Funding Policy for the Public Sector Pension Plans

On this page

- Introduction

- Purpose and scope of the funding policy

- Funding policy objectives

- Guiding principles

- Funding risks

- Actuarial methods

- Current service contributions

- Deficits and surpluses

- Risk management

- Reporting and monitoring

- Communication

- Policy approval, review and compliance

- Appendix 1: Illustration of investment risk

Introduction

The Government of Canada sponsors defined benefit pension plans for members of the public service, the Canadian Forces (Regular Force and Reserve Force) and the Royal Canadian Mounted Police (RCMP). These plans are collectively referred to as “the public sector pension plans” or “the plans.”

This funding policy is administered by the President of the Treasury Board to support the plans and comply with the Public Service Superannuation Act, the Canadian Forces Superannuation Act, the Royal Canadian Mounted Police Superannuation Act, the Public Sector Pension Investment Board Act and the Public Pensions Reporting Act. Summary tables of the benefits of the plans can be viewed in the 2020 Report on Public Sector Pension Plans.

The President of the Treasury Board is responsible for the management and overall administration of the public service pension plan, the funding of each of the plans, and in consultation with the Minister of National Defence and the Minister of Public Safety, for recommending member contribution rates for the plans to the Treasury Board of Canada for approval. The Treasury Board of Canada Secretariat (TBS) provides support to the President of the Treasury Board regarding plan funding.

The Public Sector Pension Plans Coordinating Committee (PSPP-CC), an assistant deputy minister‑level committee, ensures that the government receives appropriate information and advice to support funding decisions for the plans. This funding policy assists the PSPP-CC in its mandate. The PSPP-CC members are:

- TBS: Associate Assistant Deputy Minister, Employee Relations and Total Compensation Sector (Chair)

- Department of Finance Canada: Assistant Deputy Minister, Fiscal Policy Branch

- National Defence: Assistant Chief of Military Personnel

- RCMP: Chief Financial Officer

- Public Safety Canada: Senior Assistant Deputy Minister, Community Safety and Countering Crime Branch

- Public Services and Procurement Canada: Assistant Deputy Minister, Receiver General and Pension Branch

Since April 1, 2000, the Public Sector Pension Investment Board (PSPIB) has managed, on behalf of the public sector pension plans, the amounts transferred to it by the Government of Canada. The Public Sector Pension Investment Board Act requires the PSPIB to establish a Statement of Investment Policy Standards and Procedures regarding the investment of each fund it manages.

The Office of the Chief Actuary is an independent unit of the Office of the Superintendent of Financial Institutions Canada. The Chief Actuary of Canada conducts actuarial valuations on the plans to assist the President of the Treasury Board determine the funding requirements of the plans.

1. Purpose and scope of the funding policy

- 1.1 The purpose of the funding policy is to provide the decision framework to support the funding of the plans, and formalize the relationship between TBS, the Office of the Chief Actuary and the PSPIB. The policy provides guidance and rules to support prudent governance of the plans, and ensures that sufficient assets are accumulated to meet the cost of the accrued pension benefits.

- 1.2 The scope of the funding policy is limited to the Government of Canada’s liabilities from pensionable service accrued since April 1, 2000, under each plan (2007 for the Canadian Forces Reserve Force plan).

- 1.3 The Public Sector Pension Investment Board Act requires that the assets managed by the PSPIB be invested “with a view to achieving a maximum rate of return, without undue risk of loss, having regard to the funding, policies and requirements of the pension plans established under the Acts.” The Public Pensions Reporting Act provides certain requirements regarding actuarial reporting for the plans. This funding policy complements the acts and provides additional detail and direction in support of the requirements for the plans and the government’s pension plan funding objectives.

2. Funding policy objectives

- 2.1 To ensure that the plans accumulate and sustain sufficient assets to provide the accrued pension benefits to plan members.

- 2.2 To limit the degree of volatility in plan funding and achieve stable and predictable current service cost and special payments, recognizing that a certain amount of funding volatility is inherent for the plans.

- 2.3 To keep the plans affordable for members and the government, while ensuring that the plans remain sustainable over the long term.

