Report on Public Sector Pension Plans as at March 31, 2020

Table of contents

- Overview

- Fiscal year at a glance

- Plan benefits

- Membership statistics

- Financial status

- Roles and responsibilities

- Source documents

- Appendix A: public service pension plan

- Appendix B: Royal Canadian Mounted Police pension plan

- Appendix C: Canadian Armed Forces pension plans

- Glossary

Overview

In this section

About the plans

The Government of Canada sponsors a number of defined benefit pension plans, as well as other retirement compensation arrangements for its employees. Pension plans are one component of a total compensation package that is sustainable, flexible and adapted to new workplace realities.

The public service, the Royal Canadian Mounted Police (RCMP), the Canadian Armed Forces (CAF) and the Reserve Force each have their own pension plan.

The four main public sector pension plans are contributory defined benefit pension plans established under legislation.Footnote 1 The plans provide pension benefits to eligible plan members upon retirement, disability or termination, and provide benefits to their eligible survivors upon the member’s death.

About the report

This report provides overviews of the four main public sector pension plans. These overviews are based on information from the most recent edition of each plan’s annual and actuarial reports, the Public Sector Pension Investment Board annual report, and the Public Accounts of Canada.

Data in this report is for fiscal year ended March 31, 2020. If data as of this date is not available, data from other years is presented and noted.

