Audit of Canada Pension Plan Program delivery

On this page

- List of abbreviations

- Background

- Context

- Audit objective

- Scope

- Methodology

- Audit findings

- Collection of information to adjudicate CPP benefits can be more efficient

- The Department can strengthen controls to prevent error, omissions and fraud

- Controls to achieve correct and consistent decisions are adequate

- The Department processes information affecting CPP benefits in a timely manner

- There is a need to implement service standards and a quality assurance framework for reconsiderations

- Conclusion

- Statement of Assurance

- Appendix A: Audit criteria assessment

List of abbreviations

- BISB

- Benefits and Integrated Services Branch

- CPP

- Canada Pension Plan

- ESDC

- Employment and Social Development Canada

- QPP

- Quebec Pension Plan

- SADM

- Senior Assistant Deputy Minister

1. Background

1.1 Context

ESDC (the Department) is responsible for the administration of the CPP. The Plan operates throughout Canada with the exception of Québec. In this province, the QPP provides similar benefits through Retraite Québec. Together, these 2 plans provide financial assistance to contributors and their families in the case of retirement, disability and death.

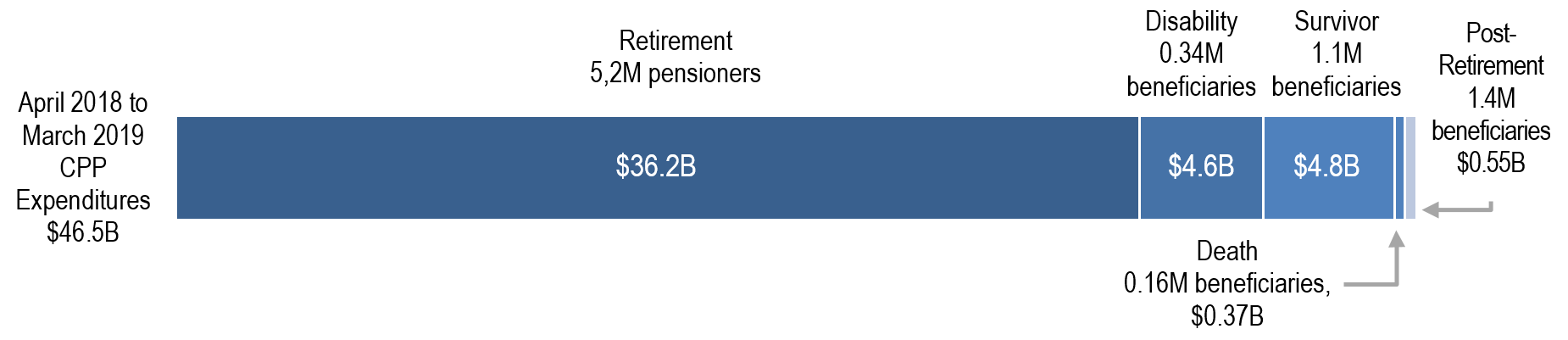

According to the latest CPP annual report available (for fiscal year 2018 to 2019), the program paid $46.5 billion to 5.9 million clients. The majority of program payments was the monthly retirement pension. The program also includes disability benefits, children of disabled contributor's benefits, survivor's pension, surviving child's benefit, death benefits and post-retirement benefits.

Figure 1 – Text version

This staked bar figure illustrates the breakdown of $46.5 billion of CPP expenditures for the April 2018 to March 2019 fiscal year:

- 5.2 million CPP retirement pensioners were paid $36.2 billion

- 340,000 people with disabilities and 83,000 of their children were paid $4.6 billion

- 1.1 million surviving spouses or common-law partners and 63,000 children of deceased contributors were paid $4.8 billion

- 166,000 death benefits totaling $377 million were paid

- 1.4 million post-retirement beneficiaries were paid $553 million

Since 2019, the Government has been gradually phasing-in the CPP enhancement. The enhancement will increase the retirement, survivor's and disability pensions and post-retirement benefits of individuals who work and contribute in 2019 or later. The Department has also initiated modernization initiatives such as the CPP Service Improvement Strategy. These initiatives respond to the unprecedented influx of beneficiaries due to the aging population. They also respond to the increasing demand to make government services more accessible, online and otherwise. Further, they aim to achieve user-friendlier electronic services, resolve client issues faster and strengthen service standards. In addition, Benefits Delivery Modernization intends to modernize 3 statutory programs (including CPP) through a strategic, multi-year initiative. The modernization intends to achieve long-term benefits for clients through people, process, and technology changes.

