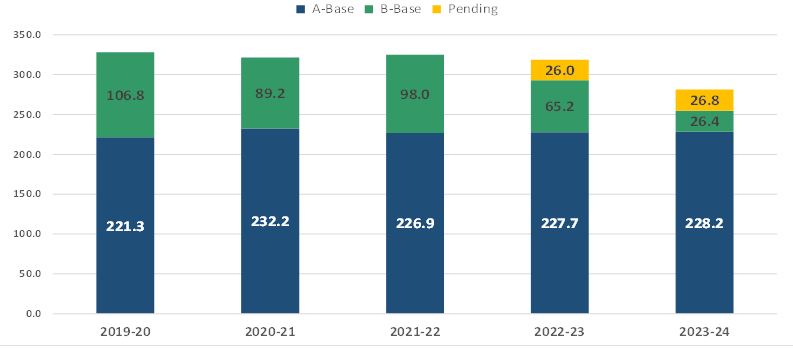

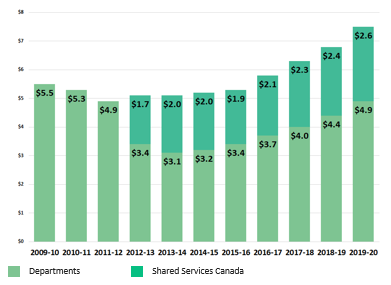

Financial overview: Treasury Board Secretariat operating budget 2021–22

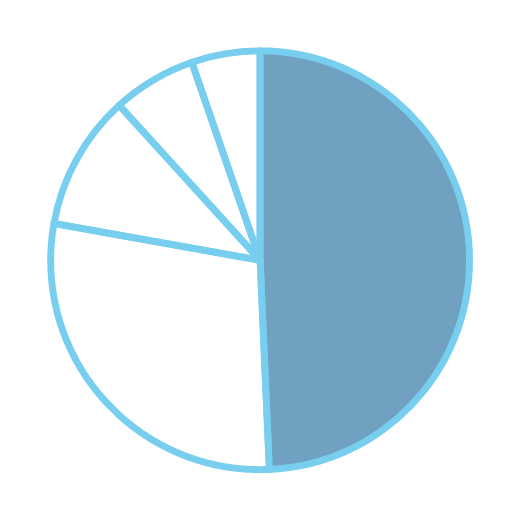

- The Treasury Board Secretariat has an approved operating budget of $324.9 million in 2021–22, of which $228 million (70%) is for salary and $96.9 million (30%) is for goods and services.

- For 2021–22, 28% of the Treasury Board Secretariat’s Vote 1 funding envelope comprises temporary funding; another $36 million is recovered from other government departments through Memoranda of Understanding.

Text version

| Year | A-Base | B-Base | Pending |

|---|---|---|---|

| 2019–20 | $221.3 million | $106.8 million | |

| 2020–21 | $232.2 million | $89.2 million | |

| 2021–22 | $226.9 million | $98.0 million | |

| 2022–23 | $226.9 million | $65.2 million | $26.0 million |

| 2023–24 | $228.2 million | $26.4 million | $26.8 million |

Note: “Pending” refers to items for which funding is earmarked in the Fiscal Framework, but the funding has not yet been accessed via a Treasury Board submission.

Financial overview: initiatives with temporary funding

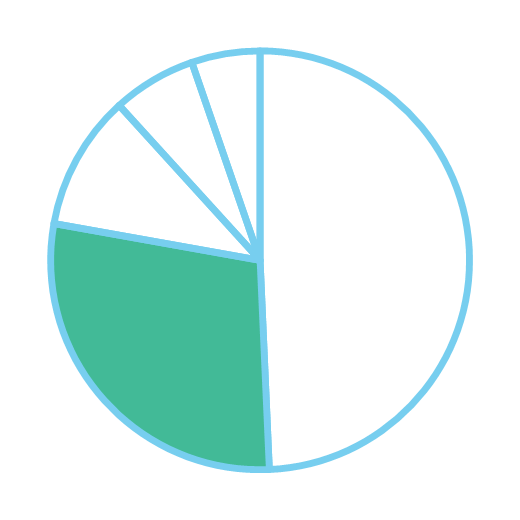

- The Treasury Board Secretariat has 14 initiatives with temporary funding that will end in the next three years that have 272 Full-time Equivalents (FTEs) and funding of $66 million.