Fiscal year at a glance

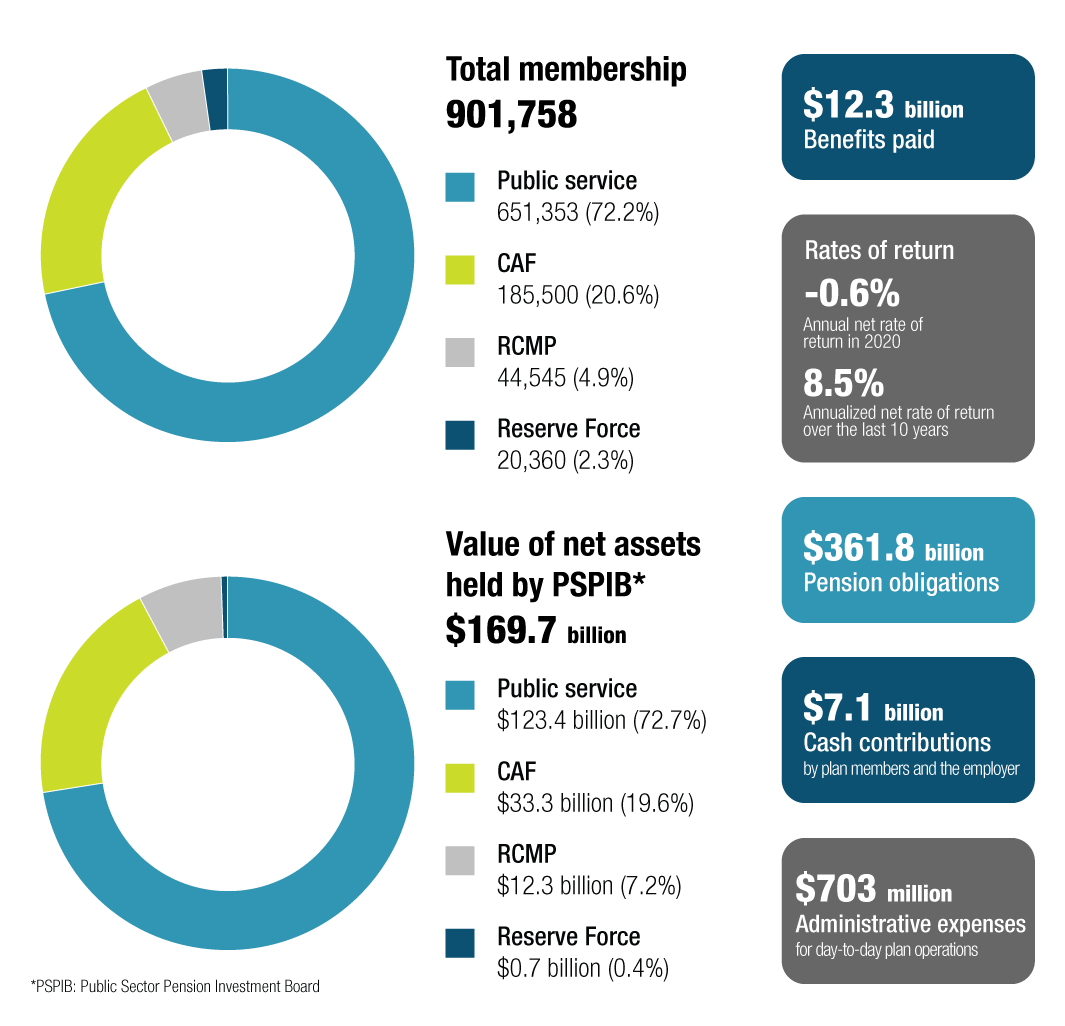

Text version

| Pension plan | Number of members | Percentage of total |

|---|---|---|

| Public service |

651,353 |

72.2% |

| Canadian Armed Forces |

185,500 |

20.6% |

| Royal Canadian Mounted Police |

44,545 |

4.9% |

| Reserve Force |

20,360 |

2.3% |

| Total membership (all plans) |

901,758 |

100% |

| Pension plan | Net assets held by PSPIB | Percentage of total |

|---|---|---|

| Public service |

$123.4 billion |

72.7% |

| Canadian Armed Forces |

$33.3 billion |

19.6% |

| Royal Canadian Mounted Police |

$12.3 billion |

7.2% |

| Reserve Force |

$0.7 billion |

0.4% |

| Total net assets |

$169.7 billion |

99.9% |

* Due to rounding, the individual plan percentages presented do not total 100% when added.

Benefits paid: $12.3 billion

Annual net rate of return in 2020: -0.6%

Annualized net rate of return over the last 10 years: 8.5%

Pension obligations: $361.8 billion

Cash contributions by plan members and the employer: $7.1 billion

Administrative expenses for day-to-day plan operations: $703 million

Plan benefits

In this section

Benefit formulas

The benefits that a plan member receives are based on the member’s years of pensionable service and on their pensionable salary, and are calculated using a formula set out in the applicable regulations. Benefits are not affected by the financial status of the plan.

The basic benefit formula is a percentage of a member’s average salary for the highest‑paid five consecutive years of service multiplied by their years of pensionable service (see Table 1). The formula coordinates benefits paid under the public sector pension plans with those paid under the Canada Pension Plan and the Québec Pension Plan.

| Contributions | A percentage of member’s salarytable 1 note * |

|---|---|

| Lifetime pension | 1.375% × average of the 5 consecutive years of highest-paid salary up to the AMPEtable 1 note ** × years of pensionable service (maximum 35 years) |

| 2% × average of the 5 consecutive years of highest-paid salary in excess of the AMPEtable 1 note ** × years of pensionable service (maximum 35 years) | |

| Bridge benefit | 0.625% × average of the 5 consecutive years of highest-paid salary up to the AMPEtable 1 note ** × years of pensionable service (maximum 35 years) |

Table 1 Notes

|

|

| Contributions |

Legislated in the Reserve Force Pension Plan Regulations |

|---|---|

| Lifetime pension |

1.5% × greater of total pensionable earnings and total updated pensionable earnings |

| Bridge benefit |

0.5% × greater of total bridge benefit earnings and total updated bridge benefit earnings |

Benefits paid

Benefits paid under the plans, which include immediate unreduced pensions, deferred pensions, annual allowances, disability retirement benefits and survivor benefits, are indexed annually to take into account the cost of living, which is based on increases in the Consumer Price Index. In calendar year 2020, the indexation rate was 2.0% (2.2% in 2019).

In fiscal year ended March 31, 2020, $12.3 billion in benefits were paid to participants of the four main public sector pension plans (see Figure 1).

| Public service | Canadian Armed Forces and Reserve Force | Royal Canadian Mounted Police | |

|---|---|---|---|

| Benefits paid ($ billions) | 8.1 | 3.3 | 1.0 |

Note: The individual plan amounts presented do not equal total benefits paid due to rounding.

Source of data: Public Accounts of Canada 2020, Volume I, Section 6

Average pension paid

The average pension paid to retired members and survivors for fiscal year ended March 31, 2020, was as follows:

- Public service: $36,000

- RCMP: $43,700

- CAF: $32,800

- Reserve Force: $5,300

Figure 2 shows average annual pensions paid over the last 10 years.

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Public service ($ dollars) |

25,991 | 27,135 | 27,380 | 28,019 | 28,711 | 29,314 | 30,034 | 31,628 | 34,001 | 36,030 |

| Royal Canadian Mounted Police ($ dollars) |

36,114 | 36,848 | 37,930 | 38,940 | 39,715 | 40,828 | 41,719 | 42,143 | 42,921 | 43,697 |

| Canadian Armed Forces ($ dollars) |

22,970 | 23,443 | 24,382 | 24,851 | 25,696 | 26,908 | 26,035 | 31,639 | 32,509 | 32,770 |

| Reserve Force ($ dollars) |

n/a | n/a | n/a | n/a | n/a | n/a | n/a | 5,510 | 5,387 | 5,332 |

Note: Before 2018, average annual pension paid for the CAF was a combination of Regular Force and Reserve Force data. Since 2018, Regular Force and Reserve Force data has been presented separately.

