Departmental Results Report for fiscal year 2019 to 2020

On this page

- Ministers’ message

- Results at a glance and operating context

- Results: what we achieved

- Analysis of trends in spending and human resources

- Additional information

- Appendix: definitions

Alternate formats

Large print, braille, MP3 (audio), e-text and DAISY formats are available on demand by ordering online or calling 1 800 O-Canada (1-800-622-6232). If you use a teletypewriter (TTY), call 1-800-926-9105.

Complete a survey on your experience using this Departmental Results Report

Ministers’ message

We are pleased to present the 2019 to 2020 Departmental Results Report for Employment and Social Development Canada (ESDC). This report outlines the results achieved and the progress made toward the Department’s mandate to build a stronger and more inclusive country. This includes helping individuals live productive and rewarding lives and delivering many of the Government of Canada’s services that Canadians access throughout their lives.

Looking back on our key highlights, we would like to acknowledge the Department’s efforts to help support Canadians through the COVID-19 pandemic.

When the pandemic first shuttered the Canadian economy last spring, the Government of Canada moved swiftly to support Canadians. A keystone piece of that support was the Canada Emergency Response Benefit (CERB). The Department developed this new temporary income support benefit in collaboration with the Canada Revenue Agency. The benefit was designed and implemented in a matter of weeks. ESDC realigned its objectives from the traditional Employment Insurance program to support millions of Canadians suddenly out of work due to the pandemic. Having closed Service Canada Centres across the country, ESDC quickly shifted to respond and deliver while more than 25,000 employees suddenly began working from home.

ESDC provides many other supports for Canadian individuals, parents, families, organizations, workers and businesses. We want to express our sincere gratitude to all ESDC employees for their ongoing contributions. The Department’s cross-government collaboration, innovation and dedication to serving Canadians were once again recognized this year: ESDC was named one of Canada’s Top 100 employers and diversity employers in 2019. This is a reflection of our extremely talented and skilled workforce.

Now, more than ever, we see the importance of our mandate to support Canadians, especially the most vulnerable. In 2019, we launched Reaching Home: Canada’s Homelessness Strategy. This community-based program contributes to the goals of the National Housing Strategy. It maintains safe, stable and affordable housing and will reduce chronic homelessness nationally by 50 % by 2028. We have been working hard to improve the standard of living for all Canadians. That’s why we worked toward lifting Canadians out of poverty through investments and initiatives. To ensure continued accountability on poverty reduction, the Department formed the National Advisory Council on Poverty. This council will advise and report on yearly poverty reduction progress.

We continue to work to improve the quality of life for seniors in Canada. Through the New Horizons for Seniors Program, we launched community projects that increase connection, reduce isolation and help seniors maintain a social support network. In addition, we took steps to provide more financial security for seniors by enhancing the Guaranteed Income Supplement earnings exemption and proactively enrolling eligible seniors in the Canada Pension Plan. To help seniors with higher costs during the pandemic, we provided one-time, tax-free payments, with extra support for those with the lowest incomes. To ensure those seniors continue to get the benefits they depend on, we temporarily extended Guaranteed Income Supplement and Allowances payments for those who could not file their income information on-time.

The Government of Canada remains committed to ensuring parents have more money to help with the costs of raising kids. Since 2018, the Canada Child Benefit has been indexed annually to inflation to keep up with the cost of living. In July 2019, the yearly maximum benefit was increased once again. Over the past 3 years, ESDC has been working with the provinces and territories to create more affordable child care spaces across the country. This will ensure every child gets the best start in life. New bilateral agreements are currently underway to further support the early learning and child care sector. We are also strengthening early learning and child care programs for Indigenous children. In 2019, First Nations, Inuit and Métis Nation communities received new funding through community agreements and our federal partner departments.

To help youth participate in the labour market, we launched a renewed Youth Employment and Skills Strategy. We also expanded the Student Work Placement Program so that more students would have access to learning opportunities. We promoted skilled trades as a first-choice career. We lowered interest rates on Canada Student Loans and Canada Apprentice Loans. We also introduced a new option to help borrowers return their defaulted loans to good standing. In addition, we made it easier for students with permanent disabilities to access further funding when returning to school. As announced in Budget 2019, we introduced interest-free and payment-free leave for Canada Student Loan borrowers. This allows for temporary leave from studies for medical or parental reasons, including mental health leave. Supports for students were also a priority early on in the COVID-19 pandemic. We provided additional financial relief to student loan borrowers by temporarily pausing the repayment of Canada Student Loans.

We continued to enhance the Employment Insurance program to keep it aligned with the changing labour market. In the event of an employment transition such as job loss, illness or maternity/parental leave, financial support is available to Canadian workers.

Canadians have a right to fair, equitable, safe and healthy workplaces. We made a number of important changes to the Canada Labour Code to bring federal labour standards into the 21st century. This includes new breaks, leaves and the right to request flexible work arrangements. Gender equality and inclusiveness are important goals for modern workplaces. Ensuring all workers in federally regulated workplaces receive equal pay for work of equal value is a big step forward in meeting the expectations of today’s workers and best recognizing everyone’s contributions to the workplace. To that end, we continued to make progress on the implementation of the Pay Equity Act. We appointed the first-ever federal Pay Equity Commissioner. Furthermore, we are moving forward with new pay transparency measures in the federally regulated private sector. This aims to address the wage gaps affecting not only women, but also Indigenous peoples, persons with disabilities and visible minorities. These results are built on extensive ongoing consultation, which has created better results for workers and for employers.

Creating communities, workplaces and services that enable everyone to participate fully and without barriers is another priority area for the Government of Canada. In July 2019, the first-ever Accessible Canada Act came into effect. The Act established a framework to create a barrier-free Canada through the proactive identification, removal and prevention of accessibility barriers in the federal jurisdiction. It continues to guide us in everything we do.

It is critical that government services be reliable, accurate, secure and available to everyone, including those living in remote areas. By increasing its outreach activities, the Department is better able to accommodate vulnerable and marginalized populations. ESDC has made progress on the Department’s Service Strategy, meeting and exceeding numerous target goals. We modernized departmental IT systems and improved the quality of the client service experience and outcomes. We also ensured that all eligible Canadians have access to our services. As a result, the Department is better equipped to adapt to new challenges as they arise. This was proven during the onset of the COVID-19 pandemic, when the Department acted decisively and quickly to pivot services to ensure continuity of service for Canadians while keeping Canadians safe.

Canadians should rest assured that we will continue to assess and adjust our priorities. In this regard, the health, safety and financial security of Canadians will remain top of mind. Next year’s report will tell the more detailed story of how COVID-19 has affected our lives, our families and our work. We will continue to prove that together, we will get through this and build a better, more inclusive and stronger Canada.

We invite you to read the full report for more details about these. You will also learn about the many other accomplishments achieved by the Department over the past year.

Minister of Employment, Workforce Development and Disability Inclusion,

Carla Qualtrough

Minister of Families, Children and Social Development, Ahmed Hussen

Minister of Labour, Filomena Tassi

Minister of Seniors, Deb Schulte

Results at a glance and operating context

Operating context

The operating context for the 2019 to 2020 fiscal year can be split into 2 very distinct periods. First, there was the period before the COVID-19 pandemic, which lasted from April 2019 to February 2020. Then, there was the month of March, in which the department was significantly impacted by the COVID-19 pandemic and resulting global economic downturn.

From April 2019 to February 2020, the department operated in an environment characterized by:

- a healthy economy and labour market, with more jobs created and more money spent by consumers

- a strong housing market

- a growing global economy

- significant government investments in people and infrastructure

- strong government support for families with children and for seniors

In 2019, Canada experienced the second largest percentage growth in Gross Domestic Product (GDP) among G7 countries. It had a higher rate of GDP growth than the European Union.

The annual unemployment rate of 5.7% in 2019 was the lowest on record. Employment rose by nearly 400,000 from its 2018 level, its strongest growth since 2007. As a result, the number of Employment Insurance claimants receiving regular income benefits decreased, reaching its lowest point in more than 20 years. At the same time, the percentage of Canadians aged 15 to 64 who were employed reached an all-time high.

Trade disputes and skills pressures still posed risks to the Canadian economy. In addition, new technologies continued to change the way Canadians do their jobs. These changes benefitted employers and employees in many ways. They increased productivity, speed and ease of communication. They also highlighted where some Canadians may need to be re-trained in the future.

Challenges in hiring remained an issue and the percentage of firms reporting vacant jobs remained higher than the historical average. Labour market tightness was observed in many provinces, industries and occupations. Despite this, some groups continued to struggle in the labour market. These included recent immigrants, Indigenous Peoples, Black Canadians and members of other visible minorities. They also include persons with disabilities, youth, and persons with lower levels of educational attainment.

The department continued to address the expectations of Canadians with regard to government service delivery online, through call centres, and in person. We recognize that Canadians expect high-quality, easy-to-access, simple and secure services that are responsive to their needs.

Designing and delivering services with the client in mind and improving the client experience remained top priorities for the department. It listened and responded to the needs and expectations of Canadians by enhancing online service delivery. It also addressed security and privacy concerns, and strived to ensure full access to government programs for vulnerable Canadians.

Canadians expect the reliable delivery of benefits. In response, the department continued to invest in improving and modernizing its benefit delivery systems. These systems support the delivery of Employment Insurance, Canada Pension Plan and Old Age Security programs. The pandemic highlighted the critical importance for the department of a reliable and trusted digital infrastructure to guarantee delivery of benefits to Canadians when they need it.