Initiatives with temporary funding in Treasury Board Secretariat Vote 1, with funding ending after…

2022–23 (201 FTEs, $42.6 million)

- HR-to-Pay / Pay Stabilization (96 FTEs, $21.3 million)

- COVID-19 Vaccination Policy Implementation (28 FTEs, $5.4 million)

- Classification Program (25 FTEs, $4.5 million)

- Official Languages Modernization (23 FTEs, $4.2 million)

- Centre on Diversity and Inclusion (14 FTEs, $4.4 million)

- Regulatory Reviews (15 FTEs, $2.8 million)

2023–24 (39 FTEs, $9.2 million)

- Office of Public Service Accessibility (17 FTEs, $3.1 million) and Centralized Enabling Workplace Fund (2 FTEs, $1.3 million)

- Access to Information Action Plan (11 FTEs, $2.9 million)

- Centre of Expertise on Real Property (4 FTEs, $1.2 million)

- E-Payroll (3 FTEs, $0.4 million)

- Advancing Gender Equality / Women’s Program (2 FTEs, $0.3 million)

2024–25 (32 FTEs, $14.2 million)

- Pay Equity Administration and Machinery (26 FTEs, $13.1 million)

- Indigenous Procurement Strategy (4 FTEs, $0.6 million)

- Federal Contaminated Sites Action Plan – Phase IV (2 FTEs, $0.5 million)

- Some of these initiatives may be required to operate beyond their existing funding profiles, depending on government priorities and Cabinet decisions. The Treasury Board Secretariat may need to submit funding proposals to seek renewed funds.