Source of data: Individual pension plan annual reports

Membership statistics

Plan members are classified as either active members (which includes full-time and part-time employees of the federal public service, employees of certain public service corporationsFootnote 2 and employees of the public service of the territorial governments), or pension recipients (which includes survivors and deferred annuitants). The breakdown of members for each pension plan appears in Figure 3.

As at March 31, 2020

Figure 3 - Text version

| Number of members | Percentage of total | |

|---|---|---|

| Active members | 331,665 | 51% |

| Pension recipients | 319,688 | 49% |

| Total members | 651,353 | 100% |

| Number of members | Percentage of total | |

|---|---|---|

| Active members | 22,644 | 51% |

| Pension recipients | 21,901 | 49% |

| Total members | 44,545 | 100% |

| Number of members | Percentage of total | |

|---|---|---|

| Active members | 71,614 | 39% |

| Pension recipients | 113,886 | 61% |

| Total members | 185,500 | 100% |

| Number of members | Percentage of total | |

|---|---|---|

| Active members | 18,311 | 90% |

| Pension recipients | 2,049 | 10% |

| Total members | 20,360 | 100% |

Source of data: Individual pension plan annual reports

Figure 4 compares the total number of members of the four public sector pension plans.

| Public service | Canadian Armed Forces | Royal Canadian Mounted Police | Reserve Force | |

|---|---|---|---|---|

| Number of members | 651,353 | 185,500 | 44,545 | 20,360 |

Source of data: Individual pension plan annual reports

Financial status

In this section

Net assets

As at March 31, 2020, the value of net assets held by the Public Sector Pension Investment Board (PSPIB) totalled $169.7 billion ($167.9 billion in the previous fiscal year). These net assets mainly consist of net investments managed by the PSPIB on behalf of the plans (see Figure 5). The annual total value of net assets held by the PSPIB for each of the last 10 years is presented in Figure 6.

| Public service | Canadian Armed Forces | Royal Canadian Mounted Police | Reserve Force | |

|---|---|---|---|---|

| Net assets held by PSPIB | 123.4 | 33.3 | 12.3 | 0.7 |

Note: Due to rounding, the individual plan percentages presented do not total 100%.

Source of data: PSPIB 2020 Annual Report

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Public service | 42.3 | 47.1 | 55.5 | 68.2 | 81.3 | 84.7 | 98.4 | 111.1 | 122.0 | 123.4 |

| Canadian Armed Forces | 11.3 | 12.4 | 14.9 | 18.4 | 22.0 | 23.0 | 26.7 | 30.1 | 33.0 | 33.3 |

| Royal Canadian Mounted Police | 4.1 | 4.6 | 5.4 | 6.7 | 8.1 | 8.5 | 9.8 | 11.1 | 12.1 | 12.3 |

| Reserve Force | 0.3 | 0.4 | 0.4 | 0.5 | 0.6 | 0.6 | 0.6 | 0.7 | 0.7 | 0.7 |

| Total | 58.0 | 64.5 | 76.1 | 93.7 | 112.0 | 116.8 | 135.6 | 153.0 | 167.9 | 169.7 |

Source of data: PSPIB annual reports for fiscal years ended March 31, 2011, to March 31, 2020

Investment asset mix

As part of its investment approach, the PSPIB has developed a diverse policy portfolio designed to mitigate risks. The policy portfolio represents the long-term target asset allocation among various asset classes. The PSPIB’s actual investment asset mix is based on the policy portfolio (see Figure 7).

| Equity | Real assets | Government fixed income | Credit | |

|---|---|---|---|---|

| Investment breakdown | 43.0 | 29.3 | 19.7 | 8.0 |

Source of data: PSPIB 2020 Annual Report

Investment returns

The PSPIB reported a net rate of return of -0.6% for fiscal year ended March 31, 2020. This slightly exceeds the policy portfolio benchmark of -1.6%. The one-year return of -0.6% reflects the severe decline in the equity markets in the weeks just before year-end. Over the past 10 years, the PSPIB has achieved a net annualized rate of return of 8.5%, compared with the return objective of 5.7% set by the Government of Canada.

Responsible corporate governance mechanisms are in place to allow for appropriate control of investment risk and costs by taking a disciplined approach to investment and ensuring an appropriate balance between risks and returns, the PSPIB has generated above-benchmark returns in 9 of the past 10 years (see Figure 8).

Figure 8 shows the annual net rate of return on assets held by the PSPIB against its comparative benchmark at March 31.