The department’s operating context changed very suddenly and dramatically in March 2020 because of the pandemic. All levels of government began to implement physical and social distancing measures to contain its spread. Unemployment increased from 5.6% in February 2020 to 7.8% in March 2020. Over one million jobs were lost in that month. In addition, the number of persons employed, but working no hours, almost quadrupled from 565,500 in February to 2,085,000 in March. The number of persons employed and on the job, but working less than half their regular hours, also almost quadrupled from 242,000 in February to 943,000 in March (seasonally adjusted). These were unexpected events that the department had never dealt with before. In some cases, these events have meant that the department was unable to achieve its expected results while being called upon to deliver unexpectedly in other areas. The impacts of the beginning of the pandemic in March 2020, on the department are described in more detail later in the report.

Key Policy Achievements

The department continued to build a stronger and more inclusive Canada in fiscal year 2019 to 2020. It continued to help Canadians live productive and rewarding lives and to improve their quality of life. The department focused its attention and resources on supporting growth that benefits all and on transforming its services. This report outlines the main initiatives that the department undertook to meet its mandate, including the following:

The department launched the renewed Youth Employment and Skills Strategy to help all young people participate in the labour market. The strategy helps youth to access the supports and training they need to integrate the labour market. It introduced the Goal Getters stream to help youth under 15 to complete high school and transition to post-secondary education.

The department launched Reaching Home: Canada’s Homelessness Strategy to support Canadians experiencing, and at risk of, homelessness. As a part of the National Housing Strategy, it will contribute to reducing chronic homelessness by 50% by fiscal year 2027 to 2028. Reaching Home provides funding to community-based organizations to help them prevent and reduce homelessness.

The department supported amendments to the Canada Labour Code that improve employee eligibility for medical, maternity and parental leave. Other amendments give employees in federally regulated workplaces the right to request flexible work arrangements and new types of paid and unpaid leave. These new types of leave include leave for prescribed personal reasons, victims of family violence, traditional Indigenous practices, bereavement and absence for members of the Canadian Reserve Force.

In July 2019, the department supported the passage of the Accessible Canada Act. This act established a framework to create a barrier-free Canada through the proactive identification, removal and prevention of accessibility barriers in federal jurisdictions.

The department funded more than 2,800 projects under the New Horizons for Seniors Program. These projects helped more seniors benefit from, and contribute to, the quality of life in their communities. At least 848,700 Canadians benefitted from these projects.

The department began to work on the foundational elements of a Social Innovation and Social Finance Strategy. The strategy will strengthen the ability of communities to develop, finance and scale new solutions to persistent social challenges in Canada. The first pillar of the strategy, the Investment Readiness Program, was launched in June 2019 to help community organizations become ready for social finance.

Key Service Achievements

The department advanced its ambitious service agenda as outlined in its Service Strategy and implemented it through the Service Transformation Plan. The department’s efforts to ensure service excellence for clients are grouped into 3 main areas:

- maintaining the momentum in modernizing departmental IT systems, which underpin online service delivery

- continuing to improve upon the client service experience and outcomes

- ensuring all eligible Canadians can access our services so no one is left behind as a result of the digital transformation

Many service enhancements were achieved in the fiscal year prior to the pandemic. These contributed to the department’s rapid and effective rollout of government support measures in response to the pandemic. They also contributed to maintaining uninterrupted delivery of services to Canadians.

Technology and systems modernization

Canadians expect government services to be reliable, accurate, secure, and increasingly offered online. In addition, services must be flexible enough to quickly adapt to changes when necessary. All this requires continued modernization and investments in service infrastructure. In its 2019 to 2020 modernization efforts, the department made a number of advancements and achieved very concrete results, including:

- completing the migration of the Pensions Call Centre (Canada Pension Plan and Old Age Security) and of the Employment Insurance Call Centres to a new platform. The new technology platform greatly improves Canadians’ access to automated service and self-serve features. This migration addresses technology limitations that were preventing call centres from being 100% accessible to clients, which was also a key concern stemming from the OAG Call Centre audit

- moving forward on the design of the Interactive Voice Response System used for Canada Pension Plan and Old Age Security. This new design will introduce additional self-service features, which will be available to clients in fiscal year 2020 to 2021

- significantly progressing towards the migration of current and previous Old Age Security pension data to a more modern Canada Pension Plan platform. Once fully implemented, this will create a streamlined, reliable solution for the 2 pension programs to better serve Canadians

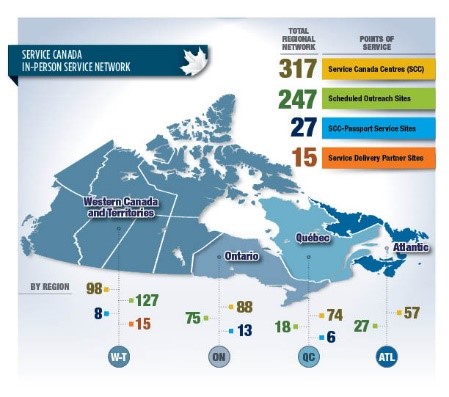

- designing, testing and launching a way to capture foreign nationals’ biometric information and transmit it to Immigration, Refugees and Citizenship Canada. Between December 3, 2019 and March 17, 2020, Service Canada Centres booked approximately 141,000 biometric collection appointments from the online Service Canada appointment booking system and completed approximately 95,000 biometric collections

- significantly advancing the planning of the Benefits Delivery Modernization programme, including the future state, requirements and procurement needs. This initiative, which will span over 10 years, will transform service delivery for the department’s 3 major programs. These major programs include Employment Insurance, Old Age Security and the Canada Pension Plan. Through this programme, the department will adopt a modern technology platform, which will simplify the processing of benefits. It will also offer new digital services, and it will enhance the department’s capacity to manage its services

Improving the client service experience and outcomes

Service modernization and investments in technology are ultimately a means to improve the client service experience. As a citizen-centred organization, the department achieved tangible improvements for clients. Some noteworthy examples include:

- optimizing its web pages to make them more accessible for those who use voice to search for trusted content. This increased voice search results by 20% and web search results in general by about 50%

- making it easier for organizations to apply to grants and contributions programs. Organizations can track their status, sign agreements, manage active projects, submit supporting documents and data, and review past projects online

- simplifying the language on the websites, forms, and letters to clients issued by Social Security Tribunal of Canada. The tribunal also introduced case navigators to help appellants better understand the process and how to prepare for a hearing

- streamlining application processes and improving services to eligible Canadian seniors by implementing service improvement strategies. These included automated processing for the Canada Pension Plan, the Canada Pension Plan enhancement and the Old Age Security

- harmonizing the processes for requests for reconsideration of Employment Insurance applications. This improved the efficiency of decision making and provided more timely decisions and information to clients on their entitlement

- supporting the coordination of client services provided on-line, in-person, and by phone through the implementation of the Integrated Channel Strategy. This coordination enabled greater consistency in the client service experience and better management of the workload

- increasing the number of self-service options students can access to manage their funding using almost any device. This includes tracking funding status and a “Virtual Repayment Counselor”, as well as financial literacy tools and tips

Ensuring no one is left behind

The department recognizes that government services must be available to everyone, especially to vulnerable Canadians. As such, the department undertook several measures and initiatives to strengthen accessibility of its services to vulnerable populations, including:

- expanding its outreach efforts to remote areas, northern and Indigenous communities

- reaching out to vulnerable Canadians through virtual community outreach to support people with barriers in accessing services online. To this end, community organizations serving those who experience internet connectivity issues were contacted. The department provided them with information on programs and services, including the manner in which clients can access services. This ongoing solution will result in the ability to provide equal access to services and benefits to all Canadians, regardless of where they live

- supporting veterans and their families through the delivery of information services. The department responded to over 1,600 requests for information, including approximately 50 referrals to Veterans Affairs Canada (VAC) employees. It also assisted with approximately 250 applications for VAC programs and services. The department also supported VAC with the launch of Pensions for Life in April 2019. It ensured the information was up to date and available throughout its service delivery network

