Introduction - 2016–17 Estimates

Introduction

Governments collect funds through taxes and other levies in order to provide services to their citizens. In Canada, the federal government's primary sources of revenue are income and sales taxes.

Payments that go directly to individuals, to provincial and territorial governments, and to other organizations are called "transfers." Transfers are the largest category of spending for the federal government. The largest transfers include elderly benefits, as well as transfers to provinces and territories to help fund health care services.

Federal departments, agencies and Crown corporations also provide programs and services for Canadians. In order for federal government organizations to operate, Parliament must give these organizations authority to spend.

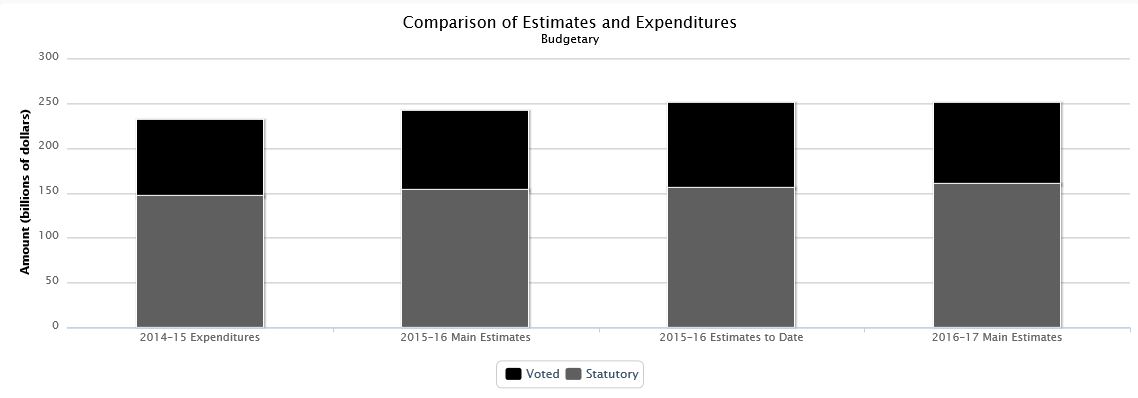

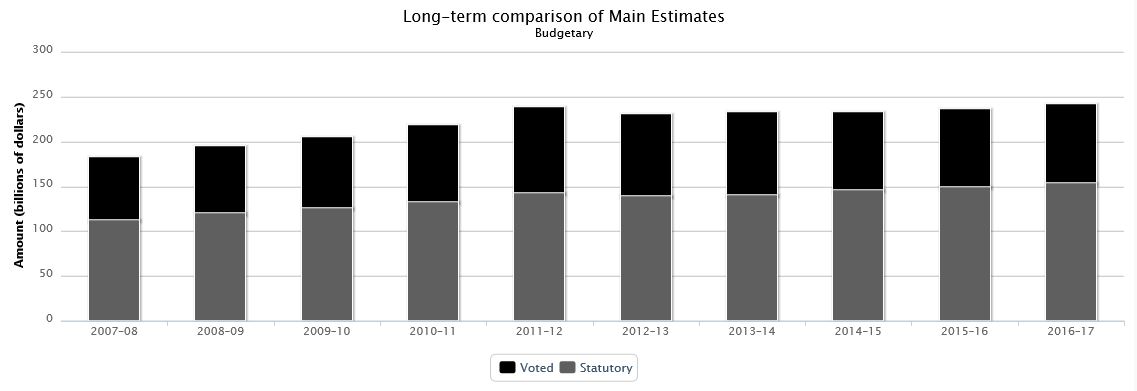

While spending is often announced in a Federal Budget, spending authority is actually granted through legislation passed by Parliament. Approximately one-third of federal government spending is approved by Parliament on an annual basis. These expenditures are authorized through an appropriation act and are called "voted" expenditures. Expenditures authorized through other legislation are called "statutory". Due to the need to table Main Estimates on or by March 1, emerging priorities and items announced in Budget 2016 will be included in future Estimates documents.

Estimates publications explain how federal organizations plan to spend funds. The Main Estimates and Supplementary Estimates provide information on spending authority that Parliament will be asked to approve during the fiscal year. Individual departments and agencies also produce Reports on Plans and Priorities (RPPs) and Departmental Performance Reports (DPRs). The RPPs are typically tabled soon after the Main Estimates and show an organization's priorities and planned results for the next three years. DPRs, tabled in the fall, are accounts of results achieved during the most recent fiscal year.

Estimates documents are prepared on a near cash basis of accounting, which recognizes payments when goods or services are received. This allows Parliament to control the amounts spent during a fiscal year through the appropriation acts it passes. Forecasts in the Federal Budget and the Update of Economic and Fiscal Projections are prepared on a full accrual basis, which recognizes that the economic benefit of expenditures may last for more than a fiscal year.

The Public Accounts of Canada include financial statements for the Government of Canada as well as details of expenses and revenues for completed fiscal years. Information in Volume I corresponds to the Federal Budget. Volume II provides information on the same near cash basis as the Estimates.

This Document

Part I of this document, the Government Expenditure Plan, gives an overview of spending requirements for 2016–17 and comparisons to previous fiscal years.

Part II of this document, the Main Estimates, provides information on estimated spending by each federal organization requesting authority to spend through a 2016-17 appropriation bill.