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Portfolio returns | 14.1 | 2.6 | 10.3 | 15.9 | 14.2 | 0.7 | 12.8 | 9.8 | 7.1 | -0.6 |

| Benchmark returns | 12.7 | 1.6 | 8.6 | 13.9 | 13.1 | 0.3 | 11.9 | 8.7 | 7.2 | -1.6 |

Source of data: PSPIB 2020 Annual Report

Obligations

As at March 31, 2020, pension obligations of the four main public sector pension plans totalled $361.8 billion (see Figure 9).

| Public service | Canadian Armed Forces | Royal Canadian Mounted Police | Reserve Force | |

|---|---|---|---|---|

| Obligations | 235.2 | 94.9 | 30.8 | 0.9 |

Note: Due to rounding, the individual plan percentages presented do not total 100%.

Source of data: Financial statements contained in individual pension plan annual reports

Contributions

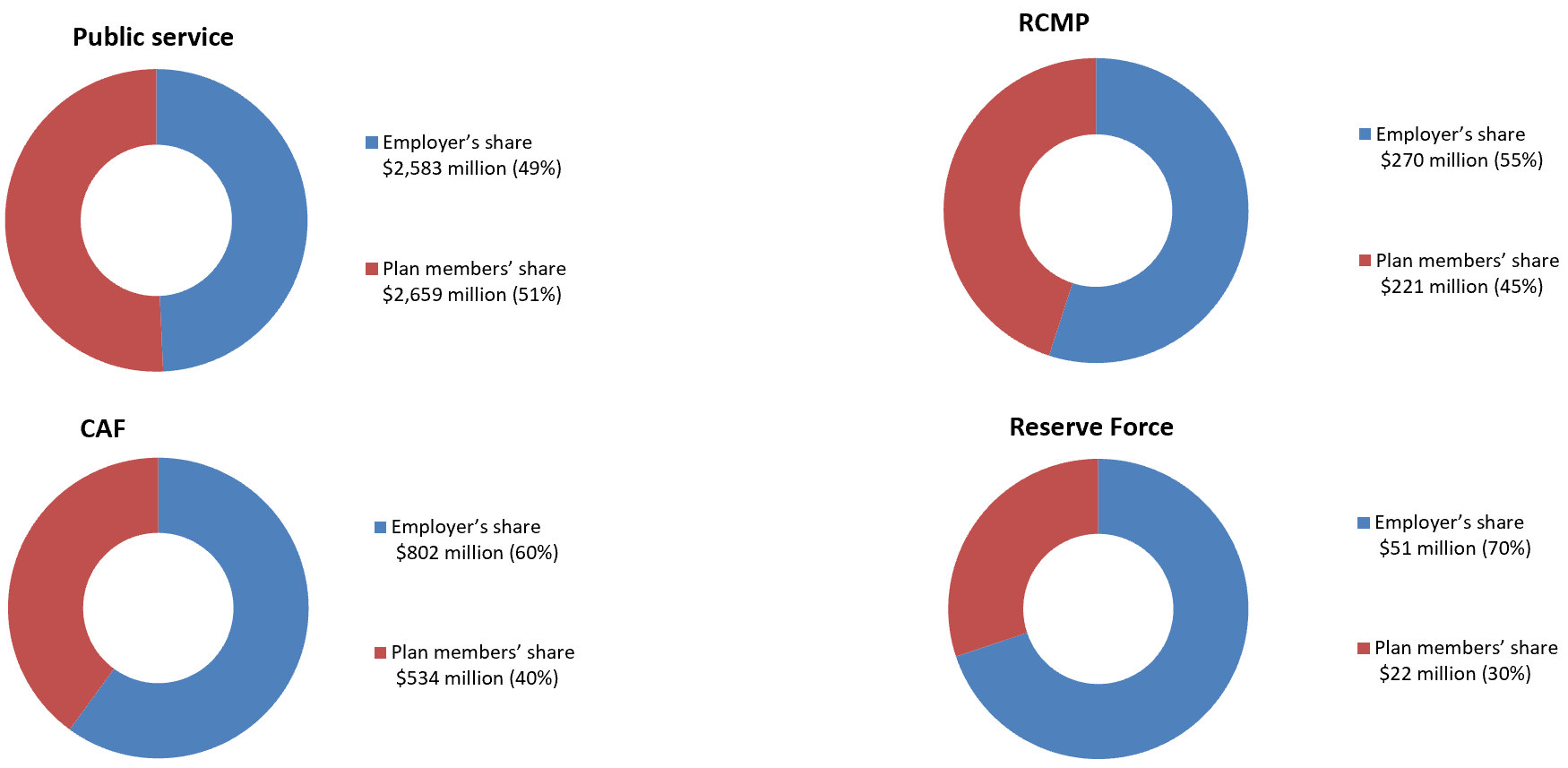

Public sector pension plan benefits are funded by contributions from active plan members and the employer (Government of Canada), as well as from investment earnings. Figure 10 shows, for each plan, the share of cash contributions by plan members and the employer. Cash contributions include current service and past service contributions (for example, service buybacks) received during the year and do not include actuarial adjustments.