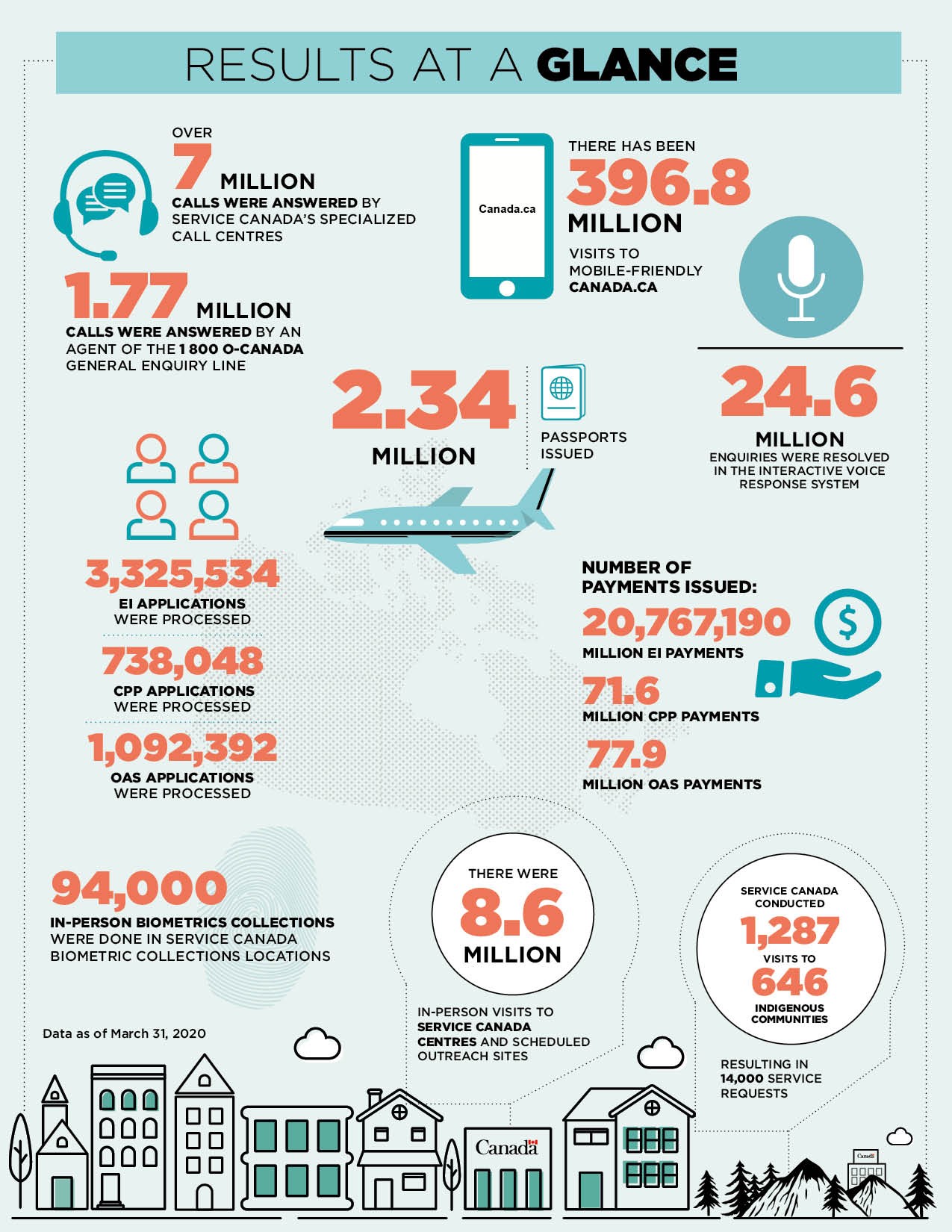

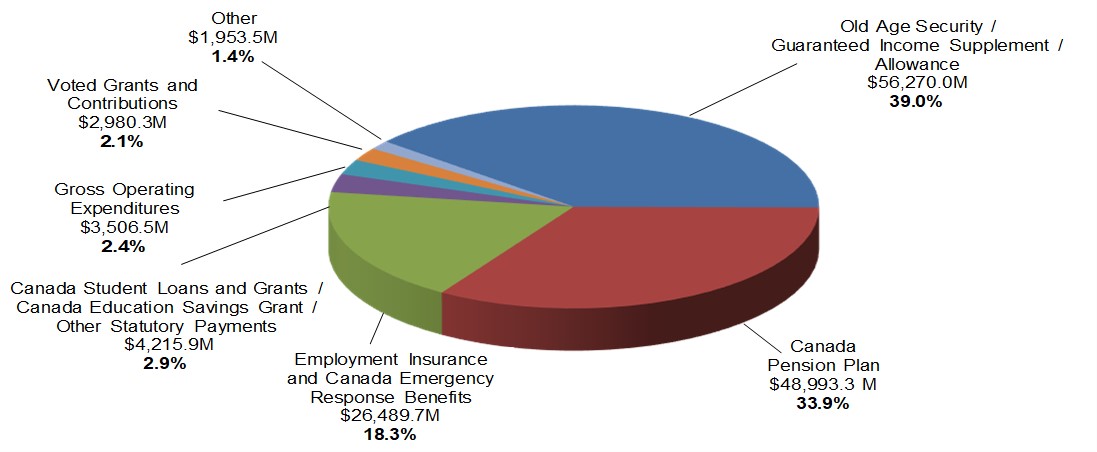

Text description of figure 1:

- Over 7 million calls were answered by Service Canada’s specialized call centres

- 1.77 million calls were answered by an agent of the 1 800 O-Canada general enquiry line

- There has been 396.8 million visits to mobile-friendly Canada.ca

- 2.34 million passports issued

- 24.6 million enquiries were resolved in the interactive voice response system

- Number of payments issued:

- EI: 20,767,190 payments

- CPP: 71.6 million payments

- OAS: 77.9 million payments

- Number of applications processed:

- EI: 3,325,534

- CPP: 738,048

- OAS: 1,092,392

- 94,000 in-person biometrics collections were done in Service Canada biometric collections locations

- There were 8.6 million in-person visits to Service Canada Centres and scheduled outreach sites

- Service Canada conducted 1,287 visits to 646 Indigenous communities, resulting in 14,000 service requests

Response to COVID-19

In March 2020, the department began to put in place measures to support Canada’s whole-of-government response to the COVID-19 pandemic. These measures are part of a comprehensive plan to support all Canadians. The department focused its efforts on workers, families, students, seniors, persons with disabilities, individuals experiencing and at risk of homelessness, and Indigenous peoples. Department employees across the country took part in this collective effort. They worked hard to serve as many Canadians as possible, whether through direct service delivery or by providing a supporting role.

The department’s initial response to the pandemic crisis was implemented in just a matter of weeks. It included the initiation of new initiatives, adjustments to existing programs, and finding new ways of delivering services to Canadians. Below is an overview of the measures taken to support the government response to the pandemic, which were implemented in fiscal year 2019 to 2020.

New initiatives

The Canada Emergency Response Benefit (CERB) was the main initiative that the department put in place. Through collaboration, ESDC and the Canada Revenue Agency designed and implemented this new temporary income benefit in a matter of weeks. The CERB provided Canadian workers who had stopped working due to COVID-19 with a taxable benefit of $2,000 a month. Since March 2020, almost 9 million people have received CERB benefits. As noted by Maclean’s Magazine on May 4, 2020: “The scope and speed of what happened to get the CERB out the door is unparalleled – a truly historic moment for the public service.”

Adjustments to existing programs

As the impacts of the pandemic evolved, the department worked hard to adjust its programs to address the new reality. It identified measures that would enhance support to Canadians as quickly as possible. This included changes to the Employment Insurance regime and increasing the flexibility of public pensions.

Many Canadians had to stop working or lost their jobs because of COVID-19. To support these affected workers, the department made important changes to the Employment Insurance regime, by:

- waiving the one-week waiting period for people in quarantine or who were directed to self-isolate, and were claiming EI sickness benefits

- extending the maximum duration of the Work-Sharing program from 38 weeks to 76 weeks for employers who were experiencing a downturn in business due to COVID-19, and their workers. This measure provided income support to employees eligible for EI who agreed to reduce their normal working hours because of developments beyond the control of their employers

Changes to the public pension programs made it easier for pension beneficiaries to access their benefits. They also reduced barriers to access caused by the pandemic. Some of these changes to processes included:

- giving beneficiaries of the Guaranteed Income Supplement, Allowance, and Allowance for the Survivor until October 1, 2020 (instead of June 1, 2020) to provide their income information. The department uses this information to renew their benefits. The period was extended given the deferred 2019 income tax filing deadline. Benefits will be retroactively adjusted to July 2020. This will ensure that beneficiaries continue receiving benefits without interruption until December 2020

- simplifying various requirements, such as eliminating the need for a wet signature, waiving some documentary evidence, and creating generic email boxes

The department secured an additional $157.5 million to help those experiencing, or at risk of, homelessness as a result of the COVID-19 crisis. Reaching Home: Canada’s Homelessness Strategy will use the funds in fiscal year 2020 to 2021, to help communities adapt service delivery and put in place emergency measures to try and reduce the risk of COVID-19 transmission for Canadians experiencing, or at risk of, homelessness and those serving them.

The department also took measures to support students and apprentices through the Canada Student Loans Program and Canada Apprentice Loans. The department introduced a 6-month, interest-free period on Canada Student Loans and Canada Apprentice Loans, from March 30 to September 30, 2020.

Adjustments to Service Delivery

After temporarily closing its Service Canada Centres on March 26 to protect clients and employees, the department reinvented itself to ensure Canadians could access services. Among many initiatives, the department:

- developed a new approach to service delivery with the launch of e‑ServiceCanada, which began with the first quarantines on February 7th, 2020. With this service, clients can request assistance online, then be contacted by a Citizen Service Officer within 2 business days

- set up the new Canada Emergency Response Benefit call center in only 9 days. The department redeployed around 1,500 employees to operate it. At its peak, the call centre handled more than 30,000 calls daily

The department contributed to keeping Canadians informed during these challenging times through several means, including:

- working with Health Canada to ensure Canadians always had the most reliable and up-to-date information about COVID-19. This was done through:

- maintaining the Canada.ca/coronavirus website, that provided information resources for Canadians

- implementing the Government of Canada's coronavirus information line (1‑833-784-4397), available from 7:00 a.m. to midnight (EST) 7 days a week. The line was supported by the 1-800 O Canada contact centre

- building the Canada Emergency Response Benefit web pages on Canada.ca, in collaboration with the Canada Revenue Agency. These pages were launched in early April (over 2.5 million visitors on April 6 alone). They included an innovative triage tool to steer Canadians between Canada Revenue Agency and Service Canada support

- building a COVID-19 Virtual Assistant in less than 48 hours to help Canadians find the latest COVID-19 information on Canada.ca. By March 31st, it had supported over 490,000 requests

