Your Pension and Benefits Liaison: Information for retired members of the federal public service pension plan, Issue 12

Issue 12: 2018

On this page

- Going digital: submit health care claims online or from your smartphone

- Pension: understanding the minimum benefit

- How re-employment could affect your pension and group insurance benefits

- Sharing the cost of your health and dental plans

- A retirement story: learning the history of an adopted country

- Optional monthly pension payment deductions

- British Columbia Medical Services Plan

- Keep us informed

- Government of Canada Pension Centre: contact information

Going digital: submit health care claims online or from your smartphone

If you live in Canada, you can now submit Public Service Health Care Plan (PSHCP) claims, including claims for vision care benefits and paramedical services, online or from your smartphone.

To get started, you must register on the Sun Life Plan Member Services website and provide both your email address and banking details. To submit claims from your smartphone, download the free my Sun Life Mobile app from the App Store or Google Play.

Online

Log into your Sun Life account to submit health claims and review those you have previously submitted. You can also coordinate benefits between two benefit plans or with another member of the PSHCP. As part of the new digital services, you will also find a tool to search for health care providers in your area, find out what is covered, access your PSHCP benefit card, and consult a wellness page to help you manage your personal health.

On the app

Once you have downloaded the my Sun Life Mobile app on your smartphone, you will be able to submit claims and supporting documents electronically, including physician referrals and receipts, locate health care providers in your area, review your coverage, and access your PSHCP benefit card.

Pension: understanding the minimum benefit

In the event of your death, the public service pension plan provides pension benefits to your eligible surviving spouse or common-law partner and dependant children. If you have no eligible survivors, your designated beneficiary under the Supplementary Death Benefit (SDB) Plan or your estate is guaranteed a minimum amount. This is known as the minimum benefit, which is the greater of five times your annual unreduced pension (excluding indexation), or the total contributions you have paid into the plan plus interest, less any pension benefit paid to you and your survivors. The balance is paid to your SDB beneficiary or to your estate. In some cases, even if the plan member has received a pension for over four years, the return of contributions plus interest may be the greater amount.

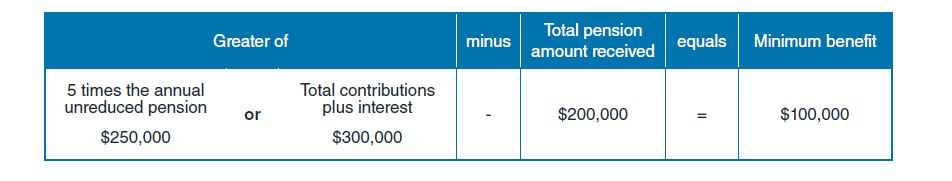

In the example below, a member retired with an annual unreduced pension of $50,000 but had contributed $300,000 (with interest) to the pension plan throughout their career. The member passed away four years after retirement, having received $200,000 in pension payments. In this case, the minimum benefit would be:

Figure 1 - Text version

In the example above, a member retired with an annual unreduced pension of $50,000 but had contributed $300,000 (with interest) to the pension plan throughout their career. The member passed away four years after retirement, having received $200,000 in pension payments. In this case, the minimum benefit would be:

The greater of 5 times the annual unreduced pension, which would be 5 multiplied by $50,000 which equals $250,000, or the total pension contributions plus interest, which would be $300,000, minus the total pension amount received of $200,000, equals a minimum benefit of $100,000 ($300,000 minus $100,000).

How re-employment could affect your pension and group insurance benefits

Are you thinking of rejoining the public service? If so, becoming re-employed could affect your current pension payment and group insurance benefits. Although you may continue to receive your pension payment while earning a salary, there are certain situations where your pension payment will stop if you again become eligible to contribute to the public service pension plan. These situations include:

- being appointed on an indeterminate basis

- being hired for a period of more than six months

- after six months of continuous employment, if you were originally hired for a period of six months or less

Becoming a contributor again would affect your pension and indexation entitlements, as well as retiree group insurance benefits, including health and dental, and may also impact your Supplementary Death Benefit.

Contact the Government of Canada Pension Centre (Pension Centre) to discuss how rejoining the public service may affect you.

Sharing the cost of your health and dental plans

On , contribution rates for retired members with supplementary coverage under the Public Service Health Care Plan (PSHCP) reached a 50:50 cost-sharing ratio. This equally divides the cost of the Plan between retired members and the Government of Canada. These new rates were reflected in the pension payments.