Fiscal year ended March 31, 2020

Figure 10 - Text version

| Employers’ share | Plan members’ share | Total | |||

|---|---|---|---|---|---|

| Millions ($) | Percentage (%) | Millions ($) | Percentage (%) | Millions ($) | |

| Public service | $2,583 | 49% | $2,659 | 51% | $5,242 |

| Royal Canadian Mounted Police | $270 | 55% | $221 | 45% | $491 |

| Canadian Armed Forces | $802 | 60% | $534 | 40% | $1,336 |

| Reserve Force | $51 | 70% | $22 | 30% | $73 |

| Total contributions | $7,142 | ||||

Source of data: Public Accounts of Canada 2020, Volume I, Section 6

Plan members’ contributions are a percentage of their salary and are collected through payroll deductions. Members contribute at a lower rate on salary up to the yearly maximum pensionable earnings (YMPE) that apply under the Canada Pension Plan and the Québec Pension Plan and at a higher rate above the YMPE. In 2020, the YMPE were $58,700 ($57,400 in 2019).

The public service pension plan has two groups of members:

- Group 1: members who were participating in the plan on or before December 31, 2012

- Group 2: members who began participating in the plan on or after January 1, 2013

The member contribution rates are approved on a calendar basis. Table 2 shows members’ contribution rates as a percentage of their salary for calendar years 2019 and 2020.

| Salary | Public service | RCMP | CAF | ||

|---|---|---|---|---|---|

| Group 1 | Group 2 | Regular Forces | Reserve Forcetable 2a note * | ||

| Up to the YMPE | 9.6% | 8.7% | 9.6% | 9.6% | 5.2% |

| Above the YMPE | 11.8% | 10.2% | 11.8% | 11.8% | |

Table 2a Notes

|

|||||

| Salary | Public service | RCMP | CAF | ||

|---|---|---|---|---|---|

| Group 1 | Group 2 | Regular Forces | Reserve Forcetable 2b note * | ||

| Up to the YMPE | 9.5% | 8.7% | 9.5% | 9.5% | 5.2% |

| Above the YMPE | 11.7% | 10.2% | 11.7% | 11.7% | |

Table 2b Notes

|

|||||

Source of data: Public Accounts of Canada 2020, Volume I, Section 6

Since April 1, 2000 (March 1, 2007, for the Reserve Force pension plan), plan member and employer contributions, net of benefit payments and other charges to the plans have been transferred to the PSPIB for investment.

Before April 1, 2000, plan member and employer contributions were not invested. Contributions, as well as benefit payments, interest, charges and transfers that pertain to service before April 1, 2000, have been tracked in the superannuation accounts in the Public Accounts of Canada.

Administrative expenses

According to legislation, pension-related administrative expenses of the following government organizations may be charged to the public sector pension plans:

- Treasury Board of Canada Secretariat

- National Defence

- RCMP

- Public Services and Procurement Canada

- Health Canada

- Office of the Chief Actuary

The PSPIB’s administrative expenses are also charged to the plans. These expenses have increased as a result of the growth in the number of employees and investments in technology and initiatives underway as part of its strategic plan.

Figure 11 shows the administrative expenses charged to the plans for the last 10 years, as shared between government organizations and the PSPIB.

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Government organizations | 165 | 160 | 179 | 191 | 186 | 191 | 169 | 149 | 143 | 152 |

| PSPIB | 114 | 148 | 184 | 216 | 243 | 295 | 370 | 450 | 503 | 551 |

Source of data: PSPIB annual reports and the Public Accounts of Canada for years ended March 31, 2011, to March 31, 2020

In fiscal year ended March 31, 2020, total administrative expenses for the public sector pension plans were $703 million.* Administrative expenses for each pension plan were as follows:

- public service pension plan: $504 million

- RCMP pension plan: $49 million

- CAF pension plan: $139 million

- Reserve Force pension plan: $10 million

* Due to rounding, the total of the amounts listed for the individual plans does not match this figure.

Impact on public finances

Pension expenses are calculated based on Canadian public sector accounting standards and are included in the Public Accounts of Canada 2020.

- Pension expense includes employers’ contributions and recognized actuarial valuation gains and losses and other adjustments.

- Net interest expense is calculated based on the average accrued pension obligations (benefits earned by members under their pension plan for pensionable service).