- working with federally regulated employers and workers to deliver essential services to Canadians safely and efficiently. This includes those in the trucking, food supply chain, railways, ports, and airways, along with many other industries

The department continued to support the Government’s response to the pandemic past March 2020. As the impact of the pandemic on the lives of Canadians became clearer, the department worked hard to implement and adjust programs to better respond to the crisis. The following measures outline additional initiatives the department put in place in response to the pandemic:

- providing an additional amount of up to $300 per child through the Canada Child benefit, for benefit year 2019 to 2020

- providing a one-time, tax-free payment of $300 for seniors eligible for Old Age Security and a further $200 for seniors eligible for the Guaranteed Income Supplement. Those eligible for the Allowances also received a payment of $500

- providing a one-time payment of up to $600 in recognition of the expenses incurred by persons with disabilities during the COVID-19 pandemic

- creating a new E-SIN online application, in 10 working days, for clients looking to obtain or renew a Social Insurance Number. This application eliminated the need to complete paper documents and submit them by mail or in person. Obtaining a valid Social Insurance Number enabled clients to obtain employment and important benefits

- launching over a thousand additional local seniors projects through the New Horizons for Seniors Program to reduce isolation, improve seniors’ quality of life, and help them maintain a social support network

- establishing the Emergency Community Support Fund, through the Social Development Partnerships Program, in fiscal year 2020 to 2021. This fund will provide $350 million to support community organizations serving vulnerable Canadians during the COVID-19 crisis

- adapting the Enabling Accessibility Fund to allow organizations to get funding faster, with less administrative burden. Changes include the implementation of a flat rate model, and doubling the time allowed to organizations, under the small projects component, to complete activities

- making temporary changes to the Canada Summer Jobs program, which allow employers to receive an increased wage subsidy. Other changes include extending the end date of employment to February 28, 2021 and allowing hiring on a part-time basis

The long-term economic and socio-economic impacts of COVID-19 in Canada remain to be seen. As the pandemic evolves, the department will continue to focus on supporting Canadians and ensuring access to accurate government information and services that meet their needs.

For more information on Employment and Social Development Canada’s plans, priorities and results achieved, see the “Results: what we achieved” section of this report.

Results: what we achieved

Social development

Description

To increase inclusion and opportunities for Canadians to participate in their communities.

Results

In 2019 to 2020, the department undertook the following initiatives to advance this core responsibility:

The department contributed to preventing and reducing homelessness

The department launched Reaching Home: Canada’s Homelessness Strategy on April 1st, 2019. This community-based program’s goals are to prevent and reduce homelessness. It does so by providing direct financial support to designated communities, Indigenous and rural and remote communities across Canada. The program is part of the National Housing Strategy. Reaching Home contributes to the goal of reducing chronic homelessness by 50% by fiscal year 2027 to 2028. In fiscal year 2019 to 2020, Reaching Home provided approximately $189 million to communities across the country.

Under Reaching Home, the department introduced coordinated access processes. Coordinated access helps communities identify people that need assistance and match them to the right housing and services in a more streamlined way. Reaching Home is also putting more focus on addressing Indigenous homelessness. This includes the unique needs of First Nations, Inuit and Métis communities.

The department also expanded Reaching Home to 6 additional designated communities through an open and transparent process. As a result, Abbotsford, Cochrane District (Timmins), Lambton County, Cowichan Valley, Chilliwack, and Kenora are now funded through the Designated Communities stream.

The department worked to reduce poverty

The department formed the National Advisory Council on Poverty, a key commitment of Opportunity for All: Canada’s First Poverty Reduction Strategy. Statistics Canada and Employment and Social Development Canada conducted a comprehensive review of the Market Basket Measure (MBM), Canada’s Official Poverty Line. This will ensure that the MBM reflects the up-to-date cost of goods and services representing a modest, basic standard of living.

The department helped not-for-profit organizations, communities, and other groups enhance their capacity to address social issues

Persons with disabilities

The department funded 81 projects under the Disability component of the Social Development Partnerships Program. Eight of these were completed in fiscal year 2019 to 2020, and were able to obtain over $1.8 million in supplementary investments from various partners. The department also launched 4 new calls for proposals for persons with disabilities targeted at improving financial security, youth leadership, Accessible Canada partnerships, and Indigenous Leadership. Projects are expected to begin in fiscal year 2020 to 2021.

The department also supported the social inclusion of people with disabilities by:

- facilitating the Canadian disability community’s contributions to the development of:

- the United Nations Convention on the Rights of Persons with Disabilities

- the Accessible Canada Act

- developing, testing and identifying promising practices and tools to promote social inclusion of persons with disabilities

- supporting capacity building within disability organizations that encourage partnerships and collaboration between organizations. This allows them to improve their operations, expand their impact, and improve their sustainability. Six organizations addressed limitations in their organizational capacity, and received assistance with Board and management recruitment. They also worked on promotion, branding, marketing, and communication, and addressed legal barriers facing their organizations such as those related to intellectual property or corporate structure

The department also facilitated the production and distribution of alternate format publications to support Canadians with print disabilities.

Children and Families

The department funded projects that directly benefitted 512,724 vulnerable Canadians (children, youth and adults) through the Children and Families component of the Social Development Partnerships Program. This funding enabled community organizations to raise an additional $0.78 from non-federal partners for every dollar received from the program.

Black communities

Budget 2019 provided $25 million over 5 years, in recognition of the United Nations International Decade for People of African Descent. This funding, starting in fiscal year 2019 to 2020, will serve to establish the Supporting Black Canadian Communities Initiative. This initiative will build foundational infrastructure within Black communities. It will also increase awareness of the realities for Black communities within government. Through the Social Development Partnerships Program, the department funded an initial project under the Supporting Black Canadian Communities Initiative. It funded Caribbean African Canadian Social Services to conduct a feasibility study and to develop a concept paper. This work will help plan the creation of a Canadian Institute for People of African Descent. The institute will be dedicated to addressing social issues faced by Black Canadian communities.

Community organizations

The department launched the Investment Readiness Program. This 2-year, $50 million pilot program is aimed at helping social purpose organizations to participate in the social finance market. The department established 24 partnerships to support the implementation of the program.

By the end of the pilot, it is expected that funding will be redistributed to 300 to 500 social purpose organizations by 5 Readiness Support Partners. Of these partners, 2 are Indigenous-focused and one is women-focused. With this funding, social purpose organizations will increase their readiness to access social finance opportunities. They will also enhance their capacity to address persistent social issues. They will be able to access expertise to get ready for financing opportunities.

Through the program, the department also supported the development of the social finance ecosystem in Canada by providing funding to projects that will:

- expand and strengthen the social finance ecosystem by engaging underrepresented groups, such as those from Indigenous, Black, and women-led or focused organizations

- address system-level gaps in the social finance marketplace, such as expanding the focus of the common approach to impact measurement

The department helped to improve seniors' quality of life, and to better promote seniors' participation and inclusion in their communities

The department funded at least 2,831 projectsFootnote 1 across Canada under the Community-Based stream of the New Horizons for Seniors Program. These helped seniors benefit from, and contribute to, the quality of life in their communities through active living and social activities. Most funded organizations reported an increase in their capacity to:

- provide activities to seniors

- recruit volunteers

- develop partnerships

- enhance facilities that support seniors’ initiatives in their communities

An estimated total of more than 848,700 community members benefitted from these projects in fiscal year 2019 to 2020.

The department exceeded its 2019 to 2020 funding target, which was at least 1,850 projects. This is partly due to an additional investment of $100 million over 5 years for the New Horizons for Seniors Program. This additional funding resulted in 666 additional community-based projects funded in 2019 to 2020.

The department also funded multi-year projects of up to 5 years in duration under the Pan-Canadian stream of the New Horizons for Seniors Program. These projects used innovative approaches to address senior’s issues and included:

- funding 22 organizations to support the development and implementation of collective impact plans. These projects, which brought together organizations from different sectors within a community, focus on building long-lasting community networks. The goal is to help meet the growing social needs of seniors, with a focus on addressing the social isolation of seniors

- funding the United Way of the Lower Mainland in the amount of $250K to increase the capacity and effectiveness of Community Based Seniors Services agencies. The project is helping agencies to better communicate, coordinate, collaborate, and learn from each other about effective ways to promote and support healthy aging, and address the growing challenges of an aging population. This will be done through the development and implementation of a national online knowledge hub

- funding the Canadian Mental Health Association Ontario to support the sustainability of some partnerships formed under the Toronto Collective Impact Plan entitled 'ENRICHES'. This project allowed for greater knowledge transfer of the programs developed as well as more training of senior peer leaders for various activities

The department supported the National Seniors Council in implementing its 3-year mandate.

This mandate includes a work plan to provide advice on ways to address financial crimes and harm against seniors. It also includes a national seniors strategy, initiatives to support healthy aging and identifying measures to counter ageism. It also aims to strengthen attention to seniors’ housing needs and on the value of a national seniors’ strategy. The department provided the Council with administrative and logistical support. This helped the Council contribute to the engagement of seniors, caregivers, and community stakeholders.

The department contributed to removing barriers to accessibility for people with disabilities

The department started to implement the Accessible Canada Act, which came into force on July 11, 2019. This included helping to launch Accessibility Standards Canada, a new standards development organization, and beginning to develop foundational regulations.

The department signed a 5-year Memorandum of Understanding with Statistics Canada to develop a new Accessibility Data and Measurement Strategy. This collaboration resulted in a Performance Indicator Framework and Implementation Plan. These tools will help measure and monitor the progress of the act in removing barriers to accessibility for Canadians. The department also conducted public opinion research. This research will gather information on attitudes towards accessibility and on the experiences of persons with disabilities with barriers to accessibility.