- 2.4 To support intergenerational fairness by recognizing that the plans’ costs and risks are shared between current and future plan members, as well as current and future taxpayers.

3. Guiding principles

- 3.1 Funding decisions should be aligned with the long-term nature of the plans and funding objectives. In order to fund the plans at an acceptable cost over the long term, a degree of investment and other funding risks is necessary. The government is responsible for determining the acceptable overall level of funding risk, for setting funding risk targets, for determining strategies to mitigate funding risks and for any funding deficit or surplus.

- 3.2 Funding targets will focus on the net funded status of the plans rather than their liabilities or assets individually.

- 3.3 The plans’ benefits are indexed to inflation, making investments that can hedge the risk of inflation attractive for the plans. Diversification of investments across asset classes is expected to reduce overall investment risk, and active management of investment assets is expected to add value over the long term.

- 3.4 Funding will be managed with appropriate regard for the governance and ethical standards expected for the management of pension plans for the Government of Canada. The government expects that the PSPIB will describe in its Statement of Investment Policy Standards and Procedures, and other publicly available documents, how environmental, social and governance factors are incorporated into the PSPIB’s investment practices.

4. Funding risks

- 4.1 The plans are impacted by a range of economic risk factors, including inflation rates and interest rates. Canadian inflation rates directly affect benefit indexation and can affect overall salary increases, while interest rates can impact the value of plan liabilities and investment returns.

- 4.2 Investment risk is a significant risk factor that affects the funding of the plans. Investment performance has a direct influence on the plans’ funded status, and changes to investment return expectations influence both the funded status and the projected trend for the plans’ current service costs.

- 4.3 Demographic risk factors for the plans include the general characteristics of the plans’ populations, such as member age, sex, marital status, expected longevity, salary progression rates, termination rates and early retirement rates. These variables directly impact the projected pension liability, and, over the short term, there is a risk that the plans’ demographic experience varies from the projection. While demographic factors in general change slowly over the short term, they are important drivers of long-term plan funding risk, particularly long-term longevity factors.

- 4.4 The distinction between Group 1 and Group 2 membership for the public service pension plan is an important demographic risk factor, since current service cost is determined for Group 1 and Group 2, and the resulting Group 1 member contribution rates are used to set the contribution rates for the members of the Canadian Forces Regular Force and RCMP pension plans.

- 4.5 The risks related to having assets readily available to fund benefit payments when needed requires effective management of the plans’ liquidity. To the extent that the average duration of the plans’ liabilities are relatively long, with no immediate net cash outflow, the assets may be managed with a longer time horizon, exhibiting low-liquidity and high-equity allocation. When assets invested by the PSPIB are expected to directly support benefit payments, managing the risk related to asset liability matching will be important.

- 4.4 The public sector pension plans face a level of scrutiny and attention not faced by other pension plans. There is a risk that funding decisions can become unduly influenced by temporary external pressures or opinions. Adopting a funding policy for the plans establishes a solid framework for funding decisions and mitigates this risk.

- 4.7 Governance of the plans requires careful coordination between many departments and ministers. Authority, accountability, cost monitoring and reporting related to the plans are challenging given the distributed nature of the governance structure.

- 4.8 Confidence in the risk assessment of the plans depends on plan data, computer systems, programs and risk models used to conduct this assessment. Ensuring accuracy of plan data, systems and models is important to mitigate risk.

5. Actuarial methods

- 5.1 The actuarial valuations for funding purposes are conducted by the Chief Actuary at least every 3 years or as needed in compliance with the Public Pensions Reporting Act.

- 5.2 Actuarial valuation reports or advice prepared for the plans are done in a manner consistent with the Standards of Practice as published by the Canadian Institute of Actuaries.

- 5.3 The projected unit credit method is used to determine plan liabilities and current service cost. This method determines the present value cost of the annual earned benefit and is aligned with the policy objective of fair intergenerational cost allocation.

- 5.4 Actuarial valuations prepared for the funding of the plans are on a going concern basis using discount rates that are based on the Chief Actuary’s expected return on the invested assets. This approach is aligned with the plans’ objectives and long-term funding goals.