Table 3 shows a summary of transactions for the plans that resulted in expenses for the Government of Canada in fiscal year ended March 31, 2020.

| Pension plan | Pension expense | Net interest expense | Total expense |

|---|---|---|---|

| Public service | 4,091 |

1,420 |

5,511 |

| RCMP | 677 |

268 |

945 |

| CAF | 2,381 |

992 |

3,373 |

| Reserve Force | 38 |

2 |

40 |

| Total expenses | 7,187 |

2,682 |

9,869 |

Source of data: Public Accounts of Canada 2020, Volume I, Table 6.16

Pension plan funding

Key measures to support sustainability

The governance framework of the public sector pension plans includes key measures that help ensure that the plans remain sustainable and affordable for plan members and taxpayers. These measures include:

- actuarial valuations, which provide an estimate of expenses and obligations

- reviews of the funded status of the plans

- the pension plans’ annual reports

Each plan also has an advisory committee that comprises representatives of the employer, active plan members and retired plan members. These committees provide additional oversight, accountability and transparency by reviewing administration, design and funding of benefits.

In response to the 2014 Auditor General of Canada’s performance audit of the public sector pension plans, work is ongoing to strengthen the governance framework.

As part of the implementation of the Funding Policy for the Public Sector Pension Plans, which TBS, the RCMP and National Defence approved in 2018, a sustainability review of the plans is currently underway.

Actuarial valuations

Actuarial valuations are performed regularly to support the administration of the pension plans. The Office of the Chief Actuary performs two types of actuarial valuations:

- Actuarial valuations for accounting purposes are conducted as at March 31 of each fiscal year to measure and report on the pension expense and obligations in the Public Accounts of Canada, and to provide the necessary information to prepare the plans’ financial statements.

- Actuarial valuations for funding purposes are conducted at least once every three years to determine the contribution rates, actuarial liability and the funded status of the plans. These valuations help the President of the Treasury Board make informed decisions on the financing of the pension plans. Assessments of the funded status of the pension plans are done annually, in consultation with the Office of the Chief Actuary.

Methodology and assumptions used in actuarial valuations

Economic assumptions are set in order to conduct actuarial valuations. Population characteristics and benefit provisions are specific to each pension plan. Assumptions underlying the actuarial valuation for accounting purposes are based on management’s best estimates. The Office of the Chief Actuary determines the best‑estimate assumptions used in actuarial valuations for funding purposes.

As part of the economic assumptions, discount rates are used to determine the present value of the future pension payments (the accrued benefit obligation or the actuarial liability), the costs of benefits earned, and the interest expenses.

Discount rates are set as follows:

For accounting purposes:

- For funded pension benefits (post-March 2000), the discount rates are the streamed expected rates of return on funds invested by the PSPIB.

- For unfunded pension benefits (pre-April 2000), the discount rates are the government’s cost of borrowing. That cost is derived from the yields on the actual zero-coupon yield curve for Government of Canada bonds, which reflect the timing of the expected future cash flows.

For funding purposes:

- For funded pension benefits (post-March 2000), the discount rates are the streamed expected rates of return on funds invested by the PSPIB.

- For unfunded pension benefits (pre-April 2000), the discount rates are the streamed weighted average of Government of Canada long-term bond rates. This average is a calculated 20-year weighted moving average of Government of Canada long-term bond rates projected over time. The streamed rates take into account historical Government of Canada long-term bond rates and, over time, reflect expected Government of Canada long-term bond rates.

Table 4 presents some of the key economic assumptions used in the most recent actuarial valuations.

| Actuarial report | Long-term discount rate | Long-term rate | ||

|---|---|---|---|---|

| Funded pension benefits (post-March 2000)table 4 note * | Unfunded pension benefits (pre-April 2000) | Salary increase | Pension indexation | |

Table 4 Notes

|

||||

| For accounting purposes (as at March 31, 2020) |

5.6% | 1.2% | 2.6% | 2.0% |

| For funding purposes | ||||

Public service (as at March 31, 2017) |

6.0% | 4.7% | 2.8% | 2.0% |

RCMP (as at March 31, 2018) |

6.0% | 4.6% | 2.7% | 2.0% |

CAF (as at March 31, 2019) |

6.0% | 4.5% | 2.7% | 2.0% |

Reserve Force (as at March 31, 2019) |

6.0% | n/a | 2.7% | 2.0% |

Source of data: Actuarial reports of the Office of the Chief Actuary and Public Accounts of Canada 2020

Sensitivity analysis of actuarial assumptions

Changes in actuarial assumptions for valuation sensitivity analysis purposes can result in significantly higher or lower estimates of the accrued pension obligations. Table 5 shows the possible impact of a 1% increase or decrease to the long‑term actuarial assumptions on the four main public sector pension plans, as well as on the pension arrangements for members of Parliament, federally appointed judges, non‑career diplomats, the Governor General and lieutenant governors, and retirement compensation arrangements.