Through the Disability component of the Social Development Partnerships Program, the department:

- supported 13 projects for the 2019 National AccessAbility Week. These projects carried out activities such as film festivals, art exhibits, workshops, training modules, and social media campaigns. These projects contributed to raising awareness of the importance of accessibility and inclusion in different sectors and communities

- supported innovative ways to identify barriers and best practices to ensure the development of regulations is an accessible process. The department also facilitated the participation of disability stakeholders in regulatory processes

The department led a project to better understand the barriers associated with electronic payment terminals. The project also identified options for improving accessibility.

Under the Enabling Accessibility Fund, the department funded 376 projects. Fewer projects than targeted were funded, as part of the funds were transferred to the Disability component of the Social Development Partnerships Program. These funds were transferred to respect a Budget 2019 commitment to help produce new accessible reading materials. However, the department funded more than twice the number of youth-led projects it supported in the previous year. These projects improved access to programs, services and employment opportunities for Canadians with disabilities.

The department also funded 504 projects over 2 years through the Investing in Canada Plan. The program has now reached 27% of its goal of supporting an additional 1,800 projects by 2028.

The department increased access to early learning and child care

The government set a target to create up to 40,000 child care spaces in Canada by March 2020. The department supported the government’s negotiations with provinces and territories for bilateral agreements. Results from fiscal year 2017 to 2018 and 2018 to 2019 show that 38,000 more affordable child care spaces have been created through federal investments, which is 95% of the target. Final results for fiscal year 2019 to 2020 will be available in Fall 2020, once annual progress reports are submitted by provinces and territories.

The department also provided $16.4 million to various organizations to explore innovative methods of delivering early learning and child care (ELCC). Examples of these methods include:

- creating simulated environments and training materials for early learning and child care education professionals

- connecting users to resources and services in the community

- facilitating access to resources for parents

The department helped realize the goals and priorities of Indigenous peoples set out in the Indigenous Early Learning and Child Care Framework

The department provided new funding to First Nations, Inuit and Métis Nation communities through agreements with these communities and other federal partner departments. In fiscal year 2019 to 2020, these agreements strengthened services for Indigenous families and resulted in:

- all 634 First Nations receiving new funding for a range of early learning and child care needs

- increased funding to support improved existing early learning and child care services in 73 Inuit communities

- new Métis-specific early learning and child care programs, services and supports

In addition, the Aboriginal Head Start in Urban and Northern Communities program received increased support to transform early learning and child care for Indigenous people. This transformation initiative also funded quality improvement projects to support Indigenous-led best practices. These projects are meant to advance foundational elements of Indigenous early learning and child care.

To ensure clients receive high-quality, timely and efficient services that meet their needs, the department

- met the service standard target for the Social Development program priority service. It processed grants and contributions program payments in the prescribed timeframes, which are:

- 90% of contribution payments are processed within 28 calendar days of receiving completed claim package

- 90% of grant payments are processed within 15 calendar days after the approved grant project start date

- implemented several pilot projects to make it easier to apply to grants and contributions programs. These projects included a simplified grant application form and a targeted promotion for the 2019 call for proposals for the New Horizons for Seniors Program. Results from these projects will be used to make improvements in other programs

- interviewed applicants to the Enabling Accessibility Fund to get their input and feedback on their experience applying to the program. Results from these interviews have helped identify areas for improvements to service delivery for this and other programs. This includes streamlining documents and simplifying applicant requirements

The department helped advance the United Nations 2030 Agenda for Sustainable Development and its 17 Sustainable Development Goals (SDGs)

Following nationwide consultations, the department released Towards Canada’s 2030 Agenda National Strategy in June 2019. This is an important step toward establishing the structures, processes and activities needed to move the 2030 Agenda forward. In the context of the pandemic, the sustainable development goals are of particular importance to help rebuild more inclusive, resilient and sustainable communities.

The department also provided $4.6 M in grant funding to initiatives from 50 not-for-profit organizations, communities and other groups across the country. These initiatives helped increase public awareness of the sustainable development goals. They also supported collaboration across sectors, and drove progress on multiple goals to improve outcomes for Canadians. Among others, these initiatives aim to improve life outcomes for Indigenous communities and vulnerable and marginalized populations.

Finally, the department developed a first draft of the Canadian Indicator Framework. The framework will help track and report on national progress on the 17 sustainable development goals.

Gender-based analysis plus

His section highlights some of the key achievements related to GBA+ for this core responsibility. For more information on GBA+ initiatives in the department, see the Gender-Based Analysis Plus Supplementary Information Table.

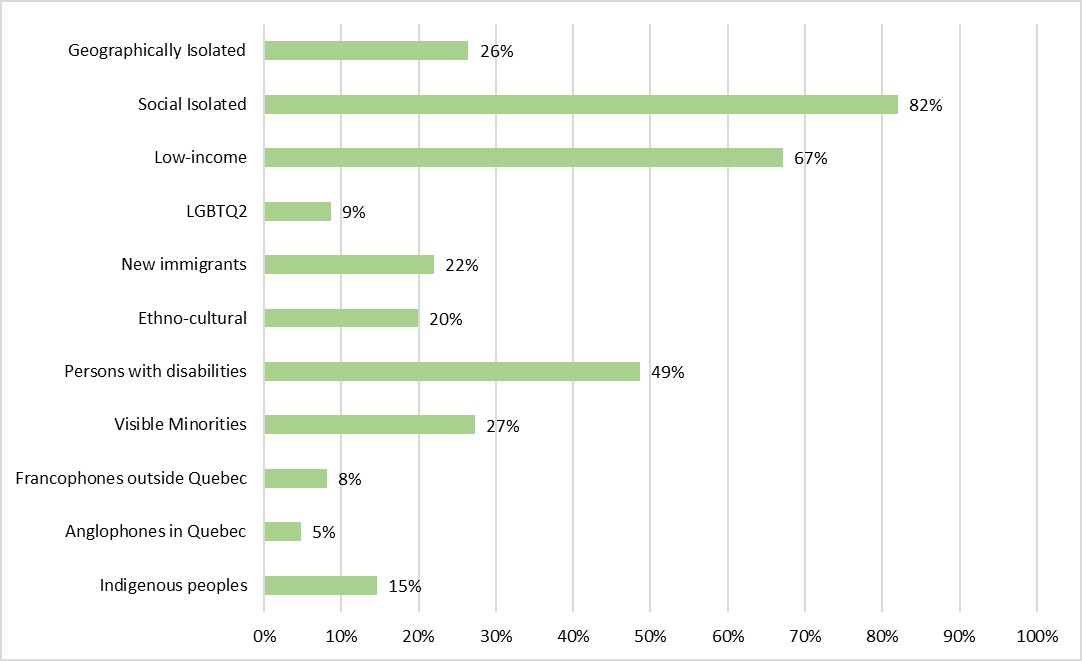

The New Horizons for Seniors Program (NHSP) funds various projects aimed at supporting the social well-being and community vitality of Canada’s seniors. Through its community-based projects stream, the program has funded targeted projects focussed on reaching the most vulnerable senior populations. The current call for proposals is the first time these vulnerable populations have been engaged by NHSP in a concerted outreach effort. These senior populations include the socially isolated, low-income earners, persons with disabilities, visible minorities, the geographically isolated, new immigrants, ethno-cultural minorities, indigenous peoples, women, and members of the Lesbian, gay, bisexual, transgender, queer, and 2-spirit (LGBTQ2) community.

Text description of figure 2:

- Geographically isolated: 26%

- Socially isolated: 82%

- Low-income: 67%

- LGBTQ2: 9%

- New immigrants: 22%

- Ethno-cultural: 20%

- Persons with disabilities: 49%

- Visible minorities: 27%

- Francophones outside Québec: 8%

- Anglophones in Québec: 5%

- Indigenous peoples: 15%

As a result of the 2015 call for proposals, the pan-Canadian stream funded 48 collective impact projects across Canada, which were completed in 2019 to 2020. About 187,400 of the seniors who participated in these projects reported a reduction in their social isolation, 71% of whom were women.

