Infographic: Canada Pension Plan (CPP) Evaluation

Description

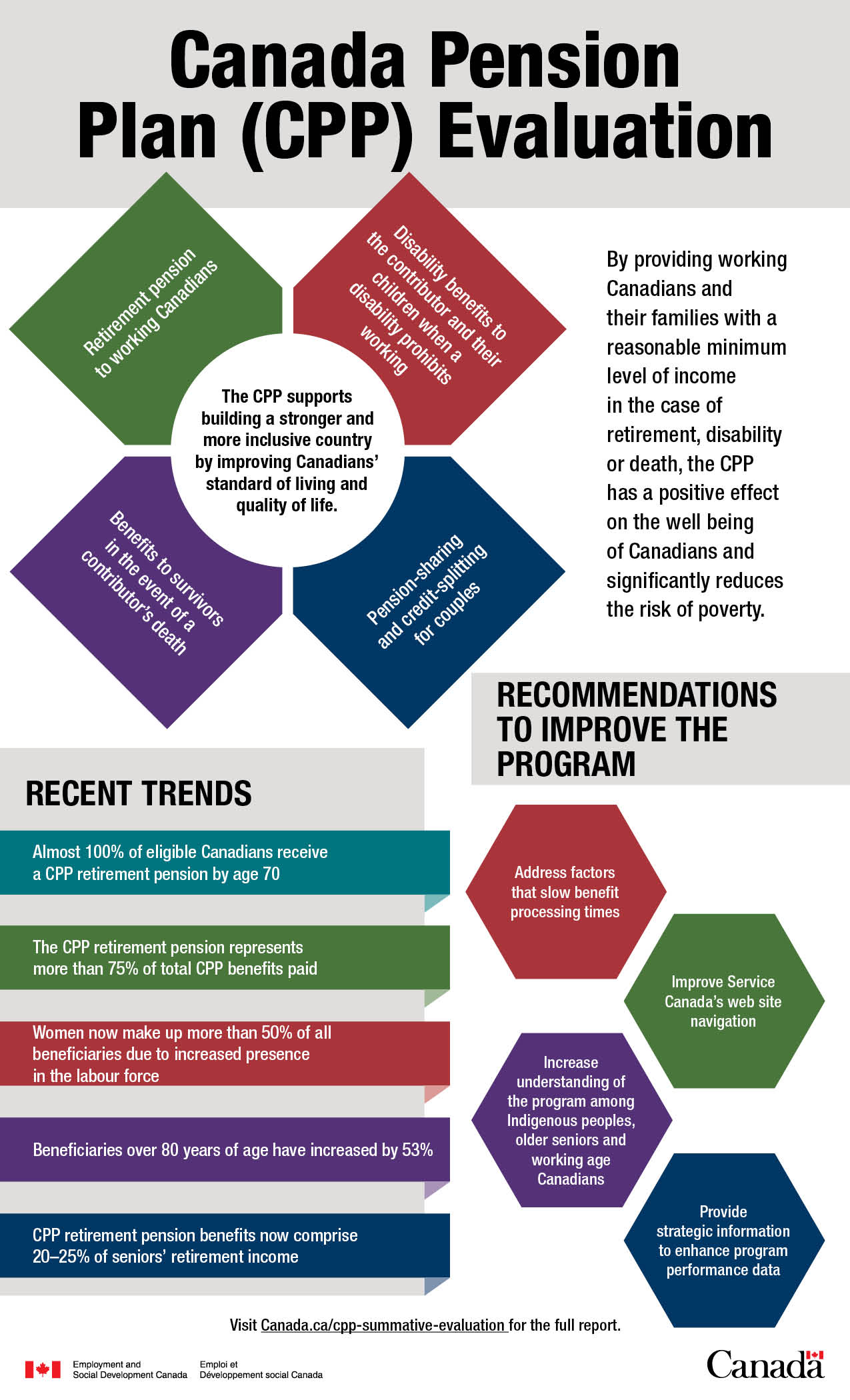

By providing working Canadians and their families with a reasonable minimum level of income in the case of retirement, disability or death, the CPP has a positive effect on the well being of Canadians and significantly reduces the risk of poverty.

The CPP supports building a stronger and more inclusive country by improving Canadians’ standard of living and quality of life.

- Retirement pension to working Canadians

- Disability benefits to the contributor and their children when a disability prohibits working

- Pension-sharing and credit-splitting for couples

- Benefits to survivors in the event of a contributor’s death

Recent trends

- Almost 100% of eligible Canadians receive a CPP retirement pension by age 70

- The CPP retirement pension represents more than 75% of total CPP benefits paid

- Women now make up more than 50% of all beneficiaries due to increased presence in the labour force

- Beneficiaries over 80 years of age have increased by 53%

- CPP retirement pension benefits now comprise 20–25% of seniors’ retirement income

Recommendations to improve the program

- Address factors that slow benefit processing times

- Improve Service Canada’s website navigation

- Increase understanding of the program among Indigenous peoples, older seniors and working age Canadians

- Provide strategic information to enhance program performance data

Visit Canada.ca/cpp-summative-evaluation for the full report.

Employment and Social Development Canada / Emploi et Développement social Canada

Canada Wordmark

Download

Download Canada Pension Plan (CPP) Evaluation [PDF - 82KB]