| Changes in actuarial assumptions | Funded pension benefits (post-March 2000) |

Unfunded pension benefits (pre-April 2000) |

|---|---|---|

| Increase of 1% in discount rates | (25,000) | (28,600) |

| Decrease of 1% in discount rates | 32,600 | 35,700 |

| Increase of 1% in the rate of inflation | 22,300 | 32,300 |

| Decrease of 1% in the rate of inflation | (18,200) | (26,800) |

| Increase of 1% in general wage increase | 7,700 | 800 |

| Decrease of 1% in general wage increase | (6,800) | (1,100) |

Source of data: Public Accounts of Canada 2020, Volume I, Section 2

Actuarial valuation report: financial position

Tables 6 and 7 show the results of the superannuation account and the pension fund of each pension plan as of the last triennial funding valuation.

| Balance | Public service (2017) |

RCMP (2018) |

CAF (2019) |

|---|---|---|---|

| Regular Forces | |||

| Account balance | 94,270 | 13,123 | 45,630 |

| Actuarial liability | 97,137 | 14,009 | 48,057 |

| Actuarial excess (shortfall) | (2,867) | (886) | (2,427) |

Source of data: Actuarial reports of the Office of the Chief Actuary

| Balance | Public service (2017) |

RCMP (2018) |

CAF (2019) |

|

|---|---|---|---|---|

| Regular Forces | Reserve Force | |||

| Actuarial value of assetstable 7 note * | 92,956 | 10,293 | 31,586 | 538 |

| Actuarial liability | 87,313 | 9,721 | 31,007 | 711 |

| Actuarial surplus (deficit) | 5,643 | 572 | 579 | (173) |

Table 7 Notes

| ||||

Source of data: Actuarial reports of the Office of the Chief Actuary

Roles and responsibilities

The President of the Treasury Board has overarching policy responsibility for the four main public sector pension plans, but each plan is managed separately and has its own governance structure and reporting requirements (see Table 8).

| Pension plan | Ensures adequate funding | Plan administration | Supports Minister with plan administrationtable 8 note * | Day-to-day plan administrationtable 8 note ** |

|---|---|---|---|---|

| Public service | President of the Treasury Board | President of the Treasury Board | Treasury Board of Canada Secretariat | Public Services and Procurement Canada |

| RCMP | Minister of Public Safety and Emergency Preparedness | RCMP | ||

| CAF and Reserve Force | Minister of National Defence | National Defence | ||

Table 8 Notes

|

||||

The Office of the Chief Actuary, an independent unit of the Office of the Superintendent of Financial Institutions, performs periodic actuarial valuations for funding purposes and calculates the yearly pension obligations included in the pension plans’ financial statements.

The PSPIB is a Crown corporation established under the Public Sector Pension Investment Board Act that is accountable to Parliament through the President of the Treasury Board. The PSPIB is responsible for managing the funds transferred to it by the four main public sector pension plans and for maximizing investment returns without undue risk of loss, while respecting the funding, policies and requirements and financial obligations of each of the plans. The PSPIB has been investing for the public service, the RCMP and the CAF pension plans since April 1, 2000, and for the Reserve Force pension plan since March 1, 2007.

Source documents

- Report on the Public Service Pension Plan for the Fiscal Year Ended March 31, 2020

- Royal Canadian Mounted Police Pension Plan Annual Report, 2019–2020

- Canadian Armed Forces Pension Plans Annual Report, 2019–2020

- Public Sector Pension Investment Board annual reports, 2011 to 2020

- Public Accounts of Canada 2020

- Actuarial Report on the Pension Plan for the Public Service of Canada as at 31 March 2017

- Actuarial Report on the Pension Plan for the Royal Canadian Mounted Police as at 31 March 2018

- Actuarial Report on the Pension Plans for the Canadian Forces: Regular Force and Reserve Force as at 31 March 201 9

Appendix A: public service pension plan

| Type of benefit | Eligibility | |

|---|---|---|

| Group 1table 9 note * (pension eligibility at age 60) |

Group 2table 9 note ** (pension eligibility at age 65) |

|

| Immediate pension |

|

|

| Deferred pension |

|

|

| Annual allowance |

|

|

| Transfer value | The actuarial value of the member’s pension benefits, payable in a lump sum. This amount must be transferred to another registered pension plan or to a locked-in retirement savings vehicle. |

|

|

|

|

| Return of contributions |

|

|

| Survivor benefit |

|

|

| Child allowance |

|

|

| Indexation | Pension is increased on January 1 of each year to take into account the cost of living, based on increases in the Consumer Price Index. |

|

Table 9 Notes

|

||

Appendix B: Royal Canadian Mounted Police pension plan

| Type of benefit | Eligibility |

|---|---|

| Immediate pension |

|

| Deferred pension | Between 2 years and less than 20 years of service in the Force: An unreduced pension benefit payable at age 60 |

| Annual allowance | A permanently reduced pension, payable based on more than 20 but less than 25 years of service in the Force |

| Transfer value |

|

| Return of contributions |

|

| Survivor benefits |

|

| Child allowance |

|

| Indexation | Pension is increased on January 1 of each year to take into account the cost of living, based on increases in the Consumer Price Index. |