- 5.5 The plans’ funded status and required special payments will be determined using a smoothed value of assets calculation method. This approach is aligned with the policy objective of maintaining low funded status volatility.

- 5.6 The plans’ funding risk is borne entirely by the government, and the cost to mitigate this risk is also borne entirely by the government. Consequently, the assumptions used to establish funding risk targets or to conduct actuarial funding valuations will use best estimate assumptions, without additional margins to protect against an adverse funding deviation.

6. Current service contributions

- 6.1 Member contribution rates for the public service pension plan, for the Canadian Forces Regular Force pension plan and the RCMP pension plan are set by the Treasury Board on the recommendation of the President of the Treasury Board, in consultation with the Minister of National Defence and the Minister of Public Safety. The contribution rates are based on actuarial advice and are set in compliance with the Public Service Superannuation Act, the Canadian Forces Superannuation Act and the Royal Canadian Mounted Police Superannuation Act.

- 6.2 Member contributions for the public service pension plan must not exceed 50% of the total current service cost.

- 6.3 For members of the Canadian Forces Regular Force and RCMP pension plans, contribution rates are not to exceed the rates paid by Group 1 contributors of the public service pension plan.

- 6.4 For members of the Canadian Forces Reserve Force pension plan, the contribution rate is set under the Reserve Force Pension Plan Regulations.

- 6.5 The current service contributions made by the government will be the amount required to meet the current service cost of the respective plan, after taking into consideration member contributions.

7. Deficits and surpluses

- 7.1 For a deficit, the timing and amount of special payments made by the government will be determined by the President of the Treasury Board, with the exception of a deficit in the Canadian Forces Reserve Force pension plan. The normal operating practice will be to amortize a deficit in equal annual special payments over 15 years. The President of the Treasury Board will retain the authority to override this practice. The special payments may be adjusted as required, based on actuarial advice in a subsequent valuation.

- 7.2 A deficit in the Canadian Forces Reserve Force pension plan will be amortized in equal annual special payments over a period of 15 years, as prescribed in the Reserve Force Pension Plan Regulations.

- 7.3 For any surplus that is below the non-permitted surplus limit set in the Public Service Superannuation Act, the Canadian Forces Superannuation Act and the Royal Canadian Mounted Police Superannuation Act, the normal operating practice will be to retain the surplus in the plan as a prudent margin. The President of the Treasury Board will retain the authority to recommend to the Treasury Board to override this practice.

- 7.4 For a surplus above the non-permitted surplus limit, government contributions will cease until, in the opinion of the President of the Treasury Board, the non-permitted surplus no longer exists, with the exception of a non-permitted surplus in the Canadian Forces Reserve Force pension plan. The Treasury Board can decide to take further action such as immediate removal of the surplus or a temporary reduction in employee contributions based on the recommendation of the President of the Treasury Board.

- 7.5 For a non-permitted surplus in the Canadian Forces Reserve Force pension plan, government contributions to the fund will cease until the next actuarial valuation confirms that a non-permitted surplus no longer exists, as prescribed in the Reserve Force Pension Plan Regulations.

8. Risk management

- 8.1 TBS will report on the plans’ funding risk no less than annually to the PSPP-CC. The report will include analysis of the risk of a funding deficit, the risk of non-permitted surplus, the risk to the government’s fiscal position, the risk of special payments, or any other appropriate risk metrics.

- 8.2 An Asset Liability Committee (ALCO), established by TBS, will include actuarial and investment experts who will be responsible for conducting all necessary funding risk analysis related to the plans, and any other funding analysis that may be requested by TBS. The ALCO will be responsible for developing the methodologies and analysis needed to determine and assess funding risks for the plans, for confirming all assumptions used to conduct the analysis and for monitoring whether funding risks remain within the established funding targets. The ALCO will include departmental officials representing each of the plans, the Department of Finance, as well as the Office of the Chief Actuary and PSPIB.