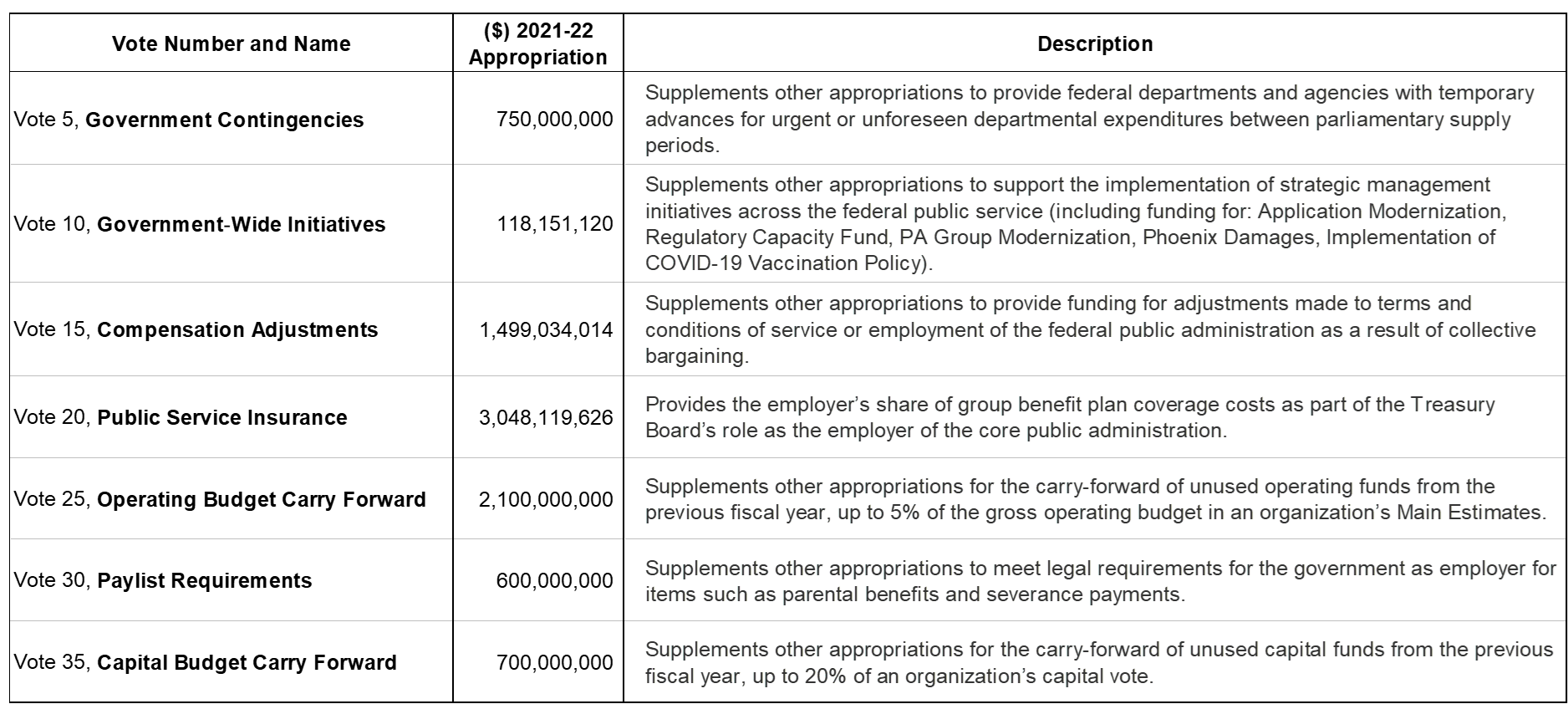

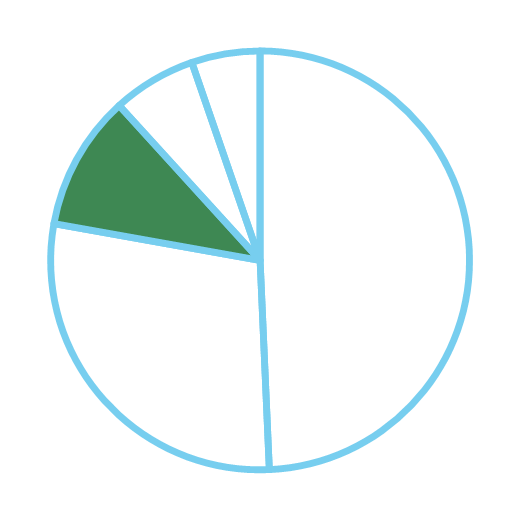

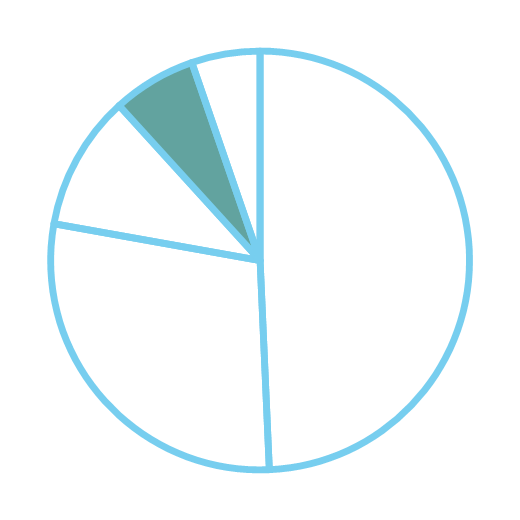

Financial overview: Vote 20 and other central votes

- The Corporate Services Sector provides oversight of Treasury Board Secretariat Vote 1 and Vote 20.

- Vote 20 is a quasi-statutory vote managed by the Office of the Chief Human Resources Officer and is used to pay the

employer’s share of group benefit plan coverage costs as part of the Treasury Board’s role as the employer

of the core public administration.

- The Treasury Board Secretariat regularly seeks incremental funding for Vote 20 to address price and volume increases and to offset any operating fund deficits in the group benefit plans.