BISB and the regional management are jointly responsible for daily operations of CPP processing and call centres. In addition, 3 other branches support the delivery of the program:

- Income Security and Social Development Branch for policy development

- Integrity Services Branch for compliance activities

- Citizen Service Branch for service delivery channels

Furthermore, to deliver the CPP program, the Department shares information with other federal departments, the provinces and territories.

1.2 Audit objective

The objective of this audit was to determine whether the Department manages the delivery of the CPP effectively and efficiently.

1.3 Scope

The scope of this audit included key controls related to the intake, processing, maintenance and reconsideration of the following benefits:

- retirement pension

- death benefit

- survivor's pension

- surviving child's benefit

- post-retirement benefit

The audit also included key controls related to information protection as well as monitoring and reporting of the above benefits. However, the audit excluded:

- disability pensions and disabled contributor's child's benefit (covered by the Office of the Auditor General and internal audit in 2015)

- payment accuracy and authority, as it relates to the Financial Administration Act (covered in an upcoming internal audit of controls around payment processes)

- any payments made under the QPP as Retraite Québec administers these benefits

- any benefits paid under International Social Security Agreements as internal audit subjected these to an audit in 2017

- any appeals to the Social Security Tribunal under the General Division or Appeal Division as the Tribunal is independent from the Department

1.4 Methodology

The audit used a number of methodologies, which included:

- documentation review and analysis

- on-site observation and walkthroughs of processes within the Atlantic, Ontario, and Western Canada and Territories regions

- interviews with management and staff from stakeholder branches and regions visited

2. Audit findings

2.1 Collection of information to adjudicate CPP benefits can be more efficient

To apply for CPP, clients can either:

- apply online for their CPP retirement pension

- complete the ISP-1000 form (available online for home printing)

Clients can complete online applications through the "My Service Canada Account" portal since 2015. From April 2017 to March 2018, approximately 81,000 people, representing 27% of all applications, applied for their CPP retirement pension online. A year later, that number rose to 135,000 (43% of all applications). From April 2020 to March 2021 that number increased to 48% of all applications. However, at the time of the audit, online applications were still limited. For example the following individuals cannot apply online:

- clients that live outside of Canada

- previously applied for or receive(d) disability benefits

- preferred to receive their benefits by cheque

As the Department keeps improving its online application process, it will be important that paper and online applications offer the same flexibility to clients. The Department also ought to use consistent controls for both online and paper applications to reduce errors or omissions. For example, when using a paper form to apply for the Child Rearing Provision, officers will contact clients that appear unlikely to be eligible for the provision (to confirm their intention to apply). However, officers interviewed indicated they do not perform the same check for online applications.

Clients can also apply for their retirement pension using the paper ISP-1000 form. When they do so, they can either:

- mail their application to one of the Department's mail processing facilities, or

- they can drop it off at an in-person Service Canada Centre

With a length of 8 pages and a separate 8-page "Information Sheet", the Department needs to review the form for clarity, conciseness and usability. All officers interviewed agreed that most clients did not read or print the "Information Sheet". In our opinion, CPP forms should consider to include all important information that assist clients in completing their application correctly. For example, the Child Rearing Provision section of the ISP-1000 form does not include the definition of "primary caregiver" (found in the "Information Sheet"). This has resulted in some clients applying for the provision by mistake, creating additional work for adjudicating officers.

Internal Audit also found that the form used to apply for the CPP Death Benefit contained unclear instructions about which supporting documents to provide. This can result in officers having to contact the client to request additional documents to complete the processing of benefits. Another example is the form used to apply for a Survivor's Pension and Children's Benefits. The form does not collect information to verify if the deceased could qualify for the Child Rearing Provision. This could result in an underpayment or erroneous determination of eligibility. Furthermore, Internal Audit did not find a formal or regular process aimed at improving the usability of the CPP paper forms.

