Report on the Administration of the Supplementary Retirement Benefits Act for the Fiscal Year Ended March 31, 2017

The Supplementary Retirement Benefits Act (SRBA) applies primarily to pension benefits payable to federal judges under the Judges Act, as well as to pension benefits payable under other statutes listed in Schedule I of the SRBA, such as the Diplomatic Service (Special) Superannuation Act, the Lieutenant Governors Superannuation Act, the Defence Services Pension Continuation Act of the Canadian Armed Forces and the Royal Canadian Mounted Police Pension Continuation Act.

The SRBA does not apply to pension benefits payable under the major federal public service pension plans governed by the Public Service Superannuation Act, the Canadian Forces Superannuation Act, the Royal Canadian Mounted Police Superannuation Act and the Members of Parliament Retiring Allowances Act.

On this page

Her Excellency the Right Honourable Julie Payette, C.C., C.M.M., C.O.M., C.Q., C.D.

Governor General of Canada

Excellency:

I have the honour to submit to Your Excellency, the Report on the Administration of the Supplementary Retirement Benefits Act for the Fiscal Year Ended .

Respectfully submitted,

Original signed by

The Honourable Scott Brison, P.C., M.P.

President of the Treasury Board

Year at a glance

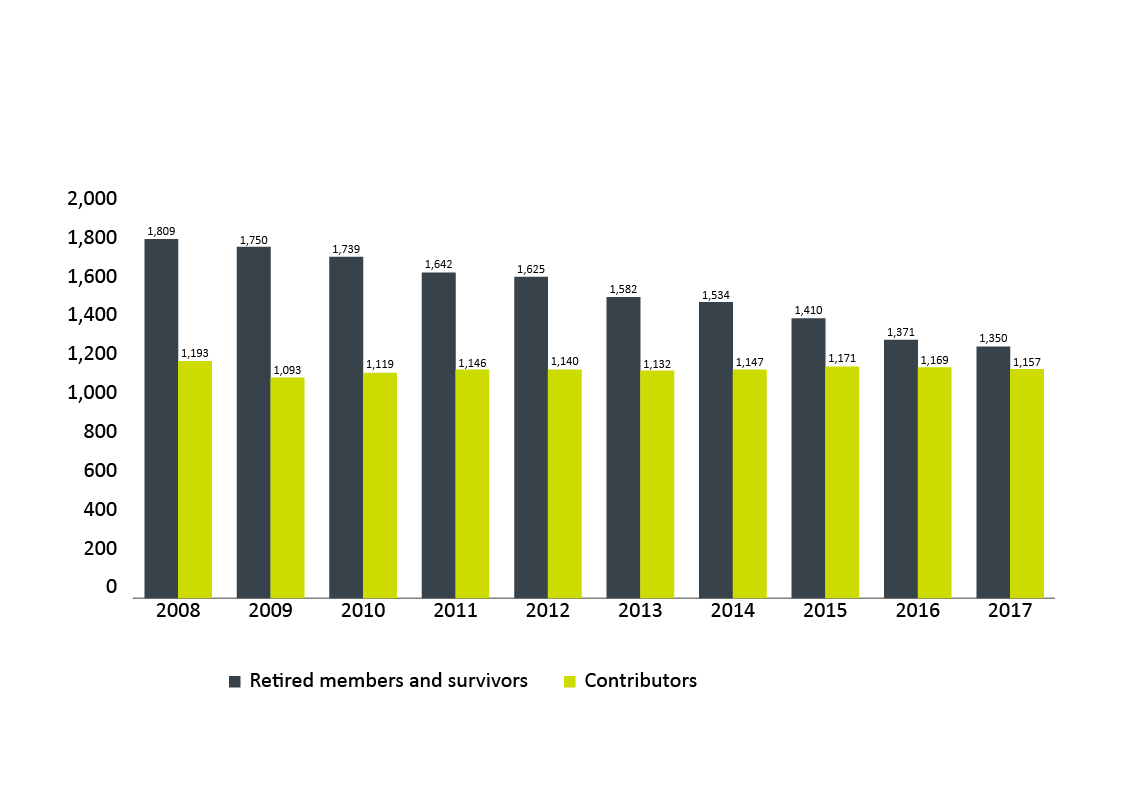

- Active contributors decreased by 1.0% to 1,157 members (1,169 members in 2016).

- Retired members and survivors decreased by 1.5% to 1,350 members (1,371 members in 2016).

- As a result of indexation, pension benefits were increased by 1.3% in (1.3% in ).

Historical context

The SRBA provides supplementary benefits for recipients of pensions or allowances payable under the acts or regulations listed in Schedule I of the SRBA.

Effective , an annual increase in pensions reflecting the full increase in the cost of living was permitted, payable starting in January of each year. This increase is based on the percentage increase in the average of the Consumer Price Index (CPI) for the 12 months ended on the preceding September 30, over the CPI average for the 12 months ended a year earlier. Since 1982, the legislation has required that the increase payable in the first year after a person retires be pro-rated to the number of complete months of retirement in the previous year.