- The other central votes are managed by the Expenditure Management Sector. Funding in the other central votes is transferred from the Treasury Board Secretariat to individual departments and agencies once specified criteria are met.

Text version

A table showing TBS central votes, the amount (in dollars) appropriated in 2021-22 for each vote, and a description of each vote.

| Vote number and name | ($) 2021-22 Appropriation | Description |

|---|---|---|

| Vote 5, Government Contingencies. | 750,000,000 | Supplements other appropriations to provide federal departments and agencies with temporary advances for urgent or unforeseen departmental expenditures between parliamentary supply periods. |

| Vote 10, Government-wide Initiatives | 118,151,120 | Supplements other appropriations to support the implementation of strategic management initiatives across the public service (including funding for: Application Modernization, Regulatory Capacity Fund, PA Group Modernization, Phoenix Damages, Implementation of COVID-19 Vaccination Policy). |

| Vote 15, Compensation Adjustments | 1,499,034,014 | Supplements other appropriations to provide funding for adjustments made to terms and conditions of service or employment of the federal public administration as a result of collective bargaining. |

| Vote 20, Public Service Insurance | 3,048,119,626 | Provides the employer’s share of group benefit plan coverage costs as part of the Treasury Board’s role as the employer of the core public administration. |

| Vote 25, Operating Budget Carry-Forward | 2,100,000,000 | Supplements other appropriations for the carry-forward of unused operations funds from the previous fiscal year, up to 5 % of the gross operating budget in an organization’s Main Estimates. |

| Vote 30, Paylist Requirements | 600,000,000 | Supplements other appropriations to meet legal requirements for the government as employer for items such as parental benefits and severance payments. |

| Vote 35, Capital Budget Carry Forward | 700,000,000 | Supplements other appropriations for the carry-forward of unused capital funds from the previous fiscal year, up to 20% of an organization’s capital vote. |

Summary of Hot Issues, [redacted]

Summary of Hot Issues Across the Treasury Board Secretariat

| Item | Action Required | Deadline |

|---|---|---|

| Renewal of 16 audit committee members in 13 departments |

|

February 2022 |

| [redacted] | [redacted] | [redacted] |

| Developing the Directive on the Stewardship of Financial Management Systems |

|

By March 31, 2022 |

| Publishing the President of the Treasury Board’s Fees Report for the 2020-21 Fiscal Year, as required by the Service Fees Act |

|

By March 31, 2022 |

| Item | Action Required | Deadline |

|---|---|---|

| [redacted] | [redacted] | [redacted] |

| Advancing Canada-US regulatory cooperation | Meeting with the Acting Director of the US Office of Management and Budget to solidify the path forward | Earliest convenience / contingent upon Senate Confirmation hearings |

| Chair ad hoc Deputy Minister committee meeting on regulatory modernization | Call next meeting to advance priorities on Regulatory Modernization | TBD (January-February 2022) |

| Tabling of 2nd Annual Regulatory Modernization Bill (ARMB) | Support to the President in leading the bill through Parliament | TBD (early to mid 2022) |

| [redacted] | [redacted] | [redacted] |

| Initiate Round 3 of Targeted Regulatory Reviews | Approval of topics for Round 3 and launch review with support of implicated departments | TBD (dependant upon interdepartmental consultations, underway) |

| Item | Action Required | Deadline |

|---|---|---|

| Mandatory vaccination in the Public Service |

|

Winter 2022 [redacted] |

| Total compensation and collective bargaining |

|

[redacted] |

| NextGen HR and Pay Solution |

|

Winter 2022 |

| Modernization of the Official Languages Act |

|

February 2022 |

| Senior Leaders Strategy |

|

January 2022 March 2022 |

| [redacted] | [redacted] | [redacted] |

| 2022 benefit plan premium rate update |

|

By January 15, 2022 |

| Phoenix Litigation |

|

January 2022 |

| Pay equity implementation |

|

Spring 2022 and ongoing |

| Re-appointment of the Public Sector Integrity Commissioner (PSIC) |

|

The re-appointment must be approved by both Houses and complete by March 26, 2022. |