Recommendation

- The SADM of BISB should periodically review online and paper forms to improve their usability as well as control consistency. This review process should consider client feedback.

Management response

BISB agrees with this recommendation.

BISB makes every effort to ensure client usability as forms are updated due to required changes and/or as the result of specific exercises (for example, Service Improvement Strategy initiatives, etc.).

The Branch also agrees that client feedback should be considered as part of the form review process where appropriate.

BISB makes every effort to ensure that online and paper CPP forms are consistent to the extent possible. As forms are updated and new online services are implemented, BISB will continue to ensure that consistency between paper and online forms exists where appropriate. However, the differing nature of the online environment means that this is not always appropriate given built-in automation processes and form controls for online applications.

When a client submits forms or supporting documents in a Service Canada Centre, the receiving officer performs a quick summary verification for completeness. There is little guidance on form verification in the reference tool used by in-person staff. This leads to inconsistent client service. Some officers familiar with the CPP program will verify if the client has correctly filled the forms and that supporting documents are adequate. Others will only verify that the client has completed the form (filled all required fields).

Furthermore, whenever a Service Canada Centre officer receives a document, they ought to create a note in the system to allow for document tracking. Currently, officers receiving documents at the welcome zone do not track them in the system. As a result, documents could be lost or delayed in transit without the Department's knowledge. The Department could avoid unnecessary channel churn if Service Canada Centre officers played a more active role in recording the receipt of documents and processing certain forms.

Mail processing facilities are the last step before adjudication. These facilities sort, tag, record in the system and assign incoming mail to processing officers. The CPP program still relies heavily on paper files, which significantly impairs its ability to distribute workload across its network efficiently. Mail clerks have to store, retrieve, and ship client files accross Canada to enable the majority of processing or quality assurance tasks. In addition, if an incident damaged or destroyed client files in a storage facility, it could impede the ability of the Department to deliver portions of the CPP program. In our opinion, the delayed acquisition of an imaging solution for documents has created a number of issues. The delay has impeded the ability of the Department to deliver the CPP program efficiently. Furthermore, the mix of digital and paper processes has created peculiar interactions. For example, following certain client calls, officers will send an email to processing centres for follow-up. Mail processing facilities then print, sort, tag, record in the system and assign these enquiry emails to processing officers.

Due to the COVID-19 pandemic the Department reviewed its processes and procedures to allow clients to submit applications via email instead of using regular mail. The Department also reduced evidentiary requirements where possible. Mass scanning of paper applications has also been implemented to support remote processing. This has resulted in a significant shift from a paper based work environment to digital. However this shift is temporary as these measures will need to be re-evaluated once the pandemic has subsided.

Recommendation

- The SADM of BISB should review information intake and paper handling processes to to optimize digital solutions and minimize the use of paper in the CPP program. This review should focus on leveraging current workload and processing systems.

Management Response

BISB agrees with the recommendation.

At the start of the pandemic, BISB reviewed its processes and procedures in light of the fact clients might have difficulty submitting applications and documentation via regular mail. As a result, processes such has the ability to submit applications via email, and reduced evidentiary requirements were implemented. Mass scanning of applications received has also been implemented to support processing done remotely. This has resulted in a significant shift from a paper based work environment to digital, albeit on a temporary basis, as these measures will need to be re-evaluated once the pandemic has subsided.

As part of ongoing business, BISB continues to identify processes that are good candidates for digitisation. An examples of this are the ground breaking work on robotic automated processing, and the trusted digital repository work, both of which are being led by BISB.

One of the key challenges to further digitizing our processes particularly for CPP is the ongoing need for certified copies of documents such as marital status and death certificates.

2.2 The Department can strengthen controls to prevent error, omissions and fraud

Supporting document certification

When applying for CPP benefits, clients usually have to send the Department certain supporting documents. Whether it be a birth, marriage or death certificate, the Department suggests that clients send a certified copy instead of their original. For the Department to accept a photocopy, it must:

- be signed and dated by a member of 1 of 21 possible professions

- state the name, title and telephone number of the person certifying the photocopy

- state, "This photocopy is a true copy of the original document which has not been altered in any way"

- not be certified by the client themselves, or any of their relatives

[This paraprah has been redacted]

Due to the COVID-19 pandemic, the Department adopted interim measures for documentary evidence that allowed officers to accept uncertified copies of documents. Rather than returning to a certification model, the Department ought to develop a risk assessment model to determine when supporting documents are required and when validation with an issuing authority is necessary.