Summary of Estimates

These Estimates support the government's request to Parliament for authority to expend through annual appropriations:

- $89.8 billion for budgetary expenditures – operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations; and

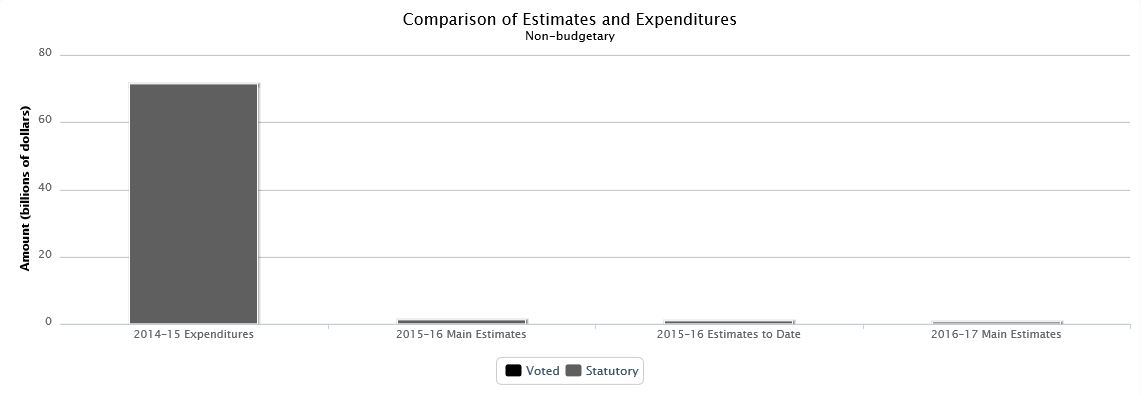

- $26.7 million for non-budgetary expenditures – net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

These voted expenditures require annual approval from Parliament which is sought through an appropriation bill. The bill provides the specific wording that governs the purpose and conditions under which expenditures can be made and the funds subject to these terms and conditions.

Statutory forecasts represent payments to be made under legislation previously approved by Parliament. Statutory forecasts are included in these Estimates to provide a more complete picture of total estimated expenditures. Of these forecasts, $160.3 billion is for budgetary expenditures including the cost of servicing the public debt. Major transfer payments, most notably elderly benefits and the Canada Health Transfer, account for the bulk of the increase from the 2015–16 Main Estimates. Forecast cash outlays for loans, investments and advances are expected to exceed recoveries by $338.8 million.

| 2014–15 Expenditures | 2015–16 Main Estimates | 2015–16 Estimates To Date | 2016–17 Main Estimates | |

|---|---|---|---|---|

Note: Totals may not add and may not agree with details presented later in this document due to rounding. |

||||

| Budgetary | ||||

| Voted | 84.16 | 88.18 | 94.97 | 89.85 |

| Statutory | 146.96 | 153.39 | 155.72 | 160.29 |

| Total Budgetary | 231.12 | 241.57 | 250.69 | 250.14 |

| Non-budgetary | ||||

| Voted | 0.04 | 0.07 | 0.07 | 0.03 |

| Statutory | 71.13 | 0.93 | 0.68 | 0.34 |

| Total Non-budgetary | 71.17 | 1.00 | 0.75 | 0.37 |

The following graphs present the voted and statutory components of Main Estimates and a comparison of Main Estimates over the last ten years of Main Estimates.

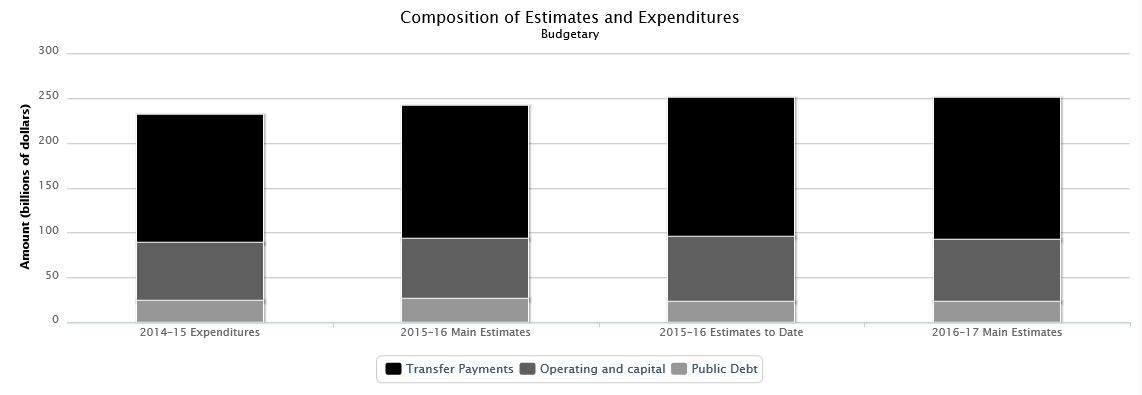

| 2014–15 Expenditures | 2015–16 Main Estimates | 2015–16 Estimates To Date | 2016–17 Main Estimates | |

|---|---|---|---|---|

Note: Totals may not add and may not agree with details presented later in this document due to rounding. |

||||

| Budgetary | ||||

| Transfer Payments | 142.13 | 148.80 | 154.84 | 158.58 |

| Operating and capital | 65.50 | 67.16 | 72.80 | 68.77 |

| Public Debt | 23.49 | 25.62 | 23.05 | 22.78 |

| Total Budgetary | 231.12 | 241.57 | 250.69 | 250.14 |

| Non-budgetary | ||||

| Loans, Investments and Advances | 71.17 | 1.00 | 0.75 | 0.37 |

| Total Non-budgetary | 71.17 | 1.00 | 0.75 | 0.37 |

Composition of Estimates

The majority of expenditures in 2016–17 will be transfer payments – payments made to other levels of government, individuals and other organizations. Transfer payments make up approximately 63.4% of expenditures or $158.6 billion, operating and capital expenditures account for approximately 27.5% of expenditures or $68.8 billion, while public debt charges are approximately 9.1% of expenditures or $22.8 billion.

Public Debt Charges

Total interest costs are approximately 9.1% of expenditures or $22.8 billion, a projected decrease of $2.8 billion or 10.9% from previous Main Estimates and $0.7 billion less than actual expenditures for 2014–15. The decrease largely reflects the downward revision of forecasted interest rates by private sector economists, consistent with the 2015 Update of Economic and Fiscal Projections, as well as a decrease in the average Government of Canada long-term bond rate that is used to calculate interest on the public sector pension obligations pertaining to service prior to April 1, 2000. Total interest costs are comprised of interest on unmatured debt of $15.7 billion and other interest costs of $7.1 billion. Interest on unmatured debt represents the interest resulting from certificates of indebtedness issued by the Government of Canada that have not yet become due. Other interest costs include interest on liabilities for federal public service pension plans, deposit and trust accounts and other specified purpose accounts.