Appendix C: Canadian Armed Forces pension plans

| Type of benefit | Eligibility | |

|---|---|---|

| Regular Forces (CFSA, Part I) | Reserve Force (CFSA, Part I.I) | |

| Immediate pension |

|

|

|

|

|

| Deferred pension | At least 2 years of pensionable service: Accrued pension calculated according to the pension formula, payable at age 60 |

|

| Annual allowance | At least 2 years of pensionable service: A permanently reduced pension, payable as early as age 50 and before age 60 |

|

| Transfer value | The actuarial value of the member’s pension benefits, payable in a lump sum. This amount must be transferred to another registered pension plan or to a locked-in retirement savings vehicle. |

|

| Return of contributions |

|

|

| Survivor benefit |

|

|

| Child allowance |

|

3 or more children: Half of the basic survivor allowance divided by the number of children |

| Indexation | Pension is increased on January 1 of each year to take into account the cost of living, based on increases in the Consumer Price Index. |

|

Glossary

- actuarial adjustments

- The special payments that the Government of Canada is required to make to fund actuarial deficits.

- actuarial assumptions

- Economic and demographic assumptions, such as future expected rates of return, inflation, salary levels, retirement ages and mortality rates, that are used by actuaries when carrying out an actuarial valuation or calculation.

- actuarial valuation

- An actuarial analysis that provides information on the financial condition of a pension plan.

- administrative expenses

- Expenses by government departments for the administration of the public sector pension plans and for operating expenses incurred by the PSPIB to invest pension assets. Investment management fees are either paid directly by the PSPIB or offset against distributions received from the investments.

- benchmark

- A standard against which rates of return can be measured, such as stock and bond market indexes developed by stock exchanges and investment managers.

- bridge benefit

- A temporary amount payable from the date a member’s pension begins until age 65 or when CPP or QPP disability benefits begin, whichever occurs first.

- Consumer Price Index

- A measure of price changes published by Statistics Canada on a monthly basis. The Consumer Price Index measures the retail prices of about 300 goods and services, including food, housing, transportation, clothing and recreation. The index is weighted, meaning that it gives greater importance to price changes for some products than others (for example, more to housing than to entertainment), in an effort to reflect typical spending patterns. Increases in the Consumer Price Index are also referred to as “cost‑of‑living increases.”

- contributions

- Sums credited or paid by the employer and plan members to finance future pension benefits. Each year, the employer contributes amounts sufficient to fund the future benefits earned by employees in respect of that year, as determined by the President of the Treasury Board.

- defined benefit pension plan

- A type of pension plan that offers eligible members a certain level of pension, which is usually based on their salary and years of service.

- disability

- A physical or mental impairment that prevents an individual from engaging in any employment for which the individual is reasonably suited by virtue of their education, training or experience and that can reasonably be expected to last for the rest of the individual’s life.

- pension obligation

- Corresponds to the value, discounted in accordance with actuarial assumptions, of all future payable benefits accrued as of the valuation date in respect of all previous pensionable service.

- pensionable service

- Periods of service to the credit of a public sector pension plan member. This service includes any complete or partial periods of purchased service (for example, service buyback or elective service).

- service buyback

- A service buyback is a legally binding agreement under which a member purchases a period of prior service to increase their pensionable service.

- survivor

For the purposes of the public service pension plan, a person who, at the time of a plan member’s death, was married to the plan member before their retirement or was cohabiting with the plan member in a conjugal relationship prior to the member’s retirement and for at least 1 year prior to the date of death.

For the purposes of the pension plans for the CAF and RCMP, a survivor is a person who, at the time of a plan member’s death, was married to the plan member, or was cohabiting with the plan member in a conjugal relationship for at least 1 year prior to the plan member’s retirement, or if retired, prior to the member’s 60th birthday.

- yearly maximum pensionable earnings (YMPE)

- The maximum earnings based on which contributions are made to the Canada Pension Plan and the Québec Pension Plan during the year. In 2020, yearly maximum pensionable earnings were $58,700 ($57,400 in 2019).