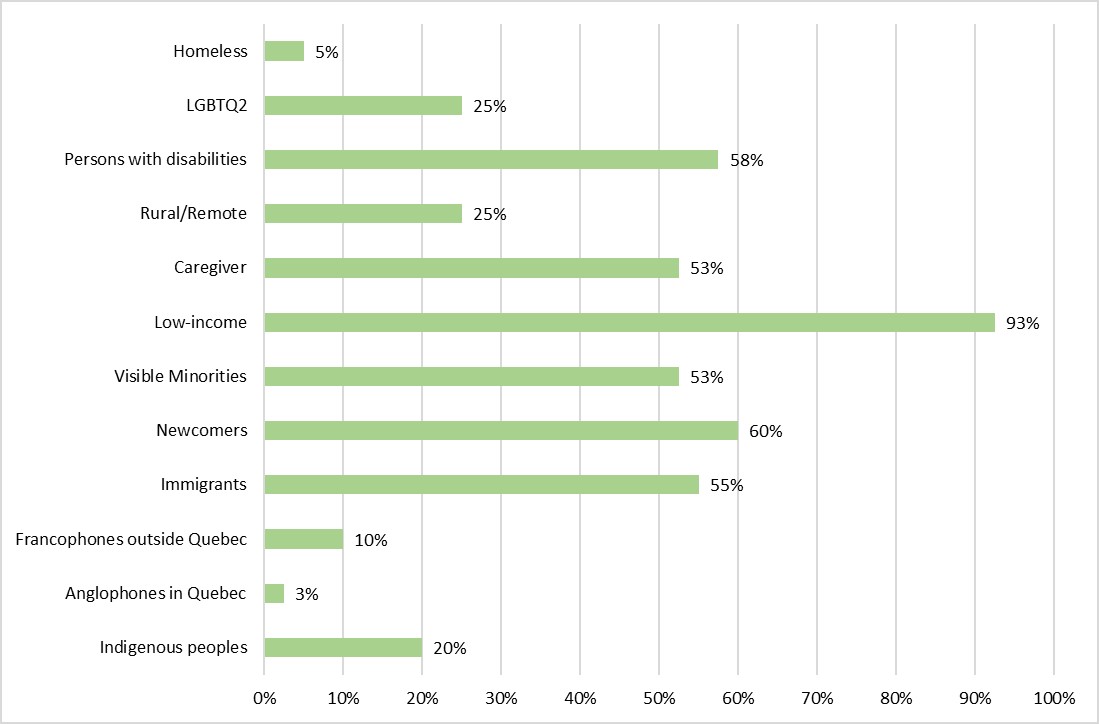

Text description of figure 3:

- Homeless: 5%

- LGBTQ2: 25%

- Persons with disabilities: 58%

- Rural/remote: 25%

- Caregiver: 53%

- Low-income: 93%

- Visible minorities: 53%

- Newcomers: 60%

- Immigrants: 55%

- Francophones outside Québec: 10%

- Anglophones in Québec: 3%

- Indigenous peoples: 20%

In the last call for concepts, applicant organizations had to develop a multi-partner approach, called Collective Impact, to increase seniors’ social inclusion within a specific community. The Collective Impact approach had to address systemic barriers that are known to contribute to the social exclusion of seniors. Organizations had to develop a strategy to address the unmet needs of vulnerable sub-populations of seniors. These sub-populations included women; members of the LGBTQ2+ community; persons with disabilities; Indigenous peoples; persons with lower income; immigrants; visible minorities; and, members of Official Language Minority Communities.

22 collective impact initiatives were approved, all focussing on vulnerable sub-populations of seniors. One project in particular is focussed specifically on seniors who are from the LGBTQ2+ community.

The Gilbert Centre for Social and Support Services will lead the “Georgian 2SLGBTQ Seniors Project” collective impact initiative. It will work in collaboration with not-for-profit community organizations to increase the social inclusion of LGBTQ2+ seniors in Barrie, Sudbury and North Bay. The project will address the social isolation, discrimination and systemic barriers that LGBTQ2+ older adults can face. This will be done by increasing organizational capacity through the “Safer Spaces” program. It will include developing a community engagement strategy based on peer support activities, and building individual capacity through social networks.

Experimentation

The department’s Accessibility Secretariat and Innovation Lab led a project to “co-develop” guidance material with people with disabilities and industry to support the implementation of the Accessible Canada Act. This guidance material will inform the development of accessibility plans, feedback processes and strengthen accessibility for industry. Workshops were fully accessible and co-facilitated by persons with disabilities. The project brought together a diversity of perspectives across industry and persons with disabilities on best practices related to reducing barriers for a more accessible Canada.

An experiment was launched under the Enabling Accessibility Fund. It tested a method to improve the participation of Youth Accessibility Leaders in solving the accessibility issues within their community. These volunteers identify accessibility challenges in their community and work with organizations to submit a proposal to fund a solution. In the first 2 years of the youth stream, few youth successfully worked with organizations to submit completed project applications. Feedback from participants suggested that mentoring and connection with past and current youth accessibility leaders could help them complete their projects. The department then tested a new online platform to engage youth and increase the number of projects submitted. While only 14% of youth used the platform and only 3% helped submit project proposals, the participation rate of youth was its best ever.

Results achieved

Departmental result: Homelessness is prevented and reduced

Performance indicator: Reduction in the estimated number of shelter users who are chronically homeless See note 1

Target: 31% See note 2

Date to achieve target: March 2024

2019 to 2020 actual result: Not available (2019)

2018 to 2019 actual result: Not available (2018)

2017 to 2018 actual result: Increase of 8.7% compared to 2016 baseline See note 3

Departmental result: Not-for-profit organizations, communities and other groups have an enhanced capacity to address a range of social issues such as the social inclusion of people with disabilities, the engagement of seniors and support for children and families

Performance indicator: For every dollar invested through the Social Development Partnerships Program, amount leveraged/invested by non-federal partners See note 4

Target: $0.30

Date to achieve target: March 2020

2019 to 2020 actual result:

- Children and Families component: $0.78

- Disability component: $0.39

2018 to 2019 actual result:

- Children and Families component: $0.78

- Disability component: $0.39

2017 to 2018 actual result:

- Children and Families component: $1.02

- Disability component: $0.22

Departmental result: Barriers to accessibility for people with disabilities are removed

Performance indicator: Number of community spaces and workplaces that are more accessible due to Enabling Accessibility Fund funding

Target: 400 See note 5

Date to achieve target: March 2020

2019 to 2020 actual result: 376 See note 6

2018 to 2019 actual result: 473

2017 to 2018 actual result: 609

Departmental result: Access to early learning and child care is increased

Performance indicator 1 of 2: Number of children in regulated child care spaces and/or early learning programs

Target: 40,000 See note 7

Date to achieve target: March 2020

Performance indicator 2 of 2: Number of children receiving subsidies or other financial supports

Target: To be determined

Date to achieve target: March 2020

2019 to 2020 actual result: Not available See note 8

2018 to 2019 actual result: 38,000 (combined total for both indicators for both fiscal years: 2017 to 2018 and 2018 to 2019)

2017 to 2018 actual result: 21,205 (combined total for both indicators)

Departmental result: Clients receive high-quality, timely and effective services that meet their needs See note 9

Performance indicator: Service standard target for Social Development program priority service, as defined by the Government of Canada’s Policy on Service, was met.

Target: 90% See note 10

Date to achieve target: March 2020

2019 to 2020 actual result: 94%

2018 to 2019 actual result: 1 out of 1

2017 to 2018 actual result:1 out of 1

Notes:

- This indicator is based on the calendar year. There is a 3-year lag in the availability of data. Results for 2018 are anticipated to be available in 2021. Results for 2019 are anticipated to be available in 2022

- 2027 to 2028 target: 50% (Date to achieve target: March 2028). Baselines estimated at 26,900 (2016)

- The 2017 figure uses an enhanced methodology for the cleaning and processing of shelter data. The approach used in 2017 is more inclusive of individual experiences of chronic homelessness and increases the accuracy of the estimate

- Organizations are encouraged to use the Social Development Partnership Program funding to leverage cash and in-kind investments from other non-federal organizations. This allows the pool of investment brought to bear on any given issue to be increased. However, it is no longer mandatory to leverage the Social Development Partnership Program funding. Increased partnerships, through cash and/or in-kind contributions, increases the impact of program funding. It expands the capacity of recipients to build and further their knowledge, understanding and capacity to address complex social issues

- This target was based on the anticipated number of projects for fiscal year 2019 to 2020

- Because of a Budget 2019 commitment, the Enabling Accessibility Fund transferred $1 million to the Social Development Partnerships Program–Disability component. This sum was to help produce new accessible reading materials. While this resulted in a slightly lower number of funded projects than projected, the Enabling Accessibility Fund still achieved 94% of its target

- At the time of the publication of the 2019 to 2020 Departmental Plan, the target was: “To be determined”

- Results for the final year of the bilateral agreements will be available in the Fall 2020 with the submission of provincial and territorial Annual Progress Reports

- Service standards are published on the web

- This indicator’s target was converted to a percentage for fiscal year 2019 to 2020. The target being expressed as a percentage (instead of as a number) is consistent with applicable service standards. As the target (for fiscal year 2019 to 2020) is expressed as a percentage, the actual result (for the aforementioned fiscal year) is also expressed as a percentage