In 1992, the SRBA was amended to reflect changes being made to the Public Service Superannuation Act, the Canadian Forces Superannuation Act, the Royal Canadian Mounted Police Superannuation Act and the Members of Parliament Retiring Allowances Act and no longer applied to pension benefits payable under these statutes. Consequently, these statutes were amended to incorporate the authority to provide increases in their respective pensions as if they were determined under the SRBA.

Supplementary Retirement Benefits Account

The SRBA establishes an account known as the Supplementary Retirement Benefits Account (the account) in the Public Accounts of Canada. Plan members who have not yet retired, except the Governor General, contribute to the account. The government matches these contributions.

Before , all supplementary benefits were charged to the account. Since that date, however, the benefits paid to former contributors have been charged to the account only until they equal the total amount credited to the account. Supplementary benefits paid in excess of that total are charged to the Consolidated Revenue Fund.

Under the 1992 amendments mentioned in the previous section, the appropriate portions of the account were transferred to the superannuation accounts established under the Public Service Superannuation Act, the Canadian Forces Superannuation Act, the Royal Canadian Mounted Police Superannuation Act and the Members of Parliament Retiring Allowances Act. These transfers have greatly reduced the size of the account.

Membership statistics

As at , there were 1,157 members (1,169 members in 2016) contributing to the account and 1,350 retired members and survivors (1,371 members in 2016).

Figure 1 shows the number of contributors relative to the number of retired members and survivors from 2008 to 2017.

Figure 1 - Text version

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Contributors | 1,093 | 1,093 | 1,119 | 1,146 | 1,140 | 1,132 | 1,147 | 1,171 | 1,169 | 1,157 |

| Retired members and survivors | 1,809 | 1,750 | 1,739 | 1,642 | 1,625 | 1,582 | 1,534 | 1,410 | 1,371 | 1,350 |

Funding

Between , and , members contributed 0.5% of their salary. Effective , this rate was increased to 1%.

Interest on the account is payable at the end of each quarter. It is calculated monthly on the minimum balance in the account at an interest rate that represents the yield on outstanding Government of Canada bonds that have a term to maturity of 5 years, reduced by 0.125%.

Account transactions

In fiscal year ended , total receipts from contributors and the government, including interest, amounted to $8.69 million ($8.81 million in fiscal year ended ).

The total amount paid under the SRBA was $30.33 million ($30.70 million in fiscal year ended ), of which $20,721 ($25,819 in fiscal year ended ) was charged to the account; the remaining $30.31 million ($30.67 million in fiscal year ended ) was charged to the Consolidated Revenue Fund, in accordance with subsection 8(2) of the SRBA.

The balance in the account at the end of the year was $224.53 million ($215.86 million in fiscal year ended ).

Details of the transactions in the account during the fiscal year appear in the “Account transaction statements” section.

Account transaction statements

| 2017 | 2016 | |

|---|---|---|

Table 1 Notes

|

||

| Supplementary Retirement Benefits Account, opening balance (A) |

215,856 | 207,072 |

| Receipts | ||

|

Contributions

|

||

|

Members

|

3,596 | 3,625 |

|

Government

|

3,583 | 3,625 |

|

Interest

|

1,515 | 1,560 |

| Total receipts (B) | 8,694 | 8,810 |

| Payments | ||

|

Annuities

table 1 note 2

|

30,326 | 30,700 |

|

Less charges to Consolidated Revenue Fund

in accordance with subsection 8(2) of the SRBA table 1 note 2 |

30,306 | 30,674 |

| Net payments (C) | 20 | 26 |

| Increase (B – C = D) | 8,674 | 8,784 |

| Supplementary Retirement Benefits Account, closing balance (A + D) |

224,530 | 215,856 |

| Judges | Others | Total | |

|---|---|---|---|

Table 2 Notes

|

|||

| Supplementary Retirement Benefits Account, opening balance (A) |

215,089 | 767 | 215,856 |

| Receipts | |||

|

Contributions

|

|||

|

Members

|

3,558 | 38 | 3,596 |

|

Government

|

3,558 | 25 | 3,583 |

|

Interest

|

1,509 | 6 | 1,515 |

| Total receipts (B) | 8,625 | 69 | 8,694 |

| Payments | |||

|

Annuities

table 2 note 2

|

0 | 20 | 20 |

|

Return of contributions

|

0 | 0 | 0 |

| Total Payments (C) | 0 | 20 | 20 |

| Increase (B – C = D) | 8,625 | 49 | 8,674 |

| Supplementary Retirement Benefits Account, closing balance (A + D) |

223,714 | 816 | 224,530 |

© Her Majesty the Queen in Right of Canada, represented by the President of the Treasury Board, 2018,

Catalogue No. BT1-12E-PDF, ISSN: 1489-4866