Eligibility controls for the Child Rearing Provision

The Child Rearing Provision protects both the amount and eligibility of future benefits of individuals who stopped working or reduced their paid employment or self-employment to raise children. The provision allows the removal of low earnings months while the individual was providing primary care to a child under the age of 7. Low earnings months are removed from their earnings history when determining eligibility for and the amount of a CPP benefit. This can help eligible individuals receive a higher CPP benefit amount. The provision applies only to the period when the contributor was the primary caregiver for children under the age of 7. In addition, the applicant or their spouse or common-law partner must meet one of the following criteria:

- have received Family Allowance

- have been eligible to receive the Canada Child Benefit

- have been eligible to receive the Canada Child Tax Benefit

[This paraprah has been redacted]

For children born or who lived outside Canada before age 7, applicants using paper forms must provide proof of the child's arrival date in Canada. This allows officers to adjudicate the period of eligibility based on the client's assertion regarding when the child entered Canada.

[This paraprah has been redacted]

Recommendation

- [ This recommendation has been redacted]

Management Response

[This management response has been redacted]

2.3 Controls to achieve correct and consistent decisions are adequate

Training, reference tools and advice

The delivery of training varied between regions. In general, interviewees agreed that the mix of in class and virtual training worked very well. Also of note, the Department periodically reviews training curricula to reflect new legislation.

In addition to training, officers have at their disposal several reference tools to assist them in accomplishing their daily tasks. The Department regularly updates these tools to reflect new procedures. Reference tools are also readily available to all who need them. Officers have remarked that the quality of the information found in those tools is adequate.

Officers unable to locate the information they are seeking in available reference tools can submit their questions to the regional Business Expertise Advisors. Advisors typically answer enquiries within 48 hours or less. Officers confirmed that the response quality and the turn-around time of typically less than 48 hours is useful and timely.

Quality assurance monitoring

Call centres have an effective, nationally calibrated, quality program in place. This program provides constructive feedback and quality assessment of the work performed by call centre officers. Advisors evaluate 3 calls twice a year, chosen at random and provide feedback resulting from those calls to both the officer and their team leader. Interviewees noted that this program provided valuable insights for improvement.

Notwithstanding the lack of quality assurance work on reconsiderations outlined in section 2.5, the quality monitoring system works equally well within the processing centres. At the program level, the Department performs processing and payment accuracy reviews to monitor overall program health. For quality assurance work done for processing accuracy review, the audit team did not find a national procedure to validate consistency and accuracy. However, processing accuracy reviews were paused in March 2020 and will soon be replaced with a nationally calibrated individual quality feedback program. This new program will provide officers with feedback on a monthly basis to help them manage the quality of their work.

On the other hand, Service Canada Centres have not developed a quality-monitoring regime that is as effective as the call or processing centres. Advisors assess in-person officers once every 2 or 3 years, depending on the region. While the audit team acknowledges distance, budget and advisor availability constraints, opportunities exist to explore virtual quality assurance approaches.

2.4 The Department processes information affecting CPP benefits in a timely manner

Once a processing centre officer deems a client eligible, several factors can influence the payment amount or the suspension of a benefit. An address, direct deposit, marital status change or the death of a client are some important elements that could affect payments. Some of these changes, if not actioned rapidly, could result in an overpayment or underpayment. In order to avoid such situations, it is important to update client files in a timely manner.

In-person officers are able to perform basic transactions immediately with a client, such as a change of address or a change of direct deposit. However, they do not have the authority to suspend a benefit upon a client's death. The officer must contact a processing centre by email to stop payments which could result in delays. Of note, in January 2020, the Department empowered call centre officers with the ability to suspend benefits immediately to prevent an overpayment. However the Department has not completed required system and procedure changes to enable that new ability. The Department expects to have completed these changes by March 2022.