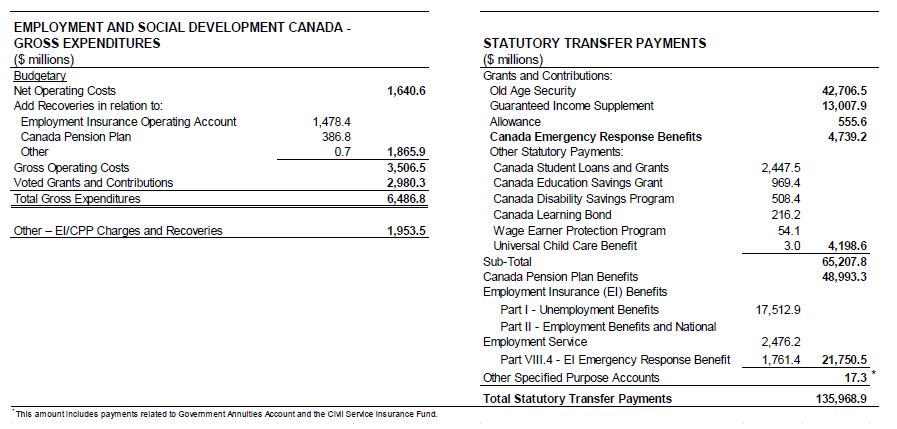

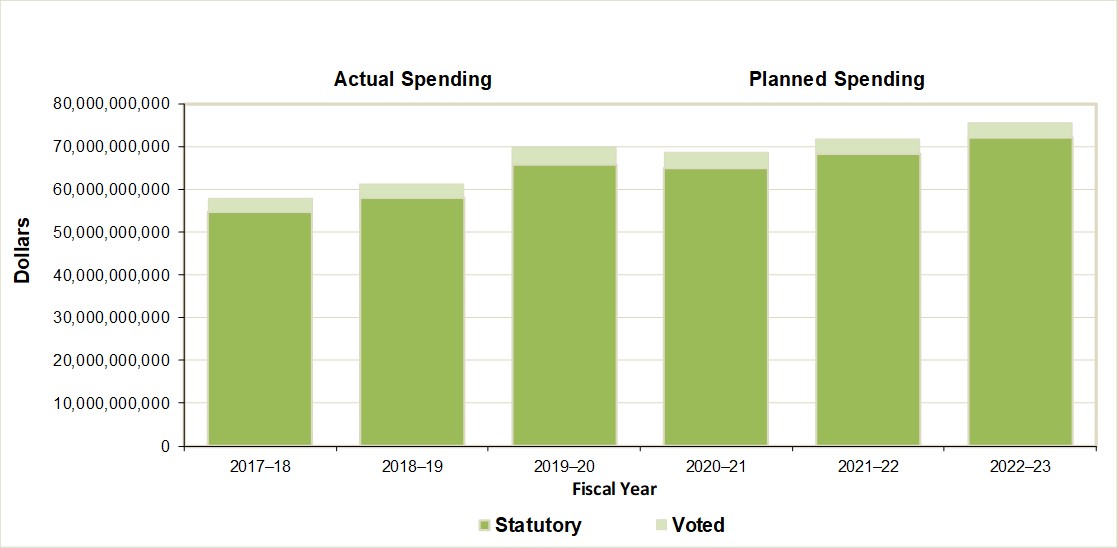

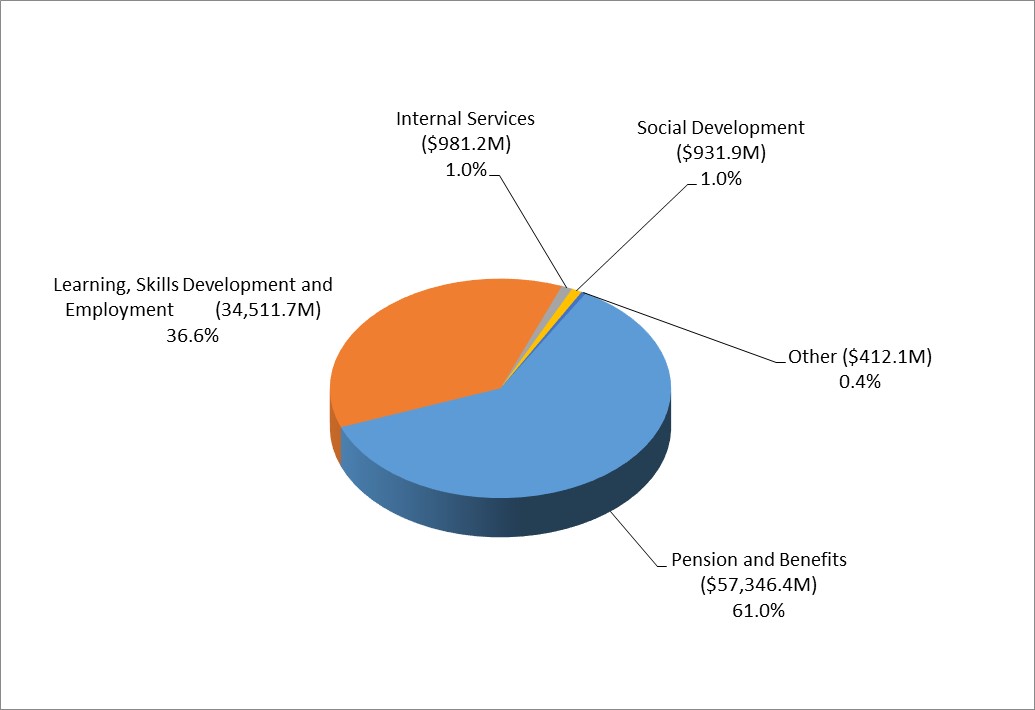

Budgetary financial resources (dollars)

| Spending category | 2019 to 2020 Main Estimates* | 2019 to 2020 Planned spending* | 2019 to 2020 Total authorities available for use | 2019 to 2020 Actual spending (authorities used) | 2019 to 2020 Difference (Actual spending minus Planned spending) |

|---|---|---|---|---|---|

| Gross Spending | 759,435,703 | 759,435,703 | 943,816,344 | 921,816,281 | 162,380,578 |

| Spending in Specified Purpose Accounts | 0 | 0 | 0 | 0 | 0 |

| Revenues netted against expenditures | 0 | 0 | 0 | 0 | 0 |

| Net Spending | 759,435,703 | 759,435,703 | 943,816,344 | 921,816,281 | 162,380,578 |

Variance explanation: The variance can be explained by different new programs and new funds received and consequently actuals spending were more than anticipated.

Notes:

*Amounts do not reflect 2019 Budget Implementation measures included in ESDC's 2019 to 2020 Main Estimates.

“Planned spending” may differ from Main Estimates as they include the amounts to be spent for the Specified Purpose Accounts (such as Employment Insurance and Canada Pension Plan accounts). These amounts include benefits paid to clients and amounts associated with the payment of these benefits.

“Net Spending” excludes amounts spent under Specified purpose accounts.

Refer to the department's financial framework section for a complete description of the departmental financial profile, including explanation of gross actual and planned spending.

Human resources (full-time equivalents)

2019 to 2020 Planned full-time equivalents: 526

2019 to 2020 Actual full-time equivalents: 457

2019 to 2020 Difference (actual full-time equivalents minus planned full-time equivalents): (69)

Variance explanation: The FTE variance captures changes within the program as well as in other areas of social development policy. It includes delays in staffing, leave with income averaging, leave without pay, and unexpected departures.

Financial, human resources and performance information for the Employment and Social Development Canada’s Program Inventory is available in GC InfoBase.

Pensions and benefits

Description

Assist Canadians in maintaining income for retirement, and provide financial benefits to survivors, people with disabilities and their families.

Results

In 2019 to 2020, the department undertook the following initiatives to advance this core responsibility.

The department ensured seniors have income support for retirement

The Old Age Security Act includes what is known as the Guaranteed Income Supplement earnings exemption. It allows recipients who work to exempt a portion of their earnings from the calculation of their benefits. Since July 2020, the enhanced earnings exemption applies to both employment and self‑employment income. It provides a full exemption on up to $5,000 of annual earnings, and a 50% exemption on the next $10,000 of earnings. This means that low-income seniors who work can keep more of their Guaranteed Income Supplement benefits.

The department also introduced legislative amendments to proactively enroll Canada Pension Plan (CPP) eligible seniors who have not applied for their retirement benefit. This amendment was effective in 2020 and applies to CPP contributors aged 70 or older.

The department took measures to better support people with disabilities and their families, through the Canada Disability Savings Program

- expanded outreach activities to increase awareness and take-up of the Registered Disability Savings Plan (RDSP)

- implemented improvements to the RDSP by eliminating the requirement to close it when a beneficiary no longer qualifies for the Disability Tax Credit. Doing so will allow Canada Disability Savings Grants and Canada Disability Savings Bonds to remain in the RDSP. Otherwise, these would have to be repaid to the government

- exempted RDSP from seizure in bankruptcy to better protect the long-term savings of persons with disabilities. This change came into force on November 1, 2019

The department continued to improve the Canada Pension Plan Disability (CPPD) program to better respond to the needs of Canadians with severe and prolonged disabilities

The department implemented the Medical Adjudication Quality Assurance program. This program provides information about the process that medical adjudicators follow to make decisions to grant or deny benefits. The results from this program will allow the department to make recommendations to enhance policy development and improve training.

The department also began implementing a new strategy to address CPPD data quality issues, strengthen evidence-based analysis, and improve program outcomes.

The department expanded external engagement to include non-profit disability organizations and public programs in other jurisdictions. These include provinces, territories and the International Social Security Association. It also consulted on ways to improve the CPPD program through the CPPD Client and Stakeholder Roundtable.

It also initiated a review and analysis of current supports available to CPPD beneficiaries when they attempt to return to work.

The department ensured clients receive high-quality, timely and efficient services that meet their needs

The department continued to modernize the delivery of Canada Pension Plan (CPP) and Old Age Security (OAS). This will ensure that clients receive the benefits to which they are entitled in a timely and accurate manner. This modernization included:

- implementing a new e-Service for OAS pension and Guaranteed Income Supplement (GIS) in November 2019. This online tool combines applications for both the OAS pension and GIS. This makes it easier for some of Canada’s most vulnerable individuals to apply for these benefits

- launching a CPP-Disability (CPP-D) online application to enable clients to apply online through their My Service Canada Account. This online application was developed in consultation with internal and external stakeholders and helps shorten the application process and improves understanding of eligibility. It also gives some of Canada’s most vulnerable individuals the confidence to fill out the application at their own pace

- providing an array of electronic tools and features to help clients get information and submit an application. These proved to be popular as indicated by the following results:

- the ‘‘View My Application Status’’ feature has been used approximately 186,000 times by OAS Clients

- approximately 18,000 clients downloaded the interactive version of the OAS Toolkit and 12,000 clients downloaded the printable version

- approximately 17,000 clients downloaded the interactive version of the CPP Disability Toolkit and 13,000 clients downloaded the printable version

- the CPP online retirement application was used approximately 120,000 times

The department automatically enrolled about 200,000 OAS clients, who did not have to submit an application to receive their benefits.