| Item | Action Required | Deadline |

|---|---|---|

| Direction on the President’s 2021 mandate commitments | Direction | January 2022 |

| Treasury Board Secretariat 2022-23 Departmental Plan | Approval (President sign-off required) | January 2022 |

| Supplementary Information to the Departmental Plan – publication to the Treasury Board Secretariat Website | Approval of information on work at TBS related to gender-based analysis plus, sustainable development and TBS’s transfer payment programs | February 2022 |

| Management Accountability Framework Government-wide and Departmental Reports | Approval | April 29, 2022 |

| Office of the Auditor General Audit on Human Ressources Management (Tabling in March 2022) | Signature | February 2022 |

| Office of the Auditor General Audit on Gender Based Analysis Plus (Tabling in March 2022) | Signature | February 2022 |

| Office of the Auditor General Audit Plan Summary – Benefits Delivery Modernization | Signature | February 2022 |

| Office of the Auditor General Audit on Greening Government (Tabling in April 2022) | Signature | February/March 2022 |

| Item | Action Required | Deadline |

|---|---|---|

| Tabling of Supplementary Estimates (C) and Main Estimates | Support the President’s appearance before Parliamentary Committee in respect of the Estimates | Tabling Date: February 2022 Committee appearance: March 2022 |

| (Mandate Letter) Ensure government policy is developed through an intersectional lens by strengthening the quality of life framework, gender-based analysis plus, and integrated climate lenses | Provide advice to President | Winter 2022 |

| (Mandate letter) Conduct comprehensive and continuous strategic policy review of government programs | Provide advice to President | Winter 2022 |

| Item | Action Required | Deadline |

|---|---|---|

| Broad Financial Situation |

|

Ongoing discussion |

| Addressing priorities related to COVID-19 |

|

Ongoing; expected Winter 2022 |

| Delegation of Spending and Financial Authorities |

|

January 2022 |

| Sustainable Cloud Funding |

|

1 April 2022 |

| Support to Treasury Board |

|

Ongoing |

| Co-lead the Budget 2022 process with Priorities & Planning |

|

January 2022 |

| Item | Action Required | Deadline |

|---|---|---|

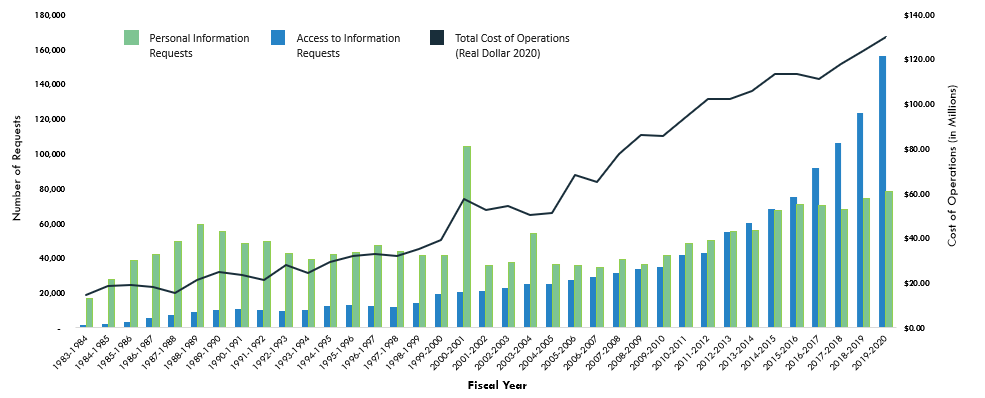

| Access to Information (ATI) Review | The Government committed to a full review of the access to information process and to holding a broad engagement process during the review, including engagement with the general public, Indigenous groups and representatives, federal institutions and other consultation activities. [redacted] | [redacted] |

| National Security and Intelligence Committee of Parliamentarians (NSICOP) Report 2021 |

|

February 2022 |

| Item | Action Required | Deadline |

|---|---|---|

| Access to Information Act (Legislative review and ongoing requests) | Communicate the outcome of the review and ongoing issues management | Ongoing |