This change brings the cost-sharing ratio for the PSHCP in line with that of the Pensioners’ Dental Services Plan (PDSP). Equally sharing the cost of the PSHCP and the PDSP ensures that these plans remain sustainable.

An analysis of the rates will be conducted regularly, and rates may be adjusted in the future to maintain the 50:50 cost-sharing ratio. You can help manage costs by choosing to receive your PSHCP Bulletin and PDSP Communiqué electronically, signing up for direct deposit and submitting claims electronically.

A retirement story: learning the history of an adopted country

Graham Gibbs is a retired Canadian diplomat who immigrated to Canada from the United Kingdom in his mid-twenties and became a proud Canadian in 1975.

Graham realized his ambition of being able to promote Canada abroad starting in 1988. He joined the Canadian Space Agency for a posting in Washington, DC, where he spent 22 years representing the Canadian Space Agency.

Graham and his wife Jay, who is also an immigrant from the United Kingdom, returned to Canada in 2010 and settled in Ottawa. Graham retired eighteen months later. They hit the open road in a camper van and decided to learn more about their adopted country’s history up-close-and-personal.

Graham and Jay covered 40,000 km (five times the distance of the Trans-Canada Highway) taking them from coast-to-coast. They visited numerous historic and archaeological sites, interpretive centres and museums. Graham kept extensive notes, which resulted in his “retirement project,” to write a book about the history of Canada.

Their adventures continue in this beautiful and wonderfully culturally diverse country of ours!

Thank you, Graham, and to those who shared their retirement stories with us!

Would like to have your retirement story to appear in the next issue of Liaison? Send it to us by email in the official language of your choice. We ask that your story be brief. You will be contacted if it is selected.

Optional monthly pension payment deductions

Did you know that you can choose to have additional deductions taken from your pension payment other than those for the Public Service Health Care Plan, the Pensioners’ Dental Services Plan and the Supplementary Death Benefit?

Other deductions include membership fees for the National Association of Federal Retirees or charitable contributions to the Government of Canada Workplace Charitable Campaign (United Way).

For a complete list of deductions and to learn more about these options, contact the Pension Centre.

British Columbia Medical Services Plan

If you are a resident of British Columbia, the end of British Columbia Medical Services Plan premiums in 2020 will impact you.

Information concerning these changes will be communicated as soon as they are available.

Keep us informed

It is important to notify the Pension Centre if there are changes to the following:

- your mailing address (even if you are enrolled in direct deposit)

- your banking information

- your marital status (married, common-law, widowed, separated, divorced or single)

- the mailing address of your designated beneficiary

- the name and mailing address of a person to contact in the event of incapacity

Government of Canada Pension Centre: contact information

We encourage you to visit Pension and benefits for information.

When communicating with the Pension Centre, it is important that you always provide your:

- pension number

- surname, first name and initials

- address (with postal code)

- telephone number (with area code)

Stay vigilant: Beware of calls or emails claiming to be from the Pension Centre seeking personal information.

Call Monday to Friday

1-800-561-7930 (toll-free)

8:00 a.m. to 4:00 p.m. (your local time)

Outside Canada and the United States

506-533-5800 (collect calls accepted) 8:00 a.m. to 5:00 p.m. (Atlantic time)

Telephone teletype (TTY)

506-533-5990 (collect calls accepted) 8:00 a.m. to 5:00 p.m. (Atlantic time)

Facsimile

418-566-6298

In writing

Government of Canada Pension Centre Mail Facility

PO Box 8000

Matane QC G4W 4T6

If you have comments or questions about our communication products, email us.

Note: For security reasons, please do not provide personal information by email.

Note: Some federal agencies, Crown corporations and territorial governments do not participate in the public service group benefit plans. Even if your former employer did not participate in all public service group insurance benefit plans, as a retired member you may be eligible to join these plans. To find out if you are eligible, please call the Pension Centre.

Disclaimer: Your Pension and Benefits Liaison newsletter is provided for information purposes only and is not a legal document on your rights and obligations. Should there be any discrepancy between the information in this document and that contained in the Public Service Superannuation Act and related regulations or other applicable laws, the legislative provisions will apply. Similarly, should there be any discrepancy between information in this document and that contained in the group insurance benefits plan provisions or insurance contracts, the plan provisions or insurance contracts will apply.

© Her Majesty the Queen in Right of Canada, represented by the President of the Treasury Board, 2018,

ISSN: 2292-261X