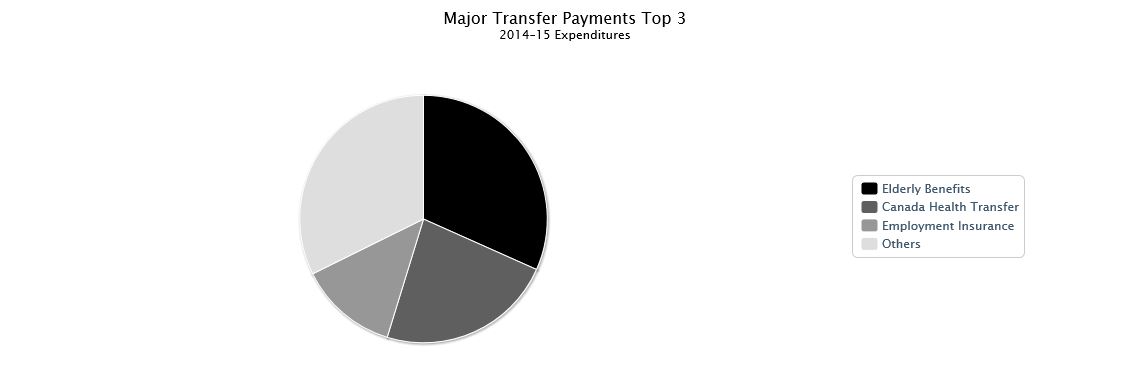

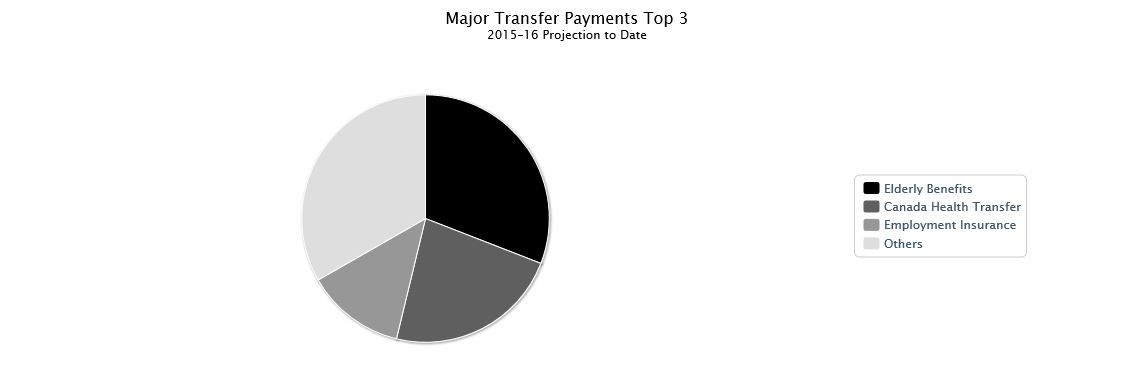

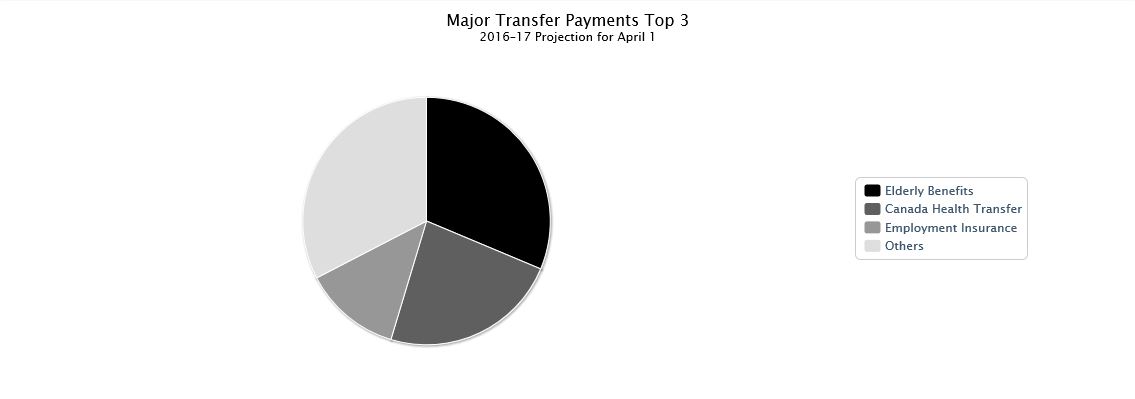

Major Transfer Payments

| 2014–15 Expenditures | 2015–16 Projection for April 1 | 2015–16 Projection to Date | 2016–17 Projection for April 1 | |

|---|---|---|---|---|

Note: Totals may not add and may not agree with details presented later in this document due to rounding. |

||||

| Transfers to other levels of government | ||||

| Canada Health Transfer | 32.11 | 34.03 | 34.03 | 36.07 |

| Fiscal Equalization | 16.67 | 17.34 | 17.34 | 17.88 |

| Canada Social Transfer | 12.58 | 12.96 | 12.96 | 13.35 |

| Territorial Financing | 3.47 | 3.56 | 3.56 | 3.54 |

| Gas Tax Fund | 2.00 | 2.00 | 2.00 | 2.10 |

| Additional Fiscal Equalization Offset Payment to Nova Scotia | 0.06 | 0.04 | 0.04 | 0.03 |

| Additional Fiscal Equalization to Nova Scotia | 0.13 | 0.08 | 0.09 | 0.02 |

| Youth Allowances Recovery | (0.77) | (0.85) | (0.84) | (0.89) |

| Alternative Payments for Standing Programs | (3.47) | (3.87) | (3.82) | (4.04) |

| Total transfers to other levels of government | 62.80 | 65.28 | 65.35 | 68.05 |

| Transfers to persons | ||||

| Elderly Benefits | 44.13 | 46.07 | 46.01 | 48.41 |

| Employment Insurance | 18.05 | 18.20 | 19.30 | 19.70 |

| Other Children's Benefits | 11.56 | 15.45 | 10.56 | 10.70 |

| Universal Child Care Benefits | 2.74 | 2.85 | 7.64 | 7.70 |

| Total transfers to persons | 76.49 | 82.57 | 83.51 | 86.50 |

| Total Major Transfer Payments | 139.28 | 147.85 | 148.86 | 154.55 |

Major Transfer Payments

Major transfer payments – significant transfers to other levels of government and transfers to persons – account for a large proportion of the government's total expenditure framework.