| Collective Bargaining | Issues management, strategic pivot to proactive communications stance as needed | Ongoing |

| Vaccination policy public reporting & litigation | Entreprise coordination of public reporting & issues management | Ongoing |

| Easing restrictions at federal worksites | Entreprise coordination of internal communications & issues management | Ongoing |

| Return to secure posture (Treasury Board & Cabinet) | Manage ongoing operational issues & establish future steady state | Q4 2022 |

| Harassement & discrimination lawsuits (e.g. Thompson & Diallo) | Communications coordination with implicated depts & issues management | Ongoing |

| Appearance for Supplementary Estimates C (TBC) | N/A | February/March |

| Item | Action Required | Deadline |

|---|---|---|

|

Policy on COVID-19 Vaccination |

Status update on:

|

None |

|

Treasury Board Secretariat Hybrid workplace |

Departmental Updates through Deputies Portfolio Committee |

No immediate action |

| Item | Action Required | Deadline |

|---|---|---|

| [redacted] | ||

| Item | Action Required | Deadline |

|---|---|---|

| The future of the COVID Alert exposure notification app | A decision is needed on the future of the COVID Alert exposure notification service, which is owned by Health Canada and operated by the Canadian Digital Service. Targeted programmatic funding provided to the Canadian Digital Service to support the initiative sunsets in March 2022. If the service is to remain operational, additional federal investment will be required to keep it operational, accessible and secure. | January 2022 |

| Canadian Digital Service Chief Executive Officer Recruitment | Canadian Digital Service has been without a permanent CEO since September 2021. Recruitment materials have been prepared in consultation with Treasury Board Secretariat's Human Resources Division. Approval is required for the materials and to launch the public recruitment process. | January 2022 |

| Item | Action Required | Deadline |

|---|---|---|

| Publishing the Internal Audit of Acquisition Cards | N/A. Memo to President for information prepared. | By January 31, 2022 |

[redacted]

[redacted]

Planned reports of the Office of the Auditor General and the Commissioner of the Environment and Sustainable Development

Auditor General of Canada Reports

Spring 2022

- Management of Government Human Resources*

- Gender-Based Analysis Plus*

- Systemic Barriers in Correctional Services

- Disability Benefits for Veterans and their Survivors

Fall 2022

- Cybersecurity of Personal Information in the Cloud*

- Protecting the North

- Benefits Delivery Modernization*

- Chronic Homelessness in Canada

- Preparedness for Emergencies in Indigenous Communities

- Vaccine Expenditures

- Post-Payment Verification under the Canada Emergency Response Benefit and the Canada Emergency Wage Subsidy

* TBS currently implicated

Commissioner of the Environment and Sustainable Development Reports

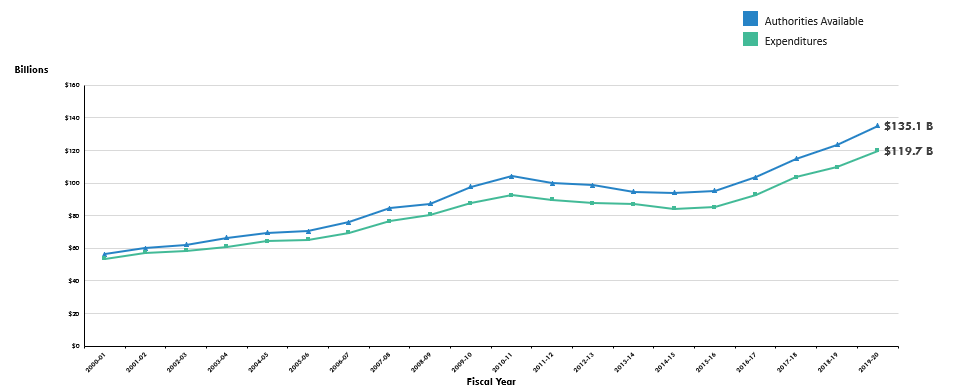

Spring 2022