2.5 There is a need to implement service standards and a quality assurance framework for reconsiderations

Clients dissatisfied with the decision on their CPP benefits may, within 90 days, make a formal request for reconsideration. This request triggers the reconsideration process performed by the Department on behalf of the Minister. The intent of this first level of recourse is to provide a quick, effective and efficient redress mechanism. The Department has not established a publically communicated service standard for the reconsideration process. In 2015, Internal Audit completed an audit of recourse management and found that CPP reconsiderations were unnecessarily long. At the time of this audit, the situation had not changed. Officers completed only 40% of reconsideration requests within the internal target of 120 days and 15% took longer than a year to complete. Of note, the Canada Pension Plan states, "the Minister shall reconsider without delay […] decisions".

Recommendation

- The SADM of BISB, in conjunction with regional ADMs, should monitor and periodically report on reconsideration processing time.

Management Response

BISB agrees with this recommendation.

The volumes of reconsiderations for non-disability related reconsiderations is relatively low (1039 from April 2020 to March 2021) and does not justify the resources required to implement and regularly report on processing time.

The 2015 internal audit on recourse management also found that the CPP did not have an established quality assurance framework for reconsiderations. At the time of this audit, the Department had not implemented quality assurance processes to assess the quality and consistency of CPP reconsideration.

Recommendation

- The SADM of BISB, in conjunction with regional ADMs, should assess the quality and consistency of CPP reconsiderations periodically.

Management Response

BISB agrees with this recommendation.

As previously noted, the volumes of reconsiderations for non-disability related files is relatively low (1039 from April 2020 to March 2021). Likewise, while it is true that there is no quality program specific to this work, there is equally no substantive evidence to justify the development of a dedicated quality assurance process specific to these files.

3. Conclusion

Overall, the audit concluded that the Department is largely efficient and effective in the delivering of CPP benefits.

Controls to achieve correct and consistent decisions are adequate. However, the Department should ensure controls to prevent errors, omissions and fraud are effective, efficient and consistent, whether the client uses online or paper forms.

Other areas of improvement include the need to monitor and periodically report on reconsideration processing time, quality and consistency. Internal Audit also noted opportunities to improve the efficiency of information collection to adjudicate CPP benefits, such as periodic client-focused usability reviews.

4. Statement of assurance

In our professional judgment, the audit team gathered and analysed sufficient and appropriate evidence to support the accuracy of conclusions found in this report. The audit team based these conclusions on observations and analyses at the time of the audit. These conclusions are applicable only for CPP program delivery. The audit team followed the Treasury Board Policy on Internal Audit and the International Standards for the Professional Practice of Internal Auditing.

Appendix A: Audit criteria assessment

Audit criteria:

Is the Department efficiently collecting all information required to process applications?

Rating:

Sufficiently controlled; low-risk exposure.

Audit criteria:

Has the Department designed and implemented controls to achieve correct and consistent manual and automated decisions, including controls preventing errors, omissions and fraud?

Rating:

Controlled, but should be strengthened; medium-risk exposure.

Audit criteria:

Is the Department collecting information affecting a beneficiary's receipt of benefits and acting on it in a timely manner to minimize under- and overpayments?

Rating:

Sufficiently controlled; low-risk exposure.

Audit criteria:

Has the Department adopted a reconsideration process with appropriate controls to achieve, without delay, correct and adequately documented reconsideration decisions?

Rating:

Controlled, but should be strengthened; medium-risk exposure.

Audit criteria:

Is the Department adequately safeguarding personal and business information collected and created throughout intake, processing, maintenance and reconsideration activities?

Rating:

Sufficiently controlled; low-risk exposure.

Audit criteria:

Has the Department planned for the continued availability of benefits to beneficiaries?

Rating:

Sufficiently controlled; low-risk exposure.

Audit criteria:

Has the Department established oversight, quality assurance and feedback mechanisms to adequately monitor performance and enable continuous improvement of iIntake, processing and maintenance activities?

Rating:

Sufficiently controlled; low-risk exposure.

Audit criteria:

Has the Department established oversight, quality assurance and feedback mechanisms to adequately monitor performance and enable continuous improvement of reconsideration activities?

Rating:

Controlled, but should be strengthened; medium-risk exposure.