- 8.3 The ALCO will recommend to TBS for approval by the President of the Treasury Board, the funding risk targets and all assumptions used to assess and measure funding risk and to determine the risk targets, including liability, demographic, economic and investment assumptions, and determining the Reference PortfolioFootnote 1. The funding risk targets for the plans will be determined using a stochastic analytical framework and, in the context of the funding policy objectives, the current environment and conditions of the plans.

- 8.4 The funding risk for the plans will be limited to have a lower than 5% chance of being less than 70% funded over a 10‑year horizon, assuming a fully funded initial position.Footnote 2

- 8.5 TBS will conduct a sustainability review of the plans at least every 5 years, or if the total current service cost for any plan is projected to increase by more than 2% of pensionable payroll since the last review. A sustainability review will also be conducted if the annual special payment for any plan is projected to exceed the government’s share of the current service cost for that plan. This review will examine all aspects of the plans’ funding and structure. The report will be submitted to the PSPP-CC and provided to the President of the Treasury Board, the Minister of National Defence and the Minister of Public Safety.

- 8.6 TBS will provide funding recommendations to the President of the Treasury Board.

9. Reporting and monitoring

- 9.1 The PSPP-CC will, on an annual basis, provide a summary report of the plans’ funded status and risks compared with the targets established by this funding policy to the President of the Treasury Board, the Minister of National Defence and the Minister of Public Safety. The review will be based on the statutory actuarial valuations, actuarial advice, reports and analysis provided by the ALCO and any other information reviewed by the PSPP-CC.

- 9.2 The PSPP-CC will provide an annual summary report on the plans’ funding status to the Pension Advisory Committees.

- 9.3 A comprehensive sustainability review is to be conducted periodically, as set out by the requirements of the funding policy.

10. Communication

- 10.1 The funding policy will be made available online and accessible to all stakeholders, including plan members and beneficiaries, taxpayers, parliamentarians, the Office of the Chief Actuary, the PSPIB and the pension advisory committees. Any amendments to the funding policy will be communicated to all stakeholders.

11. Policy approval, review and compliance

- 11.1 The funding policy, as developed by the President of the Treasury Board with the concurrence of the Minister of National Defence and the Minister of Public Safety, was approved by the Treasury Board in 2018.

- 11.3 The funding policy will be reviewed annually by the PSPP-CC. Any recommended change or amendment to any policy statement contained within the funding policy will be submitted to the President of the Treasury Board, the Minister of National Defence and the Minister of Public Safety for consideration. Any consequential change to any of the policy statements will be submitted by the President of the Treasury Board, with the concurrence of the Minister of National Defence and the Minister of Public Safety, to the Treasury Board for approval.

- 11.3 The Pension Advisory Committees will be consulted on any change or amendment to any policy statement contained within the funding policy.

- 11.4 TBS, the Office of the Chief Actuary, the PSPIB, the Canadian Forces and RCMP plan administrators, each within their respective areas of responsibility and professional standards, will operate in accordance with the funding policy.

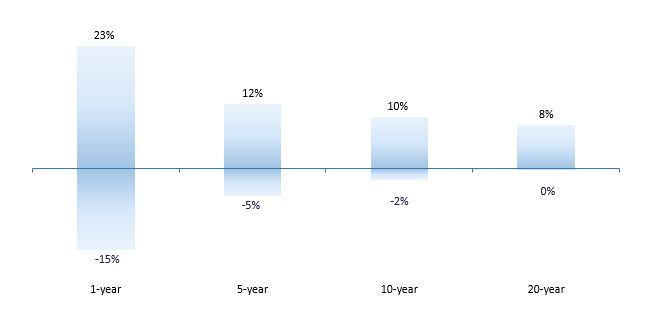

Appendix 1: Illustration of investment risk

Range of real returns (annualized average) - Text version

An illustration of the investment risk metric using an asset mix of fixed income 20%, Canadian equity 20%, foreign equity 27%, emerging markets 8%, real assets 25%. The chart shows the 90% probability that investment returns will fall within the range shown for the selected time periods. The investment risk may vary depending on market conditions and assumptions, but must not result in funding risk in excess of the policy limit.

© Her Majesty the Queen in Right of Canada, represented by the President of the Treasury Board, 2019,

ISBN: 978-0-660-29474-2