Forecast expenditures for major transfer payments are included in the total budgetary Main Estimates of the responsible organization, with two exceptions. One is Employment Insurance, which is reported through the Employment Insurance Operating Account and is separate from any of the appropriated organizations listed in these Main Estimates. The other exception is "Other Children's Benefits", details of which are included in the Department of Finance's Tax Expenditures and Evaluations report.

As presented in the table, major statutory transfers to other levels of government are projected to total $68.1 billion in 2016–17, an increase of $2.8 billion over the previous year's Main Estimates.

The Canada Health Transfer (CHT) is a federal transfer provided to provinces and territories in support of health care. As of 2014–15, the CHT is distributed on an equal per capita cash basis. In 2016–17, the CHT will increase by $2.0 billion, or 6%, from the 2015–16 amount to a total of $36.1 billion. Starting in 2017-18, growth of the CHT will be based on a 3-year moving average of nominal gross domestic product, with funding guaranteed to increase by at least 3% per year. CHT support is subject to the five conditions of The Canada Health Act: universality; comprehensiveness; portability; accessibility; and public administration, and the prohibitions against extra-billing and user fees.

Fiscal Equalization refers to unconditional transfer payments to enable less prosperous provincial governments to provide their residents with public services that are reasonably comparable to those in other provinces, at reasonably comparable levels of taxation. These payments will be $17.9 billion in 2016–17, an increase of $0.5 billion from the Main Estimates 2015–16, and $1.2 billion more than 2014–15 actual expenditures.

The Canada Social Transfer (CST) is a federal transfer to provinces and territories in support of social assistance and social services, post-secondary education, and programs for children. The legislated 3% growth rate results in an increase of $388.8 million to $13.3billion in 2016-17.

The Territorial Formula Financing (TFF) Program, provides unconditional federal transfers that allow territorial governments to provide their residents with public services comparable to those offered by provincial governments, at comparable levels of taxation. The transfers are based on a formula that fills the gap between a proxy of territorial expenditure requirements and a territory's revenue-raising capacity. These payments will be $3.5 billion in 2016–17, $24.7 million lower than the 2015–16 Main Estimates.

The Gas Tax Fund provides predictable, long-term, stable funding for Canadian municipalities to help them build and revitalize their local public infrastructure while creating jobs and long term prosperity. Beginning in 2014–15, the Gas Tax Fund became a statutory payment. Prior to the 2014–15 fiscal year, payments were approved through Appropriation Acts (Voted).

The Additional Fiscal Equalization Offset Payment to Nova Scotia is a payment related to its 2005 Offshore Accord. This Accord guaranteed the province that its Equalization payments would not be reduced due to offshore oil and gas revenues that entered the Equalization formula. This is derived by applying the Equalization formula with and without offshore oil and gas revenues and comparing the resulting Equalization payments. The province is expected to receive $33.3 million for 2016–17, a decrease of $3.5 million compared with the amount for 2015–16.

Additional Fiscal Equalization Payments to Nova Scotia are payments related to its 2005 Offshore Accord. Following the introduction of a new formula for Equalization in 2007, Nova Scotia was guaranteed that, on a cumulative basis beginning in 2008–09 over the lifetime of the Accord, the new formula would not reduce its Equalization payments and 2005 Offshore Accord payments when compared with what the province would have received under the formula that was in place when it signed its 2005 Offshore Accord. Based on the first calculation of 2016–17, Nova Scotia is entitled to an advance payment of $16.0 million in 2016–17, a decrease of $63.3 million when compared to Main Estimates 2015–16. However, the December 2015 official determination of 2015–16 (upon which payments will be made), is $88.2 million, which is reflected in the Supplementary Estimates (C), 2015–16.

The Youth Allowance Recovery relates to tax points transferred to the province of Quebec for the Youth Allowance program, which has since expired. The equivalent value of the tax point reduction is recovered each year from the province of Quebec. The change in recoveries for the Youth Allowances Recovery Program is entirely due to year-over-year changes to the value of federal personal income taxes, the recovery being a percentage of these taxes. For 2016–17, the forecast recovery of $890.7 million is $37.6 million higher than the initial 2015–16 forecast in Main Estimates and $48.5 million higher than the forecast in the 2015–16 Supplementary Estimates (C) due to higher forecast levels of federal personal income taxes.

Alternative Payments for Standing Programs represent recoveries from Quebec of an additional tax point transfer above and beyond the tax point transfer traditionally computed under the Canada Health Transfer, the Canada Social Transfer and the Youth Allowances Recovery. The change in recoveries for the Alternative Payments for Standing Programs is entirely due to year-over-year changes to the value of federal personal income taxes, the recovery being a percentage of these taxes. For 2016–17, the forecast recovery of $4.0 billion is $170.8million higher than the forecast in the 2015–16 Main Estimates and $219.4 million higher than that in 2015–16 Supplementary Estimates (C) due to higher forecast levels of federal personal income taxes.

Transfers to Persons

Elderly benefits include Old Age Security, Guaranteed Income Supplement, and Allowance payments. Elderly benefit payments are expected to be $48.4 billion in 2016–17, an increase of $2.3 billion over the 2015–16 Main Estimates and $4.3 billion more than actual expenditures in 2014–15.

The Universal Child Care Benefit is a taxable child benefit provided to families in monthly payments. "Other Children's Benefits" include the Canada Child Tax Benefit – a tax-free monthly payment made to eligible families to help them with the cost of raising children under age 18. The Universal Child Care Benefit was increased on July 1, 2015, from $100 per month for each child under the age of six to $160 per month, and a new benefit of $60 per month for each child age six through seventeen was created. The change was retroactive to January 1, 2015. Payments from the two programs are forecast to total $18.4 billion in 2016–17, an increase of $0.2 billion over the 2015–16 Main Estimates and $4.1 billion more than actual expenditures in 2014–15.

Employment Insurance provides temporary financial assistance to unemployed Canadians who have lost their job through no fault of their own, while they look for work or upgrade their skills. Employment Insurance is reported through the Employment Insurance Operating Account and is separate from any of the appropriated organizations listed in these Main Estimates.

