Report on the Administration of the Supplementary Retirement Benefits Act for the Fiscal Year Ended March 31, 2020

On this page

His Excellency the Right Honourable Richard Wagner, P.C.

Administrator of the Government of Canada

Excellency:

I have the honour of submitting to Your Excellency the Report on the Administration of the Supplementary Retirement Benefits Act for the Fiscal Year Ended .

Respectfully,

Original signed by

The Honourable Jean-Yves Duclos, P.C., M.P.

President of the Treasury Board

Overview

About this report

This report provides information on the administration of the Supplementary Retirement Benefits Act (SRBA) for the fiscal year ended March 31, 2020. It includes account transaction statements and statistics on benefits, contributions and membership.

The report is tabled in Parliament each year, in accordance with section 12 of the SRBA.

About the act

The SRBA applies to pension benefits payable to federal judges under the Judges Act, as well as to pension benefits payable under other statutes listed in Schedule I of the SRBA, such as the Diplomatic Service (Special) Superannuation Act, the Lieutenant Governors Superannuation Act, the Defence Services Pension Continuation Act of the Canadian Armed Forces, the Royal Canadian Mounted Police Pension Continuation Act, and Part VI of the Members of Parliament Retiring Allowances Act.

The SRBA, along with the relevant pension statutes, governs the benefit index of the major federal public sector pension plans, including plans governed by the Public Service Superannuation Act, the Canadian Forces Superannuation Act, the Royal Canadian Mounted Police Superannuation Act and the Members of Parliament Retiring Allowances Act.

Fiscal year at a glance

| Plan member and employer contributions |

$8.0 million |

| Benefits increase (as a result of indexation) |

2019: 2.2% 2020: 2.0% |

|

Account balance at fiscal year end |

$259.1 million |

| Active contributors |

1,234 |

|---|---|

| Retired members and survivors |

1,283 |

| Total membership |

2,517 |

Funding

Between April 1, 1970, and December 31, 1976, members contributed 0.5% of their pensionable salary to the Supplementary Retirement Benefits Account. Effective January 1, 1977, this rate was increased to 1%.

The Government of Canada, as the employer, matches plan members’ contributions.

Interest on the account is payable at the end of each quarter. It is calculated monthly on the minimum balance in the account at an interest rate that represents the yield on outstanding Government of Canada bonds that have a term to maturity of 5 years, reduced by 0.125%.

Membership demographics

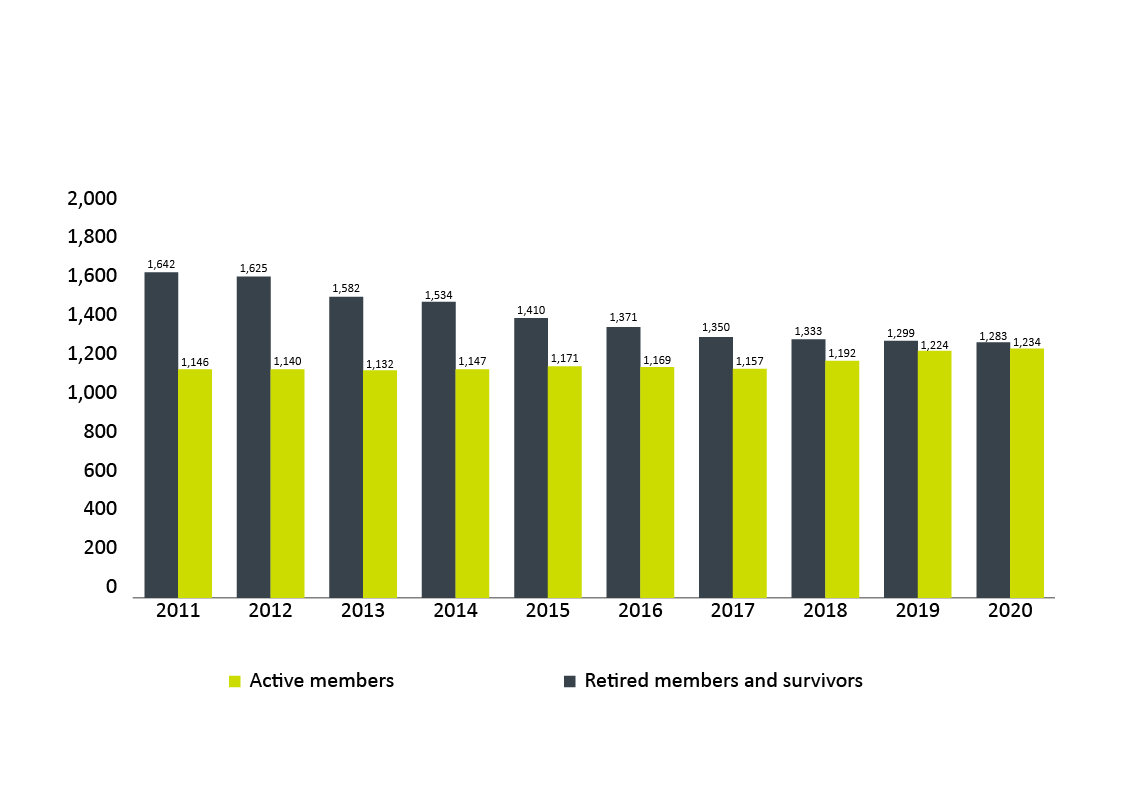

Figure 1 shows the number of active and retired members and survivors from 2011 to 2020.

Fiscal year ended March 31

Figure 1 - Text version

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Active members | 1,146 | 1,140 | 1,132 | 1,147 | 1,171 | 1,169 | 1,157 | 1,192 | 1,224 | 1,234 |

| Retired members and survivors | 1,642 | 1,625 | 1,582 | 1,534 | 1,410 | 1,371 | 1,350 | 1,333 | 1,299 | 1,283 |

Account transaction statements

Supplementary Retirement Benefits Account statement

| 2020 | 2019 | |

|---|---|---|

| Opening balance |

$247,634 |

$235,256 |

| Receipts | ||

| Contributions | ||

| Members |

4,027 |

3,843 |

| Government |

4,024 |

3,843 |

| Interest |

3,466 |

4,714 |

| Total receipts |

$11,517 |

$12,399 |

| PaymentsFootnote 2 | ||

| Annuities |

31,932 |

30,722 |

| Less charges to Consolidated Revenue Fund in accordance with subsection 8(2) of the SRBA |

31,903 |

30,701 |

| Net payments |

$29 |

$21 |

| Closing balance |

$259,121 |

$247,634 |

Supplementary Retirement Benefits Account statement

| Judges | Others | Total | |

|---|---|---|---|

| Opening balance |

$246,666 |

$968 |

$247,634 |

| Receipts | |||

| Contributions | |||

| Members |

3,996 |

31 |

4,027 |

| Government |

3,996 |

29 |

4,024 |

| Interest |

3,451 |

14 |

3,466 |

| Total receipts |

$11,443 |

$74 |

$11,517 |

| PaymentsFootnote 2 | |||

| Annuities |

25,166 |

6,765 |

31,932 |

| Less charges to Consolidated Revenue Fund in accordance with subsection 8(2) of the SRBA |

25,166 |

6,736 |

31,903 |

| Net payments |

$0 |

$29 |

$29 |

| Closing balance |

$258,109 |

$1,013 |

$259,121 |

Further information

For additional information on the SRBA, refer to the following reports: