Report on the Public Service Pension Plan for the Fiscal Year Ended March 31, 2018

On this page

- Message from the President of the Treasury Board

- Message from the Chief Human Resources Officer

- Introduction

- Year at a glance

- Pension objective

- Highlights for fiscal year ended

- Demographic highlights

- Financial overview

- Roles and responsibilities

- Summary of plan benefits

- Communications with plan members

- Public service pension plan history

- Overview of financial statements

- Further information

- Account transaction statements

- Statistical tables

- Financial statements of the public service pension plan for the fiscal year ended

Her Excellency the Right Honourable Julie Payette, C.C., C.M.M., C.O.M., C.Q., C.D.

Governor General of Canada

Excellency:

I have the honour to submit to Your Excellency the Report on the Public Service Pension Plan for the Fiscal Year Ended .

Respectfully submitted,

Original signed by

The Honourable Joyce Murray, P.C., M.P.

President of the Treasury Board and Minister of Digital Government

Message from the President of the Treasury Board and Minister of Digital Government

I am pleased to present the Report on the Public Service Pension Plan for the Fiscal Year Ended . It gives plan members, parliamentarians, and the public information on how the Government of Canada managed this plan in the 2017 to 2018 fiscal year.

The Treasury Board of Canada Secretariat oversees the management of the plan, providing the strategic leadership, governance and administrative oversight that helps ensure its integrity.

As the employer of the federal public service, we recognize that a strong pension plan is key to the government’s ability to attract and retain innovative and high-performing employees. These are the people whose efforts on behalf of Canadians contribute to this country’s reputation for having the most effective public service in the world.

The Secretariat continues to ensure that the plan provides fair, appropriate and affordable benefits, and remains sustainable. To support the plan, we have recently strengthened our governance with the approval of a formal funding policy for the public sector pension plans. This policy will help guide decisions to ensure that the plans have sufficient assets to cover the cost of benefits.

I would like to thank Canada’s federal employees for their ongoing and dedicated service, and for giving us a world-class public service of which we can all be proud.

Original signed by

The Honourable Joyce Murray, P.C., M.P.

President of the Treasury Board and Minister of Digital Government

Message from the Chief Human Resources Officer

Part of my work as Chief Human Resources Officer has been to strengthen the funding governance for the pension plan and the broader oversight role provided by the Treasury Board of Canada Secretariat. Over the past year, we have been making significant progress toward improving and modernizing our systems, tools and practices.

Among our successes in 2018, we finalized a formal funding policy for the public sector pension plans. In addition, net assets reached $111.1 billion (up from $98.5 billion last year), supported by equal cash contributions from plan members and from the employer ($2.4 billion each). These achievements continue to ensure the sustainability of the plan.

Awareness of the availability of online information continues to be strong. There were more than 4.1 million page views on the government’s pension and benefits website. This is a testament to the availability of useful information and a demonstration of interest in pension information by current and former federal employees and stakeholders.

As we continue to improve the work we do, this report will help plan members, parliamentarians, and Canadians obtain the information and related services they need to make informed decisions about the public service pension plan.

This report would not be complete without the work of the pension plan’s administrator, Public Services and Procurement Canada. I would like to acknowledge their commitment and dedication, as well as that of all those involved in the effective delivery of the Public Service Pension Plan. I look forward to continued collaboration among all our partners to ensure a healthy pension plan now and into the future.

Original signed by

Nancy Chahwan

Chief Human Resources Officer

Introduction

The public service pension plan is a defined benefit pension plan that is funded by contributions from members and the Government of Canada. The pension plan serves 607,587 active and retired members, including survivors and deferred annuitants. The plan is the largest of its kind in Canada in terms of total membership, covering nearly all employees of the Government of Canada. Members include employees of departments and agencies in the federal public service, certain Crown corporations and the territorial governments. The Government of Canada has a legal obligation to pay pension benefits. The public service pension plan has been governed by the Public Service Superannuation Act since 1954.

Year at a glance

9.8%

Net rate of return

303,483

Active plan members

304,104

Retired plan members, survivors and deferred annuitants

Employer and plan member contributions

Pension benefits paid

Average annual pension paid

Net value of assets held by the Public Sector Pension Investment Board

Pension objective

The objective of the Public Service Superannuation Act and related statutes is to provide a source of lifetime retirement income for retired and disabled public service pension plan members. Upon a plan member’s death, the pension plan provides an income for eligible survivors and dependants. Pension benefits are based on a plan member’s age, salary and years of pensionable public service.

Highlights for fiscal year ended

- The government has reviewed its methodologies for selecting discount rates used in the measurement of its unfunded pension obligations. The review considered industry practices and emerging changes in accounting standards, and resulted in a revised discount rate methodology. This change does not impact pension payments to current retired members or their survivors, nor does it impact future benefits of active plan members. For more information, see Note 3 of the financial statements.

- Work continued to strengthen governance, in response to the 2014 Auditor General of Canada’s performance audit of the public sector pension plans. The Treasury Board of Canada Secretariat, in collaboration with the Royal Canadian Mounted Police and the Department of National Defence, has developed a funding policy for the three main public sector plans. This policy, which strengthens plan governance and sustainability, is available on the Pension and benefits page on Canada.ca.

- To help members keep up‑to‑date on the plan, information is provided on the Pension and benefits page on Canada.ca. The page had more than 4.1 million views this fiscal year.

- Leveraging the successful modernization and centralization of federal pension administration, Public Services and Procurement Canada provided high‑quality pension services to plan members.

Demographic highlights

Active members and retired members over last 10 years

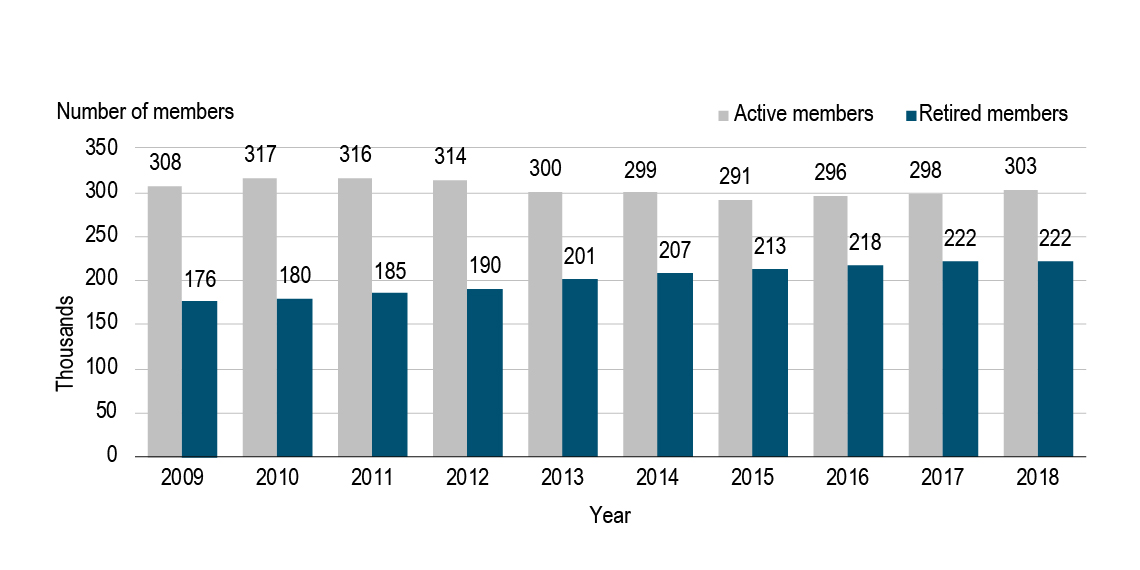

Figure 1 shows the number of active members relative to the number of retired members for the last 10 years.

(fiscal year ended March 31)

Figure 1 - Text version

| Year | Active members | Retired members |

|---|---|---|

| 2009 | 308 | 176 |

| 2010 | 317 | 180 |

| 2011 | 316 | 185 |

| 2012 | 314 | 190 |

| 2013 | 300 | 201 |

| 2014 | 299 | 207 |

| 2015 | 291 | 213 |

| 2016 | 296 | 218 |

| 2017 | 298 | 222 |

| 2018 | 303 | 222 |

In fiscal year ended , the 10-year annual growth rateFootnote 1 for active members was 0.3% (0.5% in the previous year) compared with 2.6% for retired members (2.8% in the previous year).

Active members by age group (2009 and 2018)

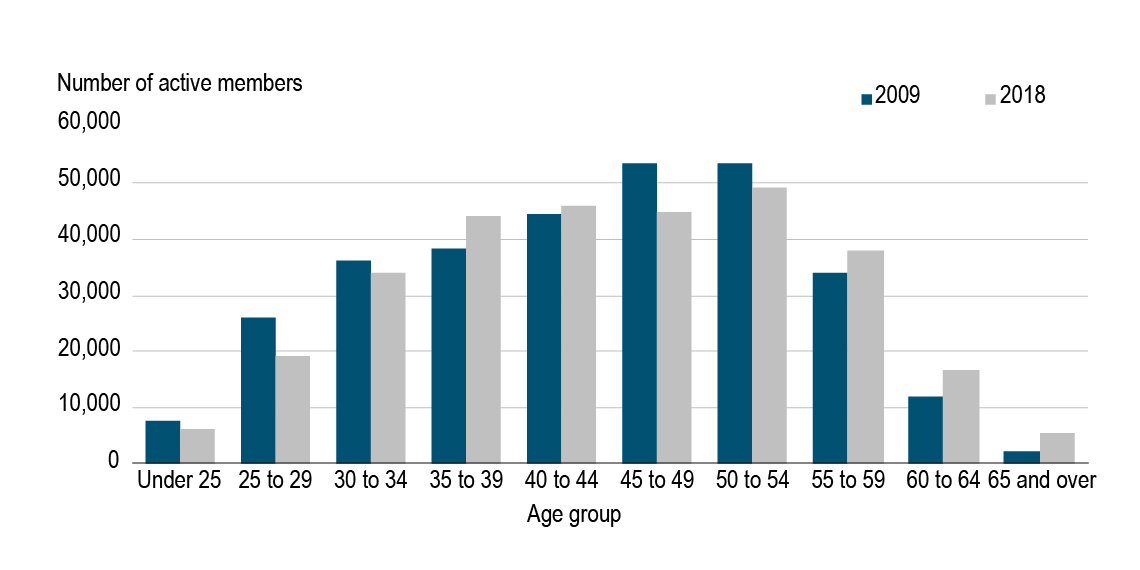

Figure 2 shows the number of active members by age group in 2018 relative to the number of active members in 2009.

(fiscal year ended March 31)

Figure 2 - Text version

| Age group | 2008 Total Active Members | 2017 Total Active Members |

|---|---|---|

| Under 25 | 7,784 | 6,419 |

| 25 to 29 | 26,029 | 19,346 |

| 30 to 34 | 36,275 | 33,903 |

| 35 to 39 | 38,294 | 44,156 |

| 40 to 44 | 44,290 | 45,727 |

| 45 to 49 | 53,574 | 44,682 |

| 50 to 54 | 53,428 | 49,226 |

| 55 to 59 | 33,913 | 37,761 |

| 60 to 64 | 11,992 | 16,591 |

| 65 and over | 2,386 | 5,672 |

| Total | 307,965 | 303,483 |

Note: The breakdown of members by age group was estimated by applying a pro rata methodology using data from the Actuarial Report on the Pension Plan for the Public Service of Canada. Data for 2009 was obtained from the actuarial report as at , and data for 2018 was obtained from the actuarial report as at .

Members by membership type (2009 and 2018)

Table 1 shows the breakdown of plan membership by membership type in 2009 and 2018.

| Membership type | Number of members 2009 | Number of members 2018 |

|---|---|---|

| Active members | 307,965 | 303,483 |

| Retired members | 175,757 | 222,169 |

| Survivors | 58,584 | 54,115 |

| Deferred annuitantstable 1 note 1 | 5,985 | 27,820 |

| Total | 548,291 | 607,587 |

Table 1 Notes

|

||

From 2009 to 2018, the ratio of active to retired members (including survivors and deferred annuitants) in the public service pension plan declined:

- 2009: 1.3 active members to 1 retired member

- 2018: 1.0 active member to 1 retired member

Financial overview

Contribution rates

Public service pension plan benefits are funded through compulsory contributions from the employer and from plan members, as well as from investment earnings. To ensure the sustainability of the public service pension plan, contribution rates continue to be maintained at the 50:50 employer‑employee cost-sharing ratio. The ratio was reached at the end of 2017.

Generally, if an employee was participating in the plan on or before , the contribution rates for Group 1 (members with a normal retirement age of 60) are applied. If an employee began participating in the plan on or after , the contribution rates for Group 2 (members with a normal retirement age of 65) are applied.

Plan members who are employed in operational service with Correctional Service Canada pay Group 1 rates and are entitled to special retirement benefits. Plan members who perform deemed operational service with Correctional Service Canada pay Group 1 rates and make an additional contribution of 0.62% of salary.

As illustrated in Table 2, Group 2 members, who are eligible to receive an unreduced pension benefit at age 65 (5 years later than Group 1 members), pay lower contribution rates than Group 1 members. Because Group 2 members receive a benefit that has a lower overall cost, they pay less than Group 1 members, who are eligible for an unreduced pension at age 60.

| 2018 | 2017 | |

|---|---|---|

| Members who were participating in the plan on or before (Group 1) | ||

|

On salarytable 2 note 1 up to the year’s maximum pensionable earningstable 2 note 2

|

9.83% | 9.47% |

|

On salary over the year’s maximum pensionable earnings

|

12.13% | 11.68% |

| Members who began participating in the plan on or after (Group 2) | ||

|

On salary up to the year’s maximum pensionable earnings

|

8.77% | 8.39% |

|

On salary over the year’s maximum pensionable earnings

|

10.46% | 9.94% |

Table 2 Notes

|

||

Cash contributions

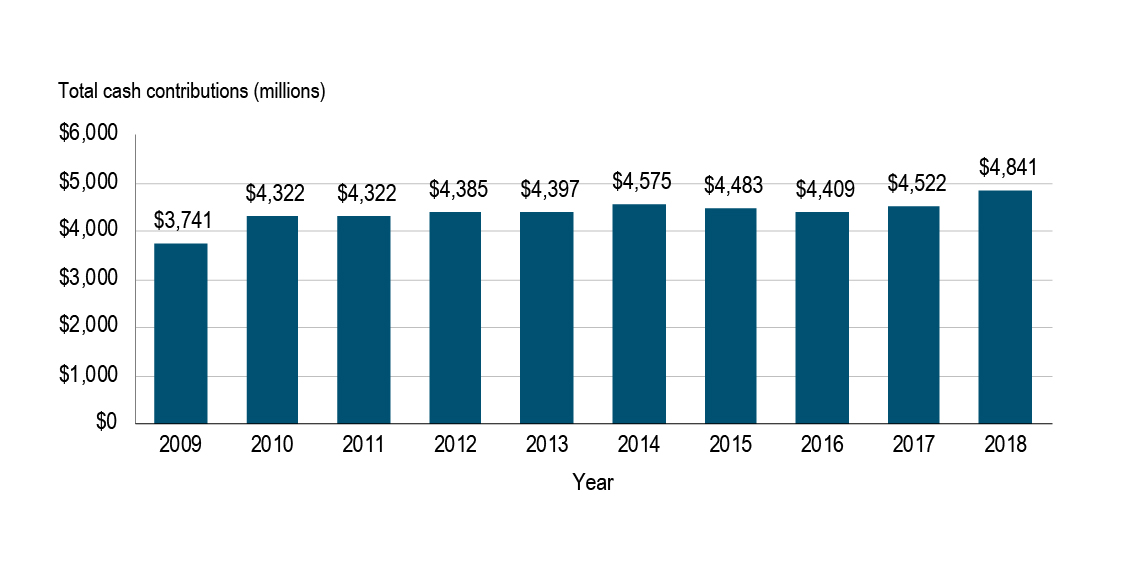

Figure 3 shows total cash contributions from both the employer and plan members for the last 10 years.

(fiscal year ended March 31)

Figure 3 - Text version

| Year | Total cash contributions ($ millions) |

|---|---|

| 2009 | 3,741 |

| 2010 | 4,322 |

| 2011 | 4,322 |

| 2012 | 4,385 |

| 2013 | 4,397 |

| 2014 | 4,575 |

| 2015 | 4,483 |

| 2016 | 4,409 |

| 2017 | 4,522 |

| 2018 | 4,841 |

The 10-year annual growth rate of cash contributions from both the employer and plan members was 3.3%. The contributions do not include the year-end accrual adjustments, which are reported in the plan’s financial statements.

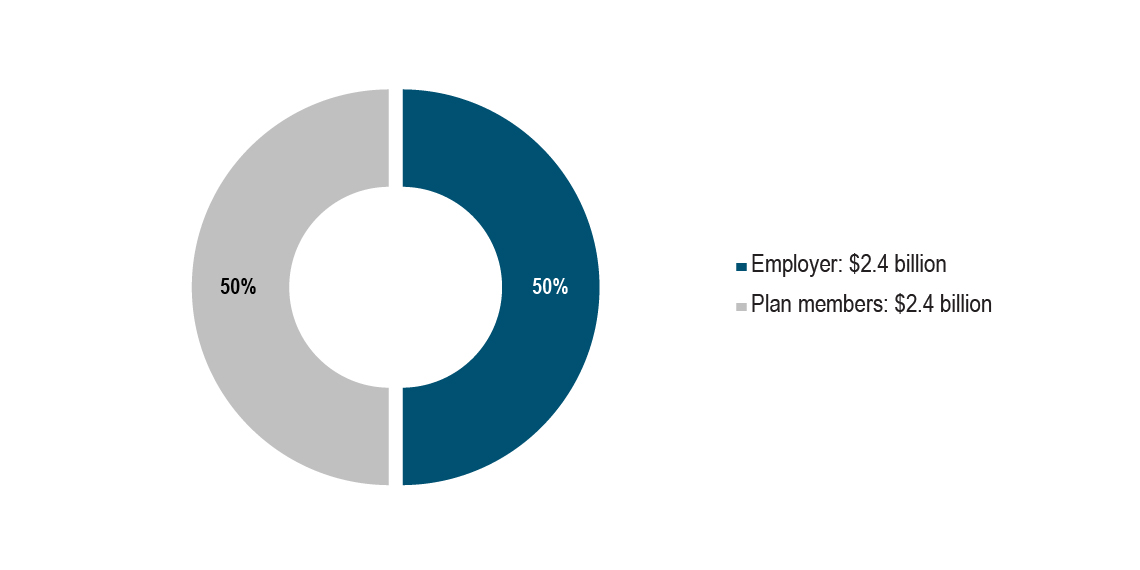

Figure 4 shows the share of cash contributions by the employer and by plan members as at .

(fiscal year ended )

Figure 4 - Text version

| Total cash contributions ($ billion) | Per cent | |

|---|---|---|

| Employer | 2.40 | 50 |

| Plan members | 2.40 | 50 |

| Total | 4.80 | 100 |

Cash contributions received in fiscal year ended , totalled $4.8 billion ($4.5 billion in fiscal year ended ), excluding year-end accrual adjustments. The employer contributed $2.4 billion ($2.3 billion in fiscal year ended ), and plan members contributed $2.4 billion ($2.2 billion in fiscal year ended ).

As shown in Figure 4, the employer paid 50% of total contributions in fiscal year ended (51% in fiscal year ended ); plan members paid 50% (49% in fiscal year ended ). Cash contributions in Figure 4 include both current service and past service (for example, service buybacks, pension transfers).

Benefits

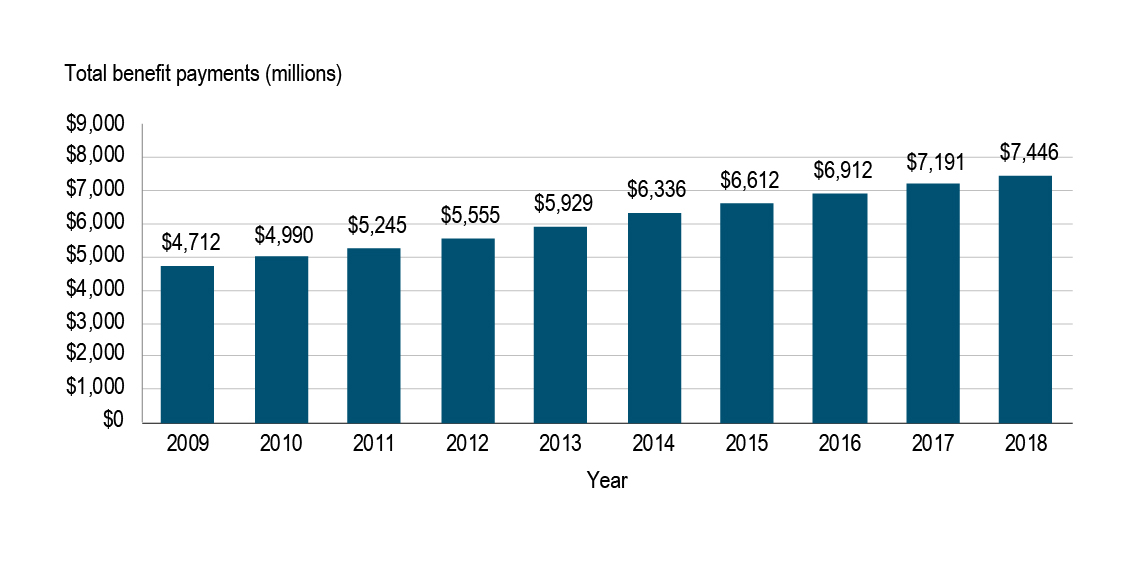

In fiscal year ended , the public service pension plan paid out $7.4 billion in benefits, which represents an increase of $255 million over the previous year.

Benefits were paid to 276,284 retired members and survivors in fiscal year ended (276,796 in fiscal year ended ).

Of the 13,090 members who retired in fiscal year ended :

- 7,641 were entitled to an immediate annuity (6,821 in fiscal year ended )

- 1,278 received an annual allowance (1,468 in fiscal year ended )

- 446 were eligible to receive disability retirement benefits (501 in fiscal year ended )

- 3,725 were entitled to a deferred annuity (532 in fiscal year ended )

In fiscal year ended , a total of 1,618 plan members left the public service before the age of 55 (1,796 in fiscal year ended ) and withdrew approximately $232 million ($274 million in fiscal year ended ) in lump‑sum amounts (in other words, the present value of their future benefits), excluding return of contributions for non‑vested members. These sums were transferred to other registered pension plans, to locked‑in retirement savings vehicles or to financial institutions to purchase annuities. Any portion of a transfer value that exceeds the limit set by the Income Tax Act is paid in a lump sum and is taxable.

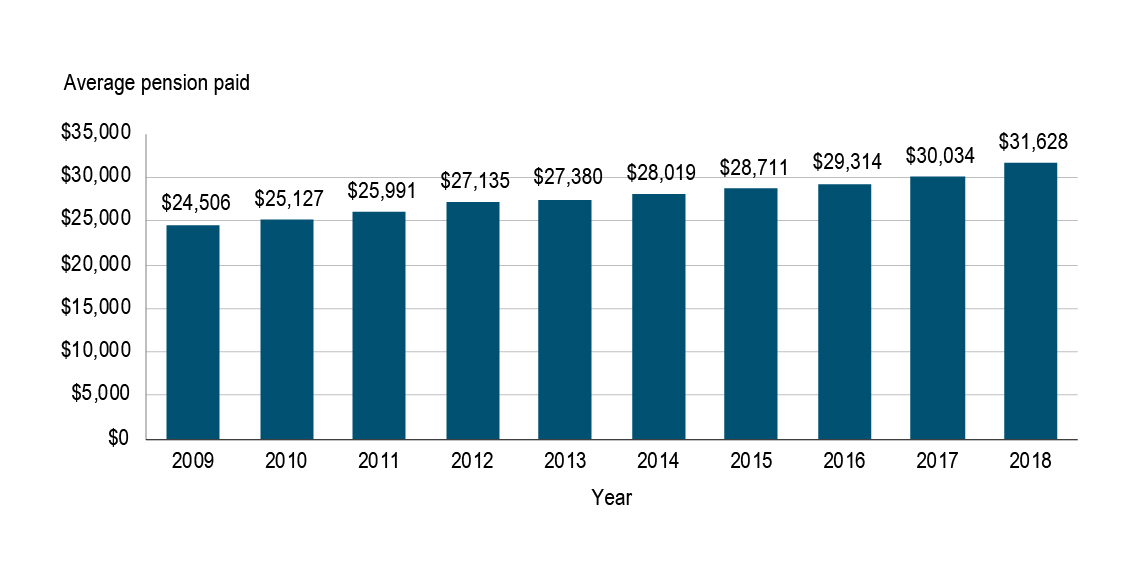

The average annual pension for members who retired in fiscal year ended , was $37,391, compared with $37,785 for members who retired in fiscal year ended . This represents a decrease of 1.0%. The average pension paid to all retired members was $31,628 in fiscal year ended ($30,034 in fiscal year ended ), an increase of 5.3% over fiscal year ended .

Figure 5 presents the average pension paid to retired members for the last 10 years.

(fiscal year ended March 31)

Figure 5 - Text version

| Year | Average pension paid ($) |

|---|---|

| 2009 | 24,506 |

| 2010 | 25,127 |

| 2011 | 25,991 |

| 2012 | 27,135 |

| 2013 | 27,380 |

| 2014 | 28,019 |

| 2015 | 28,711 |

| 2016 | 29,314 |

| 2017 | 30,034 |

| 2018 | 31,628 |

Pensions paid under the public service pension plan are indexed annually to take into account the cost of living, which is based on increases in the Consumer Price Index. In 2018, the indexation rate was 1.5% (1.4% in 2017).

Figure 6 presents the total amount of benefits paid to plan members and survivors each year from 2009 to 2018.

(fiscal year ended March 31)

Figure 6 - Text version

| Year | Total benefits payments ($ millions) |

|---|---|

| 2009 | 4,712 |

| 2010 | 4,990 |

| 2011 | 5,245 |

| 2012 | 5,555 |

| 2013 | 5,929 |

| 2014 | 6,336 |

| 2015 | 6,612 |

| 2016 | 6,912 |

| 2017 | 7,191 |

| 2018 | 7,446 |

Benefit payments have increased on average by 5.3% annually over the past 10 years. For details, see the “Summary of plan benefits” section.

Figure 7 presents the share of benefits paid to retired members and to survivors in fiscal year ended .

(fiscal year ended )

Figure 7 - Text version

| Benefit payments ($ billions) | Per cent | |

|---|---|---|

| Retired members | 6.7 | 90% |

| Survivors | 0.7 | 10% |

| Total | 7.4 | 100% |

Benefits paid to retired members in fiscal year ended , totalled $6.7 billion ($6.4 billion in fiscal year ended ), including benefits paid to plan members who retired on grounds of disability, which represents 90% of pension payments paid in the year.

Benefits paid to survivors in fiscal year ended , totalled $0.7 billion ($0.8 billion in fiscal year ended ), which represents 10% of pension payments paid in the year.

Investment returns

Rate of return

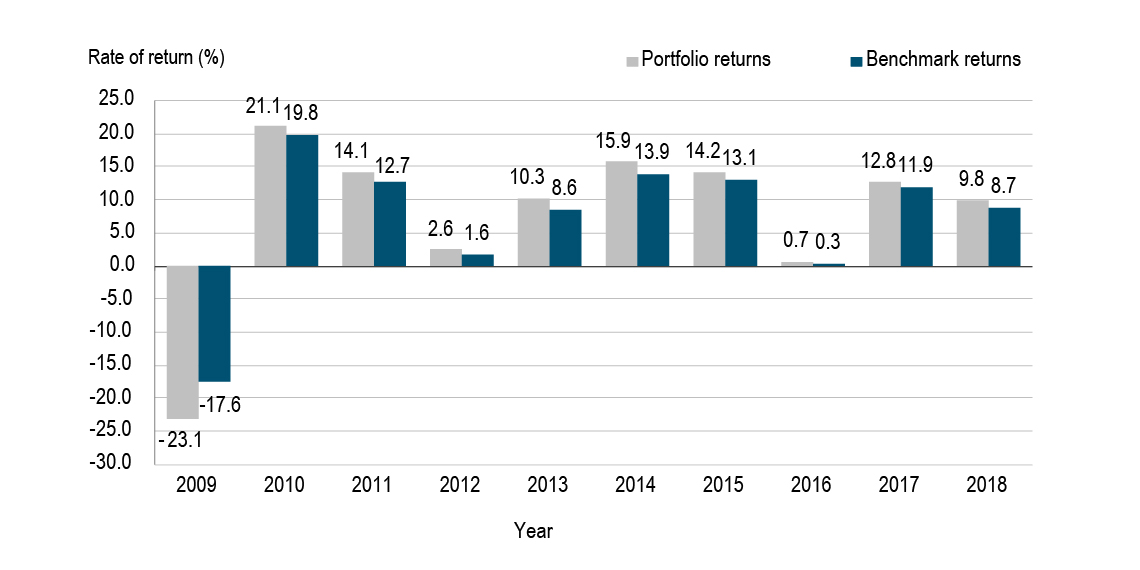

For fiscal year ended , the Public Sector Pension Investment Board (PSPIB) reported a net rate of return of 9.8% (12.8% in fiscal year ended ), compared with the benchmark rate of return of 8.7% (11.9% in fiscal year ended ).

Over the past 10 years, the PSPIB has recorded a net annualized rate of return of 7.1%, compared with the long-term return objective of 5.8% over the same period.

Figure 8 shows the rate of return on the assets held by the PSPIB against its comparative benchmark for the last 10 years.

(fiscal year ended March 31)

Figure 8 - Text version

| Year | Portfolio returns | Benchmark returns |

|---|---|---|

| 2009 | -23.1% | -17.6% |

| 2010 | 21.1% | 19.8% |

| 2011 | 14.1% | 12.7% |

| 2012 | 2.6% | 1.6% |

| 2013 | 10.3% | 8.6% |

| 2014 | 15.9% | 13.9% |

| 2015 | 14.2% | 13.1% |

| 2016 | 0.7% | 0.3% |

| 2017 | 12.8% | 11.9% |

| 2018 | 9.8% | 8.7% |

More information on the rate of return on assets held by the PSPIB and comparative benchmarks is available on the PSP Investments website.

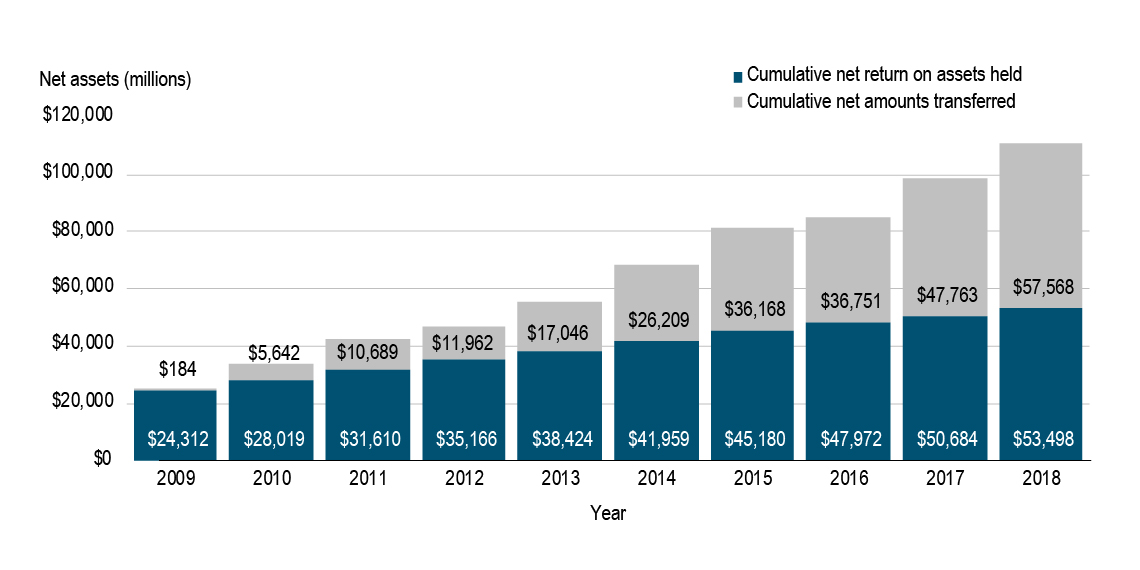

Net value of assets

In 2018, the net value of assets reached $111.1 billion, which can be broken down as follows:

- $53.5 billion (48.2%): the cumulative net amount transferred from the Government of Canada to the PSPIB since its inception in 2000

- $57.6 billion (51.8%): the cumulative net return on assets held

Figure 9 presents the net value of public service pension plan assets held by the PSPIB each year for the last 10 years.

(fiscal year ended March 31)

Figure 9 - Text version

| Year | Cumulative net return on assets held | Cumulative net amounts transferred |

|---|---|---|

| 2009 | 184 | 24,312 |

| 2010 | 5,642 | 28,019 |

| 2011 | 10,689 | 31,610 |

| 2012 | 11,962 | 35,166 |

| 2013 | 17,046 | 38,424 |

| 2014 | 26,209 | 41,959 |

| 2015 | 36,168 | 45,180 |

| 2016 | 36,751 | 47,972 |

| 2017 | 47,763 | 50,684 |

| 2018 | 57,568 | 53,498 |

Administrative expenses

The legislation provides for the pension-related administrative expenses of certain government organizations to be charged to the public service pension plan:

- Treasury Board of Canada Secretariat

- Public Services and Procurement Canada

- Health Canada

- Office of the Chief Actuary

Administrative expenses also include PSPIB operating expenses.

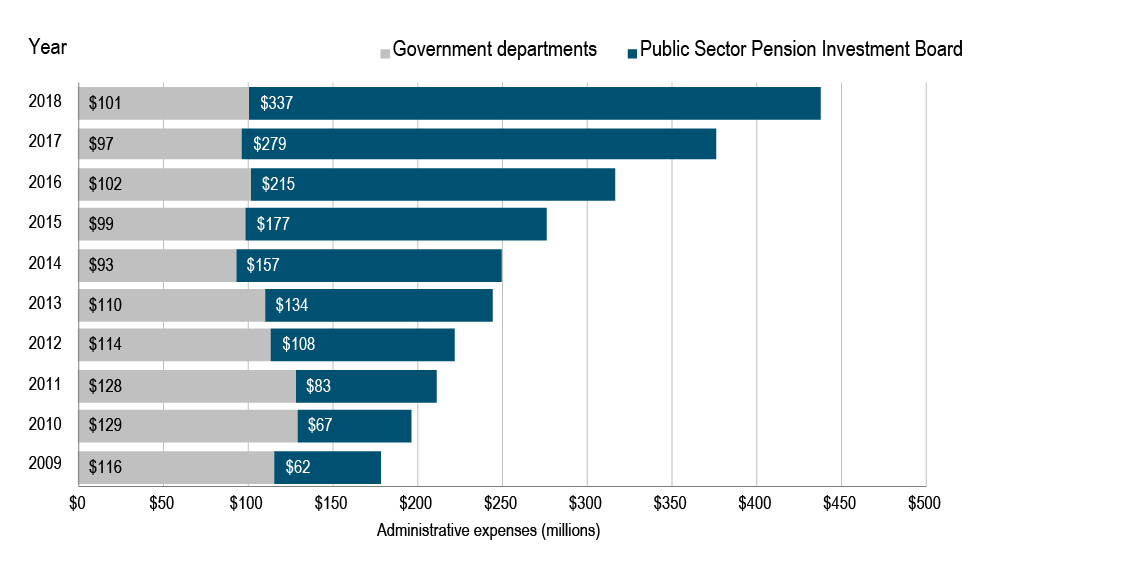

Figure 10 presents the administrative expenses charged to the public service pension plan each year for the past 10 years, as shared between government departments and the PSPIB.

(fiscal year ended March 31)

Figure 10 - Text version

| Administrative expenses (millions) | Government departments | Public Sector Pension Investment Board |

|---|---|---|

| 2009 | $ 116 | $ 62 |

| 2010 | $ 129 | $ 67 |

| 2011 | $ 128 | $ 83 |

| 2012 | $ 114 | $ 108 |

| 2013 | $ 110 | $ 134 |

| 2014 | $ 93 | $ 157 |

| 2015 | $ 99 | $ 177 |

| 2016 | $ 102 | $ 215 |

| 2017 | $ 97 | $ 279 |

| 2018 | $ 101 | $ 337 |

The following explains the fluctuations in administrative expenses shown in Figure 10.

2009 to 2010

The increase in administrative expenses for government departments from 2009 to 2010 was due in large part to the capital expenditure requirements related to the pension modernization project that started in fiscal year ended . This project was completed in .

2011 to 2014

The decrease in administrative expenses for government departments from 2011 to 2014 was due to the completion of the centralization of pension services that started in fiscal year ended .

2015 to 2016

The increase in administrative expenses in 2015 and 2016 was due to an increase in system maintenance costs.

2016

Starting in 2016, the increase in the PSPIB’s operating expenses has stemmed primarily from the growth in the assets under its management. In response to the larger portfolio, the Board strengthened its internal investment management capabilities, increased staffing, opened international offices and upgraded several systems.

2017

In fiscal year ended , the PSPIB’s cost ratio increased to 70.5 cents per $100 of average net investment assets, up from 63.0 cents per $100 in fiscal year ended . This increase is due to increased operating expenses, as well as increased management fees and transaction costs related to private market investment activities.

2018

The total cost ratio decreased from 70.5 cents per $100 of average net investment assets in fiscal year ended , to 69.8 cents per $100 in fiscal year ended . Although there was an increase in operating expenses, it was offset by a decrease in management fees and transactions costs for assets under management.

See Note 21 of the financial statements for more details on administrative expenses.

Roles and responsibilities

Overall responsibility for the public service pension plan lies with the President of the Treasury Board, supported by the Treasury Board of Canada Secretariat, as the administrative arm of the Treasury Board. Public Services and Procurement Canada is the day-to-day administrator of the plan.

The President’s responsibilities include ensuring that the plan is adequately funded to fully cover member benefits. To determine the plan’s funding requirements, the President enlists the help of the Office of the Chief Actuary, to provide advice and a range of actuarial services, as well as the Public Sector Pension Investment Board (PSPIB), to manage the pension assets for the public sector pension plans. The Public Service Pension Advisory Committee advises the President on the administration, design and funding of the benefits and on other pension-related matters referred to it by the President.

The roles and responsibilities of each organization are as follows.

Treasury Board of Canada Secretariat

The Secretariat supports the Treasury Board’s role as the employer of the public service by developing policy for the funding, design and governance of the plan and of other retirement programs and arrangements. In addition, the Secretariat provides strategic direction, program advice and interpretation; develops legislation; liaises with stakeholders; communicates with plan members; and prepares the annual report on the Public Service Pension Plan.

Public Services and Procurement Canada

Public Services and Procurement Canada is responsible for the day-to-day administration of the public service pension plan. This includes developing and maintaining the public service pension systems, books of accounts, records, and internal controls, as well as preparing the account transaction statements for reporting in the Public Accounts of Canada.

In addition, Public Services and Procurement Canada processes payments and carries out all accounting and financial administrative functions. Through its pay and pension services, Public Services and Procurement Canada ensures that federal government employees receive their pay and that retired pension plan members receive their pension benefits payments.

Public Sector Pension Investment Board

The PSPIB is a non-agent Crown corporation established under the Public Sector Pension Investment Board Act. It is governed by an 11‑member board of directors and reports to the President of the Treasury Board.

In accordance with its mandate, the PSPIB’s statutory objectives are to manage the funds transferred to it in the best interests of the contributors and beneficiaries, and to invest its assets with a view to achieving a maximum rate of return without undue risk of loss, having regard to the funding, policies and requirements of the pension plan.

Since , the PSPIB has been investing, on behalf of the public sector pension plans, the amounts transferred to it by the Government of Canada. The relevant financial results of the PSPIB are included in the financial statements in this report.

Office of the Chief Actuary

The Office of the Chief Actuary, an independent unit within the Office of the Superintendent of Financial Institutions Canada, provides a range of actuarial services and advice to the Government of Canada on the public service pension plan. The Office of the Chief Actuary conducts a statutory valuation of the pension plan for funding purposes at least every 3 years, and conducts a valuation for accounting purposes every year. Details can be found in the “Financial statements content overview” section.

Public Service Pension Advisory Committee

The Public Service Pension Advisory Committee, established under the Public Service Superannuation Act, provides advice to the President of the Treasury Board on matters relating to the administration of the public service pension plan, the design of the benefit plan, and the funding of benefits.

The Committee has 13 members:

- 1 pensioner representative, nominated by the public servant pensioner association

- 6 employee representatives, nominated by the National Joint Council of the Public Service of Canada

- 6 members nominated by the President of the Treasury Board, traditionally chosen from the executive ranks of the public service

All members are appointed by the Governor in Council to hold office for a term not exceeding 3 years, and they are eligible for reappointment for one or more additional terms.

Summary of plan benefits

The following is an overview of the main benefits offered under the public service pension plan as at . If there is a discrepancy between this information and information contained in the Public Service Superannuation Act, the Public Service Superannuation Regulations or other applicable laws, the legislation prevails at all times.

Types of pension benefits

The benefits that pension plan members are entitled to when they leave the public service depend on their age and the number of years of pensionable service to their credit (see Tables 3 and 4).

| If a member is… | and leaves the public service with pensionable service of… | the member would be entitled to… |

|---|---|---|

| Age 60 or over | At least 2 years | An immediate annuity |

| Age 55 or over | At least 30 years | An immediate annuity |

| Age 50 up to age 60 | At least 2 years | A deferred annuity payable at age 60 or An annual allowance payable as early as age 50 |

| Under age 50 | At least 2 years | A deferred annuity payable at age 60 or An annual allowance payable as early as age 50 or A transfer value |

| Under age 60 | At least 2 years and retiring because of disability | An immediate annuity |

| Any age | Less than 2 years | A return of contributions with interest |

| If a member is… | and leaves the public service with pensionable service of… | the member would be entitled to… |

|---|---|---|

| Age 65 or over | At least 2 years | An immediate annuity |

| Age 60 or over | At least 30 years | An immediate annuity |

| Age 55 up to age 65 | At least 2 years | A deferred annuity payable at age 65 or An annual allowance payable as early as age 55 |

| Under age 55 | At least 2 years | A deferred annuity payable at age 65 or An annual allowance payable as early as age 55 or A transfer value |

| Under age 65 | At least 2 years and retiring because of disability | An immediate annuity |

| Any age | Less than 2 years | A return of contributions with interest |

Protection from inflation

Pensions paid under the public service pension plan are indexed annually to take into account the cost of living, which is based on increases in the Consumer Price Index.

Survivor benefits

If a member is vested (has at least 2 years of pensionable service) when he or she dies, the eligible survivor and children are entitled to the following:

- Survivor benefit: A monthly allowance equal to half of the member’s unreduced pension, payable immediately to the eligible survivor for the rest of the survivor’s life.

- Child allowance: A monthly allowance equal to 10% of the member’s unreduced pension (20% of the member’s unreduced pension if the member has no eligible survivor). The amount is payable until age 18, or until age 25 if the child is a full‑time student. The maximum allowance for all children is 40% of the member’s pension, or 80% if there are dependent children but no spouse eligible for a survivor benefit.

- Supplementary death benefit: A lump-sum benefit equal to twice the member’s annual salary, rounded-up to the nearest $1,000, payable to the designated beneficiary or to the estate. Coverage decreases by 10% each year starting at age 66 to a minimum of $10,000 by age 75. If the member is still employed in the public service after age 65, minimum coverage is the greater of $10,000 or one third of his or her annual salary.

If the member has no eligible survivor or children, the designated beneficiary of the supplementary death benefit or the estate will receive an amount equal to the greater of the return of contributions with interest or 5 years of pension payments less any payments already received.

If a member dies before they are vested (has completed 2 years of pensionable service), contributions with interest are refunded to any eligible survivor or children, or to the designated beneficiary or the estate if the member has no eligible survivors.

Communications with plan members

The Government of Canada recognizes that the public service pension plan is an integral part of the public service workforce recruitment, retention and renewal strategy, and it is committed to providing timely and accurate information about the plan to members. To fulfill this commitment, the government has focused on a number of initiatives designed to raise awareness and to educate plan members. These initiatives include:

- providing plan information through various publications

- increasing in-person outreach

- ensuring that information on the Pension and benefits web page is in plain language

- expanding the pension plan’s social media presence on Facebook and on Twitter (hashtag #pensiontalk)

Public service pension plan history

1870

The first act entitling certain public service employees to retirement income came into effect.

1954

The public service pension plan took many forms until the Public Service Superannuation Act came into effect on , and broadened pension coverage to include nearly all public service employees.

1966

The Canada Pension Plan and the Québec Pension Plan were introduced, leading to major amendments to the Public Service Superannuation Act to coordinate public service pension plan contribution rates and benefits with those of the 2 new plans.

1999 to 2000

Amendments were made to the Public Service Superannuation Act, including changes aimed at improving plan management and introducing the Public Sector Pension Investment Board Act. This act provided for the creation of the Public Sector Pension Investment Board (PSPIB) in . Before that, employer and member contributions to the plan were credited to an account that was part of the Public Accounts of Canada and were not invested in capital markets (for example, in stocks and bonds).

In , the government began transferring to the PSPIB amounts equal to pension contributions net of benefit payments and departmental administrative expenses for the plan.

2006

The Public Service Superannuation Act was amended to lower the factor used in the Canada Pension Plan or Québec Pension Plan coordination formula to calculate a pension at age 65. This change increased public service pension benefits for members reaching age 65 in 2008 or later.

2012

The Public Service Superannuation Act was amended to allow pension plan member contribution rates to be gradually increased to reach a 50:50 employer‑employee cost‑sharing ratio by the end of 2017.

The age of eligibility for an unreduced pension benefit was increased from 60 to 65 for new public service employees who began participating in the plan on or after .

Overview of financial statements

Financial and performance audits

The Office of the Auditor General of Canada audits federal government operations and provides Parliament with independent information, advice and assurance to help hold the government to account for its stewardship of public funds. The Office of the Auditor General of Canada is responsible for conducting performance audits and studies of federal departments and agencies. It conducts financial audits of the Public Accounts of Canada (the government’s financial statements) and performs special examinations and annual financial audits of Crown corporations, including the Public Sector Pension Investment Board (PSPIB). With respect to the public service pension plan, the Office of the Auditor General of Canada acts as the independent auditor.

Actuarial valuation

Pursuant to the Public Pensions Reporting Act, the President of Treasury Board directs the Chief Actuary of Canada to conduct an actuarial valuation for funding purposes at least every 3 years. The purpose of the actuarial review is to determine the state of the pension account and pension fund, as well as to assist the President of the Treasury Board in making informed decisions regarding the financing of the government’s pension obligations. The last funding valuation was conducted as at .

In addition, the Office of the Chief Actuary performs an annual actuarial valuation for accounting purposes, which serves as the basis for determining the government’s pension obligations and expenses reported in the Public Accounts of Canada and in the public service pension plan’s financial statements included in this annual report. The economic assumptions used in the annual actuarial valuation represent management’s best estimate.

Net assets available for benefits

The Statement of Financial Position shows that as at , net assets available for benefits were $112.3 billion compared with $99.9 billion last year. The net assets available for benefits mainly consist of the assets managed by the PSPIB on behalf of the pension plan and contributions receivable for past service elections.

The Statement of Changes in Net Assets Available for Benefits shows increases and decreases to the public service pension plan from various sources.

Increases can come from the following:

- contributions from pension plan members and employers

- income from investments

- transfers to the public service pension plan from other pension plans when employees leave an outside organization and join an employer covered under the Public Service Superannuation Act

Decreases can come from the following:

- benefits

- administrative expenses

- transfers or refunds from the public service pension plan to other registered pension plans

Detailed information can be found in the financial statements.

Investment management

Contributions relating to service since , are recorded in the Public Service Pension Fund in the Public Accounts of Canada. An amount equal to contributions net of benefit payments and government departments’ administration expenses is transferred regularly to the PSPIB and is invested in capital markets.

The PSPIB’s board of directors has established an investment policy with an expected real rate of return at least equal to the return assumption used to fund the plan, which at , was set at an annual real return of 3.3% for the next 10 years, reaching an annual real return of 4.0% after that. This rate is aligned with the assumption used in the most recently tabled actuarial valuation for funding purposes of the public sector pension plans (public service, Canadian Forces, Reserve Force and Royal Canadian Mounted Police).

As noted in the PSPIB’s 2018 annual report, the investments allocated to the public service pension plan during the year ended , were in compliance with the Public Sector Pension Investment Board Act and the statement of investment policies, standards and procedures approved by its board of directors.

Pension obligations

The Statement of Changes in Pension Obligations shows the present value of benefits earned for service to date that will be payable in the future. For fiscal year ended , the value of pension obligations was $207.6 billion ($204.7 billion in fiscal year ended ), an increase of $2.9 billion from the previous fiscal year. The increase is due primarily to interest earned during the year on the pension obligations and pension benefits.

Assets held by the Public Sector Pension Investment Board

In accordance with the investment policy, assets held by the PSPIB are invested with the following long-term target weights (as at ):

- 43.0% in public market and private equities

- 30.0% in real assets, such as real estate, infrastructure and natural resources

- 20.0% in government fixed income, cash and cash equivalents

- 7.0% in credit

In fiscal year ended , assets earned a net rate of return of 9.8%. See Note 6 of the financial statements or to the PSP Investments website for more details.

Interest credited to the Public Service Superannuation Account

The Public Service Superannuation Account is credited quarterly with interest at rates calculated as though amounts recorded in this account were invested quarterly in a notional portfolio of Government of Canada 20-year bonds held to maturity. No formal debt instrument is issued to this account by the government in recognition of the amounts in it. The reduction in interest credited to the account relates to declining bond interest rates. The interest credited to the Public Service Superannuation Account is no longer recognized as interest income in the Statement of Changes in Net Assets Available for Benefits and is reported only in the “Account transaction statements” section of this report.

Table 5 shows the annualized interest rate credited for the past 10 years.

| Year | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Interest rate on account (%) | 7.0 | 6.7 | 6.5 | 6.0 | 5.6 | 5.4 | 5.1 | 4.7 | 4.4 | 4.2 |

Administrative expenses

Pension-related administrative expenses of the following government organizations are charged to the public service pension plan:

- Treasury Board of Canada Secretariat

- Public Services and Procurement Canada

- Health Canada

- Office of the Chief Actuary

Administrative expenses of the plan also include the PSPIB’s operating expenses. Investment management fees are either paid directly by the PSPIB or offset against distributions received from the investments.

In fiscal year ended , total expenses recorded by the pension plan were as follows:

- government departments: $101 million ($97 million in fiscal year ended )

- PSPIB: $337 million ($279 million in fiscal year ended )

Transfer agreements

The public service pension plan has transfer agreements with other levels of government, universities and private sector employers.

In fiscal year ended , transfers in and out of the plan under these agreements were as follows:

- transfers in: $51 million ($28 million in fiscal year ended )

- transfers out: $37 million ($36 million in fiscal year ended )

Retirement compensation arrangements

Under the authority of the Special Retirement Arrangements Act, separate Retirement Compensation Arrangements No. 1 and No. 2 have been established to provide supplementary benefits to some employees. Because these arrangements are covered by separate legislation, the balance and corresponding value of their accrued pension benefits is not consolidated in the public service pension plan’s financial statements. A summary of these arrangements is provided in Note 23 to the financial statements.

Retirement Compensation Arrangement No. 1 provides for benefits in excess of those permitted under the Income Tax Act for registered pension plans. In 2018, this primarily included benefits on salaries over $164,700 ($163,100 in 2017), plus some survivor benefits.

Retirement Compensation Arrangement No. 2 provides for pension benefits to public service employees declared surplus as a result of the 3‑year Early Retirement Incentive Program that ended on , which allowed eligible employees to retire with an unreduced pension.

Contributions and benefit payments in excess of limits permitted under the Income Tax Act for registered pension plans are recorded in the Retirement Compensation Arrangements Account in the Public Accounts of Canada. The balance in the Retirement Compensation Arrangements Account is credited with interest at the same rate as that of the Public Service Superannuation Account.

Further information

Additional information concerning the public service pension plan is available at the following sites:

Account transaction statements

Public Service Superannuation Account

Prior to , all pension transactions accumulated in relation to the pension plan were accounted for, and recorded in, the Public Service Superannuation Account in the Public Accounts of Canada (to the extent that any funds held in the Consolidated Revenue Fund had been earmarked specifically for the pension plan).

The Superannuation Account does not consist of cash or marketable securities. It is used to record transactions such as contributions, benefit payments, interest, administrative expenses and other charges that pertain to service prior to .

The interest is credited quarterly at rates calculated as though the net cash flows were invested quarterly in 20-year Government of Canada bonds issued at prescribed rates and held to maturity.

| 2018 | 2017 | |

|---|---|---|

| Opening balance (A) | $94,209,273,550 | $95,566,249,001 |

| Receipts and other credits | ||

|

Employee contributions

|

||

|

Government employees

|

1,315,935 | 1,501,715 |

|

Retired employees

|

6,815,848 | 9,012,222 |

|

Public service corporation employees

|

173,134 | 154,532 |

|

Employer contributions

|

||

|

Government

|

6,835,107 | 8,770,006 |

|

Public service corporations

|

242,136 | 126,595 |

|

Actuarial liability adjustment

|

0 | 0 |

|

Transfers from other pension funds

|

166,299 | 5,009 |

|

Interest

|

3,829,428,464 | 4,128,334,225 |

| Total receipts and other credits (B) | $3,844,976,923 | $4,147,904,304 |

| Payments and other charges | ||

|

Annuities

|

$5,413,342,616 | $5,380,371,208 |

|

Minimum benefits

|

15,545,715 | 18,161,964 |

|

Pension division payments

|

17,052,340 | 26,427,720 |

|

Pension transfer value payments

|

13,257,051 | 20,129,143 |

|

Returns of contributions

|

||

|

Government employees

|

317,101 | 379,702 |

|

Public service corporation employees

|

19,162 | 41,739 |

|

Transfers to other pension funds

|

3,460,193 | 4,093,957 |

|

Administrative expenses

|

54,895,880 | 55,274,322 |

| Total payments and other charges (C) | $5,517,890,058 | $5,504,879,755 |

| Receipts less payments (B − C) = (D) | $(1,672,913,135) | $(1,356,975,451) |

| Closing balance (A + D) | $92,536,360,415 | $94,209,273,550 |

| The above account transaction statement is unaudited. | ||

Public Service Pension Fund

All pension transactions related to service accrued since , are recorded in the Public Service Pension Fund in the Public Accounts of Canada. An amount equal to contributions in excess of benefit payments and government organizations’ administrative expenses is transferred regularly to the Public Sector Pension Investment Board (PSPIB) for investment. The balance in the Public Service Pension Fund at year‑end represents net contributions transferable to the PSPIB.

The treatment of any actuarial surplus or deficit in the fund is outlined in the financial statements of the Public Service Pension Plan, which are included in this report.

As a result of the actuarial valuation of the pension plan that was tabled in Parliament on , an annual actuarial adjustment payment of $340 million was made in fiscal year ended ($340 million in the previous year).

The Public Service Superannuation Act requires that any actuarial deficit be dealt with by transferring equal instalments to the pension fund over a period of up to 15 years, starting in the year in which the actuarial report is tabled in Parliament.

| 2018 | 2017 | |

|---|---|---|

| Opening balance (A) | $322,529,984 | $355,052,200 |

| Receipts and other credits | ||

|

Employee contributions

|

||

|

Government employees

|

2,169,100,496 | 1,919,728,160 |

|

Retired employees

|

45,516,546 | 45,599,636 |

|

Public service corporation employees

|

199,435,058 | 189,381,592 |

|

Employer contributions

|

||

|

Government

|

2,175,183,716 | 2,125,185,996 |

|

Public service corporations

|

196,270,115 | 206,551,912 |

|

Actuarial liability adjustment

|

340,000,000 | 340,000,000 |

|

Transfers from other pension funds

|

42,461,065 | 26,607,302 |

|

Transfer value election

|

8,200,876 | 1,874,328 |

| Total receipts and other credits (B) | $5,176,167,872 | $4,854,928,926 |

| Payments and other charges | ||

|

Annuities

|

$2,001,624,358 | $1,779,822,584 |

|

Minimum benefits

|

15,266,575 | 12,206,438 |

|

Pension division payments

|

36,665,209 | 38,740,034 |

|

Pension transfer value payments

|

218,599,278 | 254,365,622 |

|

Returns of contributions

|

||

|

Government employees

|

10,757,037 | 7,973,419 |

|

Public service corporation employees

|

3,886,809 | 3,960,135 |

|

Transfers to other pension funds

|

36,975,930 | 36,371,533 |

|

Administrative expenses

|

45,960,045 | 41,664,160 |

| Total payments and other charges (C) | $2,369,735,241 | $2,175,103,925 |

| Receipts less payments (B − C) | $2,806,432,631 | $2,679,825,001 |

| Transfers to PSPIB (D) | $(2,814,187,268) | $(2,712,347,217) |

| Closing balance (A + B − C + D) | $314,775,347 | $322,529,984 |

| The above account transaction statement is unaudited. | ||

Retirement Compensation Arrangements

Supplementary benefits for certain federal public service employees are provided under the Retirement Compensation Arrangements Regulations, No. 1, Parts I and II (public service portion), and the Retirement Compensation Arrangements Regulations, No. 2 (Early Retirement Incentive Program). These regulations were established under the Special Retirement Arrangements Act for the purpose of paying benefits and established the Retirement Compensation Arrangements for the payment of benefits.

Transactions pertaining to Retirement Compensation Arrangement No. 1 and Retirement Compensation Arrangement No. 2, such as contributions, benefits and interest credits, are recorded in the Retirement Compensation Arrangements Account in the Public Accounts of Canada. The Retirement Compensation Arrangements Account is credited with interest quarterly at the same rates as those credited to the Public Service Superannuation Account.

The Retirement Compensation Arrangements Account is registered with the Canada Revenue Agency, and a transfer is made annually between the Retirement Compensation Arrangements Account and the Canada Revenue Agency either to remit a 50% refundable tax for the net contributions and interest credits or to be credited a reimbursement based on the net benefit payments.

Any actuarial shortfalls found between the balance and the actuarial liabilities in the Retirement Compensation Arrangements Account are credited to the Retirement Compensation Arrangements Account in equal instalments over a period of up to 15 years. These adjustments are based on triennial actuarial valuations.

For fiscal year ended , as in fiscal year ended , no credit adjustment was made to Retirement Compensation Arrangement No. 1 or No. 2.

Retirement Compensation Arrangement No. 1

For tax purposes, financial transactions related to pension plan members’ pensionable earnings over $164,700 in calendar year 2018, are recorded separately.

For fiscal year ended , there were 4,765 public service employees (4,896 in the previous year) and 21,385 retired members and dependants (14,214 in the previous year) in this category.

| 2018 | 2017 | |

|---|---|---|

| Opening balance (A) | $1,193,245,711 | $1,163,127,305 |

| Receipts and other credits | ||

|

Employee contributions

|

||

|

Government employees

|

8,980,064 | 6,579,649 |

|

Retired employees

|

569,949 | 384,934 |

|

Public service corporation employees

|

2,374,935 | 2,188,425 |

|

Employer contributions

|

||

|

Government

|

67,312,931 | 44,338,063 |

|

Public service corporations

|

17,247,731 | 13,569,038 |

|

Actuarial liability adjustment

|

0 | 0 |

|

Interest

|

50,240,945 | 51,842,117 |

|

Transfer from other pension funds

|

0 | 1,846 |

|

Transfer value election

|

356 | (974) |

| Total receipts and other credits (B) | $146,726,911 | $118,903,098 |

| Payments and other charges | ||

|

Annuities

|

$45,045,351 | $40,723,826 |

|

Minimum benefits

|

39 | 161,842 |

|

Pension division payments

|

271,948 | 643,887 |

|

Pension transfer value payments

|

634,514 | 555,752 |

|

Returns of contributions

|

||

|

Government employees

|

69,079 | 15,601 |

|

Public service corporation employees

|

7,769 | 11,540 |

|

Transfers to other pension plans

|

1,038,273 | 39,685 |

|

Refundable tax

|

51,729,846 | 46,632,558 |

| Total payments and other charges (C) | $98,796,819 | $88,784,691 |

| Receipts less payments (B − C) = (D) | $47,930,092 | $30,118,407 |

| Closing balance (A + D) | $1,241,175,803 | $1,193,245,712 |

| The above account transaction statement is unaudited. | ||

Retirement Compensation Arrangement No. 2

During the 3‑year period starting April 1, 1995, a number of employees between the ages of 50 and 54 left the public service under the Early Retirement Incentive Program, which waived the pension reduction under the Public Service Superannuation Act for employees who were declared surplus.

| 2018 | 2017 | |

|---|---|---|

| Opening balance (A) | $717,522,186 | $807,056,879 |

| Receipts and other credits | ||

|

Government interest

|

28,510,933 | 34,240,959 |

|

Actuarial liability adjustment

|

0 | 0 |

| Total receipts and other credits (B) | 28,510,933 | 34,240,959 |

| Payments and other charges | ||

|

Annuities

|

84,757,461 | 84,823,287 |

|

Refundable tax

|

(27,459,101) | 38,952,365 |

| Total payments and other charges (C) | 57,298,360 | 123,775,652 |

| Receipts less payments (B − C) = (D) | $(28,787,427) | $(89,534,693) |

| Closing balance (A + D) | $688,734,759 | $717,522,186 |

| The above account transaction statement is unaudited. | ||

Supplementary death benefit

As at , there were 302,231 active participants (296,024 in the previous year) and 184,612 retired elective participants (180,975 in the previous year) entitled to a supplementary death benefit under Part II of the Public Service Superannuation Act. In fiscal year ended , a total of 4,519 claims (3,863 in the previous year) for supplementary death benefits were paid.

| 2018 | 2017 | |

|---|---|---|

| Opening balance (A) | $3,626,907,397 | $3,526,551,938 |

| Receipts and other credits | ||

|

Contributions

|

||

|

Employees (government and public service corporation)

|

102,889,773 | 100,187,514 |

|

Government

|

||

|

General

|

11,899,531 | 11,050,681 |

|

Single premium for $10,000 benefit

|

3,058,443 | 2,990,295 |

|

Public service corporations

|

1,514,931 | 1,469,385 |

|

Interest

|

149,738,670 | 154,846,365 |

| Total receipts and other credits (B) | $269,101,348 | $270,544,240 |

| Payments and other charges | ||

|

Benefit payments

|

||

|

Generaltable 10 note 1

|

$142,436,539 | $132,418,038 |

|

$10,000 benefittable 10 note 2

|

38,508,525 | 37,580,606 |

|

Other death benefit payments

|

357,836 | 190,137 |

| Total payments and other charges (C) | $181,302,900 | $170,188,781 |

| Receipts less payments (B − C) = (D) | $87,798,448 | $100,355,459 |

| Closing balance (A + D) | $3,714,705,845 | $3,626,907,397 |

|

The above account transaction statement is unaudited. Table 10 Notes

|

||

Statistical tables

Statistical table 1. Pensions in pay

| Year | Pensionstable 11 note 1 | Survivor pensionstable 11 note 2 | Total |

|---|---|---|---|

| 2018 | 222,169 | 54,115 | 276,284 |

| 2017 | 221,673 | 55,123 | 276,796 |

| 2016 | 218,028 | 61,716table 11 note 3 | 279,744table 11 note 3 |

Table 11 Notes

|

|||

| Year | Averages | Pensionstable 12 note 1 | Survivor pensions | ||||

|---|---|---|---|---|---|---|---|

| Men | Women | Overall | Spouse or common‑law partner | Children | Students | ||

| 2018 | Annual amount | $36,273 | $27,121 | $31,628 | $14,391 | $2,302 | $3,952 |

| Age | 71.8 | 68.7 | 70.2 | 79.8 | 12.8 | 21.5 | |

| Pensionable service (years) | 25.9 | 23.1 | 24.6 | 22.5 | 13.0 | 19.8 | |

| 2017 | Annual amount | $34,015 | $25,351 | $30,034 | $14,245 | $2,165 | $3,376 |

| Age | 71.7 | 68.6 | 70.3 | 81.2 | 12.6 | 21.6 | |

| Pensionable service (years) | 25.4 | 23.1 | 24.3 | 22.5 | 12.4 | 17.9 | |

| 2016 | Annual amount | $33,254 | $24,517 | $29,314 | $14,145 | $2,127 | $3,686 |

| Age | 71.6 | 68.7 | 70.3 | 82.0 | n/a | n/a | |

| Pensionable service (years) | 25.4 | 22.9 | 24.3 | 22.9 | n/a | n/a | |

Table 12 Notes

|

|||||||

Statistical table 2. Pensions that became payable

| Year | Men | Women | Total | Total amount paid | Average pension |

|---|---|---|---|---|---|

| 2018 | 6,065 | 7,025 | 13,090 | $465,451,113 | $37,391 |

| 2017 | 4,046 | 5,276 | 9,322 | $352,228,283 | $37,785 |

| 2016 | 4,323 | 5,437 | 9,760 | $356,718,556 | $36,549 |

Table 13 Notes

|

|||||

| Year | Spouse or common-law partner | Children and students | Total | Total amount paid | Average pension | |

|---|---|---|---|---|---|---|

| Spouse or common-law partner | Children and students | |||||

| 2018 | 2,636 | 98 | 2,734 | $44,604,440 | $16,796 | $3,378 |

| 2017 | 2,432 | 129 | 2,561 | $42,135,714 | $17,157 | $3,180 |

| 2016 | 2,091 | 578 | 2,669 | $34,784,709 | $16,556 | $3,430 |

Table 14 Notes

|

||||||

| Year | Number of pensions at age at retirement | Average | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 50 to 54table 15 note 2 | 55 | 56 | 57 | 58 | 59 | 60table 15 note 3 | 61 | 62 | 63 | 64 | 65 | 66 and over | Total | Agetable 15 note 4 | Unreduced pensiontable 15 note 5 | |

| 2018 | 49 | 913 | 499 | 373 | 384 | 319 | 1,712 | 636 | 470 | 407 | 390 | 472 | 1,018 | 7,641 | 61 | $42,623 |

| 2017 | 54 | 1,124 | 487 | 422 | 372 | 313 | 1,145 | 522 | 450 | 388 | 300 | 414 | 830 | 6,821 | 60 | $41,832 |

| 2016 | 50 | 1,293 | 510 | 382 | 327 | 333 | 1,159 | 514 | 450 | 381 | 350 | 457 | 841 | 7,047 | 60 | $41,072 |

Table 15 Notes

|

||||||||||||||||

| Year | Reduced pensionstable 16 note 1 | Lump-sum paymentstable 16 note 2 | ||||

|---|---|---|---|---|---|---|

| Men | Women | Total | Average allowance | Number | Amount | |

| 2018 | 444 | 834 | 1,278 | $35,010 | 6,549 | $340,990,108 |

| 2017 | 541 | 927 | 1,468 | $32,912 | 10,330 | $392,483,005 |

| 2016 | 575 | 997 | 1,572 | $30,330 | 12,230 | $468,442,200 |

Table 16 Notes

|

||||||

Statistical table 5. Changes in number of active members, retired members and survivors on pension

| Men | Women | Total | |

|---|---|---|---|

| Number of active members, | 131,470 | 166,287 | 297,757 |

|

Additions

|

10,566 | 14,037 | 24,603 |

|

Deletionstable 17 note 1

|

8,231 | 10,796 | 19,027 |

| Adjustmentstable 17 note 2 | 26 | 124 | 150 |

| Number of active members, | 133,831 | 169,652 | 303,483 |

Table 17 Notes

|

|||

| Men | Women | Total | |

|---|---|---|---|

| Number of retired members, | 120,211 | 101,462 | 221,673 |

|

Additions

|

6,065 | 7,025 | 13,090 |

|

Deletions

|

1,236 | 523 | 1,759 |

| Adjustmentstable 18 note 1 | (6,830) | (4,005) | (10,835) |

| Number of retired members, | 118,210 | 103,959 | 222,169 |

Table 18 Notes

|

|||

| Men | Women | Total | |

|---|---|---|---|

| Number of survivors on pension, | 6,550 | 47,426 | 53,976 |

|

Additions

|

546 | 2,090 | 2,636 |

|

Deletions

|

417 | 3,113 | 3,530 |

| Adjustmentstable 19 note 1 | (2) | 0 | (2) |

| Number of survivors on pension, | 6,677 | 46,403 | 53,080 |

Table 19 Notes

|

|||

| Men | Women | Total | |

|---|---|---|---|

| Number of children and students on pension, | 535 | 612 | 1,147 |

|

Additions

|

48 | 50 | 98 |

|

Deletions

|

127 | 155 | 282 |

| Adjustmentstable 20 note 1 | 32 | 40 | 72 |

| Number of children and students on pension, | 488 | 547 | 1,035 |

Table 20 Notes

|

|||

| Years of pensionable service | Age at termination | ||||||

|---|---|---|---|---|---|---|---|

| Under 30 | 30 to 34 | 35 to 39 | 40 to 44 | 45 to 49 | 50 to 55 | Total | |

| Under 5 | 165 | 105 | 68 | 46 | 58 | 31 | 473 |

| 5 to 9 | 71 | 142 | 140 | 83 | 70 | 17 | 523 |

| 10 to 14 | 0 | 24 | 99 | 82 | 64 | 22 | 291 |

| 15 to 19 | 0 | 1 | 26 | 83 | 77 | 25 | 212 |

| 20 to 24 | 0 | 0 | 0 | 8 | 32 | 22 | 62 |

| 25 to 29 | 0 | 0 | 0 | 1 | 24 | 25 | 50 |

| 30 to 35 | 0 | 0 | 0 | 0 | 3 | 4 | 7 |

| Overall total | 236 | 272 | 333 | 303 | 328 | 146 | 1,618 |

| Total women | 125 | 142 | 197 | 170 | 189 | 89 | 912 |

| Total men | 111 | 130 | 136 | 133 | 139 | 57 | 706 |

| Year | Active participantstable 22 note 1 | Retired participantstable 22 note 2 | Death benefits paid | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Men | Women | Total | Men | Women | Total | Men | Women | Total | Amount paid | |

| 2018 | 132,291 | 169,940 | 302,231 | 97,698 | 86,914 | 184,612 | 3,038 | 1,481 | 4,519 | $181,302,900 |

| 2017 | 129,784 | 166,240 | 296,024 | 97,480 | 83,495 | 180,975 | 2,685 | 1,178 | 3,863 | $170,188,781 |

| 2016 | 125,472 | 160,484 | 285,956 | 97,479 | 80,320 | 177,799 | 2,063 | 791 | 2,854 | $173,928,280 |

Table 22 Notes

|

||||||||||

Financial statements of the public service pension plan for the fiscal year ended

Statement of responsibility

Responsibility for the integrity and fairness of the financial statements of the public service pension plan (the pension plan) rests with Public Services and Procurement Canada (PSPC) and the Treasury Board of Canada Secretariat (the Secretariat). The Secretariat carries out responsibilities in respect of the overall management of the pension plan, while PSPC is responsible for the day‑to‑day administration of the pension plan and for maintaining the books of accounts.

PSPC and the Secretariat have prepared the financial statements of the pension plan for the year ended , in accordance with the stated accounting policies set out in Note 2 of the financial statements, which are based on Canadian accounting standards for pension plans. The presentation and results using the stated accounting policies do not result in any significant differences from Canadian accounting standards for pension plans. The financial statements include management’s best estimates and judgments where appropriate.

To fulfill its accounting and reporting responsibilities, PSPC has developed and maintains books, records, internal controls, and management practices designed to provide reasonable assurance as to the reliability of the financial information and to ensure that transactions are in accordance with the Public Service Superannuation Act (PSSA) and regulations, as well as the Financial Administration Act (FAA) and regulations.

Additional information, as required, is obtained from the Public Sector Pension Investment Board (PSPIB). PSPIB maintains its own records and systems of internal control to account for the funds managed on behalf of the pension plan in accordance with the Public Sector Pension Investment Board Act, regulations and by-laws.

These statements have been audited by the Auditor General of Canada, the independent auditor for the Government of Canada.

Approved by:

Bill Matthews

Deputy Minister

Public Services and Procurement Canada

Original signed

Peter Wallace

Secretary of the Treasury Board

Treasury Board of Canada Secretariat

Original signed

Independent Auditor’s report

To the President of the Treasury Board and the Minister of Public Services and Procurement and Accessibility

Report on the Financial Statements

I have audited the accompanying financial statements of the public service pension plan, which comprise the statement of financial position as at , and the statement of changes in net assets available for benefits and statement of changes in pension obligations for the year then ended, and a summary of significant accounting policies and other explanatory information.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in accordance with the stated accounting policies set out in Note 2 of the financial statements, which are based on Canadian accounting standards for pension plans, and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

Auditor’s Responsibility

My responsibility is to express an opinion on these financial statements based on my audit. I conducted my audit in accordance with Canadian generally accepted auditing standards. Those standards require that I comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.

I believe that the audit evidence I have obtained is sufficient and appropriate to provide a basis for my audit opinion.

Opinion

In my opinion, the financial statements present fairly, in all material respects, the financial position of the public service pension plan as at , and the changes in its net assets available for benefits and changes in its pension obligations for the year then ended in accordance with Canadian accounting standards for pension plans.

Report on Other Legal and Regulatory Requirements

In my opinion, the transactions of the public service pension plan that have come to my notice during my audit of the financial statements have, in all significant respects, been in accordance with the Public Service Superannuation Act and regulations, the Public Sector Pension Investment Board Act and regulations and the by-laws of the Public Sector Pension Investment Board.

Mélanie Cabana, CPA, CA

Principal

for the Auditor General of Canada

Ottawa, Canada

Financial statements

| As at | As at Restated (Note 3) | As at Restated (Note 3) | |

|---|---|---|---|

| Assets | |||

|

Public Service Pension Fund (Note 5)

|

$315 | $323 | $355 |

|

Investments (Note 6)

|

129,877 | 115,296 | 95,400 |

|

Contributions receivable

|

|||

|

From plan members (Note 9)

|

483 | 583 | 555 |

|

From employers (Note 9)

|

412 | 508 | 510 |

|

Other assets (Note 10)

|

165 | 148 | 131 |

| Total assets | $131,252 | $116,858 | $96,951 |

| Liabilities | |||

|

Investment-related liabilities (Note 6)

|

$9,928 | $8,983 | $4,251 |

|

Accounts payable and other liabilities

|

199 | 168 | 128 |

| 8,849 | 7,846 | 6,421 | |

| Net assets available for benefits | $112,276 | $99,861 | $86,151 |

| Pension obligations | |||

| $114,603 | $117,330 | $126,388 | |

|

Funded (Note 14)

|

93,030 | 87,407 | 79,469 |

| Total pension obligations | $207,633 | $204,737 | $205,857 |

| Deficit to be financed by the Government of Canada (Note 15) | $(95,357) | $(104,876) | $(119,706) |

|

Commitments (Note 25) The accompanying notes are an integral part of these financial statements. |

|||

| 2018 | 2017 | |

|---|---|---|

| Net assets available for benefits, beginning of year | $99,861 | $86,151 |

| Increase in net assets available for benefits | ||

|

Investment income, excluding changes in fair values of investment assets and investment liabilities (Note 16)

|

2,994 | 2,498 |

|

Changes in fair values of investment assets and investment liabilities, realized and unrealized gains and losses (Note 16)

|

7,567 | 9,086 |

|

Contributions

|

||

|

From plan members (Note 17)

|

2,314 | 2,183 |

|

From employers (Note 17)

|

2,275 | 2,330 |

|

Actuarial adjustment (Note 18)

|

340 | 340 |

|

Transfers from other pension plans

|

51 | 28 |

| Total increase in net assets available for benefits | $15,541 | $16,465 |

| Decrease in net assets available for benefits | ||

|

Benefits paid with respect to service after (Note 19)

|

$2,017 | $1,792 |

|

Refunds and transfers (Note 19)

|

307 | 341 |

|

Investment-related expenses (Note 20)

|

419 | 301 |

|

Administrative expenses (Note 21)

|

383 | 321 |

| Total decrease in net assets available for benefits | $3,126 | $2,755 |

| Net increase in net assets available for benefits | $12,415 | $13,710 |

| Net assets available for benefits, end of year | $112,276 | $99,861 |

|

The accompanying notes are an integral part of these financial statements. |

||

| 2018 Funded | 2018 Unfunded | 2018 Total | 2017 Funded | 2017 Unfunded Restated (Note 3) | 2017 Total Restated (Note 3) | |

|---|---|---|---|---|---|---|

| Pension obligations, beginning of year | $87,407 | $117,330 | $204,737 | $79,469 | $126,388 | $205,857 |

| Increase in pension obligations | ||||||

|

Interest on pension obligations

|

4,256 | 2,509 | 6,765 | 3,713 | 2,337 | 6,050 |

|

Benefits earned

|

4,823 | 0 | 4,823 | 4,648 | 0 | 4,648 |

|

Experience losses (gains)table 25 note 1 (Note 14)

|

(12) | 1,022 | 1,010 | (942) | (341) | (1,283) |

|

Transfers from other pension plans

|

51 | 0 | 51 | 28 | 0 | 28 |

| Total increase in pension obligations | $9,118 | $3,531 | $12,649 | $7,447 | $1,996 | $9,443 |

| Decrease in pension obligations | ||||||

|

Benefits paid (Note 19)

|

$2,017 | $5,429 | $7,446 | $1,792 | $5,399 | $7,191 |

|

Change in actuarial assumptions: gains (losses)table 25 note 1 (Note 14)

|

1,125 | 740 | 1,865 | (2,666) | 5,549 | 2,883 |

|

Refunds and transfers (Note 19)

|

307 | 34 | 341 | 341 | 51 | 392 |

| 46 | 55 | 101 | 42 | 55 | 97 | |

| Total decrease in pension obligations | $3,495 | $6,258 | $9,753 | $(491) | $11,054 | $10,563 |

| Net increase (decrease) in pension obligations | $5,623 | $(2,727) | $2,896 | $7,938 | $(9,058) | $(1,120) |

| Pension obligations, end of year | $93,030 | $114,603 | $207,633 | $87,407 | $117,330 | $204,737 |

|

The accompanying notes are an integral part of these financial statements. Table 25 Notes

|

||||||

Notes to the financial statements

For the fiscal year ended (Canadian $)

1. Description of the public service pension plan

The public service pension plan (the pension plan), governed by the Public Service Superannuation Act (PSSA), provides pension benefits for federal public service employees. While the PSSA has been in effect since , federal legislation has been providing pensions for public servants since 1870.

The main provisions of the pension plan are summarized below.

(A) General

The pension plan is a contributory defined benefit plan covering substantially all of the full-time and part-time employees of the Government of Canada (the government), public service corporations as defined in the PSSA, and territorial governments. Membership in the pension plan is compulsory for all eligible employees.

The government is the sole sponsor of the pension plan. The President of the Treasury Board is the Minister responsible for the PSSA. The Treasury Board of Canada Secretariat (the Secretariat) is responsible for the management of the pension plan while Public Services and Procurement Canada (PSPC) provides the day-to-day administration of the pension plan and maintains the books of accounts. The Office of the Chief Actuary (OCA), an independent unit within the Office of the Superintendent of Financial Institutions (OSFI), performs periodic actuarial valuations of the pension plan.

Until , separate invested funds were not set aside to provide for payment of pension benefits. Instead, transactions relating to the pension plan were recorded in the Public Service Superannuation Account (superannuation account) created by legislation in the accounts of Canada. Pursuant to the PSSA, as amended by the Public Sector Pension Investment Board Act, transactions relating to service since , are now recorded in the Public Service Pension Fund (pension fund). An amount equal to contributions in excess of benefit payments and administrative costs is transferred regularly to the Public Sector Pension Investment Board (PSPIB) for investment. PSPIB is a Crown corporation whose statutory objectives are to manage the funds transferred to it for investment and to maximize investment returns without undue risk of loss, having regard to the funding, policies and requirements of the three main public sector pension plans (public service, Royal Canadian Mounted Police (RCMP) and Canadian Forces).

(B) Funding policy

The pension plan is funded from plan member and employer contributions, and from investment earnings. For the fiscal year, public service employees who were members of the pension plan on or before (Group 1) contributed 9.47% (9.05% in 2017) for the first 9 months and 9.83% (9.47% in 2017) for the last 3 months of pensionable earnings up to the maximum covered by the Canada Pension Plan (CPP) or Québec Pension Plan (QPP); and 11.68% (11.04% in 2017) for the first 9 months and 12.13% (11.68% in 2017) for the last 3 months of pensionable earnings above that maximum.

The contribution rates for public service employees joining the pension plan on or after (Group 2) was set at 8.39% (7.86% in 2017) for the first 9 months and 8.77% (8.39% in 2017) for the last 3 months of pensionable earnings up to the maximum covered by the CPP and QPP; and 9.94% (9.39% in 2017) for the first 9 months and 10.46% (9.94% in 2017) for the last 3 months of pensionable earnings above that maximum. The government’s contribution is made monthly to provide for the cost (net of plan member contributions) of the benefits that have accrued in respect of that month at a rate determined by the President of the Treasury Board. The contribution rates are determined based on actuarial valuations, which are normally performed triennially.

The PSSA provides that all pension obligations arising from the pension plan be met by the government. The PSSA requires that any actuarial deficit in the pension fund be dealt with by transferring equal instalments to the pension fund over a period of up to 15 years, commencing in the year in which the actuarial report is tabled in Parliament. The PSSA also allows any surplus to be lowered by reducing government and pension plan member contributions. In addition, if there is an amount considered to be a non-permitted surplus (refer to PSSA section 44.4(5) for the definition of non-permitted surplus) related to the pension fund, no further government pension contributions are permitted while pension plan member contributions under the pension fund may be reduced and amounts managed by PSPIB may be transferred to the government’s Consolidated Revenue Fund (CRF).

(C) Benefits

The pension plan provides pension benefits based on the number of years of pensionable service up to a maximum of 35 years. Benefits are determined by a formula set out in the legislation; they are not based on the financial status of the pension plan. The basic benefit formula is 2% per year of pensionable service multiplied by the average of the 5 consecutive years of highest paid service. To reflect the Income Tax Act restrictions on registered pension plan benefits, separate retirement compensation arrangements (RCAs) have been implemented to provide benefits that exceed the limits established in the Income Tax Act. Since the RCAs are covered by separate legislation, their account balances in the accounts of Canada are not consolidated in these financial statements; however, condensed information is presented in Note 23.

Pension benefits are coordinated with the CPP and QPP, and the resulting pension reduction factor for pension plan members reaching age 65, or earlier if totally and permanently disabled, has been lowered from a level of 0.7% for those turning age 65 in calendar year 2007 or earlier and to 0.625% for those turning age 65 in calendar year 2012 and later. Also, benefits are fully indexed to the increase in the Consumer Price Index.

Other benefits include survivor pensions, minimum benefits in the event of death, unreduced early retirement pensions, and disability pensions.

2. Significant accounting policies

The significant accounting policies that have been applied in the preparation of these financial statements are summarized below.

(A) Basis of presentation