Estimates by Organization

One hundred thirty-one organizations are represented in the 2016–17 Estimates. More information about each organization can be found in Part II – Main Estimates

| 2014–15 Expenditures | 2015–16 Main Estimates | 2015–16 Estimates To Date | 2016–17 Main Estimates | |

|---|---|---|---|---|

| Budgetary | ||||

| Administrative Tribunals Support Service of Canada | 26,737,475 | 60,896,030 | 60,896,030 | 58,024,536 |

| Agriculture and Agri-Food | 2,013,991,368 | 2,257,088,060 | 2,345,960,234 | 2,263,733,256 |

| Atlantic Canada Opportunities Agency | 305,273,091 | 298,584,989 | 303,757,469 | 308,197,204 |

| Atomic Energy of Canada Limited | 326,743,000 | 119,143,000 | 336,326,692 | 968,615,589 |

| Auditor General | 81,863,430 | 78,295,020 | 78,295,020 | 78,533,732 |

| Canada Border Services Agency | 2,001,144,370 | 1,774,214,921 | 1,850,524,916 | 1,673,039,553 |

| Canada Council for the Arts | 182,224,388 | 182,097,387 | 182,224,388 | 182,347,387 |

| Canada Industrial Relations Board | 7,488,344 | 0 | 0 | 0 |

| Canada Mortgage and Housing Corporation | 2,053,213,063 | 2,025,629,000 | 2,025,629,000 | 2,027,901,048 |

| Canada Post Corporation | 22,210,000 | 22,210,000 | 22,210,000 | 22,210,000 |

| Canada Revenue Agency | 4,060,833,990 | 3,804,844,388 | 3,887,739,495 | 4,085,718,183 |

| Canada School of Public Service | 88,509,012 | 70,879,683 | 70,879,683 | 83,244,944 |

| Canadian Air Transport Security Authority | 623,896,764 | 678,420,347 | 684,934,134 | 624,005,722 |

| Canadian Broadcasting Corporation | 1,038,023,798 | 1,038,023,798 | 1,038,023,798 | 1,038,023,798 |

| Canadian Centre for Occupational Health and Safety | 4,685,938 | 5,070,269 | 5,070,269 | 8,952,372 |

| Canadian Commercial Corporation | 14,240,000 | 8,880,000 | 8,880,000 | 3,510,000 |

| Canadian Dairy Commission | 3,884,137 | 3,605,377 | 3,605,377 | 3,599,617 |

| Canadian Environmental Assessment Agency | 29,757,089 | 17,351,870 | 23,928,920 | 30,911,035 |

| Canadian Food Inspection Agency | 848,492,889 | 698,151,888 | 738,061,543 | 739,739,165 |

| Canadian Grain Commission | (16,912,346) | 5,475,177 | 5,475,177 | 5,381,924 |

| Canadian Heritage | 1,481,855,307 | 1,254,696,561 | 1,263,479,582 | 1,294,505,478 |

| Canadian High Arctic Research Station | 0 | 0 | 263,078 | 19,475,274 |

| Canadian Human Rights Commission | 23,219,162 | 22,162,418 | 22,162,418 | 22,149,172 |

| Canadian Human Rights Tribunal | 2,468,673 | 0 | 0 | 0 |

| Canadian Institutes of Health Research | 1,017,279,382 | 1,008,583,999 | 1,025,117,614 | 1,025,620,003 |

| Canadian Intergovernmental Conference Secretariat | 5,169,487 | 5,967,541 | 5,967,541 | 5,974,970 |

| Canadian International Trade Tribunal | 5,724,496 | 0 | 0 | 0 |

| Canadian Museum for Human Rights | 21,700,000 | 21,700,000 | 21,700,000 | 21,700,000 |

| Canadian Museum of History | 68,923,716 | 83,369,477 | 83,369,477 | 66,199,477 |

| Canadian Museum of Immigration at Pier 21 | 9,900,000 | 7,700,000 | 7,700,000 | 7,700,000 |

| Canadian Museum of Nature | 26,276,818 | 26,129,112 | 26,129,112 | 26,129,112 |

| Canadian Northern Economic Development Agency | 49,120,561 | 50,668,666 | 50,731,666 | 26,233,451 |

| Canadian Nuclear Safety Commission | 138,139,569 | 133,179,745 | 133,283,236 | 136,166,216 |

| Canadian Polar Commission | 2,355,267 | 2,574,085 | 2,574,085 | 0 |

| Canadian Radio-television and Telecommunications Commission | 11,446,162 | 12,256,890 | 12,160,264 | 12,123,695 |

| Canadian Security Intelligence Service | 515,275,578 | 537,037,245 | 551,928,885 | 572,069,066 |

| Canadian Space Agency | 376,090,938 | 483,428,281 | 487,428,282 | 432,394,821 |

| Canadian Tourism Commission | 57,975,770 | 57,975,770 | 62,975,770 | 70,475,770 |

| Canadian Transportation Accident Investigation and Safety Board | 32,219,331 | 29,729,799 | 29,729,799 | 29,788,652 |

| Canadian Transportation Agency | 28,777,849 | 27,733,404 | 27,733,404 | 27,792,087 |

| Chief Electoral Officer | 150,766,375 | 395,959,817 | 395,959,817 | 98,535,261 |

| Citizenship and Immigration | 1,360,751,108 | 1,464,667,008 | 1,762,638,045 | 1,650,832,227 |

| Civilian Review and Complaints Commission for the Royal Canadian Mounted Police | 9,599,971 | 10,011,723 | 10,011,723 | 10,028,317 |

| Commissioner for Federal Judicial Affairs | 517,620,426 | 524,851,120 | 527,851,120 | 555,174,253 |

| Communications Security Establishment | 856,433,238 | 538,201,730 | 577,615,137 | 583,624,818 |

| Copyright Board | 3,069,506 | 3,110,713 | 3,110,713 | 3,111,724 |

| Correctional Service of Canada | 2,575,228,312 | 2,350,488,926 | 2,363,378,926 | 2,362,592,079 |

| Courts Administration Service | 69,150,406 | 63,952,587 | 63,952,587 | 72,351,643 |

| Economic Development Agency of Canada for the Regions of Quebec | 253,897,916 | 261,082,194 | 264,519,194 | 303,119,941 |

| Employment and Social Development | 52,204,757,172 | 54,265,536,116 | 59,205,590,929 | 61,637,881,808 |

| Enterprise Cape Breton Corporation | 9,865,841 | 0 | 0 | 0 |

| Environment | 976,186,637 | 961,051,076 | 983,310,734 | 902,089,198 |

| Federal Economic Development Agency for Southern Ontario | 104,103,143 | 215,251,719 | 211,251,719 | 234,447,852 |

| Finance | 85,683,154,816 | 89,646,397,112 | 87,199,382,405 | 89,463,792,510 |

| Financial Transactions and Reports Analysis Centre of Canada | 51,404,430 | 50,450,180 | 54,439,944 | 56,697,062 |

| Fisheries and Oceans | 1,736,967,289 | 1,889,240,348 | 2,278,555,600 | 2,241,049,589 |

| Foreign Affairs, Trade and Development | 5,939,344,157 | 5,526,817,200 | 6,052,320,264 | 5,515,540,897 |

| Governor General | 20,861,040 | 20,131,117 | 21,993,417 | 23,145,434 |

| Health | 3,814,473,966 | 3,658,770,349 | 3,691,631,997 | 3,756,604,937 |

| House of Commons | 421,827,802 | 443,449,092 | 469,016,903 | 463,627,783 |

| Immigration and Refugee Board | 119,750,033 | 112,709,491 | 114,412,311 | 114,502,666 |

| Indian Affairs and Northern Development | 7,691,653,138 | 8,187,417,868 | 8,812,909,136 | 7,505,552,140 |

| Indian Residential Schools Truth and Reconciliation Commission | 5,994,737 | 3,660,158 | 3,660,158 | 0 |

| Industry | 1,097,414,496 | 1,170,502,156 | 1,272,292,861 | 1,297,074,670 |

| International Development Research Centre | 190,023,783 | 183,478,242 | 183,478,242 | 149,205,625 |

| International Joint Commission (Canadian Section) | 6,764,952 | 6,761,044 | 6,761,044 | 6,772,067 |

| Justice | 708,851,618 | 673,866,874 | 683,917,443 | 678,860,530 |

| Library and Archives of Canada | 102,593,650 | 93,011,489 | 100,097,505 | 116,858,567 |

| Library of Parliament | 41,830,343 | 42,739,595 | 42,739,595 | 43,071,239 |

| Marine Atlantic Inc. | 127,484,000 | 19,384,000 | 374,331,000 | 140,122,000 |

| Military Grievances External Review Committee | 6,249,905 | 6,741,810 | 6,741,810 | 6,753,945 |

| Military Police Complaints Commission | 4,965,273 | 5,614,814 | 5,614,814 | 4,685,311 |

| National Arts Centre Corporation | 35,321,395 | 34,222,719 | 54,722,719 | 79,397,056 |

| National Battlefields Commission | 12,097,378 | 12,976,836 | 12,976,836 | 8,687,714 |

| National Capital Commission | 92,446,209 | 92,721,330 | 93,039,331 | 88,792,180 |

| National Defence | 18,453,938,461 | 18,942,053,629 | 19,353,508,936 | 18,640,268,933 |

| National Energy Board | 87,321,083 | 76,820,510 | 94,102,055 | 89,425,447 |

| National Film Board | 62,562,516 | 59,652,377 | 59,652,377 | 61,894,820 |

| National Gallery of Canada | 44,308,269 | 43,773,542 | 43,773,542 | 43,888,410 |

| National Museum of Science and Technology | 33,370,395 | 29,754,746 | 59,109,746 | 59,979,776 |

| National Research Council of Canada | 955,704,916 | 853,254,782 | 974,567,390 | 1,053,658,576 |

| Natural Resources | 2,049,418,787 | 2,214,476,711 | 2,515,174,980 | 1,592,518,753 |

| Natural Sciences and Engineering Research Council | 1,085,445,456 | 1,086,570,325 | 1,117,728,643 | 1,120,184,669 |

| Northern Pipeline Agency | 516,310 | 750,775 | 750,775 | 751,835 |

| Office of Infrastructure of Canada | 3,095,882,113 | 3,633,262,748 | 3,739,441,053 | 3,869,509,257 |

| Office of the Commissioner of Lobbying | 4,680,527 | 4,452,540 | 4,452,540 | 4,462,686 |

| Office of the Commissioner of Official Languages | 22,415,874 | 20,833,525 | 20,833,525 | 20,891,619 |

| Office of the Communications Security Establishment Commissioner | 2,043,560 | 2,031,067 | 2,031,067 | 2,125,377 |

| Office of the Conflict of Interest and Ethics Commissioner | 6,277,212 | 6,952,226 | 6,952,226 | 6,970,653 |

| Office of the Co-ordinator, Status of Women | 30,125,744 | 29,543,077 | 30,669,444 | 31,736,324 |

| Office of the Correctional Investigator | 4,768,000 | 4,655,541 | 4,655,541 | 4,664,536 |

| Office of the Director of Public Prosecutions | 175,246,750 | 170,718,195 | 183,335,490 | 185,665,457 |

| Office of the Public Sector Integrity Commissioner | 4,841,027 | 5,448,442 | 5,448,442 | 5,462,474 |

| Office of the Superintendent of Financial Institutions | 146,308,874 | 147,934,112 | 147,934,112 | 149,703,956 |

| Offices of the Information and Privacy Commissioners of Canada | 37,340,644 | 35,586,666 | 35,586,666 | 35,809,330 |

| Parks Canada Agency | 721,799,860 | 737,273,003 | 1,095,080,224 | 1,173,538,301 |

| Parliamentary Protective Service | 0 | 0 | 20,572,818 | 62,115,110 |

| Parole Board of Canada | 50,122,396 | 45,915,750 | 46,960,291 | 46,789,956 |

| Patented Medicine Prices Review Board | 7,930,280 | 10,945,181 | 10,945,181 | 10,965,108 |

| PPP Canada Inc. | 209,500,000 | 231,200,000 | 231,200,000 | 279,500,000 |

| Privy Council | 123,193,655 | 118,833,279 | 123,011,733 | 120,684,380 |

| Public Health Agency of Canada | 636,969,185 | 567,152,421 | 580,812,095 | 589,737,802 |

| Public Safety and Emergency Preparedness | 675,462,786 | 1,150,436,251 | 1,135,152,033 | 1,096,958,408 |

| Public Service Commission | 77,597,931 | 83,601,016 | 84,105,017 | 83,603,063 |

| Public Service Labour Relations Board | 8,004,719 | 0 | 0 | 0 |

| Public Service Staffing Tribunal | 2,973,549 | 0 | 0 | 0 |

| Public Works and Government Services | 2,767,163,511 | 2,871,525,596 | 3,024,776,320 | 2,870,459,398 |

| Registry of the Competition Tribunal | 575,378 | 0 | 0 | 0 |

| Registry of the Public Servants Disclosure Protection Tribunal | 965,243 | 0 | 0 | 0 |

| Registry of the Specific Claims Tribunal | 1,312,698 | 0 | 0 | 0 |

| Royal Canadian Mounted Police | 2,861,888,975 | 2,630,057,696 | 2,789,675,280 | 2,759,327,834 |

| Royal Canadian Mounted Police External Review Committee | 1,584,606 | 952,848 | 1,552,849 | 1,554,862 |

| Security Intelligence Review Committee | 2,980,020 | 2,796,368 | 3,086,243 | 2,801,996 |

| Senate Ethics Officer | 703,221 | 1,168,700 | 1,168,700 | 1,171,300 |

| Shared Services Canada | 1,622,381,855 | 1,444,044,025 | 1,498,258,332 | 1,549,854,701 |

| Social Sciences and Humanities Research Council | 712,926,648 | 717,089,852 | 718,933,521 | 720,012,809 |

| Standards Council of Canada | 12,889,535 | 9,829,000 | 9,829,000 | 9,329,000 |

| Statistics Canada | 467,202,461 | 525,090,820 | 525,090,821 | 751,484,013 |

| Supreme Court of Canada | 31,992,787 | 31,763,943 | 31,763,943 | 33,217,202 |

| Telefilm Canada | 95,453,551 | 95,453,551 | 95,453,551 | 95,453,551 |

| The Federal Bridge Corporation Limited | 8,138,200 | 35,281,996 | 35,281,996 | 31,414,312 |

| The Jacques-Cartier and Champlain Bridges Inc. | 244,957,619 | 368,737,000 | 426,801,000 | 351,919,000 |

| The Senate | 85,402,391 | 88,747,958 | 88,747,958 | 90,115,308 |

| Transport | 1,605,081,311 | 1,615,012,278 | 1,685,413,449 | 1,265,907,597 |

| Transportation Appeal Tribunal of Canada | 884,415 | 0 | 0 | 0 |

| Treasury Board Secretariat | 3,221,689,682 | 6,892,444,333 | 7,941,060,118 | 6,570,806,029 |

| Veterans Affairs | 3,376,879,954 | 3,522,078,175 | 3,660,068,788 | 3,628,281,702 |

| Veterans Review and Appeal Board | 11,423,299 | 10,896,563 | 10,896,563 | 10,921,149 |

| VIA Rail Canada Inc. | 406,210,121 | 330,077,000 | 395,067,134 | 382,830,000 |

| Western Economic Diversification | 162,002,536 | 159,913,914 | 163,429,033 | 173,391,536 |

| Windsor-Detroit Bridge Authority | 8,059,104 | 58,469,905 | 461,094,912 | 215,989,827 |

| Total Budgetary | 231,119,942,327 | 241,574,296,708 | 250,686,079,790 | 250,136,477,494 |

| Non-budgetary | ||||

| Canada Mortgage and Housing Corporation | (10,465,313,333) | (139,123,000) | (139,123,000) | (644,314,000) |

| Canadian Dairy Commission | (34,865,529) | 0 | 0 | 0 |

| Citizenship and Immigration | 1,201,648 | 0 | 0 | 0 |

| Correctional Service of Canada | (170) | 0 | 0 | 0 |

| Employment and Social Development | 844,568,846 | 1,027,422,531 | 776,467,550 | 979,969,792 |

| Finance | 80,735,156,755 | 0 | 0 | 0 |

| Foreign Affairs, Trade and Development | 66,603,112 | 45,146,541 | 45,471,875 | 3,098,451 |

| Indian Affairs and Northern Development | 38,448,505 | 70,303,000 | 70,303,000 | 25,903,000 |

| Industry | 0 | 800,000 | 800,000 | 800,000 |

| National Defence | (4,645,510) | 0 | 0 | 0 |

| Public Works and Government Services | (11,463,186) | 0 | 0 | 0 |

| Veterans Affairs | (416) | 0 | 0 | 0 |

| Total Non-budgetary | 71,169,690,722 | 1,004,549,072 | 753,919,425 | 365,457,243 |

Structure of these Estimates

Votes

The basic structural units of the Estimates are the Votes. The following kinds of Votes appear in the Estimates:

A program expenditures vote is used when there is no requirement for either a separate "capital expenditures" vote or a "grants and contributions" vote because neither equals or exceeds $5 million. In this case, all expenditures are charged to the one vote.

An operating expenditures vote is used when there is also a requirement for either a "capital expenditures" vote or a "grants and contributions" vote or both; that is, when expenditures of either type equal or exceed $5 million. Where they do not, the appropriate expenditures are included in the "program expenditures" vote.

A capital expenditures vote is used when the aggregate of capital expenditures equal or exceed $5 million. Capital expenditures are those made for the acquisition or development of items that are classified as tangible capital assets as defined by Government accounting policies. For example, the acquisition of real property, infrastructure, machinery or equipment, or for purposes of constructing or developing assets, where an organization expects to draw upon its own labour and materials, or employs professional services or other services or goods. Expenditure items in a Capital Expenditures Vote are for items that generally exceed $10,000; although an organization may select a reduced threshold to be applied to different capital classes.