Gender-based analysis plus

This section highlights some of the key achievements related to GBA+ for this core responsibility. For more information on GBA+ initiatives in the department, see the Gender-Based Analysis Plus Supplementary Information Table.

On average, Canadian women live longer than men, which makes them over-represented in the senior population, particularly in the oldest age groups. Women also have lower lifetime earnings than men on average, and so they are more likely to be lower income. Single senior women account for the majority of low-income seniors in the country.

Income security programs are designed to support low-income seniors and other vulnerable Canadians. Data shows that these programs disproportionately benefitted women.

Old Age Security (OAS) pensions provide income for seniors 65 and older, and are an important financial support especially for those who can no longer work. In 2019 to 2020, 54% of OAS recipients were women, 57% had incomes below $30,000, and 85% had incomes below $50,000.

The Guaranteed Income Supplement (GIS) has provided additional and much needed financial support to some of the most vulnerable low-income seniors. The GIS top-up provides additional income from OAS for single seniors with annual incomes below

$18,600, or couples with a combined income below $24,576. In 2019 to 2020, 60% of GIS recipients were women, and 52% were over the age of 75.

Additionally, the GIS allowance supports spouses, common-law partners, and survivors of GIS recipients who are in low-income situations. In 2019 to 2020, 86% of these allowance beneficiaries were women.

Experimentation

The department completed 3 pilots in the Canada Pension Plan Disability Program. The department is currently analysing data from these pilots to finalize results and develop recommendations.

- The first pilot used predictive analytics to identify files that required more information prior to making a determination. The goal was to obtain this information earlier in the process and reduce the time required to make a decision

- The second pilot involved information sharing from third party disability payers related to CPP-Disability benefits applicants. The purpose was to determine if having complete information earlier in the determination process would reduce the time required to reach a decision

- The third pilot examined ways to reduce the time required to finalize an appeal on a CPP Disability decision

The department used behavioural science to encourage more Canadians to apply to the Canada Pension Plan and to use the online application. As a result, the number of Canadians applying online, instead of using paper forms, doubled.

The department conducted significant remote user research using a third-party user panel. This allowed the department to conduct user research with people across Canada and the globe. It also significantly reduced the time required to recruit and conduct this research. This new approach increases departmental capacity to conduct user research and usability tests. It also diversifies the participant base compared to traditional methods, and heightens the client-centric approach to service design and delivery.

Through its Acceleration Hub, the department continued to promote design thinking and agile methodologies in the development of client solutions. The Hub provides programme design teams a space to experiment and test new program and service design options. It served to drive the design and rapid prototyping of many solutions. These include the Client Centric Playbook, Community Outreach and Liaison Model.

The department’s Innovation Lab co-led a project to better understand the take-up of the Guaranteed Income Supplement among low-income seniors. The goal was to analyze why seniors who qualify for the Guaranteed Income Supplement are not applying to receive it. The department aimed to increase the take-up of the supplement among those seniors who receive the annual take-up letters. These letters are mailed to potentially eligible low-income seniors to encourage them to apply. The project helped the department assess whether these annual letters are useful. It also allowed the identification of factors that prevented or encouraged low-income seniors to apply for the benefit. From the results and key findings of the project, the department identified new approaches to communicate with clients and stakeholders. It also simplified application procedures and strengthened outreach services for vulnerable sectors.

Results achieved

Departmental result: Seniors have income support for retirement

Performance indicator 1 of 4: Percentage of seniors receiving the Old Age Security pension in relation to the estimated total number of eligible seniors

Target: 97%

Date to achieve target: March 2020

2019 to 2020 actual result: 97.2% (2017) See note 1

2018 to 2019 actual result: 97% (2016)

2017 to 2018 actual result: 97% (2015)

Performance indicator 2 of 4: Percentage of seniors receiving the Guaranteed Income Supplement in relation to the estimated total number of eligible seniors

Target: 90%

Date to achieve target: March 2020

2019 to 2020 actual result: 91.1% (2017) See note 1

2018 to 2019 actual result: 91% (2016)

2017 to 2018 actual result: 91% (2015)

Performance indicator 3 of 4: Percentage of Canada Pension Plan contributors aged 70 or more receiving retirement benefits

Target: 99%

Date to achieve target: March 2020

2019 to 2020 actual result: Not available at the time of publishing (2018) See note 2

2018 to 2019 actual result: 99% (2017)

2017 to 2018 actual result: 99% (2016)

Performance indicator 4 of 4: Percentage of seniors living in low income

Target: Not applicable See note 3

Date to achieve target: Not applicable

2019 to 2020 actual result: 3.5% (2018) See note 2

2018 to 2019 actual result: 4.3% (2017)

2017 to 2018 actual result: 4.7% (2016)

Departmental result: People with disabilities and their families have financial support

Performance indicator 1 of 3: Percentage of Canada Pension Plan contributors who have contributory eligibility for Canada Pension Plan disability benefits and therefore have access to financial support in the event of a severe and prolonged disability

Target: 66%

Date to achieve target: March 2020

2019 to 2020 actual result: 65% (2018) See notes 2 and 4

2018 to 2019 actual result: 63% (2017)

2017 to 2018 actual result: 66% (2016)

Performance indicator 2 of 3: Percentage of Canadians eligible for the Disability Tax Credit who have a Registered Disability Savings Plan to encourage private savings

Target: 33%

Date to achieve target: December 2019

2019 to 2020 actual result: 2019 data not available at the time of publishing

2018 to 2019 actual result: 34% (2018)

2017 to 2018 actual result: 31% (2017)

Performance indicator 3 of 3: Percentage of Canadians with disabilities eligible for a Registered Disability Savings Program that have received a grant and/or a bond to assist them and their families to save for their long-term financial security

Target: 84%

Date to achieve target: December 2019

2019 to 2020 actual result: 84%

2018 to 2019 actual result: 83%

2017 to 2018 actual result: 85%

Departmental result: Clients receive high-quality, timely and efficient services that meet their need

Performance indicator: Standard targets for Pensions and Benefits program priority services, as defined by the Government of Canada’s Policy on Service, that are being met

Target: 10

Date to achieve target: March 2020

2019 to 2020 actual result: 5 out of 10 See note 5

2018 to 2019 actual result: 5 out of 10

2017 to 2018 actual result: 3 out of 10

Key measure 1 of 3: Percentage of Canada Pension Plan retirement benefits paid within the first month of entitlement

Target: 90%

Date to achieve target: March 2020

2019 to 2020 actual result: 97%

2018 to 2019 actual result: 96%

2017 to 2018 actual result: 96%

Key measure 2 of 3: Percentage of decisions on applications for a Canada Pension Plan disability benefit within 120 calendar days

Target: 80%

Date to achieve target: March 2020

2019 to 2020 actual result: 54% See note 6

2018 to 2019 actual result: 63%

2017 to 2018 actual result: 77%

Key measure 3 of 3: Percentage of Old Age Security basic benefits paid within the first month of entitlement

Target: 90%

Date to achieve target: March 2020

2019 to 2020 actual result: 91%

2018 to 2019 actual result: 92%

2017 to 2018 actual result: 87%

Notes:

- There is a 3-year lag in the availability of data

- There is a 2-year lag in the availability of data

- The department uses contextual indicators such as this one to monitor overall social trends and inform policy development. Specific outcomes are not actively targeted in the areas measured by these indicators. This contextual indicator is based on the Low Income Cut Off (LICO) after tax. Data is collected by Statistics Canada through the annual Canadian Income Survey

- There is a 2-year lag in the availability of data. This contextual indicator is influenced by the economic situation and employment. The result may be explained by the increase in non-permanent residents in 2018 and the decrease in participation rates among people under 25 years of age

- 2 of the 5 missed targets are related to changes in Pensions call centres. The migration of these call centres to a new telephony platform in May 2019, greatly improved accessibility (to almost 100% post-migration). This allowed more Canadians to wait and speak to a Call Centre Agent. However, an increase in callers waiting to speak to an agent also resulted in an increase in wait times. In fiscal year 2019 to 2020, 96% of clients contacting the Pensions Call Centre were able to speak to an agent. Of those, 48% of callers were able to speak to an agent within 10 minutes. On average, clients waited approximately 12 minutes before speaking to an agent. The other 3 targets were related to the processing of Canada Pension Plan Disability applications

- The target was not met. For initial application decisions, the average time to make a decision was 125 days. Increased inventory resulted in Service Canada having to balance the processing of older applications and the prioritization of files for gravely ill and terminally ill clients. For reference, year-over-year improvements were made in targets for decisions on gravely and terminally ill applications. Applications for a grave medical condition were processed on time 92% of the time compared to 84% last fiscal year. Applications for terminally illness condition were processed in time 92% of the time compared to 91% the previous year

Budgetary financial resources (dollars)

| Spending category | 2019 to 2020 Main Estimates* | 2019 to 2020 Planned spending* | 2019 to 2020 Total authorities available for use | 2019 to 2020 Actual spending (authorities used) | 2019 to 2020 Difference (Actual spending minus Planned spending) |

|---|---|---|---|---|---|

| Gross Spending | 57,353,008,462 | 107,075,411,089 | 106,395,627,770 | 106,337,930,425 | (737,480,663) |