A grants and contributions vote is used when grants and/or contributions expenditures equal or exceed $5 million. It should be noted that the inclusion of a grant, contribution or other transfer payment item in the Estimates imposes no requirement to make a payment, nor does it give a prospective recipient any right to the funds. It should also be noted that in the vote wording, the meaning of the word "contributions" is considered to include "other transfer payments" because of the similar characteristics of each.

A non-budgetary vote, identified by the letter "L", provides authority for spending in the form of loans or advances to, and investments in, Crown corporations; and loans or advances for specific purposes to other governments, international organizations or persons or corporations in the private sector.

Where it is necessary to appropriate funds for a payment to a Crown corporation or for the expenditures of a legal entity that is part of a larger program, a separate vote is established. Where this is the case, a separate vote structure is established for each. A legal entity for these purposes is defined as a unit of government operating under an Act of Parliament and responsible directly to a Minister.

To support the Treasury Board in performing its statutory responsibilities for managing the government's financial, human and materiel resources, a number of special authorities are required. These authorities are described in the vote wording found in the Proposed Schedules to the Appropriation Bill.

Information Presented in the 2016–17 Main Estimates

Departments and agencies are presented alphabetically according to the legal name of the department or agency. For some organizations, the legal name differs from the name in common usage. In such cases, their commonly-used name is noted in their raison d'être.

Forecast statutory expenditures are summarized in this document. Details are available in the 2016–17 Statutory Forecasts online table.

Abbreviated vote wordings are used in organization summaries. Complete vote wording is shown in the Proposed Schedules to the Appropriation Bill following Part II.

Information on 2014–15 actual expenditures and 2015–16 Estimates to Date are included to provide context for the 2016–17 amounts. The 2014–15 actual expenditures are taken from the 2014–15 Public Accounts of Canada. 2015–16 Estimates to Date is the sum of the amounts presented in the 2015–16 Main Estimates and increases sought through the 2015–16 Supplementary Estimates A, B and C. Estimates to date excludes any funding deemed to have been appropriated to a department following the transfer of a portion of the federal administration. Allocations from Treasury Board Central Votes are made throughout the year and the expenditure authority provided by these allocations is also not included in Estimates to Date.

The 2016–17 Program Alignment Architecture is used for the tables presenting information by Strategic Outcome and Program. If there has been a change in the Architecture, amounts for previous years have not been reclassified to the new structure and are reported as "Funds not allocated to the 2016–17 Program Alignment Architecture".

If applicable, a table provides a listing of transfer payments planned for the 2016–17 fiscal year, with comparative amounts from previous fiscal years for programs with funding in 2016–17. A transfer payment is a grant, contribution or other payment made for the purpose of furthering program objectives but for which no goods or services are received. Details on transfer payments made in a previous year can be found in Volumes 2 and 3 of the Public Accounts of Canada.

Supplementary online tables for the 2016–17 Main Estimates show forecast expenditures by:

- Standard Object: the table shows the types of goods or services to be acquired, or the transfer payments to be made and the revenues to be credited to the vote; and,

- Strategic Outcome and Program: planned expenditures are classified under the 2016–17 Program Alignment Architecture. If there has been a change in the Architecture, amounts for previous years have not been reclassified to the new structure.

In-year information on expenditure authorities is available in departmental Quarterly Financial Reports, and final expenditure authority and actual expenditures for a fiscal year are reported in the Public Accounts of Canada. The Treasury Board Secretariat (TBS) InfoBase also provides financial and people management data for all organizations that receive government appropriations.

Changes to these Estimates

The purpose of this section is to provide the reconciliation of these Estimates with the previous year's Main Estimates in the following areas:

- Changes to government organization and structure; and

- Changes in authorities (Votes).

Changes to Government Organization and Structure

Following the tabling of the 2015–16 Main Estimates on February 24, 2015, these changes were made.

- Supplementary Estimates (A), 2015–16:

- The Canadian High Arctic Research Station Act, which came into force on June 1, 2015, established the Canadian High Arctic Research Station.

- Supplementary Estimates (B), 2015–16:

- The Economic Action Plan 2015 Act, No. 1 established the Parliamentary Protective Service.

Changes in Voted Authorities

This sub-section lists Votes which contain specific authorities that differ from those included in the previous year's Main Estimates as well as new expenditure authorities appearing for the first time. In light of the House of Commons Speaker's rulings in 1981, the government has made a commitment that the only legislation that will be enacted through the Estimates process, other than cases specifically authorized by Statute, will be previous Appropriation Acts.

- Citizenship and Immigration

-

The department has a new capital expenditures vote in 2016–17.

Wording is added to the grants and contributions vote, adding authority to provide goods and services.

- Finance

-

Vote 1 becomes a vote for program expenditures and contributions. A separate grants and contributions vote is no longer required.

The wording of Vote 10 sets out the maximum amount of financial assistance to the International Development Association for the 2016–17 fiscal year.

- Financial Transactions and Reports Analysis Centre of Canada

-

The authority to expend revenues received in a fiscal year through the provision of internal support is removed from the wording of Vote 1.

- Foreign Affairs, Trade and Development

-

The wording of Votes 20 and L25 sets out the maximum amount of financial assistance to international financial institutions for the 2016–17 fiscal year.

- Library and Archives of Canada

-

The organization has a new capital expenditures vote in 2016–17.

Vote 1 program expenditures wording adds authority for contributions.

- National Defence

-

The wording of Vote 1 sets out the maximum total amount of commitments the department can make during the 2016–17 fiscal year, regardless of the year in which the payment of those commitments comes due.

- National Research Council of Canada

-

Vote 10 grants and contributions wording adds authority to provide goods and services for the international Thirty Meter Telescope Observatory.

- Offices of the Information and Privacy Commissioners of Canada

-

The wording of Vote 5 adds authority to expend revenues received in a fiscal year through the provision of internal support.

- Statistics Canada

-

Vote 1 program expenditures wording adds authority for the payment of grants listed in the estimates.

- Transport

-

Parliament is asked to approve appropriations by vote. The vote structure is currently based on the type of expenditure (e.g. operating, capital, grants and contributions). The Department of Transport is the subject of a pilot project through which its grants and contributions will appear in separate votes based on a program structure. Transport's grants and contributions are divided into three separate votes in 2016–17 based on the departmental Program Alignment Architecture. More information about the pilot project may be found in a separate online document.